Investment Company Business Plan Template

Written by Dave Lavinsky

Investment Company Business Plan

Over the past 20+ years, we have helped over 1,000 entrepreneurs and business owners create business plans to start and grow their investment companies. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through an investment company business plan template step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is an Investment Company Business Plan?

A business plan provides a snapshot of your investment company as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for an Investment Company

If you’re looking to start an investment company, or grow your existing investment company, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your investment company in order to improve your chances of success. Your business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Investment Companies

With regards to funding, the main sources of funding for an investment company are bank loans and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Investors, grants, personal investments, and bank loans are the most common funding paths for investment companies.

Finish Your Business Plan Today!

How to write a business plan for an investment company.

If you want to start an investment company or expand your current one, you need a business plan. Below we detail what you should include in each section of your own business plan:

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of investment company you are operating and the status. For example, are you a startup, do you have an investment company that you would like to grow, or are you operating investment companies in multiple markets?

Next, provide an overview of each of the subsequent sections of your business plan. For example, give a brief overview of the investment company industry. Discuss the type of investment company you are operating. Detail your direct competitors. Give an overview of your target customers. Provide a snapshot of your marketing plan. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of investment company you are operating.

For example, you might operate one of the following types of investment companies:

- Closed-End Funds Investment Company : this type of investment company issues a fixed number of shares through a single IPO to raise capital for its initial investments.

- Mutual Funds (Open-End Funds) Investment Company: this type of investment company is a diversified portfolio of pooled investor money that can issue an unlimited number of shares.

- Unit Investment Trusts (UITs) Investment Company: this type of investment company offers a fixed portfolio, generally of stocks and bonds, as redeemable units to investors for a specific period of time.

In addition to explaining the type of investment company you will operate, the Company Analysis section of your business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of investments made, number of client positive reviews, reaching X amount of clients invested for, etc.

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry analysis, you need to provide an overview of the investment industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the investment industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy, particularly if your research identifies market trends.

The third reason for market research is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your business plan:

- How big is the investment industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your investment company? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: companies or employees in specific industries, couples with double income, families with kids, small business owners, etc.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of investment company you operate. Clearly, couples with families and double income would respond to different marketing promotions than corporations, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, include a discussion of the ages, genders, locations and income levels of the customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Investment Company Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

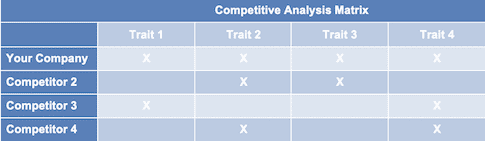

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other investment companies.

Indirect competitors are other options that customers have to purchase from that aren’t direct competitors. This includes robo investors and advisors, company 401Ks, etc. You need to mention such competition as well.

With regards to direct competition, you want to describe the other investment companies with which you compete. Most likely, your direct competitors will be investment companies located very close to your location.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of clients do they serve?

- What type of investment company are they and what certifications do they have?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide better investment strategies?

- Will you provide services that your competitors don’t offer?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For an investment company, your marketing plan should include the following:

Product : In the product section, you should reiterate the type of company that you documented in your Company Analysis. Then, detail the specific products you will be offering. For example, in addition to an investment company, will you provide insurance products, website and app accessibility, quarterly or annual investment reviews, and any other services?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your marketing plan, you are presenting the services you offer and their prices.

Place : Place refers to the location of your company. Document your location and mention how the location will impact your success. For example, is your investment company located in a busy retail district, a business district, a standalone office, etc. Discuss how your location might be the ideal location for your customers.

Promotions : The final part of your investment company marketing plan is the promotions section. Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Advertising in local papers and magazines

- Commercials and billboards

- Reaching out to websites

- Social media marketing

- Local radio advertising

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your investment company, including researching the stock market, keeping abreast of all investment industry knowledge, updating clients on any new activity, answering client phone calls and emails, networking to attract potential new clients.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to land your Xth client, or when you hope to reach $X in revenue. It could also be when you expect to expand your investment business to a new city.

Management Team

To demonstrate your investment company’s ability to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally you and/or your team members have direct experience in managing investment companies. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act like mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing an investment company or successfully advised clients who have achieved a successful net worth.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet and cash flow statements.

Income Statement : an income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you take on one new client at a time or multiple new clients? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets : Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your investment company, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

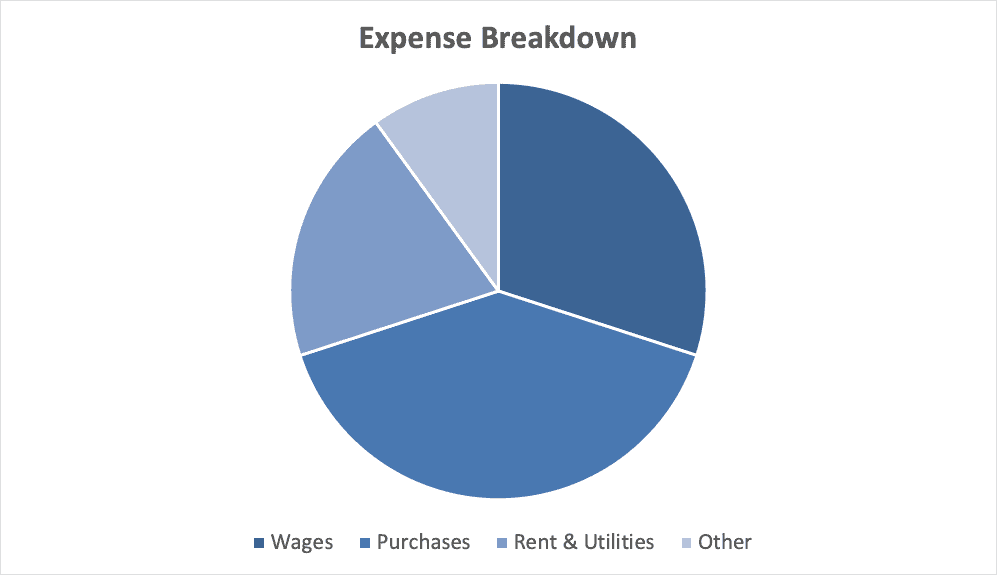

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing an investment company:

- Cost of investor licensing..

- Cost of equipment and supplies

- Payroll or salaries paid to staff

- Business insurance

- Taxes and permits

- Legal expenses

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office location lease or list of clients that you have acquired.

Putting together a business plan for your investment company is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will really understand the investment industry, your competition, and your customers. You will have developed a marketing plan and will really understand what it takes to launch and grow a successful investment company.

Investment Company Business Plan FAQs

What is the easiest way to complete my investment company business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily complete your Investment Company Business Plan.

What is the Goal of a Business Plan's Executive Summary?

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of investment company you are operating and the status; for example, are you a startup, do you have an investment company that you would like to grow, or are you operating a chain of investment companies?

Don’t you wish there was a faster, easier way to finish your Investment Company business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to hire someone to write a business plan for you from Growthink’s team.

Other Helpful Business Plan Articles & Templates

Don't bother with copy and paste.

Get this complete sample business plan as a free text document.

Investment Company Business Plan

Start your own investment company business plan

Investment Company

Executive summary executive summary is a brief introduction to your business plan. it describes your business, the problem that it solves, your target market, and financial highlights.">.

