Transfer of Property Legal Consultant

Agreement to Sell vs Sale Deed/Assignment Deed – Difference

Listen to the audio file –

Important Points

Agreement to Sell Meaning –

An Agreement to sell is a document that contains terms and conditions of the sale of a property. It includes token amount detail and the terms and conditions regarding the amount at which the flat to be sold, the time limit for both the parties to complete the sale, and the buyer’s promise to make full payment within a certain time.

Sale Deed/Assignment Deed –

In this document, the ownership/title of the property gets transferred to the buyer.

Benefits of registration of Agreement to Sell–

It obligates the buyer and seller that throughout the sale process they must follow the terms and conditions mentioned in the agreement for sale until the final sale deed gets registered. An agreement for Sale is the base document on which the deed of assignment or sale deed is drafted (Deed of assignment/sale deed is the document prepared at the time of full payment made by the buyer and when the actual transfer of the property takes place).

Stamp Duty and Registration Charges –

In Maharashtra, the Registration Charges are fixed, which are Rs. 30,000/- or 1% of the Transaction Value (whichever is lower).

Stamp Duty gets changed as per the property location, for example – usually, Stamp Duty is less in Rural Areas compared to Corporations.

To check the online Stamp Duty calculator, visit – https://procounsel.in/online-stamp-duty-calculator/

Search bar.

- Legal Queries

- Files

- Online Law Courses

- Lawyers Search

- Legal Dictionary

- The Indian Penal Code

- Juvenile Justice

- Negotiable Instruments

- Commercial Courts Act

- The 3 New Criminal Laws

- Matrimonial Laws

- Data Privacy

- Court Fees Act

- Commercial Law

- Criminal Law

- Procedural Law

- The Constitutional Expert

- Matrimonial

- Writs and PILs

- CrPC Certification Course

- Criminal Manual

- Execution U/O 21

- Transfer of Property

- Domestic Violence

- Muslim Laws

- Indian Constitution

- Arbitration

- Matrimonial-Criminal Law

- Indian Evidence Act

- Live Classes

- Writs and PIL

Share on Facebook

Share on Twitter

Share on LinkedIn

Share on Email

pashyanti (legal manager) --> 06 March 2010

difference between deed of assignment & sale deed

Dear Experts, Please tell me what is the difference between Deed of Assignment & Sale Deed?

4 Replies

Umesh Bhatt (advocate) --> 06 March 2010

assignment is ''a duty given to someone'' but the sale deed is ''transfer our right''.

Suchitra. S (Advocate) --> 06 March 2010

Deed of assignment :

Agreement under which some or all assets of an insolvent debtor are assigned to a trustee , for selling them and distributing the sale proceeds equitably among the creditors .

Sale agreement :

A sale deed acts as the main legal document for evidencing sale and transfer of ownership of property in favour of the buyer, from the seller.

Further, it also acts as the main document for further sale by the buyer as it establishes his proof of ownership of the property.

Manish Singh (Advocate) --> 06 March 2010

Emawatson --> 17 June 2023

VMware 2V0-33.22 is an exam that tests the knowledge and skills of IT professionals in deploying and managing VMware Cloud on AWS solutions. This VMware Exam focuses on validating the candidate's ability to configure, deploy, and optimize VMware Cloud on AWS infrastructure. The VMware 2V0-33.22 exam consists of multiple-choice questions that cover various topics, including VMware Cloud on AWS architecture, networking, storage, and security. Candidates are also assessed on their understanding of the deployment process, troubleshooting techniques, and best practices for managing and monitoring the VMware Cloud on AWS environment.

By successfully passing the 2V0-33.22 exam, candidates demonstrate their proficiency in implementing and maintaining VMware Cloud on AWS solutions. This certification can enhance their career prospects by validating their expertise in hybrid cloud deployments and increasing their credibility as VMware professionals. Preparing for the VMware 2V0-33.22 Exam Questions involves studying the official exam guide, reviewing relevant documentation and resources provided by VMware, and gaining hands-on experience with VMware Cloud on AWS.

Additionally, practice exams and sample questions can help candidates familiarize themselves with the exam format and assess their readiness. It's important to note that the specific details of the VMware 2V0-33.22 exam may change over time, so candidates should refer to the official VMware certification website for the most up-to-date information and resources.

Leave a reply

Your are not logged in . Please login to post replies Click here to Login / Register

Recent Topics

- Arbitrary fines being leived by educational instit

- Jurisdiction

- Maintenance cannot be suspended in the trial court

- Is there any provision to reject / dismiss interim

- Family partitions

- I want to start a manufacturing unit of either aga

- Civil defamation suit

- Certified copy of registered gpa

- Issuance of new housing society share certificate

Related Threads

Popular Discussion

- Carry forward of physically handicapped

- True copies collected under rti act from

- Appeal from order of acquittal in magist

- parking charges for visitors over 24 hou

- Cheque bounce

- Maintenance cannot be suspended in the t

- Property partition

- Sbi credit card arbiration award passed

- Service laws

view more »

Browse by Category

- Business Law

- Constitutional Law

- Labour & Service Law

- Legal Documents

- Intellectual Property Rights

- Property Law

- Forum Portal

- Today's Topic

- Popular Threads

- Post New Topic

- Unreplied Threads

- Top Members

- Share Files

- LCI Online Learning

Member Strength 9,46,156 and growing..

Download LCI APP

Our Network Sites

- We are Hiring

- Terms of Service

- Privacy Policy

© 2024 LAWyersclubindia.com. Let us grow stronger by mutual exchange of knowledge.

Lawyersclubindia Search

Whatsapp groups, login at lawyersclubindia.

Alternatively, you can log in using:

0807 794 3514, 0703 668 1104

What is a Deed of Assignment and the Foolish Risk your taking for not having a Deed of Assignment for your Land

By omonilelawyer | july 15, 2017 | 42,595 | 39.

A deed of Assignment is one of the most important documents YOU MUST HAVE when you conclude a Land Transaction. In fact it baffles me that 6 out of 10 people I know who have bought lands in the past have no deed of assignment . They are always the first to complain that Omonile has defrauded them but they have no proof to show the property has been sold to them other than a receipt.

It’s funny that everyone has the title documents to their car showing who the seller was and how it was transferred from the Seller of that car to you the new owner but when it comes to landed properties which are 10 times more valuable than cars, we fail to ask for this one simple important document that can prove ownership of that land. What then is this all important deed of Assignment I am alluding to? This can be found from the following definitions below:

A deed of Assignment is an Agreement between the Seller of a Land or Property and a Buyer of that Land or property showing evidence that the Seller has transferred all his rights, his title, his interest and ownership of that land to that the Seller that has just bought land.

The Deed of Assignment acts a main document between the buyer and seller to show proof of ownership in favour of the seller . The person or Seller who transfers his rights or interests in that property is usually called the Assignor and the person who receives such right or interest from the Seller is called the Assignee.

A Deed of Assignment therefore is an Agreement where an assignor states his promise that from the date of the assignment or any date stipulated therein, the assignor assigns his ownership in that Land to the assignee. The deed contains very pertinent information for a real estate transaction. For one, it spells out the date when the ownership of the property transfers from one owner to the other. The deed also gives a specific description of the property that is included in the transfer of ownership.

Signing a Deed of Assignment and having that Deed is your number 1 evidence against another person that is trying to claim ownership of that same land too. If you have a land and no deed yet, i feel sorry for you! Better consult your Lawyer to go draft one for you now to save yourself future problems

In most situations, when the Deed of Assignment has been exchanged between both parties, it has to be recorded in the land registry to show legal proof that the land has exchanged hands and the public should be aware of the transaction. Such recorded Deed of Assignment come in the form of either a Governor’s consent or registered conveyance.

The Deed of Assignment spells out the key issues in the transaction between the Seller and the Buyer so that there won’t be any confusion or assumption after the property has been transferred to the new owner . Such Key issues include:

1. The Parties’ to the Agreement e.g between Mr A and Mrs K

2. The addresses of both parties and how it is binding on their successors, friends, colleagues and those representing them in any capacity.

