- Global (EN)

- Albania (en)

- Algeria (fr)

- Argentina (es)

- Armenia (en)

- Australia (en)

- Austria (de)

- Austria (en)

- Azerbaijan (en)

- Bahamas (en)

- Bahrain (en)

- Bangladesh (en)

- Barbados (en)

- Belgium (en)

- Belgium (nl)

- Bermuda (en)

- Bosnia and Herzegovina (en)

- Brasil (pt)

- Brazil (en)

- British Virgin Islands (en)

- Bulgaria (en)

- Cambodia (en)

- Cameroon (fr)

- Canada (en)

- Canada (fr)

- Cayman Islands (en)

- Channel Islands (en)

- Colombia (es)

- Costa Rica (es)

- Croatia (en)

- Cyprus (en)

- Czech Republic (cs)

- Czech Republic (en)

- DR Congo (fr)

- Denmark (da)

- Denmark (en)

- Ecuador (es)

- Estonia (en)

- Estonia (et)

- Finland (fi)

- France (fr)

- Georgia (en)

- Germany (de)

- Germany (en)

- Gibraltar (en)

- Greece (el)

- Greece (en)

- Hong Kong SAR (en)

- Hungary (en)

- Hungary (hu)

- Iceland (is)

- Indonesia (en)

- Ireland (en)

- Isle of Man (en)

- Israel (en)

- Ivory Coast (fr)

- Jamaica (en)

- Jordan (en)

- Kazakhstan (en)

- Kazakhstan (kk)

- Kazakhstan (ru)

- Kuwait (en)

- Latvia (en)

- Latvia (lv)

- Lebanon (en)

- Lithuania (en)

- Lithuania (lt)

- Luxembourg (en)

- Macau SAR (en)

- Malaysia (en)

- Mauritius (en)

- Mexico (es)

- Moldova (en)

- Monaco (en)

- Monaco (fr)

- Mongolia (en)

- Montenegro (en)

- Mozambique (en)

- Myanmar (en)

- Namibia (en)

- Netherlands (en)

- Netherlands (nl)

- New Zealand (en)

- Nigeria (en)

- North Macedonia (en)

- Norway (nb)

- Pakistan (en)

- Panama (es)

- Philippines (en)

- Poland (en)

- Poland (pl)

- Portugal (en)

- Portugal (pt)

- Romania (en)

- Romania (ro)

- Saudi Arabia (en)

- Serbia (en)

- Singapore (en)

- Slovakia (en)

- Slovakia (sk)

- Slovenia (en)

- South Africa (en)

- Sri Lanka (en)

- Sweden (sv)

- Switzerland (de)

- Switzerland (en)

- Switzerland (fr)

- Taiwan (en)

- Taiwan (zh)

- Thailand (en)

- Trinidad and Tobago (en)

- Tunisia (en)

- Tunisia (fr)

- Turkey (en)

- Turkey (tr)

- Ukraine (en)

- Ukraine (ru)

- Ukraine (uk)

- United Arab Emirates (en)

- United Kingdom (en)

- United States (en)

- Uruguay (es)

- Uzbekistan (en)

- Uzbekistan (ru)

- Venezuela (es)

- Vietnam (en)

- Vietnam (vi)

- Zambia (en)

- Zimbabwe (en)

- Financial Reporting View

- Women's Leadership

- Corporate Finance

- Board Leadership

- Executive Education

Fresh thinking and actionable insights that address critical issues your organization faces.

- Insights by Industry

- Insights by Topic

KPMG's multi-disciplinary approach and deep, practical industry knowledge help clients meet challenges and respond to opportunities.

- Advisory Services

- Audit Services

- Tax Services

Services to meet your business goals

Technology Alliances

KPMG has market-leading alliances with many of the world's leading software and services vendors.

Helping clients meet their business challenges begins with an in-depth understanding of the industries in which they work. That’s why KPMG LLP established its industry-driven structure. In fact, KPMG LLP was the first of the Big Four firms to organize itself along the same industry lines as clients.

- Our Industries

How We Work

We bring together passionate problem-solvers, innovative technologies, and full-service capabilities to create opportunity with every insight.

- What sets us apart

Careers & Culture

What is culture? Culture is how we do things around here. It is the combination of a predominant mindset, actions (both big and small) that we all commit to every day, and the underlying processes, programs and systems supporting how work gets done.

Relevant Results

Sorry, there are no results matching your search., assets held for sale and discontinued operations: ifrs® accounting standards vs us gaap.

Top 10 differences between IFRS 5 and ASC Subtopics 360-10 and 205-20.

From the IFRS Institute – September 7, 2023

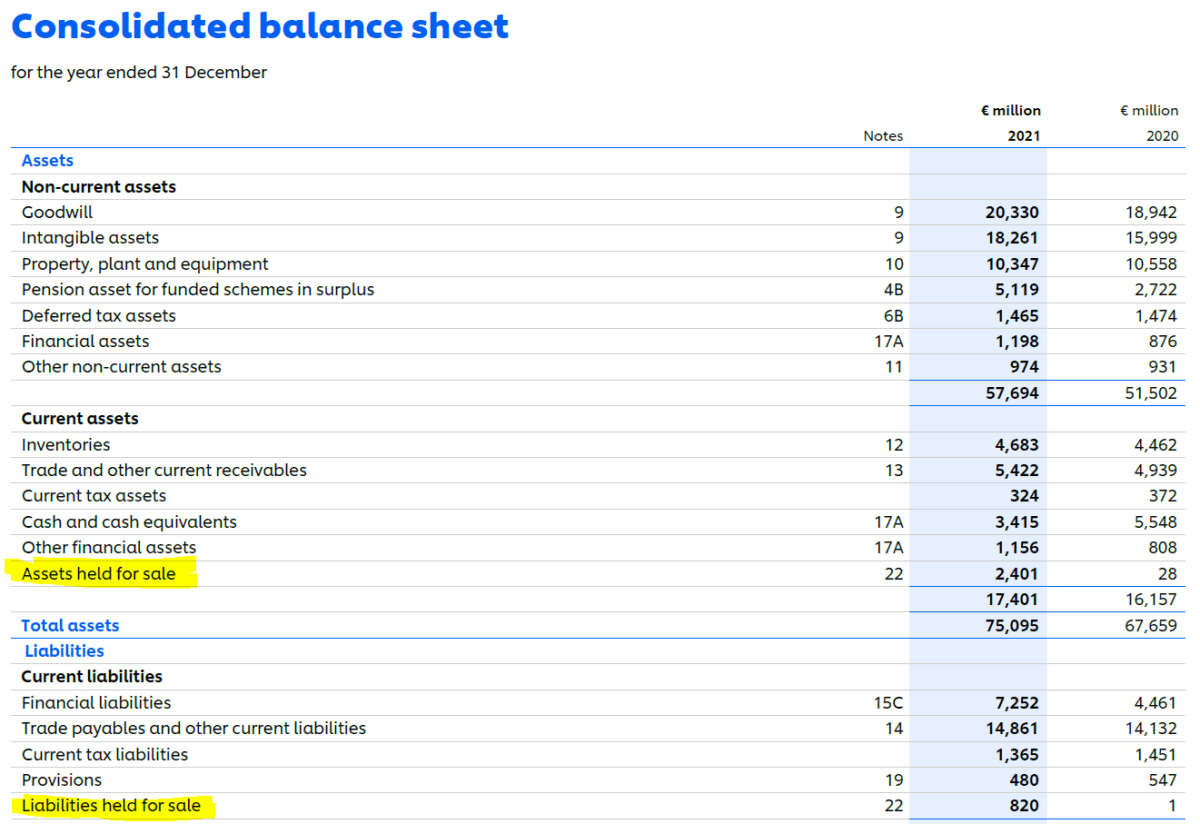

Even before a company disposes of a group of assets or discontinues a major line of business or a geography, the financial statements may need to reflect the possible effects of the planned transaction. For example, when certain criteria are met, both IFRS Accounting Standards and US GAAP require that (1) assets and liabilities held-for-sale be presented separately on the balance sheet and (2) results and cash flows of discontinued operations be presented separately from those of continuing operations. These requirements are largely aligned, but differences exist.

