Concord now offers a built-in HubSpot integration!

Send and sign agreements in seconds, with Concord

Effortless contract management, from drafting to e-signing and beyond. Book a live demo to see Concord in action.

- Templates Center

Assignment of Deed of Trust Template

An assignment of trust deed is a document that lenders and financial institutions use when working with loans secured by trust deeds.

ASSIGNMENT OF DEED OF TRUST

This Assignment (hereafter “Assignment”) is effective [ DATE ] between [ ASSIGNOR NAME ], a company organized and existing under the laws of the State of [ STATE ], with its principle place of business located at [ COMPLETE ADDRESS ] (“Assignor”) and [ ASSIGNEE NAME ], a company organized and existing under the laws of the State of [ STATE ], with its principle place of business located at: [ COMPLETE ADDRESS ] (“Assignee”). The parties may be referenced jointly as “Parties”.

Effective [ DATE ] (the “Assignment Date”), Assignor assigns, conveys and transfers to Assignee all of Assignor’s rights, title and interest in the Deed of Trust, and the right to exercise any and all rights and remedies of the Assignor, with respect to the terms therein. Assignor represents and warrants that:

- Assignor has the right, power and authority to execute this Assignment;

- that to the best of Assignor’s knowledge the Deed of Trust is a good, valid and binding agreement between the parties and is in full force and effect in accordance with its terms which have not been amended or modified; and

- that no act or omission on the part of Assignor has occurred that would be considered a default under the Deed of Trust.

Assignor disclaims any further interest in the Deed of Trust.

Acceptance and Indemnification

Assignee accepts this assignment and promises to perform all services and obligations required of Assignor under the Deed of Trust, as of and after the Assignment Date, and continuing after for as long as the Deed of Trust remains in full force and effect.

Binding Effect

This Agreement shall be binding upon the Parties, their successors and assigns.

Our templates are intended for reference use. Concord holds no responsibility for any reliance placed on these templates. These templates do not constitute legal counsel and should not be treated as such. By using any of these templates, you acknowledge and consent to these conditions.

This site uses cookies to deliver and enhance the quality of its services and to analyze traffic.

Assignment of Deed of Trust Template

Document description.

This assignment of deed of trust template has 1 pages and is a MS Word file type listed under our legal agreements documents.

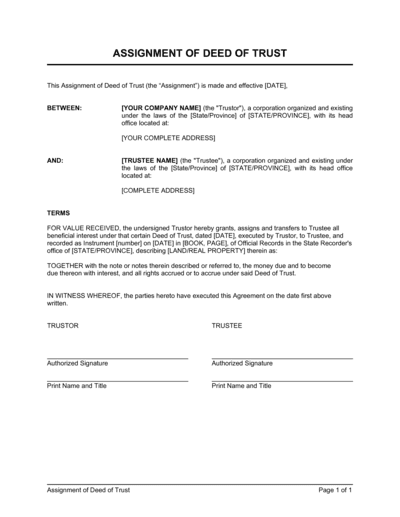

Sample of our assignment of deed of trust template:

ASSIGNMENT OF DEED OF TRUST This Assignment of Deed of Trust (the �Assignment�) is made and effective [DATE], BETWEEN: [YOUR COMPANY NAME] (the "Trustor"), a corporation organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [YOUR COMPLETE ADDRESS] AND: [TRUSTEE NAME] (the "Trustee"), a corporation organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] TERMS FOR VALUE RECEIVED, the undersigned Trustor hereby grants, assigns and transfers to Trustee all beneficial inter

Related documents

3,000+ templates & tools to help you start, run & grow your business, all the templates you need to plan, start, organize, manage, finance & grow your business, in one place., templates and tools to manage every aspect of your business., 8 business management modules, in 1 place., document types included.

Partnership

Sole proprietorship, limited partnership, compare businesses, employee rights, osha regulations, labor hours, personal & family, child custody & support, guardianship, incarceration, civil and misdemeanors, legal separation, real estate law, tax, licenses & permits, business licenses, wills & trusts, power of attorney, last will & testament, living trust, living will.