3. The history of the land in question how it was first obtained down to the moment its about to be sold including and documents it previously had till this date

4. The agreed cost of the land and the willingness of the Seller to finally accept that price paid for the land

5. The description and size of the land to be transferred.

6. The covenants or promises both parties choose to undertake to perfect the transfer of the document

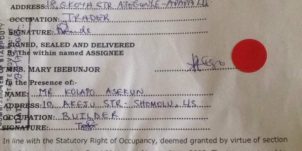

7. The signature of the parties to the Assignment and Witnesses to the Transaction

8. Finally the section for the Commissioner of Oaths or Governors Consent to sign and validate the agreement.

These are the important features of a Deed of Assignment and must be included in all Documents for it to be valid. Don’t listen to any Omonile who tells you he doesn’t or the family doesn’t sign a deed of assignment and that it is only a receipt you need. He is only looking for a way to resell your land to another person and to use receipt as a ploy to prevent you from establishing true ownership of your land.

Always consult a property lawyer before you buy a land to help prepare a deed of assignment. It will be your greatest mistake if you don’t have one. Below is a sample deed of assignment and how it looks so that you don’t fall victim of land swindlers

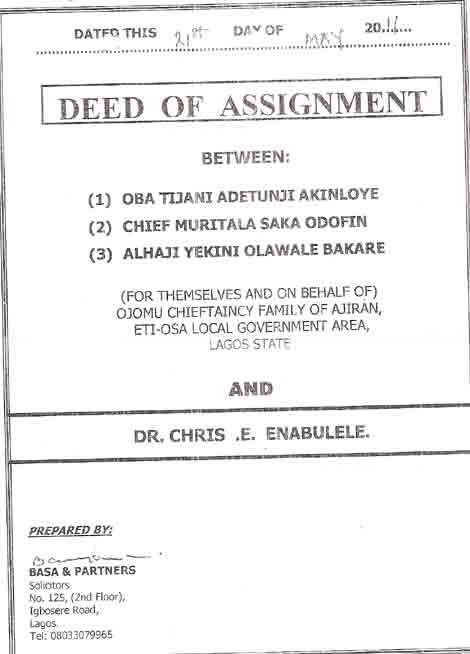

SAMPLE DEED OF ASSIGNMENT

The Cover of the Deed of Assignment must show the parties to the transaction and the description of the land sold

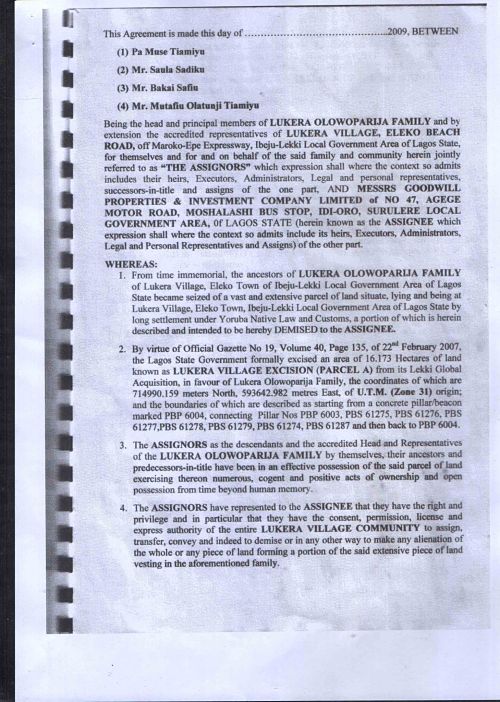

The first page of the Deed of Assignment must contain the parties to the transaction and the brief history of how the land became the Sellers property

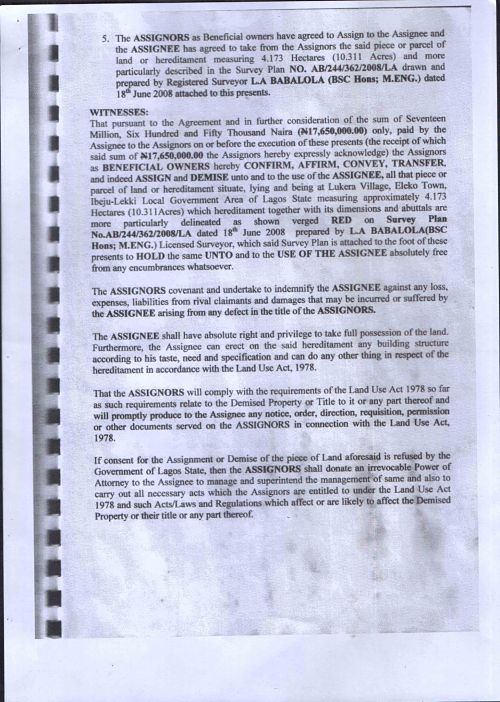

The third page must contain the description of the land to be sold, the surveyor that did it, the cost of the land, the acceptance of the cost of the land and the promises both parties will make to themselves to abide with after the deal has been sealed.

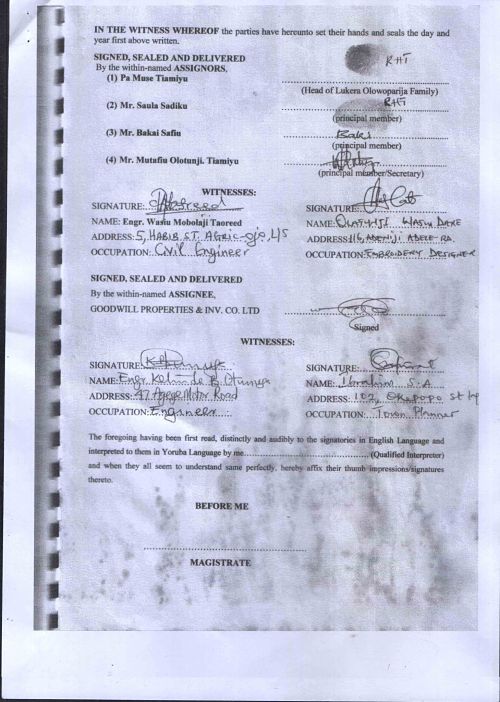

The last page must show the signatures of the parties and the witnesses to that transaction and finally below , the section for the commissioner of oaths to endorse or the Governor to assent his consent to this transaction

Always consult a property lawyer before entering a legal contract.

Omonile Lawyer in your inbox

Subscribe to Omonile Lawyer's Newsletter and stay up to date with more great news and articles like this one

WRITTEN BY: OmonileLawyer

Hey, I'm the Omonile Lawyer. Do you want expert verification on that new land? Contact me now!

Related Post

Beware-A Contract of sale is not a good title. Don’t be fooled

THE DANGERS OF BUYING AN “EXCISION IN PROCESS” LAND IN LAGOS

9 Extremely Dangerous Land Survey Plan Scams by Fraudulent Land Surveyors You Must be Aware of

Omonile Lawyer’s 25 Critical Questions To Ask To Avoid Falling For A Real Estate Scam In Lagos

How Deceitful Sellers Lure Innocent Buyers To Buy Lands With Fake Governor’s Consent

39 comments.

owolabi animashaun

how much is it to obtain governor consent of 3plots of land at okegbegun phase 2.,winner church along laspotech road ikorodu? or if there is C OF O Availiable? thanks

Barr. Matthew Ottah

I need the square meters of the survey plan so that I can fathom out N estimate of what it would cost. Cheers

I have a parcel of Land i had alredy built a 3-Bedroom Bungalow on at Magada behind MFM Prayer City. I only have a Signed Agreement from the One I bought it from. I have paid to the Omonile but yet to get a receipt from them. I have not done a survey yet. Kindly advice.

babatunde Ogunnowo

good morning. what is the difference bewteen a deed of sublease and a deed of assignment? which is preferable 2. what are the cost implications for processing any tyeo of deed. thanks. keep up the good work

Sir, I have plot at ogun state and for the deed of assignment, the land owners said I will pay 100K for them to get it done that there are four signatories to it. The issue now is that the said amount is too much. Pls I need your input on this. Thank You

Matthew Ottah

You need to negotiate with them to reduce the price

Please Mr Ottah can you send your number so I can call to ask for help?

My numbers are everywhere on the site. Cheers

sir,this deed…who is resposible to issusing it,i.e is it part of the document the omonile will give you when you have paid for the land or the buyer contracts a lawyer to draw it up after payment and takes to family(olori ebi) to sign their portions.

Your very correct sir. Both options are the right way to go about it.

how do you know a false land

I wanted to buy a land from one of this estate, I was told the estate has a Global C of O from Ogun state government and that upon payment I will be issued a Deed of Assignment. There after I can do the survey. My questions are: 1. I was told since the Estate has Global C of O, I might not necessarily need individual C of O. 2. What other documents do I need to process apart from the survey. You sincere advice will be appreciated. Thanks

sir, thank you very much sir for your advise, all what u said above is true even i presently find myself in dat situation, i bought just half plot of land from a family representative at abeokuta in which i only collected receipt from them without the deed of assigmnet and i started work on the land, im even through with the foundation about to start the main building. Sir, i will be very glad and happy if you can put me through on what are d next steps to take, though i have printed out all the deed of assignment you pasted up for me to rewrite and give them to sign.

