- Customer Reviews

- Net 30 Account

- Wise Services

- Steps & Timeline

- Work at a Glance

- Market Research at a Glance

- Business Plan Writing Services

- Bank Business Plan

- Investor Business Plan

- Franchise Business Plan

- Cannabis Business Plan

- Strategic Business Plan

- Corporate Business Plan

- Merge and Acquisition Business Plan (M&A)

- Private Placement Memorandums (PPM)

- Sample Business Plans

- Professional Feasibility Study

- PowerPoint Presentations

- Pitch Deck Presentation Services

- Business Plan Printing

- Market Research

- L-1 Business Plan

- E-2 Business Plan

- EB-5 Business Plan

- EB-5 Regional Centers

- Immigration Attorneys

- Nonprofit Business Plan

- Exit Business Planning

- Business Planning

- Business Formation

- Business License

- Business Website

- Business Branding

- Business Bank Account

- Digital Marketing

- Business Funding Resources

- Small Business Loans

- Venture Capital

- Net 30 Apply

- Frequently Asked Questions

- Business Credit Cards

- Talk to Us 1-800-496-1056

What is a business plan? Definition, Purpose, and Types

In the world of business, a well-thought-out plan is often the key to success. This plan, known as a business plan, is a comprehensive document that outlines a company’s goals, strategies , and financial projections. Whether you’re starting a new business or looking to expand an existing one, a business plan is an essential tool.

As a business plan writer and consultant , I’ve crafted over 15,000 plans for a diverse range of businesses. In this article, I’ll be sharing my wealth of experience about what a business plan is, its purpose, and the step-by-step process of creating one. By the end, you’ll have a thorough understanding of how to develop a robust business plan that can drive your business to success.

What is a business plan?

Purposes of a business plan, what are the essential components of a business plan, executive summary, business description or overview, product and price, competitive analysis, target market, marketing plan, financial plan, funding requirements, types of business plan, lean startup business plans, traditional business plans, how often should a business plan be reviewed and revised, what are the key elements of a lean startup business plan.

- What are some of the reasons why business plans don't succeed?

A business plan is a roadmap for your business. It outlines your goals, strategies, and how you plan to achieve them. It’s a living document that you can update as your business grows and changes.

Looking for someone to write a business plan?

Find professional business plan writers for your business success.

These are the following purpose of business plan:

- Attract investors and lenders: If you’re seeking funding for your business , a business plan is a must-have. Investors and lenders want to see that you have a clear plan for how you’ll use their money to grow your business and generate revenue.

- Get organized and stay on track: Writing a business plan forces you to think through all aspects of your business, from your target market to your marketing strategy. This can help you identify any potential challenges and opportunities early on, so you can develop a plan to address them.

- Make better decisions: A business plan can help you make better decisions about your business by providing you with a framework to evaluate different options. For example, if you’re considering launching a new product, your business plan can help you assess the potential market demand, costs, and profitability.

The executive summary is the most important part of your business plan, even though it’s the last one you’ll write. It’s the first section that potential investors or lenders will read, and it may be the only one they read. The executive summary sets the stage for the rest of the document by introducing your company’s mission or vision statement, value proposition, and long-term goals.

The business description section of your business plan should introduce your business to the reader in a compelling and concise way. It should include your business name, years in operation, key offerings, positioning statement, and core values (if applicable). You may also want to include a short history of your company.

In this section, the company should describe its products or services , including pricing, product lifespan, and unique benefits to the consumer. Other relevant information could include production and manufacturing processes, patents, and proprietary technology.

Every industry has competitors, even if your business is the first of its kind or has the majority of the market share. In the competitive analysis section of your business plan, you’ll objectively assess the industry landscape to understand your business’s competitive position. A SWOT analysis is a structured way to organize this section.

Your target market section explains the core customers of your business and why they are your ideal customers. It should include demographic, psychographic, behavioral, and geographic information about your target market.

Marketing plan describes how the company will attract and retain customers, including any planned advertising and marketing campaigns . It also describes how the company will distribute its products or services to consumers.

After outlining your goals, validating your business opportunity, and assessing the industry landscape, the team section of your business plan identifies who will be responsible for achieving your goals. Even if you don’t have your full team in place yet, investors will be impressed by your clear understanding of the roles that need to be filled.

In the financial plan section,established businesses should provide financial statements , balance sheets , and other financial data. New businesses should provide financial targets and estimates for the first few years, and may also request funding.

Since one goal of a business plan is to secure funding from investors , you should include the amount of funding you need, why you need it, and how long you need it for.

- Tip: Use bullet points and numbered lists to make your plan easy to read and scannable.

Access specialized business plan writing service now!

Business plans can come in many different formats, but they are often divided into two main types: traditional and lean startup. The U.S. Small Business Administration (SBA) says that the traditional business plan is the more common of the two.

Lean startup business plans are short (as short as one page) and focus on the most important elements. They are easy to create, but companies may need to provide more information if requested by investors or lenders.

Traditional business plans are longer and more detailed than lean startup business plans, which makes them more time-consuming to create but more persuasive to potential investors. Lean startup business plans are shorter and less detailed, but companies should be prepared to provide more information if requested.

Need Guidance with Your Business Plan?

Access 14 free business plan samples!

A business plan should be reviewed and revised at least annually, or more often if the business is experiencing significant changes. This is because the business landscape is constantly changing, and your business plan needs to reflect those changes in order to remain relevant and effective.

Here are some specific situations in which you should review and revise your business plan:

- You have launched a new product or service line.

- You have entered a new market.

- You have experienced significant changes in your customer base or competitive landscape.

- You have made changes to your management team or organizational structure.

- You have raised new funding.

A lean startup business plan is a short and simple way for a company to explain its business, especially if it is new and does not have a lot of information yet. It can include sections on the company’s value proposition, major activities and advantages, resources, partnerships, customer segments, and revenue sources.

What are some of the reasons why business plans don't succeed?

- Unrealistic assumptions: Business plans are often based on assumptions about the market, the competition, and the company’s own capabilities. If these assumptions are unrealistic, the plan is doomed to fail.

- Lack of focus: A good business plan should be focused on a specific goal and how the company will achieve it. If the plan is too broad or tries to do too much, it is unlikely to be successful.

- Poor execution: Even the best business plan is useless if it is not executed properly. This means having the right team in place, the necessary resources, and the ability to adapt to changing circumstances.

- Unforeseen challenges: Every business faces challenges that could not be predicted or planned for. These challenges can be anything from a natural disaster to a new competitor to a change in government regulations.

What are the benefits of having a business plan?

- It helps you to clarify your business goals and strategies.

- It can help you to attract investors and lenders.

- It can serve as a roadmap for your business as it grows and changes.

- It can help you to make better business decisions.

How to write a business plan?

There are many different ways to write a business plan, but most follow the same basic structure. Here is a step-by-step guide:

- Executive summary.

