- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How To Write the Funding Request for Your Business Plan

What goes into the funding request, parts of the funding request, important points to remember when writing your request, frequently asked questions (faqs).

MoMo Productions / Getty Images

A business plan contains many sections, and if you plan to seek funding for your business, you will need to include the funding request section. The good news is that this section of your business plan is only needed if you plan to ask for outside business funding. If you're not seeking financial help, you can leave it out of your business plan. There are a variety of ways to fund your business without debt or investors. Below, we'll cover how to write the funding request section of your business plan.

Key Takeaways

- The funding request section of your business plan is required if you plan to seek funding from a lender or investors.

- You'll want to include information on the business, your current financial situation, how the money will be used, and more.

- Tailor each funding request to the specific funding source, and make sure you ask for enough money to keep your business going.

The funding request section provides information on your future financial plans, such as when and how much money you might need. You will also include the possible sources you could consider for securing your funds, such as loans or crowdfunding. Later, you can update this section when you need outside funding again for business growth.

An Outline of the Business

Yes, you've done this already in past sections, but you want to give potential lenders and investors a recap of your business. In some cases, you might simply share the funding request section so you need to have your business details such as what you provide, information about your target market, your structure (i.e. LLC), owners' and members' information (for partnerships and corporations), and any successes you've had to date in your business.

Current Financial Situation

Again, you've provided some financial information in the financial data section , but it doesn't hurt to summarize. If you're submitting just the funding request, you'll need this information to help financial sources understand your money situation.

Provide financial details such as income and cash flow statements, and balance sheets in your funding request section.

Offer your projected financial information as well. If you're asking for a loan for which you'll be offering collateral, include information about the asset. If the business had debt, outline your plan for paying it off. Finally, share how you'll pay the loan or what sort of return on investment (ROI) investors can expect by investing in your business.

How Much Money Do You Need Now and in the Future?

Indicate what type of funding you're asking for such as a loan or investment. Outline what you need now and what you might need in the future as far as five years out.

How Will the Funds Be Used?

Detail how you'll be using the money, whether it's for inventory, paying a debt, buying equipment, hiring help, and more. If you plan to use the money for several things, highlight each and how much money will go to each.

Most financial sources would rather invest in things that grow a thriving business than things that pay for debt or overhead expenses.

Current and Future Financial Plans

Current and future financial plans include items such as loan repayment schedules or plans to sell the business. If you're getting a loan, outline your plans for repayment (although most lenders will have their own schedules). If you have plans to sell the business, let the lender know that and how it will affect them. Other issues to consider are relocation (if you move) or a buyout. Finally, let investors know how they can exit the deal, such as cashing out (and how long before they can do that).

You're asking for money, so you need to always be professional and know your business inside and out. Here are some other things to keep in mind:

- Tailor your funding request to each financial source : Lenders and investors need different information, such as loan repayment versus ROI, so create different reports for each.

- Keep your funding sources in mind : Each resource will have different questions and concerns. Do a little research so you can address them in your report.

- Ask for enough to keep your business going : Don't be stingy, as you don't want your business to fail from a lack of money. At the same time, don't be greedy, asking for more than you need.

How do you request funding for a nonprofit?

Most nonprofits seek funding in the form of grants. Write a grant proposal that includes information on the project or organization, preliminary budget needs, and more. Be sure to format it with a cover letter, proposal summary, the introduction of the organization, problem statement, objectives, methods, evaluation, future funding needs, and the budget.

What are three methods of funding?

Grants and scholarships, equity financing, and debt financing are the main three methods of funding for small businesses . Grants and scholarships do not need to be repaid and are often best for nonprofit organizations. Equity financing is when you receive money in exchange for ownership and profits. Debt financing is when you borrow money that needs to be repaid.

Want to read more content like this? Sign up for The Balance’s newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

Small Business Administration. " Fund Your Business ."

Congressional Research Service. " How To Develop and Write a Grant Proposal ."

Library of Congress Research Guides. " Types of Financing ."

How to Write a Business Plan: Step-by-Step Guide + Examples

Noah Parsons

24 min. read

Updated April 17, 2024

Writing a business plan doesn’t have to be complicated.

In this step-by-step guide, you’ll learn how to write a business plan that’s detailed enough to impress bankers and potential investors, while giving you the tools to start, run, and grow a successful business.

- The basics of business planning

If you’re reading this guide, then you already know why you need a business plan .

You understand that planning helps you:

- Raise money

- Grow strategically

- Keep your business on the right track

As you start to write your plan, it’s useful to zoom out and remember what a business plan is .

At its core, a business plan is an overview of the products and services you sell, and the customers that you sell to. It explains your business strategy: how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

Most business plans also include financial forecasts for the future. These set sales goals, budget for expenses, and predict profits and cash flow.

A good business plan is much more than just a document that you write once and forget about. It’s also a guide that helps you outline and achieve your goals.

After completing your plan, you can use it as a management tool to track your progress toward your goals. Updating and adjusting your forecasts and budgets as you go is one of the most important steps you can take to run a healthier, smarter business.

We’ll dive into how to use your plan later in this article.

There are many different types of plans , but we’ll go over the most common type here, which includes everything you need for an investor-ready plan. However, if you’re just starting out and are looking for something simpler—I recommend starting with a one-page business plan . It’s faster and easier to create.

It’s also the perfect place to start if you’re just figuring out your idea, or need a simple strategic plan to use inside your business.