Thanks you very much sir

Hi, I bought a land from a relative of which the land have a c of o under my Anty family name, my question is; 1. Do I have to do personal c of o on my name. 2. is’t secure under my Anty family name. I need an advice, and I will be looking forward to hear back from you because I don’t know what to do before is too late…thanks!

Good evening barrister, Pls must I first so a survey before I do a deed. We Purchased a land and we have just a receipt. Thank you

please is it legal for a non lawyer to prepare a deed of assignment? Thanks.

Please explain to me the difference between Deed of Assignment and Deed of Agreement. I am getting different interpretation and it is confusing. When I buy a family land, which one should I prepare for the family to sign?

They are the same thing sir and perform the same function.

Could you please tell me the importance of that red seal in a deed? What is its significance? How important is it? Thanks

Its of no serious importance in modern day execution of documents. As long as the parties have signed or attested to the documents with their signatures or personal thumbprint, the document is as good as been executed properly. People who use it are mostly Customary Land Families to show how important their signatures are

Giulia Devey

I have a deed of assignment which is signed but the property has an outstanding mortgage on the property. I have been paying this, however it fell into arrears and now the assignor is claiming against me for receiving adverse credit. This person did not take their name off the mortgage therefore would I be liable for her claim in court?

Yes you would because you have chosen to continue paying the outstanding mortgage. Your lawyer should have advised you on the perils of continuing the mortgage payment in your name

Pls. must a land have C of O before Governor conscent can be acquired if purchased from the owner? What happen when the land doesnot have C of O? can the buyer seek to get C of O in place of Governors conscent

Please can a commissioner for oath of Lagos State endorse the dead while the land is situated in ogun state

Can a deed of assignment be prepared for land that does not have C of O yet but which Allocation paper or R of O is ready?

name withheld

my friend bought a property an does not know how much to pay his attorney, the attorney are asking for 500k 180, and claimed they have to bribe some people to get them to follow the deed of assignment , is it a fraud of are the lawyers just trying to be a fraudulent?? thanks and have a good day

Good day Sir, I found this site and info therein helpful. Is it possible for a the seller to issue a 2 Deed of assignment to different person on the sme land.

What is the functional different between C of O and deed of assignment

Two people bought a plot of land. The seller bought it from another person. What documents must the new buyers get? Must each survey his own portion before the agreement?

omonile lawyer, pls i have power of attorney and deed of partition for a piece of land in abuja (4 of us bought and shared the land), do i still need deed of assignment?

Sir, I want you to send a soft copy of deed of assignment to my email. How much would it cost? [email protected]

Good day sir. I bought a plot of land, have a signed deed of assignment. But resently, d surveyor called me that there is need to create a road at my (land) back i.e a plot will b inbetween two roads and that i should shift my pillar and the corner piece. Now, i need ur advice on what to do sir. Thanks. N.B He is d one who sold d land, measured, pegged and put d pillar.

l can get in touch with the company l signed deed of assignment with 4 times no reply to me

Gabriel Joseph

To be honest with you this is really helpful. Thanks

how do I submit my deed of assignment for record purpose

pls sir,I bought a land with power of attorney from estate management.Am I entitle to omonile receipt and deed of assignment?

i have a land which was purchased from the estate developers but i lost all documents to it by an act of God. what can i do

please sir, can u help us with a sample of the shedule page so that i ccan coinfirm that the schedule page of the deed of assignment for my land is made in the right form

Ola Abiodun

I bought a land in my name and wife’s name. I have now built a property on this land and all the paper works including CofO and the plan have our names both. The land and the property was solely bought and built with my money. I understand we both have claim because her name is on the documents.

What do I need to do to take her name off the the property, both the land and the building? Can you also please advise the likely cost?

I look forward to hearing from you

Leave a Comment Cancel Reply

- Home (current)

- Intellectual Property Law

- Constitutional Developments

- Protests and Riots

- Recent Updates

- Criminal Law

- Finology Legal

what is Patent Assignment Deed and its Advantages

It’s an agreement between Assignor and Assignee which explains the rights and conditions related to patent assigned property which means intellectual property of Assignor who is holding monopoly power towards that property. Under Indian law, its mandatory to register Patent Assignment Deed under Section 68 of the Patents Act, 1970 which giving Assignee absolute rights from date of execution of deed.

Kind of assignment deed:

- Legal assignment – in this Assignee may enter his name as patent owner.

- Equitable assignment – in this certain share is given to another person. Equitable Assignee can’t enter his name as owner but can register as having interest in the patent.

- Mortgage – in this patent right is partially or wholly transferred to obtain money. On repayment of money, mortgagor becomes entitle to register his name as owner.

Illustration:

A is the Assignor who got grant of patent for his invented product from Government of India willing to assign that to B’s company for loyalty in terms of share of 30% from every year earnings. And further it mentions the rights and duty of Assignor and Assignee under the legal agreement. This helps parties get relief in case of breach of contractual obligations.

Who is Assignor and Assignee?

Assignor is the person who is willing to transfer the title of patent and Assignee is the person who is willing to receive the title, interest and such other rights of patent from the Assignor by giving the required consideration.

What is the advantage of Patent Assignment Deed?

- It helps parties to understand their rights and duties with respect to the said Patent.

- Since all the provisions are written and mutually agreed upon by the parties it minimizes ambiguity. More so in case of any dispute arising between the parties it shall be resolved according to the dispute redressal clauses mentioned in the Deed.

- Formation of assignment deed gives legality and enforceability to the transfer of any Intellectual Property.

- An Assignment Deed is a prima facie evidence of contractual relationship between Assignor and Assignee.

What are general rights and duties of Assignor and Assignee under this deed?

- Assignor need an absolute title against the patented goods for transferring such rights to Assignee.

- Deed need to comply with all the essentials of contract in order to execute legally. If it violates public policy or does not have a lawful consideration, then such contract is void ab initio.

- Assignor can transfer his intellectual rights fully or conditionally to Assignee for the consideration. Consideration could be of monetary value forming a large sum or shared percentage from income or stocks exchange of the concerned parties.

- Assignee will get the monopoly right as Assignor assigns the patented goods. Henceforth, the Assignee steps into the shoes of the Assignor and by the virtue of the deed acquires an absolute right to use and enjoy the patented goods.

- Assignee has the right to get indemnified against any intervention/inconvenience caused while he is exercising his rights.

- Assignee can sue for damages caused to him by Assignor’s action, it maybe mistakes or voluntary negligence/disturbance or fraudulent activity in the deed.

- Assignee is obligated to pay the consideration mentioned if he fails to do so within a stipulated period of time. Assignor can bring a legal action for the recovery of consideration but cannot terminate the title already transferred.

- Assignee shall pay renewal and such other charges after the assignment. Prior to the assignment the Assignor needs to ensure that the title is free from any encumbrances.

Can the Assignment Deed be Terminated/Amended?

- This amendment mostly happens in equitable assignment deed. The deed must be registered before the Controller of Patent and in case of infringement or mutual consciousness the parties may mutually agree to amend any provision of the deed.

- Termination of the deed is unlikely as it’s irrevocable and permanent in nature. As assignment being transfer of title in a patent which is permanent. It may be terminated in case of mortgage assignment deed.

Akshay is a Language Enthusiast & an HNLU alumnus. He believes in simplicity & takes legal literacy very close to his heart.

Liked What You Just Read? Share this Post:

Wanna share your views on this comment here:.

Related to this

9 Best Practices on Contract Vetting

Website Development Agreement

Intricacies of the Employee Contract

Freelancing

What are the various types of Buyer Broker Agreement?

Under legal.

5 Important Rights Every Tenant Should Know

Elections' Myth vs. Reality

How Does the Basic Structure Doctrine Contribute to Ensuring Free & Fair Elections?

Right Against Climate Change is now Part of Fundamental Rights

Enforcement Directorate (ED) - Power and Composition Explained

Finology legal on facebook, finology legal on twitter.

Copyright © 2024 Finology Ventures Pvt. Ltd. | All Rights Reserved

Popular Tags

Popular authors.

