- Financial Accounting Tutorial

- Financial Accounting - Home

- Rectification of Errors

- Capital and Revenue

- Final Accounts

- Provision and Reserves

- Measurement of Business Income

- Bills of Exchange & Promissory Notes

- Inventory Valuation

- Analysis of Changes in Income

- Accounting for Consignment

- Joint Venture

- Non-Trading Accounts

- Single Entry

- Investment Account

- Insolvency Accounts

- Stock Exchange Transactions

- Accounts of Private Individuals

- Co-Operative Societies

- Insurance Claims

- Government Accounting

- Contract Account

- Departmental Accounting

- Voyage Accounting

- Royalty Accounts

- Financial Accounting Resources

- Financial Accounting - Quick Guide

- Financial Accounting - Resources

- Financial Accounting - Discussion

- Selected Reading

- UPSC IAS Exams Notes

- Developer's Best Practices

- Questions and Answers

- Effective Resume Writing

- HR Interview Questions

- Computer Glossary

Financial Accounting - Royalty Accounts

Royalty is payable by a user to the owner of the property or something on which an owner has some special rights. A royalty agreement is prepared between the owner and the user of such property or rights. If payment is made to purchase the right or property that will be treated as capital expenditure instead of a Royalty.

Payment made by the lessee on account of a royalty is normal business expenditure and will be debited to the Royalty account. It is a nominal account and at the end of the accounting year, balance of Royalty account need to be transferred to the normal Trading and Profit & Loss account. Royalty, based on the production or output, will strictly go to the Manufacturing or Production account. In case, where the Royalty is payable on sale basis, it will be part of the selling expenses.

Types of Royalties

There are following types of Royalties −

Copyright − Copyright provides a legal right to the author (of his book/s), the photographer (on his photographs), or any such kind of intellectual works. Copyright royalty is payable by the publisher (lessee) of a book to the author (lessor) of that book or to the photographer, based on the sale made by the publisher.

Mining Royalty − Lessee of a mine or quarry pays royalty to lessor of the mine or quarry, which is generally based on the output basis.

Patent Royalty − Patent royalty is paid by the lessee to lessor on the basis of output or production of the respective goods.

Basis of Royalty

In case of the patent, publisher of the book pays royalty to the author of the book on the basis of number of books sold. So, holder of patent gets royalty on the basis of output and the mine owner gets royalty on the basis of production.

Important Terms

Following are the important terms, which are used in Royalty agreements −

A periodic payment, which may be based on a sale or output is called Royalty. Royalty is payable by the lessee of a mine to the lessor, by publisher of the book to the author of the book, by the manufacturer to the patentee, etc.

Landlords are the persons who have the legal rights on mine or quarry or patent right or copybook rights.

An Author or publisher; lessee or patentor who takes out rights (usually commercial or personal rights) from the owner on lease against the consideration is called tenet..

Minimum Rent

According to the lease agreement, minimum rent, fixed rent, or dead rent is a type of guarantee made by the lessee to the lessor, in case of shortage of output or production or sale. It means, lessor will receive a minimum fix rent irrespective of the reason/s of the shortage of production.

Payment of royalty will be minimum rent or actual royalty, whichever is higher for example −

M/s Hyderabad publication printed a book on Java on the minimum rent of Rs. 1,000,000/- per annum royalty being payable @ Rs. 20 per book sold. In the first year of publication, Hyderabad publication sold 75,000 copy of the books and in the second year, number of sold books fell down to 45,000 only. Amount of royalty will be payable as under −

Shortworkings

Difference of minimum rent and actual royalty is known as shortworkings where payment of Royalty is payable on the basis of minimum rent due to shortage in the production or sale. For example, if calculated royalty is Rs. 900,000/- as per sale of books based on the above example, but royalty payable is Rs. 1000,000 as per minimum rent, shortworking will be Rs. 100,000 (Rs. 1,000,000 – Rs. 9,00,000).

Ground Rent

The rent, paid to the landlord for the use of land or surface on the yearly or half yearly basis is known as Ground Rent or Surface Rent .

Right of Recouping

It may contain in the royalty agreement that excess of minimum rent paid over the actual royalty (i.e. shortworkings), may be recoverable in the subsequent years. So, when the royalty is in excess of the minimum rent is called the right of recoupment (of shortworkings).

Right of recoupment will be decided for the fixed period or for the floating period. When the right of recoupment is fixed for the certain starting years from the date of royalty agreement, it is said to be fixed or restricted. On the other hand, when the lessee is eligible to recoup the shortworkings in next 2 or 3 years from the year of its commencement, it is said to be floating.

Shortworking will be shown on the asset side of Balance sheet up to allowable year of recouping after that it will be transferred to profit & loss account (after expiry of allowable period).

Lease Premium

An Extra payment in addition to royalty, if any, paid by lessee to lessor is called Lease premium and will be treated as capital expenditure and it will be written off on yearly basis through profit and loss account as per the suitable method.

TDS (Tax Deducted at sourceSource)

If there is an applicability of TDS (Tax deducted at source) as per Income Tax Act, lessee will make the payment to lessor after deducting TDS as per applicable rate and lessee is liable to deposit it to the credit of Central Government. Amount of royalty will be gross amount of royalty (inclusive of TDS), that will be charged to profit and loss account.

For example, if royalty amount is 1,000,000/-& rate of TDS is 10%, then lessee will pay Rs. 900,000/- to lessor. Amount of royalty charge to profit and loss account will be Rs. 1,000,000/- and balance amount of Rs. 100,000/- will be deposited in the credit of central Government account.

Stoppage of Work

Sometime, there may be stoppage of work due to conditions beyond control like strike, flood, etc. in this case, minimum rent is required to be revised as provided in the agreement.

Revision of the minimum rent will be −

- Reduction of minimum rent in the proportion of the stoppage of work;

- On the basis of fixed percentage; or

- By a fixed amount in the year of stoppage.

Sometime, landlord or lessor allows lessee to sublet some part of the mine or land as a sub-lessee. In this case, lessee will become lessor for sub lessee and lessee for main landlord.

In such a case, as Lessee, he will maintain the following books of accounts −

Accounting Entries

Illustration.

From the below given information’s, please open prepare the necessary accounts in the books of M/s Black Diamond Limited.

Company leased a colliery on 01-01-2010 at a minimum rent of Rs. 75,000.

Royalty Rate@ Rs. 1/- per ton.

Right of recouping of shortworkings is restricted to first 3 years.

Output for the first four years of the lease was 40,000, 65,000, 1,05,000, and 90,000 tons respectively.

Solution −

Analytical Table

In the books Books of M/s Black Diamonds Ltd

Royalties Account

Landlord Account

Shortworkings Account

Double Entry Bookkeeping

learn bookkeeping online for free

Home > Bookkeeping Basics > Royalties in Accounting

Royalties in Accounting

The owner of a long term asset such as for example a patent or copyright can issue a licence to another party allowing then to use the asset in return for payments referred to as royalties. The owner of the asset who issues the licence and receives the royalty is known as the licensor. The person who makes use of the asset and pays the royalty is known as the licensee.

Royalties can take many different forms and the calculations can be complex however, fundamentally they depend on the amount to which the asset is used by the licensee. For example, a publisher might pay a royalty to an author for each copy of their book sold, or a manufacturer might pay a royalty to an inventor based on the revenue earned from the sale of their product.

Royalty Payment Accounting Example – Licensee

The royalty payments to the developer are to be made in two stages.

- An advance royalty payment of 5,000 when the agreement is signed.

- A regular payment of 8.00 for each game sold.

Advance on Royalties

The advance royalty payment of 5,000 is paid on the signing of the royalty agreement and is classified as a prepayment in the accounting records of the publisher (licensee).

The following bookkeeping journal is used to record the royalty advance.

Since the developer earns 8.00 for each game sold, the 5,000 represents a prepayment of 625 (5,000/8) sales. From the publishers point of view this is a prepayment and is included as a balance sheet current asset until the royalty is earned by the developer when the game is sold.

