Tally Practical Assignment with Solutions PDF

Tally Practical Assignment including GST with Solutions PDF for free download. Super Success Institute Tally computer training coaching classes day by day task. Notes is very useful for learn and practice the tally ERP 9 with GST. We found that student face problem to find the practice assignment of Tally. The Training Faculty of Super Success Institute compiled the practice task in this PDF for self study of students.

Our Tally Coaching Class Assignment / task includes following:-

Purchase Invoice Bills Sundry Creditors Sales Invoice Bills Sundry Debtors Purchase Invoice Bills Batch Wise Details

Brief of GST Business For Purchase & Sales Of Goods Business for Service providing Who are Compulsory For GST Registration Document Required For GST Registration GST What is GSTIN Number Types of GST Rates GST Rates How GST Apply in Tally How GST Apply in Invoice SGST (State Tax) & CGST (Central Tax) IGST (Interstate Tax) – Purchase GST Invoice Sundry Creditors Sale GST Invoice Sundry Debtors

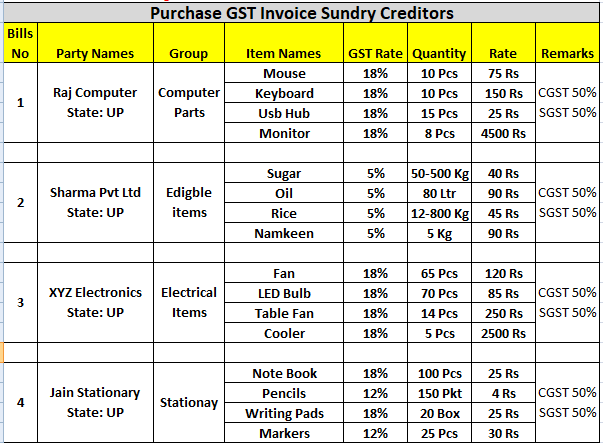

Purchase Entry

Purchase Invoice with GST (Sundry Creditors)

Sales Invoice with GST Sundry Debtors

Entry of 25 Sundry Debater bills are given in the PDF

Download Tally Practice Assignment PDF

Document Name : Tally Practice Assignment with solution

Publisher : S uper Success Institute Muzaffarnagar and https://onlinestudytest.com Author : Super Computer Muzaffarnagar Number of Pdf Pages : 28 Quality Very good

Note : The Tally Practical Assignment with Solutions notes PDF are property of Super Success Institute Muzaffarnagar. We are sharing the google drive download link with due consent of Computer Coaching Institute.

Tally Prime Notes

- Fundamental of Accounting and Tally Prime Notes

- Introduction of Tally Prime Notes

- Groups and Ledgers in Tally Prime Notes

- Voucher Entry in Tally Prime Notes

- Create Stock Item in Tally Prime Notes for Practice

- Bill wise entry in Tally Prime

- Batch wise Details in Tally Prime Notes

- Cost Center in Tally Prime Notes

- Export Import Ledger in Tally Prime

More Tally PDF may be found – Tally Notes PDF Archives – SSC STUDY

Tally Prime Book PDF Free Download – SSC STUDY

Tally ERP9 Question Paper in Hindi – Online Study Test

Related Posts

O level computer course book pdf download, tally computer course notes pdf download, computer book pdf for competitive exams in hindi, computer questions pdf for competitive exams.

Invalid username or password.

Tally.ERP 9 Topics

- Release Notes for 6.6.1

- Release Notes for 6.6

- Installing Tally.ERP 9

- Activating Your Tally.ERP 9 License as a Multi-Site Account

- Licensing Activities

- Renewing Your TSS Subscription

- Upgrading to the Latest Tally.ERP 9 Release

- Rental License

- Licensing - FAQ

- Upgrade to Tally.ERP 9 Release 6.6.1

- Set Up Company

- Use Your Tally.ERP 9 Company from Anywhere

- Group Company

- F11: Company Features

- Numeric Symbols

- Accts / Inventory info.

- Voucher Entry

- Invoice/Orders Entry

- Banking Configuration

- Advanced Printing Configuration

- Purchase Order

- Receipt Note

- Purchase Voucher/Invoice

- Payment Voucher

- POS Invoice Printing Configuration

- Delivery Note

- Sales Order/Quotation

- Sales Invoice

- Receipt Voucher

- Journal/Contra

- Debit/Credit Note

- Reminder Letters

- Confirmation Statements

- Payment Advice Configuration

- Data Configuration

- Advanced Configuration

- Product & Features

- Enabling Multi Address

- Use Multiple Addresses for Ledger Account

- Print Multiple Addresses in Reports

- Default Groups

- Pre-defined Groups

- Create, Alter, Delete Groups

- Manage Groups in Multiple Companies

- Group with Advanced Options

- Bank Ledger

- Party Ledger

- Purchase/Sales Ledger

- Pre-defined Voucher Types

- Multi User Voucher Numbering

- Sales and Manufacturing Journal Voucher Types

- Voucher Class

- Cost Centre Class

- Predefined Vouchers in Tally.ERP

- Creating Contra Entry in Single Entry Mode

- Creating Contra Entry in Double Entry Mode

- Creating a Payment Entry

- Creating a Payment Entry with Narration for each Entry

- Creating a Payment Entry using Bank

- Warn on Negative Cash Balance

- Pre Allocate Bills for Payment/Receipt

- Creating a Journal Entry

- Allowing Cash Accounts in Journals

- Printing Payment, Receipt and Journal Vouchers based on Due Date

- Debit Note Entry

- Credit Note Entry

- Post-dated Cheque Entry

- Memorandum Voucher

- Optional Vouchers

- Reversing Journals

- Post Dated Vouchers

- Using Cost Categories and Cost Centres

- Cost Categories

- Cost Centres

- Multi-currency

- Using Multi-currency

- Credit Limits

- Creating Budgets for Groups

- Creating Budgets for Ledgers

- Creating Budgets for Cost Centres

- Viewing Budget Variance

- Managing Scenarios

- Interest Calculation based on Bank Date/Voucher Date

- Including/excluding date of transaction for interest calculation

- Book Entries and adjustment of interest

- Stock Items

- Stock Groups

- Stock Categories

- Units of Measure

- Godown Summary/Location Summary

- Manage Stock Items for Third-Party

- Bill of Materials for a Stock Item

- Batches and Expiry Dates

- Stock Journal Voucher Class

- Manufacturing Journal Voucher Type

- Receipt Note Voucher (GRN)

- Rejections In Voucher (Sales Returns)

- Delivery Note Voucher

- Rejections Out Voucher (Purchase Returns)

- Material Out

- Material In

- Manufacturing Journal Voucher

- Transfer Journal Voucher

- Physical Stock Voucher

- Using Batchwise details

- Using Mfg. and expiry dates

- Reorder levels and Reorder Quantity

- Price Levels

- Price Lists

- Item Cost Tracking in Transactions

- Item Cost Analysis Reports

- Introduction to Job Work in Tally.ERP 9

- Enabling Job Work in Tally.ERP 9

- Job Worker and Principal Manufacturers Ledgers

- Voucher Types - Material Out and In

- Stock Items - Finished Goods

- Stock Item - Scrap/By-Products/Co-Products

- Stock Items - Raw Materials

- Job Work Out Order (for a Stock Item without BOM)

- Job Work Out Order (for a stock Item with BOM)

- Transfer of Material towards a Job Order

- Receipt of Finished Goods Against a Job Order

- Accounting Purchase of Job Work Service

- Payment to Job Worker

- Material Movement Register

- Issue Variance

- Receipt Variance

- Annexure - IV

- Job Work In Order

- Receipt of Material towards a Job Order

- Transfer of Own Consumed Goods for Production

- Manufacture of Finished Goods

- Delivery of Finished Goods towards a Job Order

- Raising Sales Bill for the Job Work

- Receipts from Principal Manufacturer

- Job Work In Orders Book

- Material Out Register

- Material In Register

- Annexure - V

- Sales of Goods & Services

- Printing a Sales Invoice

- Allow Income Accounts in Sales Vouchers

- Recording a Purchase Entry

- Creating a POS Voucher Type without Voucher Class

- Creating POS Voucher Type with Voucher Class

- Creating a POS Invoice

- Creating a POS Invoice with Multi-Mode Payment

- Printing a POS Invoice

- Displaying POS Register

- Enabling Order Processing

- Creating a Sales Order

- Closure from Order Voucher

- Closure from Delivery/Receipt Note

- Closure from Invoice

- Using Additional Cost of Purchase

- Using Tracking Numbers

- FAQs - Advanced Accounting and Inventory Features

- Creating Purchase Vouchers

- Creating Stock Journal Vouchers for Job Costing

- Creating Journal Vouchers for Job Costing

- Creating Payment Vouchers for Job Costing

- Creating Sales Voucher for Job Costing

- Job Work Analysis Report

- Materials Consumption Summary Report

- Comparing Jobs or Projects

- Modifying Reports

- Balance Sheet

- Profit & Loss Account

- Trial Balance

- Receipts and Payments Report

- Display Columnar Sales Register

- Sales Register (Sales Day Book)

- Display Monthly Sales Summary

- Display Extract of Sales Register

- Display Sales Register with Profitability

- Display Comparative Sales Register

- Display Cash Book

- Display Multi-Column Cash Book

- Statements of Accounts

- List of Accounts (Chart of Accounts)

- Display Group Summary

- Display Group Vouchers

- Display Ledger Vouchers

- Display Statistics

- Display Purchase Register

- Display Journal Register

- Credit Note Register

- Debit Note Register

- Payment Register

- Display Day Book

- Stock Valuation Methods

- Godown Types

- Stock Group Summary

- Stock Category Summary

- Viewing Stock Item Vouchers

- Stock Query

- Stock Transfers Register

- Physical Stock Register

- Stock Cost Estimation

- Godown Location Stock Flow Reconciliation

- Stock Group Analysis

- Stock Category Analysis

- Stock Item Analysis

- Group Analysis

- Ledger Analysis

- Transfer Analysis

- Stock Ageing Analysis

- How to change default ageing period

- Item Inward Details

- Sales Order Book

- Sales Order Summary

- Purchase Orders Book

- Purchase Order Summary

- Purchase Bills Pending

- Sales Bills Pending

- Reorder Status

- Display Batch-wise Reports

- Display Receivables

- Display Payables

- Ledger Outstandings Report

- Group Outstandings Report

- Ageing Analysis Report

- Bill- Party-wise Outstandings Report

- Configuring and Printing Reminder Letters

- Configuring and Printing Confirmation Statements

- Cost Centre Reports

- Cost Category Summary

- Show Opening Balance for Revenue Items.