- Share Tweet Email Print

LIVING TRUST

What is an assignment of trust deed.

By Tom Streissguth

- What Is a Corporate Assignment of Deed of Trust?

If you own a home, you may have signed a trust deed that gives the mortgage lender a claim on the property. A default on the loan gives the lender the legal authority to foreclose on the loan and take possession of the house. An assignment of a trust deed conveys that claim to another party.

Considerations

Lenders have the right to sell their home loans. This can happen once or several times over the long life of a mortgage. The usual customers for mortgages are banks and other companies that are seeking safe and stable investment returns. This "secondary" market for mortgages is quite active, and a lender has plenty of opportunity to sell a mortgage and turn a profit. Read More: What Is a Corporate Assignment of Deed of Trust?

When a lender sells the loan, it assigns the trust deed to the buyer. “Assignment” means to convey a claim or a right to another party, known as the “assignee.” This is done by creating another legal document — the assignment of trust deed — and having it signed by both buyer and seller. The trust deed, and other documents associated with the loan, become the property of the buyer.

The assignment of trust deed is a short, usually single-page document. The body text gives the names of the deed buyer and the property owner, the date of the original trust deed, and the legal description of the property for which the original deed was executed. It may also give the terms of the deed sale. The seller signs and dates the document, and has it notarized. The buyer then has the assignment of trust deed recorded with the registrar of the county where the property is located.

A borrower has no legal right to block or negotiate the terms of an assignment of trust deed. The assignment does not affect the terms of the loan. The monthly payments remain the same, although the borrower will have to send them to a new address. The new owner of the trust deed becomes the lender and collects all mortgage payments, sometimes on its own and sometimes through a servicing company. If a default occurs, the latest assignee has the right to foreclose and repossess the home.

- US Legal: Assignment of Trust Deed

- Guide to the Stock Market: Assignment of Trust Deed

Founder/president of the innovative reference publisher The Archive LLC, Tom Streissguth has been a self-employed business owner, independent bookseller and freelance author in the school/library market. Holding a bachelor's degree from Yale, Streissguth has published more than 100 works of history, biography, current affairs and geography for young readers.

Related Articles

- How to Fill Out the Deed of a Trust to Secure Assumption

- How to Write a Wrap-Around Mortgage

- The Definition of a Leasehold Deed of Trust

Deed of Trust Templates

When you’re closing on a home, there can be a lot of paperwork. You might wonder what, exactly, you’re signing and how it all works.

Often, one of the documents you’ll sign is a deed of trust. This critical document signifies an agreement between you and your bank, so it’s essential to understand what it means and how it works.

What Is a Deed of Trust?

A deed of trust form is a real estate document you might encounter at the end of the home buying process. It represents an agreement between the home buyer and the home loan lender.

In this deed, the buyer agrees that the lender will hold the legal title of the property until the buyer repays the loan.

If that sounds similar to a mortgage, it is. Some states offer deeds of trust instead of mortgages when financing is involved in a home purchase.

Deed of Trust by State

- Connecticut

- Massachusetts

- Mississippi

- New Hampshire

- North Carolina

- North Dakota

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- West Virginia

Who’s Involved in a Deed of Trust?

A deed of trust involves three parties:

- Trustor (borrower)

- Trustee (independent and neutral third party)

- Beneficiary (lender)

The trustor or borrower is usually the person buying the home, and the beneficiary is usually a bank.

The trustee is typically a title or escrow company. They’ll hold the legal title on the property until the borrower repays the loan.

If the borrower fails to make their loan payments, the trustee initiates the foreclosure process, ensures the lender receives payment, and then dissolves the trust.

How Deeds of Trust Work

In the aforementioned deed, the borrower or home buyer gives the bank a promissory note . Promissory notes are a written promise to repay the loan. They state the terms of the loan, including the interest rate and loan length.

When the buyer pays off the loan, the promissory note is marked “paid in full” and returns to the buyer. If the buyer fails to pay off the loan or meet the loan terms, the trustee or escrow company will initiate the foreclosure process.

