Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

What’s in an Equity Research Report?

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

Even though you can easily find real equity research reports via the magical tool known as “Google,” we’ve continued to get questions on this topic.

Whenever I see the same question over and over again, you know what I do: I bash my head in repeatedly and contemplate jumping off a building…

…and then I write an article to answer the question.

To understand an equity research report, you must understand what goes into a stock pitch first.

The idea is similar, but an ER report is a “watered-down” version of a stock pitch.

But banks have some very solid reasons for publishing equity research reports:

Why Do Equity Research Reports Matter?

You might remember from previous articles that equity research teams do not spend that much time writing these reports .

Most of their time is spent speaking with management teams and institutional investors and sharing their views on sectors and companies.

However, equity research reports are still important because:

- You do still spend some time doing the required modeling work (~15%) and writing the reports (~20%).

- You might have to write a research report as part of the interview process.

For example, if you apply to an equity research role or an equity research internship , especially in an off-cycle process, you might be asked to draft a short report on a company.

And then in roles outside of ER, you need to know how to interpret reports quickly and extract the key information.

Equity Research Reports: Myth vs. Reality

If you want to understand equity research reports, you have to understand first why banks publish them: to earn higher commissions from trading activity.

A bank wants to encourage institutional investors to buy more shares of the companies it covers.

Doing so generates more trading volume and higher commissions for the bank.

This is why you rarely, if ever, see “Sell” ratings, and why “Hold” ratings are far less common than “Buy” ratings.

Different Types of Equity Research Reports

One last point before getting into the tutorial: There are many different types of research reports.

“Initiating Coverage” reports tend to be long – 50-100 pages or more – and have tons of industry research and data.

“Sector Reports” on entire industries are also very long. And there are other types, which you can read about here .

In this tutorial, we’re focusing on the “Company Update” or “Company Note”-type reports, which are the most common ones.

The Full Tutorial, Video, and Sample Equity Research Reports

For our full walk-through of equity research reports, please see the video below:

Table of Contents:

- 1:43: Part 1: Stock Pitches vs. Equity Research Reports

- 6:00: Part 2: The 4 Main Differences in Research Reports

- 12:46: Part 3: Sample Reports and the Typical Sections

- 20:53: Recap and Summary

You can get the reports and documents referenced in the video here:

- Equity Research Report – Jazz Pharmaceuticals [JAZZ] – OUTPERFORM [BUY] Recommendation [PDF]

- Equity Research Report – Shawbrook [SHAW] – NEUTRAL [HOLD] Recommendation [PDF]

- Equity Research Reports vs. Stock Pitches – Slides [PDF]

If you want the text version instead, keep reading:

Watered-Down Stock Pitches

You should think of equity research reports as “watered-down stock pitches.”

If you’ve forgotten, a hedge fund or asset management stock pitch ( sample stock pitch here ) has the following components:

- Part 1: Recommendation

- Part 2: Company Background

- Part 3: Investment Thesis

- Part 4: Catalysts

- Part 5: Valuation

- Part 6: Investment Risks and How to Mitigate Them

- Part 7: The Worst-Case Scenario and How to Avoid It

In a stock pitch, you’ll spend most of your time and energy on the Catalysts, Valuation, and Investment Risks because you want to express a VERY different view of the company .

For example, the company’s stock price is $100, but you believe it’s worth only $50 because it’s about to report earnings 80% lower than expectations.

Therefore, you recommend shorting the stock. You also recommend purchasing call options at an exercise price of $125 to limit your losses to 25% if the stock moves in the opposite direction.

In an equity research report, you’ll still express a view of the company that’s different from the consensus, but your view won’t be dramatically different.

You’ll spend more time on the Company Background and Valuation sections, and far less time and space on the Catalysts and Risk Factors. And you won’t even write a Worst-Case Scenario section.

If a company seems overvalued by 50%, a research analyst would probably write a “Hold” recommendation, say that there’s “uncertainty around several customers,” and claim that the company’s current market value is appropriate.

Oh, and by the way, one risk factor is that the company might report lower-than-expected earnings.

The Four Main Differences in Equity Research Reports

The main differences are as follows:

1) There’s More Emphasis on Recent Results and Announcements

For example, how does a recent product announcement, clinical trial result, or earnings report impact the company?

You’ll almost always see recent news and updates on the first page of a research report:

These factors may play a role in hedge fund stock pitches as well, but more so in short recommendations since timing is more important there.

2) Far-Outside-the-Mainstream Views Are Less Common

One comical example of this trend is how all 15 equity research analysts covering Enron rated it a “buy” right before it collapsed :

Sell-side analysts are far less likely to point out that the emperor has no clothes than buy-side analysts.

3) Research Reports Give “Target Prices” Rather Than Target Price Ranges

For example, the company is trading at $50.00 right now, but we expect its price to increase to exactly $75.00 in the next twelve months.

This idea is completely ridiculous because valuation is always about the range of possible outcomes, not a specific outcome.

Despite horrendously low accuracy , this practice continues.

To be fair, many analysts do give target prices in different cases, which is an improvement:

4) The Investment Thesis, Catalysts, and Risk Factors Are “Looser”

These sections tend to be “afterthoughts” in most reports.

For example, the bank might give a few reasons why it expects the company’s share price to rise: the company will capture more market share than expected, it will be able to increase its product prices more rapidly than expected, and a competitor is about to go bankrupt.

However, the sell-side analyst will not tie these factors to specific share-price impacts as a buy-side analyst would.

Similarly, the report might mention catalysts and investment risks, but there won’t be a link to a specific valuation impact from each factor.

So the typical stock pitch logic (“We think there’s a 50% chance of gaining 80% and a 50% chance of losing 20%”) won’t be spelled out explicitly:

Your Sample Equity Research Reports

To illustrate these concepts, I’m sharing two equity research reports from our financial modeling courses :

The first one is from the valuation case study in our Advanced Financial Modeling course , and the second one is from the main case study in our Bank Modeling course .

These are comprehensive examples, backed by industry data and outside research, but if you want a shorter/simpler example you can recreate in a few hours, the Core Financial Modeling course has just that.

In each case, we started by creating traditional HF/AM stock pitches and valuations and then made our views weaker in the research reports.

The Typical Sections of an Equity Research Report

So let’s briefly go through the main sections of these reports, using the two examples above:

Page 1: Update, Rating, Price Target, and Recent Results

The first page of an “Update” report states the bank’s recommendation (Buy, Hold, or Sell, sometimes with slightly different terminology), and gives recent updates on the company.

For example, in both these reports we reference recent earnings results from the companies and expectations for the next fiscal year:

We also give a “target price,” explain where it comes from, and give our estimates for the company’s key financial metrics.

We mention catalysts in both reports, but we don’t link anything to a specific valuation impact.

One problem with providing a specific “target price” is that it must be based on specific multiples and specific assumptions in a DCF or DDM.

So with Jazz, we explain that the $170.00 target is based on 20.7x and 15.3x EV/EBITDA multiples for the comps, and a discount rate of 8.07% and Terminal FCF growth rate of 0.3% in the DCF.

Next: Operations and Financial Summary

Next, you’ll see a section with lots of graphs and charts detailing the company’s financial performance, market share, and important metrics and ratios.

For a pharmaceutical company like Jazz, you might see revenue by product, pricing and # of patients per product per year, and EBITDA margins.

