Samsung Electronics—A Detailed Case Study

Devashish Shrivastava

Samsung is a South Korean electronic gadget manufacturer in Samsung Town, Seoul. Samsung Electronics was established by Lee Byung-Chul in 1938 as an exchanging organization.

We all know this information about Samsung. Don't we? But what we don't know? Do you know how much Samsung has grown in these years? What are the Future Plans of Samsung? How much Samsung invested in its R&D? What difficulties did the company face coming all this way? What is the history behind this multinational conglomerate?

Don't worry we got you covered. We have penned down a detailed Case Study on Samsung Electronics. Let's find out in this thoroughly studied Samsung case study.

Let's start the detailed case study from here.

Samsung entered the electronics industry in the late 1960s and the development and shipbuilding ventures in the mid-1970. Following Lee's demise in 1987, Samsung was divided into five business groups - Samsung Group, Shinsegae Group, CJ Group, Hansol Group and Joongang Group.

Some of the notable Samsung industrial subsidiaries include Samsung Electronics, Samsung Heavy Industries Samsung Engineering, and Samsung C&T (separately the world's 13th and 36th biggest development companies). Other notable subsidiaries include Samsung Life Insurance, Samsung Everland, and Cheil Worldwide.

Samsung has a powerful influence on South Korea's monetary advancement, legislative issues, media, and culture. Samsung has played a significant role behind the "Miracle on the Han River". Its subsidiary organizations produce around a fifth of South Korea's complete exports. Samsung's revenue was equivalent to 17% of South Korea's $1,082 billion GDP.

History of Samsung Electronics Samsung's Business Strategy Samsung Rides High In India Business Growth in India Future Plans of Samsung FAQ's

History of Samsung Electronics

1938 (Inception of Samsung)-

- In 1938, Lee Byung-Chul (1910–1987) of a huge landowning family in the Uiryeong region moved to nearby city Daegu and established Samsung Sanghoe.

- Samsung began as a little exchanging organization with forty representatives situated in Su-dong. It managed dried fish, privately developed staple goods and noodles. The organization succeeded and Lee moved its head office to Seoul in 1947.

- When the Korean War broke out, Lee had to leave Seoul. He began a sugar processing plant in Busan named Cheil Jedang. In 1954, Lee founded Cheil Mojik. It was the biggest woollen factory in the country.

- Samsung broadened into a wide range of territories. Lee wanted to build Samsung as a pioneer in a wide scope of enterprises.

- In 1947, Cho Hong-Jai, the Hyosung gathering's organizer, put resources into another organization called Samsung Mulsan Gongsa or the Samsung Trading Corporation with Samsung's founder Lee Byung-Chul. The exchanging firm developed into the present-day Samsung C&T Corporation .

- After few years in business, Cho and Lee got separated due to the differences in the management style. In 1980, Samsung acquired the Gumi-based Hanguk Jeonja Tongsin and entered the telecommunications market . During the initial days, it sold switchboards.

1987 (Demise of Lee Byung-Chul)-

- After Lee's demise in 1987, the Samsung Group was divided into four business gatherings—Samsung Group, Shinsegae Group, CJ Group, and the Hansol Group.

- One Hansol Group agent stated, "Just individuals uninformed of the laws overseeing the business world could think something so ridiculous," while also adding, "When Hansol got separated from the Samsung Group in 1991, it cut off all installment assurances and offer holding ties with Samsung subsidiaries."

- One Hansol Group source attested, "Hansol, Shinsegae, and CJ have been under autonomous administration since their particular divisions from the Samsung Group."

- One Shinsegae retail chain official executive stated, "Shinsegae has no installment certifications related to the Samsung Group." In 1982, it constructed a TV get-together plant in Portugal, a plant in New York in 1984, a plant in Tokyo in 1985 and an office in England in 1996.

2000 (Samsung in 20th Century)

- In 2000, Samsung opened a development center in Warsaw, Poland. It started with set-top-box technology before moving to TV and cell phones. The cell phone stage was created with accomplices and formally propelled with the first Samsung Solstice line of gadgets and different subordinates in 2008. It later emerged into the Samsung Galaxy line of gadgets that is Notes, Edge, and other models.

- In 2010, Samsung declared a ten-year development system based on five businesses. One of these organizations was to be centered around bio-pharmaceuticals in which ₩2,100 billion was invested.

- In the first quarter of 2012, Samsung Electronics turned into the world's biggest cell phone creator by unit deals, surpassing Nokia which had been the market chief since 1998.

- In 2015, Samsung was granted U.S. patents as compared to other organizations like IBM , Google , Sony, Microsoft , and Apple. Samsung got 7,679 utility licenses before 11 December 2015.

- On 2 August 2016, Samsung Electronics revealed the Galaxy Note7 smartphone, which went on sale on 19 August 2016. At the beginning of September 2016, it halted its selling of smartphones due to some problems with the smartphones. Samsung suspended the selling of the smartphones and recalled its units for inspection.

- This happened after certain units of the telephones had batteries with a deformity that made them produce extreme warmth, prompting flames and blasts. Samsung replaced the reviewed units of the telephones with a new version. It was later found that the new version of the Galaxy Note 7 also had the same battery deformity.

- Samsung recalled all Galaxy Note7 cell phones worldwide on 10 October 2016 and permanently ended its production on the same day.

Samsung's Business Strategy

Great business strategies have been applied by Samsung over the years. Not very far back, Samsung wasn't as famous as now. Samsung has now advanced so much that it is the principal contender of Apple Inc. Samsung is the biggest tech business by income and the seventh most significant brand today. The showcasing procedure it applied encouraged Samsung electronics to turn into an industry driving innovation organization.

The Samsung marketing strategy was one of the best systems at any point because it helped a cost-driven organization to change its structure and become a power producer. Due to the consistently changing tastes of purchasers in the innovation business, organizations needed to pursue the pace and offer dynamic and advancing devices to their clients. In this way, Samsung additionally needed to change to pick up the high ground available, and the new Samsung showcasing methodology was the way to advancement.

Some of the business strategies of Samsung Electronics are listed below:

Promotional Mix Of Samsung

Samsung has arrived at fantastic statures with its cell phones which helped the brand to turn into an image of value and unwavering quality for its purchasers.

Samsung Marketing Mix Pricing Strategy and Samsung Advertising Methodology are the two estimating techniques used by the organization. Other than its items, Samsung is celebrated for its customer support . However, item variety is the most dominant part of the promoting blend of Samsung.

- Skimming Price

Like Apple , Samsung uses skimming costs to pick up the high ground over its rivals. For example, Galaxy S6 and S6 Edge are the brand's new results of Samsung conveying the trademark "Next is Now" and guaranteeing that they are the best smartphone maker at any point made.

What will happen when different contenders will dispatch a cell phone with indistinguishable highlights? Straightforward. Samsung will bring down the cost and effectively steal the customers from its competitors.

- Focused Pricing

Samsung experiences issues in increasing an edge over its rivals with different items. Doubtlessly, Samsung is a credible brand. However, regarding home appliances, it can't be in any way, shape, or form outperform LG In the cameras segment and other home appliance units. Also, Samsung cannot compete with Canon and Nikon.

For Samsung to withstand this savage challenge, it's crucial to utilize aggressive valuing of its products. Moreover, Samsung is neither a newbie underway nor non-inventive. For the most part, it is often the first company to be innovative with its products and present a change among its competitors.

- Putting in Samsung Marketing Strategy

Samsung uses divert advertising strategies. Retailers who present the innovation chain will undoubtedly incorporate Samsung in their rundown on account of the firm being a world-celebrated brand. Samsung can likewise fill in as an option for the purchasers. The circulation is a convincing piece of the Samsung promoting methodology.

In specific urban communities, Samsung has an agreement with a solitary dissemination organization that circulates the items all through the city. For example, Mumbai is an incredible case where Samsung conveys its products through a solitary organization.

Samsung Rides High In India

The greatest leader by far in the smartphone business is Samsung Electronics, the world's greatest cell phone and TV producer.

Samsung is India's greatest, versatile brand. It is the developer of Reliance Jio's 4G LTE system — the greatest and busiest information system on the planet.