Non-Judicial Foreclosures

Deeds of trust typically contain a power-of-sale clause that allows the trustee to issue a non-judicial foreclosure .

Non-judicial foreclosures are heavily regulated and usually require lenders to provide special notice to the property owner. They may also specify a certain amount of time before the trustee can put the property up for auction. But they don’t require the trustee to go through the court system.

Because they don’t involve the courts, non-judicial foreclosures happen much faster than traditional foreclosures. This makes his type of deed tthe favorable option for many banks and lenders.

Why Do I Need a Deed of Trust?

A deed of trust ensures that borrowers will repay their loan; otherwise, they forfeit their property. Depending on where you’re purchasing property, you may need this deed to proceed.

Some states require this deed when buyers use financing to purchase a home. Other states rely on mortgages to serve the same purpose. There are also several states that accept both.

Even in states that will accept either a deed of trust or a mortgage, many lenders may only offer financing with a deed of trust. That’s because deeds of trust feature a streamlined foreclosure process if the homebuyer defaults on their loan.

Deed of Trust vs. Mortgage

Deeds of trust and mortgages fulfill the same purpose. Both provide a path for banks to pursue foreclosure. State laws also regulate them both.

However, trust deeds and mortgages differ in two significant ways:

The Number of Parties Involved

Mortgages have two parties; the lender and the borrower. Trust deeds have three; the lender, the borrower, and a neutral third party, usually an escrow company.

Foreclosure Process

Mortgages don’t include non-judicial foreclosures. If a borrower defaults on their loan, the bank must pursue them through the court system. Going through the court system takes more of the lender’s resources and makes the foreclosure process longer than it is with a deed of trust.

Creating a Deed of Trust: Step-By-Step Guide

Enacting a deed of trust involves collecting information for the deed form, executing the agreement, and recording the deed form with the appropriate government office.

Many online law services offer a free deed of trust or deed of trust template that you can use if you choose not to use one of the attached templates. Or, you may choose to use a real estate lawyer for this process.

Complete the Deed of Trust Form

The first step in any process for this specific deed is to gather and fill in the information needed on the deed form. Deed of trust forms usually require:

- Names and addresses of all parties

- Legal description of the property

- Main terms of repayment

You can obtain thelegal description of the property by contacting your county registrar or the county recorder of deeds. They’ll ask for the property address and tax parcel number. With that information, they can quickly look up the property’s legal description.

Alternatively, you may be able to find the legal description on a tax assessment document or land title document. Or, if you’re working with a real estate attorney, you can ask them for help attaining the legal description.

The main terms of repayment summarize the terms listed on the promissory note. They’ll include the principal amount owed, interest rate, and how the interest calculates (monthly or annually). Sometimes they’ll also include additional loan terms.

Execute the Agreement

Once the form is complete, all of the parties will sign and date the agreement in the presence of a notary. Some states require one witness during the signing and will count the notary as that witness.

Others require two witnesses. The notary can be one of them; the other one needs to be a disinterested party who’s at least eighteen years old.

Record the Agreement

Your state may or may not require you to record your deed of trust within a specific time, but whether it’s a requirement or not, you should record the agreement right away. Recording protects the home buyer from adverse title claims by other parties.

Usually, trust deeds are recorded at the County Recorder’s or County Clerk’s office, and each county sets its own filing requirements. Most counties post these requirements online, or you can call them for more information.

Once all of the involved parties complete and sign the deed, then record it with the local county, the document is functional.

Frequently Asked Questions

Deeds of trust can seem complicated, and you might still have questions. Below are some of the most common questions (and answers) surrounding deeds of trust.

A deed of trust protects the lender, usually a bank, in case a borrower defaults on their loan. From a borrower’s perspective, this deed can provide financial stability.

As long as the borrower doesn’t default and makes consistent payments, a deed of trust can also increase the buyer’s credit score.

Deeds of trust and title are both real estate terms, but they’re not the same thing.

This specific deed is an agreement between a borrower and a lender. The property title is a record of past and current owners that allows for the establishment of a chain of title and shows property ownership.