Regular Royalty Payments

Suppose at the end of the first accounting period 500 video games have been sold. The royalty due to the developer is 4,000 (500 x 8.00), and the publisher posts the following journal entry to record the payment.

The developer has now earned royalties of 4,000 and the publisher transfers this from the prepayment account (advance on royalties) to the royalty expense account. The balance on the advance on royalties account is now 1,000.

During period 2 a further 600 games are sold and the royalty due to the developer (licensor) is 4,800 (600 x 8.00). The publisher (licensee) now posts the following bookkeeping entry.

The royalty expense for the period is 4,800, since the balance on the advance payments account is 1,000, the developer is owed a further 3,800. If the amount is paid after the period end (which it is in this example), it is shown as a balance sheet current liability account under the heading royalties payable. The balance on the advance payments account is now zero.

Stepped Royalty Payments

Stepped royalties are simply a method of calculating the royalty due. A stepped royalty arrangement changes the royalty rate at different levels of sales.

In the above example the royalty due was 8.00 for each video game sold. Under a stepped royalty arrangement the rate might have been 8.00 for the first 1,000 games sold and 9.00 thereafter. In this case the royalty due would have been calculated as follows.

The total sales are 1,100, during period 2 the sales reach the 1,000 step and the royalty rate is increased to 9.00 per sale for the final 100 units sold during the accounting period.

Royalty Income Accounting Example – Licensor

The licensor receives royalty income from the licensee. In the above example, the developer was the licensor and received a royalty at the agreed rate from the publisher (the licensee).

Using the same information from the example above, the developer would make the following bookkeeping entries to record the transactions.

Advance on Royalties Income

The developer receives the royalty advance of 5,000 from the publisher

Since the royalty has not yet been earned, the advance is recorded in a balance sheet (unearned royalties) account representing a current liability to the publisher until the game has been sold in sufficient quantities to earn the royalty.

Regular Royalties Income

In period 1, 500 copies of the game are sold and the developer earns 4,000 in royalties and makes the following posting.

The developer has earned 4,000 and makes the entry to transfer this amount from unearned royalties in the balance sheet to the royalty revenue account in the income statement.

In period 2 a further 600 games are sold and the developer makes the following entry.

The royalty revenue for the period is 4,800, since the balance on the unearned royalty account is 1,000, the developer is owed a further 3,800. If the amount is paid after the period end (which it is in this example), it is shown as a balance sheet current asset account under the heading royalties receivable. The balance on the unearned royalty account is now zero.

About the Author

Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

You May Also Like

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

I lived in South Africa for well over a decade, but I grew up the American Midwest – and I have always taken music seriously. I’ve explored everything from country music to rap, and a lot of independent music. So, at Christmas lunch last year, when one friend said to another, “Rodriguez is coming to South Africa again,” and everyone at the table gasped in excitement, I was caught off guard. Little did I know that the story behind this recording artist would teach me about the importance of royalty accounting.

“Who is Rodriguez?” I asked, assuming he was a minor South African musician.

“What?” Shocked and slightly horrified faces stared back at me. “You don’t know Rodriguez?”

As is turns out, Sixto Rodriguez is a Detroit-based folk singer who released a couple of albums in the early 70s. Few people in the States have ever heard of him; fewer still bought the music when it was originally released. But in South Africa, this guy was bigger than Elvis or the Rolling Stones. His songs were anthems for entire generations. He was a superstar – and he never knew it.

Why? Because he never received the royalty payments he was due, nor did he understnand the importance of royalty accouting.

And that means he stopped making music. Only when a handful of South Africans tracked him down in the late 1990s did he discover his legendary status. As the Oscar-winning documentary Searching for Sugarman explored, it seems likely that this obscure ex-musician living barely above the breadline is owed millions in back royalty payments.

Royalties and the Basics of Royalty Accounting

Payments to songwriters often take the form of royalties. These payments occur when songwriters do not have the means to produce and distribute their own music. Even if they could distribute their music on their own, it is understandably difficult for a single entity to keep track of a song’s sales and the amount of radio play it receives. Record companies tend to take over this role. Because the sales of any song are so variable, songwriters get a cut based on the total income earned. Hance the imortance of royalty accoutning.

These are not ad hoc payments based on what the record company feels like sharing; instead, legal contracts bind the relevant parties and strictly govern royalty payments. These agreements outline the who, what, when, where, why and how of any royalty system. Depending on the industry, these are largely standard, with specifics changing according to individual needs. Contracts cover every aspect of payments, such as whether payments are distributed monthly or quarterly and whether payments are based on gross or net revenues. With all the challenges involved in tracking sales across the globe and the importance of royalty accounting, these contracts must include specifics.

There are several different accounting methods for determining royalty payments. Although agreements between parties largely determine payments, every industry tends to work with one consistent accounting and payment disbursal method. Payments due to a songwriter, author, or other intellectual property owner are usually calculated according to one of the following systems:

Gross Revenue Payment – The amount due to the songwriter is a percentage of the total income before taking any other expenses into account.

Net Revenue Payment – Songwriters receive a check based on the income earned after expenses. For example, in the publishing world, writers are paid according to sales of a title only after the cost of printing and marketing have been paid.

Price Per Unit Payment – These are flat amounts paid for a song or a book within a specific format. Songwriters are often due a flat rate amount for each CD sold, and a different amount every time a song is played on the radio.

Minimum Rent Payments – This means a minimum amount is paid per month, even if no sales are made. If sales exceed the minimum, a greater amount may be paid.

Accounting Columns and Considerations

Any royalty agreement or rights contract will include the method of accounting and an outline of all the considerations that would augment or detract from payment. Some examples are:

Royalty Advances – These payments are given to an artist before they are actually earned, meaning that the artist’s percentage of sales then goes towards this amount until the amount is paid off.

Monthly Royalty Expense – Typically, royalty payments accumulate over a few months. Record companies account for the payments owed to their artists by listing monthly royalty expenses within their royalty accounting program.

Subsidiary Rights Income – Not all record companies operate internationally, so they often license companies based in other countries to produce and/or distribute music on their behalf. Payments from these subsidiaries must be included within the accounting.

Author’s Charges – These count against royalty payments and include things like proofreading expenses, indexing, or perhaps the photo shoot a production house paid for to market an artist.

Reserves – These are amounts held back at the author’s or publisher’s discretion to insure against future sales.

Joint Accounting – This occurs when there are disparate sales between multiple albums or books created by the same songwriter or author. Although individual titles are often accounted individually, it is sometimes more economical to merge the accounts.

These days most of this accounting, from the type of payment used to the date of payment, is fully automated. Depending on the size of the companies involved, it can be run by a single person or an entire department. Many of these processes are now online, so artists can check their figures and sales on their own. The main thing is that all parties are comfortable with the system, the disbursement of payments, and understand the importance of royalty accounting.

So What About Rodriguez?

As the documentary Searching for Sugarman started to gain a following, a new generation became interested in Rodriguez’s music. His albums have been re-released and are available on iTunes – and, for the first time, he has started receiving royalty payments for his music. But what about all those licensed releases sold in South Africa years ago?

The South African distributors sent checks to the Rodriguez’s record company, and the checks were cashed – only, Rodriguez never received his cut. When he first came to South Africa and realized the extent of his popularity, he didn’t want to know about the money from old sales. But after 15 years of consideration, he is now pursuing the case in court. After all, someone was earning – just not him. Now it is a matter of forensic royalty accounting and examining the royalty agreements and contracts that were initially put in place.

After diving into the world of Rodriguez, I am sold. His music is brilliant, and his story is really quite powerful. The other night, I enjoyed an informal dinner at a friend’s house and, for the first time, I recognized a Rodriguez song playing. The album “Cold Fact” is all I want for Christmas – and fortunately, Rodriguez will now get his royalty payment from my enjoyment. Hopefully one day he will get all the money owed him for old South African sales. At the very least, his story should provide a warning to production houses who want to hide sales from their artists or to artists who really don’t understand the importance of royalty accounting.