- Cash Flow in Tally.ERP 9

- Fund Flow in Tally.ERP 9

- Ratio Analysis Report

- Cash Flow Projection in Tally.ERP 9

- Negative Stock

- Negative Ledgers

- Overdue Receivables

- Overdue Payables

- Display Memorandum Vouchers

- Display Reversing Journals

- Display Optional Vouchers

- Display Cancelled Vouchers

- Display Post Dated Vouchers

- e-Mail IDs Report

- Excise Dealer Exception Report

- View Tally.ERP 9 Reports in Browser

- FAQ - Browser Reports

- Exceptions and Resolutions - Browser Reports

- Setting up Banking Features

- Creating Bank Ledgers

- Creating Party Ledgers

- Creating Payment Voucher with Voucher Class

- Cash Deposit Slip

- Payment Advice

- Cheque Deposit Slip

- Configure Bank Ledgers and Print Cheques

- Printing a Self Cheque

- Disabling company name during cheque printing

- Printing Cheques Without Date

- Cheque Register

- Creating a Post-dated Voucher

- Enabling Notional Bank

- Post-dated Summary

- Post-dated Issued

- Post-dated Received

- Post-dated Transactions

- Viewing Post-dated reports with or without Actuals

- Viewing Current and Final Balances

- Setting Security Control for e-Payments

- Providing Bank Details in a Party Ledger

- Sending Transactions to Bank from Voucher

- Transactions with Incomplete Information

- Transactions with Information Mismatch (with master)

- Sending Payment Instructions to Bank

- Viewing Status of Transactions Sent to Bank

- Manual Bank Reconciliation

- Auto Bank Reconciliation - View and import or re-import Bank Statement

- Removing Opening BRS after Splitting the Company Data

- FAQ on Banking

- Activate GST for Your Company

- Setting Up GST Rates

- Creating GST Classification

- Updating Stock Items and Stock Groups for GST Compliance

- Updating a Service Ledger for GST Compliance

- Updating Sales and Purchase Ledgers for GST Compliance

- Updating Party GSTIN

- Creating GST Ledgers

- Creating Income and Expense Ledgers

- Providing GST Details

- Record Taxable Sales

- Record Purchases

- Record a Tax Payment

- Inward Supply of Goods and Services under Reverse Charge

- Inward Supply from Unregistered Dealers under Reverse Charge

- Advance Receipts from Customers

- Advance Payments under Reverse Charge

- Deemed Exports under Reverse Charge

- GST Purchases - Nil Rated, Exempt, SEZ, EEZ, Works Contract

- Sales - Nil Rated, Exempt, SEZ, EEZ, Deemed Export

- Sales of Composite Supply Under GST

- Sales of Mixed Supply Under GST

- Reverse Charge on Sales

- Sales Returns

- Purchase Returns

- Change in Assessable Values of Purchases and Sales

- Import of Services

- Export Sales

- Sale of Fixed Assets

- Import of Goods

- Pure Agent Transactions

- Record Import and Export Services Offered by Courier Services

- Journal Vouchers for Adjustments Against Tax Credit

- Journal Voucher for TDS Adjustment

- Journal Voucher for TCS Adjustment

- Journal Voucher for Refund of Tax Credit

- Journal Voucher for ISD Credit

- Journal Voucher for Transitional Credit

- Journal Vouchers for Other Liabilities

- Journal Vouchers for Reversal of Tax Credit

- Resolve Incomplete/Mismatch in Information

- File GSTR-1

- Document Summary for GST

- Advance Receipts Summary

- Status Reconciliation (GSTR-1)

- Data Captured in GSTR-2 (MS Excel)

- Purchase of Reverse Charge Supplies Report - GST

- Import of Services - GST Report

- Tax Liability on Reverse Charge Advance Payments

- Purchase from URD - Reverse Charge Liability Report

- Input Credit to be Booked

- File GSTR-3B and Make Payments

- GST Annual Computation

- File GSTR-9

- File GSTR-9C

- Mark Changed Vouchers

- e-Sugam for Karnataka under GST

- HSN/SAC Summary

- Map UoM - UQC

- Challan Reconciliation

- Kerala Flood Cess

- Managing Kerala Flood Cess - Valid till 6.5.2

- KFC Computation Report

- Filing Form KFC-A using Tally.ERP 9

- GST Registration Change

- GST Compliance for Composition Dealers

- Stock Items and Ledgers

- Tax Rate Setup

- Sales and Print Invoices

- Tax Liability

- Print Form GST CMP-08 to File Returns

- How to File GST CMP 08 - Valid till 6.5.3

- File GSTR-4

- File GSTR-9A

- FAQ - Generate e-Way Bill Details

- FAQ - Masters

- FAQ - Transactions

- FAQ - GST Reports

- Configuring VAT masters

- Configuring Excise Masters

- Configuring TCS Masters

- Configuring TDS Masters

- Configuring Service Tax Masters

- Recording Transactions

- Tax Rate Setup for VAT and Excise

- Excise Tariff Setup

- VAT Rate Setup

- Copy Default Accounting Details

- Triangulate and Generate Returns

- Filling Form MSME-1 Using Tally.ERP 9

- Getting started with Service Tax

- Other Configurations for Service Tax

- Define Service Tax Rates

- Creating a Group with Service Tax Details

- Creating Service Purchase Ledger

- Creating Service Sales Ledger

- Service Provider and Receiver Ledgers

- Creating Service Tax Ledgers

- Creating a Tax Unit

- Creating Stock Item and Stock Group

- Configurations for Masters

- Sale of Service

- Purchase of Service

- Pure Agent Services

- Sale of Service by Professionals

- Advance Receipt with Service Tax

- Sale of Service with Tax Abatement

- Exempted Services

- Input Service Distributor

- Voucher Class for Sales

- Service Received from Non-taxable Territory

- Reverse Charge

- Modifying Tax Details in Transactions

- Availing Input Credit

- Service Tax Adjustment Flags

- Adjustment Towards Advance Swachh Bharat Cess Paid

- Adjustment Towards Tax Paid but Service not Rendered

- Adjustment Towards Excess Swachh Bharat Cess Paid

- Regular Payment

- Advance Payment

- Recipient Liability

- Interest or Penalty payable towards Service Tax

- Interest or Penalty on Swachh Bharat Cess

- Interest or Penalty on Krishi Kalyan Cess

- Printing Invoice

- Summary of Vouchers

- Printing, Exporting and Validating Form ST-3 Report (Service Tax)

- Enabling TDS

- TDS Nature of Payment

- Creating Expense Ledger

- Creating TDS Party Ledger

- Creating TDS Ledger

- Creating Stock Item

- Creating Fixed Asset Ledger

- TDS on Expenses

- TDS on Advance Payment

- TDS at Lower Rate

- TDS at Zero Rate

- Accounting for Expenses, Deducting TDS Later

- Recording TDS Payment Transaction

- Reversal of Expenses with TDS

- TDS on Expenses with Inventory

- TDS on Fixed Assest

- TDS on Purchase of Software

- TDS on Transport

- TDS on Interest Paid Towards Overdue Payments

- TDS on Interest Paid on Loans

- Form 26Q (TDS)

- Saving Form 26Q

- Form 27Q (TDS)

- Saving Form 27Q

- Uncertain Transactions

- TDS Outstanding Report

- Ledgers without PAN

- Validate e-TDS Forms

- File TDS Returns

- Changes in Finance Bill No. 2 for 2019-20

- Enabling TCS

- TCS Nature of Goods

- Creating Party Ledger

- Creating Sales Ledger

- Creating TCS Ledger

- Sale of TCS Goods at Lower Rate

- Sale of TCS Goods at Zero Rate

- TCS on Purchases

- Payment of TCS

- Payment of Late Fee

- Payment of Interest and Penalty

- Saving Form 27EQ

- Return Transaction Book

- File TCS Returns

- TCS Outstanding Report

- Defining Tax Rates at Company Level

- Defining Tax Rates at Group Level

- Defining Tax Rates at Ledger or Stock Item Level

- Enabling VAT

- Stock Group

- Purchase, Sales and Additional Expense/Income Ledger

- VAT, CST, Additional Tax, Surcharge, and Cess Ledgers

- VAT Classifications

- Viewing the history of VAT rates

- Taxable Purchases (VAT)

- Branch Transfer Within the State (VAT)

- Consignment Transfer Inward (VAT)

- Exempt Purchases of Works Contract (VAT)

- Labour Charges Paid on Interstate Purchases (VAT)

- Imports (VAT)

- Interstate Branch Transfer Inward (VAT)

- Interstate Consignment Transfer Inward (VAT)

- Interstate Purchases Against Form C (VAT)

- Interstate Purchases Against Form E1 (VAT)

- Interstate Purchases Against Form E2 (VAT)

- Interstate Purchase Deemed Export (VAT)

- Interstate Purchase Exempt Against Form E1 (VAT)

- Interstate Purchase Exempt - With Form C

- Interstate Purchase Exempt (VAT)

- Interstate Purchase of Works Contract (VAT)

- Interstate Purchase - Tax Free (VAT)

- Interstate Purchase with Transfer of Right to Use (VAT)

- Labour Charges Paid (VAT)

- Non Creditable Purchase of Special Goods (VAT)

- Other Purchases (VAT)

- Purchase of Capital Goods (VAT)

- Purchase of Exempt Capital Goods (VAT)

- Purchase of Exempt Goods (VAT)

- Purchase From Composition Dealer (VAT)

- Purchase High Seas (VAT)

- Purchases of Non-Creditable Goods (VAT)

- Purchase of Capital Goods Taxable at Notional Rate (VAT)

- Purchases of Schedule H Items (U/s 19(1)) (VAT)

- Purchase of Works Contract (VAT)

- Purchase from Unregistered Dealer (VAT)

- Purchases Treated As Deemed Exports (VAT)

- Purchase with Transfer of Right to Use (VAT)

- Tax Free Purchases (VAT)

- Taxable Interstate Purchases (VAT)

- Zero Rated Interstate Purchases (VAT)

- Zero Rated Purchases (VAT)

- Taxable Sales (VAT)

- Interstate Sales Taxable (VAT)

- Branch Transfer Outward (VAT)

- Consignment Transfer Outward (VAT)

- Deemed Exports (VAT)

- Exports (VAT)

- Interstate Branch Transfer Outward (VAT)