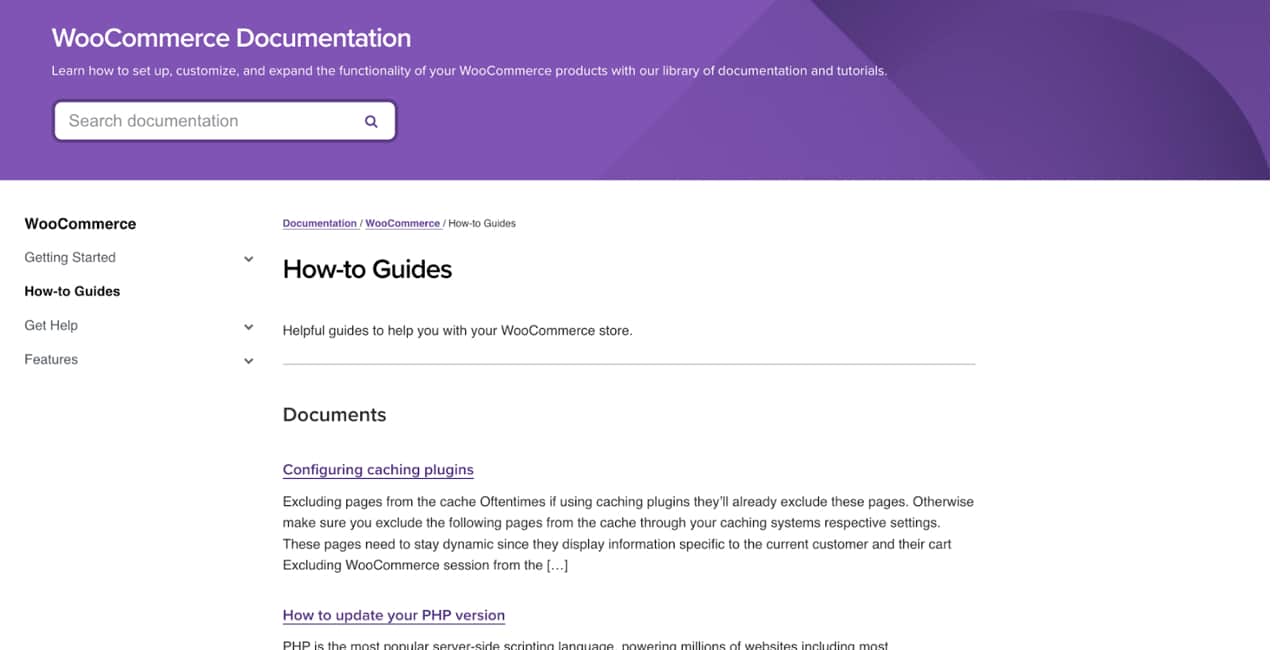

Dig deeper : How to write a one-page business plan

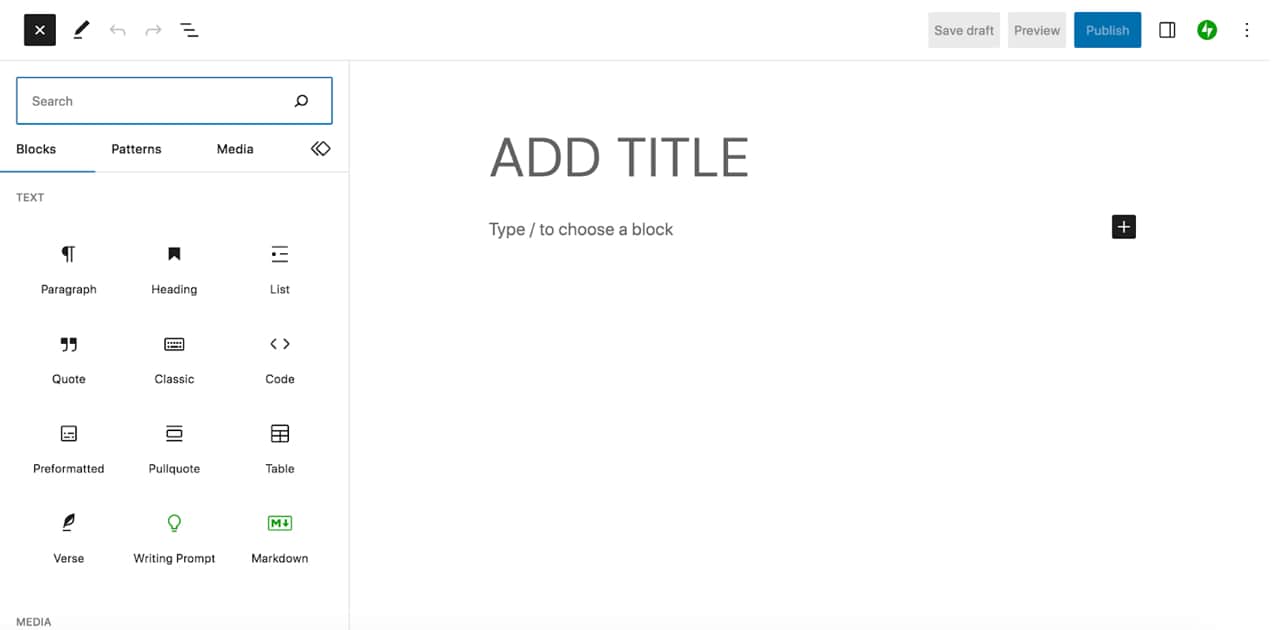

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- What to include in your business plan

Executive summary

The executive summary is an overview of your business and your plans. It comes first in your plan and is ideally just one to two pages. Most people write it last because it’s a summary of the complete business plan.

Ideally, the executive summary can act as a stand-alone document that covers the highlights of your detailed plan.

In fact, it’s common for investors to ask only for the executive summary when evaluating your business. If they like what they see in the executive summary, they’ll often follow up with a request for a complete plan, a pitch presentation , or more in-depth financial forecasts .

Your executive summary should include:

- A summary of the problem you are solving

- A description of your product or service

- An overview of your target market

- A brief description of your team

- A summary of your financials

- Your funding requirements (if you are raising money)

Dig Deeper: How to write an effective executive summary

Products and services description

This is where you describe exactly what you’re selling, and how it solves a problem for your target market. The best way to organize this part of your plan is to start by describing the problem that exists for your customers. After that, you can describe how you plan to solve that problem with your product or service.

This is usually called a problem and solution statement .

To truly showcase the value of your products and services, you need to craft a compelling narrative around your offerings. How will your product or service transform your customers’ lives or jobs? A strong narrative will draw in your readers.

This is also the part of the business plan to discuss any competitive advantages you may have, like specific intellectual property or patents that protect your product. If you have any initial sales, contracts, or other evidence that your product or service is likely to sell, include that information as well. It will show that your idea has traction , which can help convince readers that your plan has a high chance of success.

Market analysis

Your target market is a description of the type of people that you plan to sell to. You might even have multiple target markets, depending on your business.

A market analysis is the part of your plan where you bring together all of the information you know about your target market. Basically, it’s a thorough description of who your customers are and why they need what you’re selling. You’ll also include information about the growth of your market and your industry .

Try to be as specific as possible when you describe your market.

Include information such as age, income level, and location—these are what’s called “demographics.” If you can, also describe your market’s interests and habits as they relate to your business—these are “psychographics.”

Related: Target market examples

Essentially, you want to include any knowledge you have about your customers that is relevant to how your product or service is right for them. With a solid target market, it will be easier to create a sales and marketing plan that will reach your customers. That’s because you know who they are, what they like to do, and the best ways to reach them.

Next, provide any additional information you have about your market.

What is the size of your market ? Is the market growing or shrinking? Ideally, you’ll want to demonstrate that your market is growing over time, and also explain how your business is positioned to take advantage of any expected changes in your industry.

Dig Deeper: Learn how to write a market analysis

Competitive analysis

Part of defining your business opportunity is determining what your competitive advantage is. To do this effectively, you need to know as much about your competitors as your target customers.

Every business has some form of competition. If you don’t think you have competitors, then explore what alternatives there are in the market for your product or service.

For example: In the early years of cars, their main competition was horses. For social media, the early competition was reading books, watching TV, and talking on the phone.

A good competitive analysis fully lays out the competitive landscape and then explains how your business is different. Maybe your products are better made, or cheaper, or your customer service is superior. Maybe your competitive advantage is your location – a wide variety of factors can ultimately give you an advantage.

Dig Deeper: How to write a competitive analysis for your business plan

Marketing and sales plan

The marketing and sales plan covers how you will position your product or service in the market, the marketing channels and messaging you will use, and your sales tactics.

The best place to start with a marketing plan is with a positioning statement .

This explains how your business fits into the overall market, and how you will explain the advantages of your product or service to customers. You’ll use the information from your competitive analysis to help you with your positioning.

For example: You might position your company as the premium, most expensive but the highest quality option in the market. Or your positioning might focus on being locally owned and that shoppers support the local economy by buying your products.

Once you understand your positioning, you’ll bring this together with the information about your target market to create your marketing strategy .

This is how you plan to communicate your message to potential customers. Depending on who your customers are and how they purchase products like yours, you might use many different strategies, from social media advertising to creating a podcast. Your marketing plan is all about how your customers discover who you are and why they should consider your products and services.

While your marketing plan is about reaching your customers—your sales plan will describe the actual sales process once a customer has decided that they’re interested in what you have to offer.

If your business requires salespeople and a long sales process, describe that in this section. If your customers can “self-serve” and just make purchases quickly on your website, describe that process.

A good sales plan picks up where your marketing plan leaves off. The marketing plan brings customers in the door and the sales plan is how you close the deal.

Together, these specific plans paint a picture of how you will connect with your target audience, and how you will turn them into paying customers.

Dig deeper: What to include in your sales and marketing plan

Business operations

The operations section describes the necessary requirements for your business to run smoothly. It’s where you talk about how your business works and what day-to-day operations look like.

Depending on how your business is structured, your operations plan may include elements of the business like:

- Supply chain management

- Manufacturing processes

- Equipment and technology

- Distribution

Some businesses distribute their products and reach their customers through large retailers like Amazon.com, Walmart, Target, and grocery store chains.

These businesses should review how this part of their business works. The plan should discuss the logistics and costs of getting products onto store shelves and any potential hurdles the business may have to overcome.

If your business is much simpler than this, that’s OK. This section of your business plan can be either extremely short or more detailed, depending on the type of business you are building.

For businesses selling services, such as physical therapy or online software, you can use this section to describe the technology you’ll leverage, what goes into your service, and who you will partner with to deliver your services.

Dig Deeper: Learn how to write the operations chapter of your plan

Key milestones and metrics

Although it’s not required to complete your business plan, mapping out key business milestones and the metrics can be incredibly useful for measuring your success.

