- Predictive Analytics Workshops

- Corporate Strategy Workshops

- Advanced Excel for MBA

- Powerpoint Workshops

- Digital Transformation

- Competing on Business Analytics

- Aligning Analytics with Strategy

- Building & Sustaining Competitive Advantages

- Corporate Strategy

- Aligning Strategy & Sales

- Digital Marketing

- Hypothesis Testing

- Time Series Analysis

- Regression Analysis

- Machine Learning

- Marketing Strategy

- Branding & Advertising

- Risk Management

- Hedging Strategies

- Network Plotting

- Bar Charts & Time Series

- Technical Analysis of Stocks MACD

- NPV Worksheet

- ABC Analysis Worksheet

- WACC Worksheet

- Porter 5 Forces

- Porter Value Chain

- Amazing Charts

- Garnett Chart

- HBR Case Solution

- 4P Analysis

- 5C Analysis

- NPV Analysis

- SWOT Analysis

- PESTEL Analysis

- Cost Optimization

Moore Medical Corp.

- Technology & Operations / MBA EMBA Resources

Next Case Study Solutions

- Bush Boake Allen Case Study Solution

- Destiny WebSolutions, Inc. Case Study Solution

- E-Commerce at Williams-Sonoma Case Study Solution

- Modular Strategies: B2B Technology and Architectural Knowledge Case Study Solution

- Strategic Management of Product Recovery Case Study Solution

Previous Case Solutions

- E-Business: Revolution, Evolution, or Hype? Case Study Solution

- Ace Quality Improvement Exercise (A) Case Study Solution

- Jaguar Comes to Halewood: The Story of a Turnaround Case Study Solution

- Microsoft.NET Case Study Solution

- Dynamic Synchronization of Strategy and Information Technology Case Study Solution

Predictive Analytics

April 25, 2024

Popular Tags

Case study solutions.

Case Study Solution | Assignment Help | Case Help

Moore medical corp. description.

Moore Medical is a medium-sized distributor of medical supplies to practitioners, such as podiatrists and emergency medical technicians. At the time of the case, it has relied on traditional customer channels such as catalogs, phones, and faxes to communicate product offerings, promotions, and availability, and to take orders. It is now attempting to shift to a "bricks and clicks" distributor with a strong Internet presence. It has already made substantial investments in an e-commerce Web site and in "back office" ERP software to improve the fulfillment performance of its four distribution centers. The ERP software has not lived up to expectations in all areas, and the company must decide whether to invest in more modules for this system that might address its shortcomings. It must also decide whether to make a significant additional investment in customer relationship management software.

Case Description Moore Medical Corp.

Strategic managment tools used in case study analysis of moore medical corp., step 1. problem identification in moore medical corp. case study, step 2. external environment analysis - pestel / pest / step analysis of moore medical corp. case study, step 3. industry specific / porter five forces analysis of moore medical corp. case study, step 4. evaluating alternatives / swot analysis of moore medical corp. case study, step 5. porter value chain analysis / vrio / vrin analysis moore medical corp. case study, step 6. recommendations moore medical corp. case study, step 7. basis of recommendations for moore medical corp. case study, quality & on time delivery.

100% money back guarantee if the quality doesn't match the promise

100% Plagiarism Free

If the work we produce contain plagiarism then we payback 1000 USD

Paypal Secure

All your payments are secure with Paypal security.

300 Words per Page

We provide 300 words per page unlike competitors' 250 or 275

Free Title Page, Citation Page, References, Exhibits, Revision, Charts

Case study solutions are career defining. Order your custom solution now.

Case Analysis of Moore Medical Corp.

Moore Medical Corp. is a Harvard Business (HBR) Case Study on Technology & Operations , Texas Business School provides HBR case study assignment help for just $9. Texas Business School(TBS) case study solution is based on HBR Case Study Method framework, TBS expertise & global insights. Moore Medical Corp. is designed and drafted in a manner to allow the HBR case study reader to analyze a real-world problem by putting reader into the position of the decision maker. Moore Medical Corp. case study will help professionals, MBA, EMBA, and leaders to develop a broad and clear understanding of casecategory challenges. Moore Medical Corp. will also provide insight into areas such as – wordlist , strategy, leadership, sales and marketing, and negotiations.

Case Study Solutions Background Work

Moore Medical Corp. case study solution is focused on solving the strategic and operational challenges the protagonist of the case is facing. The challenges involve – evaluation of strategic options, key role of Technology & Operations, leadership qualities of the protagonist, and dynamics of the external environment. The challenge in front of the protagonist, of Moore Medical Corp., is to not only build a competitive position of the organization but also to sustain it over a period of time.

Strategic Management Tools Used in Case Study Solution

The Moore Medical Corp. case study solution requires the MBA, EMBA, executive, professional to have a deep understanding of various strategic management tools such as SWOT Analysis, PESTEL Analysis / PEST Analysis / STEP Analysis, Porter Five Forces Analysis, Go To Market Strategy, BCG Matrix Analysis, Porter Value Chain Analysis, Ansoff Matrix Analysis, VRIO / VRIN and Marketing Mix Analysis.

Texas Business School Approach to Technology & Operations Solutions

In the Texas Business School, Moore Medical Corp. case study solution – following strategic tools are used - SWOT Analysis, PESTEL Analysis / PEST Analysis / STEP Analysis, Porter Five Forces Analysis, Go To Market Strategy, BCG Matrix Analysis, Porter Value Chain Analysis, Ansoff Matrix Analysis, VRIO / VRIN and Marketing Mix Analysis. We have additionally used the concept of supply chain management and leadership framework to build a comprehensive case study solution for the case – Moore Medical Corp.

Step 1 – Problem Identification of Moore Medical Corp. - Harvard Business School Case Study

The first step to solve HBR Moore Medical Corp. case study solution is to identify the problem present in the case. The problem statement of the case is provided in the beginning of the case where the protagonist is contemplating various options in the face of numerous challenges that Medical Moore is facing right now. Even though the problem statement is essentially – “Technology & Operations” challenge but it has impacted by others factors such as communication in the organization, uncertainty in the external environment, leadership in Medical Moore, style of leadership and organization structure, marketing and sales, organizational behavior, strategy, internal politics, stakeholders priorities and more.

Step 2 – External Environment Analysis

Texas Business School approach of case study analysis – Conclusion, Reasons, Evidences - provides a framework to analyze every HBR case study. It requires conducting robust external environmental analysis to decipher evidences for the reasons presented in the Moore Medical Corp.. The external environment analysis of Moore Medical Corp. will ensure that we are keeping a tab on the macro-environment factors that are directly and indirectly impacting the business of the firm.

What is PESTEL Analysis? Briefly Explained

PESTEL stands for political, economic, social, technological, environmental and legal factors that impact the external environment of firm in Moore Medical Corp. case study. PESTEL analysis of " Moore Medical Corp." can help us understand why the organization is performing badly, what are the factors in the external environment that are impacting the performance of the organization, and how the organization can either manage or mitigate the impact of these external factors.

How to do PESTEL / PEST / STEP Analysis? What are the components of PESTEL Analysis?

As mentioned above PESTEL Analysis has six elements – political, economic, social, technological, environmental, and legal. All the six elements are explained in context with Moore Medical Corp. macro-environment and how it impacts the businesses of the firm.

How to do PESTEL Analysis for Moore Medical Corp.

To do comprehensive PESTEL analysis of case study – Moore Medical Corp. , we have researched numerous components under the six factors of PESTEL analysis.

Political Factors that Impact Moore Medical Corp.

Political factors impact seven key decision making areas – economic environment, socio-cultural environment, rate of innovation & investment in research & development, environmental laws, legal requirements, and acceptance of new technologies.

