- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

ZenBusiness

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

Find small-business financing

Compare multiple lenders that fit your business

- Online Invoice Generator

- All Features call_made

- Estimates and Invoices

- Saved Invoices

- Secure Access

- Construction Invoice

- Consulting Invoice

- Freelance Invoice

- Rental Invoice

- Free Auto Repair & Mechanic Invoice Templates

- Graphic Design

- Photography Invoice

- Contractor Invoice

- Printable Invoice

- Pro Forma Invoice

- Word Invoice

- Excel Invoice

- Invoice PDF

- Google Sheets

- Itemized Bill

- Online Invoice Generator call_made

- Rent Receipt

- Cash Receipt

- Donation Receipt

- Receipt Maker call_made

- Free Quote Templates

- Estimate Maker call_made

- Profit Margin Calculator

- TRY IT FREE NOW call_made

- Support call_made

- Login call_made

How To Write a Business Plan: A Step-By-Step Guide

April 23, 2024.

No matter how unique your ideas are, launching a successful business without a well-crafted plan is tough. That’s why learning how to write a business plan is key to seeing success from the start.

An actionable business plan helps you and potential investors understand exactly where you want to go and how to get there. And if you aren’t trying to secure funding, a lean business plan can summarize the highlights to help you in other areas. Here’s everything you need to write a business plan that clarifies your company’s vision.

Business Plan Basics

A business plan outlines the company’s products or services, how it makes money, and its customers. It should also identify the business’s long-term goals and how it’ll achieve them.

But what does a business plan look like? There’s no singular format, but most contain the following core elements:

- Executive Summary . The executive summary is a high-level summary of your business plan’s key points. Include this early in the document, but write it last so you can accurately describe what’s in it.

- Company Description . This section covers your company’s mission, leadership team, and goals. If your business has operated for several years, include a history.

- Market Analysis . This is where you’ll write out your market research. Gather data on your industry. That includes target customer segments and the current competitive landscape. This info demonstrates the viability of your business idea.

- Product and Service Offerings . Describe your company’s offerings and what sets them apart from competitors. This is your unique value proposition.

- Marketing Plan . Outline your marketing tactics and overall strategy. Mention your plan for pricing, promoting, selling, and distributing your products. This helps investors know you have a strategy in place to grow your business.

- Logistics and Operations Plan . After describing your products and how you plan to generate demand, lay out how you intend to drive, accept payment for, and support sales.

- Management Overview . Potential investors want to know who they’re betting on. This section provides crucial information about who’s in charge. Include their track records of success, relevant expertise, and roles and responsibilities.

- Financial Analysis and Projections . If you have them, include any historical financial details and performance metrics. This includes assets, liabilities, expenses , projected financial statements, cash flow statements, and anything else offering insights.

- Appendix . This final section is a catch-all for any miscellaneous but valuable background information. Examples might be licenses or patents.’

RELATED ARTICLE — How to Keep Track of Business Expenses

How To Create a Business Plan

With a clear understanding of these documents, it’s time to learn how to write one. Here’s how to put together a strong business plan for your company:

- Carry out a Market Analysis on target demographics, competitors, industry trends, and market.

- In the Company Description and Products and Service Offerings sections, explain what makes your offerings unique.

- Outline your Marketing Plan and sales strategy. Describe your target market and ideal customer. Include factors like geographic region, age range, and education level.

- Map out your Financial Analysis and Projections. If you’re an established business, include data like profit-and-loss statements, a balance sheet delineating your assets and liabilities, and cash flow statements or projections. If you’re still in the early stages, focus just on financial projections instead. Mention anticipated startup costs and your current cash flow.

- Your Logistics and Operations Plan explains how you’ll execute your ideas. Describe any relationships with suppliers, office space, or equipment. Make sure to mention production logistics and any shipping and fulfillment plans. This demonstrates that you understand the day-to-day operations of producing your product.

- Introduce yourself and/or your Management Team and principal hires. Emphasize past successes in related sectors and any unique expertise your staff has.

- Regardless of what order you prepare your business plan in, write the Executive Summary last. Do this by turning your market research and value proposition into tangible objectives and key milestones. This section is typically the first your readers see, so it should make them want to read more.

Be sure to get feedback from colleagues, industry contacts, and friends and family. The more eyes you get on your business plan, the less likely you are to make mistakes or leave out details.

RELATED ARTICLE — How to Offer Net 30 Terms

What Are Business Plans For?

Writing and adhering to a business plan allows you to think through every aspect of your business. This helps you clarify your vision and shows where your ideas aren’t as developed.

But business plans don’t just clarify the company’s mission and direction. Entrepreneurs hope to answer this tough question with a business plan: how to attract investors. A well-written document can instill confidence by showing how supported it is. This is the main reason many business owners create a comprehensive overview.

And investors aren’t the only ones you’re trying to impress. An inspiring business plan attracts top talent in your industry. It proves that your team is organized, knows what it wants, and has ideas for the future.

Exploring Different Types of Business Plans

Business plans can be categorized based on type and style. Let’s explore three of the most common types.

A traditional business plan is the most common. This is what lenders and investment funds want to see before making any decisions. Traditional business plans are typically long. That’s because they provide a thorough overview of your company’s abilities, finances, and prospects

If you’re not courting investors, you might prefer a lean business plan. This type of document is shorter, focusing on the highlights instead of completeness. A lean business plan is great for brainstorming or onboarding new team members with reduced time and effort. But, because they’re less comprehensive, lean business plans aren’t ideal for seeking outside investment. Investors might not see how viable your business is without the added details.

Finally, if your organization is a nonprofit, focus on the impact you hope to make for your chosen cause, not how you’ll grow revenue. But donors may want to see a more detailed business plan before making sizable donations.

RELATED ARTICLE — How to Write an Invoice in 5 Steps

Caveats To Watch Out For

An actionable step-by-step business plan requires a strong understanding of how it will help you reach your company’s goals. Now that you know how to start a business plan, here are some common mistakes to avoid when you start writing:

- Putting on Rose-colored Glasses . When you believe in your company and its mission, it’s easy to be too optimistic about future prospects. You might also overlook potential roadblocks. Be sure to keep one foot on the ground to avoid misrepresenting your company’s potential.

- Focusing Too Much on the Details . If your company is new or not yet established, focus on high-level strategy and vision. Save the details for when you’ve generated some actionable data.

- Setting Fuzzy Goals . Keep milestones concrete and measurable to meaningfully track progress.

- Overcomplicating . There’s nothing wrong with being comprehensive, but creating an overly intricate strategy makes it harder to execute. Keep it simple.