IFRS 5 1 requirements for asset groups held-for-sale (distribution)

Classification as held-for-sale (distribution).

When a company decides to dispose of a noncurrent asset or disposal group 2 (referred to as asset group) through a sale transaction rather than through continuing use, the asset group is assessed for held-for-sale classification until sold. Examples of asset groups include a plant, a subsidiary, an operating segment or a cash generating unit. Similarly, asset groups to be distributed to the company’s owners acting in their capacity as owners (e.g. in a spin off) are assessed for held-for-distribution classification.

An asset group is classified as held-for-sale (distribution) if it meets the following criteria.

IFRS 5 criteria for held-for-sale classification

- The asset group is available for immediate sale in its present condition subject only to terms that are usual and customary for sales of such assets; and

- The sale is highly probable. Highly probable means:

a. the appropriate level of management is committed to a plan to sell; b. an active program to locate a buyer and complete the plan to sell has been initiated; c. the asset is being marketed for sale at a price that is reasonable in relation to its current fair value; and d. actions required to complete the plan indicate that it’s unlikely that significant changes will be made or the plan will be withdrawn.

IFRS 5 criteria for held-for-distribution classification

- The asset group is available for immediate distribution in its present condition; and

- The distribution is highly probable.

Once classified as held-for-sale (distribution), the asset group is subject to specific measurement, presentation, and disclosure requirements.

Measurement at lower of carrying amount and fair value less cost to sell (distribute)

An asset group classified as held-for-sale (distribution) is measured at the lower of its carrying amount and fair value less costs to sell (distribute). This means that expected losses are generally recognized before the transaction closes, while gains are generally recognized at closing. Costs to sell (distribute) are incremental costs directly attributable to the transaction, excluding finance costs and income tax expense. Further, property, plant, equipment and intangible assets in the asset group are no longer depreciated or amortized.

Presentation and disclosure

From the date an asset group is classified as held-for-sale (distribution), its assets and liabilities are classified as current and presented separately from other assets and other liabilities on the balance sheet. Prior years are not adjusted to present the asset group as held-for-sale (distribution). Specific disclosure requirements also apply.

IFRS 5 requirements for discontinued operations

Classification as discontinued operations.

A discontinued operation is a component of a company that either has been disposed of or is classified as held-for-sale (distribution). It represents a separate major line of business or geographic area (or is part of a single plan to dispose of one), or a subsidiary acquired exclusively with a view to resale.

Classification of an asset group as discontinued operations occurs at the earlier of these two dates:

- when the company actually disposes the asset group or, in our view, the distribution to owners has occurred; and

- when the operation meets the criteria to be classified as held-for-sale (distribution) or has ceased to be used.

Measurement

There are no recognition or measurement impacts from classifying operations as discontinued. However, discontinued operations will generally include asset groups held-for-sale (distribution), which follow the measurement requirements described above.

The results of discontinued operations are presented separately from continuing operations, as a single amount in the statement of profit or loss and other comprehensive income (OCI). An analysis of this single amount is provided either on the statement of profit or loss and OCI or in the notes to the financial statements. Net cash flow information attributable to operating, investing and financing activities of discontinued operations are disclosed, either on the statement of cash flows or in the notes.

The comparative statement of profit or loss and OCI and cash flow information are re-presented each period so that the comparative information includes all operations classified as discontinued at the current reporting date.

How is IFRS 5 different from US GAAP?

Although the guidance in IFRS 5 is quite similar to US GAAP (i.e. ASC Subtopics 205-20 and 360-10 3 ), there are some important differences regarding specific classification, measurement, presentation and disclosure requirements. Here, we highlight 10 of these differences.

1. Held-for-distribution designation

Unlike IFRS 5, under US GAAP no special held-for-distribution designation exists. Instead, an asset group to be distributed to owners is treated as follows until distributed:

a. it continues to be classified as held-and-used; b. its long-lived assets continue to be depreciated or amortized; and c. its results continue to be presented in continuing operations. Once the distribution is complete, the results are presented separately as discontinued, if the appropriate criteria are met.

2. Definition of a discontinued operation

When assessing the magnitude of the effect of a disposal, the IFRS 5 definition of a discontinued operation focuses on whether it represents a separate major line of business or geographic area .

Unlike IFRS 5, US GAAP focuses on whether a disposal represents a strategic shift that has (or will have) a major effect on a company’s operations and financial results . The requirement for there to be a strategic shift under US GAAP presents a high hurdle as post-separation results must be qualitatively and quantitatively measured to qualify for discontinued operations classification. Yet, US GAAP includes the disposal of a major line of business or major geographic area as an example of a discontinued operations.

In practice, this assessment requires judgment and conclusions should be well documented. It is often a source of comments from the SEC staff to registrants.

3. Assets scoped out from held-for-sale (or distribution under IFRS 5) measurement requirements

Under both IFRS 5 and US GAAP certain assets in a held-for-sale (distribution) asset group are excluded from the held-for-sale measurement (i.e. lower of carrying amount and fair value less cost to sell). Instead, they remain measured under the guidance that normally applies to those assets. However, the list of excluded assets under IFRS 5 and US GAAP do not align.

4. Equity accounting application when investee is held-for-sale (or distribution under IFRS 5)

Under IFRS Accounting Standards, when an interest in an investee under significant influence meets the criteria to be classified as held-for-sale, it is measured under IFRS 5 and presented as held-for-sale (distribution). Equity accounting pursuant to IAS 28 5 cannot be applied.

Unlike IFRS 5, under US GAAP equity accounting continues to apply as long as the investor holds significant influence. Further, unlike IFRS 5, the interest is not presented as held-for-sale unless it also qualifies as a discontinued operation (i.e. represents a strategic shift).

5. Subsequent measurement until disposal

Under both IFRS 5 and US GAAP an asset group classified as held-for-sale (or distribution under IFRS 5) is remeasured at the lower of carrying amount and fair value less costs to sell until its disposal. An increase in fair value less costs to sell may therefore result in a gain. The gain is limited to the cumulative amount of impairment losses previously recognized.

To determine the cumulative amount of impairment losses previously recognized, IFRS 5 considers impairment losses recognized in accordance with both the held-for-sale (distribution) guidance and the impairment standard (IAS 36) before the asset group was classified as held-for-sale (distribution). Impairment losses allocated to goodwill are included in determining the maximum gain that can be recognized.

Unlike IFRS 5, US GAAP only considers impairment losses recognized under the held-for-sale guidance. It is not possible to reverse impairment losses recognized before the asset group was classified as held-for-sale. This means that a higher amount of gain may be recorded before disposal under IFRS 5 because reversals of historical impairments, per IAS 36, are allowed.

6. Reclassification as held-for-use 6

Under both IFRS 5 and US GAAP when an asset group is no longer held for sale (or distribution under IFRS 5), it is reclassified as held-for-use and remeasured. Under IFRS 5 it is remeasured at the lower of its recoverable amount and the carrying amount it would have absent the held-for-sale (distribution) classification. This is the carrying amount before the asset group was classified as held-for-sale (distribution) adjusted for any depreciation, amortization or revaluations that would have been recognized had the asset remained classified as held-for-use.

Under US GAAP a long-lived asset that is reclassified is measured separately at the lower of its fair value at the date of the decision not to sell (unlike IFRS 5) and the carrying amount it would have absent the held-for-sale classification (like IFRS 5).

The recoverable amount under IFRS 5 is the higher of the asset group’s fair value less costs of disposal and the value in use. The recoverable amount may therefore differ from fair value under US GAAP, which may affect the amount of remeasurement gain or loss recorded on reclassification as held-for-use.

7. Presentation of assets held-for-sale (or distribution under IFRS 5) in comparative financial statements

Under IFRS 5 the comparative balance sheet is not adjusted to reflect the presentation of assets held-for-sale (distribution) in the current period.

Under US GAAP, unlike IFRS 5, in the period that a discontinued operation is disposed of or classified as held-for-sale, the comparative balance sheet is adjusted to reflect that classification for all periods presented. Unlike IFRS 5, there is no specific guidance for held-for-sale assets groups that are not discontinued operations, and practice varies.