Popular Posts

Drafting a Deed of Assignment

Try our AI Legal Assistant - it's free while in beta 🚀

Genie's AI Legal Assistant can draft, risk-review and negotiate 1000s of legal documents

Note: Want to skip the guide and go straight to the free templates? No problem - scroll to the bottom. Also note: This is not legal advice.

Introduction

A Deed of Assignment is a vital legal document used to transfer rights, interests or assets between parties. It is regularly used in business transactions, and often regarding real estate or intellectual property. A well-crafted deed of assignment can protect both sides from potential legal disputes, ensuring that everyone involved understands their obligations and responsibilities.

The Genie AI team has seen many instances where having a valid deed of assignment can make all the difference - without it businesses could be exposed to considerable risk. That’s why we offer free templates and step-by-step guides to help those wishing to draft their own deed.

When creating a Deed of Assignment it is important to take the specific circumstances into account - any changes or additions should be accurately documented and agreed by all involved parties beforehand. Furthermore, it is essential that the terms are clearly written out in an unambiguous way so every party knows exactly what they have signed up for. Beyond protecting both sides’ interests, this type of agreement can also be used for copyright assignments, leases, debt transfers and trusts.

Before signing on the dotted line it’s also critical that executing such documentation is done properly - all parties must sign in the presence of a witness who will also affix their signature and date the document accordingly. Once this process has been completed filings must then be made with any relevant government authorities whenever necessary (especially in cases involving real estate or intellectual property transfers).

In summary, drafting a Deed of Assignment not only safeguards everyone’s best interests but also provides additional benefits depending on its use case - reading through our step-by-step guidance below should provide you with more information on how to access our template library today and start benefitting from its advantages without needing to sign up for an account with Genie AI first!

Definitions (feel free to skip)

Legal Binding: When a legally binding document is used, it means that all parties involved are legally obligated to follow the terms and conditions set forth in the document.

Assignor: The assignor is the person who is transferring rights, interests or assets to someone else.

Assignee: The assignee is the person who is receiving the rights, interests or assets from the assignor.

Witness: A witness is an independent third-party who is present when a document is signed, in order to ensure that the process is completed in a secure and legally binding manner.

Stamp: A stamp is an official seal or mark that is used to verify and authenticate a document.

Tax: A tax is a sum of money that is paid to a government or public authority.

Duty: Duty is an obligation or responsibility assigned to someone.

Defining the Deed of Assignment

What is a deed of assignment and what is its purpose, parties involved, who needs to be involved in the making of a deed of assignment, drafting the deed, determine what kind of deed of assignment needs to be drafted, consider the subject matter to be assigned in the deed, research the legal requirements for the kind of deed to be drafted, draft the deed of assignment in accordance with the legal requirements, executing the deed, check that the parties to the deed are correctly identified, confirm that the deed is correctly signed and dated by all parties, confirm that the deed is witnessed by an independent third party, have the deed of assignment properly executed by all parties, registration, determine whether the deed of assignment needs to be registered, if registration is necessary, confirm the registration procedures, take necessary steps to register the deed of assignment, considerations, consider any applicable tax or stamp duty implications of the deed of assignment, consider any restrictions or limitations on the rights being assigned, consider whether the deed of assignment needs to be registered in any public records, common mistakes, not accurately identifying all of the parties to the deed, not having the deed properly executed by all parties, not having the deed witnessed by an independent third party, not considering any applicable tax or stamp duty implications, not considering any applicable restrictions or limitations on the rights being assigned, record keeping, ensure that the original deed of assignment is securely stored, create a digital copy of the deed and store it in a secure manner, review the deed of assignment to ensure accuracy, confirm that all steps have been completed correctly, seek advice from legal professionals if necessary, get started.

- Establish the parties involved in the Deed of Assignment

- Identify the property or service being assigned

- Specify the terms of the assignment

- Ensure the Deed of Assignment is properly witnessed

- Check that all signatures are valid

When you have completed the steps above, you will have successfully defined the Deed of Assignment and can proceed to the next step.

- A deed of assignment is a legal document that is used to transfer the rights and responsibilities of one party (the assignor) to another party (the assignee)

- It is used to transfer contractual rights and obligations between parties

- It should include information such as the names of the parties, the date of the assignment, and the description of the rights transferred

- You will know that you have completed this step when you have an understanding of what a deed of assignment is and why it is used.

- Identify the party transferring their rights (the assignor) and the party receiving the rights (the assignee)

- Draft the deed in the name of both parties, including full names and contact details

- Ensure the deed is signed by both the assignor and assignee

- Once the deed is signed, the parties should exchange copies of the document

Once the assignor and assignee have been identified and the deed has been drafted and signed, you can check this step off your list and move on to the next step.

- Identify the parties involved in the Deed of Assignment. This would typically include the assignor (the party transferring their rights or interest) and the assignee (the party receiving the rights or interest).

- Ensure that all parties involved have the legal capacity to enter into a contract.

- When all parties have been identified and their legal capacity has been verified, you can check this step off your list and move on to drafting the Deed.

- Read the applicable laws in your jurisdiction to determine the required language and structure of the Deed of Assignment

- Gather the necessary information on the parties, the asset being assigned, and other relevant details

- Draft the Deed of Assignment, taking into account all the necessary details

- Make sure the language is clear and unambiguous

- Have the Deed of Assignment reviewed by a legal professional

- When the Deed of Assignment has been drafted and reviewed, you can move on to the next step.

- Identify the type of assignment that needs to be drafted and the legal requirements that need to be satisfied

- Consider the purpose of the Deed and the rights and obligations of the parties to the Deed

- Determine if the Deed is for an absolute or conditional assignment

- Consider if the Deed should be an express or implied assignment

- Determine if the Deed needs to be in writing or if it can be oral

- Check the applicable laws in your jurisdiction to ensure that you are drafting a valid Deed

- Check if there are any additional requirements that need to be included in the Deed

When you can check this off your list: Once you have identified the type of assignment and the relevant legal requirements, you can move on to considering the subject matter to be assigned in the Deed.

- Identify the subject matter of the Deed of Assignment, such as a patent, trademark, copyright, or other intellectual property

- Assess the value of the subject matter and any associated liabilities

- Understand the relationship between the assignor and assignee

- Have all necessary documents, such as a purchase agreement, to provide more detail about the assignment

Once you have identified the subject matter of the Deed of Assignment, assessed its value, understand the relationship between the assignor and assignee, and gathered any additional documents, you can move onto the next step of researching the legal requirements for the kind of Deed to be drafted.

- Research the relevant legislation, case law, and other materials related to the Deed of Assignment to be drafted

- Consult with a lawyer familiar with the relevant law to understand the requirements

- Take detailed notes on the legal requirements that must be adhered to in the Deed of Assignment

- Once you have all the necessary information, double-check that you understand the requirements before moving on to the next step.

- Prepare the text of the Deed, ensuring that all relevant information regarding the parties, the subject matter, and the consideration is included

- Check to make sure the language conforms with relevant laws and regulations

- Have the Deed reviewed by a solicitor to ensure that it complies with all legal requirements

- Once the Deed has been approved by a solicitor, have the parties sign the document

- Once the Deed has been signed by both parties, make multiple copies and ensure each party has a copy

- This step is complete once the Deed has been signed and each party has a copy of the document.

- Ensure both parties sign the Deed of Assignment in the presence of two witnesses who are over the age of 18 and not parties to the Deed

- Have both parties sign the deed in the presence of two witnesses and have the witnesses sign the deed to attest to witnessing the signature of the parties

- Check that the parties have signed the Deed in the presence of the witnesses by noting the signatures and the dates of signature in the execution clause of the Deed

- Once the Deed has been executed, have the parties date and keep a copy of the Deed in a secure place

- You will know that you have completed this step when the Deed has been properly executed by the parties in the presence of two witnesses.

- Identify all parties to the Deed and verify that their details are correct.

- Ensure that all parties to the Deed are identified in the document and that the details of each party are accurate and up-to-date.

- Check that the names, addresses and contact details of each party are correct.

- Once you have verified that the parties and their details are correctly identified, you can move on to the next step.

- Check that all parties have signed the Deed in the correct place, and that the date of signature is correct

- Ensure that each party has signed the Deed in the presence of an independent witness

- Check that all parties have signed the Deed with their full name and title, if applicable

- Confirm that the date of signature is correct and that all parties have signed on the same date

- Once you have verified that all parties have correctly signed and dated the Deed, you can proceed to the next step.

- Ensure that the Deed is witnessed by an independent third party who is not a party to the Deed.

- Ask the third party to sign the Deed and provide their name, address, occupation and date of signing.

