- Skip to main content

- Skip to main navigation

- Skip to search

- Skip to talk navigation

Advertisement

Mumsnet has not checked the qualifications of anyone posting here. If you have any legal concerns we suggest you consult a solicitor.

Legal matters

Assignment & agreement form.

Greybrows · 01/03/2014 14:07

My parked car was written off by a drunk driver. I have been paid by my insurance company and told the other party was insured. This morning their insurance company have sent me some forms to sign as they say the other party was in breach of their terms and therefore not insured. It's called an assignmenment and agreement form and is asking me to transfer my right of recovery to them. They say that unless I sign they will not settle the claim unless I obtain a court judgement. Another form is about my hire car asking if I could have managed with a cheaper one or used public transport. I took the car offered which was in a similar category to my own, as decreed by my own insurance - technically I could have managed with a cheaper one. Is all this ok, should i sign the form? Also if I agree I could have managed with a cheaper hire car could I end up with a bill for the price difference? Thanks anyone who can advise.

If you have legal expenses on your car insurance, appoint a solicitor through that so they can deal with it on your behalf.

Assignment and agreement is fine. Basically the insurers are liable under the RTA to pay any unsatisfied judgement. This form allows them to get their money back from their policyholder after they have paid you. I would tell them that you had a comparable hire car-which you needed due to kids work whatever,

Thanks for replying. I rang my insurer today and they confirmed it was ok. It just seemed a bit odd that the other party's insurer was contacting me directly. The young kid that hit our cars is going to get a big bill as well as a ban. Silly boy!

To comment on this thread you need to create a Mumsnet account.

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Legal Templates

Home Business Assignment Agreement

Assignment Agreement Template

Use our assignment agreement to transfer contractual obligations.

Updated February 1, 2024 Reviewed by Brooke Davis

An assignment agreement is a legal document that transfers rights, responsibilities, and benefits from one party (the “assignor”) to another (the “assignee”). You can use it to reassign debt, real estate, intellectual property, leases, insurance policies, and government contracts.

What Is an Assignment Agreement?

What to include in an assignment agreement, how to assign a contract, how to write an assignment agreement, assignment agreement sample.

Partnership Interest

An assignment agreement effectively transfers the rights and obligations of a person or entity under an initial contract to another. The original party is the assignor, and the assignee takes on the contract’s duties and benefits.

It’s often a requirement to let the other party in the original deal know the contract is being transferred. It’s essential to create this form thoughtfully, as a poorly written assignment agreement may leave the assignor obligated to certain aspects of the deal.

The most common use of an assignment agreement occurs when the assignor no longer can or wants to continue with a contract. Instead of leaving the initial party or breaking the agreement, the assignor can transfer the contract to another individual or entity.

For example, imagine a small residential trash collection service plans to close its operations. Before it closes, the business brokers a deal to send its accounts to a curbside pickup company providing similar services. After notifying account holders, the latter company continues the service while receiving payment.

Create a thorough assignment agreement by including the following information:

- Effective Date: The document must indicate when the transfer of rights and obligations occurs.

- Parties: Include the full name and address of the assignor, assignee, and obligor (if required).

- Assignment: Provide details that identify the original contract being assigned.

- Third-Party Approval: If the initial contract requires the approval of the obligor, note the date the approval was received.

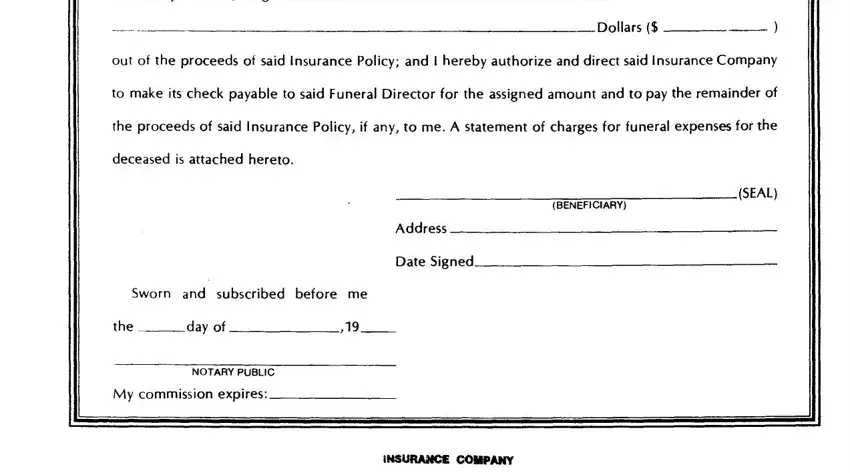

- Signatures: Both parties must sign and date the printed assignment contract template once completed. If a notary is required, wait until you are in the presence of the official and present identification before signing. Failure to do so may result in having to redo the assignment contract.

Review the Contract Terms

Carefully review the terms of the existing contract. Some contracts may have specific provisions regarding assignment. Check for any restrictions or requirements related to assigning the contract.

Check for Anti-Assignment Clauses

Some contracts include anti-assignment clauses that prohibit or restrict the ability to assign the contract without the consent of the other party. If there’s such a clause, you may need the consent of the original parties to proceed.

Determine Assignability

Ensure that the contract is assignable. Some contracts, especially those involving personal services or unique skills, may not be assignable without the other party’s agreement.

Get Consent from the Other Party (if Required)

If the contract includes an anti-assignment clause or requires consent for assignment, seek written consent from the other party. This can often be done through a formal amendment to the contract.

Prepare an Assignment Agreement

Draft an assignment agreement that clearly outlines the transfer of rights and obligations from the assignor (the party assigning the contract) to the assignee (the party receiving the assignment). Include details such as the names of the parties, the effective date of the assignment, and the specific rights and obligations being transferred.

Include Original Contract Information

Attach a copy of the original contract or reference its key terms in the assignment agreement. This helps in clearly identifying the contract being assigned.

Execution of the Assignment Agreement

Both the assignor and assignee should sign the assignment agreement. Signatures should be notarized if required by the contract or local laws.

Notice to the Other Party

Provide notice of the assignment to the non-assigning party. This can be done formally through a letter or as specified in the contract.

File the Assignment

File the assignment agreement with the appropriate parties or entities as required. This may include filing with the original contracting party or relevant government authorities.

Communicate with Third Parties

Inform any relevant third parties, such as suppliers, customers, or service providers, about the assignment to ensure a smooth transition.

Keep Copies for Records

Keep copies of the assignment agreement, original contract, and any related communications for your records.

Here’s a list of steps on how to write an assignment agreement:

Step 1 – List the Assignor’s and Assignee’s Details

List all of the pertinent information regarding the parties involved in the transfer. This information includes their full names, addresses, phone numbers, and other relevant contact information.

This step clarifies who’s transferring the initial contract and who will take on its responsibilities.