For a commercial bank like Shawbrook, you might see loan growth, interest rates, interest income and net income, and regulatory capital figures such as the Common Equity Tier 1 (CET 1) and Tangible Common Equity (TCE) ratios:

This section of the report explains how the analyst or equity research associate forecast the company’s performance and came up with the numbers used in the valuation.

The valuation section is the one that’s most similar in a research report and a stock pitch.

In both fields, you explain how you arrived at the company’s implied value, which usually involves pasting in a DCF or DDM analysis and comparable companies and transactions.

The methodologies are the same, but the assumptions might differ substantially.

In research, you’re also more likely to point to specific multiples, such as the 75 th percentile EV/EBITDA multiple, and explain why they are the most meaningful ones.

For example, you might argue that since the company’s growth rates and margins exceed the medians of the set, it deserves to be valued at the 75 th percentile multiples rather than the median multiples:

Investment Thesis, Catalysts, and Risks

This section is short, and it is more of an afterthought than anything else.

We do give reasons for why these companies might be mis-priced, but the reasoning isn’t that detailed.

For example, in the Shawbrook report we state that the U.K. mortgage market might slow down and that regulatory changes might reduce the market size and the company’s market share:

Those are legitimate catalysts, but the report doesn’t explain their share-price impact in the same way that a stock pitch would.

Finally, banks present Investment Risks mostly so they can say, “Well, we warned you there were risks and that our recommendation might be wrong.”

By contrast, buy-side analysts present Investment Risks so they can say, “There is a legitimate chance we could lose 50% – let’s hedge against that risk with options or other investments so that our fund does not collapse .”

How These Reports Both Differ from the Corresponding Stock Pitches

The Jazz equity research report corresponds to a “Long” pitch that’s much stronger:

- We estimate its intrinsic value as $180 – $220 / share , up from $170 in the report.

- We estimate the per-share impact of each catalyst: price increases add 15% to the share price, more patients from marketing efforts add 10%, and later-than-expected generics competition adds 15%.

- We also estimate the per-share impact from the risk factors and conclude that in the worst case , the company’s share price might decline from $130 to $75-$80. But in all likelihood, even if we’re wrong, the company is simply valued appropriately at $130.

- And then we explain how to hedge against these risks with put options.

The same differences apply to the Shawbrook research report vs. the stock pitch, but the stock pitch there is a “Short” recommendation where we claim that the company is overvalued by 30-50%.

And that sums up the differences perfectly: A Short recommendation with 30-50% downside in a stock pitch turns into a “Hold” recommendation with roughly equal upside and downside in a sell-side research report.

I’ve been harsh on equity research here, but I don’t want to disparage it too much.

There are many positives: You do get more creativity than in IB, it might be better for hedge fund or asset management exits, and it’s more fun to follow companies than to grind through grunt work on deals.

But no matter how you slice it, most equity research reports are watered-down stock pitches.

So, make sure you understand the “strong stuff” first before you downgrade – even if your long-term goal is equity research.

You might be interested in:

- The Equity Research Analyst Career Path: The Best Escape from a Ph.D. Program, or a Pathway into the Abyss?

- Private Equity Regulation : 2023 Changes and Impact on Finance Careers

- Stock Pitch Guide: How to Pitch a Stock in Interviews and Win Offers

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Read below or Add a comment

15 thoughts on “ What’s in an Equity Research Report? ”

Hi Brian, what softwares are available to publish Research Reports?

We use Word templates. Some large banks have specialized/custom programs, but not sure how common they are.

Is it possible if you can send me a template in word of an equity report? It will help the graduate stock management fund a lot at Umass Boston.

We only have PDF versions for these, but Word should be able to open any PDF reasonably well.

Do you also provide a pre constructed version of an ER in word?

We have editable examples of equity research reports in Word, but we generally only share PDF versions on this site.

Hey Brian Can you please help me with coverage initiated reports on oil companies. I could not find them on the net. I need to them to get equity research experience, after which only I will be able to get into the field. I searched but reports could not be found even for a price. Thanks

We have an example of an oil & gas stock pitch on this site… do a search…

https://mergersandinquisitions.com/oil-gas-stock-pitch/

Beyond that, sorry, we cannot look for reports and then share them with you or we’d be inundated with requests to do that every day.

No worries. Thanks!

Hi! Brian! Do u know how investment bankers design and layout an equity research? the software they use. like MS Word, Adobe Indesign or something…? And how to create and layout one? Thanks

where can I get free equity research report? I am a Chinese student and now study in Australia. Is the Morning Star a good resource for research report?

Get a TD Ameritrade to access free reports there for certain companies.

How do you view the ER industry since the trading commission has been down 50% since 2007. And there are new in coming regulation governing the ER reports have to explicitly priced and funds need to pay for the report explicity rather than as a service comes free with brokerage?

In addition the whole S&T environment is becoming highly automated.

People have been predicting the death of equity research for over a decade, but it’s still here. It may not be around in 100 years, but it will still be around in another 10 years, though it will be smaller and less relevant.

Yes, things are becoming more automated, but the actual job of an equity research analyst or associate hasn’t changed dramatically. A machine can’t speak with investors to assess their sentiment on a company – only humans can do that.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Learn Valuation and Financial Modeling

Get a crash course on accounting, 3-statement modeling, valuation, and M&A and LBO modeling with 10+ global case studies.

A Student’s Guide to Writing A Buy-Side Equity Research Report

- via Research , Resources

Marina Chang

A career in finance can take on many different forms — from investment banking to equity research. Equity researchers conduct detailed analyses in order to offer well-supported investment recommendations. Their analyses are then compiled into what is referred to as an equity research report. These reports differ on the sell-side and buy-side, but they do have some overlaps. This guide will break down the key components and formats to help you successfully craft your own equity research report.

What is an equity research report? What is the purpose of a research report?

An equity research report is a document prepared by an analyst that gives an overview of a business, including the industry it operates in, its management team, its financial performance, risks, and its target price. The purpose of a research report is to provide a recommendation on whether investors should buy, hold, or sell shares of a public company.

What’s the difference between a buy-side and sell-side equity research report?

Sell-side reports are the most common type of equity research report. They are typically produced by investment banks for their clients to help guide investment decisions. Sell-side analysts issue the often-heard recommendations of “buy,” “hold,” “neutral,” or “sell” to help clients with their investment decisions. This is favorable for the brokerage firm as each time a client decides to trade the brokerage firm gets a commission on the transaction.

Buy-side reports are internal reports, produced for the bank itself, and are guided by differing perspectives and motivations. Buy-side analysts determine how promising an investment seems and how well it fits with the fund’s investment strategy. These recommendations are made exclusively for the benefit of the fund that employs them and are not available to anyone outside the fund.

What information should be included within your equity research report?

- Recommendation – Typically to buy, sell, or hold shares in the company. This section also usually includes a target price (i.e., $47.00 in the next 12 months).

- Company Update – New releases, quarterly or annual results, major contracts, management changes, or any other recent or important information about the company.

- Investment Thesis – A summary of why the analyst believes the stock will over or underperform and what will cause it to reach the share price target included in the recommendation. This is probably the most interesting part of the report.

- Financial Information & Valuation – A forecast of the company’s income statement, balance sheet, cash flow, and valuation. This section is often an output from a financial model built in Excel.