8. Disclosure of cash flow information for discontinued operations

Like IFRS 5, under US GAAP cash flow information for discontinued operations is required to be disclosed. Unlike IFRS, under US GAAP the requirements to provide information by categories of cash flows (operating, investing and financing) for discontinued operations vary between private and public companies.

9. Certain disclosure exemptions on newly acquired subsidiaries

Under IFRS 5 certain disclosure (e.g. analysis of result and cash flow information) can be omitted when a newly acquired subsidiary is classified as held-for-sale (distribution) on acquisition.

Unlike IFRS 5, US GAAP provides no disclosure exemptions for a disposal group that is a newly acquired subsidiary classified as held-for-sale on acquisition.

10. Additional US GAAP only disclosures

Unlike IFRS 5, US GAAP requires specific disclosures about entities’ continuing involvement with discontinued operations and disposals of individually significant components that do not qualify as discontinued operations.

Key takeaways

Accounting requirements for assets held-for-sale (distribution) and discontinued operations are designed to help users of the financial statements understand continuing operations and project the financial position of the company after the transaction completes. While this objective seems quite similar to that of pro forma financial statements, the process of complying with IFRS 5 or US GAAP is not a pro forma exercise and obeys much stricter rules, e.g. in terms of allocating costs and revenues to the discontinued operations. However, significant disposals may also trigger the preparation of pro forma financial statements under applicable laws and regulations. Users and preparers therefore need to be able to navigate these various requirements and the related accounting implications. If in doubt, please reach out to your KPMG advisor.

- IFRS 5, Non-current Assets Held for Sale and Discontinued Operations

- A group of assets, and possibly some associated liabilities, that a company intends to dispose of in a single transaction.

- ASC 360, Property, Plant, and Equipment, and ASC 205, Presentation of Financial Statements

- Servicing rights represent a commitment to supply a service and can only be settled by delivery of the service.

- IAS 28, Investments in Associates and Joint Ventures

- US GAAP uses the term ‘held-and-used’ instead of ‘held-for-use’, but this article uses ‘held-for-use’ for both US GAAP and IFRS 5 for simplification.

Explore more

Sale and leaseback: IFRS® Accounting Standards vs US GAAP

Seller-lessee accounting for sale-and-leaseback transactions under IFRS 16 versus ASC Topic 842.

ISSB Standards: general and climate

A holistic approach to identifying sustainability-related risks and opportunities and disclosing material information.

Contributing author

KPMG Executive Education

CPE seminars and customized training

Subscribe to the IFRS® Perspectives Newsletter

Subscribe to receive timely updates on the application of IFRS® Accounting and Sustainability Standards in the United States: our latest thought leadership, articles, webcasts and CPE seminars.

IFRS Perspectives Newsletter

By submitting, you agree that KPMG LLP may process any personal information you provide pursuant to KPMG LLP's Privacy Statement .

Thank you for contacting KPMG. We will respond to you as soon as possible.

Contact KPMG

Job seekers

Visit our careers section or search our jobs database.

Use the RFP submission form to detail the services KPMG can help assist you with.

Office locations

International hotline

You can confidentially report concerns to the KPMG International hotline

Press contacts

Do you need to speak with our Press Office? Here's how to get in touch.

Assets Held for Sale in the Balance Sheet – Classification, Recognition, Measurement, and More

The assets held for sale are the non-current assets that the business intends to sell. In other words, confirm the intention of the business to sell the non-current assets converts the presentation of the non-current assets to the current assets. This is the change of classification which brings changes in the implications of the accounting treatment on the assets. For instance, once an asset is classified as held for sale in the section of current assets, no depreciation is applied.

The company may commit to sale the group of assets instead of a single asset. However, the accounting treatment and presentation of the assets held for sale remain the same irrespective of whether it’s a single asset or a group of assets.

If the company decides to sell the business unit/disposal group, the assets and liabilities are netted off, and the disposal group is shown as a single line item in the section of current assets. So, there is no difference in reporting for the single asset or the disposal group.

Criteria to classify the assets as held for sale

The business can classify the assets as held for sale if the following criteria are met.

- The management is committed to a plan to sell the assets. The commitment is to be proved by identifying the asset classified as held for sale and setting an expected date to close the sales transaction.

- The asset to be sold is in the present condition. In other words, there is no need to incur modification costs in the assets to be sold.

- The business is actively looking for the buyer – an advertisement in the newspaper, active marketing, and discussion with different parties can prove an active buyer allocation program.

- The sale of the assets is probable and expected to complete within one year.

- The price demanded by the business is not unreasonably higher, and it’s more or less the same as the fair value of the assets.

- The business does not seem to withdraw its plan to sell the assets.

Accounting treatment – assets held for sale

The assets held for sale are valued at lower carrying value, and fair value less cost to sell. The carrying value is an amount after accumulated depreciation, impairment, and other charges are deducted from the recorded cost of the asset. Let’s understand the accounting treatment for measurement and recording of the assets held for sale.

Consider the asset’s cost is USD 25,000, accumulated depreciation amounts to USD 10,000, and the impairment amounts to USD 2,000. So, the carrying value would be USD 13,000 (25,000-10,000-2,000). On the other hand, the asset’s fair value is USD 18,000, and the sale cost is USD 2,000.

So, the carrying value amounts to USD 13,000, and the fair value after the sale cost is USD 16,000 (18,000-22,000). The asset held to sale would be recorded on USD 13,000 (carrying value), which is lower than the fair value of USD 18,000.

Difference between discontinued operations and assets held for sale

Discontinued operations is the term used when the business intends to sell part of the operations. It may be a product line, business unit, or some segment earning revenue and incurring expenses. However, the following criteria need to be met for classifications of assets as discontinued operations.

- The assets to be disposed of representing a major line of business. It may be geographical location, key market, business unit, or some product line.

- The business has a committed plan to sell the asset.

- The disposal will lead to the loss of control over the discontinued operations.

Frequently asked questions

Which of the assets can be classified as held for sale.

There must be the commitment of the management to sell the assets, and they should be actively looking for the buyer. The logic behind this classification is that the business will recover the carrying amount with the sale transaction rather than continuous usage of the asset. Hence, an asset should be classified as held for sale rather than the business’s normal assets.

Where are assets held for sale presented in the balance sheet?

The assets held for sale are presented in the section of current assets. These assets are presented as a line item at the end of the current asset section.

Is there any difference between inventory and assets held for sale?

Although inventory and assets held for sale are classified as current assets, there is a difference. The inventory is sold in the normal course of the business, while the sale of the asset held for sale is one of the rare events or even one-off.

What’s the treatment of depreciation for assets held for sale?

The assets held for sale are classified as current assets and no depreciation is charged. However, the business needs to carry out an impairment review at the end of an accounting period.

What’s the objective of classifying assets as held for sale?

The objective of the assets held for sale is to separately present the asset to be sold from assets being used by the company in the business. It helps the users of the financial statement assess the business’s performance and their intention to sell the assets/discontinued operations. In addition to this, the assets classified as held for sale do not need to depreciate.

Conclusion

The business needs to classify non-current assets/discontinued operations in the current asset section when certain criteria are filled. The criteria are based on the commitment of the business to sell the assets, active program to locate the buyer, and selling the asset in the current position.

Once an asset is classified as held for sale, the business does not need to charge depreciation. However, the business needs to assess impairment if the fair value has declined. On initial recognition of the asset held for sale, the assets are lower of the carrying value, and the fair value less cost to sale. The carrying value is the value after deducting accumulated depreciation and impairment from the cost of the asset.

Related Posts

What are the recognition criteria for assets in the balance sheet, what are recognition criteria of liabilities in balance sheet, 3 element of balance sheet – what are they, what are the advantages of the balance sheet explained.

