- Log in

- Site search

Postgraduate loans in Northern Ireland

In 2023/24, postgraduate loans of up to £6,500 are available towards tuition fees for Northern Ireland-resident students undertaking Masters study in the UK

NORTHERN IRISH POSTGRADUATE LOANS AT A GLANCE

- Borrow up to £6,500 in 2023/24.

- For Masters, PGDip or PGCert courses.

- Paid directly to your university to cover tuition fees.

- For UK or Irish nationals resident in Northern Ireland.

- Study at any UK university.

How much can I borrow?

Northern Irish postgraduate loans are available from Student Finance NI to help you cover the cost of tuition fees. The maximum amount available in 2023/24 is £6,500 . This support isn't means-tested, so the amount you receive is not based on your financial background.

However, if tuition fees for your course are lower than £6,500, you won't be able to borrow the full amount - only enough to cover your fees. If your fees are higher than the maximum, you'll need to find other sources of postgraduate funding to pay the difference.

For more information, see Student Finance NI - Postgraduate NI students .

Am I eligible for a Northern Irish postgraduate loan?

- be a UK or Irish national or have settled status

- normally live in Northern Ireland

- have lived in the UK, Channel Islands or the Isle of Man for the three years prior to the first day of the first academic year of your course.

There's no upper or lower age limit for Northern Irish postgraduate loans.

You can apply even if you already hold a postgraduate qualification, but not if you've previously received a postgraduate loan from Student Finance NI.

If you're a European Union (EU) national, you're eligible if you:

- live in Northern Ireland on the first day of your course

- have lived in the UK, Gibraltar, the European Economic Area (EEA) or Switzerland for the last three years

- have settled status under the EU Settlement Scheme (EUSS)

- study your postgraduate course at a Northern Irish university.

You may also be able to get a loan if you're a refugee (or a relative of one), have been granted discretionary leave to remain in the UK, are an EEA or Swiss migrant worker, a child of a Swiss national or the child of a Turkish worker.

Is my course eligible?

Taught and research Masters courses , postgraduate diplomas (PGDip) and certificates (PGCert) studied at a UK university are eligible for loans. You can study full time, part time or via distance learning.

You can't get a Northern Irish postgraduate loan for courses lasting for more than three years. Loans are also not available for postgraduate Doctoral degrees, Masters degrees that are part of a Doctoral degree and postgraduate courses eligible for undergraduate support.

How do I apply?

Apply for a Northern Irish postgraduate loan by logging in or creating an account at Student Finance NI - Login . As well as completing the online form, you'll have to send them any evidence requested (such as proof of identity) and sign a declaration.

A paper application form is available for anyone who can't apply online.

You'll need your university and course details and your National Insurance number. You can make your application before your place at university is confirmed - if you change your course, you can update the details later.

It's possible to apply once you've started your course, up to nine months after the first day of the academic year. If your course lasts for more than one year, you have to submit an application for each year separately.

How will I receive my loan?

The loan will be paid directly to your university on your behalf once your attendance is confirmed and you'll receive it in three instalments spread evenly throughout the academic year.

If you borrow the full £6,500, the university will receive:

- all the money in one year if it's a one-year course

- £3,250 each academic year if it's a two-year course.

When do I start repaying my loan?

You'll start repaying your loan in the April after you've finished or left your course, as long as your income is at least £22,015 per year (for academic year 2023/24), £1,834 per month or £423 per week (before tax and other deductions). Bear in mind that this income threshold changes each year. Your repayments will be 9% of your income above the threshold.

Northern Irish postgraduate loans are combined with undergraduate student loans for repayment purposes, so you'll make a single monthly or weekly payment of 9% of your income above the threshold, not two separate payments.

If you leave your course early and your loan has already been paid to your university, you'll have to repay the amount that has been overpaid regardless of your income.

Interest will be charged on your postgraduate loan from the day the first instalment is paid to the university.

Find out more

- Search for postgraduate courses in NI .

- Learn about Masters degrees .

- Read the full guide at Student Finance NI - Postgraduate Tuition Fee Loan .

How would you rate this page?

On a scale where 1 is dislike and 5 is like

- Dislike 1 unhappy-very

- Like 5 happy-very

Thank you for rating the page

Health professional courses

If you are planning a degree course in Allied Health Professional nursing, midwifery or dental hygiene and therapy, you will have different funding arrangements from other higher education students.

Studying a Health Professional course

If you've lived in Northern Ireland for the last three years, you can apply for an income-assessed bursary to help with living costs. You may also be eligible to apply for a reduced rate non-income assessed loan. The Department of Health in Northern Ireland (DoH) will pay your tuition fees directly to the university.

Students from EU countries who are ordinarily resident and studying in Northern Ireland may also qualify for financial support.

The amount of bursary you may receive will depend on your own and your family's income. You may also get extra allowances, for example, if you're disabled or have dependants. Your local Student Finance NI office will be able to advise you.

How to apply

If you're a Northern Ireland student you should apply to your Student Finance NI office. They will assess your bursary entitlement using the information provided on the application form for student finance, that is PN1 or PR1 form.

- Completing your student finance application

Nursing and midwifery courses

If you're from Northern Ireland, you can apply for a non-income-assessed bursary to help with living costs.

You'll not be eligible to apply for a maintenance loan.

DoH will pay your tuition fees directly to the university.