- Risk & Disclaimers – An overview of the risks associated with investing in the stock. This is usually a laundry list of all conceivable risks, thus making it feel like a legal disclaimer. The reports also have extensive disclaimers in addition to the risk section.

What information is needed for the industry pages?

- Competitive Rivalry – This looks at the number and strength of competitors. How many rivals does the company have? Who are they, and how does the quality of their products and services compare?

- Supplier Power – This is determined by how easy it is for suppliers to increase their prices. How many potential suppliers does the company have? How unique is the product or service that it provides, and how expensive would it be to switch from one supplier to another?

- Buyer Power – Here, you ask how easy it is for buyers to drive prices down. How many buyers are there, and how big are their orders? How much would it cost them to switch from the company’s products and services to those of a rival? Are buyers strong enough to dictate terms?

- Threat of Substitution – This refers to the likelihood of customers finding a different way to do what the company offers.

- Threat of New Entry – The company’s position can be affected by how easy it is for a new company to enter the industry. How much would it cost, and how tightly is the industry regulated?

How to create and forecast a financial model.

- Gather the company’s most recent 10-K and 10-Q SEC filings.

- For all three financial statements, copy and paste the line items that can be forecasted.

- Make income statement projections based on margins as a percentage of revenue.

- Create a depreciation schedule to account for the reduction of PP&E and intangible assets over time.

- Calculate working capital assumptions.

- Forecast current assets and liabilities on the balance sheet.

- Adjust net change in cash and cash equivalents (CCE) with the cash flow statement.

- Reconcile the cash flow statement with the balance sheet.

- Compute the dividend payout ratio if the company offers a dividend.

- Create the shares repurchase schedule if the company has a share buyback program.

- Construct the debt schedule.

- Calculate interest income and interest expense from the debt schedule.

- Run multiple scenarios – Wall Street Case, Bear Case, Bull Case.

- Sanity check your assumptions.

How many pages should your equity research report contain?

An equity research report should not be more than 10 to 15 pages long. Aim to be both concise and cohesive.

What kind of disclaimer should be included?

It is important for the report to have certain disclaimers to show that the analyst writing the report isn’t biased. Some typical disclaimers are as follows:

- Every ER report entirely reflects the views and personal opinions of the analyst as on the date of publication.

- The equity research analyst does not have an interest in the shares of the company.

- Compensation of the analyst is not linked directly to any specific research recommendations contained in the report.

- Financial analysts or equity research analysts working in brokerage firms or sell-side analysts write equity research reports.

With all these points in mind, you are now ready to write your own equity research report. Select a public company, use this guide as a reference, and see what results from your analysis. Congratulations in advance on completing your research report!

Romero Mentoring’s Analyst Prep Program

In just 15-weeks, you can become a world-class finance professional. The Romero Mentoring Analyst Prep Program is an all-inclusive internship, mentorship, and training experience like no other. Learn the in-depth principles of finance and apply what you learn through an extensive internship led by a finance professional with over 12 years of experience. Learn more here.

The Analyst Prep Program teaches the technical and practical skills that investment banks, hedge funds, and private equity & consulting firms look for in a candidate. Students begin with little to no technical skills and develop into fully prepared professionals who can perform as first-year analysts from day one.

About Romero Mentoring

Since 2016, Romero Mentoring investment banking training programs have been delivering career mentoring to job seekers, professionals, and college students pursuing careers in finance. We’ve helped over 400 students start their careers on Wall Street through our Analyst Prep and Associate Investment Banking Training Programs. Our graduates work at top-bulge bracket banks and consulting firms, including Goldman Sachs, JP Morgan, McKinsey, and many more.

References:

- https://www.financewalk.com/equity-research-report/

- https://corporatefinanceinstitute.com/resources/knowledge/valuation/equity-research-report/#:~:text=What%20is%20an%20Equity%20Research,distributes%20that%20research%20to%20clients.

- https://quickbooks.intuit.com/r/marketing/market-research-tips-how-to-conduct-an-industry-analysis/

About the Author

Marina Chang is a business student at New York University pursuing a double concentration in Finance and Data Science. She is currently an Investment Research Intern at Romero Capital. Marina is an Analyst at NYU's Smart Woman Securities, where she worked with a team of 5 to compete in a stock pitch. She is also a Staff Consultant at 180 Degrees Consulting. The organization provides affordable advising services for non-profits and social enterprises. Marina was a mentee of the Analyst Prep Program.

Recommendations For You

Securing A Financial Analyst Role & The Recruiting Process

The Cost of a College Education

Maximizing Your Networking Potential: Navigating the Finance and Investment Banking Industry

Free Career Consultation

Speak to a professional veteran with 15 years of experience, fill out the form below to request your appointment. learn how we can help you maximize your potential..

What is your highest level of education? High school student College/university student Master’s program student Working professional Other

What is your current annual income? $0-25,000 $26,000-50,000 $51,000-75,000 $76,000-100,000 $1000,000+

Upload Resume

By submitting this form, you agree to receive emails from or on behalf of Romero Mentoring. You understand that such emails may be sent using automated technology. You may opt out at any time. Please view our Privacy Policy or Contact Us for more details.

Start my free trial

Please fill out the form below and an AlphaSense team member will be in touch within 20 minutes to help set up your trial.

The Value of Equity Research

Equity research is an invaluable asset for anyone looking to stay up-to-date on market and industry trends. In this guide, you will learn about the type of information contained in equity research, the value it offers to corporate professionals, and how the most advanced teams are already leveraging the expertise of Wall Street’s top analysts to inform critical business decisions.

Get the guide

Introduction.

Equity research, which forms a multi-billion dollar industry for investment banks, is produced by thousands of analysts worldwide to provide the market with valuable information on companies, industries, and market trends. Today, over 90% of equity research is consumed by fund managers, who have the Wall Street relationships to acquire it and the analyst resources to mine it for insights. For corporate strategy professionals who lack this access, however, equity research has historically been challenging to obtain and navigate.

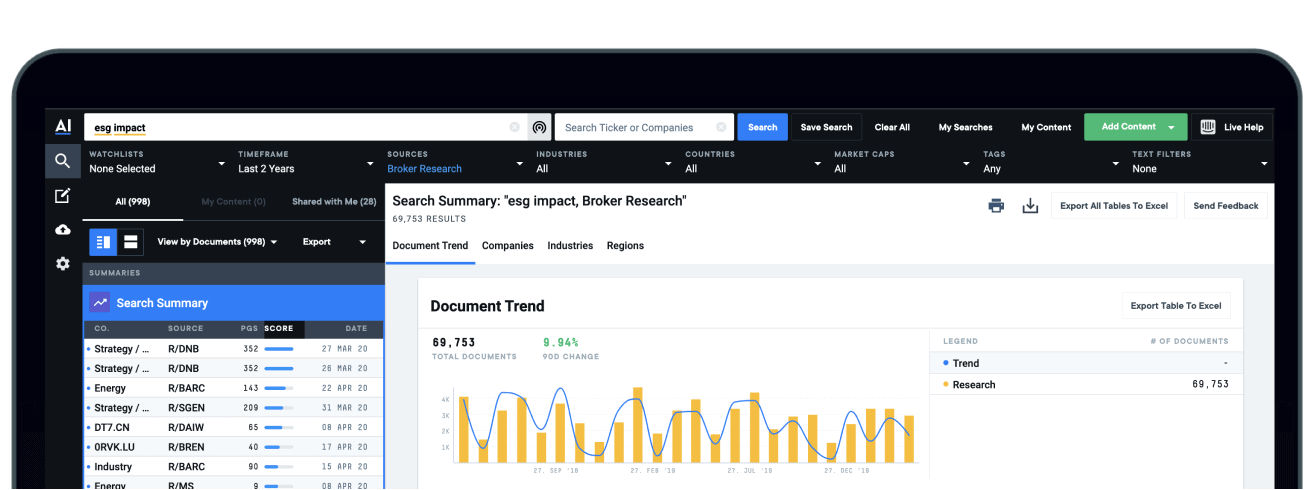

To help corporations circumvent these challenges, AlphaSense has introduced Wall Street Insights, the first and only equity research collection purpose-built for the corporate user. Through the AlphaSense platform, any business making strategic plans or product decisions, conducting competitive analysis, evaluating M&A, or engaging in investor relations can now tap into the deep industry expertise of Wall Street’s top analysts.