Step 2 – Provide Original Contract Information

Describing and identifying the contract that is effectively being reassigned is essential. This step avoids any confusion after the transfer has been completed.

Step 3 – State the Consideration

Provide accurate information regarding the amount the assignee pays to assume the contract. This figure should include taxes and any relevant peripheral expenses. If the assignee will pay the consideration over a period, indicate the method and installments.

Step 4 – Provide Any Terms and Conditions

The terms and conditions of any agreement are crucial to a smooth transaction. You must cover issues such as dispute resolution, governing law, obligor approval, and any relevant clauses.

Step 5 – Obtain Signatures

Both parties must sign the agreement to ensure it is legally binding and that they have read and understood the contract. If a notary is required, wait to sign off in their presence.

Related Documents

- Purchase Agreement : Outlines the terms and conditions of an item sale.

- Business Contract : An agreement in which each party agrees to an exchange, typically involving money, goods, or services.

- Lease/Rental Agreement : A lease agreement is a written document that officially recognizes a legally binding relationship between two parties -- a landlord and a tenant.

- Lease Agreement

- Power of Attorney

- Non-Disclosure Agreement

- Eviction Notice

- Legal Resources

- Partner With Us

- Terms of Use

- Privacy Policy

- Do Not Sell My Personal Information

The document above is a sample. Please note that the language you see here may change depending on your answers to the document questionnaire.

Thank you for downloading one of our free legal templates!

Would you leave us a review?

We hope you've found what you need and can avoid the time, costs, and stress associated with dealing with a lawyer.

A review would mean the world to us (it only takes about 15 seconds).

Thanks again, and good luck!

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

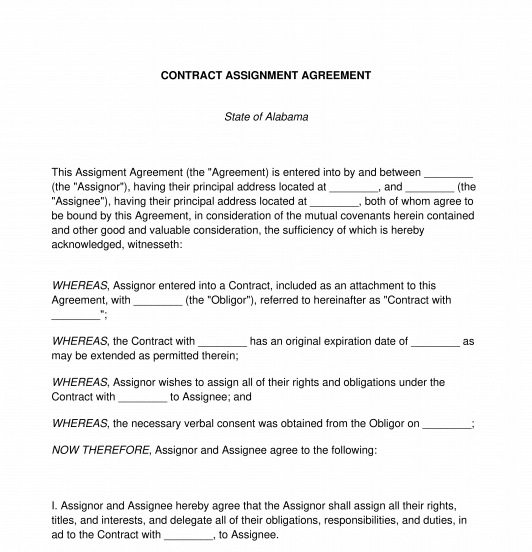

Contract Assignment Agreement

Rating: 4.8 - 105 votes

This Contract Assignment Agreement document is used to transfer rights and responsibilities under an original contract from one Party, known as the Assignor, to another, known as the Assignee. The Assignor who was a Party to the original contract can use this document to assign their rights under the original contract to the Assignee, as well as delegating their duties under the original contract to that Assignee. For example, a nanny who as contracted with a family to watch their children but is no longer able to due to a move could assign their rights and responsibilities under the original service contract to a new childcare provider.

How to use this document

Prior to using this document, the original contract is consulted to be sure that an assignment is not prohibited and that any necessary permissions from the other Party to the original contract, known as the Obligor, have been obtained. Once this has been done, the document can be used. The Agreement contains important information such as the identities of all parties to the Agreement, the expiration date (if any) of the original contract, whether the original contract requires the Obligor's consent before assigning rights and, if so, the form of consent that the Assignor obtained and when, and which state's laws will govern the interpretation of the Agreement.

If the Agreement involves the transfer of land from one Party to another , the document will include information about where the property is located, as well as space for the document to be recorded in the county's official records, and a notary page customized for the land's location so that the document can be notarized.

Once the document has been completed, it is signed, dated, and copies are given to all concerned parties , including the Assignor, the Assignee, and the Obligor. If the Agreement concerns the transfer of land, the Agreement is then notarized and taken to be recorded so that there is an official record that the property was transferred.

Applicable law

The assignment of contracts that involve the provision of services is governed by common law in the " Second Restatement of Contracts " (the "Restatement"). The Restatement is a non-binding authority in all of U.S common law in the area of contracts and commercial transactions. Though the Restatement is non-binding, it is frequently cited by courts in explaining their reasoning in interpreting contractual disputes.

The assignment of contracts for sale of goods is governed by the Uniform Commercial Code (the "UCC") in § 2-209 Modification, Rescission and Waiver .

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Other names for the document:

Assignment Agreement, Assignment of Contract Agreement, Contract Assignment, Assignment of Contract Contract, Contract Transfer Agreement

Country: United States

General Business Documents - Other downloadable templates of legal documents

- Amendment to Agreement

- Loan Agreement

- Loan Agreement Modification

- Release of Loan Agreement

- Non-Compete Agreement

- Partnership Dissolution Agreement

- Notice of Withdrawal from Partnership

- Power Of Attorney

- Debt Acknowledgment Form

- Meeting Minutes

- Request to Alter Contract

- Release Agreement

- Guaranty Agreement

- Joint Venture Agreement

- Debt Settlement Agreement

- Breach of Contract Notice

- Corporate Proxy

- Mutual Rescission and Release Agreement

- Notice for Non-Renewal of Contract

- Meeting Notice

- Other downloadable templates of legal documents

- 7208 W. Sand Lake Road, Ste. 206, Orlando, FL 32819

- 407-855-1000

- Commercial Fleet Insurance

- Restaurant Business Insurance

- Catering Insurance

- Electrician Insurance

- Home Insurance

- Auto Insurance Florida

- RV Insurance

- Boat Insurance

- Motorcycle Insurance

- Pet Insurance

- Pet Liability Insurance

- Life Insurance For Florida

- Hall of Fame

- Testimonials

- Request A Certificate (COI)

- Client Portal

What is an Assignment of Benefits Agreement?

Jason levine.

- December 10, 2019

You come home from work one day to find that a leak under your sink has sprayed water all over the floor. Panicking, you shut off the water main and call the first plumber that pops up on Angie’s List. He fixes the leak and recommends a company to take care of all the water damage.

You’re satisfied with their work, so you take the referral and call the remediation company. But when they show up, that’s when the problem starts.

They present you with an Assignment of Benefits form and say that they won’t start work until you sign it.

What Is An Assignment of Benefits Agreement?

An Assignment of Benefits (AOB) is an agreement that effectively allows a third party to deal directly with your insurance carrier on your behalf.

This means they can file insurance claims, make repair decisions, and even collect money without you having to lift a finger. On the surface, this just sounds like great customer service. You get to hand over the hassle of dealing with your insurance company and still get your house fixed.

What could possibly go wrong?

Here’s How It All Goes Wrong…

If all contractors were honest, there might not be anything wrong with signing an AOB form and letting the pros do all the heavy lifting, so to speak.

But—and this might surprise you—not all people are honest.

Shocking, I know.