Students from EU countries who are studying in Northern Ireland may also qualify for financial help.

The amount of bursary you may receive will depend on your own and your family's income. You may also get extra allowances, for example, if you’re disabled or have dependants. The bursaries unit in the regional Business Services Organisation (BSO) will be able to advise you.

All applications should be submitted to the BSO. Contact your university for the relevant details.

If you plan to enter a degree in nursing or midwifery in England, Wales or Scotland, you should apply for tuition fee loan, maintenance loan and grant to your Student Finance NI office using a PN1 or PR1 form.

Medical and dental courses

If you're a pre-registration student of medicine or dentistry from Northern Ireland, DoH will give you a bursary in your fifth and later years of study, regardless of where you study in the UK.

Support for your first four years of study will be on the same basis as for other higher education students, so if you started in 2020-2021 a DoH bursary will become payable from 2024-2025.

During the period for which the bursary is payable, the DoH will pay your tuition fee contribution in full. No contribution will be required from you or your family towards your fees.

The bursary is administered and paid by your local Student Finance NI office on behalf of the DoH and how much you get depends on your income. You will also be able to get a reduced rate, non-income assessed loan for the balance of your maintenance support. Student Finance will also pay your tuition fees to your university on behalf of DoH.

Graduate-entry medical courses

If you're doing a four year graduate-entry medical course (fast-track course) in England, Wales or Scotland you're not eligible for a Health Service bursary or tuition fee support or a Higher Education bursary.

You may however apply to your local Student Finance NI office for support for living costs through student loans and certain extra grants for your entire course.

If you're from England, Scotland or Wales and are studying in Northern Ireland, you should apply for financial support, including tuition fee loans and maintenance loans, from your own jurisdiction.

More useful links

- Get facts and figures on universities, colleges and courses

Translation help

Help improve this page - send your feedback.

You will not receive a reply. We will consider your feedback to help improve the site. Don't include any personal or financial information, for example National Insurance, credit card numbers, or phone numbers.

What to do next

Comments or queries about angling can be emailed to [email protected]

If you have a comment or query about benefits, you will need to contact the government department or agency which handles that benefit. Contacts for common benefits are listed below.

Carer's Allowance

Call 0800 587 0912 Email [email protected]

Discretionary support / Short-term benefit advance

Call 0800 587 2750 Email [email protected]

Disability Living Allowance

Call 0800 587 0912 Email [email protected]

Employment and Support Allowance

Call 0800 587 1377

Jobseeker’s Allowance

Contact your local Jobs & Benefits office

Personal Independence Payment

Call 0800 587 0932

If your query is about another benefit, select ‘Other’ from the drop-down menu above.

Comments or queries about the Blue Badge scheme can be emailed to [email protected] or you can also call 0300 200 7818.

For queries or advice about careers, contact the Careers Service .

For queries or advice about Child Maintenance, contact the Child Maintenance Service .

For queries or advice about claiming compensation due to a road problem, contact DFI Roads claim unit .

If you can’t find the information you’re looking for in the Coronavirus (COVID-19) section , then for queries about:

- Restrictions or regulations — contact the Department of Health

- Travel advice (including self-isolation) — contact the Department of Health

- Coronavirus (COVID-19) vaccinations — contact the Department of Health or Public Health Agency

If your query is about another topic, select ‘Other’ from the drop-down menu above.

For queries about your identity check, email [email protected] and for queries about your certificate, email [email protected] .

For queries or advice about criminal record checks, email [email protected]

Application and payment queries can be emailed to [email protected]

For queries or advice about employment rights, contact the Labour Relations Agency .

For queries or advice about birth, death, marriage and civil partnership certificates and research, contact the General Register Office Northern Ireland (GRONI) by email [email protected]

For queries about the High Street Spend Local Scheme, email [email protected] .

For queries about:

- Car tax, vehicle registration and SORN contact the Driver and Vehicle Licensing Agency (DVLA), Swansea

- Driver licensing and tests, MOT and vehicle testing contact the Driver & Vehicle Agency (DVA), Northern Ireland

For queries about your identity check, email [email protected] .

For queries or advice about passports, contact HM Passport Office .

For queries or advice about Penalty Charge Notices (PCNs), including parking tickets and bus lane PCNs, email [email protected]

For queries or advice about pensions, contact the Northern Ireland Pension Centre .

If you wish to report a problem with a road or street you can do so online in this section .

If you wish to check on a problem or fault you have already reported, contact DfI Roads .

For queries or advice about historical, social or cultural records relating to Northern Ireland, use the Public Record Office of Northern Ireland (PRONI) enquiry service .

For queries or advice about rates, email [email protected]

For queries or advice about 60+ and Senior Citizen SmartPasses (which can be used to get concessionary travel on public transport), contact Smartpass - Translink .

If you have a question about a government service or policy, you should contact the relevant government organisation directly . We don't have access to information about you.

Skip to content

Student finance: Postgraduate Studentships terms and conditions

Date published: 17 November 2021

Last updated: 02 January 2024

- Higher education

- Higher education finance and student support

This booklet sets out the terms and conditions of the Department for the Economy (DfE) postgraduate studentships held at Queen’s University Belfast and Ulster University.

Help viewing documents

Cookies on GOV.UK

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

You have accepted additional cookies. You can change your cookie settings at any time.

You have rejected additional cookies. You can change your cookie settings at any time.

