More results...

- Sunday, March 31, 2024

- The Financial Encyclopedia

- February 15, 2022

Fair Presentation

An accounting standards’ requirement that an entity’s financial statements should be presented in a fair way to all relevant users of these statements. In other words, it is premised on the requirement that these statements should not be misleading. Under the principle of fair presentation, financial statements must fairly present the financial position, financial performance and cash flows of the entity. Fair presentation requires the faithful (unbiased) representation of the monetary effects of transactions, other events and circumstances in accordance with the applicable concepts and recognition criteria for assets , liabilities , income and expenses .

Fair presentation is the US and International Accounting Standards (IAS) equivalent of the British requirement that financial statements provide a true and fair view (which entails that statements/ accounts have been truly prepared and fairly presented in accordance with applicable accounting standards and framework . It also implies that the financial statements are free from material misstatements and faithfully represent the financial position and performance of an entity, subject-matter of an audit process.).

- Face of Balance Sheet

- Primary Currency

- Accounting Currency

- Reporting Currency

- Presentation Currency

- Presentation Statement

- Comparability

Latest Terms

- Financial Statement Variable

- Financial Variable

- Factory Overhead Control Account

- Finance Cost

- FV Approximation

- Fair Value Approximation

- Fair Value Hierarchy

Leave Your Comment Cancel Reply

Your email address will not be published.*

Save my name, email, and website in this browser for the next time I comment.

- Subscriber Services

- For Authors

- Publications

- Archaeology

- Art & Architecture

- Bilingual dictionaries

- Classical studies

- Encyclopedias

- English Dictionaries and Thesauri

- Language reference

- Linguistics

- Media studies

- Medicine and health

- Names studies

- Performing arts

- Science and technology

- Social sciences

- Society and culture

- Overview Pages

- Subject Reference

- English Dictionaries

- Bilingual Dictionaries

Recently viewed (0)

- Save Search

- Share This Facebook LinkedIn Twitter

Related Content

Related overviews.

true and fair view

International Accounting Standard

International Accounting Standards Board

financial statements

More Like This

Show all results sharing these subjects:

fair presentation

Quick reference.

The requirement that financial statements should not be misleading. ‘Fair presentation’ is the US and International Accounting Standards equivalent of the British requirement that financial statements give a true and fair view.

From: fair presentation in A Dictionary of Finance and Banking »

Subjects: Social sciences — Economics

Related content in Oxford Reference

Reference entries.

View all related items in Oxford Reference »

Search for: 'fair presentation' in Oxford Reference »

- Oxford University Press

PRINTED FROM OXFORD REFERENCE (www.oxfordreference.com). (c) Copyright Oxford University Press, 2023. All Rights Reserved. Under the terms of the licence agreement, an individual user may print out a PDF of a single entry from a reference work in OR for personal use (for details see Privacy Policy and Legal Notice ).

date: 31 March 2024

- Cookie Policy

- Privacy Policy

- Legal Notice

- Accessibility

- [66.249.64.20|185.194.105.172]

- 185.194.105.172

Character limit 500 /500

- 101 Accounting Basics Strong foundation on fundamental concepts and the accounting process

- FIN Financial Accounting Financial accounting and reporting, financial statements, IFRS and GAAP

- MNG Managerial Accounting Managerial/management accounting topics to aid in decision-making

- DIC Accounting Dictionary Accounting terms defined and carefully explained

- MIS Misc Articles Miscellaneous topics about anything accounting

- ≡ Explore

Accounting Basics Accounting 101

Introduction to accounting.

- What is Accounting? Its Definition and Meaning

- Purpose of Accounting – Why It is Important

- Users of Financial Statements / Accounting Information

- Types of Accounting (Branches / Fields of Specialization)

- Areas of Accounting Practice

- Types of Business and Forms of Ownership

- Summary of Topics Covered

- Quiz and Answers

Fundamental Accounting Concepts

- Basic Accounting Principles

- Elements of Accounting: Assets, Liabilities and Capital

- The Accounting Equation and How It Stays in Balance

- Accounting Equation: More Examples and Illustration

- Expanded Accounting Equation: The Spread-Out Version

- The Double Entry Accounting System

- Accounting Cycle: 9-Step Accounting Process

The Financial Statements

- Introduction to Financial Statements: An Overview

- Income Statement a.k.a. Profit and Loss Statement

- Statement of Changes in Owner's Equity

- Balance Sheet: Statement of Financial Position

- Statement of Cash Flows

Analyzing, Recording, and Classifying

- Understanding and Analyzing Business Transactions

- Rules of Debit and Credit: Left versus Right

- The Chart of Accounts: Explanation and Example

- Journal Entries: Recording Business Transactions

- More Journal Entry Examples

- Posting to the Accounting Ledger

- Trial Balance: Checking the Equality of Debits and Credits

- Correcting Entries for Errors Discovered

Adjusting Entries

- Introduction to Adjusting Journal Entries

- Adjusting Entry for Accrued Income

- Adjusting Entry for Accrued Expense

- Adjusting Entry for Unearned Income

- Adjusting Entry for Prepaid Expense

- Depreciation Expense

- Bad Debts Expense

- Adjusted Trial Balance

How to Prepare Financial Statements

- How to Prepare an Income Statement

- How to Prepare a Statement of Owners Equity

- How to Make a Balance Sheet

Closing Entries

Post-closing trial balance, reversing entries.