Contractors don’t use Assignment of Benefits agreements to make your life easier, but to make their lives easier (and get more money).

hen you sign an AOB form, you are handing your contractor the keys to your insurance policy (without any backup copies for yourself). What does this mean? It means you can’t collect any payments from the insurance company. You can’t even talk to them about the claim.

You have signed your rights as the insured entirely over to the contractor.

Why Should You Care?

Their usual tactic is to submit an invoice to your insurance company with a grossly inflated price, well above the adjuster’s estimate and/or the price their competitors are charging.

So the contractor is getting a few extra dollars for a hard day’s work. You don’t have to pay them…why should you care?

But Assignment of Benefit agreements do affect you individually, as well as the insurance industry as a whole.

For starters, your insurance company doesn’t usually reimburse that inflated price without a fight. In most cases, they’ll challenge the amount and the two of them will go back and forth until they reach an agreement. (Remember, since you signed away your rights, you won’t have a say at all.)

Unfortunately, it’s even worse—for everyone—when the insurance company agrees to pay that ridiculous price. We’ve talked about the dangers of insurance fraud before. Well, this is just another example of that.

When the insurance companies are forced to pay out more than they expected (and more than they should), they need to take in more money to continue paying claims and stay in business. So how do they make up for these losses?

By raising premiums.

AOBs are not a victimless crime. When the insurance industry is put through the ringer, Florida consumers pay the price.

Is This Legal?

AOB forms wreaked havoc on Florida homeowners for a long time because they were completely legal. However, in December 2022, Florida Senate Bill 2-A prohibited AOB forms.

This means that you are unable to sign an AOB on policies issued after January 1, 2023. We may still see some unscrupulous contractors trying to slip under the radar, so be on your guard!

What Should You Do?

As a savvy homeowner, what can you do?

First, when you have a claim, call your insurance company or independent agent FIRST. They can help you find a reputable, high-quality contractor that hasn’t cost them an arm and a leg.

Second, beware of referrals to water damage or other remediation companies. The contractor referring you may only be recommending them because they get compensation for doing so. You want your home repair professionals to be recommended based on how good they are, nothing else.

However, some of you reading this might already have signed an AOB form. What do you do now?

Luckily, you are permitted under Florida law to revoke the contract

- within 14 days of signing it;

- within 30 days if the AOB doesn’t include a commencement date and “substantial work” hasn’t yet been done;

- if the contractor has not “substantially performed” the work within 30 days of the commencement date.

If you can rescind the Assignment of Benefits agreement , do so as soon as possible.

Stay In Control

You are the homeowner and the policy holder; DON’T let a contractor take your rights away from you!

When you report a claim, ask your insurance company or agent for the name of a reputable contractor and NEVER sign an Assignment of Benefits form. The hassle you will deal with later is not worth the minor convenience of not dealing with the insurance company yourself.

If you have already signed an AOB form, review the terms for rescission and follow them, if possible. Under Florida law, it is illegal for a contractor to charge you a penalty or fee for cancelling your AOB.

As always, if you have additional questions about Assignment of Benefits forms, contact Florida’s Chief Financial Officer or call one of the friendly agents at Harry Levine Insurance .

With two convenient offices to serve all of Central Florida, our main focus is on building a network of coverage that fits your needs and your budget. Get a free quote today to protect your home, auto, or business!

Ready For Your Custom Insurance Quote?

Jennifer Gonzalez

We are currently living in our own custom designed by us, my husband and I have also been able to purchase the entire acre lot the custom designed home by us and we were here for the entire time of the building of the home as we were living just 5 miles away from the home as it was under construction by a very small but very well known Alvarez Building Company of Tampa Florida! We had this house built of solid wood no particle wood anywhere as well it’s a real Brick home not Brick on concrete as well as a 4 foundation for the interior of the full almost 8,000 square feet of this home with building standards set in place after Hurricane Andrew hit Miami with Spanish Barrel Tile Roofing and its a two story, 4 Bedroom 5 Bathroom home with a 3 car garage with an upgraded interior floor with a lifetime guaranteed by the company that we paid to install it after the painted concrete flooring was continued to need repainted! We have lived here as the original custom designed home since we moved into our home in April of 1993, this house took a full year with out any delay to be built with our own personal daily inspections as we watched it being built for that amount of time it’s also in wonderful condition with tile floors on the downstairs and real wood floors in our office and full size family room with 2 carpeted guest bedrooms also and our upstairs master bedroom of over 2,000 square feet with separate full custom designed walk in closets for us and a double head glass cube shower and a full double whirlpool porcelain on a Kohler tub and a separate bathroom with a full sized toilet and bidet. Also another full bedroom with full bathroom upstairs and we are using it as a full time gym equipped with professional gym equipment! Our we have 2 different chimneys we have a fireplace in our master bedroom and we have a fireplace in our family room which are both wood burning!! We have had it completely paid off for years now and we might be considering the need for a new roof as we started to only have our gutters cleaned and now of course they are telling us that they are seeing signs of rain damage to our roof and we have not seen any signs at all and our roof is made of the same Spanish Barrel Tile that has lasted for centuries and I am truly aware of roofer scams!! We are looking for some kind of service to give us an honest opinion about the exact truth of roofing situation!!

Hello Jennifer, Thank you so much for contacting us! It sounds like you have a beautiful home that you put a lot of care into designing. I’m not entirely sure what your question is. Would you be so kind as to restate it? I can offer that tile roofs have been actuarially shown to have a realistic expected life span of 30 years. That doesn’t mean that a tile roof cannot last longer, or that some tile roofs won’t have shorter useful lives. You responded to our installment on Assignment of Benefit contacts, so allow me to offer the following as well: If you do have roof damage and your contractor starts asking a lot of questions about your Homeowner Insurance you should be very skeptical. Maybe even given a second opinion or a new contractor altogether. The most important thing is to fully read the contractor that any roofer or other contractor offers to you to sign. DO NOT EVER sign a contract with an “Assignment of Benefits” clause. Such a clause takes control of the claim and you insurance policy in regards to the claim altogether away from you. It opens the door for lawsuits, liens against your home and outrageous dishonest price inflation. Good luck!

Leave a comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

The HLI Newsletter

Recent posts.

What Is Coverage C: Personal Property Insurance?

What Is Defensive Driving?

8 Surprising Things Car Insurance Covers

Online Request

Understanding an assignment and assumption agreement

Need to assign your rights and duties under a contract? Learn more about the basics of an assignment and assumption agreement.

Find more Legal Forms and Templates

by Belle Wong, J.D.

Belle Wong, is a freelance writer specializing in small business, personal finance, banking, and tech/SAAS. She ...

Read more...

Updated on: November 24, 2023 · 3min read

The assignment and assumption agreement

The basics of assignment and assumption, filling in the assignment and assumption agreement.

