Introduction to Amex Airline Credit

Eligible amex cards for airline credit, selecting an airline for your credit, eligible expenses covered by the credit, how to use your amex airline credit, maximizing your amex airline credit: a complete guide.

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Hilton Honors American Express Aspire Card. The details for these products have not been reviewed or provided by the issuer.

- Several premium American Express cards offer airline incidental fee credits** as a benefit.

- Purchases that officially qualify include checked bag fees, seat selection fees, and lounge passes.

- You'll receive statement credits up to a maximum per year after you make a qualifying purchase.

Overview of the Airline Fee Credit

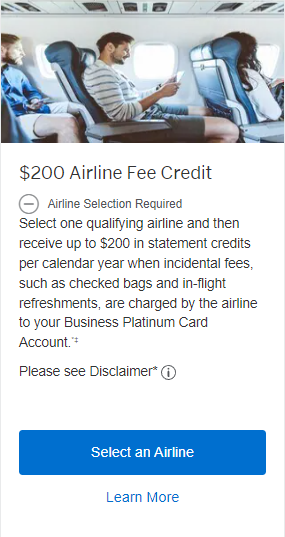

One of the most valuable benefits offered by premium American Express cards like The Platinum Card® from American Express , The Business Platinum Card® from American Express , and Hilton Honors American Express Aspire Card is a yearly airline incidental fee credit. When you use your card to pay for extras like checked baggage, seat selection, or inflight purchases on one eligible airline of your choice, you'll receive a statement credit toward the charge, up to a certain amount each year.

Benefits of the Airline Credit

The maximum airline fee credits you can receive varies by card, but in all cases, the benefit resets at the end of the calendar year . They don't roll over to the next year; if you don't use them, you lose them.

Here's where things get a little tricky: American Express only publishes a partial list of airline fees that qualify for reimbursement. And although the terms and conditions for the benefit specifically exclude certain types of airline purchases, some cardholders have had success triggering the credit with transactions that aren't listed as eligible.

Cards Offering Airline Fee Credit

Depending on the Amex card you have, you'll receive up to a specified amount in airline incidental fee credits on your selected airline:

- The Platinum Card® from American Express — Up to $200 per calendar year

- The Business Platinum Card® from American Express — Up to $200 per calendar year

- Hilton Honors American Express Aspire Card — Up to $250 per calendar year

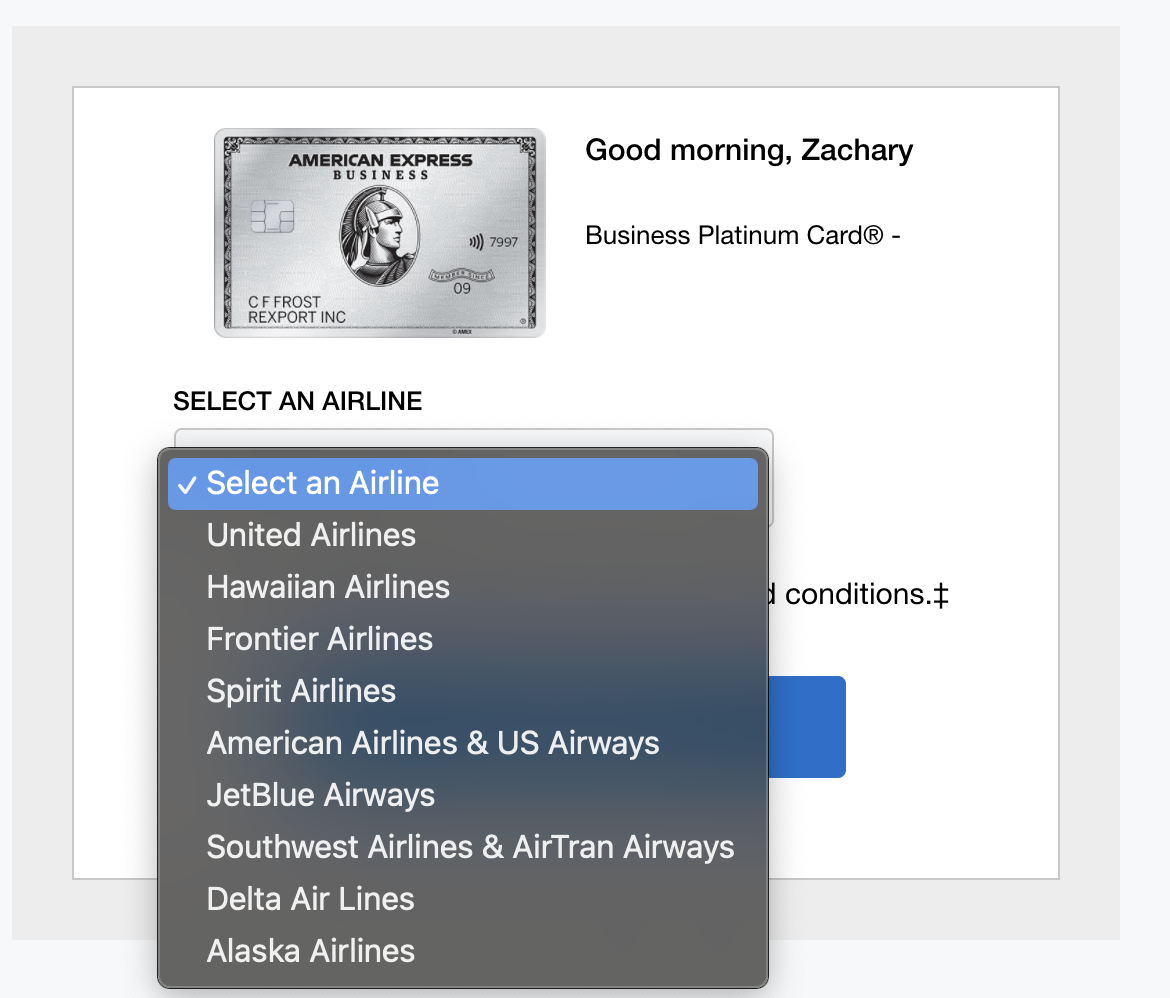

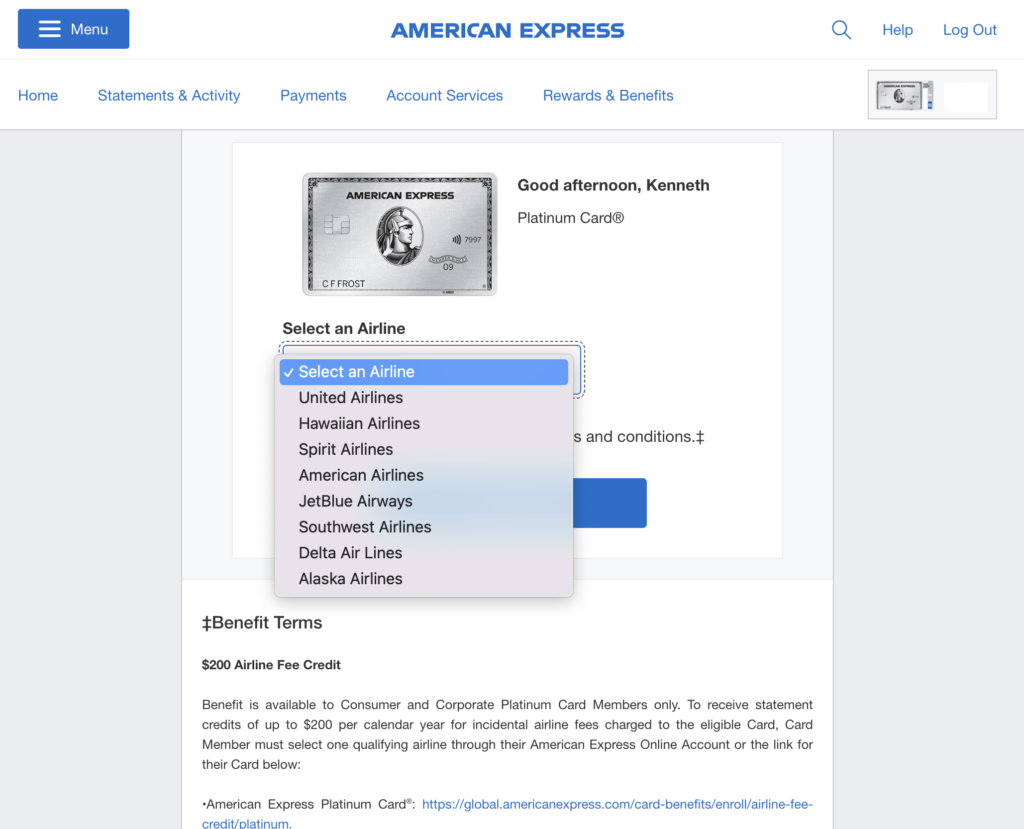

When you open the card, Amex allows you to choose one airline from a list with which to use the credit, and you can change your selection each January. You can make your selection under the "Benefits" section in your Amex online account, through online chat, or by calling the number on the back of your card.

Changing Your Selected Airline

Unofficially, it's possible to change your airline even if it's not January — in the past, many cardholders (self included) have been able to do so easily via online chat — but there's no guarantee this will always work. This can be handy if you've had a change of travel plans, or if it's near the end of the year and you want to use up the credit before it expires.

Once you've made your choice, you'll receive a statement credit toward eligible purchases made with the card on your selected airline, up to the yearly limit. The reimbursement typically posts within a few days of the transaction, although the terms say it can take up to four weeks.

Amex relies on airline transaction data to determine if a charge qualifies for the credit, so if you don't see a statement credit after four weeks, use online chat or call the number on the back of your card for help.

In-flight Purchases

American Express is very clear about what will not qualify for the airline incidental fee reimbursement. According to the terms and conditions, you won't receive a credit for these types of purchases:

- Airline tickets (basically, airfare)

- Mileage points purchases

- Mileage points transfer fees

- Duty-free purchases

- Award tickets

However, these exclusions haven't always been strictly enforced. For example, until mid-2019, gift card purchases from some airlines would trigger the reimbursement even though they weren't technically allowed. And some cardholders have reported receiving the credit for cheap airfare purchases (typically less than $100) on certain airlines. That doesn't mean similar purchases will work for you, so proceed with caution if you use the card to pay for a fee that isn't explicitly included.

Officially, the airline incidental fee credit reimbursement will cover the following charges:

- Checked baggage fees (including overweight and oversize fees)

- Itinerary change fees

- Phone reservation fees

- Pet flight fees

- Seat assignment fees

- In-flight amenity fees (beverages, food, pillows and blankets, headphones)

- Inflight entertainment fees (excluding wireless internet, which isn't usually charged by the airline)

- Airport lounge day passes and annual memberships

Anecdotal reports from cardmembers suggest other incidental fees — not mentioned by Amex — are also eligible, including priority boarding, award ticket cancellation, and mileage-redeposit fees. However, be aware that because such fees are not on the official list, you may have trouble getting reimbursement if it doesn't appear automatically.

Remember, these purchases only qualify if they're with your selected airline.

Some people still aren't traveling as much as they used to, so cardholders might find themselves unable to use all of their Amex airline fee credits right now. Because these credits are a good way to partially offset the hefty annual fees on these cards , it's natural to want to maximize them before they reset at the end of the year.

Even if you don't have immediate travel plans, here are a few options (all of which are officially eligible) for using up your Amex airline fee credit:

- Pre-pay for checked baggage fees, seat assignment fees, or pet fees for flights you've booked later in the year (note that this won't work if you pay the fees at the same time you book the ticket — it has to be a separate charge)

- Buy airport lounge passes for yourself or as a gift to use in the future (just be mindful of expiration dates)

- Offer to pay for a friend or family member's checked bags or seat selection fees if they're traveling soon

If you are traveling but won't have any fees or purchases to make, you could always pay for someone else's bag fee at the check-in counter or treat your seatmate to an inflight beverage or snack. You'll have the satisfaction of using up your credits, and will make someone's day a little better at the same time.