- Check that the third party has signed and dated the Deed.

- Once the above is complete, you can check this step off your list and move on to the next step.

- Obtain signatures from all parties on the deed of assignment, ensuring that each party signs in the presence of a witness

- Have an independent third party witness each party’s signature

- Ensure that all parties have a valid form of identification, such as a driver’s license or passport, available for inspection by the witness

- Ensure that all parties sign the deed of assignment in the presence of the witness

- Obtain the witness’ signature, confirming that all parties signed in the presence of the witness

- You will know this step is completed once all parties have signed the deed of assignment and the witness has signed confirming they were present during the signing.

- Obtain a copy of the executed Deed of Assignment from all parties

- Contact the relevant state or territory office to determine whether the Deed of Assignment needs to be registered

- If registration is required, complete the necessary forms, pay the registration fee, and submit the required documents

- Once the Deed of Assignment is registered, the registrar will issue a certificate of registration

- Check off this step when you have received and reviewed the certificate of registration.

- Research the applicable laws and regulations in the relevant jurisdiction to decide if the Deed of Assignment needs to be registered

- Consult a legal professional if unsure

- When you have the answer, you can move on to the next step.

- Confirm what type of Deed of Assignment requires registration with the relevant government agency or registry.

- Research the registration procedures and the requirements you must meet in order to register the Deed of Assignment.

- Obtain any fees or additional documents that are necessary to complete the registration process.

- Ensure that all parties to the Deed of Assignment understand the registration process and the requirements for completing it.

You can check off this step once you have researched and confirmed the registration procedures for the Deed of Assignment.

- Gather the necessary documents for registration, such as the Deed of Assignment, supporting documents, and the applicable fee

- Visit the registration office to register the Deed of Assignment

- Submit the necessary documents to the registration office

- Pay the applicable fee

- Obtain a copy of the registered Deed of Assignment

- Upon completion of the above steps, you can check this off your list and move on to the next step.

- Review and understand the nature of the rights and obligations being assigned

- Determine if there are any restrictions or limitations in the assignment

- Assess if any approvals are needed from third parties before the assignment is valid

- Confirm that the assignor has the right to assign the interest being transferred

- Check to see if the assignee has the necessary capacity to accept the assignment

- Analyze if the assignment is subject to any applicable laws or regulations

- Determine if any additional documentation is needed to support the assignment

- Once you have considered all of the above, you can proceed with drafting the Deed of Assignment.

- Check with your local taxation authority or a qualified tax professional to see if the Deed of Assignment is subject to any taxes or stamp duty.

- Ensure that the Deed of Assignment includes any required taxes or stamp duty payments.

- Check to see if the tax or stamp duty implications vary by jurisdiction.

- Once you’ve considered the tax or stamp duty implications, you can move on to the next step.

- Identify any restrictions or limitations that could affect the transfer of rights in the Deed of Assignment

- Consider whether there are any legal restrictions that must be observed in the transfer of the rights being assigned

- Research any relevant industry standards or regulations to ensure that the restrictions or limitations on the rights being assigned are compliant

- Ensure that the Deed of Assignment clearly outlines the restrictions or limitations of the rights being assigned

- When all restrictions or limitations on the rights being assigned are taken into consideration, checked for compliance and outlined in the Deed of Assignment, this step is complete.

- Consider whether the Deed of Assignment needs to be registered with any government or public agencies.

- Determine if any registration is required or optional.

- Research the relevant regulations and laws to ensure that the assignments are properly recorded.

- Check any local requirements or restrictions.

- Once you have determined that the Deed of Assignment does or does not need to be registered, you can move on to the next step in the process.

• Read over the Deed of Assignment twice to make sure you’re accurately identifying all of the parties to the Deed. Make sure you include the full names and addresses of the assignor and assignee, as well as any other relevant parties. • Check that the legal description of the subject property is accurate. • Ensure that the consideration (the amount being exchanged for the assignment) is stated clearly and accurately. • Make sure that the names of the initial parties to the Deed are also included in the recitals. • Ensure that the recitals and the express terms of the Deed are consistent with one another. • Make sure that the Deed is signed, notarized, and delivered in accordance with state law.

Once you’ve completed the above steps, you can check off this task and move on to the next step in the guide.

- Identify the assignor and assignee. The assignor is the party transferring their rights and the assignee is the party receiving the rights.

- Check all of the details are correct. This includes the names, addresses and other contact information for both parties.

- Draft the deed to ensure that the assignor and assignee are accurately identified.

- You can check this off your list and move on to the next step once you have confirmed that the assignor and assignee have been accurately identified in the deed.

- Ensure that all parties to the Deed have read, understood and agreed to the terms and conditions of the agreement.

- Have all parties affix their signature to the Deed and the accompanying documents.

- Check that all the signatures are dated and in the presence of a witness.

- When all parties have properly executed the Deed, you can move on to the next step.

- Ensure all parties have signed the Deed in the presence of a witness.

- The witness must be an independent third party who is not a party to the Deed.

- The witness must sign each page of the Deed that contains a party’s signature.

- The witness must also include their full name, address and occupation on the Deed.

- Once all of the above requirements are met, then you can check this off your list and move on to the next step.

- Determine the applicable taxes or stamp duty implications for the Deed of Assignment.

- Research any applicable taxes or stamp duty fees for the Deed of Assignment.

- Calculate the applicable taxes or stamp duty fees for the Deed of Assignment.

- Make sure to include the applicable taxes or stamp duty fees in the Deed of Assignment.

Once you have determined the applicable taxes or stamp duty implications for the Deed of Assignment, and included them in the Deed of Assignment, you can move on to the next step.

- Determine the rights that you are assigning and review any applicable laws or regulations to ensure that the assignment of such rights is permitted.

- Consider any applicable contractual restrictions or limitations on the rights being assigned, such as any applicable confidentiality obligations or restrictions on the transfer of rights.

- Once you have determined that the assignment of the rights is permitted and there are no applicable restrictions or limitations, you can proceed to the next step of recording keeping.

- Create a record of the Deed of Assignment, including the date it was executed, by each party

- Maintain a copy of the Deed of Assignment in a secure place

- Record any additional related documents, such as any security documents, release documents, or other agreements

- When all of the above have been done, you can check this off your list and move on to the next step.

- Obtain a physical copy of the original Deed of Assignment

- Ensure the original Deed is signed by both parties

- Keep the original Deed in a safe and secure place, such as a locked filing cabinet or safe

- Make sure the document is stored in a location that is accessible to both parties

- Ensure that the original Deed is not destroyed or tampered with in any way

You can check this off your list and move on to the next step once the original Deed of Assignment is safely stored in a secure location.

- Scan or take a digital photo of the original Deed of Assignment and save it to a secure location.

- Ensure that the digital copy is readable and clearly displays all of the information contained in the original document.

- Ensure that the digital copy is stored in a secure location, preferably on a cloud-based storage system or other secure server.

- Make sure that only authorized personnel have access to the digital copy of the Deed.

- When finished, you will have created a digital copy of the Deed and stored it in a secure manner.

- Read over the Deed of Assignment to ensure accuracy

- Make sure all details are correct, and all parties are named

- Verify that all signatures are complete and accurate

- Make sure the date of the assignment is correct

- Check that the document is formatted and laid out correctly

- Once you are satisfied with the accuracy of the Deed of Assignment, you can move on to the next step.

- Read through the entire document to make sure all the information is correct

- Double check that the names and details of the parties involved are spelled correctly

- Ensure that all the dates are accurate, and that any and all parties have signed the deed in the right places

- Check that the terms and conditions in the deed are consistent with the agreement between the parties

- When you have verified all the details, you can check this off your list and move on to the next step.

- Check the Deed of Assignment to ensure that all required elements are present, including accurate information and signatures of all parties.

- Verify that any and all attachments to the Deed of Assignment are included and accurate.

- Ensure that all dates, signatures, and other pieces of information are accurate and up-to-date.

- Once you’ve confirmed that all of the steps have been completed correctly, you can move on to the next step.

- Seek professional advice from a lawyer or other legal professional to ensure that the deed of assignment is legally binding and enforceable.

- Request that the legal professional checks that all steps have been completed correctly, and that the deed of assignment meets all requirements under local law.

- Ask the legal professional to provide you with written advice on any changes or revisions that may be necessary to make the deed of assignment valid and enforceable.

- Once the legal professional has confirmed that the deed is legally sound, you can check off this step and proceed with the next one.

