- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- *New* Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

13 Financial Performance Measures Managers Should Monitor

- 05 May 2020

While you may not have a background in finance, a basic understanding of the key concepts of financial accounting can help you improve your decision-making process , as well as your chances for career success. With a better understanding of how your organization measures financial performance, you can take steps to provide additional value in your daily activities.

Finance can be intimidating for the uninitiated. To help you become more comfortable understanding and speaking about financial topics, here’s a list of the top financial metrics managers need to understand.

What Are Financial KPIs?

Financial KPIs (key performance indicators) are metrics organizations use to track, measure, and analyze the financial health of the company. These financial KPIs fall under a variety of categories, including profitability, liquidity, solvency, efficiency, and valuation.

By understanding these metrics, you can be better positioned to know how the business is performing from a financial perspective. You can then use this knowledge to adjust the goals of your department or team and contribute to critical strategic objectives.

For managers, these metrics and KPIs should be made available internally and distributed on a weekly or monthly basis in the form of email updates, dashboards, or reports. If they’re not readily distributed, you can still become familiar with the metrics via financial statement analysis.

Access your free e-book today.

What Is Financial Statement Analysis?

Financial statement analysis is the process of reviewing key financial documents to gain a better understanding of how the company is performing. While there are many different types of financial statements that can be analyzed as part of this process, some of the most important, especially to managers, include the:

- Balance Sheet : A statement that lists a business’s assets, liabilities, and owners’ equity at a specific point in time.

- Income Statement : A statement that summarizes a business’s revenues, expenses, and profits over a period.

- Cash Flow Statement : A statement that captures how cash flow is affected by activities from the balance sheet and income statement, categorized into operating, investing, and financing activities.

- Annual Report : A document that describes the company’s operations and financial conditions, and typically includes the documents listed above, in addition to other insights and narrative from key figures within the company.

13 Financial Performance Measures to Monitor

The metrics below are typically found in the financial statements listed above and among the most important for managers and other key stakeholders within an organization to understand.

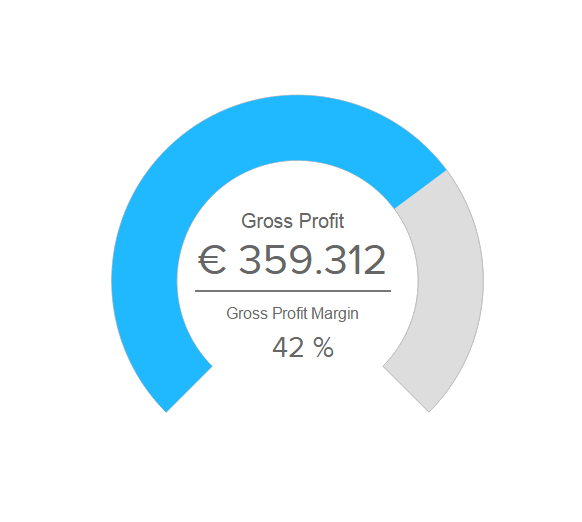

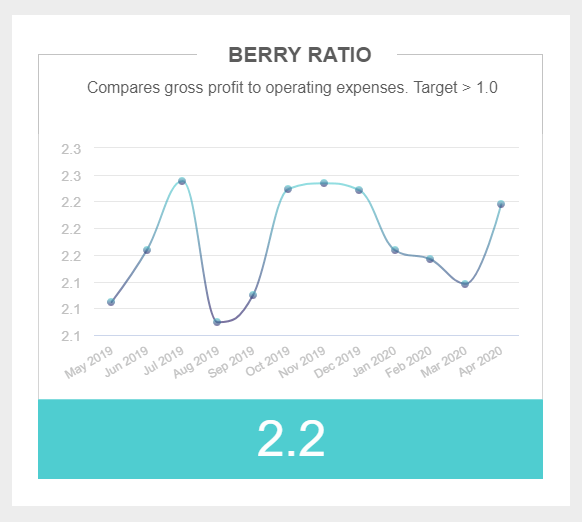

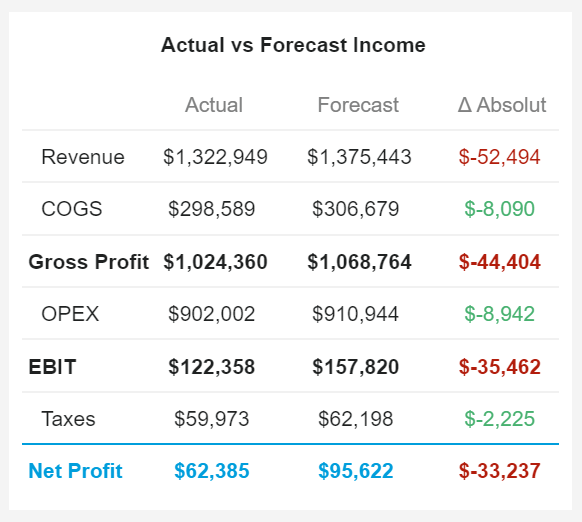

1. Gross Profit Margin

Gross profit margin is a profitability ratio that measures what percentage of revenue is left after subtracting the cost of goods sold. The cost of goods sold refers to the direct cost of production and does not include operating expenses, interest, or taxes. In other words, gross profit margin is a measure of profitability, specifically for a product or item line, without accounting for overheads.

Gross Profit Margin = (Revenue - Cost of Sales) / Revenue * 100

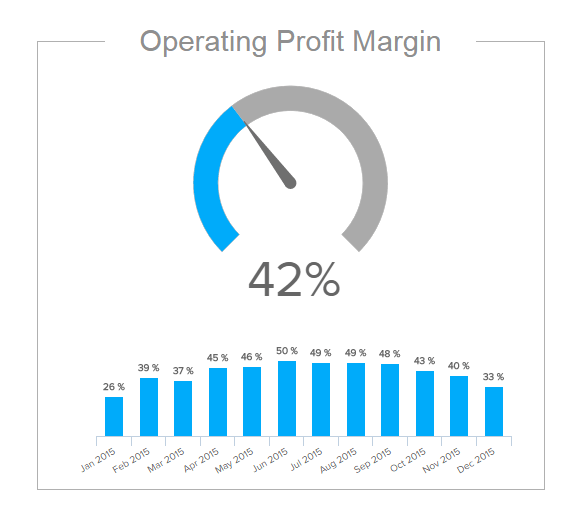

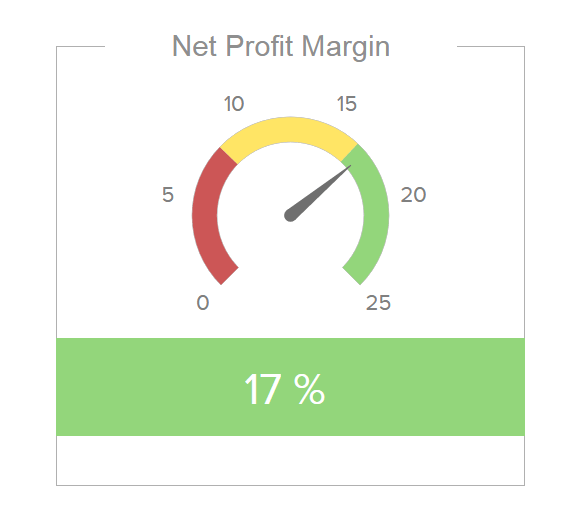

2. Net Profit Margin

Net profit margin is a profitability ratio that measures what percentage of revenue and other income is left after subtracting all costs for the business, including costs of goods sold, operating expenses, interest, and taxes. Net profit margin differs from gross profit margin as a measure of profitability for the business in general, taking into account not only the cost of goods sold, but all other related expenses.

Net Profit Margin = Net Profit / Revenue * 100

3. Working Capital

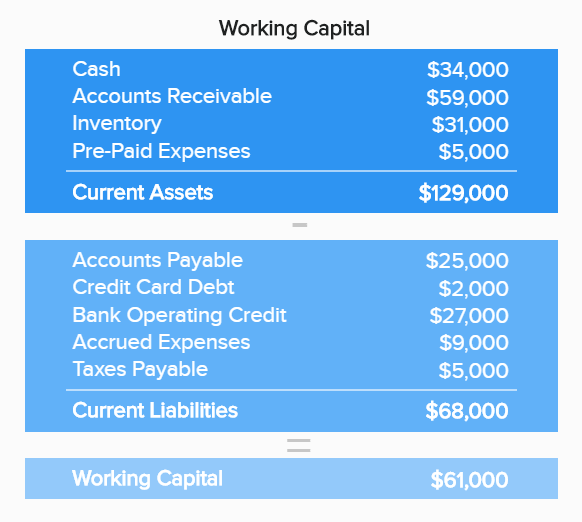

Working capital is a measure of the business’s available operating liquidity, which can be used to fund day-to-day operations.

Working Capital = Current Assets - Current Liabilities

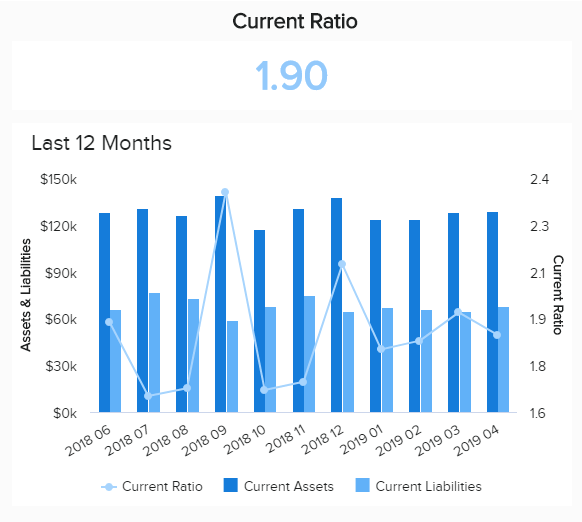

4. Current Ratio

Current ratio is a liquidity ratio that helps you understand whether the business can pay its short-term obligations—that is, obligations due within one year— with its current assets and liabilities.

Current Ratio = Current Assets / Current Liabilities

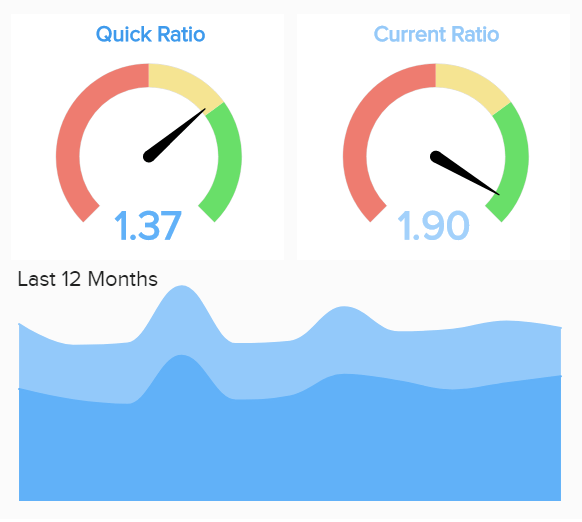

5. Quick Ratio

The quick ratio , also known as an acid test ratio , is another type of liquidity ratio that measures a business’s ability to handle short-term obligations. The quick ratio uses only highly liquid current assets, such as cash, marketable securities, and accounts receivables, in its numerator. The assumption is that certain current assets, like inventory, are not necessarily easy to turn into cash.