Student finance login

Use your student finance account to:

- view statements and letters from Student Finance England ( SFE )

- track an existing application

- check when your payments are due

- update some of your personal or application details

- reset your password or find your customer reference number

- apply for finance as a new or continuing student

You can also use this service if you’re supporting a student finance application and SFE has asked for details of your household income.

Sign in on the Student Finance England website

Before you start

You’ll be given a customer reference number ( CRN ) and asked to create a password and secret answer when you first set up your account.

You’ll get a letter telling you how to sign in to your account, if you do not apply online.

You need your CRN or email and your password each time you sign in.

Recover your sign in details online .

Other ways to apply

If you cannot apply online, use the form finder to get the forms you need.

You can call Student Finance England if you want to apply online but you cannot use a computer without help.

Part of Get undergraduate student finance: step by step

Step 1 : check if you're eligible.

- Check if you're eligible for student finance

There’s a different process if you’re a student from:

- Northern Ireland

- Isle of Man

Step 2 : Find out how much loan you could get

Find out the maximum tuition fee and maintenance loan you could get if you're a:

- new full-time student

- continuing full-time student

- part-time student

- student who started before 1 August 2016

How much maintenance loan you get depends on where you'll study and your household income.

- Use the student finance calculator to estimate your maintenance loan

You'll have to pay back any loan you get.

- Find out how much you'll repay

- Find out when you'll start repaying

and Check if you can get extra help

You might be able to get extra money if you:

- are under 25, have no contact with your parents and support yourself

- pay for childcare

- are a full-time student with children

- have an adult who depends on you financially

- have a disability, mental or physical health problem or learning difficulty like dyslexia

You might also be able to get other financial help, for example from your university or the government.

- Find out about extra help

Step 3 : Prepare your application

- Check when you can apply

- Check what ID you'll need

- Check if you need to give proof of your household income

Step 4 : Apply online

- Apply online

If you're eligible for Tuition Fee Loans, Maintenance Loans, or Maintenance Grants, you can apply online.

You'll need to create a student finance account if you're a new student or sign into an existing account if you're a returning student.

It can take up to 6 weeks to process your application. You might have to provide extra evidence.

or Apply by post

- Apply by post

If you’re eligible for tuition fee-only funding, you must complete a form and send it by post instead. You cannot apply online.

You can also apply by post if you're unable to apply online.

Step 5 : Update your details if your circumstances change

You must update your application if your circumstances change. For example if you:

- change your course through clearing

- change where you're going to live - for example with your parents instead of halls

- Find out how to update your application

Step 6 : Make sure you can be paid

After you register at your university or college you'll usually get your maintenance loan paid directly into your bank account at the start of each term.

- update your bank details - for example if you open a student account

- check how much you'll be paid

- check when you'll be paid

- You are currently viewing: Sign in to your student finance account

Step 7 : Check what to do while you're studying

You'll need to reapply for student finance for each year of your course.

You must keep your details up to date throughout your course because some changes can affect your loan payments, for example if your household income or bank details change.

- Check how to update your details

- Find out what to do if you suspend or leave your course

Step 8 : Check what to do when you stop studying

When you stop studying the Student Loans Company (SLC) will create a student loans repayment account for you.

Make sure your contact details are up to date in your repayment account. The log in details will be the same as for your student finance account.

- Sign in to your student loan repayment account

- Update your employment details

Step 9 : Repay your loan

Is this page useful.

- Yes this page is useful

- No this page is not useful

Help us improve GOV.UK

Don’t include personal or financial information like your National Insurance number or credit card details.

To help us improve GOV.UK, we’d like to know more about your visit today. We’ll send you a link to a feedback form. It will take only 2 minutes to fill in. Don’t worry we won’t send you spam or share your email address with anyone.

A Gen Xer who got $250,000 in student loans forgiven said he can now finally start saving for retirement — and consider his dream of studying in India

- Joel Lambdin, 49, received $250,000 in student-loan forgiveness in January.

- It's a result of the Education Department's one-time account adjustments.

- Lambdin said the relief would allow him to save for retirement and consider long-term dreams.

Joel Lambdin finished graduate school in 1998 — but as a professional musician, he was hardly making enough money to pay off his student loans and other bills.

So Lambdin, now 49, said his only option to make ends meet was to put his student loans in forbearance — in which he was not making payments but interest was still accumulating .

"It was just so that I could subsist, so that I could survive," Lambdin told Business Insider. "With the hope that at some point, I would be making enough money that I would be able to take them out of forbearance and start paying them down."

But he grew to realize that the only way he could make a significant dent in his student loans was by switching careers. He didn't want to do that because he loved working in music, so he decided to keep his larger student loan in forbearance and begin paying off his smaller loan with a lower monthly payment.

He continued making those payments until the pandemic pause on student-loan payments , at which point he and his wife started making a plan of action to tackle the larger debt once the pause ended. That led them to discover the Education Department's initiative allowing some borrowers a one-time account adjustment . It lets the department evaluate borrowers' accounts and update payment progress toward forgiveness on income-driven repayment plans and Public Service Loan Forgiveness, including any payments made during a forbearance period.

That account adjustment led to a letter Lambdin received on January 31, reviewed by BI, from his student-loan servicer Aidvantage. It said: "Congratulations! The Biden-Harris Administration has forgiven your federal student loan(s) listed below with Aidvantage in full."