While every business should try its best to meet its contractual obligations, changes in circumstance can happen that could necessitate transferring your rights and duties under a contract to another party who would be better able to meet those obligations.

If you find yourself in such a situation, and your contract provides for the possibility of assignment, an assignment and assumption agreement can be a good option for preserving your relationship with the party you initially contracted with, while at the same time enabling you to pass on your contractual rights and duties to a third party.

An assignment and assumption agreement is used after a contract is signed, in order to transfer one of the contracting party's rights and obligations to a third party who was not originally a party to the contract. The party making the assignment is called the assignor, while the third party accepting the assignment is known as the assignee.

In order for an assignment and assumption agreement to be valid, the following criteria need to be met:

- The initial contract must provide for the possibility of assignment by one of the initial contracting parties.

- The assignor must agree to assign their rights and duties under the contract to the assignee.

- The assignee must agree to accept, or "assume," those contractual rights and duties.

- The other party to the initial contract must consent to the transfer of rights and obligations to the assignee.

A standard assignment and assumption contract is often a good starting point if you need to enter into an assignment and assumption agreement. However, for more complex situations, such as an assignment and amendment agreement in which several of the initial contract terms will be modified, or where only some, but not all, rights and duties will be assigned, it's a good idea to retain the services of an attorney who can help you draft an agreement that will meet all your needs.

When you're ready to enter into an assignment and assumption agreement, it's a good idea to have a firm grasp of the basics of assignment:

- First, carefully read and understand the assignment and assumption provision in the initial contract. Contracts vary widely in their language on this topic, and each contract will have specific criteria that must be met in order for a valid assignment of rights to take place.

- All parties to the agreement should carefully review the document to make sure they each know what they're agreeing to, and to help ensure that all important terms and conditions have been addressed in the agreement.

- Until the agreement is signed by all the parties involved, the assignor will still be obligated for all responsibilities stated in the initial contract. If you are the assignor, you need to ensure that you continue with business as usual until the assignment and assumption agreement has been properly executed.

Unless you're dealing with a complex assignment situation, working with a template often is a good way to begin drafting an assignment and assumption agreement that will meet your needs. Generally speaking, your agreement should include the following information:

- Identification of the existing agreement, including details such as the date it was signed and the parties involved, and the parties' rights to assign under this initial agreement

- The effective date of the assignment and assumption agreement

- Identification of the party making the assignment (the assignor), and a statement of their desire to assign their rights under the initial contract

- Identification of the third party accepting the assignment (the assignee), and a statement of their acceptance of the assignment

- Identification of the other initial party to the contract, and a statement of their consent to the assignment and assumption agreement

- A section stating that the initial contract is continued; meaning, that, other than the change to the parties involved, all terms and conditions in the original contract stay the same

In addition to these sections that are specific to an assignment and assumption agreement, your contract should also include standard contract language, such as clauses about indemnification, future amendments, and governing law.

Sometimes circumstances change, and as a business owner you may find yourself needing to assign your rights and duties under a contract to another party. A properly drafted assignment and assumption agreement can help you make the transfer smoothly while, at the same time, preserving the cordiality of your initial business relationship under the original contract.

You may also like

What does 'inc.' mean in a company name?

'Inc.' in a company name means the business is incorporated, but what does that entail, exactly? Here's everything you need to know about incorporating your business.

October 9, 2023 · 10min read

How to write a will: A comprehensive guide to will writing

Writing a will is one of the most important things you can do for yourself and for your loved ones, and it can be done in just minutes. Are you ready to get started?

February 9, 2024 · 11min read

How to start an LLC in 7 steps: A complete guide for 2024

It's easy to create a new LLC by filing paperwork with the state. But to set yourself up for success, you'll also need to think about your business name, finances, an operating agreement, and licenses and permits. Here's a step-by-step guide.

March 21, 2024 · 20min read

- Construction Accidents

Practice Areas

Assignment of benefits: what you need to know.

- August 17, 2022

- Steven Schwartzapfel

Insurance can be useful, but dealing with the back-and-forth between insurance companies and contractors, medical specialists, and others can be a time-consuming and ultimately unpleasant experience. You want your medical bills to be paid without having to act as a middleman between your healthcare provider and your insurer.

However, there’s a way you can streamline this process. With an assignment of benefits, you can designate your healthcare provider or any other insurance payout recipient as the go-to party for insurance claims. While this can be convenient, there are certain risks to keep in mind as well.

Below, we’ll explore what an assignment of insurance benefits is (as well as other forms of remediation), how it works, and when you should employ it. For more information, or to learn whether you may have a claim against an insurer, contact Schwartzapfel Lawyers now at 1-516-342-2200 .

What Is an Assignment of Benefits?

An assignment of benefits (AOB) is a legal process through which an insured individual or party signs paperwork that designates another party like a contractor, company, or healthcare provider as their insurance claimant .

Suppose you’re injured in a car accident and need to file a claim with your health insurance company for medical bills and related costs. However, you also need plenty of time to recover. The thought of constantly negotiating between your insurance company, your healthcare provider, and anyone else seems draining and unwelcome.

With an assignment of benefits, you can designate your healthcare provider as your insurance claimant. Then, your healthcare provider can request insurance payouts from your healthcare insurance provider directly.

Through this system, the health insurance provider directly pays your physician or hospital rather than paying you. This means you don’t have to pay your healthcare provider. It’s a streamlined, straightforward way to make sure insurance money gets where it needs to go. It also saves you time and prevents you from having to think about insurance payments unless absolutely necessary.

What Does an Assignment of Benefits Mean?

An AOB means that you designate another party as your insurance claimant. In the above example, that’s your healthcare provider, which could be a physician, hospital, or other organization.

With the assignment of insurance coverage, that healthcare provider can then make a claim for insurance payments directly to your insurance company. The insurance company then pays your healthcare provider directly, and you’re removed as the middleman.

As a bonus, this system sometimes cuts down on your overall costs by eliminating certain service fees. Since there’s only one transaction — the transaction between your healthcare provider and your health insurer — there’s only one set of service fees to contend with. You don’t have to deal with two sets of service fees from first receiving money from your insurance provider, then sending that money to your healthcare provider.

Ultimately, the point of an assignment of benefits is to make things easier for you, your insurer, and anyone else involved in the process.

What Types of Insurance Qualify for an Assignment of Benefits?

Most types of commonly held insurance can work with an assignment of benefits. These insurance types include car insurance, healthcare insurance, homeowners insurance, property insurance, and more.

Note that not all insurance companies allow you to use an assignment of benefits. For an assignment of benefits to work, the potential insurance claimant and the insurance company in question must each sign the paperwork and agree to the arrangement. This prevents fraud (to some extent) and ensures that every party goes into the arrangement with clear expectations.

If your insurance company does not accept assignments of benefits, you’ll have to take care of insurance payments the traditional way. There are many reasons why an insurance company may not accept an assignment of benefits.