Government policies have significant impact on the business environment of any country. The firm in “ Moore Medical Corp. ” needs to navigate these policy decisions to create either an edge for itself or reduce the negative impact of the policy as far as possible.

Data safety laws – The countries in which Medical Moore is operating, firms are required to store customer data within the premises of the country. Medical Moore needs to restructure its IT policies to accommodate these changes. In the EU countries, firms are required to make special provision for privacy issues and other laws.

Competition Regulations – Numerous countries have strong competition laws both regarding the monopoly conditions and day to day fair business practices. Moore Medical Corp. has numerous instances where the competition regulations aspects can be scrutinized.

Import restrictions on products – Before entering the new market, Medical Moore in case study Moore Medical Corp." should look into the import restrictions that may be present in the prospective market.

Export restrictions on products – Apart from direct product export restrictions in field of technology and agriculture, a number of countries also have capital controls. Medical Moore in case study “ Moore Medical Corp. ” should look into these export restrictions policies.

Foreign Direct Investment Policies – Government policies favors local companies over international policies, Medical Moore in case study “ Moore Medical Corp. ” should understand in minute details regarding the Foreign Direct Investment policies of the prospective market.

Corporate Taxes – The rate of taxes is often used by governments to lure foreign direct investments or increase domestic investment in a certain sector. Corporate taxation can be divided into two categories – taxes on profits and taxes on operations. Taxes on profits number is important for companies that already have a sustainable business model, while taxes on operations is far more significant for companies that are looking to set up new plants or operations.

Tariffs – Chekout how much tariffs the firm needs to pay in the “ Moore Medical Corp. ” case study. The level of tariffs will determine the viability of the business model that the firm is contemplating. If the tariffs are high then it will be extremely difficult to compete with the local competitors. But if the tariffs are between 5-10% then Medical Moore can compete against other competitors.

Research and Development Subsidies and Policies – Governments often provide tax breaks and other incentives for companies to innovate in various sectors of priority. Managers at Moore Medical Corp. case study have to assess whether their business can benefit from such government assistance and subsidies.

Consumer protection – Different countries have different consumer protection laws. Managers need to clarify not only the consumer protection laws in advance but also legal implications if the firm fails to meet any of them.

Political System and Its Implications – Different political systems have different approach to free market and entrepreneurship. Managers need to assess these factors even before entering the market.

Freedom of Press is critical for fair trade and transparency. Countries where freedom of press is not prevalent there are high chances of both political and commercial corruption.

Corruption level – Medical Moore needs to assess the level of corruptions both at the official level and at the market level, even before entering a new market. To tackle the menace of corruption – a firm should have a clear SOP that provides managers at each level what to do when they encounter instances of either systematic corruption or bureaucrats looking to take bribes from the firm.

Independence of judiciary – It is critical for fair business practices. If a country doesn’t have independent judiciary then there is no point entry into such a country for business.

Government attitude towards trade unions – Different political systems and government have different attitude towards trade unions and collective bargaining. The firm needs to assess – its comfort dealing with the unions and regulations regarding unions in a given market or industry. If both are on the same page then it makes sense to enter, otherwise it doesn’t.

Economic Factors that Impact Moore Medical Corp.

Social factors that impact moore medical corp., technological factors that impact moore medical corp., environmental factors that impact moore medical corp., legal factors that impact moore medical corp., step 3 – industry specific analysis, what is porter five forces analysis, step 4 – swot analysis / internal environment analysis, step 5 – porter value chain / vrio / vrin analysis, step 6 – evaluating alternatives & recommendations, step 7 – basis for recommendations, references :: moore medical corp. case study solution.

- sales & marketing ,

- leadership ,

- corporate governance ,

- Advertising & Branding ,

- Corporate Social Responsibility (CSR) ,

Amanda Watson

Leave your thought here

© 2019 Texas Business School. All Rights Reserved

USEFUL LINKS

Follow us on.

Subscribe to our newsletter to receive news on update.

Dark Brown Leather Watch

$200.00 $180.00

Dining Chair

$300.00 $220.00

Creative Wooden Stand

$100.00 $80.00

2 x $180.00

2 x $220.00

Subtotal: $200.00

Free Shipping on All Orders Over $100!

Wooden round table

$360.00 $300.00

Hurley Dry-Fit Chino Short. Men's chino short. Outseam Length: 19 Dri-FIT Technology helps keep you dry and comfortable. Made with sweat-wicking fabric. Fitted waist with belt loops. Button waist with zip fly provides a classic look and feel .

- Order Status

- Testimonials

- What Makes Us Different

Moore Medical Corp. Harvard Case Solution & Analysis

Home >> Harvard Case Study Analysis Solutions >> Moore Medical Corp.

Moore Medical is the average distributor of medicines for practitioners, such as pediatricians and emergency medical equipment. At the time of the case, he relied on traditional channels of customer, such as catalogs, phone and fax to communicate product offerings, promotions, and availability, and take orders . He is now trying to move to the "bricks and clicks" distributor with a strong presence of the internet. He has already made significant investments in e-commerce, web site and in the "back office" ERP software to improve productivity performance of its four distribution centers. ERP software has not met expectations in all areas, and the company must decide whether to invest in additional modules for the system, which could solve their shortcomings. He must also decide whether to make a substantial additional investment in software for managing customer relationships. "Hide by Andrew McAfee, Gregory border Source: Harvard Business School 21 pages. Publication Date: April 23, 2001. Prod. #: Six hundred and one thousand one hundred forty-two-PDF-ENG

Related Case Solutions & Analyses:

Hire us for Originally Written Case Solution/ Analysis

Like us and get updates:.

Harvard Case Solutions

Search Case Solutions

- Accounting Case Solutions

- Auditing Case Studies

- Business Case Studies

- Economics Case Solutions

- Finance Case Studies Analysis

- Harvard Case Study Analysis Solutions

- Human Resource Cases

- Ivey Case Solutions

- Management Case Studies

- Marketing HBS Case Solutions

- Operations Management Case Studies

- Supply Chain Management Cases

- Taxation Case Studies

More From Harvard Case Study Analysis Solutions

- University Technology Ventures: October 2000

- Federal Express: Early History

- Wintel (E): From Multi-Market Contact to Multi-Geographic Contact

- Vision Thing

- Sykue Bioenergya

- Nokia India Battery Recall Logistics

- Cookie man- Exploring New Frontiers

Contact us:

Check Order Status

How Does it Work?

Why TheCaseSolutions.com?

Moore Medical Corp

- Harvard Case Studies

Moore Medical Corp Case Study Solution & Analysis

In most courses studied at Harvard Business schools, students are provided with a case study. Major HBR cases concerns on a whole industry, a whole organization or some part of organization; profitable or non-profitable organizations. Student’s role is to analyze the case and diagnose the situation, identify the problem and then give appropriate recommendations and steps to be taken.

To make a detailed case analysis, student should follow these steps:

STEP 1: Reading Up Harvard Case Study Method Guide:

Case study method guide is provided to students which determine the aspects of problem needed to be considered while analyzing a case study. It is very important to have a thorough reading and understanding of guidelines provided. However, poor guide reading will lead to misunderstanding of case and failure of analyses. It is recommended to read guidelines before and after reading the case to understand what is asked and how the questions are to be answered. Therefore, in-depth understanding f case guidelines is very important.

STEP 2: Reading The Moore Medical Corp Harvard Case Study:

To have a complete understanding of the case, one should focus on case reading. It is said that case should be read two times. Initially, fast reading without taking notes and underlines should be done. Initial reading is to get a rough idea of what information is provided for the analyses. Then, a very careful reading should be done at second time reading of the case. This time, highlighting the important point and mark the necessary information provided in the case. In addition, the quantitative data in case, and its relations with other quantitative or qualitative variables should be given more importance. Also, manipulating different data and combining with other information available will give a new insight. However, all of the information provided is not reliable and relevant.

