- Go to content /

- Corporate navigation /

- Main navigation /

- Search form

Four Questions on China in Africa. An Interview with Christopher Alden

- Quatre questions sur

Christopher Alden

Professor Chris Alden teaches International Relations at the London School of Economics and Political Science (LSE) and is a Research Associate with the South African Institute of International Affairs (SAIIA). He is the author and editor of numerous books, including China in Africa (Zed 2007), Land, Liberation and Compromise in Southern Africa (Palgrave/Macmillan 2009), The South and World Politics (Palgrave 2010), Foreign Policy Analysis – new approaches 2 nd edition (Routledge 2017), and co-editor of China and Mozambique: From Comrades to Capitalist (Johannesburg: Jacana 2014), China Returns to Africa (Hurst 2008), China and Africa – Building Peace and Security Cooperation on the Continent (Palgrave 2017).

Professor Alden is currently visiting scholar at CERI and has agreed to answer to some of our questions on the China/Africa relationship. Chris Alden has been working on this topic since 1990, when he moved to South Africa to do field work for his PhD on South African foreign policy. While teaching at Wits University in Johannesburg, he set up with a colleague the “East Asia Project” which started the first academic study of this topic based in the region.

What have been the main steps of China’s increasing presence and involvement in Africa and how has China managed to generate such dependency of some African States?

African resources remain the top driver, reflected in the trade data, but also diplomacy of recognition as well as a search for markets for Chinese firms and goods. The ability to provide development finance has played a key role in the rapid growth of the Chinese presence in African economies.

However, least when it comes to debt – there are specific countries like Kenya, Cameroon, Zambia and others which have a very high proportion of their domestic debt owed to China but plenty of others have diversified their borrowing and therefore are not in a dependent position to one country.

What would happen to African economies if the Chinese domestic market continued to drop off?

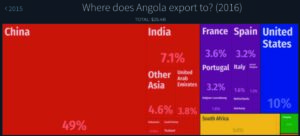

When oil prices fall or when global growth slows, countries like Angola experience shocks as they did after 2014. Problems like scheduled repayments on loans become difficult and African governments have to find ways of managing their shortfalls.

How far does China interfere in domestic affairs and is there any resistance to the Chinese presence by local population?

China’s involvement in domestic affairs in African countries begins, as it would with any external actor, from the point of putting major investments into the local economy. With an economic stake in place, naturally firms become exposed to the risks and issues of operating there; seeking ways to preserve their interests becomes increasingly important and is mediated in scope by the nature risks they face and complexity of local politics.

Second, It is hard to generalise about something like resistance or security issues that would be faced by Chinese authorities in Africa. African societies have seen the Chinese as sources of new employment and infrastructure in some cases while in others they are experienced as competitors or negatively in areas like illegal logging and wildlife trade.

Investing in Africa is part of a Chinese grand strategy. What could be the next steps in what is commonly called "the Global South"?

The Belt and Road Initiative is the overarching vehicle for Chinese aspirations in the Global South and developing countries have by and large signed up to it. This amounts to a global strategy predicated on development and in that sense is very attractive to the Global South.

Interview by Miriam Perier, CERI

- Mission statement

- Fields of Research

- Map of research

- PhD Students & candidates

- Contract Researchers

- Associate Faculty

- Research Associates

- Visiting Scholars

- Director’s Office

- Observatories & chair

- PhD Dissertations Defended

- Research Groups

- Dossiers du CERI

- Les Etudes du CERI

- Past Series

- Publications and beyond

Menu corporate

- Admissions & financial aid

- Student Account

- Student services & life

- Virtual tours

- Alphabetical directory

- Thematic directory

- Research Units

- Faculty Account

- Faculty life & resources

- Recruitments & careers

- Recruitment (jobs & internships)

- Employee training

- Support Sciences Po

- Digital campus

- Digital Uses

A business journal from the Wharton School of the University of Pennsylvania

China’s Investments in Africa: What’s the Real Story?

January 19, 2016 • 11 min read.

Is China exploiting Africa for its natural resources, or is it aiding the continent’s development? Three experts from the front lines of the controversial China-Africa economic relationship weigh in.