For Lambdin, that letter meant his $249,255 outstanding student-loan balance was effectively wiped out.

"It had started to feel like my fate was being decided for me by the cold hand of finance," Lambdin said, "and that was a weight that I didn't realize was there until it wasn't there."

He added: "The feeling was much more like putting down a backpack that was really full of books that you got used to. And then you put it down, and you're like, 'Oh, man, that feels so much better.' It's more like that, rather than sort of a jump-for-joy kind of situation."

While Lambdin is still working to determine what exactly the relief will mean for him and his wife, he said, discussing retirement is "a much more present conversation now" because contributing to savings is viable after the relief. He can also begin to look into buying a home.

Related stories

The Education Department continues to cancel student debt through its one-time account adjustments, a process it plans to complete this summer. Most recently, the department wiped out $7.4 billion in student debt for 277,000 borrowers , some of whom benefited from the adjustments.

Beyond financial goals, Lambdin said the relief was also allowing him the freedom to pursue some of his long-term dreams, including taking a sabbatical to study with his meditation teacher in India.

"It's something that I wouldn't have been able to even consider doing if we had to pay off student loans, but without them, it's something that I can really seriously consider doing," he said. "And so those are the kinds of things that I think get really lost in the monetary side of the conversation about debt relief."

'I've been really lucky'

While Lambdin said he felt as though he earned the relief given his decades of payments, he recognized that it's not that easy for many other borrowers.

For example, as BI has previously reported , some borrowers who might qualify for relief through different repayment programs may not have gotten it yet because of paperwork backlogs and administrative errors. On top of that, funding for federal student-loan servicers is strained — meaning many borrowers face hourslong hold times and cannot get clear answers from customer service regarding their payment progress.

"There are some real horror stories out there, and I've been really lucky in that I haven't experienced the kinds of shenanigans that other people have experienced," Lambdin said. "So I actually feel very lucky that things have transpired the way they have."

Some of those horror stories include inaccurate payment projections and delayed billing statements . When it comes to student-loan forgiveness, some borrowers told BI that their servicer made a mistake with the forgiveness , reinstating their payments months later.

The Education Department has said it's aware of the challenges borrowers face and has established an accountability framework to punish servicers when they fail to fulfill their contractual obligations.

The department is also in the process of crafting its new plan for student-loan forgiveness — it recently released the draft text of the rules , which included relief for borrowers with unpaid interest and those who have been in repayment for at least 20 years.

As for Lambdin, he's still figuring out how to approach life without student debt hanging over his head. But now he can consider various options, and he can thank the loan forgiveness for that freedom.

"There's a certain amount of waiting for the other shoe to drop because it's not that I don't trust that it's happening but just that the debt has been with me for so long, and then it's not there," Lambdin said. "And it's something that I think really takes some getting used to."

Watch: Biden announces who can have $10,000 erased in student loans

- Main content

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My watchlist

- Stock market

- Biden economy

- Personal finance

- Stocks: most active

- Stocks: gainers

- Stocks: losers

- Trending tickers

- World indices

- US Treasury bonds

- Top mutual funds

- Highest open interest

- Highest implied volatility

- Currency converter

- Basic materials

- Communication services

- Consumer cyclical

- Consumer defensive

- Financial services

- Industrials

- Real estate

- Mutual funds

- Credit cards

- Credit card rates

- Balance transfer credit cards

- Business credit cards

- Cash back credit cards

- Rewards credit cards

- Travel credit cards

- Checking accounts

- Online checking accounts

- High-yield savings accounts

- Money market accounts

- Personal loans

- Student loans

- Car insurance

- Home buying

- Options pit

- Investment ideas

- Research reports

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

LAPD makes arrests at USC amid Israel-Hamas war protests

The Los Angeles Police Department arrived at USC on Wednesday evening, arresting people protesting the Israel-Hamas war on campus.

An encampment in Alumni Park — where the university's main-stage commencement is scheduled to take place next month — went up before sunrise and grew into the late morning as students, wearing kaffiyehs and holding "free Palestine" and "liberated zone" signs, banged drums and chanted.

Dozens of police officers formed a line around the park and arrested protesters at the camp. As of 7 p.m., more than 30 had been taken into custody. Earlier, there had been a few clashes between police and demonstrators.

"Disclose! Divest! We will not stop, we will not rest!" said the crowd, which billed itself in a statement as the "USC Divest from Death Coalition."

"Carol, Carol, you can't hide! You're supporting genocide!" went another chant, a reference to USC President Carol Folt.

Protesters included members of pro-Palestinian groups such as Trojans for Palestine, Students for Justice in Palestine and Jewish Voice for Peace.

The protesters at the USC encampment joined a growing number of student-led demonstrations at college campuses since last week, when more than 100 arrests at a camp-in at Columbia University spurred solidarity protests at universities from Massachusetts to California.

Read more: 'We will not move.' Pro-Palestinian encampments, protests grow at California universities

An encampment at UC Berkeley is in its third day, while the campus of Cal Poly Humboldt in Arcata is shut down through Wednesday, after students occupied an administration building Monday night. Police have also arrested activists at Yale University, New York University and the University of Minnesota.