Quick Ratio = (Current Assets - Inventory) / Current Liabilities

6. Leverage

Financial leverage , also known as the equity multiplier , refers to the use of debt to buy assets. If all the assets are financed by equity, the multiplier is one. As debt increases, the multiplier increases from one, demonstrating the leverage impact of the debt and, ultimately, increasing the risk of the business.

Leverage = Total Assets / Total Equity

7. Debt-to-Equity Ratio

The debt-to-equity ratio is a solvency ratio that measures how much a company finances itself using equity versus debt. This ratio provides insight into the solvency of the business by reflecting the ability of shareholder equity to cover all debt in the event of a business downturn.

Debt to Equity Ratio = Total Debt / Total Equity

8. Inventory Turnover

Inventory turnover is an efficiency ratio that measures how many times per accounting period the company sold its entire inventory. It gives insight into whether a company has excessive inventory relative to its sales levels.

Inventory Turnover = Cost of Sales / (Beginning Inventory + Ending Inventory / 2)

9. Total Asset Turnover

Total asset turnover is an efficiency ratio that measures how efficiently a company uses its assets to generate revenue. The higher the turnover ratio, the better the performance of the company.

Total Asset Turnover = Revenue / (Beginning Total Assets + Ending Total Assets / 2)

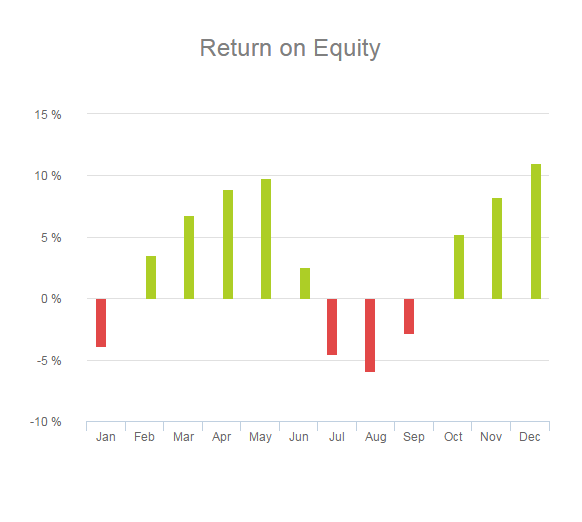

10. Return on Equity

Return on equity, more commonly displayed as ROE, is a profitability ratio measured by dividing net profit over shareholders’ equity. It indicates how well the business can utilize equity investments to earn profit for investors.

ROE = Net Profit / (Beginning Equity + Ending Equity) / 2

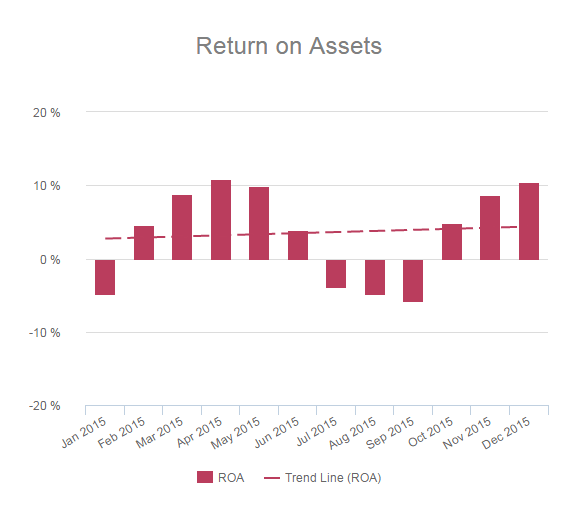

11. Return on Assets

Return on assets, or ROA, is another profitability ratio, similar to ROE, which is measured by dividing net profit by the company’s average assets. It’s an indicator of how well the company is managing its available resources and assets to net higher profits.

ROA = Net Profit / (Beginning Total Assets + Ending Total Assets) / 2

12. Operating Cash Flow

Operating cash flow is a measure of how much cash the business has as a result of its operations. This measure could be positive, meaning cash is available to grow operations, or negative, meaning additional financing would be required to maintain current operations. The operating cash flow is usually found on the cash flow statement and can be calculated using one of two methods: direct or indirect .

13. Seasonality

Seasonality is a measure of how the period of the year is affecting your company’s financial numbers and outcomes. If you’re in an industry that’s affected by high and low seasons, this measure will help you sort out confounding variables and see the numbers for what they truly are.

It’s important to note there’s no absolute good or bad when it comes to financial KPIs. Metrics need to be compared to prior years or competitors in the industry to see whether your company’s financial performance is improving or declining and how it’s performing relative to others.

The Bottom Line

There are many other financial KPIs you can track and monitor to understand how your company is doing and how your actions impact progress toward shared goals. The financial KPIs listed above are a great place to start if you’re unfamiliar with finance. Understanding how these metrics influence business strategy is a critical financial accounting skill for all managers to develop.

Are you looking to develop or hone your finance skills? Explore our online finance and accounting courses to develop your toolkit for making and understanding financial decisions. If you aren't sure which course is the right fit, download our free course flowchart to determine which best aligns with your goals.

About the Author

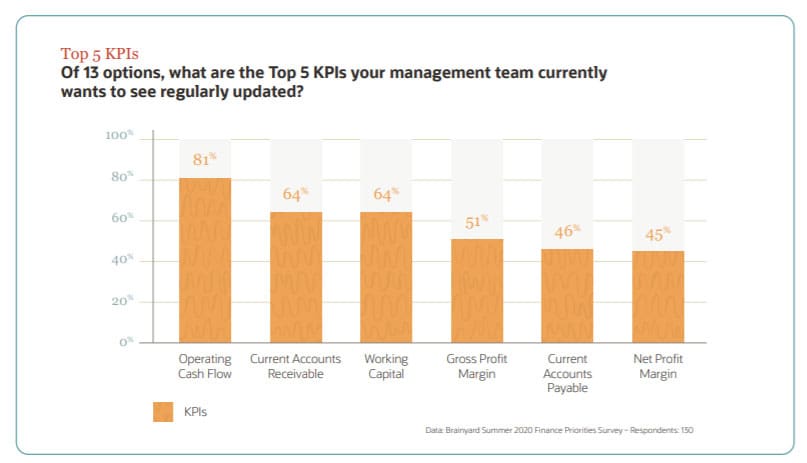

15 Financial KPIs And Metrics Every Business Should Track (+ Template)

Looking for some financial KPIs and metrics?

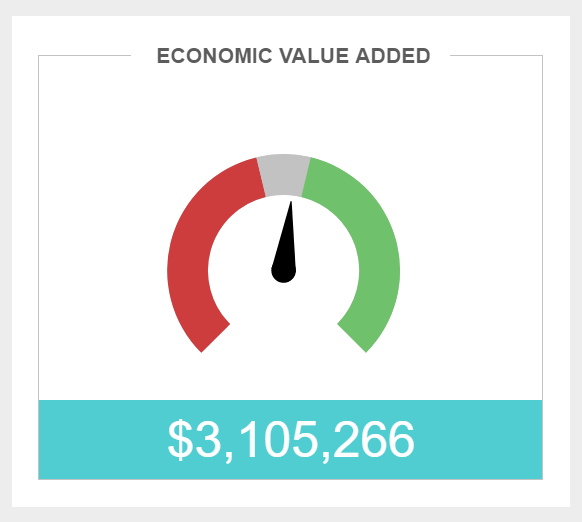

Financial KPIs help CFOs and financial teams assess their company’s financial health and tell the story behind the company’s performance. However, every business manager should be able to read the financial signals and unlock strategic insights to identify opportunities for improvements that can affect the bottom line.

This awareness gives you an opportunity to strengthen your strategic role in the business and surface insights that will drive business performance.

But which metrics should you be focusing on? And most importantly, how should you track them to support data-driven decision-making at any given time?

In this article, we share key financial KPIs that every business manager should know, as well as how to track them through real-time dashboards and KPI reports .

What Are Financial KPIs?

Financial KPIs are a set of measurable values used by organizations and finance teams to measure and track their progress on specific business objectives . Monitoring these KPIs shows whether a business is achieving its financial goals.

We've decided to kick things off with some of the most important examples of KPIs for running your business.

Those that relate to your financial performance . Whether you're a member of a finance team or not, these financial key performance indicators are critical to measure and understand the success of your business operations.

Financial KPI Examples

Financial kpis for understanding your profitability.

These examples of KPIs are for helping you understand how well your business is performing in terms of profitability. This can help you benchmark both internally and externally as well as help you set growth targets over time.

Gross Profit Margin

Expresses your profits as a percentage of total sales revenues generated after subtracting the cost of goods sold (COGS). It gives you a high-level view of how much profit you're making.

The gross profit margin doesn't factor in all expenses and shouldn't be used for detailed decision-making. However, it’s useful for bench-marking your performance over time or comparing your profitability to another similar company.

Net Profit Margin (NPM)

NPM is the percentage of revenue remaining after operating expenses, interest, and taxes have been deducted from total revenue. It gives a more accurate understanding of profit at your company, but is less useful for making comparisons with other companies.

Financial KPIs: Monthly Recurring Revenue (MRR)

Monthly recurring revenue is a very popular financial metric for SaaS companies such as ours. This metric looks only at the revenue generated each month, which will re-occur with little to no additional investment required. For example, any customer who signs up for a recurring monthly subscription to Cascade increases our MRR.

Return on Equity (ROE)

Measures your net income against each unit of shareholder equity. In other words, ROE measures the amount of profit a company generates for each dollar of shareholder equity invested. Return on equity ratio not only provides a measure of your organization’s profitability but also its efficiency. It’s an important KPI because it provides investors with insight into how efficiently a company is using its equity to generate profits.

Financial KPIs For Understanding Your Liquidity

Being profitable is key, but if you're not able to pay your debts or stay liquid, you won't be around for long. These examples of finance KPIs will help do that.

Current Ratio

Current Ratio weighs your assets, such as accounts receivables, against your current liabilities, including accounts payable. The KPI is used to help you understand the solvency of your business.

Current Ratio formula = Current Assets / Current Liabilities

Quick Ratio

The quick ratio, also known as the acid test ratio , is a financial KPI that measures a company's ability to pay its short-term obligations using only its most liquid assets such as cash, marketable securities, and accounts receivable. The quick ratio is calculated by dividing the sum of a company's quick assets by its current liabilities.

This KPI is essential for companies that operate in industries with volatile cash flows or cyclical demand patterns, as it can help them evaluate their ability to weather unexpected disruptions or delays in cash receipts.