Discernments, advertise wars, openings, rivalry — now and then from conventional remote adversaries, from nearby upstarts, and emerging Chinese brands trouble Samsung.

Be that as it may, every time Samsung has had the option to fight off the dangers and hold its ground. It has been leading the market in the TV fragment for more than 12 years and in the versatile business for a long time after it toppled Nokia in 2012.

Riding The Smartphone Wave

As indicated by some statistical surveying firms following cell phone shipments, Chinese firm Xiaomi is creeping nearer — or has even surpassed Samsung after December 2017 quarter.

While for the entire year 2017, Samsung was No. 1 in the cell phone space, IDC information indicated Xiaomi drove the last quarter with 26.8% piece of the overall industry. Samsung was at 24.2%. Different players, for example, Vivo, Lenovo, and Oppo stayed at 6.5, 5.6, and 4.9%, separately.

Warsi, who has been working with Samsung for as far back as 12 years and has as of late been advanced as Global Vice President, is unflinching, "These difficulties offer us the chance to work more earnestly for our customers and with our accomplices.

Furthermore, shoppers love marks that emphasis on them," he says. "Samsung is India's No. 1 cell phone organization crosswise over sections — premium, mid and reasonable. That is what makes a difference."

Statistical surveying firm GfK tracks disconnected offers of handsets — which make up around 70% of the market — in which Xiaomi is attempting to make advances.

Samsung had a 42% worth piece of the overall industry in the general cell phone showcase in the nation in 2019 and 55% in the superior fragment as indicated by GfK. An industry official who would not like to be named says that India must be Samsung's greatest market by large volumes.

The thought currently is to become the cell phone business which gets more worth. As indicated by reports, Samsung India's incomes from cell phone deals in 2018-19 remained at an astounding INR 34,300 crore. That is over $5.5 billion and development of 27%. Samsung's nearest adversaries are talking about incomes of $1 billion in India, going up to $2 billion.

Samsung is the world's largest manufacturer of consumer electronics by revenue. As of 2019, Samsung Electronics is the world's second-largest technology company by revenue, and its market capitalization stood at US$301.65 billion, the 18th largest in the world.

Shopper Is At The Center

Samsung is a worldwide advancement powerhouse that leads the patterns. It profoundly put resources in India — 22 years of connections in the exchange, and tremendous interests in neighborhood R&D . It has around 10,000 architects working in research offices in India and is perhaps the greatest scout from the IITs.

"Samsung has a solid brand picture in India, as it has been available in various customer electronic portions with quality items for quite a while now. The brand is trusted because of its long history in the nation, dish India nearness, and a vigorous after deals support for buyers," says Shobhit Srivastava, explore expert at Counterpoint Research.

Indeed, even an item fizzle of the size of the Galaxy Note7 in September 2016 couldn't affect Samsung. While the organization was fast enough to get back to every one of the units that had been sold and cease the gadget totally, Samsung's activities and ensuing effective dispatches of leads like Galaxy S8, Note8, the Galaxy S9 and S9+, which were propelled in February, rescued the harm and raised the profile of the brand as a dependable organization. "They rushed to concede their error and that helped them interface with the perceiving clients of today far superior," says Koshy.

Make For India

Samsung's system 'Make for India', which resounds with the administration's ' Make in India ' activity, was conceived in the late spring of 2015. Samsung India's new President and CEO, H.C. Hong, had recently moved in from Latin America and was looked with the prompt tough assignment of fighting a firm challenge from two nearby versatile organizations that is Micromax and Intex.

Samsung's customer hardware business containing TVs, fridges, and other advanced machines were additionally confronting challenges from Sony and LG.

Around a similar time, the legislature of India propelled its 'Make in India' activity. "In this way, Mr. Hong revealed to us we have been doing Make in India effectively for two decades. What we should concentrate on widely to remain on top of things is Make for India (MFI)," says Dipesh Shah, Managing Director of Samsung R&D Institute in Bengaluru, the greatest R&D community for Samsung outside Korea.

Truth be told, the R&D focuses in India contribute intensely to the improvement of worldwide items, for example, Samsung's lead cell phones (Galaxy S9 and S9+). While different organizations focused on propelling their worldwide items in India, Samsung went about rethinking items for the nation at its R&D focuses.

India is significant for Samsung, thinking of the nation as the second biggest cell phone showcase on the planet today, and it is possibly the greatest undiscovered market for some advanced apparatuses. The entrance of iceboxes, clothes washers, microwaves, and forced air systems are appallingly low because of components like the accessibility of continuous power, social conduct, way of life, and earnings.

Business Growth in India

Samsung India crossed the INR 50,000 crore deals achievement in 2017 according to the simply distributed organization filings with the Registrar of Companies (RoC), uniting its situation as the nation's biggest unadulterated play purchaser products MNC. The Korean mammoth's all-out salary, including turnover and other pay, developed by 15.5% to INR 55,511.9 crore in FY 2017 from INR 48,053 crore in the earlier year regardless of Chinese organizations making genuine advances into the Indian cell phone advertise.

Samsung's cell phone business developed deals at 26.7% to INR 34,261 crore, while the home apparatus business developed by 12% to INR 6,395.6 crore. The organization's TV business stayed dormant at INR 4,481.2 crore even though Samsung held the market initiative.

The organization's net benefit developed at a quicker pace of 38% to INR 4,156.2 crore which industry examiners credited to more concentrate on premium models crosswise over cell phones and customer hardware having higher edges.

Samsung, in its filings, said the 'Make for India' activity, through which a large portion of the items was planned and created given the Indian customer's needs, has been an enormous achievement and a major factor behind the development.

All the units at Samsung India improved their gross productivity with the TV business dramatically increasing it and the home machine business nearly trebling it. The cell phone business was the biggest supporter of gross benefit having developed by 44% in FY17 at INR 5,005.9 crore.

Future Plans of Samsung

Samsung has arranged a new venture of around INR 2,500 crore to transform its India tasks into a center for parts business, two senior industry administrators said. The ventures could be increased further, they included. The Korean organization has set up two new parts fabricating substances in India—Samsung Display Co and Samsung SDI India—for the generation of cell phones and batteries.

Independently, Samsung's funding arm—Samsung Venture Investment Corp—has set up activities in India to support new companies in gadgets equipment and programming organizations. The segment organizations will supply items to both Samsung India and other cell phone merchants who as of now source parts from Samsung's abroad tasks.

Samsung sees a big opportunity for segment business considering the administration's push on 'Make in India' where expense on imported cell phone segments and purchaser hardware is going up, the administrators said.

Samsung is likewise pitching to the administration for fare impetuses so it can even fare segments from India. Samsung Display has just marked an update of comprehension with the Uttar Pradesh government for an INR 1,500 crore plant for assembling telephone show to be operational by one year from now April. The plant will come up in Noida, the administrators said.

Samsung SDI India has plans to set up an assembling unit in India for lithium-particle batteries after the organization was drifted a month ago, according to its administrative filings with the Registrar of Companies (RoC).

As per the administrators, Samsung SDI has plans to contribute another INR 900-1,000 crore and will settle the plans after counseling with the Center post general races. These speculations come after it introduced the world's biggest cell phone fabricating unit in India a year ago at an all-out cost of INR 4,915 crore. It is expected to be completed in 2020.

That's all for now. Share your learnings and findings. What did you learn from this article? Which information surprised or amused you the most? Feel free to reach us and share your feedback. We would love to hear from you. Do comment us in the comments section below. Happy Reading.

Who is the owner of Samsung Electronics?

Samsung Group is the owner of Samsung Electronics.

Who is the Founder of Samsung?

Samsung Electronics was established by Lee Byung-Chul (1910–1987) in 1938 as an exchanging organization.

Who is the current CEO of Samsung?

Kim, Ki Nam, Kim, Hyun Suk and Koh, Dong Jin are the current CEO of multinational conglomerate Samsung.

What does Samsung Electronics make?

Samsung Electronics produces smartphones, TV sets, laptops, solid-state drives, digital cinemas screens, etc.

Is Samsung a Chinese company?

Samsung is a South Korean electronic gadget manufacturer in Samsung Town, Seoul.

What is Samsung's strategy?

- Promotional Mix of Samsung

How large is Samsung Electronics?

