Why Is Market Research Important: We Give You 7 Reasons

Planning and conducting market research is a critical component of any business. It provides decision-makers with important information to decide the course of the company, launch a new product, or to keep a tab on what competitors are doing.

Data indicates that market research is a growing industry of 47.36bn USD , globally – and rightly so. For a business to succeed, all its resources – financial and otherwise – must be invested in areas where they are needed the most. Conducting market research helps you identify those areas. It also helps you discover and understand your customers’ needs so you can innovate better, expand when the time is right, and work with more focus.

In this article below, we will share a few pointers with you about why market research is important for every business – big and small. But first, let’s talk about the types of market research.

Types Of Market Research

Depending on the purpose of your research, you can choose either of the two main types of market research. These are primary research and secondary research.

– Primary Research

Primary research is direct research that you conduct yourself or hire someone else to do it for you. It involves reaching out to your target market, asking them questions, collecting data, and analyzing the information gathered. Based on the data, strategies are devised, decisions are made, and policies are created.

Primary research helps you explore issues, dig deeper, and ask specific questions that are relevant to what you are looking for. Because it takes more time and effort, it may also cost a bit more than secondary research but it is more effective and helps you gain a solid picture of what’s going on.

– Secondary Research

Secondary research is using somebody else’s primary research for your business purposes. Research that is already conducted, organized, and published is often used by small businesses to gauge market trends, current economies, and to devise plans.

A lot of government agencies conduct market research for various purposes. If you’re on a budget, going to one of those agencies may help you out a lot as most of that research is freely available to the public. If you want to access a private market research company’s report, you may have to pay a fee to access the complete file.

However, there are private companies that publish their reports publicly. Additionally, you can also go online and conduct Google searches looking for specific phrases relevant to your research purpose to find valuable data.

Why Is It Important?

Now that we know what market research is and what different kinds it has, it’s time to learn why it is important, and why you should invest in it if you want to become a successful entrepreneur.

1. It Helps You Identify The Problem Areas As Well As Strong Areas

Knowing what you are good at and what you’re not, help you take profitable risks in life. It’s true in business too. Accurate market research helps you identify business areas that are performing well, those that need more attention, and also those that you should perhaps give up.

Back in 2010 , two young tech enthusiasts launched a location-based app – Burbn – that would allow consumers to check-in, make plans of hangouts with friends, share pictures, and more. Few weeks into the launch, they realized through internal discussions and reevaluation of the market, that Burbn is cluttered and their target market is more into Foursquare and they won’t be able to budge them.

They took a long, hard look at their app again – which had already been launched – and started working on it from scratch, removing all the features and only letting the photo-sharing, liking, and commenting options intact. And thus, Instagram was born.

It also helps you discover and understand your customers’ needs so you can innovate better, expand when the time is right, and work with more focus. For example, if you plan on starting a digital marketing agency , you’d know that there’s more need for social media in your area, than for PPC services. Thus, you’ll hire more social media experts.

2. It Helps You Understand Your Customers’ Needs

It is not enough that you know your business; you got to know what your customers are saying about you – and about your competitors. If you have got your pulse on what your customer is thinking, you’d create products that solve their issues, reach out to them when they are most ready to listen, and help them become your loyal ambassadors.

A huge part of business market research is always dedicated to gauging customer satisfaction rates, their reactions to a new product, and what they are looking for next.

In 2005, when YouTube initially launched, it was for a very different purpose : dating. Pretty soon into launch, however, and by investing in robust market research (a part of which they conducted themselves) the founders realized that their video dating app is not what their customers are looking for. Analyzing the data, they discovered that there is no app or platform in the market for video sharing. The websites that were offering this service were patchy at best and not intuitive at all.

Being attuned to their customers’ needs and spotting a wide space in the market, they tweaked their video platform and launched YouTube .

Following what your customers are talking about, listening to them, and then delivering on their needs is an important task that you can fulfill with timely customer-centered market research.

3. Helps You Conduct Your Marketing Based On Informed Decisions

Launching and running a business means making decisions every day – about products, services, expansions, HR, and so much more. Without solid market research backing your decisions, all you are doing is guess-work, hoping the results will be in your favor.

With research helping your business, you are better informed about areas to invest in, gauge the potential success of new products, test new markets to expand into, and to determine what kinds of products/services will be most favored by your customers.

This is certainly what Starbucks does. The company has a whole dedicated platform ‘My Starbucks Idea’ where employees and customers and anyone who wants can pitch in and share what they think the company should do next, the flavors it should try, the new products it should launch, bring back some old favorites, and more.

The platform helps them remain informed on all important aspects of business investment and propels them towards ventures and venues that hold the most potential.

If you aren’t a humungous company like Starbucks and cannot afford to host dedicated platforms to gain important information, invest in market research whenever you have a big decision coming up. It isn’t as expensive as you think and doesn’t take that much time. Plus the results can be relevant for a lot of related areas that you may want information on.

4. Helps You Keep An Eye On Your Competitors

As a startup founder, you may think being original is all about being focused on what you’re doing and not worry about what everyone else may be up to. This approach spells long-term disaster. While you should certainly keep your focus on your own efforts, it is critical – and smart – to keep tabs on your rivals and know what they are thinking or planning.

With sound market research on your side, you can better prepare for what your competitor may be about to do next and make sure they aren’t able to put a dent in your market share. With regular research, you can not only learn to anticipate their next move but be in a better position to avert any possible damage from their end.

In addition to conducting market research , you can pair it up with regularly monitoring their social media or to increase Instagram followers , blog posts, and seeing what is trending in your market. Here is a great resource on how you can go about it.

5. Helps You Expand And Innovate

Market research can help you identify markets and geographical areas where you can expand to. It can also help you to invest in ideas that have the most potential to succeed based on what customers are looking for and what the market is lacking.

For example, if you are a retail company, conducting market research can help you identify locations where your store can profit the most. If you are planning to buy a business to increase your market share, market research can help you point towards businesses that may be ripe for acquiring. Not only that, conducting market research before you launch your business can help you figure out ways to put your best foot forward.

It guides you towards opportunities where you have the most room to innovate and take risks with the highest return potential. For example, if your competition is employing cutting edge tech such as VoIP to get better results, you can also employ the same to improve your customer care and business goals.

6. Helps You Set Business Goals

Goal-setting is one of the major parts of running a business – big and small. Goals give you directions, help you remain in sight of the bigger picture, and set you on the path of continued success. Goals can be of different kinds: short-term, long-term, department-oriented, over-arching, and such.

To set all these kinds of goals and get ready to meet them, businesses need to have a thorough and complete knowledge of their strengths and weaknesses. They need to be aware of how the market is behaving and predict what may come next.

All of this is only possible after conducting market research. With the help of focused market research, you can set achievable business goals and not follow some vague notions of instant success. These often include how to improve productivity, customer satisfaction, and business’ financial health. You can also use market research to learn ways you can reduce expenses without hurting the business, find out how to amplify your digital marketing , generate copywriting tips for research paper writers , or introduce a new employee incentive program.

7. Helps You Know Which Risks To Take And Increases Earning Potential

Risk-taking is an important component of the business. Without it, you can become stagnant and a sitting-duck for a more ambitious rival. But risk-taking cannot be a shot in the dark. To know which risks to take and when to take the plunge are attributes of successful innovators. From Dropbox’s Drew Houston who refused Steve Jobs to Google’s buying of YouTube when it was a fledgling startup, the history of business success and innovating is packed full of stories of ambitious – but informed – risk-taking.

Using market research, you can also join the ranks of informed-decision makers who do not shy away from taking risks. It prevents you from making costly mistakes that could have been avoided and take steps that result in massive profits.

Take the example of Frito-Lay . When the potato chip maker wanted to introduce a new brand , it launched online market research conducted through Facebook to ask its customer-base which flavor they would like the best. The results showed that beer-battered onion-ring flavor is a hit in California and Ohio, while New Yorkers preferred the Churros flavor idea. This research also helped him increase Instagram followers as his posts became popular over the internet.

The research helped the company come up with different flavors and market them strategically to different states. If the research would not have been done, the company would have come up with a new flavor that could have been a hit – or a miss.

Popular Instruments Of Market Research

As technology keeps advancing, market research keeps evolving. Where before you had to rely on face-to-face interviews, telephone surveys, or lengthy online questionnaires, now it’s all about short online surveys, instant case studies aided by technologies, and focused groups that are already available on your social media channels.

Below we talk about 4 popular instruments of market research that are frequently used by companies worldwide with excellent results.

