- Browse All Articles

- Newsletter Sign-Up

- 15 Dec 2020

- Working Paper Summaries

Designing, Not Checking, for Policy Robustness: An Example with Optimal Taxation

The approach used by most economists to check academic research results is flawed for policymaking and evaluation. The authors propose an alternative method for designing economic policy analyses that might be applied to a wide range of economic policies.

- 31 Aug 2020

- Research & Ideas

State and Local Governments Peer Into the Pandemic Abyss

State and local governments that rely heavily on sales tax revenue face an increasing financial burden absent federal aid, says Daniel Green. Open for comment; 0 Comments.

- 12 May 2020

Elusive Safety: The New Geography of Capital Flows and Risk

Examining motives and incentives behind the growing international flows of US-denominated securities, this study finds that dollar-denominated capital flows are increasingly intermediated by tax haven financial centers and nonbank financial institutions.

- 01 Apr 2019

- What Do You Think?

Does Our Bias Against Federal Deficits Need Rethinking?

SUMMING UP. Readers lined up to comment on James Heskett's question on whether federal deficit spending as supported by Modern Monetary Theory is good or evil. Open for comment; 0 Comments.

- 20 Mar 2019

In the Shadows? Informal Enterprise in Non-Democracies

With the informal economy representing a third of the GDP in an average Middle East and North African country, why do chronically indebted regimes tolerate such a large and untaxed shadow economy? Among this study’s findings, higher rates of public sector employment correlate with greater permissibility of firm informality.

- 30 Jan 2019

Understanding Different Approaches to Benefit-Based Taxation

Benefit-based taxation—where taxes align with benefits from state activities—enjoys popular support and an illustrious history, but scholars are confused over how it should work, and confusion breeds neglect. To clear up this confusion and demonstrate its appeal, we provide novel graphical explanations of the main approaches to it and show its general applicability.

- 02 Jul 2018

Corporate Tax Cuts Don't Increase Middle Class Incomes

New research by Ethan Rouen and colleagues suggests that corporate tax cuts contribute to income inequality. Open for comment; 0 Comments.

- 13 May 2018

Corporate Tax Cuts Increase Income Inequality

This paper examines corporate tax reform by estimating the causal effect of state corporate tax cuts on top income inequality. Results suggest that, while corporate tax cuts increase investment, the gains from this investment are concentrated on top earners, who may also exploit additional strategies to increase the share of total income that accrues to the top 1 percent.

- 08 Feb 2018

What’s Missing From the Debate About Trump’s Tax Plan

At the end of the day, tax policy is more about values than dollars. And it's still not too late to have a real discussion over the Trump tax plan, says Matthew Weinzierl. Open for comment; 0 Comments.

- 24 Oct 2017

Tax Reform is on the Front Burner Again. Here’s Why You Should Care

As debate begins around the Republican tax reform proposal, Mihir Desai and Matt Weinzierl discuss the first significant tax legislation in 30 years. Open for comment; 0 Comments.

- 08 Aug 2017

The Role of Taxes in the Disconnect Between Corporate Performance and Economic Growth

This paper offers evidence of potential issues with the current United States system of taxation on foreign corporate profits. A reduction in the US tax rate and the move to a territorial tax system from a worldwide system could better align economic growth with growth in corporate profits by encouraging firms to invest domestically and repatriate foreign earnings.

- 07 Nov 2016

Corporate Tax Strategies Mirror Personal Returns of Top Execs

Top executives who are inclined to reduce personal taxes might also benefit shareholders in their companies, concludes research by Gerardo Pérez Cavazos and Andreya M. Silva. Open for comment; 0 Comments.

- 18 Apr 2016

Popular Acceptance of Morally Arbitrary Luck and Widespread Support for Classical Benefit-Based Taxation

This paper presents survey evidence that the normative views of most Americans appear to include ambivalence toward the egalitarianism that has been so influential in contemporary political philosophy and implicitly adopted by modern optimal tax theory. Insofar as this finding is valid, optimal tax theorists ought to consider capturing this ambivalence in their work, as well.

- 20 Nov 2015

Impact Evaluation Methods in Public Economics: A Brief Introduction to Randomized Evaluations and Comparison with Other Methods

Dina Pomeranz examines the use by public agencies of rigorous impact evaluations to test the effectiveness of citizen efforts.

- 07 May 2014

How Should Wealth Be Redistributed?

SUMMING UP James Heskett's readers weigh in on Thomas Piketty and how wealth disparity is burdening society. Closed for comment; 0 Comments.

- 08 Sep 2009

The Height Tax, and Other New Ways to Think about Taxation

The notion of levying higher taxes on tall people—an idea offered largely tongue in cheek—presents an ideal way to highlight the shortcomings of current tax policy and how to make it better. Harvard Business School professor Matthew C. Weinzierl looks at modern trends in taxation. Key concepts include: Studies show that each inch of height is associated with about a 2 percent higher wage among white males in the United States. If we as a society are uncomfortable taxing height, maybe we should reconsider our comfort level for taxing ability (as currently happens with the progressive income tax). For Weinzierl, the key to explaining the apparent disconnect between theory and intuition starts with the particular goal for tax policy assumed in the standard framework. That goal is to minimize the total sacrifice borne by those who pay taxes. Behind the scenes, important trends are evolving in tax policy. Value-added taxes, for example, are generally seen as efficient by tax economists, but such taxes can bear heavily on the poor if not balanced with other changes to the system. Closed for comment; 0 Comments.

- 02 Mar 2007

What Is the Government’s Role in US Health Care?

Healthcare will grab ever more headlines in the U.S. in the coming months, says Jim Heskett. Any service that is on track to consume 40 percent of the gross national product of the world's largest economy by the year 2050 will be hard to ignore. But are we addressing healthcare cost issues with the creativity they deserve? What do you think? Closed for comment; 0 Comments.

Guide to Researching US Tax Policy

General tips, ask your professor, general guides to choosing a topic, browse cilp, ssrn, or bepress, newsletters, circuit splits, blogs & web resources, table of contents.

- Finding Books

- Congressional Research Service Reports

- Finding Articles

- Finding Statutes

- Legislative History & Bill Tracking

- Finding Cases by Headnote

- Federal Administrative Law

- Web Resources

- Evaluating Sources

- Decoding Abbreviations

- Bluebook Citation 101 -- Academic Format

- Citation Management Services

- Law Student Guide to Identifying & Preventing Plagiarism

- Law Library Useful Links

- Accessing Databases & E-Resources

- Get Help & About the Author

If this is for a seminar class, you will want to consult with your professor about what is required from you. Some faculty prepare a list of topic ideas. When choosing a topic, keep the following things in mind:

(1) choose something you find interesting since you will be spending a large amount of time living with this topic;

(2) think carefully about the scope of the topic – avoid overly broad or general topics as well as topics that are too narrow; and

(3) write about something new or look at an issue in a new light.

If you are writing a paper for a seminar class, your professor may have a list of topics that you can use or give you some ideas.

In addition to the Volokh and Falk books that were listed under Writing an Article - General Tips , the following are guides on finding a topic:

Available on HeinOnline, Lexis, Westlaw.

This Article has two sections. The first suggests ways to find an appropriate topic; the second outlines a procedure for "vetting"-- checking for preemption of the topic.

- Note Topic Selection on the LexisNexis Services This does reference Lexis.com resources rather than Lexis Advance.

- Westlaw, Guide to Legal Research for Law Review

By looking at what others are currently writing about, you can often find ideas about what you want to write about.

- SSRN (Social Science Research Network) This service offers separate electronic journals with abstracts of working papers and articles on various legal topics. Your liaison can assist you in becoming a subscriber to the journals in your areas of interest.

Bloomberg Law Reports

Bloomberg Law publishes over 40 current report services that track news, topics and trends. Beyond the circuit splits found in the United States Law Week, Bloomberg Law Reports are an excellent resource for potential topics. You can even subscribe to email alerts or an RSS feed.

Mealey’s Newsletters (through Lexis)

Mealey's reports include case summaries, commentaries, and breaking news across different practice areas.

Law360 covers 45 practice areas and provides news on litigation, legislation and regulation, corporate deals, major personnel moves, and legal industry news and trends.