Good milestones clearly lay out the parameters of the task and set expectations for their execution. You’ll want to include:

- A description of each task

- The proposed due date

- Who is responsible for each task

If you have a budget, you can include projected costs to hit each milestone. You don’t need extensive project planning in this section—just list key milestones you want to hit and when you plan to hit them. This is your overall business roadmap.

Possible milestones might be:

- Website launch date

- Store or office opening date

- First significant sales

- Break even date

- Business licenses and approvals

You should also discuss the key numbers you will track to determine your success. Some common metrics worth tracking include:

- Conversion rates

- Customer acquisition costs

- Profit per customer

- Repeat purchases

It’s perfectly fine to start with just a few metrics and grow the number you are tracking over time. You also may find that some metrics simply aren’t relevant to your business and can narrow down what you’re tracking.

Dig Deeper: How to use milestones in your business plan

Organization and management team

Investors don’t just look for great ideas—they want to find great teams. Use this chapter to describe your current team and who you need to hire . You should also provide a quick overview of your location and history if you’re already up and running.

Briefly highlight the relevant experiences of each key team member in the company. It’s important to make the case for why yours is the right team to turn an idea into a reality.

Do they have the right industry experience and background? Have members of the team had entrepreneurial successes before?

If you still need to hire key team members, that’s OK. Just note those gaps in this section.

Your company overview should also include a summary of your company’s current business structure . The most common business structures include:

- Sole proprietor

- Partnership

Be sure to provide an overview of how the business is owned as well. Does each business partner own an equal portion of the business? How is ownership divided?

Potential lenders and investors will want to know the structure of the business before they will consider a loan or investment.

Dig Deeper: How to write about your company structure and team

Financial plan

Last, but certainly not least, is your financial plan chapter.

Entrepreneurs often find this section the most daunting. But, business financials for most startups are less complicated than you think, and a business degree is certainly not required to build a solid financial forecast.

A typical financial forecast in a business plan includes the following:

- Sales forecast : An estimate of the sales expected over a given period. You’ll break down your forecast into the key revenue streams that you expect to have.

- Expense budget : Your planned spending such as personnel costs , marketing expenses, and taxes.

- Profit & Loss : Brings together your sales and expenses and helps you calculate planned profits.

- Cash Flow : Shows how cash moves into and out of your business. It can predict how much cash you’ll have on hand at any given point in the future.

- Balance Sheet : A list of the assets, liabilities, and equity in your company. In short, it provides an overview of the financial health of your business.

A strong business plan will include a description of assumptions about the future, and potential risks that could impact the financial plan. Including those will be especially important if you’re writing a business plan to pursue a loan or other investment.

Dig Deeper: How to create financial forecasts and budgets

This is the place for additional data, charts, or other information that supports your plan.

Including an appendix can significantly enhance the credibility of your plan by showing readers that you’ve thoroughly considered the details of your business idea, and are backing your ideas up with solid data.

Just remember that the information in the appendix is meant to be supplementary. Your business plan should stand on its own, even if the reader skips this section.

Dig Deeper : What to include in your business plan appendix

Optional: Business plan cover page

Adding a business plan cover page can make your plan, and by extension your business, seem more professional in the eyes of potential investors, lenders, and partners. It serves as the introduction to your document and provides necessary contact information for stakeholders to reference.

Your cover page should be simple and include:

- Company logo

- Business name

- Value proposition (optional)

- Business plan title

- Completion and/or update date

- Address and contact information

- Confidentiality statement

Just remember, the cover page is optional. If you decide to include it, keep it very simple and only spend a short amount of time putting it together.

Dig Deeper: How to create a business plan cover page

How to use AI to help write your business plan

Generative AI tools such as ChatGPT can speed up the business plan writing process and help you think through concepts like market segmentation and competition. These tools are especially useful for taking ideas that you provide and converting them into polished text for your business plan.

The best way to use AI for your business plan is to leverage it as a collaborator , not a replacement for human creative thinking and ingenuity.

AI can come up with lots of ideas and act as a brainstorming partner. It’s up to you to filter through those ideas and figure out which ones are realistic enough to resonate with your customers.

There are pros and cons of using AI to help with your business plan . So, spend some time understanding how it can be most helpful before just outsourcing the job to AI.

Learn more: 10 AI prompts you need to write a business plan

- Writing tips and strategies

To help streamline the business plan writing process, here are a few tips and key questions to answer to make sure you get the most out of your plan and avoid common mistakes .

Determine why you are writing a business plan

Knowing why you are writing a business plan will determine your approach to your planning project.

For example: If you are writing a business plan for yourself, or just to use inside your own business , you can probably skip the section about your team and organizational structure.

If you’re raising money, you’ll want to spend more time explaining why you’re looking to raise the funds and exactly how you will use them.

Regardless of how you intend to use your business plan , think about why you are writing and what you’re trying to get out of the process before you begin.

Keep things concise

Probably the most important tip is to keep your business plan short and simple. There are no prizes for long business plans . The longer your plan is, the less likely people are to read it.

So focus on trimming things down to the essentials your readers need to know. Skip the extended, wordy descriptions and instead focus on creating a plan that is easy to read —using bullets and short sentences whenever possible.

Have someone review your business plan

Writing a business plan in a vacuum is never a good idea. Sometimes it’s helpful to zoom out and check if your plan makes sense to someone else. You also want to make sure that it’s easy to read and understand.

Don’t wait until your plan is “done” to get a second look. Start sharing your plan early, and find out from readers what questions your plan leaves unanswered. This early review cycle will help you spot shortcomings in your plan and address them quickly, rather than finding out about them right before you present your plan to a lender or investor.

If you need a more detailed review, you may want to explore hiring a professional plan writer to thoroughly examine it.