- Company description.

- Management and organization description.

- Financial projections.

How to write a business plan step by step?

Start with an executive summary, then describe your business, analyze the market, outline your products or services, detail your marketing and sales strategies, introduce your team, and provide financial projections.

Why do I need a business plan for my startup?

A business plan helps define your startup’s direction, attract investors, secure funding, and make informed decisions crucial for success.

What are the key components of a business plan?

Key components include an executive summary, business description, market analysis, products or services, marketing and sales strategy, management and team, financial projections, and funding requirements.

Can a business plan help secure funding for my business?

Yes, a well-crafted business plan demonstrates your business’s viability, the use of investment, and potential returns, making it a valuable tool for attracting investors and lenders.

Leave a Reply

Your email address will not be published. Required fields are marked *

Quick Links

- Investor Business Plans

- M&A Business Plan

- Private Placement

- Feasibility Study

- Hire a Business Plan Writer

- Business Valuation Calculator

- Business Plan Examples

- Real Estate Business Plan

- Business Plan Template

- Business Plan Pricing Guide

- Business Plan Makeover

- SBA Loans, Bank Funding & Business Credit

- Finding & Qualifying for Business Grants

- Leadership for the New Manager

- Content Marketing for Beginners

- All About Crowdfunding

- EB-5 Regional Centers, A Step-By-Step Guide

- Logo Designer

- Landing Page

- PPC Advertising

- Business Entity

- Business Licensing

- Virtual Assistant

- Business Phone

- Business Address

- E-1 Visa Business Plan

- EB1-A Visa Business Plan

- EB1-C Visa Business Plan

- EB2-NIW Business Plan

- H1B Visa Business Plan

- O1 Visa Business Plan

- Business Brokers

- Merger & Acquisition Advisors

- Franchisors

Proud Sponsor of

- 1-800-496-1056

- (613) 800-0227

- +44 (1549) 409190

- +61 (2) 72510077

Transition to growth mode

with LivePlan Get 40% off now

0 results have been found for “”

Return to blog home

What Is a Business Plan? Definition and Planning Essentials Explained

Posted february 21, 2022 by kody wirth.

What is a business plan? It’s the roadmap for your business. The outline of your goals, objectives, and the steps you’ll take to get there. It describes the structure of your organization, how it operates, as well as the financial expectations and actual performance.

A business plan can help you explore ideas, successfully start a business, manage operations, and pursue growth. In short, a business plan is a lot of different things. It’s more than just a stack of paper and can be one of your most effective tools as a business owner.

Let’s explore the basics of business planning, the structure of a traditional plan, your planning options, and how you can use your plan to succeed.

What is a business plan?

A business plan is a document that explains how your business operates. It summarizes your business structure, objectives, milestones, and financial performance. Again, it’s a guide that helps you, and anyone else, better understand how your business will succeed.

Why do you need a business plan?

The primary purpose of a business plan is to help you understand the direction of your business and the steps it will take to get there. Having a solid business plan can help you grow up to 30% faster and according to our own 2021 Small Business research working on a business plan increases confidence regarding business health—even in the midst of a crisis.

These benefits are directly connected to how writing a business plan makes you more informed and better prepares you for entrepreneurship. It helps you reduce risk and avoid pursuing potentially poor ideas. You’ll also be able to more easily uncover your business’s potential. By regularly returning to your plan you can understand what parts of your strategy are working and those that are not.

That just scratches the surface for why having a plan is valuable. Check out our full write-up for fifteen more reasons why you need a business plan .

What can you do with your plan?

So what can you do with a business plan once you’ve created it? It can be all too easy to write a plan and just let it be. Here are just a few ways you can leverage your plan to benefit your business.

Test an idea

Writing a plan isn’t just for those that are ready to start a business. It’s just as valuable for those that have an idea and want to determine if it’s actually possible or not. By writing a plan to explore the validity of an idea, you are working through the process of understanding what it would take to be successful.

The market and competitive research alone can tell you a lot about your idea. Is the marketplace too crowded? Is the solution you have in mind not really needed? Add in the exploration of milestones, potential expenses, and the sales needed to attain profitability and you can paint a pretty clear picture of the potential of your business.

Document your strategy and goals

For those starting or managing a business understanding where you’re going and how you’re going to get there are vital. Writing your plan helps you do that. It ensures that you are considering all aspects of your business, know what milestones you need to hit, and can effectively make adjustments if that doesn’t happen.

With a plan in place, you’ll have an idea of where you want your business to go as well as how you’ve performed in the past. This alone better prepares you to take on challenges, review what you’ve done before, and make the right adjustments.

Pursue funding

Even if you do not intend to pursue funding right away, having a business plan will prepare you for it. It will ensure that you have all of the information necessary to submit a loan application and pitch to investors. So, rather than scrambling to gather documentation and write a cohesive plan once it’s relevant, you can instead keep your plan up-to-date and attempt to attain funding. Just add a use of funds report to your financial plan and you’ll be ready to go.

The benefits of having a plan don’t stop there. You can then use your business plan to help you manage the funding you receive. You’ll not only be able to easily track and forecast how you’ll use your funds but easily report on how it’s been used.

Better manage your business

A solid business plan isn’t meant to be something you do once and forget about. Instead, it should be a useful tool that you can regularly use to analyze performance, make strategic decisions, and anticipate future scenarios. It’s a document that you should regularly update and adjust as you go to better fit the actual state of your business.

Doing so makes it easier to understand what’s working and what’s not. It helps you understand if you’re truly reaching your goals or if you need to make further adjustments. Having your plan in place makes that process quicker, more informative, and leaves you with far more time to actually spend running your business.

What should your business plan include?

The content and structure of your business plan should include anything that will help you use it effectively. That being said, there are some key elements that you should cover and that investors will expect to see.

Executive summary

The executive summary is a simple overview of your business and your overall plan. It should serve as a standalone document that provides enough detail for anyone—including yourself, team members, or investors—to fully understand your business strategy. Make sure to cover the problem you’re solving, a description of your product or service, your target market, organizational structure, a financial summary, and any necessary funding requirements.

This will be the first part of your plan but it’s easiest to write it after you’ve created your full plan.

Products & Services

When describing your products or services, you need to start by outlining the problem you’re solving and why what you offer is valuable. This is where you’ll also address current competition in the market and any competitive advantages your products or services bring to the table. Lastly, be sure to outline the steps or milestones that you’ll need to hit to successfully launch your business. If you’ve already hit some initial milestones, like taking pre-orders or early funding, be sure to include it here to further prove the validity of your business.

Market analysis

A market analysis is a qualitative and quantitative assessment of the current market you’re entering or competing in. It helps you understand the overall state and potential of the industry, who your ideal customers are, the positioning of your competition, and how you intend to position your own business. This helps you better explore the long-term trends of the market, what challenges to expect, and how you will need to initially introduce and even price your products or services.