- Public Policy

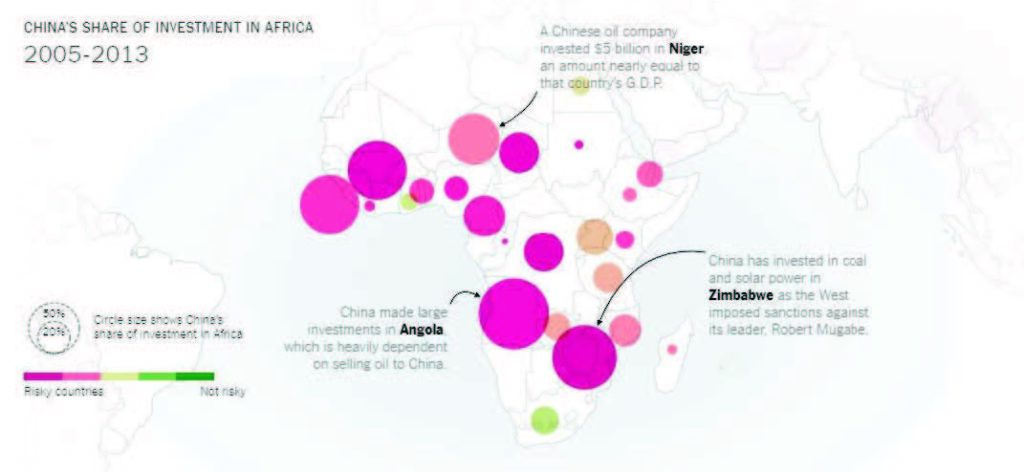

In December, Chinese president Xi Jinping offered a whopping $60 billion loan and aid package to Africa, according to Voice of America. Xi said that China aims to develop infrastructure, improve agriculture and reduce poverty on the continent. This is only the latest example of China’s burgeoning economic presence in Africa. Its investment there has skyrocketed in recent years from $7 billion in 2008 to $26 billion in 2013, according to figures cited at a Wharton Africa Business Forum held last fall. But the relationship is fraught with controversy.

Opponents assert that it is exploitative for China to finance African infrastructure projects in exchange for the continent’s natural resources. Some accuse China of “neo-colonialist” behavior as it acquires the raw materials like oil, iron, copper and zinc that it urgently needs to fuel its own economy. Supporters, on the other hand, say that China’s initiatives to build and improve infrastructure such as roads, railways and telecom systems have been a boon to Africa’s manufacturing sector; have freed up domestic resources for other critical needs such as health care and education; and have aided everyone doing business on the continent.

Three experts from the front lines of the China-Africa relationship offered their views on this complicated issue at the Forum. (The panel was provocatively titled “China in Africa: The Real Story.”)

Looking at the Numbers

Wenjie Chen, an economist in the African Department of the International Monetary Fund (IMF), said there are widespread misconceptions about China’s involvement with Africa. She presented data reported by China’s Ministry of Commerce, which also appeared in a paper Chen recently authored with David Dollar of the Brookings Institution and Heiwai Tang of Johns Hopkins University.

“One of the great misconceptions about the China-Africa business relationship is that there’s some smoke-filled room in Beijing where all the [state-owned enterprises] sit around and divvy up the projects.” –Aubrey Hruby

While acknowledging that Chinese investment on the African continent has been on the upswing since 2009, Chen said that nevertheless, “there’s not really this pattern where you see more deals going into natural-resource-rich countries.” According to her data, the top 20 African nations in which China is involved include not only commodity-rich nations such as Nigeria and South Africa, but commodity-poor nations like Ethiopia, Kenya and Uganda.

Chen said that the largest deals — which tend to be government-to-government — do in fact involve infrastructure projects and natural resources. Those are the deals that make headlines. But, she asserted, they tend to skew the total reality. When looking at all Chinese firms that invested in Africa between 1998 and 2012, she said a picture emerges of small- and medium-sized private Chinese firms whose activities have nothing to do with commodities. “The number-one industry, in fact, is in services. It’s business services; it’s wholesale and retail,” said Chen, noting that many Chinese entrepreneurs run restaurants, hotels and import/export furniture companies.

“You can see [China’s activity is] really not discriminating in any way. It does not [turn] out to be just in natural resources,” said Chen.

According to Chen, another misconception is that China – compared with Western nations — provides a huge amount of foreign direct investment, in addition to aid, to Africa. “That’s not the case,” she said. “In terms of total FDI that goes into sub-Saharan Africa from China, it makes up about 5% of the total FDI that sub-Saharan Africa receives. It’s a very, very small percentage.” She noted that the aid percentage was even smaller.