When having a fast reading, following points should be noted:

- Nature of organization

- Nature if industry in which organization operates.

- External environment that is effecting organization

- Problems being faced by management

- Identification of communication strategies.

- Any relevant strategy that can be added.

- Control and out-of-control situations.

When reading the case for second time, following points should be considered:

- Decisions needed to be made and the responsible Person to make decision.

- Objectives of the organization and key players in this case.

- The compatibility of objectives. if not, their reconciliations and necessary redefinition.

- Sources and constraints of organization from meeting its objectives.

After reading the case and guidelines thoroughly, reader should go forward and start the analyses of the case.

STEP 3: Doing The Case Analysis Of Moore Medical Corp:

To make an appropriate case analyses, firstly, reader should mark the important problems that are happening in the organization. There may be multiple problems that can be faced by any organization. Secondly, after identifying problems in the company, identify the most concerned and important problem that needed to be focused.

Firstly, the introduction is written. After having a clear idea of what is defined in the case, we deliver it to the reader. It is better to start the introduction from any historical or social context. The challenging diagnosis for Moore Medical Corp and the management of information is needed to be provided. However, introduction should not be longer than 6-7 lines in a paragraph. As the most important objective is to convey the most important message for to the reader.

After introduction, problem statement is defined. In the problem statement, the company’s most important problem and constraints to solve these problems should be define clearly. However, the problem should be concisely define in no more than a paragraph. After defining the problems and constraints, analysis of the case study is begin.

STEP 4: SWOT Analysis of the Moore Medical Corp HBR Case Solution:

SWOT analysis helps the business to identify its strengths and weaknesses, as well as understanding of opportunity that can be availed and the threat that the company is facing. SWOT for Moore Medical Corp is a powerful tool of analysis as it provide a thought to uncover and exploit the opportunities that can be used to increase and enhance company’s operations. In addition, it also identifies the weaknesses of the organization that will help to be eliminated and manage the threats that would catch the attention of the management.

This strategy helps the company to make any strategy that would differentiate the company from competitors, so that the organization can compete successfully in the industry. The strengths and weaknesses are obtained from internal organization. Whereas, the opportunities and threats are generally related from external environment of organization. Moreover, it is also called Internal-External Analysis.

In the strengths, management should identify the following points exists in the organization:

- Advantages of the organization

- Activities of the company better than competitors.

- Unique resources and low cost resources company have.

- Activities and resources market sees as the company’s strength.

- Unique selling proposition of the company.

WEAKNESSES:

- Improvement that could be done.

- Activities that can be avoided for Moore Medical Corp.

- Activities that can be determined as your weakness in the market.

- Factors that can reduce the sales.

- Competitor’s activities that can be seen as your weakness.

OPPORTUNITIES:

- Good opportunities that can be spotted.

- Interesting trends of industry.

- Change in technology and market strategies

- Government policy changes that is related to the company’s field

- Changes in social patterns and lifestyles.

- Local events.

Following points can be identified as a threat to company:

- Company’s facing obstacles.

- Activities of competitors.

- Product and services quality standards

- Threat from changing technologies

- Financial/cash flow problems

- Weakness that threaten the business.

Following points should be considered when applying SWOT to the analysis:

- Precise and verifiable phrases should be sued.

- Prioritize the points under each head, so that management can identify which step has to be taken first.

- Apply the analyses at proposed level. Clear yourself first that on what basis you have to apply SWOT matrix.

- Make sure that points identified should carry itself with strategy formulation process.

- Use particular terms (like USP, Core Competencies Analyses etc.) to get a comprehensive picture of analyses.

STEP 5: PESTEL/ PEST Analysis of Moore Medical Corp Case Solution:

Pest analyses is a widely used tool to analyze the Political, Economic, Socio-cultural, Technological, Environmental and legal situations which can provide great and new opportunities to the company as well as these factors can also threat the company, to be dangerous in future.

Pest analysis is very important and informative. It is used for the purpose of identifying business opportunities and advance threat warning. Moreover, it also helps to the extent to which change is useful for the company and also guide the direction for the change. In addition, it also helps to avoid activities and actions that will be harmful for the company in future, including projects and strategies.

To analyze the business objective and its opportunities and threats, following steps should be followed:

- Brainstorm and assumption the changes that should be made to organization. Answer the necessary questions that are related to specific needs of organization

- Analyze the opportunities that would be happen due to the change.

- Analyze the threats and issues that would be caused due to change.

- Perform cost benefit analyses and take the appropriate action.

- Next political elections and changes that will happen in the country due to these elections

- Strong and powerful political person, his point of view on business policies and their effect on the organization.

- Strength of property rights and law rules. And its ratio with corruption and organized crimes. Changes in these situation and its effects.

- Change in Legislation and taxation effects on the company

- Trend of regulations and deregulations. Effects of change in business regulations

- Timescale of legislative change.

- Other political factors likely to change for Moore Medical Corp.

ECONOMICAL:

- Position and current economy trend i.e. growing, stagnant or declining.

- Exchange rates fluctuations and its relation with company.

- Change in Level of customer’s disposable income and its effect.

- Fluctuation in unemployment rate and its effect on hiring of skilled employees

- Access to credit and loans. And its effects on company

- Effect of globalization on economic environment

- Considerations on other economic factors

SOCIO-CULTURAL:

- Change in population growth rate and age factors, and its impacts on organization.

- Effect on organization due to Change in attitudes and generational shifts.

- Standards of health, education and social mobility levels. Its changes and effects on company.

- Employment patterns, job market trend and attitude towards work according to different age groups.

- Social attitudes and social trends, change in socio culture an dits effects.

- Religious believers and life styles and its effects on organization

- Other socio culture factors and its impacts.

TECHNOLOGICAL:

- Any new technology that company is using

- Any new technology in market that could affect the work, organization or industry

- Access of competitors to the new technologies and its impact on their product development/better services.

- Research areas of government and education institutes in which the company can make any efforts

- Changes in infra-structure and its effects on work flow

- Existing technology that can facilitate the company

- Other technological factors and their impacts on company and industry

These headings and analyses would help the company to consider these factors and make a “big picture” of company’s characteristics. This will help the manager to take the decision and drawing conclusion about the forces that would create a big impact on company and its resources.

STEP 6: Porter’s Five Forces/ Strategic Analysis Of The Moore Medical Corp Case Study:

To analyze the structure of a company and its corporate strategy, Porter’s five forces model is used. In this model, five forces have been identified which play an important part in shaping the market and industry. These forces are used to measure competition intensity and profitability of an industry and market.

These forces refers to micro environment and the company ability to serve its customers and make a profit. These five forces includes three forces from horizontal competition and two forces from vertical competition. The five forces are discussed below:

- THREAT OF NEW ENTRANTS:

- as the industry have high profits, many new entrants will try to enter into the market. However, the new entrants will eventually cause decrease in overall industry profits. Therefore, it is necessary to block the new entrants in the industry. following factors is describing the level of threat to new entrants:

- Barriers to entry that includes copy rights and patents.

- High capital requirement

- Government restricted policies

- Switching cost

- Access to suppliers and distributions

- Customer loyalty to established brands.