Save 40% on Online Finance Courses

- The Investment Banker Micro-degree

- The Project Financier Micro-degree

- The Private Equity Associate Micro-degree

- The Research Analyst Micro-degree

- The Portfolio Manager Micro-degree

- The Restructurer Micro-degree

- Fundamental Series

- Asset Management

- Markets and Products

- Corporate Finance

- Mergers & Acquisitions

- Financial Statement Analysis

- Private Equity

- Financial Modeling

- Try for free

- Pricing Full access for individuals and teams

- View all plans

- Public Courses

- Investment Banking

- Investment Research

- Equity Research

- Professional Development for Finance

- Commercial Banking

- Data Analysis

- Team Training

- Felix Continued education, eLearning, and financial data analysis all in one subscription

- Learn more about felix

- Publications

- Online Courses

- Classroom Courses

- My Store Account

- Learning with Financial Edge

- Certification

- Masters in Investment Banking MSc

- Student Discount

- Find out more

- Diversity and Inclusion

- The Investment banker

- The Private Equity

- The Portfolio manager

- The real estate analyst

- The credit analyst

- Felix: Learn online

- Masters Degree

- Public courses

Assets Held-For-Sale

By Majid Kazi |

December 2, 2020

What are Assets Held-For-Sale?

Assets held for sale are non-current (or long-lived) assets, which a company plans to sell. The process of selling assets can be complex and take time. This is particularly true for specialized assets for which suitable buyers may take a long time to find. During this time, the assets are not used for the operation of the business and are not generating any revenue.

The accounting treatment of assets held for sale is consistent under both IFRS and US GAAP and these rules require companies to classify a non-current asset as held for sale if its carrying amount will be recovered by selling the asset and not from its continuous use.

In some cases, a company may want to sell a group of assets, for example, a single business unit of a large company, in a single transaction. Such a group of assets is called a disposal group and the disposal group will include all the assets and liabilities of this business unit. Disposal groups are treated in the same way as a single asset held for sale for reporting purposes.

Key Learning Points

- Assets held for sale are non-current (or long-lived) assets, which a company plans to sell.

- If a company wants to sell a group of assets in a single transaction, such a group is called a disposal group.

- There are six criteria for assets to qualify as held for sale.

- Assets held for sale are reported at the lower of the carrying amount and fair value fewer costs to sell. Such assets are not depreciated.

Criteria for Held for Sale Accounting

For an asset to be classified as held-for-sale it needs to meet the following criteria:

- Management commits to a plan to sell the asset (e.g., identifying the asset, setting an expected date of completion, etc.)

- The asset is available for sale in its present condition

- Management has initiated an active program to locate a buyer (e.g. marketing or initiating discussions with third parties)

- The sale is probable and is expected to close within 1 year

- The selling price is reasonable in relation to the asset’s current fair value

- It is unlikely there will be any changes in or withdrawal of the plan to sell the asset

Accounting Treatment of Assets Held for Sale

IFRS and US GAAP both require measuring assets held for sale at the lower of the carrying amount and fair value less costs to sell.

The carrying value is calculated as original cost less accumulated depreciation (for physical assets) or less amortization expense (for intangible assets, such as patents). For example, an asset has been purchased at $20,000 and has accumulated depreciation of $9,000.

For example, an asset has been purchased at $20,000 and has accumulated depreciation of $9,000. Its carrying amount or carrying value will be $11,000 (20,000-9,000).

The fair value of the asset is the estimated worth of the asset in the market. Suppose the fair value of the asset mentioned above is $12,000, and the cost to sell this asset is around $3,000. In such cases, the fair value less cost to sell works out to $9,000. In this example, the asset held for sale will be shown in the balance sheet at a value of$9,000.

Finding Assets Held-For-Sale in Financial Statements

Both IFRS and US GAAP require assets held for sale to be presented separately in the financial statements. These can be reported either in the statement of financial position (the balance sheet) or in the notes to financial statements. Here is a snapshot from the 2017 annual report of the Coca-Cola Company. The company reports assets held for sale for 2016 and 2017.

The Coca-Cola Company – Extract from Balance Sheet 2017

Difference between Assets Held for Sale and Discontinued Operations

Discontinued operations refer to a part of a company’s operations (such as a business unit or a product line) that has either been disposed of or classified as held for sale. Additionally, for an asset to qualify as discontinued operations, it has to meet the following criteria:

- Represents either a major line of business (e.g., a business unit) or a geographical area of operations (e.g., a key market)

- Is part of a plan to dispose of the asset , or

- The subsidiary has been acquired exclusively with a view to resale and the disposal involves a loss of control by the parent organization

Accounting standards require discontinued operations to be presented separately in the financial statements. This allows a realistic and fair assessment of the company’s future financial results. The post-tax profit/loss of the discontinued operations is added to any post-tax gain/loss on disposal. The sum is shown as a single amount in the income statement . Separately, a break-up of the two amounts should be included either on the face of the income statement or in the notes to the financial statements.

Assets Held-For-Sale – MCQ

Download the accompanying Excel files to test your knowledge and for a full explanation of the correct answer.

Share this article

Assets held for sale excel example.

Sign up to access your free download and get new article notifications, exclusive offers and more.

Featured Course

IFRScommunity.com

IFRS Forums and IFRS Knowledge Base

Assets Held for Sale (IFRS 5)

Last updated: 25 October 2023

Under IFRS 5, a non-current asset or a disposal group is classified as ‘held for sale’ if its carrying amount will be recovered primarily through sale instead of continuing use. This classification arises when the following conditions (outlined in IFRS 5.6-7) are satisfied:

- The asset or disposal group is ready for immediate sale in its present condition.

- The sale is highly probable .

Being classified as ‘held for sale’ leads to specific presentation , measurement , and disclosure consequences.

Let’s delve deeper.

Availability for immediate sale

An asset or disposal group, as per IFRS 5.7, should be ready for immediate sale in its current condition subject only to terms that are usual and customary for sales of such assets (IFRS 5.7). Refer to Examples 1-3 in IFRS 5 for illustration.

Sale being highly probable

For a sale to be deemed highly probable, the criteria detailed in IFRS 5.8 must be fulfilled:

- The appropriate management level must be committed to selling the asset or disposal group.

- An active search for a buyer and steps to finalise the sale should be underway.

- The asset or disposal group must be on the market at a price that’s fair compared to its current value.

- The sale must be expected to be completed within a year from the classification.

- Actions related to the sale plan should signify a low chance of significant alterations or the plan’s cancellation.

Exceptions to the one-year sale requirement

If an asset or disposal group’s sale is extended due to unforeseen events or circumstances beyond the entity’s control, it can still be classified as ‘held for sale’, provided the entity remains committed to the sale (IFRS 5.9, B1). Exceptions to the one-year sale completion requirement include:

- Anticipated external conditions on the asset’s transfer which can only be addressed post a firm purchase commitment.

- Unexpected conditions imposed after securing a firm purchase, provided the entity has taken prompt actions and expects a positive resolution.

- Unforeseen delays within the first year, where the entity has actively marketed the asset at a reasonable price and meets specific criteria.

See also Examples 5-7 in IFRS 5.

Are you tired of the constant stream of IFRS updates? I know it's tough! That's why I created Reporting Period – a once-a-month summary for professional accountants. It consolidates all essential IFRS developments and Big 4 insights into one readable email. I personally curate every issue to ensure it's packed with the most relevant information, delivered straight to your inbox. It's free, with no spam, and you can unsubscribe with just one click. Ready to give it a try?

Assets acquired for resale

Assets (like properties) typically seen as non-current, when bought exclusively for resale, cannot be classified as current (or held for sale) unless they meet the criteria below (IFRS 5.3, 11):

- The sale is anticipated to finalise within a year (unless an exception to this timeframe applies).

- It’s highly likely that the previously mentioned criteria for a sale being highly probable will be met shortly, usually within three months post-acquisition.

This rule also pertains to subsidiaries acquired for resale. Refer to Example 13 in IFRS 5.

Impact of events after the reporting period

If the criteria from IFRS 5 are met after the end of the reporting period, the asset or disposal group can’t be classified as ‘held for sale’ within that reporting period. Nonetheless, entities should provide disclosures outlined in IFRS 5.41(a)(b)(d) in the explanatory notes (IFRS 5.12).