Request A Demo

" * " indicates required fields

- AuthorPortal.com

- Case Studies

- Digital Rights Management

- Glossary of Terms

- Industry News

- Instruction

- Music Royalties

- Press Releases

- Rights Management

- Royalty Accounting

- Royalty Accounting Software

- Royalty Management Software

- Royalty Software

- Royalty Statements

- Technical Enhancements

- The Royalty Management Life Cycle™ Model

- Uncategorized

Sidebar Search

- Search Search Please fill out this field.

What Is a Royalty?

Understanding royalties, types of royalties, special considerations, examples of royalties, royalties faqs, the bottom line.

- Corporate Finance

What Is a Royalty? How Payments Work and Types of Royalties

:max_bytes(150000):strip_icc():format(webp)/AmyImage-AmyDrury-d6b6143c6d5c49a0add2201e25969457.jpg)

A royalty is a legally binding payment made to an individual or company for the ongoing use of their assets, including copyrighted works, franchises, and natural resources. An example of royalties would be payments received by musicians when their original songs are played on the radio or television, used in movies, performed at concerts, bars, and restaurants, or consumed via streaming services. In most cases, royalties are revenue generators specifically designed to compensate the owners of songs or property when they license out their assets for another party's use.

Key Takeaways

- A royalty is an amount paid by a third party to an owner of a product or patent for the use of that product or patent.

- The terms of royalty payments are laid out in a licensing agreement.

- The royalty rate or the amount of the royalty is typically a percentage based on factors such as the exclusivity of rights, technology, and the available alternatives.

- Royalty agreements should benefit both the licensor (the person receiving the royalty) and the licensee (the person paying the royalty).

- Investments in royalties can provide a steady income and are considered less risky than traditional stocks.

Investopedia / Jessica Olah

Royalty payments typically constitute a percentage of the gross or net revenues obtained from the use of property. However, they can be negotiated on a case-by-case basis in accordance with the wishes of both parties involved in the transaction.

An inventor or original owner may choose to sell their product to a third party in exchange for royalties from the future revenues the product may generate. For example, computer manufacturers pay Microsoft Corporation royalties for the right to use its Windows operating system in the computers they manufacture.

Payment may be nonrenewable resource royalties, patent royalties , trademark royalties, franchises, copyrighted materials, book publishing royalties, music royalties, and art royalties. Well-known fashion designers can charge royalties to other companies for the use of their names and designs.

Third parties pay authors, musical artists, and production professionals for the use of their produced, copyrighted material. Television satellite companies provide royalty payments to air the most viewed stations nationwide. In the oil and gas sectors, companies provide royalties to landowners for permission to extract natural resources from the landowners' covered property.

Royalty agreements should benefit both the licensor (the person receiving the royalty) and the licensee (the person paying the royalty). For the licensor, a royalty agreement to allow another company to use its product can allow them access to a new market. For the licensee, an agreement may give them access to products they could not access otherwise.

Royalty payments may cover many different types of property. Some of the more common types of royalties are book royalties, performance royalties, patent royalties, franchise royalties, and mineral royalties.

Book royalties: They are paid to authors by publishers. Typically, for every book that is sold, the author will receive an agreed amount.

Performance royalties: In this case, the owner of copyrighted music receives an amount whenever the music or song is played by a radio station, used in a movie, or otherwise used by a third party. A musician might rely on a private performing rights organization, such as ASCAP or BMI, to collect the royalties for them.

Patent royalties: Innovators or creators patent their products. Then, if a third party wants to use that same product of patent, they must enter into a licensing agreement that will require them to pay royalties to the patent owner. This way, the inventor is compensated for their intellectual property.

Franchise royalties: A franchisee, a business owner, will pay a royalty to the franchisor for the right to open a branch under the company name. For example, in 2024 the cost to invest in a McDonald’s franchise ranges from $464,500 to $2,306,500. This includes an initial franchise fee of up to $45,000 that must be paid to the McDonald's Corporation.

Mineral royalties: Also called mineral rights, mineral royalties are paid by mineral extractors to property owners. The party that wants to extract the minerals will often pay the property owner an amount based on either revenue or units, such as barrels of oil or tons of coal.

Licensing Agreements

The terms of royalty payments are laid out in a licensing agreement . The licensing agreement defines the limits and restrictions of the royalties, such as its geographic limitations, the duration of the agreement, and the type of products with particular royalty cuts. Licensing agreements are uniquely regulated if the resource owner is the government or if the license agreement is a private contract.

Royalty Rates

In most licensing agreements, royalty rates are defined as a percentage of sales or a payment per unit. The many factors that can affect royalty rates include the exclusivity of rights, available alternatives, risks involved, market demand, and innovation levels of the products in question.

To accurately estimate royalty rates , the transactions between the buying and selling parties must be willingly executed. In other words: the agreements must not be forced. Furthermore, all royalty transactions must be conducted at arm's length, meaning that both parties act independently, and have no prior relationship with one other.

According to Upcounsel, a nationwide legal services company, the industries with the highest average royalty rates are software (9.6%), energy and environment (8%), and health care equipment and products (6.4%). The industries with the lowest average royalty rates are automotive (3.3%), aerospace (4%), and chemicals (4.3%).

An author might receive a share of the proceeds from the sales of their book. An example of the royalty structure could be that the author receives 15% on net sales of hardbacks and 7.5% on net sales of paperbacks.

An individual can pay to open a restaurant franchise, McDonald's or Kentucky Fried Chicken, for example. A franchisee of the McDonald's Corporation has a typical initial investment of one to two million dollars, which includes an initial franchise fee of up to $45,000 paid to the McDonalds corporation.

The satellite TV services such as Direct TV and cable television services pay networks and superstations a royalty fee to broadcast those channels on their systems.

What Are Royalties in Business?

Royalties are designed to protect the intellectual property rights of a company. A company might file a patent on an innovation so that a third party must pay them a fee to use that patent. Intellectual property can be in the form of copyrights, patents, and trademarks.

How Do Royalties Work?

Typically, the parties involved will sign a contract or agreement. The agreement will lay out the royalty fees and payment amounts. For example, there may be a fixed fee, or the fee may be a variable percentage of gross sales.

Royalties for specific products (like a book) might be based on the number of units sold. Royalties for oil, gas, and mineral properties may be based on either revenue or on units, such as barrels of oil or tons of coal. In some cases, newly created intellectual property, for example, the royalty percentage. might increase as the sales increase. Some royalties are paid for public licenses. Cable operators pay The Copyright Office for the right to retransmit TV and radio broadcasts.

What Are Royalty Investments?

It is possible to invest in royalties. Typically, an investor may receive a regular monthly or quarterly payment based on a company’s sales. These types of investments are considered less risky than traditional stocks because they are not dependent on the stock market or interest rates. Also, royalty investments add diversity to a portfolio. Like stock, royalties can be bought and sold.

What Is a Royalty Agreement?

A royalty agreement is a legal contract between a licensor and a licensee. The agreement grants the licensee the right to use the licensor’s intellectual property in exchange for royalty payments. The agreement will show the royalty rate, or the terms and amount of the payment to be made, by the user of the property to the owner of the property. The agreement will also state the parties involved, the rights granted, and the period of use.

What Are Royalty Interests?

Royalty interest applies to mineral rights agreements. A royalty interest entitles the mineral rights owner to receive a portion of the minerals produced or a portion of the gross revenue from sold production.

Royalties are, fundamentally, a way for creators, innovators, intellectual property owners, or landowners to earn money from their assets. Royalties take the form of agreements or licenses that lay out the terms by which a third party can use assets that belong to someone else. Intellectual property comes in the form of copyrights, patents, or trademarks. Royalties can be earned on books, music, minerals, franchises, and many other assets. Some royalty agreements are for a set period, while other royalties are earned in perpetuity.

International Franchise Professionals Group. " McDonald's ."

Upcounsel. " Patent Licensing Royalty Rates: Everything You Need to Know ."