Tensions have grown at colleges since the Oct. 7 attack on Israel by Hamas militants, who killed about 1,200 people and took roughly 240 hostages. Gaza health authorities say Israel's retaliatory war has killed more than 34,000 Palestinians. The health authorities don't distinguish between combatants and noncombatants but say at least two-thirds of the dead are children and women. According to the United Nations, 2 million Gazans are living in near-famine conditions.

On Wednesday, the tents at USC repeatedly went up and down, as officers with the campus Department of Public Safety told students to remove them and, at one point, dragged away lawn chairs. Students picked up their tents and walked with them in circles to avoid being in violation of a university "no camping" policy. At least two L.A. Police Department helicopters circled above Alumni Park.

At least two LAPD SWAT officers were present at the scene. Around noon, several campus officers surrounded and grabbed a protester during a confrontation. As students yelled for officers to let go of the person, the officers pulled out their batons but did not hit anybody. It is unclear what led to the clash.

Officers detained the person in a white vehicle as protesters followed and demanded the person's release. The protesters gathered around both sides of the vehicle, chanting, "Let him go!" and "Shame on you!"

After roughly 30 minutes, the officers released the protester as the crowd moved back to Alumni Park, where they stood with white signs that read "Let Gaza live."

Off-campus groups circulated video of the protests and called on the public to show up at USC. "Los Angeles get here now!! We need bodies!!!" said social media posts by the People's City Council.

Shortly after 1 p.m., the university sent out a text message alert saying it closed the campus gates.

"Anyone coming to campus should be prepared to show an ID at the gates for class or for business. Please continue to avoid the center of campus unless you have a class," it said.

By 2 p.m., Provost Andrew Guzman sent a campus-wide email saying protesters "threatened the safety of our officers and campus community."

"The university values freedom of expression and protects the right of every member of our community to express themselves. We have well-established policies regarding limits on the time, place, and manner of free expression. These include a prohibition on erecting tents or other encampments, use of loudspeakers, signs on poles or stakes, and the disruption of classes and other essential functions of the university," the letter said.

Guzman said protesters were "repeatedly asked by security personnel to remove their tents and other prohibited items as well as relocate to a compliant location. In each case, protesters refused. Their actions have escalated to the point of confrontation and have threatened the safety of our officers and campus community."

The protest at USC comes after more than a week of campus tensions that began when Folt canceled a speaking engagement by valedictorian Asna Tabassum that was supposed to take place at the May 10 main-stage commencement, which is expected to draw 65,000 people.

The decision came after on- and off-campus pro-Israel groups criticized Tabassum for posting a pro-Palestinian link on her Instagram bio that they said was antisemitic. USC said the cancellation was not tied to Tabassum's political views and was instead in response to unspecified threats to campus safety targeted at her speech. The university has also canceled a main-stage commencement address by director Jon M. Chu and appearances by honorary degree recipients, including tennis star Billie Jean King.

"Everyone, from our valedictorian Asna Tabassum all the way to any student who speaks up against genocide, should have the full support of the university, contrary to what we are seeing, which was incredible repression," said Ahmad, a Palestinian American protester with the Palestinian Youth Movement who would not share his last name. "The university has to this date not said a word about our families, the genocide we are experiencing in Gaza."

Several professors also joined the protest on Wednesday, holding a sign that said, "USC faculty against the genocide in Palestine." One of them was Amelia Jones, a professor at the Roski School of Art and Design.

"This is about what's happening in Gaza, but it's also about what's happening here," said Jones. "They pulled a student from commencement for nothing she actually said or did. Yet a university is supposed be a place of free speech. We haven't heard a word from our president about anything. We feel unheard and disconnected."

In a statement, the USC administration said it believed the demonstrators — most of whom appeared undergraduate age — were not from USC.

"The university has a policy that prohibits camping on campus, which is in the Student Handbook. About 10-15 people came to campus at 4:30 a.m. today with tents. DPS officers advised them of the policy, and the people took the tents down," the statement said.

"The people remain in Alumni Park — most appeared to be unaffiliated with the university," the statement continued. "Our students, faculty and staff are allowed to express their views and have been doing so throughout the school year."

Sign up for Essential California for news, features and recommendations from the L.A. Times and beyond in your inbox six days a week.

This story originally appeared in Los Angeles Times .

Recommended Stories

Pro-palestinian demonstrations have spread across college campuses. what exactly do protesters want.

Pro-Palestinian demonstrations continue to grow at a number of major U.S. universities. They have all made it clear that they are all against Israel's war with Hamas in Gaza, but what can they really do about the conflict in the Middle East from a college campus?Here's a look at what protesters are really demanding from their demonstrations.

More arrests at University of Minnesota Tuesday as pro-Palestinian demonstrations spread from coast to coast. What's happening?

Pro-Palestinian protests and encampments are springing up at numerous colleges, leading to arrests and heightened security concerns. Here’s what's happening.

Bengals All-Pro Trey Hendrickson reportedly joins Tee Higgins in requesting trade

Hendrickson is coming off a career-high 17.5-sack season.

This sophisticated beach cover-up doubles as a top you can wear to dinner, and it's down to $20

'My new favorite piece of clothing': This workhorse is a stunner by the water, on the boardwalk and everywhere in between.

Reggie Bush finally gets his Heisman back and Colorado's Dylan Edwards hits the portal

Dan Wetzel, Ross Dellenger, and SI's Pat Forde react to the news of Reggie Bush getting his Heisman trophy back, Dylan Edwards hitting the portal, and their favorite NFL Draft memories.