- Interstate Consignment Transfer Outward (VAT)

- Interstate Deemed Export (VAT)

- Interstate Labour Charges Collected

- Interstate Sales - Against Form C (VAT)

- Interstate Sales High Seas (VAT)

- Interstate Sales - Others (VAT)

- Interstate Sales - Works Contract (VAT)

- Interstate Sales - Zero Rated (VAT)

- Interstate Sales - E1 (VAT)

- Interstate Sales - E2 (VAT)

- Interstate Sales Exempt (VAT)

- Interstate Sales Exempt - E1 (VAT)

- Interstate Sales Exempt - With Form C (VAT)

- Interstate Sales - Tax Free (VAT)

- Interstate Transfer Outward - Principal (VAT)

- Labour Charges Collected (VAT)

- Sales Transfer of Right to Use - Exempt (VAT)

- Sales Exempt - On Going (VAT)

- Sales Exempt - Works Contract - Ongoing (VAT)

- Sales Exempt - Works Contract (VAT)

- Sales Exempt (VAT)

- Sales High Seas (VAT)

- Sales Non-Creditable (VAT)

- Sales - Others (VAT)

- Sales - Tax Free (VAT)

- Sales Taxable - On Going (VAT)

- Sales Transfer of Right to Use (VAT)

- Sales - Works Contract (VAT)

- Sales - Works Contract - Ongoing (VAT)

- Sales Zero Rated (VAT)

- Sales with VAT Based on Quantity for Petrol and Diesel

- Adjustment of Turnover (VAT)

- Adjustment Towards TDS Certificate (VAT)

- Decrease in Sales (VAT)

- Decrease of CST (VAT)

- Decrease of Input Tax (VAT)

- Decrease of Output Tax (VAT)

- Increase of Output Tax (VAT)

- Increase of Tax Liability (VAT)

- Increasing Input Tax (VAT)

- Increase in Notional Input Tax (VAT)

- Input Tax Adjustment Towards Purchase Tax on Schedule H Items (VAT)

- Input Tax Adjustment for Purchases From URDs (VAT)

- Input Tax Credit Admitted on Capital Goods (VAT)

- Notional Input Tax Credit (VAT)

- Opening Balance of Purchase Tax (VAT)

- Reducing Tax Liability (VAT)

- Refund of Input Tax (VAT)

- Reversal of Input Tax (VAT)

- Reversal of Notional Tax Credit (VAT)

- Tax on Purchase from Unregistered Dealers (VAT)

- Returns Summary

- Particulars (Computation details) for Annual Return

- Annual Return Summary

- Payment Details in Report

- Payment Details for Annual Return

- Exception Resolution (VAT)

- Saving Annual Return as Revised

- Saving Return Form as Revised

- Saving Annual Return (Bihar)

- Saving the Return

- Overwriting the Return Form

- Challan Reconciliation Report

- Forms Issuable

- Forms Receivable

- Form VAT 200 (Andhra Pradesh)

- Printing Form VAT 200 (Andhra Pradesh)

- Printing Form 213 (Andhra Pradesh)

- Purchase Annexure (Andhra Pradesh)

- Sales Annexure (Andhra Pradesh)

- Sales Returns Annexure (Andhra Pradesh)

- Debit Note (Debit Note Issued-Price Rise) (Andhra Pradesh)

- Debit Note (Credit Note Received) (Andhra Pradesh)

- Credit Note (Credit Note Issued) (Andhra Pradesh)

- Credit Note (Debit Note Received-Price Rise) (Andhra Pradesh)

- Debit Note Issued by Purchaser (Andhra Pradesh)

- Debit Note Received by Seller (Andhra Pradesh)

- Credit Note Received by Purchaser for Additional Quantities (Andhra Pradesh)

- Credit Note Issued by Seller for Additional Quantities (Andhra Pradesh)

- CST Form VI (Andhra Pradesh)

- VAT Form 13 (Assam)

- Exporting Form 13 (Assam)

- Annexure G (Assam)

- Annexure GG (Assam)

- Annexure H (Assam)

- Annexure I (Assam)

- Annexure J (Assam)

- Annexure K (Assam)

- Annexure L (Assam)

- Annexure M (Assam)

- Annexure N (Assam)

- CST Form III (Assam)

- Form RT-I (Bihar)

- Exporting Form RT-I (Bihar)

- e-CST Form 1 (Bihar)

- Annual Return Summary (Bihar)

- Particulars (Computation details) for Annual Return (Bihar)

- Payment Details for Annual Return (Bihar)

- Overwriting Annual Return Form (Bihar)

- Saving Annual Return as Revised (Bihar)

- Exporting Form RT-III (Bihar)

- RT001- Box B I (Bihar)

- RT001- Box B II (Bihar)

- RT001- Box B III (Bihar)

- RT001- Box C I (Bihar)

- RT001- Box C II (Bihar)

- RT001- Box E1 (Bihar)

- RT001- Box E2 (Bihar)

- RT001- Box G (Bihar)

- RT001- Box H (Bihar)

- RT001- Box I (Bihar)

- RT001- Box J-I (Bihar)

- RT001- Box J-II (Bihar)

- RT001- Box J-III (Bihar)

- RT001- Box K (Bihar)

- RT001- Box L (Bihar)

- RT003 Box D (Bihar)

- RT003 Box F (Bihar)

- RT003 Box G (Bihar)

- RT003 Box H (Bihar)

- RT003 Box I (Bihar)

- Form CH-I for VAT (Bihar)

- Form CH-I for CST (Bihar)

- Form 15 (Chandigarh)

- Printing Form 16 (Chandigarh)

- Exporting Form VAT 15 (Chandigarh)

- Annexure 18 (Chandigarh)

- Annexure 19 (Chandigarh)

- Annexure 23 (Chandigarh)

- Annexure 24 (Chandigarh)

- Form VAT-2 (Chandigarh)

- Form II Challan - CST (Chandigarh)

- CST Form I (Chandigarh)

- VAT Form 17 (Chhattisgarh)

- Printing Form 17 (Chattisgarh)

- Sales List (Chhattisgarh)

- Purchase List ITR Claimed (Chhattisgarh)

- Purchase List ITR Not Claimed (Chhattisgarh)

- Form V (Chattisgarh)

- e-CST Inter-State Sales C Form (Chhattisgarh)

- Online C Form (Chhattisgarh)

- Online EI Form (Chhattisgarh)

- Online EII Form (Chhattisgarh)

- Online F Form (Chhattisgarh)

- Form 34 (Chhattisgarh)

- Form X (Chhattisgarh)

- Form DVAT 16 Report (Dadra and Nagar Haveli)

- Print Form DVAT 16 (Dadra and Nagar Haveli)

- Annexure DVAT 30 (Dadra and Nagar Haveli)

- Annexure DVAT 30A (Dadra and Nagar Haveli)

- Annexure 31 (Dadra and Nagar Haveli)

- Annexure 31A (Dadra and Nagar Haveli)

- Online Requisition Form C (Dadra and Nagar Haveli)

- Online Requisition Form F, H and E1 (Dadra and Nagar Haveli)

- Online Receipt Form SF (Dadra and Nagar Haveli)

- CST Form 1 (Dadra and Nagar Haveli)

- Form DVAT 16 (Delhi)

- Printing and Generating Form DVAT 16 (Delhi)

- Printing and Generating Form 1 (Delhi)

- Annexure 2A (Delhi)

- Annexure 2B (Delhi)

- Annexure 2C2D (Delhi)

- Annexure 1D (Delhi)

- Annexure 30 (Delhi)

- Annexure 30A (Delhi)

- Annexure 31 (Delhi)

- Annexure 31A (Delhi)

- CST Annexure Form 2A (Delhi)

- CT Annexure Form Bill (Delhi)

- CST Annexure Form 4 (Delhi)

- Form VAT III (Goa)

- Printing Form VAT III (Goa)

- Annexure A (Goa)

- Annexure B (Goa)

- e-CST Form 1V (Goa)

- e-CST C - Form Requisition (Goa)

- Form 201 (Gujarat)

- Exporting e-VAT Form 201 (Gujarat)

- Form 205 (Gujarat)

- Exporting e-VAT Form 205 (Gujarat)

- Form 402 (Gujarat)

- E-Form 402 (Gujarat)

- Payment Challan (Gujarat)

- Annexure 201 A (Gujarat)

- Annexure 201 B (Gujarat)

- Annexure 201 C (Gujarat)

- Annexure 205A (Gujarat)

- Form 3B (Gujarat)

- Purchase Details (Gujarat)

- Sales Details (Gujarat)

- ITC Reversal Computation (Gujarat)

- ITC Reversal Stock Item (Gujarat)

- Form VAT R1 (Haryana)

- E-filing of Returns (Haryana)

- Annexure LP 1 (Haryana)

- Annexure LP 2 (Haryana)

- Annexure LP 3 (Haryana)

- Annexure LP 3A (Haryana)

- Annexure LP 3B (Haryana)

- Annexure LP 4 (Haryana)

- Annexure LP 5 (Haryana)

- Annexure LP 6 (Haryana)

- Annexure LP 7 (Haryana)

- Annexure LP 7A (Haryana)

- Annexure LP 7B (Haryana)

- Annexure LP 7C (Haryana)

- Annexure LP 7D (Haryana)

- Annexure LP 8 (Haryana)

- Annexure LP 8A (Haryana)

- Annexure LP 8B (Haryana)

- Annexure LP 8C (Haryana)

- Annexure LS 1 (Haryana)

- Annexure LS 2A (Haryana)

- Annexure LS 2B (Haryana)

- Annexure LS 3 (Haryana)

- Annexure 4A (Haryana)

- Annexure 4ATab (Haryana)

- Annexure 4B (Haryana)

- Annexure 4BTab (Haryana)

- Annexure 4C (Haryana)

- Annexure LS 5 (Haryana)

- Annexure LS 6 (Haryana)

- Annexure LS 7 (Haryana)

- Annexure LS 8 (Haryana)

- Annexure LS 9A (Haryana)

- Annexure LS 9B (Haryana)

- Annexure LS 9C (Haryana)

- Annexure LS 10A (Haryana)

- Annexure LS 10B (Haryana)

- Annexure LS 10C (Haryana)

- Annexure LS 11 (Haryana)

- Annexure ITC Reversal (Haryana)

- Annexure Purchase Tax (Haryana)

- Form CST 1 (Haryana)

- Form C (Haryana)

- Form VAT C4 (Haryana)

- Tax Payment Export (Haryana)

- Form VAT-XV (Himachal Pradesh)