Check out our full guide for how to conduct a market analysis in just four easy steps .

Marketing & sales

Here you detail how you intend to reach your target market. This includes your sales activities, general pricing plan, and the beginnings of your marketing strategy. If you have any branding elements, sample marketing campaigns, or messaging available—this is the place to add it.

Additionally, it may be wise to include a SWOT analysis that demonstrates your business or specific product/service position. This will showcase how you intend to leverage sales and marketing channels to deal with competitive threats and take advantage of any opportunities.

Check out our full write-up to learn how to create a cohesive marketing strategy for your business.

Organization & management

This section addresses the legal structure of your business, your current team, and any gaps that need to be filled. Depending on your business type and longevity, you’ll also need to include your location, ownership information, and business history. Basically, add any information that helps explain your organizational structure and how you operate. This section is particularly important for pitching to investors but should be included even if attempted funding is not in your immediate future.

Financial projections

Possibly the most important piece of your plan, your financials section is vital for showcasing the viability of your business. It also helps you establish a baseline to measure against and makes it easier to make ongoing strategic decisions as your business grows. This may seem complex on the surface, but it can be far easier than you think.

Focus on building solid forecasts, keep your categories simple, and lean on assumptions. You can always return to this section to add more details and refine your financial statements as you operate.

Here are the statements you should include in your financial plan:

- Sales and revenue projections

- Profit and loss statement

- Cash flow statement

- Balance sheet

The appendix is where you add additional detail, documentation, or extended notes that support the other sections of your plan. Don’t worry about adding this section at first and only add documentation that you think will be beneficial for anyone reading your plan.

Types of business plans explained

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. So, to get the most out of your plan, it’s best to find a format that suits your needs. Here are a few common business plan types worth considering.

Traditional business plan

The tried-and-true traditional business plan is a formal document meant to be used for external purposes. Typically this is the type of plan you’ll need when applying for funding or pitching to investors. It can also be used when training or hiring employees, working with vendors, or any other situation where the full details of your business must be understood by another individual.

This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix. We recommend only starting with this business plan format if you plan to immediately pursue funding and already have a solid handle on your business information.

Business model canvas

The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

The structure ditches a linear structure in favor of a cell-based template. It encourages you to build connections between every element of your business. It’s faster to write out and update, and much easier for you, your team, and anyone else to visualize your business operations. This is really best for those exploring their business idea for the first time, but keep in mind that it can be difficult to actually validate your idea this way as well as adapt it into a full plan.

One-page business plan

The true middle ground between the business model canvas and a traditional business plan is the one-page business plan. This format is a simplified version of the traditional plan that focuses on the core aspects of your business. It basically serves as a beefed-up pitch document and can be finished as quickly as the business model canvas.

By starting with a one-page plan, you give yourself a minimal document to build from. You’ll typically stick with bullet points and single sentences making it much easier to elaborate or expand sections into a longer-form business plan. This plan type is useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Now, the option that we here at LivePlan recommend is the Lean Plan . This is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance.

It holds all of the benefits of the single-page plan, including the potential to complete it in as little as 27-minutes . However, it’s even easier to convert into a full plan thanks to how heavily it’s tied to your financials. The overall goal of Lean Planning isn’t to just produce documents that you use once and shelve. Instead, the Lean Planning process helps you build a healthier company that thrives in times of growth and stable through times of crisis.

It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

Try the LivePlan Method for Lean Business Planning

Now that you know the basics of business planning, it’s time to get started. Again we recommend leveraging a Lean Plan for a faster, easier, and far more useful planning process.

To get familiar with the Lean Plan format, you can download our free Lean Plan template . However, if you want to elevate your ability to create and use your lean plan even further, you may want to explore LivePlan.

It features step-by-step guidance that ensures you cover everything necessary while reducing the time spent on formatting and presenting. You’ll also gain access to financial forecasting tools that propel you through the process. Finally, it will transform your plan into a management tool that will help you easily compare your forecasts to your actual results.

Check out how LivePlan streamlines Lean Planning by downloading our Kickstart Your Business ebook .

Like this post? Share with a friend!

Posted in Business Plan Writing

Join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

What is a Business Plan? Definition, Tips, and Templates

Published: June 07, 2023

In an era where more than 20% of small enterprises fail in their first year, having a clear, defined, and well-thought-out business plan is a crucial first step for setting up a business for long-term success.

Business plans are a required tool for all entrepreneurs, business owners, business acquirers, and even business school students. But … what exactly is a business plan?

In this post, we'll explain what a business plan is, the reasons why you'd need one, identify different types of business plans, and what you should include in yours.

What is a business plan?

A business plan is a documented strategy for a business that highlights its goals and its plans for achieving them. It outlines a company's go-to-market plan, financial projections, market research, business purpose, and mission statement. Key staff who are responsible for achieving the goals may also be included in the business plan along with a timeline.

The business plan is an undeniably critical component to getting any company off the ground. It's key to securing financing, documenting your business model, outlining your financial projections, and turning that nugget of a business idea into a reality.

What is a business plan used for?

The purpose of a business plan is three-fold: It summarizes the organization’s strategy in order to execute it long term, secures financing from investors, and helps forecast future business demands.

Business Plan Template [ Download Now ]

Working on your business plan? Try using our Business Plan Template . Pre-filled with the sections a great business plan needs, the template will give aspiring entrepreneurs a feel for what a business plan is, what should be in it, and how it can be used to establish and grow a business from the ground up.

Purposes of a Business Plan

Chances are, someone drafting a business plan will be doing so for one or more of the following reasons:

1. Securing financing from investors.

Since its contents revolve around how businesses succeed, break even, and turn a profit, a business plan is used as a tool for sourcing capital. This document is an entrepreneur's way of showing potential investors or lenders how their capital will be put to work and how it will help the business thrive.

All banks, investors, and venture capital firms will want to see a business plan before handing over their money, and investors typically expect a 10% ROI or more from the capital they invest in a business.

Therefore, these investors need to know if — and when — they'll be making their money back (and then some). Additionally, they'll want to read about the process and strategy for how the business will reach those financial goals, which is where the context provided by sales, marketing, and operations plans come into play.

2. Documenting a company's strategy and goals.

A business plan should leave no stone unturned.

Business plans can span dozens or even hundreds of pages, affording their drafters the opportunity to explain what a business' goals are and how the business will achieve them.

To show potential investors that they've addressed every question and thought through every possible scenario, entrepreneurs should thoroughly explain their marketing, sales, and operations strategies — from acquiring a physical location for the business to explaining a tactical approach for marketing penetration.

These explanations should ultimately lead to a business' break-even point supported by a sales forecast and financial projections, with the business plan writer being able to speak to the why behind anything outlined in the plan.

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

You're all set!

Click this link to access this resource at any time.

Free Business Plan [Template]

Fill out the form to access your free business plan., 3. legitimizing a business idea..