The loan percentage is more robust, however, constituting about 13% of what Africa received in 2014, Chen said. But she commented that China’s loans to Africa tend to be non-concessional, meaning they are tied to more market-based interest rates than loans from Europe and North America. The Western loans tend to come with a very low, or no, interest rate. “That’s a major difference that we see.” Chen noted. “For us, it’s really about country to country relationships, and a two-way benefit.”

How Deals Are Made

Aubrey Hruby, co-founder of the Africa Expert Network and co-author of the 2015 book The Next Africa: An Emerging Continent Becomes a Global Powerhouse , also believes there are several myths to clear up about China’s presence in Africa. She is a longtime advisor to companies and individuals investing in African markets, as well as to several African presidents.

“One of the great misconceptions about the China-Africa business relationship is that there’s some smoke-filled room in Beijing where all the SOEs (state-owned enterprises) sit around and divvy up the projects. This doesn’t exist,” she stated. Instead, there is “a ton of competition” among Chinese state-owned enterprises for projects, and even among subsidiaries of the same enterprise.

“It’s a myth that no Africans get to work on these projects…. The reason the Chinese go there is because of cheap labor, since labor costs in China itself are rising.” –Wenjie Chen

Hruby shed further light on the process: Chinese company representatives scout infrastructure projects in Africa such as roads or railways. Then they arrange high-level meetings with government ministers or the president to pitch the idea. Once an African government signs an MOU, the Chinese firm does a feasibility study.

Next a contract is drawn up, she said, and the project is pitched to China’s export-import bank (EXIM) to obtain a loan package. If the size of the loan is of concern, the IMF gets involved to make sure the African country in question can realistically meet its debt obligations. Then the agreement is finalized and the project moves forward.

Hruby observed that in Africa, the Chinese are known for moving quickly. Once the MOU is signed, the Chinese can be “on the ground in a week” doing the feasibility study. And the study itself is not comprehensive, she said, but merely to analyze the cost of the project. “This is why you hear African governments saying ‘Oh, the American firms take so long to do a feasibility study. The Chinese will do it in two months.’”

She described a dam project that Ghana had with the World Bank that was stalled for about seven years. “Nothing ever got built, and there was all sorts of frustration. They went through a social audit, an environmental audit … which is all good in a way, but a president only has one term, maybe two, and they have to deliver power to the people.” Eventually, then-president of Ghana John Kufuor “just went to China,” according to Hruby, and “they started digging [in about] one month.”

By contrast, U.S. companies have “a disconnect … around some of the infrastructure projects and project financing approaches so that it takes a long time to put deals together,” said Hruby.

African ‘Wish Lists’

Thomas Laryea, a partner at the global law firm Dentons whose clients include African governments as well as private investors, agreed with Hruby’s statement that the Chinese are actively scouting infrastructure projects in Africa. He noted that this activity has given rise to a cadre of professional facilitators of such deals. “You find these facilitators in many places…. That is now becoming quite a phenomenon.”

On the African side, many African governments maintain “wish lists” (to use Laryea’s term) of infrastructure projects, although they are not necessarily compiled with China in mind. “Unfortunately … these aren’t necessarily projects that are bankable, or are sufficiently thought through, in order to attract and develop the financing.” But this situation was improving, he said. “I looked over the Ivory Coast’s so-called wish list last week or so, and it really is becoming quite substantive.”

When it comes to hammering out the details of big projects with China, Laryea believes that Africa is often at a disadvantage. He called negotiation and decision-making “a major weakness of many African governments…. The deals that are going through as government-to-government deals tend to be very high-level negotiations, sometimes between presidents,” he said, noting that there can be a gap between a leader’s political decision and how the deal can be structured in a way that makes financial, legal and economic sense. He noted that it was critical that African leaders seek out appropriate advisors no matter what country they are dealing with. “The African governments really need to take this issue more seriously.”

The Relationship Evolves

The China-Africa relationship has evolved over time, the panelists agreed, but said that outsiders’ perceptions have not always followed suit. For instance, Hruby said that although American firms often complain that Chinese firms are “going around bribing everyone,” corruption is on the wane. “A lot of the companies I’ve seen and worked with in the past may have paid bribes for projects, but they literally are interested in other ways of doing business. They’re saying, ‘This is not working that well. Can you help us find another way?’”