Accounting is known as the language of business. Through a series of steps known as accounting cycle , it gathers information about business transactions, and collates and summarizes them to generate reports for a business entity.

This course offers free online tutorials on accounting basics. It aims to build and solidify one's knowledge of the foundations which are vital in building a career in accounting & finance or in managing a small business.

The lessons here will serve as a primer for beginners and a refresher for those who already have some accounting background.

More topics

- • Financial Accounting

- • Management Accounting

- • Accounting Dictionary

- • Accounting Certifications

- • Big 4 Accounting Firms

- Skip to main content

- Skip to primary sidebar

Business Jargons

A Business Encyclopedia

Presentation

Definition : A presentation is a form of communication in which the speaker conveys information to the audience. In an organization presentations are used in various scenarios like talking to a group, addressing a meeting, demonstrating or introducing a new product, or briefing a team. It involves presenting a particular subject or issue or new ideas/thoughts to a group of people.

It is considered as the most effective form of communication because of two main reasons:

- Use of non-verbal cues.

- Facilitates instant feedback.

Business Presentations are a tool to influence people toward an intended thought or action.

Parts of Presentation

- Introduction : It is meant to make the listeners ready to receive the message and draw their interest. For that, the speaker can narrate some story or a humorous piece of joke, an interesting fact, a question, stating a problem, and so forth. They can also use some surprising statistics.

- Body : It is the essence of the presentation. It requires the sequencing of facts in a logical order. This is the part where the speaker explains the topic and relevant information. It has to be critically arranged, as the audience must be able to grasp what the speaker presents.

- Conclusion : It needs to be short and precise. It should sum up or outline the key points that you have presented. It could also contain what the audience should have gained out of the presentation.

Purpose of Presentation

- To inform : Organizations can use presentations to inform the audience about new schemes, products or proposals. The aim is to inform the new entrant about the policies and procedures of the organization.

- To persuade : Presentations are also given to persuade the audience to take the intended action.

- To build goodwill : They can also help in building a good reputation

Factors Affecting Presentation

Audience Analysis

Communication environment, personal appearance, use of visuals, opening and closing presentation, organization of presentation, language and words, voice quality, body language, answering questions, a word from business jargons.

Presentation is a mode of conveying information to a selected group of people live. An ideal presentation is one that identifies and matches the needs, interests and understanding level of the audience. It also represents the facts, and figures in the form of tables, charts, and graphs and uses multiple colours.

Related terms:

- Verbal Communication

- Visual Communication

- Non-Verbal Communication

- Communication

- 7 C’s of Communication

Reader Interactions

Abbas khan says

October 2, 2022 at 11:33 pm

Thank you so much for providing us with brief info related to the presentation.

Farhan says

February 23, 2023 at 9:45 am

yusra shah says

July 3, 2023 at 2:04 am

it was helpful👍

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Accounting Explained With Brief History and Modern Job Requirements

- Search Search Please fill out this field.

What Is Accounting?

What is the purpose of accounting, history of accounting, what types of careers are in the accounting field.

- Requirements

What Are Major Accounting Software Platforms?

Why accounting is important.

- Accounting FAQs

:max_bytes(150000):strip_icc():format(webp)/jason_mugshot__jason_fernando-5bfc261946e0fb00260a1cea.jpg)

Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics. Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit.

Accounting is the process of recording financial transactions pertaining to a business. The accounting process includes summarizing, analyzing, and reporting these transactions to oversight agencies, regulators, and tax collection entities. The financial statements used in accounting are a concise summary of financial transactions over an accounting period, summarizing a company's operations, financial position, and cash flows .

Key Takeaways

- Regardless of the size of a business, accounting is a necessary function for decision making, cost planning, and measurement of economic performance.

- A bookkeeper can handle basic accounting needs, but a Certified Public Accountant (CPA) should be utilized for larger or more advanced accounting tasks.

- Two important types of accounting for businesses are managerial accounting and cost accounting. Managerial accounting helps management teams make business decisions, while cost accounting helps business owners decide how much a product should cost.

- Professional accountants follow a set of standards known as the Generally Accepted Accounting Principles (GAAP) when preparing financial statements.

- Accounting is an important function of strategic planning, external compliance, fundraising, and operations management.

Investopedia / Jiaqi Zhou

Accounting is one of the key functions of almost any business. A bookkeeper or an accountant may handle it at a small firm. At larger companies, there might be sizable finance departments guided by a unified accounting manual with dozens of employees. The reports generated by various streams of accounting, such as cost accounting and managerial accounting, are invaluable in helping management make informed business decisions.

The financial statements that summarize a large company's operations, financial position, and cash flows over a particular period are concise and consolidated reports based on thousands of individual financial transactions. As a result, all professional accounting designations are the culmination of years of study and rigorous examinations combined with a minimum number of years of practical accounting experience.

The history of accounting has been around almost as long as money itself. Accounting history dates back to ancient civilizations in Mesopotamia, Egypt, and Babylon. For example, during the Roman Empire, the government had detailed records of its finances. However, modern accounting as a profession has only been around since the early 19th century.