This sample plan was created for a hypothetical investment company that buys other companies as investments. In this sample, the hypothetical Venture Capital firm starts with $20 million as an initial investment fund. In its early months of existence, it invests $5 million each in four companies. It receives a management fee of two percent (2%) of the fund value, paid quarterly. It pays salaries to its partners and other employees, and office expenses, from the management fee.

The investments show up in the Cash Flow table as the purchase of long-term assets, which also puts them into the balance sheet as long-term assets. You can see them in this sample plan, in the first few months.

In the third year, one of the target companies fails, so $5 million is written off as failure. You’ll see how that looks as a $5 million sale of long-term assets in the cash flow, and a balancing entry of $5 million in costs of sales in the profit and loss, making for a loss and write-off that year. The result is a tax loss, and the balance of investments goes to $15 million.

In the fifth year, one of the target companies is transacted at $50 million. You’ll see in the sample how that shows up as a $45 million equity appreciation in the sales forecast, plus a $5 million sale of long-term assets in the cash flow. At that point there’s been a $45 million profit, and the balance of long-term assets goes down to $10 million.

This is a simplified example. The business model holds long-term assets and waits for them to appreciate. It doesn’t show appreciation of assets until they are finally sold, and it doesn’t show write-down of assets until they fail. Sales and cost of sales are the appreciation and write-down of assets, plus the management fees.

The explanation above has been broken down and copied into key topics in the outline that are linked to corresponding tables. These topics are:

- 2.2 Start-up Summary

- 5.5.1 Sales Forecast

- 6.4 Personnel

- 7.4 Projected Profit and Loss

- 7.5 Projected Cash Flow

- 7.6 Projected Balance Sheet

Company Summary company overview ) is an overview of the most important points about your company—your history, management team, location, mission statement and legal structure.">

Content has been omitted from this sample plan topic, and following sub-topics. This sample plan has an abbreviated plan outline. With the exception of the Executive Summary, only those topics linked to key tables have been used.

The focus of this sample plan is to show the financials for this type of company. Brief descriptions can be found in the topics associated with key tables.

2.1 Start-up Summary

This hypothetical Venture Capital firm starts with $20 million as an initial investment fund. The venture capital partners invest $100,000 as working capital needed to balance the cash flow from quarter to quarter.

Market Analysis Summary how to do a market analysis for your business plan.">

Strategy and implementation summary, sales forecast forecast sales .">.

Management Summary management summary will include information about who's on your team and why they're the right people for the job, as well as your future hiring plans.">

7.1 personnel plan.

This hypothetical company pays salaries to its partners and other employees, and office expenses, from the management fee of two percent (2%).

Financial Plan investor-ready personnel plan .">

8.1 projected profit and loss.

Please note that in the third year one investment is written off as a failure, producing a $5 million cost which ends up showing a loss for the year of nearly $5 million. The sale of equity at the end of the period enters the sales forecast and the profit and loss statement as a $45 million gain.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

8.2 Projected Cash Flow

The Cash Flow shows four $5 million investments made in the first few months of the plan.

In the third year, one of the target companies fails, so $5 million is written off as failure. You’ll see that shows as a $5 million sale of long-term assets in the cash flow, and a balancing entry of $5 million in costs of sales in the profit and loss, making for a loss and write-off that year. The result is a tax loss, and the balance of investments goes to $15 Million.

In the fifth year, another investment is transacted at $50 million. This shows up as a $5 million equity appreciation in the Sales Forecast, plus a $5 million sale of long-term assets in the Cash Flow. At that point there’s been a $45 million profit and the balance of long-term assets goes down to $10 million.

The partners invest an additional $100,000 in the fourth year as additional working capital to balance the cash flow of the company.

8.3 Projected Balance Sheet

You can see in the balance sheet how the ending balances for long-term assets were not re-valued. They remain at the original purchase price until they are sold, or written off as a complete loss. There is a $5 million write-off in the third year, and a sale of $5 million worth of assets in the last year. That sale of $5 million in assets produces the $5 million sale at book value plus the $45 million gain in the sales forecast and profit and loss table.

8.4 Business Ratios

The Standard Industry Code (SIC) for this type of business is 7389, Business Services. The Industry Data is provided in the final column of the Ratios table.

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

It should be noted that there is no special software required to use these templates. All business plans come in Microsoft Word and Microsoft Excel format. Each business plan features:

- Excecutive Summary

- Company and Financing Summary

- Products and Services Overview

- Strategic Analysis with current research!

- Marketing Plan

- Personnel Plan

- 3 Year Advanced Financial Plan

- Expanded Financial Plan with Monthly Financials

- Loan Amortization and ROI Tools

- FREE PowerPoint Presentation for Banks, Investors, or Grant Companies!

1.0 Executive Summary

The purpose of this business plan is to raise $10,000,000 for the development of a mutual fund while showcasing the expected financials and operations over the next three years. Mutual Fund, Inc. (“the Company”) is a New York based corporation that will provide investments into marketable securities on behalf of investors. The Company was founded by John Doe.

1.1 Products and Services

The business, through its open ended mutual fund, will manage investments into marketable securities including stocks and bonds that are traded within the United States. At this time, Management is seeking to retain a qualified securities law firm that will draft the Company’s N-1A filing along with other appropriate filings so that the business can acquire its custodial accounts and begin soliciting capital from the general public. The Mutual Fund will generate assets under management fees equal to 1.5% of the total assets that are in the Mutual Fund. The third section of the business plan will further describe the services offered by the Mutual Fund.

1.2 The Financing

Mr. Doe is seeking to raise $10 million from a number of investors via a private placement offering that will be used to make investments into publicly traded companies. Primarily the financing will be used for the following: • Development of the Company’s Mutual Fund location. • Financing for the first six months of operation. • Financing for the investments to be made by the Mutual Fund.

1.3 Mission Statement

Management’s mission is to develop the Mutual Fund into a premier asset management firm that uses highly proprietary market research to determine the best companies for investment within the United States.

1.4 Mangement Team

The Company was founded by John Doe. Mr. Doe has more than 10 years of experience in the investment management industry. Through his expertise, he will be able to bring the operations of the business to profitability within its first year of operations.

1.5 Sales Forecasts

Mr. Doe expects a strong rate of growth at the start of operations. Below are the expected financials over the next three years.

1.6 Expansion Plan

The Founder expects that the business will aggressively expand during the first three years of operation. Mr. Doe intends to implement marketing campaigns that will effectively target investors and publicly traded companies within the target market.

2.0 Company and Financing Summary

2.1 Registered Name and Corporate Structure

Mutual Fund, Inc. The Company is registered as a corporation in the State of New York. All shares of investments will be held through a third party entity.

2.2 Required Funds

At this time, the Mutual Fund requires $10 million of investment funds funds. Below is a breakdown of how these funds will be used:

2.3 Investor Equity

Mr. Doe is seeking to raise capital via the Company’s private placement memorandum. He will retain a 100% ownership interest in the investment management company that will oversee the firm’s publicly traded stock investments.

2.4 Management Equity

This will be further discussed in the Company’s private placement memorandum.