- Research legal professionals who are able to provide advice and assistance with the drafting of a deed of assignment

- Contact the legal professionals to discuss the specific requirements and details of the deed of assignment

- Ask the legal professionals if they are able to provide advice and assistance with the deed of assignment

- Receive advice from the legal professionals and make changes to the deed of assignment accordingly

- Once you are satisfied with the changes to the deed of assignment, you can move on to the next step.

Q: Does a Deed of Assignment need to be signed?

Asked by John on April 23rd 2022. A: Yes, a Deed of Assignment needs to be signed by both the assignor and the assignee in order for it to be legally binding. The signatures should be witnessed and dated, and should be in front of an independent witness who is not related to either party. It is also important to include the relevant clauses and provisions in the deed, as these will set out the rights and obligations of each party.

Q: What is the difference between an assignment and a novation?

Asked by Sarah on July 29th 2022. A: An assignment is a transfer of rights or obligations from one party to another, while a novation is a transfer of rights or obligations from one party to another with the consent of all parties involved. An assignment does not necessarily require the consent of all parties, while a novation always requires the consent of all parties. Additionally, an assignment can transfer rights or obligations without necessarily extinguishing any pre-existing agreements, while a novation extinguishes any pre-existing agreements.

Q: Is a Deed of Assignment legally binding in different jurisdictions?

Asked by Tyler on October 17th 2022. A: Yes, a Deed of Assignment can be legally binding in different jurisdictions, though the exact requirements for validity may differ from jurisdiction to jurisdiction. In general, however, a Deed of Assignment needs to be signed by both parties and witnessed by an independent third party in order for it to be legally binding. Additionally, the deed should include all relevant clauses and provisions that are applicable in each jurisdiction.

Q: Are there any tax implications when drafting a Deed of Assignment?

Asked by Emma on January 15th 2022. A: Yes, there are tax implications that need to be taken into account when drafting a Deed of Assignment. Depending on the jurisdiction and specific tax laws, there may be tax implications for both parties if they are transferring rights or obligations under the deed. It is important to seek professional tax advice before entering into any agreement that involves transferring rights or obligations between parties as this could have significant financial implications for all involved.

Q: Do I need legal advice when drafting a Deed of Assignment?

Asked by Jacob on June 5th 2022. A: While it is not necessary to seek legal advice when drafting a Deed of Assignment, it is generally recommended in order to ensure that all relevant legal requirements are satisfied and that all involved parties are aware of their rights and obligations under the deed. It is also important to make sure that all language used in the deed is clear and unambiguous so that it can easily be understood by all parties involved.

Q: How can I ensure that my Deed of Assignment is valid?

Asked by Michael on August 28th 2022. A: In order for your Deed of Assignment to be valid, it must meet certain legal requirements which vary between jurisdictions. Generally speaking, your deed should include all relevant clauses and provisions applicable in your jurisdiction as well as signatures from both parties which should be witnessed by an independent third party who is not related to either party involved. Additionally, any language used within the document should be clear and unambiguous so that it can easily be understood by all involved parties.

Q: What information do I need to provide when drafting a Deed of Assignment?

Asked by Ashley on November 10th 2022. A: When drafting a Deed of Assignment, you will need to provide information about both parties involved such as their names, addresses, contact details and any other relevant information required under applicable laws in your jurisdiction. Additionally, you will need to include any relevant clauses or provisions applicable in your jurisdiction which will set out the rights and obligations of each party under the deed as well as any other information required for the document to be legally binding.

Q: What are common mistakes made when drafting a Deed of Assignment?

Asked by Joshua on February 20th 2022. A: One common mistake made when drafting a Deed of Assignment is failing to include all relevant clauses or provisions applicable in your jurisdiction which set out the rights and obligations of each party involved in the agreement. Additionally, failing to have the document signed by both parties or witnessed by an independent third party can render the document invalid or unenforceable under applicable law in some jurisdictions. Moreover, using ambiguous language within the document can also lead to misunderstandings and disputes further down the line which could be avoided if clear language was used throughout the document instead.

Example dispute

Lawsuit referencing a deed of assignment.

- The plaintiff may raise a lawsuit if they have been wronged by the defendant in a way that is outlined in the deed of assignment.

- For example, the deed of assignment may outline that the defendant is responsible for paying a certain amount of money to the plaintiff, and the defendant has failed to do so.

- The plaintiff may also raise a lawsuit if the defendant has failed to adhere to any other obligations laid out in the deed of assignment.

- The plaintiff would need to prove that the defendant has breached the deed of assignment in order to win the lawsuit.

- If successful, the plaintiff may be able to obtain a judgment in their favor, which may require the defendant to pay the plaintiff the money they are owed.

- In addition, the plaintiff may be able to seek other damages, such as punitive damages, if the breach of the deed of assignment was particularly egregious.

- Depending on the severity of the breach, the plaintiff may also be able to seek an injunction to prevent the defendant from continuing to breach the deed of assignment.

- Settlement of the dispute may also be possible, wherein the defendant agrees to pay a certain amount of money to the plaintiff, or agrees to adhere to the obligations laid out in the deed of assignment.

Templates available (free to use)

Deed Of Assignment For Rent Deposits Occupation Lease Deed Of Assignment Of Benefit Of Claim For The Freehold Or Extended Lease House Under Section 8 Or Section 14 Deed Of Assignment Of Equitable Interest In Residential Land Deed Of Assignment Of Goodwill And Intellectual Property Rights Transfer Of A General Partnership To An Llp Deed Of Assignment Of Property Sale Benefits [Section 42 Deed Of A

Helpful? Not as helpful as you were hoping? Message me on Linkedin

Links to get you started

Our AI Legal Assistant (free while in beta) Contract Template Library Legal Clause Library

Try the world's most advanced AI Legal Assistant, today

The Different Types Of Legal Deeds In India And Their Significance

In general, a deed is a special type of binding promise to do something. There are many different types of deeds that can be executed in India. Keep reading to learn about them.

A deed is any written legal instrument that transfers, affirms, or verifies an interest, right, or property, among other things. A legitimate deed requires the grantor, the original owner of the land, to surrender his interest to the guarantee, the title recipient. It is also important that the grantor must have legal capacity, which means that the grantor must be of sound mind and lawful contracting age. In most of the places the legal minimum age to fulfill the criteria for contracting capacity is eighteen.

Table of Contents

Difference Between Deed and Agreement

The basis of a contract in law is offer and acceptance. It is an agreement to be legally obligated on consideration. Consideration forms the base for an agreement. The parties need consideration to show that they have ‘bought’ the promise by doing some act or providing something in return for the promise. In contrast to an agreement or contract, there is no requirement for consideration to execute a deed , this is because consideration is not mandatory.

Types of Deeds

Warranty deed.

This type of deed is commonly used for the sale of residential real estate. A warranty deed acts as a guarantee to the buyer that the seller has all the right to sell the property and that the property is free of debts and other liabilities. If any issues emerge, the buyer has the right to seek compensation from the seller.

In other words, this type of deed assures that the seller owns the property and has the legal right to sell it. It also guarantees that there are no liabilities, debts, or charges against it. Despite being a warranty act, this type of deed serves as a promise to the buyer, and if any problems arise, the buyer has the right to seek reimbursement from the seller.

A general warranty deed provides the maximum level of security for the buyer because it involves crucial agreements or guarantees being transferred to the grantor. Typically, warranties include specific details such a warranty, the right to convey, burden exemption, and title protection against all other claims. You Can Also Know about the Land Registration.

Special Warranty Deeds

A Special Warranty Deed is not the same as a warranty deed. Here the seller’s guarantee to the buyer does not cover the entire property. The seller only guarantees the concerns that arise during the period of the seller’s property ownership . One usually uses a special warranty for purchases involving commercial property. It conveys all rights to the buyer but only guarantees what is clearly stated.

The grantor of this form of deed conveys only two warranties to the property:

- the grantor currently owns the property title, and that

- The land had not been tampered with during the grantor’s ownership period.

Such a deed provides no assurance that the property was free and clear until the grantor took possession. This means that the seller or grantor may have had no idea what occurred to the property until the grantor gained possession, and it does not guarantee that the title was secure prior to then.

This deed is usually preferred while transferring a trust or when selling a commercial property.

Quitclaim Deeds

A quitclaim is primarily utilised by family members, spouses, and people who are well-informed and capable of transferring ownership rights and claims from one party to a different party.

Bargain and Sale Deeds

Typically, sale deed is used to sell court-seized assets or real estate. It normally does not guarantee to the buyer that the seller owns the property free and clear.