TikTok ban signed into law by President Biden: How we got here, and what comes next

TikTok faces an uncertain fate in the U.S. once again. A bill including a deadline for TikTok parent company Bytedance to divest within nine months or face a ban on app stores to distribute the app in the U.S., was signed by President Joe Biden on Wednesday as part of broader legislation including military aid for Israel and Ukraine. The White House's approval comes swiftly after strong bipartisan approval in the House and a 79-18 Senate vote Tuesday in favor of moving the bill forward.

TikTok Lite axes ‘addictive as cigarettes’ reward-to-watch feature under the EU’s watchful eye

The EU has effectively vanquished a TikTok feature that Europe’s digital commissioner described as “toxic” and “addictive as cigarettes.” TikTok owner ByteDance said on Wednesday that TikTok Lite’s reward-to-watch feature would be suspended.

Stock market today: Tesla surges 12%, stocks go nowhere amid earnings rush

Tesla's surge is putting Big Tech earnings center stage as investors look to megacaps to lift stocks.

Boeing stock slides after tumultuous quarter headlined by 737 Max crisis

Boeing (BA) on Wednesday reported results that beat Wall Street expectations after a tumultuous first quarter.

Only Amazon Prime members can score these 9 secret deals — and they start at just $8

Hidden bargains include $200 off a Eufy robovac, and there's plenty more where that came from.

Meta stock plummets 15% after second quarter outlook disappoints

Meta reported its Q1 earnings after the bell, beating analysts' expectations on the top and bottom, but a disappointing Q2 forecast sent shares falling.

Reggie Bush's Heisman redemption and the fallacy of amateurism

Amateurism is dead. Even the self-important Heisman Trust knows it after Reggie Bush's reinstatement. Now it's the NCAA's turn to take a symbolic step.

'You LOVE to see it': Robert Griffin III, Johnny Manziel, many others congratulate Reggie Bush on Heisman

So many people were happy to see Bush get his Heisman back.

Bluey grows up in 'Surprise!' For some parents, seeing her change hits home.

The touching episode has parents feeling complicated emotions about the future of the show — and about their own kids growing up.

Biden signs bill that would ban TikTok if ByteDance fails to sell the app

President Biden has signed a bill that would ban TikTok if its Chinese parent company, ByteDance, fails to sell it within a year. The bill, which includes aid for Ukraine and Israel, was passed by the U.S. Senate in a 79-18 vote late Tuesday after the House passed it with overwhelming majority over the weekend. The bill gives ByteDance nine months to divest TikTok, with a 90-day extension available to complete a deal.

Apple looks to Southeast Asia, India as hedge against China difficulties

Apple is looking to increase its manufacturing presence in Southeast Asia and its market share in India as China troubles loom.

Stripe, doubling down on embedded finance, de-couples payments from the rest of its stack

Stripe continues to hold the title of being the biggest financial technology business still in private hands, with a current valuation of about $65 billion and a whopping $1 trillion in total processed payment volume last year alone. Today, Stripe announced that it will be de-coupling payments -- the jewel in its crown -- from the rest of its financial services stack. This is a big change, considering that in the past, even as Stripe grew its list of services, it required businesses to be payments customers in order to use any of the rest.

2025 BMW i4 and 4 Series Gran Coupe refreshed with tweaks throughout

The 2025 BMW i4 and 4 Series Gran Coupe get tiny cosmetic tweaks and new 48V mild hybrid help, with most of the work done on the in-cabin technology.

Lions, Penei Sewell reportedly agree to 4-year, $112M deal that makes him highest-paid OT in NFL

The Lions are handing out extensions like they just pulled the winning lottery ticket.

Bengals pick up 5th-year option on WR Ja'Marr Chase

Chase caught a career-high 100 balls in 2023 for 1,216 yards and seven touchdowns.

- Updated Terms of Use

- New Privacy Policy

- Your Privacy Choices

- Closed Captioning Policy

Quotes displayed in real-time or delayed by at least 15 minutes. Market data provided by Factset . Powered and implemented by FactSet Digital Solutions . Legal Statement .

This material may not be published, broadcast, rewritten, or redistributed. ©2024 FOX News Network, LLC. All rights reserved. FAQ - New Privacy Policy

Private student loan interest rates continue upward surge

The latest private student loan interest rates from the Credible marketplace, updated weekly. ( iStock )

