BforB Business Blog

Market Economy Examples: Case Studies, Countries, and Success Stories

A market economy is an economic system in which the production, distribution, and pricing of goods and services are determined by the forces of supply and demand. It is characterized by private ownership of means of production, individual decision-making, and a focus on efficiency and productivity.

One example of a market economy is the mixed economy of New Zealand. This country operates with a market-based system while also allowing for government intervention in certain sectors such as healthcare and welfare. The government in New Zealand plays a role in ensuring that its citizens have access to essential services and resources.

In a market economy, producers and consumers interact in a free market, where prices are determined based on supply and demand. The motive of producers is to maximize profits by producing goods and services that meet the needs and wants of consumers. Consumers, on the other hand, have the freedom to choose what to buy and where to spend their money.

One of the key characteristics of a market economy is the absence of government control over pricing and production. Unlike in a command economy, where the government has centralized decision-making authority, in a market economy, production and pricing decisions are made by individual producers and consumers. This allows for competition and innovation, as producers are motivated to provide the best products at competitive prices to attract consumers.

Market economies have proven to be successful in many countries around the world. They have been associated with higher levels of economic growth and prosperity. However, it is important to note that market economies are not without their challenges. Income inequality, lack of access to basic necessities for some individuals, and the potential for market failures are all issues that need to be addressed in order to ensure a fair and equitable society.

🔔 Understanding Market Economies

A market economy is an economic system in which the production and distribution of goods and services are primarily determined through the interactions of buyers and sellers in competitive markets.

In a market economy, individuals and businesses own and control the means of production. They decide what to produce and how much to produce based on their own interests and the demands of consumers. The government’s role is limited to establishing the rules of the market and enforcing property rights.

Market economies rely on the price mechanism to connect producers and consumers. Prices are determined by supply and demand, and they serve as the signals that guide resource allocation. When the demand for a good or service is high, prices rise, indicating that more production is needed. On the other hand, when demand is low, prices fall, prompting producers to reduce production.

In 2021, the top 25 nations with the most market-oriented economies, according to the Index of Economic Freedom, were mainly developed countries such as Hong Kong, Singapore, New Zealand, and Switzerland. These countries have relatively low government intervention and high levels of economic freedom.

Benefits of Market Economies

- Efficiency: Market economies are generally more efficient than planned economies. The profit motive encourages producers to allocate resources efficiently and produce goods and services that consumers demand.

- Wealth creation: Market economies have been historically successful in creating wealth for nations and individuals. The ability to own and acquire property, invest, and innovate has resulted in increased productivity and economic growth.

- Choice and competition: Market economies offer consumers a wide range of choices and foster competition among producers, leading to better quality products and lower prices.

Differences between Market, Command, and Mixed Economies

In a command economy, such as the one in North Korea, the government exercises extensive control over the allocation of resources and the production of goods and services. The government determines what is produced, how much is produced, and how it is distributed. Individual choice and private ownership are limited.

In mixed economies, such as Canada, both the private sector and the government play a significant role in economic decision-making. The government provides certain public goods and services, such as healthcare and education, while leaving other economic activities to the market.

Market economies have proven to be the most effective method for creating wealth and providing citizens with the goods and services they need. While there may be occasional market failures and shortages, market mechanisms and competition generally lead to efficient outcomes.

🔔 Market Economy Case Studies

Market economies are characterized by the presence of free markets, where goods and services are exchanged based on supply and demand. In this system, individuals and businesses make decisions about what to produce, how to produce, and how to distribute goods and services. The market economy is defined by private ownership of property and assets, and wealth is generated through market transactions.

New Zealand

New Zealand is often cited as a successful example of a market economy. The country shifted from a heavily regulated economy to a more market-oriented one in the 1980s. As a result, New Zealand experienced significant economic growth, improved productivity, and increased living standards. The government implemented reforms to reduce trade barriers, deregulate industries, and promote competition. This allowed the market to allocate resources efficiently and incentivized businesses to innovate and adapt to market conditions.

Sweden is another example of a market economy that combines free markets with a strong welfare state. While the Swedish government provides healthcare, education, and social security services, the majority of the economy is driven by market forces. Swedish citizens enjoy a high standard of living, and the country is known for its innovation and high-tech industries. The government plays a role in regulating and ensuring that markets are fair and competitive, but businesses are largely privately owned and operated.

China’s transition from a planned economy to a market economy has been one of the most significant economic transformations in recent history. The government implemented economic reforms in the late 1970s, allowing market forces to play a larger role in the country’s economy. This shift resulted in rapid economic growth and lifted hundreds of millions of people out of poverty. While the government retains control over key sectors and industries, such as banking and energy, China’s market-oriented reforms have unleashed the entrepreneurial spirit and productive capabilities of its population.

Market economy case studies provide valuable insights into how free markets can contribute to economic growth, innovation, and improved living standards. New Zealand, Sweden, and China are examples of countries that have successfully implemented market-oriented reforms to stimulate their economies. While each country has its own unique approach and challenges, the common denominator is the emphasis on market mechanisms and the role of the private sector in driving economic activity.

🔔 Successful Market Economies

In a market economy, the revision and work is driven by the common motive of profit, with individuals and businesses making decisions based on supply and demand.

Many nations have embraced market economies, reducing or eliminating central planning and allowing the free market to determine prices and production. These countries have seen success in various industries.

One example of a successful market economy is New Zealand. In the 1980s, the government-owned industries were privatized, and market forces were allowed to dictate decision-making. As a result, New Zealand experienced economic growth and reduced shortages in various sectors.

Consumers in New Zealand also benefited from a free-market economy. Without government interference, businesses were able to meet the needs of consumers more efficiently and at competitive prices.

Healthcare Systems

Another example of successful market economies is seen in the healthcare systems of many countries. In a market-based healthcare system, the production and pricing of healthcare services are determined by supply and demand.

Market economies in healthcare allow for competition among providers, leading to a greater variety of services and lower prices for consumers. When healthcare decisions are driven by market forces, resources are allocated efficiently and based on consumer preferences.

Market economies also incentivize innovation and technological advancements in healthcare, as providers strive to attract consumers and gain a competitive edge.

Mixed Economies

It’s important to note that not all successful economies operate solely on free-market principles. Many countries have mixed economies, which combine elements of both market and command economies.

In mixed economies, the government plays a role in regulating certain industries, providing public goods, and addressing market failures. However, the majority of production and decision-making is left to the market forces.

Examples of successful mixed economies include countries like the United States and Germany, where a balance is struck between government intervention and free-market principles.

Defining Success

The definition of success in market economies can vary depending on the economist and their perspective. Some economists may focus on GDP growth, while others may prioritize income equality or environmental sustainability.

Overall, successful market economies are characterized by efficient allocation of resources, high economic growth, innovation, and improved living standards for their citizens.

In conclusion, market economies have proven to be successful in many countries when the decision-making is driven by market forces and business incentives. Whether operating on a free-market or mixed economy approach, the top market economies have seen significant economic and social advancements.

🔔 Market Economies vs. Planned Economies

Market economies and planned economies are two different systems for organizing and managing economic activities within a country. While market economies rely on free-market principles and individual decision-making, planned economies are centrally controlled by the government.

Defining Characteristics of Market Economies

In a market economy, the production, distribution, and pricing of goods and services are primarily determined by the interactions of buyers and sellers in the marketplace. The government’s role is typically limited to ensuring fair competition, protecting property rights, and enforcing contracts. Some defining characteristics of market economies include:

- Allocation of resources based on supply and demand

- Private ownership of businesses and property

- Freedom for individuals to make economic decisions

- Prices determined by market forces

- Profit motive driving economic activity

Defining Characteristics of Planned Economies

In a planned economy, the government controls the means of production and makes decisions about what goods and services should be produced, how they should be produced, and to whom they should be distributed. Some defining characteristics of planned economies include:

- Centralized control over economic activities

- Government ownership of businesses and property

- Government setting production goals and timetables

- Prices and allocation of resources determined by government planning

- Emphasis on collective goals and equitable distribution

Comparison of Market Economies and Planned Economies

Market economies and planned economies differ in several key aspects:

- Decision-Making: In market economies, decisions are made by individuals and businesses based on supply and demand. In planned economies, decisions are made by the government according to its goals and priorities.