To speak with a Schwartzapfel Lawyers expert about this directly, call 1-516-342-2200 for a free consultation today. It will be our privilege to assist you with all your legal questions, needs, and recovery efforts.

Who Uses Assignments of Benefits?

Many providers, services, and contractors use assignments of benefits. It’s often in their interests to accept an assignment of benefits since they can get paid for their work more quickly and make critical decisions without having to consult the insurance policyholder first.

Imagine a circumstance in which a homeowner wants a contractor to add a new room to their property. The contractor knows that the scale of the project could increase or shrink depending on the specifics of the job, the weather, and other factors.

If the homeowner uses an assignment of benefits to give the contractor rights to make insurance claims for the project, that contractor can then:

- Bill the insurer directly for their work. This is beneficial since it ensures that the contractor’s employees get paid promptly and they can purchase the supplies they need.

- Make important decisions to ensure that the project completes on time. For example, a contract can authorize another insurance claim for extra supplies without consulting with the homeowner beforehand, saving time and potentially money in the process.

Practically any company or organization that receives payments from insurance companies may choose to take advantage of an assignment of benefits with you. Example companies and providers include:

- Ambulance services

- Drug and biological companies

- Lab diagnostic services

- Hospitals and medical centers like clinics

- Certified medical professionals such as nurse anesthetists, nurse midwives, clinical psychologists, and others

- Ambulatory surgical center services

- Permanent repair and improvement contractors like carpenters, plumbers, roofers, restoration companies, and others

- Auto repair shops and mechanic organizations

Advantages of Using an Assignment of Benefits

An assignment of benefits can be an advantageous contract to employ, especially if you believe that you’ll need to pay a contractor, healthcare provider, and/or other organization via insurance payouts regularly for the near future.

These benefits include but are not limited to:

- Save time for yourself. Again, imagine a circumstance in which you are hospitalized and have to pay your healthcare provider through your health insurance payouts. If you use an assignment of benefits, you don’t have to make the payments personally or oversee the insurance payouts. Instead, you can focus on resting and recovering.

- Possibly save yourself money in the long run. As noted above, an assignment of benefits can help you circumvent some service fees by limiting the number of transactions or money transfers required to ensure everyone is paid on time.

- Increased peace of mind. Many people don’t like having to constantly think about insurance payouts, contacting their insurance company, or negotiating between insurers and contractors/providers. With an assignment of benefits, you can let your insurance company and a contractor or provider work things out between them, though this can lead to applications later down the road.

Because of these benefits, many recovering individuals, car accident victims, homeowners, and others utilize AOB agreements from time to time.

Risks of Using an Assignment of Benefits

Worth mentioning, too, is that an assignment of benefits does carry certain risks you should be aware of before presenting this contract to your insurance company or a contractor or provider. Remember, an assignment of benefits is a legally binding contract unless it is otherwise dissolved (which is technically possible).

The risks of using an assignment of benefits include:

- You give billing control to your healthcare provider, contractor, or another party. This allows them to bill your insurance company for charges that you might not find necessary. For example, a home improvement contractor might bill a homeowner’s insurance company for an unnecessary material or improvement. The homeowner only finds out after the fact and after all the money has been paid, resulting in a higher premium for their insurance policy or more fees than they expected.

- You allow a contractor or service provider to sue your insurance company if the insurer does not want to pay for a certain service or bill. This can happen if the insurance company and contractor or service provider disagree on one or another billable item. Then, you may be dragged into litigation or arbitration you did not agree to in the first place.

- You may lose track of what your insurance company pays for various services . As such, you could be surprised if your health insurance or other insurance premiums and deductibles increase suddenly.

Given these disadvantages, it’s still wise to keep track of insurance payments even if you choose to use an assignment of benefits. For example, you might request that your insurance company keep you up to date on all billable items a contractor or service provider charges for the duration of your treatment or project.

For more on this and related topic, call Schwartzapfel Lawyers now at 1-516-342-2200 .

How To Make Sure an Assignment of Benefits Is Safe

Even though AOBs do carry potential disadvantages, there are ways to make sure that your chosen contract is safe and legally airtight. First, it’s generally a wise idea to contact knowledgeable legal representatives so they can look over your paperwork and ensure that any given assignment of benefits doesn’t contain any loopholes that could be exploited by a service provider or contractor.

The right lawyer can also make sure that an assignment of benefits is legally binding for your insurance provider. To make sure an assignment of benefits is safe, you should perform the following steps:

- Always check for reviews and references before hiring a contractor or service provider, especially if you plan to use an AOB ahead of time. For example, you should stay away if a contractor has a reputation for abusing insurance claims.

- Always get several estimates for work, repairs, or bills. Then, you can compare the estimated bills and see whether one contractor or service provider is likely to be honest about their charges.

- Get all estimates, payment schedules, and project schedules in writing so you can refer back to them later on.

- Don’t let a service provider or contractor pressure you into hiring them for any reason . If they seem overly excited about getting started, they could be trying to rush things along or get you to sign an AOB so that they can start issuing charges to your insurance company.

- Read your assignment of benefits contract fully. Make sure that there aren’t any legal loopholes that a contractor or service provider can take advantage of. An experienced lawyer can help you draft and sign a beneficial AOB contract.

Can You Sue a Party for Abusing an Assignment of Benefits?

Sometimes. If you believe your assignment of benefits is being abused by a contractor or service provider, you may be able to sue them for breaching your contract or even AOB fraud. However, successfully suing for insurance fraud of any kind is often difficult.

Also, you should remember that a contractor or service provider can sue your insurance company if the insurance carrier decides not to pay them. For example, if your insurer decides that a service provider is engaging in billing scams and no longer wishes to make payouts, this could put you in legal hot water.

If you’re not sure whether you have grounds for a lawsuit, contact Schwartzapfel Lawyers today at 1-516-342-2200 . At no charge, we’ll examine the details of your case and provide you with a consultation. Don’t wait. Call now!

Assignment of Benefits FAQs

Which states allow assignments of benefits.

Every state allows you to offer an assignment of benefits to a contractor and/or insurance company. That means, whether you live in New York, Florida, Arizona, California, or some other state, you can rest assured that AOBs are viable tools to streamline the insurance payout process.

Can You Revoke an Assignment of Benefits?

Yes. There may come a time when you need to revoke an assignment of benefits. This may be because you no longer want the provider or contractor to have control over your insurance claims, or because you want to switch providers/contractors.

To revoke an assignment of benefits agreement, you must notify the assignee (i.e., the new insurance claimant). A legally solid assignment of benefits contract should also include terms and rules for this decision. Once more, it’s usually a wise idea to have an experienced lawyer look over an assignment of benefits contract to make sure you don’t miss these by accident.

Contact Schwartzapfel Lawyers Today

An assignment of benefits is an invaluable tool when you need to streamline the insurance claims process. For example, you can designate your healthcare provider as your primary claimant with an assignment of benefits, allowing them to charge your insurance company directly for healthcare costs.