Samsung is the world's largest manufacturer of consumer electronics by revenue. Samsung Electronics is the world's second-largest technology company by revenue, and its market capitalization stood at US$ 301.65 billion, the 18th largest in the world.

What are the future plans of Samsung Company?

Samsung has arranged a new venture of around INR 2,500 crore to transform its India tasks into a center for parts business, two senior industry administrators said.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Payment Gateway- Razorpay

- Spy on your Competitors- Adspyder

- Manage your business smoothly- Google Workspace

Nveda: Revolutionizing Healthcare with Nutraceutical Solutions

India's Nutritional Supplements Market was valued at U$ 11.85 billion in 2023 and is projected to hit the market valuation of US$ 28.70 billion by 2032 at a CAGR of 10.7% during the forecast period 2024–2032. Nveda is a fast-growing brand engaged in bringing high quality

Shipping and Fulfillment Guide for E-commerce Businesses

This article has been contributed by Ganesh Nair, Director Operations at Mehar. In today's world of e-commerce, the increase in online stores is clearly intensifying the relentless pace of growth. Navigating the complex world of shipping and fulfillment is necessary for one's business success. This comprehensive guide focuses on three

BASIC Home Loan Success Story: Revolutionizing Home Loans in India

Getting a home loan is a big step toward owning a home, providing financial assistance to make your dream a reality. The Indian home loan market, valued at approximately USD 300 billion, is expected to achieve a CAGR of 22.5% during the forecast period from 2024 to 2029. However,

Arpita Katyal of Roperro Shares the Journey of Embracing Indian Craftsmanship in Luxury Bags

In an exclusive interview with StartupTalky, Arpita Katyal, CEO of Roperro, shares insights into the brand's journey. Roperro, an Indian luxury label specializing in luxury bags, emphasizes Indian craftsmanship on a global scale. Katyal discusses Roperro's mission to make luxury accessible, its bootstrapped journey, and maintaining international quality standards while

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

How Samsung Became a Design Powerhouse

- Youngjin Yoo

- Kyungmook Kim

Until 20 years ago, South Korea’s Samsung Electronics manufactured inexpensive, imitative electronics for other companies. Its leaders valued speed, scale, and reliability above all. The few designers working for the company were dispersed in engineering and new-product units, and they had little status in an organization that emphasized efficiency and engineering rigor.

Then, in 1996, Lee Kun-Hee, the chair of Samsung Group, grew frustrated by the company’s lack of innovation and concluded that in order to become a top brand, Samsung needed expertise in design, which he believed would become “the ultimate battleground for global competition in the 21st century.” He set out to create a design-focused culture that would support world-class innovation. But shifting to an innovation-focused culture without losing an engineering edge is not a simple matter. It involves managing a number of very real tensions.

Samsung’s success in making this shift stems from a single early decision—to build design competency in-house rather than import it. The authors describe how the company created a committed, resourceful corps of designers who overcame internal resistance by deploying the same tools they use in pursuing innovation: empathy, visualization, and experimentation in the marketplace.

HBR Reprint R1509E

The electronics manufacturer now emphasizes design over efficiency.

Idea in Brief

The challenge.

Samsung Electronics knew that in order to become a top brand, it needed a design-focused culture that would support world-class innovation.

The Problem

Designers faced constant challenges stemming from the company’s efficiency-focused management practices, which were deep-rooted. Managers who were invested in the status quo had to be persuaded to buy in to idealized visions of the future.

The Solution

The company built a corps of designers with a capacity for strategic thinking and the tenacity that enabled them to overcome resistance by deploying the same tools—empathy, visualization, and market experimentation—that they use in pursuing innovation.

Until 20 years ago, South Korea’s Samsung Electronics manufactured inexpensive, imitative electronics for other companies. Its leaders valued speed, scale, and reliability above all. Its marketers set prices and introduced features according to what original-equipment manufacturers wanted. Its engineers built products to meet prescribed price and performance requirements. At the end of the process designers would “skin” the product—make it look nice. The few designers working for the company were dispersed in engineering and new-product units, and individual designers followed the methods they preferred. In a company that emphasized efficiency and engineering rigor, the designers had little status or influence.

- YY Youngjin Yoo is the Harry A. Cochran Professor in Management Information Systems and the founding director of the Center for Design+Innovation at Temple University. He is also an overseas advisory fellow of the Samsung Economic Research Institute and consults for Samsung Electronics.

- Kyungmook Kim is a principal designer at Samsung Electronics’ Corporate Design Center.

Partner Center

Remarkable Recovery: Samsung Crisis Management Case Study

Have you ever wondered how a global tech giant like Samsung managed to navigate a major crisis and bounce back stronger?

In the world of corporate governance, effective crisis management can be the difference between irreparable damage to a company’s reputation and a successful recovery.

In this blog post, we delve into a Samsung crisis management case study to learn about exploding batteries to the intricate strategies employed to restore trust.

Samsung’s journey offers valuable insights into the intricacies of crisis management in the digital age.

Join us as we explore the key lessons learned and best practices from this high-stakes situation, shedding light on the remarkable recovery efforts that propelled Samsung forward.

Let’s learn about sailing through tough times through Samsung crisis management case study

Background of Samsung History and growth of Samsung as a global conglomerate

Samsung, founded in 1938 by Lee Byung-chul, started as a small trading company in South Korea. Over the years, it steadily expanded into various industries, such as textiles, insurance, and retail.

In the 1960s, Samsung ventured into electronics, marking the beginning of its transformation into a global conglomerate.

With a focus on technological innovation and a commitment to quality, Samsung rapidly gained recognition for its consumer electronics products, including televisions and appliances.

Throughout the 1980s and 1990s, Samsung significantly diversified its business portfolio, entering the semiconductor, telecommunications, and shipbuilding industries.

This diversification strategy helped Samsung become a key player in multiple sectors, solidifying its position as a global leader. Notably, Samsung’s semiconductor division became one of the largest chip manufacturers in the world, supplying components to various electronic devices worldwide.

Samsung’s ascent continued in the 2000s, driven by its successful expansion into the mobile phone market. The introduction of the Galaxy series, powered by the Android operating system, catapulted Samsung to the forefront of the smartphone industry.

The company’s innovative designs, cutting-edge features, and aggressive marketing campaigns contributed to its rise as a major competitor to Apple’s iPhone.

With its global reach, Samsung has consistently ranked among the world’s largest technology companies, epitomizing South Korea’s economic prowess and technological advancements.

Samsung has also been considered one the best companies that successfully managed and implemented change initiatives.

Overview of Samsung’s position in the technology industry

In the consumer electronics segment, Samsung has established itself as a dominant force. Its diverse product lineup encompasses televisions, smartphones, tablets, wearables, home appliances, and audio devices.

The Galaxy series of smartphones, in particular, has enjoyed immense popularity and has emerged as a fierce competitor to other industry giants. Samsung’s televisions are also highly regarded for their cutting-edge display technologies, such as QLED and MicroLED.

The company’s advancements in semiconductor technology have contributed to faster computing speeds, increased storage capacities, and improved energy efficiency.

Samsung’s influence extends beyond consumer electronics and semiconductors. The company is actively involved in telecommunications infrastructure, including the development of 5G networks and the production of network equipment.

Samsung has also made notable strides in the realm of software solutions, including its own mobile operating system, Tizen, and various software platforms for smart devices.

Samsung Galaxy Note 7 Crisis

The Note 7 battery issue marked a significant crisis for Samsung, leading to a widespread recall of the flagship smartphone and causing considerable damage to the company’s reputation.

The crisis began in September 2016 when reports emerged of Note 7 devices catching fire or exploding due to faulty batteries. These incidents raised concerns about consumer safety and triggered a wave of negative publicity for Samsung.

Upon receiving initial reports of battery-related incidents, Samsung initially responded by issuing a voluntary recall of the Note 7 in September 2016. The company acknowledged the problem and expressed its commitment to addressing the issue promptly and effectively.

Samsung attributed the battery malfunctions to a manufacturing defect, specifically a flaw in the design that caused a short circuit.

To ensure customer safety, Samsung advised Note 7 owners to power down their devices and refrain from using them. The company swiftly implemented measures to exchange the affected devices, offering customers the option to either replace their Note 7 with a new unit or receive a refund.