- Ownership: Market economies emphasize private ownership, allowing individuals and businesses to own and operate their assets. In planned economies, the government owns and controls major industries and resources.

- Pricing: Market economies rely on the free-market system to determine prices based on supply and demand. In planned economies, the government sets prices and determines the allocation of resources.

- Efficiency: Market economies generally promote efficiency by allowing competition and the pursuit of profit. Planned economies focus on meeting the needs of the society as a whole, prioritizing social welfare over individual profit.

Examples of Market Economies

Most countries in the world have market economies to some extent. Some examples of countries with market economies include:

- United States

- United Kingdom

Examples of Planned Economies

Planned economies have been less common historically, but there have been several notable examples in the past:

- Soviet Union (until its dissolution in 1991)

- China (until economic reforms in the late 1970s)

- North Korea

In summary, market economies and planned economies represent two different approaches to economic organization. Market economies rely on individual decision-making, private ownership, and market forces to allocate resources and determine prices. Planned economies, on the other hand, are centrally controlled by the government, with decisions made at the national level according to planned goals and priorities.

🔔 Examples of Planned Economies

In contrast to market economies, which are driven by supply and demand, planned economies are systems where the government controls most aspects of economic activities. Here are some examples of planned economies:

1. Command Economy

In a command economy, the government directs all economic activities. It decides on production levels, resource allocation, and pricing. Examples of command economies include North Korea and Cuba.

2. Socialist Economy

Socialist economies have a central planning structure where the government determines production and distribution. They aim to address social inequalities through resource redistribution. Countries like China and Vietnam have socialist economies.

3. Mixed Economy with Central Planning

Some countries combine elements of both planned and market economies. While they still have a central planning structure, they also allow for some market forces in decision-making. China, for example, has transitioned from a purely planned economy to a mixed economy.

4. Former Soviet Union and Eastern Bloc

During the Cold War, several countries in the Soviet Union and Eastern Bloc operated under planned economies. The government controlled all aspects of production, and resources were distributed based on the needs defined by the government rather than consumer demand.

5. War-Time Economy

During periods of war, some countries adopt a planned economy to efficiently allocate resources for the war effort. This involves central planning and directing resources towards military production rather than consumer goods. Examples include the United States during World War II.

6. Ancient and Pre-Modern Planned Economies

In ancient and pre-modern times, some civilizations operated planned economies. For example, the Inca Empire in South America organized production and distribution based on the needs of society as a whole.

In summary, planned economies differ from market economies in terms of the central planning structure, pricing, decision-making, and ownership of property. While market economies rely on the invisible hand of supply and demand, planned economies aim to address social inequalities through government control and resource redistribution.

🔔 Comparing Market and Planned Economies

When it comes to economic systems, there are two primary models that countries operate under: market economies and planned economies. These two methods of organizing an economy have significant differences in terms of decision-making, resource allocation, and the role of the government. Let’s explore the contrasting features of these systems.

Market Economies

In a market economy, decisions about production, distribution, and pricing are primarily determined by the interactions of supply and demand. Here, individuals and businesses are free to engage in economic activities based on their self-interest. This means that the government’s role is typically limited to creating and enforcing regulations that ensure fair competition and protect property rights.

Market economies allow for the free movement of goods, services, and labor. Prices are determined by supply and demand, and they serve as signals that guide producers and consumers in their decision-making. Producers respond to higher demand by increasing supply, leading to a better allocation of resources and increased productivity. In contrast, if demand decreases, producers reduce supply accordingly.

One notable feature of market economies is the role of competition in driving efficiency. Companies are forced to improve their products and services in order to attract and retain customers. This constant drive for innovation and efficiency is a key driver of economic growth.

It’s important to note that market economies don’t guarantee equal outcomes for all citizens. The distribution of wealth and resources can vary significantly, depending on factors such as skills, education, and luck. Some individuals may thrive and accumulate wealth, while others may struggle to meet basic needs.

Planned Economies

In a planned economy, also known as a command economy, the government takes a more central role in making economic decisions. The government determines what goods and services are produced, how they are distributed, and at what prices. This system is characterized by centralized planning, where a central authority, such as the government, dictates production quotas and allocates resources.

Planned economies aim to address the inequalities and inefficiencies that can arise in free-market economies. By controlling the means of production, the government can redistribute wealth and ensure access to essential goods and services for all citizens, regardless of their ability to pay.

However, planned economies have their challenges. The lack of price signals and competition can lead to inefficiencies, limited choice, and shortages of goods and services. The central planning authorities may not accurately anticipate consumer demand, resulting in overproduction of certain goods and shortages of others. The lack of incentives for producers to innovate can also lead to stagnation and lower overall productivity.

While market and planned economies represent two extreme ends of the economic spectrum, most countries operate under mixed economies. These are systems that combine elements of both market and planned approaches. The specific balance between market forces and government intervention varies from country to country.

For example, countries like the United States and New Zealand have market economies with limited government intervention, while countries like Sweden and Norway have mixed economies with a more significant role for the government in areas such as healthcare and social welfare.

The defining method of managing an economy, whether market or planned, has a significant impact on a country’s economic growth, prosperity, and overall well-being. It’s important to recognize the strengths and weaknesses of both approaches when considering which system is most suitable for a particular country or situation.

🔔 Lessons from Market Economy Success Stories

A market economy is an economic system in which decisions regarding production, distribution, and consumption of goods and services are guided by the forces of supply and demand in free and competitive markets.

There are several success stories of market economies around the world that provide valuable lessons for other nations. These success stories demonstrate the benefits of a market economy in promoting economic growth, innovation, and efficiency. Here are some key lessons we can learn from these success stories:

1. The role of competition

In a market economy, competition is a driving force that leads to better products, lower prices, and increased efficiency. Successful market economies emphasize competition and create a level playing field for businesses to compete. This encourages innovation and ensures that resources are allocated efficiently.

2. The importance of property rights

Property rights are crucial for a market economy to function effectively. It provides individuals and businesses with the incentive to invest, innovate, and create wealth. Ensuring strong and enforceable property rights creates a sense of security and encourages long-term investment and economic growth.

3. The role of prices

Prices play a crucial role in a market economy. They provide information about the scarcity of goods and services and help allocate resources efficiently. In a market economy, prices are determined by the interaction of supply and demand. This price mechanism guides consumers and producers in making economic decisions.

4. The power of consumer sovereignty

In a market economy, consumers have the power to choose what they want to consume. This drives producers to satisfy consumer demands and ensures that resources are used efficiently. Consumer sovereignty is a key characteristic of market economies and is essential for economic growth and prosperity.

5. The benefits of free trade

Market economies thrive on free trade. Allowing the free flow of goods and services across borders encourages specialization, increases competition, and expands consumer choice. Successful market economies have embraced free trade and have seen the benefits of connecting with the global marketplace.

6. The role of entrepreneurship

Entrepreneurship is a driving force in market economies. Entrepreneurs identify opportunities, take risks, and create new businesses and jobs. Market economies provide an environment that fosters entrepreneurship and rewards innovation. Supporting entrepreneurship is essential for economic growth and prosperity.

In conclusion, the success stories of market economies demonstrate the effectiveness of free-market systems in creating wealth, promoting innovation, and improving living standards. By embracing competition, ensuring property rights, relying on prices, empowering consumers, embracing free trade, and supporting entrepreneurship, nations can achieve economic success and prosperity.

About BforB

The BforB Business Model is based on the concept of referral-based networking. Where small, intimate, and tightly knit teams drive strong relationships between each other based on a great understanding and deep respect for what each member delivers through their business, expanding those networks to neighboring groups.