“I take a very hard line with my clients in the U.S. if they’re really worried about how much of the pie China is taking. They need to get into the game and find a way through.” –Thomas Laryea

Another shift, said the experts, is that most contracts now stipulate the number of African workers that must be employed on projects. “Maybe the early [projects] had a lot of Chinese workers brought in, but in all the conversations and negotiations that I’ve been part of, the African governments have asked — and mandated by contract — how many [African] workers were used,” said Hruby.

“It’s a myth that no Africans get to work on these projects,” agreed Chen. “The reason the Chinese go there is because of cheap labor, since labor costs in China itself are rising.” She noted that at the IMF she is privy to information about specific projects, for instance the Mombasa-Nairobi Standard Gauge Railway now being built. “You can read it in the staff report … there is an explicit number of African workers.”

What factors are fueling the continuing negative view of China in Africa? In Hruby’s opinion, many in the U.S. government have an “obsession” with the China-Africa relationship — “a longing for the Cold War or something” — that blinds them to a more global view. “There’s no question there’s been a diversification of African partners. There’s the Turkey interplay, Brazil is coming up, and Malaysia was the largest investor one year, even bigger than China. So there are a lot of other players.”

She described meetings in which American companies routinely complain about how Chinese companies unfairly grab projects, but in her view these are typically contracts the American firms would turn down anyway. “[The Chinese] are building roads that can get your Coca-Cola there faster, further, cheaper… Everyone needs the roads. Those benefit local entrepreneurs, international investors,” she noted.

Laryea said he, too, disagrees with the notion that “China is bad for Africa and we should all be worried about it.” He asserted that the relationship has been generally beneficial for African countries as well as the global economy. “I take a very hard line with my clients in the U.S. if they’re really worried about how much of the pie China is taking. They need to get into the game and find a way through.”

What does the future hold now that China’s booming economy is slowing down? “There’s no doubt that the Chinese slowdown is impacting Africa,” commented Hruby. She said that the IMF and World Bank’s projections reduce African growth to less than 4%, much lower than rates seen across the continent two years ago. “It lowers all boats, if you will,” she said. “But I don’t believe it totally derails the African growth story.”

More From Knowledge at Wharton

From Amazon to Uber: Why Platform Accountability Requires a Holistic Approach

Should ESG Be Politicized? Why ESG Has Become an Easy Target

How Social Insurance Drives Credit Card Debt

Looking for more insights.

Sign up to stay informed about our latest article releases.

- AsianStudies.org

- Annual Conference

- EAA Articles

- 2025 Annual Conference March 13-16, 2025

- AAS Community Forum Log In and Participate

Education About Asia: Online Archives

China in africa: essential questions and teaching resource suggestions.

Editor’s note: Please see the recommended resources for links to all websites mentioned in this essay.

Around the world, nations in desperate need of infrastructure are finding a willing partner in China, whose Belt and Road Initiative offers the potential for transformative benefits. For sub-Saharan African countries, the construction of a cross-continental road/rail from Dakar to Djibouti promises economic development, as goods, services, and people find reliable transportation to markets. This project, which will cross ten countries, is only part of China’s growing footprint in Africa, where Chinese investments are also building energy capacity, port access, hospitals, and schools. Still, the extent to which Chinese investments in Africa represent a “win-win” for both sides remains a controversial and important issue for students to understand from various historical and contemporary lenses. This resource essay considers several key questions and issues, and offers resources to address this important subject in the high school classroom.

Several interactive resources will help students gain a deeper understanding of what China and sub-Saharan African countries produce and trade, and the areas/industries in which China is most invested. By viewing MIT’s Observatory of Economic Complexity , a student can see a nation’s main exports and imports, and the industries these represent; a deeper search also shows trade partners for each good. While African nations are a relatively minor portion of China’s import/export destinations (China sends many goods to many places), China is often one of Africa’s biggest trade partners. You can also see how economies have advanced and how these relationships may change over time by viewing different years of data. To view a general overview of Chinese investments by region and/or country, students can view The American Enterprise Institute ’s “China Global Investment Tracker” and The New York Times ’s interactive “The World According to China.” Both interactive resources will help students get started with their research.