2.5 Exit Strategy

If the business is very successful, Mr. Doe may seek to sell the business to a third party for a significant earnings multiple. In all likeliness, a qualified investment bank would be hired to manage the complex aspects of selling the Mutual Fund to a third party for a significant earnings multiple. We encourage you to review the Company’s PPM in regards to the potential sale of the Mutual Fund to a third party investor.

3.0 Products and Services

Below is a description of the mutual fund services offered by the Mutual Fund, Inc.

3.1 Assets Under Management Services

The primary revenue center for the business will come from the ongoing assets under management fees that will be received from the ongoing management of publicly traded securities that are bought and sold through the Company’s mutual fund. The business will focus on a number of different types of investment strategies including value and growth investing. The business will hire number of highly educated investment professionals that can provide insight into the economic viability of any business that is reviewed by the Mutual Fund for a potential investment.

4.0 Strategic and Market Analysis

4.1 Economic Outlook

This section of the analysis will detail the economic climate, the mutual fund industry, the customer profile, and the competition that the business will face as it progresses through its business operations. Currently, the economic market condition in the United States is moderate. The meltdown of the sub prime mortgage market coupled with increasing gas prices has led many people to believe that the US is on the cusp of a double dip economic recession.

4.2 Industry Analysis

The financial services sector has become one of the fastest growing business segments in the U.S. economy. Computerized technologies allow financial firms to operate advisory and brokerage services anywhere in the country. In previous decades, most financial firms needed to be within a close proximity to Wall Street in order to provide their clients the highest level of service. This is no longer the case as a firm can access almost every facet of the financial markets through Internet connections and specialized trading and investment management software. With these advances, several new firms have been created to address the needs of people in rural and suburban areas. The Bureau of Labor Statistics estimates that there are approximately 94,000 investment advisors currently employed throughout the United States. The average annual income for an investment advisor (including mutual fund employees) is $62,700. Salaries are expected to increase at a rate of 2.1% a year as inflation increases. In the last study conducted by the U.S. Economic Census, it was found that the revenues of the investment advisory industry increased from $14.8 billion dollars in 1999 to over $52.9 billion dollars by 2009. The number of investment advisory establishments increased 61.5% over the same period.

4.3 Customer Profile

As the Company intends to operate an open-ended mutual fund, any person will be able to make an investment into the business’ fund. However, Management has developed the following demographic profile of individual investors that will provide capital for the mutual fund: • Between the ages of 35 and 65 • Annual household income of $60,000+ • Will invest $3,000 to $25,000 with the mutual fund. Based on the above demographic profile, approximately 45 million Americans could become potential investors in the fund.

4.4 Competitive Analysis

As the investment advisory industry has grown, so has the level of competition. One of the drawbacks to the industry is that there are very low barriers to entry. Any individual or business may register itself as an investment advisor after completing the proper examinations and filings. The expected costs to build an investment advisory are low as it is a service oriented business. Success in this market will depend on several factors including: • The ability to create and market new and innovative products. • Generation of an outstanding track record for Mutual Fund, Inc. As stated earlier, there are more than 8,000 other mutual funds that operate in a similar capacity.

5.0 Marketing Plan

The Mutual Fund intends to develop a marketing campaign that will attract both investors and potential investment companies to the brand name of the firm. Below is an overview of these strategies.

5.1 Marketing Objectives

• Develop relationships with brokers throughout the United States.

• Develop a strong presence among funds of funds.

• Remain within the letter of law regarding the advertisements and marketing campaigns carried out by the Mutual Fund.

5.2 Marketing Strategies

Management intends to use a broad based marketing campaign that will target individual investors (or retail investors), investment institutions, other mutual funds, stock brokerages, and other firms that will invest capital into the Company’s open ended mutual funds. As this is a highly competitive industry, Management will hire a qualified investment focused marketing firm to assist in this process. These marketing firm will work closely with the Company’s Chief Compliance Officer and retained securities law firm to ensure that all advertisements are in line with the requirements set forth by the Securities and Exchange Commission. The Company will also maintain a highly informative website showcasing the operations of Mutual Fund, an outline of the Company’s mutual fund program, and how to contact the business for more information regarding the Company’s asset management services.. This website will also have a portal for investors to learn more about the Company’s operations and its investments.

5.3 Pricing

In this section, describe the pricing of your services and products. You should provide as much information as possible about your pricing as possible in this section. However, if you have hundreds of items, condense your product list categorically. This section of the business plan should not span more than 1 page.

6.0 Organizational Plan and Personnel Summary

6.1 Corporate Organization

6.2 Organizational Budget

6.3 Management Biographies

In this section of the business plan, you should write a two to four paragraph biography about your work experience, your education, and your skill set. For each owner or key employee, you should provide a brief biography in this section.

7.0 Financial Plan

7.1 Underlying Assumptions

• Mutual Fund will have an annual revenue growth rate of 16% per year.

• The Owner will acquire $10,000,000 of equity funds.

• The business will generate revenues equal to 1.5% of the total funds managed by the Company.

7.2 Sensitivity Analysis

The Company’s revenues are not sensitive to changes in the general economy or securities marketplace. The mutual fund intends to invest in a number of other mutual funds that produce profits despite deleterious stock market conditions.

7.3 Source of Funds

7.4 General Assumptions

7.5 Profit and Loss Statements

7.6 Cash Flow Analysis

7.7 Balance Sheet

7.8 General Assumptions

7.9 Business Ratios

Expanded Profit and Loss Statements

Expanded Cash Flow Analysis

- Guide to Mutual Funds

How to Invest in Mutual Funds

A beginner’s guide to mutual fund investing

- Search Search Please fill out this field.

Type of Mutual Funds

How to invest in mutual funds, step by step, risks and considerations for mutual fund investors, the bottom line.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Mutual funds have long been a popular choice for first-time investors, and for good reason. These investment vehicles offer a simple, accessible, and diversified way to enter the investing world, making them a good option for many Americans.

Given the many changes in the U.S. economy in recent decades, including the steep drop in the number of Americans with defined pension plans , mutual funds are frequently the vehicle of choice for long-term investing, with a majority—52%—of American households with money in them as of 2022, a vast increase from the 5.7% in 1980. They are now the backbone of middle America’s retirement savings.

Key Takeaways

- Mutual funds are a convenient way for individuals to invest in a diversified portfolio of securities.

- Clearly determining your investment goals and understanding how much risk you can tolerate against the potential rewards are crucial before investing in mutual funds.

- Different types of mutual funds, such as equity, bond, and balanced funds, are for different investment strategies.

- It’s important to assess different mutual funds based on their performance, expense ratios, and fund manager experience. With over 9,000 mutual funds in the United States, you have many to choose from.

Mutual funds pool money from many investors to purchase a diversified portfolio of securities, such as stocks and bonds. Established by 1940 legislation , these funds are meant to be relatively lower in risk. They were to pool the investment capital of many Americans and provide access to a broader range of assets and the safeguards of professional money management that otherwise would have been too costly to obtain on their own.

A significant benefit of investing in mutual funds is diversification . By spreading your investment across a variety of securities, sectors, and locations, you reduce your portfolio ’s overall risk. The performance of different investments is often different even in the same market conditions, so gains in another can offset losses in one.