A deed of trust will appear on your credit report as a credit account. Your lender or bank will report payments that you make to the credit bureau. Consistent and on-time payments raise your credit score, but a late payment can significantly lower it.

Whether a deed of trust is a good idea or not depends on the buyer, the lender, and the terms of the loan.

If the buyer can afford to make the required payments consistently and on time, this deed can provide extra financial stability. It could also increase their credit score over time.

If a buyer can’t afford to make the payments required in the trust deed, signing the agreement would be a mistake. Missed payments will negatively impact the buyer’s credit score. And if the buyer defaults, the trustee can begin the foreclosure process on the property.

Yes, you can sell a home with a deed of trust. Just like with a mortgage, when you sell, the lender will receive the funds from the sale which you still owe.

The trustee will ensure the money from the sale is dispersed appropriately and then will ensure the trust dissolves. If you plan to sell the home for less than you owe, you’ll need lender approval.

Final Thoughts

When closing on a home, you may come across a deed of trust. This essential document gives the bank a path to foreclosure on your property should you default on your loan. It also lays out the loan terms, so it’s essential to understand how this deed works before you sign the document.

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

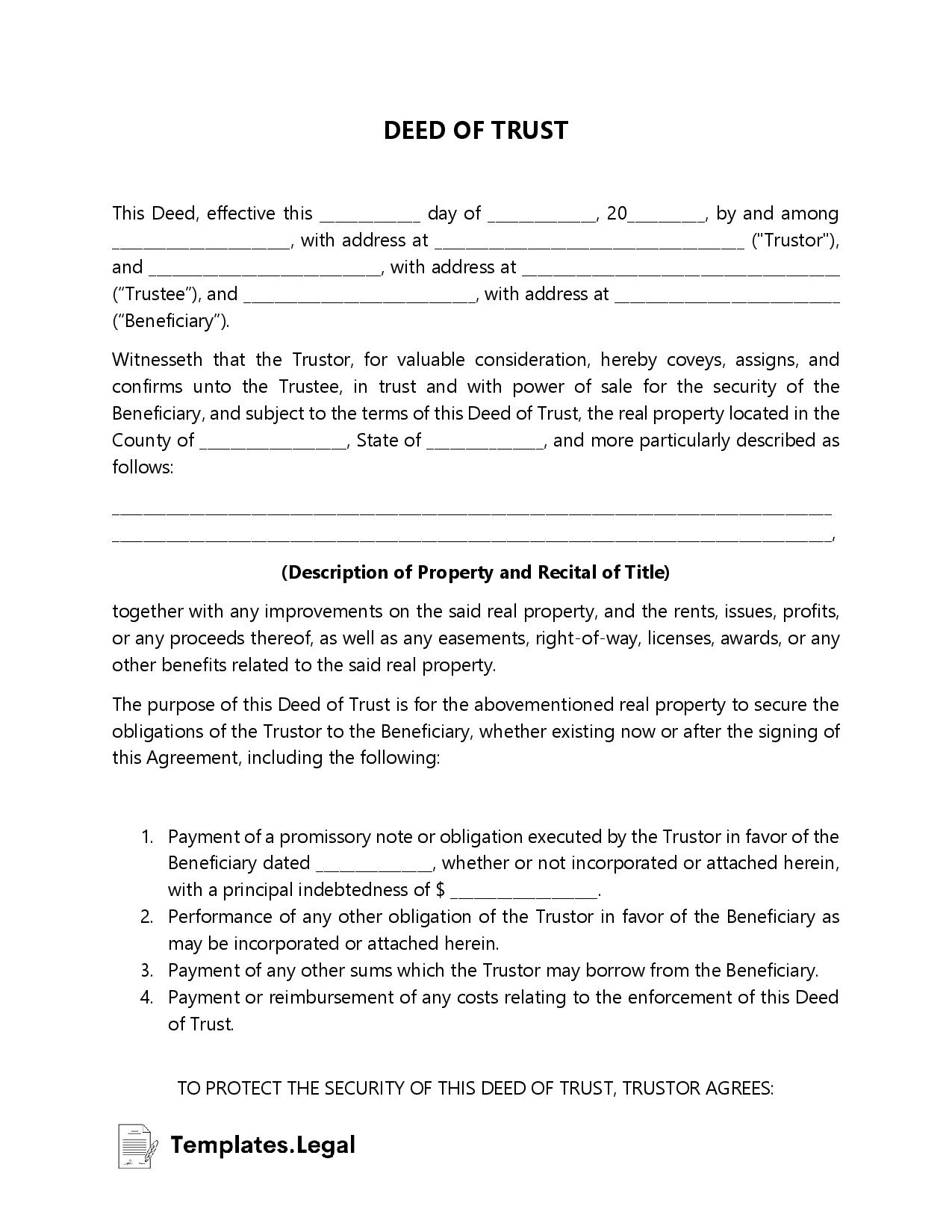

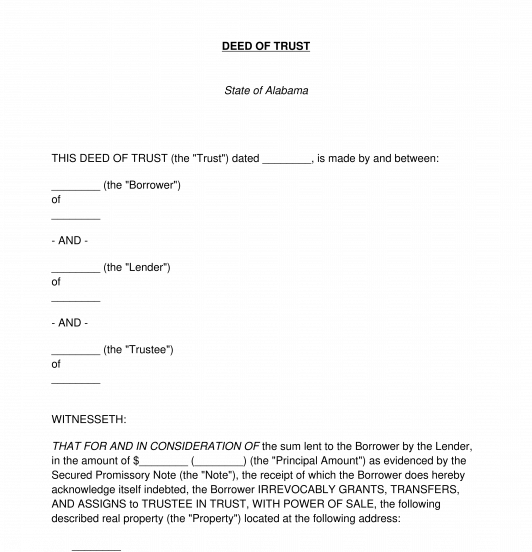

Deed of Trust

Rating: 4.8 - 5 votes

A Deed of Trust is a document used to create a lien on a piece of real property (e.g. a house, plot of land, farm, etc.) to serve as security or collateral for a loan . If the borrower does not repay the loan on time, the lender can use this document to foreclose on and sell the property in order to pay off the outstanding balance of the loan. Unlike a typical deed, it does not immediately transfer to the ownership of real property in the usual sense. Instead, it transfers the property into a trust managed by someone known as the trustee . A Deed of Trust is always used in combination with a Secured Promissory Note which sets out the amount and terms of the loan between the borrower and the lender.