Samsung also collaborated with mobile network operators and retail partners to facilitate the recall process.

In its initial response, Samsung took steps to communicate with customers and the public about the issue. The company published official statements expressing regret for the inconvenience caused and assuring customers of its commitment to resolving the problem. Samsung emphasized its dedication to quality and safety, promising to conduct thorough investigations and implement necessary improvements to prevent similar incidents in the future.

Media coverage and public perception during the crisis

During the Note 7 crisis, media coverage played a significant role in shaping public perception and amplifying the negative impact on Samsung’s brand.

The crisis received extensive coverage from both traditional media outlets and online platforms, leading to widespread awareness and public scrutiny. Here’s an overview of media coverage and its influence on public perception:

- News Outlets: Major news organizations across the globe reported on the Note 7 battery issue, highlighting incidents, the recall, and subsequent developments. Television news segments, newspapers, and online news articles extensively covered the crisis , emphasizing the potential safety risks and consumer concerns. The constant media attention contributed to the widespread dissemination of information and increased public awareness of the issue.

- Online Platforms and Social Media: Social media platforms played a pivotal role in the crisis, enabling the rapid spread of information and user-generated content. Users took to platforms such as Twitter, Facebook, and YouTube to share their experiences, express concerns, and criticize Samsung’s handling of the situation. Viral videos, photos, and personal accounts of Note 7 incidents gained traction, further fueling negative sentiment and influencing public perception.

- Expert Analysis and Opinions: Alongside news coverage, experts and industry analysts provided their insights and opinions on the crisis. Their assessments of Samsung’s response, the potential causes of the battery issue, and the implications for the company’s brand reputation contributed to the overall narrative. Expert opinions had the power to sway public perception and shape the understanding of the crisis.

- Consumer Forums and Discussion Platforms: Online forums and discussion boards dedicated to technology and consumer experiences became hubs for discussions surrounding the Note 7 crisis. Consumers shared their frustrations, exchanged information, and warned others about potential risks. These platforms served as gathering places for individuals affected by the crisis and amplified the negative sentiment surrounding Samsung’s brand.

Financial implications and losses incurred by Samsung

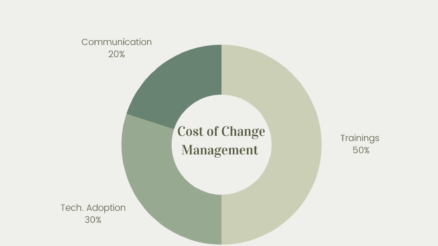

The Note 7 crisis had significant financial implications for Samsung, resulting in substantial losses for the company. Here are some of the key financial impacts experienced by Samsung as a result of the crisis:

- Recall and Replacement Costs: The recall and replacement process incurred significant costs for Samsung. The expenses involved in collecting and replacing over 2 million of Note 7 devices, including logistics, shipping, and refurbishment, were substantial. The costs also encompassed the testing and certification of replacement devices to ensure their safety. The total recall cost was estimated at $5.3 billion.

- Decline in Sales and Market Share: The crisis had a detrimental impact on Samsung’s sales and market share in the smartphone industry. As consumer confidence in the Note 7 and Samsung’s brand reputation declined, potential buyers shifted their preferences to alternative smartphone options. The decline in sales of the Note 7, coupled with the negative impact on the perception of other Samsung products, led to a loss of market share for the company.

- Stock Price Decline: The Note 7 crisis had an immediate impact on Samsung’s stock price. News of the battery issue, recalls, and subsequent negative media coverage led to a decline in Samsung’s stock value. Samsung shares fell approximately to 7 percent right after 2 months of the crisis.

Crisis Management Strategy Employed by Samsung

Following are the key aspects of Samsung Galaxy Note 7 crisis management strategy:

Immediate actions taken by Samsung to address the crisis

In the face of the Note 7 crisis, Samsung swiftly implemented a range of immediate actions to address the situation and mitigate the impact on consumers and the company’s brand reputation. Here are some of the key actions taken by Samsung:

- Voluntary Recall: As soon as reports of battery issues emerged, Samsung initiated a voluntary recall of the Note 7. This proactive step demonstrated the company’s commitment to consumer safety and willingness to take responsibility for the problem.

- Temporary Production Halt: To address the root cause of the battery issue, Samsung temporarily halted production of the Note 7. This decision aimed to prevent further distribution of potentially defective devices and allow for thorough investigations and corrective measures.

- Transparent Communication: Samsung made efforts to communicate openly and transparently about the crisis. The company issued official statements and press releases acknowledging the problem, expressing regret for the inconvenience caused, and reassuring customers of its commitment to resolving the issue. Transparent communication was crucial in maintaining trust and providing timely updates to affected consumers.

- Collaboration with Authorities: Samsung collaborated closely with regulatory authorities and industry experts to investigate the battery issue comprehensively. By engaging external expertise, the company aimed to identify the root cause and develop effective solutions. This collaboration demonstrated Samsung’s commitment to finding the best possible resolution.

- Customer Support and Safety Guidelines: Samsung provided clear instructions to consumers regarding the use of Note 7 devices, emphasizing the importance of safety. The company advised customers to power down their devices, participate in the recall, and utilize alternative devices in the interim. This approach prioritized customer safety and aimed to prevent further incidents.

- Increased Battery Testing and Safety Measures: Samsung implemented enhanced battery testing procedures and stringent safety measures to prevent similar incidents in the future. The company adopted more rigorous quality control processes, including additional safety certifications and testing standards, to ensure the highest levels of product safety.

Communication strategies employed by Samsung

Samsung employed various communication strategies to address the Note 7 crisis and manage the impact on its brand reputation. Effective communication was crucial in maintaining transparency, addressing consumer concerns, and rebuilding trust. Here are some of the communication strategies employed by Samsung:

- Official Statements and Press Releases: Samsung issued official statements and press releases to provide updates on the progress of the recall, investigations, and corrective actions. These statements expressed remorse for the inconvenience caused and reiterated the company’s commitment to customer safety. Clear and concise communication helped keep customers informed and reassured them that Samsung was actively working to resolve the issue.

- Direct Customer Communication: Samsung directly communicated with customers to provide instructions and updates on the recall process. The company utilized various channels such as email, SMS messages, and notifications through its official website and smartphone apps. This direct communication ensured that customers received important information and guidance regarding the recall and replacement program.

- Social Media Engagement: Samsung actively engaged with customers and the public on social media platforms, including Twitter, Facebook, and YouTube. The company responded to customer queries, addressed concerns, and provided updates on the progress of the recall. By engaging in two-way communication, Samsung demonstrated its willingness to listen, respond, and provide assistance to affected customers.

- Collaboration with Industry Experts: Samsung collaborated with industry experts, battery manufacturers, and regulatory authorities to investigate the root cause of the battery issue. This collaboration was communicated to the public, showcasing Samsung’s commitment to finding solutions and ensuring that the necessary expertise was involved in resolving the crisis.

- Advertisements and Marketing Campaigns: Samsung launched advertising and marketing campaigns focused on rebuilding trust and emphasizing its commitment to quality and safety. These campaigns highlighted Samsung’s dedication to addressing the issue and regaining consumer confidence. Advertisements often emphasized the company’s rigorous testing procedures and quality control measures to assure customers of the safety of its products.

- CEO Apology: Samsung’s CEO issued a public apology, taking personal responsibility for the crisis and expressing regret for the inconvenience and concern caused to customers. The CEO’s apology aimed to convey sincerity, empathy, and a commitment to rectifying the situation, while also reinforcing the company’s accountability and determination to regain trust. The apology was published on a full page in 03 major US newspapers – the Wall Street Journal, The Washington Post and The New York Times.

Collaborations with regulatory authorities and industry experts

Samsung worked closely with government agencies and regulatory bodies in various countries where incidents related to the Note 7 were reported. The company shared information, conducted investigations, and cooperated with authorities to ensure compliance with safety regulations and guidelines. Collaboration with government agencies helped align efforts to address the crisis and establish industry-wide safety standards.

In the United States, Samsung collaborated with the CPSC, an independent federal agency responsible for ensuring the safety of consumer products. Samsung worked together with the CPSC to investigate the battery issue and coordinate the recall process. This collaboration ensured that the recall efforts followed established safety protocols and provided consumers with accurate information.