Mutual funds also cater to various investment goals and risk tolerances. There are over 9,000 mutual funds to choose from in the U.S. alone. Each has its own investment strategy and goals. Whether you’re looking for aggressive growth, steady income, or a balanced approach, there is likely a mutual fund that aligns with your needs.

But how can you add mutual funds to your portfolios? Putting your money into mutual funds is done differently from trading stocks. Unlike stocks, which are traded throughout the day on stock exchanges, mutual fund shares are purchased and sold directly through the mutual fund company or a brokerage firm. Fund shares are priced once at the close of each trading day. Many people set money aside in mutual funds through their paychecks, some with matching funds from their employer.

But don’t let this overwhelm you. Owning mutual funds is easier than it sounds. Just read on to find out how.

Understanding the different types of mutual funds can help you find the one that best aligns with your financial goals and risk tolerance .

Here are some of the main types:

Equity Funds

Also known as stock funds, equity funds live up to their name by investing in publicly traded companies. Their goal is to increase the value of your investment by putting money into companies expected to grow.

An essential factor to consider when evaluating equity funds is market capitalization , which refers to the total value of a company’s outstanding shares. Generally, larger companies tend to be more stable and less risky, while smaller companies may offer higher growth potential but also have increased risk . They may be the next big thing or soon forgotten.

Equity funds can be broken down by looking at these factors:

- Market capitalization : Large-cap funds invest in companies with a market value exceeding $10 billion, which are ordinarily more established and less volatile. Midcap funds focus on companies worth $2 billion to $10 billion, offering a balance between growth and stability. Small-cap funds invest in companies with a market value below $2 billion, which may have higher growth potential and risk.

- Investment style : Growth funds invest in companies with high growth potential, prioritizing capital appreciation over income through dividends. Value funds seek undervalued stocks believed to be trading below their true worth, aiming to benefit from a potential price increase. Blend funds provide a more balanced approach between the two.

- Geography : Domestic funds focus on stocks of U.S. companies, while international funds invest in stocks outside the U.S. Some funds may also focus on a specific region, such as Europe or Asia. International funds can offer diversification benefits but may also be subject to additional risks, such as currency fluctuations and political instability.

Bond funds invest primarily in fixed-income securities, such as corporate, government, and municipal bonds. They aim to provide regular income and add stability to a portfolio. Bond funds can be categorized based on the type of issuer or bonds in which they invest (e.g., government vs. corporate), the credit quality of the issuers (from investment-grade to junk ), and the duration of the bonds (from short-term to long-term).

Balanced Funds

Also known as hybrid funds, balanced funds invest in a mix of stocks and bonds to offer a balance of growth and income. The allocation between stocks and bonds depends on the fund’s investment strategy and risk profile, but the most common is 60% in stocks and 40% in bonds. These funds are suitable for investors seeking a single, diversified investment solution.

Money Market Funds

Money market funds invest in short-term, low-risk debt securities, such as Treasury bills, certificates of deposit (CDs), and commercial paper. They aim to maintain a stable value and provide a low-risk, liquid investment option. Money market funds are often used for short-term savings or as a temporary holding place for cash. They are more attractive when interest rates are high since they earn more interest.

Index Funds

Index funds and target-date funds are the most popular. Index funds passively track the performance of a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. If that index performs well, so does the fund.

Target-Date Funds

Target-date funds , also known as life cycle funds, are designed for investors with a specific retirement date in mind. Over 85% of 401(k) plans offer these funds, which automatically adjust their asset allocation over time, becoming more conservative as the target date approaches. This “set it and forget it” approach is great for investors who want a simple, long-term investment solution.

Specialty Funds

Specialty funds focus on specific investment strategies or asset classes beyond stocks and bonds. Here are some examples:

- Sector funds invest in companies within a particular industry or sector, such as healthcare, energy, or technology.

- Socially responsible investment (SRI) funds, also known as environmental, social, and governance (ESG) funds, invest in companies that meet specific social, environmental, or ethical criteria.

- Real estate funds invest in real estate investment trusts or buy their own real estate holdings.

- Commodity funds invest in physical commodities like gold, oil, agricultural products, or commodity-linked derivatives.

Active vs. Passive Funds

Actively managed mutual funds try to beat a benchmark index using professional managers to make investment decisions, typically leading to higher fees. Passively managed funds, like index funds, aim to match the performance of a market index by mirroring its composition and usually have lower fees.

1. Set Your Investment Goals and Budget

As with any investment, it’s important to set clear goals that align with your broader financial objectives, time horizon , and risk tolerance before investing in mutual funds. Determining your investment goals and budget is crucial before investing in mutual funds. Consider the following factors:

- Investment objectives : Identify your reasons for investing, such as saving for retirement, buying a home, funding your child’s education, or building wealth over the long term.

- Time horizon : Determine how long you plan to invest before you need to access your funds. This will help you choose the mutual fund that matches your timeline.

- Risk tolerance : Assess your willingness to take on financial risk. Some investors are comfortable with the potential for higher returns despite increased volatility, while others prefer a more conservative approach.

- Financial situation : Assess your current income, expenses, and debts to determine how much you can realistically afford to invest without compromising your financial stability.

You can sort these out by answering a few questions:

- What are my primary financial goals, and how can mutual funds help me achieve them?

- How long do I plan to invest in this fund, and am I comfortable with the potential market ups and downs during that time?

- Am I willing to accept more risk for potentially higher returns, or do I prefer a more stable investment approach?

- How much can I afford to invest in mutual funds, and how often (e.g., one-time lump sum, or monthly contributions, or something else)?

- What types of mutual funds best align with my goals and risk tolerance (e.g., equity, bond, and balanced funds)?

- Do I prefer actively managed funds with higher fees or passively managed funds with lower costs?

2. Narrow Down Your Choices

There are many, many mutual funds—more than 9,000—from scores of providers. With your goals and budget in mind, begin researching the mutual funds that match your answers to the above questions.

If you choose your retirement plan through your employer, you might be given a catalog (virtual or a glossy version) detailing different funds offered there. However, these can be out of date—even a few months can matter—and produced by the management companies pitching you to join them . Even if they are scrupulous and have fair judgments about their own products, it’s best to see what outsiders think, too.

Use your brokerage platform or reputable financial websites like Morningstar or Yahoo! Finance to compare funds and read expert analyses. You can also find helpful tools like mutual fund “screeners,” where you put what kind of fund you are looking for, and the results are narrowed down for you.

As you choose a mutual fund , these items can act as your 10-point checklist. It looks like more work than it is—most details are found in the same places online:

- Fund type : Choose funds that match your investment objectives, such as growth, income, or a combination of both.

- Investment style : Consider whether you prefer actively managed funds that attempt to outperform the market or passively managed index funds that track market performance.

- Expense ratios: Look for funds with low expense ratios , as high annual management costs can eat into your returns over time. Try to find the least expensive funds for your fund type and style, but don’t choose based on fees alone.

- Loads : Be aware of any extra fees with mutual funds. Some funds carry sales charges, known as loads, that can eat into your investment returns. Front-end loads are charged when you first buy shares in the fund, while back-end loads are charged when you sell shares.

- Additional fees : Look for no-load funds to avoid these charges. Additionally, pay attention to other fees, such as redemption fees and 12b-1 fees , which are for marketing and distribution. These fees vary significantly among funds, so comparing them carefully and understanding their influence on your returns is essential.