Though a Deed of Trust is similar to a mortgage, the main difference is that the Deed of Trust gives the trustee, a neutral third-party, legal ownership of the property in the trust. This means that the trustee has no control over the property as long as the borrower continues to make loan payments to the lender on time, as well as meeting all of the other terms of the Deed of Trust. However, if the borrower defaults, the trustee has the power to sell the property in order to pay off the loan to the lender without having to involve the courts. This is called a non-judicial foreclosure and is a much swifter and easier process than a judicial foreclosure where the lender must file a lawsuit against the borrower to get their money back.

Though they sound similar, a Deed of Trust is not used to transfer property to a Living Trust . A Living Trust is an agreement created by a person known as a Grantor to hold some portion of their assets during their lifetime . The Trust provides for payment of income to the Grantor and then the distribution of their remaining trust assets once they die. A Quitclaim Deed is a document used to transfer property from the Grantor into the Living Trust. Other than sounding similar, Deeds of Trust and Living Trusts have little else in common and have very different purposes .

How to use this document

This document contains all of the information necessary to place a piece of property in a trust so that it can be used as security or collateral for a loan. Firstly, the Deed should contain all of the information necessary to identify the involved parties , including the borrower, lender, and trustee. The Deed then includes a precise description of the property being transferred. This description includes the address, the legal description, and the parcel ID number of the property . The legal description for the property can be found on previous deeds, tax forms, or at the county's Register of Deeds where deeds are recorded by the county. The parcel ID number, also known as an Assessor's Parcel Number (APN), can be found on past tax statements, a revaluation notice, or a personal property listing form. Finally, the Deed outlines the basic terms of the Secured Promissory Note that is being secured by the property that is being put in the trust to be used as collateral. These terms include details such as how often payments will be made, the amount of the payments, and any applicable interest rates and/or penalties.