- Setting It in Stone . Your business plan won’t be much of a guide if you’re constantly making changes. But it’s important to move on from ineffective strategies or unachievable goals. Striking the right balance between stable ideas and flexible methods ensures your business plan is a help, not a hindrance.

5 Tips for an Effective Business Plan

Now that you know what to avoid, let’s learn some tips for making your business plan as effective as possible:

- Clearly Articulate Your Value Proposition . What unsolved problem does your company provide the solution for?

- Don’t Skimp on Market Research . A seemingly great idea won’t sell if no one is interested in buying it.

- Set Quantifiable Goals You Can Track . It’s difficult to measure progress toward vague, qualitative milestones.

- Hype up Your Team . Lenders and investors want to see that qualified personnel run your company.

- Manage Expectations . Don’t make promises you can’t keep. Surpassing your targets is impressive; falling short isn’t.

Business Expense Tracker

Make it painless to include expenses in your business plan by tracking them using our in-app receipt scanner.

Share this with your network

You may also like, related posts.

How To Calculate Retained Earnings And Why It’s Important

Revenue Versus Income: Definition and Differences

How to Write a Strong Invoice Email – 3 Examples/Templates

How to Keep Track of Invoices & Payments: A Comprehensive Guide

Accounts Receivable Versus Payable: Differences and Examples

Invoice Versus Receipt Basics: Everything Business Owners Need to Know

What Is Invoice Reconciliation?

How to Write a Past Due Invoice Email

Get started for free, send your first invoice right now (it's free), featured in.

How to make a business plan

Table of Contents

How to make a good business plan: step-by-step guide.

A business plan is a strategic roadmap used to navigate the challenging journey of entrepreneurship. It's the foundation upon which you build a successful business.

A well-crafted business plan can help you define your vision, clarify your goals, and identify potential problems before they arise.

But where do you start? How do you create a business plan that sets you up for success?

This article will explore the step-by-step process of creating a comprehensive business plan.

What is a business plan?

A business plan is a formal document that outlines a business's objectives, strategies, and operational procedures. It typically includes the following information about a company:

Products or services

Target market

Competitors

Marketing and sales strategies

Financial plan

Management team

A business plan serves as a roadmap for a company's success and provides a blueprint for its growth and development. It helps entrepreneurs and business owners organize their ideas, evaluate the feasibility, and identify potential challenges and opportunities.

As well as serving as a guide for business owners, a business plan can attract investors and secure funding. It demonstrates the company's understanding of the market, its ability to generate revenue and profits, and its strategy for managing risks and achieving success.

Business plan vs. business model canvas

A business plan may seem similar to a business model canvas, but each document serves a different purpose.

A business model canvas is a high-level overview that helps entrepreneurs and business owners quickly test and iterate their ideas. It is often a one-page document that briefly outlines the following:

Key partnerships

Key activities

Key propositions

Customer relationships

Customer segments

Key resources

Cost structure

Revenue streams

On the other hand, a Business Plan Template provides a more in-depth analysis of a company's strategy and operations. It is typically a lengthy document and requires significant time and effort to develop.

A business model shouldn’t replace a business plan, and vice versa. Business owners should lay the foundations and visually capture the most important information with a Business Model Canvas Template . Because this is a fast and efficient way to communicate a business idea, a business model canvas is a good starting point before developing a more comprehensive business plan.

A business plan can aim to secure funding from investors or lenders, while a business model canvas communicates a business idea to potential customers or partners.

Why is a business plan important?

A business plan is crucial for any entrepreneur or business owner wanting to increase their chances of success.

Here are some of the many benefits of having a thorough business plan.

Helps to define the business goals and objectives

A business plan encourages you to think critically about your goals and objectives. Doing so lets you clearly understand what you want to achieve and how you plan to get there.

A well-defined set of goals, objectives, and key results also provides a sense of direction and purpose, which helps keep business owners focused and motivated.

Guides decision-making

A business plan requires you to consider different scenarios and potential problems that may arise in your business. This awareness allows you to devise strategies to deal with these issues and avoid pitfalls.

With a clear plan, entrepreneurs can make informed decisions aligning with their overall business goals and objectives. This helps reduce the risk of making costly mistakes and ensures they make decisions with long-term success in mind.

Attracts investors and secures funding

Investors and lenders often require a business plan before considering investing in your business. A document that outlines the company's goals, objectives, and financial forecasts can help instill confidence in potential investors and lenders.

A well-written business plan demonstrates that you have thoroughly thought through your business idea and have a solid plan for success.

Identifies potential challenges and risks

A business plan requires entrepreneurs to consider potential challenges and risks that could impact their business. For example:

Is there enough demand for my product or service?

Will I have enough capital to start my business?

Is the market oversaturated with too many competitors?

What will happen if my marketing strategy is ineffective?

By identifying these potential challenges, entrepreneurs can develop strategies to mitigate risks and overcome challenges. This can reduce the likelihood of costly mistakes and ensure the business is well-positioned to take on any challenges.

Provides a basis for measuring success

A business plan serves as a framework for measuring success by providing clear goals and financial projections . Entrepreneurs can regularly refer to the original business plan as a benchmark to measure progress. By comparing the current business position to initial forecasts, business owners can answer questions such as:

Are we where we want to be at this point?

Did we achieve our goals?

If not, why not, and what do we need to do?

After assessing whether the business is meeting its objectives or falling short, business owners can adjust their strategies as needed.

How to make a business plan step by step

The steps below will guide you through the process of creating a business plan and what key components you need to include.

1. Create an executive summary

Start with a brief overview of your entire plan. The executive summary should cover your business plan's main points and key takeaways.

Keep your executive summary concise and clear with the Executive Summary Template . The simple design helps readers understand the crux of your business plan without reading the entire document.

2. Write your company description

Provide a detailed explanation of your company. Include information on what your company does, the mission statement, and your vision for the future.

Provide additional background information on the history of your company, the founders, and any notable achievements or milestones.

3. Conduct a market analysis

Conduct an in-depth analysis of your industry, competitors, and target market. This is best done with a SWOT analysis to identify your strengths, weaknesses, opportunities, and threats. Next, identify your target market's needs, demographics, and behaviors.

Use the Competitive Analysis Template to brainstorm answers to simple questions like:

What does the current market look like?

Who are your competitors?

What are they offering?

What will give you a competitive advantage?

Who is your target market?

What are they looking for and why?

How will your product or service satisfy a need?

These questions should give you valuable insights into the current market and where your business stands.

4. Describe your products and services

Provide detailed information about your products and services. This includes pricing information, product features, and any unique selling points.