Debt-To-Equity Ratio

The debt-to-equity ratio measures a company's level of financial leverage and risk. A higher debt-to-equity ratio indicates that a company has more debt than equity, which increases its financial risk. On the other hand, a low debt-to-equity ratio indicates that a company has a strong balance sheet and a better ability to weather financial shocks.

Investors, lenders, and management use this KPI to evaluate a company's creditworthiness and financial stability.

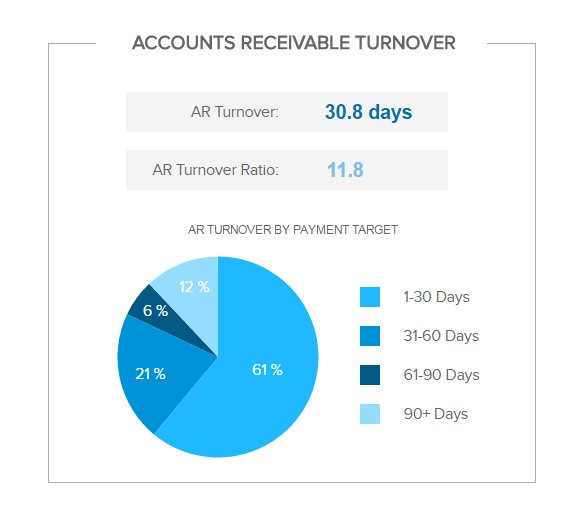

Accounts Receivable Turnover

Accounts receivable turnover shows how well you collect what is owed to you by your customers. To calculate the KPI, take total earnings for a given period and divide them by average accounts receivable.

Monitoring this over time allows you to detect problems early. It will help you identify customers starting to take longer and longer to pay. You’ll soon see an impact on your own liquidity if this happens.

Runway and Burn Rate

The two KPIs work together to give you an idea of how much time you have for survival if sales were to cease completely in the worst-case scenario.

Divide the total amount of cash you have available by how much you spend each month—this is your burn rate .

Runway will tell you how much time you have before your company runs out of money. To calculate it, divide your total available cash by your burn rate.

Working Capital

Working capital measures a company's ability to meet its short-term obligations and manage its cash flow effectively. If a company's working capital is positive, it has enough liquid assets to meet its short-term liabilities. Having this information can help companies avoid financial distress such as missed payments, defaults, or bankruptcy.

Financial KPIs For Understanding Your Efficiency

If you're profitable and liquid, you've already passed some of the hardest tests in the business. Now is the time to optimize the efficiency of your business operations and look for opportunities to improve, which in turn will increase profitability and stability.

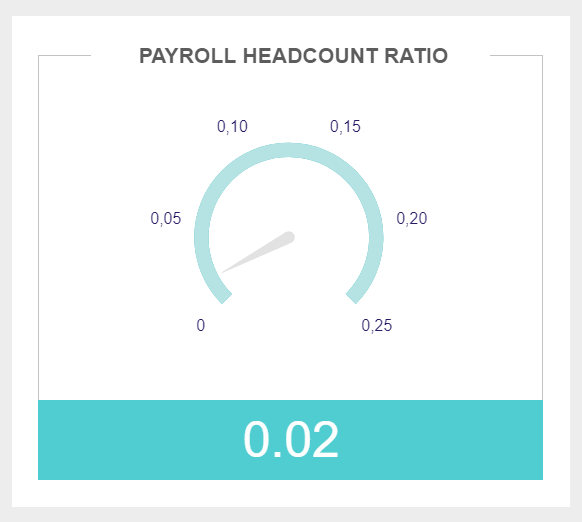

Revenue Per Employee

Employee costs usually make up the bulk of a company's expenses. Therefore, it's often useful to measure how much revenue you are actually generating for each employee in your company.

You can then determine whether you're making an appropriate amount of revenue based on your business size.

Revenue Per Customer

This gives you an idea of how much gross revenue you make per customer. The method you use to calculate it will vary depending on your business.

As a SaaS business, we consider Life Time Value (LTV) based on what customers pay for their subscription and how long a subscription typically lasts. Another example might be a telecom company that offers services such as cable TV, internet, and phone. The company can calculate its revenue per customer by dividing its total revenue from these services by the total number of customers who subscribe to one or more of these services.

Revenue Growth Rate

This KPI helps ensure your business continues to grow at a target rate, measured by a percentage. Therefore, you would measure this monthly or on a 12-month rolling average basis.

A consistently high revenue growth rate can be a sign of a healthy and profitable company, while a declining revenue growth rate can indicate issues with the company's operations, competition, or market conditions.

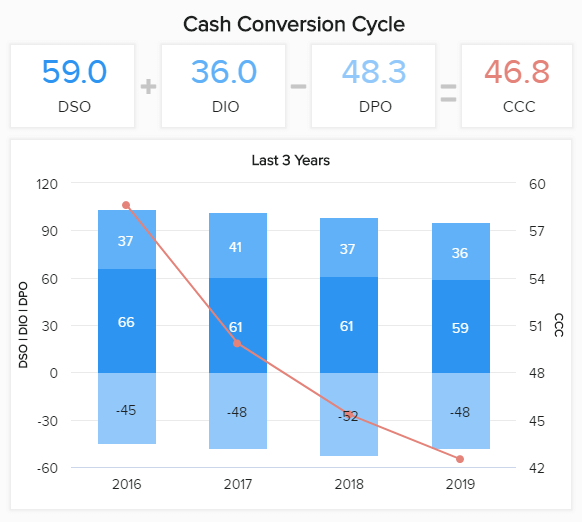

Cash Conversion Cycle

Measures the time it takes to convert an investment in inventory or some other resource input into cash. This gives you an understanding of how long cash is tied up in inventory before the inventory is sold and cash is collected from customers.

Total Asset Turnover

The total asset turnover of a company shows how efficiently it uses its assets to generate revenue. In other words, the metric measures how much revenue a company generates for every dollar it owns.

When a company has a high asset turnover ratio, it can generate more profits and grow faster than its competitors with similar asset bases. Companies with a low asset turnover ratio may be underutilizing their assets and may need to optimize their operations or divest inefficient assets.

As an example, a ratio of .5 means that every dollar of assets generates 50 cents of sales.

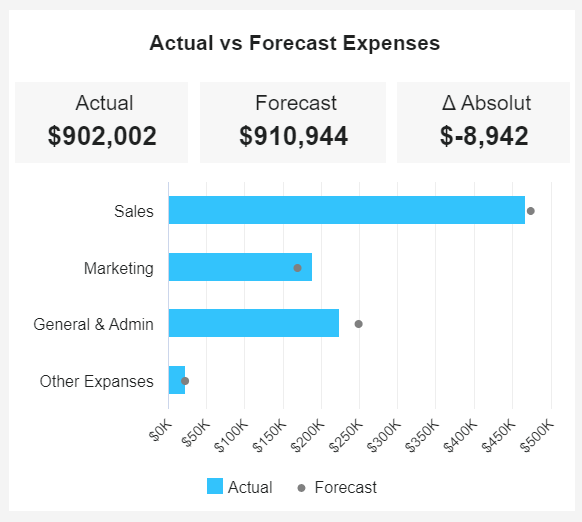

Operating Cash Flow

Operating cash flow is an important financial KPI for businesses because it measures how well they generate cash from their core operations.

With a strong operating cash flow, a company can invest in growth opportunities, repay debt, or return value to shareholders. In contrast, a company with negative operating cash flow may take steps to stay afloat by cutting costs, raising prices, or seeking external financing.

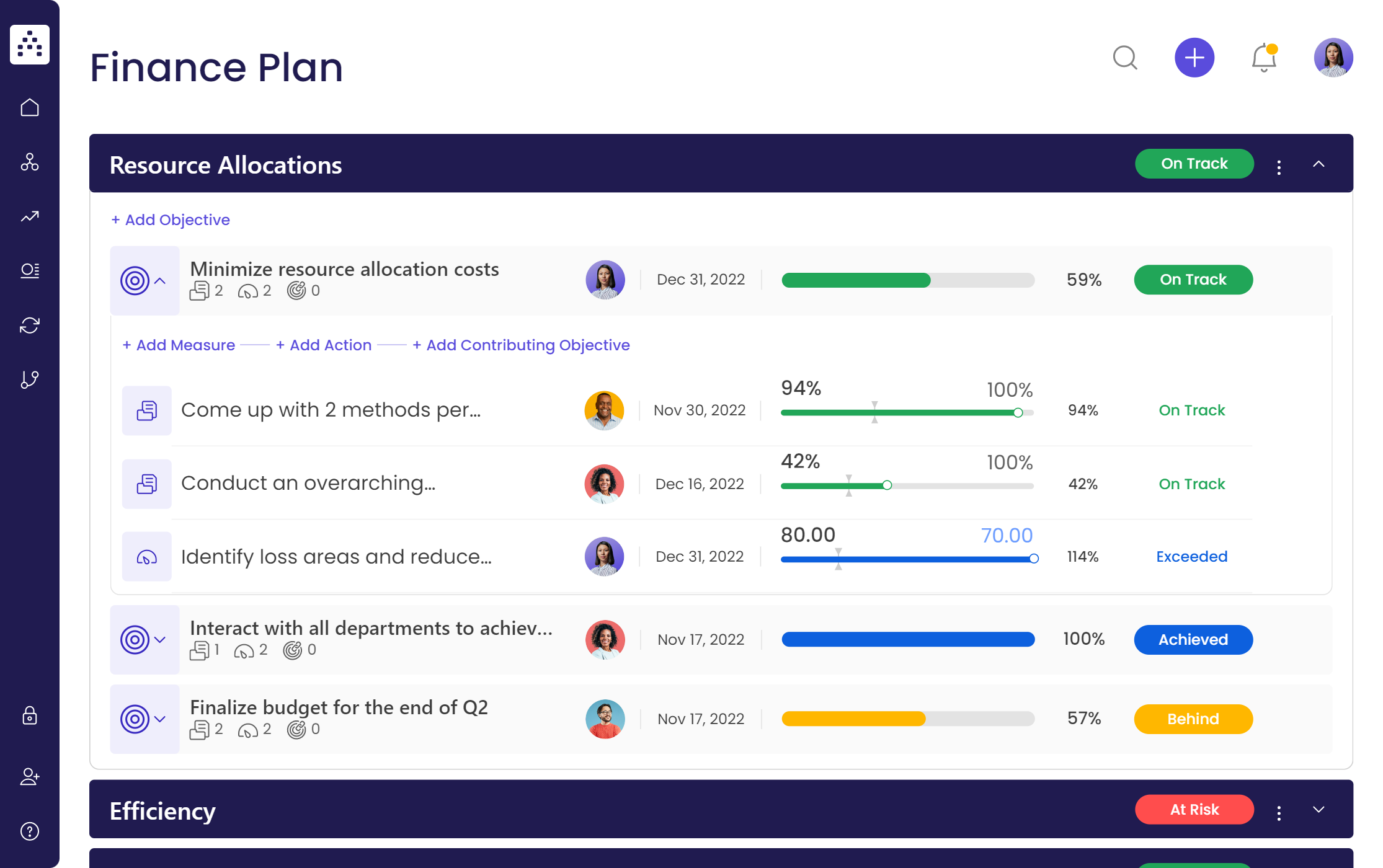

How To Track Financial KPIs With Cascade?