However, there are also risks associated with an assignment of benefits. If you believe a contractor or healthcare provider is charging your insurance company unfairly, you may need legal representatives. Schwartzapfel Lawyers can help.

As knowledgeable New York attorneys who are well-versed in New York insurance law, we’re ready to assist with any and all litigation needs. For a free case evaluation and consultation, contact Schwartzapfel Lawyers today at 1-516-342-2200 !

Schwartzapfel Lawyers, P.C. | Fighting For You™™

What Is an Insurance Claim? | Experian

What is assignment of benefits, and how does it impact insurers? | Insurance Business Mag

Florida Insurance Ruling Sets Precedent for Assignment of Benefits | Law.com

Related Posts

What are the most common types of crane accidents.

Crane accidents can cause significant injuries, costly damages, and considerable disruptions to construction sites. Moreover, if you’re a construction worker,

Maryland Bridge Collapse: Potential Theories of Liability

In the still, pre-dawn hours of Tuesday, March 26, 2024, a critical system failure aboard the Dali cargo ship plunged

Preponderance Of Evidence: Meaning & Legal Breakdown

Understanding civil lawsuits can feel overwhelming, especially when you’re trying to wrap your head around all the legal jargon. To

We'll Fight For You

Schwartzapfel® lawyers has a 99% client satisfaction rate, quick links.

- News & Events

- Verdicts & Settlements

- Video Gallery

- Wrongful Death

- Vehicle Accidents

- Slip & Fall

- Medical Malpractice

- Workers' Compensation

- Personal Injuries

- Product Liability

- Garden City

Contract Assignment Agreement

Used 5,046 times

Download the Contract Assignment Agreement to transfer your duties, obligations, and rights. An agreement between two parties outlines the conditions of a contract assignment.

e-Sign with PandaDoc

Prepared by:

[Assignor.FirstName] [Assignor.LastName]

[Assignor.Phone] [Assignor.Email]

[Assignor.StreetAddress] [Assignor.City] [Assignor.State] [Assignor.PostalCode]

Contract Assignment Agreement Template

Prepared for:

[Assignee.FirstName] [Assignee.LastName]

[Assignee.Company]

[Assignee.Phone]

[Assignee.Email]

[Assignee.StreetAddress] [Assignee.City] [Assignee.State] [Assignee.PostalCode]

This Contract Assignment Agreement (hereinafter referred to as the "Agreement") made and entered on [Document.CreatedDate] , by and between:

Name: [Assignor.FirstName] [Assignor.LastName] [Assignor.Company] (hereinafter referred to as "Assignor"), and

Name: [Assignee.FirstName] [Assignee.LastName] [Assignee.Company] (hereinafter referred to as "Assignee"), and

Assignor and Assignee are hereinafter referred to as “Parties” collectively in this Agreement.

A. Assignor assigns and transfers the Assignee all of its rights, title, and interest in and to the contract, named (insert name of the original contract) (hereinafter referred to as the "Contract"), dated (insert date of the original contract), and expires on (insert the date when the original contract expires).

In consideration for the assignment, the Assignee will pay the Assignor the sum of (insert amount).

B. Assignor desires to assign the Contract to Assignee and Assignee desires to accept the assignment of the Contract.

C. The terms of this Assignment Agreement shall supersede the terms of the original Contract to the extent that there is any conflict between the terms of the original Contract and the terms of this Assignment Agreement.

This Agreement is subject to the following conditions:

Both Parties have all necessary rights and authority to enter into this Agreement and to assign the Contract to Assignee;

This Agreement does not and will not be construed to violate any agreement to which either the Assignor or the Assignee is a party or by which they are bound; and

Parties have had the opportunity to seek independent legal counsel prior to signing this Agreement and have either done so or have voluntarily waived their right to do so.

Indemnification

The Assignee agrees to indemnify and hold the Assignor harmless from and against any and all costs, losses, damages, claims, liabilities, and expenses (including reasonable attorneys' fees and costs) arising out of or in connection with any claims or suits based on allegations that arise.

Counterparts

This Agreement may be executed in counterparts (and by different Parties hereto on different counterparts), each of which shall be deemed an original, but all of which together shall constitute the same instrument.

Non-Transferability

Except as expressly provided in this Agreement, the rights and obligations of the Parties under this Agreement are not assignable or transferable, neither whole nor in part.

Termination

Subsequently, this Agreement may not be terminated except by mutual agreement of the Assignor and the Assignee. In the event of termination, any sums paid by Assignee to Assignor under this Agreement shall be reimbursed to Assignee within (insert number of days) of the termination of this Agreement.

Confidentiality

Assignee shall maintain all information regarding the Contract in the strictest confidence and shall not reveal such information to any person or entity without the express written consent of Assignor.

Governing Laws

This Agreement shall be governed by and construed under the laws of the State of [Assignor.State] .

Agreed and Accepted

IN WITNESS WHEREOF, the parties hereto have executed and delivered this Agreement as of the date written below.

Care to rate this template?

Your rating will help others.

Thanks for your rate!

Useful resources

- Featured templates

- Sales proposals

- NDA agreements

- Operating agreements

- Service agreements

- Sales documents

- Marketing proposals

- Rental and lease agreement

- Quote templates

- Practical Law

Assignment of insurance policies and claims

Practical law uk practice note w-031-6021 (approx. 19 pages).

- Construction and engineering

- Construction insurance

- Credit, terrorism and political risks

- Cyber insurance

- Directors and officers

- Disputes, investigations and enforcement

- Insurance in commercial transactions

- Insurance intermediaries

- Legal expenses

- Making and dealing with claims

- Reinsurance

- Security, risk management and business continuity

- Commercial Insurance

- Current Customers

- Request A Quote

The Good and Bad of Assignment of Benefits Agreements

- August 23, 2022

An Assignment of Benefits Agreement (AOB) is an agreement that allows a third party to work directly with your insurance company on your behalf. If an AOB is signed, the third party can file insurance claims, collect money and make decisions without having you do anything extra. While this all may sound great for you, there are some things you need to consider before signing an Assignment of Benefits Agreement.

Where you may see an Assignment of Benefits agreement:

If you are a homeowner and have some unexpected damage to your house, such as a water leak, you would naturally hire a contractor to fix the damage. One of your contractor’s selling points might include taking care of all the paperwork. The paperwork would most likely have an AOB. Unfortunately, this could result in more of a headache for you than working with your insurance agent yourself.

Contractors like to work directly with insurance companies to try and get the most money out of them for the hard work they did or will be doing on your home. If your contractor inflated the price of a claim, the insurance company will take its time and maybe even fight the claim. This process could take weeks. This means your house could still be in shambles, or the damage could be getting worse. If the work has been completed, but the insurance company hasn’t settled yet, the contractor can place a lien on your home until you pay, which could mean money out of your own pocket.