Luca Pacioli is considered "The Father of Accounting and Bookkeeping" due to his contributions to the development of accounting as a profession. An Italian mathematician and friend of Leonardo da Vinci, Pacioli published a book on the double-entry system of bookkeeping in 1494.

By 1880, the modern profession of accounting was fully formed and recognized by the Institute of Chartered Accountants in England and Wales . This institute created many of the systems by which accountants practice today. The formation of the institute occurred in large part due to the Industrial Revolution. Merchants not only needed to track their records but sought to avoid bankruptcy as well.

The Alliance for Responsible Professional Licensing (ARPL) was formed in August 2019 in response to a series of state deregulatory proposals making the requirements to become a CPA more lenient. The ARPL is a coalition of various advanced professional groups including engineers, accountants, and architects.

What Are the Different Types of Accounting?

Accountants may be tasked with recording specific transactions or working with specific sets of information. For this reason, there are several broad groups that most accountants can be grouped into.

Financial Accounting

Financial accounting refers to the processes used to generate interim and annual financial statements. The results of all financial transactions that occur during an accounting period are summarized in the balance sheet, income statement, and cash flow statement. The financial statements of most companies are audited annually by an external CPA firm.

For some, such as publicly-traded companies, audits are a legal requirement. However, lenders also typically require the results of an external audit annually as part of their debt covenants. Therefore, most companies will have annual audits for one reason or another.

Managerial Accounting

Managerial accounting uses much of the same data as financial accounting, but it organizes and utilizes information in different ways . Namely, in managerial accounting, an accountant generates monthly or quarterly reports that a business's management team can use to make decisions about how the business operates. Managerial accounting also encompasses many other facets of accounting, including budgeting, forecasting, and various financial analysis tools. Essentially, any information that may be useful to management falls underneath this umbrella.

Cost Accounting

Just as managerial accounting helps businesses make decisions about management, cost accounting helps businesses make decisions about costing. Essentially, cost accounting considers all of the costs related to producing a product. Analysts, managers, business owners, and accountants use this information to determine what their products should cost . In cost accounting, money is cast as an economic factor in production, whereas in financial accounting, money is considered to be a measure of a company's economic performance.

Tax Accounting

While financial accountants often use one set of rules to report the financial position of a company, tax accountants often use a different set of rules. These rules are set at the federal, state, or local level based on what return is being filed. Tax accounts balance compliance with reporting rules while also attempting to minimize a company's tax liability through thoughtful strategic decision-making. A tax accountant often oversees the entire tax process of a company: the strategic creation of the organization chart , the operations, the compliance, the reporting, and the remittance of tax liability.

While basic accounting functions can be handled by a bookkeeper, advanced accounting is typically handled by qualified accountants who possess designations such as Certified Public Accountant (CPA) or Certified Management Accountant (CMA) in the United States.

In Canada, the three legacy designations—the Chartered Accountant (CA), Certified General Accountant (CGA), and Certified Management Accountant (CMA)—have been unified under the Chartered Professional Accountant (CPA) designation.

A major component of the accounting professional is the "Big Four". These four largest accounting firms conduct audit, consulting, tax advisory, and other services. These firms, along with many other smaller firms, comprise the public accounting realm that generally advises financial and tax accounting.

Careers in accounting may vastly difference by industry, department, and niche. Some relevant job titles may include:

- Auditor (internal or external): ensures compliance with reporting requirements and safeguarding of company assets.

- Forensic Accountant : monitors internal or external activity to investigate the transactions of an individual or business.

- Tax Accountant: strategically plans the optimal business composition to minimize tax liabilities as well as ensures compliance with tax reporting.

- Managerial Accountant: analyzes financial transactions to make thoughtful, strategic recommendations often related to the manufacturing of goods.

- Information and Technology Analyst/Accountant: maintains the system and software in which accounting records are processed and stored.

- Controller : oversees the accounting functions of financial reporting, accounts payable, accounts receivable, and procurement.

As of May 2023, the average Certified Public Accountant in the United States made $113,095 per year.

What Are Accounting Standards?

In most cases, accountants use generally accepted accounting principles (GAAP) when preparing financial statements in the U.S. GAAP is a set of standards and principles designed to improve the comparability and consistency of financial reporting across industries. Its standards are based on double-entry accounting, a method in which every accounting transaction is entered as both a debit and credit in two separate general ledger accounts that will roll up into the balance sheet and income statement.

In most other countries , a set of standards governed by the International Accounting Standards Board named the International Financial Reporting Standards (IFRS) is used.

Tax accountants overseeing returns in the United States rely on guidance from the Internal Revenue Service. Federal tax returns must comply with tax guidance outlined by the Internal Revenue Code (IRC). Tax accounts may also lean in on state or county taxes as outlined by the jurisdiction in which the business conducts business. Foreign companies must comply with tax guidance in the countries in which it must file a return.

Accountants often leverage software to aid in their work. Some accounting software is considered better for small businesses such as QuickBooks, Quicken, FreshBooks, Xero, SlickPie, or Sage 50. Larger companies often have much more complex solutions to integrate with their specific reporting needs. This includes add-on modules or in-home software solutions. Large accounting solutions include Oracle, NetSuite, or Sage products.