Use the Product/Market Fit Template to explain how your products meet the needs of your target market. Describe what sets them apart from the competition.

5. Design a marketing and sales strategy

Outline how you plan to promote and sell your products. Your marketing strategy and sales strategy should include information about your:

Pricing strategy

Advertising and promotional tactics

Sales channels

The Go to Market Strategy Template is a great way to visually map how you plan to launch your product or service in a new or existing market.

6. Determine budget and financial projections

Document detailed information on your business’ finances. Describe the current financial position of the company and how you expect the finances to play out.

Some details to include in this section are:

Startup costs

Revenue projections

Profit and loss statement

Funding you have received or plan to receive

Strategy for raising funds

7. Set the organization and management structure

Define how your company is structured and who will be responsible for each aspect of the business. Use the Business Organizational Chart Template to visually map the company’s teams, roles, and hierarchy.

As well as the organization and management structure, discuss the legal structure of your business. Clarify whether your business is a corporation, partnership, sole proprietorship, or LLC.

8. Make an action plan

At this point in your business plan, you’ve described what you’re aiming for. But how are you going to get there? The Action Plan Template describes the following steps to move your business plan forward. Outline the next steps you plan to take to bring your business plan to fruition.

Types of business plans

Several types of business plans cater to different purposes and stages of a company's lifecycle. Here are some of the most common types of business plans.

Startup business plan

A startup business plan is typically an entrepreneur's first business plan. This document helps entrepreneurs articulate their business idea when starting a new business.

Not sure how to make a business plan for a startup? It’s pretty similar to a regular business plan, except the primary purpose of a startup business plan is to convince investors to provide funding for the business. A startup business plan also outlines the potential target market, product/service offering, marketing plan, and financial projections.

Strategic business plan

A strategic business plan is a long-term plan that outlines a company's overall strategy, objectives, and tactics. This type of strategic plan focuses on the big picture and helps business owners set goals and priorities and measure progress.

The primary purpose of a strategic business plan is to provide direction and guidance to the company's management team and stakeholders. The plan typically covers a period of three to five years.

Operational business plan

An operational business plan is a detailed document that outlines the day-to-day operations of a business. It focuses on the specific activities and processes required to run the business, such as:

Organizational structure

Staffing plan

Production plan

Quality control

Inventory management

Supply chain

The primary purpose of an operational business plan is to ensure that the business runs efficiently and effectively. It helps business owners manage their resources, track their performance, and identify areas for improvement.

Growth-business plan

A growth-business plan is a strategic plan that outlines how a company plans to expand its business. It helps business owners identify new market opportunities and increase revenue and profitability. The primary purpose of a growth-business plan is to provide a roadmap for the company's expansion and growth.

The 3 Horizons of Growth Template is a great tool to identify new areas of growth. This framework categorizes growth opportunities into three categories: Horizon 1 (core business), Horizon 2 (emerging business), and Horizon 3 (potential business).

One-page business plan

A one-page business plan is a condensed version of a full business plan that focuses on the most critical aspects of a business. It’s a great tool for entrepreneurs who want to quickly communicate their business idea to potential investors, partners, or employees.

A one-page business plan typically includes sections such as business concept, value proposition, revenue streams, and cost structure.

Best practices for how to make a good business plan

Here are some additional tips for creating a business plan:

Use a template

A template can help you organize your thoughts and effectively communicate your business ideas and strategies. Starting with a template can also save you time and effort when formatting your plan.

Miro’s extensive library of customizable templates includes all the necessary sections for a comprehensive business plan. With our templates, you can confidently present your business plans to stakeholders and investors.

Be practical

Avoid overestimating revenue projections or underestimating expenses. Your business plan should be grounded in practical realities like your budget, resources, and capabilities.

Be specific

Provide as much detail as possible in your business plan. A specific plan is easier to execute because it provides clear guidance on what needs to be done and how. Without specific details, your plan may be too broad or vague, making it difficult to know where to start or how to measure success.

Be thorough with your research

Conduct thorough research to fully understand the market, your competitors, and your target audience . By conducting thorough research, you can identify potential risks and challenges your business may face and develop strategies to mitigate them.

Get input from others

It can be easy to become overly focused on your vision and ideas, leading to tunnel vision and a lack of objectivity. By seeking input from others, you can identify potential opportunities you may have overlooked.

Review and revise regularly

A business plan is a living document. You should update it regularly to reflect market, industry, and business changes. Set aside time for regular reviews and revisions to ensure your plan remains relevant and effective.

Create a winning business plan to chart your path to success

Starting or growing a business can be challenging, but it doesn't have to be. Whether you're a seasoned entrepreneur or just starting, a well-written business plan can make or break your business’ success.

The purpose of a business plan is more than just to secure funding and attract investors. It also serves as a roadmap for achieving your business goals and realizing your vision. With the right mindset, tools, and strategies, you can develop a visually appealing, persuasive business plan.

Ready to make an effective business plan that works for you? Check out our library of ready-made strategy and planning templates and chart your path to success.

Get on board in seconds

Join thousands of teams using Miro to do their best work yet.

Plan Smarter, Grow Faster:

25% Off Annual Plans! Save Now

0 results have been found for “”

Return to blog home

How to Write a Detailed Business Plan, Step-by-Step (Free Templates)

Posted november 14, 2022 by noah parsons.

Writing a business plan is one of the most valuable things you can do for your business. Study after study proves that business planning significantly improves your chances of success by up to 30 percent . That’s because the planning process helps you think about all aspects of your business and how your business will operate and grow.

In fact, writing a business plan is one of the only free things you can do to greatly impact the success and growth of your business. Ready to write your own detailed business plan? Here’s everything you need ( along with a free template ) to create your plan.

Before you write a detailed business plan, start with a one-page business plan

Despite the benefit of planning, it’s easy to procrastinate writing a business plan. Most people would prefer to work hands-on in their business rather than think about business strategy. That’s why, to make things easier, we recommend you start with a simpler and shorter one-page business plan .

With a one-page plan, there’s no need to go into a lot of details or dive deep into financial projections—you just write down the fundamentals of your business and how it works. A one-page plan should cover:

- Value proposition

- Market need

- Your solution

Competition

Target market.

- Sales and marketing

- Budget and sales goals

- Team summary

- Key partners

- Funding needs

A one-page business plan is a great jumping-off point in the planning process. It’ll give you an overview of your business and help you quickly refine your ideas.

If you’re ready to work on your one-page plan, check out our guide to writing a one-page business plan . It has detailed instructions, examples, and even a free downloadable template .

When do you need a more detailed business plan?

A one-page plan doesn’t always capture all the information that you need, however. If that’s the case, then it may be time to expand into a more detailed business plan.