If the insurance company agrees to pay the large amount of money, it could result in your premium going up. Insurance companies need money to pay claims to remain in business. The way that they get this money is by increasing your premiums.

If you find yourself being asked to sign an Assignment of Benefits Agreement, be cautious before doing so. Not sure if you should sign one? Reach out to a DSI agent, and we can talk you through it to see if it is the best route for you to take.

We serve all of Florida from Leesburg to Jacksonville to Fleming Island .

Want to Learn More About DSI?

See how DSI can help provide you or your business the coverage you need.

- Renew Membership

- My Community

- Find an Agent

- Order Manuals

- Public Anonymous User.old

Advocacy Resource Center

You are here: advocacy resources > legislative summaries > 2019 legislative summary > property insurance > insurance assignment agreements, insurance assignment agreements.

- Executed in writing by the assignee and assignor.

- Give the insured 14 days to rescind the assignment without penalty, and 30 days to rescind the assignment if the assignee has not begun substantial work during that 30 days.

- The assignee must provide a copy of the AOB to the insurer within three (3) days.

- Contain a written, itemized cost estimate of services to be performed.

- Relate only to work to be performed by the assignee

- Contain an 18-point uppercase bold notice to the consumer informing them that they are assigning the benefits of their policy to a third party.

- Require the assignee to hold harmless the assignor if the policy doesn’t allow for assignment rights.

- A rescission penalty.

- Check or mortgage processing fee.

- A penalty or fee for cancellation.

- An administrative fee.

Assignment Insurance Form – Fill Out and Use This PDF

Assignment Insurance Form is a document that you receive when you purchase your policy. It's like proof of insurance and tells the insurer that they must cover any losses associated with an assignment.

Assignment Insurance Form PDF Details

Are you a student who dreads the thought of completing your college assignments? Do you worry about whether or not you will have enough time to get everything done? If so, you may want to consider purchasing assignment insurance. Assignment insurance is a type of insurance that protects students from having to pay for a missed assignment if something unexpected comes up. If you're interested in learning more about this type of insurance, keep reading. In this blog post, we'll discuss what assignment insurance is, how it works and why it might be a good idea for students. We'll also provide some tips on how to choose the right policy for your needs. So, whether you're just starting out at college or are nearing the end of your degree program,

Form Preview Example

How to Edit Assignment Insurance Form Online for Free

assignment of insurance form can be completed easily. Simply open FormsPal PDF editor to get it done fast. Our team is committed to providing you with the ideal experience with our editor by consistently releasing new capabilities and improvements. Our editor is now much more intuitive with the newest updates! At this point, filling out documents is simpler and faster than before. It just takes several basic steps:

Step 1: Just click on the "Get Form Button" above on this webpage to access our pdf form editing tool. There you'll find all that is required to work with your file.

Step 2: As you launch the PDF editor, you will see the document all set to be filled in. Apart from filling in different blanks, you may as well perform various other things with the form, including writing custom textual content, editing the original textual content, inserting graphics, signing the form, and much more.

To be able to complete this form, make sure that you enter the information you need in each and every blank:

1. Whenever filling in the assignment of insurance form, ensure to complete all needed blank fields within its associated area. It will help speed up the process, allowing your details to be handled swiftly and accurately.

2. Soon after filling out the previous section, go to the subsequent part and enter the essential details in all these blank fields - .

As to this field and next field, be certain that you get them right here. The two of these are the most important ones in the form.

Step 3: When you've glanced through the information in the document, click "Done" to conclude your FormsPal process. Sign up with FormsPal now and immediately get access to assignment of insurance form, available for download. Every last edit made is handily preserved , so that you can modify the form later when required. FormsPal ensures your information privacy by having a secure system that never saves or distributes any personal data used in the form. Feel safe knowing your paperwork are kept safe any time you use our editor!

Assignment Insurance Form isn’t the one you’re looking for?

Related documents.