- Exporting Form XVN (Himachal Pradesh)

- Form LP1 (Himachal Pradesh)

- Form LP-II (Himachal Pradesh)

- Form LS-I (Himachal Pradesh)

- Form LS-II (Himachal Pradesh)

- Form XXVI (Himachal Pradesh)

- Form XXVI A (Himachal Pradesh)

- Request for Online CST Form (Himachal Pradesh)

- Request for Online CST Forms EI-EII (Himachal Pradesh)

- Form VAT XI (Jammu & Kashmir)

- Exporting Form VAT 11 (Jammu & Kashmir)

- Annexure 48 (Jammu and Kashmir)

- Annexure 48C (Jammu and Kashmir)

- Annexure 48I (Jammu and Kashmir)

- Annexure 48IS (Jammu and Kashmir)

- Annexure 48L (Jammu and Kashmir)

- Annexure 48S (Jammu and Kashmir)

- Annexure 49 (Jammu and Kashmir)

- Annexure 49E (Jammu and Kashmir)

- Annexure 49I (Jammu and Kashmir)

- Annexure 49IS (Jammu and Kashmir)

- Annexure 49L (Jammu and Kashmir)

- Annexure 49S (Jammu and Kashmir)

- CST Form IV (Jammu and Kashmir)

- Form VAT-15 Challan (Jammu and Kashmir)

- Online e-CST Requisition Form (Jammu and Kashmir)

- Form VAT 200 (Jharkhand)

- Print Form JVAT 200 (Jharkhand)

- Form 213 (Jharkhand)

- CST Form I (Jharkhand)

- Annexure B (Jharkhand)

- Annexure C (Jharkhand)

- Annexure D (Jharkhand)

- Annexure E (Jharkhand)

- Annexure F (Jharkhand)

- Annexure-G (Jharkhand)

- Annexure-H (Jharkhand)

- Annexure-I (Jharkhand)

- Annexure J (Jharkhand)

- Annexure K (Jharkhand)

- Annexure L (Jharkhand)

- Annexure M (Jharkhand)

- Annexure N (Jharkhand)

- Form 500 (Jharkhand)

- Form 501 (Jharkhand)

- Sugam B (Jharkhand)

- Sugam G (Jharkhand)

- Sugam P (Jharkhand)

- E1 and E2 Requisition Form (Jharkhand)

- CST Forms Received From Other States (Jharkhand)

- E-CST Form (Jharkhand)

- VAT Form 100 (Karnataka)

- Printing and Generating Returns (Karnataka)

- Local Sales Annexure (Karnataka)

- Local Sales Returns Annexure (Karnataka)

- Interstate Sales Annexure (Karnataka)

- Interstate Sales Returns (Karnataka)

- Exports Annexure (Karnataka)

- Exports Credit Note Annexure (Karnataka)

- Local Purchase Annexure (Karnataka)

- Local Purchase Returns Annexure (Karnataka)

- Interstate Purchase Annexure (Karnataka)

- Interstate Purchase Return Annexure (Karnataka)

- e-Sugam (Karnataka)

- Form 10 (Kerala)

- Annexure - Sales Invoice (Kerala)

- Annexure - Purchase Invoice (Kerala)

- e-VAT Closing Stock Summary (Kerala)

- e-VAT Closing Stock Statement (Kerala)

- Form VAT 10 (Madhya Pradesh)

- Exporting Form 10 (Madhya Pradesh)

- e-CST Form 5 (Madhya Pradesh)

- Form 26 (Madhya Pradesh)

- VAT Form 231 (Maharashtra)

- Exporting e-VAT Form 231 (Maharashtra)

- Form 233 (Maharashtra)

- Exporting e-VAT Form 233 (Maharashtra)

- Form III E (Maharashtra)

- Exporting Form III E (Maharashtra)

- Purchase Annexure

- Sales Annexure

- Form VAT 201 (Odisha)

- Exporting e-VAT Form 201 (Odisha)

- Annexure I (Odisha)

- Annexure II (Odisha)

- Annexure III (Odisha)

- Annexure IIIA (Odisha)

- Annexure IV (Odisha)

- Annexure V (Odisha)

- Annexure VII (Odisha)

- Purchase Annexure (Odisha)

- Sales Annexure (Odisha)

- CST Form I (Odisha)

- Annexure A (Odisha)

- Annexure B (Odisha)

- Annexure C (Odisha)

- Annexure D (Odisha)

- Annexure E (Odisha)

- Annexure F (Odisha)

- Annexure G (Odisha)

- Annexure H (Odisha)

- VAT Form I (Puducherry)

- Printing Form I (Puducherry)

- Annexure II

- Annexure III

- Annexure IV

- e-CST C Form Requisition

- Exporting Data - e-VAT Form 15 (Punjab)

- Payment Section of e-VAT Form 15 (Punjab)

- Exporting Data - e-VAT Form 16 (Punjab)

- Exporting Data - e-CST Form 1 (Punjab)

- Worksheet 3 (Punjab)

- Worksheet 4 (Punjab)

- Worksheet 5 (Punjab)

- Worksheet 6 (Punjab)

- Annexure 18 (Punjab)

- Annexure 19 (Punjab)

- Annexure 23 (Punjab)

- Annexure 24 (Punjab)

- Form 2 Challan (Punjab)

- Form II (CST) Challan (Punjab)

- Form VAT 10 (Rajasthan)

- Form VAT 10 Description (Rajasthan)

- Form-7 (Rajasthan)

- Form-7A (Rajasthan)

- Form 8 (Rajasthan)

- Form 8A (Rajasthan)

- Form 12 (Rajasthan)

- Form 47A (Rajasthan)

- Form 48 (Rajasthan)

- Form 49A (Rajasthan)

- Form 50 (Rajasthan)

- e-CST Form 1 (Rajasthan)

- Form C Annexure (Rajasthan)

- Form E1 E2 Annexure (Rajasthan)

- Form F Annexure (Rajasthan)

- Form I Annexure (Rajasthan)

- Form J Annexure (Rajasthan)

- Exports Annexure (Rajasthan)

- Annexure-1 (Tamil Nadu)

- Annexure-2 (Tamil Nadu)

- Annexure-3 (Tamil Nadu)

- Annexure-4 (Tamil Nadu)

- Annexure-5 (Tamil Nadu)

- Annexure-6 (Tamil Nadu)

- Annexure-7 (Tamil Nadu)

- Annexure-8 (Tamil Nadu)

- Annexure-9 (Tamil Nadu)

- Annexure-10 (Tamil Nadu)

- Annexure-11 (Tamil Nadu)

- Annexure-12 (Tamil Nadu)

- Annexure-13-14 (Tamil Nadu)

- Annexure-15 (Tamil Nadu)

- Annexure-16 (Tamil Nadu)

- Annexure-17 (Tamil Nadu)

- Annexure-18 (Tamil Nadu)

- Annexure-19 (Tamil Nadu)

- Annexure-20 (Tamil Nadu)

- Annexure-21 (Tamil Nadu)

- Annexure-22 (Tamil Nadu)

- Annexure-23 (Tamil Nadu)

- Annexure-24 (Tamil Nadu)

- Annexure-25 (Tamil Nadu)

- Annexure-26 (Tamil Nadu)

- Annexure-27 (Tamil Nadu)

- Annexure-28 (Tamil Nadu)

- Annexure-29 (Tamil Nadu)

- Non-Annexure Vouchers for Base Form (Tamil Nadu)

- Printing and Generating Form I (Tamil Nadu)

- VAT Form I Annexures (Tamil Nadu)

- Printing and Generating Form I-1 (Tamil Nadu)

- Form I - 1 - Annexures (Tamil Nadu)

- Viewing and Printing CST Form I

- CST Annexure (Tamil Nadu)

- Form VAT 200 (Telangana)

- Printing VAT Form 200 and 213 (Telangana)

- CST Form VI (Telangana)

- Form 200 A (Telangana)

- Form VAT 24 (Uttar Pradesh)

- Physical and e-VAT Form XXIV

- Annexure A1

- Annexure A2

- Annexure B1

- Annexure Commission Agent

- CST Annexure A

- CST Annexure B

- CST List of Interstate Sales

- C Form Requisition

- Form I - Payment Challan

- e-VAT Form VAT III (Uttarakhand)

- e-VAT Form VAT III - Exporting Data to Template (Uttarakhand)

- Annexure-1A (Uttarakhand)

- Annexure-1B (Uttarakhand)

- Annexure-1C (Uttarakhand)

- Annexure-1D (Uttarakhand)

- Annexure-1E (Uttarakhand)

- Annexure-2 (Uttarakhand)

- Annexure-2A (Uttarakhand)

- Annexure 2B (Uttarakhand)

- Annexure-3 (Uttarakhand)

- Annexure-3A (Uttarakhand)

- Annexure-4 (Uttarakhand)

- Annexure-5 (Uttarakhand)

- Annexure-6 (Uttarakhand)

- Annexure-7 (Uttarakhand)

- Annexure-8 (Uttarakhand)

- Annexure-9 (Uttarakhand)

- Annexure-10 (Uttarakhand)

- Annexure-12 (Uttarakhand)

- Annexure-13 (Uttarakhand)

- Annexure-15 (Uttarakhand)

- Annexure-16 (Uttarakhand)

- Annexure-17XI (Uttarakhand)

- Annexure-17C (Uttarakhand)

- Annexure-17F (Uttarakhand)

- Annexure-17H (Uttarakhand)

- Annexure-17I (Uttarakhand)

- Annexure-17J (Uttarakhand)

- Form XI (Uttarakhand)

- Form XVI (Uttarakhand)

- Form 14 (West Bengal)

- Export Form-14 (West Bengal)

- Annexure A (West Bengal)

- Annexure B Part I (West Bengal)

- Annexure B Part II (West Bengal)

- Annexure B Part III (West Bengal)

- Annexure B Part IV (West Bengal)

- Annexure D Part I (West Bengal)

- Annexure D Part II (West Bengal)

- Annexure F (West Bengal)

- Annexure Sales Return (West Bengal)

- CST Form I (West Bengal)

- Annexure A- CST (West Bengal)

- Annexure B - Part 1 CST (West Bengal)

- Annexure B- Part II CST (West Bengal)

- Annexure C (West Bengal)

- Annexure D (West Bengal)

- Annexure E (West Bengal)

- Annexure G (West Bengal)

- Annexure SR (West Bengal)

- Receipt Forms - C Form (West Bengal)

- Receipt Forms - E1 Form (West Bengal)