Cascade is the ultimate strategy execution platform that empowers businesses to execute their strategies flawlessly. Our powerful tool comes with a range of features, including extensive KPI dashboards , real-time data integration, and analytics capabilities.

Whether you’re an executive manager, CFO, or head of operations, Cascade provides the tools you need to make data-driven decisions and achieve your financial goals.

👉Here’s how you can track KPIs in Cascade:

1. Get your free financial strategy plan template

Sign up for Cascade and download your template. The template will help you define your financial goals, objectives, and KPIs to measure success.

Here’s a preview of your template:

✨ More related templates:

- Financial Risk Management Plan Template

- Sales Plan Template

- Business Development Strategy Template

- Business Acquisition Strategy Template

- Investment Strategy Template

- Strategic Cost Reduction Plan Template

2. Customize your data

While the Cascade template comes pre-filled with examples, you have the power to customize your data and financial metrics to ensure they are relevant to your specific business needs.

3. Integrate Cascade with your data sources

With Cascade, you have two options to track your KPIs: manually and automatically .

The latter option is far more efficient, as it simplifies data collection and ensures you're working with accurate and up-to-date data.

By integrating Cascade with your favorite business tools, such as Excel, Google Sheets, or Power BI, you can easily import your KPI data and keep your team in the loop.

No more worrying about manual data entry or inaccuracies—let Cascade take care of the hard work for you.

4. Bring in your team

Send an invite to your team members to collaborate on shared KPIs and ensure everyone is on the same page.

With Cascade, you can assign roles and responsibilities, set up notifications, and communicate with your retail teams in one place.

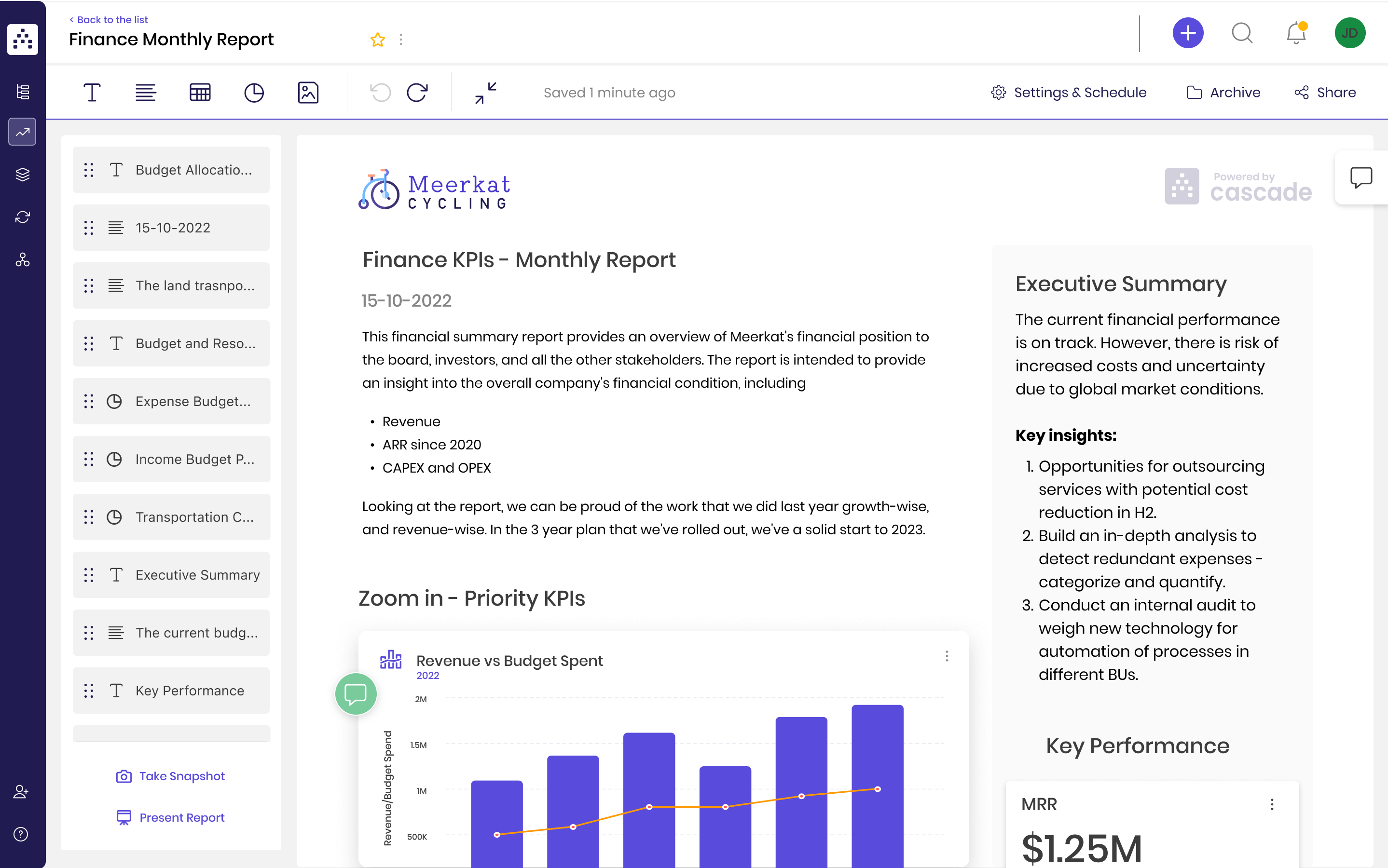

5. Start tracking performance with dashboards and reports

Cascade's powerful dashboards provide real-time visibility into your KPIs and allow you to quickly identify areas that need attention.

With customizable widgets and drag-and-drop features, you can easily visualize and analyze key metrics to improve financial performance and operational efficiency.

Need to explain the “why” behind your financial KPIs?

Using Cascade's strategy reports , you can choose a set of data and add context to it. By providing this context, your stakeholders will be able to make informed and data-driven decisions.

You can customize the reports to fit your specific needs and drill down into the underlying reasons behind your financial performance.

📚 Recommended read: How To Track KPIs To Hit Your Business Goals

Get Real-Time Visibility Into Your Financial Health With Cascade 🚀

Manually tracking all of the financial KPIs spread across multiple business tools is time-consuming, tedious, and leaves a ton of room for error. The lack of real-time visibility into your financial health and the highly competitive nature of your business environment can quickly lead you to lag behind.

Cascade offers powerful reporting tools that make it easy to take total control of your financial reporting by doing the calculations and visualizations for you.

By centralizing your financial data in one place that updates in real-time, you’ll always have an accurate picture of your business’s financial performance.

Automating your financial reporting with Cascade will help you focus more time and energy on strategic work that will move your business forward.

Ready to take it for a spin? Start today with a free forever plan or book a 1:1 product tour with Cascade’s in-house strategy expert.

Editor’s note: We've been compiling a whole bunch of KPI examples as part of our KPI examples mini-series . This post is a small supplement to that series, which provides 12 of the most common financial KPIs, and also includes a brief description of why you may want to use each.

Popular articles

Viva Goals Vs. Cascade: Goal Management Vs. Strategy Execution

What Is A Maturity Model? Overview, Examples + Free Assessment

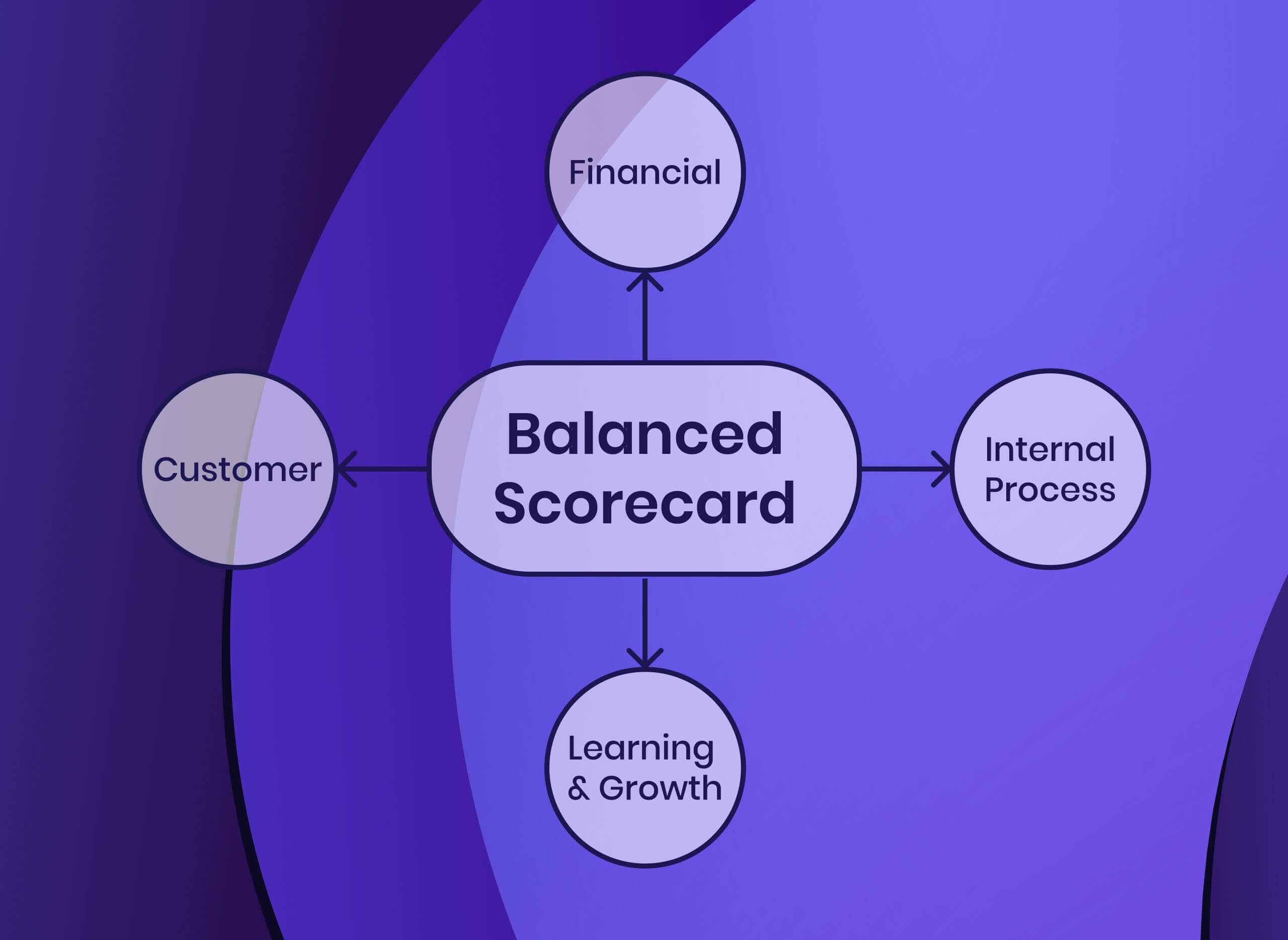

How To Implement The Balanced Scorecard Framework (With Examples)

The Best Management Reporting Software For Strategy Officers (2024 Guide)

Your toolkit for strategy success.