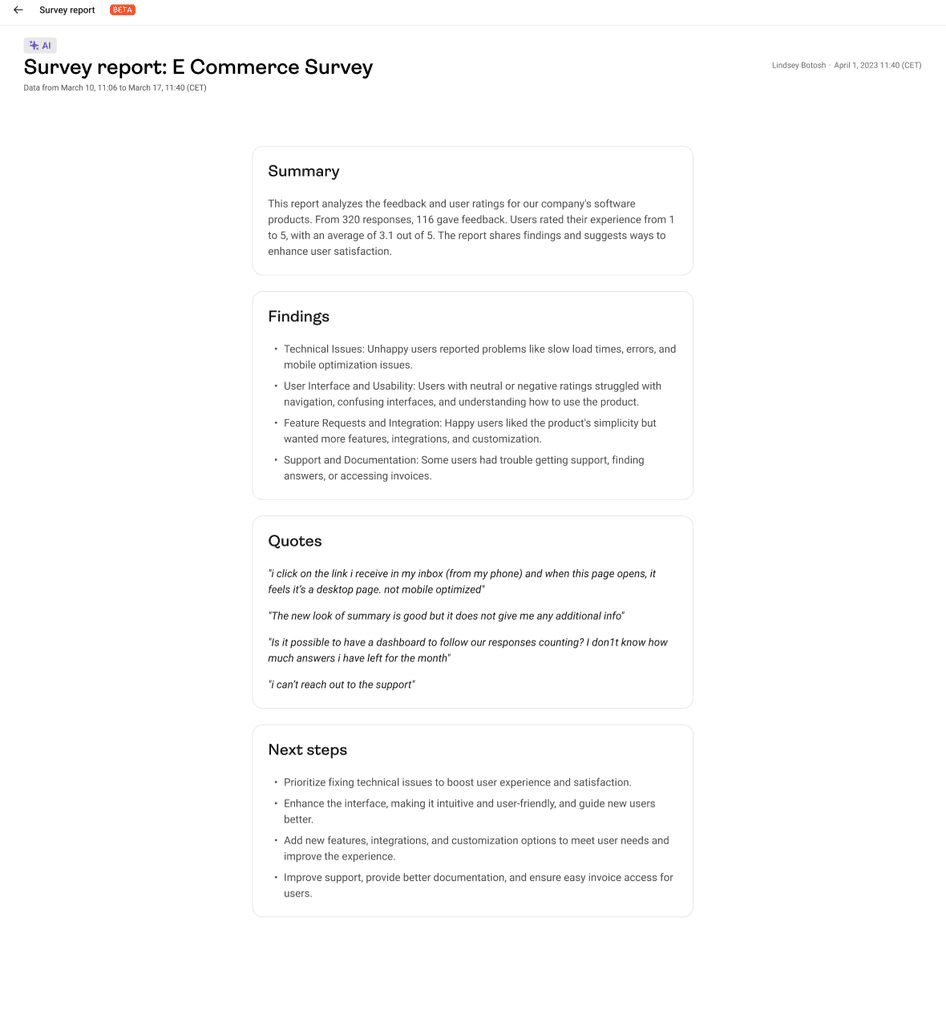

– Surveys

The survey is a quantitative method of research which means it gives you numerical scores. These scores pertain to specific answers and don’t leave much room for multiple interpretations. Because they are precise, provide specific answers, and immediate interpretation, quantitative methods are popular to conduct research when you are looking for exact information: to find out how to solve a particular problem, etc.

According to a study conducted by Statista.com , 26% of all market research is conducted through online quantitative methods, with online surveys accounting for a major share of 79%.

If you know how to create an easy survey online for your company, here is a great resource to get you started.

– Case Studies

Case studies are usually qualitative research methods; however, you can incorporate a mixed approach with a quantitative questionnaire thrown in for additional information. Using case studies, you focus on a single individual or single entity to research them thoroughly. The purpose of using case studies in business market research is usually to test theories of what went wrong in a particular situation or what went right.

Case studies are time-taking but provide extremely valuable information, detailed data, and in-depth analysis opportunities.

– Focus Groups

Focus groups are another popular instrument to conduct market research in business. A focus group consists of a small portion of your target audience that you can study in detail. It is a qualitative method of research and allows you to bring together a group of individuals that can take part in a guided form of discussion.

You can give them one or more focus questions that the group can talk about and share their views on. Focus groups are great to use when you’re creating a new product, researching a particular market segment, or want to know what your customers are thinking about you or your market.

Similar to case studies, focus groups give you a comprehensive view of a situation and allow you to conduct an in-depth analysis of different business elements.

The Future Of Market Research

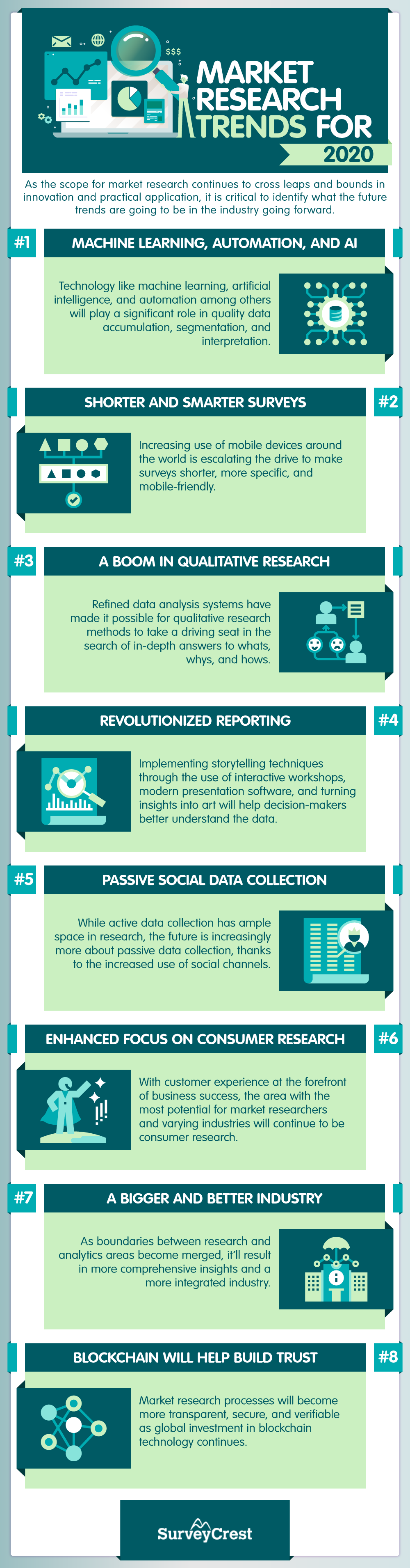

The future of market research is bright. As a budding and burgeoning industry, it shows all the trends of continued growth. But as technology becomes more accessible and mobile devices more popular than desktops, market research is also evolving to fulfill the shifting customer needs.

The surveys are becoming shorter as nobody has got the time or interest to fill out a 10-page questionnaire. Artificial Intelligence is making the data collection process quicker and more intuitive. And as time passes, you’ll see more and more market surveys being optimized for mobile.

So use all that modern market research has to offer you and use it to propel your business for the success you’d always dreamed of.

Embed this Infographic on your site using the html below:

<br /><a href="https://www.surveycrest.com/blog/why-market-research-is-important/"><br /><img src="https://www.surveycrest.com/blog/wp-content/uploads/2020/06/Market-Research-Trends.png" title="[INFOGRAPHIC] Why Is Market Research Important: We Give You 7 Reasons" alt="[INFOGRAPHIC] Why Is Market Research Important: We Give You 7 Reasons" border="0" /><br /></a></p> by <a href="https://www.surveycrest.com/">Surveycrest.com</a><br />

« Re-Imagine Marketing Strategy To Ensure Your Business Thrives Even In The Lockdown

Why mental health surveys are important during the covid-19 pandemic ».

About The Author Kelvin Stiles

Kelvin Stiles is a tech enthusiast and works as a marketing consultant at SurveyCrest – FREE online survey software and publishing tools for academic and business use. He is also an avid blogger and a comic book fanatic.

- How it Works

- Survey Templates

- Terms and Conditions

- Privacy Policy

Copyright © 2024 SurveyCrest.com

Don't have an account? Register Here

Already have an account? Sign in Here

Forgot Password

To reset your password please enter username or email below and press reset button.

OR login using a social network account

- --> Login with Facebook

- Login with Facebook

- --> Sign in with Google

How to Do Market Research: The Complete Guide

Learn how to do market research with this step-by-step guide, complete with templates, tools and real-world examples.

Access best-in-class company data

Get trusted first-party funding data, revenue data and firmographics

What are your customers’ needs? How does your product compare to the competition? What are the emerging trends and opportunities in your industry? If these questions keep you up at night, it’s time to conduct market research.

Market research plays a pivotal role in your ability to stay competitive and relevant, helping you anticipate shifts in consumer behavior and industry dynamics. It involves gathering these insights using a wide range of techniques, from surveys and interviews to data analysis and observational studies.

In this guide, we’ll explore why market research is crucial, the various types of market research, the methods used in data collection, and how to effectively conduct market research to drive informed decision-making and success.

What is market research?

Market research is the systematic process of gathering, analyzing and interpreting information about a specific market or industry. The purpose of market research is to offer valuable insight into the preferences and behaviors of your target audience, and anticipate shifts in market trends and the competitive landscape. This information helps you make data-driven decisions, develop effective strategies for your business, and maximize your chances of long-term growth.

Why is market research important?