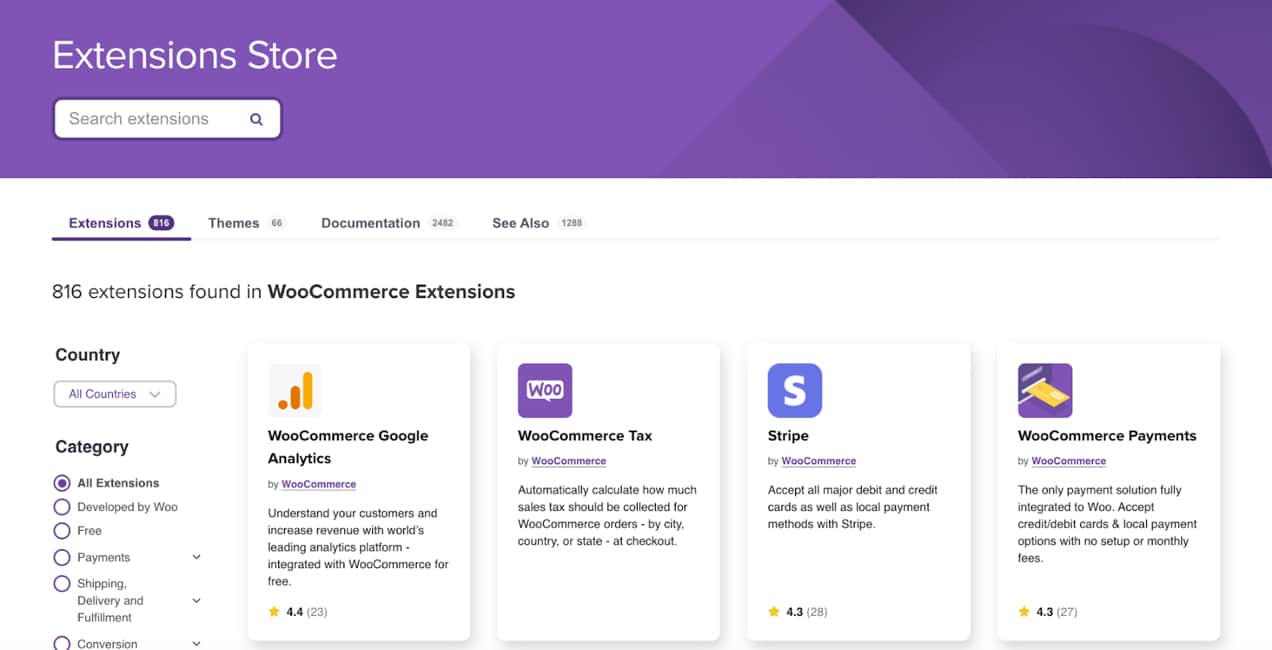

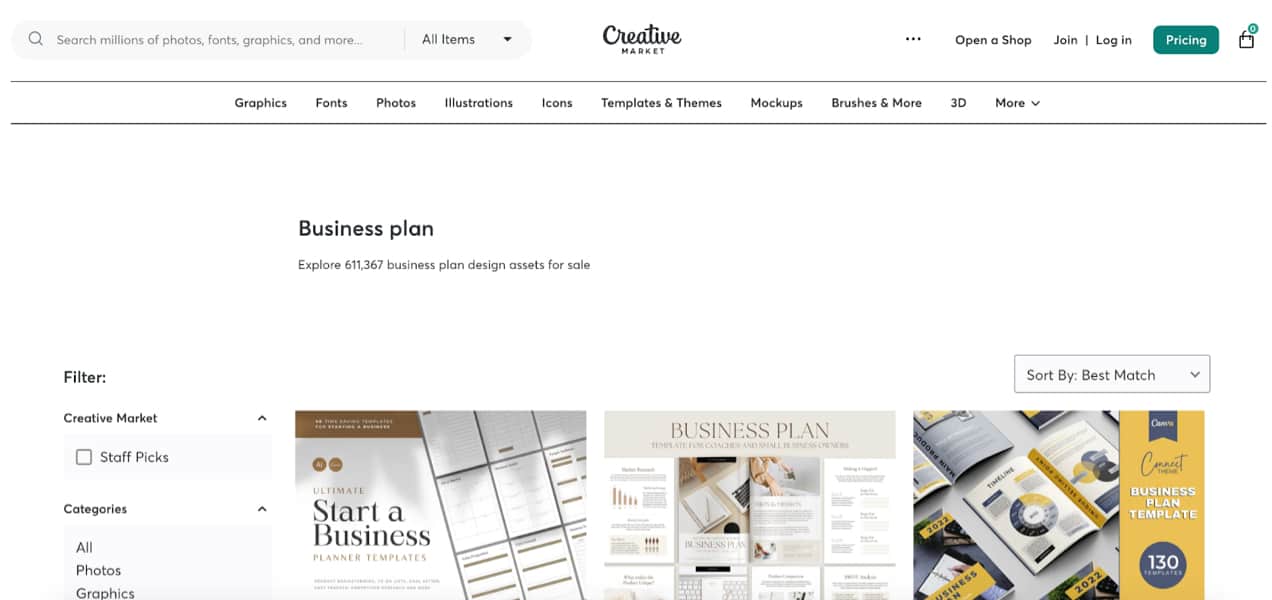

Use a free business plan template and business plan examples to get started

Knowing what information to include in a business plan is sometimes not quite enough. If you’re struggling to get started or need additional guidance, it may be worth using a business plan template.

There are plenty of great options available (we’ve rounded up our 8 favorites to streamline your search).

But, if you’re looking for a free downloadable business plan template , you can get one right now; download the template used by more than 1 million businesses.

Or, if you just want to see what a completed business plan looks like, check out our library of over 550 free business plan examples .

We even have a growing list of industry business planning guides with tips for what to focus on depending on your business type.

Common pitfalls and how to avoid them

It’s easy to make mistakes when you’re writing your business plan. Some entrepreneurs get sucked into the writing and research process, and don’t focus enough on actually getting their business started.

Here are a few common mistakes and how to avoid them:

Not talking to your customers : This is one of the most common mistakes. It’s easy to assume that your product or service is something that people want. Before you invest too much in your business and too much in the planning process, make sure you talk to your prospective customers and have a good understanding of their needs.

- Overly optimistic sales and profit forecasts: By nature, entrepreneurs are optimistic about the future. But it’s good to temper that optimism a little when you’re planning, and make sure your forecasts are grounded in reality.

- Spending too much time planning: Yes, planning is crucial. But you also need to get out and talk to customers, build prototypes of your product and figure out if there’s a market for your idea. Make sure to balance planning with building.

- Not revising the plan: Planning is useful, but nothing ever goes exactly as planned. As you learn more about what’s working and what’s not—revise your plan, your budgets, and your revenue forecast. Doing so will provide a more realistic picture of where your business is going, and what your financial needs will be moving forward.

- Not using the plan to manage your business: A good business plan is a management tool. Don’t just write it and put it on the shelf to collect dust – use it to track your progress and help you reach your goals.

- Presenting your business plan

The planning process forces you to think through every aspect of your business and answer questions that you may not have thought of. That’s the real benefit of writing a business plan – the knowledge you gain about your business that you may not have been able to discover otherwise.

With all of this knowledge, you’re well prepared to convert your business plan into a pitch presentation to present your ideas.

A pitch presentation is a summary of your plan, just hitting the highlights and key points. It’s the best way to present your business plan to investors and team members.

Dig Deeper: Learn what key slides should be included in your pitch deck

Use your business plan to manage your business

One of the biggest benefits of planning is that it gives you a tool to manage your business better. With a revenue forecast, expense budget, and projected cash flow, you know your targets and where you are headed.

And yet, nothing ever goes exactly as planned – it’s the nature of business.

That’s where using your plan as a management tool comes in. The key to leveraging it for your business is to review it periodically and compare your forecasts and projections to your actual results.

Start by setting up a regular time to review the plan – a monthly review is a good starting point. During this review, answer questions like:

- Did you meet your sales goals?

- Is spending following your budget?

- Has anything gone differently than what you expected?

Now that you see whether you’re meeting your goals or are off track, you can make adjustments and set new targets.

Maybe you’re exceeding your sales goals and should set new, more aggressive goals. In that case, maybe you should also explore more spending or hiring more employees.

Or maybe expenses are rising faster than you projected. If that’s the case, you would need to look at where you can cut costs.

A plan, and a method for comparing your plan to your actual results , is the tool you need to steer your business toward success.

Learn More: How to run a regular plan review

Free business plan templates and examples

Kickstart your business plan writing with one of our free business plan templates or recommended tools.

Free business plan template

Download a free SBA-approved business plan template built for small businesses and startups.

Download Template

One-page plan template

Download a free one-page plan template to write a useful business plan in as little as 30-minutes.

Sample business plan library

Explore over 500 real-world business plan examples from a wide variety of industries.

View Sample Plans

How to write a business plan FAQ

What is a business plan?

A document that describes your business , the products and services you sell, and the customers that you sell to. It explains your business strategy, how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

What are the benefits of a business plan?

A business plan helps you understand where you want to go with your business and what it will take to get there. It reduces your overall risk, helps you uncover your business’s potential, attracts investors, and identifies areas for growth.

Having a business plan ultimately makes you more confident as a business owner and more likely to succeed for a longer period of time.

What are the 7 steps of a business plan?

The seven steps to writing a business plan include:

- Write a brief executive summary

- Describe your products and services.

- Conduct market research and compile data into a cohesive market analysis.

- Describe your marketing and sales strategy.

- Outline your organizational structure and management team.

- Develop financial projections for sales, revenue, and cash flow.

- Add any additional documents to your appendix.

What are the 5 most common business plan mistakes?

There are plenty of mistakes that can be made when writing a business plan. However, these are the 5 most common that you should do your best to avoid:

- 1. Not taking the planning process seriously.

- Having unrealistic financial projections or incomplete financial information.

- Inconsistent information or simple mistakes.

- Failing to establish a sound business model.

- Not having a defined purpose for your business plan.

What questions should be answered in a business plan?

Writing a business plan is all about asking yourself questions about your business and being able to answer them through the planning process. You’ll likely be asking dozens and dozens of questions for each section of your plan.

However, these are the key questions you should ask and answer with your business plan:

- How will your business make money?