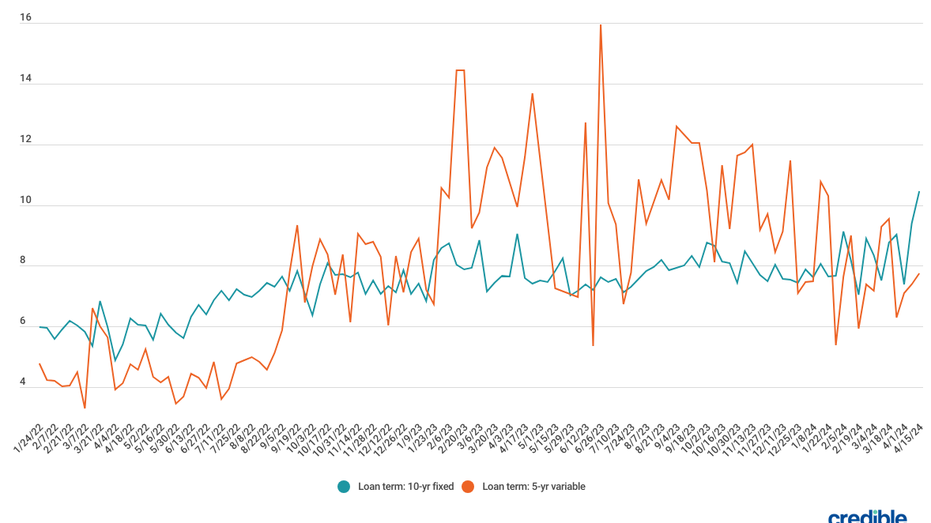

During the week of Apr. 15, 2024, average private student loan rates increased for borrowers with credit scores of 720 or higher who used the Credible marketplace to take out 10-year fixed-rate loans and 5-year variable-rate loans.

- 10-year fixed rate: 10.45%, up from 9.40% the week before, +1.05

- 5-year variable rate: 7.75%, up from 7.39% the week before, +0.36

Through Credible, you can compare private student loan rates from multiple lenders.

For 10-year fixed private student loans, interest rates rose by over a full percentage point, while 5-year variable student loan interest ticked up by more than a third of a percentage point.

Borrowers with good credit may find a lower rate with a private student loan than with some federal loans. For the 2023-24 academic school year, federal student loan rates will range from 5.50% to 8.05%. Private student loan rates for borrowers with good to excellent credit can be lower right now.

Because federal loans come with certain benefits, like access to income-driven repayment plans, you should always exhaust federal student loan options first before turning to private student loans to cover any funding gaps. Private lenders such as banks, credit unions, and online lenders provide private student loans. You can use private loans to pay for education costs and living expenses, which might not be covered by your federal education loans.

Interest rates and terms on private student loans can vary depending on your financial situation, credit history, and the lender you choose.

Take a look at Credible partner lenders’ rates for borrowers who used the Credible marketplace to select a lender during the week of April 15:

Private student loan rates (graduate and undergraduate)

Who sets federal and private interest rates?

Congress sets federal student loan interest rates each year. These fixed interest rates depend on the type of federal loan you take out, your dependency status and your year in school.

Private student loan interest rates can be fixed or variable and depend on your credit, repayment term and other factors. As a general rule, the better your credit score, the lower your interest rate is likely to be.

You can compare rates from multiple student loan lenders using Credible.

How does student loan interest work?

An interest rate is a percentage of the loan periodically tacked onto your balance — essentially the cost of borrowing money. Interest is one way lenders can make money from loans. Your monthly payment often pays interest first, with the rest going to the amount you initially borrowed (the principal).

Getting a low interest rate could help you save money over the life of the loan and pay off your debt faster.

What is a fixed- vs. variable-rate loan?

Here’s the difference between a fixed and variable rate:

- With a fixed rate, your monthly payment amount will stay the same over the course of your loan term.

- With a variable rate, your payments might rise or fall based on changing interest rates.

Comparison shopping for private student loan rates is easy when you use Credible.

Calculate your savings

Using a student loan interest calculator will help you estimate your monthly payments and the total amount you’ll owe over the life of your federal or private student loans.

Once you enter your information, you’ll be able to see what your estimated monthly payment will be, the total you’ll pay in interest over the life of the loan and the total amount you’ll pay back.

About Credible

Credible is a multi-lender marketplace that empowers consumers to discover financial products that are the best fit for their unique circumstances. Credible’s integrations with leading lenders and credit bureaus allow consumers to quickly compare accurate, personalized loan options – without putting their personal information at risk or affecting their credit score. The Credible marketplace provides an unrivaled customer experience, as reflected by over 4,300 positive Trustpilot reviews and a TrustScore of 4.7/5.

IMAGES

VIDEO

COMMENTS

Downloadable Guides. A Guide to Postgraduate Tuition Fee Loan - 2023/24 PDF (392.4KB) A Guide to Postgraduate Tuition Fee Loan - 2022/23 PDF (217.7KB) Postgraduate Tuition Fee Loan, a guide to your suspending or withdrawing studies - 2023/24 PDF (86.8KB) Postgraduate Tuition Fee Loan, a guide to your suspending or withdrawing studies - 2022/23 ...

The maximum Postgraduate Tuition Fee Loan available to Northern Ireland domiciled students is £5,500 for the course, and Northern Ireland students will have to financially make up the difference of any tuition fee charged by their Higher Education Institution. You should establish the amount of tuition fees with your Higher Education ...

Overview. A Postgraduate Doctoral Loan can help with course fees and living costs while you study a postgraduate doctoral course, such as a PhD. There's different funding if you normally live in ...

The Northern Ireland Department for the Economy (DfE) provides a tuition fee loan of up to £6,500 per student for postgraduate study. (announced 27 October 2022) Please note that for courses completed over more than 1 year, you may not be able to draw down the maximum available loan. If your course fees are higher in any year than the amount ...

Welcome to Student Finance NI. Full-time undergraduate student finance applications for 2024 to 2025 are now open! Apply now! Postgraduate applications will be available by the end of May.

Written by Mark Bennett. A Northern Irish postgraduate tuition fee loan lets you borrow up to £6,500 towards the cost of your UK Masters degree, Postgraduate Certificate or Postgraduate Diploma. The loan is provided by Student Finance Northern Ireland on behalf of the Student Loans Company. You only repay it once you finish your course and ...