:max_bytes(150000):strip_icc():format(webp)/gettyimages-112901940-1-7e1da2346e934329ab8511a0fe3ca145.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Your Article Library

Royalty accounts: meaning and treatment (with journal entries).

ADVERTISEMENTS:

Minimum Rent:

Usually, the royalty agreements contain a clause for the payment of a fixed minimum amount to the lessor every year as royalty—irrespective of the actual benefit to be taken by the lessee—simply in order to assure the lessor of a certain regular income from his property.

This minimum amount is known as “Minimum Rent, ‘Dead Rent’, etc. It is to be remembered that the Minimum Rent may or may not vary in different years. The Minimum Rent or actual royalty, whichever is higher, is to be paid to the lessor. For example, X leased a mine from Y at a Minimum Rent of Rs. 12,000 p.a. merging a royalty of Rs. 2 per ton of coal raised.

Now, if the quantity raised for the 1st year amounted to 4,000 tons and that of 2nd year 8,000 tons, in that case, X will have to pay Rs. 12,000 for the 1st year to Y, i.e., the Minimum Rent [since actual royalty (8,000 = 4,000 × 2) is less than Minimum Rent]. On the contrary, he will have to pay Rs. 16,000 to Y for the 2nd year [since actual royalty (16,000 = 8,000 × 2) is more than the Minimum Rent.].

Short-working :

The excess of Minimum Rent over actual royalty is known as short-working. Therefore, question of short-working will only arise when the actual royalty is less than the Minimum Rent. Short-workings which are recoupable will appear in the assets side of the Balance Sheet as a current asset.

In the above example, short-working for the 1st year will be Rs. 4,000 [i.e., Rs. 12,000 – Rs. 8,000 (4,000 × Rs. 2)], since actual royalty is less than the Minimum Rent. But, in the 2nd year, there will be no such short-working since actual royalty is more than the Minimum Rent.

Recoupment of Short-working:

Usually, in a royalty agreement, a further provision is included about the recoupment of short-working, i.e., the lessor allows the lessee the right to carry forward and set off the short-working against the excess or surplus of royalties over the Minimum Rent in the subsequent years.

In other words, the lessor promises to adjust or return the excess which was charged in the first few years out of excess earned in the later or subsequent years. This right is known as the right of recoupment of short-working.

It can be presented in the following manner:

(b) Floating.

If the lessor or landlord agrees to compensate the losses which were incurred in the first few years (say, three or four years) the same is known as fixed, i.e., if any short-working falls beyond this period, the same cannot be reimbursed.

(b) Floating:

If the lessor or landlord agrees to compensate the loss which were incurred in the first few years, in the next or following or subsequent three or four years, the same is known as floating as the same can be adjusted in any year if short-working arises, i.e., each year’s short-working will have to be adjusted against the excess royalties earned in the subsequent years accordingly.

Students must remember in this respect that the short-workings which are not recovered within the stipulated period should be treated as irrecoverable, and, hence, should be transferred to Profit and Loss Account of the year in which the same is lapsed. The recoupable part of short-working is shown in the asset side of the Balance Sheet. Provision to be made for Short-workings

It has already been stated above that recoupable short-working appears in the assets side of the Balance Sheet as a current asset on the assumption that the same will be recouped in future. But it is uncertain. Sometimes, it may not be possible for the lessee to recoup the amount of short-working due to many factors although he has got the legal right to recoup.

From the standpoint of conservatism a provision should be made for such short-workings against Profit and Loss Account in that particular year when such short-working appears. It is needless to say that provisions for short-working will appear in the liabilities side of the Balance Sheet.

Whereas short-workings (recoupable) will appear in the assets side of the Balance Sheet. Consequently, un-recoupable part of the short-workings will be adjusted against such provision and not against Profit and Loss Account. The balance of provision, if any, should be credited to Profit and Loss Account.

Short-working and Minimum Rent—their relationship :

It has already been explained earlier that when the actual royalty (calculated on the basis of a fixed rate to total quality) is less than the amount of the minimum fixed amount (i.e., Minimum Rent) short-working arises. In short, short-workings arises only when actual royalty is less than the Minimum Rent i.e.,

Short-working = Minimum Rent – Actual Royalty

or, Minimum Rent = Actual Royalty + Short-working

However, in the case of landlord, the amount of Minimum Rent is equal to Actual Royalty Receivable plus the short-workings, i.e.,

Minimum Rent— Actual Royalty Receivable + Short-working

It must be remembered that the landlord is entitled to get the Minimum Rent or Actual Royalties, whichever is higher, (after adjusting the amount of Short-workings, if any.)

Ground Rent — Sometimes the Lessee is to pay an additional fixed rent in addition to the minimum rent which is known as Ground Rent or Surface Rent.

Method of Accounting :

A. where there is a clause on minimum rent and recoupment of short- working consequently :.

Books of Lessee or Tenants or Licence:

Practically, royalties based on output should be debited to Manufacturing or Production Account whereas royalty based on sales be treated as selling expenses) should be debited to Trading Account on Profit and Loss Account.

Students are advised to prepare the following chart before making actual attempt for

1. The landlord is entitled to have the Minimum Rent or Actual Royalty, whichever is more (after adjusting the recoupment of short-working, if any).

2. If there is no clause in the Royalty agreement about the Minimum Rent, there will neither be any short-working nor any recoupment.

3. The short-working which is recouped is to be shown as current asset in the asset side of the Balance Sheet.

4. The recoupable part of short-working should be transferred to Profit and Loss Account.

5. Royalty based on output should be debited to Manufacturing Account or Production Account and royalty based on sales should be debited to Trading Account or Profit and Loss Account.

Recognition of Royalty as a Revenue Ind AS-18 :

As per Ind AS-18, Revenue Recognition, revenues arising from the use by others of enterprise recourses yielding interest, royalties and dividends should only be recognised when no significance uncertainty as to measurability or collectability exists.

These revenues are recognised on the following basis:

In case of Royalty:

On the Accrual Basis in accordance with the terms of the relevant agreement.

It becomes clear from the above that royalty receivable should be recognised as revenue.

Illustration 1:

Bengal Coal Ltd. got the lease of a colliery on the basis of 50 paise per ton of coal raised subject to a Minimum Rent of Rs. 20,000 p.a. The tenant has the right to recoup short-workings during first four years of the lease and not afterwards. The output in four years was 1st year-18,000 tons. 2nd year—26,000 tons. 3rd year—50,000 tons. 4th year—60,000 tons. 5th year—1, 00,000 tons. You are required to give the Journal entries and ledger accounts in the books of the company.

Interpretation:

Actual royalty is less than the minimum rent by Rs. 11,000 (i.e., Rs. 20,000 – Rs. 9,000) which should be carried forward up to first four years if not recouped.

Again actual royalty is less than minimum rent by Rs. 7,000 (i.e., Rs. 20,000 – Rs. 13,000) which again carried forward. Thus, total amount of short-working which is carried forward is Rs. 18,000 (i.e., Rs. 11,000 for first year and Rs. 7,000 for 2nd year).

Since actual royalty is more than the minimum, rent by Rs. 5,000 (i.e., Rs. 25,000 – Rs. 20,000) the same should be recouped against the short-working of Rs. 18,000. Now, balance of short-working comes down to Rs. 13,000 (Rs. 18,000 – Rs. 5,000).

In this year also, actual royalty is more than the minimum rent by Rs. 10,000 (Rs. 30,000 – Rs. 20,000) which will be recouped against the balance of short-working of Rs. 13,000. So, un-recoupable part of short-working, i.e.. Rs. 3,000 (Rs. 13,000 – Rs.10, 000) should be transferred to P&L A/c as maximum period allowed for recoupment of short-working was first four years.

As there was no short-workings landlord will get Rs. $0,000 i.e., actual royalty or minimum rent whichever is higher.

When Minimum Rent Account is opened:

Entries in the books of Lessee/Licence/Users:

This method is particularly applicable when Actual Royalty is less than Minimum Rent.