- Receipt Forms - E2 Form (West Bengal)

- Receipt Forms - F Form (West Bengal)

- Excise Registration and Invoice Requirements

- Pre-requisites after migrating data

- Getting Started with Excise

- Configurations for Excise Details

- Defining Tariff Rates at the Company Level

- Defining Tariff Rates at the Group Level

- Defining Tariff Rates at the Ledger Level

- Hierarchy for considering duty rates

- Excise Classification

- Excise Duty Classification

- Excise Book and Serial Number

- Duty Ledger

- Income and Expense Ledger

- Purchase and Sales Ledger

- Excise Unit or Godown

- Configurations for Creating Masters

- Excise Purchase Transactions

- Sale of Excisable Goods

- Excise Sales of Jewellery Goods

- Excise Sales with CST

- Sales Inclusive of Tax

- Inter unit Transfer

- Excise Supplementary Invoice

- Accounting Direct Exports

- Sales to SEZs

- Sale to 100% EoUs

- Adjustment Towards Duty Liability

- Adjustment Towards Miscellaneous Payment

- Adjustment Towards Other Payments (Arrears)

- Adjustment Towards Removal As Such (Capital Goods)

- Adjustment Towards Removal As Such (Inputs)

- Adjustment Towards Rule 10A

- Adjustment Towards Rule 6

- Availment of CENVAT Credit (Capital Goods)

- Availment of CENVAT Credit (Inputs)

- Availment of Credit Under Rule 12BB

- Excise Duty Payment

- Statistics of Vouchers

- Computation

- Saving the Returns

- Generating Form ER 8 - Jewel

- Return Transactions

- Daily Stock Register

- Rule 16 Register

- PLA Register

- RG 23A Part1

- RG 23A Part2

- Annexure 10

- CT-1 Outstandings Report

- CT-3 Outstandings Report

- Pre-requisites - Dealer Excise Data Migration

- Define Tariff and Rate of Duty

- Hierarchy for Considering Duty Rates

- Enabling Excise for Dealers

- Excise Classification and Excise Duty Classification

- Godowns, Stock Groups, Stock Items

- Purchase and Sales Ledgers

- Excise Purchase

- Excise Sales

- Stock Transfer

- Excise Debit Note

- Excise Credit Note - Linked to Buyer

- Excise Credit Note - Linked to Original Supplier (Excise for Dealer)

- Excise Journal Voucher

- Excise Opening Stock

- Transferring Stock to Maintain Either Dealer or Importer Registration

- Duty Summary

- Return Transactions Book

- Export Form 2

- RG 23D Register

- Excise for Dealer - FAQ

- Enabling Excise for Importers

- Defining Tariff Rates at company level

- Defining Tariff Rate at Group Level

- Defining Tariff Rate at Ledger Level

- Hierarchy for considering duty details

- Excise Classifications

- Party Ledgers

- Excise Godown

- Material In/Out

- Adjustment Journal

- Configurations for transactions

- Introduction to Reports

- Customs Clearance Register

- Excise Journal Adjustments

- Stock Items and Stock Groups

- Service Ledgers

- Sales and Purchase Ledgers

- Tax Ledgers

- Expense and Income Ledgers

- Record Sales and Print Invoices as per FTA (for UAE)

- Record Sales and Print Invoices

- Supply of Used Goods

- Transfer of Right to Use

- Import for Subsequent Sales

- Advances Received

- VAT Payment Voucher

- Accounting for Tax Liability

- Accounting for Input Tax Credit

- Sales of Fixed Assets

- Application of VAT on Non-revenue Accounts

- VAT Opening Balance

- Payments and Receipts with Party Details

- Record Transactions with Excise and VAT

- UAE VAT Returns

- KSA VAT Returns

- Bahrain VAT Returns

- Resolve Mismatch in Transactions

- Save VAT Returns

- File VAT Returns (UAE)

- File VAT Returns (KSA)

- File VAT Returns (Bahrain)

- Tax Payment Reconciliation

- Reverse Charge Summary

- Sale on Profit Margin

- Configuring VAT Masters

- Creating Company and Enabling VAT

- Taxable Purchases

- Taxable Purchases with Additional Ledgers

- Purchases - Imports @ 16%

- Purchase and Purchase Returns of Capital Goods (Kenya VAT)

- Zero Rated Purchases

- Purchase - Exempt

- Taxable Sales

- POS Invoice

- Taxable Sales with Additional Ledgers

- Zero Rated Sales

- Sales Exempt

- Overriding Assessable Value and Tax in Invoice

- Change in Agreed Purchase Consideration

- Change in Agreed Sales Consideration

- Non-Deductible Input Tax

- Carrying Forward Input Tax Credit

- Adjustment of VAT Withheld

- VAT Refund Claim

- VAT Payment

- Particulars (Computation Details)

- Payment Details

- Summary of Exceptions

- Overwriting VAT Form-3

- Saving VAT Form-3 As Revised

- Exporting VAT 3 Form

- Payroll Features of Tally.ERP 9

- Enabling Payroll in Tally.ERP 9

- Five Easy Steps to Generate a Pay Slip

- Employee Groups

- Employee Categories

- Payroll Units

- Attendance or Production Types

- Payroll Voucher Types

- Attendance based Earnings Pay Head

- Computation based Earnings Pay Head

- Flat Rate based Earnings Pay Head

- Production based Earnings Pay Head

- User Defined Earnings Pay Head

- Deduction Pay Heads

- Statutory Deduction Pay Heads

- Statutory Contributions Pay Heads

- Gratuity Pay Head

- Reimbursement Pay Head

- EDLI, PF Admin Charges Pay Heads

- Income Tax Pay Head Configuration

- Income Tax Declarations

- Override Exemption Value

- Override Income Tax Value

- Income Tax Configuration

- Previous Employer Details for Income Tax

- Salary Details for Employee and Employee Group

- Creating Payable Ledgers (Payroll)

- Attendance / Production Voucher

- Salary Payment

- NPS Payment

- Income Tax Payment

- Professional Tax Payment

- User Defined Pay Head Process

- Salary Process

- ESI Process

- NPS Process

- Employer PF Admin Charges processing

- Single Pay Slip

- E-Mailing Multi Pay Slips

- E- Mail IDs

- Payroll Statement

- Payroll Register

- All Employees

- Single Employee

- Group of Employees

- Employee Head Count Report

- Employee Pay Head Breakup

- Pay Head Employee Breakup

- Attendance Sheet

- Attendance Register

- Expat Reports - Passport, Visa, Contract Expiry

- Payroll Statutory Summary

- Payroll Statutory Pay Head Details

- Employee Breakup of Pay Head

- Employee Vouchers

- ESI E-Return Form 3

- ESI Monthly Statement

- PF Form 12A

- PF Monthly Statement

- PF E-Challan Return (ECR)

- Professional Tax Computation Report

- Professional Tax Statement

- Gratuity Report

- Subscriber Contribution Details

- NPS Summary

- PRAN Not Available

- Tax Computation

- Salary Projection

- Annexure I to 24Q

- Annexure II to 24Q

- Print Form 27A

- PAN Not Available

- Tracking Loans & Advances

- Salary Increments and Arrears Calculation

- Other Records

- TDS Variance

- New Tax Regime Under Section 1115BAC

- Changes as per Finance Bill 2020-21 (Payroll)

- Audit at CA's Office

- Audit at Client's Office

- Audit Remotely (Anywhere)

- Auditor/Firm Profile in Control Centre

- Audit Programme

- Auditor's Report

- Annexures to Auditor's Report (CARO)

- Accounting Standards

- Standards on Auditing

- Audit Working Paper

- Statutory Audit Dashboard

- Ledger Vouchers

- Verification of Stock Items

- Verification of Opening Balances

- Verification of Balances for Group

- Ledger Balance Variance

- Negative Cash Report

- Analytical Procedures

- Pending Purchase Orders

- Pending Sales Orders

- Pending Purchase Bills

- Pending Sales Bills

- Receivables - Age wise

- Ledger Outstandings

- Statutory Payments

- Identifying Periodic Ledgers

- Periodic Ledger Monthly Summary

- Ledger Vouchers - Periodic Payments

- Ledger Vouchers - Repeated Transactions

- RSF - Ledger Vouchers

- Inter Bank Transactions

- Cash Withdrawals /Deposits to Bank

- Fixed Assets Analysis

- Transactions on Holiday

- Highest and Lowest Value Transactions

- Pending Advances

- Stale Cheques/Instruments

- External Confirmation (Third Party Confirmation)

- Account Reconciliation

- Sampling Methods

- Verification of Vouchers - Ledger Vouchers

- Auditing of Vouchers

- Identifying Related Parties

- Related Party Transactions - Ledger Vouchers

- Voucher Register

- Forex Vouchers

- Identifying Micro, Small & Medium Enterprises

- Micro, Small & Medium Enterprises - Ledger Vouchers

- Head Count Details

- Salary/Wages Monthly Summary

- Finalisation Entries

- Significant Accounting Policies

- Inserting and Renaming Heads

- Classification of Groups/Ledgers using Move & To-BS

- Schedule VI Master Configuration

- Schedule VI Rule Configuration

- Current and Non Current Classification

- Agewise Bifurcation of Sundry Debtors

- Note Number Configuration

- Note Summary

- Printing Schedule VI Balance Sheet

- Schedule Rule Configuration

- Income/Expense Disclosure

- Changes in Inventories

- Purchases of Stock-in-Trade

- Cost of Materials Consumed

- Schedule VI Configuration - Inventory

- Printing Schedule-VI Profit & Loss Ac

- Additional Details

- List of Clarification Vouchers

- Enabling Analysis and Verification Tool

- Verification of Chart of Accounts

- Pending Purchase Order Summary

- Pending Sales Order Summary

- Pending Sales Order

- Pending Purchase Bills Summary

- Pending Sales Bills Summary

- Pending Sales Bill

- Pending Bills Payables Summary

- Pending Bills Receivables Summary

- Ledger Outstandings-Receivables

- Receivables- Age Wise

- Ledger Outstandings- Payables

- Ledger Voucher- Periodic Payments

- Ledger Vouchers- Repeated Transactions

- Repeated Transactions

- RSF- Ledger Vouchers

- Relative Size Factor (RSF)