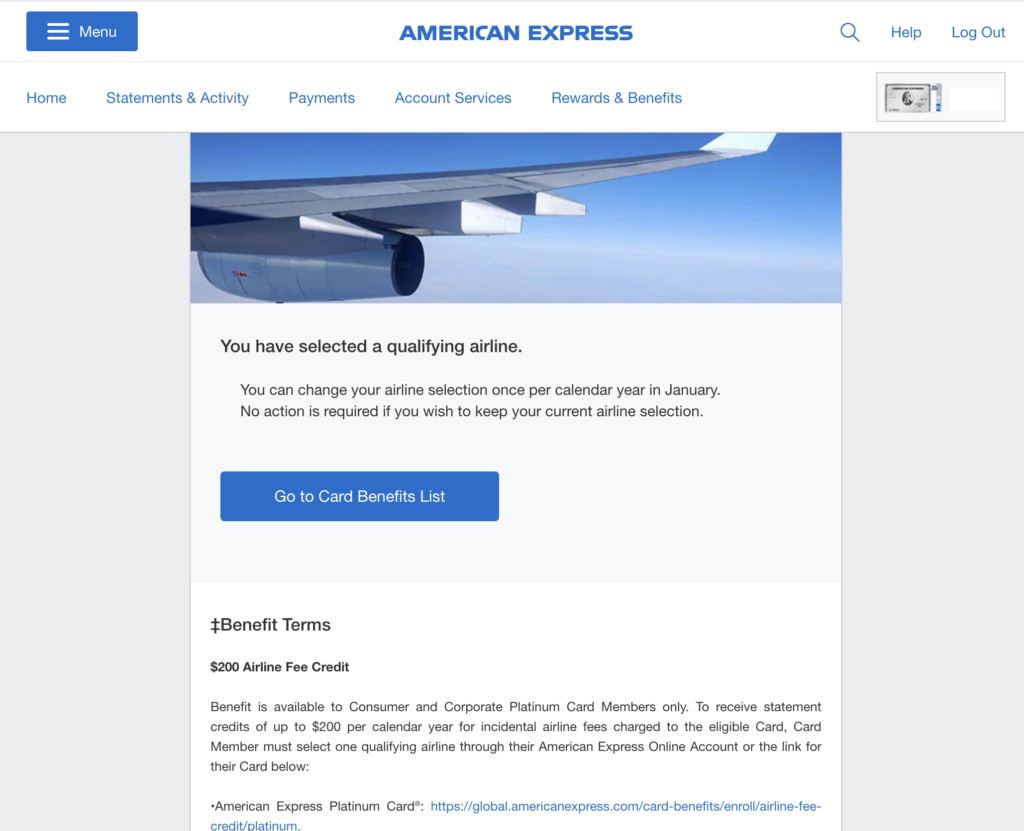

Log into your Amex account and navigate to the benefits section to select your preferred airline. Note that you can typically change your airline selection once per year in January.

The credit can be used for checked baggage fees, in-flight refreshments, and Wi-Fi, seat selection fees, and other incidentals. Note that ticket purchases, upgrades, and gift cards are usually not covered.

Yes, as long as the charges are from the airline you've selected for your credit and fall under the eligible expense categories.

Check your Amex account statement. Credits for eligible purchases typically appear within 2-4 weeks after the transaction.

Unused credits do not roll over to the next year. It's important to utilize the full credit amount within the calendar year.

For rates and fees of The Platinum Card® from American Express, please click here.

For rates and fees of The Business Platinum Card® from American Express, please click here.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Trip Delay Insurance, Trip Cancellation and Interruption Insurance, and Cell Phone Protection Underwritten by New Hampshire Insurance Company, an AIG Company. Global Assist Hotline Card Members are responsible for the costs charged by third-party service providers. If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers. Extended Warranty, Purchase Protection, and Baggage Insurance Plan Underwritten by AMEX Assurance Company. Car Rental Loss & Damage Insurance Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

- Main content

Don’t forget to select your American Express Airline fee credit for 2024

- January 20, 2024

15 Comments

We may receive a commission when you use our links. Monkey Miles is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com and CardRatings. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Monkey Miles is also a Senior Advisor to Bilt Rewards. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

You need to select your American Express Airlines Fee credit

It’s a new calendar year which means all of your Amex airline fee credits have refreshed. I have 4 cards that provide a total of $800 in incidental airline fee credits, and my wife has $850 ( good lord ) so we need to be very strategic in our selections. Amex Airline fee credits are limited to what Amex defines as incidental. Namely those include bag fees, pet fees, in flight refreshments, etc, but other things have triggered it in the past. Let’s take a closer look and identify where we intend to use ours, which airline we chose, and all those juicy details.

Don’t forget you can officially select until 1/31/24

*unofficially many people have had success changing the airline well past this date, but this is on a case by case basis and I would recommend selecting your airline by the due date to avoid confusion.

Table of Contents

Which American Express Cards Include an Airline Fee Credit?

- The Platinum Card® from American Express $200

- The Business Platinum Card® from American Express $200

- American Express Hilton Honors Aspire $250

We’ve used Amex Membership Rewards to accomplish many of our travel goals.

Choosing an airline for your Amex Incidental Airline Fee Credit

If you’re unfamiliar, for each card that you hold with Amex that includes an Airline fee credit, you’ll need to choose which airline you want to apply it to. We have readers that are saying the United Travel bank is still triggering the credit and some people are even having $100 fares refunded with JetBlue. It all comes down to how Amex codes the purchases, but just an FYI.

- Alaska Airlines

- American Airlines

- Delta Airlines

- Frontier Airlines

- Hawaiian Airlines

- JetBlue Airways

- Spirit Airlines

- Southwest Airlines

- United Airlines

Which fees have been included in the past?

The following fees will only trigger the credit when you purchase them on your selected airline.

- Airport Lounge membership and passes

- Overweight or oversize fees

- Inflight purchases like food and beverage – note that WIFI may not trigger it since it can be processed by 3rd parties

- Pet flight fee

- Phone reservation fees

- If you’re get a economy plus, etc

- Ticket Change fees

Amex changed how incidental fees are credited

In 2019, Amex eliminated the ability to purchase under $50 tickets on Alaska and get reimbursements, but also the ability to purchase gift cards for future travel on AA, Delta, and Southwest. Anecdotally, it seems some people are still getting reimbursement, but it can’t be counted on, and is few and far between. Throughout 2020, United’s Travel Bank still was triggering the incidental credit, but I added funds in 2022 and this wasn’t recognized by Amex as incidental.

Where we will use our fee credits

My wife and I have 5 Amex Business Platinum cards between us, 2 Amex Platinum, and an Amex Aspire, and since we quite often travel with our dog, it hasn’t been an issue using up all of the incidental credits seeing as those pet fees can often be $95 to $150 each way. We have $1650 in airline fee credits, which is kind of hard to imagine, but for 2023, we suspect we’ll use them up again.

This year I will spread them across a few different airlines: Delta, Southwest, and AA are our choices.

Terms and Conditions from Amex

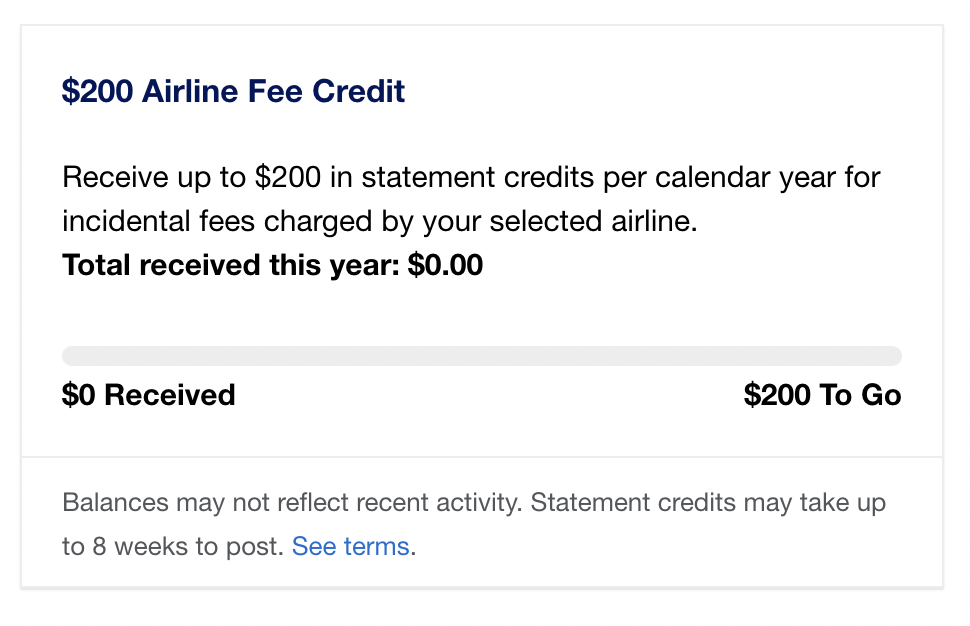

$200 Airline Fee Credit

Benefit is available to Consumer and Corporate Platinum Card Members only. To receive statement credits of up to $200 per calendar year for incidental airline fees charged to the eligible Card, Card Member must select one qualifying airline through their American Express Online Account or the link for their Card below:

• American Express Platinum Card®: https://global.americanexpress.com/card-benefits/enroll/airline-fee-credit/platinum

• Goldman Sachs Platinum Card®: https://global.americanexpress.com/card-benefits/enroll/airline-fee-credit/goldman-platinum-card

• Morgan Stanley Platinum Card®: https://global.americanexpress.com/card-benefits/enroll/airline-fee-credit/morgan-stanley-platinum-card

• American Express Platinum Card® for Schwab: https://global.americanexpress.com/card-benefits/enroll/airline-fee-credit/schwab-platinum-card

• American Express Corporate Platinum Card®: https://global.americanexpress.com/card-benefits/enroll/airline-fee-credit/corporate-platinum

Qualifying airlines include Alaska Airlines, American Airlines, Delta Airlines, Hawaiian Airlines, JetBlue Airways, Spirit Airlines, Southwest Airlines, and United Airlines. Only the Basic Card Member or Authorized Account Manager(s) on the Card Account can select the qualifying airline. Card Members who have not chosen one qualifying airline will be able to do so at any time. Card Members who have already selected one qualifying airline will be able to change their choice one time each year in January through their American Express Online Account or by calling the number on the back of the Card. Card Members who do not change their airline selection will remain with their current airline. Statement Credits: Incidental airline fees must be charged to the Card Member on the eligible Card Account for the benefit to apply. Incidental airline fees charged by both the Basic and Additional Card Members on the eligible Card Account are eligible for statement credits. However, each Card Account is eligible for up to a total of $200 per calendar year in statement credits across all Cards on the Account. Incidental airline fees must be separate charges from airline ticket charges. Fees not charged by the Card Member’s selected airline (e.g. wireless internet and fees incurred with airline alliance partners) do not qualify for statement credits. Incidental airline fees charged prior to selection of a qualifying airline are not eligible for statement credits. Airline tickets, upgrades, mileage points purchases, mileage points transfer fees, gift cards, duty free purchases, and award tickets are not deemed to be incidental fees. The airline must submit the charge under the appropriate merchant code, industry code, or required service or product identifier for the charge to be recognized as an incidental air travel fee. Please allow 6-8 weeks after the qualifying incidental air travel fee is charged to your Card Account for statement credit(s) to be posted to the Account. We rely on airlines to submit the correct information on airline transactions, so please call the number on the back of the Card if statement credits have not posted after 8 weeks from the date of purchase. Card Members remain responsible for timely payment of all charges. To be eligible for this benefit, Card Account(s) must be not canceled and not past due at the time of statement credit fulfillment.

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

- Best Starter Card

Affiliate link

Welcome Offer

Points Earned

- Worth $750 in Chase Travel℠ and way more if you maximize transfer partners

- 5x on all travel purchased through Chase Travel℠

- 3x on dining, including eligible delivery services for takeout & dining out

- 3x on select streaming services

- (excluding Target, Walmart and wholesale clubs)

- The begins immediately for new cardmembers and after your account anniversary for existing cardmembers

- 2x on all other travel

- Every year you keep the card, your total spend will yield a 10% points bonus. If you spend $10k in a year, you’ll get 1k bonus points

- Chase Sapphire Preferred continues to redeem at 1.25c in the Chase Travel℠ and the slew of other benefits remain in tact including Auto Rental Collision Damage Waiver ( primary ), purchase protections, etc.