Samsung collaborated with battery manufacturers to investigate the specific manufacturing defects that caused the battery issue. The company worked closely with these partners to analyze the battery designs, manufacturing processes, and quality control measures. By involving battery manufacturers in the investigation, Samsung aimed to identify the root cause and implement corrective actions to prevent similar issues in the future.

Samsung engaged independent testing labs to conduct thorough assessments of the Note 7 batteries and verify the effectiveness of corrective measures. These labs specialized in battery testing and certification, providing expertise and unbiased evaluation of the battery performance and safety. Collaboration with independent testing labs helped validate Samsung’s efforts to address the battery issue and instill confidence in the effectiveness of the solutions.

Post-Crisis Recovery and Rebuilding

Samsung implemented more stringent quality control measures across its product development and manufacturing processes. This included enhanced battery testing protocols, increased inspections, and stricter quality assurance standards. By demonstrating a commitment to producing reliable and safe products, Samsung aimed to rebuild customer trust.

Extended Warranty and Customer Support: Samsung extended warranty periods for existing and new devices, including the Note 7, to provide customers with added assurance. The company also enhanced its customer support services, ensuring that customers could easily access assistance, product information, and technical support. These initiatives aimed to demonstrate Samsung’s commitment to customer satisfaction and support.

Launch of subsequent product lines and their impact on brand perception

Following the Note 7 crisis, Samsung launched subsequent product lines, including flagship smartphones like the Galaxy S8 and subsequent iterations. These launches played a crucial role in shaping brand perception and rebuilding trust. Key factors that influenced brand perception and the recovery process include:

- Emphasis on Safety and Quality: Samsung placed a strong emphasis on safety and quality in its subsequent product launches. The company implemented rigorous testing procedures and introduced new safety features to ensure the reliability and safety of its devices. By highlighting these improvements, Samsung aimed to regain customer trust and reassure them of its commitment to producing high-quality products.

- Positive User Experience: Samsung focused on delivering positive user experiences with its new product lines. This included improvements in design, performance, and functionality to enhance customer satisfaction. By providing users with exceptional products, Samsung aimed to rebuild its reputation and generate positive word-of-mouth, contributing to brand recovery.

- Brand Messaging and Marketing: Samsung’s marketing efforts during subsequent product launches were carefully crafted to reinforce positive brand associations and regain customer trust. The company emphasized innovation, customer-centricity, and the commitment to quality and safety. Marketing campaigns highlighted features, benefits, and technological advancements to create a positive brand image and overcome the negative perceptions associated with the Note 7 crisis.

Final Words

Samsung’s handling of the Note 7 crisis serves as a case study in crisis management. Despite the significant financial and reputational setbacks, the company took proactive steps to address the crisis, regain customer trust, and prevent similar incidents in the future.

The Samsung crisis management case study highlights the importance of swift and transparent communication, customer-centric actions, and continuous improvement in product safety and quality. By effectively addressing the crisis, Samsung was able to navigate the challenging situation and rebuild its brand, reaffirming its position as a leading global technology company.

Overall, the Samsung crisis management case study provides valuable insights into how a company can recover from a major setback, restore customer trust, and strengthen its position in the market through strategic actions and a relentless commitment to customer satisfaction and product excellence.

About The Author

Tahir Abbas

Related posts.

How to Estimate Cost of Change Management

08 Steps to Create Communication Plan in Change Management

Short Term Wins in Change Management

- About / Contact

- Privacy Policy

- Alphabetical List of Companies

- Business Analysis Topics

Samsung’s Generic Competitive Strategy & Growth Strategies

Samsung’s generic competitive strategy and intensive growth strategies set business goals for technological innovation as a critical factor in developing competitive advantages. Headquartered in Korea, the conglomerate competes with technology-intensive firms, such as Apple , Google (Alphabet) , Microsoft , Sony , and Intel , which create strong competitive forces, as determined through a Five Forces analysis of Samsung. The industry environment imposes aggressive competitive behavior that typically involves rapid technological innovation for product differentiation, as seen in the evolution of smartphones available in the global market. To effectively compete, Samsung’s generic competitive strategy and growth strategies must involve investment in technological innovation. The resulting competitive advantages enable the company to keep its competitive position as one of the best performers in the semiconductors, consumer electronics, and home appliances industries. Samsung’s generic competitive strategy and intensive strategies for growth are suited to the current business environment and the strategic positioning of the multinational organization’s operations.

The generic competitive strategy and intensive growth strategies of Samsung Group permeate its entire organization, influencing the strategic choices and implementations of its divisions and subsidiaries. The Group’s unitary leadership is responsible for the corporate strategic direction and competitive advantages of the conglomerate and its technology-focused subsidiaries. Samsung’s generic competitive strategy and intensive growth strategies are observable in product design, marketing strategies, and the business organizational development direction of subsidiaries.

Samsung’s Generic Competitive Strategy (Porter Model)

Samsung applies broad differentiation as its generic competitive strategy. Based on Michael E. Porter’s competitive strategy model, the strategic objective of broad differentiation is to maintain competitive advantage by providing unique (or differentiated) products targeting a wide market, which in this case is industry-wide, involving practically every person or group that buys smartphones, laptops, and other equipment. To achieve Samsung’s strategic plans for growth and expansion in the global market, this generic competitive strategy requires the application of product development as a main intensive growth strategy to compete with other technology firms.

Samsung’s investments in product development are a strategic implication of differentiation as its generic competitive strategy. For example, the company invests in technological innovation to support the competitive advantage of its products in the consumer electronics market. Another implication of this generic competitive strategy is Samsung’s marketing mix (4Ps) and related strategies that promote products as unique or different alternatives to the majority of competitors. This marketing approach and technological innovation sustain the corporation’s competitive advantages and value chain effectiveness in satisfying customers’ needs in consumer electronics, computing technology, and home appliances.

Other generic competitive strategies, such as cost leadership, differentiation focus, and cost focus, are also applied in Samsung’s operations, but to a limited extent. Cost focus leads to the company’s being the best-cost provider in some segments of the semiconductor and electronic components markets. The limited application of cost focus still comes with innovation standards that reflect Samsung’s main generic competitive strategy of broad differentiation. These generic strategies align with the company’s intensive growth strategies to succeed in sustaining the technology firm’s competitive advantages.

Samsung’s Intensive Growth Strategies (Ansoff Matrix)

Market Penetration (Primary) . Samsung’s revenue growth depends on market penetration as the primary intensive strategy. In Igor Ansoff’s matrix, the strategic objective of market penetration is to grow the technology business by increasing its revenues from the sale of current products in current markets, such as the European Union’s consumer electronics market, where the corporation already has operations. Competitive advantages and business strengths identified in the SWOT analysis of Samsung combat negative forces from competition in these markets. As an intensive growth strategy, market penetration depends on the effectiveness of the generic competitive strategy of broad differentiation, in terms of how the company creates technologically innovative products that are differentiated enough to attract target customers in current or existing markets.

Product Development (Secondary) . Considering the emphasis of product superiority in Samsung’s corporate mission and vision statements , product development is a major intensive growth strategy of the enterprise. A strategic objective of product development in this case is to grow the business through new products, such as new electronic gadgets. Also, this intensive strategy grows Samsung’s operations through iterative innovation, which leads to improved versions or variants of existing products. For example, the company regularly rolls out new smartphone models, similar to what competitors are doing in their product development strategy. The implementation of product development as an intensive growth strategy is based on Samsung’s generic competitive strategy of differentiation, which requires product development for uniqueness that differentiates the business from the competition. Economies of scope based on the conglomerate’s various subsidiaries support product development and competitive advantage by providing technological expertise and material inputs from the subsidiaries. Samsung’s organizational culture (work culture) affects human-resource support for operational effectiveness, value chain efficiencies, supply chain management, and other business activities that fulfill the strategic objectives of product development.