What is Equity Research?

Equity research is developed by sell-side firms to help investors and hedge fund managers discover market opportunities and make informed investment decisions. Increasingly, this expert analysis has also been identified by forward-looking corporations as a highly valuable tool to inform strategic decision-making.

There are thousands of sell-side firms that employ expert analysts around the globe to write equity research for the market. The majority of firms producing equity research are hyper-focused and only have one or two analysts developing reports on a specific industry. However, larger firms, such as Morgan Stanley and Bank of America, collectively employ thousands of analysts to write reports on thousands of public companies–covering everything from TMT giants to niche products.

Equity research analysts are deep subject matter experts who are often former executives, industry veterans, or academics. These analysts conduct in-depth research and publish reports on corporations, industries, and macro trends, offering an expert lens into a subject.

Historically, over 90% of equity research was consumed by buy-side fund managers, who had the Wall Street relationships to acquire it and the analyst resources to mine it for insights. For buy-side professionals, equity research is a critical tool to inform sound investment decisions backed by expert insights.

Today, equity research is increasingly relied upon by corporate teams as a high-value source of information. These teams leverage equity research to make strategic business plans, conduct competitive analysis, evaluate mergers and acquisitions, and make product and marketing decisions. For corporations, the value of equity research lies in the detailed coverage of their company, their competitors, and how they are performing related to the marketplace they are within.

What is an Equity Research Report?

An equity research report is a document prepared by an equity research analyst that often provides insight on whether investors should buy, hold, or sell shares of a public company. In an equity research report, an analyst lays out their recommendation, target price, investment thesis, valuation, and risks.

There are multiple forms of equity research, including (but not limited to):

An update report that highlights the latest news, company announcements, earnings reports, Buy Sell Hold ratings, M&A activity, anything that impacts the value of the company.

A comprehensive company report that is compiled when an analyst or firm initiates their coverage of a stock. Initiation reports cover all of the divisions and products of a company in-depth to provide a baseline of what the company is and how it is performing. Initiation reports can be tens to hundreds of pages long, depending on the complexity of a company.

General industry updates that cover a group of similar companies within a sector. Industry-specific reports typically dive into additional factors such as loan growth, interest rates, interest income, net income, and regulatory capital.

A report compiled by research firms either daily or weekly. These reports can often be a great place to get more in-depth insight on commodities and also get market opinions from commodity analysts or traders who write the reports.

A quick 1-2 page report that comments on a news release from a company or other quick information

What is Included in a Typical Equity Research Report?

Research reports don’t need to follow a specific formula. Analysts at different investment banks have some latitude in determining the look and feel of their reports. But more often than not, research reports follow a certain protocol of what investors expect them to look like.

A typical equity research report includes in-depth industry research, management analysis, financial histories, trends, forecasting, valuations, and recommendations for investors. Sometimes called broker research reports or investment research reports, equity research reports are designed to provide a comprehensive snapshot that investors or corporate leaders can leverage to make informed decisions.

Here’s a quick overview of what a standard equity research report covers:

This section covers events, such as quarterly results, guidance, and general company updates.

Upgrades/Downgrades are positive or negative changes in an analyst’s outlook of a particular stock valuation. These updates are usually triggered by qualitative and quantitative analysis that contributes to an increase or decrease in the financial valuation of that security.

Estimates are detailed projections of what a company will earn over the next several years. Valuations of those earnings estimates form price targets. The price target is based on assumptions about the asset’s future supply & demand and fundamentals.

Management Overview and Commentary helps potential investors understand the quality and makeup of a company’s management team. This section can also include a history of leadership within the company and their record with capital allocation, ESG, compensation, incentives, stock ownership. Plus, an overview of the company’s board of directors.

This section covers competitors, industry trends, and a company’s standing among its sector. Industry research includes everything from politics to economics, social trends, technological innovation, and more.

Historical Financial Results typically cover the history of a company’s stock, plus expectations based on the current market and events surrounding it. To determine if a company is at or above market expectations, Analysts must deeply understand the history of a specific industry and find patterns or trends to support their recommendations.

Based on the market analysis, historical financial results, etc., an analyst will run equity valuation models. In some cases, analysts will run more than one valuation model to determine the worth of company stock or asset.

Absolute valuation models : calculates a company’s or asset’s inherent value.

Relative equity valuation models : calculates a company’s or asset’s value relative to another company or asset. Relative valuations base their numbers on price/sales, price/earnings, price/cash flow.

An equity research analyst’s recommendation to buy, hold, or sell. The analyst also will have a target price that tells investors where they expect the stock to be in a year’s time.

What Does an Equity Research Analyst Do?

Equity research analysts exist on both the buy-side and the sell-side of the financial services market. Although these roles differ, both buy-side and sell-side analysts produce reports, projections, and recommendations for specific companies and stocks.

An equity research analyst specializes in a group of companies in a particular industry or country to develop high-level expertise and produce accurate projects and recommendations. Since ER analysts generally focus on a small set of stocks (5-20), they become specialists in those specific companies and industries that they evaluate or follow. These analysts monitor market data and news reports and speak to contacts within the companies/industries they study to update their research daily.

Analysts need to comprehend everything about their ‘coverage’ to give investment endorsements. Equity research analysts must be conversant with the business regulations and regime policies within the country to decide how it will affect the market environment and business in general. The more you understand the industries in detail, the easier it will be for you to decipher market dynamics.

One prevalent aspect of an equity research analyst’s job is building and maintaining valuable relationships with corporate leaders, clients, and peers. Equity research is largely about an analyst’s ability to service clients and provide insightful ideas that positively influence their investing strategy.

EQUITY RESEARCH ANALYSTS:

- Analyze stocks to help portfolio managers make better-informed investment decisions.

- Analyze a stock against market activity to predict a stock’s outlook.

- Develop investment models and provide trading strategies.

- Provide expertise on markets and industries based on their competitive analysis, business analysis, and market research.

- Use data to model and measure the financial risk associated with particular investment decisions.

- Understand the details of various markets to compare a company’s and sector’s stock

Buy-Side vs. Sell-Side Analysts

Although the roles of buy-side and sell-side analysts do overlap in some respects, the purpose of their research differs.

How Do Corporates Currently Access Equity Research?

If you were to Google “equity research reports,” you would not get access to equity research, earnings call transcripts or trade journals. You would, however, discover an unmanageable amount of noise to sift through.