- Points are transferrable to 14 Ultimate Rewards partners

- Redeem in Chase Travel℠ for 1.25 cents per point

- No foreign transaction fees

- Auto Rental Collision Damage Waiver is my favorite

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024

- $95 Annual Fee

- Full Review

- Best uses of Chase Ultimate Rewards

- Chase Application Rules

- Complete Guide to Chase Credit Cards

- Credit Card Spreadsheet with historical data on best offer

We keep an up to date spreadsheet that lists the best ever offers: You can find that spreadsheet here.

Historically 80k is a very, very good offer and hit in both 2022 and 2023. In 2021, we saw the offer hit an all time high of 100k. Who knows if that will ever come back.

Main Cast:

The Chase Sapphire Preferred® is exceptional starter card and offers transferrable Ultimate Rewards, and pairs well with other Chase cards.

Share This Post:

How to share your american express uber credits across multiple accounts, bank of america alaska airlines visa® business card 75k offer + companion fare from $122.

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

American Express Platinum: https://americanexpress.com/en-us/referral/KENNYBgDlW?XLINK=MYCP

The Platinum is currently offering an 80,000 sign up bonus after $8,000 spend in 6 months.

The numerous perks on the Platinum card make it worth it for me as I use so many of them whether at home or traveling. I like to accumulate additional Amex points by using shopping portals like Rakuten.

American Express Gold Card: Earn 60,000 points after spending $4,oo0 in the first 6 months.

https://americanexpress.com/en-us/referral/RILEYHtJdd?xl=cp15

Good luck, thank you!

[…] easily make use of the card each and every year I hold the card. Read this for tips, but it’s a solid […]

I am try to reach my goal. Apply for an American Express Card with this link. We can both get rewarded if you’re approved! http://refer.amex.us/JAMESMCDVa?XLINK=MYCP

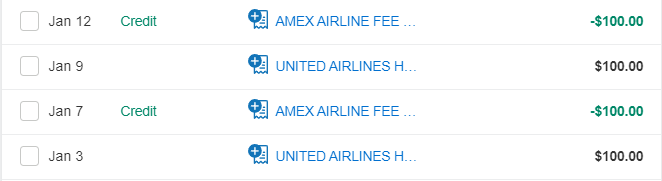

United Travel Bank is alive and well – this morning got credited the $200 for the AMEX PLAT Personal. Purchased 2x in $100 a couple of days ago and reports on Flyertalk also confirm reimbursement so keep checking.

This is pretty misleading. Chatting with Amex or calling them anytime during the year will allow them to change which airline u select as long as you dont use the credit. i picked southwest in dec 2020 and used it that same day.

The policy is it needs to be selected by 1/31 – if a rep decides to give an exception it’s on a case by case basis, especially concerning 2020 which you refer to, but it’s something I’ll add so readers know they may have a possible option in the future.

all the blogs are stating jan. 31 is last day to choose airline. Not tue. If you haven’t changed your designation from the previous year, call AmEx and they will make the change after 1/31. I’ve done this twice.

@Miles: For AA the 500-mile upgrades ($40) still trigger the benefit 🙂

Also, AA’s mileage multiplier triggered the credit late last year. Haven’t tried this year yet since I don’t have any other flights planned.

awesome thank you for the data point!

Great data point – thank you!

Southwest triggers reimbursements on at least tickets below $100. I got 4 tickets reimbursed in December and January. I also read most Spirit fees and other small purchases on JetBlue even should trigger.

On Jan 2nd, I purchased a $49 ticket on Alaska hoping it would trigger the reimbursement and was unsuccessful. Do you know what airlines still trigger the reimbursement for low priced tickets? thanks!

definitely an eroding benefit. I fly primarily Delta and am a diamond. so DON’T pay for bags, drinks, etc. And if I recall correctly this credit doesn’t apply to the fees / taxes on award bookings. argh….

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

My Points Life

Travel Smarter & Better

How to Maximize Amex Airline Fee Credit (2024)

It is becoming increasingly difficult to circumvent the Amex Airline Fee Credit benefit. The reimbursement fee credit is helpful because, if used properly, it essentially offsets the high annual fee on the Amex card that has this airline fee credit benefit.

According to American Express, only incidental air travel fees such as baggage fees, inflight food, and beverages, to name a few, are considered qualified purchases. Any airline gift card or flight ticket purchases are not eligible purchases. It makes this benefit very restrictive to use for people who do not like to check bags or do not often fly to pay for those incidental air travel fees in a year with a specific airline.

In this post, we are compiling a list of known workarounds that trigger the Amex Airline Fee Credit from the points and miles community, mainly FlyerTalk. We monitor FlyerTalk closely and update this post accordingly. Feel free to bookmark this page or subscribe to our blog posts below .

Table of Contents

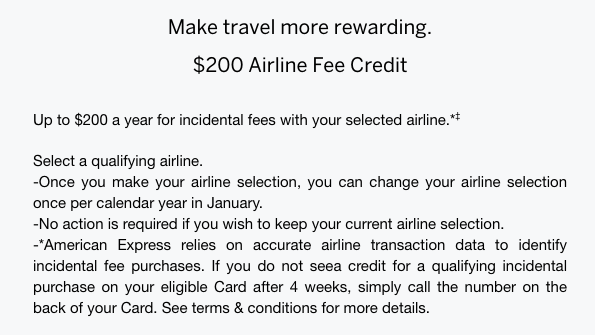

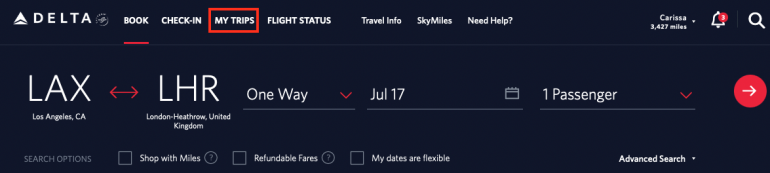

Selecting A Qualifying Airline for Amex Airline Fee Credit

First and foremost, you must select one qualifying airline you want. This can be done online, via chat, or by calling the number on the back of your card.

Moreover, you can only change your airline selection once a year in January, and if you do not change it, the previous year’s preferred airline selection remains in place.

To select a qualifying airline for Amex Airline Fee Credit online, go Here .

What Qualifies for Amex Airline Fee Credit?

First, according to American Express, only incidental air travel fees are considered qualified purchases. Below is an extensive list of eligible and ineligible charges.

Here are the Amex terms and conditions on airline fee credit:

Statement Credits: Incidental air travel fees must be charged to the Card Member on the eligible Card Account for the benefit to apply. Incidental air travel fees charged by both the Basic and Additional Card Members on the eligible Card Account are eligible for statement credits. Incidental air travel fees must be separate charges from airline ticket charges. Fees not charged by the Card Member’s airline of choice (e.g. wireless internet and fees incurred with airline alliance partners) do not qualify for statement credits. Incidental air travel fees charged prior to the selection of a qualifying airline are not eligible for statement credits. Airline tickets, upgrades, mileage points purchases, mileage points transfer fees, gift cards, duty free purchases, and award tickets are not deemed to be incidental fees. The airline must submit the charge under the appropriate merchant code, industry code, or required service or product identifier for the charge to be recognized as an incidental air travel fee.

Eligible airline fee charge billed AFTER airline section:

- Airport lounge day passes and annual memberships

- Change fees

- Checked baggage fees

- Early check-in fees

- In-flight amenity fees (beverages, food, pillows/blankets, and so on)

- In-flight entertainment fees (excluding wireless internet)

- Overweight/oversized baggage fees

- Pet flight fees

- Phone reservation fees

- Seat assignment fees

- Unaccompanied minor fees

Ineligible airline fee charges include:

- Eligible airline fee charge billed to the account before airline selection

- Airline tickets

- Award ticket fees

- Cancellation fees

- Charges processed by Merchants other than the airline the Card Member has selected (for example, in-flight internet services providers such as GoGo)

- Charges made by airline partner (for example, Card Member purchases tickets on selected airline Delta, but buy food on an Air France flight)

- Duty-free purchase

- Frequent Flyer purchase

- Gift Cards issued by airlines

- Point transfer fees

- Trip insurance/baggage insurance

- Ticket upgrades (including American Airlines Upgrade Stickers)

- Travel agent fees

Airlines Workaround That Triggers Amex Airline Fee Reimbursement Credit

Below is a compilation list of known workaround for a specific airline that triggers Amex airline fee credit provided by the miles and points community at the FlyerTalk .

Alaska Airlines

With the exception of the Saver fare, Alaska Airlines allows ticket changes and cancellations free of charge before departure. In other words, instead of receiving a refund on your credit card when you cancel a ticket, the credit is deposited into your Alaska Airlines Wallet. The funds in the Wallet are good for one year from the date of the ticket’s purchase.

- Select Alaska Airlines as your preferred airline first in your Amex account.

- Wait a day or so to allow your selection to take effect in the system.

- Use any credit cards or Alaska’s wallet funds to purchase an Alaska Airlines ticket.

- After purchasing the ticket, use the right Amex card to pay for a Premium Class seat assignment.

- The premium class seat assignment definitely qualifies for the Amex airline fee credit because the seat assignment does fall under Amex’s incidental air travel fees.

- If you decide to take the trip 24 hours after purchasing the ticket, that’s great. If not, Alaska Airlines allows free changes (except for Saver fare). You can also cancel the ticket, and all the airfare, along with the premium seat assignment fees, will be credited to your Alaska Airlines Wallet to be used for future travels.

Some people receive automatic airline fee reimbursement from the points and miles community for the premium seat assignment. However, some have to contact Amex to request the credit to be manually applied. If you don’t see an automatic airline fee credit 14 days after the charge is posted to your account, you can contact Amex through chat/phone. If you contact them before 14 days, they will tell you to wait until the 14 days are up because they can manually apply the airline fee credit for you only after the 14-day mark.

Please note that you must refer to the charge as “seat assignment fee,” not seat upgrade fee, because an upgrade is not an eligible charge for the airline fee credit.

Data Point Reference: FlyerTalk (Alaska)

JetBlue Airways

- Select JetBlue Airways as your preferred airline first in your Amex account.

- Purchase a JetBlue ticket with an airfare under $99. Any flight ticket with an airfare above $99 will not work.

- Be sure to purchase the ticket with the right Amex card.

- Suppose you are going to use that JetBlue ticket—great! If not, after 24 hours of purchase, you can cancel the ticket and receive a refund in the form of the TravelBank fund, which is good for one year from the date of deposit (thanks to the current free change and cancellation policy, except for the Blue Basic fare ) .

- Please allow some time for the Amex system to process your purchase and fee reimbursement. It generally takes 2-4 days after the charge is posted to your account.

Here’s a timeline example:

- January 10 – Purchased JetBlue ticket for $98.86.

- January 10 – Amex account shows Pending JetBlue Airways $98.86.

- January 10 – Purchase is successfully charged and posted as JETBLUE AIRWAYS.

- January 12 – Amex airline fee of $98.86 reimbursed.

Data Points Reference: FlyerTalk (JetBlue)

Delta Air Lines

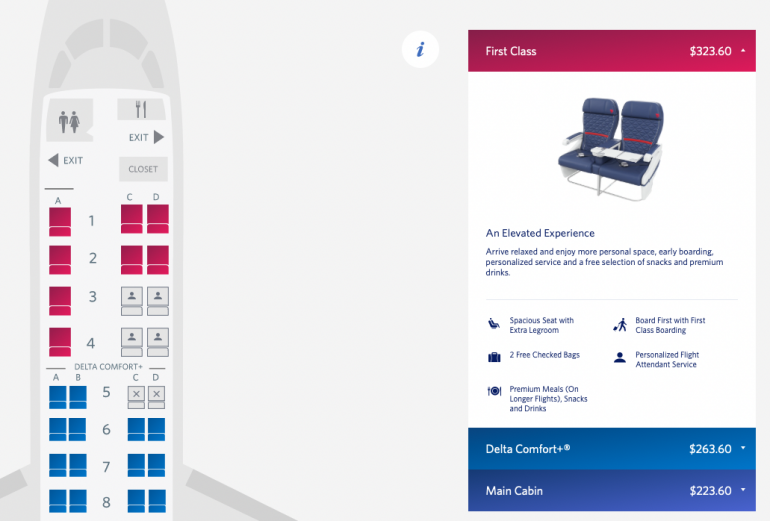

- Select Delta Air Lines as your preferred airline first in your Amex account.