Everyone's got a great idea for a company — until they put pen to paper and realize that it's not exactly feasible.

A business plan is an aspiring entrepreneur's way to prove that a business idea is actually worth pursuing.

As entrepreneurs document their go-to-market process, capital needs, and expected return on investment, entrepreneurs likely come across a few hiccups that will make them second guess their strategies and metrics — and that's exactly what the business plan is for.

It ensures an entrepreneur's ducks are in a row before bringing their business idea to the world and reassures the readers that whoever wrote the plan is serious about the idea, having put hours into thinking of the business idea, fleshing out growth tactics, and calculating financial projections.

4. Getting an A in your business class.

Speaking from personal experience, there's a chance you're here to get business plan ideas for your Business 101 class project.

If that's the case, might we suggest checking out this post on How to Write a Business Plan — providing a section-by-section guide on creating your plan?

What does a business plan need to include?

- Business Plan Subtitle

- Executive Summary

- Company Description

- The Business Opportunity

- Competitive Analysis

- Target Market

- Marketing Plan

- Financial Summary

- Funding Requirements

1. Business Plan Subtitle

Every great business plan starts with a captivating title and subtitle. You’ll want to make it clear that the document is, in fact, a business plan, but the subtitle can help tell the story of your business in just a short sentence.

2. Executive Summary

Although this is the last part of the business plan that you’ll write, it’s the first section (and maybe the only section) that stakeholders will read. The executive summary of a business plan sets the stage for the rest of the document. It includes your company’s mission or vision statement, value proposition, and long-term goals.

3. Company Description

This brief part of your business plan will detail your business name, years in operation, key offerings, and positioning statement. You might even add core values or a short history of the company. The company description’s role in a business plan is to introduce your business to the reader in a compelling and concise way.

4. The Business Opportunity

The business opportunity should convince investors that your organization meets the needs of the market in a way that no other company can. This section explains the specific problem your business solves within the marketplace and how it solves them. It will include your value proposition as well as some high-level information about your target market.

5. Competitive Analysis

Just about every industry has more than one player in the market. Even if your business owns the majority of the market share in your industry or your business concept is the first of its kind, you still have competition. In the competitive analysis section, you’ll take an objective look at the industry landscape to determine where your business fits. A SWOT analysis is an organized way to format this section.

6. Target Market

Who are the core customers of your business and why? The target market portion of your business plan outlines this in detail. The target market should explain the demographics, psychographics, behavioristics, and geographics of the ideal customer.

7. Marketing Plan

Marketing is expansive, and it’ll be tempting to cover every type of marketing possible, but a brief overview of how you’ll market your unique value proposition to your target audience, followed by a tactical plan will suffice.

Think broadly and narrow down from there: Will you focus on a slow-and-steady play where you make an upfront investment in organic customer acquisition? Or will you generate lots of quick customers using a pay-to-play advertising strategy? This kind of information should guide the marketing plan section of your business plan.

8. Financial Summary

Money doesn’t grow on trees and even the most digital, sustainable businesses have expenses. Outlining a financial summary of where your business is currently and where you’d like it to be in the future will substantiate this section. Consider including any monetary information that will give potential investors a glimpse into the financial health of your business. Assets, liabilities, expenses, debt, investments, revenue, and more are all useful adds here.

So, you’ve outlined some great goals, the business opportunity is valid, and the industry is ready for what you have to offer. Who’s responsible for turning all this high-level talk into results? The "team" section of your business plan answers that question by providing an overview of the roles responsible for each goal. Don’t worry if you don’t have every team member on board yet, knowing what roles to hire for is helpful as you seek funding from investors.

10. Funding Requirements

Remember that one of the goals of a business plan is to secure funding from investors, so you’ll need to include funding requirements you’d like them to fulfill. The amount your business needs, for what reasons, and for how long will meet the requirement for this section.

Types of Business Plans

- Startup Business Plan

- Feasibility Business Plan

- Internal Business Plan

- Strategic Business Plan

- Business Acquisition Plan

- Business Repositioning Plan

- Expansion or Growth Business Plan

There’s no one size fits all business plan as there are several types of businesses in the market today. From startups with just one founder to historic household names that need to stay competitive, every type of business needs a business plan that’s tailored to its needs. Below are a few of the most common types of business plans.

For even more examples, check out these sample business plans to help you write your own .

1. Startup Business Plan

As one of the most common types of business plans, a startup business plan is for new business ideas. This plan lays the foundation for the eventual success of a business.

The biggest challenge with the startup business plan is that it’s written completely from scratch. Startup business plans often reference existing industry data. They also explain unique business strategies and go-to-market plans.

Because startup business plans expand on an original idea, the contents will vary by the top priority goals.

For example, say a startup is looking for funding. If capital is a priority, this business plan might focus more on financial projections than marketing or company culture.

2. Feasibility Business Plan

This type of business plan focuses on a single essential aspect of the business — the product or service. It may be part of a startup business plan or a standalone plan for an existing organization. This comprehensive plan may include:

- A detailed product description

- Market analysis

- Technology needs

- Production needs

- Financial sources

- Production operations

According to CBInsights research, 35% of startups fail because of a lack of market need. Another 10% fail because of mistimed products.

Some businesses will complete a feasibility study to explore ideas and narrow product plans to the best choice. They conduct these studies before completing the feasibility business plan. Then the feasibility plan centers on that one product or service.

3. Internal Business Plan

Internal business plans help leaders communicate company goals, strategy, and performance. This helps the business align and work toward objectives more effectively.

Besides the typical elements in a startup business plan, an internal business plan may also include:

- Department-specific budgets

- Target demographic analysis

- Market size and share of voice analysis

- Action plans

- Sustainability plans

Most external-facing business plans focus on raising capital and support for a business. But an internal business plan helps keep the business mission consistent in the face of change.

4. Strategic Business Plan

Strategic business plans focus on long-term objectives for your business. They usually cover the first three to five years of operations. This is different from the typical startup business plan which focuses on the first one to three years. The audience for this plan is also primarily internal stakeholders.

These types of business plans may include:

- Relevant data and analysis

- Assessments of company resources

- Vision and mission statements

It's important to remember that, while many businesses create a strategic plan before launching, some business owners just jump in. So, this business plan can add value by outlining how your business plans to reach specific goals. This type of planning can also help a business anticipate future challenges.

5. Business Acquisition Plan

Investors use business plans to acquire existing businesses, too — not just new businesses.

A business acquisition plan may include costs, schedules, or management requirements. This data will come from an acquisition strategy.

A business plan for an existing company will explain:

- How an acquisition will change its operating model

- What will stay the same under new ownership

- Why things will change or stay the same

- Acquisition planning documentation

- Timelines for acquisition

Additionally, the business plan should speak to the current state of the business and why it's up for sale.