Once the Deed of Trust is completed, the borrower must sign and date it in front of a notary and have the document notarized . A notary page is included at the end of the document. After the Deed of Trust is signed and notarized, it needs to be recorded in the county where the property is located . Often a small fee must be paid at the time of filing. The county will keep the original copy of the Deed, but the Parties should keep a copy of the Deed in a safe and secure location for their records and in case of future dispute.

Applicable law

Deeds of Trust are governed by state law . Different states have different requirements for when and how the Deed should be filed. Contact the local county Register of Deeds to get information about which governmental agency should be given the Deed to file and record before being returned to the parties.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

- How to Notarize a Document

- Mortgage Deed vs. Deed of Trust

Other names for the document:

Trust Deed, Deed of Trust for Real Property, Real Estate Deed of Trust, Deed of Trust for Real Estate, Deed of Trust (Real Property)

Country: United States

Commercial Activity - Other downloadable templates of legal documents

- Service Agreement

- Sale of Goods Agreement

- Agency Agreement

- Broker Agreement

- Franchise Agreement

- Security Agreement

- Consignment Agreement

- Catering Agreement

- Building Construction Agreement

- Returned Check Notice

- Promissory Note

- Letter of Intent

- General Receipt

- Distribution Agreement

- Production Agreement

- Marketing Agreement

- Event Agreement & Waiver

- Music Recording Contract

- Independent Contractor Agreement

- Speaking Engagement Agreement

- Other downloadable templates of legal documents

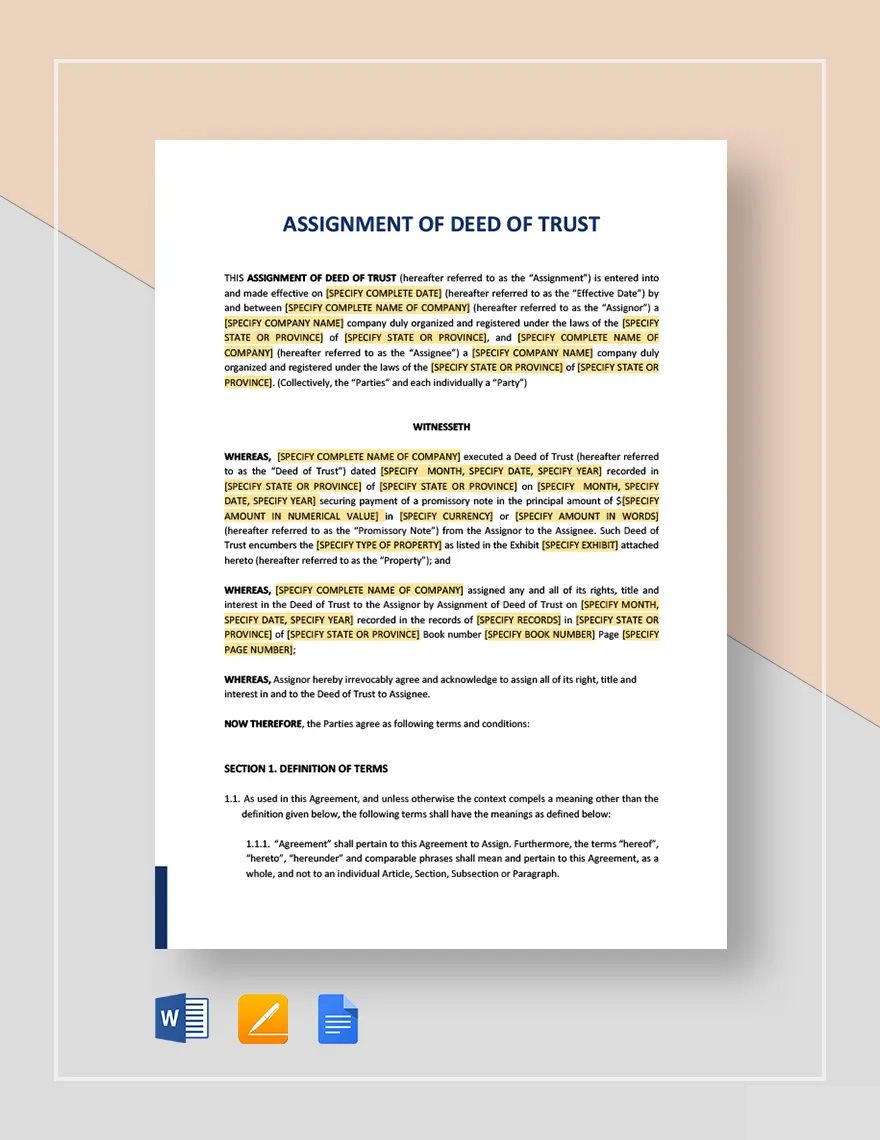

Printable Assignment of Deed of Trust Template

Download this Printable Assignment of Deed of Trust Template Design in Word, Google Docs, Apple Pages Format. Easily Editable, Printable, Downloadable.

Create a document that is used with mortgages in the event of foreclosure. This gives the mortgage lender a claim on a property. To help you create one, download our premium Assignment of Deed of Trust template. It is designed to allow a property buyer or owner to take out a loan that uses the property as security on that loan, but using a third party, the trustee, as part of the transaction. the file is ready-made and easy to use using the available file formats presented. It can also be customized to suit the user's specific preferences. Such a high-quality template at such a reasonable price should not be missed! Download today!