By understanding the significance of market research, you can make sure you’re asking the right questions and using the process to your advantage. Some of the benefits of market research include:

- Informed decision-making: Market research provides you with the data and insights you need to make smart decisions for your business. It helps you identify opportunities, assess risks and tailor your strategies to meet the demands of the market. Without market research, decisions are often based on assumptions or guesswork, leading to costly mistakes.

- Customer-centric approach: A cornerstone of market research involves developing a deep understanding of customer needs and preferences. This gives you valuable insights into your target audience, helping you develop products, services and marketing campaigns that resonate with your customers.

- Competitive advantage: By conducting market research, you’ll gain a competitive edge. You’ll be able to identify gaps in the market, analyze competitor strengths and weaknesses, and position your business strategically. This enables you to create unique value propositions, differentiate yourself from competitors, and seize opportunities that others may overlook.

- Risk mitigation: Market research helps you anticipate market shifts and potential challenges. By identifying threats early, you can proactively adjust their strategies to mitigate risks and respond effectively to changing circumstances. This proactive approach is particularly valuable in volatile industries.

- Resource optimization: Conducting market research allows organizations to allocate their time, money and resources more efficiently. It ensures that investments are made in areas with the highest potential return on investment, reducing wasted resources and improving overall business performance.

- Adaptation to market trends: Markets evolve rapidly, driven by technological advancements, cultural shifts and changing consumer attitudes. Market research ensures that you stay ahead of these trends and adapt your offerings accordingly so you can avoid becoming obsolete.

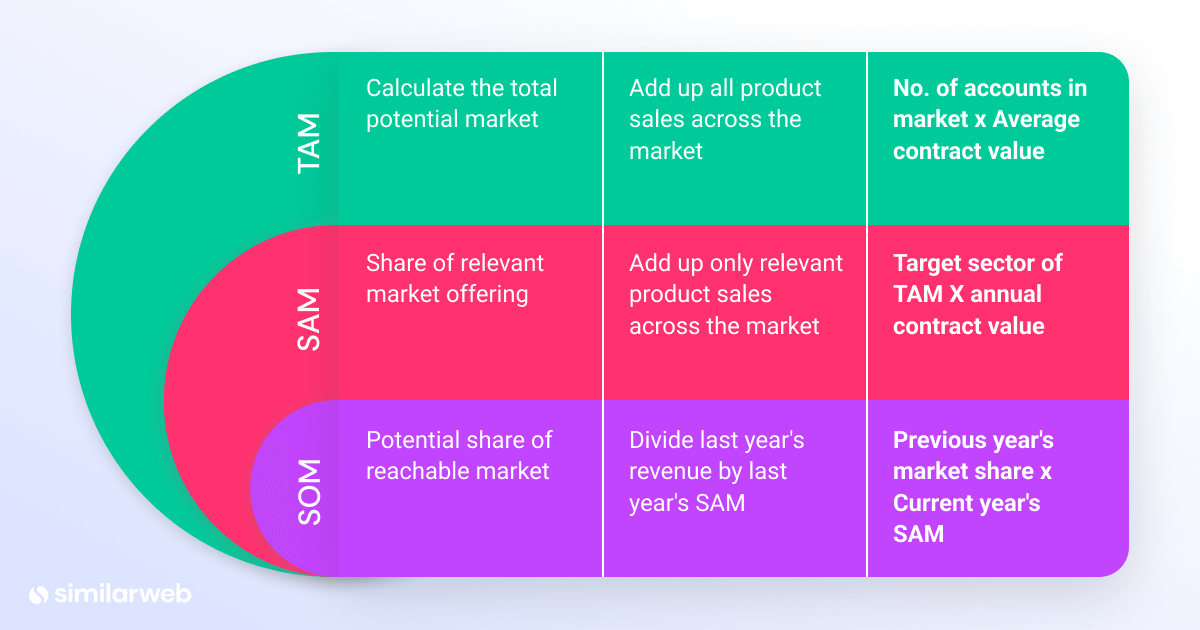

As you can see, market research empowers businesses to make data-driven decisions, cater to customer needs, outperform competitors, mitigate risks, optimize resources and stay agile in a dynamic marketplace. These benefits make it a huge industry; the global market research services market is expected to grow from $76.37 billion in 2021 to $108.57 billion in 2026 . Now, let’s dig into the different types of market research that can help you achieve these benefits.

Types of market research

- Qualitative research

- Quantitative research

- Exploratory research

- Descriptive research

- Causal research

- Cross-sectional research

- Longitudinal research

Despite its advantages, 23% of organizations don’t have a clear market research strategy. Part of developing a strategy involves choosing the right type of market research for your business goals. The most commonly used approaches include:

1. Qualitative research

Qualitative research focuses on understanding the underlying motivations, attitudes and perceptions of individuals or groups. It is typically conducted through techniques like in-depth interviews, focus groups and content analysis — methods we’ll discuss further in the sections below. Qualitative research provides rich, nuanced insights that can inform product development, marketing strategies and brand positioning.

2. Quantitative research

Quantitative research, in contrast to qualitative research, involves the collection and analysis of numerical data, often through surveys, experiments and structured questionnaires. This approach allows for statistical analysis and the measurement of trends, making it suitable for large-scale market studies and hypothesis testing. While it’s worthwhile using a mix of qualitative and quantitative research, most businesses prioritize the latter because it is scientific, measurable and easily replicated across different experiments.

3. Exploratory research

Whether you’re conducting qualitative or quantitative research or a mix of both, exploratory research is often the first step. Its primary goal is to help you understand a market or problem so you can gain insights and identify potential issues or opportunities. This type of market research is less structured and is typically conducted through open-ended interviews, focus groups or secondary data analysis. Exploratory research is valuable when entering new markets or exploring new product ideas.

4. Descriptive research

As its name implies, descriptive research seeks to describe a market, population or phenomenon in detail. It involves collecting and summarizing data to answer questions about audience demographics and behaviors, market size, and current trends. Surveys, observational studies and content analysis are common methods used in descriptive research.

5. Causal research

Causal research aims to establish cause-and-effect relationships between variables. It investigates whether changes in one variable result in changes in another. Experimental designs, A/B testing and regression analysis are common causal research methods. This sheds light on how specific marketing strategies or product changes impact consumer behavior.

6. Cross-sectional research

Cross-sectional market research involves collecting data from a sample of the population at a single point in time. It is used to analyze differences, relationships or trends among various groups within a population. Cross-sectional studies are helpful for market segmentation, identifying target audiences and assessing market trends at a specific moment.

7. Longitudinal research

Longitudinal research, in contrast to cross-sectional research, collects data from the same subjects over an extended period. This allows for the analysis of trends, changes and developments over time. Longitudinal studies are useful for tracking long-term developments in consumer preferences, brand loyalty and market dynamics.

Each type of market research has its strengths and weaknesses, and the method you choose depends on your specific research goals and the depth of understanding you’re aiming to achieve. In the following sections, we’ll delve into primary and secondary research approaches and specific research methods.

Primary vs. secondary market research

Market research of all types can be broadly categorized into two main approaches: primary research and secondary research. By understanding the differences between these approaches, you can better determine the most appropriate research method for your specific goals.

Primary market research

Primary research involves the collection of original data straight from the source. Typically, this involves communicating directly with your target audience — through surveys, interviews, focus groups and more — to gather information. Here are some key attributes of primary market research:

- Customized data: Primary research provides data that is tailored to your research needs. You design a custom research study and gather information specific to your goals.

- Up-to-date insights: Because primary research involves communicating with customers, the data you collect reflects the most current market conditions and consumer behaviors.

- Time-consuming and resource-intensive: Despite its advantages, primary research can be labor-intensive and costly, especially when dealing with large sample sizes or complex study designs. Whether you hire a market research consultant, agency or use an in-house team, primary research studies consume a large amount of resources and time.

Secondary market research

Secondary research, on the other hand, involves analyzing data that has already been compiled by third-party sources, such as online research tools, databases, news sites, industry reports and academic studies.

Here are the main characteristics of secondary market research:

- Cost-effective: Secondary research is generally more cost-effective than primary research since it doesn’t require building a research plan from scratch. You and your team can look at databases, websites and publications on an ongoing basis, without needing to design a custom experiment or hire a consultant.

- Leverages multiple sources: Data tools and software extract data from multiple places across the web, and then consolidate that information within a single platform. This means you’ll get a greater amount of data and a wider scope from secondary research.

- Quick to access: You can access a wide range of information rapidly — often in seconds — if you’re using online research tools and databases. Because of this, you can act on insights sooner, rather than taking the time to develop an experiment.

So, when should you use primary vs. secondary research? In practice, many market research projects incorporate both primary and secondary research to take advantage of the strengths of each approach.

One rule of thumb is to focus on secondary research to obtain background information, market trends or industry benchmarks. It is especially valuable for conducting preliminary research, competitor analysis, or when time and budget constraints are tight. Then, if you still have knowledge gaps or need to answer specific questions unique to your business model, use primary research to create a custom experiment.