15 Key Financial Metrics & KPIs for Small Businesses

It’s critical that small-business leaders understand the financial health of their organizations, and financial metrics and key performance indicators (KPIs) inform that understanding. Small-business financial metrics shed light on the company’s current financial state and its short- and long-term outlook.

Financial metrics and KPIs help small businesses understand if they have the cash on hand to fund big capital investments—or are on the fast track to insolvency . These numbers are obviously important to business owners, but lenders and investors will also want to review them before they sign any contract with a company.

There are certain metrics that are vital to the success of a small business.

What Are Metrics?

Metrics are any quantifiable data a company may monitor to track performance and improvements across the business. While financial metrics are among the most important and widely used, businesses can use metrics to monitor the success of any aspect of their operations, like monthly website visitors or average order fulfillment times.

Once an organization starts tracking an important metric, it has a baseline against which it can compare future numbers to see how the performance of various processes or teams has changed over time. As a business grows, it often starts tracking more metrics, including ones specific to certain initiatives or departments.

What Are KPIs?

Key performance indicators, or KPIs, are metrics that are particularly important to your business. These numbers have the biggest impact on whether your company thrives and grows or struggles and shuts down. A distinguishing feature of KPIs is they usually have predetermined goals, which is not true of all metrics—a company might monitor certain metrics for years without specific targets in mind. Certain financial metrics are also KPIs since profitability and cash flow play major roles in the immediate and future viability of a business.

Small-business executives should choose their critical KPIs early on and establish a clear understanding of what numbers will indicate success, or raise warning flags. KPIs should be closely tied to key business objectives. For example, average customer account size could be a manufacturing KPI to watch if a company wants to increase revenue by 10% this year. If that manufacturer is looking to increase productivity at its plant, another KPI could be the number of products produced per day.

Defining and Choosing the Right KPIs and Metrics for Small Businesses

The metrics small-business leaders need to pay attention to vary from one company to the next, and KPIs are even more specific and depend on industry, business and financial model and goals. The leadership team should first establish business objectives for the quarter or year and work backward from there, identifying the KPIs and metrics that will help it stay on target. These discussions should include employees from all key departments to ensure goals are relevant to the entire company.

However, there are a few common financial metrics that all companies need to keep an eye on. They need to have a firm grasp of total revenue, expenses, assets and liabilities and how each shifts over time. The cost of customer acquisition and how long those customers stick around, a.k.a. churn rate, are other metrics important to many young companies. For products-based companies, tracking the efficiency of various processes and employee productivity at manufacturing plants or warehouses is often important.

While organizations need a firm grasp of what will make them successful and which industry-specific KPIs matter to them, there are metrics relevant to most businesses. Here are our Top 15 most commonly applicable metrics and KPIs:

Revenue is the amount of money a business takes in for sales of its products or services before any expenses are taken out. Revenue, also called sales or top-line income, is part of the calculation for most financial metrics. There are multiple ways to measure revenue. In accrual accounting, customer purchases made on credit count toward revenue before the business has actually received payment. In cash accounting, only money already in the company’s bank account counts toward revenue.

Revenue = Sales Price x Units Sold

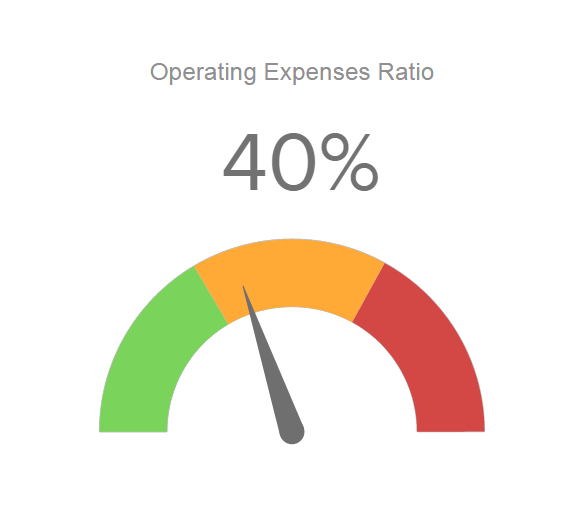

Expenses are all the costs a business must cover to operate and earn revenue. With some exceptions, such as VC-backed startups, a business needs more revenue than expenses to survive. Examples of expenses are labor, equipment, and supplies. Just like with revenue, accrual accounting factors in expenses as they are incurred, even if they haven’t been paid yet, while cash accounting includes these expenses only once they’re paid.

Expenses can be grouped into two broad categories: operating expenses and nonoperating expenses. Operating expenses are a direct result of doing business, like mortgages, production costs and administrative costs. Nonoperating expenses are more indirect and include interest and other lending fees.

Expenses = Cost of Goods Sold + Salaries + Sales Commissions + Marketing Costs + Real Estate Expenses + Utilities

Net income or net profit is the money left over after subtracting all expenses and taxes from revenue. Although there are investor-backed startups that lose money, most small businesses need to bring in enough revenue to cover their expenses. If they don’t, they risk falling into debt and eventually going out of business.

Net income is also referred to as the “bottom line” because it shows up below revenue (the “top line”) on profit and loss (P&L) statements.

Net Profit = Revenue – Total Expenses

Cash is the lifeblood of small businesses—they rely on the money coming in to pay expenses. Cash flow is the amount of money moving in and out of a business over a certain timeframe. If more money is coming in than going out, a business has positive cash flow, and if it’s paying out more money than it’s receiving, it has negative cash flow.

Operating cash flow (OCF) is the amount of cash a company generates through typical operations. This metric can give a business a sense of how much cash it can spend in the immediate future and whether it should reduce spending. OCF can also reveal issues like customers taking too long to pay their bills or not paying them at all.

Operating Cash Flow = Net Income + Non-Cash Expenses – Increase in Working Capital

Working capital is the difference between current assets (cash, accounts receivable and short-term investments) and liabilities (accounts payable, payroll, taxes and debt payments). This metric helps paint a picture of a business’s financial state for the near term by looking at is available liquidity to cover immediate expenses.

Working Capital = Current Assets - Current Liabilities

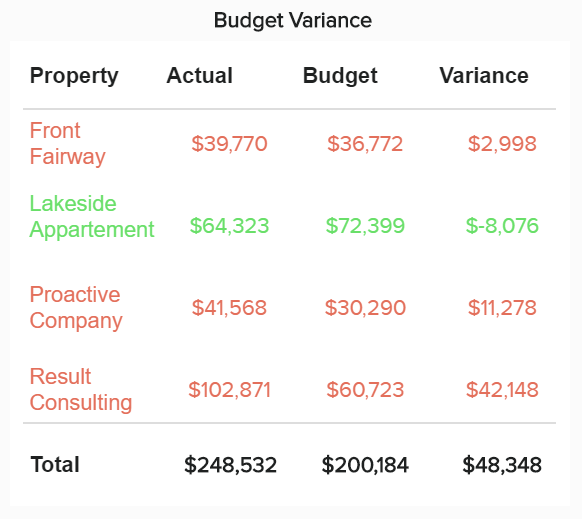

Just as it sounds, budget vs. actual compares a company’s actual spend or sales in a certain area against the budgeted amounts. Although budgets and expense are related , budget vs. actual can be used to compare both revenue and expenses.

This “budget variance analysis” helps small business leaders identify areas of the business where they’re overspending that may need further attention. It also reveals areas of the business that outperformed expectations.

Budget Variance Percentage = Actual/Forecast – 1 x 100

Accounts receivable aging is a report that measures how many days it takes your customers to pay their bills. Companies often include credit terms on an invoice that say how many days the customer has to submit payment; 30 days is common.

On an accounts receivable aging report, a business typically organizes clients by due date—immediately, 1–30 days late, 31–60 days late—to see how much money is collectable from different companies and timeframes.

When accounts receivable consistently runs behind, it hurts cash flow and working capital. As more time passes, the chances of ever collecting that revenue decrease. Businesses may need to cut ties with customers that are consistently late, as these delays can cause a cash flow crunch. Companies should consider offering customers a small discount for early payment to prevent delays.

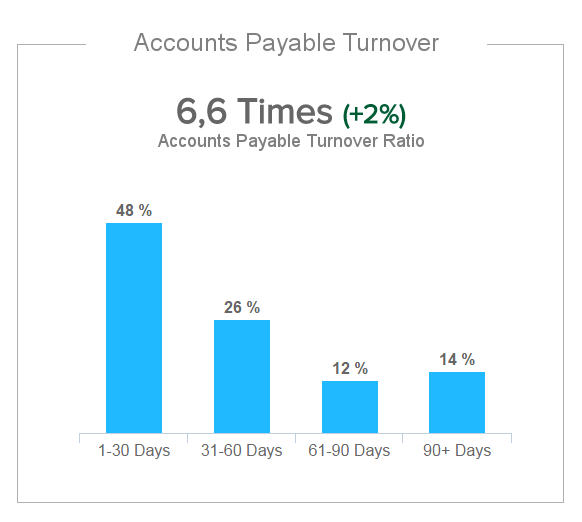

Accounts payable aging is a report similar to accounts receivable aging, except it looks at how many days it takes your business to pay its bills. Like with accounts receivable aging, a company lists its upcoming bills based on when they’re due to ensure it can meet all obligations and resolve any problems ahead of time. Revenue, cash flow and accounts receivable aging can all affect your ability to keep up with invoices from suppliers, technology vendors and other business partners.

How quickly a company pays its bills affects its creditworthiness and ability to get a loan. Companies that are able to stay on top of their financial obligations can reinvest the savings from early payments back into the business.

The break-even point (opens in new tab) is when revenue is equal to costs, meaning there is no profit or loss. Also known as margin of safety, break-even point helps a business know when it will earn more than it spends and start earning a profit. By calculating the break-even point, a software provider knows how many licenses it needs to sell, or a manufacturer understands how many products it must move to cover monthly costs.

Break-even Point = Fixed Costs/(Sales Price Per Unit – Variable Cost Per Unit)

Gross profit margin ratio shows revenue after deducting the cost of goods sold (COGS) —that is, the direct costs of making a product. This ratio, written as a percentage, reveals the gross profit for every dollar of revenue a business earns. A ratio of 60%, for instance, means the company receives 60 cents of profit for each dollar of revenue.