- Cash Withdrawals/Deposits to Bank

- Fixed Asset Analysis

- Verification of Vouchers- Ledger Vouchers

- Related Party Transactions-Ledger Vouchers

- Working Paper

- Verification Status

- Voucher Clarification

- Authorising Tally.NET Auditors

- For Tally.NET User

- For Tally.NET Auditor

- Taking a Data Backup

- Restoring Backup

- Splitting Company Data

- Import Masters

- Import Vouchers

- Export Formats

- Export Data from Masters in Tally.ERP 9

- Exporting of Data

- E-mail a Report from Tally.ERP 9

- Mass Mailing

- Uploading reports generated from Tally.ERP 9

- Outward Connectivity

- Outward Connectivity from Tally.ERP 9

- Connectivity and Compatibility with Tally.Server 9

- Assigning Security Level

- Create a New Security Level

- Voucher Type Security

- Configuring Password Policy

- Password Policy

- Enable Tally Audit

- Audit Listing for Vouchers

- Audit Listing for Masters

- Audit Listing for Users

- Enabling Tally Vault

- Altering TallyVault for a Company

- Data Security in Tally Products

- How to Synchronise Data

- Configuring Client/Server

- Creating Sync Rule on Client

- Activating Sync Rule on Server

- Synchronising Data

- Connecting Server Company to Tally.NET Server

- Connect Company to Tally.NET Server

- Changing SMS Suffix of a Company in Tally.ERP 9

- Natural Language for the Business

- Natural Language for the System

- Login as Remote User

- Control Centre for an Account

- User Management

- Recruiting Candidates

- Candidate Search

- Job Management

- Recruiting on Client's Behalf

- Test Paper Management

- Employee Assessment

- Change Account Administrator E-mail ID

- Change Password

- My Sessions

- Manage Data Sessions

- Create Security Levels

- Deploying Account TDLs

- Unlink TDL Configuration

- About Support Centre

- Local Access

- Select Account

- Adding New Issue in Support Centre

- Reply to an Issue

- Close an Issue

- Button Options in Support Center

- Installation

- Introduction to TallyShop

- Buy Customised Solutions

- Configure Add-Ons

Share your Feedback

- Class 6 Maths

- Class 6 Science

- Class 6 Social Science

- Class 6 English

- Class 7 Maths

- Class 7 Science

- Class 7 Social Science

- Class 7 English

- Class 8 Maths

- Class 8 Science

- Class 8 Social Science

- Class 8 English

- Class 9 Maths

- Class 9 Science

- Class 9 Social Science

- Class 9 English

- Class 10 Maths

- Class 10 Science

- Class 10 Social Science

- Class 10 English

- Class 11 Maths

- Class 11 Computer Science (Python)

- Class 11 English

- Class 12 Maths

- Class 12 English

- Class 12 Economics

- Class 12 Accountancy

- Class 12 Physics

- Class 12 Chemistry

- Class 12 Biology

- Class 12 Computer Science (Python)

- Class 12 Physical Education

- GST and Accounting Course

- Excel Course

- Tally Course

- Finance and CMA Data Course

- Payroll Course

Interesting

- Learn English

- Learn Excel

- Learn Tally

- Learn GST (Goods and Services Tax)

- Learn Accounting and Finance

- GST Tax Invoice Format

- Accounts Tax Practical

- Tally Ledger List

- GSTR 2A - JSON to Excel

Are you in school ? Do you love Teachoo?

We would love to talk to you! Please fill this form so that we can contact you

You are learning...

Click on any of the links below to start learning from Teachoo ...

Learn Latest Tally ERP9 with GST free at Teachoo. Notes and videos provided on how to put ledgers, learn in which head the ledger will come, important tally features, reports and errors in Tally, how to prepare files for return filing

To practice GST Return Filing with Tally, take our Tally course .

In this Tally Tutorial, we cover

- Basics - What is Tally, How to install Tally for GST, Creating Company in Tally ERP9

- Ledgers - Creating Ledgers, Heads in which Ledger comes, Seeing Ledgers created, Alter or Changing Ledgers, Putting Opening Balances in Tally

- Passing Entries in Tally - Type of Accounting Vouchers in Tally ERP9, Seeing Entries Passed, Passing Duplicate Entries, Deleting Entries, Passing Receipt, Payment, Contra Entries, Passing Purchase Entries, Sales Entries, Mixed Entries

- Important Tally Features - Tally Shortcuts, Copying Narration in Tally, Copying Tally GST Data in Pendrive, How to Paste or load Tally Data, Mailing Tally Data, Exporting Tally Data in Excel or PDF, Seeing Party or Ledger Balance, Printing Voucher in Tally, Checking Daily Breakup of Transactions in Tally, Deleting Company from Tally

- Important Tally Reports - Debtor Aging Report, Cost Center Reporting/Segment Reporting, BRS (Bank Reconciliation in Tally)

- Common Errors in Tally - Duplicate Ledger, Period not accepting while passing entries in Tally, Difference in opening balances

Get the notes now... Click a topic to start!

You can now watch free videos for these Topics....Click a topic to watch!

You can also download various topics as assignments

Basics of Tally

Ledger creation and alteration, passing entry in tally, important tally features, important tally reports, common errors in tally.

What's in it?

Hi, it looks like you're using AdBlock :(

Please login to view more pages. it's free :), solve all your doubts with teachoo black.

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Lesson 5: Voucher Entry in Tally.ERP 9

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

How to Maintain inventory in tally ERP 9 (Part I): Stock Groups

Posted on Last updated: September 27, 2021

Inventory management is one of the toughest business activities for small and growing businesses. Not only do you need to physically care for the stuff, but you also have to make sure that you don’t run out of some items or have too much of some other items.

Now the good news …

Tally provides outstanding features that make inventory management a lot easy. With not too much effort, you can probably get your inventory management system up and running.

As you record sales and purchases, Tally will keep track of your inventory, just as the point-of-sale system at the supermarket does when it scan items.

In this Tally Tutorials, you’ll learn how to maintain inventory in Tally using inventory masters such as stock categories , stock groups, and stock items.

Setting Inventory features in Tally ERP 9

Before you can track your inventory, first, of course, you need to tell Tally that you want to track inventory by enabling the inventory features. By default, most settings in Tally pertaining to inventory are set to No. You, therefore, have to set them to Yes before you can be able to work with Tally inventory features.

Turning on inventory features in Tally

To turn on the inventory features just follow the below steps:

- Whilst in the Gateway of Tally window, press F12 or click F12: Configure to display the Company Features menu. See screenshot:

From this menu, double-click Accounting Features (or press A on your keyboard for the same effect). Your screen should look remarkably similar to the one below:

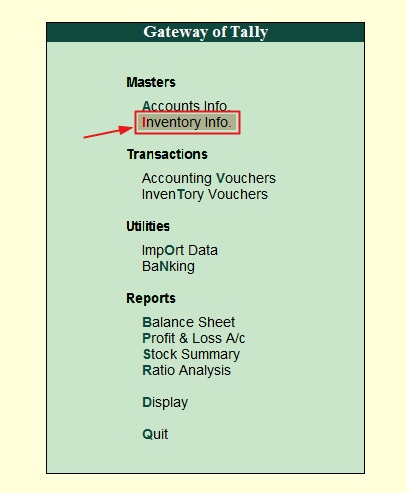

- As seen in the above picture, under the General Category, set Maintain accounts only to No and press Ctrl+A to save the settings. You should now be able to see the Inventory Info. option from the Gateway of Tally under Masters. See screenshot:

Inventory Masters

When you click the Inventory Info. menu from the Gateway of Tally, the program opens up a menu called Inventory info. as in the picture below:

This menu contains items called Inventory Masters which collectively makes inventory management a lot simple. These items include Stock Groups, Stock Categories, Stock Items, Units of measure, Voucher Types, and Copy Allocation Details. But for beginners, our main focus will be on the first four items, Groups, Categories, Items, and Units of Measure.

Let’s now look at these inventory masters one after the other to get them all clarified.

Stock Groups in Tally ERP 9

Stock groups in Inventory masters are similar to that of Accounting masters. Groups are very helpful when it comes to classifying stock items. It enables you to locate stock items easily and report their details in statements.

With Tally stock groups, you can group stock items base on some common features such as the product type, the product brand, etc. For example, you can group stock items in a structure like this:

Thus, the above group structure can help you to locate items easily as well as produce reports on each of the groups, such as reports on Laptop computers or report on Desktop computers.

Creating a single Stock Group

To illustrate this very well, we’ll create a stock group called Lenovo Computers using the single stock group creation option. To create single Stock Groups in Tally ERP 9:

- Go to Gateway of Tally →Inventory Info. → Stock Groups → Create (Under Single Stock Group)

- Enter the necessary information as follows:

Name: Provide the name of the stock group you are creating. Example Lenovo Computers.

Alias: Enter another name for this group apart from the name you provide under the name field. You can use a numerical code for the alias name for easy access. This field is optional though.

Under: The under field lets you specify whether to create a primary group or a sub-group under another group.

While in the Under field, if you want to make the group a sub-group under another group, say Computers, which doesn’t exist in the List of Groups, you can press Alt+C to create a parent group.

Should Quantities of items be added? : This field is concern about the units of measurements for the items you will place under this group. All items to be placed under a particular group should have the same measurement units before their quantities can be added. For example, you cannot add quantities in liters to quantities in kgs. Thus, if the stock items that will fall under the group have different units of measurements, then quantities of items should not be added.

- Now press Ctrl+A to save the stock group

NOTE: If you specify Primary when filling the Under field, it means that you are creating a main group. But if you specify another group in the Under field, then you are creating a sub-group.

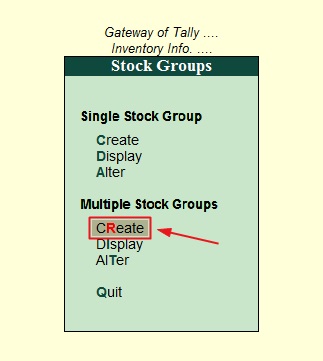

Creating Multiple Stock Group

Maybe you have more than one stock groups you need to create. Tally lets you create several stock groups all in one window.