Focused on strengthening micro, small, and medium business , BforB is the right place for you if you are looking:

- For a great environment to build deep relationships with people across many industries;

- To drive business growth through trusted relationships and quality referrals and introductions;

- To identify strategic alliances for your business to improve profitability;

- To dramatically improve your skills in pitching, networking, and selling exactly what you do;

- To grow your business, achieve and exceed your goals, and increase cash in the bank.

The Role of Government in Market Economies

Course Number 1195

Course Overview and Objectives

This course is about one question: What is the proper role of the government in the market economy? We study the role of government as it plays out in the real world, using vivid case studies from many countries, decades, and policy angles. At the same time, we align these cases with a rigorous theoretical framework that clarifies the circumstances under which government intervention in the market can improve outcomes.

The goal of this course is to deepen your insight into and influence on the debate over economic policy. Private-sector managers are better able to position their organizations, both defensively and offensively, if they understand why and how governments act. Moreover, exceptional private-sector leaders are now widely expected to provide informed, intelligent leadership on the policy issues at the heart of this course.

Career Focus

The course is designed for students who aim to lead private-sector institutions of systemic importance, influence public debates over government policy, or occupy policymaking positions at some point in their careers. The skills and knowledge it develops, however, are increasingly valuable to the broad range of businesses, non-profit organizations, and civil society institutions whose activities intersect with government policy.

Course Structure

The course opens with a case on why a hypothetical competitive market economy can be used as a starting point for analyzing what role government should play. Market economies are miraculous when at their best: flexible, decisive, and self-correcting.

But markets are not always at their best, and the first module of the course confronts major real-world departures from this hypothetical starting point. These departures mean that government policy can improve the efficiency of the economy, in principle making all individuals better off. Policy areas addressed here include antitrust regulation, environmental protection, education, health care, and fiscal and monetary policy.

We may want the government to do more than remove inefficiencies, so the second module tackles questions of economic justice and their implications for the government's role. In particular, in this module we study central debates over the taxation of individuals and firms, the provision of economic assistance, and the determination of the boundaries of policy.

As this summary shows, the cases we discuss take us step-by-step through a rigorous conceptual framework that provides the intellectual backbone for the course. At the same time, each case gives us a chance to examine an important policy area in some depth. Accompanying each case are a set of core concepts and suggested readings. The core concepts represent fundamental insights into the role of government, so an understanding of them can substantially increase one's ability to analyze a given policy decision. The suggested supplemental readings are starting points for pursuing areas of particular interest in greater detail. They include many foundational pieces of scholarship, as well as newer and less scholarly works that shed light on these issues.

Course Administration

Course grades will be based on class participation (50%) and a short paper (50%). For the paper, students will apply the tools and ideas from the course to prepare, with one or two partners if they wish, an analysis of a government policy problem of their choice. The course is designed so that the time required to prepare the paper is comparable to the time a student would devote to a final exam. Throughout the term, Professor Weinzierl will be available to meet with students by appointment. To arrange a meeting, please contact his assistant, Deannah Blemur, at [email protected] .

Copyright © 2022 President & Fellows of Harvard College. All Rights Reserved.

- Search Search Please fill out this field.

What Is a Market Economy?

Understanding market economies, market theory, modern market economies, the bottom line.

- Monetary Policy

- Federal Reserve

What Is a Market Economy and How Does It Work?

:max_bytes(150000):strip_icc():format(webp)/Group1805-3b9f749674f0434184ef75020339bd35.jpg)

A market economy is a system in which production decisions and the prices of goods and services are guided primarily by the interactions of consumers and businesses. That is, the law of supply and demand, not a central government's policy, is allowed to determine what is available and at what price.

The United States is an example of a market economy. It has a central bank, the Federal Reserve, that attempts to influence the overall direction of the economy. It has a Congress that can pass legislation to boost economic activity or protect consumers. But the main driver of the economy is the law of supply and demand.

Key Takeaways

- In a market economy, the law of supply and demand is allowed to determine levels of production and the prices of goods and services.

- A market economy gives entrepreneurs the freedom to pursue profits by creating new products, and the freedom to fail if they misread the market.

- Economists broadly agree that market-oriented economies produce better economic outcomes, but they differ on the precise balance between a free market and central planning.

Investopedia / Mira Norian

The theoretical basis for market economies was developed by classical economists such as Adam Smith , David Ricardo, and Jean-Baptiste Say.

These liberal free market advocates believed that the “invisible hand” of the profit motive and market incentives generally guided economic decisions down more productive and efficient paths than government planning of the economy.

They argued that government intervention often led to economic inefficiencies that made people in general worse off.

Market economies rely on the forces of supply and demand to determine the appropriate prices and quantities for most goods and services.

Entrepreneurs marshal the factors of production (land, labor, and capital) and combine them in cooperation with workers and financial backers to produce goods and services for consumers or other businesses to buy.

Buyers and sellers agree on the terms of these transactions voluntarily by agreeing on a price.

The allocation of resources by entrepreneurs across different businesses and production processes is determined by the consumer demand that they hope to create. Successful entrepreneurs are rewarded with profits that can be reinvested in future business. Unsuccessful entrepreneurs revise their products or go out of business.

Every economy in the modern world falls somewhere along a continuum running from pure market to fully planned. Most developed nations are technically mixed economies because they blend free markets with some government interference . They are still labeled market economies because they allow market forces to drive the vast majority of activities, typically engaging in government intervention only to the extent it is needed to provide stability.

Market economies may still engage in some government interventions, such as price-fixing , licensing, quotas , and industrial subsidies. Most commonly, market economies feature government production of public goods , often as a government monopoly. But overall, market economies are characterized by decentralized economic decision-making by buyers and sellers transacting everyday business.

In particular, market economies are distinguished by having functional markets for corporate control, which allow for the transfer and reorganization of the economic means of production among entrepreneurs.

Although the market economy is clearly the modern system of choice, there continues to be significant debate regarding the amount of government intervention considered optimal for efficient economic operations.

Most economists believe that market-oriented economies are most successful at generating wealth, economic growth, and rising living standards for a nation. But they differ on the precise scope, scale, and specific roles for government intervention that are necessary to provide the fundamental legal and institutional framework that markets need to function well.

What Is a Mixed Economy?

Most modern nations considered to be market economies are, strictly speaking, mixed economies. That is, the law of supply and demand is the main driver of the economy. The interactions between consumers and producers are allowed to determine what goods and services are offered and what prices are charged for them.

That is, the law of supply and demand rules.

However, most nations also see the value of a central authority that steps in to prevent malpractice, correct injustices, or provide necessary but unprofitable services. Without government intervention, there can be no worker safety rules, consumer protection laws, emergency relief measures, subsidized medical care, or public transportation systems.

Is Capitalism and a Market Economy the Same Thing?

Capitalism and a market economy both are used to describe a system that allows the law of supply and demand, not a central government, to determine the production and prices of goods and services. Capitalism, as a political philosophy, maintains that production must remain in private hands and be motivated by the pursuit of private profit.

Is a Market Economy Good or Bad?

Most economists say that a market economy system is best able to deliver a high quality of life to most of its citizens. Its benefits include increased efficiency, steady economic growth, and motivation for innovation. Its potential downsides include the risks of monopolies, exploitation of labor, and income inequality.

A market economy is driven by the law of supply and demand. However, most modern economies could strictly be called mixed economies. That is, the government steps in as needed to alleviate problems or correct injustices. The real problem, for economists and for all citizens, is defining the degree of government intervention that is needed.

Federal Reserve Bank of St. Louis. " The Role of Self-Interest and Competition in a Market Economy - The Economic Lowdown Podcast Series ."