Once students comprehend the relative economic status of the trade partners, they should consider the inherent costs and benefits of Chinese investments on the continent. Several excellent sources provide background context for teachers and students. The New York Times Magazine’ s “Is China the World’s New Colonial Power?” reviews the historical relationship between the trade partners and highlights areas of interest concerning infrastructure projects and Chinese–African cultural connections. The question of whether Chinese investments resemble a form of colonialism is worth asking, especially in sub- Saharan Africa; students should consider historical parallels, like China’s heavy emphasis on resources, and differences, such as the potential long-term infrastructure benefits for African nations. Moreover, students should examine China’s involvement in the political system of the countries in which it invests. Are the investments equally helpful to the government and the nation’s citizens? Will greater economic development lead to stability and recognition of human rights? Are these investments a true kickstart for growth or a debt trap that will keep African nations under Chinese influence? Other broad overviews of the topic have been presented by the Council on Foreign Relations, the China–Africa Research Initiative (Johns Hopkins), The Diplomat’ s “China-Africa Relations” page, and the China–Africa Project’s ongoing podcast series.

Howard French contributes to the conversation through his book, China’s Second Continent: How a Million Migrants Are Building a New Empire in Africa, and a feature article in The Atlantic , “The Next Empire.” French’s journalism is accessible to students and paints a complex profile of Chinese investments. In addition to Chinese companies (some staterun, some not), individual Chinese migrants also see Africa as an investment opportunity. Migrants face challenges of learning a new land and culture as they navigate local political and economic realities; they also may face prejudice depending on their areas of settlement and the goods/services they trade. Their tales bring a more human element to the story; just as industrious Chinese citizens once moved from farm to factory, they now take the risk of moving to a faraway continent. Bram Van Paesschen’s documentary Empire of Dust takes a ground-level view of Chinese–African interactions in the Democratic Republic of Congo. By putting a face on these interactions, students may better understand the daily challenges that both Chinese and African sides must overcome to build a working relationship.

Finally, students should consider whether Chinese investments are a direct challenge to America’s foreign policy interests. On one hand, a more developed African continent is beneficial to the entire global community, but does growing Chinese influence pose a concern to American access to resources and markets, and our underlying support for democratic institutions? The Foreign Policy Association ’s “China in Africa: Feeding the Dragon” considers these questions, as does the Wilson Center in a “New Era of US–China Competition.” Can Chinese and US interests coexist on the African continent, or will geopolitical influences in this area resemble a new Cold War?

Ultimately, the issues and questions presented in this brief description of curriculum resources represent a critical juncture for China, sub-Saharan Africa, and our students. Whether the growing connections between these societies will be mutually beneficial is extremely difficult to determine; such intellectual exercises are perfect opportunities for students to flex their analytical muscles and gain context on a topic that will inevitably change the world around them.

Share this:

- Click to share on LinkedIn (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on Pinterest (Opens in new window)

Recommended Resources

“Gapminder Tools,” Gapminder: Unveiling the Beauty of Statistics for a Fact Based World View , https://tinyurl.com/y7vy4mn3.

OEC: The Observatory of Economic Complexity , https://atlas.media.mit.edu/en/.

“China Global Investment Tracker,” The American Enterprise Institute , https://tinyurl.com/y77recss.

Gregor Aisch, Josh Keller, and K. K. Rebecca Lai. “The World According to China.” The New York Times . July 24, 2015. https://tinyurl.com/y8lagh5e.

Brook Larmer, “Is China the World’s New Colonial Power?” The New York Times . May 2, 2017. https://tinyurl.com/kt7ngt3.

“China in Africa,” Council on Foreign Relations , https://www.cfr.org/backgrounder/china-africa.

China Africa Research Initiative , http://www.sais-cari.org/.

The China Africa Project , https://chinaafricaproject.com/.

“China-Africa Relations,” The Diplomat , https://tinyurl.com/y8rxrfht.

Howard W. French, Chinas Second Continent: How a Million Migrants Are Building a New Empire in Africa (New York: Vintage Books, 2015).

Howard W. French, “The Next Empire,” The Atlantic , May 2010, https://tinyurl.com/y9xntxff.

Daniel James Scott,“Director Bram Van Paesschen on Empire of Dust,” Filmmaker Magazine , December 4, 2011, https://tinyurl.com/y8m8k7ga.

“China in Africa,” The Foreign Policy Association , https://tinyurl.com/y8q4zs7w.