Lexis Emerging Issues

Emerging Issues Analysis articles provides guidance written by attorneys practicing in the field. The commentaries examine a wide range of recent cases, regulations, trends, and developments. They also cover national, state and international issues and provide expert insight in important areas and legal developments.

Westlaw Newsletters

- Westlaw Legal Newspapers & Newsletters

CCH Topical Newsletters

CCH is a subsidiary of Wolters Kluwer publishing company and it is well known for business, labor and employment, tax, and health resources. Find and click on your topical area of interest. Then look at the news options for your topic.

A circuit split is where there is a difference of opinion among the United States Courts of Appeal. These often make great law review topics.

United States Law Week (Bloomberg BNA)

The easiest way to browse the Split Circuit Roundup is to use the BNA Online Publications link off of the Law Library’s webpage.

Seton Hall Circuit Review

This law review includes a Current Circuit Splits feature that briefly summarizes current circuit splits, but it also features longer, more in-depth articles analyzing important developments in law at the federal appellate level.

Lexis & Westlaw Searches of Case Law

- Potential search to use: split or conflict /s court or circuit or authority

- Note that you will want to limit by date and subject to avoid an overwhelming list of results.

- Howard J. Bashman, How Appealing

Review the Table of Contents, comments, and/or notes in a textbook or treatise to generate topic ideas.

- << Previous: Home

- Next: Finding Books >>

- Last Updated: Nov 13, 2023 3:09 PM

- URL: https://guides.libraries.uc.edu/taxpolicy

University of Cincinnati Libraries

PO Box 210033 Cincinnati, Ohio 45221-0033

Phone: 513-556-1424

Contact Us | Staff Directory

University of Cincinnati

Alerts | Clery and HEOA Notice | Notice of Non-Discrimination | eAccessibility Concern | Privacy Statement | Copyright Information

© 2021 University of Cincinnati

- Search Menu

- Browse content in Arts and Humanities

- Browse content in Archaeology

- Anglo-Saxon and Medieval Archaeology

- Archaeological Methodology and Techniques

- Archaeology by Region

- Archaeology of Religion

- Archaeology of Trade and Exchange

- Biblical Archaeology

- Contemporary and Public Archaeology

- Environmental Archaeology

- Historical Archaeology

- History and Theory of Archaeology

- Industrial Archaeology

- Landscape Archaeology

- Mortuary Archaeology

- Prehistoric Archaeology

- Underwater Archaeology

- Urban Archaeology

- Zooarchaeology

- Browse content in Architecture

- Architectural Structure and Design

- History of Architecture

- Residential and Domestic Buildings

- Theory of Architecture

- Browse content in Art

- Art Subjects and Themes

- History of Art

- Industrial and Commercial Art

- Theory of Art

- Biographical Studies

- Byzantine Studies

- Browse content in Classical Studies

- Classical History

- Classical Philosophy

- Classical Mythology

- Classical Literature

- Classical Reception

- Classical Art and Architecture

- Classical Oratory and Rhetoric

- Greek and Roman Epigraphy

- Greek and Roman Law

- Greek and Roman Papyrology

- Greek and Roman Archaeology

- Late Antiquity

- Religion in the Ancient World

- Digital Humanities

- Browse content in History

- Colonialism and Imperialism

- Diplomatic History

- Environmental History

- Genealogy, Heraldry, Names, and Honours

- Genocide and Ethnic Cleansing

- Historical Geography

- History by Period

- History of Emotions

- History of Agriculture

- History of Education

- History of Gender and Sexuality

- Industrial History

- Intellectual History

- International History

- Labour History

- Legal and Constitutional History

- Local and Family History

- Maritime History

- Military History

- National Liberation and Post-Colonialism

- Oral History

- Political History

- Public History

- Regional and National History

- Revolutions and Rebellions

- Slavery and Abolition of Slavery

- Social and Cultural History

- Theory, Methods, and Historiography

- Urban History

- World History

- Browse content in Language Teaching and Learning

- Language Learning (Specific Skills)

- Language Teaching Theory and Methods

- Browse content in Linguistics

- Applied Linguistics

- Cognitive Linguistics

- Computational Linguistics

- Forensic Linguistics

- Grammar, Syntax and Morphology

- Historical and Diachronic Linguistics

- History of English

- Language Acquisition

- Language Evolution

- Language Reference

- Language Variation

- Language Families

- Lexicography

- Linguistic Anthropology

- Linguistic Theories

- Linguistic Typology

- Phonetics and Phonology

- Psycholinguistics

- Sociolinguistics

- Translation and Interpretation

- Writing Systems

- Browse content in Literature

- Bibliography

- Children's Literature Studies

- Literary Studies (Asian)

- Literary Studies (European)

- Literary Studies (Eco-criticism)

- Literary Studies (Romanticism)

- Literary Studies (American)

- Literary Studies (Modernism)

- Literary Studies - World

- Literary Studies (1500 to 1800)

- Literary Studies (19th Century)

- Literary Studies (20th Century onwards)

- Literary Studies (African American Literature)

- Literary Studies (British and Irish)

- Literary Studies (Early and Medieval)

- Literary Studies (Fiction, Novelists, and Prose Writers)

- Literary Studies (Gender Studies)

- Literary Studies (Graphic Novels)

- Literary Studies (History of the Book)

- Literary Studies (Plays and Playwrights)

- Literary Studies (Poetry and Poets)

- Literary Studies (Postcolonial Literature)

- Literary Studies (Queer Studies)

- Literary Studies (Science Fiction)

- Literary Studies (Travel Literature)

- Literary Studies (War Literature)

- Literary Studies (Women's Writing)