- Minimum investment : While some mutual funds do not have a minimum investment to start investing, some do. The upfront investment could be $100, $1,000, or more. These tend to be waived if you choose a fund through your employer.

- Fund manager experience : To assess the fund manager’s track record, visit the mutual fund company’s website or review the fund’s prospectus. Look for the manager’s biography, including their investment philosophy, educational background, and previous experience managing funds. A manager who has been with the fund for several years, ideally five or more, may indicate a more stable management approach.

- Fund size : The fund’s assets under management (AUM) can be found in the fund’s fact sheet or prospectus. A larger AUM, typically $100 million or more, suggests that the fund is well-established and has enough to manage the fund effectively.

- Liquidity : This refers to how easily the fund can convert its investments into cash to meet redemption requests. Funds with higher liquidity can accommodate investors coming into and out of the fund. A good indication of liquidity is if the fund invests primarily in large-cap stocks or high-quality bonds that can be bought and sold quickly without significantly impacting the fund’s performance.

- Tax implications : If investing in a taxable account, consider tax-efficient funds that minimize turnover and distribute fewer capital gains.

Remember, there is no one-size-fits-all approach to selecting mutual funds. Your circumstances and goals should guide your investment decisions.

3. Select the Right Mutual Fund for You

Next, examine the fund’s prospectus , which provides detailed information about the fund’s investment objectives, strategies, risks, and fees. Pay close attention to the fund sponsor’s reputation, the managers’ profiles, and the fund’s historical performance—but keep in mind that past performance doesn’t guarantee future results.

After thoroughly researching potential mutual funds, select those that best align with your investment goals and risk tolerance while minimizing costs. Diversification is key to managing risk, so consider spreading your investments across various fund types, sectors, and locations. Asset allocation , or the distribution of your investments among stocks, bonds, real estate, cash, and other assets, is crucial in building a well-balanced portfolio.

4. Open an Investment Account

If you’re not acting through your employer, you’ll need to open an investment account with a brokerage firm or directly with a mutual fund company to invest in mutual funds. If you don’t already have one, here are a few types of investment accounts that you may be able to choose from:

- Taxable brokerage accounts : These accounts allow you to invest in a wide range of securities, including mutual funds, stocks, and bonds. They can be held as an individual, as a joint account with a spouse or partner, or as a custodial account held on behalf of minor dependents.

- Retirement accounts : 401(k) plans and individual retirement accounts (IRAs) offer tax advantages and are designed for long-term investing. Roth IRAs are a tax-exempt retirement account option where you can put dividend-paying mutual funds without triggering taxable events.

- Education savings accounts : Accounts like 529 plans can help you save for future education expenses.

When opening a new account, you will provide personal information such as your name, address, Social Security number, and employment details. You will also need to fund your account by transferring money from your bank account or mailing a check.

5. Place Orders and Make Contributions

Once your investment account is set up and funded, you can start investing in mutual funds. You can invest a lump sum or make regular contributions over time—perhaps right out of your paycheck. Lump-sum investing involves investing a significant amount of money at once, which can be advantageous if you believe the market will rise. However, this approach also exposes you to greater market risk.

Another strategy is dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, regardless of market conditions. This approach can help mitigate the impact of market volatility on your investments, as you buy more shares when prices are low and fewer shares when prices are high.

To place an order, log into your investment account and select the mutual fund you wish to buy. Specify the amount you want to invest and submit your order. Mutual fund orders are typically processed at the end of each trading day, with the price per share determined by the fund’s net asset value (NAV) at the close of the market.

The process for selling your mutual fund shares is similar. You place a sell order with the fund company or brokerage firm, and the order is executed at the next available NAV. The proceeds from the sale, minus any applicable fees or taxes, are then credited to your account.

Mutual fund shares are valued at their net asset value (NAV), which is calculated once per day after the stock market closes by dividing the fund’s total assets minus liabilities by the number of outstanding shares. When you buy or sell mutual fund shares, your transaction is processed at the next available NAV.

6. Monitor and Manage Your Portfolio

Investing in mutual funds is not a one-time event; it requires ongoing monitoring and management to ensure your portfolio continues to align with your goals and risk tolerance. Regularly review your investments’ performance and compare them to relevant benchmarks and peer funds. If a fund consistently underperforms its benchmark or peers, it may be time to consider selling it and investing in a better-performing alternative. That said, “regularly” doesn’t mean giving yourself the stress of checking on your retirement savings every hour or every day when volatility might lead to temporary losses that you would never notice otherwise.

As your investment goals or market conditions change, you may need to rebalance your portfolio to maintain your desired asset allocation. Rebalancing involves selling investments that have become overweighted in your portfolio and buying investments that have become underweighted to bring your portfolio back in line with your target allocation.

Additionally, stay informed about the mutual funds you own. Read the fund’s annual reports as they are sent to you and stay up to date on any changes to the fund’s investment strategy, management team, or fee structure. If a fund experiences significant changes that no longer align with your investment objectives, it may be necessary to sell your shares and invest elsewhere.

By following these steps and maintaining a long-term perspective, you can effectively invest in mutual funds and work toward achieving your financial goals. Remember, investing in mutual funds involves risk, and it’s essential to research your options thoroughly, understand the costs involved, and make informed decisions based on your circumstances.

Don’t hesitate to consult a financial advisor who can help you develop a personalized investment plan, select suitable mutual funds, and provide ongoing guidance as your needs and market conditions evolve. It’s perhaps the first and most important decision of your investing life, so getting it right can pay dividends.

While mutual funds offer many benefits, such as diversification and professional management, they also have certain risks to be aware of.

Market Risk

Market risk is the possibility that the value of a mutual fund’s investments will decline because of factors affecting the overall financial markets. This risk is inherent in all investments, including mutual funds, and cannot be eliminated. When the market experiences a downturn, the value of a mutual fund’s holdings may decrease, resulting in a lower NAV, potentially lowering your returns.

If a mutual fund’s returns do not keep pace with inflation , the real value of the investment may decline. For example, if a mutual fund generates an annual return of 5%, but the inflation rate is 3%, the real return (adjusted for inflation) would be about 2%. Over an extended period, this difference can significantly affect your ability to meet your financial goals.

Cash and Fee Drags

Cash drag refers to the potential negative effect on a mutual fund’s performance because of holding cash or cash equivalents, such as money market instruments or short-term bonds. Mutual funds often keep a part of their assets in cash to meet redemption requests, take advantage of investment opportunities, or maintain liquidity. However, holding too much cash can be a drag on performance, especially during bull markets, when stocks are appreciating.

Fee drag refers to the negative impact of mutual fund fees and expenses on investor returns. Mutual funds charge various fees, such as expense ratios, sales loads, and redemption fees, which can eat into returns over time. Expense ratios, which cover the fund’s operating costs, are particularly important to consider. If a fund has an expense ratio of 1% and generates a 10% return before fees, the investor’s actual return would be 9% after accounting for the expense ratio. High fees and expense ratios can significantly alter returns, especially over long investment horizons.