- THREAT OF SUBSTITUTES:

- this describes the threat to company. If the goods and services are not up to the standard, consumers can use substitutes and alternatives that do not need any extra effort and do not make a major difference. For example, using Aquafina in substitution of tap water, Pepsi in alternative of Coca Cola. The potential factors that made customer shift to substitutes are as follows:

- Price performance of substitute

- Switching costs of buyer

- Products substitute available in the market

- Reduction of quality

- Close substitution are available

- DEGREE OF INDUSTRY RIVALRY:

- the lesser money and resources are required to enter into any industry, the higher there will be new competitors and be an effective competitor. It will also weaken the company’s position. Following are the potential factors that will influence the company’s competition:

- Competitive advantage

- Continuous innovation

- Sustainable position in competitive advantage

- Level of advertising

- Competitive strategy

- BARGAINING POWER OF BUYERS:

- it deals with the ability of customers to take down the prices. It mainly consists the importance of a customer and the level of cost if a customer will switch from one product to another. The buyer power is high if there are too many alternatives available. And the buyer power is low if there are lesser options of alternatives and switching. Following factors will influence the buying power of customers:

- Bargaining leverage

- Switching cost of a buyer

- Buyer price sensitivity

- Competitive advantage of company’s product

- BARGAINING POWER OF SUPPLIERS:

- this refers to the supplier’s ability of increasing and decreasing prices. If there are few alternatives o supplier available, this will threat the company and it would have to purchase its raw material in supplier’s terms. However, if there are many suppliers alternative, suppliers have low bargaining power and company do not have to face high switching cost. The potential factors that effects bargaining power of suppliers are the following:

- Input differentiation

- Impact of cost on differentiation

- Strength of distribution centers

- Input substitute’s availability.

STEP 7: VRIO Analysis of Moore Medical Corp:

Vrio analysis for Moore Medical Corp case study identified the four main attributes which helps the organization to gain a competitive advantages. The author of this theory suggests that firm must be valuable, rare, imperfectly imitable and perfectly non sustainable. Therefore there must be some resources and capabilities in an organization that can facilitate the competitive advantage to company. The four components of VRIO analysis are described below: VALUABLE: the company must have some resources or strategies that can exploit opportunities and defend the company from major threats. If the company holds some value then answer is yes. Resources are also valuable if they provide customer satisfaction and increase customer value. This value may create by increasing differentiation in existing product or decrease its price. Is these conditions are not met, company may lead to competitive disadvantage. Therefore, it is necessary to continually review the Moore Medical Corp company’s activities and resources values. RARE: the resources of the Moore Medical Corp company that are not used by any other company are known as rare. Rare and valuable resources grant much competitive advantages to the firm. However, when more than one few companies uses the same resources and provide competitive parity are also known as rare resources. Even, the competitive parity is not desired position, but the company should not lose its valuable resources, even they are common. COSTLY TO IMITATE : the resources are costly to imitate, if other organizations cannot imitate it. However, imitation is done in two ways. One is duplicating that is direct imitation and the other one is substituting that is indirect imitation. Any firm who has valuable and rare resources, and these resources are costly to imitate, have achieved their competitive advantage. However, resources should also be perfectly non sustainable. The reasons that resource imitation is costly are historical conditions, casual ambiguity and social complexity. ORGANIZED TO CAPTURE VALUE : resources, itself, cannot provide advantages to organization until it is organized and exploit to do so. A firm (like Moore Medical Corp) must organize its management systems, processes, policies and strategies to fully utilize the resource’s potential to be valuable, rare and costly to imitate.

STEP 8: Generating Alternatives For Moore Medical Corp Case Solution:

After completing the analyses of the company, its opportunities and threats, it is important to generate a solution of the problem and the alternatives a company can apply in order to solve its problems. To generate the alternative of problem, following things must to be kept in mind:

- Realistic solution should be identified that can be operated in the company, with all its constraints and opportunities.

- as the problem and its solution cannot occur at the same time, it should be described as mutually exclusive

- it is not possible for a company to not to take any action, therefore, the alternative of doing nothing is not viable.

- Student should provide more than one decent solution. Providing two undesirable alternatives to make the other one attractive is not acceptable.

Once the alternatives have been generated, student should evaluate the options and select the appropriate and viable solution for the company.

STEP 9: Selection Of Alternatives For Moore Medical Corp Case Solution:

It is very important to select the alternatives and then evaluate the best one as the company have limited choices and constraints. Therefore to select the best alternative, there are many factors that is needed to be kept in mind. The criteria’s on which business decisions are to be selected areas under:

- Improve profitability

- Increase sales, market shares, return on investments

- Customer satisfaction

- Brand image

- Corporate mission, vision and strategy

- Resources and capabilities

Alternatives should be measures that which alternative will perform better than other one and the valid reasons. In addition, alternatives should be related to the problem statements and issues described in the case study.

STEP 10: Evaluation Of Alternatives For Moore Medical Corp Case Solution:

If the selected alternative is fulfilling the above criteria, the decision should be taken straightforwardly. Best alternative should be selected must be the best when evaluating it on the decision criteria. Another method used to evaluate the alternatives are the list of pros and cons of each alternative and one who has more pros than cons and can be workable under organizational constraints.

STEP 11: Recommendations For Moore Medical Corp Case Study (Solution):

There should be only one recommendation to enhance the company’s operations and its growth or solving its problems. The decision that is being taken should be justified and viable for solving the problems.

- My presentations

Auth with social network:

Download presentation

We think you have liked this presentation. If you wish to download it, please recommend it to your friends in any social system. Share buttons are a little bit lower. Thank you!

Presentation is loading. Please wait.

To view this video please enable JavaScript, and consider upgrading to a web browser that supports HTML5 video

Moore Medical Corporation

Published by Miles Rice Modified over 8 years ago

Similar presentations

Presentation on theme: "Moore Medical Corporation"— Presentation transcript:

Enterprise e-Business Systems

Company Background: Nestlé SA is a giant food and pharmaceuticals company that operates virtually all over the world. Headquartered in Vevey, Switzerland,

Chapter 9 Achieving Operational Excellence and Customer Intimacy: Enterprise Applications Video Cases Video Case 1a: What Is Workday: Enterprise Software.

8.1 © 2007 by Prentice Hall 8 Chapter Achieving Operational Excellence and Customer Intimacy: Enterprise Applications.

To Accompany Russell and Taylor, Operations Management, 4th Edition, 2003 Prentice-Hall, Inc. All rights reserved. Resource Planning Chapter 14.

Customer relationship management.

Chapter 8 Enterprise Business Systems

Enterprise Systems.

LARGE SYSTEMS IMPLETATION PROCESS Overview Review process diagram homework practice.

McGraw-Hill/Irwin Copyright © 2008, The McGraw-Hill Companies, Inc. All rights reserved.

Achieving Operational Excellence Enterprise Applications Business Information Systems Laudon & Laudon Ch.8 (P.266)

Chapter 7 Functional and Enterprise Systems. Chapter 7Slide 2 Customer Relationship Management Customer Relationship Management The philosophy that.

Enterprise Applications and Business Process Integration

IN THE NEW PARADIGMS OF BUSINESS MANAGEMENT. ENTERPRISE RESOURCE PLANNING What is ERP? Business Challenges Today Why purchase an ERP solution ? Intway.

Enterprise Systems Organizations are finding benefits from using information systems to coordinate activities and decisions spanning multiple functional.

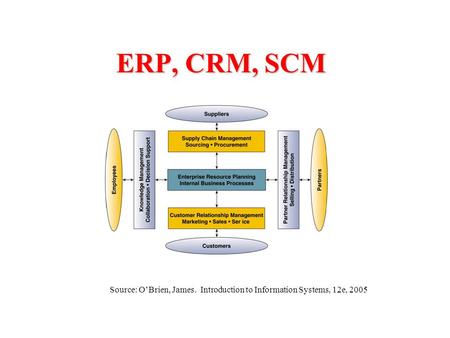

ERP, CRM, SCM Source: O’Brien, James. Introduction to Information Systems, 12e, 2005.