Accessing equity research reports is highly dependent on relationships and entitlements, particularly for corporate teams. Unlike financial firms and investor relations teams, who can access equity research by procuring the right entitlements, corporate teams have a much harder time finding and purchasing high-quality equity research.

If you were to search online for equity research, for example, you would be presented with sub-par options such as:

Some websites allow you to search for research reports on companies or by firms. Some of the reports are free, but you must pay for most of them. Prices range from just $15 to thousands of dollars.

If you want just the bottom-line recommendations from analysts, many sites summarize the data. Nearly all the websites that provide stock quotes also compile analyst recommendations, however, you will only get the big picture and not any of the detailed analysis.

Some independent research providers sell their reports directly to investors. These reports typically include an overview of what a stock’s price could be, plus an analysis of the company’s earnings. These reports often cost less than $100 but can be more.

The majority of equity research is completely unsearchable, which is why AlphaSense’s Wall Street Insights is changing the game for corporations globally. Now, with WSI, corporations can leverage this high-quality research to augment their understanding of specific companies and industries; plus, AlphaSense’s corporate clients can now conduct more meaningful analysis and make more data-driven decisions.

Real-Time Research : Real-Time research is available to eligible users (based on an entitlement) immediately upon publication by the broker. Financial Services users with entitlements are the primary consumers of real-time research, while some Corporate professionals are also eligible. Payment for real-time research is made directly from clients to brokers through trading commissions or hard dollar agreements.

Aftermarket Research : Aftermarket research is a collection of many of the same documents as the real-time collection, but it is available after a zero to fifteen-day delay. Investment bankers, consultants, and corporate users are the primary consumers of Aftermarket research.

What is Wall Street Insights?

Wall Street Insights is the first and only equity research collection purpose-built for the corporate market, providing corporations unprecedented access to a deep pool of equity research reports from thousands of expert analysts.

Through partnerships with Morgan Stanley, Bank of America, Barclays, Bernstein, Bernstein Autonomous, Cowen, Deutsche Bank, Evercore ISI, HSBC, and others, corporate professionals can now access the world’s most revered equity research, indexed and searchable in the AlphaSense platform.

From macro market trends and industry analyses to company deep-dives, the Wall Street Insights content collection provides corporate professionals with a 360-degree view of every market. With the valuable expertise of thousands of analysts on your side, corporate teams can quickly compare insights, validate internal assumptions, and generate new ideas to guide critical business decisions and strategies.

In terms of search and accessibility, Wall Street Insights is the first of its kind. Not only does AlphaSense offer hard-to-find equity research reports, but we also provide a robust and seamless search experience.

What Research Do You Get Access to with WSI?

Get access to the world’s leading equity research with Wall Street Insights. Download the e-book to learn more about equity research from Morgan Stanley, Barclays, Bernstein, Deutsche Bank, and more.

“We are delighted to partner with AlphaSense to expand access to Morgan Stanley’s global research platform,” says Simon Bound, Global Head of Research at Morgan Stanley. We have over 600 publishing analysts covering companies, industries, commodities, and macroeconomic developments across more than 50 countries. Morgan Stanley will bring corporates a unique perspective from our best in class analysts, a global platform, and a collaborative culture that enables us to unravel the most complex market and industry trends.”

How Can Companies Leverage Equity Research?

Discover how the world’s most innovative companies leverage Wall Street Insights to make critical business decisions every day. Download the e-book to read real case studies from a Corporate Development team and a Corporate Strategy team.

“AlphaSense’s corporate users are typically Corporate Strategy, Corporate Development, and Investor Relations professionals. Today, thousands of enterprises rely on equity research to power data-driven decision making. These teams leverage equity research reports to:”

- Create investment ideas

- Monitor peers in real-time (and discover what equity research is being produced about them)

- Model and evaluate companies (for M&A or general benchmarking)

- Dive deep into customers, partners, and prospects

- Get up-to-speed quickly on specific industry trends

- Prepare for earnings season

Ready to explore the world’s leading equity research

An Ultimate Guide to Equity Research

We have all heard the adage that information is power - this could not ring more true than it does with financial planning, investments, and M&A.

With this idea in mind, the function of equity research is to provide high-level information and analysis of a company (or sector) so that other companies can in turn use this information to guide investments and investment banking M&A transactions.

This work is completed by professionals on both the buy-side and the sell-side .

Specifically, on the sell-side, the equity research division is comprised of analysts and investment bankers, while on the buy-side it is usually a division of senior analysts that work directly for the company.

They study small groups of stocks (about ten - give or take) within a specific industry, becoming experts in their domain, and produce formal reports to communicate their findings, namely whether clients should buy, sell, or hold stocks.

In this article we, at DealRoom, will explore investment banking vs. equity research as well as equity research buy-side vs. sell-side. We provide software solutions for deal management for all of them and have some interesting insights to share with you.

Let's start with equity research definition.

What is equity research?

Equity research, often referred to as ‘securities research’, is the process through which investment bankers and other investment firms like asset managers and investment funds invest equities and decide on whether they’re attractive investments.

The people responsible for this process - equity analysts - typically produce 3-6 page documents outlining the prospects for the equity in question in the context of the business, its management, and the wider industry and economic picture.

The bigger the investment bank or investment firm, the more reports that they’ll tend to churn out, and the more detailed the analysis included will be.

Examples of the kind of analysis would include:

- Commentary on how the macroeconomic picture is likely to affect the company

- Operational changes or investments that are likely to affect the company’s performance

- Reviews of the company’s financial statements and explanations of movements therein

- Projections on where the company’s revenues (and share price) are headed.

- Recommendations on whether to buy, hold, or sell the company’s equity.

How is equity analysis conducted?

In a word, research.

And lots of it, both primary (talking with the company’s investment relations team) and secondary (reading industry reports, etc.).

The equity analyst, usually part of a team, looks at scenarios that the company could face, and how that will affect the company’s financials, and by extension, its fundamental valuation.

The aim is to gain a more informed picture of the company’s prospects in the coming period.

Usually this research is conducted on an ongoing basis.

Companies employ investment relations teams to speak with equity analysts on an ongoing basis, and the annual report is always the subject of an investor call, where the CEO answers questions from senior equity analysts from high profile investment banks.

Piecing all of the information together, allows the equity analyst to generate a valuation, which can then be compared with the company’s share price, enabling them to make a statement on whether investors should buy, sell, or hold the equity in question.

What is equity research report

Whether a report is a buy or sell- side equity research report, it is prepared by an analyst and usually include the following:

- An industry research overview, including trends and news related to competing companies

- Company overview, specifically any new information as well as quarterly results

- Investment thesis, which is the analyst explaining why he/she thinks the stock will or will not perform well; the share target price is also included here - many consider this the most important piece of the report

- A forecast of the company’s income, cashflow, and valuation produced from a financial model

- Risks associated with stock

Difference between equity research and investment banking

Equity research sell-side is related to investment banking, though it often does not get the same amount of attention.

The research analysts relay information to the investment banks’ sales-forces and executives.

We will discuss additional differences between these two areas in the career section below.

Roles in equity research

1. sell-side analysts.

The sell-side’s mission is to sell opportunities and/or assets , therefore, the analysts on the sell-side are usually investment bankers trained to study capital markets in the interest of providing investment recommendations to the buy-side (also known as institutional investors) or to the investment bank itself.