Assets held for distribution to owners

IFRS 5’s classification, presentation, and measurement requirements also apply to non-current assets and disposal groups held for distribution to owners (IFRS 5.5A). An asset or disposal group is classified as ‘held for distribution to owners’ when (IFRS 5.12A):

- They’re available for immediate distribution in their existing condition.

- The distribution is highly probable.

The distribution is considered highly probable when:

- Steps towards the distribution’s completion have begun.

- The distribution’s completion is projected within a year from the classification.

- Significant modifications to the distribution plan or its withdrawal are deemed improbable.

Abandoned assets

Assets destined for abandonment could be those used until their economic useful life concludes or those meant for closure rather than sale. Since their value won’t be recovered through sale, they aren’t classified as ‘held for sale’. However, a group of assets (possibly with related liabilities) marked for abandonment might qualify as a discontinued operation (IFRS 5.13).

Disposal groups

A disposal group refers to a set of assets intended for disposal, either through sale or another method, together in a singular transaction. This also encompasses liabilities directly tied to those assets that will be transferred in the same transaction. Notably, if the group qualifies as a CGU to which goodwill has been allocated or operates within such a unit, it includes goodwill (IFRS 5 Appendix A). Consequently, if a non-current asset within the scope of IFRS 5 is part of a disposal group, the remaining assets and liabilities are a part of that disposal group classified as held for sale, even if some are exempt from IFRS 5’s measurement provisions (IFRS 5.4).

It’s worth noting that when a subsidiary is classified as ‘held for sale’, all its assets and liabilities fall under the ‘disposal group’, even if the parent company plans to maintain a non-controlling interest after the sale (IFRS 5.8A).

Measurement

Measurement framework.

Assets or disposal groups classified as ‘held for sale’ are measured at the lower of (IFRS 5.15):

- The carrying amount measured immediately before the reclassification (see IFRS 5.18) and

- The fair value less costs to sell (FVLCTS).

Costs to sell

These are incremental costs directly attributable to disposing of an asset or disposal group, excluding finance costs and income tax expenses (IFRS 5 Appendix A). In simpler terms, they are the costs that wouldn’t exist if there were no transaction.

Typically, if a sale is projected to finalise after a year, these costs are discounted to their present value. Any rise in the present value of the sales costs, which inherently reduces an asset’s carrying value, is recognised in profit or loss as a financing expense (IFRS 5.17).

Fair value remeasurement of a disposal group

For assets or liabilities in a disposal group not within the scope of IFRS 5 (i.e., current assets), their carrying amount is remeasured under the relevant IFRSs first. This is done before determining the disposal group’s FVLCTS (IFRS 5.19). For example, even if liabilities are part of the disposal group, interest expenses are still recognised (IFRS 5.25).

Measurement of assets held for distribution to owners

Non-current assets or disposal groups held for distribution to owners are measured at the lower of:

- The carrying amount.

- The fair value less costs to distribute, with these costs being incremental and directly related to the distribution, excluding finance costs and income tax expense (IFRS 5.15A).

Depreciation

Non-current assets classified as ‘held for sale’ or those in a disposal group are not subject to depreciation (IFRS 5.25).

Impairment losses

Any decline in the fair value of a non-current asset or disposal group below the carrying amount is recognised as an impairment loss. An impairment loss isn’t recognised if the reduction in value has been previously accounted for under another relevant IFRS (IFRS 5.20). This loss is initially allocated to goodwill, then distributed proportionally to other non-current assets that are within the scope of IFRS 5’s measurement provisions (IFRS 5.23).

If the fair value increases, the impairment losses can be reversed, but only up to the amount of previously recognised losses under IFRS 5 or IAS 36 (IFRS 5.21-22). While IFRS 5 doesn’t expressly state whether impairment losses allocated to goodwill in a disposal group can be reversed, IAS 36 generally prohibits this. However, IFRS 5 sees a disposal group as a singular unit of account for impairment considerations, suggesting either approach could be valid.

Example 10 in IFRS 5 illustrates how an impairment loss on a disposal group is allocated. If an impairment loss recognised under IFRS 5 surpasses the carrying amount of non-current assets within its scope, the entity should allocate the remaining impairment to other assets (refer to this agenda decision ).

Investments in associates and joint ventures

IFRS 5 applies to an investment, or part of one, in an associate or joint venture if it qualifies as ‘held for sale’. If any portion of an investment in an associate or joint venture isn’t deemed as ‘held for sale’, it continues to be accounted for using the equity method (IAS 28.20-21).

Exceptions to IFRS 5 measurement provisions

The measurement requirements of IFRS 5 don’t apply to assets listed in IFRS 5.5.

Changes to a plan of sale

When a non-current asset or disposal group no longer qualifies as ‘held for sale’ or ‘held for distribution to owners’, its value should be the lesser of (IFRS 5.27):

- Its original carrying amount before being classified as ‘held for sale’, adjusted for potential depreciation, amortisation, or revaluations that would’ve been applicable if it hadn’t been so classified.

- Its recoverable amount as of the date the decision against selling or distributing was made.

Pre-classification carrying amount

The carrying amount, prior to the asset’s ‘held for sale’ classification, should be adjusted to reflect any depreciation, amortisation, or revaluations that would’ve been applicable if the asset or disposal group hadn’t received such classification. These adjustments to the carrying value should be reflected in the current year’s income statement and presented under continuing operations (IFRS 5.28).

Comparative information

For assets or disposal groups that are a subsidiary, joint operation, joint venture, associate, or part of an interest in a joint venture or associate and no longer fall under the ‘held for sale’ category, comparative information in financial statements should be retrospectively adjusted. This isn’t overtly stated, but one can infer this from IFRS 5.28, which notes that financial statements, from when the classification as ‘held for sale’ started, should be ‘amended accordingly’. Furthermore, IAS 28.21 explicitly calls for retrospective adjustments. Although IFRS 10 or IFRS 11 lack a direct equivalent to IAS 28.21, interpreting IFRS 5.28 alongside IAS 28.21 clarifies the intended meaning of amending financial statements ‘accordingly’ as mentioned in IFRS 5.28.

Recoverable amount

Should a non-current asset be part of a CGU , its recoverable amount is the value that would’ve been identified post the allocation of any impairment loss on that CGU (as footnoted in IFRS 5.27).

Transfers between ‘held for sale’ and ‘held for distribution’

IFRS 5.26A offers detailed guidance on accounting for the reclassification of an asset or disposal group from ‘held for sale’ to ‘held for distribution’, and vice versa.

Presentation

Assets classified as ‘held for sale’, as well as the assets and liabilities within a disposal group, should be presented separately in the statement of financial position, without being netted against each other.

Typically, entities will show one line that consolidates all assets within the disposal group and another that consolidates liabilities. If this approach is taken, the major classes of assets and liabilities involved should be detailed in the accompanying notes (IFRS 5.38). The only exception to this is if a newly acquired subsidiary qualifies to be classified as ‘held for sale’ upon acquisition (IFRS 5.39). The presentation requirements apply prospectively, meaning past data or comparative information doesn’t need to be restated (IFRS 5.40).

Furthermore, any cumulative income or expense recognised in OCI associated with a non-current asset or disposal group classified as ‘held for sale’ should also be distinctly displayed within equity (IFRS 5.38). An instance of this could foreign currency translation adjustment under IAS 21. It’s noteworthy that IFRS 5 doesn’t mandate the disclosure of a non-controlling interest for a subsidiary regarded as a disposal group.

The extracts below demonstrate application of these requirements by Unilever plc:

Refer also to Examples 11-12 that accompany IFRS 5, as they illustrate how assets and disposal groups held for sale should be presented.

Specific disclosure requirements concerning assets held for sale and disposal groups are outlined in IFRS 5.41-42. It’s crucial to understand that assets and disposal groups within the scope of IFRS 5 aren’t bound by disclosure requirements of other IFRS standards, unless stated otherwise (IFRS 5.5B). An example of such a specific requirement can be found in the treatment of interests in other entities. Even if these interests are classified as ‘held for sale’ (or as discontinued operations ), they remain within the scope of IFRS 12 (IFRS 12.5A).

© 2018-2024 Marek Muc

The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Excerpts from IFRS Standards come from the Official Journal of the European Union (© European Union, https://eur-lex.europa.eu). You can access full versions of IFRS Standards at shop.ifrs.org. IFRScommunity.com is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org.