Market research methods

- Surveys and questionnaires

- Focus groups

- Observational research

- Online research tools

- Experiments

- Content analysis

- Ethnographic research

How do primary and secondary research approaches translate into specific research methods? Let’s take a look at the different ways you can gather data:

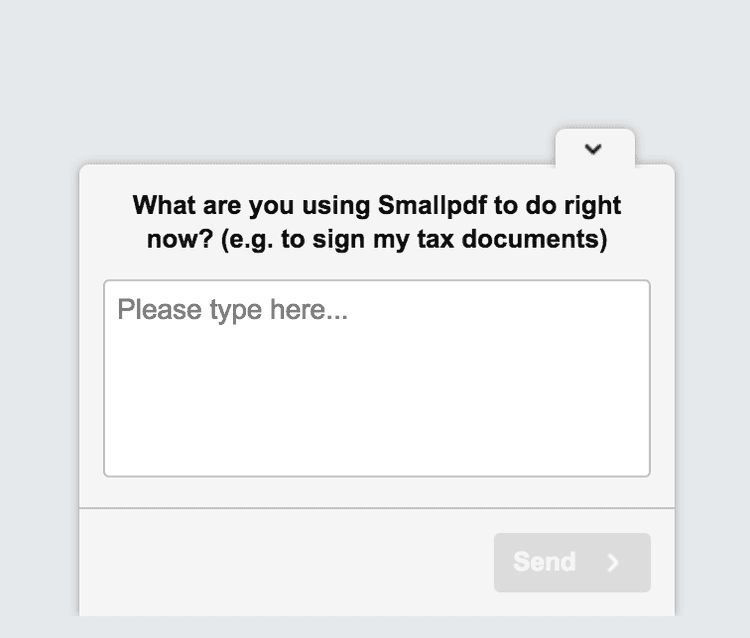

1. Surveys and questionnaires

Surveys and questionnaires are popular methods for collecting structured data from a large number of respondents. They involve a set of predetermined questions that participants answer. Surveys can be conducted through various channels, including online tools, telephone interviews and in-person or online questionnaires. They are useful for gathering quantitative data and assessing customer demographics, opinions, preferences and needs. On average, customer surveys have a 33% response rate , so keep that in mind as you consider your sample size.

2. Interviews

Interviews are in-depth conversations with individuals or groups to gather qualitative insights. They can be structured (with predefined questions) or unstructured (with open-ended discussions). Interviews are valuable for exploring complex topics, uncovering motivations and obtaining detailed feedback.

3. Focus groups

The most common primary research methods are in-depth webcam interviews and focus groups. Focus groups are a small gathering of participants who discuss a specific topic or product under the guidance of a moderator. These discussions are valuable for primary market research because they reveal insights into consumer attitudes, perceptions and emotions. Focus groups are especially useful for idea generation, concept testing and understanding group dynamics within your target audience.

4. Observational research

Observational research involves observing and recording participant behavior in a natural setting. This method is particularly valuable when studying consumer behavior in physical spaces, such as retail stores or public places. In some types of observational research, participants are aware you’re watching them; in other cases, you discreetly watch consumers without their knowledge, as they use your product. Either way, observational research provides firsthand insights into how people interact with products or environments.

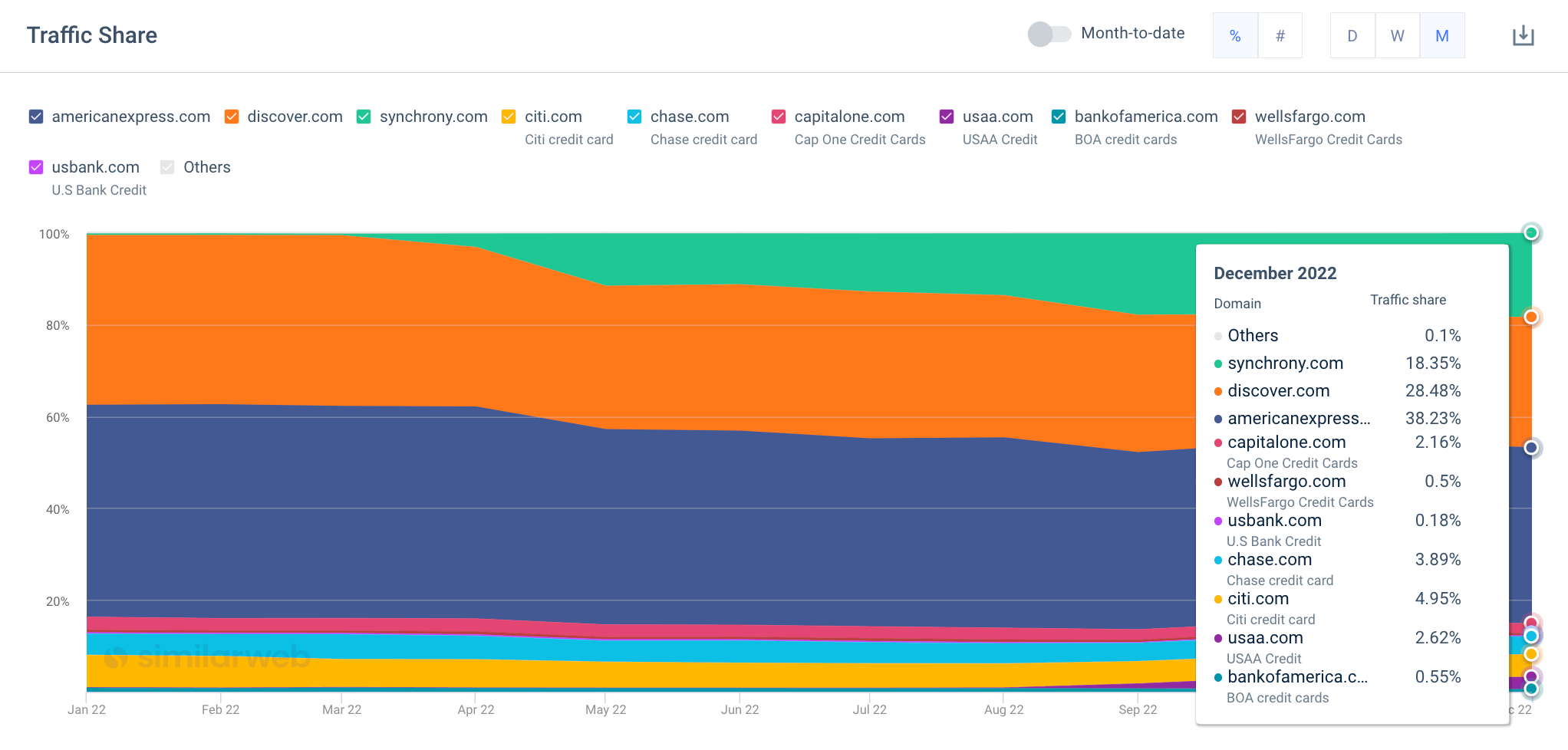

5. Online research tools

You and your team can do your own secondary market research using online tools. These tools include data prospecting platforms and databases, as well as online surveys, social media listening, web analytics and sentiment analysis platforms. They help you gather data from online sources, monitor industry trends, track competitors, understand consumer preferences and keep tabs on online behavior. We’ll talk more about choosing the right market research tools in the sections that follow.

6. Experiments

Market research experiments are controlled tests of variables to determine causal relationships. While experiments are often associated with scientific research, they are also used in market research to assess the impact of specific marketing strategies, product features, or pricing and packaging changes.

7. Content analysis

Content analysis involves the systematic examination of textual, visual or audio content to identify patterns, themes and trends. It’s commonly applied to customer reviews, social media posts and other forms of online content to analyze consumer opinions and sentiments.

8. Ethnographic research

Ethnographic research immerses researchers into the daily lives of consumers to understand their behavior and culture. This method is particularly valuable when studying niche markets or exploring the cultural context of consumer choices.

How to do market research

- Set clear objectives

- Identify your target audience

- Choose your research methods

- Use the right market research tools

- Collect data

- Analyze data

- Interpret your findings

- Identify opportunities and challenges

- Make informed business decisions

- Monitor and adapt

Now that you have gained insights into the various market research methods at your disposal, let’s delve into the practical aspects of how to conduct market research effectively. Here’s a quick step-by-step overview, from defining objectives to monitoring market shifts.

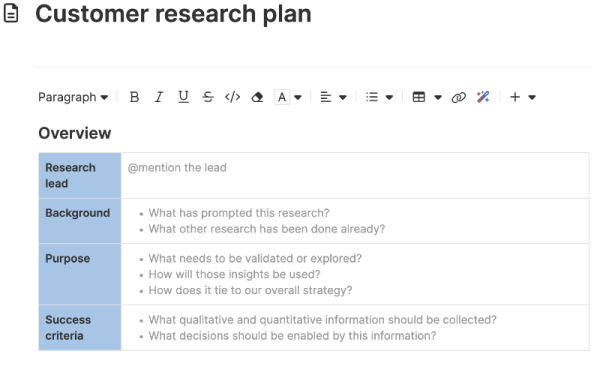

1. Set clear objectives

When you set clear and specific goals, you’re essentially creating a compass to guide your research questions and methodology. Start by precisely defining what you want to achieve. Are you launching a new product and want to understand its viability in the market? Are you evaluating customer satisfaction with a product redesign?