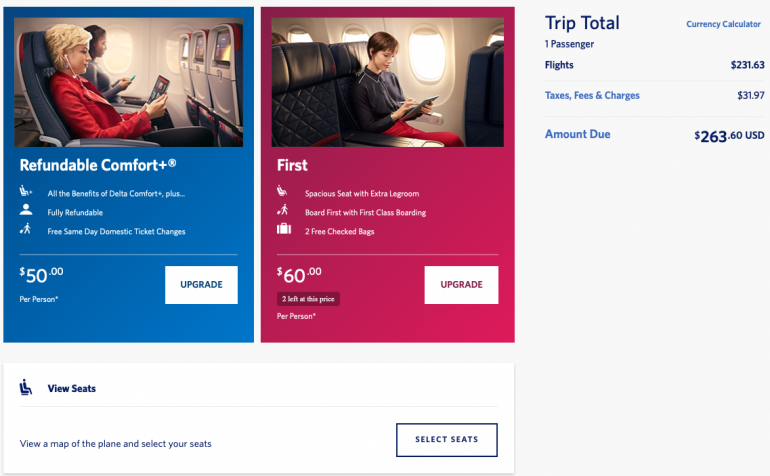

- When you purchase a Delta ticket, be sure to pay a portion of the airfare with a Delta gift card or Delta eCredit and charge the remaining balance to your Amex card. This “additional collection” will trigger the Amex airline fee credit if the amount is $250 or less.

For example:

- October 25 – Purchase a $280 ticket with a $50 Delta gift card and charge the remaining $230.20 to the Amex card.

- October 26 – Check the transaction posted as “additional collection.”

- October 27 – $200 airline fee credit posted.

Your timeline may be different. Allow some time for the Amex system to process your purchase and the fee reimbursement. It generally takes 2-4 days after the charge is posted.

Data Points Reference: FlyerTalk (Delta)

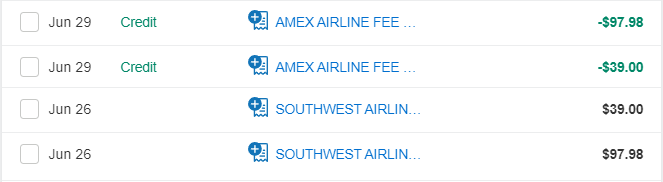

Southwest Airlines

- Select Southwest Airlines as your preferred airline first in your Amex account.

- Use Southwest’s helpful low-fare calendar to help search for those less than $ 100 tickets.

- I do not recommend canceling the ticket right inside the 24-hour window because the refund will go back to your Amex card, and there’s a chance Amex may claw back that credit in the future.

- January 3 – Purchased Southwest ticket for $79.86.

- January 3 – Amex account shows Pending Southwest Airlines $79.86.

- January 3 – Purchase is successfully charged and posted as SOUTHWEST AIRLINES DALLAS TX.

- January 5 – Amex airline fee of $79.86 reimbursed.

Data Points Reference: FlyerTalk (Southwest)

Recommended Post:

- How to Transfer Southwest Travel Funds to Another Person With Wanna Get Away Plus

United Airlines

- Be sure to select United Airlines as your preferred airline first in your Amex account.

- Add that Amex card to your saved payments wallet first in your United account .

- Repeat your purchase using the card that was stored.

- Allow some time for the Amex system to process your purchase and the fee reimbursement. Be patient, and do not call Amex to inquire about this. The screenshot below shows an example timeline.

Data Point Reference: FlyerTalk (United)

If you found this article useful, please share it:

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to email a link to a friend (Opens in new window)

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Notify me of follow-up comments by email.

Notify me of new posts by email.

Using My $200 Amex Airline Fee Credit [2023]

By: Author Kenny

Posted on Last updated: July 26, 2023

In this post, I’ll talk through how to use the $200 airline incidentals credit on the American Express Platinum card. I’ll start with an introduction to the credit, including what it covers and how to enroll in it, before discussing my experience using the credit. Read on to learn all about the Amex Platinum airline fee credit.

Basics of the Airline Fee Credit

The $200 airline fee credit is a perk of both the Amex Platinum Personal and Business cards. The credit is, without a doubt, one of the most complex travel credits in the industry. There are two big things to know about the credit, and we’ll cover both.

The first thing to know is you have to opt into the credit and pre-select the airline (from Amex’s list of eligible airlines) you’ll use it at. This is a once-per-year thing (details below), so your $200 annual credit can only be used at one airline each year.

The other thing to know is that this is a fairly limited credit. It’s not a broad “travel credit” like the Chase Sapphire Reserve travel credit . And not even all expenses on your selected airline will count for the credit (airfare isn’t eligible, for example).

On the logistics end, the one good thing I can say about the credit is that it should apply to your account automatically and relatively quickly, assuming you’ve followed the necessary steps in selecting your airline and making an eligible expense.

What the Airline Fee Credit Covers

American Express is relatively opaque when it comes to which charges are eligible for the credit. Generally, it’s meant to be used for “incidentals.”

The terms spell out some things that are excluded: Airline tickets, upgrades, mileage points purchases, mileage points transfer fees, gift cards, duty free purchases, and award tickets are not deemed to be incidental fees. Most expected here is “Airline tickets,” as there’s nothing “incidental” about airfare.

Luckily, there is one place Amex provided me with more explicit information on what’s covered. Here’s a list of some eligible charges that Amex provided by email once I activated the credit:

- Checked baggage fees (including overweight/oversize)

- Itinerary change fees

- Phone reservation fees

- Pet flight fees

- Seat assignment fees

- In-flight amenity fees (beverages, food, pillows/blankets, headphones)

- In-flight entertainment fees (excluding wireless internet because it’s not charged by the airline)

- Airport lounge day passes & annual memberships

This list is…weird, and presumably incomplete. It includes “Checked baggage fees” without a mention of carry-on fees, which some airlines (like Spirit) have. The list also appears to exclude all wireless internet charges, but I imagine there might be cases where the airline itself does charge the fee.

Upgrades vs. Seat Assignments

There’s one issue I want to go on a quick tangent about. Amex specifically includes “seat assignment fees” while specifically excluding “upgrades.”

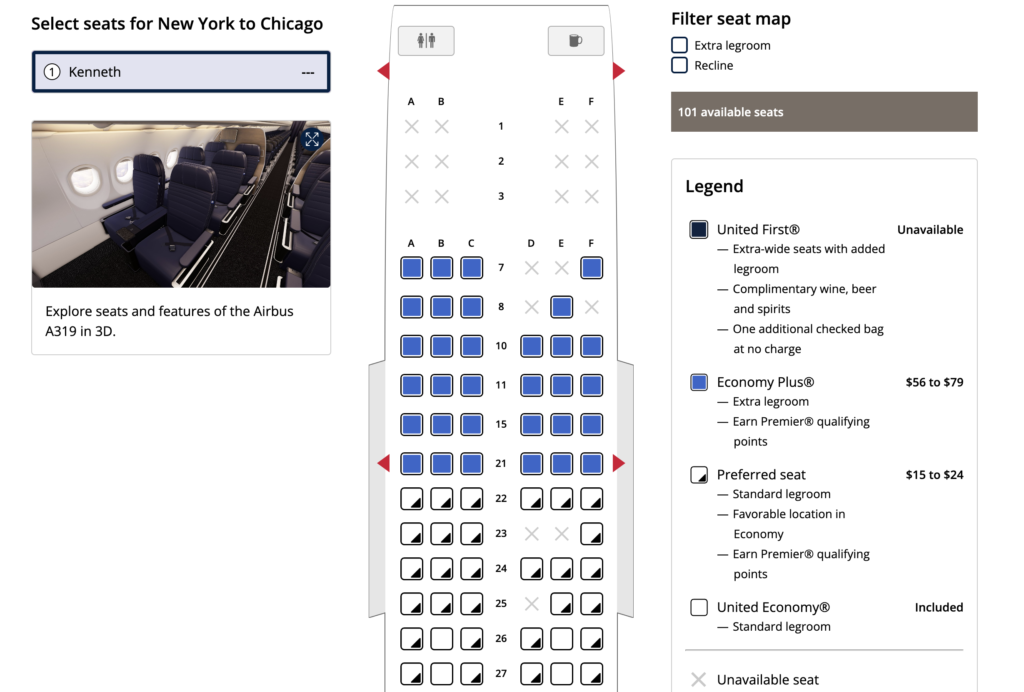

In some cases this is cut and dry. If you book United economy, you can get reimbursed for the cost of selected a seat in the economy cabin. This should include “preferred” and “Economy Plus” seats. But you can’t get reimbursed for an upgrade to first class. United generally allows upgrades up until shortly before departure if space is available. I even upgraded to United First Class less than an hour before boarding once .

Generally I can see how this makes some sense—people flying premium cabins could book a lower fare and then pay for the upgrade on their Amex Platinum, essentially “hacking” the credit to count for their airfare. (Still, this won’t always be easy or cost effective to do, and it’s probably a relatively small problem.)

But not all cases are cut and dry. Delta Main Cabin and Delta Comfort Plus are treated as different classes by Google Flights, for example, and Comfort Plus has its own fare code. This would be treated by Amex as an “upgrade,” I believe, though you might check some place like Reddit for more info .

JetBlue has its “Even More Space” seats , which are more spacious and come with a carry on even if you’re flying Blue Basic. These would be, I believe, a seat assignment.

Then there’s something like the Spirit Big Seat . This is a clear case of a seat assignment, as it comes with no other perks. But these seats are a huge improvement over Delta Comfort Plus or Jet Blue Even More Space.

Best Ways to Use the Airline Fee Credit

Realistically, you’re likely to use your airline incidental fee on one of three things:

- Seat selection

- Baggage fees

- Onboard expenses (snacks / drinks)

Personally, seat selection for a family of three is going to be where I get most value. If no free seats on a flight are available, I always pay for three seats to keep us together. If free seats are available, I’m about 50/50 whether I take a free row or pay a bit more to be farther up. A few rows don’t matter to us, but the difference between the front and back rows with a toddler can be significant.

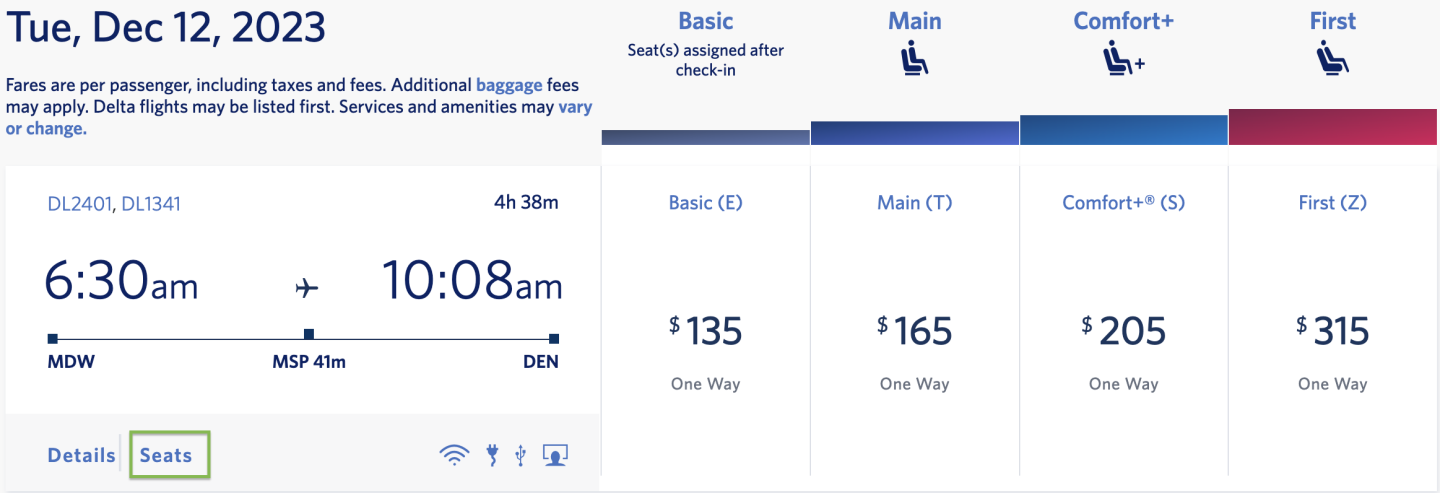

That said, even with a family of three, it won’t be easy to find full value in a single trip. Consider the below route from New York to Chicago. We’d typically pay for a preferred seat, and 22A, B & C costs $58 total. That’s only $116 roundtrip. We could (and will, see below) instead buy Economy Plus seats. But once you’re spending more than you would without the credit, you’re not really getting full value from the credit (and you might be losing money overall).