For example, the buy-side might use the research to decide whether to buy a specific stock or company.

The sell-side researchers must possess robust research skills and have the ability to produce valuation models and research reports.

Additionally, they must be experts in financial modeling and analysis as their work influences a company’s value and is made public.

Sell-side analysts will also spend time using a finance data room to complete due diligence with the buyer.

2. Buy-side analysts

The buy-side is comprised of asset managers, hedge funds, and institutional investors; its goal is to expand its opportunities, increase its assets, and raise capital .

With this in mind, buy-side equity researchers and analysts study and build financial research on companies.

More specifically, they examine and analyze companies to ensure that risks are limited and future investments stay true to their institution’s overall strategy and mission.

Consequently, it is critical that they track current news and trends in order to craft strong financial models.

Here we should note that buy-side equity research reports differ from sell-side equity research in that they are not for public consumption.

Finally, additional skills buy-side equity researchers should possess include the ability to analyze risks, the ability to produce high quality reports in a timely fashion, the ability to identify and track new business opportunities, and the ability to effectively communicate.

The most famous equity research firms

The following are some top ranked equity research firms:

- Merrill Lynch Bank of America

- Morgan Stanley

- Wells Fargo Securities

- Guggenheim Securities

- Washington Analysis

- Zelman & Associates

- Wolfe Research

- Deutsche Bank

- Goldman, Sachs & Co

- BGC Partners

- BMO Capital Markets Corp.

- Sberbank CIB

Things to consider when hiring an equity research firm

Here we must return to the notion of information being powerful and valuable.

Equity research can allow companies to gain capital and entice new buyers and/or investors.

Equity research firms can also help companies generate new ideas and identify potential red flags.

When you are looking to hire an equity research firm to address these needs or others, the following are top considerations:

- The background, training, and skills of the research analysts

- The quality of the firm’s research reports

- The analyst’s ability to understand the type of information that is relevant to you as the client

How to get into equity research

Equity research is an excellent entry point for people from a non-finance or economics background to enter the world of investments.

The ability to research, write well, and generate solid conclusions - arguably more the strengths of a good liberal arts major than an accounting graduate - are extremely important skills for the equity analyst.

A short course on valuations or corporate finance can allow them to quickly fill the gaps in quantitative areas where they’re lacking.

Whether you’re from a finance or economics background or not, the best way to get into equity research is by proving your ability.

Although the blue chip investment banks rarely if ever stray from the summer internship - junior analyst route, smaller investment firms will be happy to receive a well-written equity report which shows strong valuation and reasoning skills.

Use SeekingAlpha.com to see what some of the best equity research reports out there look like. And be better.

Tips here include:

- If you can find a stock that is highly undervalued or overvalued and your take on the stock goes against the grain, go for it. Investment firms will be more interested in something that changes their mindset than “Apple’s revenue is going to grow 10%, not 8%...”

- Use plenty of charts and tables that reinforce your argument. An article of 1,000-2,000 words should have at least five informative charts and tables. FYI - a stock chart of the company is not particularly informative for an equity research report, unless you’re using it to make an argument about how the stock has performed against its peers.

- Don’t be afraid to go more detailed than you think is required. Ultimately, your aim is to show the investment firm that you know financial metrics, how they work, and the story they’re telling about a company. But if you are adding it, it has to be correct (there’s a good chance SeekingAlpha’s editors won’t be long in telling you if they’re not!).

Repeat these steps and hone your equity research and valuation skills.

After two or three, you should already have something to send to senior research analysts at investment firms, and begin the conversation about how you can join their ranks.

Careers in equity research vs. investment banking

Careers in capital markets tend to fall into the two categories of investment banking and equity research.

Equity researchers must be strong research paper writers since they communicate critical information through reports, as well as skilled financial analysts.

The abilities to stay organized and work in a timely manner are also essential - in many regards, equity research can be seen as a highly structured career.

This does not mean, however, contrary to the stereotypes of analysts vs. investment bankers, that equity researchers and analysts do not need to possess strong social and oral communication skills.

In fact, the best equity research analysts meet with clients and help facilitate meetings; therefore, they must be able to communicate effectively both on paper and in person.

Oftentimes, on larger teams, the senior team members spend more time meeting with clients and companies, while the junior team members tend to spend more time working on financial models.

There is a general consensus in the industry that financial analysts tend to face lower levels of stress and work fewer hours than investment bankers.

On average, financial analysts are recorded as working 12 hour days , while investment bankers are usually reported as working 16 hour days .

For example, during due diligence , investment bankers may spend 50 plus hours a week solely inside the finance data room.

Read also

How to find the right data room for investment banking.

Of course, buy-side or sell-side equity research analysts do deal with stress, as one does in any job, but reports show the job is generally less stressful than the constant high stress endured by investment bankers.

Generally, the most stressful time for equity researchers is during earnings season.

Additionally, M&A deals will certainly create longer hours and higher stress for these individuals.

To pursue a career as a research analyst, one must have at least a bachelor’s degree, although MBAs are often preferred.

To truly progress in this career, one should earn the Chartered Financial Analyst certification (CFA), which requires at least three years experience in the field.

Difference between equity research and private equity

Another two industries that often get confused is equity research and private equity .

The difference is that equity research consists of finding the valuation of the listed companies on stock exchanges, while private equity is researching and analysing the private companies and interpreting the results.

An equity research analyst would speak with firm’s traders and brokers for discussing and sharing investment recommendations for clients.

Where as a private equity analyst uses financial modeling techniques and a private equity software and CRM to research and analyse private companies.

Just like with banking, private equity analysts also use a private equity due diligence checklist template to work with their clients and collect information during diligence.

While equity research produces valuable information, we would be remiss not to acknowledge that the industry has faced some criticism in recent years, which has led to reports of a decline in industry practitioners.

However there are some sources that predict the number of jobs in this career will actually increase faster than other careers in the next few years.

Whatever the number of practicing equity researchers, it is important to note that one should not rely solely on equity reports when making major decisions as analysts can both make mistakes and exaggerate or compose information in ways that benefit their customers and/or the market.

For instance, the sell-side might work to frame its subject in a favorable light to potential buyers.

While one should be aware of these trends and potential red flags, equity research is still a substantial part of our business world, specifically M&A.

.jpeg)

Get your M&A process in order. Use DealRoom as a single source of truth and align your team.

What is an Equity Research Report?

One of the most powerful tools at investors’ disposal is equity research reports. Wall Street firms employ some of the sharpest minds in the industry who study companies with publicly traded stocks. These analysts delve into every aspect of the company, from its financial statements to its management team and competitors. Equity research reports provide solid analysis and the opinions of the analysts who follow the companies and their stocks extremely closely.

What Is an Equity Research Report?

An equity research report is a detailed report written by an analyst at a sell-side firm or independent investment research firm that analyzes the company’s business and finances and gives the analyst’s opinion of the company’s prospects and future stock price.

Analysts are experts in the companies’ businesses, finance, and industries they follow. They research a company’s financials, performance, and competitive landscapes. They also create models to predict metrics like future earnings per share, sales, and a target price for the stock.

Analysts keep a close eye on every move of the companies they follow and update their equity research reports at least once a quarter after the company issues its quarterly earnings report. If significant material changes occur mid-quarter, the analyst will write an update to their research report in a flash report.