- Economics Defined with Types, Indicators, and Systems 1 of 33

- Economy: What It Is, Types of Economies, Economic Indicators 2 of 33

- A Brief History of Economics 3 of 33

- Is Economics a Science? 4 of 33

- Finance vs. Economics: What's the Difference? 5 of 33

- Macroeconomics Definition, History, and Schools of Thought 6 of 33

- Microeconomics Definition, Uses, and Concepts 7 of 33

- 4 Economic Concepts Consumers Need To Know 8 of 33

- Law of Supply and Demand in Economics: How It Works 9 of 33

- Demand-Side Economics Definition, Examples of Policies 10 of 33

- Supply-Side Theory: Definition and Comparison to Demand-Side 11 of 33

- What Is a Market Economy and How Does It Work? 12 of 33

- Command Economy: Definition, How It Works, and Characteristics 13 of 33

- Economic Value: Definition, Examples, Ways To Estimate 14 of 33

- Keynesian Economics Theory: Definition and How It's Used 15 of 33

- What Is Social Economics, and How Does It Impact Society? 16 of 33

- Economic Indicator: Definition and How to Interpret 17 of 33

- Top 10 U.S. Economic Indicators 18 of 33

- Gross Domestic Product (GDP) Formula and How to Use It 19 of 33

- What Is GDP and Why Is It So Important to Economists and Investors? 20 of 33

- Consumer Spending: Definition, Measurement, and Importance 21 of 33

- Retail Sales: Definition, Measurement, and Use As an Economic Indicator 22 of 33

- Job Market: Definition, Measurement, Example 23 of 33

- The Top 25 Economies in the World 24 of 33

- What Are Some Examples of Free Market Economies? 25 of 33

- Is the United States a Market Economy or a Mixed Economy? 26 of 33

- Primary Drivers of the Chinese Economy 27 of 33

- Japan Inc.: What It is, How It Works, History 28 of 33

- The Fundamentals of How India Makes Its Money 29 of 33

- European Union (EU): What It Is, Countries, History, Purpose 30 of 33

- The German Economic Miracle Post WWII 31 of 33

- The Economy of the United Kingdom 32 of 33

- How the North Korean Economy Works 33 of 33

:max_bytes(150000):strip_icc():format(webp)/MixedEconomicSystem-29e40821b3a3467ba01eb0c34c7dc569.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

6.3 Market Failure

Learning objectives.

- Explain what is meant by market failure and the conditions that may lead to it.

- Distinguish between private goods and public goods and relate them to the free rider problem and the role of government.

- Explain the concepts of external costs and benefits and the role of government intervention when they are present.

- Explain why a common property resource is unlikely to be allocated efficiently in the marketplace.

Private decisions in the marketplace may not be consistent with the maximization of the net benefit of a particular activity. The failure of private decisions in the marketplace to achieve an efficient allocation of scarce resources is called market failure . Markets will not generate an efficient allocation of resources if they are not competitive or if property rights are not well defined and fully transferable. Either condition will mean that decision makers are not faced with the marginal benefits and costs of their choices.

Think about the drive that we had you take at the beginning of this chapter. You faced some, but not all, of the opportunity costs involved in that choice. In particular, your choice to go for a drive would increase air pollution and might increase traffic congestion. That means that, in weighing the marginal benefits and marginal costs of going for a drive, not all of the costs would be counted. As a result, the net benefit of the allocation of resources such as the air might not be maximized.

Noncompetitive Markets

The model of demand and supply assumes that markets are competitive. No one in these markets has any power over the equilibrium price; each consumer and producer takes the market price as given and responds to it. Under such conditions, price is determined by the intersection of demand and supply.

In some markets, however, individual buyers or sellers are powerful enough to influence the market price. In subsequent chapters, we will study cases in which producers or consumers are in a position to affect the prices they charge or must pay, respectively. We shall find that when individual firms or groups of firms have market power, which is the ability to change the market price, the price will be distorted—it will not equal marginal cost.

Public Goods

Some goods are unlikely to be produced and exchanged in a market because of special characteristics of the goods themselves. The benefits of these goods are such that exclusion is not feasible. Once they are produced, anyone can enjoy them; there is no practical way to exclude people who have not paid for them from consuming them. Furthermore, the marginal cost of adding one more consumer is zero. A good for which the cost of exclusion is prohibitive and for which the marginal cost of an additional user is zero is a public good . A good for which exclusion is possible and for which the marginal cost of another user is positive is a private good .

National defense is a public good. Once defense is provided, it is not possible to exclude people who have not paid for it from its consumption. Further, the cost of an additional user is zero—an army does not cost any more if there is one more person to be protected. Other examples of public goods include law enforcement, fire protection, and efforts to preserve species threatened with extinction.

Free Riders

Suppose a private firm, Terror Alert, Inc., develops a completely reliable system to identify and intercept 98% of any would-be terrorists that might attempt to enter the United States from anywhere in the world. This service is a public good. Once it is provided, no one can be excluded from the system’s protection on grounds that he or she has not paid for it, and the cost of adding one more person to the group protected is zero. Suppose that the system, by eliminating a potential threat to U.S. security, makes the average person in the United States better off; the benefit to each household from the added security is worth $40 per month (about the same as an earthquake insurance premium). There are roughly 113 million households in the United States, so the total benefit of the system is $4.5 billion per month. Assume that it will cost Terror Alert, Inc., $1 billion per month to operate. The benefits of the system far outweigh the cost.

Suppose that Terror Alert installs its system and sends a bill to each household for $20 for the first month of service—an amount equal to half of each household’s benefit. If each household pays its bill, Terror Alert will enjoy a tidy profit; it will receive revenues of more than $2.25 billion per month.

But will each household pay? Once the system is in place, each household would recognize that it will benefit from the security provided by Terror Alert whether it pays its bill or not. Although some households will voluntarily pay their bills, it seems unlikely that very many will. Recognizing the opportunity to consume the good without paying for it, most would be free riders. Free riders are people or firms that consume a public good without paying for it. Even though the total benefit of the system is $4.5 billion, Terror Alert will not be faced by the marketplace with a signal that suggests that the system is worthwhile. It is unlikely that it will recover its cost of $1 billion per month. Terror Alert is not likely to get off the ground.

The bill for $20 from Terror Alert sends the wrong signal, too. An efficient market requires a price equal to marginal cost. But the marginal cost of protecting one more household is zero; adding one more household adds nothing to the cost of the system. A household that decides not to pay Terror Alert anything for its service is paying a price equal to its marginal cost. But doing that, being a free rider, is precisely what prevents Terror Alert from operating.

Because no household can be excluded and because the cost of an extra household is zero, the efficiency condition will not be met in a private market. What is true of Terror Alert, Inc., is true of public goods in general: they simply do not lend themselves to private market provision.

Public Goods and the Government

Because many individuals who benefit from public goods will not pay for them, private firms will produce a smaller quantity of public goods than is efficient, if they produce them at all. In such cases, it may be desirable for government agencies to step in. Government can supply a greater quantity of the good by direct provision, by purchasing the public good from a private agency, or by subsidizing consumption. In any case, the cost is financed through taxation and thus avoids the free-rider problem.

Most public goods are provided directly by government agencies. Governments produce national defense and law enforcement, for example. Private firms under contract with government agencies produce some public goods. Park maintenance and fire services are public goods that are sometimes produced by private firms. In other cases, the government promotes the private consumption or production of public goods by subsidizing them. Private charitable contributions often support activities that are public goods; federal and state governments subsidize these by allowing taxpayers to reduce their tax payments by a fraction of the amount they contribute.