There are several reasons for putting together a detailed business plan:

Flesh out the details

A one-page business plan is just a summary of your business. If you want to document additional details such as market research, marketing and sales strategies, or product direction—you should expand your plan into a longer, more detailed plan.

Build a more detailed financial forecast

A one-page plan only includes a summary of your financial projections. A detailed plan includes a full financial forecast, including a profit and loss statement , balance sheet , and cash flow forecast —one of the most important forecasts for any business.

Be prepared for lenders and investors

While investors might not ask to actually read your business plan, they will certainly ask detailed questions about your business. Planning is the only way to be well-prepared for these investor meetings.

Selling your business

If you’re selling your business, a detailed business plan presentation will be part of your sales kit. Potential buyers will want to know the details of how your business works, from marketing details to your product roadmap.

How to write a detailed business plan

When you do need to write a detailed business plan, focus on the parts most important to you and your business. If you plan on distributing your plan to outsiders, you should complete every section. But, if your plan is just for internal use, focus on the areas that will help you right now.

For example, if you’re struggling with marketing, spend time working on your target market section and marketing strategy and skip the sections covering the company organization.

Let’s go step-by-step through the sections you should include in your business plan:

1. Executive summary

Yes, the executive summary comes first in your plan, but you should write it last, once you know all the details of your business plan. It is truly just a summary of all the details in your plan, so be careful not to be too repetitive—just summarize and try to keep it to one or two pages at most. If you’ve already put together a one-page business plan, you can use that here instead of writing a new executive summary.

Your executive summary should be able to stand alone as a document because it’s often useful to share just the summary with potential investors. When they’re ready for more detail, they’ll ask for the full business plan.

For existing businesses, write the executive summary for your audience—whether it’s investors, business partners, or employees. Think about what your audience will want to know and just hit the highlights.

The key parts of your plan that you’ll want to highlight in your executive summary are:

- Your opportunity: This is a summary of what your business does, what problem it solves, and who your customers are. This is where you want readers to get excited about your business

- Your team: For investors, your business’s team is often even more important than what the business is. Briefly highlight why your team is uniquely qualified to build the business and make it successful.

- Financials: What are the highlights of your financial forecast ? Summarize your sales goals , when you plan to be profitable, and how much money you need to get your business off the ground.

2. Opportunity

The “opportunity” section of your business plan is all about the products and services that you are creating. The goal is to explain why your business is exciting and the problems that it solves for people. You’ll want to cover:

Mission statement

A mission statement is a short summary of your overall goals. It’s a short summary of how you hope to improve customers’ lives with your products and services. It’s a summary of the aspirations of your business and the guiding north star for you and your team.

Problem & solution

Most successful businesses solve a problem for their customers. Their products and services make people’s lives easier or fill an unmet need in the marketplace. In this section, you’ll want to explain the problem that you solve, whom you solve it for, and what your solution is. This is where you go in-depth to describe what you do and how you improve the lives of your customers.

In the previous section, you summarized your target customer. Now you’ll want to describe them in much greater detail. You’ll want to cover things like your target market’s demographics (age, gender, location, etc.) and psychographics (hobbies and other behaviors). Ideally, you can also estimate the size of your target market so you know how many potential customers you might have.

Every business has competition , so don’t leave this section out. You’ll need to explain what other companies are doing to serve your customers or if your customers have other options for solving the problem you are solving. Explain how your approach is different and better than your competitors, whether it’s better features, better pricing, or a better location. Explain why a customer would come to you instead of going to another company.

3. Execution

This section of your business plan dives into how you’re going to accomplish your goals. While the Opportunity section discussed what you’re doing, you now need to explain the specifics of how you’re going to do it.

Marketing & sales

What marketing tactics do you plan to use to get the word out about your business? You’ll want to explain how you get customers to your door and what the sales process looks like. For businesses that have a sales force, explain how the sales team gets leads and what the process is like for closing a sale.

Depending on the type of business that you are starting, the operations section needs to be customized to meet your needs. If you are building a mail-order business you’ll want to cover how you source your products and how fulfillment will work .

If you’re building a manufacturing business, explain the manufacturing process and the facilities you need to use. This is where you’ll talk about how your business “works,” meaning, you should explain what day-to-day functions and processes are needed to make your business successful.

Milestones & metrics

Until now, your business plan has mostly discussed what you’re doing and how you’re going to do it. The milestones and metrics section is all about timing. Your plan should highlight key dates and goals that you intend to hit. You don’t need extensive project planning in this section, just key milestones that you want to hit and when you plan to hit them. You should also discuss key metrics: the numbers you will track to determine your success.

Use the Company section of your business plan to explain the overall structure of your business and the team behind it.

Organizational structure

Describe your location, facilities, and anything else about your physical location that is relevant to your business. You’ll also want to explain the legal structure of your business—are you an S-corp, C-corp, or an LLC? What does company ownership look like?

Arguably one of the most important parts of your plan when seeking investment is the “Team” section. This should explain who you are and who else is helping you run the business. Focus on experience and qualifications for building the type of business that you want to build.

It’s OK if you don’t have a complete team yet. Just highlight the key roles that you need to fill and the type of person you hope to hire for each role.

5. Financial plan and projections

Your business plan has now covered the “what”, the “how”, and the “when” for your business. Now it’s time to talk about money. What revenue do you plan on bringing in and when? What kind of expenses will you have?

Financial Forecasts

Your sales forecast should cover at least the first 12 months of your business and ideally contain educated guesses at the following two years in annual totals. Some investors and lenders might want to see a five-year forecast, but three years is usually enough.

You’ll want to cover sales, expenses, personnel costs, asset purchases, and more. You’ll end up with three key financial statements: An Income Statement (also called Profit and Loss), a Cash Flow Statement , and a Balance Sheet .

If you’re raising money for your business, the Financing section is where you describe how much you need. Whether you’re getting loans or investments, you should highlight what you need, and when you need it. Ideally, you’ll also want to summarize the specific ways that you’ll use the cash once you have it in hand.

6. Appendix

The final section of your business plan is the appendix. Include detailed financial forecasts here as well as any other key documentation for your business. If you have product schematics, patent information, or any other details that aren’t appropriate for the main body of the plan but need to be included for reference.

Download a business plan template

Are you ready to write your business plan? Get started by downloading our free business plan template . With that, you will be well on your way to a better business strategy, with all of the necessary information expected in a more detailed plan.

If you want to elevate your ability to build a healthy, growing business, you may want to consider LivePlan.