An example of an equity research report is a report on Apple written by a sell-side analyst from Argus. This report includes the analyst’s analysis and opinions about the company’s financials and future revenue and earnings predictions. The report also provides the analyst’s target price estimate and rating.

Important Components of a Typical Equity Research Report

The typical equity research report includes components that dig into the company’s financials, industry landscape, risks, and other vital aspects that can materially affect the company’s future business performance and stock price.

Recent Results & Company Announcements

Shortly after a company announces its quarterly results, an analyst will issue a new equity research report. This report will include an analysis of the recent quarterly results, including EPS, sales, and various financial metrics like EBITDA and profit margins.

When releasing quarterly results, a company often makes announcements in a press release or through a conference call between management and the analyst community. The equity research report will include an analysis of these company announcements.

Organizational Overview and Commentary

An equity research report typically summarizes the company’s organizational structure. This summary outlines the management structure and the company’s major divisions.

If the company makes any significant structural changes, such as appointing a new CEO or shutting down a division, the analyst will discuss the implications of these changes in the equity research report.

Valuation Information

Perhaps the most impactful part of an equity research report is the valuation analysis provided by the research analyst. The analyst provides an overview of the company’s performance through this analysis.

The valuation information included within an equity research report includes margin analysis, EPS and sales estimates, the stock’s target price estimate, and other valuation and financial metrics calculated through a deep dive into the company’s financial statements.

An analyst uses a company’s reported results and their own research into the company’s operations and the industry to calculate various estimates. The most prominent estimate is the EPS estimate, the analyst’s estimate for earnings per share for future quarters and fiscal years. Analysts also calculate forecasts for sales, margins, and other financial metrics.

Many equity brokerage reports include a target price estimate, which is a short-term estimate for the stock’s price. An analyst may also issue a rating for the company’s stock, such as buy, sell, or hold.

Financial Histories

An equity research report typically contains financial data going back several years on both a quarterly and fiscal year basis. The analyst uses this financial data to perform an analysis of the company’s financial health and create projections.

While research reports typically do not include complete financial statements, the reports often include important line items, valuation ratios, and financial metrics in tables which the analyst will reference in the commentary.

Evaluating trends is a big part of an analyst’s job; equity research reports discuss these trends. The report includes trends like year-over-year and quarter-over-quarter growth rates for metrics such as EPS, sales, and margins.

The trend analysis gives an excellent overview of the growth of the company. For example, suppose sales significantly grew year-over-year, but EPS was stagnant. In this case, the company may be facing higher expenses, and the analyst will dive into the financial results and attempt to uncover the cause of the problem.

Many equity research reports include a section that describes the risks the company and investors may encounter. These risks may include economic headwinds, an increasingly competitive landscape, and company-specific risks like failed product launches or management changes.

In-Depth Industry Research

While analysts are experts on the companies they follow, they are also experts on the companies’ industries. Equity research reports include the analyst’s evaluation of the industry trends, the competitive landscape, and how the company’s prospects align with changes within the industry.

Buy Side vs. Sell Side: What Role Do Both Sides Play?

Buy-side and sell-side firms play different roles in financial markets, and it is vital to understand the role of each.

Buy-side firms, such as hedge funds, pension funds and asset managers, have money to invest. They buy stocks and other investments and are fiduciaries of their client’s money. Sell-side firms, such as brokerage houses, sell investments to their clients, including buy-side firms.

Sell-side firms employ analysts that write equity research reports. The sell-side firms provide these equity research reports to their buy-side clients. Buy-side firms use these equity research reports to help make investment decisions.

Other Types of Research Reports

Analysts produce several types of equity research reports. These include initiation of coverage reports, quarterly results reports, flash reports, and sector and industry reports.

Initiating Coverage Reports

When a sell-side firm begins covering a stock, the first analyst report is called an initiation of coverage report. This report gives the analyst’s first take on a company and its stock. Many investors pay attention to initiation of coverage reports because they provide a fresh perspective on a stock.

Quarterly Results Reports

After a company reports its earnings, an analyst will issue a new research report incorporating recent results. The analyst discusses the results and what went wrong and right in the last quarter. The analyst will also calculate new financial projections based on the results, company guidance, and management commentary.

Related Resource: Portfolio Management: What it is and How Visible Can Help

Related Resource: How To Write the Perfect Investor Update (Tips and Templates)

Flash Reports

Analysts issue flash reports when significant material changes involving the company, or the company’s industry, occur. An analyst may issue a flash report if the company’s CEO resigns, the company initiates a significant stock buyback program, or other major news breaks. In a flash report, the analyst will discuss the relevant news and how it may impact the company and its stock price.

Sector Reports

Sell-side firms also issue sector reports. The sector reports will dive into trends within the sector, a high-level analysis of the top companies in the sector, and past and future predicted performance of the stocks within the sector.

Industry Reports

Like sector reports, industry reports discuss the competitive landscape and major players within an industry. An industry is a subset of a sector. For example, the technology sector includes the semiconductor, personal computer, and cloud computing industries. Industry reports focus on a narrower industry rather than a broader sector.

Equity Research Report Example

Although each sell-side firm has a unique style for presenting analysts’ research in equity research reports, most contain similar types of information. Let’s conclude our discussion of equity research reports by looking at a recent Microsoft report written by Argus analyst Joseph Bonner after the company issued its fourth quarter 2022 results.

The report starts with several tables of key statistics, such as financial and valuation ratios and the analyst’s investment thesis. The table also includes the analyst’s rating and target price for the stock.

The report continues with the analyst’s investment thesis for Microsoft stock. This thesis briefly explains the analyst’s rationale for his Buy rating on MSFT stock.

A section detailing recent developments within the company, which the analyst derives from the company’s earnings report and conference call, is followed by a look at select financial data. An analysis of growth rates for several key metrics like revenue and margins leads to an overview of risks that investors of Microsoft may face.

Equity research reports offer investors a great way to harness the power of Wall Street analysts. These analysts live and breathe the companies they follow. Investors can use their expertise to advise them in the investing process.

Equity Research Report Template

Demonstrate transparency, accountability, and provide sound financial recommendations to investors with this equity research report template..

- Design style modern

- Colors light

- Size Letter (8.5 x 11 in)

- File type PNG, PDF, PowerPoint

- Plan premium

Equity research is the process of analyzing a publicly traded company to determine its investment potential. It provides investors with detailed financial analysis and recommendations on whether to buy, hold, or sell a particular investment. Equity research can be conducted by individuals working in an investment bank's equity research division, by employees at a buy-side institution such as a mutual fund or pension fund, or by independent analysts. The primary purpose of equity research is to help investors make informed decisions about where to allocate their capital. Banks often use equity research to support their investment banking and sales and trading clients by providing timely, high-quality information and analysis. Portfolio managers also use equity research at buy-side institutions to build and manage their portfolios. The work of equity researchers is divided into three main categories: company analysis, sector analysis, and stock analysis. In company analysis, equity researchers examine a company's financial statements and track its historical performance. They also assess a company's competitive landscape and determine its prospects. In sector analysis, equity researchers look at the overall industry in which a company

Read more >

Explore more

- Search Search Please fill out this field.