Grant Deeds

In exchange for an agreed price, a grant certificate transfers the interest in an estate from the seller to the buyer. It guarantees that the seller owns the property free from all debts. Whereas, it does not provide a guarantee for the defects of the title like the warranty deed.

Fiduciary Deeds

One can use a fiduciary deed when the grantor is a fiduciary such as a trustee to transfer the land.

Trust Deeds

A trust deed is a written instrument in which property is transferred to a trustee to secure a debt in the form of a promissory note or a mortgage. In the event of default, the trustee has the authority to sell the property.

Court Order Deeds

There are various forms of court order deeds which are executed after a court order. It covers things such as deeds of the sheriff, master deeds, etc. The court executes these deeds without the owner’s consent. One of its unique aspects of this deed is that it lists the real price of the property as a consideration in advance.

The Bottom line

Various types of deeds are available to help both the buyer and seller. However, before performing a deed, the terms and conditions must be read in order to avoid future troubles.

Why Vakilsearch

If you are looking for a legal deed, there is no better place to go than Vakilsearch. Here are four reasons why:

1. We have a team of experienced legal professionals who can help you draft the perfect legal deed for your needs.

2. We offer a hassle-free online process that makes it easy to get your legal deed done quickly and without any stress.

3. We provide affordable pricing that fits within your budget.

4. We have a 100% satisfaction guarantee, so you can be sure you will be happy with the final product.

- Relinquishment Deeds Vs Gift Deeds

- Gift Deed for Cash in India

- Gift Deed Format

Ancestral Property or Self-Acquired Property

What Is the Concept of Ancestral Property? Ancestral property means any movable or immovable property an individual inherits from their…

How To Apply for Patta Online In Tamil Nadu? – eservices.tn.gov.in

Apply for Patta Online In Tamil Nadu India’s Land and Revenue Administration has recently seen a positive transformation due to…

How Can I Get Old Land Records in India?

Introduction Common men have always desired to own property or land and work hard to accomplish this goal. Imagine, however,…

How to Cancel a Power of Attorney in India?

What Is a Power of Attorney (POA)? Power of Attorney (POA) is a way in which an individual can authorise…

Understanding G-Secs and How to Invest in Them for Business?

G-secs refer to government securities or, in other words, loans or capital issued by the government. The biggest advantage associated…

Startups to Continue Receiving a Tax Holiday

Businesses of all sizes and types have been having a tough year courtesy of the coronavirus pandemic. The Indian government…

How the Rupee Depreciation is Enticing NRIs in Real Estate?

The Indian currency has depreciated as much as 5.2% against the US dollar in 2022 so far. The rupee’s depreciation…

Subscribe to our newsletter blogs

Private Limited Company Registration Private Limited Company with Indian and Foreign Shareholders One Person Company Registration Limited Liability Partnership (LLP) Registration Partnership Firm Registration Subisdary Company Registration Subsidiary of an Indian Company in India Public Limited Company Registration Section 8 (Not-for-Profit) Company Registration Trust Registration Society Registration USA Company Incorporation Register a NBFC Company in India NIDHI Company Registration Producer Company Registration Digital Signature Certificate (DSC) Tax Deduction Account Number (TAN) Trademark Registration - India Trademark Renewal International Trademark Application Trademark Ownership Transfer Respond to a Trademark Objection File a Trademark Opposition Judgments Vakil GPT Libra Winding Up of Company roDTEP Private Company into OPC Patent Search Apply for a Provisional Patent Apply for a Patent Changes in IEC Changes in GST LUT Application ITR for LLP Business Ideas Business Loans NGO Registration Change the Objectives of Your Company Sole Proprietorship Scope of Work and Deliverables Agreement Service Level Agreement Business Compliance PIL Web Ecommerce Development Hallmark Registration Caveat Petition OSP License GDPR APEDA Registration Money Recovery Vendor Termination RBI Compounding Application Patent Infringement Labour Law Non Compete Agreement Relinquishment Deed Spice Board Registration Convert Private to Public Limited Company Posh Compliance Trademark Assignment Restitution Of Conjugal Rights Company Name Search Corporate tax e-FIR Property Documents Verification Trademark Infringement Well Known Trademarks Copyright Infringement Intellectual Property Employment Agreement Income tax Notice Financial Agreement Trademark Search NRI Legal Services Professional Tax for Employees Professional Tax for Directors ESI Registration PF Registration ESI Filing PF Filing Cancellation of GST Professional Tax Registration DIPP Certification Basic Food License State Food License Central Food License Fundraising PF and ESI Filings PF and ESI Registration Professional Tax Filing Shops and Establishment Act Registration Importer Exporter Code Registration SSI / MSME Registration Trade License Registration Copyright Registration Change in trademark application Trademark Withdrawal Payroll Services Goods & Service Tax (GST) Registration Trademark Watch ISO Registration Hearing Labour Welfare Fund Registration USA Company Compliances NGO Compliance Non-Disclosure Agreement Memorandum of Understanding (MoU) Get Advice from a Lawyer Get a Detailed Legal Opinion from an Expert Commercial Rental / Lease Agreement Leave and License Agreement Prepare a Power of Attorney Agreement Review Shareholders' Agreement Term Sheet Review a Term Sheet given by an Investor Share Purchase Agreement Terms of Service and Privacy Policy Terms of Service Privacy Policy Get Basic Legal Advice Get Basic Legal Opinion Get an Advanced Legal Opinion Get Expert Legal Opinion Legal Agreement Legal Notice Disclaimer Draft a Consumer Complaint Founders Agreement Franchise Agreement Vendor Agreement Master Service Agreement Joint Venture Agreement Freelancer Agreement Consultancy Agreement Profit Sharing Agreement Cheque Bounce Notice Freelancer / Contractor's Agreement Loan Agreement Terms of Service and Privacy Policy Website Terms of Service and Privacy Policy App Terms of Service and Privacy Policy - Web & App Probate of Will Divorce Consultation Property Registration Property Consultancy - opinion Management of a Trust Management of a Society Dissolution of Partnership Firm Accounting and Book Keeping GST Filings TDS Filings File Annual Returns for your Private Limited Company Get help from a Company Secretary for your Private Limited Company Get help from a Company Secretary for your Limited Liability Partnership Change your Company Name Change the Objectives of Your Company Appointment of a Director Removal/Resignation of a Director Change the Official Address of Private Company Close your Private Limited Company Convert your Partnership into a Private Limited company Convert your Sole Proprietorship into a Private Limited Company Convert your Private Limited Company into an LLP Convert your Private Limited Company into a Public Limited Company Income tax returns - Propreitorship Firm Financial Projections for Bank Loan Investor Pitch Deck CA/CS certification Increase in Authorized Capital of your Company Change the Objectives of Your LLP Change your LLP Name Adding a Designated Partner Change the Official Address of Your LLP Increase in Contribution to your LLP Change LLP Agreement Close your Limited Liability Partnership Convert your Sole Proprietorship into an LLP Compliance - Section 8 Close down your Not-for-Profit (Section 8) Company Get Share Certificates for your Company Replacement of a Director Change in the Designation of Director Adding a Partner in LLP Replacement of Designated Partner Resignation of Designated Partner Resignation of Partner Change Name of your LLP Close your Partnership firm Close your Proprietorship firm Close your Public Limited Company Convert your LLP into a Private Limited Company Convert your Partnership into an LLP Convert your Sole Proprietorship into a Partnership Audit your Company Valuation of Business Convert your Private Limited Company into an One Person Company Transfer of Shares Change in Authorized Capital of your Company Employee Stock Options (ESOP) Issue of New Shares (To existing promoters) RBI & SECRETARIAL COMPLIANCES FOR FOREIGN INVESTMENT ISSUE OF NEW SHARES IN YOUR COMPANY (TO OTHER THAN EXISTING PROMOTERS) Employment Agreement with ESOP Due Diligence of Company Convert your One Person Company into a Private Limited Company DIR-3 KYC Filing Issue of Convertible Debentures (CCD) Permanent Account Number (PAN) Religion change Gender Change Apply for Name Change - Minor Name Change Application FSSAI Marriage Certificate Mutual Divorce Court Marriage Public Notice - Gazette Notification Make a Will Residential Rental Agreement Gift Deed File your Income Tax Returns - Salaried Individual Logo design Free GST Registration Internal Start a Branch Office in India Get a Section 80 G Tax Exemption Trademark Search ISI Registration Apply for Birth Certificate Employment Contract without ESOP Sale Deed CA Advisory Service Apply for Succession Certificate Legal notice for recovery of dues Apply for legal heir certificate Apply for Psara License RERA complaints Main Service Startup India Registration Integrated Accounting + GST Talk to a CA Talk to a Lawyer Talk to a CS FCRA Registration FCRA Renewal Change in Member or Nominee of OPC Change in Particulars of Director Creation or Modification of Charge Satisfaction of Charge Conversion of Dormant Company to Active Company Conversion of Loan into Equity Shares Change the Official Address of Your Business (from one state to another state ) Get Support on Opening Current Bank Account Design registration Legal Metrology NGO Deed Drafting File an Opposition for Brand Infringement Darpan Registration Cessation of Partner or Designated Partner SEBI IA Registration Surrender of DIN/DPIN Foreign Liabilities and Assets (FLA) Return Change the Official Address of Your LLP (From One State to Another State) Change the Official Address of Your Company (Outside the City) CSR-1 Registration Service