Illustration 2:

Applying Minimum Rent Account Method:

M. Ltd leases a property from Sri D. Poddar at a royalty of Rs. 1.50 per ton with a Minimum Rent of Rs. 10,000 p.a. Each year’s excess of Minimum Rent over royalties are recoverable out of royalties of next five years.

The results of working of the property are:

1998— As there was no royalty, the whole amount is treated as short-working and the same is carried forward.

1999— Actual royalty is less than the minimum rent by Rs. 6,700 (Rs. 10,000 – Rs.3, 300) and the same is again carried forward. Total amount of short-working was Rs. 16,700 (i.e., Rs. 10,000 + Rs. 6,700)

2000— Again there was a short-working of Rs. 1,000 (Rs. 10,000 – Rs. 9,000) which was again carried forward. Now, the balance of short-working was Rs. 17,700.

2001— Actual royalty is more than the minimum rent by Rs. 1,100 (Rs. 11,100 – Rs. 10,000) and the short-working were recoup by the like amount out of Rs. 10,000 of 1998.

Here, recoupment terms are very important. As per question, excess royalties are recoverable out of royalties of next five years. The word next is very significant here. It means, short-workings of first year should be recouped against the excess royalty of 2nd, 3rd, 4th, 5th and 6th year. Similarly, short-working of 2nd year should be recouped against the excess royalties of 3rd, 4th, 5th, 6th and 7th year and so on.

2002— So, again, as actual royalty is more than the minimum rent by Rs. 4,000 (Rs. 15,000 – Rs. 10,000) it should be recouped against the un-recoupable part of short-working of 1998. Still, there was a balance of Rs. 4,900 (Rs. 10,000 – Rs. 1,100 – Rs. 4,000) for 1998.

2003— In this year also, actual royalties are more than the minimum rent by Rs. 5,000 (Rs. 15,000 – Rs. 10,000) which should be recouped against the un-recoupable part of short-workings of 1998 i.e., Rs. 4,900 and Rs. 100 should be recouped against the short-working of Rs. 1,999.

Illustration 3:

Accounts to be prepared in the books of Lessor:

M owned the patent of a folding chair. On 1st Jan. 2008, he granted N a licence for 5 years to manufacture and sell the chair on the following terms:

(a) Royalty of Rs. 10 per chair sold,

(b) Minimum Rent of Rs. 15,000 p.a.

(c) Short-working could be recouped only within two years following the year in which the short- working occurs, subject to a maximum of Rs. 3,500 p.a., and

(d) If in any year normal sale was not attained due to strike, the Minimum Rent was to be regarded as having been reduced proportionately, having regard to the length of the stoppage.

The number of chairs sold during the lease period was:

During 2011, there was a stoppage due to strike lasting 4 months.

You are required to show the entries and the ledger account of:

(i) Royalties Receivable,

(ii) Royalties Suspense, and

(iii) N’s account in the books of M for each of the above years.

Minimum Rent Rs. 15,000 and actual royalties were Rs. 9,000. So there was a short-working of Rs. 6,000 (which was transferred to Royalty Suspense A/c)

Again there was a short-working of Rs. 2,000 (Rs. 15,000 – Rs. 13,000). So, total amount of short-working amounted to Rs. 8,000 (Rs. 6,000 + Rs. 2,000) which was carried forward.

This year is very important. In this year, there was an excess of Rs. 5,000 which could be recouped. But, as per question, maximum amount of recoupment should be Rs. 3,500. Hence, Rs. 2,500 (Rs. 6,000 – Rs. 3,500) should be credited to Profit and Loss Account as the lease agreement provided that short-working could be recouped only within two following years in which the short-working occurred.

During strike period minimum rent would be reduced proportionately i.e., Rs. 15,000 x 8/12 = Rs. 10,000 (as 4 months were the stoppage period) so, royalties in excess of minimum rent could be recouped i.e., Rs. 1,000 (Rs. 11,000 – Rs. 10,000) out of the short-workings of Rs. 2,000 in 2009. As such balance of un-recoupable part i.e., Rs. 1,000 should be credited to P & L A/c.

For further details about strike, please see the subsequent paragraph.

Again, there was a short-working amounting to Rs. 1,000 which should be credited to P & L A/c as the contract was made for 5 years i.e., there was no chance for recoupment.

B. Where there is no Minimum Rent?

Under the circumstances, there will not be any short-working; as such question of recoupment of short-working also will not arise at all. Landlord is entitled to get the actual royalties only.

The entries under this method are:

Strike and Lock Out :

In the event of strike or lock-out, if the Minimum Rent is not raised, the amount of Minimum Rent depends on the clause of the agreement between the two parties, i.e., Lessor and Lessee.

However, it may be treated in two following ways, viz., the clause may contain like the following:

(1) During strike or lock-out, the actual royalty earned will discharge all rental obligations (if actual royalty is less than Minimum Rent).

(2) During strike or lock-out, the Minimum Rent will be reduced proportionately having regard to the length of stoppage.

(1) Where Actual Royalty earned will discharge all rental obligations:

Under the circumstances, during the period of Strike or Lock-out, there will neither be short-working nor will there be any recoupment. For example, the contract stipulates that the Minimum Rent is Rs. 12,000 per year. But, during the period of strike, actual royalty earned Rs. 8,000. Hence, landlord will get only Rs. 8,000. As such, there will not be any short-working of Rs. 4,000 (Rs. 12,000 – Rs. 8,000) which may be considered in other years.

(2) Where Minimum Rent is reduced proportionately:

Under the circumstances, the amount of Minimum rent will be reduced proportionately having regard to the length of stoppage. For example, the Minimum Rent is. 12,000 per year. Strike period is 3 months, as such, the amount of Minimum Rent will be Rs. 9,000 (i.e., Rs. 12,000 × 9/12).

As such, if actual royalty earned is less than Rs. 9,000 there will be short-working and, similarly, if actual royalties are more than Rs. 9,000, the excess portion may be recouped (of course, if there is any short-working balance).

The following example will help to understand the principle clearly:

Illustration 5:

In case of strikes, recoupment of short-working etc.:

P Ltd. took a mine on lease from Landlord at a given rate of royalty with a Minimum Rent of Rs. 12,000 per year. Each year’s excess of Minimum Rent over royalties is recoverable out of the royalties for the next two years. In the event of Strike, the Minimum Rent was to be reduced proportionately, having regard to the length of the stoppage. But in the case of Lock Out, it was provided that the actual royalties earned for the year would discharge the full rental obligation for that year.

The results of the workings were:

1. In case of Strike, the Minimum Rent should be reduced proportionately i.e., Rs. 12,000 x Rs. 9,000.

Minimum Rent for the 4th year will be Rs. 9,000 and, as actual royalty is Rs. 10,000, so Rs. 1,000 is recouped.

2. In case of lockout the actual royalties will discharge all rental obligation i.e., landlord will get only Rs. 8,000 for the 5th year although the Minimum Rent is Rs. 12,000.

3. Since in the first year the actual royalty is ‘Nil’ the entire amount is treated as short-working.

Deduction of Income Tax :

We know that as per Income Tax Act, 1961, Income Tax must be deducted at the prescribed rate by the lessee from the actual payment so made to the landlord and deposited to the credit of the Central Government within the stipulated time.

Entries in the books of lessee will remain the same, i.e., the tax deducted at source must not affect the royalty, except the following entries:

1. When payment is made to landlord:

Landlord A/c Dr. ―Minimum Rent

To Bank A/c ―Actual Payment

To Income Tax Payable A/c ―Amount of Income Tax deducted.

The following illustration will help us to understand the principles clearly:

Illustration 6:

Application of Income Tax:

Mr. Raman, a scientist, owned a patent for the manufacture of electric blanket. In 2006 he allowed Hindustan Manufacturing Ltd. the use of the patent on the terms that he would receive a royalty of Rs. 10 per blanket manufactured subject to a Minimum Rent of Rs. 12,000 in 2006, Rs. 16,000 in 2007, and thereafter Rs. 30,000 every year. Any short-workings is recoverable out of the royalties of the two years subsequent to the year in which short-workings may arise.