If you’re flying mostly premium cabins (i.e. not economy / main cabin / coach) then seat selection, baggage fees, and onboard expenses probably aren’t something you’re paying for in any case. I’ve got two suggestions in this case.

Alternative Uses for the Credit

The first is to use Google, Reddit, and most importantly, FlyerTalk and see if you can find interesting ways people are using the credit (er, sorry if Google sent you here for that question). I don’t want to mention specifics here because once things get “interesting” the rules can change quickly and won’t always be clear. What works for Amy one day may not work for Beth the next.

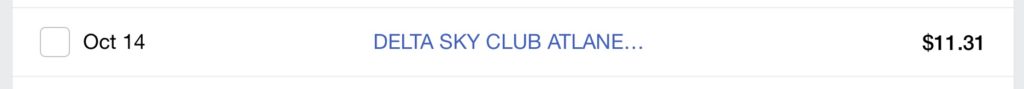

My second suggestion is to consider lounge day passes. As an Amex Platinum cardholder, your Priority Pass, Centurion Lounge, and SkyClub access will serve you well in many cases. To get value out of the credit, you’ll have to find an exception. One idea might be to use the credit for SkyClub guest fees ($50 each), which should be covered (note that Centurion Lounge guests fees would not be since they aren’t affiliated with any airline).

Opting In To The Amex Airline Fee Credit

Before you can use the credit, you have to logon to your account and select the airline you want it to apply to this year. The available airlines are:

You can make this selection after becoming a cardholder, and you can change it once a year in January. If you don’t make a change and February 1 hits, you’re stuck with whatever airline you selected last year.

This creates an obvious challenge for many cardholders, as you won’t always know which airline makes the most sense for you by the end of January. Here are some thoughts on how to approach this.

Tips on Selecting Your Airline

Just Plan a Trip (Or Two). Chances are if you’re reading this post you have some idea of what trips you’ll be taking in the next year. So just make up your mind and book one already. Lots of us put off booking trips for too long because the planning can be frustrating, but the easiest way to start using your airline fee credit is to just book a trip you’ve been putting off.

Our personal example (discussed below) is just such a case. Between holidays and family events, I knew there were three trips I had to take this year that I hadn’t booked. As I got frustrated having not used the airline fee credit, I finally sat down and planned those trips, identifying my chosen airline and using the credit in the process.

Be careful about Basic Economy or similar fares. “Basic Economy” fares were introduced by several airlines a few years back as a way of competing with low cost carriers. While you might think Basic Economy is a good way to weasel into using your credit, be careful. You might think, for example, “I’ll fly basic economy and use my fee to pay for a carry on.” Then you discover that United Basic Economy doesn’t even allow you to pay for a carry on —they’re just not allowed at all. Or you discover that American Basic Economy allows a carry-on for free (that’s nice but not helpful in this case).

Two Specific Airlines to Be Aware Of

Be careful about Southwest. Southwest allows a lot of things for free on all fares (carry ons and your choice of seat, for example). You’ll have to do a bit of work to use your credit with them ( Upgraded Boarding is a good option , I think).

Consider Spirit. Spirit is sort of the opposite of Southwest. If you can find a good reason to fly Spirit (i.e. they fly your route at a reasonable fare), you’ll probably have little problem using the credit. Between carry-on and seat fees, Spirit can eat through $200 pretty quickly. Worst case, you’re a solo traveler without a carry-on who only flies Spirit once a year. In that case, you might just spring for a Big Front Seat.

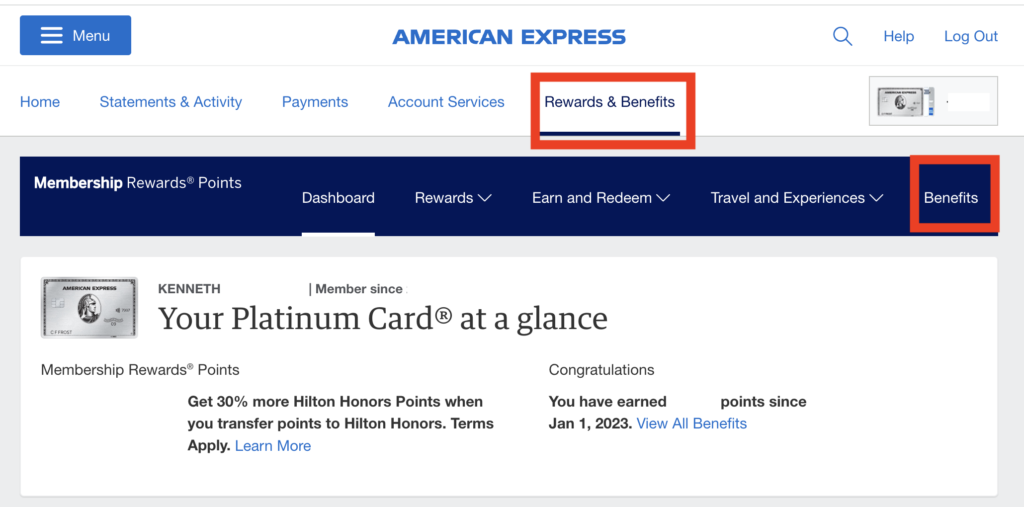

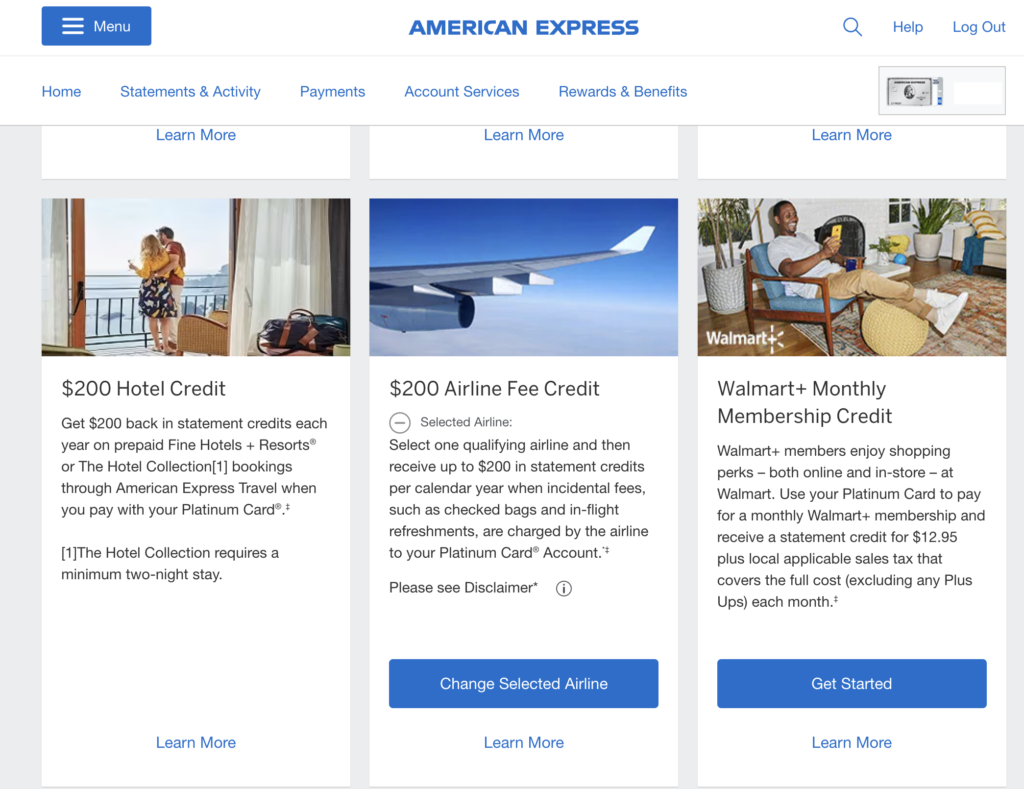

Making Your Selection

To make your airline selection, log in to your American Express account and navigate to Rewards & Benefits -> Benefits for your Platinum card.

Scroll down to “$200 Airline Fee Credit”. If you already selected an airline it will be noted. If you haven’t (because you’re a new cardholder), or if it’s January (when all cardholders can change their selected airline), you’ll see the option to “Change Selected Airline.”

Click in and scroll down to the selection menu:

Pick your airline and click “Submit Selection”, and you’ll be brought to the confirmation screen:

Using the Airline Fee Credit

There isn’t much you need to do to “use” the credit, but there is one important point. You need to make sure your incidental purchase is separate from your airfare purchase. This means if you pay for seat selection at the time you buy your ticket, you shouldn’t expect to get the credit. (It’s sometimes technically possible for these items to charge separately but don’t count on it.)

There might be cases where this means you’re actually out a few dollars if the airline charges less for seat assignment or a carry on at the time of purchase. Unfortunately there’s no real way around this. If your flight is covered by the 24-hour cancellation rule , you can at least avoid an outrageous upcharge by cancelling and rebooking with your incidentals. Then you’ve left your credit for another trip.

My Experience With the Airline Fee Credit

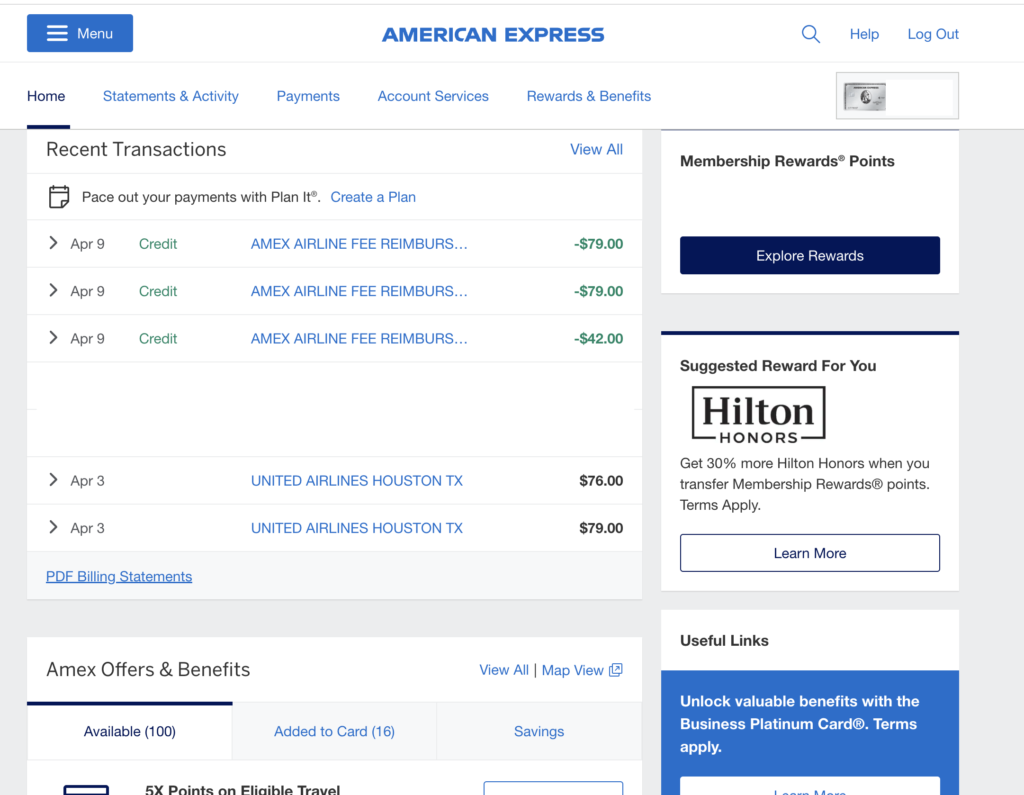

My most recent use of the credit was for seat selection on United. I paid $234 for three bulkhead seats in United Economy Plus (one way). This was more a “treat” than a typical selection we’d make, to be fair. But it will give us the opportunity to do a review of this specific offering. (I also decided to forego seat selection on some other trips I was booking, so it all balances out.)

This was actually my first use of the credit, so I made my airline selection just before purchasing. I wondered if it was prudent to wait a few minutes, or even a day, before making my purchase but ultimately decided I’d just give it a go.

The seat selections billed as three charges ($79, $79, $76). Six days later, the credit was applied in three amounts ($79, $79, and the remaining $42).