Questions or comments? Join our Forums

- Fixed Assets

- Tangible Assets

- Purchase of Fixed Assets

- Basket Purchase

- Depreciation

- Component Depreciation

- Group Depreciation

- Accelerated Depreciation

- Depreciation Methods

- Carrying Value

- Exchange of Fixed Assets

- Held for Sale Assets

- Impairment Test

- Recoverable Amount

- Value in Use

- Full Cost Method

- Impairment of Intangible Assets

- Excel SLN Function

- Excel DB Function

- Excel DDB Function

- Excel SYD Function

Held for sale assets are long -lived assets for which a company has a concrete plan to dispose of the asset by sale. They are carried on balance sheet at the lower of carrying value or fair value and no depreciation is charged on them.

Many long-lived assets which a company owns are specialized in nature and they can’t be sold over-night. In many cases, it takes months since the date the company decides to sell the asset till the date a contract for sale is executed. During this period, the asset is not being used in the operations and hence not depreciation expense need to be charged on the asset.

IFRS 5 contains the international accounting rules related to held-for-sale assets which is broadly in compliance with the requirements of the US GAAP.

The asset which a company want to classify as held-for-sale must meet the following conditions:

Management must have a concrete plan to sell the asset at a price which is reasonable in relation to its fair value, The asset must be immediately available for disposal if a sale is finalized, The management is actively searching for a buyer (by advertising, engaging third-parties, etc.), and It is probable that a buyer will be found in near future i.e. within 12 months and any change to the disposal plan is unlikely.

In many cases, a company decides to sell a group of assets in a single transaction. Such a group of assets is called disposal group.

Accounting Adjustment

Before classifying an asset or a disposal group as held-for-sale, a company works out its carrying value. An asset’s carrying value equals its cost minus accumulated depreciation and accumulated amortization. Once the conditions mentioned above are met, the asset is classified as a held-for-sale and its carrying value is reduced if the fair value less cost to sell is lower and the difference is charged to income statement as a loss on held-for-sale assets. If the fair value less costs to sell is higher than the carrying value, no adjustment is needed, and the classification only results in additional disclosure.

Because IFRS allows a revaluation model for long-lived asset, it also allows companies to net off any impairment loss arising on held-for-sale assets against any positive revaluation surplus balance.

On 1 January 2018, JKR, Inc. decided to replace its existing machinery which it had acquired on 1 January 2015 for $40 million and initiated process for acquisition of new machinery. Simultaneously, it also initiated efforts to sell of the old machinery. The new machinery was commissioned on 30 March 2018. The company depreciates machinery assuming a zero residual value and 5-year total useful life. The carrying value of old machinery as at 1 January 2018 worked out to $16 million. If the fair value of the old machinery is $12 million and it would cost 10% of the sale proceeds to close the deal, find out when the company should classify the machinery as held-for-sale.

Because the new machinery wasn’t commissioned until 30 March 2018, it is the date when the old machinery can be reclassified as held for sale. The accumulated depreciation on the old machinery as at 30 March 2018 works out to $26 million resulting in a carrying value of $14 million.

Before reclassifying the old machinery as held for sale, JK must recognize the depreciation expense to update the carrying value:

As at 30 March 2018, JK must pass the following journal entry:

by Obaidullah Jan, ACA, CFA and last modified on Jul 4, 2018

Related Topics

- Carrying Costs

All Chapters in Accounting

- Intl. Financial Reporting Standards

- Introduction

- Accounting Principles

- Business Combinations

- Accounting Cycle

- Financial Statements

- Non-Current Assets

- Investments

- Revenue Recognition

- Current Assets

- Receivables

- Inventories

- Shareholders' Equity

- Liability Accounts

- Accounting for Taxes

- Employee Benefits

- Accounting for Partnerships

- Financial Ratios

- Cost Classifications

- Cost Accounting Systems

- Cost Behavior

- CVP Analysis

- Relevant Costing

- Capital Budgeting

- Master Budget

- Inventory Management

- Cash Management

- Standard Costing

Current Chapter

XPLAIND.com is a free educational website; of students, by students, and for students. You are welcome to learn a range of topics from accounting, economics, finance and more. We hope you like the work that has been done, and if you have any suggestions, your feedback is highly valuable. Let's connect!

Copyright © 2010-2024 XPLAIND.com

Non-Current Assets Held for Sale: Presentation and Disclosure | IFRS 5

Presentation and disclosure.

Under IFRS 5 ‘An entity shall present and disclose information that enables users of the financial statements to evaluate the financial effects of discontinued operations and disposals of non-current assets (or disposal groups)’.

Non-current assets classified as held for sale must be disclosed separately from other assets in the statement of financial position.

This allows users of the financial statements to make their own assessments about the future prospects for the entity.

Also, assets and liabilities that are part of a disposal group held for sale must be disclosed separately from other assets and liabilities in the statement of financial position.

They should not be offset or combined into a single line item.

Discontinued Operation

A discontinued operation is a component of an entity that has been disposed of, or classified as “held for sale”.

A discontinued operation:

- Represents a separate major line of business or geographical area of operations,

- Is part of a single co-ordinated plan to dispose of a separate major line of businesses or geographical area of operations, or

- Is a subsidiary acquired exclusively with a view to resale.

Illustrative Example

An example of the subsidiary acquired with a view to resale happened a few years ago when Communicorp, the owner of 98FM and Spin 1038, bought EMAP’s radio holdings in Ireland.

They wanted to buy Today FM, EMAP’s biggest station.

As part of the deal they also ended up buying FM104 in Dublin and Highland Radio in Donegal.

The government insisted they sell FM104 and Highland Radio as soon as possible if the deal was to be allowed.

If you looked at the accounts of Communicorp, they would most likely show those two stations as discontinued operations for that year.

NB. 1 Non-current assets classified as “held for sale” and the assets of a disposal group classified as “held for sale” must be disclosed separately from other assets in the statement of financial position. NB. 2 If those assets comprise a “disposal group” the assets and the liabilities of the group must be disclosed separately either in the notes or on the face of the statement of financial position.

Income Statement Disclosure

Information about discontinued operations (both discontinued and “held for sale”) must be presented in the statement of comprehensive income or in a note to the financial statements.

There must be a single amount on the face of the statement of comprehensive income (or income statement) for the total of:

- the post-tax profit or loss for the period from the discontinued operations, and

- the post-tax gain or loss on disposal (based on the fair value minus costs to sell of the asset or disposal group).

The total amount should be analysed by:

- the revenue, expenses and pre-tax profit for the period from the discontinued operations

- the related tax charge (under IAS 12 – Income Taxes)

- the gain or loss recognised on the measurement to fair value less costs to sell or on the disposal of the assets or disposal group constituting the discontinued operations.

This analysis may be contained in the notes or on the face of the statement of profit or loss and other comprehensive income.

When presented in the statement of profit or loss and other comprehensive income, it shall be presented in a separate section identified as discontinued operations, which is separate from continuing operations.

The comparative figures for the previous financial period should be re-presented, so the disclosures relating to discontinued operations in the prior period relate to all discontinued operations up to the current period.

Cash Flow Disclosures

Discontinued operations should also be shown as a separate line item on the statement of cash flows.

This will be allocated to the relevant category, whether operating, investing or financing in the statement of cash flows.

These disclosures may be presented either on the face of the statement of cash flows or in the notes to the financial statements.

5 Additional Disclosures

An entity should disclose the following information in the notes of the financial statements in which an asset or disposal group has been sold or classified as “held for sale”:

- a description of the non-current asset or disposal group

- a description of the facts and circumstances of the sale

- in the case of operations and non-current assets ‘held for sale’, a description of the facts and circumstances leading to the expected disposal and the expected manner and timing of the disposal.

- Any gain or loss recognised in accordance with IAS 36 – Impairment of Assets

- The segment in which the assets or disposal group belongs (if applicable) under IFRS 1 – Operating Segments

Comparative Figures

Although you re-present the discontinued operations performance figures in the previous statement of comprehensive income, you don’t do that in the statement of financial position.