- Is there a need for your product or service?

- Who are your customers?

- How are you different from the competition?

- How will you reach your customers?

- How will you measure success?

How long should a business plan be?

The length of your business plan fully depends on what you intend to do with it. From the SBA and traditional lender point of view, a business plan needs to be whatever length necessary to fully explain your business. This means that you prove the viability of your business, show that you understand the market, and have a detailed strategy in place.

If you intend to use your business plan for internal management purposes, you don’t necessarily need a full 25-50 page business plan. Instead, you can start with a one-page plan to get all of the necessary information in place.

What are the different types of business plans?

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. Here are a few common business plan types worth considering.

Traditional business plan: The tried-and-true traditional business plan is a formal document meant to be used when applying for funding or pitching to investors. This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix.

Business model canvas: The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

One-page business plan: This format is a simplified version of the traditional plan that focuses on the core aspects of your business. You’ll typically stick with bullet points and single sentences. It’s most useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Lean Plan: The Lean Plan is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance. It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

What’s the difference between a business plan and a strategic plan?

A business plan covers the “who” and “what” of your business. It explains what your business is doing right now and how it functions. The strategic plan explores long-term goals and explains “how” the business will get there. It encourages you to look more intently toward the future and how you will achieve your vision.

However, when approached correctly, your business plan can actually function as a strategic plan as well. If kept lean, you can define your business, outline strategic steps, and track ongoing operations all with a single plan.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- Use AI to help write your plan

- Common planning mistakes

- Manage with your business plan

- Templates and examples

Related Articles

5 Min. Read

Should You Stick to the Business Plan or Change It?

6 Min. Read

11 Common Business Plan Mistakes You Should Avoid

9 Common Mistakes with Business Financial Projections

9 Min. Read

How to Create a Sales Plan for Your Business

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- 400+ Sample Business Plans

- WHY UPMETRICS?

Customer Success Stories

Business Plan Course

Strategic Planning Templates

E-books, Guides & More

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai Pitch Deck Generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

Small Business Tools

Write the Funding Request Section of Your Business Plan

Free Startup Fundraising Checklist

Aayushi Mistry

- December 12, 2023

While writing a business plan to seek funding, you must be clear about what needs to be written under the section where you would request funding. This is an important and essential section of your business plan.

What Is the Funding Request?

A funding request section of your business plan allows you to ask for the required fund. While writing the request, you always have to mention the timeline in which you will utilize the funds. Usually, this timeline is up to the next 5 years from the request.

The funding request may differ on the age of your company. If your company is only a start-up, it will have to provide more details than any older company. Generally, any business up to its 7th year is called a startup company. Although this criterion may differ with respect to location and industry.

Step-by-Step Guide to Writing the Funding Request of Your Business Plan

Before you start writing your requests, be clear about your requirements. And, in the same line, be very clear explaining it. Your readers want you to get to the point. So, they can make accurate decisions just in time. Moreover, it will also save you a lot of time and effort.

Once the facts and figures are drawn (accurately), you need to draft them properly into your business plan. And you have to be very careful and precise while doing it.

So ideally, you need to figure out your requirements. And then put it into the context of the business plan.

So, How to derive your funding requirements?

Deriving funding requirements get a little overwhelming. But if you take it one step at a time, it starts getting easier.

First, determine what you need money for

It could be for hiring new staff, getting new equipment, or starting your business at a new location . Just be very clear with the goals. Then list down the requirements and the required fund for it. In the end, sum it up. If you want funds for recovering your debts, explain all your debts in detail.

Now, It Is Time to Know How Much Amount Can You Get on Your Own.

- Calculate the financial resources: Look out for your saved capital in cash as well as in personal assets. Other than that, see if you can gather the funds from friends and family.

- Grants and subsidies: Check if your company is eligible for any government grants and subsidies. If yes, apply for it and add the amount. Calculate and find the difference between the required amount and the amount you can already put together. And that will be the amount you will be needing from the third party, investors, or from the bank. Once you have the right fund requirement at hand, list out the investors, moneylenders, and loans who can provide you with the sum.

Now, Let’s Start Writing Your Funding Request

1. Provide Business Information

Yes, you still have to give this brief even though you have already explained it in detail. No, it does not get redundant-It does not have to be. In fact, you can take it up as an opportunity to give a little recap to your potential prospects and moneylenders.

Moreover, sometimes, you might have to only send the funding request section and not the entire business plan. In such cases, such information comes handy.

So, here’s what you will have to explain in the funding request section of your business plan-

- Target Market

- Your business structure like LTD, LLC, or more

- Brief about your product/service

- Partners involved

- Business heir, if there exists.

2. Mention the Current Financial Situation

You might have provided some financial information in the financial section. But, you have to add some figures here anyway. Not only will make it contextual, but even easier to have a clear picture in one place.

Here are some financial details that you will have to include in this section:

- Quarterly as well as yearly cash inflow and outflow

- Balance sheets

- P&L statement

- Expected financial condition in the upcoming quarter and year

- Include the list of assets and their ownership details if you are asking loan from the bank

- If your business is in debt, explain the situation in the detail and a brief plan for paying it.

- Mention how much return on investment can they expect.

- In the end, mention how will you pay off the loan or transfer the ownership of the business.

3. Announce How Much Funds Do You Need?

When you explain the situation in brief and have all the facts and figures put aside, narrow it down to your requirements. Mention how much money you need.

4. Discuss Briefly How Will You Use the Money?

Here, you have to narrow down what you need the money for and how you are going to use it. Just list down the details and put the figure for it- so much like how you do your billing. If they are taking the money for multiple things, highlight every detail.

5. Dive Deep into Current and Future Financial Planning

You must have explained a little about the inflow and outflow in the financial section. But over here, you have to get into the details like-

- If you are getting a loan, outline your timelines for payments.

- If you are looking forward to selling, mention how it will affect the investors.

- And then, finally, mention the exit strategy . Your exit strategy includes how you will transfer the business ownership at the end.

- You only have to add the funding request if only you want the funding from outside. If you don’t want to raise your funds from a third party, then you don’t have to include them in your business plan.

- Your investors would like to invest in your business if only it is thriving or promising. They are less likely to lend money if you are in debt.

- You see, you are asking for money. So don’t take this section casually. Know your business inside out and only involve people who know everything about your business.

- Be as specific about your requirements and the funding that you require.

- If you are planning to send it to different investors, tailor your funding request according to the reader.

- All your sources have different mindsets and different funding criteria. Be very specific about it. Do detailed research before starting to write your funding request.

- Don’t hesitate while asking for the funds. Be open and ask just as much as your business really requires. But at the same time, don’t be greedy.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

About the Author

Since childhood, I was in awe of the magic that words bring. But while studying computer science in college, my world turned upside down. I found my calling in being a copywriter and I plunged into a world of words. Since then, there is no looking back. Even today, nothing excites me to find out the wonders the words can bring!

Related Articles

Convince Your Investors that Business is Ready to Scale-Up

7 Small Business Financing Options

How to Prepare a Financial Plan for Startup Business (w/ example)

Reach your goals with accurate planning.

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Plan Projections

ideas to numbers .. simple financial projections

Home > Business Plan > Funding Requirements in a Business Plan

Funding Requirements in a Business Plan

… our funding requirements are …

The summary given in the funding requirement section should be consistent with the rest of the business plan. The amount needed, and when it is needed should follow from the detailed financial projections, and the purpose of the funding, sales and marketing, hire of employees, to achieve a milestone etc. should again link in with the rest of the plan,

Funding Requirements Presentation

This is part of the financial projections and Contents of a Business Plan Guide , a series of posts on what each section of a simple business plan should include. The next post in this series is the final section, and deals with the planned exit for investors.

About the Author

Chartered accountant Michael Brown is the founder and CEO of Plan Projections. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

You May Also Like

How to Write Your Business Plan to Secure Funding

Unlock funding for your business! Master the art of writing a funding-worthy business plan with our ultimate guide.