For example, if someone is purchasing a failing business, the business plan should explain why the business is being purchased. It should also include:

- What the new owner will do to turn the business around

- Historic business metrics

- Sales projections after the acquisition

- Justification for those projections

6. Business Repositioning Plan

.webp?width=650&height=450&name=businessplan_6%20(1).webp)

When a business wants to avoid acquisition, reposition its brand, or try something new, CEOs or owners will develop a business repositioning plan.

This plan will:

- Acknowledge the current state of the company.

- State a vision for the future of the company.

- Explain why the business needs to reposition itself.

- Outline a process for how the company will adjust.

Companies planning for a business reposition often do so — proactively or retroactively — due to a shift in market trends and customer needs.

For example, shoe brand AllBirds plans to refocus its brand on core customers and shift its go-to-market strategy. These decisions are a reaction to lackluster sales following product changes and other missteps.

7. Expansion or Growth Business Plan

When your business is ready to expand, a growth business plan creates a useful structure for reaching specific targets.

For example, a successful business expanding into another location can use a growth business plan. This is because it may also mean the business needs to focus on a new target market or generate more capital.

This type of plan usually covers the next year or two of growth. It often references current sales, revenue, and successes. It may also include:

- SWOT analysis

- Growth opportunity studies

- Financial goals and plans

- Marketing plans

- Capability planning

These types of business plans will vary by business, but they can help businesses quickly rally around new priorities to drive growth.

Getting Started With Your Business Plan

At the end of the day, a business plan is simply an explanation of a business idea and why it will be successful. The more detail and thought you put into it, the more successful your plan — and the business it outlines — will be.

When writing your business plan, you’ll benefit from extensive research, feedback from your team or board of directors, and a solid template to organize your thoughts. If you need one of these, download HubSpot's Free Business Plan Template below to get started.

Editor's note: This post was originally published in August 2020 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

24 of My Favorite Sample Business Plans & Examples For Your Inspiration

![definition business plan wikipedia How to Write a Powerful Executive Summary [+4 Top Examples]](https://blog.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write a Powerful Executive Summary [+4 Top Examples]

19 Best Sample Business Plans & Examples to Help You Write Your Own

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2023

![definition business plan wikipedia 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://blog.hubspot.com/hubfs/gantt-chart-example.jpg)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![definition business plan wikipedia The 8 Best Free Flowchart Templates [+ Examples]](https://blog.hubspot.com/hubfs/flowchart%20templates.jpg)

The 8 Best Free Flowchart Templates [+ Examples]

16 Best Screen Recorders to Use for Collaboration

The 25 Best Google Chrome Extensions for SEO

Professional Invoice Design: 28 Samples & Templates to Inspire You

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

- Recent changes

- Random page

- Help about MediaWiki

- What links here

- Related changes

- Special pages

- Printable version

- Permanent link

- Page information

- View source

Business Plan

A business plan is a written document that describes in detail how a business — usually a new one — is going to achieve its goals. A business plan lays out a written plan from a marketing, financial and operational viewpoint. Business plans are important to allow a company to lay out its goals and attract investment. They are also a way for companies to keep themselves on track going forward. Although they're especially useful for new companies, every company should have a business plan. Ideally, a company would revisit the plan periodically to see if goals have been met or have changed and evolved. Sometimes, a new business plan is prepared for an established business that is moving in a new direction. [1]

- 1 Elements of A Business Plan [2]

- 2 Types of Business Plans [3]

- 3 Components of a Good Business Plan [4]

- 4 The Need For A Business Plan [5]

- 5 The Audience for Business Plans [6]

- 6 Who Needs a Business Plan [7]

- 7 Common Business Plan Mistakes [8]

- 8 Business Plan Vs. Strategic Plan [9]

- 9 Benefits of a Good Business Plan [10]

- 10 See Also

- 11 References

- 12 Further Reading

Elements of A Business Plan [2]

There are four common elements to an excellent business plan.

- An explanation of why your company is relevant and the need are you addressing

- A description of corporate priorities and the processes to achieve them.

- An overview of the various resources, including the people that will be needed, to deliver what’s expected by the customer.

- A description of the state of your market and its important trends.

- A detailed description of your customers.

- A description of your current competitors and their advantages. Which ones will you displace?

- A description of your products, how they compete with other brands, and why they are needed.

- An explanation of why customers will pay a fair economic value for your product or service. This element is conspicuously absent from some of today’s most expensive unicorns. Companies such as Uber and Tesla are losing massive amounts of money on rapidly growing sales because these companies may not be selling their services/products for fair economic value. Of course, sales grow rapidly when customers can buy your services/products for far less than their fair economic values!

- Conservative

- Each scenario should have realistic and achievable sales, margins, expenses, and profits on monthly, quarterly, and annual bases. Again, these elements appear to be conspicuously absent from some of today’s most expensive unicorns.

Types of Business Plans [3]

- One-Page Business Plan: A one-page business plan is exactly what it sounds like: a quick summary of your business delivered on a single page. No, this doesn’t mean a very small font size and cramming tons of information onto a single page — it means that the business is described in very concise language that is direct and to-the-point. A one-page business plan can serve two purposes. First, it can be a great tool to introduce the business to outsiders, such as potential investors. Since investors have very little time to read detailed business plans, a simple one-page plan is often a better approach to get that first meeting. Later in the process, a more detailed plan will be needed, but the one-page plan is great for getting in the door. This simple plan format is also great for early-stage companies that just want to sketch out their idea in broad strokes. Think of the one-page business plan as an expanded version of jotting your idea down on a napkin. Keeping the business idea on one page makes it easy to see the entire concept at a glance and quickly refine concepts as new ideas come up. Learn more about how to create a one-page business plan.

- The Lean Business Plan: A Lean Plan is more detailed than a one-page plan and includes more financial information, but it’s not as long as a traditional business plan. Lean Plans are more likely to be used internally as tools for strategic planning and growth. The Lean Business Plan dispenses with the formalities that are needed when presenting a plan externally for a loan or investment and focuses almost exclusively on business strategy, tactics, milestones, metrics, budgets, and forecasts. These lean business plans skip sections like company history and management team since everyone in the company almost certainly knows this information. You don’t do an exit strategy section of your business plan if you’re not writing for investors and therefore you aren’t concerned with an exit. The simplest lean business plan uses bullet points to define strategy, tactics, concrete specific dates and tasks, and essential numbers including projected sales, spending, and cash flow. It’s just five to 10 pages when printed. And few Lean Plans need printing. Leave them on the computer. Review and revise them at least once a month. The first Lean Plan takes just a few hours to do (or less), and a monthly review and revision can take only an hour or two per month. Lean business plans are management tools used to guide the growth of both startups and existing businesses. They help business owners think through strategic decisions and measure progress towards goals.