Start by creating SMART goals — objectives that are specific, measurable, achievable, relevant and time-bound. Not only will this clarify your research focus from the outset, but it will also help you track progress and benchmark your success throughout the process.

You should also consult with key stakeholders and team members to ensure alignment on your research objectives before diving into data collecting. This will help you gain diverse perspectives and insights that will shape your research approach.

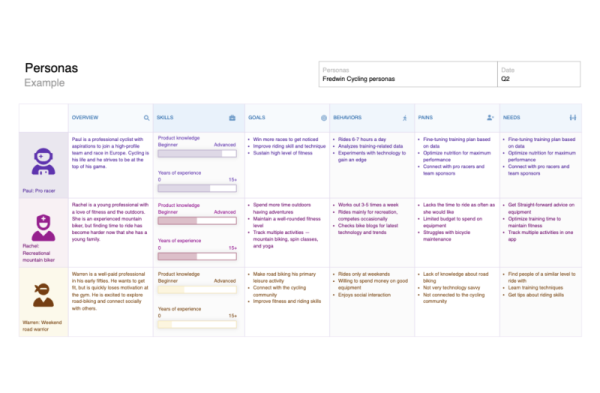

2. Identify your target audience

Next, you’ll need to pinpoint your target audience to determine who should be included in your research. Begin by creating detailed buyer personas or stakeholder profiles. Consider demographic factors like age, gender, income and location, but also delve into psychographics, such as interests, values and pain points.

The more specific your target audience, the more accurate and actionable your research will be. Additionally, segment your audience if your research objectives involve studying different groups, such as current customers and potential leads.

If you already have existing customers, you can also hold conversations with them to better understand your target market. From there, you can refine your buyer personas and tailor your research methods accordingly.

3. Choose your research methods

Selecting the right research methods is crucial for gathering high-quality data. Start by considering the nature of your research objectives. If you’re exploring consumer preferences, surveys and interviews can provide valuable insights. For in-depth understanding, focus groups or observational research might be suitable. Consider using a mix of quantitative and qualitative methods to gain a well-rounded perspective.

You’ll also need to consider your budget. Think about what you can realistically achieve using the time and resources available to you. If you have a fairly generous budget, you may want to try a mix of primary and secondary research approaches. If you’re doing market research for a startup , on the other hand, chances are your budget is somewhat limited. If that’s the case, try addressing your goals with secondary research tools before investing time and effort in a primary research study.

4. Use the right market research tools

Whether you’re conducting primary or secondary research, you’ll need to choose the right tools. These can help you do anything from sending surveys to customers to monitoring trends and analyzing data. Here are some examples of popular market research tools:

- Market research software: Crunchbase is a platform that provides best-in-class company data, making it valuable for market research on growing companies and industries. You can use Crunchbase to access trusted, first-party funding data, revenue data, news and firmographics, enabling you to monitor industry trends and understand customer needs.

- Survey and questionnaire tools: SurveyMonkey is a widely used online survey platform that allows you to create, distribute and analyze surveys. Google Forms is a free tool that lets you create surveys and collect responses through Google Drive.

- Data analysis software: Microsoft Excel and Google Sheets are useful for conducting statistical analyses. SPSS is a powerful statistical analysis software used for data processing, analysis and reporting.

- Social listening tools: Brandwatch is a social listening and analytics platform that helps you monitor social media conversations, track sentiment and analyze trends. Mention is a media monitoring tool that allows you to track mentions of your brand, competitors and keywords across various online sources.

- Data visualization platforms: Tableau is a data visualization tool that helps you create interactive and shareable dashboards and reports. Power BI by Microsoft is a business analytics tool for creating interactive visualizations and reports.

5. Collect data

There’s an infinite amount of data you could be collecting using these tools, so you’ll need to be intentional about going after the data that aligns with your research goals. Implement your chosen research methods, whether it’s distributing surveys, conducting interviews or pulling from secondary research platforms. Pay close attention to data quality and accuracy, and stick to a standardized process to streamline data capture and reduce errors.

6. Analyze data

Once data is collected, you’ll need to analyze it systematically. Use statistical software or analysis tools to identify patterns, trends and correlations. For qualitative data, employ thematic analysis to extract common themes and insights. Visualize your findings with charts, graphs and tables to make complex data more understandable.

If you’re not proficient in data analysis, consider outsourcing or collaborating with a data analyst who can assist in processing and interpreting your data accurately.

7. Interpret your findings

Interpreting your market research findings involves understanding what the data means in the context of your objectives. Are there significant trends that uncover the answers to your initial research questions? Consider the implications of your findings on your business strategy. It’s essential to move beyond raw data and extract actionable insights that inform decision-making.

Hold a cross-functional meeting or workshop with relevant team members to collectively interpret the findings. Different perspectives can lead to more comprehensive insights and innovative solutions.

8. Identify opportunities and challenges

Use your research findings to identify potential growth opportunities and challenges within your market. What segments of your audience are underserved or overlooked? Are there emerging trends you can capitalize on? Conversely, what obstacles or competitors could hinder your progress?

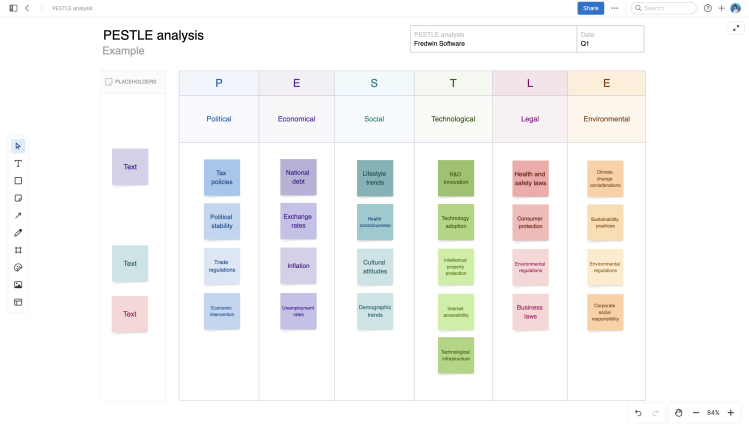

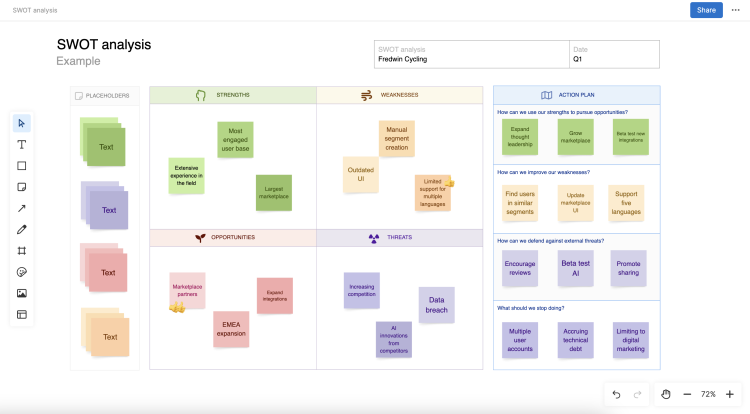

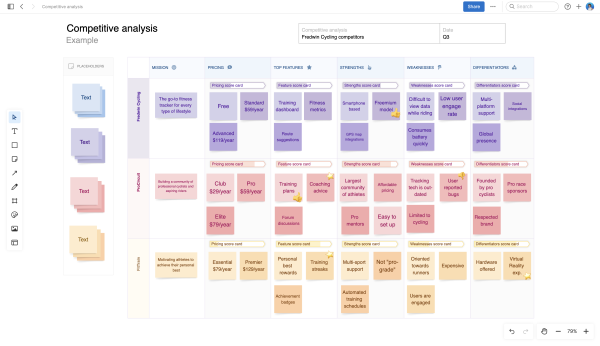

Lay out this information in a clear and organized way by conducting a SWOT analysis, which stands for strengths, weaknesses, opportunities and threats. Jot down notes for each of these areas to provide a structured overview of gaps and hurdles in the market.

9. Make informed business decisions

Market research is only valuable if it leads to informed decisions for your company. Based on your insights, devise actionable strategies and initiatives that align with your research objectives. Whether it’s refining your product, targeting new customer segments or adjusting pricing, ensure your decisions are rooted in the data.

At this point, it’s also crucial to keep your team aligned and accountable. Create an action plan that outlines specific steps, responsibilities and timelines for implementing the recommendations derived from your research.

10. Monitor and adapt

Market research isn’t a one-time activity; it’s an ongoing process. Continuously monitor market conditions, customer behaviors and industry trends. Set up mechanisms to collect real-time data and feedback. As you gather new information, be prepared to adapt your strategies and tactics accordingly. Regularly revisiting your research ensures your business remains agile and reflects changing market dynamics and consumer preferences.

Online market research sources

As you go through the steps above, you’ll want to turn to trusted, reputable sources to gather your data. Here’s a list to get you started:

- Crunchbase: As mentioned above, Crunchbase is an online platform with an extensive dataset, allowing you to access in-depth insights on market trends, consumer behavior and competitive analysis. You can also customize your search options to tailor your research to specific industries, geographic regions or customer personas.