The actual output is:

2006 —1000; 2007 – 1,200; 2008 — 3,200 and 2009 — 3,200. Income-tax was deducted at source @ 20% every year before actual payment of royalty.

You are required to show:

(i) Royalty Account;

(ii) Short-workings Account and

(iii) Mr. Raman Account from 2006 to 2009.

Related Articles:

- Accounting Entries in the Books of Lessee (With Specimen)

- Journal Entries on Royalties Receivable (With Illustration)

Comments are closed.

Case Study: How To Value (And Not Undervalue) Royalties

By Matthew Smith, CEO @RoyaltyExchange

Today, I'd like to share with you my thoughts on how to recognize value and make informed investment decisions when bidding on music royalties.

To illustrate the point, let’s focus on an actual auction that closed a few months ago . The listing was for sound recording royalties on a 90’s hip-hop catalog. To kick the auction off, it needed an opening bid of $300,000.

We’ve conducted hundreds of auctions on Royalty Exchange. All but a handful have received an opening bid within 24 hours of listing. This was one of the few that didn’t get an immediate bid.

For one reason or another, bidders weren’t interested in this auction. So, after sitting for more than 48 hours with no activity, I personally placed the opening bid. As is our policy, no employee or insider at Royalty Exchange can bid against our investors. But, we can place an opening bid.

The auction ran for several days, but there was never a second bid. As you can see below, I was the top (and only) bidder. Although I was happy to win the auction, I never expected that would happen. I couldn’t imagine I’d be the only one interested. And yet, I was. The question is, what did I see that other investors didn’t?

Outside of Private Syndicates, auctions (currently) are the primary means to acquire royalty assets on Royalty Exchange. The competitive nature of auctions facilitates price discovery, and that’s a good thing. But it also can create a scenario where the role of social proof in auctions overrides sound analysis.

By that I mean it’s common to feel better about a decision when others are making the same decision and to doubt a decision if we’re the only one making it. We’ve seen social proof drive “bidding wars” in which, sometimes, animal spirits seem to knock investors out of their senses. And we’ve seen the opposite, where a lack of bidding activity paralyzes investors and keeps them from snapping up good assets at great values.

So it’s important to look beyond the social signals of auctions when making investment decisions. The purpose of this month’s letter is to help you understand what makes royalty assets valuable. And, importantly, to help you recognize that often the right move in auctions is the contrarian move.

For instance, most investors focus on three key factors when evaluating a listing on Royalty Exchange before placing a bid.:

- The Nominal Price

- Multiple of last 12 month’s earnings.

Both of these are sensible guardrails to inform risk and reward in any bidding decision. When the nominal price (position size) and multiple are low enough, bidding on an asset can feel like a no-brainer. But, then there’s the less rational factor...

3. Social Signals. When bidders see that others are actively bidding on an auction, they feel more confident placing a bid as well. Which increases the confidence of others who then bid further. Conversely, when there are few or no other bidders they hesitate and worry that they might be making a mistake.

These factors all involve surface level analysis. They’re useful, but never complete. And sometimes, used alone, these three factors can lead to mistakes and missed opportunities.

In the example above for instance: 90s Hip Hip Sound Recording Royalties

- This catalog was larger than most so the starting price was on the higher side, at $300,000. That’s well above the average starting price of about $40,000.

- The starting multiple was also higher than average as well, at 7x LTM. That’s not only higher than the average starting multiple (3x), but also the average closing multiple (just over 6x)

Taken together, these factors affected bidding activity in two ways:

- Out of Reach—A $300k asset is simply too expensive for many of the bidders on Royalty Exchange.

- Risk/Reward—For those that can afford six-figure assets, a $300k “position” in a single asset can be perceived as riskier compared to spreading that $300k over several different assets. Add to that, a starting multiple that’s twice the average listing and bidders get, understandably, nervous.

So, why was this catalog compelling to me?

I start looking at auctions the same way everyone does. What’s the nominal price and what’s the multiple? But, the next step is looking at the Theoretical Internal Rate of Return (TIRR). We derive TIRR in a formulaic way by applying the same financial model universally to all assets on the platform.

The TIRR on this listing at the starting price was 23.89%. I know TIRR is not a guarantee or even a prediction. The model is built by analyzing the underlying drivers in a catalog. A high TIRR indicates, to me, that there’s something going on with this catalog beneath the surface that might justify a higher multiple.

Let’s take a closer look at the underlying drivers that led to how 23.89% TIRR informed my decision:

In my opinion, this is the single most important factor when viewing the risk profile of any music catalog. In short, a song released 10 years ago that earned $1,000 last year is far more valuable than a song earning the same released two years ago.

Catalog Dollar Age is a measure of The Lindy Effect , a concept popularized by Nassim Taleb in his book The Black Swan.

The Lindy Effect suggests that the future life expectancy of some non-perishable things like a technology or an idea is proportional to their current age, so that every additional period of survival implies a longer remaining life expectancy. Where the Lindy effect applies, mortality rate decreases with time.

In this case, over the last 12 months, the top-earning songs are all 20+ years old. Streaming wasn’t even a format when these songs were released, yet they lead the catalog’s streaming activity.

These are songs that have stood the test of time. They’re not dependent on a short-lived fad, or a sync placement, or an active touring schedule to remain relevant. They just are relevant. They're still streamed by a fan base who remain attached to the songs out of nostalgic value, not fickle whims.

Songs this old that receive this kind of streaming activity today are a rare opportunity and should not be overlooked.

Now let’s take a closer look at those earnings...

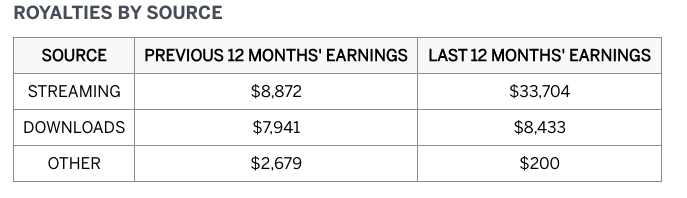

Earning Trends

When evaluating any investment, you want to examine prior earnings. While past performance is no indicator of future success, it remains a key stat in understanding the value of a music royalty catalog...

We do this by comparing growth across 12-month periods. In this example, the total earnings for the period of April 2017 - March 2018 grew 117% over the total earnings during the period of April 2016 - March 2017.

But what was particularly notable was the fact that this growth rate is increasing . Total earnings from April 2016 - March 2017 increased 25% over the total earnings of April 2015 - March 2016. Most catalogs with a similar Dollar Age are either decreasing or if increasing, doing so at a decreasing rate. This catalog is increasing at an increasing rate.

Format Trends

How a catalog earns is just as important as how much it earns. That’s because you want to make sure the source of those earnings is sustainable.

In the example catalog, the primary driver of growth is streaming. In fact, 80% of the catalog’s earnings come from streaming. That makes it more valuable because streaming is a growing format predicted to continue growing well into the future. It’s not like radio airplay (which naturally declines for all music) or downloads/sales (which is on a sharp downward trend).

What’s more the catalog’s streaming growth outpaces its overall growth. For instance, in the timeframe when its overall earnings grew 25%, the catalog’s streaming earnings grew 62%. And in the timeframe when overall earnings grew 117%, streaming earning grew 279%. Both well outpace the overall industry’s calendar year growth rates as well.

It’s also worth noting that this is a hip-hop catalog. And whether or not you’re personally a fan of hip-hop it is the most-streamed genre of music.

It’s always good to look for a spike in earnings, and determine the reason for them. You don’t want to pay a higher multiple for earnings spikes that aren’t repeatable.

Personally, I’m highly suspicious of sync payments. These are one-time licensing fees for the use of a work often in TV or film. Sure, they can be lucrative, but I think it’s a mistake to count on them being repeated.