- Literary Theory and Cultural Studies

- Mythology and Folklore

- Shakespeare Studies and Criticism

- Browse content in Media Studies

- Browse content in Music

- Applied Music

- Dance and Music

- Ethics in Music

- Ethnomusicology

- Gender and Sexuality in Music

- Medicine and Music

- Music Cultures

- Music and Religion

- Music and Media

- Music and Culture

- Music Education and Pedagogy

- Music Theory and Analysis

- Musical Scores, Lyrics, and Libretti

- Musical Structures, Styles, and Techniques

- Musicology and Music History

- Performance Practice and Studies

- Race and Ethnicity in Music

- Sound Studies

- Browse content in Performing Arts

- Browse content in Philosophy

- Aesthetics and Philosophy of Art

- Epistemology

- Feminist Philosophy

- History of Western Philosophy

- Metaphysics

- Moral Philosophy

- Non-Western Philosophy

- Philosophy of Science

- Philosophy of Language

- Philosophy of Mind

- Philosophy of Perception

- Philosophy of Action

- Philosophy of Law

- Philosophy of Religion

- Philosophy of Mathematics and Logic

- Practical Ethics

- Social and Political Philosophy

- Browse content in Religion

- Biblical Studies

- Christianity

- East Asian Religions

- History of Religion

- Judaism and Jewish Studies

- Qumran Studies

- Religion and Education

- Religion and Health

- Religion and Politics

- Religion and Science

- Religion and Law

- Religion and Art, Literature, and Music

- Religious Studies

- Browse content in Society and Culture

- Cookery, Food, and Drink

- Cultural Studies

- Customs and Traditions

- Ethical Issues and Debates

- Hobbies, Games, Arts and Crafts

- Lifestyle, Home, and Garden

- Natural world, Country Life, and Pets

- Popular Beliefs and Controversial Knowledge

- Sports and Outdoor Recreation

- Technology and Society

- Travel and Holiday

- Visual Culture

- Browse content in Law

- Arbitration

- Browse content in Company and Commercial Law

- Commercial Law

- Company Law

- Browse content in Comparative Law

- Systems of Law

- Competition Law

- Browse content in Constitutional and Administrative Law

- Government Powers

- Judicial Review

- Local Government Law

- Military and Defence Law

- Parliamentary and Legislative Practice

- Construction Law

- Contract Law

- Browse content in Criminal Law

- Criminal Procedure

- Criminal Evidence Law

- Sentencing and Punishment

- Employment and Labour Law

- Environment and Energy Law

- Browse content in Financial Law

- Banking Law

- Insolvency Law

- History of Law

- Human Rights and Immigration

- Intellectual Property Law

- Browse content in International Law

- Private International Law and Conflict of Laws

- Public International Law

- IT and Communications Law

- Jurisprudence and Philosophy of Law

- Law and Politics

- Law and Society

- Browse content in Legal System and Practice

- Courts and Procedure

- Legal Skills and Practice

- Primary Sources of Law

- Regulation of Legal Profession

- Medical and Healthcare Law

- Browse content in Policing

- Criminal Investigation and Detection

- Police and Security Services

- Police Procedure and Law

- Police Regional Planning

- Browse content in Property Law

- Personal Property Law

- Study and Revision

- Terrorism and National Security Law

- Browse content in Trusts Law

- Wills and Probate or Succession

- Browse content in Medicine and Health

- Browse content in Allied Health Professions

- Arts Therapies

- Clinical Science

- Dietetics and Nutrition

- Occupational Therapy

- Operating Department Practice

- Physiotherapy

- Radiography

- Speech and Language Therapy

- Browse content in Anaesthetics

- General Anaesthesia

- Neuroanaesthesia

- Browse content in Clinical Medicine

- Acute Medicine

- Cardiovascular Medicine

- Clinical Genetics

- Clinical Pharmacology and Therapeutics

- Dermatology

- Endocrinology and Diabetes

- Gastroenterology

- Genito-urinary Medicine

- Geriatric Medicine

- Infectious Diseases

- Medical Toxicology

- Medical Oncology

- Pain Medicine

- Palliative Medicine

- Rehabilitation Medicine

- Respiratory Medicine and Pulmonology

- Rheumatology

- Sleep Medicine

- Sports and Exercise Medicine

- Clinical Neuroscience

- Community Medical Services

- Critical Care

- Emergency Medicine

- Forensic Medicine

- Haematology

- History of Medicine

- Browse content in Medical Dentistry

- Oral and Maxillofacial Surgery

- Paediatric Dentistry

- Restorative Dentistry and Orthodontics

- Surgical Dentistry

- Browse content in Medical Skills

- Clinical Skills

- Communication Skills

- Nursing Skills

- Surgical Skills

- Medical Ethics

- Medical Statistics and Methodology

- Browse content in Neurology

- Clinical Neurophysiology

- Neuropathology

- Nursing Studies

- Browse content in Obstetrics and Gynaecology

- Gynaecology

- Occupational Medicine

- Ophthalmology

- Otolaryngology (ENT)

- Browse content in Paediatrics

- Neonatology

- Browse content in Pathology

- Chemical Pathology

- Clinical Cytogenetics and Molecular Genetics

- Histopathology

- Medical Microbiology and Virology

- Patient Education and Information

- Browse content in Pharmacology

- Psychopharmacology

- Browse content in Popular Health

- Caring for Others

- Complementary and Alternative Medicine

- Self-help and Personal Development

- Browse content in Preclinical Medicine

- Cell Biology

- Molecular Biology and Genetics

- Reproduction, Growth and Development

- Primary Care

- Professional Development in Medicine

- Browse content in Psychiatry

- Addiction Medicine

- Child and Adolescent Psychiatry

- Forensic Psychiatry

- Learning Disabilities

- Old Age Psychiatry

- Psychotherapy

- Browse content in Public Health and Epidemiology

- Epidemiology

- Public Health

- Browse content in Radiology

- Clinical Radiology

- Interventional Radiology

- Nuclear Medicine

- Radiation Oncology

- Reproductive Medicine

- Browse content in Surgery

- Cardiothoracic Surgery

- Gastro-intestinal and Colorectal Surgery

- General Surgery

- Neurosurgery

- Paediatric Surgery

- Peri-operative Care

- Plastic and Reconstructive Surgery

- Surgical Oncology

- Transplant Surgery

- Trauma and Orthopaedic Surgery

- Vascular Surgery

- Browse content in Science and Mathematics

- Browse content in Biological Sciences

- Aquatic Biology

- Biochemistry

- Bioinformatics and Computational Biology

- Developmental Biology

- Ecology and Conservation

- Evolutionary Biology

- Genetics and Genomics

- Microbiology

- Molecular and Cell Biology

- Natural History

- Plant Sciences and Forestry

- Research Methods in Life Sciences

- Structural Biology

- Systems Biology

- Zoology and Animal Sciences

- Browse content in Chemistry

- Analytical Chemistry

- Computational Chemistry

- Crystallography

- Environmental Chemistry

- Industrial Chemistry

- Inorganic Chemistry

- Materials Chemistry

- Medicinal Chemistry

- Mineralogy and Gems

- Organic Chemistry

- Physical Chemistry

- Polymer Chemistry

- Study and Communication Skills in Chemistry

- Theoretical Chemistry

- Browse content in Computer Science

- Artificial Intelligence

- Computer Architecture and Logic Design

- Game Studies

- Human-Computer Interaction

- Mathematical Theory of Computation

- Programming Languages

- Software Engineering

- Systems Analysis and Design

- Virtual Reality

- Browse content in Computing

- Business Applications

- Computer Security

- Computer Games

- Computer Networking and Communications

- Digital Lifestyle

- Graphical and Digital Media Applications

- Operating Systems

- Browse content in Earth Sciences and Geography

- Atmospheric Sciences

- Environmental Geography

- Geology and the Lithosphere

- Maps and Map-making

- Meteorology and Climatology

- Oceanography and Hydrology

- Palaeontology

- Physical Geography and Topography

- Regional Geography

- Soil Science

- Urban Geography

- Browse content in Engineering and Technology

- Agriculture and Farming

- Biological Engineering

- Civil Engineering, Surveying, and Building

- Electronics and Communications Engineering

- Energy Technology

- Engineering (General)

- Environmental Science, Engineering, and Technology

- History of Engineering and Technology

- Mechanical Engineering and Materials

- Technology of Industrial Chemistry

- Transport Technology and Trades

- Browse content in Environmental Science

- Applied Ecology (Environmental Science)

- Conservation of the Environment (Environmental Science)

- Environmental Sustainability

- Environmentalist Thought and Ideology (Environmental Science)

- Management of Land and Natural Resources (Environmental Science)

- Natural Disasters (Environmental Science)

- Nuclear Issues (Environmental Science)

- Pollution and Threats to the Environment (Environmental Science)

- Social Impact of Environmental Issues (Environmental Science)