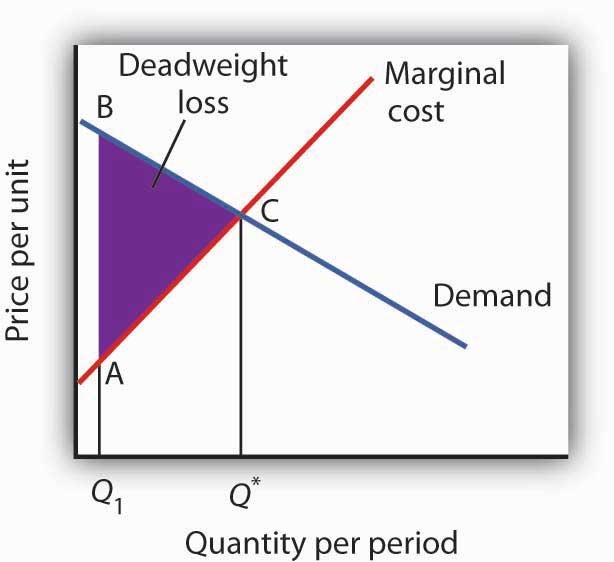

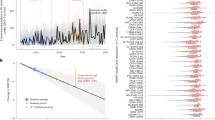

Figure 6.15 Public Goods and Market Failure

Because free riders will prevent firms from being able to require consumers to pay for the benefits received from consuming a public good, output will be less than the efficient level. In the case shown here, private donations achieved a level of the public good of Q 1 per period. The efficient level is Q *. The deadweight loss is shown by the triangle ABC.

While the market will produce some level of public goods in the absence of government intervention, we do not expect that it will produce the quantity that maximizes net benefit. Figure 6.15 “Public Goods and Market Failure” illustrates the problem. Suppose that provision of a public good such as national defense is left entirely to private firms. It is likely that some defense services would be produced; suppose that equals Q 1 units per period. This level of national defense might be achieved through individual contributions. But it is very unlikely that contributions would achieve the correct level of defense services. The efficient quantity occurs where the demand, or marginal benefit, curve intersects the marginal cost curve, at Q *. The deadweight loss is the shaded area ABC; we can think of this as the net benefit of government intervention to increase the production of national defense from Q 1 up to the efficient quantity, Q *.

Note that the definitions of public and private goods are based on characteristics of the goods themselves, not on whether they are provided by the public or the private sector. Postal services are a private good provided by the public sector. The fact that these goods are produced by a government agency does not make them a public good.

External Costs and Benefits

Suppose that in the course of production, the firms in a particular industry generate air pollution. These firms thus impose costs on others, but they do so outside the context of any market exchange—no agreement has been made between the firms and the people affected by the pollution. The firms thus will not be faced with the costs of their action. A cost imposed on others outside of any market exchange is an external cost .

We saw an example of an external cost in our imaginary decision to go for a drive. Here is another: violence on television, in the movies, and in video games. Many critics argue that the violence that pervades these media fosters greater violence in the real world. By the time a child who spends the average amount of time watching television finishes elementary school, he or she will have seen 100,000 acts of violence, including 8,000 murders, according to the American Psychological Association. Thousands of studies of the relationship between violence in the media and behavior have concluded that there is a link between watching violence and violent behaviors. Video games are a major element of the problem, as young children now spend hours each week playing them. Fifty percent of fourth-grade graders say that their favorite video games are the “first person shooter” type 1 .

Any tendency of increased violence resulting from increased violence in the media constitutes an external cost of such media. The American Academy of Pediatrics reported in 2001 that homicides were the fourth leading cause of death among children between the ages of 10 and 14 and the second leading cause of death for people aged 15 to 24 and has recommended a reduction in exposure to media violence (Rosenberg, M., 2003). It seems reasonable to assume that at least some of these acts of violence can be considered an external cost of violence in the media.

An action taken by a person or firm can also create benefits for others, again in the absence of any market agreement; such a benefit is called an external benefit . A firm that builds a beautiful building generates benefits to everyone who admires it; such benefits are external.

External Costs and Efficiency

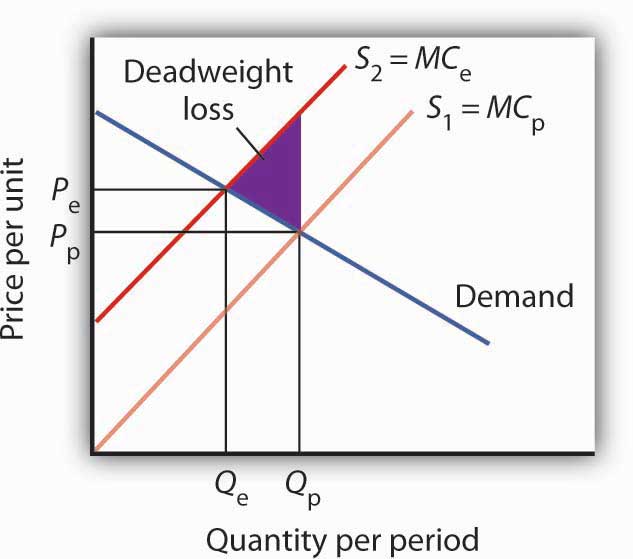

Figure 6.16 External Costs

When firms in an industry generate external costs, the supply curve S 1 reflects only their private marginal costs, MC P . Forcing firms to pay the external costs they impose shifts the supply curve to S 2 , which reflects the full marginal cost of the firms’ production, MC e . Output is reduced and price goes up. The deadweight loss that occurs when firms are not faced with the full costs of their decisions is shown by the shaded area in the graph.

The case of the polluting firms is illustrated in Figure 6.16 “External Costs” . The industry supply curve S 1 reflects private marginal costs, MC p . The market price is P p for a quantity Q p . This is the solution that would occur if firms generating external costs were not forced to pay those costs. If the external costs generated by the pollution were added, the new supply curve S 2 would reflect higher marginal costs, MC e . Faced with those costs, the market would generate a lower equilibrium quantity, Q e . That quantity would command a higher price, P e . The failure to confront producers with the cost of their pollution means that consumers do not pay the full cost of the good they are purchasing. The level of output and the level of pollution are therefore higher than would be economically efficient. If a way could be found to confront producers with the full cost of their choices, then consumers would be faced with a higher cost as well. Figure 6.16 “External Costs” shows that consumption would be reduced to the efficient level, Q e , at which demand and the full marginal cost curve ( MC e ) intersect. The deadweight loss generated by allowing the external cost to be generated with an output of Q p is given as the shaded region in the graph.

External Costs and Government Intervention

If an activity generates external costs, the decision makers generating the activity will not be faced with its full costs. Agents who impose these costs will carry out their activities beyond the efficient level; those who consume them, facing too low a price, will consume too much. As a result, producers and consumers will carry out an excessive quantity of the activity. In such cases, government may try to intervene to reduce the level of the activity toward the efficient quantity. In the case shown in Figure 6.16 “External Costs” , for example, firms generating an external cost have a supply curve S 1 that reflects their private marginal costs, MC p . A per-unit pollution fee imposed on the firms would increase their marginal costs to MC e , thus shifting the supply curve to S 2 , and the efficient level of production would emerge. Taxes or other restrictions may be imposed on the activity that generates the external cost in an effort to confront decision makers with the costs that they are imposing. In many areas, firms and consumers that pollute rivers and lakes are required to pay fees based on the amount they pollute. Firms in many areas are required to purchase permits in order to pollute the air; the requirement that permits be purchased serves to confront the firms with the costs of their choices.

Another approach to dealing with problems of external costs is direct regulation. For example, a firm may be ordered to reduce its pollution. A person who turns his or her front yard into a garbage dump may be ordered to clean it up. Participants at a raucous party may be told to be quiet. Alternative ways of dealing with external costs are discussed later in the text.

Common Property Resources

Common property resources are resources for which no property rights have been defined. The difficulty with common property resources is that individuals may not have adequate incentives to engage in efforts to preserve or protect them. Consider, for example, the relative fates of cattle and buffalo in the United States in the nineteenth century. Cattle populations increased throughout the century, while the buffalo nearly became extinct. The chief difference between the two animals was that exclusive property rights existed for cattle but not for buffalo.

Owners of cattle had an incentive to maintain herd sizes. A cattle owner who slaughtered all of his or her cattle without providing for replacement of the herd would not have a source of future income. Cattle owners not only maintained their herds but also engaged in extensive efforts to breed high-quality livestock. They invested time and effort in the efficient management of the resource on which their livelihoods depended.