That said, you don’t want to undervalue a catalog for certain one-off payments either. In the example catalog, 2017 earnings averaged around $2,000 a month until November, when it spiked to over $10,000. The cause of this was a large lump-sum payment from the service Pandora, which had held back royalties during the negotiation of a direct licensing deal. While the spike was not repeatable, the long-term results of the direct licensing deal produce a structural change to the income profile of the catalog... with monthly averages subsequent to the deal totaling over $3,000.

Additionally, I liked the fact that royalties from this catalog paid monthly. With more frequent payments, I could better monitor the performance of the catalog. And, of course, what investor wouldn’t prefer monthly income vs. quarterly or semi-annually as is common with other catalogs?

Two weeks after winning the auction, I received my first royalty statement and payment. I was expecting around $4,200 but to my surprise, the payment was over $9,100.

A few months later, we relisted the same catalog at the same opening price to give investors another chance at it. This time, 22 bids came in. Once investors had a better sense of the key metrics worth analyzing, the value and potential of the catalog became much clearer, which led to more confident bidding.

Key Takeaways

So let’s summarize the key points we’ve covered.

- Don’t let social proof override investing decisions.

- Higher Dollar Age implies higher quality and lower risk

- Earnings either decrease, increase at a decreasing rate, or increase at an increasing rate. Changes in earnings matter at least as much as earnings themselves.

- Streaming is the industry’s tailwind. Look for catalogs benefiting from that trend.Investing in streaming gives you a tailwind.

- Price and Multiple are just a guide, not the full story.

Investor Guides

Investor resources.

Talk to our experts

1800-120-456-456

- Royalty Accounts

What is Royalty?

Royalty can be defined as a proper and periodic payment that is made by one person to another in order to use the right to some resources. There are two different sides to royalty. The person who is responsible for providing the right for using the resource is known as the lessor. The person who is responsible for the use of the resource by making the payment is known as the lessee. In these notes about royalty accounts, students will be able to learn what these are and what the significance of royalty is.

Royalty in Terms of Accounting

When it comes to deciding royalty meaning in accounting, it can be said that royalty is basically what the lessee is supposed to pay to the lessor in order to use the rights or resources which are provided by them. These resources might include some rights, franchises, copyrights, or some of the other assets of a similar kind. Royalty meaning in accounts is a really important topic for students to understand so that they can get the basics correct in order to score good marks in the examination.

Most students have the question that a royalty account is which type of account. Well, it is technically a nominal account. The system of having to share certain revenues that occurs between the lessor and the lessee can be formally defined as royalty. Hence, this can answer the question that students have about royalty is which type of account.

Some Basic Terminologies Related to Royalty Accounts

After understanding the meaning of a royalty account it is important to understand some basic terminologies related to them. Here are some terminologies of royalty accounting treatment.

What is a Lease?

A lease is basically an agreement that is made between two people. Here one person will acquire the particular rights to use certain assets for a particular time period from someone else. This person is basically the asset’s owner and will require some sort of payment. The owner is called the Lessor and the person who takes the right to the asset is called the lessee. In the royalty account notes, there is often a mention of the lease which is made between two people. The amount which is to be paid to the lessor on behalf of the lessee is known as Royalties.

Different Treatments of The Royalties in Accounting

Now we are proceeding towards the discussion of the treatment of royalty in final accounts. When it comes to that, there are certain aspects that students need to know about. We can say that in the case of the lessee, royalty in final accounts is basically just an expenditure made normally. The royalties which are paid on a proper basis of the output will be provided to the Manufacturing or Trading Account. However, when it comes to paying the royalties on a sales basis, the amount would be debited to the Profit & Loss Account. In the notes, students will also get to know about different types of royalty accounts, so you need to read all of this very carefully.

Fixed Rent or Dead Rent

This can be defined as a minimum amount that the lessee has to pay to the lessor inevitably whether or not they have been able to make proper use of the asset. It is also known as the Minimum Rent or Rock Rent. Dead rent is almost fixed every single year and there can be a few different changes when it comes to the agreement made between the lessor and the lessee. There can be two different scenarios when it comes to the Minimum Rent.

In case the value of Actual Royalty that is set for a year comes out less than what the minimum rent is supposed to be, then the lessor will be paid the minimum rent from the lessee

In case the value of Actual Royalty that is set for a year comes out more than what the minimum rent is supposed to be, then the lessor will be paid the actual royalty from the lessee.

What is Short working in a Royalty Account?

Well, Short working in Royalty accounts can be defined as the particular amount by which the Dead Rent or the Minimum Rent becomes more than the Actual Royalty which is to be paid. It can be calculated by finding out the difference between the actual Royalty and the Minimum Rent.

What Are the Other Important Terms in Royalty Accounting?

Excess Workings: It is the amount by which the actual royalty is more than the minimum rent.

Fixed Right: This means that the lessee can recover short workings from the lessor only within a stipulated time period from the date of lease of the asset. If a lessee fails to recover short workings, within the stipulated time period, the recoupment lapses or ends.

Fluctuating Right : Under fluctuating right, the lessee can recover Short Workings for a certain period of time during the subsequent period or periods. For example, Short Workings of the previous year can be recovered in the following year.

Performance Royalty: The owner of copyrighted music will get an amount whenever the music or song is played by a radio station, used in a film, or used by any other third party.

Book Royalty: These are paid by publishers to authors. Generally, the author will receive a fixed amount decided via an agreement, for every book that is sold.

Patent Royalty: If a creator or innovator has patented their products they are compensated for their intellectual property. When a third party wants to use the same product, they have to have a license agreement that will require them to pay royalties to the patent owner.

Franchise Royalty: The business owner who is a franchisee, has to pay a royalty to the franchisor for the rights that he will get to open a branch under the company name.

Mining Royalty: Mineral royalties are paid by mineral extractors to property owners. If a party wants to extract minerals from a certain land, they will pay the property owner an amount based on units such as barrels of oil or tons of coal.

FAQs on Royalty Accounts

1. Who is a Lessor in Royalty Accounts?

A Lessor is a person who is responsible for transferring the rights to any particular asset by accepting a payment from the lessee in Royalty Accounts.

2. What does Royalty Mean?

Royalty meaning in accounting is the amount that the lessor is paid by the lessee for providing the right to any resources such as franchises, copyrights, and much more.

3. What is Shortworking?

It is the difference between the minimum rent and the actual royalty to be paid. More information can be found in the Royalty meaning in Accounts notes.

We hope that with the help of these notes, you can understand the royalty in accounting meaning. These notes are definitely going to be useful when students need to revise some answers so that they can score well.

4. What is recoupment of short workings?

Generally, the agreement between a lessor and the lessee under Royalty Accounting comes with a provision. This provision allows the short workings to be carried forward and adjusted in the future.

So, the short workings are adjusted against the excess royalty amount, in the following years. This process where Short Working capital is adjusted is called the recoupment of Short Workings.

The recoupment clause in Royalty Agreement gives the lessee the right to recover the excess payment made to the lessor for complying with the minimum rent clause in earlier years. Generally, a time period (fixed or fluctuating) is stipulated in the agreement for this.

If the lessee fails to recover the Short Workings within the decided time, the Short Working’s lapse and are debited to the P&L Account.

5. What is a licensing agreement in royalty accounting terms?

The involved parties sign a contract or an agreement laying out the royalty fees and payment amounts.

A licensing agreement is where the terms of royalty payments are laid out. The licensing agreement defines the restrictions and limits of the royalties. This includes the duration of the agreement, its geographic limitations, the type of products and the rates of royalty cuts. The royalty rate usually is the percentage of the sales or a per-unit payment. The factors that can affect royalty rates include the exclusivity of rights, risks involved, market demand, available alternatives and innovation levels of the product.

Royalty accounts [ Introduction, Difference, Important, Types ]

Table of Contents

Royalty accounts

Income Under the head Capital Gains

Introduction:

Royalty is an amount payable for utilizing the benefit of certain rights vested with some other person. For example a landlord possesses right over the mine in his land, the author of book possesses right over his book. When the rights are leased the owner receives a consideration for the same which is called royalty.