Introduction to Writing a Funding-Worthy Business Plan

When it comes to securing funding for your business, a well-written business plan plays a pivotal role. It serves as a roadmap that outlines your goals, strategies, and financial projections, giving potential investors or lenders a comprehensive understanding of your business. In this section, we will explore the importance of a well-written business plan and delve into the purpose it serves.

Importance of a Well-Written Business Plan

A well-crafted business plan is essential for multiple reasons. Firstly, it showcases your professionalism and commitment to your business idea. It demonstrates that you have thoroughly thought through every aspect of your venture and have a solid plan in place.

Additionally, a well-written business plan acts as a communication tool between you and potential investors or lenders. It allows you to effectively convey your business concept, market analysis, and financial projections, helping them understand the viability and potential of your business.

Moreover, a comprehensive business plan can help you identify any potential pitfalls or gaps in your strategy. By thoroughly analyzing your business model, market conditions, and financial projections, you can proactively address any weaknesses and make necessary adjustments.

Understanding the Purpose of a Business Plan

The purpose of a business plan extends beyond just securing funding. It serves as a strategic document that guides your business operations and helps you stay focused on your goals. Some key purposes of a business plan include:

- Attracting Investors and Lenders: A well-written business plan provides potential investors or lenders with the information they need to make an informed decision about whether to invest in your business or provide financial support. It showcases the potential return on investment and outlines the steps you will take to achieve success.

- Setting Clear Goals and Strategies: A business plan helps you define your short-term and long-term goals, as well as the strategies you will implement to achieve them. It provides a roadmap that keeps you on track and allows you to measure your progress along the way.

- Identifying Strengths and Weaknesses: By conducting a thorough market analysis and assessing your business's strengths and weaknesses, a business plan helps you identify areas where you excel and areas that require improvement. This enables you to develop strategies to leverage your strengths and mitigate any weaknesses.

- Guiding Financial Decision-Making: A business plan includes financial projections and analysis that help you make informed financial decisions. It provides a clear understanding of your revenue streams, costs, and potential profitability, enabling you to allocate resources effectively.

- Facilitating Collaboration and Communication: A business plan serves as a tool for collaboration and communication within your organization. It ensures that all team members are aligned with the business goals and strategies, fostering a cohesive and unified approach.

Understanding the importance and purpose of a well-written business plan is the first step towards creating a document that effectively communicates your vision and secures the funding you need. In the following sections, we will explore the key components, step-by-step guide, and best practices for crafting a funding-worthy business plan.

Key Components of a Funding-Worthy Business Plan

To create a business plan that attracts funding, it's essential to include key components that provide a comprehensive overview of your business. These components will help potential investors understand your business's potential and make informed decisions. Here are the key components you should include in your funding-worthy business plan:

Executive Summary

The executive summary is a concise overview of your entire business plan. It should provide a clear and compelling summary of your business, highlighting its unique selling proposition, market opportunities, and financial projections. This section should be written in a way that captures the attention of potential investors and encourages them to read further.

Company Overview

The company overview section provides an introduction to your business. It should include details about your company's mission, vision, and values. Additionally, this section should highlight key information such as the legal structure of your business, its history, location, and any notable achievements or milestones.

Market Analysis

The market analysis section presents a thorough examination of your target market, industry trends, and competitors. It should showcase your understanding of the market dynamics, customer needs, and competitive landscape. Including market research, data, and relevant statistics can strengthen your analysis and demonstrate the market opportunity your business intends to tap into.

Product or Service Description

In this section, you should provide a detailed description of your product or service. Explain how it addresses a need or solves a problem in the market. Include information about its features, benefits, and any unique selling points. Use this section to showcase the value proposition of your offering and differentiate it from competitors.

Marketing and Sales Strategy

The marketing and sales strategy section outlines how you plan to promote and sell your product or service. It should include your target market segmentation, pricing strategy, distribution channels, and promotional activities. Demonstrating a well-thought-out marketing and sales strategy can instill confidence in investors regarding your ability to reach and attract customers.

Organizational Structure and Management

In this section, provide an overview of your organizational structure, including key personnel and their roles. Highlight the qualifications and experience of your management team, as well as any advisors or board members. Investors want to see that your team has the expertise and capabilities to execute your business plan successfully.

Financial Projections and Analysis

The financial projections and analysis section is crucial for illustrating the financial viability of your business. Include projected income statements, balance sheets, and cash flow statements for at least the next three years. Additionally, provide a detailed analysis of your financial assumptions and key performance indicators. It's important to present realistic and well-supported financial projections.

Funding Request and Use of Funds

In this section, clearly state the amount of funding you are seeking and how you intend to use it. Break down the allocation of funds, highlighting specific areas such as product development, marketing, operations, or expansion. Providing a detailed breakdown of the use of funds demonstrates your ability to effectively utilize the investment.

The appendix section serves as a supplemental section that includes any additional information that supports your business plan. This may include market research data, product samples, patents, licenses, permits, or any other relevant documents. The appendix provides investors with access to more detailed information without overwhelming the main body of the business plan.

By including these key components in your funding-worthy business plan, you can present a comprehensive overview of your business and increase your chances of securing the funding you need to bring your entrepreneurial vision to life.

Step-by-Step Guide to Writing a Funding-Worthy Business Plan

Writing a business plan that is compelling and attractive to potential investors is a crucial step in securing funding for your venture. To help you navigate this process, here is a step-by-step guide to writing a funding-worthy business plan.

Research and Gather Information

Before diving into the writing process, it's essential to conduct thorough research and gather all the necessary information. This includes understanding your industry, target market, competitors, and potential investors. Collecting data and market insights will provide a solid foundation for your business plan.

Define Your Business and Goals

Clearly define your business and outline your goals. Describe the nature of your business, the products or services you offer, and what sets you apart from your competitors. Additionally, establish both short-term and long-term goals for your business, focusing on specific, measurable, achievable, relevant, and time-bound (SMART) objectives.

Conduct a Comprehensive Market Analysis

Perform a comprehensive market analysis to gain insights into your target market, customer demographics, and industry trends. Identify your target audience's needs, preferences, and purchasing behavior. Analyze your competitors to understand their strengths, weaknesses, and market positioning. Presenting this information in tables can help organize and present the data effectively.

Market Analysis Factors Data

Target Market Size

Customer Demographics

Industry Trends

Competitor Analysis

Develop a Strong Marketing and Sales Strategy

Outline a robust marketing and sales strategy that highlights how you plan to reach and attract customers. Define your unique selling proposition (USP) and outline your pricing strategy, distribution channels, and promotional activities. This section should demonstrate your understanding of your target market and how you plan to position your business in the competitive landscape.

Outline Your Organizational Structure and Management

Describe your organizational structure and management team. Provide an overview of key personnel, their roles, and their qualifications. Highlight any relevant industry experience, expertise, or accomplishments that make your team well-equipped to execute the business plan successfully. A clear and concise organizational chart can help visualize the structure.

Create Financial Projections and Analysis

Develop financial projections that estimate your business's future revenue, expenses, and profitability. Include a projected income statement, balance sheet, and cash flow statement. Use realistic assumptions based on your market research and industry benchmarks. Additionally, conduct a comprehensive financial analysis that evaluates the financial health and viability of your business.

Craft a Compelling Executive Summary

The executive summary is a concise overview of your entire business plan and should entice readers to continue reading. Summarize the key elements of your plan, including your business concept, market opportunity, competitive advantage, and financial projections. Craft a compelling and engaging executive summary that captures the attention of potential investors.

Polish and Revise Your Business Plan

Once you have completed the initial draft of your business plan, take the time to polish and revise it. Review the content for clarity, coherence, and accuracy. Ensure that your plan flows logically and presents a compelling case for investment. Proofread for grammar and spelling errors. Consider seeking feedback from trusted advisors or professionals to refine your plan further.

By following this step-by-step guide, you can create a comprehensive and compelling business plan that increases your chances of securing funding for your venture. Remember to tailor your plan to the specific needs and preferences of your target audience, providing them with all the necessary information to make an informed investment decision.