- History of Science and Technology

- Browse content in Materials Science

- Ceramics and Glasses

- Composite Materials

- Metals, Alloying, and Corrosion

- Nanotechnology

- Browse content in Mathematics

- Applied Mathematics

- Biomathematics and Statistics

- History of Mathematics

- Mathematical Education

- Mathematical Finance

- Mathematical Analysis

- Numerical and Computational Mathematics

- Probability and Statistics

- Pure Mathematics

- Browse content in Neuroscience

- Cognition and Behavioural Neuroscience

- Development of the Nervous System

- Disorders of the Nervous System

- History of Neuroscience

- Invertebrate Neurobiology

- Molecular and Cellular Systems

- Neuroendocrinology and Autonomic Nervous System

- Neuroscientific Techniques

- Sensory and Motor Systems

- Browse content in Physics

- Astronomy and Astrophysics

- Atomic, Molecular, and Optical Physics

- Biological and Medical Physics

- Classical Mechanics

- Computational Physics

- Condensed Matter Physics

- Electromagnetism, Optics, and Acoustics

- History of Physics

- Mathematical and Statistical Physics

- Measurement Science

- Nuclear Physics

- Particles and Fields

- Plasma Physics

- Quantum Physics

- Relativity and Gravitation

- Semiconductor and Mesoscopic Physics

- Browse content in Psychology

- Affective Sciences

- Clinical Psychology

- Cognitive Psychology

- Cognitive Neuroscience

- Criminal and Forensic Psychology

- Developmental Psychology

- Educational Psychology

- Evolutionary Psychology

- Health Psychology

- History and Systems in Psychology

- Music Psychology

- Neuropsychology

- Organizational Psychology

- Psychological Assessment and Testing

- Psychology of Human-Technology Interaction

- Psychology Professional Development and Training

- Research Methods in Psychology

- Social Psychology

- Browse content in Social Sciences

- Browse content in Anthropology

- Anthropology of Religion

- Human Evolution

- Medical Anthropology

- Physical Anthropology

- Regional Anthropology

- Social and Cultural Anthropology

- Theory and Practice of Anthropology

- Browse content in Business and Management

- Business Strategy

- Business Ethics

- Business History

- Business and Government

- Business and Technology

- Business and the Environment

- Comparative Management

- Corporate Governance

- Corporate Social Responsibility

- Entrepreneurship

- Health Management

- Human Resource Management

- Industrial and Employment Relations

- Industry Studies

- Information and Communication Technologies

- International Business

- Knowledge Management

- Management and Management Techniques

- Operations Management

- Organizational Theory and Behaviour

- Pensions and Pension Management

- Public and Nonprofit Management

- Strategic Management

- Supply Chain Management

- Browse content in Criminology and Criminal Justice

- Criminal Justice

- Criminology

- Forms of Crime

- International and Comparative Criminology

- Youth Violence and Juvenile Justice

- Development Studies

- Browse content in Economics

- Agricultural, Environmental, and Natural Resource Economics

- Asian Economics

- Behavioural Finance

- Behavioural Economics and Neuroeconomics

- Econometrics and Mathematical Economics

- Economic Systems

- Economic History

- Economic Methodology

- Economic Development and Growth

- Financial Markets

- Financial Institutions and Services

- General Economics and Teaching

- Health, Education, and Welfare

- History of Economic Thought

- International Economics

- Labour and Demographic Economics

- Law and Economics

- Macroeconomics and Monetary Economics

- Microeconomics

- Public Economics

- Urban, Rural, and Regional Economics

- Welfare Economics

- Browse content in Education

- Adult Education and Continuous Learning

- Care and Counselling of Students

- Early Childhood and Elementary Education

- Educational Equipment and Technology

- Educational Strategies and Policy

- Higher and Further Education

- Organization and Management of Education

- Philosophy and Theory of Education

- Schools Studies

- Secondary Education

- Teaching of a Specific Subject

- Teaching of Specific Groups and Special Educational Needs

- Teaching Skills and Techniques

- Browse content in Environment

- Applied Ecology (Social Science)

- Climate Change

- Conservation of the Environment (Social Science)

- Environmentalist Thought and Ideology (Social Science)

- Natural Disasters (Environment)

- Social Impact of Environmental Issues (Social Science)

- Browse content in Human Geography

- Cultural Geography

- Economic Geography

- Political Geography

- Browse content in Interdisciplinary Studies

- Communication Studies

- Museums, Libraries, and Information Sciences

- Browse content in Politics

- African Politics

- Asian Politics

- Chinese Politics

- Comparative Politics

- Conflict Politics

- Elections and Electoral Studies

- Environmental Politics

- European Union

- Foreign Policy

- Gender and Politics

- Human Rights and Politics

- Indian Politics

- International Relations

- International Organization (Politics)

- International Political Economy

- Irish Politics

- Latin American Politics

- Middle Eastern Politics

- Political Methodology

- Political Communication

- Political Philosophy

- Political Sociology

- Political Behaviour

- Political Economy

- Political Institutions

- Political Theory

- Politics and Law

- Public Administration

- Public Policy

- Quantitative Political Methodology

- Regional Political Studies

- Russian Politics

- Security Studies

- State and Local Government

- UK Politics

- US Politics

- Browse content in Regional and Area Studies

- African Studies

- Asian Studies

- East Asian Studies

- Japanese Studies

- Latin American Studies

- Middle Eastern Studies

- Native American Studies

- Scottish Studies

- Browse content in Research and Information

- Research Methods

- Browse content in Social Work

- Addictions and Substance Misuse

- Adoption and Fostering

- Care of the Elderly

- Child and Adolescent Social Work

- Couple and Family Social Work

- Developmental and Physical Disabilities Social Work

- Direct Practice and Clinical Social Work

- Emergency Services

- Human Behaviour and the Social Environment

- International and Global Issues in Social Work

- Mental and Behavioural Health

- Social Justice and Human Rights

- Social Policy and Advocacy

- Social Work and Crime and Justice

- Social Work Macro Practice

- Social Work Practice Settings

- Social Work Research and Evidence-based Practice

- Welfare and Benefit Systems

- Browse content in Sociology

- Childhood Studies

- Community Development

- Comparative and Historical Sociology

- Economic Sociology

- Gender and Sexuality

- Gerontology and Ageing

- Health, Illness, and Medicine

- Marriage and the Family

- Migration Studies

- Occupations, Professions, and Work

- Organizations

- Population and Demography

- Race and Ethnicity

- Social Theory

- Social Movements and Social Change

- Social Research and Statistics

- Social Stratification, Inequality, and Mobility

- Sociology of Religion

- Sociology of Education

- Sport and Leisure

- Urban and Rural Studies

- Browse content in Warfare and Defence

- Defence Strategy, Planning, and Research

- Land Forces and Warfare

- Military Administration

- Military Life and Institutions

- Naval Forces and Warfare

- Other Warfare and Defence Issues

- Peace Studies and Conflict Resolution

- Weapons and Equipment

Taxation: An Interdisciplinary Approach to Research

- Cite Icon Cite

- Permissions Icon Permissions

Taxation involves complex questions of policy, law, and practice. The book offers an innovative introduction to tax research by combining commentary on disciplinary-based and interdisciplinary approaches. Its objective is to guide and encourage researchers how to produce taxation research that is rigorous and relevant. It comments upon how disciplinary-based approaches to tax research have developed in law, economics, accounting, political science, and social policy. Its authors then go to introduce an inter-disciplinary research approach to taxation research. Effective approaches to research problem definition and research method choice are outlined by leading authors in their fields, and topical studies provide bibliographic surveys of specific areas of tax research. The book provides suggestions of topics, readings, and approaches that are intended to help the new researcher choose ways to begin their tax research. Written by a group of international experts, this book will be essential reading for new researchers in the tax field, including PhD students; for existing researchers wishing to broaden their understanding of taxation; for policymakers wanting to gauge where the leading edge of current tax research lies; and for tax practitioners interested in scholarly contributions to their field of practice.

Signed in as

Institutional accounts.

- GoogleCrawler [DO NOT DELETE]

- Google Scholar Indexing

Personal account

- Sign in with email/username & password

- Get email alerts

- Save searches

- Purchase content

- Activate your purchase/trial code

Institutional access

- Sign in with a library card Sign in with username/password Recommend to your librarian

- Institutional account management

- Get help with access

Access to content on Oxford Academic is often provided through institutional subscriptions and purchases. If you are a member of an institution with an active account, you may be able to access content in one of the following ways:

IP based access

Typically, access is provided across an institutional network to a range of IP addresses. This authentication occurs automatically, and it is not possible to sign out of an IP authenticated account.

Sign in through your institution

Choose this option to get remote access when outside your institution. Shibboleth/Open Athens technology is used to provide single sign-on between your institution’s website and Oxford Academic.

- Click Sign in through your institution.

- Select your institution from the list provided, which will take you to your institution's website to sign in.

- When on the institution site, please use the credentials provided by your institution. Do not use an Oxford Academic personal account.

- Following successful sign in, you will be returned to Oxford Academic.

If your institution is not listed or you cannot sign in to your institution’s website, please contact your librarian or administrator.

Sign in with a library card

Enter your library card number to sign in. If you cannot sign in, please contact your librarian.

Society Members

Society member access to a journal is achieved in one of the following ways:

Sign in through society site

Many societies offer single sign-on between the society website and Oxford Academic. If you see ‘Sign in through society site’ in the sign in pane within a journal:

- Click Sign in through society site.

- When on the society site, please use the credentials provided by that society. Do not use an Oxford Academic personal account.

If you do not have a society account or have forgotten your username or password, please contact your society.

Sign in using a personal account

Some societies use Oxford Academic personal accounts to provide access to their members. See below.

A personal account can be used to get email alerts, save searches, purchase content, and activate subscriptions.

Some societies use Oxford Academic personal accounts to provide access to their members.

Viewing your signed in accounts

Click the account icon in the top right to:

- View your signed in personal account and access account management features.

- View the institutional accounts that are providing access.