To illustrate multiple stock group creation, let’s create the following main stock groups (under Primary):

- Dell computers

- HP computers

- Acer Computers

- Go to Gateway of Tally → Inventory Info. → Stock Groups → Create (Under the Multiple Stock Groups)

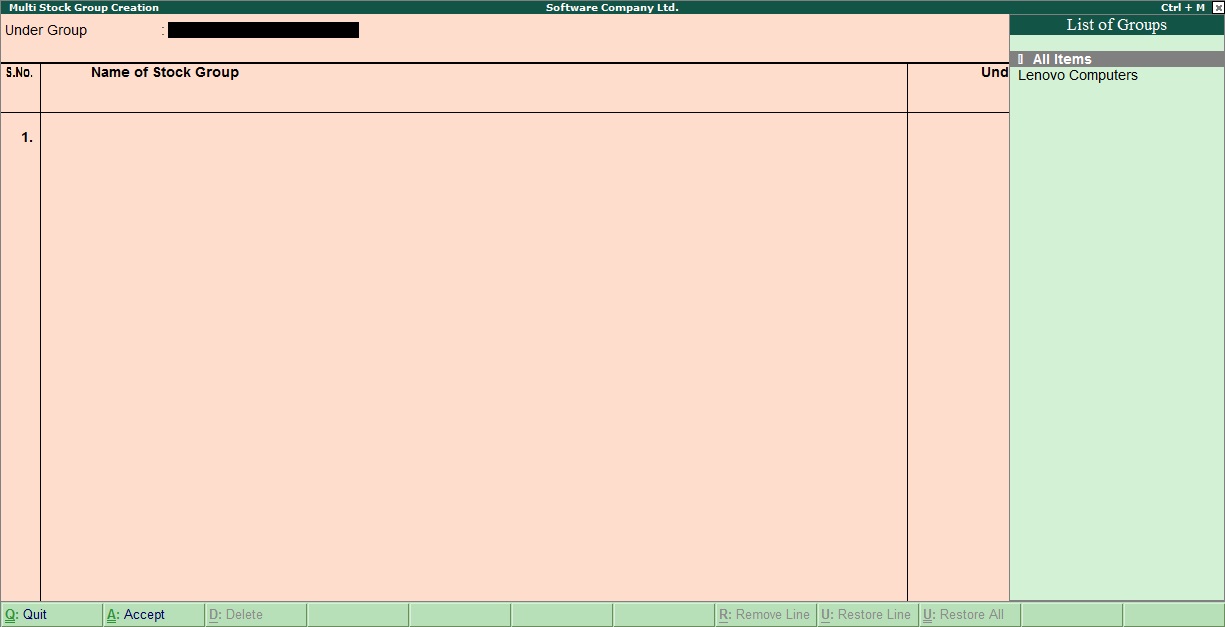

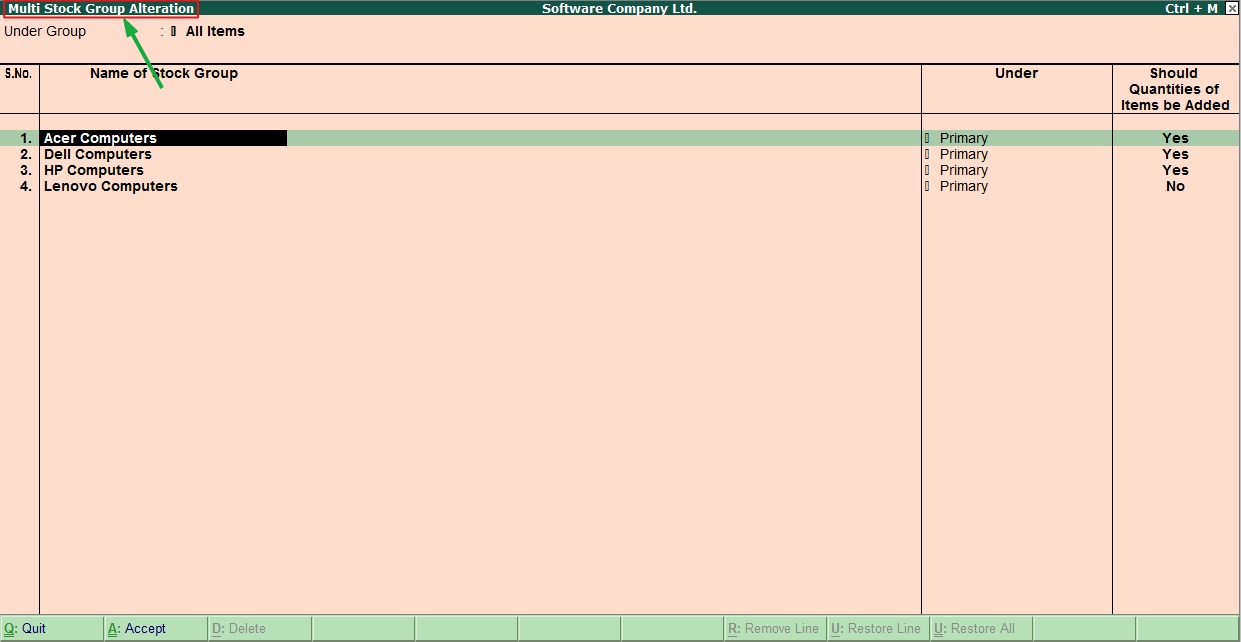

After selecting the CReate option, you should see a screen similar to the one below:

- Provide the details of the Stock Groups as follows:

Under Group: Specifying this field depends on the stock groups you are about to create. Are they main groups or sub-groups? And if they are sub-groups, are they under the same group? Or does each one of them fall under a different group of its own?

If they are all main groups or sub-groups but fall under different parent groups, then All Items should be chosen as it allows you the option to select different groups for different stocks. If they are not main groups but fall under one group as sub-groups, then the group they all fall under should be selected in the Under Group field.

In our case, we want to create all three groups under Primary. Thus we need to select All Items to enable us the option to specify the group.

S.No.: This is the serial number column that is generated automatically. Thus, you don’t need to specify the serial number. Tally will not even give you the chance.

Name of Stock Group: This is the column to list the names of the stock groups you wish to create. As you can see, you don’t have the option to give a second (or Alias) name for your stock group under the multiple stock group creation sections. However, you can do that by altering the ledger under a single ledger.

Under: This column depends on what you select in the under group field at the initial stage. If you select All items, it means you didn’t specify any parent group for your stock group, Tally will, therefore, allow you the chance to do so. But if you already select a group in the Under Group field, that group will be used as the parent group for all the stock groups and will be entered automatically for you in the Under column.

You can also create new parent Stock Groups from this field by pressing Alt+C simultaneously on your keyboard.

Should Quantities of Items be Added: This option has been explained under the single ledger creation. This option is concern about the units of measurements for the items you will place under this group. All items to be placed under a particular group should have the same measurement units before their quantities can be added. This way, you can know the total number of items under Dell Computers, HP Computers or Acer Computers.

For example, you cannot add quantities in litres to quantities in kgs. Thus, if the stock items that will fall under the group have different units of measurements, then quantities of items should not be added and can be set to NO . But if they have the same measuring units, this option may be set to Yes . (see screenshot)

- After providing all the relevant details, press Ctrl+A to finalize the multiple ledger creation.

Display and Alter Stock Groups

After the stock groups have been created, you may need to peek at all the stock groups to check for accuracy and maybe make some changes to some of them. Tally can help with that as it allows you the option to Display and Alter stock groups, both under Single and Multiple options.

Displaying Stock Groups

- To display stock groups, go to Gateway of Tally → Inventory Info. → Stock Groups → Display (You can either choose to display under the single stock group or multiple stock group)

- Tally will prompt you a List of Stock Groups. Select the group you want to display. If you are displaying under the Multiple Stock Group, you’ll have to select All Items from the list of stock groups to be able to display all available stock groups. Below is a picture of multiple stock groups in display mode:

Note: you cannot make changes to stock groups whilst in the display mode. To make any changes you need to use the Alter feature.

Stock Group Alteration

To Alter stock groups in Tally, go to Gateway of Tally → Inventory Info. → Stock Groups → Alter (You can either choose to Alter under the single stock group or multiple stock group)

- Tally will prompt you a List of Stock Groups. Select the group you want to Alter. If you are Altering under the Multiple Stock Group, you’ll have to select All Items from the list of stock groups to be able to Alter all available stock groups. Below is a picture of multiple stock groups in the Alteration mode:

- After making all the necessary alteration to the Stock Groups, press Ctrl+A to save the changes.

Deleting Stock Groups

You can also delete any stock group provided the following conditions are met:

- If the Stock group is not used by any sub-group or stock items.

Thus to delete a stock group, first, of course, delete the stock items and subgroups that fall under that group.

After deleting the stock items and subgroups, go to the alteration page of that group. Whilst in the alteration mode for that particular stock group, press Alt+D.

Tally will prompt you for confirmation to delete the stock group. Once you accept to delete, it will be deleted completely forever.

Next step: Inventory Management Part 2

My attempt to explain the concepts into details has called for a lengthy tutorial. That’s why I need to break this article into several parts.

In the next parts of this guide, you’ll learn how to manage stock units of measurement, stock categories , and stock items.

manish mani tiwari

Wednesday 8th of January 2020

how to maintain petroal pump accounting with inventory in tally erp 9

Mathan kumar

Monday 29th of March 2021

This is one of the indirect expenses in accounts.

The Assignment with Audie Cornish

Each week on the assignment, host audie cornish pulls listeners out of their digital echo chambers to hear from the people whose lives intersect with the news cycle. from the sex work economy to the battle over what’s taught in classrooms, no topic is off the table. listen to the assignment every monday and thursday..

- Apple Podcasts

Back to episodes list

And does Country need Beyoncé? The likely answer to both of those questions is no. But the discussion Beyoncé sparked seems to be the larger point of her new album, Cowboy Carter . Sidney Madden is a reporter for NPR Music, and has delved deep into the intricate dynamics of race, genre, and industry politics addressed on the album. Audie and Sidney talk about these bigger themes and explore the conversation that's been started by Beyoncé's latest bold venture.

Sidney Madden is also co-host of the podcast Louder Than a Riot .

Watch, “ Call Me Country: Beyoncé & Nashville’s Renaissance ,” available to stream in the U.S. on Friday, April 26 on Max (subscription required). The documentary examines this reckoning in the genre, straight from the country music capital of the world.

- Election 2024

- Entertainment

- Newsletters

- Photography

- Personal Finance

- AP Investigations

- AP Buyline Personal Finance

- AP Buyline Shopping

- Press Releases

- Israel-Hamas War

- Russia-Ukraine War

- Global elections

- Asia Pacific

- Latin America

- Middle East

- Election Results

- Delegate Tracker

- AP & Elections

- Auto Racing

- 2024 Paris Olympic Games

- Movie reviews

- Book reviews

- Personal finance

- Financial Markets

- Business Highlights

- Financial wellness

- Artificial Intelligence

- Social Media

Tuesday’s Transactions

- Copy Link copied

Major League Baseball

American League

ARIZONA DIAMONDBACKS — Sent RHP Paul Sewald to Reno (PCL) on a rehab assignment.