- External Business Plan (a.k.a the standard business plan document): External business plans, the formal business plan documents, are designed to be read by outsiders to provide information about a business. The most common use of a full business plan is to convince investors to fund a business, and the second most common is to support a loan application. Occasionally this type of business plan is also used to recruit or train or absorb key employees, but that is much less common. A formal business plan document is an extension of the internal business plan, or the Lean Plan. It’s mostly a snapshot of the internal plan as it existed at a certain time. But while the an internal plan is short on polish and formality, a formal business plan document should be very well-presented, with more attention to detail in the language and format. See example business plans in our sample plan library to give you an idea of what the finished product might look like. In addition, an external plan details how potential funds are going to be used. Investors don’t just hand over cash with no strings attached—they want to understand how their funds will be used and what the expected return on their investment is. Finally, external plans put a strong emphasis on the team that is building the company. Investors invest in people rather than ideas, so it’s critical to include biographies of key team members and how their background and experience is going to help grow the company.

Components of a Good Business Plan [4]

The 10 components of a business plan are as follows:

- Executive Summary: The executive summary should appear first in your business plan. It should summarize what you expect your business to accomplish. Since it’s meant to highlight what you intend to discuss in the rest of the plan, the Small Business Administration suggests that you write this section last. A good executive summary is compelling. It reveals the company’s mission statement , along with a short description of its products and services. It might also be a good idea to briefly explain why you’re starting your company and include details about your experience in the industry you’re entering.

- Company Description: The next section that should appear in your business plan is a company description. It’s best to include key information about your business, your goals and the customers you plan to serve. Your company description should also discuss how your business will stand out from others in the industry and how the products and services you’re providing will be helpful to your target audience.

- Market Analysis : Ideally, your market analysis will show that you know the ins and outs of the industry and the specific market you’re planning to enter. In that section, you’ll need to use data and statistics to talk about where the market has been, where it’s expected to go and how your company will fit into it. In addition, you’ll have to provide details about the consumers you’ll be marketing to, such as their income levels.

- Competitive Analysis : good business plan will present a clear comparison of your business to your direct and indirect competitors. You’ll need to show that you know their strengths and weaknesses and you know how your business will stack up. If there are any issues that could prevent you from jumping into the market, like high upfront costs, it’s best to say so. This information will go in your market analysis section.

- Description of Management and Organization: Following your market analysis, your business plan will outline the way that your organization will be set up. You’ll introduce your company managers and summarize their skills and primary job responsibilities. If you want to, you can create a diagram that maps out your chain of command. Don’t forget to indicate whether your business will operate as a partnership, a sole proprietorship or a business with a different ownership structure. If you have a board of directors, you’ll need to identify the members.

- Breakdown of Your Products and Services: If you didn’t incorporate enough facts about your products and services into your company description (since that section is meant to be an overview), it might be a good idea to include extra information about them in a separate section. Whoever’s reading this portion of your business plan should know exactly what you’re planning to create and sell, how long your products are supposed to last and how they’ll meet an existing need. It’s a good idea to mention your suppliers, too. If you know how much it’ll cost to make your products and how much money you’re hoping to bring in, those are great details to add. You’ll need to list anything related to patents and copyright concerns as well.

- Marketing Plan : In your business plan, it’s important to describe how you intend to get your products and services in front of potential clients. That’s what marketing is all about. As you pinpoint the steps you’re going to take to promote your products, you’ll need to mention the budget you’ll need to implement your strategies.

- Sales Strategy : How will you sell the products you’re building? That’s the most important question you’ll answer when you discuss your sales strategy. It’s best to be as specific as possible. It’s a good idea to throw in the number of sales reps you’re planning to hire and how you’ll go about finding them and bringing them on board. You can also include sales targets.

- Request for Funding: If you need funding, you can devote an entire section to talking about the amount of money you need and how you plan to use the capital you’re trying to raise. If you’ll need extra cash in a year or two to complete a certain project, that’s something that’s important to disclose.

- Financial Projections: In the final section of your business plan, you’ll reveal the financial goals and expectations that you’ve set based on market research. You’ll report your anticipated revenue for the first 12 months and your annual projected earnings for the second, third, fourth and fifth years of business.

The Need For A Business Plan [5]

A business plan is important in that it serves two core purposes; it provides 1) financial validation and 2) serves as a roadmap .

- Financial Validation: With regards to financial validation, your business plan gives a strong indication, to both you and outside funding sources, as to whether your venture will be financially successful. Your financial projections, if completed properly (more on this below), allow financing sources to calculate whether you’ll be able to repay your loan or provide an appropriate Return on Investment. Importantly, the written sections of your business plan support your financial projections. For instance, the Industry Analysis section must prove that your market size is large enough to support your success. And your Marketing Plan section must show that you’ll be employing promotional tactics that allow you to attract customers at a reasonable cost.

- Serves as a Roadmap: In particular, the Operations Plan section of your business plan lays out your action plan. It details the key accomplishments and milestones you have established and when you expect to complete this. The roadmap gives you and your team a clear path to follow. It keeps you focused and improves your odds of reaching the goals you’ve set.

The Audience for Business Plans [6]

Business plans may be internally or externally focused. Externally-focused plans draft goals that are important to outside stakeholders, particularly financial stakeholders. These plans typically have detailed information about the organization or the team making effort to reach its goals. With for-profit entities, external stakeholders include investors and customers, for non-profits, external stakeholders refer to donors and clients, for government agencies, external stakeholders are the tax-payers, higher-level government agencies, and international lending bodies such as the International Monetary Fund, the World Bank, various economic agencies of the United Nations, and development banks. Internally-focused business plans target intermediate goals required to reach the external goals. They may cover the development of a new product, a new service, a new IT system, a restructuring of finance, the refurbishing of a factory or a restructuring of the organization. An internally-focused business plan is often developed in conjunction with a balanced scorecard or a list of critical success factors. This allows success of the plan to be measured using non-financial measures. Business plans that identify and target internal goals, but provide only general guidance on how they will be met are called strategic plans. Operational plans describe the goals of an internal organization, working group or department. Project plans, sometimes known as project frameworks, describe the goals of a particular project. They may also address the project's place within the organization's larger strategic goals.

Who Needs a Business Plan [7]

About the only person who doesn't need a business plan is one who's not going into business. You don't need a plan to start a hobby or to moonlight from your regular job. But anybody beginning or extending a venture that will consume significant resources of money, energy or time, and that is expected to return a profit, should take the time to draft some kind of plan.

- Startups: The classic business plan writer is an entrepreneur seeking funds to help start a new venture. Many, many great companies had their starts on paper, in the form of a plan that was used to convince investors to put up the capital necessary to get them under way. Most books on business planning seem to be aimed at these startup business owners. There's one good reason for that: As the least experienced of the potential plan writers, they're probably most appreciative of the guidance. However, it's a mistake to think that only cash-starved startups need business plans. Business owners find plans useful at all stages of their companies' existence, whether they're seeking financing or trying to figure out how to invest a surplus.