It’s a product that makes planning easy and features step-by-step guidance that ensures you cover everything necessary while reducing the time spent on formatting and presenting. You’ll also gain access to financial forecasting tools that propel you through the process. Finally, it will transform your plan into a management tool that will help you easily compare your forecasts to your actual results.

Using your plan to grow your business

Your business plan isn’t just a document to attract investors or close a bank loan. It’s a tool that helps you better manage and grow your business. And you’ll get the most value from your business plan if you use it as part of a growth planning process .

With growth planning, you’ll easily create and execute your plan, track performance, identify opportunities and issues, and consistently revise your strategy. It’s a flexible process that encourages you to build a plan that fits your needs. So, whether you stick with a one-page plan or expand into a more detailed business plan—you’ll be ready to start growth planning.

Ready to try it for yourself? Learn how LivePlan can help you use this modern business planning method to write your plan and consistently grow your business.

Like this post? Share with a friend!

Noah Parsons

Posted in business plan writing, join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

Home > Business > Business Startup

How To Write a Business Plan

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

Starting a business is a wild ride, and a solid business plan can be the key to keeping you on track. A business plan is essentially a roadmap for your business — outlining your goals, strategies, market analysis and financial projections. Not only will it guide your decision-making, a business plan can help you secure funding with a loan or from investors .

Writing a business plan can seem like a huge task, but taking it one step at a time can break the plan down into manageable milestones. Here is our step-by-step guide on how to write a business plan.

Table of contents

- Write your executive summary

- Do your market research homework

- Set your business goals and objectives

- Plan your business strategy

- Describe your product or service

- Crunch the numbers

- Finalize your business plan

By signing up I agree to the Terms of Use and Privacy Policy .

Step 1: Write your executive summary

Though this will be the first page of your business plan , we recommend you actually write the executive summary last. That’s because an executive summary highlights what’s to come in the business plan but in a more condensed fashion.

An executive summary gives stakeholders who are reading your business plan the key points quickly without having to comb through pages and pages. Be sure to cover each successive point in a concise manner, and include as much data as necessary to support your claims.

You’ll cover other things too, but answer these basic questions in your executive summary:

- Idea: What’s your business concept? What problem does your business solve? What are your business goals?

- Product: What’s your product/service and how is it different?

- Market: Who’s your audience? How will you reach customers?

- Finance: How much will your idea cost? And if you’re seeking funding, how much money do you need? How much do you expect to earn? If you’ve already started, where is your revenue at now?

Step 2: Do your market research homework

The next step in writing a business plan is to conduct market research . This involves gathering information about your target market (or customer persona), your competition, and the industry as a whole. You can use a variety of research methods such as surveys, focus groups, and online research to gather this information. Your method may be formal or more casual, just make sure that you’re getting good data back.

This research will help you to understand the needs of your target market and the potential demand for your product or service—essential aspects of starting and growing a successful business.

Step 3: Set your business goals and objectives

Once you’ve completed your market research, you can begin to define your business goals and objectives. What is the problem you want to solve? What’s your vision for the future? Where do you want to be in a year from now?

Use this step to decide what you want to achieve with your business, both in the short and long term. Try to set SMART goals—specific, measurable, achievable, relevant, and time-bound benchmarks—that will help you to stay focused and motivated as you build your business.

Step 4: Plan your business strategy

Your business strategy is how you plan to reach your goals and objectives. This includes details on positioning your product or service, marketing and sales strategies, operational plans, and the organizational structure of your small business.

Make sure to include key roles and responsibilities for each team member if you’re in a business entity with multiple people.

Step 5: Describe your product or service

In this section, get into the nitty-gritty of your product or service. Go into depth regarding the features, benefits, target market, and any patents or proprietary tech you have. Make sure to paint a clear picture of what sets your product apart from the competition—and don’t forget to highlight any customer benefits.

Step 6: Crunch the numbers

Financial analysis is an essential part of your business plan. If you’re already in business that includes your profit and loss statement , cash flow statement and balance sheet .

These financial projections will give investors and lenders an understanding of the financial health of your business and the potential return on investment.

You may want to work with a financial professional to ensure your financial projections are realistic and accurate.

Step 7: Finalize your business plan

Once you’ve completed everything, it's time to finalize your business plan. This involves reviewing and editing your plan to ensure that it is clear, concise, and easy to understand.

You should also have someone else review your plan to get a fresh perspective and identify any areas that may need improvement. You could even work with a free SCORE mentor on your business plan or use a SCORE business plan template for more detailed guidance.

Compare the Top Small-Business Banks

Data effective 1/10/23. At publishing time, rates, fees, and requirements are current but are subject to change. Offers may not be available in all areas.

The takeaway

Writing a business plan is an essential process for any forward-thinking entrepreneur or business owner. A business plan requires a lot of up-front research, planning, and attention to detail, but it’s worthwhile. Creating a comprehensive business plan can help you achieve your business goals and secure the funding you need.

Related content

- 5 Best Business Plan Software and Tools in 2023 for Your Small Business

- How to Get a Business License: What You Need to Know

- What Is a Cash Flow Statement?

Best Small Business Loans

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2023 All Rights Reserved.

- Online Degree Explore Bachelor’s & Master’s degrees

- MasterTrack™ Earn credit towards a Master’s degree

- University Certificates Advance your career with graduate-level learning

- Top Courses

- Join for Free

Business Plan: What It Is + How to Write One

Discover what a business plan includes and how writing one can foster your business’s development.

![business plan guidance [Featured image] Woman showing a business plan to a man at a desk.](https://d3njjcbhbojbot.cloudfront.net/api/utilities/v1/imageproxy/https://images.ctfassets.net/wp1lcwdav1p1/3GxwyORRIvag1Dj3jnHuiZ/a23bcf202d72e7074fd83a5222a1de79/GettyImages-1127726432__1_.jpg?w=1500&h=680&q=60&fit=fill&f=faces&fm=jpg&fl=progressive&auto=format%2Ccompress&dpr=1&w=1000)

What is a business plan?

Think of a business plan as a document that guides the journey to start-up and beyond. Business plans are written documents that define your business goals and the strategies you’ll use to achieve those goals. In addition to exploring the competitive environment in which the business will operate, a business plan also analyses a market and different customer segments, describes the products and services, lists business strategies for success, and outlines financial planning.

How to write a business plan

In the sections below, you’ll build the following components of your business plan:

Executive summary

Business description

Products and services

Competitor analysis

Marketing plan and sales strategies

Brand strategy

Financial planning

Explore each section to bring fresh inspiration and reveal new possibilities for developing your business. Depending on your format, you may adapt the sections, skip over some, or go deeper into others. Consider your first draft a foundation for your efforts and one you can revise, as needed, to account for changes in any area of your business.