Already a premium member? Sign in

You may also like

IMAGES

VIDEO

COMMENTS

Register and Subscribe Now to work on VA Assignment of Deed Trust & more fillable forms. pdfFiller allows users to edit, sign, fill and share all type of documents online.

FOR VALUE RECEIVED, the undersigned hereby grants, assigns and transfers to. all beneficial interest under that certain Deed of Trust dated executed by. to and recorded as Instrument No. Recorder's office of. on. , as Trustor , Trustee , of Official Records in the County County, California. Describing land therein as (insert legal description):

Assignment. Effective [DATE] (the "Assignment Date"), Assignor assigns, conveys and transfers to Assignee all of Assignor's rights, title and interest in the Deed of Trust, and the right to exercise any and all rights and remedies of the Assignor, with respect to the terms therein. Assignor represents and warrants that:

Deed of Trust Form. Use our deed of trust to create a contract in which a third party holds property until a borrower pays back debt to the lender. A deed of trust is a document that dictates an arrangement between a borrower, a lender, and a trustee. It states that a lender will loan money to a borrower to purchase a home or another property ...

Deed of Trust. Both a warranty deed and deed of trust are used to transfer the title of a property from one person to another. However, the difference between these two contracts is who is ...

This assignment of deed of trust template has 1 pages and is a MS Word file type listed under our legal agreements documents. Sample of our assignment of deed of trust template: ASSIGNMENT OF DEED OF TRUST This Assignment of Deed of Trust (the Assignment ) is made and effective [DATE], BETWEEN: [YOUR COMPANY NAME] (the "Trustor"), a corporation ...

A Deed of Trust, also known as a trust deed, is a document used during financed real estate transactions, meaning a buyer borrows money from a lender to buy a property.. It transfers the property's legal title to a neutral third party, the trustee, who holds it until the buyer pays back the lender.. Once repayment is complete, the trustee reconveys the legal title to the buyer, and the ...

Assignment. When a lender sells the loan, it assigns the trust deed to the buyer. "Assignment" means to convey a claim or a right to another party, known as the "assignee.". This is done by creating another legal document — the assignment of trust deed — and having it signed by both buyer and seller. The trust deed, and other ...