Conclusions

The Amex Platinum airline incidentals fee credit is like all the other Amex Platinum credits. It’s nice on its face but a little complicated in the details.

If you’re a Spirit airline regular, you’ll have no problem using the credit. With a carrier like United, Delta, American, or JetBlue, you’ll probably need a few flights or a pricey seat selection to get full value out of the credit. And if you’re loyal to Southwest, you’ll struggle to get real value.

We fly enough that getting good value out of the credit won’t ever be a challenge. Getting optimal value will require rolling the dice a little. Next year, if I don’t have anything to book in January I’ll probably roll the dice and change my selection to Spirit. Then it’s just a matter of remembering six months down the road that I have the credit to use…

Travel on Point(s)

- ToP Guide: How to Maximize the Amex Airline Fee Credit

- March 3, 2024

- Brian Soares

Travel on Point(s) is an independent, advertising-supported website. This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites like Cardratings.com. This compensation does not impact how or where products appear on this site. Travel on Point(s) has not reviewed all available credit card offers on this site. Reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any partner entities.

Amex Airline Fee Credit

The Amex airline fee credit is one of the most popular benefits from American Express's premium credit cards that can help offset the cards' high annual fees. This perk is intended to cover airline incidental charges, such as checked bags or in-flight refreshments. But, as with many things in the points & miles world, folks have found other (and better) uses for these credits.

Table of Contents

This ToP Guide covers everything you need to know about the Amex airline incidental credits. That includes which cards offer this benefit, which airlines you can use it with, how the credit works, and what kinds of other purchases can trigger the credit, depending on the airline.

Updated 3/3/24

Which Credit Cards Offer An Airline Fee Credit?

Currently, these Amex cards offer an annual airline incidentals credit:

- Platinum Card from American Express ($695 annual fee)

- Business Platinum Card from American Express ($695 annual fee)

The Amex Platinum and the Business Platinum airline fee credits cover up to $200 each each calendar year. Since it is based on calendar year, it does allow some to triple dip the credit on new accounts . The Hilton Aspire card used to be included as a card with an airline incidental credit but they changed the set up for the card in 2024 .

Which Airlines Can You Select For Your American Express Incidental Credit?

Amex offers 8 airlines to choose from for using your fee credit:

- United Airlines

- Hawaiian Airlines

- Spirit Airlines

- American Airlines

- JetBlue Airways

- Southwest Airlines

- Delta Air Lines

- Alaska Airlines

To select your airline, just click on the Benefits tab on Amex's website and find the airline fee credit. Click on that benefit and the website will prompt you to make your airline choice.

Once you have selected an airline, you cannot change it for the rest of the calendar year. You can change your airline once per year in January. In the past, Amex has allowed folks to change their airline later in the year as long as none of the credits had been used so far in the year. This is by no means guaranteed and very much YMMV . If you do not change your airline in January, then your selected airline remains the same as from the previous year with no action required on your part. Here is some more detail on how to change Amex airline fee credit selection in year 2 .

If you have multiple cards that offer the airline fee credit, you can select a different airline for each card.

Tips For Selecting Your Airline

You shouldn't take your selection lightly, since you changing it later can be tough, or not possible at all. One approach is to select whatever airline you fly the most. This might seem like an obvious choice, but it might not be the most helpful.

If you have status with that airline, you'll likely have free checked bags, preferred seating, and other perks that you won't need to pay cash for. The same could be said if you carry an airline credit card with perks. So what would you use the Amex airline fee credit for with that airline?

That's why some folks prefer to select an airline they fly less often. So that in the rare occasion that you have to fly that different airline, you can get such things as checked bags and preferred seating for free without relying on status.

Yet another approach is to select the airline with which the credit is easiest to use. As we discuss below, different purchases with different airlines can trigger the credit even despite not falling within Amex's terms & conditions .

There is no right or wrong approach. Just give it some thought before making your selection.

Lastly, keep in mind that if you're selecting an airline with the Business Platinum card, that airline will also be your airline of choice for the 35% points rebate benefit for economy flights. (All business and first class flights qualify for the 35% points rebate regardless of your selected airline.)

How Does The Airline Fee Credit Work?

The airline fee credit itself is quite simple. Once you've selected your airline, any qualifying purchase will trigger the credit. The credit works with purchases by the primary cardholder or any authorized user or, in the case of the Business Platinum card, employee cards.

To trigger the airline fee credit, the purchase must be processed by the airline. For example, in-flight Wi-Fi generally does not trigger the credit because they are not charged by the airline directly.

The terms & conditions make it clear that purchases charged before you select your airline are not eligible for the fee credit.

According to the terms & conditions , statement credits take between 6 and 8 weeks to post. But in practice, they often post a lot faster; sometimes, in a matter of days. That said, they can take a couple of weeks at times.

What Purchases Does The Amex Airline Fee Credit Cover?

According to the terms & conditions , the following purchases are not considered incidental fees and should not work :

“airline tickets, upgrades, mileage points purchases, mileage points transfer fees, gift cards, duty free purchases, and award tickets.”

- Airline tickets and airfare

- Mileage points purchases

- Mileage points transfer fees

- Gift cards,

- Duty free purchases

- Award tickets

And these are the types of charges that should work as they are usually charged as incidentals by the airline:

- Checked bags (including overweight/oversize fees)

- In-flight purchases charged by the airline (food, beverages, etc.)

- Seat assignment

- Lounge day passes and lounge membership

But in practice, this varies widely depending on the airline. Before we get into how you can maximize the credit with each airline, remember this: if you purchase something listed above and it doesn't trigger the credit, do not call Amex . That purchase isn't supposed to work in the first place, so calling Amex will do you no good . The terms are pretty clear on what doesn't shouldn't count.

Below is what we have seen work with each airline. There are additional data points here and there that we did not include either because those examples were too old, too sporadic, or just not entirely reliable.

Alaska Airlines (AS)

Alaska is among the tougher airlines to use the Amex airline fee credit. Uses are mostly limited to what you would expect:

- Award redeposit fees

- Checked bags

- Lounge passes

- In-flight purchases

- Link to most recent data points on what works here

American Airlines (AA)

American is another tough airline to use your credits. Here is what we have seen work for American:

- Admirals Club day passes and membership (including premium food and drink purchases at Admirals Clubs)

- Link to most recent data points on what works

We have also seen mixed data points about Main Cabin Extra seating purchased online. In this regard, we note that Amex's terms & conditions state that “upgrades” are not eligible for statement credits.

JetBlue Airways (B6)

JetBlue is a pretty easy option. Here is what we have seen work with JetBlue:

- Fares under $100

- Even More Space seating

- Link to most recent data points

Fares under $100 on JetBlue typically will trigger the credit, just like Southwest (see below), even though it codes as airfare rather than an incidental charge.

Even More Space seating on JetBlue also usually trigger the credit, even though Amex's terms & conditions exclude upgrades.

Delta Air Lines (DL)

Delta is another pretty easy alternative. Here is what works with Delta:

- Paying a balance under $250 when combining airfare purchase with an existing gift card or flight credit

- Companion ticket taxes

- Sky Club access

- Link to most recent data points on what still works

The most common option with Delta is to use an existing gift card or flight credit and pay the balance with your Amex card to trigger the credit. The balance paid has to be under $250 for this to work. When the purchase is processed, Delta adds an “additional collection” to the transaction instead of showing a fare booking like regular airfare purchases. Mark was able to confirm that this works when booking over the phone and paying in part with a gift card. That is true even if one of the passenger's tickets are booked with Delta credit in full.

Hawaiian Airlines (HA)

Hawaiian offers very limited uses. Here is what we have seen work:

- Airfare under $50

We have seen reports of airfare under $50 working. But unless you're planning on taking some intra-Hawaii flights, this is unlikely to be helpful in the long run.

Southwest Airlines (WN)

Southwest is one of the easiest airlines to trigger the credit. The usual things that would trigger the credit include overweight bag fees, Early Bird Check In, Upgraded Boarding, and pet fees.

Here is what we know works with Southwest:

- Purchases under $100 each (including airfare)

- Overweight bag fees

- Early Bird Check In

- Upgraded Boarding

If you find a cheap flight for under $100, you can charge it to your card directly (assuming you selected Southwest as your airline) and you'll receive a statement credit. If you want to book a flight that costs more than $100, you can first book a couple of flights for under $100 each, and then cancel both of them for Southwest travel funds. Then, book the flight you want and pay for it with those travel funds.

We have a seen some airfare charges slightly over $100 also triggering the credit. However, I recently tested this with a flight that cost $112 and it did not trigger the credit.

You can also use the airline fee credit for award bookings with Southwest. Southwest charges $5.60 in fees for domestic award bookings. Fees for international flights are a bit higher. These fees will also trigger the fee credit.

If you have the Southwest Companion Pass , then selecting Southwest as your airline is an excellent option.

Spirit Airlines (NK)

Spirit charges a fee for just about anything other than the basic fare, making it a decent option as an airline selection. Here is what typically works with Spirit:

- Spirit Saver$ Club membership

- Checked bags and carry-on bags

- Link to most recent data points on what still works here.

Spirit's Saver$ Club offers access to lower fares and discounted prices on bags, seats, and other perks. Essentially, using the airline fee credit to cover a Saver$ Club membership is an indirect way to use the credit towards airfare, since Saver$ Club will save you cash on your Spirit flights.

United Airlines (UA)

United Airlines is another easy option. Officially, the fee credit applies to such things as checked bags and in-flight refreshments. But the United TravelBank is by far the easiest way to essentially turn your credits virtually into cash.

Here is what we know works for United:

- United TravelBank deposits of up to $50 or $100 each

- United Club Lounge access

United TravelBank lets you add money to your United account and then use those funds as payment on United's website or on their mobile app. You can use TravelBank Cash alone or in combination with other forms of payment to pay for flights on United.

TravelBank deposits of up $50 or $100 are known to trigger the airline fee credit. It's as simple as that.

In the past, United TravelBank has been unavailable for brief periods of time. This is a good reminder that none of these methods are ever guaranteed to stick around indefinitely. Best to avoid procrastinating with your airline fee credit!

Amex Airline Fee Credit: ToP Thoughts

Amex's airline fee credit can be almost as good as cash when you think outside the box of how to use it. As with many things in points & miles, what works today may not work tomorrow. And if you're unsure whether something will trigger the credit, we encourage you to be the data point you want to see and try it for yourself!

What is your favorite airline for redeeming your airline fee credits? Come share your thoughts in our Facebook group !

- Join Facebook Group

Recent Posts

Our complete guide to the amazing world of amex offers, how to get the better 150k amex platinum welcome offer, turkish airlines launching flights to denver in june 2024, how to get the better 90k amex gold welcome offer, how long are amex referral bonus points taking to post, top posts & pages.

- Is This The Best Credit Card For Lounge Access That No One Talks About?

- Our Favorite Business Card: An Earnings Workhorse and No Annual Fee

- Coming Soon: Higher Application Fees for Trusted Traveler Programs like Global Entry

- (UPDATES) Ruh Roh: American Airlines Botched Loyalty Points Accrual

How Do Amex Offers Work? The American Express Amex Offers program is a great benefit

150K Amex Platinum Offer A few weeks back I shared in on how to get

Turkish Airlines Denver Route Turkish Airlines announced it’s newest route in North America: Denver! We

Amex Gold 90K Welcome Offer At ToP we always want to try to share the

Amex Referral Bonus You have a friend that you talk up a credit card you

SIGN UP TO RECEIVE ToP TIPS STRAIGHT TO YOUR INBOX

We promise to keep things short, sweet, and packed with awesome insights!

Simple Flying

Us airlines raking in billions from seat assignment fees.

Selling preferred seats is a big revenue earner but needs to be improved if airlines are to maximize its potential.

It took airlines a long time to realize they could make billions from getting economy customers to pay twice for their seat. Once for getting access to a seat via their ticket and the second time when they wanted to sit in a particular seat, and so was born the seat assignment business model.

Selling preferred seats is big business

There are a handful of airlines globally that earn more income from selling ancillary products and services than they do from selling tickets. While this fee-for-service approach started in the world of low-cost carriers , it is now embedded in most legacy carriers that have unbundled fares in the name of giving passengers more choice, with one choice being where to sit, which is not a reference to their class of travel.