1. Executive summary

This short section introduces the business plan as a whole to the people who will be reading it, including investors, lenders, or other members of your team. Start with a sentence or two about your business, development goals, and why it will succeed. If you are seeking funding, summarise the basics of the financial plan.

2. Business description

You can use this section to provide detailed information about your company and how it will operate in the marketplace.

Mission statement: What drives your desire to start a business? What purpose are you serving? What do you hope to achieve for your business, the team, and your customers?

Revenue streams: From what sources will your business generate revenue? Examples include product sales, service fees, subscriptions, rental fees, licence fees, and more.

Leadership: Describe the leaders in your business, their roles and responsibilities, and your vision for building teams to perform various functions, such as graphic design, product development, or sales.

Legal structure: If you’ve incorporated your business, include the legal structure here and the rationale behind this choice.

3. Competitor analysis

This section will assess potential competitors, their offers, and marketing and sales efforts. For each competitor, explore the following:

Value proposition: What outcome or experience does this brand promise?

Products and services: How does each solve customer pain points and fulfill desires? What are the price points?

Marketing: Which channels do competitors use to promote? What kind of content does this brand publish on these channels? What messaging does this brand use to communicate value to customers?

Sales: What sales process or buyer’s journey does this brand lead customers through?

4. Products and services

Use this section to describe everything your business offers to its target market. For every product and service, list the following:

The value proposition or promise to customers, in terms of how they will experience it

How the product serves customers, addresses their pain points, satisfies their desires, and improves their lives

The features or outcomes that make the product better than those of competitors

Your price points and how these compare to competitors

5. Marketing plan and sales strategies

In this section, you’ll draw from thorough market research to describe your target market and how you will reach it.

Who are your ideal customers?

How can you describe this segment according to their demographics (age, ethnicity, income, location, etc.) and psychographics (beliefs, values, aspirations, lifestyle, etc.)?

What are their daily lives like?

What problems and challenges do they experience?

What words, phrases, ideas, and concepts do consumers in your target market use to describe these problems when posting on social media or engaging with your competitors?

What messaging will present your products as the best on the market? How will you differentiate messaging from competitors?

On what marketing channels will you position your products and services?

How will you design a customer journey that delivers a positive experience at every touchpoint and leads customers to a purchase decision?

6. Brand strategy

In this section, you will describe your business’s design, personality, values, voice, and other details that go into delivering a consistent brand experience.

What are the values that define your brand?

What visual elements give your brand a distinctive look and feel?

How will your marketing messaging reflect a distinctive brand voice, including tone, diction, and sentence-level stylistic choices?

How will your brand look and sound throughout the customer journey?

Define your brand positioning statement. What will inspire your audience to choose your brand over others? What experiences and outcomes will your audience associate with your brand?

7. Financial planning

In this section, you will explore your business’s financial future. Suppose you are writing a traditional business plan to seek funding. In that case, this section is critical for demonstrating to lenders or investors you have a strategy for turning your business ideas into profit. For a lean start-up business plan, this section can provide a valuable exercise for planning how to invest resources and generate revenue [ 1 ].

Use past financials and other sections of this business plan to begin your financial planning, such as your price points or sales strategies.

How many individual products or service packages do you plan to sell over a specific period?

List your business expenses, such as subscribing to software or other services, hiring contractors or employees, purchasing physical supplies or equipment, etc.

What is your break-even point or the amount you must sell to cover all expenses?

Create a sales forecast for the next three to five years: (No. of units to sell X price for each unit) – (cost per unit X No. of units) = sales forecast

Quantify how much capital you have on hand.

When writing a traditional business plan to secure funding, you may append supporting documents, such as licences, permits, patents, letters of reference, resumes, product blueprints, brand guidelines, the industry awards you’ve received, and media mentions and appearances.

Business plan key takeaways and best practices

Remember: Creating a business plan is crucial when starting a business. You can use this document to guide your decisions and actions and even seek funding from lenders and investors.

Keep these best practices in mind:

Your business plan should evolve as your business grows. Return to it periodically, such as quarterly or annually, to update individual sections or explore new directions your business can take.

Make sure everyone on your team has a copy of the business plan, and welcome their input as they perform their roles.

Ask fellow entrepreneurs for feedback on your business plan and look for opportunities to strengthen it, from conducting more market and competitor research to implementing new strategies for success.

Start your business with Coursera

Ready to start your business? Watch this video on the Lean approach from the Entrepreneurship Specialisation on Coursera:

Article sources

Inc. “ How to Write the Financial Section of a Business Plan , https://www.inc.com/guides/business-plan-financial-section.html.” Accessed April 15, 2024.

Keep reading

Coursera staff.

Editorial Team

Coursera’s editorial team is comprised of highly experienced professional editors, writers, and fact...

This content has been made available for informational purposes only. Learners are advised to conduct additional research to ensure that courses and other credentials pursued meet their personal, professional, and financial goals.

Cookies on GOV.UK

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

You have accepted additional cookies. You can change your cookie settings at any time.

You have rejected additional cookies. You can change your cookie settings at any time.

- Business and self-employed

- Business finance and support

Write a business plan

Download free business plan templates and find help and advice on how to write your business plan.

Business plan templates

Download a free business plan template on The Prince’s Trust website.

You can also download a free cash flow forecast template or a business plan template on the Start Up Loans website to help you manage your finances.

Business plan examples

Read example business plans on the Bplans website.

How to write a business plan

Get detailed information about how to write a business plan on the Start Up Donut website.

Why you need a business plan

A business plan is a written document that describes your business. It covers objectives, strategies, sales, marketing and financial forecasts.

A business plan helps you to:

- clarify your business idea

- spot potential problems

- set out your goals

- measure your progress

You’ll need a business plan if you want to secure investment or a loan from a bank. Read about the finance options available for businesses on the Business Finance Guide website.

It can also help to convince customers, suppliers and potential employees to support you.

Related content

Is this page useful.

- Yes this page is useful

- No this page is not useful

Help us improve GOV.UK

Don’t include personal or financial information like your National Insurance number or credit card details.

To help us improve GOV.UK, we’d like to know more about your visit today. We’ll send you a link to a feedback form. It will take only 2 minutes to fill in. Don’t worry we won’t send you spam or share your email address with anyone.