Market Development . The global scale of Samsung’s operations makes market development a minor intensive strategy for business growth. Market development’s strategic objective is to enter new markets using the company’s existing products, such as introducing new Galaxy tablets in Latin American markets after these products’ introduction in the United States. As an intensive growth strategy, market development’s success depends on product value and competitive advantage, which in this case comes with Samsung’s generic strategy of differentiation via technological innovation. For example, effective innovation for cutting-edge technological design makes the corporation’s products more competitive when rolled out in target markets. With this intensive growth strategy, introducing products to new markets may come with changes in the geographical units of Samsung’s organizational structure (company structure) .

Diversification . Samsung’s diversified business operations maintain multiple revenue channels and spread risk across industries and markets. This intensive growth strategy’s implementation is infrequent in the technology conglomerate, considering regulatory hurdles and other barriers. With the strategic objective of establishing new profitable businesses, the diversification strategy grows Samsung typically through acquisitions of smaller firms, such as Harman International Industries. The minor role designation of this intensive growth strategy limits the risks of establishing new business operations. In implementing diversification, the generic competitive strategy of differentiation is also applied for competitiveness and strategic alignment among Samsung subsidiaries’ business operations.

Some Considerations – Samsung’s Generic Competitive Strategy & Intensive Growth Strategies

Samsung’s generic competitive strategy and intensive growth strategies direct the organization’s growth and development. Differentiation plays a major role in building the company’s competitive advantage, although other generic competitive strategies, such as cost leadership and focus strategies, also support the technology enterprise and its competitiveness. Samsung’s operations management strategies and administration must align with the differentiation generic competitive strategy and the intensive growth strategies to support business growth while competing with aggressive multinational companies.

- López, D., & Oliver, M. (2023). Integrating innovation into business strategy: Perspectives from innovation managers. Sustainability, 15 (8), 6503.

- Samsung – Brand Identity .

- Samsung R&D Center .

- Samsung Catalyst Fund .

- Taherdoost, H. (2023). An overview of trends in information systems: Emerging technologies that transform the information technology industry. Cloud Computing and Data Science , 1-16.

- U.S. Department of Commerce – International Trade Administration – Software and Information Technology Industry .

- Copyright by Panmore Institute - All rights reserved.

- This article may not be reproduced, distributed, or mirrored without written permission from Panmore Institute and its author/s.

- Educators, Researchers, and Students: You are permitted to quote or paraphrase parts of this article (not the entire article) for educational or research purposes, as long as the article is properly cited and referenced together with its URL/link.

- Open access

- Published: 21 October 2019

Planting and harvesting innovation - an analysis of Samsung Electronics

- Seung Hoon Jang ORCID: orcid.org/0000-0001-7984-7383 1 ,

- Sang M. Lee 2 ,

- Taewan Kim 3 &

- Donghyun Choi 4

International Journal of Quality Innovation volume 5 , Article number: 7 ( 2019 ) Cite this article

21k Accesses

1 Citations

2 Altmetric

Metrics details

This study explores how firms manage the entire life cycle of innovation projects based on the framework of harvesting and planting innovation. While harvesting innovation seeks new products in the expectation of financial performance in the short term, planting innovation pursues creating value over a long time period. Without proper management of the process of planting and harvesting innovation, firms with limited resources may not be successful in launching innovative new products to seize a momentum in high tech industries. To examine this issue, the case of Samsung Electronics (SE), now an electronics giant originated from a former developing country, is analyzed. SE has shown to effectively utilize co-innovation to maintain numerous planting and harvesting innovation projects. Both researchers and practitioners would be interested in learning about how SE shared risks of innovation investment with external partners at the early stage of innovation cycles.

Introduction

Globalization and advances in technologies have made the global market extremely dynamic and competitive. While companies like Apple have created new customer value by introducing such products as iMac computer and iPhone, many other firms have failed to adapt to the fast-changing environment. Kodak, the creator of the film camera, became history since it failed to adapt to the digital era in a timely fashion. To compete successfully in the dynamic global market, organizations must continuously innovate ways to create value [ 1 ]. Thus, innovation has been an important topic to both management researchers and practitioners [ 2 ]. Many studies have explored the relationship between innovative activities and organizational performance [ 3 , 4 ]. The firm’s ability of managing innovative projects has been considered as a key dynamic capability, resulting in new product development [ 5 ]. Innovative activities of the firm have generally shown to positively impact organizational outcome.

Although a number of studies in this research stream have introduced various types of innovation based on learning styles [ 6 , 7 ] or objects [ 3 ], few have paid attention to the timing of financial return from innovation. Given the importance of financial payoff from innovation for firm survival and sustained competitive advantage, research on how a real business should manage both innovation and cash flow is critical. Thus, in this study, we intend to answer the following two research questions.

RQ1: Which classification of innovation can best explain the heterogeneous timing of financial payoff realization?

To answer this question, we applied a classification scheme of planting and harvesting innovation [ 8 , 9 ]. Planting innovation involves pursuing potential sources of competitive advantage, including original technology, which may create value in a long term perspective. In contrast, harvesting innovation aims to develop new ways to monetize planted innovation, including new products for market launching, in the expectation of commercial success in a relatively short term. The aim of this research stream is to determine how to implement planting and harvesting innovation and measure the results of ensuing innovative activities. From this perspective, this study examines how a real global firm manages both types of innovation.

RQ2: How are planting and harvesting activities of innovation actually implemented in a successful global business firm?

To answer this question, we focus on Samsung Electronics (SE) which has become the world’s largest electronics firm through successful planting and harvesting of innovation. While SE has developed many innovative new commercial products, it has focused on fundamental breakthrough technologies as the source of future growth momentum. This case may provide valuable implications for firms from developing economies. To compete in high tech industries, these businesses need to invest a large amount of capital to risky innovation projects. Otherwise, they may remain low value added entities, like assemblers or fast followers. The case of SE, like many other success stories, exhibits a possibility that multinationals originated from developing countries can become leading global firms based on their efforts and vision for breakthrough innovations.

Given the current turbulent global business environment, as observed by trade disputes between the USA and China and the recently disrupted supply of critical input resources from Japan to Korea, it is imperative for firms to develop core competences based on innovation. In the digital age, businesses must rely on innovation to enhance their dynamic capabilities [ 10 ] to enhance agility, flexibility, and resilience for value creation [ 1 ]. Thus, this study which focuses on the effective management of planting and harvesting innovation is expected to make important contributions to the literature.

This study examines how firms can implement innovation projects for both short- and long-term perspectives. For this purpose, we first reviewed the literature for major research streams of innovation. Then, a case method is used to examine how planting and harvesting of innovation have helped SE became a dominant global electronics firm, around 2012. In addition to secondary data, executive interviews reported in media also describe how SE employees implemented planting and harvesting innovation. The results of qualitative analyses are presented and articulated. Finally, the implications and limitations of this research are presented. The framework of planting and harvesting innovation provides a theoretical background on how firms can strive for both short-term cash flow and a long-term momentum despite their limited resources. Furthermore, the study results provide insights to practitioners through the case study of SE which struggled initially to save the cost of innovation by collaborating with external partners for planting and harvesting innovation.

Innovation under resource constraints

Planting versus harvesting innovation.

Researchers in various fields, including economics, sociology, and technology management, have been interested in innovation [ 11 ]. The characteristics of innovative outcomes have been investigated as a major research agenda [ 12 , 13 ]. As Damanpour and colleagues [ 14 ] suggested, the introduction of novel ideas or technologies is the core of innovation. According to Van de Ven [ 15 ], innovation can be described as “the development and implementation of new ideas by people who over time engage in transactions with others within an institutional order ([ 15 ], p590).” Several definitions of innovation have focused on how to apply creativity to business operations and processes [ 15 , 16 ]. These studies imply that the main focus of innovation research has been on whether the firm creates new tangible or intangible values.

However, innovation has shown to lead to varied results. The meta-analysis by Rosenbusch et al. [ 17 ] reported that different contexts explain heterogeneous outcomes resulting from innovation. Even if firms implement similar innovation projects, the result can be different due to environmental factors. In addition, innovation sometimes improves the value of marketing skills rather than creating new technical capabilities [ 18 , 19 ]. What these results imply is that characteristics of innovative activities are complex. Since a single concept cannot explain the nature and outcome of innovation, researchers need to consider diverse classifications to explain the phenomena of innovation. Given the importance of cash flow in business, a greater focus is required on the influence of innovation on the survival and prosperity of the firm. Even when firms obtain breakthrough technologies, they may not survive when they fail to create new products/services and resulting cash flow as discussed by Jang [ 8 ] and Jang and Grandzol [ 9 ]. Furthermore, the large amount of investment needed for innovative activities requires firms to prioritize and manage their projects based on the commercial potential. Thus, there is a need to search for a new framework that can provide better explanations on innovation with respect to this issue. The most existing classifications of innovation are not based on the timing of financial outcomes of innovative activities.