There’s no need to identify the discontinued operations as a separate line item in the previous year.

Privacy Overview

The global body for professional accountants

- Search jobs

- Find an accountant

- Technical activities

- Help & support

Can't find your location/region listed? Please visit our global website instead

- Middle East

- Cayman Islands

- Trinidad & Tobago

- Virgin Islands (British)

- United Kingdom

- Czech Republic

- United Arab Emirates

- Saudi Arabia

- State of Palestine

- Syrian Arab Republic

- South Africa

- Africa (other)

- Hong Kong SAR of China

- New Zealand

- Apply to become an ACCA student

- Why choose to study ACCA?

- ACCA accountancy qualifications

- Getting started with ACCA

- ACCA Learning

- Register your interest in ACCA

- Learn why you should hire ACCA members

- Why train your staff with ACCA?

- Recruit finance staff

- Train and develop finance talent

- Approved Employer programme

- Employer support

- Resources to help your organisation stay one step ahead

- Support for Approved Learning Partners

- Becoming an ACCA Approved Learning Partner

- Tutor support

- Computer-Based Exam (CBE) centres

- Content providers

- Registered Learning Partner

- Exemption accreditation

- University partnerships

- Find tuition

- Virtual classroom support for learning partners

- Find CPD resources

- Your membership

- Member networks

- AB magazine

- Sectors and industries

- Regulation and standards

- Advocacy and mentoring

- Council, elections and AGM

- Tuition and study options

- Study support resources

- Practical experience

- Our ethics modules

- Student Accountant

- Regulation and standards for students

- Your 2024 subscription

- Completing your EPSM

- Completing your PER

- Apply for membership

- Skills webinars

- Finding a great supervisor

- Choosing the right objectives for you

- Regularly recording your PER

- The next phase of your journey

- Your future once qualified

- Mentoring and networks

- Advance e-magazine

- An introduction to professional insights

- Meet the team

- Global economics

- Professional accountants - the future

- Supporting the global profession

- Download the insights app

Can't find your location listed? Please visit our global website instead

CPD technical article

01 September 2007

IFRS 5 non-current assets held-for-sale and discontinued operations

Multiple-choice questions

Graham Holt

Ifrs 5 deals with the accounting for non-current assets held-for-sale, and the presentation and disclosure of discontinued operations, explains graham holt, this article was first published in the september 2007 edition of accounting and business magazine., studying this technical article and answering the related questions can count towards your verifiable cpd if you are following the unit route to cpd and the content is relevant to your learning and development needs. one hour of learning equates to one unit of cpd. we'd suggest that you use this as a guide when allocating yourself cpd units..

IFRS 5 deals with the accounting for non-current assets held-for-sale, and the presentation and disclosure of discontinued operations. It introduces a classification for non-current assets which is called ‘held-for-sale’. An entity classifies a non-current asset as held-for-sale if its carrying amount will be recovered mainly through selling the asset rather than through usage. The classification also applies to disposal groups, which are a group of assets and possibly some liabilities which an entity intends to dispose of in a single transaction.

The conditions for a non-current asset or disposal group to be classified as held-for-sale are as follows:

- the assets must be available for immediate sale in their present condition and its sale must be highly probable

- the asset must be currently marketed actively at a price that is reasonable in relation to its current fair value

- the sale should be completed, or expected to be so, within a year from the date of the classification, and

- the actions required to complete the planned sale will have been made, and it is unlikely that the plan will be significantly changed or withdrawn.

For the sale to be highly probable, management must be committed to selling the asset and must be actively looking for a buyer. It is possible that the sale may not be completed within one year, but the delay effectively must be caused by events beyond the entity’s control and the entity must still be committed to selling the asset.

An entity has agreed in a directors’ meeting to sell a building, and has tentatively started looking for a buyer for the building. The price of the building has been fixed at $4m and a surveyor has valued the building based on market prices at $3.6m. The entity will continue to use the building until another building has been found with equivalent facilities, and in a suitable location for the office staff, who will not be relocated until the new building has been found.

Additionally, the entity is planning to sell part of its business and has actively marketed the business at a fair price but, before the business can be sold, government approval is required and any sale requires government approval. This means that the sale time is difficult to determine and it may take longer than one year to sell the disposal group.

The building will not be classified as held-for-sale as it is not available for immediate sale because, until new premises have been found, the office staff will remain in the existing building. Also, the directors have only tentatively started looking for a buyer which may indicate that the entity is not committed to the sale. Additionally, the price being asked for the building is above the market price, and is not reasonable compared to that price. It is unlikely that the entity will sell the building for that price.

The disposal group, however, would be classified as held-for-sale because the delay is caused by events or circumstances beyond the entity’s control, and there is evidence that the entity is committed to selling the disposal group.

Measurement of non-current assets which are held-for-sale

Just before the initial classification of a non-current asset (disposal group) as held-for-sale, it should be measured in accordance with IFRS. When non-current assets or disposal groups are classified as held-for-sale, they are measured at the lower of the carrying amount and fair value less cost to sell. If the sale is expected to occur in over a year’s time, the entity should measure the cost to sell at its present value, and any increase due to the unwinding of the discount is charged to profit or loss.

Any subsequent increases in fair value less cost to sell of the asset can be recognised in profit and loss to the extent that it is not in excess of the cumulative impairment loss that has been recognised.

Non-current assets or disposal groups classified as held-for-sale should not be depreciated.

Other key points

Entities often acquire non-current assets exclusively with a view to disposal. Such a non-current asset will be classified as held-for-sale at the date of the acquisition only if it is anticipated that it will be sold within the one-year period, and it is highly probable that the held-for-sale criteria will be met within a short period (normally three months) of the acquisition date.

If the criteria for classifying a non-current asset as held-for-sale occur after the balance sheet date, then the non-current asset should not be shown as held-for-sale but disclosure of the fact should be made.

If an entity is winding up operations or ‘abandoning’ assets, then these assets do not meet the definition of held-for-sale. However, a disposal group that is to be abandoned may meet the definition of a discontinued activity.

Abandonment means that the non-current asset has been used to the end of its economic life or the disposal group will be closed rather than sold. If the asset is temporarily not being used, it is not deemed to be abandoned.

An entity has stopped using certain plants because of a downturn in orders. It is maintaining the plant as the entity hopes that orders will pick up in future. Additionally, it intends to shut down one-half of its manufacturing base. The units to be closed constitute a major segment of its business and will close in the current financial year.

The equipment will not be treated as abandoned as it will subsequently be brought back into usage, and the manufacturing units will be treated as discontinued operations.

Change of plans

If criteria for an asset to be classified as held-for-sale are no longer met, then the asset or disposal group ceases to be held-for-sale. In this case, it should be valued at the lower of the carrying amount before the asset or disposal group was classified as held-for-sale (as adjusted for any subsequent depreciation, amortisation or re-valuation), and its recoverable amount at the date of the decision not to sell. Any adjustment to the value should be shown in income from continuing operations for the period.

Disclosure – non-current assets held-for-sale

Non-current assets held-for-sale and assets of disposal groups must be disclosed separately from other assets in the balance sheet. The liabilities must also be disclosed separately in the balance sheet.

There are several other discloses required, including a description of the non-current assets of a disposal group, a description of the facts and circumstances of the sale, and the expected manner and timing of that disposal.

Discontinued operations: presentation and disclosure

A discontinued operation is a part of an entity that has either been disposed of or is classified as held-for-sale, and:

- represents a separate major line of business or geographical area of operations

- is part of a single co-ordinated plan to dispose of separate major lines of business or geographical area of operations, or

- the subsidiary was acquired exclusively with a view to resale.

The total of the post-tax profit or loss of the discontinued operation, and the post-tax gain or loss recognised on the measurement to fair value less cost to sell (or on the disposal), should be presented as a single figure on the face of the income statement.

IFRS 5 requires detailed disclosure of revenue, expenses, pre-tax profit or loss, and the related income tax expense either in the notes or on the face of the income statement. If this information is presented on the face of the income statement, then the information should be separately disclosed from that of continuing operations.