Tips and Best Practices for Writing a Funding-Worthy Business Plan

Writing a business plan that is compelling and effective in securing funding requires careful attention to detail and adherence to best practices. Here are some tips to help you create a funding-worthy business plan:

Keep it Clear and Concise

When writing your business plan, it's essential to communicate your ideas clearly and concisely. Avoid using unnecessary jargon or technical terms that may confuse your readers. Use straightforward language and structure your content in a logical manner. Remember, clarity and simplicity are key to ensuring that your business plan is easily understood by potential investors.

Tailor Your Plan to the Target Audience

Each business plan should be tailored to the specific needs and expectations of the target audience. Consider the preferences and priorities of potential investors or lenders and customize your plan accordingly. For example, venture capitalists may be more interested in growth potential and return on investment, while traditional lenders may focus on cash flow and collateral. Understanding your audience will allow you to highlight the aspects of your business that are most relevant to them.

Support Claims with Data and Research

To instill confidence in your business plan, it's important to back up your claims with data and research. Provide market research, industry trends, and competitive analysis to support your assertions about the viability and potential of your business. Including relevant statistics, market projections, and customer surveys can help validate your assumptions and demonstrate that your business plan is grounded in reality.

Seek Professional Help if Needed

Writing a funding-worthy business plan can be a complex and time-consuming task. If you are unsure about certain aspects or need assistance in crafting a compelling plan, consider seeking professional help. Business consultants, accountants, or industry experts can provide valuable insights and guidance to ensure that your business plan is comprehensive, accurate, and persuasive.

Remember, a well-written business plan is not only a tool for securing funding but also a roadmap for the success of your business. By following these tips and best practices, you can increase your chances of creating a business plan that effectively communicates your vision and attracts the attention of potential investors or lenders.

Q: What is a funding-worthy business plan?

A: A funding-worthy business plan is a comprehensive document that outlines your business concept, market opportunity, competitive advantage, financial projections, and other key components to attract potential investors or lenders.

Q: What are the key components of a funding-worthy business plan?

A: The key components of a funding-worthy business plan include an executive summary, company overview, market analysis, product or service description, marketing and sales strategy, organizational structure and management, financial projections and analysis, funding request and use of funds, and appendix.

Q: How long should my business plan be?

A: While there is no strict rule on the length of a business plan, it's generally recommended to keep it concise and focused. A typical business plan can range from 15 to 30 pages. However, the most important thing is to provide all the necessary information in a clear and compelling manner.

Q: Do I need professional help to write my business plan?

A: While you can certainly write your own business plan with careful research and attention to detail, seeking professional help can provide valuable insights and guidance. Business consultants, accountants or industry experts can offer specialized knowledge that can enhance the quality of your business plan.

Q: How often should I update my business plan?

A: Your business plan should be viewed as a living document that evolves over time. It's recommended to review and update your plan regularly to reflect changes in your industry or market conditions. You may need to update it annually or even more frequently if significant changes occur in your business operations or financial performance.

By addressing these frequently asked questions about writing a funding-worthy business plan in your document or during presentations with investors or lenders can demonstrate that you have thoroughly thought through the planning process.

As an entrepreneur seeking funding for your business, a well-crafted and comprehensive business plan is essential. By following the step-by-step guide outlined in this article, you can create a funding-worthy business plan that effectively communicates your vision, market opportunity, competitive advantage, and financial projections to potential investors or lenders. Remember to tailor your plan to the specific needs and expectations of your target audience, keep it clear and concise, support claims with data and research, and seek professional help if needed. With a compelling business plan in hand, you'll be one step closer to turning your entrepreneurial dreams into reality.

https://blog.hubspot.com/sales/how-to-write-business-proposal

https://www.etu.org.za/toolbox/docs/finances/proposal.html

https://www.mybusiness.com.au/how-we-help/grow-your-business/increasing-sales/how-to-write-a-funding-proposal

Related Blog Post

Garden Programming Loan Agreement Definition

April 18, 2024

Demystifying garden programming loan agreements. Discover how they facilitate collaboration and access to resources.

What is a UCC-1 Financing Statement?

Demystifying the UCC-1 Financing Statement: Discover the purpose, components, and impact of this crucial legal document.

Can I Get a Loan with a 550 Credit Score?

Unlock loan possibilities even with a 550 credit score. Explore secured loans, payday loans, and online lenders.

How to Get a Personal Loan With a 550 Credit Score

Unlock financial freedom! Discover how to get a personal loan with a 550 credit score. Take control of your finances today.

How to Calculate Net Income

Master your finances with ease! Learn how to calculate net income and boost your wealth with smart financial strategies.

How to Start a Cleaning Business From Scratch

Unlock the secrets to starting a lucrative cleaning business from scratch! Expert tips for success in the cleaning industry.

What is a Contingency Plan?

Unraveling the mystery of contingency plans: Learn what they are, why they're crucial, and how to create your own!

Key Components to an Effective Business Contingency Plan

Unlock the key components to an effective business contingency plan. Safeguard your future with risk assessment and recovery strategies.

Use a Contingency Plan to Protect Your Business

Protect your business from the unexpected! Learn how to use a contingency plan to safeguard your operations and ensure continuity.

What is Tiffany Select Financing?

April 17, 2024

Discover Tiffany Select Financing: the ultimate shopping experience elevated. Unravel the benefits, application process, and more!

Section 179 Deduction: Does My Vehicle Qualify?

Discover if your vehicle qualifies for the Section 179 deduction. Unleash your engine's power and your tax savings potential!

Investors Need a Good WACC

Unlock investment success with a good WACC! Discover why investors need this key metric for maximizing returns.

What Is a Good WACC?

Unlocking the mystery of a good WACC! Discover industry benchmarks and strategies for optimizing your weighted average cost of capital.

What Is Weighted Average Cost of Capital (WACC)?

Demystify WACC and make informed financial decisions. Explore the formula, significance, and real-world scenarios.

What Is Cost of Capital and Why Is It Important?

Unlock the secrets of cost of capital! Discover its importance in business decision making and valuation. Find out more now!

Cost of Capital vs. Discount Rate

Unlock the secrets of cost of capital vs. discount rate! Discover their impact on investment decisions.

Discount Rate Defined

Discover the true meaning of discount rate defined. Unravel the complexity behind finance's powerful tool.

Net Present Value (NPV): What It Means

Unlock the mystery of Net Present Value (NPV) and make informed financial decisions. Discover the power of NPV calculations!

How To Grow Construction Business With Equipment

Unlock the secrets to growing your construction business with equipment. From selecting the right tools to maximizing efficiency.

Construction Equipment Financing

Unlock growth with construction equipment financing. Access high-quality equipment, improve cash flow, and enjoy tax benefits.

Effective Business Tips

Unlock success with 10 effective business tips! Build a strong foundation, navigate challenges, and cultivate relationships.

How to Grow a Successful Business

Unlock the secrets to growing a successful business! Master strategic planning, marketing, finance, operations, and more.

Ways To Grow Your Business

Unlock the path to business growth with transformative strategies! Discover innovative ways to expand your business today.

How to Grow a Small Business

Unlock the secrets to growing a small business and achieve lasting success. Discover proven strategies and expert insights to thrive.

Easy-to-Start Business Ideas

Discover easy-to-start business ideas that are both lucrative and rewarding. Say goodbye to the 9 to 5 and hello to your entrepreneurial.

Best Construction and Heavy Equipment Financing Loans

April 12, 2024

Discover the best construction and heavy equipment financing loans. Fuel your success with the right financial support.

Heavy Equipment Financing

Boost productivity with heavy equipment financing! Maximize efficiency and unlock long-term cost savings for your business operations.

Considerations in Forming a Limited Partnership

Discover key considerations for forming a limited partnership. From liability distribution to tax implications, make informed decisions.

What Is A Limited Partnership?

Unveiling the secret: What exactly is a limited partnership? Discover the definition, formation, and advantages of this business structure.

Top Line vs. Bottom Line in Business: What's the Difference?

Unraveling the difference between top line and bottom line in business. Understand the impact on success. Learn more!

The Bottom Line and What it Means

Unveiling the essence and importance of the bottom line in business. Discover its significance, strategies for improvement, and industry.