- REALTOR® Store

- Fostering Consumer-Friendly Real Estate Marketplaces Local broker marketplaces ensure equity and transparency. Close

- Social Media

- Sales Tips & Techniques

- MLS & Online Listings

- Starting Your Career

- Being a Broker

- Being an Agent

- Condominiums

- Smart Growth

- Vacation, Resort, & 2nd Homes

- FHA Programs

- Home Inspections

- Arbitration & Dispute Resolution

- Fair Housing

- All Membership Benefits

- NAR REALTOR Benefits® Bringing you savings and unique offers on products and services just for REALTORS®. Close

- Directories Complete listing of state and local associations, MLSs, members, and more. Close

- Dues Information & Payment

- Become a Member As a member, you are the voice for NAR – it is your association and it exists to help you succeed. Close

- Logos and Trademark Rules Only members of NAR can call themselves a REALTOR®. Learn how to properly use the logo and terms. Close

- Your Membership Account Review your membership preferences and Code of Ethics training status. Close

- Highlights & News Get the latest top line research, news, and popular reports. Close

- Housing Statistics National, regional, and metro-market level housing statistics where data is available. Close

- Research Reports Research on a wide range of topics of interest to real estate practitioners. Close

- Presentation Slides Access recent presentations from NAR economists and researchers. Close

- State & Metro Area Data Affordability, economic, and buyer & seller profile data for areas in which you live and work. Close

- Commercial Research Analysis of commercial market sectors and commercial-focused issues and trends. Close

- Statistical News Release Schedule

- Advocacy Issues & News

- Federal Advocacy From its building located steps away from the U.S. Capitol, NAR advocates for you. Close

- REALTORS® Political Action Committee (RPAC) Promoting the election of pro-REALTOR® candidates across the United States. Close

- State & Local Advocacy Resources to foster and harness the grassroots strength of the REALTOR® Party. Close

- REALTOR® Party A powerful alliance working to protect and promote homeownership and property investment. Close

- Get Involved Now more than ever, it is critical for REALTORS® across America to come together and speak with one voice. Close

- All Education & Professional Development

- All NAR & Affiliate Courses Continuing education and specialty knowledge can help boost your salary and client base. Close

- Code of Ethics Training Fulfill your COE training requirement with free courses for new and existing members. Close

- Continuing Education (CE) Meet the continuing education (CE) requirement in state(s) where you hold a license. Close

- Designations & Certifications Acknowledging experience and expertise in various real estate specialties, awarded by NAR and its affiliates. Close

- Library & Archives Offering research services and thousands of print and digital resources. Close

- Commitment to Excellence (C2EX) Empowers REALTORS® to evaluate, enhance and showcase their highest levels of professionalism. Close

- NAR Academy at Columbia College Academic opportunities for certificates, associates, bachelor’s, and master’s degrees. Close

- Latest News

- NAR Newsroom Official news releases from NAR. Close

- REALTOR® Magazine Advancing best practices, bringing insight to trends, and providing timely decision-making tools. Close

- Blogs Commentary from NAR experts on technology, staging, placemaking, and real estate trends. Close

- Newsletters Stay informed on the most important real estate business news and business specialty updates. Close

- NAR NXT, The REALTOR® Experience

- REALTORS® Legislative Meetings

- AE Institute

- Leadership Week

- Sustainability Summit

- Mission, Vision, and Diversity & Inclusion

- Code of Ethics

- Leadership & Staff National, state & local leadership, staff directories, leadership opportunities, and more. Close

- Committee & Liaisons

- History Founded as the National Association of Real Estate Exchanges in 1908. Close

- Affiliated Organizations

- Strategic Plan NAR’s operating values, long-term goals, and DEI strategic plan. Close

- Governing Documents Code of Ethics, NAR's Constitution & Bylaws, and model bylaws for state & local associations. Close

- Awards & Grants Member recognition and special funding, including the REALTORS® Relief Foundation. Close

- NAR's Consumer Outreach

- Find a Member

- Browse All Directories

- Find an Office

- Find an Association

- NAR Group and Team Directory

- Committees and Directors

- Association Executive

- State & Local Volunteer Leader

- Buyer's Rep

- Senior Market

- Short Sales & Foreclosures

- Infographics

- First-Time Buyer

- Window to the Law

- Next Up: Commercial

- New AE Webinar & Video Series

- Drive With NAR

- Real Estate Today

- Center for REALTOR® Development

- Leading with Diversity

- Good Neighbor

- NAR HR Solutions

- Fostering Consumer-Friendly Real Estate Marketplaces Local broker marketplaces ensure equity and transparency.

- Marketing Social Media Sales Tips & Techniques MLS & Online Listings View More

- Being a Real Estate Professional Starting Your Career Being a Broker Being an Agent View More

- Residential Real Estate Condominiums Smart Growth Vacation, Resort, & 2nd Homes FHA Programs View More Home Inspections

- Legal Arbitration & Dispute Resolution Fair Housing Copyright View More

- Commercial Real Estate

- Right Tools, Right Now

- NAR REALTOR Benefits® Bringing you savings and unique offers on products and services just for REALTORS®.

- Directories Complete listing of state and local associations, MLSs, members, and more.

- Become a Member As a member, you are the voice for NAR – it is your association and it exists to help you succeed.

- Logos and Trademark Rules Only members of NAR can call themselves a REALTOR®. Learn how to properly use the logo and terms.

- Your Membership Account Review your membership preferences and Code of Ethics training status.

- Highlights & News Get the latest top line research, news, and popular reports.

- Housing Statistics National, regional, and metro-market level housing statistics where data is available.

- Research Reports Research on a wide range of topics of interest to real estate practitioners.

- Presentation Slides Access recent presentations from NAR economists and researchers.

- State & Metro Area Data Affordability, economic, and buyer & seller profile data for areas in which you live and work.

- Commercial Research Analysis of commercial market sectors and commercial-focused issues and trends.

- Federal Advocacy From its building located steps away from the U.S. Capitol, NAR advocates for you.

- REALTORS® Political Action Committee (RPAC) Promoting the election of pro-REALTOR® candidates across the United States.

- State & Local Advocacy Resources to foster and harness the grassroots strength of the REALTOR® Party.

- REALTOR® Party A powerful alliance working to protect and promote homeownership and property investment.

- Get Involved Now more than ever, it is critical for REALTORS® across America to come together and speak with one voice.

- All NAR & Affiliate Courses Continuing education and specialty knowledge can help boost your salary and client base.

- Code of Ethics Training Fulfill your COE training requirement with free courses for new and existing members.

- Continuing Education (CE) Meet the continuing education (CE) requirement in state(s) where you hold a license.

- Designations & Certifications Acknowledging experience and expertise in various real estate specialties, awarded by NAR and its affiliates.

- Library & Archives Offering research services and thousands of print and digital resources.

- Commitment to Excellence (C2EX) Empowers REALTORS® to evaluate, enhance and showcase their highest levels of professionalism.