As regards the presentation in the cash flow statement, the net cash flows attributable to the operating, investing and financing activities of the discontinued operation should be separately shown on the face of the cash flow statement or disclosed in the notes. Retrospective classification as a discontinued operation where the criteria are met after the balance sheet date is prohibited by IFRS 5.

Swipe to view table

The property, plant and equipment and inventory were stated at deemed cost on moving to IFRS. Under IFRS, property, plant and equipment would be stated at $26m, and inventory stated at $18m. The fair value less costs to sell of the disposal group is $47m. Assume that the disposal group qualifies as held-for-sale.

Show how the disposal group would be accounted for in the financial statements for the year ended 31 December 2006.

IFRS 5 requires that immediately before the initial classification of the disposal group as held-for-sale, the carrying amounts of the disposal group be measured in accordance with applicable IFRS, and any profit or loss dealt with under that IFRS.

The reduction in the carrying amount of property, plant and equipment will be dealt with in accordance with IAS 16, and that of the inventory in accordance with IAS 2.

After the re-measurement, the entity will recognise an impairment loss of $16m on re-measurement to the lower of carrying amount and fair value less cost to sell. This loss is allocated to goodwill in accordance with IAS 36.

Thus, goodwill will be reduced to zero. The loss will be charged against profit or loss.

In the balance sheet, the major classes of assets and liabilities classified as held-for-sale should be separately disclosed on the face of the balance sheet or in the notes. Thus, in this case, there would be separate disclosure of the disposal group as follows.

Graham Holt, ACCA examiner and principal lecturer in accounting and finance, Manchester Metropolitan University Business School

Related topics.

- Corporate reporting

- ACCA Careers

- ACCA Career Navigator

- ACCA Learning Community

- Your Future

- ACCA-X online courses

Useful links

- Make a payment

- ACCA Rulebook

- Work for us

- Supporting Ukraine

Using this site

- Accessibility

- Legal & copyright

- Advertising

Send us a message

Planned system updates

View our maintenance windows

Shell online reporting suite 2021

- Reporting Hub

Top searches

- Climate change and energy transition

- Strategy and Outlook

Quick Links

Note 30 - Assets held for sale

- Download table (XLS, 12 kB)

The carrying amount of assets classified as held for sale at December 31, 2021, is $1,960 million (2020: $1,259 million ), with liabilities directly associated with assets classified as held for sale of $1,253 million (2020: $196 million ).

At December 31, 2021, assets held for sale mainly referred to Shell’s interest in two refineries within Oil Products. All transactions that resulted in the reclassification of assets held for sale at December 31, 2021, are either already completed in 2022 or are expected to be completed during the course of 2022.

At December 31, 2020, assets held for sale mainly referred to Integrated Gas. All transactions that resulted in assets held for sale reclassification at December 31, 2020, were completed in the first quarter of 2021.

You might also be interested in

How we create value

More in Consolidated Financial Statements

- Independent Auditor’s Report

More in other sections

- CEO’s review

- Outlook for 2022 and beyond

- Key Figures Comparison

IMAGES

VIDEO

COMMENTS

Presentation of assets held-for-sale (or distribution under IFRS 5) in comparative financial statements ... Under US GAAP, unlike IFRS 5, in the period that a discontinued operation is disposed of or classified as held-for-sale, the comparative balance sheet is adjusted to reflect that classification for all periods presented. Unlike IFRS 5 ...

The assets held for sale are the non-current assets that the business intends to sell. In other words, confirm the intention of the business to sell the non-current assets converts the presentation of the non-current assets to the current assets. This is the change of classification which brings changes in the implications of the accounting […]

If the major classes of assets and liabilities of a discontinued operation classified as held for sale are disclosed in the footnotes, reporting entities must reconcile the disclosure to the total assets and total liabilities of the disposal group classified as held for sale presented on the face of the balance sheet for all periods presented.

5.3.1.1 Management commitment to a plan (held for sale) ASC 360-10-45-9 (a) requires that management, having the authority to approve the action, must commit to a plan to sell the asset (disposal group). The plan should specifically identify (1) all major assets to be disposed of, (2) significant actions to be taken to complete the plan ...

DISSENTING OPINIONS. International Financial Reporting Standard 5 Non-current Assets Held for Sale and Discontinued Operations (IFRS 5) is set out in paragraphs 1-45 and Appendices A-C. All the paragraphs have equal authority. Paragraphs in bold type state the main principles.

9.4.1 Current and noncurrent classification. A reporting entity that presents a classified balance sheet (see FSP 2.3.4) should report individual debt securities classified as trading, available-for-sale (AFS), or held-to-maturity (HTM) as either current or noncurrent on an individual basis under the provisions of ASC 210, Balance Sheet.

held for sale and (or) when it is actually disposed of. Recognition and measurement of the gain or loss is determined using other applicable guidance in the ASC (e.g., the impairment recognition guidance related to assets held for sale in ASC 360-10-35). For presentation purposes, the income tax effects of

In such cases, the fair value less cost to sell works out to $9,000. In this example, the asset held for sale will be shown in the balance sheet at a value of$9,000. Finding Assets Held-For-Sale in Financial Statements. Both IFRS and US GAAP require assets held for sale to be presented separately in the financial statements.

IFRS 5 Non-current Assets Held for Sale and Discontinued Operations outlines how to account for non-current assets held for sale (or for distribution to owners). In general terms, assets (or disposal groups) held for sale are not depreciated, are measured at the lower of carrying amount and fair value less costs to ...

Under IFRS 5, a non-current asset or a disposal group is classified as 'held for sale' if its carrying amount will be recovered primarily through sale instead of continuing use. This classification arises when the following conditions (outlined in IFRS 5.6-7) are satisfied: The asset or disposal group is ready for immediate sale in its ...

As at 30 March 2018, JK must pass the following journal entry: Old machinery - held for sale (12 million × (1 - 0.1)) $10.8 million. Accumulated depreciation - old machinery. $26 million. Loss on held for sale assets. $3.2 million. Old machinery - cost. $40 million.

NB. 1 Non-current assets classified as "held for sale" and the assets of a disposal group classified as "held for sale" must be disclosed separately from other assets in the statement of financial position. NB. 2 If those assets comprise a "disposal group" the assets and the liabilities of the group must be disclosed separately ...

The objective of this IFRS is to specify the accounting for assets held for sale, and the presentation and disclosure of discontinued operations. In particular, the IFRS requires assets that meet the criteria to be classified as held for sale to be: measured at the lower of carrying amount and fair value less costs to sell, and depreciation on ...

IFRS 5 deals with the accounting for non-current assets held-for-sale, and the presentation and disclosure of discontinued operations. It introduces a classification for non-current assets which is called 'held-for-sale'. ... If the criteria for classifying a non-current asset as held-for-sale occur after the balance sheet date, then the ...

2. Measurement of asset(s) held for sale 18 2.1 Fair value less costs to sell 18 2.2 Recognition of impairment losses 19 2.3 Reversals of previous impairment losses 20 3. Measurement implications of a change in or withdrawal from the selling plan 21 D. Presenting discontinued operations and assets held for sale, and related disclosure

In accordance with ASC 360-10-45-14, a long-lived asset classified as held for sale (but that does not meet the criteria for presentation as a discontinued operation in accordance with ASC 205-20-45-10) should be presented separately on the balance sheet of the current period. The prior period comparative balance sheet, if any, is not required ...

specific disclosures in respect of non-current assets (or disposal groups) classified as held for sale or discontinued operations; or. disclosures about measurement of assets and liabilities within a disposal group that are not within the scope of the measurement. 2 However, once the cash flows from an asset or group of assets are expected to ...

7.11 Assets Held for Sale. Cash and cash equivalents may be included in a disposal group or component that is classified as an asset held for sale, regardless of whether such an asset meets the definition of a discontinued operation (see Section 3.3 for additional considerations related to the presentation of discontinued operations in the ...

a disposal group that is classified as held for sale, is not depreciated. (e) specifies that an asset classified as held for sale, and the assets and liabilities included within a disposal group classified as held for sale, are presented separately on the face of the balance sheet. (f) withdraws FRS 1352004 Discontinuing Operations and replaces