- Academic databases: Academic databases, such as ProQuest and JSTOR , are treasure troves of scholarly research papers, studies and academic journals. They offer in-depth analyses of various subjects, including market trends, consumer preferences and industry-specific insights. Researchers can access a wealth of peer-reviewed publications to gain a deeper understanding of their research topics.

- Government and NGO databases: Government agencies, nongovernmental organizations and other institutions frequently maintain databases containing valuable economic, demographic and industry-related data. These sources offer credible statistics and reports on a wide range of topics, making them essential for market researchers. Examples include the U.S. Census Bureau , the Bureau of Labor Statistics and the Pew Research Center .

- Industry reports: Industry reports and market studies are comprehensive documents prepared by research firms, industry associations and consulting companies. They provide in-depth insights into specific markets, including market size, trends, competitive analysis and consumer behavior. You can find this information by looking at relevant industry association databases; examples include the American Marketing Association and the National Retail Federation .

- Social media and online communities: Social media platforms like LinkedIn or Twitter (X) , forums such as Reddit and Quora , and review platforms such as G2 can provide real-time insights into consumer sentiment, opinions and trends.

Market research examples

At this point, you have market research tools and data sources — but how do you act on the data you gather? Let’s go over some real-world examples that illustrate the practical application of market research across various industries. These examples showcase how market research can lead to smart decision-making and successful business decisions.

Example 1: Apple’s iPhone launch

Apple ’s iconic iPhone launch in 2007 serves as a prime example of market research driving product innovation in tech. Before the iPhone’s release, Apple conducted extensive market research to understand consumer preferences, pain points and unmet needs in the mobile phone industry. This research led to the development of a touchscreen smartphone with a user-friendly interface, addressing consumer demands for a more intuitive and versatile device. The result was a revolutionary product that disrupted the market and redefined the smartphone industry.

Example 2: McDonald’s global expansion

McDonald’s successful global expansion strategy demonstrates the importance of market research when expanding into new territories. Before entering a new market, McDonald’s conducts thorough research to understand local tastes, preferences and cultural nuances. This research informs menu customization, marketing strategies and store design. For instance, in India, McDonald’s offers a menu tailored to local preferences, including vegetarian options. This market-specific approach has enabled McDonald’s to adapt and thrive in diverse global markets.

Example 3: Organic and sustainable farming

The shift toward organic and sustainable farming practices in the food industry is driven by market research that indicates increased consumer demand for healthier and environmentally friendly food options. As a result, food producers and retailers invest in sustainable sourcing and organic product lines — such as with these sustainable seafood startups — to align with this shift in consumer values.

The bottom line? Market research has multiple use cases and is a critical practice for any industry. Whether it’s launching groundbreaking products, entering new markets or responding to changing consumer preferences, you can use market research to shape successful strategies and outcomes.

Market research templates

You finally have a strong understanding of how to do market research and apply it in the real world. Before we wrap up, here are some market research templates that you can use as a starting point for your projects:

- Smartsheet competitive analysis templates : These spreadsheets can serve as a framework for gathering information about the competitive landscape and obtaining valuable lessons to apply to your business strategy.

- SurveyMonkey product survey template : Customize the questions on this survey based on what you want to learn from your target customers.

- HubSpot templates : HubSpot offers a wide range of free templates you can use for market research, business planning and more.

- SCORE templates : SCORE is a nonprofit organization that provides templates for business plans, market analysis and financial projections.

- SBA.gov : The U.S. Small Business Administration offers templates for every aspect of your business, including market research, and is particularly valuable for new startups.

Strengthen your business with market research

When conducted effectively, market research is like a guiding star. Equipped with the right tools and techniques, you can uncover valuable insights, stay competitive, foster innovation and navigate the complexities of your industry.

Throughout this guide, we’ve discussed the definition of market research, different research methods, and how to conduct it effectively. We’ve also explored various types of market research and shared practical insights and templates for getting started.

Now, it’s time to start the research process. Trust in data, listen to the market and make informed decisions that guide your company toward lasting success.

Related Articles

- Entrepreneurs

- 15 min read

What Is Competitive Analysis and How to Do It Effectively

Rebecca Strehlow, Copywriter at Crunchbase

17 Best Sales Intelligence Tools for 2024

- Market research

- 10 min read

How to Do Market Research for a Startup: Tips for Success

Jaclyn Robinson, Senior Manager of Content Marketing at Crunchbase

Search less. Close more.

Grow your revenue with Crunchbase, the all-in-one prospecting solution. Start your free trial.

Quick links

- Case Studies

- White Papers

Send Inquiry

Market Research Definition, Types, Tools and Benefits

Published on Jul 01, 2022

More than doubling in size from 2008 to 2021, the market research sector brought in over $76.4 (Statista) billion worldwide in 2021.

What is Market Research?

Market research is the process of gathering, analyzing, and interpreting information about a market, about the product or service to be offered for sale in that market. It is also about the previous, current, and potential customers for the product or service.

Data collection, analysis, and interpretation are the three main steps in any successful market research project. The data could pertain to a certain demographic, general consumers, rival businesses, or the entire market. This is the cornerstone of any thriving business. The findings can be used for anything from discovering a fresh opportunity to entering the market to developing an entirely new product or service.

Small business owners can benefit greatly from conducting market research. It can eliminate uncertainty in the creative process and direct energy and funding toward the most promising ideas and initiatives. Many types of market research are conducted by businesses at many different stages.

Market Research for Businesses

Accurate and comprehensive data gives a plethora of information on potential and existing customers, competitors, and the industry as a whole, making it the bedrock of any successful commercial endeavor. It helps entrepreneurs weigh the odds of success before sinking a lot of money into a new firm.

.jpg)

An essential aspect of every successful business plan is conducting market research to gather data that can be used to address potential marketing obstacles. In reality, it is not viable to develop tactics like market segmentation (identifying distinct groups within a market) and product differentiation (establishing a unique selling proposition for a product or service that distinguishes it from the competition) without conducting market research.

Types of Market Research

1. quantitative research .

The results of quantitative studies are typically presented using numerical and graphic representations. It's the gold standard for verifying or disproving hypotheses. It is possible to establish broad, overarching truths about a subject by conducting this kind of study. Experiments, numerically recorded observations, and surveys with a limited number of predetermined answer choices are all examples of common quantitative approaches.

2. Qualitative research

Words are the currency of qualitative inquiry. It's a tool for making sense of things like ideas and experiences. Using this method, you can learn more about a topic from every angle, which is very useful for researching controversial or poorly understood subjects. Open-ended interviews, written descriptions of observations, and in-depth analyses of the existing literature are all examples of common qualitative techniques.

Qualitative vs. Quantitative Research

Quantitative research focuses on numerical and statistical facts, while qualitative research examines concepts and interpretations. Both are necessary to learn various things. Comparatively, qualitative research draws its conclusions from interviews and documents rather than statistics and reasoning. Quantitative studies typically report their findings numerically or graphically, while qualitative studies report their findings verbally.

3. Primary Research

Primary data refers to a study that seeks to collect firsthand information from real-world participants. Primary research is data collected by the researcher themselves through various techniques of approaching the target audience directly. You have full legal and ethical rights to the data set you to create. Primary research can be challenging due to the time, money, resources, and familiarity with the topic that it demands.

4. Secondary Research

Secondary research is a study that is done after primary research has already been conducted, and it consists of analyzing, interpreting, and summarizing the results of the primary research. A more precise definition of secondary research would be any study that makes use of publicly available data. When conducting secondary research, scholars refer to information that has already been gathered, processed, and made public (and therefore, you do not own this data). Since the accessible data has already been evaluated and interpreted, the researcher just needs to determine the data he wants to use, i.e., the data that is necessary for his project.

Primary Research vs. Secondary Research

Research that involves the collection of new information, or "primary" research, is distinguished from secondary research by the fact that it is conducted for the first time on a particular topic. Instead, secondary research makes use of information that has previously been gathered through primary research. The fundamental dividing line between primary and secondary research is whether the research has been done before.

5. Market Research

Market research on branding can help a business develop, launch, and sustain its brand. This may involve the firm's ethos, branding, visuals, ideals, or very name. Interviews, focus groups, and surveys are all viable options for conducting research.

6. Customer Research

Market research on customers is learning what factors most strongly affect your demographic of interest and what adjustments may be made to better attract and retain them as paying customers. The objective of this study is to acquire an intimate understanding of your consumer base and their habits and preferences as they relate to your business.

7. Competitor Research

Conducting market research on your competitors entails learning about their businesses and assessing how they stack up against your own. Your competitive product in the market or how to break into a new market could also be a topic of discussion. The study's overarching goal is to help your company prepare for the future by identifying methods to set itself apart from competitors and by learning from customers' opinions and suggestions.

8. Product Research

Conducting market research on your items is essential to ensuring they will sell successfully once they hit the shelves. Finding out how people feel about your product and if they feel it's valuable and functioning properly is the goal of this study. The ability to think creatively about enhancements and new features is another benefit.