- Established firms seeking help: Not all business plans are written by starry-eyed entrepreneurs. Many are written by and for companies that are long past the startup stage. WalkerGroup/Designs, for instance, was already well-established as a designer of stores for major retailers when founder Ken Walker got the idea of trademarking and licensing to apparel makers and others the symbols 01-01-00 as a sort of numeric shorthand for the approaching millennium. Before beginning the arduous and costly task of trademarking it worldwide, Walker used a business plan complete with sales forecasts to convince big retailers it would be a good idea to promise to carry the 01-01-00 goods. It helped make the new venture a winner long before the big day arrived. "As a result of the retail support up front," Walker says, "we had over 45 licensees running the gamut of product lines almost from the beginning." These middle-stage enterprises may draft plans to help them find funding for growth just as the startups do, although the amounts they seek may be larger and the investors more willing. They may feel the need for a written plan to help manage an already rapidly growing business. Or a plan may be seen as a valuable tool to be used to convey the mission and prospects of the business to customers, suppliers or others.

Common Business Plan Mistakes [8]

- Not bothering to write one: This is far and away the most common error. Entrepreneurs are doers so it's natural that they want to get on with things and get them done – especially when they have an idea that they’re excited about buzzing around in their heads. But who hasn’t heard the adage "He who fails to plan plans to fail?" And that's the fate of almost every business someone starts without a business plan; failure. So yes, you need to write a business plan.

- Not being clear about the purpose of your business plan: A business plan is essentially a solution to a problem, the problem being how you are going to turn your vision of a successful business into a reality. So why are you preparing a business plan? Is it to persuade a potential lender to give you a business loan? Attract investors? Figure out if your new business idea could actually be turned into a viable business? Serve as a blueprint for your successful startup? The purpose of your business plan will affect everything from the amount of research you have to go through what the form of the finished plan will look like. If all you want to do is find out if a business idea is a good one that might be worth working up a business plan about, use these five questions to tell if your business plan idea is worth it.

- Not having a clear business model: A successful business has to make a profit. It's astonishing how many people who start small businesses don't seem to grasp this basic fact or are incredibly skilled at ignoring it. lanning to sell something is not a business model; a business model is a plan for generating revenue over and above your expenses. You can make the best mousetrap in the world, but if it costs you $90 to make each one and people are only willing to pay $10 for one, there’s no point to doing it as a business. By all means, if it provides you with personal satisfaction and you feel the cost is fair, do it. Otherwise, forget about it and move on to a business idea that does have profit potential. Professional and service businesses can be real dead-end traps if you don't have a clear business model set up.

- Not doing enough research: Not doing enough research to do the job is another common business plan mistake. Your business plan is only going to be as good as the research you put into it. To answer the central question of "Will this work?" you have to find the answers to a whole cluster of other questions, from "What are the current trends in this industry?" to "How will this business counter what its competitors are doing?" And the more complete the answers to the questions, the better prepared you'll be to either start your new business or shelve the idea and move on. Every section of the business plan will need research except for the Executive Summary. Fortunately, a lot of the required research can be done online, but there’s no getting around the fact that writing a business plan is a lot of work.

- Ignoring market realities: You and what you want to do are only one half of the equation of starting a successful business. The market is the other. You can have the best product or service in the entire world for sale but it doesn't matter if no one is willing to buy it. That is one bedrock, non-negotiable market reality. So it's crucial that you market test your product or service before you try to base a business on selling it. If you want to sell products, try selling them at local venues, such as farmers’ or flea markets and local trade shows, selling small batches online through eBay or Etsy, using focus groups to gauge interest, or giving out free samples and gathering people's feedback about them. If you want to sell services, surveys of potential interest or focus groups can work well. Do-It-Yourself Market Research explains how you can do your own market research, including tips for designing surveys and questionnaires. The competition is another market reality that has to be adequately dealt with in your business plan. It's not enough to just point out who they are; you need to examine what the competition is doing and explain specifically how you’re going to counter what they're doing to win market share. You have to make sure you take into account all the competition. Don't just think of those competitors operating exactly the same kind of businesses; think laterally, too, to be sure you identify all competitors. For instance, a prospective flower shop is not just competing against other flower shops in a particular area; it’s also competing with all the other local businesses that sell flowers, including grocery stores and big-box retailers and online flower sellers. That doesn't mean you have to list every potential competitor in your business plan and explain how you’re going to win the contest with them, but you do have to list and explain how you’re going to deal with the potential threat of each type of competition at least.

- the income statement

- the cash flow projection

- the balance sheet

To do this, you need to figure out how much money you need to start and operate your business and make educated guesses about how much money your new business will bring during its first year of operation. There are two common mistakes people make when they're tackling this section of the business plan.

- The first is not being realistic about their expenses. People often leave out expenses entirely or underestimate the cost of particular expenses. Meticulous research will prevent this mistake.

- The second is being overly optimistic about your new business's prospects. You're hoping your new business will do well. You wouldn't choose to start it otherwise, but you mustn't let your optimism lead you to create overly rosy cash flow projections.

- Setting your business plan aside after you've written it: If you write a business plan, use it to get a loan and never look at it again, you're wasting most of its value. A business plan is just that; a plan for how your new business is going to succeed. Treat it as your new business's first planning document and as you move through the startup period and beyond, edit and add to it as necessary. A pair of good first additions to your business plan is the Vision Statement and the Mission Statement ; creating these will solidify your goals and make sure you don't get sidetracked. Your original business plan will also be a useful reference document when you’re doing the ongoing business planning running a successful business requires. For instance, see Quick-Start Planning for Small Businesses for instructions on how to create an action plan for your small business.

- Not Every Business Plan is Worth Finishing: When you're writing a business plan, the answer to the central question, "Will this work?" is not always positive. And that's fine. It means the business plan is doing its job of showing you whether or not a business idea is worth doing and saving you potentially huge amounts of money and time. Usually, this discovery occurs during the course of working through a business plan, not at the end. And that's the time to quit developing that particular plan. If you discover, for instance, that the market for your proposed product is saturated while you're working on the Competitive Analysis section of the business plan, there's no point in carrying on and going to the trouble of preparing financials – your time is much better spent coming up with another business idea that may be more workable. Perseverance and determination are great traits for entrepreneurs to possess – until they turn into foolish persistence and keep you from accomplishing what you could be accomplishing. That can be the worst business plan mistake of all.

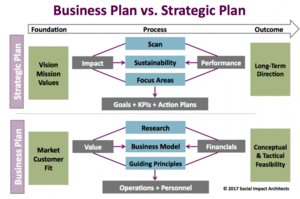

Business Plan Vs. Strategic Plan [9]

The truth is that strategic plans and business plans are more alike than different and can be combined together to create social sector genius. Business plans and pitches are more popular in the social sector than ever before, but this does not mean that strategic plans are not equally needed. In fact, a strategic business plan is a nice hybrid between the two. As the graphic below suggests, they have very similar recipes.