What Is the Accounting Cycle?

Financial accountants typically operate in a cyclical environment with the same steps happening in order and repeating every reporting period. These steps are often referred to as the accounting cycle, the process of taking raw transaction information, entering it into an accounting system, and running relevant and accurate financial reports. The steps of the accounting cycle are:

- Collect transaction information such as invoices , bank statements , receipts, payment requests, uncashed checks, credit card statements, or other mediums that may contain business transactions.

- Post journal entries to the general ledger for the items in Step 1, reconciling to external documents whenever possible.

- Prepare an unadjusted trial balance to ensure all debits and credits balance and material general ledger accounts look correct.

- Post adjusting journal entries at the end of the period to reflect any changes to be made to the trial balance run in Step 3.

- Prepare the adjusted trial balance to ensure these financial balances are materially correct and reasonable.

- Prepare the financial statements to summarize all transactions for a given reporting period.

Cash Method vs. Accrual Method of Accounting

Financial accounts have two different sets of rules they can choose to follow. The first, the accrual basis method of accounting, has been discussed above. These rules are outlined by GAAP and IFRS, are required by public companies, and are mainly used by larger companies.

The second set of rules follow the cash basis method of accounting. Instead of recording a transaction when it occurs, the cash method stipulates a transaction should be recorded only when cash has exchanged. Because of the simplified manner of accounting, the cash method is often used by small businesses or entities that are not required to use the accrual method of accounting.

Imagine a company buys $1,000 of inventory on credit. Payment is due for the inventory in 30 days.

- Under the accrual method of accounting, a journal entry is recorded when the order is placed. The entry records a debit to inventory (asset) for $1,000 and a credit to accounts payable (liability) for $1,000. When 30 days has passed and the inventory is actually paid for, the company posts a second journal entry: a debit to accounts payable (liability) for $1,000 and a credit to cash (asset) for $1,000.

- Under the cash method of accounting, a journal entry is only recorded when cash has been exchanged for inventory. There is no entry when the order is placed; instead, the company enters only one journal entry at the time the inventory is paid for. The entry is a debit to inventory (asset) for $1,000 and a credit to cash (asset) for $1,000.

The difference between these two accounting methods is the treatment of accruals. Naturally, under the accrual method of accounting, accruals are required. Under the cash method, accruals are not required and not recorded.

The Securities and Exchange Commission has an entire financial reporting manual outlining reporting requirements of public companies.

Accounting is a back-office function where employees may not directly interface with customers, product developers, or manufacturing. However, accounting plays a key role in the strategic planning, growth, and compliance requirements of a company.

- Accounting is necessary for company growth. Without insight into how a business is performing, it is impossible for a company to make smart financial decisions through forecasting . Without accounting, a company wouldn't be able to tell which products are its best sellers, how much profit is made in each department, and what overhead costs are holding back profits.

- Accounting is necessary for funding. External investors want confidence that they know what they are investing in. Prior to private funding, investors will usually require financial statements (often audited) to gauge the overall health of a company. The same rules pertain to debt financing. Banks and other lending institutions will often require financial statements in compliance with accounting rules as part of the underwriting and review process for issuing a loan.

- Accounting is necessary for owner exit. Small companies that may be looking to be acquired often need to present financial statements as part of acquisition or merger efforts. Instead of simply closing a business, a business owner may attempt to "cash-out" of their position and receive compensation for building a company. The basis for valuing a company is to use its accounting records.

- Accounting is necessary to make payments. A company naturally incurs debt, and part of the responsibility of managing that debt is to make payments on time to the appropriate parties. Without positively fostering these business relationships, a company may find itself with a key supplier or vendor. Through accounting, a company can always know who it has debts to and when those debts are coming due.

- Accounting is necessary to collect payments. A company may agree to extend credit to its customers. Instead of collecting cash at the time of an agreement, it may give a customer trade credit terms such as net 30. Without accounting, a company may have a hard time keeping track of who owes it money and when that money is to be received.

- Accounting may be required. Public companies are required to issue periodic financial statements in compliance with GAAP or IFRS. Without these financial statements, a company may be de-listed from an exchange. Without proper tax accounting compliance, a company may receive fines or penalties.

Example of Accounting

To illustrate double-entry accounting, imagine a business sends an invoice to one of its clients. An accountant using the double-entry method records a debit to accounts receivables, which flows through to the balance sheet, and a credit to sales revenue, which flows through to the income statement.

When the client pays the invoice, the accountant credits accounts receivables and debits cash. Double-entry accounting is also called balancing the books, as all of the accounting entries are balanced against each other. If the entries aren't balanced, the accountant knows there must be a mistake somewhere in the general ledger.

What Are the Responsibilities of an Accountant?

Accountants help businesses maintain accurate and timely records of their finances. Accountants are responsible for maintaining records of a company’s daily transactions and compiling those transactions into financial statements such as the balance sheet, income statement, and statement of cash flows. Accountants also provide other services, such as performing periodic audits or preparing ad-hoc management reports.

What Skills Are Required for Accounting?

Accountants hail from a wide variety of backgrounds. Generally speaking, however, attention to detail is a key component in accountancy, since accountants must be able to diagnose and correct subtle errors or discrepancies in a company’s accounts. The ability to think logically is also essential, to help with problem-solving. Mathematical skills are helpful but are less important than in previous generations due to the wide availability of computers and calculators.