Benefits of Market Research

According to a survey, the market research business is expected to increase at a rate of 12-14% (The Economic Times) per year through FY26, at which point it would have surpassed the $4 billion mark.

The following is a list of the most important reasons and benefits of marketing research:

It's a great tool for boosting companies' standing. The ability to think critically and act on that thinking is the key to success. You can keep your business one step ahead of the competition by conducting market research to expand your knowledge of your market or target audience.

Reduces the potential for loss on an investment. This is a basic point to think about, but it is often crucial to the success of a firm. When starting a firm, it makes sense to spend what amounts to a negligible amount on research and testing the market, product, concept, or idea.

Possible dangers and benefits are highlighted. Insurance against these two glaring pitfalls lies in both primary research (fieldwork) and secondary research (desk research). Opportunities or red flags may be uncovered through the combination of this with qualitative research for further investigation.

You can learn more about the advantages and disadvantages of your own business and of your competitors. To achieve entirely objective reporting, it is generally recommended to collaborate with a market research agency. Take advantage of what you've learned from study to improve in areas where you're weak and to gain an edge over the competition.

Strategic preparation is helped by this. Where do you stand with the core principles of your company plan? If it's supported by data, and you've put in the time and effort to do your own (hopefully continuous) research, you can rest assured that you're giving yourself the best chance of success in your commercial endeavors.

This aids in the identification of developing tendencies. Being the first, the best, or coming up with the idea that nobody else has is typically what it takes to stay ahead in business. Taking the pulse of your industry on a regular basis is an important habit. You can learn more about the tools available to you to identify and capitalize on these trends by consulting with a research firm or expert.

Helpful for firms in keeping up with the competition. Being the best calls for an insatiable need for knowledge and a propensity to experiment. The key to success, and the ability to maintain that success, is knowing how to effectively apply the information gleaned from market research, audience research, and data research.

It includes forecasts for future income. One of the most important parts of any market study is a forecast, which looks into the future and predicts the size, makeup, and trends of the market you're interested in. This allows for the categorization of prospective clients. You should prioritize the market that is the best fit for your business rather than the largest or fastest-growing.

It's geared toward meeting the wants and desires of its patrons. Many things in business, including research, benefit from keeping clients front and center. By reaching out to individuals through online panels, web forums, telephone surveys, in-depth interviews, and focus groups, market researchers can learn where their business's ideas, services, and products can be strengthened.

Using this method, one can measure the progress of one's company against predetermined standards. Utilize data gathered from the market to study the competition, gauge employee enthusiasm, identify knowledge or skill shortages, and identify development opportunities. This will allow you to consider novel approaches, ideas, and resources for boosting your company's efficiency.

Market Research Tools

In order to better understand your market and target audience, you need to use market research techniques. It's fundamental to every company's success, and in today's more crowded marketplace, a thorough familiarity with your target market is more important than ever. Good news: you don't have to be an "insights genius" to get started collecting the data you need, owing to the proliferation of market research tools. Some of the best and most widely used methods of market research include:

- Answer the Public

- Attest

- Google Trends

- Social Mention

- Remesh

- Heartbeat Ai

- Think With Google

- Spyfu

- Latana

- BuzzSumo

- Statista

- Typeform

- Otter.ai

- Dimensions.ai

How to Conduct Research for Your Business: Market Research Strategies

Despite their different objectives, market research and marketing research should use the same framework for gathering and analyzing information about your company's target audiences. These help in primary research as well as secondary research.

Clearly identify the problem at stake. Establish an initial research topic. Having a clear research question in mind will allow you to better organize your findings.

Start by figuring out your financial and time constraints. How much money do you have to put into your study? When do you anticipate finishing data collection? Research, like any other tactic for expanding your company, should be carried out within your means. Nonetheless, it may be worthwhile to spend more money to receive the most comprehensive results available, especially if the questions you are answering are time-sensitive.

Planning your approach and requirements. Find out what information needs to be gathered and figure out how to get it. Observation, surveys, phone calls, and focus groups are among the alternatives. Consult a professional research agency if you are unsure of how to organize your data collection.

Pick a way to sample the data. I need to know how you plan on picking people to take part in your study. You may require a cross-section of the consumer population at large, a subset of the population who share a particular characteristic of their way of life, or just the opinions of those who are already familiar with your brand. Develop a plan for tracking down and contacting the persons who will take part in your research.

Prepare a data analysis strategy. Think about the methods you'll use to examine the data. Do you require numbers for statistical analysis, or can you get a sense of things from qualitative, observable data? Spend some time learning about the many types of analysis so you can pick the one that will yield the most useful results for your study.

Gathering information. The next step is data collection, which may begin once you have settled on a research question and developed a strategy for answering it within the bounds of your time and money. Research is often outsourced to professional firms or consultants by many corporations.

Examining the information. It is important to apply certain methods of analysis to make sense of your data, no matter how simple it may appear at first. Which analytical techniques you employ are most suited to your data is a function of the information you've gathered. Also, this is the time to double-check for any mistakes that might have crept into your data gathering, analysis, or sampling.

Make the report you need. Concluding your research with a written report is the next to last stage. From formulating a problem statement to discussing the findings of your data study, your report should include it all.

Why is Market Research Important?

Over 44,000 businesses across the United States provide some form of market research. Their total annual income is around $23 billion (QuestionPro).

The importance of Market Research is the following -

1. Identifies new products or services

By conducting market research, a business can learn what consumers want and how to best meet their demands. Identifying the major challenges associated with creating a product or service can help you save money. It's useful for figuring out what customers value most and how to implement that into your product or service offering.

2. Identifies potential customers

You may learn more about your clientele by analyzing demographic information like their gender, age, income, occupation, and interests. You'll have a better idea of who to target with your future advertising efforts if you have a clear picture of your current clientele. When a product is marketed to the wrong demographic, sales suffer.

3. Establishes viability of a product or service

If your organization is considering introducing a novel product or service to consumers, you should find out if there is a need for it. Do people need this product? Do the people you plan to sell to actually want this product? Does it have any chance of succeeding, and does it even have a chance of being a viable trend?

4. Anticipates and discovers future market trends

If you are familiar with your market and the tendencies that are just beginning to emerge, you will be better prepared to build tactics to combat any negative tendencies that may threaten your company. As a result, you can use rising tendencies to your advantage and propel your company forward.

5. Keeps your company ahead of competitors

Examining your company's performance in relation to that of its rivals is a prime use for comparative research. If they're much ahead of you, it's a fantastic chance to figure out what you're doing wrong. It is possible to devise business plans that will help you surpass the competition.

6. Decide the best marketing strategy

Conducting research is helpful for pinpointing the optimal distribution platform for reaching your target audience. If you find out that a large portion of your audience prefers one form of communication over another, it makes sense to concentrate your efforts there. Because of the scarcity of these resources, it only makes sense to direct them toward endeavors with a high probability of success.

7. Reduces risk and increases profitability

The ability to assess the value of potential risks in light of past performance and anticipated future market behavior is a crucial business skill. The success or failure of a business idea depends heavily on the results of market research. Understanding your consumers and their habits is another crucial step in risk reduction. Taking less risk leads to greater financial rewards.

8. Identifies threats and opportunities

The SWOT analysis is likely familiar to many of you. The acronym SWOT refers to a company's "strengths," "weaknesses," and "All four of them can be figured out with the use of market research . While a lot of data can be collected through market research, not all of it needs to be used. Use only information that is directly related to your major objective (which you will have established in advance).

9. Helps to understand existing customers

By conducting market research, you can learn more about your current clientele. Because of this complexity, you can't assume that you know what your clients require. If you want to be successful, you need to take the temperature of your clientele on a frequent basis. Satisfaction levels among customers can also be measured with the help of surveys. You can find out what is bothering them and make adjustments if necessary. If they are already rather high, you can examine the factors that led to this success and implement changes to maintain it.

10. Assists in realistic goal setting

Goals that are more realistic can be established with the support of up-to-the-minute information on your market and customer base. Knowing what to expect and how to realistically expand growth over time is greatly aided by establishing a growth pattern throughout time. Setting objectives that are too lofty will cause you to waste time and energy trying to achieve something that is impossible.

.jpg)

How Efficient is Market Research?

You should only invest time, energy, and money into market research if you expect to see a favorable return on that investment. Because it is so worthwhile, market research continues to play a significant role in the success of any organization. Market research won't ensure your company's success on its own, but it will arm you with the data you need to make the moves that will.

Many of the advantages of this type of study were examined, but the drawbacks were also taken into account. If you don't conduct market research, you run the danger of losing clients to the competition, missing out on growth prospects, being more susceptible to hazards, making bad business decisions, and more. Some companies succeed without first doing their homework, but those situations are unusual. To build your firm and avoid typical errors, conduct market research.