The future shape of business is being redefined through outsourcing.

About project

© 2024 SlidePlayer.com Inc. All rights reserved.

Fern Fort University

Moore medical corp. change management analysis & solution, hbr change management solutions, technology & operations case study | andrew mcafee, gregory bounds, case study description.

Moore Medical is a medium-sized distributor of medical supplies to practitioners, such as podiatrists and emergency medical technicians. At the time of the case, it has relied on traditional customer channels such as catalogs, phones, and faxes to communicate product offerings, promotions, and availability, and to take orders. It is now attempting to shift to a "bricks and clicks" distributor with a strong Internet presence. It has already made substantial investments in an e-commerce Web site and in "back office" ERP software to improve the fulfillment performance of its four distribution centers. The ERP software has not lived up to expectations in all areas, and the company must decide whether to invest in more modules for this system that might address its shortcomings. It must also decide whether to make a significant additional investment in customer relationship management software.

Change Management, Change management, Internet, IT, Marketing, Strategic planning, Supply chain , Case Study Solution, Term Papers

Order a Moore Medical Corp. case study solution now

What is Change Management Definition & Process? Why transformation efforts fail? What are the Change Management Issues in Moore Medical Corp. case study?

According to John P. Kotter – Change Management efforts are the major initiatives an organization undertakes to either boost productivity, increase product quality, improve the organizational culture, or reverse the present downward spiral that the company is going through. Sooner or later every organization requires change management efforts because without reinventing itself organization tends to lose out in the competitive market environment. The competitors catch up with it in products and service delivery, disruptors take away the lucrative and niche market positioning, or management ends up sitting on its own laurels thus missing out on the new trends, opportunities and developments in the industry.

What are the John P. Kotter - 8 Steps of Change Management?

Eight Steps of Kotter's Change Management Execution are -

- 1. Establish a Sense of Urgency

- 2. Form a Powerful Guiding Coalition

- 3. Create a Vision

- 4. Communicate the Vision

- 5. Empower Others to Act on the Vision

- 6. Plan for and Create Short Term Wins

- 7. Consolidate Improvements and Produce More Change

- 8. Institutionalize New Approaches

Are Change Management efforts easy to implement? What are the challenges in implementing change management processes?

According to authorlist Change management efforts are absolutely essential for the surviving and thriving of the organization but they are also extremely difficult to implement. Some of the biggest obstacles in implementing change efforts are –

- Change efforts are often made by new leaders because they are chosen by board to do so. These leaders often have less trust among the workforce compare to the people with whom they were already working with over the years.

- Change management efforts are made when the organization is in dire need and have fewer resources. This creates silos protection mentality within the organization.

- Change efforts are often targeted at making fundamental aspects in the business – operations and culture. Change management disrupts are status quo thus face opposition from both within and outside the organization.

- Change efforts create an environment of uncertainty in the organization that impacts not only the productivity in the organization but also the level of trust in the organization.

- Change management is often a lengthy, time consuming, and resource consuming process. Managements try to avoid them because they reflect negatively on the short term financial balance sheet of the organization.

Moore Medical Corp. SWOT Analysis, SWOT Matrix, Weighted SWOT Case Study Solution & Analysis

How you can apply Change Management Principles to Moore Medical Corp. case study?

Leaders can implement Change Management efforts in the organization by following the “Eight Steps Method of Change Management” by John P. Kotter.

Step 1 - Establish a sense of urgency

What are areas that require urgent change management efforts in the “ Moore Medical Corp. “ case study. Some of the areas that require urgent changes are – organizing sales force to meet competitive realities, building new organizational structure to enter new markets or explore new opportunities. The leader needs to convince the managers that the status quo is far more dangerous than the change efforts.

Step 2 - Form a powerful guiding coalition

As mentioned earlier in the paper, most change efforts are undertaken by new management which has far less trust in the bank compare to the people with whom the organization staff has worked for long period of time. New leaders need to tap in the talent of the existing managers and integrate them in the change management efforts . This will for a powerful guiding coalition that not only understands the urgency of the situation but also has the trust of the employees in the organization. If the team able to explain at the grass roots level what went wrong, why organization need change, and what will be the outcomes of the change efforts then there will be a far more positive sentiment about change efforts among the rank and file.

Step 3 - Create a vision

The most critical role of the leader who is leading the change efforts is – creating and communicating a vision that can have a broader buy-in among employees throughout the organization. The vision should not only talk about broader objectives but also about how every little change can add up to the improvement in the overall organization.

Step 4 - Communicating the vision

Leaders need to use every vehicle to communicate the desired outcomes of the change efforts and how each employee impacted by it can contribute to achieve the desired change. Secondly the communication efforts need to answer a simple question for employees – “What it is in for the them”. If the vision doesn’t provide answer to this question then the change efforts are bound to fail because it won’t have buy-in from the required stakeholders of the organization.

Step 5 -Empower other to act on the vision

Once the vision is set and communicated, change management leadership should empower people at every level to take decisions regarding the change efforts. The empowerment should follow two key principles – it shouldn’t be too structured that it takes away improvisation capabilities of the managers who are working on the fronts. Secondly it shouldn’t be too loosely defined that people at the execution level can take it away from the desired vision and objectives.

Moore Medical Corp. PESTEL / PEST / STEP & Porter Five Forces Analysis

Step 6 - Plan for and create short term wins

Initially the change efforts will bring more disruption then positive change because it is transforming the status quo. For example new training to increase productivity initially will lead to decrease in level of current productivity because workers are learning new skills and way of doing things. It can demotivate the employees regarding change efforts. To overcome such scenarios the change management leadership should focus on short term wins within the long term transformation. They should carefully craft short term goals, reward employees for achieving short term wins, and provide a comprehensive understanding of how these short term wins fit into the overall vision and objectives of the change management efforts.

Step 7 - Consolidate improvements and produce more change

Short term wins lead to renewed enthusiasm among the employees to implement change efforts. Management should go ahead to put a framework where the improvements made so far are consolidated and more change efforts can be built on the top of the present change efforts.

Step 8 - Institutionalize new approaches

Once the improvements are consolidated, leadership needs to take steps to institutionalize the processes and changes that are made. It needs to stress how the change efforts have delivered success in the desired manner. It should highlight the connection between corporate success and new behaviour. Finally organization management needs to create organizational structure, leadership, and performance plans consistent with the new approach.

Is change management a process or event?

What many leaders and managers at the Medical Moore fails to recognize is that – Change Management is a deliberate and detail oriented process rather than an event where the management declares that the changes it needs to make in the organization to thrive. Change management not only impact the operational processes of the organization but also the cultural and integral values of the organization.

MBA Admission help, MBA Assignment Help, MBA Case Study Help, Online Analytics Live Classes

Previous change management solution.

- MedSource Technologies, Portuguese Version Change Management Solution

- Eli Lilly and Co.: Manufacturing Process Technology Strategy--1991, Spanish Version Change Management Solution

- HydroCision, Inc. Change Management Solution

- Merrimack Pharmaceuticals, Inc. (B) Change Management Solution

- Pfizer's Centers for Therapeutic Innovation (CTI) Change Management Solution

Next 5 Change Management Solution

- Sorenson Research Co. (Abridged), Spanish Version Change Management Solution

- Novartis: The Challenge of Success (B) Change Management Solution

- Merck: Investing in Science-Based Business (Abridged) Change Management Solution

- Eli Lilly: The Evista Project Change Management Solution

- PerkinElmer - Developing Products in China for China Change Management Solution

Special Offers

Order custom Harvard Business Case Study Analysis & Solution. Starting just $19

Amazing Business Data Maps. Send your data or let us do the research. We make the greatest data maps.