Signed in but can't access content

Oxford Academic is home to a wide variety of products. The institutional subscription may not cover the content that you are trying to access. If you believe you should have access to that content, please contact your librarian.

For librarians and administrators, your personal account also provides access to institutional account management. Here you will find options to view and activate subscriptions, manage institutional settings and access options, access usage statistics, and more.

Our books are available by subscription or purchase to libraries and institutions.

- About Oxford Academic

- Publish journals with us

- University press partners

- What we publish

- New features

- Open access

- Rights and permissions

- Accessibility

- Advertising

- Media enquiries

- Oxford University Press

- Oxford Languages

- University of Oxford

Oxford University Press is a department of the University of Oxford. It furthers the University's objective of excellence in research, scholarship, and education by publishing worldwide

- Copyright © 2024 Oxford University Press

- Cookie settings

- Cookie policy

- Privacy policy

- Legal notice

This Feature Is Available To Subscribers Only

Sign In or Create an Account

This PDF is available to Subscribers Only

For full access to this pdf, sign in to an existing account, or purchase an annual subscription.

How to Conduct Federal Tax Research

IN THIS ARTICLE

What is tax research and why is it necessary?

What tax research methodology should i use, how can i conduct tax research if i’m new to the topic or issue, how should i use technology to improve my tax research.

[Learn more about Bloomberg Tax Research tools to help you recommend and make the right tax planning decisions and strategies.]

Why is tax research so important? Because it’s impossible to memorize the entire Internal Revenue Code (IRC) and the way it changes over time. Add to that the regulations and other interpretive rules that are necessary to implement the statutory rules of the IRC, and it can be extremely difficult to find everything you need to effectively communicate your findings to stakeholders. And that’s only federal tax law.

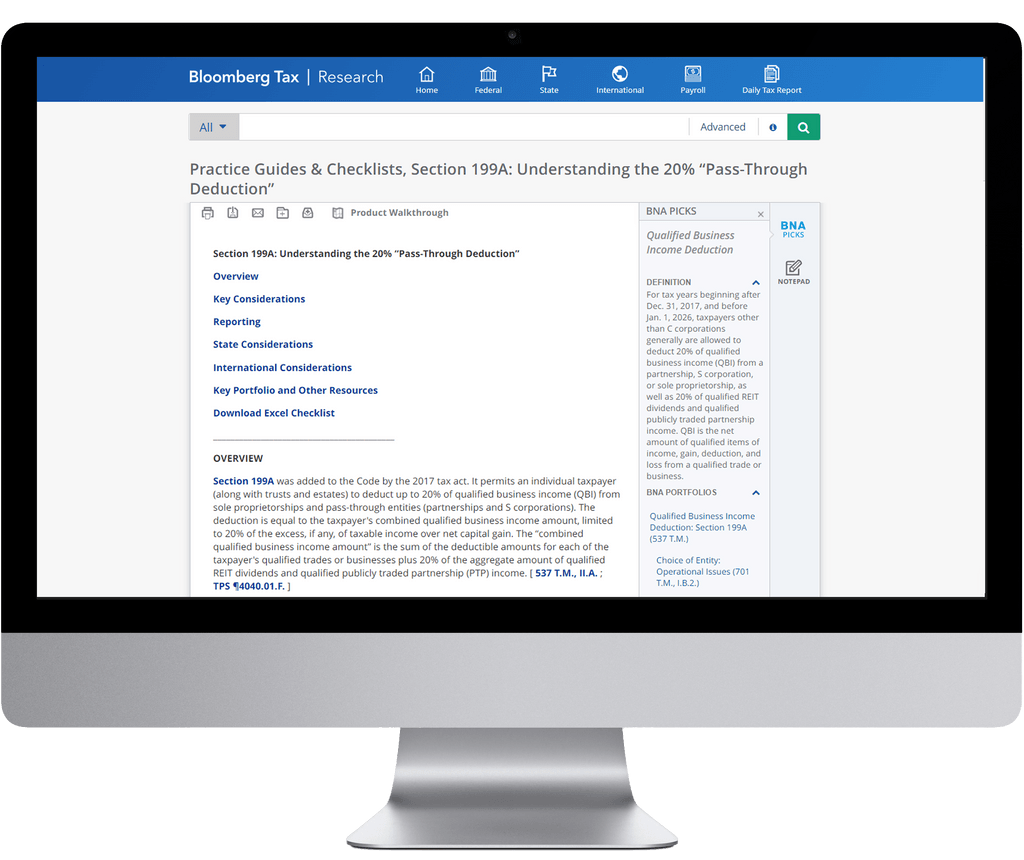

That’s why even experienced tax professionals turn to a comprehensive resource like Bloomberg Tax Research as they go through the steps of the tax research process. Bloomberg Tax Research pairs the proven expertise and perspective of its network of 1,000+ leading tax practitioners in our renowned Tax Management Portfolios with integrated news, in-depth analysis and insights, primary sources, and practice tools to help you understand complex tax topics and make informed decisions.

As the source for the most comprehensive and practical analysis of more than 500 tax and accounting topics, Bloomberg Tax Management Portfolios give you objective and balanced perspectives as well as real-world insights and guidance to help you complete your research.

[Bloomberg Tax Management Portfolios integrate expert analysis and guidance with primary sources, practice tools, and news to enhance and accelerate your search. Complete a demo to receive a free portfolio .]

The purpose of tax research is to help you properly define the tax effect or impact of certain tax positions. The results help your company and/or your clients make informed decisions for tax strategies, planning, and compliance. Tax research can also help you prepare for an IRS audit.

Tax research identifies relevant binding and persuasive authorities for a specific point of tax law or issue. For tax issues, this includes legislative, administrative, and judicial authorities.

When you conduct tax research, you’re looking for binding authorities (also known as controlling or mandatory authorities) and persuasive authorities. Binding authorities are anything that a court must follow (such as constitutions, legislation, and some court decisions depending on the jurisdiction) because they bind the court. Persuasive authorities are anything that the court may follow (including some cases, statutes, and regulations, but also opinions, law review articles, and other secondary sources) but does not have to follow.

There’s another categorization as well. Primary sources are source law such as statutes, regulations, and case law. Secondary sources are discussions of source law such as law review articles.

Given all the different sources of information you’ll need for your research, the most efficient way to approach it is to rely on a comprehensive resource that brings together everything you need in one place.

When a complex question comes up, we can start with the code, go to the regulations, build an argument and be able to support and document it – all made possible by the tools within the Bloomberg Tax platform.

It’s important to follow proven steps for conducting tax research. Following a trusted process can help you make sure you’ve done your due diligence when researching tax issues.

The steps for tax research include:

- Identifying and defining the facts and issues

- Collecting relevant authorities

- Analyzing the research

- Developing conclusions and recommendations

- Communicating the results

Fortunately, there is a one-stop resources available that make it easier and faster to conduct your tax research, leaving you more time to develop your conclusion and communicate recommendations. Bloomberg Tax Management Portfolios can help you complete the tax research process with confidence by providing comprehensive and practical analysis on the issue you’re researching.

Our Tax Management Portfolios help you understand the potential implications and considerations for both tax and nontax issues. You get commentary as well as citations to relevant authorities – from statutes to cases to administrative pronouncements.

Bloomberg Tax also goes beyond simple citations by integrating with our advanced research tools, including:

- BCite: A proprietary case citator for detailed analysis and updated information on tax cases, relevant court opinions, strength of authority, and the judicial history of a case to ensure it remains good law.

- Points of Law: Leverages machine learning and our database of court opinions to quickly finds the best language to support legal arguments. It includes links to other relevant case law, the citation map, and related points of law.

- Versions Compare: Easily compare current and prior Treasury regulations and the Internal Revenue Code with a redlined side-by-side view.

The portfolios are particularly helpful and save considerable time in researching a niche question related to a broader practice area. Instead of trying to read through separate treatises, the IRC , or cases, you can get up to speed with practical analysis before drilling down into the most relevant primary sources.

The first steps in the tax research process are to analyze the available facts, pinpoint the legal issues involved, and formulate an appropriate tax question (or questions) to be researched. But what if you don’t have enough knowledge to be able to identify the specific issues to research?