Royalty is a periodical sum based on the out put payable by the lessee to the lessor for having utilized the rights of the lessor. The person who makes the payment to the owner of asset is known as lessee and the owner of the asset is known as lessor. Royalty is a business expense and closed and transferred to profit and loss account.

According to William Pickles, “Royalty is the remuneration payable to a person in respect of the use of an asset, whether hired or purchased from such person, calculated by reference to and varying with quantities produced or sold as a result of such asset.”

Types of Royalties:

There are many types of royalties but following types of royalty are very popular:

- a)Mining Royalties,

- b)Brick-making Royalties,

- c)Oils-wells Royalties,

- d)Patent Royalties

- e)Copyright Royalties

Difference between Royalties and Rent:

In the common usage, the term royalty is used to mean rent. But there is some difference between royalty and rent. The following are the major difference between royalty and rent:

Minimum Rent:

Minimum Rent is the amount below which landlord never accepts in any year from the person who has to pay royalty in case of mines. Minimum Rent is also known as Fixed Rent, Dead Rent, Flat Rent or Contract Rent. If in any year amount of royalty is less than the amount of minimum rent, the amount of minimum rent is payable by the person who has to pay the royalty, but if the amount of royalty is more than the amount of minimum rent, royalty will be paid.

Importance of Minimum Rent:

Fixation of minimum rent is in the interest of landlord because it guarantees him the receipt of the minimum rent even in the case of low output or sales. In the absence of minimum rent clause, only the actual royalty will be paid to the landlord. Moreover, it also gives incentive to the lessee to enhance production or sales because he is bound to pay minimum rent.

Redeemable Minimum Rent:

Generally, when minimum rent is more than royalty, then minimum rent is payable if no such provision is given in the agreement, but if it is mentioned in the agreement that when royalty will be more than minimum rent, the excess of minimum rent over royalty paid in the earlier years will be written off out of the excess of the royalty over minimum rent in the coming years such minimum rent is called Redeemable Minimum Rent.

Shortworkings : The excess of minimum rent over royalty is called ‘Shortworkings’. Minimum Rent – Royalty = Shortworkings or M.R. – R = S.W.

Recoupment or Writing off Shortworkings:

Recoupment of short working refers to recovering the short working of any year, from surplus royalty of the succeeding years. the Recoupment may be permitted over a stipulated period of time (fixed Recoupment) or over a specified period following the year of short working (floating Recoupment) or within the life time of the lease(Recoupment within life time of the lease).

All the conditions regarding recoupment or writing off shortworkings are based on the mutual agreement between the lessee and lessor. Shortworkings may be recouped in all the future years or it may be recouped throughout the period of lease. For example, if It recouped during the first four years of the lease, then recoupment will take place only during the first four years, and not afterwards, in the fourth year unwritten balance of shortworking will be transferred to the Profit and Loss Account and future year’s shortworkings will also be transferred to the Profit and Loss Account of the concerning year.

Accounting entries in the books of lessee

a) Without minimum rent account is not opened

b) With minimum rent account is opened

Accounting entries in the books of lessor

Table analysis.

Sometimes a lessee grants a sub-lease to another person either for the whole land or for the portion of it. The person, to whom a sub-lease is granted, is called sub-lessee. In such a case whatever yield is taken out by the lessee and sub-lessee is added and on this total yield lessee has to pay royalty to the landlord.

As lessee he maintained royalty payable a/c, Short Workings a/c and landlord a/c and as lessor for sub-lessee he maintains royalty’s receivable a/c, shortworking suspense a/c and sub -lessee a/c .The entries in the book at all the parties will be the same as above. To the original landlord Royalty should be paid on the basis of the total output of both the lessee and sub-lease.

Leave a Comment Cancel reply

You must be logged in to post a comment.

Financial Accounting Notes: Royalty Accounts Notes | Theory | MCQs | Online Test | Accounting Treatment

Royalty accounts notes for b. com / bba/ mba/ cma exam, introduction to royalty accounts:.

Royalty is an amount payable for utilizing the benefit of certain rights vested with some other person. For example a landlord possesses right over the mine in his land, the author of book possesses right over his book. When the rights are leased the owner receives a consideration for the same which is called royalty.

Royalty is a periodical sum based on the output payable by the lessee to the lessor for having utilized the rights of the lessor. The person who makes the payment to the owner of asset is known as lessee and the owner of the asset is known as lessor. Royalty is a business expense and closed and transferred to profit and loss account.

According to William Pickles, “Royalty is the remuneration payable to a person in respect of the use of an asset, whether hired or purchased from such person, calculated by reference to and varying with quantities produced or sold as a result of such asset.”

Table of Contents

1. introduction to royalty accounts 2. types of royalty accounts 3. importance and advantages of royalty accounts 4. difference between royalty and rent 5. minimum rent – meaning, importance and difference between minimum rent and royalty 6. adjustments of minimum rent in case of strike/lock out 7. short workings and its recoupment 8. surplus 9. nazrana or salame 10. sub – lease 11. income tax on royalty 12. accounting treatment of royalty – journal entries, types of royalties:.

There are many types of royalties but following types of royalty are very popular:

a) Mining Royalties,

b) Brick-making Royalties,

c) Oils-wells Royalties,

d) Patent Royalties

e) Copyright Royalties

Importance of Royalty Accounts

The main advantages of royalty accounts are:.

1. Accounting information is used by the lessor in calculating the amount due from the lessee.

2. It helps in ascertaining the actual cost of production because the royalties paid on production is a direct expense.

3. Royalty accounts helps in knowing the amount of tax be deducted before payment of royalty to lessee.

4. In case of sub-lease, Accounting supplies through royalty accounts helps in settlement of claims between lessor, lessee and sub lessee.

Difference between Royalties and Rent:

In the common usage, the term royalty is used to mean rent. But there is some difference between royalty and rent. The following are the major difference between royalty and rent:

Minimum Rent:

Minimum Rent is the amount below which landlord never accepts in any year from the person who has to pay royalty in case of mines. Minimum Rent is also known as Fixed Rent, Dead Rent, Flat Rent or Contract Rent. If in any year amount of royalty is less than the amount of minimum rent, the amount of minimum rent is payable by the person who has to pay the royalty, but if the amount of royalty is more than the amount of minimum rent, royalty will be paid.

Importance of Minimum Rent in Royalty Accounts:

Fixation of minimum rent is in the interest of landlord because it guarantees him the receipt of the minimum rent even in the case of low output or sales. In the absence of minimum rent clause, only the actual royalty will be paid to the landlord. Moreover, it also gives incentive to the lessee to enhance production or sales because he is bound to pay minimum rent.

Redeemable Minimum Rent:

Generally, when minimum rent is more than royalty, then minimum rent is payable if no such provision is given in the agreement, but if it is mentioned in the agreement that when royalty will be more than minimum rent, the excess of minimum rent over royalty paid in the earlier years will be written off out of the excess of the royalty over minimum rent in the coming years such minimum rent is called Redeemable Minimum Rent.

Difference between Royalty and minimum rent

a) Calculation of royalty based on output or sales, but minimum rent is fixed.

b) In every lease agreement, payment of royalty is compulsory but the provisions of minimum rent may or may not be applicable.

c) Royalty is transferred to production or profit & loss account , but minimum rent is not transferred to royalty account.

Adjustments of minimum rent in case of strike / Lockout / Accident

Normally minimum rent is fixed taking into consideration the minimum expected output under normal condition. But if there is stoppage of work due to strike, lockout or other abnormal reasons, the minimum rent is required to be adjusted as provided for in the agreement. Minimum rent adjustments are done in the following manner:

a) Minimum rent is reduced by a fixed percentage. E.g. if minimum rent is Rs. 20,000 and due to strike it is reduced by 30%, then revised minimum rent will be: 20,000 – 30% = 14,000.