We make beautiful, dynamic charts, heatmaps, co-relation plots, 3D plots & more.

Buy Professional PPT templates to impress your boss

Nobody get fired for buying our Business Reports Templates. They are just awesome.

- More Services

Feel free to drop us an email

- fernfortuniversity[@]gmail.com

- (000) 000-0000

Brought to you by:

Moore Medical Corp.

By: Andrew McAfee, Gregory Bounds

Moore Medical is a medium-sized distributor of medical supplies to practitioners, such as podiatrists and emergency medical technicians. At the time of the case, it has relied on traditional customer…

- Length: 21 page(s)

- Publication Date: Apr 23, 2001

- Discipline: Operations Management

- Product #: 601142-PDF-ENG

What's included:

- Teaching Note

- Educator Copy

$4.95 per student

degree granting course

$8.95 per student

non-degree granting course

Get access to this material, plus much more with a free Educator Account:

- Access to world-famous HBS cases

- Up to 60% off materials for your students

- Resources for teaching online

- Tips and reviews from other Educators

Already registered? Sign in

- Student Registration

- Non-Academic Registration

- Included Materials

Moore Medical is a medium-sized distributor of medical supplies to practitioners, such as podiatrists and emergency medical technicians. At the time of the case, it has relied on traditional customer channels such as catalogs, phones, and faxes to communicate product offerings, promotions, and availability, and to take orders. It is now attempting to shift to a "bricks and clicks" distributor with a strong Internet presence. It has already made substantial investments in an e-commerce Web site and in "back office" ERP software to improve the fulfillment performance of its four distribution centers. The ERP software has not lived up to expectations in all areas, and the company must decide whether to invest in more modules for this system that might address its shortcomings. It must also decide whether to make a significant additional investment in customer relationship management software.

Learning Objectives

To examine the factors underpinning IT investment decisions. To understand this environment and formulate an IT investment program that makes sense within it.

Apr 23, 2001 (Revised: Feb 12, 2003)

Discipline:

Operations Management

Geographies:

Connecticut

Industries:

Medical equipment and devices

Harvard Business School

601142-PDF-ENG

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

- Harvard Business School →

- Faculty & Research →

- April 2001 (Revised February 2003)

- HBS Case Collection

Moore Medical Corporation

- Format: Print

- | Pages: 18

More from the Author

- Faculty Research

Cambrian House

- December 2007

- Health Affairs

Regional Health Information Organizations: Current Activities and Financing

- October 2007

Managing in the Information Age Module Note for Students: Function IT

- Cambrian House By: Peter A. Coles, Karim R. Lakhani and Andrew P. McAfee

- Regional Health Information Organizations: Current Activities and Financing

- Managing in the Information Age Module Note for Students: Function IT

- Silver Bee Group

- [email protected]

- NEW SOLUTION

- Top Visitors

- Popular Topics

- Newest Members

- Newest Papers

- Top Donators

Moore Medical Corporation

- University Login

Recent Topics

- cumberland metal indus

- Cumberland Metal Indus

New Entries

- Quality Parts Company

- Lincoln Electric

- Vêtements Ltée

- Google Case Analysis

Most Recent Request

- oilwell cable comp

- research methods

- human resource sho

- toyota adopts a st

Ease your MBA workload and get more time for yourself

Marketing Process Analysis

Segmentation, targeting, positioning, marketing strategic planning, marketing 5 concepts analysis, swot analysis & matrix, porter five forces analysis, pestel / pest / step analysis, cage distance analysis international marketing analysis leadership, organizational resilience analysis, bcg matrix / growth share matrix analysis, block chain supply chain management, paei management roles, leadership with empathy & compassion, triple bottom line analysis, mckinsey 7s analysis, smart analysis, vuca analysis ai ethics analysis analytics, moore medical corp. swot analysis & matrix / mba resources.

- Moore Medical Corp.

- Technology & Operations / MBA Resources

Definition of SWOT Analysis

What is SWOT Analysis & Matrix? How you can use SWOT Analysis for Moore Medical Corp.

At EMBA PRO , we specialize at analyzing & providing comprehensive, corporate SWOT Analysis of Moore Medical Corp. case study. Moore Medical Corp. "referred as Medical Moore in this analysis " is a Harvard Business Review (HBR) case study used for MBA & EMBA programs . It is written by Andrew McAfee, Gregory Bounds and deals with topics in areas such as Technology & Operations Change management, Internet, IT, Marketing, Strategic planning, Supply chain SWOT Analysis stands for – Strengths, Weaknesses, Opportunities, and Threats that Medical Moore encounters both internally and in macro environment that it operates in. Strengths and Weaknesses are often restricted to company’s internal - resources, skills and limitations. Opportunities and Threats are factors that are analyzed in view of the prevalent market forces and other factors such as technological, social, health & safety, economic , legal & environmental, and political. According to global executive survey done by Harvard Business Review & Brightline Initiative – Only 20% of the strategic targets set by organizations are realized. Rest 80% of the strategic targets are not achieved because of incomprehensive planning, limited resource allocation, and poor execution. The successful organizations such as Medical Moore are the one who able to predict market trends better than others, provide resources to develop products and services to leverage those trends, able to counter competitors’ threats, and meet customers’ expected value proposition.

Case Description of Moore Medical Corp. Case Study

Moore Medical is a medium-sized distributor of medical supplies to practitioners, such as podiatrists and emergency medical technicians. At the time of the case, it has relied on traditional customer channels such as catalogs, phones, and faxes to communicate product offerings, promotions, and availability, and to take orders. It is now attempting to shift to a "bricks and clicks" distributor with a strong Internet presence. It has already made substantial investments in an e-commerce Web site and in "back office" ERP software to improve the fulfillment performance of its four distribution centers. The ERP software has not lived up to expectations in all areas, and the company must decide whether to invest in more modules for this system that might address its shortcomings. It must also decide whether to make a significant additional investment in customer relationship management software.

Case Authors : Andrew McAfee, Gregory Bounds

Topic : technology & operations, related areas : change management, internet, it, marketing, strategic planning, supply chain, case study solution & analysis of moore medical corp., pestel / pest / step analysis of moore medical corp. case study, urgent - 12hr.

- 100% Plagiarism Free

- On Time Delivery | 27x7

- PayPal Secure

- 300 Words / Page

What are the Four Elements of SWOT Analysis? How to use them for Moore Medical Corp. case study?

The four key elements of SWOT analysis are - Strengths, Weaknesses, Opportunities & Threats . Medical Moore can use strengths to create niche positioning in the market, can strive to reduce & remove weaknesses so that it can better compete with competitors, look out to leverage opportunities provided by industry structure, regulations and other development in external environment, and finally make provisions and develop strategies to mitigate threats that can undermine the business model of Medical Moore.

For more detailed SWOT Matrix strategy please go through the detailed analysis of strengths, weaknesses, opportunities, and threats in next section.

What are Strengths in SWOT Analysis

Strengths - Moore Medical Corp.

Strengths are the Medical Moore capabilities and resources that it can leverage to build a sustainable competitive advantage in the marketplace. Strengths come from positive aspects of five key resources & capabilities - activities & processes, financial resources, physical resources such as land, building, human resources, and past experiences and successes .

- Strong Balance Sheet and Financial Statement of Medical Moore can help it to invest in new and diverse projects that can further diversify the revenue stream and increase Return on Sales (RoS) & other metrics.

- Managing Regulations and Business Environment – Medical Moore operates in an environment where it faces numerous regulations and government diktats. In Change management, Internet, IT, Marketing, Strategic planning, Supply chain areas, the firm needs to navigate environment by building strong relationship with lobby groups and political network.