That’s where it helps to have explanations and analysis from more than 1,000 expert tax practitioners at your fingertips. You can start with an overview of the more general topic in Bloomberg Tax Management Portfolios or Tax Practice Series.

The overview can help you formulate initial keywords and phrases to further explore the topic. Extensive planning points, practical examples, what-if scenarios, and comments by our expert authors help you confidently navigate and understand the issue.

Then, you can find the latest news on the topic from the Daily Tax Report , a comprehensive source for news on federal, state, and international legislative, regulatory, and judicial tax-related developments, including pensions and accounting. Daily Tax Report’s extensive network of Capitol Hill reporters and national correspondents keep you up to date with the news that impacts your company and clients as it happens.

With the Federal Tax Developments Tracker, you can track administrative documents, cases, legislation, and regulation across a wide breadth of topics in a concise summary that links to the source document. It’s the most timely and up-to-date place to find federal tax developments

Our practice guides are another place to gain a baseline understanding of a topic. These concise, easy-to-use, practitioner-written guides give you a quick overview of a topic. They’re linked to relevant Tax Management Portfolios for a deeper dive, and contain downloadable checklists.

With Bloomberg Tax, we can conduct our own research, write a position paper, and develop a conclusion before asking for a review or opinion from an external advisor.

While the internet contains nearly 5 million terabytes of data, you shouldn’t rely on a service like Google for your tax research. That’s because Google doesn’t vet the information it’s indexing. There are no standards for quality and accuracy. There’s also no curation of content to make sure it’s relevant, up to date, and from trusted sources.

Which is why research technology specifically developed and managed for tax professionals will always be the most efficient, expedient, and comprehensive approach to tax research. Bloomberg Tax Research is a comprehensive tax research and planning solution designed by tax practitioners for tax practitioners.

With Bloomberg Tax Research, you can improve your research by:

- Quickly navigating between the IRC, analysis, and related tax research tools

- Using Practice Guides & Checklists for a quick overview of the topic

- Relying on the BCite citatory tool to help you document your research and conclusions

- Reading Daily Tax Report to stay up to date with the news as it happens

- Staying current with trackers to automate and track upcoming legislation and changes

Corporate Tax Resources

What is the oecd multilateral instrument.

As companies and nations aim to avoid disputes over international taxes, the multilateral instrument (MLI) aims to preserve the role of bilateral income tax tre...

What Qualifies for Business Energy Tax Credits?

The Inflation Reduction Act introduced a variety of new corporate energy tax credits and deductions. See what qualifies for federal energy tax credits in 2023.

Inflation Reduction Act: New Corporate Alternative Minimum Tax and Tax Credits

The Inflation Reduction Act imposed a new corporate alternative minimum tax and expanded tax credits. This article details key corporate tax planning takeaways.

By clicking submit, I agree to the privacy policy .

This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

- CAMPUS TO CLIENTS

Practice and policy insights from academic tax research

- Practice Management & Professional Standards

- IRS Practice & Procedure

Editor: Annette Nellen, Esq., CPA, CGMA

In the continued spirit of bridging the gap between tax academics and tax practitioners, for the third year in a row, this column features examples of published academic tax research (see Meade, “ Campus to Clients: Academic Research for Your Practice Consideration ,” 52 The Tax Adviser 526 (August 2021), and Meade, “ Campus to Clients: Practitioners Can Benefit From Academic Tax Research ,” 51 The Tax Adviser 532 (August 2020)). The papers were selected by the External Relations Committee of the American Taxation Association (ATA) with the aim of sharing research that is relevant and of interest to practitioners. The ATA is the leading organization of tax academics, and the External Relations Committee aims to connect with tax professionals.

The five articles selected for this column highlight the wide breadth of topics and methodologies found in academic tax literature. Topics within academic tax literature that may be of interest to practitioners include tax policy, corporate and individual taxpayer behavior, effects of tax on stakeholders, tax accounting issues, and tax data analysis. Researchers provide valuable guidance on tax policy by providing insight on potential policy changes as well as feedback on existing policy.

Many academic tax papers examine corporate behavior using publicly available data such as annual reports, stock prices, rankings, and other sources of information. Studies of individual taxpayers are also common, with researchers conducting experiments or developing creative uses of public data. Federal, state, and international tax issues are often examined, as well as the impact of nontax developments on tax policy and behavior.

As with most academic research, these five articles were subject to a rigorous development and review process as outlined in the earlier columns. Researchers generally get input from peers on their “working paper” by presenting their thesis, approach, and initial findings at campus forums and conferences such as those sponsored by the American Accounting Association (AAA). Most articles undergo thorough blind peer review. Reviewers often call for some revisions, such as for clarification or deeper analysis, for the paper to be accepted for publication. The academic publishing world is often harsh, as many papers are rejected under these rigorous standards for research approach, content, novelty, and timeliness.

Of the articles summarized here, one was in a tax-specific journal, while the others come from broader accounting journals, including one focused on accounting history.

‘The Effects of Income Tax Timing on Retirement Investment Decisions’

Withdrawals from a tax-deferred (i.e., traditional) individual retirement account (IRA) or 401(k) are taxable, making the account’s after-tax value less than the nominal value appearing on a quarterly or annual account statement. This future tax liability’s salience is weak for most individuals, which may cause them to overestimate their after-tax retirement savings. Roth IRA accounts are not affected in this way because withdrawals from them generally are tax-free.

In their article published in the March 2021 issue of The Accounting Review (Vol. 96, Issue 2), Shane Stinson, Marcus Doxey, and Timothy Rupert hypothesize that individuals’ inclination to overestimate a tax-deferred account’s after-tax value may cause them to believe that it will be easier to meet their future cash flow needs than is the case. Such an individual therefore may see less of a need to generate a higher return than does an individual holding a Roth account with the same after-tax value, so investments held in tax-deferred accounts may be lower-risk, and thus lower-return, than investments held in Roth accounts.

The authors conducted an experiment to test this hypothesis. Participants allocated an account’s balance between two investments, where one of them had lower risk and a lower expected return than the other. Some participants had a tax-deferred account, while others had a Roth account. The two types of accounts had similar after-tax values. After controlling for participants’ risk preferences, the authors found that, compared with Roth account holders, tax-deferred account holders had higher estimates of their future after-tax balances, allocated more of their account to the lower-risk, lower-return investment, and perceived less difficulty in meeting their after-tax goal for retirement savings. These results are consistent with the authors’ hypothesis.

Additional parts of the experiment tested whether various interventions mitigate individuals’ inclination to take on less risk with a tax-deferred account. The authors found that tax-deferred account holders allocated more of their savings to higher-risk, higher-return investments when their retirement savings goal was stated in pretax dollars, when they had to estimate their final tax liability, and when they were given feedback about their progress toward saving for retirement. The authors also found that the effect was stronger when multiple interventions were applied simultaneously. Tax advisers and financial planning professionals are well positioned to provide such interventions, and the results of the authors’ experiment suggest that the interventions will have beneficial effects.

‘The Possible Weakening of Financial Accounting From Tax Reforms’

The objective of financial accounting is to provide information about a firm’s economic performance to shareholders and other external stakeholders. The objective of the federal income tax is to raise revenue and to provide various economic incentives to taxpayers. Because these objectives differ, a firm’s book income, which is determined under financial accounting rules, sometimes is greater than its taxable income, which is determined under tax law. This outcome can seem inappropriate to many taxpayers. Several proposals have been made in recent years to more closely link taxable income to book income, and the recently enacted Inflation Reduction Act of 2022, P.L. 117-169, includes a 15% minimum tax for large corporations that is based on adjusted financial statement income.

In her Presidential Scholar address to the AAA, which was published in the September 2021 issue of The Accounting Review (Vol. 96, Issue 5), Michelle Hanlon discusses several issues that are pertinent to such proposals. She notes that there could be full linkage, where book income is used as taxable income. There instead could be partial linkage, such as the business untaxed reported profits (BURP) adjustment that applied in the latter 1980s. Hanlon notes that the implementation of partial or full linkage is more complicated than many people realize because of such issues as net operating losses and controlled foreign corporations.