Buffalo hunters surely had similar concerns about the maintenance of buffalo herds, but they had no individual stake in doing anything about them—the animals were a common property resource. Thousands of individuals hunted buffalo for a living. Anyone who cut back on hunting in order to help to preserve the herd would lose income—and face the likelihood that other hunters would go on hunting at the same rate as before.

Today, exclusive rights to buffalo have been widely established. The demand for buffalo meat, which is lower in fat than beef, has been increasing, but the number of buffalo in the United States is rising rapidly. If buffalo were still a common property resource, that increased demand, in the absence of other restrictions on hunting of the animals, would surely result in the elimination of the animal. Because there are exclusive, transferable property rights in buffalo and because a competitive market brings buyers and sellers of buffalo and buffalo products together, we can be reasonably confident in the efficient management of the animal.

When a species is threatened with extinction, it is likely that no one has exclusive property rights to it. Whales, condors, grizzly bears, elephants in Central Africa—whatever the animal that is threatened—are common property resources. In such cases a government agency may impose limits on the killing of the animal or destruction of its habitat. Such limits can prevent the excessive private use of a common property resource. Alternatively, as was done in the case of the buffalo, private rights can be established, giving resource owners the task of preservation.

Key Takeaways

- Public sector intervention to increase the level of provision of public goods may improve the efficiency of resource allocation by overcoming the problem of free riders.

- Activities that generate external costs are likely to be carried out at levels that exceed those that would be efficient; the public sector may seek to intervene to confront decision makers with the full costs of their choices.

- Some private activities generate external benefits.

- A common property resource is unlikely to be allocated efficiently in the marketplace.

The manufacture of memory chips for computers generates pollutants that generally enter rivers and streams. Use the model of demand and supply to show the equilibrium price and output of chips. Assuming chip manufacturers do not have to pay the costs these pollutants impose, what can you say about the efficiency of the quantity of chips produced? Show the area of deadweight loss imposed by this external cost. Show how a requirement that firms pay these costs as they produce the chips would affect the equilibrium price and output of chips. Would such a requirement help to satisfy the efficiency condition? Explain.

Case in Point: Externalities and Smoking

Figure 6.17

Russellstreet – Smoker – CC BY-SA 2.0.

Smokers impose tremendous costs on themselves. Based solely on the degree to which smoking shortens their life expectancy, which is by about six years, the cost per pack is $35.64. That cost, of course, is a private cost. In addition to that private cost, smokers impose costs on others. Those external costs come in three ways. First, they increase health-care costs and thus increase health insurance premiums. Second, smoking causes fires that destroy more than $300 million worth of property each year. Third, more than 2,000 people die each year as a result of “secondhand” smoke. A 1989 study by the RAND Corporation estimated these costs at $0.53 per pack.

In an important way, however, smokers also generate external benefits. They contribute to retirement programs and to Social Security, then die sooner than nonsmokers. They thus subsidize the retirement programs of the rest of the population. According to the RAND study, that produces an external benefit of $0.24 per pack, leaving a net external cost of $0.29 per pack. Given that state and federal excise taxes averaged $0.37 in 1989, the RAND researchers concluded that smokers more than paid their own way.

Economists Jonathan Gruber of the Massachusetts Institute of Technology and Botond Koszegi of the University of California at Berkeley have suggested that, in the case of people who consume “addictive bads” such as cigarettes, an excise tax on cigarettes of as much as $4.76 per pack may improve the welfare of smokers.

They base their argument on the concept of “time inconsistency,” which is the theory that smokers seek the immediate gratification of a cigarette and then regret their decision later. Professors Gruber and Koszegi argue that higher taxes would serve to reduce the quantity of cigarettes demanded and thus reduce behavior that smokers would otherwise regret. Their argument is that smokers impose “internalities” on themselves and that higher taxes would reduce this.

Where does this lead us? If smokers are “rationally addicted” to smoking, i.e., they have weighed the benefits and costs of smoking and have chosen to smoke, then the only problem for public policy is to assure that smokers are confronted with the external costs they impose. In that case, the problem is solved: through excise taxes, smokers more than pay their own way. But, if the decision to smoke is an irrational one, it may be improved through higher excise taxes on smoking.

Sources: Jonathan Gruber and Botond Koszegi, “A Theory of Government Regulation of Addictive Bads: Optimal Tax Levels and Tax Incidence for Cigarette Excise Taxation,” NBER Working Paper 8777, February 2002; Willard G. Manning et al., “The Taxes of Sin: Do Smokers and Drinkers Pay Their Way?” Journal of the American Medical Association , 261 (March 17, 1989): 1604–1609.

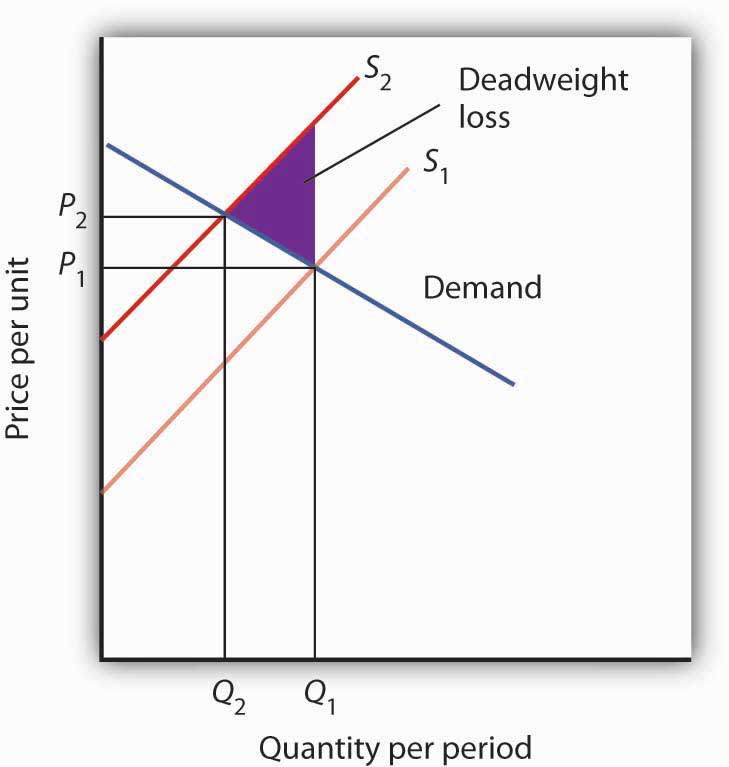

Answer to Try It! Problem

Figure 6.18

In the absence of any regulation, chip producers are not faced with the costs of the pollution their operations generate. The market price is thus P 1 and the quantity Q 1 . The efficiency condition is not met; the price is lower and the quantity greater than would be efficient. If producers were forced to face the cost of their pollution as well as other production costs, the supply curve would shift to S 2 , the price would rise to P 2 , and the quantity would fall to Q 2 . The new solution satisfies the efficiency condition.

1 See Report of the Committee on Commerce, Science, and Transportation, Children’s Protection From Violent Programming Act , Senate Report 106–509 (October 26, 2000), Washington, D.C.: U.S. Government Printing Office, 2000, and Michael Rich, “Violent Video Games Testimony,” Chicago City Council, October 30, 2000, at http://www.aap.org/advocacy/rich-videogameviolence.pdf .

2 Common property resources are sometimes referred to as open access resources.

Rosenberg, M., “Successful State Strategies,” Adolescent Health Leadership Forum, December 6, 2003, at http://www.aap.org/advocacy/ahproject/AHLSuccessful StateStrategiesMRosenberg.pps .

Principles of Economics Copyright © 2016 by University of Minnesota is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License , except where otherwise noted.

Case Studies in Business Economics, Managerial Economics, Economics Case Study, MBA Case Studies

Ibs ® case development centre, asia-pacific's largest repository of management case studies, mba course case maps.