Fund-Specific Risks

In addition to market risk, mutual funds are subject to specific risks related to their investment strategies and holdings. For example:

- Credit risk : Bond funds, particularly, are exposed to credit risk , which is the possibility that fixed-income issuers may fail to make interest payments or repay principal when due. As credit risk increases, specific bond holdings may lose value.

- Liquidity risk : Some mutual funds may invest in less liquid securities, such as small-cap stocks or emerging market bonds, which can be difficult to sell quickly without impacting the price.

- Concentration risk : Sector or region-specific funds may be more vulnerable to events affecting those particular sectors or regions, leading to higher volatility and potential losses.

- Currency risk : International funds or those that invest in foreign securities are subject to currency risk , as fluctuations in exchange rates can affect returns.

What Are Some Benefits of Investing in Mutual Funds Compared with Individual Stocks?

Mutual funds offer several advantages over individual stocks, including professional management, diversification, convenience, and accessibility. With mutual funds, investors can access a wide range of securities and assets managed by experienced professionals, reducing the risk and effort of selecting individual stocks. Mutual funds also offer easier diversification , as they invest in many securities, which can help mitigate the impact of any single investment’s performance on the overall portfolio.

What Is the Difference Between Mutual Funds and ETFs?

Mutual funds and exchange-traded funds (ETFs) are both investment vehicles that pool money from many investors to buy a diversified portfolio of securities, such as stocks or bonds. The main difference is that mutual fund shares are bought and sold directly through the fund company at the end of each trading day, while ETF shares are traded on stock exchanges throughout the day like individual stocks. They also tend to have lower fees.

How Are Returns from Mutual Funds Calculated?

Mutual fund returns are typically calculated using total return , which includes both capital appreciation (increase in the fund’s share price) and income distributions (such as dividends or interest). The total return is usually expressed as a percentage change over a specific period, such as one year or five years.

It’s important to note that returns are net of the fund’s expenses, which can impact the overall performance.

Can You Lose Money with Mutual Funds?

Yes, it is possible to lose money investing in mutual funds. Like any investment, mutual funds carry risk, and the value of your investment can fluctuate based on market conditions and the performance of the fund’s underlying securities. If you sell your mutual fund shares when they are worth less than what you paid for them, you will realize a loss.

What Are the Best Mutual Funds for Beginners?

Starting with low-cost, diversified mutual funds that provide broad market exposure, such as index or target-date funds, is generally recommended for beginners. Index funds aim to track the performance of a specific market index, such as the S&P 500 , while target-date funds adjust their asset allocation over time based on a target year. These funds offer simplicity, diversification, and lower costs, making them a good starting point for new investors.

Investing in mutual funds is often an excellent way to grow your wealth over time. By setting clear investment goals, researching and selecting suitable funds, and regularly monitoring your investments, you can start to build a diversified portfolio that aligns with your financial objectives. Mutual funds are available to buy and sell through your brokerage firm or directly from mutual fund companies, so if you’re ready to dive into mutual funds, this guide can get you started.

As with any investment, it’s essential to understand the risks and considerations involved and make informed decisions based on your circumstances. You could also start off your research by seeking a qualified financial advisor .

Investment Company Institute. “ U.S. Household Ownership of Mutual Funds in 2002 ,” Page 1.

Investment Company Institute. “ 2023 Investment Company Fact Book ,” Page 85 (Page 97 of PDF).

Investment Company Institute. “ 2023 Investment Company Fact Book ,” Pages 2–4 (Pages 14–16 of PDF).

Financial Industry Regulatory Authority. “ Market Cap Explained .”

Robert Pozen and Theresa Hamacher, via Google Books. “ The Fund Industry: How Your Money Is Managed ,” Page 96. John Wiley & Sons, 2015.

Financial Industry Regulatory Authority. “ Mutual Funds: Types .”

Financial Industry Regulatory Authority. “ Mutual Funds: Risks .”

U.S. Securities and Exchange Commission. “ Mutual Funds and Exchange-Traded Funds (ETFs)—A Guide for Investors .”

U.S. Securities and Exchange Commission. “ Investor Bulletin: Index Funds .”

Investment Company Institute. “ Target Date Funds Continue to Be Popular Investment Among Younger 401(k) Plan Participants .”

Financial Industry Regulatory Authority. “ Save the Date: Target-Date Funds Explained .”

Investor.gov, U.S. Securities and Exchange Commission. “ Environmental, Social and Governance (ESG) Funds—Investor Bulletin .”

U.S. Securities and Exchange Commission. “ Investor Bulletin: Real Estate Investment Trusts (REITs) .”

Financial Industry Regulatory Authority. “ Futures and Commodities: Overview .”

U.S. Securities and Exchange Commission. “ Updated Investor Bulletin: How Fees and Expenses Affect Your Investment Portfolio .”

Financial Industry Regulatory Authority. “ Mutual Funds: Fees and Expenses .”

U.S. Securities and Exchange Commission. “ Investor Bulletin—Mutual Fund Fees and Expenses .”

Internal Revenue Service. “ Mutual Funds (Costs, Distributions, etc.) 4 .”

Financial Industry Regulatory Authority. “ Retirement Accounts: Types .”

Investor.gov, U.S. Securities and Exchange Commission. “ Dollar Cost Averaging .”

Investor.gov, U.S. Securities and Exchange Commission. “ Net Asset Value .”

U.S. Securities and Exchange Commission. “ Cash Management and Extreme Liquidity Demand of Mutual Funds ,” Page 3, Footnotes.

Financial Industry Regulatory Authority. “ Concentrate on Concentration Risk .”

Financial Industry Regulatory Authority. “ Futures and Commodities: Risks .”

Financial Industry Regulatory Authority. “ Mutual Fund vs ETF: What’s the Difference? ”

- How to Invest in Mutual Funds 1 of 21

- What Is a Mutual Fund Fact Sheet? 2 of 21

- Why Choose Mutual Funds Over ETFs? 3 of 21

- What Are the Advantages of Mutual Funds? 4 of 21

- Why Is a Mutual Fund's Expense Ratio Important to Investors? 5 of 21

- Mutual Funds Are Not FDIC-Insured. Here’s Why 6 of 21

- An Introduction to Sector Mutual Funds 7 of 21

- Aggressive Growth Fund: Examples of Mutual Fund Class 8 of 21

- Flexi-Cap Fund: What it Means, How it Works 9 of 21

- Mutual Funds vs. Money Market Funds: What's the Difference? 10 of 21

- Blend Fund: What it is, How it Works, Examples 11 of 21

- Total Bond Fund: What It is, How It Works 12 of 21

- Balanced Fund: Definition, Investment Mix, Examples 13 of 21

- Investing in Equity Funds: A Beginner’s Guide 14 of 21

- Equity Funds vs. Income Funds: Which Is Better? 15 of 21

- International Fund: What It is, How It Works, Investing 16 of 21

- Investing $100 a Month in Stocks for 20 Years 17 of 21

- What Is a Target-Date Fund? Risk Tolerance and Example 18 of 21

- How Are You Taxed After Selling a Mutual Fund in an IRA? 19 of 21

- 4 Investment Strategies for Managing a Portfolio of Mutual Funds 20 of 21

- Are Mutual Funds Retirement Accounts? 21 of 21

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1470025568-667065ed5a39451da01f3543f9d1bcc9.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Brought to you by:

Introduction to Mutual Funds

By: Robert C. Pozen

This note is an excerpt from Professor Bob Pozen's book "The Mutual Fund Business" and is an introduction to mutual funds, contrasted with commercial banks.