Hanlon reviews research on the financial reporting effects of linking book income and taxable income, such as during the BURP adjustment’s brief life and international differences in book-tax linkages. The evidence generally indicates that firms are more likely to alter their financial reporting to attain tax objectives when book-tax linkages are stronger, and this leads to a book income that is less informative for capital market participants. While these research results are not surprising to accountants, they seem to be underappreciated by the economists and lawyers who advise policymakers. Hanlon notes that there is not much research on these financial reporting effects and advocates for more of it.

Hanlon concludes that linking taxable income more closely to book income would be unwise because it likely would impair the quality of financial reporting. The capital market costs of such impaired quality are not easy to discern but are nonetheless real. In addition, increased book-tax linkages could tempt Congress to play a stronger role in financial reporting standard setting because of the tax effects. Whether or not one agrees with Hanlon’s conclusions, her discussion of the pertinent issues does an excellent job of better educating the reader about them.

‘Transparency and Tax Evasion: Evidence From the Foreign Account Tax Compliance Act (FATCA)’

The Foreign Account Tax Compliance Act (FATCA) was enacted in 2010 (as part of the Hiring Incentives to Restore Employment Act, P.L. 111-147) to limit U.S. individuals’ ability to evade U.S. tax through the use of offshore accounts. The act requires automatic information transfers to the IRS about foreign account and cross-border payments by foreign financial institutions (FFIs). Prior to FATCA, FFIs were subject to self-reporting requirements under the qualified intermediary program established in 2001. The IRS estimated that $458 billion of annual offshore income was unreported in the years leading up to the passage of FATCA (IRS, “ The Tax Gap — Tax Gap Estimates for Tax Years 2008–2010 ”).

In their 2020 article in The Journal of Accounting Research (Vol. 58, Issue 1), Lisa DeSimone, Rebecca Lester, and Kevin Markle examine how U.S. individuals responded to the passage of FATCA. The shift from self-reporting under the prior rules to automatic third-party reporting increased the perceived and actual risk of detection, which should reduce the level of tax evasion. However, the costs of evasion could remain below the tax savings from the use of offshore accounts, resulting in continued evasion through such accounts.

The actual amount of hidden offshore assets held by U.S. investors is unobservable. To measure the effects of FATCA, the study uses “round-tripping” behavior, in which assets hidden in foreign accounts are invested back in the United States. Specifically, foreign portfolio investment by individual investors into the United States from tax havens, relative to other countries, measures the inbound investment part of the “round trip.” The amount of inbound equity investment to the United States from tax havens declined by $7.8 billion to $15.3 billion in the years following FATCA, consistent with U.S. investors’ moving financial assets out of tax havens following the rule change.

To avoid FATCA, U.S. citizens may renounce their citizenship. The authors observed a large increase in expatriations following FATCA. Investments in alternative investments that are not subject to FATCA appear to have increased following FATCA, specifically, European collective investment vehicles, real estate, and art. Taken together, these results show U.S. individuals’ behavior regarding investment location and allocation decisions changed in response to FATCA.

The study highlights an intended consequence of FATCA, specifically, the reduction of the use of offshore accounts in tax havens to avoid U.S. tax. While this is considered progress, the use of offshore accounts for tax evasion remains. As with many tax rules, unintended consequences have also been observed, in that U.S. citizens avoid the FATCA requirements in a variety of ways, including renouncing their citizenship and investing in assets not subject to FATCA. These are important considerations for policymakers moving forward with third-party reporting regimes.

‘SALTy Citizens: Which State and Local Taxes Contribute to State-to-State Migration?’

Although there are many reasons for people to relocate across state lines, it is an open question whether, how much, and which type of taxes affect individuals’ decisions on which state to reside in. In their 2021 article in The Journal of the American Taxation Association (Vol. 43, Issue 1), Amy M. Hageman, Sean W.G. Robb, and Jason M. Schwebke study the impact of taxes on location decisions by specifically investigating which state and local taxes are most associated with state-to-state movement of individuals.

Several studies have considered the relationship between taxes and state migration, with mixed results and limited sample composition. For example, one study (Young and Varner, “Millionaire Migration and State Taxation of Top Incomes: Evidence From a Natural Experiment,” 64 National Tax Journal 255 (2011)) found little evidence that taxes have any effect on the change in migration patterns for millionaires within New Jersey. However, another study (Cebula, “Migration and the Tiebout-Tullock Hypothesis Revisited,” 68 American Journal of Economics and Sociology 541 (2009)) concludes that people tend to be attracted to lower state income and property tax burdens.

The authors examine the tax-effect question by hypothesizing that there will be a greater decrease in population in states that have a higher overall burden of death/gift, sales, and property taxes. They test their hypotheses by using regression models that separately compare the net migration at the state level against each of the tax burdens. They find that states with higher taxes tend to be associated with greater out-migration. They also find, when combining all the tax burdens into one model, that property and some types of sales (selective sales) taxes are the most significant. When examining the economic impact on migration from these two taxes, they find that a one-standard-deviation increase in net migration is associated with a $12.99 and $126.73 per capita decrease in selective and property taxes, respectively, collected.

State and local policymakers would find this paper of interest as they consider the degree and type of taxation levied on residents. It is important to have the revenues to fund services and projects but at the same time recognize that an increase in taxes is associated with a decrease in overall tax participants. This paper provides some quantitative analysis that can help determine the right mix of taxes and services. Further, businesses can use this information when they consider where to locate operations to best attract talent and employees.

‘Six Decades of US Tax Reform: Why Has the Average Couple’s Tax Burden Increased?’

The IRS and many other federal and state offices and agencies collect a lot of data, typically reported as raw data, such as how many returns are filed by individuals within various income ranges. What is not always seen is a lot of analysis of this data in ways that provide insights into historical trends and possible improvements to the laws to which the data relates.

In a 2021 article published in the Accounting Historians Journal (Vol. 48, No. 2), James M. Plečnik and Shan Wang report on their findings from research and tax calculations performed for 1955 through 2018. The researchers reviewed the tax laws applicable to a hypothetical median-income married couple with no dependents and income beyond eligibility for the earned income tax credit. This research involved finding the standard deduction, personal exemption, married-filing-jointly tax rate structure, and any special temporary relief provided to individuals, all for over 60 years. They also researched payroll tax information for the years under review. U.S. Census Bureau data was used to determine the median income for the couple, which ranged from $4,421 in 1955 to $80,663 in 2018.

With this income and payroll tax information (for both employee and employer, after tax), the researchers measured for all years the effective income tax rate (EITR) and the effective tax rate (ETR). The ETR includes both income and payroll taxes borne by the median-income couple. The authors found that the EITRs have decreased but ETRs have increased. They also observe that federal tax collections relative to GDP have been mostly constant over the past decades. They conclude that with payroll taxes included in the ETR analysis, there is a higher overall tax burden for the middle-class demographic studied.

The findings are a good reminder that employees bear federal taxes beyond what is reported on their Form 1040, U.S. Individual Income Tax Return , and how a distorted picture results for taxpayers and policymakers when the somewhat hidden payroll taxes are omitted from reports on tax incidence and ETRs. The article also includes interesting lists of the major individual tax changes enacted during each presidency from that of Dwight Eisenhower to Donald Trump’s.

Practice relevance

The five articles summarized here are a small portion of the tax research produced by tax faculty annually. When practitioners visit campuses or otherwise interact with faculty, we encourage them to ask faculty about their research. Academics will benefit from additional insights into how that research relates to practice, and we believe practitioners will gain insights that can help in their planning and advocacy work.

Contributors

David Hulse, Ph.D., is an emeritus professor at the University of Kentucky in Lexington, Ky.; Kerry Inger, CPA, Ph.D., is an associate professor at Auburn University in Auburn, Ala.; Annette Nellen, Esq., CPA, CGMA, is a professor in the Department of Accounting and Finance at San José State University in San José, Calif., and is a past chair of the AICPA Tax Executive Committee; and Mitchell Oler, CPA, Ph.D., is a department chair and associate professor at the University of Wyoming in Laramie, Wyo. For more information about this column, contact [email protected] .

A $10.7 million compensation deduction miss

Short-term relief for foreign tax credit woes, irs rules that conversion of llc not a debt modification, a look at revised form 8308, state responses to federal changes to sec. 174.