One of the typologies regarding this topic is the categorization of radical and incremental innovation based on the sharpness of change in innovative practices [ 20 ]. A more drastic transformation can be expected from radical innovation projects while a relatively slight newness can be added to existing technologies during the incremental innovation process. Since radical innovation can pursue both drastic breakthrough and immediate commercialization, there exists the disparity between the distinction of radical and incremental innovation, the main focus of this paper. Space shuttle can be considered as an example of radical innovation as the realization of reusable spacecraft but it is generally considered as a product for immediate use rather than a long-term growth momentum. Such discrepancy leads researchers to develop a new categorization of innovation based on the expected timing of financial outcome.

The Code-Division Multiple Access (CDMA) wireless technology is an interesting case for this point. The CDMA technology was developed by Qualcomm ( www.qualcomm.com ), but the commercial CDMA phones were first created and produced by Korean manufacturers, including SE and LG. While Qualcomm was interested in developing CDMA as planting innovation, SE and LG focused on commercializing the technology for harvesting that innovation. Qualcomm could benefit from licensing fees in the long term with the success of commercial products based on CDMA. In contrast, the short-term cash flow was derived by SE and LG as they sold more CDMA phones to individual consumers.

From this perspective, innovation can be categorized based on its relatedness to the firm’s performance in the short or long term [ 8 , 9 ]. While certain types of innovative activities may result in an increase of the firm resources engaged in the current competition, others can create value that has long-term potential. This approach modifies the definition of innovations by Gumusluoglu and Ilsev [ 21 ] as described in Jang [ 8 ] and Jang and Grandzol [ 9 ]. First, harvesting innovation can be described as the development of a new resource that can help launch new products/services in the short term. New products, such as Toyota Prius, would be a good example of this type of innovation. Planting innovation refers to the creation of potential firm resources that are based on the state-of-the-art innovation in the expectation of long-term financial benefits. For instance, the invention of hybrid engine technology “plants” potential for future value while the creation of a hybrid car like Prius “harvests” the results of the planting of that innovation.

There are several reasons why planting innovation may not result in new commercial products/services in the short term. First, there may be social constraints that would not allow the use of innovative technology, resulting in no market for new products/services. The commercial use of human stem cell research in the USA has been prohibited by the Food and Drug Administration [ 22 ]. Firms initiating planting innovation in this area cannot expect commercial success due to this regulation, except perhaps in other countries. Second, firms may need to wait for the advent of other complementing technologies for the commercialization process. Thus, firms face a high degree of uncertainty about the financial outcome of planting innovation in the long term, especially in the biotech industry. The development of a new technology usually has a high probability of failure. Therefore, planting innovation may not lead to financial gains in the short term even if firms succeed in developing a technology.

The characteristic of planting innovation makes it distinct from invention. Innovation requires entrepreneurial utilization of technological newness by definition, while invention includes scientific and/or technological breakthrough for discovery purposes [ 23 ]. Firms invest in planting innovation projects in the expectation of long-term profits. Although the result of planting innovation may directly create cash flows in the form of patent fee, firms usually wait until finding out how to apply the result of planting innovation. In contrast, harvesting innovation pursues short-term profits by launching new products or services. In the 1970s, the Palo Alto Research Center (PARC) at Xerox initiated the development of innovative technologies such as Ethernet (or LAN technology) and copper wire-based Ethernet communication [ 24 ]. Due to the lack of commercial intention of Xerox both short and long term, these developments can be classified as examples of invention rather than planting innovation.

Given the heterogeneous characteristics of planting and harvesting innovation, ambidexterity can be important in balancing such innovative activities. Studies on exploitative and explorative innovations have examined this issue [ 6 , 7 , 25 ]. Since pioneering efforts for new processes or technology involve much risk, firms need to optimize the return of their investment in both types of innovation. One possible approach is to utilize external capabilities through M&A, alliances, or industry-academia collaborations through open innovation. Such arrangements would allow firms to share the risk of innovation with other participants [ 1 ].

In addition, convergence has played a major role in explaining value added activities in modern firms [ 1 , 26 ]. Globalization has encouraged the convergence revolution which allows value creation from the synergy of diverse disciplines, industries including IT, biotechnology, and nanotechnology [ 26 ]. The co-innovation platform helps converge diverse types of innovations for value creation [ 1 ]. Multinationals participating in co-innovation are expected to collaborate with stakeholders, including suppliers, customers, partners, and outsiders. Therefore, outside stakeholders can be active partners who co-create shared goals.

Overall, the classification of innovation can contribute to research by providing clearer guidelines related to the timing of financial outcome of innovation. While planting innovation can result in potential resources for long-term value creation, harvesting innovation is intended to generate continuous cash flows to those engaged in the current market. Following the case of exploitative and explorative innovation, researchers in this field should also consider ambidexterity of the organization. By doing so, firms under resource constraints can be prepared for an optimal portfolio of innovation projects, resulting in better organizational performance in the long term.

- Case analysis

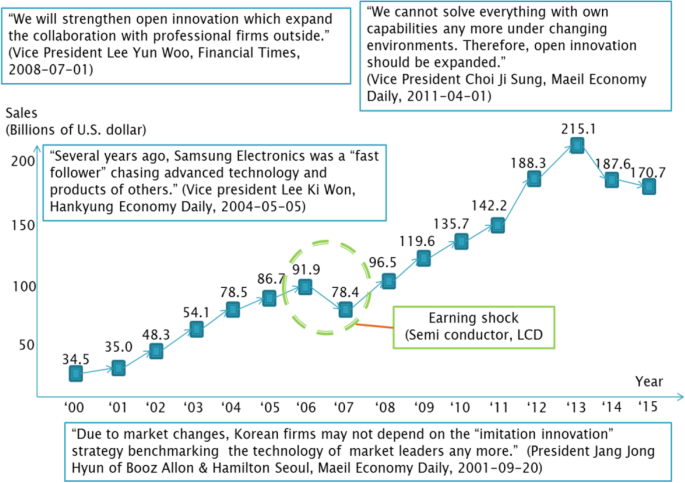

In this study, the case of Samsung Electronics (SE), now the largest electronic firm in the world from a former emerging economy, is examined to unveil the processes of harvesting and planting innovation and their results. Innovative activities have been the core strength of SE and are expected to continue creating value for SE. The Mission 2020 of Samsung ( http://www.samsung.com ) states that it will “inspire the world, create the world” through creative and innovative solutions. This implies that the firm intends to pursue innovation over time beyond the development of commercial products for short-term returns.

Several qualitative techniques are employed to investigate the SE case. First, we collected articles including executive interviews from 2000 to 2012. The articles were manually coded into planting and harvesting innovation frameworks after a careful review of contents. News reports were analyzed via local portal sites, including Lexis-Nexis ( http://www.lexisnexis.com ) and Naver ( www.naver.com ). Particularly, we searched Naver, the major Korean portal website, to collect news articles concerning SE research topics from 2002 to 2012. We chose this period, 2002 and 2012, to collect data for this study as this is when SE made the significant transformation to become a dominant global IT leader. The search keywords used were “Samsung Electronics” and “Innovation.” The search using the keywords assured the study to verify that all related articles are captured. After removing duplicates, we investigated the contents of 183 related news articles. Based on the analysis, all the key interviews of executives and managers at SE were collected and examined. In addition, the other secondary data sources like the websites of companies, universities, and local governments were examined.

Samsung Electronics

SE has been a major global player in electronics and related industries for over three decades. Hoovers ( www.hoovers.com ), a leading corporate information provider on large businesses, describes the overall state of this firm as the new “Electronics Samson.” In year 2015, it reported $171 billion revenue and $16 billion net profit. Its major products include digital electronics, semiconductors, and DVD players. Financial Times ranked Samsung Electronics as 19th in their 2015 FT Global 500 ( www.ft.com/ft500 ). It is beyond doubt that this firm has been successful in creating value for its customers.