Gross Profit Margin Ratio = (Revenue – COGS)/Revenue x 100

Profit margin ratio is similar to the gross profit margin ratio but accounts for all expenses, like payroll and other operating costs, rather than just COGS. Although standard profit margins differ between industries, many companies target a profit margin ratio of at least 25%.

Profit Margin Ratio = (Revenue – Expenses)/Revenue

Quick ratio (opens in new tab) , also called the acid test ratio, measures whether a business can fulfill its short-term financial obligations by evaluating whether it has enough assets to pay off its current liabilities. Quick ratio is written as a decimal, with a ratio of 1.0 meaning a company has just enough assets to cover its liabilities.

Quick Ratio = (Cash + Marketable Securities + Accounts Receivable)/Current Liabilities

Average customer acquisition cost uncovers how much a company spends, on average, to add new customers during a certain period of time. This metric factors in expenses for marketing, technology, payroll and more. Customer acquisition cost is typically proportional to the price of a product or service, so it varies widely by industry—the average retailer spends $10 to acquire a customer, while the typical technology provider shells out $395.

An organization can compare customer acquisition cost to customer lifetime value to make sure its business model is sustainable. If necessary, a company can lower its customer acquisition costs by reducing marketing spend and focusing on customer retention and upsells.

Cost of Customer Acquisition = (Cost of Sales + Cost of Marketing)/New Customers Acquired

Churn rate calculates how frequently customers stop using your product or service over a given timeframe. Are a quarter of customers abandoning your service after a year or do most use it for five years? Does that churn rate make sense for your industry or business model? A high churn rate suggests a company needs to change something about its offering, better nurture its customers and/or lower its customer acquisition cost.

Churn Rate = Lost Customers/Starting Number of Customers x 100

Cash runway calculates how long a company has before it runs out of cash based on the money it currently has available and how much it spends per month. This metric helps businesses understand when they need to cut back spending or get additional funding. If your cash runway shortens over time, it’s a sign your company is spending more money than it can afford to.

Cash runway is closely tied to burn rate, which measures how much money a company spends over a certain period (usually monthly). Burn rate is frequently used by investor-backed startups that lose money in their early days.

Cash Runway = Cash Balance/Monthly Burn Rate

#1 Cloud Accounting Software

How Can Financial Software Help With Setting and Tracking Financial Metrics and KPIs?

Tracking even basic metrics like revenue, expenses and income can become cumbersome with spreadsheets or other manual methods. It's difficult to keep all this information up-to-date, especially as a small company grows and its transaction volume increases, and that can lead to inaccurate information.

Manually calculating more advanced metrics, like break-even point, quick ratio and average customer acquisition cost, is even more challenging.

Financial or accounting software makes it far easier and less time-consuming to find the numbers needed for these metrics. Leading solutions can make these calculations with just a few clicks, and business stakeholders can automatically and regularly receive reports showing select metrics and KPIs.

These solutions open up countless possibilities to view and compare numbers that illuminate your business’s performance and help identify issues holding it back—all without consuming a lot of employee time or effort. There is tremendous value in real-time data, and that alone often justifies the cost of the solution.

Small businesses must set clear KPIs and track a wide variety of metrics to excel in today’s turbulent environment. Without insights, these companies have no true sense of how they’re progressing toward goals and whether they're financially healthy or digging themselves into deep holes. Corporate leaders must make it a priority to pinpoint the KPIs and metrics that matter most to their businesses, monitor them and continually adjust based on what the data tells them.

Technology, even a basic financial system, can go a long way toward helping companies track these numbers and spot changes that will have a positive or negative impact on their financial health. Small firms need metrics because they can be a deciding factor in whether or not a business makes it.

Financial Management

4 Steps to Creating a Financial Plan for Your Small Business

When it comes to long-term business success, preparation is the name of the game. And the key to that preparation is a solid financial plan. It helps you pitch investors, anticipate growth and weather cash flow…

Trending Articles

Learn How NetSuite Can Streamline Your Business

NetSuite has packaged the experience gained from tens of thousands of worldwide deployments over two decades into a set of leading practices that pave a clear path to success and are proven to deliver rapid business value. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support.

Before you go...

Discover the products that 37,000+ customers depend on to fuel their growth.

Before you go. Talk with our team or check out these resources.

Want to set up a chat later? Let us do the lifting.

NetSuite ERP

Explore what NetSuite ERP can do for you.

Business Guide

Complete Guide to Cloud ERP Implementation

Transition to growth mode

with LivePlan Get 40% off now

0 results have been found for “”

Return to blog home

Key Financial Metrics for Your Business Plan

Posted september 6, 2018 by noah parsons.

Digging into your business’s financials can feel a bit like eating your fruits and vegetables, but what’s good for your business’s health is good for you.

When you’re putting a business plan together, the financial plan can feel like the most intimidating part. If you’re like most business owners, you probably didn’t go to business school or have a degree in accounting.

That’s O.K. This article will explain everything that you need to include in your financial plan so you get off to a good start.

All business plans, whether you’re just starting a business or building a plan for an existing business, should include the following:

Profit and loss statement, cash flow statement, balance sheet, sales forecast, personnel plan.

- and maybe some business ratios and/or a break-even analysis

Even if you’re in the very beginning stages of your business, these financial statements can still work for you.

The good news is that they don’t have to be difficult to create or hard to understand. With just a few educated guesses about how much you might sell and what your expenses will be, you’ll be well on your way to creating a complete financial plan.

A profit and loss statement is essentially an explanation of how your business made a profit (or incurred a loss) over a certain period of time. It’s a table that lists all of your revenue streams and all of your expenses—typically for a three-month period—and lists at the very bottom the total amount of net profit or loss.

This is a financial statement that goes by a few different names—profit and loss statement, income statement, pro forma income statement, P&L (short for “profit and loss”)—but no matter what you call it, it’s an essential report and very important to understand.

There are different formats for profit and loss statements, depending on the type of business you’re in and the structure of your business (nonprofit, LLC, C-Corp, etc.).

A typical profit and loss statement should include:

- Your revenue (also called sales)

- Your “cost of sale” or “cost of goods sold” (COGS)—keep in mind, some types of companies, such as a services firm, may not have COGS

- Your gross margin , which is your revenue less your COGS

These three components (revenue, COGS, and gross margin) are the backbone of your business model —i.e., how you make money.

You’ll also list your operating expenses, which are the expenses associated with running your business that aren’t incurred directly by making a sale. They’re the fixed expenses that don’t fluctuate depending on the strength or weakness of your revenue in a given month—think rent, utilities, and insurance.

Your gross margin less your operating expenses will give you your operating income:

Gross Margin – Operating Expenses = Operating Income

Depending on how you classify some of your expenses, your operating income will typically be equivalent to your “earnings before interest, taxes, depreciation, and amortization” (EBITDA)—basically, how much money you made in profit before you take your accounting and tax obligations into consideration. This is also called your “profit before interest and taxes,” gross profit, and “contribution to overhead”—many names, but they all refer to the same number.

Your so-called “bottom line”—officially, your net income, which is found at the very end (or, bottom line) of your profit and loss statement—is your EBITDA less the “ITDA.” Just subtract your expenses for interest, taxes, depreciation, and amortization from your EBITDA, and you have your net income:

Operating Income – Interest, Taxes, Depreciation, and Amortization Expenses = Net Income

For further reading on profit and loss statements (a.k.a., income statements), including an example of what a profit and loss statement actually looks like, check out “ How to Read and Analyze an Income Statement.” And if you want to start building your own, download our free Income Statement Example .

A cash flow statement (also called a “statement of cash flows”) is an explanation of how much cash your business brought in, how much cash it paid out, and what its ending cash balance was, typically per-month.

That might sound like sales, expenses, and profits, but it’s not.

Consider this: What happens when you send out an invoice to a client, but they don’t pay it by the due date ? What happens when you pay your own bills late, or early? These kinds of things aren’t reflected in your profit and loss statement, but they are explained in your cash flow statement.

Your cash flow statement is just as important as your profit and loss statement. Businesses run on cash—there are no two ways around it.

Without a thorough understanding of how much cash you have, where your cash is coming from, where it’s going, and on what schedule, you’re going to have a hard time running a healthy business. And without the cash flow statement, which lays that information out neatly for lenders and investors, you’re not going to be able to raise funds. No business plan is complete without a cash flow plan.

The cash flow statement helps you understand the difference between what your profit and loss statement reports as income—your profit—and what your actual cash position is.

It is possible to be extremely profitable and still not have enough cash to pay your expenses and keep your business afloat, and it is also possible to be unprofitable but still have enough cash on hand to keep the doors open for several months and buy yourself time to turn things around—that’s why this financial statement is so important to understand.

How cash versus accrual accounting affects the cash flow statement

There are two methods of accounting—the cash method and the accrual method.

The cash method means that you just account for your sales and expenses as they happen, without worrying about matching up the expenses that are related to a particular sale or vice versa.

The accrual method means that you account for your sales and expenses at the same time—if you got a big preorder for a new product, for example, you’d wait to account for all of your preorder sales revenue until you’d actually started manufacturing and delivering the product. Matching revenue with the related expenses is what’s referred to as “the matching principle,” and is the basis of accrual accounting.

If you use the cash method of accounting in your business, your cash flow statement isn’t going to be very different from what you see in your profit and loss statement. That might seem like it makes things simpler, but I actually advise against it. I think that the accrual method of accounting gives you the best sense of how your business operates, and that you should consider switching to it if you aren’t using it already.

For the best sense of how your business operates, you should consider switching to accrual accounting if you aren’t using it already.

Here’s why: Let’s say you operate a summer camp business. You might receive payment from a camper in March, several months before camp actually starts in July—using the accrual method, you wouldn’t recognize the revenue until you’ve performed the service, so both the revenue and the expenses for the camp would be accounted for in the month of July.

With the cash method, you would have recognized the revenue back in March, but all of the expenses in July, which would have made it look like you were profitable in all of the months leading up to the camp, but unprofitable during the month that camp actually took place.

Cash accounting can get a little unwieldy when it comes time to evaluate how profitable an event or product was, and can make it harder to really understand the ins and outs of your business operations. For the best look at how your business works, accrual accounting is the way to go.

Your balance sheet is a snapshot of your business’s financial position—at a particular moment in time, how are you doing? How much cash do you have in the bank, how much do your customers owe you, and how much do you owe your vendors?

The balance sheet is standardized, and consists of three types of accounts:

- Assets (accounts receivable, money in the bank, inventory, etc.)

- Liabilities (accounts payable, credit card balances, loan repayments, etc.)

- Equity (for most small businesses, this is just the owner’s equity, but it could include investors’ shares, retained earnings, stock proceeds, etc.)

It’s called a balance sheet because it’s an equation that needs to balance out:

Assets = Liabilities + Equity

The total of your liabilities plus your total equity always equals the total of your assets.

At the end of the accounting year, your total profit or loss adds to or subtracts from your retained earnings (a component of your equity). That makes your retained earnings your business’s cumulative profit and loss since the business’s inception.