The subject of seat assignments, particularly as it relates to families sitting together, somehow made it into US President Joe Biden's State of the Union Address on February 7th, when he said:

"We'll prohibit airlines from charging up to $50 roundtrip for families just to sit together. Baggage fees are bad enough - they can't just treat your child like a piece of luggage."

IdeaWorksCompany (IWC) is a US specialist consultancy in airline ancillary revenue strategy and regularly reports on developments in the sector. Its president, Jay Sorensen, said those words strongly suggested it was time to review the state of assigned seating fees to determine the scale of activity, how these are implemented, and how this ancillary revenue business can be improved.

Last week IdeaWorksCompany (IWC) produced a report entitled Airlines Assign Big Revenue Priority to Seat Selection , which said eight key US airlines generated $4.2 billion from assigned seat revenue in 2022.

The eight airlines analyzed were Alaska , Allegiant, American, Delta, Frontier , JetBlue, Spirit, and United Airlines . It may surprise some that assigned seating now generates around 80% of the revenue that comes from checked baggage, which IWC estimates was $5.1 billion for the same eight airlines last year.

Is it too complicated?

The IWC report sets out all the methodology and assumptions made to produce the revenue estimates and also stresses that these numbers are for the US domestic services of the eight researched airlines. They do not include the longer international flights or global carriers, which would add billions more to the revenues generated by seat assignments.

IWC said that Alaska and Delta are not in the following table because they do not allow consumers who have purchased a basic economy ticket to select and pay for an assigned seat.

The report highlights that booking an assigned seat can be complex and may have terms and conditions that, in effect, don't guarantee the selected seat anyway. Sorensen believes these onerous terms and conditions and lack of disclosure "invite regulators to focus on ancillary revenue," which may explain how the subject made it into President Biden's speech.

With seat fees now a billion-dollar revenue opportunity and consumers accepting these as part of the deal, the IWC report lists five ways to improve the seat assignment business.

- Encourage purchase with miles/points and integrate assigned seats as a bonus offer

- Create a product by guaranteeing travelers will receive their assigned seat or get an automatic refund or equivalent

- Accommodate families by guaranteeing an adult and child will receive no-fee assigned seats in the booking path

- Simplify seat maps by marking each seat with a price that implies value

- Reduce and simplify the rules and decrease complexity.

Get all the latest aviation news for North America here

The IdeaWorksCompany reports are produced with the support of CarTrawler, a global B2B provider of car rental and mobility solutions to the travel industry. CarTrawler's technology platform expands ancillary revenue opportunities for airline and travel partners, including United Airlines, easyJet, Alaska Airlines, Emirates, and American Express.

Do you pay for seat assignments? Let us know in the comments.

Source: IdeaWorksCompany

- Credit Cards

- Travel Rewards Cards

- Airline Credit Cards

- Hotel Credit Cards

- Cash Back Credit Cards

- No Annual Fee Credit Cards

- Small Business Credit Cards

- 0% Intro APR Cards

- Balance Transfer Cards

- Bad or Poor Credit

- Elite Mileage Runs

- Merchandise

- αbout US ✉

My Delta Purchases That Did and Didn’t Work Towards Amex Platinum Airline Credit

I hold two American Express-branded Platinum cards: The Platinum Card® from American Express and The Business Platinum Card® from American Express . Both entitle cardholders to up to $200 in airline incidental statement credits each year. Enrollment is required and members can pick from a list of eligible airlines.

An Amex rep told me the below charges should credit back:

- Airline fee charge billed after airline selection

- Airport lounge day passes and annual memberships

- Change fees

- Checked baggage fees

- Early check-in fees

- In-flight amenity fees (beverages, food, pillows/blankets, and so on)

- In-flight entertainment fees (excluding wireless Internet)

- Overweight/oversize baggage fees

- Pet flight fees

- Phone reservation fees

- Seat assignment fees

- Unaccompanied minor fees

Here’s what is explicitly prohibited:

- Airline tickets

- Award tickets

- Duty–free purchases

- Mileage points purchases

- Mileage points transfer fees

Many of our readers hold Delta co-branded American Express cards and/or Medallion status. So checked bag fees rarely are a concern. Many fly Comfort+ or First Class — where adult beverages are free.

So what’s a person to do with that $200 in airline credit?! (Such a #FirstWorldProblem, I know!)

Here’s what purchases triggered the credit (as well as ones that didn’t) across my two Platinum cards this year. (For reference, these were my 2019 results .)

YES: Onboard Beverage Purchases

My wife and I took one for the team. We sat in Main Cabin and purchased a couple of Old Fashioneds to ensure the $10 drinks would work toward the airline statement credit. (No need to thank us. And I know the picture above was taken in first class. It’s all I had.)

I can confirm those purchases credited back!

YES: Pay With Miles Cash Balances

You might want to consider this option if you’re not flying the rest of the year and want to enjoy your airline incidental credit. Though it could be a YMMV situation.

Delta’s Pay With Miles feature is available to Delta American Express cardholders. It allows you to apply SkyMiles (at a rate of one cent per point) toward the cost of an eligible Delta fare and still earn MQM — and MQD and SkyMiles for any remaining cash balance.

And that’s where the “cash balance” part gets interesting.

I bought a couple of Pay With Miles tickets this year and made sure the cash balances were under $200 . Sure enough, those purchases worked toward statement credit.

This is not necessarily anything new — but I wanted to remind you about it.

NO: Delta Sky Club Premium Beverage Purchases

Mrs. Carley fell on the sword and let me buy her a Flower District Margarita at the Austin Sky Club . And the Atlanta F Concourse Sky Club. (Side note: the drinks differed between locations. The ATL club’s had a heavier mescal pour — which Mrs. C did not enjoy.)

As we expected, those did not earn statement credit.

Interestingly, I used my Delta SkyMiles® Reserve Business American Express Card to buy a drink at a Sky Club and that earned bonus SkyMiles and counted as a Delta purchase.

What Worked for You? What Purchases Didn’t Credit?

Please share your experiences using the $200 airline credit perk! We’d love to hear about it in the Comments section below. (I’m especially curious about award ticket taxes and fees and Sky Club guest admission fees.)

To See Rates and Fees for…

- The Business Platinum Card® from American Express , please visit this link . Terms apply.

- The Platinum Card® from American Express , please visit this link . Terms apply.

- Delta SkyMiles® Reserve Business American Express Card , please visit this link . Terms apply.

Delta Slashes Medallion and SkyMiles Earnings for Basic Economy Tickets

Hooray for (tommie) hollywood [a review of hyatt’s new tommie hotel in los angeles], chris carley.

Chris Carley is the owner, editor, and lead writer of Eye of the Flyer (formerly known as Rene's Points).

Hooray for (tommie) Hollywood? [A review of Hyatt's new tommie Hotel in Los Angeles]

Hi Chris – I recently paid a domestic short flight (~2 hours) for my child and brought the cost to just under $200 and that worked. Checked in luggage cost also worked.

I wonder if paying for a ticket on another airline to get it under $200 would work?

One time passes for UA lounges work, though obviously not the airline of focus for this blog.

Thanks for the data point!

Thanks for the heads up! I booked several last minute flights on Delta using Pay with Miles option and everything under $200 qualified. I didn’t get a chance to test anything above $200.

I bought Delta Comfort+ for my previously purchased tickets and Amex rep told me that Delta coded my purchase as “upgrade fee” , I didn’t receive the incidental credit. In my mind, paying for Delta Comfort+ was paying for seat selections so I found this very annoying. Amex rep offers me a good will 1500 MR points though. I like CSR format much better.

I have had success in purchasing a Coach seat on Delta (not Basic Economy) and then “purchasing a more comfortable seat closer to the front of the plane” (C+). It isn’t an automatic credit. I wait about two weeks and then use the chat function to explain that I purchased “a more comfortable COACH seat closer to the front of the plane.” DO NOT use the upgrade word. This worked for me in 2021 and 2022. It is considered a “seat assignment fee” and that is covered. Again – do not say you “upgraded” from Coach to C+.

Wow — great data point, Patrick. Thank you!!

Could you do all pay with miles & cash , get the airline fee credit and then cancel the flight later and get an ecredit to use whenever?

I haven’t tried miles and cash — just Pay with Miles and then charging the balance to my Amex Card. And, yes, if you have to cancel a flight, you should receive the entire amount as a credit.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Notify me of follow-up comments by email.

Notify me of new posts by email.

You have Successfully Subscribed!

➤ search eye of the flyer, great travel and cash back card offers.

Eye of the Flyer may receive a commission from the links below. See our Privacy Policy

Marriott Bonvoy Business® American Express® Card : Earn 3 Free Night Awards, valued at a total of up to 150,000 Marriott Bonvoy® points after you spend $6,000 on eligible purchases within six (6) months of being approved for card membership. Each award can be redeemed for one night at or under 50,000 Marriott Bonvoy points at hotels participating in Marriott Bonvoy®. (Certain hotels have resort fees. Terms apply.)

Chase Freedom Unlimited® Card : Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) – worth up to $300 cash back. Read more here .

The Business Platinum Card® from American Express : Earn 120,000 bonus American Express® Membership Rewards® points after you spend $15,000 on eligible purchases on the card within the first three (3) months of being approved for card membership. Terms apply.. Plus, select airport lounge access, statement credit opportunities, and more! Read here why we love this card.

Ink Business Cash® Credit Card : $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening. That's up to $750 bonus cash back (awarded as 75,000 bonus Chase Ultimate Rewards® points ) Read more here .

Hilton Honors American Express Aspire Card : A Free Night Award each year, complimentary Diamond status, and several great statement opportunities. Plus, earn 150,000 bonus Hilton Honors Bonus Points after you spend $6,000 in purchases on the card within your first 6 months of Card Membership approval. Learn here how to apply . ( See Rates and Fees. Terms apply . All information about the Hilton Honors American Express Aspire Card was collected independently by Eye of the Flyer.)

The Capital One Venture X Rewards Credit Card is a must-have “it” card for travel lovers! Earn 75,000 bonus miles after you spend $4,000 on purchases in the first three (3) months of being approved for card membership. Plus, earn $300 annually in statement credits for travel purchased through Capital One AND 10,000 bonus miles every year, after the first anniversary. The annual fee can EASILY be earned back ( here’s how ) — and then some! Read more here .

Unauthorized use and/or duplication of this material without express and written permission from this site’s author and/or owner is strictly prohibited. Excerpts and links may be used, provided that full and clear credit is given to Eye of the Flyer with appropriate and specific directions to the original content.

- ✍ Editors Disclaimer

- 💰 Advertiser Disclosure

- 🔒 Privacy Policy

- BANK & Travel Cards ★

Copyright © 2023 Eye of the Flyer. All Rights Reserved.

How (and why) to change your airline for your Amex fee credit this year

Update: Some offers mentioned below are no longer available. View the current offers here .

Many credit card issuers have made a number of changes to benefits in response to the ongoing pandemic. In some cases, cardholders can earn bonus points in new categories, while in others, you now have new perks or extended time to use existing perks.

On the other hand, some benefits remain as they were prior to the pandemic. One of the most notable examples is the annual airline fee statement credit on several American Express cards. These credits haven't been extended or publicly modified in any way, so you still have until the end of 2021 to use them.

However, as we approach the end of the year, it's important to look at any upcoming travel plans that you may have since it's possible to change your designated airline for this perk.

Here's how (and why) you can adjust your selected airline this year.

Want more credit card news and advice from TPG? Sign up for our daily newsletter .

Applicable Amex cards

Several American Express cards currently provide this perk. Here's a snapshot of some popular ones (enrollment required):

- The Platinum Card® from American Express: Up to $200 per calendar year.

- The Business Platinum Card® from American Express: Up to $200 per calendar year.

- Hilton Honors American Express Aspire Card: Up to $250 per calendar year.

The information for the Hilton Aspire Amex card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Remember that these credits typically apply solely to incidental fees on the one airline you designate, making the perk much less flexible than travel credits on cards such as the Chase Sapphire Reserve.

Nevertheless, you may be able to enjoy some flexibility this year.

Related: What still triggers Amex airline fee reimbursements?

Using online chat to change your airline

Under normal circumstances, you select your airline when you first get an eligible card, and then you can adjust your selection for these credits once per year, in January. If you do not change it, the system will automatically carry forward your previous year's airline choice.