The foundation of a strategic plan is vision, mission and values of an organization – all of which can be directly connected to an organization’s market, customer and fit. Both of these foundations serve as the “true north” for the organization, but they can and should be modified as the environment changes. The process between creating a strategic plan and a business plan are also remarkably similar. You start with an internal and external scan, or research, to gather insights on the best direction for the organization. Those insights become the basis for an organization’s strategy, which is value creation for a business and impact for a social sector organization. In both cases, value and impact must be coupled with sustainability through a strong business model or fundraising plan. Then, strategy is followed by execution, which can be set via goals, KPIs (key performance indicators) and an action plan, which are often tracked in a dashboard. A business plan takes execution to the next level of detail and dictates the resources needed to be successful, e.g., personnel, operations. However, the outcome associated with each planning process is different. A strategic plan charts the long-term direction of an organization, while a business plan tests the feasibility of a business or organization and builds a roadmap for implementation. Taken together, a business plan and strategic plan communicate the same thing – confidence in the future direction. So, the hybrid strategic business plan communicates not only your vision for the future, but also how you plan to get there. It combines hopes and dreams with reality.

Benefits of a Good Business Plan [10]

Here are the top ten benefits of a good business plan.

- See the Whole Business: Business planning done right connects the dots in your business so you get a better picture of the whole. Strategy is supposed to relate to tactics with strategic alignment. Does that show up in your plan? Do your sales connect to your sales and marketing expenses? Are your products right for your target market? Are you covering costs including long-term fixed costs, product development, and working capital needs as well? Take a step back and look at the larger picture.

- Strategic Focus: Startups and small business need to focus on their special identities, their target markets, and their products or services tailored to match.

- Set Priorities: You can’t do everything. Business planning helps you keep track of the right things, and the most important things. Allocate your time, effort, and resources strategically.

- Manage Change: With good planning process you regularly review assumptions, track progress, and catch new developments so you can adjust. Plan vs. actual analysis is a dashboard, and adjusting the plan is steering.

- Develop Accountability: Good planning process sets expectations and tracks results. It’s a tool for regular review of what’s expected and what happened. Good work shows up. Disappointments show up too. A well-run monthly plan review with plan vs. actual included becomes an impromptu review of tasks and accomplishments.

- Manage Cash: Good business planning connects the dots in cash flow. Sometimes just watching profits is enough. But when sales on account, physical products, purchasing assets, or repaying debts are involved, cash flow takes planning and management. Profitable businesses suffer when slow-paying clients or too much inventory constipate cash flow. A plan helps you see the problem and adjust to it.

- Strategic Alignment : Does your day-to-day work fit with your main business tactics? Do those tactics match your strategy? If so, you have strategic alignment. If not, the business planning will bring up the hidden mismatches. For example, if you run a gourmet restaurant that has a drive-through window, you’re out of alignment.

- Milestones: Good business planning sets milestones you can work towards. These are key goals you want to achieve, like reaching a defined sales level, hiring that sales manager, or opening the new location. We’re human. We work better when we have visible goals we can work towards.

- Metrics: Put your performance indicators and numbers to track into a business plan where you can see them monthly in the plan review meeting. Figure out the numbers that matter. Sales and expenses usually do, but there are also calls, trips, seminars, web traffic, conversion rates, returns, and so forth. Use your business planning to define and track the key metrics.

- Realistic Regular Reminders to Keep onTtrack: We all want to do everything for our customers, but sometimes we need to push back to maintain quality and strategic focus. It’s hard, during the heat of the everyday routine, to remember the priorities and focus. The business planning process becomes a regular reminder.

- IT Strategic Plan

- ↑ Definition - What Does Business Plan Mean? Investopedia

- ↑ Four Key Elements of A Business Plan Toptal

- ↑ Overview of Three Common Types of Business Plans bplans.com

- ↑ What are the 10 components of a business plan? SmartAsset

- ↑ Why do you need a business plan? GrowThink

- ↑ The Audience for Business Plans Wikipedia

- ↑ Who Needs a Business Plan? Entrepreneur

- ↑ The Most Common Business Plan Mistakes the balance

- ↑ Business Plan Vs. Strategic Plan Social Impact Architects

- ↑ What are the Benefits of a Good Business Plan? Tim Berry

Further Reading

- How To Build A Billion Dollar Business Plan: 10 Top Points Alan Hall

- The Undeniable Importance of a Business Plan SEAN HEBERLING, CFA

- 10 Benefits of Business Planning for all Businesses Evanston Chamber of Commerce

- If You Can Write a Grant, You CAN Write a Business Plan Suzanne Smith

What is a Business Plan? Definition and Resources

9 min. read

Updated March 4, 2024

If you’ve ever jotted down a business idea on a napkin with a few tasks you need to accomplish, you’ve written a business plan — or at least the very basic components of one.

The origin of formal business plans is murky. But they certainly go back centuries. And when you consider that 20% of new businesses fail in year 1 , and half fail within 5 years, the importance of thorough planning and research should be clear.

But just what is a business plan? And what’s required to move from a series of ideas to a formal plan? Here we’ll answer that question and explain why you need one to be a successful business owner.

- What is a business plan?

A business plan lays out a strategic roadmap for any new or growing business.

Any entrepreneur with a great idea for a business needs to conduct market research , analyze their competitors , validate their idea by talking to potential customers, and define their unique value proposition .

The business plan captures that opportunity you see for your company: it describes your product or service and business model , and the target market you’ll serve.

It also includes details on how you’ll execute your plan: how you’ll price and market your solution and your financial projections .

Reasons for writing a business plan

If you’re asking yourself, ‘Do I really need to write a business plan?’ consider this fact:

Companies that commit to planning grow 30% faster than those that don’t.

Creating a business plan is crucial for businesses of any size or stage.

If you plan to raise funds for your business through a traditional bank loan or SBA loan , none of them will want to move forward without seeing your business plan. Venture capital firms may or may not ask for one, but you’ll still need to do thorough planning to create a pitch that makes them want to invest.

But it’s more than just a means of getting your business funded . The plan is also your roadmap to identify and address potential risks.

It’s not a one-time document. Your business plan is a living guide to ensure your business stays on course.

Related: 14 of the top reasons why you need a business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

What research shows about business plans

Numerous studies have established that planning improves business performance:

- 71% of fast-growing companies have business plans that include budgets, sales goals, and marketing and sales strategies.

- Companies that clearly define their value proposition are more successful than those that can’t.

- Companies or startups with a business plan are more likely to get funding than those without one.

- Starting the business planning process before investing in marketing reduces the likelihood of business failure.

The planning process significantly impacts business growth for existing companies and startups alike.

Read More: Research-backed reasons why writing a business plan matters

When should you write a business plan?

No two business plans are alike.