This article discusses the history of the deduction of business meal expenses and the new rules under the TCJA and the regulations and provides a framework for documenting and substantiating the deduction.

PRACTICE MANAGEMENT

CPAs assess how their return preparation products performed.

Research Overview

Specialized tax research platforms & resources, learning tax research, federal tax statutes, federal legislative history, federal tax regulations, other irs guidance, u.s. tax court, u.s. department of justice -- tax division, treatises, books, and reporters, databases for finding tax-related scholarship (and other types of articles), specific tax journals, tax policy think tanks, online resources, other research guides, contact us, getting started.

This guide is designed to help you find laws and information on tax law issues. Although it focuses on U.S. federal tax law, it does include some information on state and local tax matters as well as some non -U.S. tax information.

The purpose of this guide is to introduce you to a number of useful tax law resources and get you started in the right direction. Legal research requires analysis and synthesis of information, and no one resource will likely provide complete information or data on any given topic.

For many of these databases, you will need to use your Harvard Key to authenticate yourself as a Harvard or HLS-affiliate. For others, you may need to register and create an account to gain access ( e.g. , Lexis, Westlaw, and Bloomberg Law). If you have any trouble accessing a database, please contact the library.

In addition, you should consider looking at the following tax-centric research platforms/resources:

- Checkpoint (Thomson Reuters) Tax topics include federal, state, international, pension & benefits, estate planning, payroll, and more. Includes the US Tax Reporter (also available on Westlaw). NOTE: HLS-Affiliates (students, faculty & staff) can use the 1st link in the HOLLIS record for general access to Checkpoint (after providing their HLSMe credentials). If STUDENTS would like to create a personal account (to save searches, create alerts, etc.), they can do so by clicking on the 2nd link in the HOLLIS record. If FACULTY or STAFF would like to create a personal account, they should contact Lisa Lilliott Rydin at [email protected].

- Cheetah (Wolters Kluwer) Cheetah for Tax Law combines authoritative content, expert analysis, practice tools, and current awareness for legal tax professionals to gain insights on today’s most challenging tax matters. (Formerly known as Intelliconnect.) Includes the Standard Federal Tax Reporter Available online using the "View Online" link in the HOLLIS record above.

- TaxNotes - Federal Available online using the "View Online" link in the HOLLIS record above. NOTE: You must first create an account using an HLS-networked computer. This can be done on-campus or remotely by using a VPN connection.

- Tax Notes - State Available online using the "View Online" link in the HOLLIS record above. NOTE: You must first create an account using an HLS-networked computer. This can be done on-campus or remotely by using a VPN connection.

- Tax Notes - International Available online using the "View Online" link in the HOLLIS record above. NOTE: You must first create an account using an HLS-networked computer. This can be done on-campus or remotely by using a VPN connection.

- IBFD - Tax Research Platform Global tax database, including country-specific tax guides, primary sources of law, tax treaties, global tax topics, books, journal articles and papers. Available online using the "View Online" link in the HOLLIS record above.

- Getting the Deal Through (Lexology) Not exactly a "research platform" but the Getting the Deal Through (GTDT) module of Lexology lets you quickly compare laws across different countries and includes such Topics as "State and Local Taxes," "Tax Controversy" and "Tax on Inbound Investment."

- Organisation for Economic Co-operation and Development (OECD) -- Tax Tax information, data, and other information regarding OECD member countries.

- European Commission -- Taxation and Customs Union Information on EU tax policies.

Below are some books that can help you better understand how Tax Law resources are organized and where you can find them.

- Federal Tax Research, by William A. Raabe KF241.T38 W47 2006x (Reference)

- Federal Tax Research: Guide to Materials and Techniques, by Gail Levin Richmond & Kevin M. Yamamoto KF241 .T38 R53 2018 (Reference)

- Federal Tax Research, by Joni Larson & Dan Sheaffer KF241 .T38 L37 2011 (Reference)

Primary Sources/Federal Government Resources

- U.S. Code (official U.S. federal government site) See "Title 26" for the Internal Revenue Code (a/k/a "The Code").

- U.S. Code (Legal Information Institute, at Cornell University) An alternative site for the U.S. Code (again, Title 26).

In addition to standard legislative history resources (e.g., ProQuest Congressional's Legislative Insight for federal legislative history), you should check out:

- Taxation & Economic Reform in America, Parts I & II (HeinOnline) This historical archive contains thousands of volumes and millions of pages of legislative history materials and other documents. It includes the complete Carlton Fox Collection which contains nearly 42 years of historical legislation related to the internal revenue laws from 1909-1950, as well as other legislative histories related to taxation, economic reform, and stimulus plans.

- The Joint Committee on Taxation's "Blue Book" Not exactly "legislative history".... At the end of each Congress, the Joint Committee Staff, in consultation with the staffs of the House Committee on Ways and Means and the Senate Committee on Finance, prepare explanations of the enacted tax legislation. The explanation follows the chronological order of the tax legislation as signed into law. For each provision, the document includes a description of present law, explanation of the provision, and effective date. Present law describes the law in effect immediately prior to enactment. It does not reflect changes to the law made by the provision or subsequent to the enactment of the provision. For many provisions, the reasons for change are also included.

- Old Editions of the Standard Federal Tax Reporter (HeinOnline) PDFs of the superseded, loose-leaf volumes (1917-1985).

- Code of Federal Regulations (official U.S. federal government site) Final IRS regulations can be found in Title 26 of the CFR. This compilation of regulations is updated annually, on a staggered basis.

- e-CFR An alternative site for final federal regulations (this compilation, while not "official" is more user-friendly and updated faster). Tax regulations still under "Title 26."

The Federal Register is where all federal agency rules and regulations are initially published (when first proposed -- perhaps re-proposed -- and later finalized). Agencies are required to include summaries of proposed regulations and the public comments received thereon, as well as an agency's reaction to the public comments when finalizing a regulation. This is typically done in the preamble to a finalized or re-proposed regulation.

- Federal Register The official government source for the Federal Register.

- FederalRegister.gov The Office of the Federal Register (OFR) of the National Archives and Records Administration (NARA), and the U.S. Government Publishing Office (GPO) jointly administer the FederalRegister.gov website. This website was developed to make it easier for citizens and communities to understand the regulatory process and to participate in Government decision-making.

- Internal Revenue Bulletins The Internal Revenue Bulletin (IRB) is the official publication for announcing Revenue Rulings, Revenue Procedures, Notices & Announcement. These are directed to all taxpayers and may be relied upon. The IRB is published weekly and through 2008 was consolidated into semi-annual Cumulative Bulletins (CB).

NOTE: IRS guidance/rulings requested by individual taxpayers ( e.g. , Private Letter Rulings, Technical Advice Memoranda, and Chief Counsel Advice) may not be relied upon by others and are not published in the IRB.

Nevertheless, they may provide insight regarding the IRS's views on various matters. They may be obtained by the public via FOIA requests and can often be found on the IRS.gov (see the IRS's FOIA Library ) or by using commercial legal research platforms.

The IRS website is not the easiest site to navigate but it does contain a lot of useful information. For example:

- Understanding IRS Guidance -- A Brief Primer Explains the difference between Regulations, Revenue Rulings, Revenue Procedures, Private Letter Rulings, Technical Advice Memoranda, Notices, and Announcements.

- Forms, Instructions, and Publications IRS Publications (on a variety of tax topics) and the Instructions to IRS Forms can often help you understand the IRS's view of tax laws. Keep in mind that these are NOT primary sources of law; however, they can be helpful.

- Tax Code, Regulations, and Official Guidance NOTE: It appears this information is no longer being updated by the IRS; however, you may be able to find useful historical information.

- Basic Tools for Tax Professionals A collection of IRS links likely to be of use to a tax professional, including a link to the Internal Revenue Manual.

- Internal Revenue Manual How the IRS is organized and how it operates. For example, procedures for examining returns, conducting audits, "Offers in Compromise," technical guidelines, etc.

- Tax Statistics Here you will find a wide range of tables, articles, and data that describe and measure elements of the U.S. tax system.

- Tax Topics Source for general individual and business tax information.

- FAQs Frequently Asked Questions (and their answers).