- Business Models

- Blue Ocean Strategy

- Competition & Strategy ⁄ Competitive Strategies

- Core Competency & Competitive Advantage

- Corporate Strategy

- Corporate Transformation

- Diversification Strategies

- Going Global & Managing Global Businesses

- Growth Strategies

- Industry Analysis

- Managing In Troubled Times ⁄ Managing a Crisis ⁄ Product Recalls

- Market Entry Strategies

- Mergers, Acquisitions & Takeovers

- Product Recalls

- Restructuring / Turnaround Strategies

- Strategic Alliances, Collaboration & Joint Ventures

- Supply Chain Management

- Value Chain Analysis

- Vision, Mission & Goals

- Global Retailers

- Indian Retailing

- Brands & Branding and Private Labels

- Brand ⁄ Marketing Communication Strategies and Advertising & Promotional Strategies

- Consumer Behaviour

- Customer Relationship Management (CRM)

- Marketing Research

- Marketing Strategies ⁄ Strategic Marketing

- Positioning, Repositioning, Reverse Positioning Strategies

- Sales & Distribution

- Services Marketing

- Economic Crisis

- Fiscal Policy

- Government & Business Environment

- Macroeconomics

- Micro ⁄ Business ⁄ Managerial Economics

- Monetary Policy

- Public-Private Partnership

- Entrepreneurship

- Family Businesses

- Social Entrepreneurship

- Financial Management & Corporate Finance

- Investment & Banking

- Business Research Methods

- Operations & Project Management

- Operations Management

- Quantitative Methods

- Leadership,Organizational Change & CEOs

- Succession Planning

- Corporate Governance & Business Ethics

- Corporate Social Responsibility

- International Trade & Finance

- HRM ⁄ Organizational Behaviour

- Innovation & New Product Development

- Social Networking

- China-related Cases

- India-related Cases

- Women Executives ⁄ CEO's

- Effective Executive Interviews

- Video Interviews

Executive Brief

- Movie Based Case Studies

- Case Catalogues

- Case studies in Other Languages

- Multimedia Case Studies

- Textbook Adoptions

- Customized Categories

- Free Case Studies

- Faculty Zone

- Student Zone

Economics case studies

Covering micro as well as macro economics, some of IBSCDC's case studies require a prior understanding of certain economic concepts, while many case studies can be used to derive the underlying economic concepts. Topics like Demand and Supply Analysis, Market Structures (Perfect Competition, Monopoly, Monopolistic, etc.), Cost Structures, etc., in micro economics and national income accounting, monetary and fiscal policies, exchange rate dynamics, etc., in macro economics can be discussed through these case studies.

Browse Economics Case Studies By

Sub-Categories

- Government and Business Environment

- Micro / Business / Managerial Economics

- Public Private Partnership

- Aircraft & Ship Building

- Automobiles

- Home Appliances & Personal Care Products

- Minerals, Metals & Mining

- Engineering, Electrical & Electronics

- Building Materials & Construction Equipment

- Food, Diary & Agriculture Products

- Oil & Natural Gas

- Office Equipment

- Banking, Insurance & Financial Services

- Telecommunications

- e-commerce & Internet

- Transportation

- Entertainment

- Advertising

- IT and ITES

- Leisure & Tourism

- Health Care

- Sports & Sports Related

- General Business

- Business Law, Corporate Governence & Ethics

- Conglomerates

Companies & Organizations

- China Aviation Oil Corp

- De Beers and Lev Leviev

- Goldman Sachs

- Gordon Brown

- Iliad Group, France Telecom

- Lehman Brothers

- Merrill Lynch

- Mittal Arcelor

- Morgan Stanley

- Northern Rock

- Temasek Holdings

- Wachovia Wells Fargo

- Dominican Republic

- Netherlands

- North America

- Saudi Arabia

- South Africa

- South Korea

- United Kingdom

- United Arab Emirates

- United States

Recently Bought Case Studies

- Tata Consultancy Services: Managing Liquidity Risk

- SSS�s Experiment: Choosing an Appropriate Research Design

- Differentiating Services: Yatra.com�s �Click and Mortar�Model

- Wedding Services Business in India: Led by Entrepreneurs

- Shinsei Bank - A Turnaround

- Accenture�s Grand Vision: �Corporate America�s Superstar Maker�

- Tata Group�s Strategy: Ratan Tata�s Vision

- MindTree Consulting: Designing and Delivering its Mission and Vision

- Coca-Cola in India: Innovative Distribution Strategies with 'RED' Approach

- IndiGo�s Low-Cost Carrier Operating Model: Flying High in Turbulent Skies

- Evaluation of GMR Hyderabad International Airport Limited (GHIAL)

- Ambuja Cements: Weighted Average Cost of Capital

- Walmart-Bharti Retail Alliance in India: The Best Way Forward?

- Exploring Primary and Secondary Data: Lessons to Learn

- Global Inflationary Trends: Raising Pressure on Central Banks

- Performance Management System@TCS

- Violet Home Theater System: A Sound Innovation

- Consumer�s Perception on Inverters in India: A Factor Analysis Case

- Demand Forecasting of Magic Foods using Multiple Regression Analysis Technique

New Case Studies In Economics

- The Sri Lankan Economic Crisis � What Went Wrong?

- Crude Oil Market and the Law of Supply

- Understanding Crude Oil Demand

- The `C` Factor: Cement Industry in India � Unhealthy Oligopoly & Controls

- Venezuela`s Macroeconomic Crisis: An Enduring Ordeal of Worsening Economy with Alarming Inflation

- Guwahati Molestation Case: Professional Responsibility Vs Moral Ethics

- The Renaissance of the South Africa Music Industry

- EU BREAK-UP?

- The Cyprus Bailout - Is the European Zone Failing?

- Global Financial Crisis and ITS Impact on Real and Financial Sectors in India

Best Selling Case Studies In Economics

- Perfect Competition under eBay: A Fact or a Factoid?

- Mexican Telecom Industry: (Un)wanted Monopoly?

- Mobile Telephony in India: Would Cheaper Rates Bring More Profits?

- US Financial Crisis: The Fall of Lehman Brothers

- Executive Pay Package: A Study of Demand and Supply

- OPEC: The Economics of a Cartel (A)

- OPEC The Economics of a Cartel (B)

- OPEC: The Economics of a Cartel (C)

- Comparative Cost Advantage and the American Outsourcing Backlash

- Global Oil Prices: Demand Side vs Supply Side Factors

Video Inerviews

Case studies on.

- View all Casebooks »

Course Case Mapping For

- View All Course Casemaps »

- View all Video Interviews »

- Executive Briefs

- Executive Inerviews

- View all Executive Briefs »

Executive Interviews

- View All Executive Interviews »

Contact us: IBS Case Development Centre (IBSCDC), IFHE Campus, Donthanapally, Sankarapally Road, Hyderabad-501203, Telangana, INDIA. Mob: +91- 9640901313, E-mail: [email protected]

Home > Case Studies

Case Studies

Discover all the ways our 2,000 customers succeed, thrive and grow with Oxford Economics. Read success stories from Oxford Economics' clients in sectors such as pensions, energy and Real Estate. Learn how they solved their business challenges, supported their businesses' growth and adapted to new markets using Oxford Economics market-leading consulting and subscription services.

Case Study | Multinational Drinks Company

Bespoke dashboards and agile on-demand economics support

Background Today’s turbulent macroeconomic and consumer environment makes strategy and planning particularly difficult for firms in the business-to-consumer sector. The pandemic, major global conflicts and geopolitical tensions have caused major supply-side disruptions. At the same time, the ever-changing consumer environment, recent unprecedented levels of inflation and the ensuing cost of living crisis have been a...

Case Study | Royal London

Exploring the implications of higher pension contributions

Many households fail to save adequately for retirement. Using in-house models, the study assesses the impact of higher pension contributions on both pension savings and UK economic growth.

Case Study | A global aggregate and building materials provider

Constructing Success by Capitalising on Long-Term Opportunities

Helping a strategy department identify its 10-year growth opportunities

Case Study | Semiconductor Industry Association

A unique policy-driven impact scenario for CHIPS Act

How Oxford Economics engaged the world’s largest chip manufacturers to develop an industry-wide impact assessment of the CHIPS and Sciences Act.