However, if you are a sole proprietor or other pass-through tax entity, “retained earnings” doesn’t really apply to you—your retained earnings will always equal zero, as all profits and losses are passed through to the owners and not rolled over or retained like they are in a corporation.

If you’d like more help creating your balance sheet, check out our free downloadable Balance Sheet Template .

The sales forecast is exactly what it sounds like: your projections, or forecast, of what you think you will sell in a given period (typically, a year to three years). Your sales forecast is an incredibly important part of your business plan, especially when lenders or investors are involved, and should be an ongoing part of your business planning process.

Your sales forecast should be an ongoing part of your business planning process.

You should create a forecast that is consistent with the sales number you use in your profit and loss statement. In fact, in our business planning software , LivePlan, the sales forecast auto-fills the profit and loss statement.

There isn’t a one-size-fits-all kind of sales forecast—every business will have different needs. How you segment and organize your forecast depends on what kind of business you have and how thoroughly you want to track your sales.

Some helpful questions to ask yourself are:

- How many customers do you anticipate?

- How much will you charge them?

- How often will you charge them?

Your sales forecast can be as detailed as you want it to be, or you can simplify your forecast by summarizing it. However you choose to do a sales forecast, you should definitely have one.

Generally, you’ll want to break down your sales forecast into segments that are helpful to you for planning and marketing purposes. If you own a restaurant, for example, you’d probably want to separate your forecasts for dinner and lunch sales; if you own a gym, it might be helpful to differentiate between single memberships, family memberships, club shop sales, and extra services like personal training sessions. If you want to get really specific, you might even break your forecast down by product, with a separate line for every product you sell.

Along with each segment of forecasted sales, you’ll want to include that segment’s “cost of goods sold” (COGS). The difference between your forecasted revenue and your forecasted COGS is your forecasted gross margin .

The importance of the personnel plan depends largely on the type of business you have. If you are a sole proprietor with no employees, this might not be that important and could be summarized in a sentence of two. But if you are a larger business with high labor costs, you should spend the time necessary to figure out how your personnel affects your business.

Think of the personnel plan as a justification of each team member’s necessity to the business.

If you create a personnel plan, it should include a description of each member of your management team, explaining what they bring to the table in terms of training, expertise, and product or market knowledge. If you’re writing a business plan to present to lenders or investors, you could think of this as a justification of each team member’s necessity to the business, and a justification of their salary (and/or equity share, if applicable). This would fall in the company overview section of your business plan.

You can also choose to use this section to list entire departments if that is a better fit for your business and the intentions you have for your business plan . There’s no rule that says you have to list only individual members of the management team.

This is also where you would list team members or departments that you’ve budgeted for but haven’t hired yet. Describe who your ideal candidate(s) is/are, and justify your budgeted salary range(s).

Additional calculations you might find useful:

Business ratios.

If you have your profit and loss statement, your cash flow statement, and your balance sheet, you have all the numbers you need to calculate the standard business ratios . These ratios aren’t necessary to include in a business plan—especially for an internal plan—but knowing some key ratios is almost always a good idea.

You’d probably want some profitability ratios, like:

- Gross margin

- Return on sales

- Return on assets

- Return on investment

And you’d probably want some liquidity ratios, such as:

- Debt-to-equity

- Current ratio

- Working capital

Of these, the most common ratios used by business owners and requested by bankers are probably gross margin, return on investment (ROI), and debt-to-equity.

Break-even analysis

Your break-even analysis is a calculation of how much you will need to sell in order to “break-even” (i.e., how much you will need to sell in order to pay for all of your expenses).

Consider a restaurant: It has to be open, with the tables set and the menus printed and with the bartender and all of the cooks and servers working, in order to make even one sale. But if it only sold one dinner, the restaurant would be operating at a loss—even a $50 meal isn’t going to cover the night’s utility bills. So the restaurant owner might use a break-even analysis to get an idea of how many meals the restaurant needs to sell on a given night in order to cover its expenses.

In determining your break-even point, you’ll need to figure out the contribution margin of what you’re selling. In the case of a restaurant, the contribution margin will be the price of the meal less any associated costs. For example, the customer pays $50 for the meal. The food costs are $10 and the wages paid to prepare and serve the meal are $15. Your contribution margin is $25 ($50 – $10 – $15 = $25).

Using this model you can determine how high your sales revenue needs to be in order for you to break even. If your monthly fixed costs are $5,000 and you average a 50 percent contribution margin (like in our example with the restaurant), you’ll need to have sales of $10,000 in order to break even.

Your financial plan might feel overwhelming when you get started, but the truth is that this section of your business plan is absolutely essential to understand.

Even if you end up outsourcing your bookkeeping and regular financial analysis to an accounting firm, you—the business owner—should be able to read and understand these documents and make decisions based on what you learn from them. Using a business dashboard tool can help, so you’re not wading through spreadsheets to put your figures on the important details.

If you create and present financial statements that all work together to tell the story of your business, and if you can answer questions about where your numbers are coming from, your chances of securing funding from investors or lenders are much higher.

Further resources:

For more business financial concepts made simple, check out these articles on cash burn rate , direct costs , net profit , operating margin , accounts payable , accounts receivable , cash flow , profit and loss statement , balance sheet , and expense budgeting .

Like this post? Share with a friend!

Noah Parsons

Posted in management, join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

How to Write a Small Business Financial Plan

Noah Parsons

3 min. read

Updated January 3, 2024

Creating a financial plan is often the most intimidating part of writing a business plan. It’s also one of the most vital. Businesses with well-structured and accurate financial statements in place are more prepared to pitch to investors, receive funding, and achieve long-term success.

Thankfully, you don’t need an accounting degree to successfully put your budget and forecasts together. Here is everything you need to include in your financial plan along with optional performance metrics, specifics for funding, and free templates.

- Key components of a financial plan

A sound financial plan is made up of six key components that help you easily track and forecast your business financials. They include your:

Sales forecast

What do you expect to sell in a given period? Segment and organize your sales projections with a personalized sales forecast based on your business type.

Subscription sales forecast

While not too different from traditional sales forecasts—there are a few specific terms and calculations you’ll need to know when forecasting sales for a subscription-based business.

Expense budget

Create, review, and revise your expense budget to keep your business on track and more easily predict future expenses.

How to forecast personnel costs

How much do your current, and future, employees’ pay, taxes, and benefits cost your business? Find out by forecasting your personnel costs.

Profit and loss forecast

Track how you make money and how much you spend by listing all of your revenue streams and expenses in your profit and loss statement.

Cash flow forecast

Manage and create projections for the inflow and outflow of cash by building a cash flow statement and forecast.

Balance sheet

Need a snapshot of your business’s financial position? Keep an eye on your assets, liabilities, and equity within the balance sheet.

What to include if you plan to pursue funding

Do you plan to pursue any form of funding or financing? If the answer is yes, then there are a few additional pieces of information that you’ll need to include as part of your financial plan.

Highlight any risks and assumptions

Every entrepreneur takes risks with the biggest being assumptions and guesses about the future. Just be sure to track and address these unknowns in your plan early on.

Plan your exit strategy

Investors will want to know your long-term plans as a business owner. While you don’t need to have all the details, it’s worth taking the time to think through how you eventually plan to leave your business.

- Financial ratios and metrics

With all of your financial statements and forecasts in place, you have all the numbers needed to calculate insightful financial ratios. While these metrics are entirely optional to include in your plan, having them easily accessible can be valuable for tracking your performance and overall financial situation.

Common business ratios

Unsure of which business ratios you should be using? Check out this list of key financial ratios that bankers, financial analysts, and investors will want to see.

Break-even analysis

Do you want to know when you’ll become profitable? Find out how much you need to sell to offset your production costs by conducting a break-even analysis.

How to calculate ROI

How much could a business decision be worth? Evaluate the efficiency or profitability by calculating the potential return on investment (ROI).

- Financial plan templates and tools

Download and use these free financial templates and calculators to easily create your own financial plan.

Sales forecast template

Download a free detailed sales forecast spreadsheet, with built-in formulas, to easily estimate your first full year of monthly sales.

Download Template

Accurate and easy financial forecasting

Get a full financial picture of your business with LivePlan's simple financial management tools.

Get Started

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- What to include for funding

Related Articles

6 Min. Read

How to Write Your Business Plan Cover Page + Template

10 Min. Read

How to Write a Competitive Analysis for Your Business Plan

3 Min. Read

What to Include in Your Business Plan Appendix

How to Write the Company Overview for a Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

Tax Season Savings

Get 40% off LivePlan

The #1 rated business plan software

Transform Tax Season into Growth Season

Discover the world’s #1 plan building software

The 5 Most Important Financial KPIs That Drive Business Strategy

Defining a strategy for your business is important—but so is measuring its success. That’s where financial metrics come in.

Part of running (and growing) a successful business is establishing the right business strategy. And part of crafting the right strategy for your business is knowing which key performance indicators (KPIs) you should use to inform that strategy—particularly when it comes to your finances.

A financial KPI can inform your business in many ways. For example, maybe you’re just getting things off the ground and rolling out your first strategic initiatives. You’ll need to measure the impact those initiatives have on your bottom line.

Maybe you’re getting ready to take your business to the next level. You’ll need financial data to help inform your plans to grow and scale. Or, let’s say you’ve had a strategy for your business in place for some time—but you’re not sure if it’s helping you achieve your goals. Digging into the numbers will help you determine whether to keep things moving forward as-is or if your strategy needs an upgrade.

So, how, exactly, can you use financial KPIs to inform your business strategy? And what are some financial KPI examples that are the most effective for driving strategic decisions?

First, Define Your Business Strategy

A business strategy is a clear, measurable plan that outlines, in detail, how to take your business from where you are now to where you want to go. You can lean on your strategy to achieve your business goals (for example, launching a new product or expanding your business to a new market), but it isn’t the same as a business goal.

If the goal is the destination, think of the strategy as the map to get there. When building a strategy, you’ll need to do the groundwork to:

- Clearly define your goals. Goals are the desired outcome—like becoming the top content marketing agency in the country.

- Clearly define your objectives. Objectives are the specific, measurable steps you’ll take to achieve your goal. If your goal is to become the top content marketing agency in the country, objectives might include hitting X dollars in revenue or closing X clients by the end of the year.

Once you can articulate your business goals and objectives, you’re ready to talk about how you’ll get there: the strategy. And what actions (also known as tactics) you’ll need to take—on a weekly, monthly, or quarterly basis—to get there.

Continuing with the content marketing agency example, that might mean pitching X potential clients each month, setting up an inbound marketing strategy to bring new leads into your business, or publishing thought leadership articles to gain more notoriety.

Related Articles

Long-Term vs. Short-Term Financial KPI Comparison

There are certain KPIs to monitor day-to-day to keep your business on track. These shorter-term KPIs, like operating cash flow , days sales outstanding, or current ratio, will give you key insights into the current financial health of your business. They can help you determine your next best step and how to keep your business moving forward in the immediate future.