BALTIMORE ORIOLES — Recalled OF Heston Kjerstad from Norfolk (IL). Optioned C David Banuelos to Norfolk.

BOSTON RED SOX — Reinstated OF Tyler O’Neil from the 7-day IL. Placed C Tyler Heineman on the 10-day IL, retroactive to April 22. Agreed to terms with RHP Adam Smith on a minor league contract.

CLEVELAND GUARDIANS — Sent LHP Sam Hentges to Columbus (IL) on a rehab assignment.

MINNESOTA TWINS — Sent RHP Jhoan Duran to St. Paul (IL) on a rehab assignment.

NEW YORK YANKEES — Sent 2B D.J. LeMahieu to Somerset (EL) on a rehab assignment.

SEATTLE MARINERS — Reinstated RHP Collin Snider from the 15-day IL and optioned him to Tacoma (PCL).

TEXAS RANGERS — Reinstated C Jonah Heim from the family/bereavement list and RHP Jonathan Hernandez from the 15-day IL. Optioned C Sam Huff and RHP Owen White to Round Rock (IL). Sent RHP Josh Sborz to Frisco (TL) on a rehab assignment. Agreed to terms with RHP Johnny Cueto on a minor league contract.

National League

ARIZONA DIAMONDBACKS — Sent RHP Paul Sewald to Reno (PCL) on a rehab assignment. Acquired INF Sergio Alcantara form Pittsburgh for cash considerations and optioned him to Reno. Claimed LHP Joe Jacques off waivers from Boston and optioned him to Reno. Released INF Jace Peterson. Placed RHP Merrill Kelly on the 15-day IL, retroactive to April 20. Placed RHP Miguel Castro on the 15-day IL, retroactive to April 21. Recalled LHPs Andrew Saalfrank, Tommy Henry and RHP Justin Martinez from Reno. Placed LHP Kyle Nelson on the 15-day IL.

CHICAGO CUBS — Placed RHP Kyle Hendricks on the 15-day IL. Designated 1B Garrett Cooper for assignment. Placed LHP Drew Smyly on the 15-day IL, retroactive to April 22. Recalled LHP Luke Little, 1B Matt Mervis and RHP Hayden Wesneski from Iowa (IL).

CINCINNATI REDS — Reinstated LHP Sam Moll from the 15-day IL. Optioned RHP Casey Legumina to Louisville (IL).

LOS ANGELES DODGERS — Sent RHP Blake Treinen to Oklahoma City (PCL) on a rehab assignment.

NEW YORK METS — Reinstated RHP Max Kranick from the 15-day IL and optioned him to Syracuse (IL).

PHILADELPHIA PHILLIES — Sent RHP Luis F. Ortiz to Clearwater (FSL) on a rehab assignment.

SAN FRANCISCO GIANTS — Optioned RHP Landen Roupp to Sacramento (PCL).

WASHINGTON NATIONALS — Selected the contract of RHP Jacob Barnes from Rochester (IL). Placed LHP Robert Garcia on the 15-day IL, retroactive to April 21. Designated INF/OF Jake Alu for assignment. Sent C Keibert Ruiz to Harrisburg (EL) on a rehab assignment.

Minor League

Atlantic League

LONG ISLAND DUCKS — Signed RHPs Dan Straily and Tyler Zuber.

Women’s National Basketball Association

MINNESOTA LYNX — Signed Fs Camryn Taylor, Mimi Collins and G Quinesha Lockett to training camp contracts.

National Football League

NFL — Reinstated Philadelphia CB Isaiah Rodgers from suspension for violating NFL’s gambling policy.

ATLANTA FALCONS — Placed QB Matt Ryan on the retired list.

CINCINNATI BENGALS — Re-signed QB Jake Browning to a two-year contract through the 2025 season and QB Logan Woodside to a one-year contract.

DENVER BRONCOS — Agreed to terms with CB Patrick Surtain on a fifth-year option.

HOUSTON TEXANS — Signed LB Jacob Phillips to a one-year contract.

KANSAS CITY CHIEFS — Re-signed LB Jack Cochrane to a one-year contract extension.

PHILADELPHIA PHILLIES — Activated CB Isaiah Rodgers from the suspended list.

National Hockey League

ARIZONA COYOTES — Announced the retirement of RW Jakub Voracek.

BOSTON BRUINS — Recalled D Mason Lohrei from Providence (AHL).

COLUMBUS BLUE JACKETS — Agreed to terms with RW Jimmy Snuggerud on a three-year, entry-level contract.

PHILADELPHIA FLYERS — Agreed to terms with G Ivan Fedotov on a two-year contract extension.

WASHINGTON CAPITALS — Recalled D Hardy Haman-Aktell from Hershey (AHL).

Minor League Hockey

CALGARY WRANGLERS — Signed D Hunter Brzustewicz to an amateur tryout contract (ATO).

CLEVELAND MONSTERS — Signed F Luca Pinelli to an amateur tryout contract (ATO).

ROCKFORD ICEHOGS — Signed F Alex Pharand to an amateur tryout contract (ATO). Acquired F Samuel Savoie from Chicago (NFL) on loan.

ECHL — Suspended Greenville D Bobby Russell two games and fined him an undisclosed amount for an illegal check to the head in a game on April 22 against Orlando.

ADIRONDACK THUNDER — Acquired F Filip Engaras and D Will MacKinnon from Utica (AHL) on loan.

Major League Soccer

MLS — Fined LA Galaxy D Eriq Zavaleta an undisclosed amount for failing to leave the field in a timely manner in a match on April 21 against San Jose. Officially warned LA Galaxy and head coach Greg Vanney for violating the mass confrontation policy for the first time this season. Fined LA Galaxy Ds Mauricia Cuevas and Julian Aude, M Gaston Grugman and F Gabriel Pec undisclosed amount for inciting and/or escalating a mass confrontation.

INTER MIAMI CF — Signed M Matias Rojas to a contract through the 2024 season.

NEW ENGLAND REVOLUTION — Acquired D Xavier Arreaga from Seattle Sounders FC in exchange for a 2025 international roster slot and $75,000 in general allocation money (GAM) if certain performance metrics are met. Signed G Aljaz Ivacic to a contract through the 2025 season. Waived G Jacob Jackson.

VANCOUVER WHITECAPS FC — Acquired D Giuseppe Bovalina via transfer from A-League sid Adelaide United FC and signed him to a contract through 2026.

National Women’s Soccer League

HOUSTON DASH — Acquired D Tarciane in transfer from Serie A Corinthians for an undisclosed fee.

Texas Rangers Ace Starts Injury Rehab Assignment At Round Rock

Max Scherzer got his first reps of the season against the Salt Lake Bees when he pitched for the Round Rock Express on Wednesday.

- Author: Matthew Postins

In this story:

Texas Rangers starter Max Scherzer began his injury rehab assignment on Wednesday with the Round Rock Express, as he pitched less than three innings in his first game action since last year’s World Series.

The 39-year-old right-hander has been on the 15-day injured list since the start of the season after he had surgery on a herniated disc in December.

Scherzer threw twice last week — a 25-pitch batting practice session in Detroit and a 40-pitch simulated game when Texas was in Atlanta to face the Braves on Friday.

The numbers for the three-time Cy Young winner weren’t impressive against Salt Lake. He pitched 2 1/3 innings, giving up five hits, three runs (all earned) and no walks. He struck out four. He threw 52 pitches, 32 of which were strikes. He faced 11 hitters.

The Rangers set 50 pitches as a goal for Scherzer.

He allowed a solo home run to Jason Martin with one out in the first inning. He gave up another solo home run, as Cole Tucker slammed one off Scherzer to lead off the second.

Later, D’Shawn Knowles doubled home Jack Lopez to give Salt Lake a 3-0 lead.

Scherzer retired Martin on a groundout and then left the game for reliever Chasen Shreve.

For the past few weeks Scherzer has said that he’s ahead of schedule when it comes to his recovery. That’s part of the reason the Rangers placed him on the 15-day injured list as opposed to the 60-day injured list, where they moved Jacob deGrom and Tyler Mahle to start the season.

The Rangers are hopeful Scherzer can join the rotation in the next few weeks.

He went a combined 13-6 with the Mets and Rangers last year, finishing with a 3.77 ERA. With the Rangers he went 4-2 with a 3.20 ERA.

Latest Rangers News

Former Seattle Mariners, New York Yankees' Star Set to Become Majority Owner of NBA Franchise

Rangers Spring Training Notebook: Wyatt Langford Adds To Historic Spring Debut

Report: A-Rod, Lore Land Backing to Close T-Wolves Ownership Sale

How To Buy Texas Rangers Gold-Trimmed Merchandise

Nathan Eovaldi Likely To Zone Out Texas Rangers Opening Day Celebration

COMMENTS

Tally ERP 9 Assignment.pdf. Tally ERP 9 Assignment.pdf. Sign In. Details ...

Tally Practical Assignment including GST with Solutions PDF for free download. Super Success Institute Tally computer training coaching classes day by day task. Notes is very useful for learn and practice the tally ERP 9 with GST. We found that student face problem to find the practice assignment of Tally. The Training Faculty of Super Success ...

Tally ERP 9 Notes + Practical Assignment - Free Download PDF.pdf - Free download as PDF File (.pdf), Text File (.txt) or read online for free. This document provides an overview of notes on using Tally ERP 9 accounting software. It discusses how the notes cover topics from basics to practical uses and are the most detailed Tally notes available.

Tally Erp 9 It Assignment - Free download as PDF File (.pdf), Text File (.txt) or read online for free. Tally ERP 9 is a business accounting software that provides comprehensive accounting, inventory management, and business intelligence solutions. It can be used by small, medium, and large businesses. Tally ERP 9 integrates key business functions like sales, purchasing, and inventory management.

Tally ERP 9 Assignment. Course. ENVIRONMENTAL STUDIES (BCOM) 288 Documents. Students shared 288 documents in this course. University University of Calcutta. Academic year: 2020/2021. Uploaded by: Sudipta Chatterjee. University of Calcutta. 0 followers. 4 Uploads. 55 upvotes. Follow. Recommended for you. 14.

Tally.ERP 9 provides you with exceptional capabilities that will simplify the way you manage all critical aspects of your business, including accounting, sales and purchase, inventory, manufacturing, taxation, payroll, MIS reporting, and much more. Tally.ERP 9 is preferred by millions as their business management software across the globe.