- Successful Go To Market Track Record – Medical Moore has a highly successful track record of both launching new products in the domestic market but also catering to the various market based on the insights from local consumers. According to Andrew McAfee, Gregory Bounds , Medical Moore has tested various concepts in different markets and come up with successful Technology & Operations solutions.

- Intellectual Property Rights – Medical Moore has garnered a wide array of patents and copyrights through innovation and buying those rights from the creators. This can help Medical Moore in thwarting the challenges of competitors in various industries Change management, Internet, IT, Marketing, Strategic planning, Supply chain.

- Diverse Product Portfolio of Medical Moore – The products and brand portfolio of Medical Moore is enabling it to target various segments in the domestic market at the same time. This has enabled Medical Moore to build diverse revenue source and profit mix.

- Robust Domestic Market that Medical Moore Operates in - The domestic market in which Medical Moore is operating is both a source of strength and roadblock to the growth and innovation of the company. Based on details provided in the Moore Medical Corp. case study – Medical Moore can easily grow in its domestic market without much innovation but will require further investment into research and development to enter international market. The temptation so far for the managers at Medical Moore is to focus on the domestic market only.

- Strong relationship with existing suppliers – As an incumbent in the industry, Medical Moore has strong relationship with its suppliers and other members of the supply chain. According to Andrew McAfee, Gregory Bounds , the organization can increase products and services by leveraging the skills of its suppliers and supply chain partners.

What are Weakness in SWOT Analysis

Weakness- Moore Medical Corp.

Weaknesses are the areas, capabilities or skills in which Medical Moore lacks. It limits the ability of the firm to build a sustainable competitive advantage. Weaknesses come from lack or absence of five key resources & capabilities - past experiences and successes, financial resources, activities & processes, physical resources such as land, building, and human resources .

- Inventory Management – Based on the details provided in the Moore Medical Corp. case study, we can conclude that Medical Moore is not efficiently managing the inventory and cash cycle. According to Andrew McAfee, Gregory Bounds , there is huge scope of improvement in inventory management.

- Project Management is too focused on internal delivery rather than considering all the interests of external stakeholders. This approach can lead to poor public relation and customer backlash.

- Low Return on Investment – Even though Medical Moore is having a stable balance sheet, one metrics that needs reflection is “Return on Invested Capital”. According to Andrew McAfee, Gregory Bounds in areas Change management, Internet, IT, Marketing, Strategic planning, Supply chain that Medical Moore operates in the most reliable measure of profitability is Return on Invested Capital rather than one favored by financial analysts such as – Return on Equity & Return on Assets.

- Track record on environment consideration is not very encouraging – Medical Moore track record on environmental issues is not very encouraging. According to Andrew McAfee, Gregory Bounds , this can lead to consumer backlash as customers are now considering environmental protections as integral to part of doing business.

- Lack of Work force diversity – I believe that Medical Moore is not diverse enough given that most of its growth so far is in its domestic market. According to Andrew McAfee, Gregory Bounds , this can reduce the potential of success of Medical Moore in the international market.

- Lack of critical talent – I believe that Medical Moore is suffering from lack of critical talent especially in the field of technology & digital transformation. Medical Moore is struggling to restructure processes in light of developments in the field of Artificial Intelligence (AI) and machine learning.

What are Opportunities in SWOT Analysis

Opportunities- Moore Medical Corp.

Opportunities are macro environment factors and developments that Medical Moore can leverage either to consolidate existing market position or use them for further expansion. Opportunities can emerge from various factors such as - economic growth, increase in consumer disposable income, changes in consumer preferences, political developments & policy changes, and technological innovations .

- Lucrative Opportunities in International Markets – Globalization has led to opportunities in the international market. Medical Moore is in prime position to tap on those opportunities and grow the market share. According to Andrew McAfee, Gregory Bounds , growth in international market can also help Medical Moore to diversify the risk as it will be less dependent on the domestic market for revenue.

- Growing Market Size and Evolving Preferences of Consumers – Over the last decade and half the market size has grown at brisk pace. The influx of new customers has also led to evolution of consumer preferences and tastes. This presents Medical Moore two big challenges – how to maintain loyal customers and how to cater to the new customers. Medical Moore has tried to diversify first using different brands and then by adding various features based on customer preferences.

- Changing Technology Landscape – Machine learning and Artificial Intelligence boom is transforming the technology landscape that Medical Moore operates in. According to Andrew McAfee, Gregory Bounds , Medical Moore can use these developments in improving efficiencies, lowering costs, and transforming processes.

- Increase in Consumer Disposable Income – Medical Moore can use the increasing disposable income to build a new business model where customers start paying progressively for using its products. According to Andrew McAfee, Gregory Bounds of Moore Medical Corp. case study, Medical Moore can use this trend to expand in adjacent areas Change management, Internet, IT, Marketing, Strategic planning, Supply chain.

- Increasing Standardization – Medical Moore can leverage this trend to reduce the number of offerings in the market and focus the marketing efforts on only the most successful products.

- Access to International Talent in Global Market – One of the challenges Medical Moore facing right now is limited access to high level talent market because of limited budget. Expansion into international market can help Medical Moore to tap into international talent market. According to Andrew McAfee, Gregory Bounds , it can also help in bringing the talent into domestic market and expanding into new areas Change management, Internet, IT, Marketing, Strategic planning, Supply chain.

What are Threats in SWOT Analysis

Threats- Moore Medical Corp.

Threats are macro environment factors and developments that can derail business model of Medical Moore. Threats can emerge from various factors such as - changes in consumer preferences, economic growth, technological innovations, increase in consumer disposable income, and political developments & policy changes .

- US China Trade Relations – Medical Moore has focused on China for its next phase of growth. But there is growing tension between US China trade relations and it can lead to protectionism, more friction into international trade, rising costs both in terms of labor cost and cost of doing business.

- Government Regulations and Bureaucracy – Medical Moore should keep a close eye on the fast changing government regulations under the growing pressure from protest groups and non government organization especially regarding to environmental and labor safety aspects.

- Culture of sticky prices in the industry – Medical Moore operates in an industry where there is a culture of sticky prices. According to Andrew McAfee, Gregory Bounds of Moore Medical Corp. case study, this can lead to inability on part of the organization to increase prices that its premium prices deserve.

- Increasing costs component for working in developed market because of environmental regulations – Medical Moore has to deal with these costs as governments are trying to levy higher environmental taxes to promote cleaner options. For Medical Moore it may result into higher logistics costs and higher packaging costs.

- Credit Binge post 2008 Recession – Easy access to credit can be over any time, so Medical Moore should focus on reducing its dependence on debt to expand. The party has lasted for more than a decade and rollback from Fed can result in huge interest costs for Medical Moore.

- Increasing bargaining power of buyers – Over the years the bargaining power of customers of Medical Moore has increased significantly that is putting downward pressure on prices. The company can pursue horizontal integration to consolidate and bring efficiencies but I believe it will be a short term relief. According to Andrew McAfee, Gregory Bounds , Medical Moore needs fundamental changes to business model rather than cosmetic changes.

5C Marketing Analysis of Moore Medical Corp.

4p marketing analysis of moore medical corp., porter five forces analysis and solution of moore medical corp., porter value chain analysis and solution of moore medical corp., case memo & recommendation memo of moore medical corp., blue ocean analysis and solution of moore medical corp., marketing strategy and analysis moore medical corp., vrio /vrin analysis & solution of moore medical corp., pestel / step / pest analysis of moore medical corp., case study solution of moore medical corp., swot analysis and solution of moore medical corp., references & further readings.

Andrew McAfee, Gregory Bounds (2018) , "Moore Medical Corp. Harvard Business Review Case Study. Published by HBR Publications.