The webpage of Samsung Electronics ( www.samsung.com ) and Samsung C&T ( www.samsungcnt.co.kr ) describes the history of Samsung Group and Electronics as follows. Samsung group was founded in 1938 as a small retail firm in Daegu, Korea. The founding chairman, Lee Byung-Chull, established Samsung-Sanyo Electronics to diversify the business in 1969. As the name implies, the firm collaborated with Japan’s electronics giant Sanyo. It began production of black-and-white TV sets for the first time in 1970, as an outsource manufacturer. After changing its name to Samsung Electronics, the firm began to produce color TV sets, video recorders, microwaves, and personal computers. It has rapidly developed as a global firm since it entered the semiconductor industry in the early 1980s. Since South Korea has recently been accepted as a developed economy [ 27 ], it can be said that SE began as an emerging market firm.

Given the fact that SE was founded only about five decades ago, the current performance and growth are astonishing. Despite the current status, the firm used to be considered as a fast follower [ 28 ]. SE had focused on producing existing products with better quality at lower prices than other global firms. It is an interesting research topic to examine how and why SE has evolved into a global giant in the electronics industry.

To provide an explanation on this issue, we investigated how SE has implemented innovation to achieve strategic objectives. In 2001, President of Booz Allen and Hamilton Korea stated that Korean firms need to pursue breakthrough innovations to adapt to new market environments [ 29 ]. In other words, SE as well as other major Korean manufacturers began to pursue innovation rather than continue to follow market leaders to survive in the dynamic global marketplace.

Harvesting innovation at Samsung Electronics

SE has engaged in various innovation activities to gain global competitive advantage. By doing so, the firm has been able to create value and benefit from new markets with expectations of stable cash inflows. For instance, SE developed new products like Rambus DRAM and Nand flash memory rather than increasing the accumulation rate of semiconductors [ 28 ]. Since these new products reflect the needs of customers, including PC or smartphone manufacturers, the innovation brought a large amount of profit in the short term. Given the astonishing results that SE has accomplished, its process of harvesting innovation has drawn much attention.

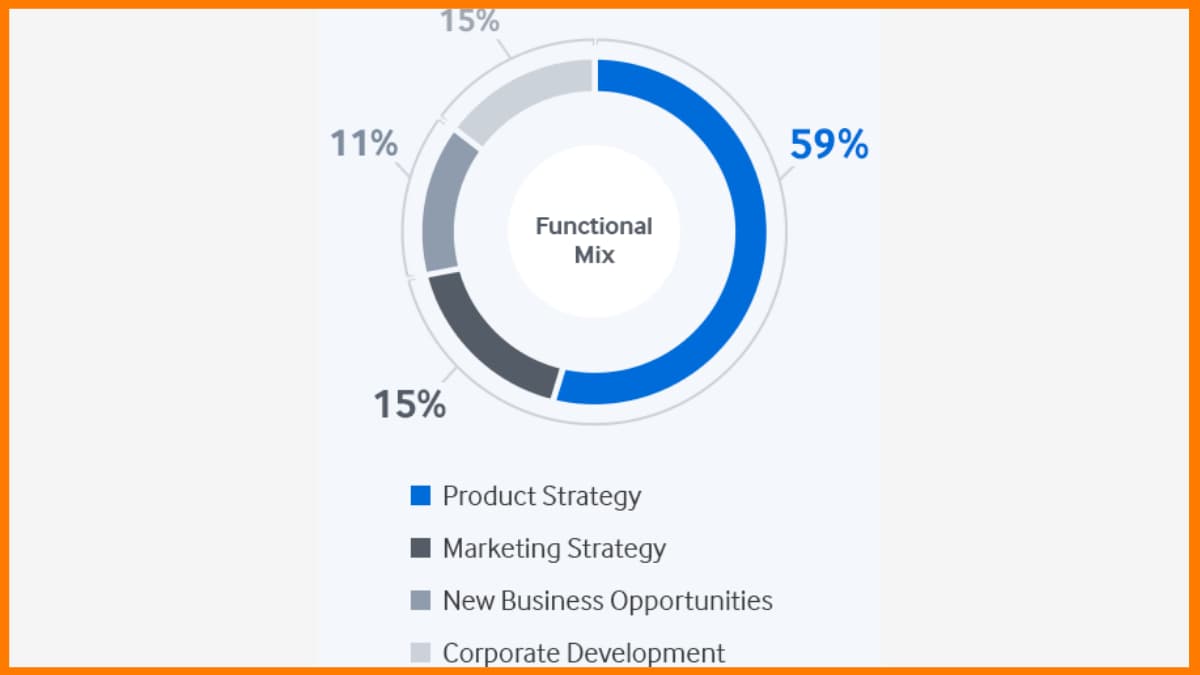

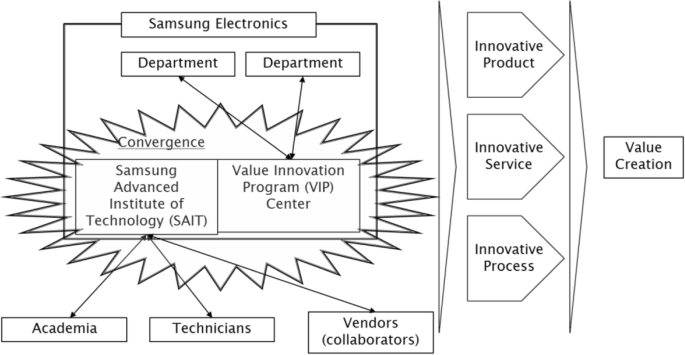

SE has continued implementing innovative activities steadily. The Value Innovation Program (VIP) Centre, setup in 1998, has played a key role in developing innovative new products at SE [ 28 , 30 , 31 ]. This Centre has shown to nurture creativity and broaden the ideas of R&D staff. As the chief researcher at SE stated, the introduction of value innovation methods has contributed to the creation of many new ideas [ 28 ]. Through this system, all participants were expected to overcome the trap of past success syndrome, leading to what is possible.

Blue Ocean Strategy (BOS) [ 32 ] has been the backbone of the harvesting innovation process at SE [ 30 ]. SE invited W. Kim, the main author of BOS, to train its executives. Senior executives have encouraged the dissemination of value innovation at SE based on the BOS approach [ 33 ]. SE strives to create value which its customers never even expected through value innovation for new products. SE’s value innovation includes value management and value creation [ 33 ]. While the former focuses on cost reduction and efficiency improvement, the latter aims to generate added value. Therefore, the firm searches for creative ideas rather than implementing traditional continuous improvement type programs.

SE has found practical tools to implement harvesting innovation based on BOS [ 31 ]. First, the VIP Centre has utilized the strategy canvas, a framework of implementing BOS [ 32 , 34 ]. In the Centre, managerial decisions on important projects have been made based on the value curve of each unit against competitors, resulting in new products like 40-inch LCD TV. In addition, the “7 Tools Method” practiced in Japan, which enables firms to empirically recognize value factors of their customers, was introduced [ 35 ]. For instance, a survey of 226 Japanese employees triggered the production of a laptop that works well even in a bad wireless environment. These types of techniques have helped SE create new products successfully by reflecting innate needs and requirements of individual and business customers.

It has been reported that all of the creative ideas from the VIP Centre have been reflected in the design and development of new products of SE [ 36 ]. As a result, innovativeness of the firm’s new products has been globally recognized as the numerous Innovation Awards of the Consumer Electronics Association (CEA) attest (see Table 1 ). These achievements prove that the innovative results of SE have been widely recognized by professionals in the field as well as ordinary customers. SE has succeeded in developing new products through harvesting innovation activities.

Planting innovation at Samsung Electronics

SE has also focused on the creation of innovative ideas which may not realize any meaningful revenue in the short term. The major results of planting innovation are original technologies which can result in competitive advantage and lead to future business success. The CEO of SE stressed the importance of “technology preparation management,” pursuing core technologies in order to respond to the convergence across technologies and products [ 37 ]. This statement exhibits the strong will of top management of SE to implement the planting innovation strategy.