Market Research Methods

Although there are a variety of approaches to conducting market research, the majority of companies opt to utilize one of the following five fundamental approaches: surveys, focus groups, personal interviews, observation, and field trials. Which strategies you decide to implement for your company will depend on the kinds of data you require as well as the amount of money you are ready to pay. Some of the major methods of market research are following -

1. Surveys

Surveys ask participants questions. They can use numerous survey methods. Surveys are a cost-effective technique to collect data for the study. Written surveys may encourage truthful responses since participants feel like they're speaking privately.

2. Discussions

Focus groups are moderated discussions. Companies assemble consumers to conduct focus groups, pose questions, and record replies. Participants' replies may reveal what consumers want in a firm or a product because they represent a broad group. Focus groups offer longer participant interaction than surveys.

3. Interviews

An interview combines focus group and one-on-one survey aspects. It includes recording one participant's comments at a time. Open-ended questions elicit in-depth answers from the interviewee. Researchers can ask follow-up questions and let interviewees ask their own.

4. Social media listening

Social media users routinely discuss corporations and their products. Researchers can search for discussion topics and measure consumer sentiment through social media listening.

5. Observations

Observation in market research means studying how consumers shop. Filming shoppers in a store and studying their shopping habits is common. This strategy can reveal their natural selves if they are ignorant of the observation.

6. Experiments

In a field trial, a corporation lets participants use a product under typical conditions and collects data. Participants' feedback was used to improve the product.

7. Competitive analysis

Competitive analysis is a secondary market research process where companies acquire and analyze competition information. It entails identifying primary and secondary rivals and analyzing their offerings, revenues, and marketing methods.

8. Statistics

Public data entails seeking and evaluating public market data. This research is often free online or in libraries. Research centers, polls, or government databases may provide this information. Public data is often used to confirm or compare primary market research.

9. Purchased data

Companies without the time or resources to perform their own market research can buy it. Several market research companies sell database subscriptions. Small and medium-sized businesses that can't afford primary market research may benefit from this approach.

10. Analysis of sales data

Competition analysis is just one way that may be used in tandem with sales data analysis to show how different business tactics affect revenue. It can also reveal consumers' buying behavior and consumer trends.

Functions of Marketing Research

The following are the main functions of Marketing Research -

Description: Marketing research details customers. Age, sex, education, income, etc., are listed. It describes the market and competitors. This description helps marketing decision-makers and problem-solvers.

Evaluation: Marketing research evaluates firm performance. It evaluates production and marketing policies. It measures customer reactions to product quality, price, packaging, advertising, sales, and promotions. If consumers dislike the company's policies, they must alter them. It contrasts company and rival policies.

Explanation: Marketing research answers all marketing questions. It explains why sales are declining, why retailers are unhappy, etc. It explains the problem's causes. It gives a solution.

Prediction: Marketing research forecasts. Predictions are future forecasts. It predicts sales, market prospects, dangers, marketing environment, customer behavior, etc. All predictions may be wrong. Predictions help the organization create plans and policies. It helps seize possibilities. It prevents future hazards.

Decision Making: Marketing research aids decision-makers. It gives decision-making data. Decision-making involves choosing between options. Decision-making requires accurate data. MR helps the marketer decide. It gives decision-making data. It offers alternatives. It compares each option's pros and cons. It helps marketing managers choose the right action.

Conclusion

The world's markets are changing at a dizzying rate, making it more important than ever for companies to adapt quickly enough to be competitive. One method is to conduct market research. The results of your market research and analysis will provide you with a thorough understanding of your target audience's wants and needs, as well as your competitors' strengths and weaknesses.

The key to making your business successful in the face of intense competition is identifying and fixing your deficiencies. The right market research tools will aid you in doing just that! The time to begin expanding your company is now.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in Market research services , SG Analytics enables organizations to achieve actionable insights into products, technology, customers, competition, and the marketplace to make insight-driven decisions. Contact us today if you are an enterprise looking to make critical data-driven decisions to prompt accelerated growth and breakthrough performance.

Our Services

Investment Insights

Market Research

Data Analytics

ESG Services

Data Solutions

ESG Data Services

Technology Services

Investment Banking

Private Equity/VC

ESG Data and Research

Marketing Analytics

Advanced Analytics

Customer Analytics

Hedge Fund Services

Market Intelligence

Equity Research

Recent Blogs

Data-Driven Decision-Making: The Key to Thriving in the Digital Age

Navigating the Roadblocks: The Path Ahead for Robotaxis

Rent Rolls to Red Flags: Regional Banks Face Growing Risks with Multifamily Loans

Unlocking the Power of Unstructured Data with AI

How Long Does It Take for Rate Cuts by The Fed to Percolate to The Economy?

Future Trends and Technological Advances in Vaccine Treatment and Disease Prevention

Emergence of Novel Immune - Mediated Therapies

2024 Trends to Watch -TV & Video Technology

US OTT (SVOD) - The New Frontier

SGA Knowledge Team

We are a dynamic team of subject matter experts who create informative, relevant and...

BRAND NEW Two-Day LIVE Summit with 20+ Ecommerce Trailblazers.

- Skip to primary navigation

- Skip to main content

A magazine for young entrepreneurs

The best advice in entrepreneurship

Subscribe for exclusive access, the complete guide to market research: what it is, why you need it, and how to do it.

Written by Mary Kate Miller | June 1, 2021

Comments -->

Get real-time frameworks, tools, and inspiration to start and build your business. Subscribe here

Market research is a cornerstone of all successful, strategic businesses. It can also be daunting for entrepreneurs looking to launch a startup or start a side hustle . What is market research, anyway? And how do you…do it?

We’ll walk you through absolutely everything you need to know about the market research process so that by the end of this guide, you’ll be an expert in market research too. And what’s more important: you’ll have actionable steps you can take to start collecting your own market research.

What Is Market Research?

Market research is the organized process of gathering information about your target customers and market. Market research can help you better understand customer behavior and competitor strengths and weaknesses, as well as provide insight for the best strategies in launching new businesses and products. There are different ways to approach market research, including primary and secondary research and qualitative and quantitative research. The strongest approaches will include a combination of all four.

“Virtually every business can benefit from conducting some market research,” says Niles Koenigsberg of Real FiG Advertising + Marketing . “Market research can help you piece together your [business’s] strengths and weaknesses, along with your prospective opportunities, so that you can understand where your unique differentiators may lie.” Well-honed market research will help your brand stand out from the competition and help you see what you need to do to lead the market. It can also do so much more.

The Purposes of Market Research

Why do market research? It can help you…

- Pinpoint your target market, create buyer personas, and develop a more holistic understanding of your customer base and market.

- Understand current market conditions to evaluate risks and anticipate how your product or service will perform.

- Validate a concept prior to launch.

- Identify gaps in the market that your competitors have created or overlooked.

- Solve problems that have been left unresolved by the existing product/brand offerings.

- Identify opportunities and solutions for new products or services.

- Develop killer marketing strategies .

What Are the Benefits of Market Research?

Strong market research can help your business in many ways. It can…

- Strengthen your market position.

- Help you identify your strengths and weaknesses.

- Help you identify your competitors’ strengths and weaknesses.

- Minimize risk.

- Center your customers’ experience from the get-go.

- Help you create a dynamic strategy based on market conditions and customer needs/demands.

What Are the Basic Methods of Market Research?

The basic methods of market research include surveys, personal interviews, customer observation, and the review of secondary research. In addition to these basic methods, a forward-thinking market research approach incorporates data from the digital landscape like social media analysis, SEO research, gathering feedback via forums, and more. Throughout this guide, we will cover each of the methods commonly used in market research to give you a comprehensive overview.

Primary vs. Secondary Market Research

Primary and secondary are the two main types of market research you can do. The latter relies on research conducted by others. Primary research, on the other hand, refers to the fact-finding efforts you conduct on your own.

This approach is limited, however. It’s likely that the research objectives of these secondary data points differ from your own, and it can be difficult to confirm the veracity of their findings.

Primary Market Research

Primary research is more labor intensive, but it generally yields data that is exponentially more actionable. It can be conducted through interviews, surveys, online research, and your own data collection. Every new business should engage in primary market research prior to launch. It will help you validate that your idea has traction, and it will give you the information you need to help minimize financial risk.

You can hire an agency to conduct this research on your behalf. This brings the benefit of expertise, as you’ll likely work with a market research analyst. The downside is that hiring an agency can be expensive—too expensive for many burgeoning entrepreneurs. That brings us to the second approach. You can also do the market research yourself, which substantially reduces the financial burden of starting a new business .

Secondary Market Research

Secondary research includes resources like government databases and industry-specific data and publications. It can be beneficial to start your market research with secondary sources because it’s widely available and often free-to-access. This information will help you gain a broad overview of the market conditions for your new business.

Identify Your Goals and Your Audience

Before you begin conducting interviews or sending out surveys, you need to set your market research goals. At the end of your market research process, you want to have a clear idea of who your target market is—including demographic information like age, gender, and where they live—but you also want to start with a rough idea of who your audience might be and what you’re trying to achieve with market research.

You can pinpoint your objectives by asking yourself a series of guiding questions:

- What are you hoping to discover through your research?

- Who are you hoping to serve better because of your findings?

- What do you think your market is?

- Who are your competitors?