But this year, American Express is allowing additional changes — and I was able to adjust the airline for my Hilton Aspire card in just a few minutes by using the online chat feature.

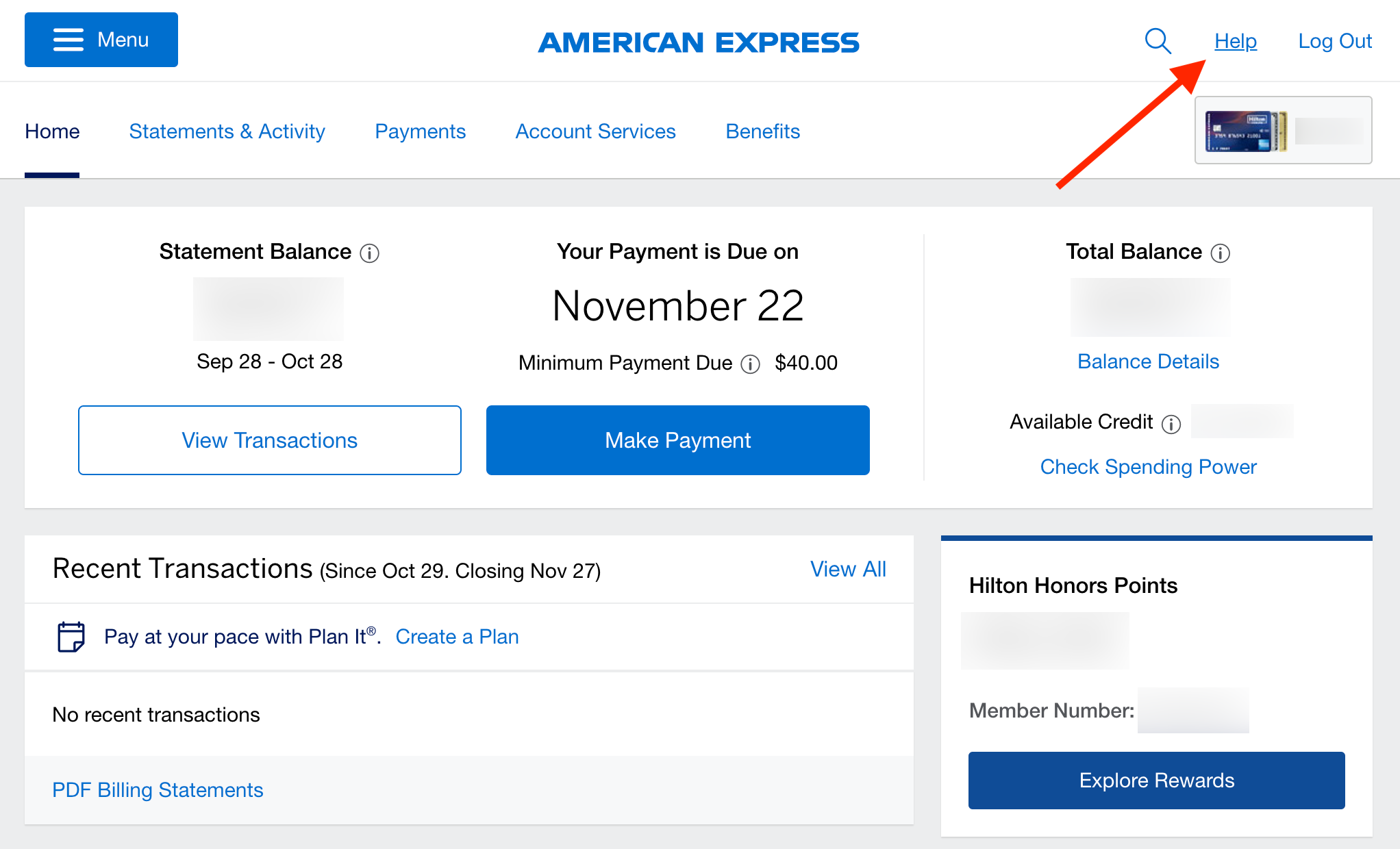

Start by logging in to your account. Navigate to the applicable card, then click Help at the top.

Scroll down to find the Chat With Us section, then click the Live Chat icon.

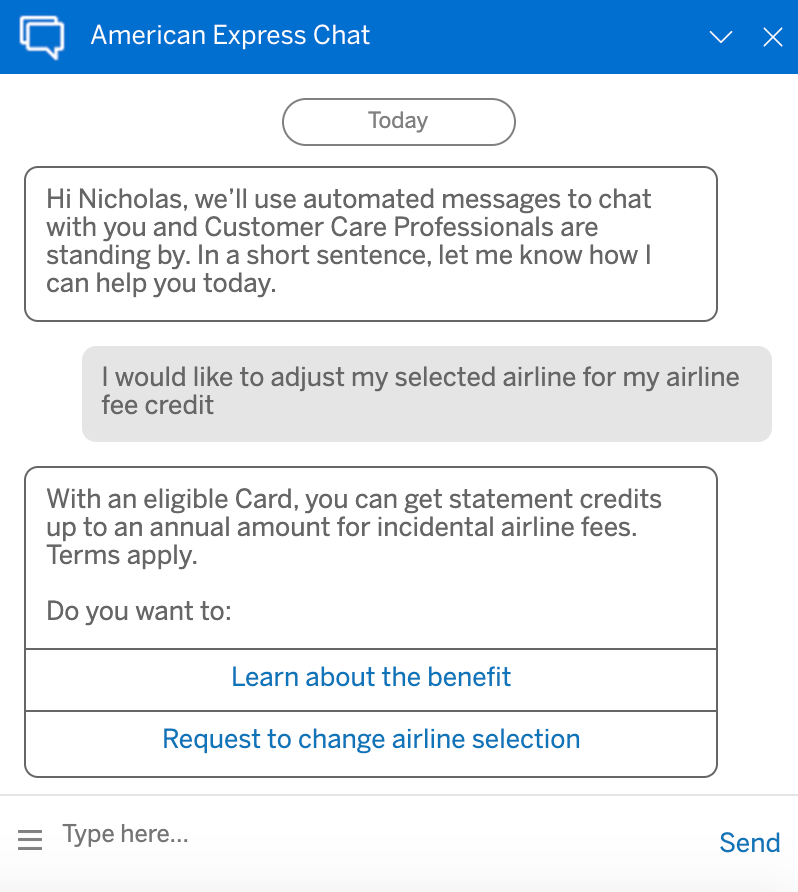

From there, you'll be asked to type in a sentence to let the automated system know what you want to do. I said, "I would like to adjust my selected airline for my airline fee credit," and the system gave me the following response:

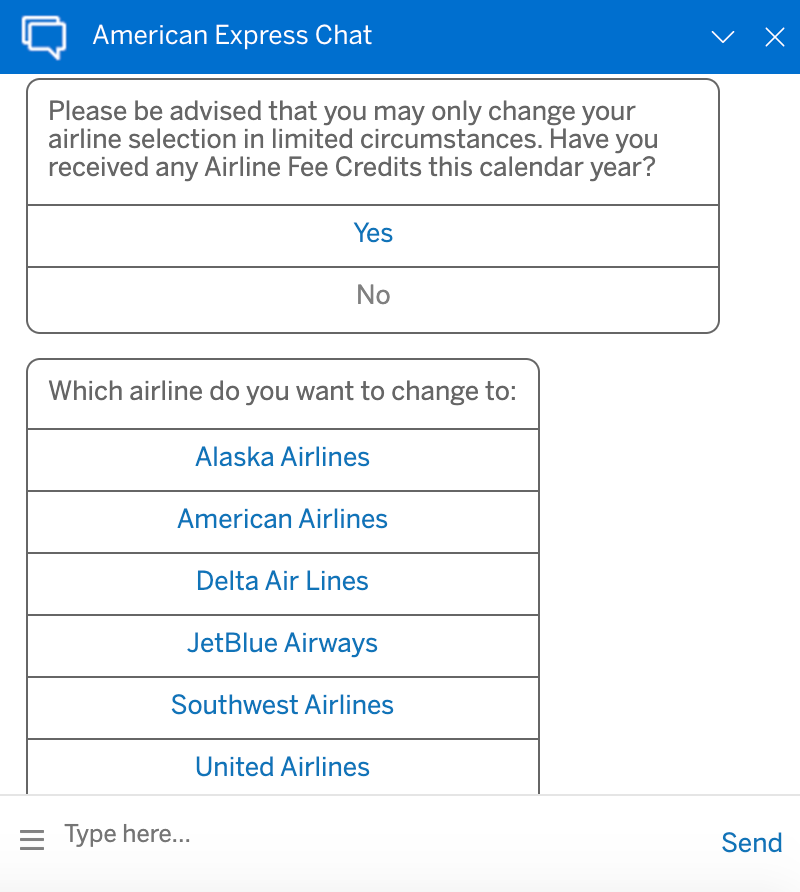

I clicked the second option and then answered two additional questions.

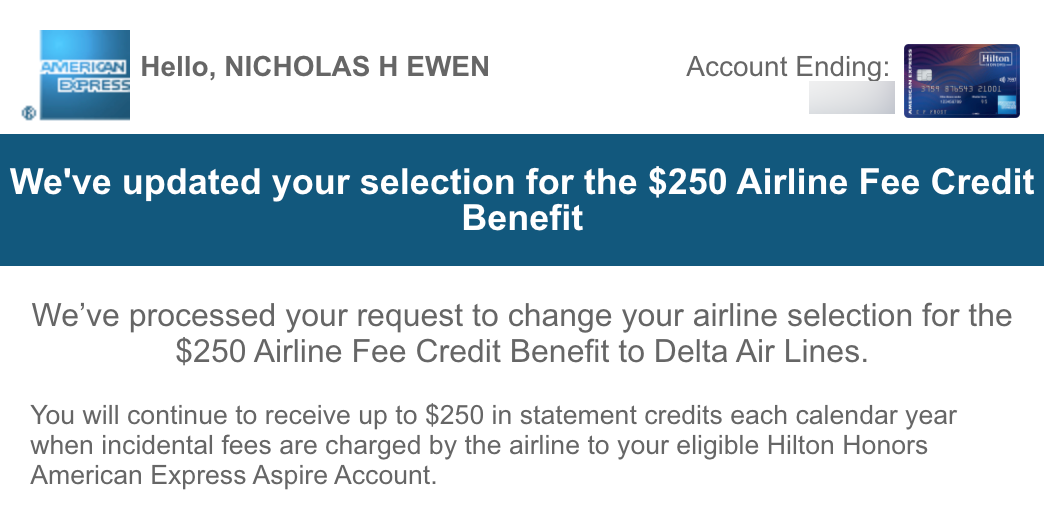

At that point, I was connected with a representative. He reminded me of the terms of the perk then processed the change. I immediately received a confirmation email as well.

It took less than five minutes from the time I started the chat to when I received the email.

Why you might want to change your airline now

There are a couple of key reasons why this may make sense right now:

- Holiday trip(s) on an airline other than the one you previously selected.

- Trips booked for 2022 with fees that you could incur now.

The former of these two led me to initiate a change.

In an average year, JetBlue is my airline of choice for the fee credit offers on my American Express cards. I frequently take the carrier from my home state of Florida to New York City for business meetings at the TPG office and to visit family in the area. It's also my go-to airline for domestic vacations, thanks to extensive service from Orlando (MCO) and Fort Lauderdale (FLL).

While my JetBlue Plus card covers baggage fees when I fly, I will typically max out the credits on my Hilton Aspire and Amex Platinum cards through seat selection on Blue Basic fares or by splurging for Even More Space seats .

However, this year, I've only taken a single, round-trip flight on JetBlue and have no upcoming travel on the books. However, I do have a Delta flight coming up for a holiday ski trip , and since I do not have Medallion status or a Delta credit card , I'd be on the hook for some hefty bag fees.

Well, not anymore. By changing my designated airline for the Hilton Aspire card from JetBlue to Delta, I now have up to $250 in credit to use on this trip. The airfare alone was quite pricey, and with lift tickets and equipment rentals, the costs will quickly pile up on this trip. Thankfully, I no longer need to worry about bag fees .

You may find yourself in a similar situation over the next couple of months — taking a holiday trip on an airline other than the one you selected back in January. Or you could use this opportunity to look ahead to your 2021 travel and identify a chance to prepay for seat assignment fees, lounge passes or other incidentals that would trigger the Amex fee credits.