Why Is Accounting Important for Investors?

The work performed by accountants is at the heart of modern financial markets. Without accounting, investors would be unable to rely on timely or accurate financial information, and companies’ executives would lack the transparency needed to manage risks or plan projects. Regulators also rely on accountants for critical functions such as providing auditors’ opinions on companies’ annual 10-K filings . In short, although accounting is sometimes overlooked, it is absolutely critical for the smooth functioning of modern finance.

American Institute of Certified Public Accountants. " CPA Licensure ."

Gary J. Previts, Peter Walton, and Peter Wolnizer. "Global History of Accounting, Financial Reporting and Public Policy: Eurasia, Middle East and Africa," Pages 1-29. Emerald Group Publishing, 2012.

Jane Gleeson-White. "Double Entry: How the Merchants of Venice Created Modern Finance," Pages 28, 47 and 91. W. W. Norton & Company, 2012.

The Institute of Chartered Accountants in England and Wales. " Timeline: 1853-1880 ."

Alliance for Responsible Professional Licensing. " AICPA, NASBA Help Launch New Coalition to Protect Professional Licensing ."

U.S. Securities and Exchange Commission. " All About Auditors: What Investors Need to Know ."

American Institute of Certified Public Accountants. " Frequently Asked Questions FAQs - Become a CPA ."

Institute of Management Accountants. " CMA Certification ."

Chartered Professional Accountants Canada. " The CPA Profession ."

Glassdoor. " CPA Salaries ."

Financial Accounting Foundation. " About GAAP ."

International Financial Reporting Standards Foundation. " Who Uses IFRS Standards? "

Internal Revenue Service. " Tax Code, Regulations, and Official Guidance ."

U.S. Securities and Exchange Commission. " Financial Reporting Manual ."

- Accounting Explained With Brief History and Modern Job Requirements 1 of 51

- What Is the Accounting Equation, and How Do You Calculate It? 2 of 51

- What Is an Asset? Definition, Types, and Examples 3 of 51

- Liability: Definition, Types, Example, and Assets vs. Liabilities 4 of 51

- Equity Definition: What it is, How It Works and How to Calculate It 5 of 51

- Revenue Definition, Formula, Calculation, and Examples 6 of 51

- Expense: Definition, Types, and How Expenses Are Recorded 7 of 51

- Current Assets vs. Noncurrent Assets: What's the Difference? 8 of 51

- What Is Accounting Theory in Financial Reporting? 9 of 51

- Accounting Principles Explained: How They Work, GAAP, IFRS 10 of 51

- Accounting Standard Definition: How It Works 11 of 51

- Accounting Convention: Definition, Methods, and Applications 12 of 51

- What Are Accounting Policies and How Are They Used? With Examples 13 of 51

- How Are Principles-Based and Rules-Based Accounting Different? 14 of 51

- What Are Accounting Methods? Definition, Types, and Example 15 of 51

- What Is Accrual Accounting, and How Does It Work? 16 of 51

- Cash Accounting Definition, Example & Limitations 17 of 51

- Accrual Accounting vs. Cash Basis Accounting: What's the Difference? 18 of 51

- Financial Accounting Standards Board (FASB): Definition and How It Works 19 of 51

- Generally Accepted Accounting Principles (GAAP): Definition, Standards and Rules 20 of 51

- What Are International Financial Reporting Standards (IFRS)? 21 of 51

- IFRS vs. GAAP: What's the Difference? 22 of 51

- How Does US Accounting Differ From International Accounting? 23 of 51

- Cash Flow Statement: What It Is and Examples 24 of 51

- Breaking Down The Balance Sheet 25 of 51

- Income Statement: How to Read and Use It 26 of 51

- What Does an Accountant Do? 27 of 51

- Financial Accounting Meaning, Principles, and Why It Matters 28 of 51

- How Does Financial Accounting Help Decision-Making? 29 of 51

- Corporate Finance Definition and Activities 30 of 51

- How Financial Accounting Differs From Managerial Accounting 31 of 51

- Cost Accounting: Definition and Types With Examples 32 of 51

- Certified Public Accountant: What the CPA Credential Means 33 of 51

- What Is a Chartered Accountant (CA) and What Do They Do? 34 of 51

- Accountant vs. Financial Planner: What's the Difference? 35 of 51

- Auditor: What It Is, 4 Types, and Qualifications 36 of 51

- Audit: What It Means in Finance and Accounting, and 3 Main Types 37 of 51

- Tax Accounting: Definition, Types, vs. Financial Accounting 38 of 51

- Forensic Accounting: What It Is, How It's Used 39 of 51

- Chart of Accounts (COA) Definition, How It Works, and Example 40 of 51

- What Is a Journal in Accounting, Investing, and Trading? 41 of 51

- Double Entry: What It Means in Accounting and How It's Used 42 of 51

- Debit: Definition and Relationship to Credit 43 of 51

- Credit: What It Is and How It Works 44 of 51

- Closing Entry 45 of 51

- What Is an Invoice? It's Parts and Why They Are Important 46 of 51

- 6 Components of an Accounting Information System (AIS) 47 of 51

- Inventory Accounting: Definition, How It Works, Advantages 48 of 51

- Last In, First Out (LIFO): The Inventory Cost Method Explained 49 of 51

- The FIFO Method: First In, First Out 50 of 51

- Average Cost Method: Definition and Formula with Example 51 of 51

:max_bytes(150000):strip_icc():format(webp)/General-ledger-b821d06e18904b86b246c191d0adc447.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Ad Creative Eye-catching designs that perform