- Length: 5 page(s)

- Publication Date: Apr 9, 2010

- Discipline: General Management

- Product #: 310117-PDF-ENG

What's included:

- Educator Copy

$4.95 per student

degree granting course

$8.95 per student

non-degree granting course

Get access to this material, plus much more with a free Educator Account:

- Access to world-famous HBS cases

- Up to 60% off materials for your students

- Resources for teaching online

- Tips and reviews from other Educators

Already registered? Sign in

- Student Registration

- Non-Academic Registration

- Included Materials

Learning Objectives

To provide students with an introduction to mutual funds.

Apr 9, 2010 (Revised: Jul 15, 2010)

Discipline:

General Management

Industries:

Banking and investment industry

Harvard Business School

310117-PDF-ENG

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

Investment Fund Business Plan

Prospectus.com’s team has written and hundreds of Business Plan and business plans related to the creation and capital acquisition for a variety of funds, including hedge funds, foreign exchange trading and investment pools. If you are thinking about creating a fund and taking in investment capital and offering a return to investors, Business Plan can help structure the deal to ensure that you comply with the necessary regulatory aspects of the venture and appear enticing to investors. Our firm offers the following collaboration and custom writing business plan services and can assist in the writing of your investment fund Business Plan:

- Foreign Exchange Custom Tailored Written Business Plan

- Hedge Fund Custom Tailored Written Business Plan

- Real Estate Fund Custom Tailored Written Business Plan

- Foreclosure Custom Tailored Written Business Plan

- Private Equity Custom Tailored Written Business Plan

- Mutual Fund Custom Tailored Written Business Plan

- Index Fund Custom Tailored Written Business Plan

- Mortgage Pool Custom Tailored Written Business Plan

- Fixed Income Custom Tailored Written Business Plan

- Asset Manager Fund Custom Tailored Written Business Plan

- Investment Pool Custom Tailored Written Business Plan

- Offshore Custom Tailored Written Business Plan

For issuers considering selling stock in the company or selling debt securities to investors a well-tailored and written business plan is mandatory, particularly in light of the current economic conditions. A business plan offering document can bring added protection to your business and is often required to raise either debt or equity capital in the public and private markets. A well written business plan will tell the story of the company, from the minute details of the types of securities being offered, e.g. stock versus bonds, to the management team, the market, the risk factors and the overall business plan model of the company, among many other features. The final part of the business plan is reserved for the subscription agreement, which is an essential component of any business plan as the subscription agreement is the contract between the issuer and the person buying the debt or equity securities.

Although the business plan is first and foremost a document used to raise capital, the structure and presentation of the business plan can add value to a company’s products and services and team by portraying them in a well-polished format. A business plan shows an investor that one is serious and has gone the extra length to ensure regulatory compliance and good business practices. Without a formal document that outlines the company’s business plan and securities structure it is often difficult to raise capital from any serious investor.

Our team at prospectus.com has years of experience writing business planes for hundreds of varying industries and businesses. We work one on one with our clients during the business plan drafting process and take it upon ourselves – in almost obligatory fashion – to assist our clients with their quest for growth once our services our complete.

Contact Us Today for a Free Consultation

Newsletter Sign Up

Get the latest updates sent to your email

For Unique Capital Growth Strategies

Questions? Fill out the Contact form , or get in touch:

- (212 ) 812-2127

- [email protected]

The Brand Hopper

All Brand Stories At One Place

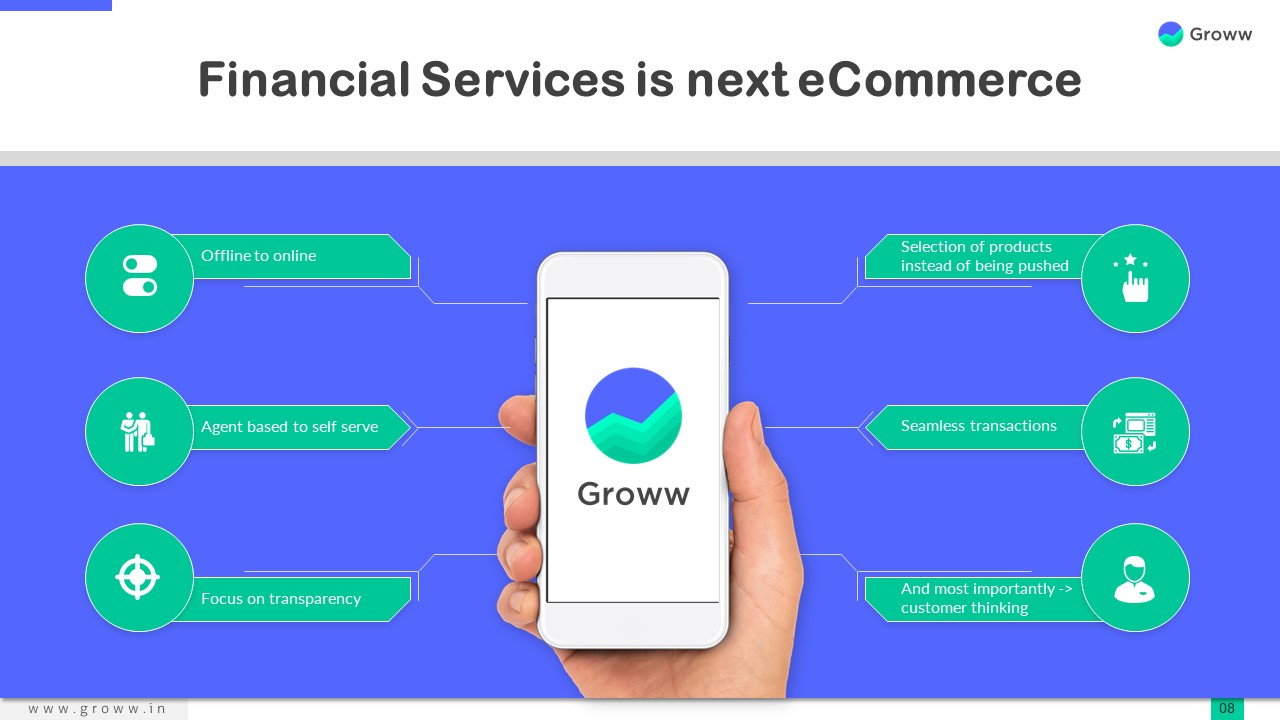

Groww – Success Story, Business Model, Revenue, Growth and Funding

Groww – Success Story, Business Model, Revenue, Growth and Funding 5 min read

Groww is a web-based investing platform that allows users to make direct investments in mutual funds and stocks. The business developed a platform for mutual fund direct access. Groww’s technology is designed to make investing simple, accessible, transparent, and completely paperless, allowing clients to easily invest in mutual funds.

SIPs and equity-linked savings are two ways Groww members can invest in mutual funds. The company claims to have over 20 million registered users, the majority of whom are under the age of 40 and prefer to utilise their phones. It provides over 5,000 mutual funds that may be invested in directly through its website and app, both of which are available on iOS and Android.