Abraham Denmark, “A New Era of Intensified US–China Competition,” Wilson Center , January 4, 2018, https://tinyurl.com/yd7xt8w2.

- Latest News

- Join or Renew

- Education About Asia

- Education About Asia Articles

- Asia Shorts Book Series

- Asia Past & Present

- Key Issues in Asian Studies

- Journal of Asian Studies

- The Bibliography of Asian Studies

- AAS-Gale Fellowship

- Council Grants

- Book Prizes

- Graduate Student Paper Prizes

- Distinguished Contributions to Asian Studies Award

- First Book Subvention Program

- External Grants & Fellowships

- AAS Career Center

- Asian Studies Programs & Centers

- Study Abroad Programs

- Language Database

- Conferences & Events

- #AsiaNow Blog

Dangers and Opportunities as China’s Loans to Africa Come Due

Many African economies are facing a period of serious economic distress with a very different character from the debt crisis of the 1980s and 1990s. This time, the People’s Republic of China (PRC) is a major player, and a dramatic decline in PRC lending has compounded economic shocks in the aftermath of Russia’s invasion of Ukraine—just as the continent tries to recover from the pandemic. From 2001 to 2022, PRC financial institutions provided more than $170 billion in credit, loans, and grants to African nations, primarily to fund infrastructure projects tied to the PRC’s Belt and Road Initiative . But new PRC loans to African governments plummeted from $28.4 billion in 2016 to less than $2 billion in 2020 and have continued to decline. African governments are awakening to the fact that opaque PRC lending practices and problematic loan terms have rendered already fragile economies at an increased risk of default. However, this moment of peril also provides an opportunity for African economies to build resilience by diversifying their economic partnerships and seeking out lenders with better terms and different motivations.

I and other CNA analysts from our China Studies and Strategy and Policy Analysis programs have just completed a series of studies on trends in the involvement of the PRC across major sectors in Africa in the context of global shocks. These include the military, mining , infrastructure, and financial sectors. We recently released the report PRC Lending in Africa: Impacts in a Time of Global Shocks . This component of the series focuses on PRC lending to nine African countries. In some cases, PRC loans helped African nations build or upgrade much-needed infrastructure. However, we also found a wide range of PRC lending practices that have contributed to the financial distress and increased the risk of default for African countries ravaged by the global shocks of the last few years. These practices include high interest rates, unfavorable terms, and uncompetitive contracting, most of which is hidden from the public in opaque contracts. And when African countries struggle to repay those loans, PRC lenders have taken inflexible positions that have delayed and hardened terms in renegotiations.

China’s Unforgiving Lenders

Today’s debt troubles have some of their roots in the loan agreements signed when the PRC was eager to plow its excess savings into foreign loans. Often these agreements made the loans due in just 10 years, compared to up to 35 years for loans from the World Bank . Interest rates are often higher, too. For example, the Export–Import Bank of China charged Djibouti a fully commercial rate for the loan to build the Ethiopia-Djibouti railway, higher than multinational lenders like the World Bank charge for loans. The PRC is Djibouti’s largest creditor, holding approximately $1.4 billion in debt , equal to about 45 percent of the country’s GDP. In January 2023, Djibouti suspended debt payments to the PRC, making it the second African nation—after Zambia—to do so.

Often these agreements require loan recipients to give business to PRC contractors—without competitive bidding. The Export–Import Bank of China contract with Kenya to finance the Standard Gauge Railway connecting the port city of Mombasa to the Great Rift Valley stipulated that most construction materials would be purchased from the PRC. The project ended up much more costly than anticipated, increasing from 220 billion to 327 billion Kenyan shillings over a period of three years. The Kenya Court of Appeal found that “the project’s design was manipulated to inflate costs while construction and supervision charges were also overpriced.” Such agreements have helped make China’s construction firms dominant on the continent. A University of London study found that of the 32 major international contractor companies working major construction projects in Ethiopia in 2017, 80 percent were PRC contractors.