- Social Media Creative Engaging assets for all platforms

- Email Design Templates & designs to grab attention

- Web Design Growth-driving designs for web

- Presentation Design Custom slide decks that stand out

- Packaging & Merch Design Head-turning apparel & merch

- eBook & Digital Report Design Your digital content supercharged

- Print Design Beautiful designs for all things printed

- Illustration Design Visual storytelling for your brand

- Brand Identity Design Expertise & custom design services

- Concept Creation Ideas that will captivate your audience

- Video Production Effortless video production at scale

- AR/3D Design New creative dimensions that perform

- AI-Enhanced Creative Human expertise at AI scale

10 AI Design Examples That Saved Our Clients Over $300,000

definition of accounting

Aug 22, 2014

600 likes | 1.8k Views

definition of accounting. Financial accounting. 1- Accounting in Action 2- The Recording Process 3- Adjusting the Accounting 4- Competing the Accounting Cycle. Nabil Abd Elraouf. www.drnabil4362.wordpress.com.

Share Presentation

- wordpress com

- accounting journal entries illustratedillustrate

- unadjusted trial balance

- essential characteristics

- nabil abd elraouf

Presentation Transcript

Financial accounting • 1- Accounting in Action • 2- The Recording Process • 3- Adjusting the Accounting • 4- Competing the Accounting Cycle

Nabil Abd Elraouf • www.drnabil4362.wordpress.com

Is the art of communicating financial information about a business entity to users such as shareholders and managers. • The communication is generally in the form of financial statements that show in money terms the economic resources under the control of management. • It is the branch of mathematical science that is useful in discovering the causes of success and failure in business. • The principles of accountancy are applied to business entities in three divisions of practical art, named • accounting, bookkeeping, and auditing. Accountancy

Accounting • Is defined by the AICPA as : "The art of recording, classifying, and summarizing in terms of money, transactions and events which are, in part at least, of financial character, and interpreting the results thereof."

Nature of Financial Accounting Accounting may best be defined by describing the three essential characteristics of accounting: • (1) Identification, measurement, and communication of financial information about • (2) economic entities to • (3) Interested persons.

Understand the Accounting Framework • What Does Accounting Cycle Mean?The name given to the collective process of recording and processing the accounting events of a company. The series of steps begin when a transaction occurs and end with its inclusion in the financial statements. The nine steps of the accounting cycle are:

Collecting and analyzing data from transactions and events. • Putting transactions into the general journal. • Posting entries to the general ledger. • Preparing an unadjusted trial balance. • Adjusting entries appropriately. • Preparing an adjusted trial balance. • Organizing the accounts into the financial statements. • Closing the books. • Preparing a post-closing trial balance to check the accounts.

Accounting Journal Entries Illustratedillustrate the process, let's review how (AYX) started his business on January 1, 2007, and record those transactions in the general journal. • Jan. 1 (AYX) invested $50,000 into his new business, (AYX) Sunglasses Shop , putting in cash. • Jan. 1 Purchased inventory for $4,500. Paid $3,000 cash, with the balance of $1,500 due in 90 days. • Jan. 1 Purchased land for $20,000 with $2,000 as a down payment, and a 15 year mortgage for $18,000. • Jan. 1 to paid as insurance for the year for $2,400.

Sample General Ledger Journal EntryAs a quick recap, the following transactions occurred on January 1, 2007 to start (AYX) Sunglasses Shop: • Jan. 1 (AYX) invested $50,000 into his new business, (AYX) Sunglasses Shop. • Jan. 1 purchased inventory for $4,500. Paid $3,000 cash, with the balance of $1,500 due in 90 days. • Jan. 1 purchased land for $20,000 with $2,000 as a down payment, and a 15 year mortgage for $18,000. • Jan. 1 Purchased insurance for the year for $2,400.

- More by User

DEFINITION OF LEADERSHIP

DEFINITION OF LEADERSHIP. Prof. Jintae Kim, PhD Alliance Theological Seminary (845) 353-2020 ext.6978 E-mail: [email protected] Website: http://all4jesus.net. DEFINITION OF LEADERSHIP .

958 views • 15 slides

DEFINITION OF HOMOPHONES

DEFINITION OF HOMOPHONES. Homophones are words which have the same pronunciation but have different spellings and different meanings . ILLUSTRATIONS OF HOMOPHONES. BLEW : To be in a state of motion. Used of the air or of wind. To expel a current of air, as from the mouth or from a bellows. .

623 views • 9 slides

DEFINITION OF AGRITOURISM

DEFINITION OF AGRITOURISM. Bohuslava Boučková. Structure. Types of definitions: alternative/sustainable tourism rural tourism agritourism Basic frame of agritourism Proposal for the AgriTourNet. Types of definitions. Basic difference: agritourism and rural tourism Mixed definitions

2.63k views • 22 slides

Definition of Productivity

Definition of Productivity. Productivity: Definition. Productivity is the relationship between the outputs generated from a system and the inputs that are used to create those outputs. Mathematically O P = I. Systems Concept. inputs. outputs. Customers.