- Assignment Of Mortgage Form

- Assignment Of Payment Form

- Db2 Assignment Form

- Fop Insurance Form

IMAGES

VIDEO

COMMENTS

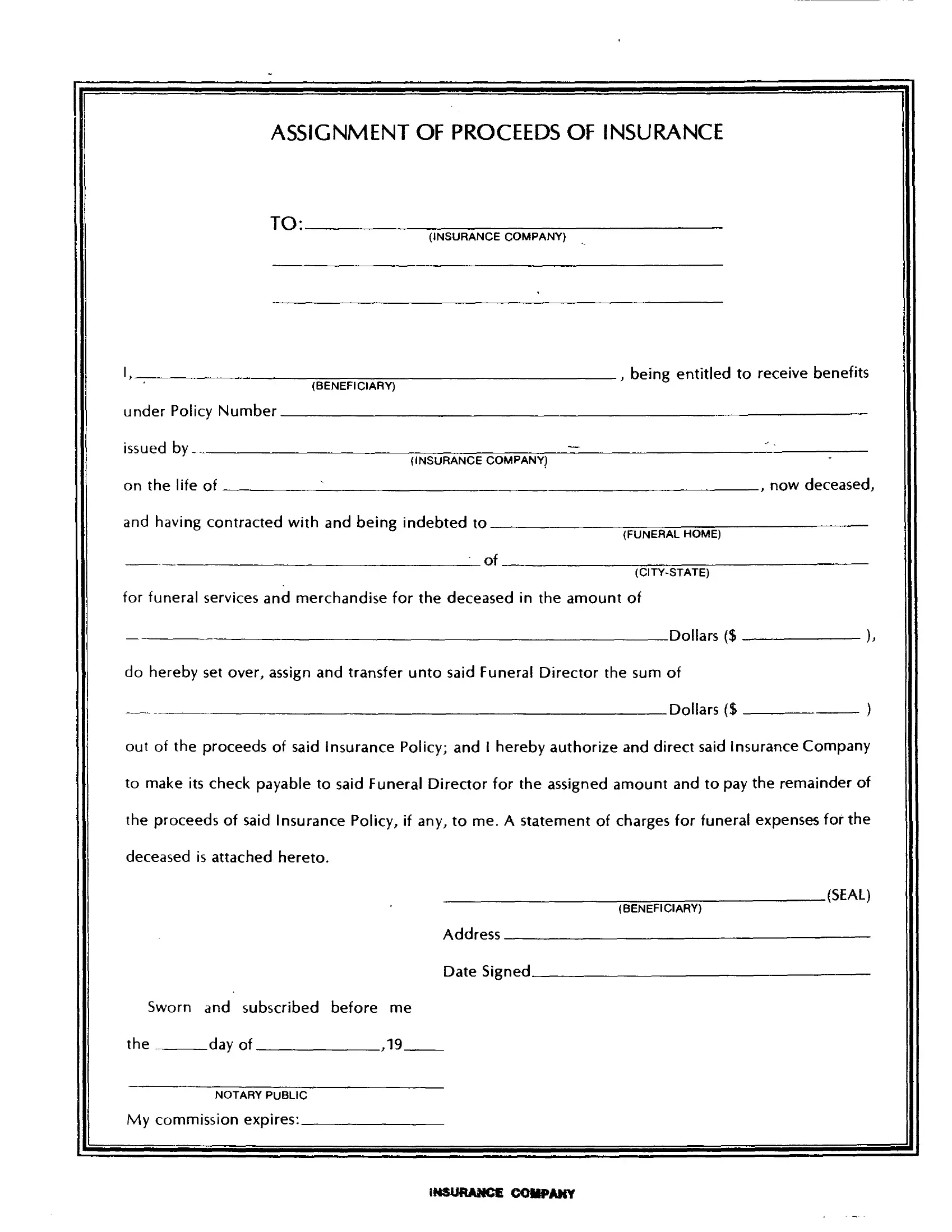

Updated June 22, 2023. An insurance assignment allows a beneficiary (assignor) to transfer all or a portion of the proceeds to someone else (assignee). This is especially common with life insurance when a family does not have the money to pay for the funeral expenses and chooses to assign a portion of the decedent's life insurance proceeds to cover the funeral costs.

II. ASSIGNMENT OF INSURANCE PROCEEDS. It is known that the Beneficiary is entitled to certain proceeds from the Insurance Company under a separate agreement with a Policy Number of _____________________ ("Insurance Proceeds"). Under this Agreement, the Beneficiary agrees to transfer: (choose one) - All of the Insurance Proceeds to the ...

Report. Bookmark. greenfolder · 03/03/2014 21:48. Assignment and agreement is fine. Basically the insurers are liable under the RTA to pay any unsatisfied judgement. This form allows them to get their money back from their policyholder after they have paid you. I would tell them that you had a comparable hire car-which you needed due to kids ...

Assignment Agreement Template. Use our assignment agreement to transfer contractual obligations. An assignment agreement is a legal document that transfers rights, responsibilities, and benefits from one party (the "assignor") to another (the "assignee"). You can use it to reassign debt, real estate, intellectual property, leases ...

This Assignment and Agreement form in vehicle insurance will primarily cover liability, coverage limits, and conditions for the assignment, safeguarding the interests of all parties involved. In conclusion, the Assignment and Agreement form insurance facilitates the transfer of rights and benefits associated with an insurance policy from ...

II. ASSIGNMENT OF INSURANCE PROCEEDS. It is known that the Beneficiary is entitled to certain proceeds from the Insurance Company under a separate agreement with a Policy Number of 91-FWS18WNAWUQ ("Insurance Proceeds"). Under this Agreement, the Beneficiary agrees to transfer: (choose one) - All of the Insurance Proceeds to the Assuming Party.

have motor vehicle liability insurance coverage which complies with the State of California minimum liability requirements and is sufficient to provide primary first vehicular coverage against any and all losses, damages, expense, fee and/or claim and hereby agree to indemnify and hold Advanced Autowerks harmless from and against any and all ...

Contract Assignment Agreement. Last revision 12/31/2023. Formats Word and PDF. Size 2 to 3 pages. 4.8 - 105 votes. Fill out the template. This Contract Assignment Agreement document is used to transfer rights and responsibilities under an original contract from one Party, known as the Assignor, to another, known as the Assignee. The Assignor ...

An Assignment of Benefits (AOB) is an agreement that effectively allows a third party to deal directly with your insurance carrier on your behalf. This means they can file insurance claims, make repair decisions, and even collect money without you having to lift a finger. On the surface, this just sounds like great customer service.

Mar 06, 2020 Share. Assignment of benefits, widely referred to as AOB, is a contractual agreement signed by a policyholder, which enables a third party to file an insurance claim, make repair ...

An assignment and assumption agreement is used after a contract is signed, in order to transfer one of the contracting party's rights and obligations to a third party who was not originally a party to the contract. The party making the assignment is called the assignor, while the third party accepting the assignment is known as the assignee.

Motor Insurers' Bureau. A Company Limited by Guarantee - Registered in England at the address below - No 412787 Linford Wood House, 6-12 Capital Drive, Milton Keynes MK14 6XT Tel: 01908 830001 Fax: 01908 671681 DX: 142620 Milton Keynes 10 Email: [email protected].

There are many reasons why an insurance company may not accept an assignment of benefits. To speak with a Schwartzapfel Lawyers expert about this directly, call 1-516-342-2200 for a free consultation today. It will be our privilege to assist you with all your legal questions, needs, and recovery efforts.

DEFINITIONS. 6. In this Assignment and Agreement-. "contract of insurance" means a policy of insurance or a security; "insurer" includes the giver of a security; "relevant liability" means a liability in respect of which a policy of insurance must insure a person in order to comply with Part VI of the Road Traffic Act 1988 ...

A. Assignor assigns and transfers the Assignee all of its rights, title, and interest in and to the contract, named (insert name of the original contract) (hereinafter referred to as the "Contract"), dated (insert date of the original contract), and expires on (insert the date when the original contract expires). In consideration for the assignment, the Assignee will pay the Assignor the sum ...

Assignment of insurance policies and claims. An overview of the legal principles that apply when assigning an insurance policy or the right to receive the insurance monies due under the policy to a third party. It considers the requirements that must be met for the assignment to be valid and explains the difference between assignment, co ...

An Assignment of Benefits Agreement (AOB) is an agreement that allows a third party to work directly with your insurance company on your behalf. If an AOB is signed, the third party can file insurance claims, collect money and make decisions without having you do anything extra. While this all may sound great for you, […]

Creates a new section of the Florida Statutes titled, "Assignment Agreements.". Defines the terms: "assignee," "assignment agreement," "assignor," "disputed amount," "judgment obtained," "pre-suit settlement demand," and "pre-suit settlement offer.". Defines what must be provided in an assignment agreement (AOB ...

ASSIGNMENT. 2.1 Subject to receipt of the compensation, this assignment ceases to be conditional and becomes fully effective such that the Claimant assigns to MIB absolutely, all rights of recovery from the Defendant, or any other person who may be discovered to have a liability, in respect of the compensation and any legal costs paid by MIB to ...

FormsPal provides only latest official forms. Prepare your Assignment Insurance Form and acquire access to numerous templates and forms right now! ... Car Payment Agreement; Family Loan Agreement; IOU Form; ... IRS Form W-2; IRS Form W-4; IRS Form 1099-MISC; IRS Form 1098; Sign In; Business; Agreement; Assignment Insurance Form; Assignment ...

This agreement assigns an official motor vehicle from a company to an employee for 4 years. The employee agrees to use the vehicle only for official purposes, maintain insurance on it, and keep it in good repair. After 4 years of employment and meeting these conditions, ownership of the vehicle will transfer to the employee. If the employee fails to meet the conditions or leaves employment ...

The #1 website for free legal forms and documents.