Because PRC loan agreements tend to be opaque, the public is usually not even aware of these loan terms. In the case of the Standard Gauge Railway, the loan with the Export–Import Bank of China was signed in 2014, but details about the terms only became publicly known in 2022, preventing oversight from Kenyan politicians or the public. In some cases, those opaque agreements and unethical business practices may contribute to corruption. The Industrial and Commercial Bank of China funded a dam project in Angola while ignoring various potential red flags, including the involvement of the daughter of Angolan President José Eduardo dos Santos. Isabel dos Santos was awarded the $4.5 billion contract to construct the dam by her father’s government in 2015. As of 2023, Angola holds more PRC debt than any other country in Africa. And the World Bank listed Angola as one of seven African countries that it considered to be at high risk of debt distress in 2020.

Our research found that when struggling African nations need to renegotiate their loans, PRC lenders have resisted standard loan forgiveness practices and have slowed debt negotiations. The PRC does not follow typical debt negotiation protocols used by multilateral institutions such as the World Bank. Instead, the PRC prefers bilateral negotiations, often behind closed doors, and strongly resists cutting the total principal owed on loans. Rather, PRC lenders favor extending repayment periods or holding infrastructure as collateral on loans. This has an impact on negotiations with other creditors as well, since lenders want concessions to be shared fairly. Recent negotiations to restructure Chad’s debt with a committee of five bilateral creditors took nearly two years. World Bank and IMF officials claimed that lenders from China unnecessarily delayed the debt deal, an accusation that has come up in debt negotiations with other African countries.

In the long run, however, this difficult period could have an upside for African nations. The reduction in PRC loans provides an opportunity for African countries to diversify, considering new economic partnerships on more favorable terms, with greater transparency and good governance. African nations can use multilateral negotiations to seek out lenders operating with different motivations, lenders that can help them build domestic economic strength and resilience for the future.

Timothy Ditter is a Research Scientist in CNA’s China Studies Program.

Related Articles

What caused Dubai floods? Experts cite climate change, not cloud seeding

- Medium Text

DID CLOUD SEEDING CAUSE THE STORM?

CAN'T CREATE CLOUDS FROM NOTHING

Sign up here.

Reporting by Alexander Cornwell; editing by Maha El Dahan and Alexandra Hudson

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

World Chevron

Pope Francis visits Venice, says his work isn't easy

Pope Francis made his first trip out of Rome for seven months on Sunday with a packed visit to Venice that took in an art exhibition, a prison and a Mass, with the 87-year pontiff acknowledging that life could be hard.

IMAGES

VIDEO

COMMENTS

1 . China's Approach to Development in Africa: A Case Study of Kenya's Standard Gauge Railway . By Oscar Otele, a lecturer at the University of Nairobi's Department of Political Science and ...

This paper examines sustainability, labor standards, transparency, and innovation in BRI projects, using a case study of the China-funded Standard Gauge Railway (SGR) in East Africa. For this case ...

A brief history of China-Africa relations. Africa has been crucial to China's foreign policy since the end of the Chinese civil war in 1947. China supported several African liberation movements during the Cold War, and for every year since 1950 bar one, the foreign minister of the People's Republic of China (PRC) has first visited an African country.

China has four overarching strategic interests in Africa. First, it wants access to natural resources, particularly oil and gas. It is estimated that, by 2020, China will import more oil worldwide than the United States. To guarantee future supply, China is heavily investing in the oil sectors in countries such as Sudan, Angola, and Nigeria.

China and Africa have forged a strong economic relationship since China's accession to the WTO in 2001. This paper examines the evolution of these economic ties starting in the early 2000s, and the subsequent shift in the relationship triggered by the commodity price collapse in 2015 and by the COVID-19 pandemic. The potential effects on the African continent of a further slowdown in Chinese ...

China has become Africa's largest trade partner and has greatly expanded its economic ties to the continent, but its growing activities there have raised questions about its noninterference policy.

China in Africa Case Study: Zambia. November 6, 2019. Africa Program. Governance Strategic Competition Southern Africa Africa China Mainland. In this edition of Wilson Center NOW we speak with Southern Voices Network for Peacebuilding Scholar Emmanuel Matambo. Matambo discusses his project which focuses on China's relations and investment in ...

China-Africa Relations: Cooperation and Mutual Respect in Retrospect followed by a critical review of China's disregard for Africa, Africans, and African Economies, which remains a miscalculation of mutual respect, complemented by China's debt trap in Africa: A case study of Angola, Kenya, and Zambia.

African countries are diverse in their economic and social characteristics and have different industrialisation needs. In order to maximise economic and development benefits for both China and Africa, China can further strengthen its production capacity cooperation, while deepening its understanding of the local contexts.