591 views • 24 slides

Definition of antibiotics

Definition of antibiotics. Antibiotics are compounds of natural, semi-synthetic, or synthetic origin which inhibit growth of microorganisms without significant toxicity to the human or animal host. . The key concept of antibiotic therapy is selectivity .

1.16k views • 42 slides

Definition of Economics

Definition of Economics. All economic questions arise because we want more than we can get. Our inability to satisfy all our wants is called scarcity . Because we face scarcity, we must make choices . The choices we make depend on the incentives we face.

915 views • 28 slides

Definition of Limit

Definition of Limit. Lesson 2-2. Verbal Definition of Limit. L is the limit of f ( x ) as x approaches c if and only if L is the one number you can keep f ( x ) arbitrarily close to just by keeping x close to c , but not equal to c . Example: A rational algebraic function .

425 views • 14 slides

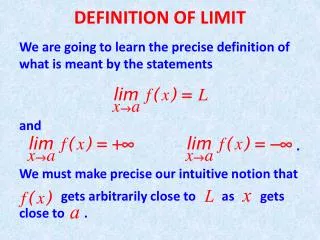

DEFINITION OF LIMIT

DEFINITION OF LIMIT. We are going to learn the precise definition of what is meant by the statements and . We must make precise our intuitive notion that

766 views • 18 slides

Definition of Expert

Definition of Expert. One who knows a lot about a subject OR One who has a powerpoint. If you treat an individual as he is he will stay as he is, but if you treat him as he ought to be, and could be, he will become what he ought to be and could be. ~ Goethe. What Do We Know?.

636 views • 54 slides

Definition of Forgetting:

Definition of Forgetting:. Cessation of memory. . Cessation of affection. . Neglect of something that should be kept in mind. Now I am going to ask YOU a question:. Did you forget me?. If you did, I am going to remind you who I was. I am Lolek And this is my story. I was born on

545 views • 46 slides

Definition of MDO

Definition of MDO. People with a Mental Disorder who Come to the Attention of the CJS or Whose behaviour poses a risk of such contact. MDO Policy, MEL 5 (1999) Health, Social Work and Related Services for Mentally Disordered Offenders in Scotland. To co-ordinate care and support

249 views • 8 slides

DEFINITION AND SCOPE ACCOUNTING STANDARDS.

DEFINITION AND SCOPE ACCOUNTING STANDARDS. ACCOUNTING IS AN ART OF RECORDING CLASSIFYING AND SUMMARIZING TRANSACTIONS IN A SYSTEMATIC MANNER AND IN TERMS OF MONEY TRANSACTIONS AND EVENTS WHICH ARE IN PART AT LEAST OF FINANCIAL CHARACTER AND INTERPRETING THE RESULTS THEREOF. Accounting.

3.85k views • 129 slides

Definition of

Definition of. a creation or expression of something beautiful. free art. applied art. painting, sculpture, dance, theatre, music…. industrial /graphic /costume design…. Art also can be used in buildings . That is architecture. Unit 3. Art and architecture.

399 views • 16 slides

Definition of Control

Definition of Control . Essential to a company or organization Involves regulation for behaviors and activities. Most Important Control Issue. Operational Control Assessment and regulation of the specific activities and methods an organization uses to produce good or services. March

199 views • 3 slides

Definition Of Jade

Jade refers to the combination of two different minerals, Jadeite and Nephrite. Most jade of gem value is Jadeite Myanmar Jade. The most valuable is the Imperial Jade, Emerald transparent green jadeite from Myanmar.

108 views • 5 slides

Definition of culture:

Module 7: Cultural Competency What is culture? How does it influence a medical encounter? What is the role of the Culture Broker? How to identify and navigate Cultural Bumps?. Definition of culture:. Culture is a shared set of belief systems values p ractices assumptions

239 views • 23 slides

Definition of Prevention

Definition of Prevention. Source: United Nations (U.N.) Population Division, Demographic Indicators, 1950-2050 (The 1996 Revision) (U.N., New York, 1996). Historical Examples of Global Prevention Activities.

295 views • 29 slides

201 views • 15 slides

DEFINITION OF ACCOUNTING

DEFINITION OF ACCOUNTING. Accounting is the process of identifying, measuring and communicating economic information about an entity to permit informed judgments and decisions by users of the information (Anthony et al, 1995). What economic information?. Examples

182 views • 16 slides

Definition of Forgetting:. 1. Cessation of memory to be had. 2. M. Cessation of affection to be had. 3. M. Neglect of something that should be kept in mind. Now I am going to ask you a question:. Did you forget me?. If you did, I’m going to remind you who I was.

532 views • 46 slides

@/Arpro Solutions “Definition of Accounting”

Step-by-step, we donu2019t expect you to be an accounting expert with @/Arpro!

126 views • 11 slides

COMMENTS

Approval by the Board of Presentation of Items of Other Comprehensive Income issued in June 2011. Presentation of Items of Other Comprehensive Income (Amendments to IAS 1) was approved for issue by fourteen of the fifteen members of the International Accounting Standards Board. Mr Pacter dissented from the issue of the amendments.