Bengaluru - Bangalore Chennai Cochin Coimbatore Delhi Gurugram - Gurgaon Hyderabad Kolkata Mumbai Noida Thiruvananthapuram Vijayawada Visakhapatnam Addanki Adilabad Agartala Agra Ahmedabad Aizawl Ajmer Akola Alappuzha Aligarh Allahabad Alwar Amaravati Ambala Amritsar Anand Anantapur Andaman Aurangabad Aurangabad-Bihar Azamgarh Badaun Badlapur Bagaha Bagalkot Bahadurgarh Baltora Baraut Bardhaman Bareilly Bathinda Begusarai Belgaum Bellary Berhampur Bhadrak Bhadreswar Bhagalpur Bharuch Bhavnagar Bhayandar Bhilai Bhilwara Bhiwandi Bhiwani Bhopal Bhubaneswar Bidar Bijapur Bikaner Bilaspur Bina Etawa Birati Birbhum Bishalgarh Botlagudur Budaun Budgam Buldhana Bundi Cachar Calicut Chandauli Chandigarh Chandigarh-Punjab Chhapur Chhatarpur Chhindwara chidambaram Chitradurga Chittoor Chittorgarh Churu Cooch Behar Cuddalore Cuttack Dahod Daman Darbhanga Dehradun Deoghar Dera Bassi Dewas Dhaka Dhanbad Darbhanga Dharmapuri Dharmanagar Dharwad Dhule Dimapur Dindigul Dispur Dombivli Dumarkunda Dungri Durgapur Dwarka Eluru Erode Faridabad Firozabad Firozpur Gandhidham Gandhinagar Gangtok Ganjam Gannavaram Ghaziabad Gonda Gorakhpur Greater Noida Gulbarga Guntur Gunupur Guwahati Gwalior Haldwani Hansi Hanumangarh Haridwar Hisar Hoshiarpur Hosur Howrah Hubli Idukki Imphal Indore Itanagar Jabalpur Jagdalpur Jaipur Jalandhar Jalgaon Jalgaon Jamod Jamalpur Jammu Jamnagar Jamshedpur Jamui Jaunpur Jhansi Jind Jodhpur Jorhat Kadapa Kakinada Kalahandi Kalimpong Kalyan Kangra Kankroli Kannur Kanpur Kanyakumari Kapurthala Karad Karaikal Karaikudi Karimnagar Karjat Karnal Karur kasganj Kashipur Katihar Katni Kavaratti Khamgaon Khammam Kharagpur Khordha Kochi Kohima Kolhapur Kollam Koppal Kota Kottayam Kozhikode Krishnagiri Kullu Kumbakonam Kurnool Kurukshetra Lalitpur Latur Loharu Lucknow Ludhiana Madhubani Madikeri Madurai Mainpuri Malappuram Malda Mandi Mandsaur Mangalore Mapusa Margao Marthandam Mathura Meerut Midnapore Mirzapur Mohali Mone Moradabad Morbi Morena Muktsar Mundra Muzaffarnagar Muzaffarpur Mysore Nabarangpur Nadiad Nagapattinam Nagaur Nagercoil Nagpur Nainital Nalanda Namakkal Nanded Nandigama Nashik Navi Mumbai Navsari Nellore Nilgiris Nizamabad Ongole Ooty Other Cities Palakkad Palampur Palgadh Pali Panaji Panchkula Panipat Paradip Pathanamthitta Pathankot Patiala Patna Pilani Port Blair Pratapgarh Puducherry Pune Raichur Raigarh Raipur Rajahmundry Rajapalayam Rajkot Ramanathapuram Ramgarh Ranchi Raniganj Ratlam Rewa Rohtak Roorkee Rourkela Rupnagar Saharanpur Salem Sangli Sangrur Satara Secunderabad Shillong Shimla Shimoga shirdi Sikar Siliguri Silvassa Singrauli Sirmaur Sirmur Sitamarhi Sitapur Sivaganga Sivakasi Siwan Solan Solapur Sonipat sonla Sri Ganganagar Srinagar Surat Talbehat Tezpur Thalassery Thane Thanjavur Theni Thoothukudi Thrissur Tiruchirappalli Tirunelveli Tirupati Tirupur Tiruvannamalai Tumkur Udaipur Udupi Ujjain Una Uppala Uttarpara Vadodara Vapi Varanasi Vasai Vellore Vidisha Vill Damla Viluppuram Vinukonda Virar Virudhunagar Warangal Washim Yamuna Nagar Yelahanka Zirakpur Select City*

Email Enter valid email addres

You'll be redirected to payment page to reserve a callback from our expert

Assignment of Deed

Table of contents, assignment of deed of trust.

An assignment of deed is used to show the deed of a property changing from one party to another, such as when a sale is made. It is used as the written proof to show who has rightful ownership of the property. When someone is purchasing property and decides to sell it before they have paid it off, an assignment of deed form would be used to transfer the rights and everything associated with the property over to the new owner.

When a debtor transfers real estate to a creditor, the Assignment of Deed is the legal document used to record this transfer. This happens when a lawsuit is filed on a property owner for a default in payment and the court’s rule in favor of the creditor; this is one example of when the deed of assignment would be put in to use. It’s used to show that the property is being transferred from the ownership of the defendant and given to the plaintiff that won the case and awarded the property.

It’s important to understand what these documents mean as they pertain to public property records as well as personal background checks into an individual. This could be exactly the type of information you need to help you gain a better understanding on someone or his or her history. It could also be in your own public background information if someone knows where to look for it.

Public records will always contain the history of who owns real property and the details on that property as it exchanges hands or ownership is passed. Anyone who knows how can access basic information about a deed or its assignments.

When a property owner uses an assignment of deed of trust, they are assigning ownership of the property to someone else and this is a very important document that should be kept in a safe and secure place. There are also public records kept on these types of documents and you should be able to request a copy – sometimes at a fee – should you need one.

The Assignment of Deed will also specify the rights the other person will receive along with the deed. As property transfers ownership like this, a recital is usually included as well which shows how many people and the identities of who has owned the property before. This allows you to see how many times the property has transferred hands over the course of its history.

Now that you know more about this particular property document, you will understand it when you use it. Whether you need it for your property or you are searching the property records of someone else for some reason, this information will be very beneficial to you.

We know that these types of legal matters can be confusing to the average person and that’s why we strive to make it easier to understand by giving you the basics here. Assignment of deed of trust documents do not have to confuse you anymore.

Contact Us About Us

Trademark Assignment Process in India: A Comprehensive Guide

Transferring ownership of trademarks is a common practice, and it can be done through various methods such as assignment, merger, or amalgamation between entities. In this article, we will focus on the assignment procedure for trademarks in India.

Assignment of Trademarks: Trademark assignment involves the transfer of ownership of a mark from one entity to another. This transfer can occur with or without the goodwill of the business. Let’s explore the two types of assignments:

1. Assignment with Goodwill: This type of assignment involves transferring not only the rights but also the value associated with the trademark as it relates to the products or services being offered. For example, if the owner of the “OFIN” trademark, Ofin Legal Private Limited , assigns the trademark to another entity, the assignee will have the right to use the trademark for the same product.

Forms and Fees: To record the assignment of a pending trademark (with goodwill), you need to submit Form TM-M (Correction of Clerical Error or for Amendment U/R 37) along with an official fee of INR 900 per mark.

For a registered trademark (with goodwill), the appropriate form is Form TM-P (Subsequent Proprietor by way of Assignment or Transfer of Mark), and the official fee is INR 9000 for each assigned mark.