Introduction. The rise of China in the world economy has resulted in a rise in Chinese foreign economic engagement with Africa (Chen, Dollar, & Tang, Citation 2018; Grimm, Citation 2014).Against this backdrop, and particularly in light of China's "Belt and Road" initiative, this special issue sought to generate debate on and enhance understanding of the nature of this engagement with ...

The emergence of China as the second most influential global power has generated a large variety of debates on the causes and implications of its global economic engagement [1,2,3,4,5].Among them, a range of discussions has centred on the economic involvement of China in Africa, as Africa has been one of China's major sources of imports, its second largest overseas construction project ...

These case studies illustrate dynamic change in lending to Africa, from resource-backed profligacy to more calculated business or geostrategic d ecision-making.. In 2020, the World Bank deemed seven African countries to be in debt distress or at risk of debt distress related to the scale of Chinese lending. 7 Five of these countries - Angola, Djibouti, Kenya, the Republic of the Congo and ...

China in Africa's Media. A Case Study of Ghana. by Emmanuel K. Dogbevi. June 1, 2022. This essay considers Ghana as a case study of China's strategy to influence media in Africa and thereby strengthen its foothold on the continent. Download.

By Paul Nantulya. April 6, 2017. China's expanding involvement in Africa is an integral piece in President Xi Jinping's grand strategy to restore the country to its perceived rightful place of global prominence. A selection of Africa Center analysis of China's military, commerical, diplomatic, and other engagements in Africa.

China and Africa have been known to share similar historical traditions and common experiences: "history of exploitation by imperialists, victimized through externally-funded civil wars and subjected to calamitous socialist projects in the name of idealism" (Alden Citation 2007, 136).In addition, about forty years ago, both China and Africa were labeled as poverty-stricken: stuck in debt ...

Kenya offers a pertinent case study of how China consolidates its voice in Africa. After Xinhua established its African headquarters in Nairobi in 2006—its largest bureau outside Beijing—it was followed by CGTN, China Daily, and China Radio International, which occupy the same building in Nairobi's upscale Westlands suburb. From there ...

Professor Chris Alden teaches International Relations at the London School of Economics and Political Science (LSE) and is a Research Associate with the South African Institute of International Affairs (SAIIA). He is the author and editor of numerous books, including China in Africa (Zed 2007), Land, Liberation and Compromise in Southern Africa (Palgrave/Macmillan 2009), The South and World ...

Xi said that China aims to develop infrastructure, improve agriculture and reduce poverty on the continent. This is only the latest example of China's burgeoning economic presence in Africa. Its ...

Editor's note: Please see the recommended resources for links to all websites mentioned in this essay. Around the world, nations in desperate need of infrastructure are finding a willing partner in China, whose Belt and Road Initiative offers the potential for transformative benefits. For sub-Saharan African countries, the construction of a cross-continental road/rail from Dakar […]

China's interests in Africa are motivated primarily by economics and diplomacy. In other words, Africa is important to China as a vast source of resources to feed its growing manufacturing base, as well as a source of energy security. In addition, China sees Africa as an important destination for its affordable manufactured goods.

reports, journal articles and other case studies on focusing on China's involvement in Africa infrastructure development. Research objective This research aims to assess China's involvement in developing Africa's infrastructure by means of reviewing various studies done in Africa over the past years. In addition, the research aims to provide

The increasing presence in Africa has drawn mixed reactions from the academic and media platforms. It has been argued that China is sapping Africa's manufacturing potential and also extracting Africa's resources without any significant benefits to Africa. Thus China is seen as a contributor to Africa's underdevelopment and ...

In Africa, China's ... A University of London study found that of the 32 major international contractor companies working major construction projects in Ethiopia in 2017, 80 percent were PRC contractors. Because PRC loan agreements tend to be opaque, the public is usually not even aware of these loan terms. In the case of the Standard Gauge ...

China in Africa 139 following the introduction, which captures a brief general overview of the "China in Africa" discourse, we delineate the Sinophilia-Sinophobia arguments characterizing the Afro-Chinese engagement. Finally, we offer our concluding thoughts and suggest avenues for future research. Sinophilia: The Context

A storm hit the United Arab Emirates and Oman this week bringing record rainfall that flooded highways, inundated houses, grid-locked traffic and trapped people in their homes.