DBA Registration Guide

Master the art of DBA registration - your guide to legitimizing your business, building brand identity, and legal protection.

What is a DBA and When to File One For Your Business

Uncover the power of a DBA for your business! From legal implications to brand identity, learn when to file and unlock new opportunities.

Business Structure: How to Choose the Right One

Unlock business success with the best legal structure! Explore sole proprietorships, partnerships, LLCs, and corporations to make the right.

Guide to Business Structures

Your ultimate guide to choosing the right business structure - navigate the pros and cons of sole proprietorship and partnership, LLC.

Alternative Forms of Business Organizations

April 11, 2024

Discover alternative business organizations and find your perfect fit! Uncover the pros and cons of partnerships, corporations, and more.

.jpeg)

Financing Options for Small Businesses

Discover the best financing options for small businesses. From traditional bank loans to crowdfunding and more, achieve your business goals

Non-Bank Small Business Financing Options

Discover non-bank small business financing options and power your business to new heights! Unveil the secrets of alternative financing today

Best Business Loans With No Credit Check Of 2024

Discover the top business loans of 2024 with no credit check. Unleash your potential and secure funding for your business today!

Capital Expenditures vs. Revenue Expenditures

Boost your financial IQ with a clear understanding of capital expenditure and revenue. Discover the crucial difference for smarter decision.

Gains and Losses vs. Revenue and Expenses

Gain insights into gains and losses vs. revenue and expenses. Master financial terms for better financial performance!

Revenue vs. Sales: What's the Difference?

Unraveling the distinction between revenue and sales: What's the difference? Discover the impact on business success and strategies.

Revenue vs. Profit: What's the difference?

Unlock the difference between revenue and profit! Master financial understanding for informed decisions. Revenue vs. profit.

Commercial Truck Insurance Coverage

Discover optimal commercial truck insurance coverage! From liability to cargo insurance, find the perfect protection for your business.

Commercial Truck Insurance

Demystifying commercial truck insurance: Discover the coverage you need to stay protected on the road.

What Is Equity in Business & How Do You Calculate It?

Discover what equity in business is and how to calculate it! Gain insights into maintaining equity balance and its impact on financial.

.jpg)

How Do You Calculate a Company's Equity?

Unraveling the mystery: Learn how to calculate a company's equity and decode its financial health.

Best Semi Truck Financing Options of 2024

Discover the top semi truck financing options of 2024! Accelerate your success with the right financing for your business.

First Time Buyer Commercial Truck Loans

Breaking barriers with first time buyer commercial truck loans. Navigate the loan process and secure your dream truck!

How To Get Zero Down Semi Truck Financing

Unlock the path to successful semi truck financing with zero down options! Discover how to get the best deals for your business.

Learn How To Get Zero Down Semi Truck Financing

April 5, 2024

Unlock the path to semi truck financing success with zero worries. Learn how to get zero down financing today!

Best Equipment Financing Options Of 2024

Discover the best equipment financing options of 2024! Explore traditional bank loans, equipment leasing, online lenders, and government.

What is an Equipment Loan and How Does It Work?

Unlock the secrets of equipment loans! Discover the process, benefits, and tips for success. Get the guide now!

Car Depreciation for Taxes

Maximize tax savings with car depreciation strategies! Learn how to optimize deductions and navigate IRS guidelines.

How To Claim Vehicle Depreciation from the IRS

Unlock savings and maximize your tax benefits with our step-by-step guide to claiming vehicle depreciation from the IRS.

How Much Does An Accountant Cost In 2024?

April 1, 2024

Cracking the code on accountant costs in 2024! Discover the average price range and tips for finding an accountant within your budget.

Best Loans for Bad Credit in March 2024

Discover the game-changing loans for bad credit in March 2024. Find the best options to unlock your financial freedom!

List of Vehicles that Qualify for Section 179 in 2024

Discover the vehicles that qualify for Section 179 in 2024. Drive your business forward with tax savings!

Guide to Small Business Loans for Veterans

Unlocking opportunities with small business loans for veterans. Navigate the world of financing and government support for veteran.

Section 179 Deduction: How It Works

Maximize your business savings with the Section 179 deduction. Discover its benefits, eligibility, and common misconceptions.

Minority Small Business Grants

Unlock financial opportunities for minority small businesses with grants. Discover eligibility, application process, and valuable resources.

What Is A DBA? Everything You Need to Know

Unlock the secrets of DBA! Discover what a DBA is, why you need it, and how to choose the perfect one for your business.

How Do Gross Profit and Gross Margin Differ?

Unraveling the finance puzzle: Discover the distinction between gross profit and gross margin for insightful financial analysis.

Commercial Semi Truck Insurance

Protect your commercial semi truck with insurance. Ensure compliance, financial security, and peace of mind. Get covered today!

National Business Capital

Unlock the keys to success with national business capital. Explore financing options and drive growth for your business today.

Calculating Cost Of Goods Sold

Master the art of calculating cost of goods sold! Discover the components, methods, and importance of accurate COGS calculation.

What to know about Form 4562

Unlock the secrets of Form 4562! Discover what you need to know about this essential tax form.

What Is a Write-Off?

Unveiling the magic of write-offs: Discover how to turn expenses into savings with this guide on personal and business write-offs.

What is Microcredit? How Does it Work?

Unveiling the power of microcredit: How it works and its impact on poverty and entrepreneurship

Revenue vs. Income: What's the Difference?

Unveiling the contrast: Revenue vs. Income. Understand the difference and its impact on financial decisions.

What Is Commercial Insurance?

Unveiling the mysteries of commercial insurance. Discover what it is, its importance, and how to find the right coverage.

Break Even Point (BEP)

Unveiling the Break Even Point (BEP): Achieve financial stability and make informed business decisions with this essential guide!

What Is Bonus Depreciation?

Unveil the secrets of bonus depreciation and maximize your tax deductions. Discover how it differs from regular depreciation and its impact

What Are Small Business Grants and How to Get Them

Unlock funding opportunities for your small business! Discover the secrets of small business grants and how to secure them for success.

Small-Business Grants: Where to Find Free Funding

Unlock the power of free grants and programs for small businesses. Discover funding options and tips for success in securing your dream.

The Basics of Financing a Business

March 30, 2024

Master the art of financing a business with essential basics. Explore debt, equity, bootstrapping, and government funding options.

Types and Sources of Financing for Start-up Businesses

Discover the types and sources of financing for start-up businesses. Crack the code to secure the funds you need for success!

Buying an Existing Business? How to Finance Your Purchase

Discover financing strategies for buying an existing business. From traditional loans to angel investors, unlock the keys to success!

4 Deadly Small Business Mistakes You Must Avoid

Avoid these deadly small business mistakes! Learn how to manage finances, market effectively, listen to customers, and plan for success.

12 Common Financial Mistakes Business Owners Make

Avoid these 12 financial mistakes! Take control of your business's financial future with expert strategies and tips.

Feasibility Analysis for New Businesses

Discover the power of feasibility analysis for new businesses. Minimize risks, make informed decisions, and increase your chances of success

How To Start A Business In 11 Steps (2024 Guide)

Master the art of starting a business in 11 steps! Your ultimate 2024 guide to entrepreneurial success.

9 Documents to Show Investors for Funding

Unlock funding success with these 9 key documents! From business plans to legal docs, impress investors and secure your future.

40 Proven Ways to Fund Your Small Business

Discover 40 proven ways to fund your small business and break through barriers to success. Explore traditional, alternative, and creative fu

Backd Review: High Limit Business Funding

Unlock growth with High Limit Funding: A comprehensive backd review. Discover larger capital, expansion opportunities, and more.

Torro Business Funding Reviews 2024

Discover the 2024 Torro Business Funding reviews! Get insights into the funding landscape and evaluate your options.

Torro Funding Group

Unleash your business potential with Torro Funding Group. Discover flexible financing options and competitive rates to fuel your growth.

Fixed vs. Variable Interest Rates: What's the Difference?

Decoding the difference between fixed and variable interest rates: Make informed financial decisions with our expert guidance.

The Pros and Cons of Fixed-Rate Loans