- NAR Academy at Columbia College Academic opportunities for certificates, associates, bachelor’s, and master’s degrees.

- NAR Newsroom Official news releases from NAR.

- REALTOR® Magazine Advancing best practices, bringing insight to trends, and providing timely decision-making tools.

- Blogs Commentary from NAR experts on technology, staging, placemaking, and real estate trends.

- Newsletters Stay informed on the most important real estate business news and business specialty updates.

- Leadership & Staff National, state & local leadership, staff directories, leadership opportunities, and more.

- History Founded as the National Association of Real Estate Exchanges in 1908.

- Strategic Plan NAR’s operating values, long-term goals, and DEI strategic plan.

- Governing Documents Code of Ethics, NAR's Constitution & Bylaws, and model bylaws for state & local associations.

- Awards & Grants Member recognition and special funding, including the REALTORS® Relief Foundation.

- Top Directories Find a Member Browse All Directories Find an Office Find an Association NAR Group and Team Directory Committees and Directors

- By Role Broker Association Executive New Member Student Appraiser State & Local Volunteer Leader

- By Specialty Commercial Global Buyer's Rep Senior Market Short Sales & Foreclosures Land Green

- Multimedia Infographics Videos Quizzes

- Video Series First-Time Buyer Level Up Window to the Law Next Up: Commercial New AE Webinar & Video Series

- Podcasts Drive With NAR Real Estate Today Center for REALTOR® Development

- Programs Fair Housing Safety Leading with Diversity Good Neighbor NAR HR Solutions

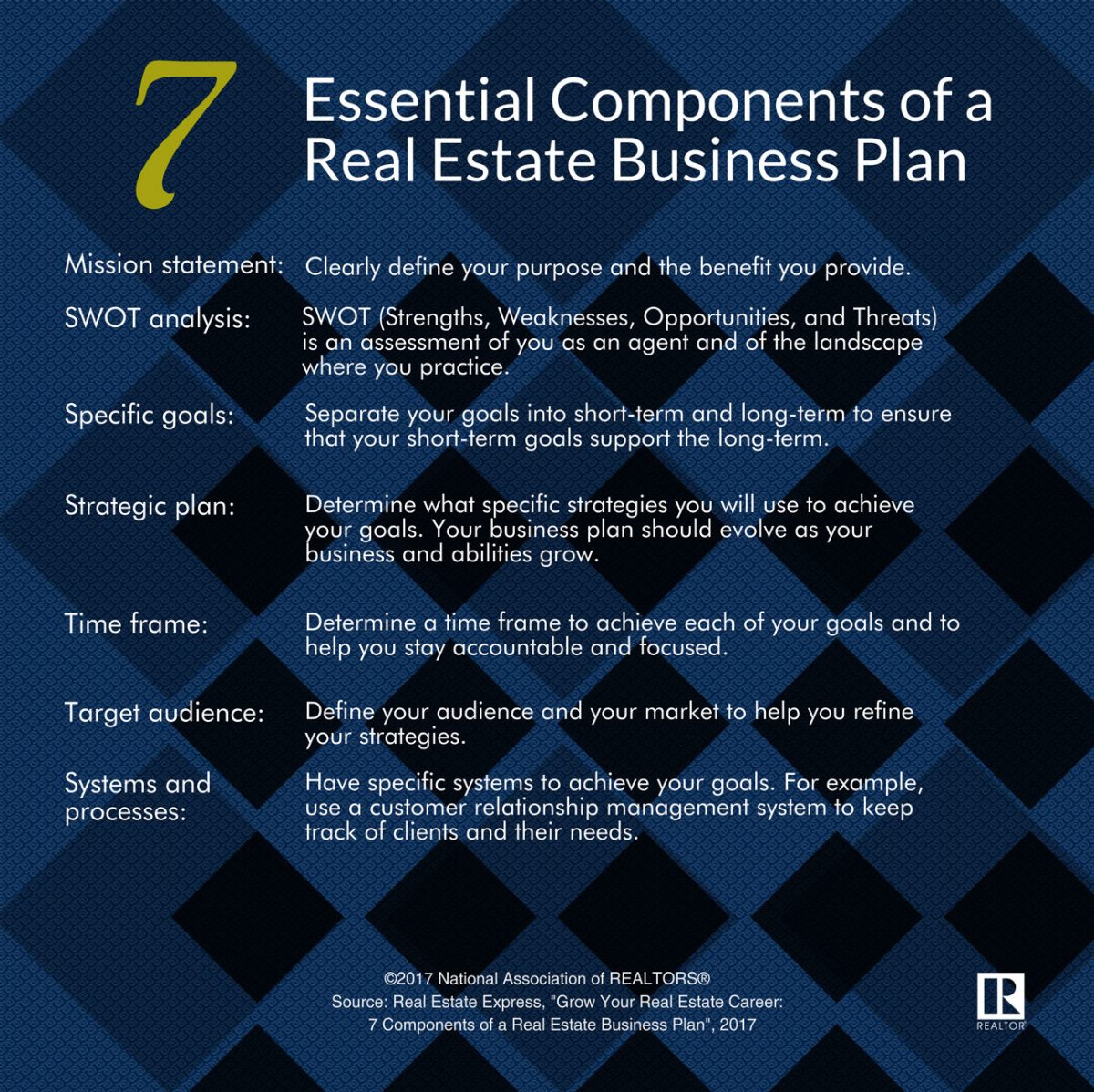

- Writing a Business Plan

Writing a business plan may seem a daunting task as there are so many moving parts and concepts to address. Take it one step at a time and be sure to schedule regular review (quarterly, semi-annually, or annually) of your plan to be sure you on are track to meet your goals.

Why Write a Business Plan?

Making a business plan creates the foundation for your business. It provides an easy-to-understand framework and allows you to navigate the unexpected.

Quick Takeaways

- A good business plan not only creates a road map for your business, but helps you work through your goals and get them on paper

- Business plans come in many formats and contain many sections, but even the most basic should include a mission and vision statement, marketing plans, and a proposed management structure

- Business plans can help you get investors and new business partners

Source: Write Your Business Plan: United States Small Business Association

Writing a business plan is imperative to getting your business of the ground. While every plan is different – and most likely depends on the type and size of your business – there are some basic elements you don’t want to ignore.

Latest on this topic

NAR Library & Archives has already done the research for you. References (formerly Field Guides) offer links to articles, eBooks, websites, statistics, and more to provide a comprehensive overview of perspectives. EBSCO articles ( E ) are available only to NAR members and require the member's nar.realtor login.

Defining Your Mission & Vision