FSP 6.2 was updated to include a summary of recently-issued FASB guidance that affects the statement of cash flows.; FSP 6.5.2 was updated to clarify guidance on the definition of cash equivalents.; FSP 6.5.3 was updated to clarify guidance on the presentation and disclosure of amounts generally described as restricted cash or restricted cash equivalents.

Overview. IAS 1 Presentation of Financial Statements sets out the overall requirements for financial statements, including how they should be structured, the minimum requirements for their content and overriding concepts such as going concern, the accrual basis of accounting and the current/non-current distinction. The standard requires a complete set of financial statements to comprise a ...

The presentation and disclosure requirements discussed in this guide presume that the related accounting topics are considered to be material and applicable to the reporting entity. That assumption applies throughout the guide and will not be restated in every instance.

Presentation and Disclosure . The final financial statement assertion is presentation and disclosure. This is the assertion that all appropriate information and disclosures are included in a ...

Under IAS 1, fair presentation also requires an entity: to select and apply accounting policies in accordance with IAS 8 Accounting policies, changes in accounting estimates and errors. IAS 8 sets out guidance for management on how to account for a transaction if no accounting standard is applicable. to provide additional disclosures where ...

An accounting standards' requirement that an entity's financial statements should be presented in a fair way to all relevant users of these statements. In other words, it is premised on the requirement that these statements should not be misleading. Under the principle of fair presentation, financial statements must fairly present the financial position, financial performance

The accounting standard that covers the presentation of financial statements, IAS 1, might be described as the 'friend investors never knew they had'. IAS 1 features principles that are intended to help companies present financial information in a way that gives investors an understanding of their financial performance and financial position.

Quick Reference. The requirement that financial statements should not be misleading. 'Fair presentation' is the US and International Accounting Standards equivalent of the British requirement that financial statements give a true and fair view. From: fair presentation in A Dictionary of Finance and Banking ». Subjects: Social sciences ...

2. Include a picture related to the topic. Include a picture. For example, if I am presenting to auditors, I might display a picture of someone being bribed. Verbal information is remembered about ten percent of the time. If a picture is included, the figure goes up to sixty-five percent. Quite a difference. 3.

Practice, practice, practice. Practice your presentation until you know it inside and out. Rehearse in front of a mirror. Run through it with a colleague or friend. Ask for honest feedback about both your content and delivery, and make any necessary adjustments. Then practice some more.

Accounting principles are the rules and guidelines that companies must follow when reporting financial data. The common set of U.S. accounting principles is the generally accepted accounting ...

Financial accounting is the process of recording, summarizing and reporting the myriad of transactions resulting from business operations over a period of time. These transactions are summarized ...

Interested in accounting, but you keep seeing terms unfamiliar to you? This A-to-Z glossary defines key accounting terms you need to know. Accountants possess a wide range of skills critical for financial management and reporting. They maintain financial records, analyze data, offer financial insights, ensure compliance, prepare reports, support audits, provide financial advice, and utilize ...

Avoid too many details about your specific role—your work should be just one example. Illustrate your points with current events or stories. It's easier for students to connect with things that are relatable to what's happening in the world or relevant to them. Help students find meaning in accounting. Many see the purpose of their future ...

Reversing Entries. Preparing reversing entries is an optional step in the accounting cycle. Reversing entries are made at the beginning of the new accounting period to enable a smoother accounting process. Accounting is known as the language of business. Through a series of steps known as accounting cycle, it gathers information about business ...

Definition of Accounting. The Accounting definition is given by the American Institute of Certified Public Accountants ('AICPA') clearly brings out the meaning of accounting. According to it, accounting is "the art of recording, classifying and summarizing in a significant manner and in terms of money, transactions and events which are, in part at least, of a financial character and ...

Definition: A presentation is a form of communication in which the speaker conveys information to the audience. In an organization presentations are used in various scenarios like talking to a group, addressing a meeting, demonstrating or introducing a new product, or briefing a team. It involves presenting a particular subject or issue or new ideas/thoughts to a group of people.

Presentation Transcript. INTRODUCTION TO ACCOUNTING. Definition of Accounting • Accounting is a system of dealing with financial information that provides information for decision-making. Accounting vs. Bookkeeping ACCOUNTING • The process of recording, analyzing, and interpreting the economic activities of a business BOOKKEEPING • A ...

Accounting is the systematic and comprehensive recording of financial transactions pertaining to a business, and it also refers to the process of summarizing, analyzing and reporting these ...

Needless to say, with millions of employees, there are millions of PowerPoint presentations. No wonder the top 10 accounting firms have invested heavily in building awesome Powerpoint templates. The Accounting Templates will also help you manage your bookkeeping with ease. At Superside, we've collected the top 10 accounting firms ...

600 likes | 1.8k Views. definition of accounting. Financial accounting. 1- Accounting in Action 2- The Recording Process 3- Adjusting the Accounting 4- Competing the Accounting Cycle. Nabil Abd Elraouf. www.drnabil4362.wordpress.com. Download Presentation. wordpress com. accounting journal entries illustratedillustrate. unadjusted trial balance.