A) (the "Note"), this Trust Deed secures to Lender the repayment of the Note, and all renewals, extensions and modifications of the Note, and the performance of Borrower's covenants and agreements under this Trust Deed and the Note. FOR THIS PURPOSE, Trustor irrevocably grants and conveys to Trustee, in trust, with power of

A deed of trust form is a real estate document you might encounter at the end of the home buying process. It represents an agreement between the home buyer and the home loan lender. In this deed, the buyer agrees that the lender will hold the legal title of the property until the buyer repays the loan. If that sounds similar to a mortgage, it is.

A Deed of Trust is a document used to create a lien on a piece of real property (e.g. a house, plot of land, farm, etc.) to serve as security or collateral for a loan.If the borrower does not repay the loan on time, the lender can use this document to foreclose on and sell the property in order to pay off the outstanding balance of the loan.

1. DEFINITIONS In this Trust Deed the following terms shall be defined: 1.1 "Trust" shall mean the trust created by this Trust Deed and named in clause 3. 1.2 "Property" shall mean that property set out in Schedule A. 1.3 "Trust Fund" shall mean that Property set out in Schedule A as well as any and all additional settlements which ...

ASSIGNMENT OF DEED OF TRUST. See Exhibit A attached hereto and made a part hereof. TOGETHER with the note or notes therein described or referred to, the money due and to become due thereon with interest, and all rights accrued or to accrue under said Deed of Trust. A notary public or other officer completing this certificate verifies only the ...

Declaration of Trust and Deed of Assignment Sample - Free download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online for free. Draft Declaration of Trust of Shares

Download this Assignment of Deed of Trust Template Design in Word, Google Docs, Apple Pages Format. Easily Editable, Printable, Downloadable. When there is a transfer of the deed from one part to another, our Assignment of Deed of Trust Template can help you create a legal document for this matter. Creating this record is possible by using our ...

The grantor transfers and conveys possession, ownership, and all right, title, and interest in the following property to the Living Trust: The grantor warrants that he or she owns this property and that he or she has the full authority to transfer and convey the property to the Living Trust. Grantor also warrants that the property is ...

The property covered by said Deed of Trust is briefly described as follows: A notary public or other officer completing this certificate verifies only the identity of the individual who signed the document to which this certificate is attached, and not the truthfulness, accuracy, or validity of that document.

This gives the mortgage lender a claim on a property. To help you create one, download our premium Assignment of Deed of Trust template. It is designed to allow a property buyer or owner to take out a loan that uses the property as security on that loan, but using a third party, the trustee, as part of the transaction. the file is ready-made ...

All rights accrued or to accrue under said Deed of Trust including the right to have reconveyed, in whole or in part, the real property described therein, commonly known as and described as follows: See Exhibit "A" attached hereto and made a part hereof Dated: _____

Use this form to assign a formerly recorded Deed of Trust to another entity. This form can be used with a public or conventional trustee. Public trustees are primarily used in Colorado, but conventional trustees are also used. [Any deed of trust that names any person other than a public trustee as trustee therein or that secures an obligation ...

17 Assignment of Escrow 18 Deed of Trust, if applicable 19 Mortgage Note 20 Assumption policy rider 21 VA Form 26-8106 (if applicable for Substitution of Entitlement) ... 8 Executed Deed of Trust, if app licable 9 Executed Assumption policy rider 10 Funding fee (0.5%) receipt, unless assumer is exempt . Title: Circular 26-19-19

Hi, When you notarized let say a deed of trust. When notory acknoledges it. Don,t you by the laws I am reading does notory have to have a certificate of authority attached. Also there should be a notory of acceptance with a certificate of authority attached. To have the deed executed for accepted for delivery. To be fully legal and recorded fully.

Beyond the deed of trust/mortgage, the document most often recorded in the land records to secure a real estate loan is an assignment of leases and rents. A listing of contents from a comprehensive and typical separate assignment of leases and rents is attached hereto as Appendix 3, although the assignment of leases and rents need not be an

No. of Non-certified Copies. Oversized Plats (8 1/2 x 14 or Larger) Oversized Plat Copies. Coversheet Pages. Page Ranges. No. of Certified Copies. Create Barcode Calculate Fee Download Coversheet XML Template Upload Coversheet XML Clear.