- Sorenson Research Co. (Abridged), Spanish Version SWOT Analysis & Matrix

- Novartis: The Challenge of Success (B) SWOT Analysis & Matrix

- Merck: Investing in Science-Based Business (Abridged) SWOT Analysis & Matrix

- Eli Lilly: The Evista Project SWOT Analysis & Matrix

- PerkinElmer - Developing Products in China for China SWOT Analysis & Matrix

- MedSource Technologies, Portuguese Version SWOT Analysis & Matrix

- Eli Lilly and Co.: Manufacturing Process Technology Strategy--1991, Spanish Version SWOT Analysis & Matrix

- HydroCision, Inc. SWOT Analysis & Matrix

- Merrimack Pharmaceuticals, Inc. (B) SWOT Analysis & Matrix

- Pfizer's Centers for Therapeutic Innovation (CTI) SWOT Analysis & Matrix

Explore More

Feel free to connect with us if you need business research.

You can download Excel Template of SWOT Analysis & Matrix of Moore Medical Corp.

Don't have an account? Sign up now

Already have an account login, get 10% off on your next order.

Subscribe now to get your discount coupon *Only correct email will be accepted

(Approximately ~ 0.0 Page)

Total Price

Thank you for your email subscription. Check your email to get Coupon Code.

Moore Medical Corp Case Study Solution

Posted by John Berg on Feb-16-2018

Introduction

Moore Medical Corp Case Study is included in the Harvard Business Review Case Study. Therefore, it is necessary to touch HBR fundamentals before starting the Moore Medical Corp case analysis. HBR will help you assess which piece of information is relevant. Harvard Business review will also help you solve your case. Thus, HBR fundamentals assist in easily comprehending the case study description and brainstorming the Moore Medical Corp case analysis. Also, a major benefit of HBR is that it widens your approach. HBR also brings new ideas into the picture which would help you in your Moore Medical Corp case analysis.

To write an effective Harvard Business Case Solution, a deep Moore Medical Corp case analysis is essential. A proper analysis requires deep investigative reading. You should have a strong grasp of the concepts discussed and be able to identify the central problem in the given HBR case study. It is very important to read the HBR case study thoroughly as at times identifying the key problem becomes challenging. Thus by underlining every single detail which you think relevant, you will be quickly able to solve the HBR case study as is addressed in Harvard Business Case Solution.

Problem Identification

The first step in solving the HBR Case Study is to identify the problem. A problem can be regarded as a difference between the actual situation and the desired situation. This means that to identify a problem, you must know where it is intended to be. To do a Moore Medical Corp case study analysis and a financial analysis, you need to have a clear understanding of where the problem currently is about the perceived problem.

For effective and efficient problem identification,

- A multi-source and multi-method approach should be adopted.

- The problem identified should be thoroughly reviewed and evaluated before continuing with the case study solution.

- The problem should be backed by sufficient evidence to make sure a wrong problem isn't being worked upon.

Problem identification, if done well, will form a strong foundation for your Moore Medical Corp Case Study. Effective problem identification is clear, objective, and specific. An ambiguous problem will result in vague solutions being discovered. It is also well-informed and timely. It should be noted that the right amount of time should be spent on this part. Spending too much time will leave lesser time for the rest of the process.

Moore Medical Corp Case Analysis

Once you have completed the first step which was problem identification, you move on to developing a case study answers. This is the second step which will include evaluation and analysis of the given company. For this step, tools like SWOT analysis, Porter's five forces analysis for Moore Medical Corp, etc. can be used. Porter’s five forces analysis for Moore Medical Corp analyses a company’s substitutes, buyer and supplier power, rivalry, etc.

To do an effective HBR case study analysis, you need to explore the following areas:

1. Company history:

The Moore Medical Corp case study consists of the history of the company given at the start. Reading it thoroughly will provide you with an understanding of the company's aims and objectives. You will keep these in mind as any Harvard Business Case Solutions you provide will need to be aligned with these.

2. Company growth trends:

This will help you obtain an understanding of the company's current stage in the business cycle and will give you an idea of what the scope of the solution should be.

3. Company culture:

Work culture in a company tells a lot about the workforce itself. You can understand this by going through the instances involving employees that the HBR case study provides. This will be helpful in understanding if the proposed case study solution will be accepted by the workforce and whether it will consist of the prevailing culture in the company.

Moore Medical Corp Financial Analysis

The third step of solving the Moore Medical Corp Case Study is Moore Medical Corp Financial Analysis. You can go about it in a similar way as is done for a finance and accounting case study. For solving any Moore Medical Corp case, Financial Analysis is of extreme importance. You should place extra focus on conducting Moore Medical Corp financial analysis as it is an integral part of the Moore Medical Corp Case Study Solution. It will help you evaluate the position of Moore Medical Corp regarding stability, profitability and liquidity accurately. On the basis of this, you will be able to recommend an appropriate plan of action. To conduct a Moore Medical Corp financial analysis in excel,

- Past year financial statements need to be extracted.

- Liquidity and profitability ratios to be calculated from the current financial statements.

- Ratios are compared with the past year Moore Medical Corp calculations

- Company’s financial position is evaluated.

Another way how you can do the Moore Medical Corp financial analysis is through financial modelling. Financial Analysis through financial modelling is done by:

- Using the current financial statement to produce forecasted financial statements.

- A set of assumptions are made to grow revenue and expenses.

- Value of the company is derived.

Financial Analysis is critical in many aspects:

- Decision Making and Strategy Devising to achieve targeted goals- to determine the future course of action.

- Getting credit from suppliers depending on the leverage position- creditors will be confident to supply on credit if less company debt.

- Influence on Investment Decisions- buying and selling of stock by investors.

Thus, it is a snapshot of the company and helps analysts assess whether the company's performance has improved or deteriorated. It also gives an insight about its expected performance in future- whether it will be going concern or not. Moore Medical Corp Financial analysis can, therefore, give you a broader image of the company.

Moore Medical Corp NPV

Moore Medical Corp's calculations of ratios only are not sufficient to gauge the company performance for investment decisions. Instead, investment appraisal methods should also be considered. Moore Medical Corp NPV calculation is a very important one as NPV helps determine whether the investment will lead to a positive value or a negative value. It is the best tool for decision making.

There are many benefits of using NPV:

- It takes into account the future value of money, thereby giving reliable results.

- It considers the cost of capital in its calculations.

- It gives the return in dollar terms simplifying decision making.

The formula that you will use to calculate Moore Medical Corp NPV will be as follows:

Present Value of Future Cash Flows minus Initial Investment

Present Value of Future cash flows will be calculated as follows:

PV of CF= CF1/(1+r)^1 + CF2/(1+r)^2 + CF3/(1+r)^3 + …CFn/(1+r)^n

where CF = cash flows r = cost of capital n = total number of years.

Cash flows can be uniform or multiple. You can discount them by Moore Medical Corp WACC as the discount rate to arrive at the present value figure. You can then use the resulting figure to make your investment decision. The decision criteria would be as follows:

- If Present Value of Cash Flows is greater than Initial Investment, you can accept the project.

- If Present Value of Cash Flows is less than Initial Investment, you can reject the project.

Thus, calculation of Moore Medical Corp NPV will give you an insight into the value generated if you invest in Moore Medical Corp. It is a very reliable tool to assess the feasibility of an investment as it helps determine whether the cash flows generated will help yield a positive return or not.

However, it would be better if you take various aspects under consideration. Thus, apart from Moore Medical Corp’s NPV, you should also consider other capital budgeting techniques like Moore Medical Corp’s IRR to evaluate and fine-tune your investment decisions.

Moore Medical Corp DCF