- Career Advice

A Day in the Life of an Equity Research Analyst

:max_bytes(150000):strip_icc():format(webp)/picture-53712-1421087725-5bfc2a93c9e77c0026b4cc1f.jpg)

Responsibilities of an Equity Research Analyst

Working as an equity research analyst requires multiple talents and skills and can make for a rewarding career. These professionals research public companies and come up with recommendations for investors about whether to buy, sell, or continue holding certain stock. Analysts are usually assigned a particular group of companies, in a specific industry, for which they are responsible.

Brokerage firms (known as the sell-side , since they provide the research to their customers interested in making investments) employ equity research analysts. Mutual funds, hedge funds , and others that manage their clients’ money and invest on their behalf, known as the buy-side , also employ equity research analysts, who make investment recommendations to their portfolio managers. But what do these analysts actually do on an everyday basis?

Key Takeaways

- Equity research analysts research public companies and come up with recommendations for investors about whether to buy, sell, or continue holding certain stock.

- Both brokerage firms on the sell-side as well as funds on the buy-side both employ equity research analysts.

- On a daily basis, an equity analyst keeps a pulse on the stock market and company-specific news that could affect returns, updates colleagues on these changes, and issues reports.

Catch up and Keep up With the News

Typically, equity research analysts start their day pretty early, before the nine-to-five grind begins, and keep abreast of what’s going on with the companies they cover. They do this by keeping up with wire services and other news sources, and also tracking global economic and market developments and trends. Throughout the day, analysts stay on top of any breaking news that impacts the stock markets and the companies they cover, getting input from both industry-specific and general news sources. On particularly volatile market days, this can make for quite a roller-coaster ride.

Update Colleagues

Another aspect of the equity research analyst's job is to inform and update colleagues on the sales side with recommendations and insight on various stocks (buy, sell, or hold ratings) so that brokers can better explain those choices to clients. This requires critical and creative thinking, strong communication skills, and the ability to quickly and accurately synthesize data from a number of different sources and present that information in an accessible way. Analysts need to anticipate and be prepared to answer questions their sales-side colleagues may have about certain stocks, and they might also need to update senior analysts about actions taken on various stocks.

Throughout the day, analysts may have to meet with colleagues, such as their supervisors, to touch base and exchange notes and ideas.

Issue Reports and Keep Track of Companies Covered

Analysts come up with forecasts and earnings estimates for the companies they cover. During earnings season , as companies release their quarterly figures, analysts come out with their take on how the company has performed and might also update and tweak their earnings models for particular companies. In addition to following general news and economic events, analysts track any specific developments that could affect the value of the stock of any company in their particular group.

For instance, if a company announces a new product that could impact its earnings, analysts assess this news and include their findings in the reports they produce. Analysts might need to update these reports on a daily basis.

Keep in Touch With Company Management

Frequently, equity research analysts meet with the management of the companies they cover so as to get the most timely information in order to update their earnings estimates and reports. They could get such updates in person or on conference calls. While management provides such input to equity research analysts, executives have to be careful not to share any information with analysts that might impact the company's stock price and that isn’t available to the public. That would give an unfair advantage to the analysts.

The Securities and Exchange Commission (SEC) has issued rules relating to such fair disclosure practices, meaning analysts have to tread carefully with management. Some companies tend not to cooperate with analysts they feel haven’t treated them fairly in reports. Analysts need to provide investors with an accurate picture of a company’s potential, but they also don’t want to alienate a company's management and risk losing access to important information.

Analyst Opportunities

In the wake of misleading research issued during the dot-com boom, the SEC enforced regulatory action meant to curtail the practices of investment banks that used research reports more as an avenue to generate investment banking business than as a means to provide accurate and objective information for investors. This led investment banks to scale back on their equity research needs. However, while sell-side roles at large investment banks have declined, there are still opportunities for equity research analysts, particularly with smaller research firms and boutiques.

The Bottom Line

Analysts typically spend more time than average at their work but don’t need to put in the grueling hours associated with investment banking. In general, analysts keep up with news, update their colleagues, catch up with the companies they cover, issue and update company reports, and attend meetings in their day-to-day work. While the job of an equity research analyst has lost some allure in recent years, as firms have cut back on the number of analysts they employ, it remains a competitive field.

U.S. Securities and Exchange Commission. " Fact Sheet: Regulation Fair Disclosure and New Insider Trading Rules ."

U.S. Securities and Exchange Commission. " Analyzing Analyst Recommendations ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-167326832-5c3762a446e0fb000128fb6a.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Penn Libraries FAQ

- Penn Libraries

Q. How do I find analyst reports (investment bank research)?

- Exhibitions

- Fisher Fine Arts

- General Information

- Phased Library Services

- Rare Books & Special Collections

- Systematic Reviews

- University Archives & Records Center

Answered By: Lippincott Library Last Updated: Apr 21, 2024 Views: 170301

Use LSEG Workspace (formerly Refinitiv).

- To find analyst reports (also known as sell-side, broker, or equity research reports) for a specific company, search for that firm's ticker symbol or name in the top search box. Then, on the News & Research menu, click on Company Research . Use filters near the top of the page to refine your search.

- To screen for analyst reports based on a set of criteria, type ADVRES in the search bar and select the Research Advanced Search app, or click on Research in the main menu. then, click on Advanced Research . You can filter for reports by industry, geography, contributor, keywords, and more.

Note: LSEG Workspace has a 150-page daily limit for viewing and downloading research content. This limit is in lieu of retail prices listed on reports and resets at 12:00 AM Eastern Time daily.

Bloomberg (see access details ) contains some analyst reports.

- Type your company's ticker symbol, then hit the yellow EQUITY key, then type DSCO and hit the green GO key.

- To find reports by industry or keyword, type RES and hit the green GO key.

Morningstar equity research reports and analyst cash flow models can be found in PitchBook .

Hoovers contains some analyst reports as well.

- Type in a company name and select the company you want.

- Scroll down the screen; if available, analyst reports appear under Advanced on the left side.

- Share on Facebook

Was this helpful? Yes 0 No 0

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Asset Management Forum AM

Breaking into buy-side equity research - my experience

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

- Share via Email

This will be my very first post to this forum, which is admittedly dedicated more to banking and private equity rather than investment research. Given the dearth of content on buy-side equity research (understandable given the small size/low turnover of the industry), I have decided to share my experience breaking into buy-side research from the sell-side.

DISCLAIMER Although I am personally a devout member of the value camp, I will be talking about long-term oriented fundamental investing in general. So when I write “buy-side research”, know that I will be referring to that instead of quarter-trading hedge funds (think the Citadel hedge fund family, Balyasny, etc) and the like.

Why would you want to work in buy-side equity research?

I can't speak for all shops, but in general, the work environment is very intellectually stimulating and the organization is very small and flat. Research teams in general number at most in the tens of people. Your work is about finding the truth the market doesn't see rather than trying to close the next deal. The market is the ultimate determinant of whether you are correct in the long-run, not whether or not you can trick the next idiot to buy your garbage (I’m very cynical about the sell-side). I will not be talking about life on the buy-side, because BlackHat wrote a very good post about it a while ago, and it still rings true today. I will note that his perspective is from that of a hedge fund, likely a fundamental shop (maybe a Tiger Cub), so there will be some differences between our comments.

If you like to think and analyze, to have a ton of autonomy, to have very reasonable work hours, to be very well compensated, and to work with a small team of smart, dedicated people, then buy-side research may be the right place for you (you results may vary).

What is my background?