Case Study | Building material manufacturer

Benchmarking Success: Building a Global Market Demand Indicator

Creating a new demand measure to enable a building material manufacturer to gauge its performance.

Case Study | Multinational services company

Quantifying the impact of climate on customers

Leveraging industry-specific climate forecasts to future-proof revenue.

Case Study | Energy UK

Achieving net zero advocacy goals

Highlighting the economic opportunities the energy transition presents and the consequences of not grasping them.

Charting a course for global growth in the shipping industry

Empowering a leading shipping company to enhance its strategic planning and identify new routes for growth

Global macroeconomic and risk scenario tool

Enabling a major automotive manufacturer to anticipate and respond effectively to evolving market dynamics across its global operations.

Risk signal identification, prioritisation and monitoring evaluation model

Despite existing internal risk management processes, a major automotive manufacturer was unprepared for and failed to anticipate and mitigate significant risks and shocks that have significantly affected its operations in recent years, including its sales, supply chain and financing.

Bespoke automotive sector sales forecasting

Automotive companies face many challenges: regulations, emission controls, litigation, political uncertainty, complex and problematic supply chains and disruptive technology are perhaps among the most pressing.

Case Study | Australian Finance Industry Association

The economic impact of Buy Now Pay Later in Australia

Governments globally are realising the importance of payments and financial services efficiency to economic growth, financial wellbeing and social participation. The Australian Finance Industry Association (AFIA) recognises innovation, competition, market efficiency, economic growth and consumer protection are interrelated and, therefore, must be addressed collectively. An informed understanding of the Buy Now Pay Later (BNPL) sector...

Case Study | City of Sydney

City of Sydney’s 2022 Business Needs Survey Report

The City of Sydney required an advisor with the capability to develop a high-impact, user-focused report to: The report had to be engaging and highly visual, containing a range of different devices to communicate economic insights to a range of readers. The solution Oxford Economics Australia developed a rich and compelling report to engage and...

Case Study | Leading Australian Law Firm

Expert Witness Report on property market influences and outlook

The repudiation of an existing development agreement resulted in Supreme Court proceedings whereby residential property market forecasts were required to demonstrate the outlook for the Darwin residential market at that time. Separate sale price and rent projections were needed (on an annual basis) for detached house and attached dwellings for the period of 2017-2030. Importantly,...

Case Study | QBE LMI

The Annual Housing Outlook 2022 – the Green Edition

The objective of this work was to reinforce QBE LMI’s position by providing an outlook of housing market performance and stimulate informed discussion about environmental sustainability within the housing market and a state by state performance analysis of housing market prices and rents. The solution The project was approached collaboratively with the QBE LMI project...

Case Study | Australia Energy Market

Forecasts and scenarios to inform the future of Australia’s energy market

Oxford Economics Australia was commissioned to produce macroeconomic and commodity scenario projections that could be used to generate long-term gas and electricity demand and supply projections across a range of energy transition scenarios. The solution We worked closely with the client’s team and their stakeholders to produce long-term (30-year) macroeconomic and commodity price forecasts, across...

Case Study | National Bureau of Statistics

Developing a leading statistical ecosystem to empower decision makers in government, the private sector and broader society

The National Bureau of Statistics asked Oxford Economics to redesign its existing statistical publications to make them more user-focused. This included: The solution Oxford Economics worked closely with the National Bureau of Statistics over a period of six months to develop 57 redesigned publication templates. The work was completed in two broad stages: The final...

Case Study | Schroders

Understanding climate-related implications on investment strategies

As global awareness of climate change continues to increase, investors are beginning to consider how climate risks and opportunities may affect long-term investment strategies and returns. Our client, Schroders, a large asset manager, is no exception, which is why they switched to our Global Climate Service as the economic foundation for their long-run asset class publication.

Case Study | Life insurance company

Improved research processes and forecasting accuracy

A leading life insurance company has used Oxford Economics' Global Economic Model to improve their global economic research processes and increase the accuracy of their own economic forecasts.

Case Study | Large global pension fund

Supporting investment strategy with long-term perspectives

Overview To make long-term investments, investors need long-term thinking. That’s why one of the largest pension funds globally subscribed to Oxford Economics’ Global Macro Service, Global Cities Service and Regional City Services. They currently use our macroeconomic forecasts as one of the references in reviewing market fundamentals for investment. The Challenge As long-term investors, our...

Find out how Oxford Economics can help you on your path to business growth

Sign up to our Resource Hub to download the latest and most popular reports.

Select to close video modal

Select to close video modal Play Video Select to play video

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

Note that the Economics 103 Case Studies are meant to supplement the course material by giving you experience applying Economic concepts to real world examples. While they are beyond the level you will be tested on, they are useful for students who want a stronger grasp of the concepts and their applications.

Note that this case study is difficult if you do not print the diagrams, or reproduce them on graph paper. If you are unable to print, we recommend reviewing the solutions to ensure you understand the general lessons presented.

In 2016 rental vacancy rates dropped to as low as 0.6% in Greater Victoria. When compared to the national average of 3.3% it is clear why many media channels and individuals were calling it a ‘housing crisis’. Students were especially hit hard by these low vacancies, with some international students at Camoson college having to return home when they couldn’t find a place to stay. Using our competitive market model, let’s examine some of the factors that played into this crisis and policies that could be used to fix it.

Read more about the Victoria Housing crisis.

Below is a representation of the Victoria Housing Market.

1. Label Figure CS3 a. with the Equilibrium price and quantity, and label supply and demand curves as either renters or landlords.

If supply is equal to demand there should be no vacancy, but we know that a 0% vacancy rate would be an extremely difficult market for renters.

2. Explain why a housing market at equilibrium could still have a vacancy rate of 4%.

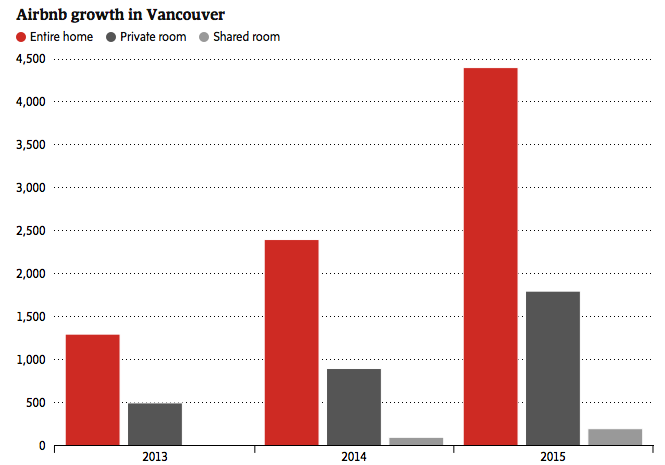

One factor that has been blamed for the housing crisis is Airbnb. Airbnb describes itself as an online marketplace and hospitality service, enabling people to list or rent short-term lodging including vacation rentals, apartment rentals, homestays, hostel beds, or hotel rooms, with the cost of lodging set by the property owner. City councillors have targeted these short term rentals, saying that many landlords have opted to Airbnb their home, rather than rent out longer term. The growth of Airbnb in Vancouver has been shown below.

3. Assume 3000 landlords decide to switch from renting to Airbnb, show the impact of the changes on Figure CS3 b. Label the new equilibrium price and quantity.

Note that Airbnb has been adamant that short-term rentals have had a neglible impact on the housing market, citing that in Vancouver only 320 hosts rent out thier properties often enough to make more money that long term rentals. That represents only 0.11% of the total housing units. In Victoria, that would mean only 25 units are affected by short-term rentals.

Tom Davidoff , a University of B.C. business professor, said t he general public frequently looks at the fact that Airbnb is popular in expensive neighbourhoods and concludes that it is Airbnb that drives up rents there. But, he said, those neighbourhoods were expensive anyway and the impact of Airbnb taking a certain slice of the available stock is minimal.

Read more about Airbnb’s supposed impact on the market.