To qualify for student finance, your course and your university or college must meet certain conditions. This page sets out the conditions that apply if you're from Northern Ireland and doing a higher education course in the UK. Contents. Checking if you qualify. When the rules on eligibility don't apply.

Tuition Fee Loan for Northern Irish master's students. Credit: Matej Kastelic - Shutterstock. Assuming you meet the eligibility criteria, in the 2023/24 academic year, you'll be able to apply for a Postgraduate Tuition Fee Loan of up to £6,500. And, compared to other Student Finance packages, it's pretty simple.

Student Finance NI is a partnership between the Education Authority, the Department for the Economy and the Student Loans Company. We are responsible for processing applications for financial support for full-time higher education, part-time higher education and postgraduate courses. We also administer and pay support on behalf of the ...

Northern Irish postgraduate loans are available from Student Finance NI to help you cover the cost of tuition fees. The maximum amount available in 2023/24 is £6,500. This support isn't means-tested, so the amount you receive is not based on your financial background. However, if tuition fees for your course are lower than £6,500, you won't ...

Student tuition fees. New eligible full-time undergraduate students studying in Northern Ireland will be charged up to £4,630 in tuition fees in academic year 2022/23. The tuition fees for academic year 2023/24 will increase to £4,710. Universities and colleges of higher education in England, Scotland or Wales are able to charge full-time ...

The Postgraduate Tuition Fee Loan is available for courses starting after 1 August 2017. If you start a postgraduate course during the 2024/25 academic year, you may be eligible to apply for a Postgraduate Tuition Fee Loan of up to £6,500 to help with the cost of your course fees. If you started the course before the 2023/24 academic year, the ...

Northern Ireland domiciled students planning to attend a Higher Education postgraduate course (including Open University courses) in Northern Ireland, England, Scotland or Wales should be aware that postgraduate tuition fees vary. The maximum Postgraduate Tuition Fee Loan available to Northern Ireland domiciled students is £5,500 for the ...

The value of a DfE studentship. For UK domiciled students the value of an award includes the cost of approved fees as well as maintenance support. In academic year 2023 to 2024 the basic rates of maintenance support are: £18,622 for a research studentship. £9,311 for a taught studentship. These awards are not affected by your parent's ...

For 2024/25 entry, students from Northern Ireland and the Republic of Ireland can be charged up to £4,750 per year in tuition fees at universities in Northern Ireland. For students from the rest of the UK, tuition fees are up to £9,250 per year. If you're an international student (including those from the EU, as of the 2021/22 academic year ...

You'll need a bigger loan to study outside Ireland. If you live in Northern Ireland and stay there to study, the most you'll pay to your chosen university for tuition is £4,750/year in 2024/25. It's even cheaper if you go to university in the Republic of Ireland, as you only have to pay a student contribution charge of €3,000/year.

Graduate-entry medical courses. If you're doing a four year graduate-entry medical course (fast-track course) in England, Wales or Scotland you're not eligible for a Health Service bursary or tuition fee support or a Higher Education bursary. You may however apply to your local Student Finance NI office for support for living costs through ...

Date published: 17 November 2021. Last updated: 02 January 2024. Topics: Higher education. Higher education finance and student support. This booklet sets out the terms and conditions of the Department for the Economy (DfE) postgraduate studentships held at Queen's University Belfast and Ulster University.

It's additional funding to help students with extra essential costs as a direct result of a disability. This can include a long-term health condition, mental-health condition, physical disability or specific learning difficulty such as dyslexia. You can apply for Disabled Students' Allowance on it's own or alongside any other available finance ...

Use your student finance account to: view statements and letters from Student Finance England ( SFE) track an existing application. check when your payments are due. update some of your personal ...

The PhD programme in Finance has an outstanding and impressive track record in terms of quality of research. Listed below are our current Phd Students. ... Zhenghui NI Research Interest: Behavioural Finance, Banking, Empirical Asset Pricing Supervisor: Allaudeen Hameed Year: 2018. View CV ...

A Gen Xer who got $250,000 in student loans forgiven said he can now finally start saving for retirement — and consider his dream of studying in India. Ayelet Sheffey. Apr 21, 2024, 3:18 AM PDT ...

Wed, April 24, 2024, 3:12 PM EDT · 4 min read. 48. More than 100 USC students erected tents, banners and signs in the center of campus Wednesday, joining in a growing national sit-in movement ...

5-year variable rate: 7.75%, up from 7.39% the week before, +0.36. Through Credible, you can compare private student loan rates from multiple lenders. For 10-year fixed private student loans ...

Parking Decals: $40/Semester (Students paying charge for Spring semesters are not responsible for Summer terms) Students in the School of Communication will be assessed an additional $100/semester technology fee Drop & Add Fee: Students changing classes after initial payment of tuition and fees will be assessed a $40.00 Change of Program fee.

Student loan debt is a burden that nearly 3 out of 4 American borrowers say has forced them to delay a major life event — whether that's buying a house, having kids or getting married ...

So, if you're paid monthly and earn £2,500 per month before tax you'll repay 9% of the difference between what you earn and the monthly threshold (£1,658). £2,500 - £1,658 = £842 9% of £842 = £75.78. Your Postgraduate Tuition Fee Loan repayment would be £75.78 in that month.