But if you want your business to succeed in the long run, you’ll need to look at KPIs that inform long-term strategy. The data you uncover with these KPIs can help you:

- Determine whether you’re on track to reach your financial goals

- Evaluate the success of your strategy

- Pinpoint areas in your business that may need improvement

- Identify any opportunities and challenges

- Assess whether your customers are happy or not

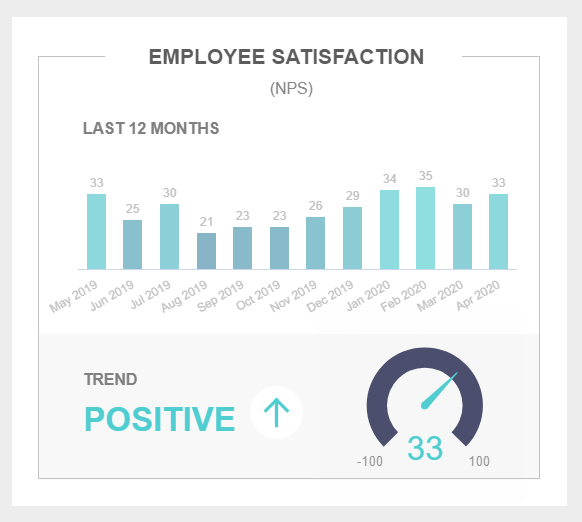

Not All KPIs Are (Just) Financial

While financial metrics are important, you’ll also want to look at other KPIs. This includes KPIs that measure your team’s effectiveness (such as staff advocacy score) or customer satisfaction and loyalty (such as net promoter score). These KPIs can give you invaluable insights into your business. And though they’re not technically financial ratios, they can directly impact your revenue. So they’re also helpful from a financial standpoint.

The 5 Most Useful Financial KPIs for Business Strategy

Whatever your business goals, there are some financial key performance indicators you should be continually tracking and using to inform your business strategy. Other metrics beyond these financial KPI examples may also be helpful. But these are fundamental.

For each financial KPI, note the performance indicators that explain how to use the data. This helps you understand a good result versus something that needs improvement and how it could affect your business strategy.

1. Sales Growth Rate

Sales growth is one of the most basic barometers of success for a business. By monitoring the growth of your sales over time, you can identify which elements of your strategy are positively impacting sales and which are falling flat.

The formula to calculate sales growth rate is:

Sales Growth Rate = (Current Net Sales – Previous Net Sales / Previous Net Sales) x 100

Performance Indicators

You always want this KPI to be a positive percentage. That means your overall strategy is working. If your sales growth rate is negative, something about your strategy isn’t connecting with your customers—and it’s time to make a change.

For example, you own a restaurant and introduce one change in Q1: a new menu. If the net sales for your new menu in Q1 were $10,000—but the net sales in Q4, with your old menu, were $15,000—your sales growth rate would be -33.33%, or:

($10,000 – $15,000 / $15,000) x 100

Your new menu isn’t driving the results you’re looking for. Now you can take steps to increase sales—for example, reverting to your old menu or putting more effort and resources into promoting your new menu to customers.

2. Revenue Concentration

The best use of your time, energy, and resources are often the clients, customers, and projects that drive the most revenue for your business. That’s why revenue concentration is another must-track financial KPI for your business.

Revenue concentration helps you identify how much revenue each client or project produces for your business as a percentage of your total revenue. Using this financial KPI, you can determine the ROI for each client.

Calculating revenue concentration starts by analyzing your revenue streams . (Your FreshBooks Dashboard provides at-a-glance summaries of your income streams, making it easy to analyze them by client or service.)

Once you know how much revenue each client, project, or service is bringing into your business, you can use that data to calculate your revenue concentration. The formula to calculate revenue concentration is:

Revenue Concentration = (Revenue by Customer or Project / Total Revenue) x 100

When you know which customers, clients, or projects are driving the most revenue (and which are not), you can shape your strategy around serving the clients and/or projects that will be the most financially lucrative.

For example, you own a copywriting business, and after analyzing your revenue streams, you realize that 80% of your income comes from white papers, while only 20% comes from other projects like blog posts or website copy.

So white papers are your big money-maker. Now you have data that supports focusing more aggressively on marketing your white paper writing services to potential clients.

Or maybe, after calculating this KPI, you realize that 75% of your revenue is coming from a single client. That’s a risky situation for a business owner. If you lose that client, you also lose most of your income.

In that situation, you could adjust your business strategy to focus on diversifying your client portfolio and spreading your revenue across a wider roster of clients.

3. Net Profit Margin

Profitability is one of the most important indicators of a company’s financial health. If you want your business to succeed in the long run, you need to be generating profit.

While several different profitability ratios can be useful—including gross profit margin and operating profit margin—net profit margin is a must.

Net profit margin measures how much profit your company makes after expenses. That includes operating expenses (like rent and utilities) and non-operating expenses (like taxes and debt payments).

Strategically speaking, the net profit margin gives you the bottom-line view of how profitable you are. If your business isn’t profitable, something needs to change. The formula to calculate net profit margin is:

Net Profit Margin = (Net Income / Revenue) x 100

Simply put, if your net profit margin is positive, you’re generating profit. You can either keep doing what you’re doing or adjust your strategy to increase your profitability.

4. Accounts Receivable Turnover

If your customers are dragging their feet and paying their invoices late (or not paying them at all!), it can seriously harm your financial health.

That’s why the accounts receivable turnover (a.k.a. debtor’s ratio) is an important KPI. It measures how well your clients pay their invoices within an allotted timeframe (for example, net 30 or net 60).

The formula for calculating annual accounts receivable turnover is:

Accounts Receivable Turnover = Net Annual Credit Sales ÷ Average Accounts Receivable

The KPI requires you to know your net credit sales, which are any amounts not paid upfront in cash. So, for a project-based business, that would typically be the payment owed for the completed project minus any retainer or fees paid at the start of the project.

It also requires you to calculate your average accounts receivable. That is:

(Beginning Accounts Receivable + Ending Accounts Receivable) ÷ 2

The accounts receivable turnover ratio shows you how many times your accounts receivable turned over in the time period you’re measuring.

By calculating your accounts receivable turnover for a year and dividing 365 days by the number of times per year your AR turns over, you will see how many days on average it takes for you to receive payments.

The higher your accounts receivable turnover, the fewer past-due invoices in your accounts on average, and the better your cash flow. It can also indicate that you have an efficient process for collecting payments from clients.

Lower isn’t always better with this KPI. Maybe your business can do just fine with payments within 15 or 30 days—and giving clients time to pay may contribute to customer retention. So, as long as the average number of days it takes your clients to pay is within that period, all is well.

If your accounts receivable turnover is too low—and customers take too many days to pay—you may start facing cash flow issues. To address the problem, you may need to examine your invoice payment terms , explore different payment methods, or take other actions to get paid faster .

5. Working Capital

As a business owner, you need cash to operate. This cash is called working capital , and it helps you meet your short-term financial obligations that keep your day-to-day operations going.

Understanding your working capital ratio will help you plan your future strategic moves, like hiring new team members to scale your business or investing in new equipment. It will also alert you to when you need funding to keep your business moving forward.

Working capital is calculated by comparing the company’s current assets to its liabilities. The formula for calculating working capital is:

Working Capital = Current Assets – Current Liabilities

If you have more assets than liabilities, you have positive working capital—which means you have enough cash on hand to cover your liabilities plus additional funds left over. On the flip side, if your liabilities are more than your assets, you have negative working capital. That means you don’t have enough money on hand to cover your financial obligations.

Both positive and negative working capital can give you key insights into the state of your business and the success of your business strategy. For example, if your working capital is extremely high (your assets far outweigh your liabilities), you’re not investing enough money into your business. You might create a business strategy to use some of your working capital to expand or target new clients in that scenario.

On the other hand, if you have negative working capital, you don’t have enough capital to cover your costs. You’ll need to adjust your strategy to focus on bringing more capital into the business—perhaps by applying for a business loan or increasing prices.

Use Financial KPIs to Drive Your Business Strategy

Hopefully, you now grasp the most important financial metrics to track for your long-term financial health, how to calculate them, and what they signal about your existing business strategy.

When used correctly, these financial key performance indicators can help inform how you work to achieve your business objectives. They’ll unlock insights that could easily be overlooked otherwise and ideally help your business grow faster and more effectively.

Written by Deanna deBara , Freelance Contributor

Posted on December 21, 2022

Freshly picked for you

Thanks for subscribing to the FreshBooks Blog Newsletter.

Expect the first one to arrive in your inbox in the next two weeks. Happy reading!

More Like this

Kpi meaning + 27 examples of key performance indicators.

As your organization begins to sketch out what your strategic plan might look like, it’s likely to come to your attention that you’ll need to gain consensus around what your key performance indicators will be and how they will impact your organization. If you haven’t thought much about your KPIs yet, that’s okay. We can help!

We’ve compiled a complete guide that includes an overview of what makes a good KPI, the benefits of good key performance indicators, and a list of KPI examples [organized by department and industry] for your reference as you develop your organization’s strategic plan and goals.

Video Transcript – How to Write KPIs

Hi, my name is Erica Olsen. Today’s whiteboard video is on key performance indicators, or KPIs for short. These are those things that are associated with either goals or objectives, whatever you’re calling them, those elements of your plan that are the expressions of what you want to achieve by when those quantifiable outcome-based statements.

So KPI’s answer the quantifiable piece of your goals and objectives. They come in three different flavors. So we’ll talk about that in just a minute. But before we do, putting great measures together and making sure they work well for you, you need to have these four attributes. And before I talk about those four attributes, so I just want to say the reason they need to work well for you is because KPIs are the heartbeat of your performance management process. They tell you whether you’re making progress, and ultimately, we want to make progress against our strategy. So KPIs are the thing that do that for us. So you’re going to live with them a lot. So let’s make sure they’re really good.

Okay, so the four things you need to have in order to make sure your these measures work for you.

Our number one is your measure. So the measure is the verbal expression very simply, in words, what are we measuring, which is fairly straightforward. The tricky thing is, is we need to be as expressive as we possibly can with our measures. So number of new customers, that’s fine. There’s nothing wrong with that. But a little bit advanced or a little bit more expressive, would be number of new customers this year, or number of new customers for a certain product or a certain service. So what is it is it? Yeah, so it is, so be really clear. And when it comes to measuring it on a monthly basis, you’re gonna want to be as clear as possible. So number of new customers, let’s say this year,

Number two, is our target, or target is the numeric value that we want to achieve. So a couple of things that are important about this is, the target needs to be apples to apples with when the goal date is set, or the due date is set. So we want to achieve 1000 new customers by the end of the year. So the due date in the target works hand in hand. The other thing is the measure and the target need to work hand in hand. So it’s a number. So this is a number, this is a percentage, this is a percentage, you get the idea.