It has a transparent pricing structure with low trading costs. There are no hidden costs when investing in a mutual fund. Groww does not charge an account setup or monthly maintenance fee. Furthermore, with Groww’s direct mutual fund plan, you may earn an extra 1.5 percent.

Groww provides stock market essentials and updates to help investors make smarter selections through E-books, Resources, and Blogs. It is incredibly simple to open a paperless account. You can apply for an IPO online if you wish to participate in the primary market. The programme includes a Brokerage Calculator.

Table of Contents

Founders/History

Groww was established in 2016 by four former Flipkart workers, Lalit Keshre, Harsh Jain, Neeraj Singh, and Ishan Bansal, with the goal of making investing more accessible to young people by simplifying the process. Most millennials favour the DIY (Do It Yourself) approach, in which individual investors create and manage their own investment portfolios.

How it started?

During their time at Flipkart, the company’s founders watched the evolution of the e-commerce business and decided that investing is the next great opportunity. The e-commerce boom suggested an increase in average income and technological expertise, and it was at this moment that the founders understood that people really have more money and will need help putting it to good use.

When the founding team began researching Indian financial choices for interested customers, they spent a significant amount of time studying about the industry and identified the users’ primary pain points. They have to do multiple experiments to identify the optimal user experience. Furthermore, the users’ hard-earned cash was at stake. As a result, they needed to provide a safe and secure solution, which took some time to design.

Groww launched in 2016 as a direct mutual fund distribution platform and has since evolved to become one of the most popular mutual fund investment platforms in the country. In response to consumer demand, Groww introduced stocks in early 2020, and the following year released digital gold, ETFs, intraday trading, and IPOs in fast succession.

Business Model

Groww charges a little fee, however it is paid by the mutual fund company, not the client. They earn from the funds they sell, but the process is difficult.

To begin, mutual fund investments are classified into two types: regular and direct. In normal mode, a distributor appears, and you must pay a commission to the distributor. The commission is established so that you are compensated for your investment and earnings.

Groww, on the other hand, provides customers with a direct investing opportunity by uniting many funds and firms into a single platform, therefore broadening their options.

The first priority for a fintech firm like Groww is to develop its client base. Groww uses technology to reach the right audience, which reduces its operational expenses. People seldom move between these kinds of apps. As a consequence, if you’ve created the right consumer base, they’re more likely to continue with you for the long haul.

Groww’s high level of technology enables customers to invest in mutual funds and shares from anywhere in the globe. You can become a shareholder in a certain stock or mutual fund with a few mouse clicks.

Revenue and Growth

Groww is one of several startups that have piqued the curiosity of investors. Earnings climbed by 4.7 times to little more than INR 1 crore in FY20, up from INR 20.14 lakhs in FY19. Operating revenue rose 3.25 times to INR 52.05 lakhs, with financial assets contributing INR 48.24 lakhs more.

In addition, the company’s operational sales increased in FY21, reaching INR 52.71 crores in consolidated operating revenues. The brokerage and allied services provided by the firm generated around INR 34.3 crore in revenue, which was followed by income from its tech platform charges and other operational revenue, which generated Rs 12.7 crore and INR 5.71 crore in revenue, respectively. The company’s expenditure also increased in lockstep, bringing the total expenditure to INR 155.66 crore. According to the company’s financials at the unit level, Groww earned Re 1 of operational revenue while spending INR 2.95 during FY21.

Although the Y Combinator-backed company’s earnings have increased, it still behind startups like Zerodha and Upstox, which have earnings of INR 1,094 crore and INR 148 crore, respectively. In FY20, Groww earned INR 1 crore, whereas ET Money earned INR 2.24 crore.

Groww is rapidly increasing and attained unicorn status in April 2021. The firm secured a $83 million Series D fundraising round sponsored by Tiger Global Management, allowing it to become a unicorn startup.

Some other growth insights of the brand can be compiled as:

- Groww boasts that it has over 20 million registered users.

- Nearly $400 million has been invested in the platform.

- Groww is a one-of-a-kind firm that has seen its worth more than tenfold increase (from $250-300 million to $3 billion) in just over a year in India.

- Groww’s main competitor is Upstox, which just raised a fresh round at a valuation of roughly $3.4 billion.

Also Read: Upstox – Success Story, Business Model, Revenue, Growth & Funding

Funding and Investors

Groww has raised around $393 million in 7 investment rounds to far. On October 24, 2021, the firm secured around $251 million in its Series E fundraising round.

Future Plans

Groww will introduce deposits, US stocks, sovereign gold bonds, Futures & Options, and other derivative products in the following months. Groww has focused financial education content from its inception.

Over the next two years, the business plans to launch a flurry of financial education programmes aimed at millennials, as well as strengthen the financial services industry. According to the company, it signed up around 7 million users between September 2020 and April 2021, with 60% of them in Tier 2 cities and beyond .

Official Website – https://groww.in/

To read more content like this, subscribe to our newsletter

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Related Posts

Vercel – Founders, Business Model, Revenue, Funding & Competitors

Brex – Business Model, Founders, Revenue, Funding & Competitors

From Onboarding to Optimization: The Rippling Story

Terms and Conditions

IMAGES

VIDEO

COMMENTS

Investment Company Business Plan. Over the past 20+ years, we have helped over 1,000 entrepreneurs and business owners create business plans to start and grow their investment companies. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through an investment ...

When creating financial projections for a mutual fund business plan, it is essential to include projected income statements, cash flow statements, balance sheets, and break-even analysis over a 5-year period . These projections help to demonstrate the financial viability and potential profitability of the mutual fund business.

Business Plan for The Hiawatha Fund (Southeast Minnesota) — 5 — Strategic Plan The Strategic Plan of the Hiawatha Fund calls for both immediate activity to animate local investment, and longer-term activity toward creating a regional investment fund. 1. Immediate actions that require relatively minor financial support ($75,000 to $400,000)

This sample plan was created for a hypothetical investment company that buys other companies as investments. In this sample, the hypothetical Venture Capital firm starts with $20 million as an initial investment fund. In its early months of existence, it invests $5 million each in four companies. It receives a management fee of two percent (2% ...

1.0 Executive Summary. The purpose of this business plan is to raise $10,000,000 for the development of a mutual fund while showcasing the expected financials and operations over the next three years. Mutual Fund, Inc. ("the Company") is a New York based corporation that will provide investments into marketable securities on behalf of ...

A mutual fund is an SEC-registered open-end investment company that pools money from many investors and invests . the money in stocks, bonds, short-term money-market instru-ments, other securities or assets, or some combination of these investments. The combined securities and assets the mutual fund owns are known as its portfolio, which is managed

each business day by dividing the total value of the fund's holdings (less expenses) by the number of shares owned by the fund's shareholders. Investors of mutual funds purchase at the NAV next calculated after they place their trade order. Mutual fund shares are "redeemable," meaning that investors can sell their shares back to

A mutual fund is an investment company that pools money from shareholders and invests in a diversified portfolio of securities. An estimated 88 million individual Americans in 51 million. U.S. households own mutual fund shares. This brochure provides an overview of the types of mutual funds and how they operate.

1. Set Your Investment Goals and Budget. As with any investment, it's important to set clear goals that align with your broader financial objectives, time horizon, and risk tolerance before ...