How to Write the Management Team Section of a Business Plan + Examples

Written by Dave Lavinsky

Over the last 20+ years, we’ve written business plans for over 4,000 companies and hundreds of thousands of others have used our business plan template and other business planning materials.

From this vast experience, we’ve gained valuable insights on how to write a business plan effectively , specifically in the management section.

What is a Management Team Business Plan?

A management team business plan is a section in a comprehensive business plan that introduces and highlights the key members of the company’s management team. This part provides essential details about the individuals responsible for leading and running the business, including their backgrounds, skills, and experience.

It’s crucial for potential investors and stakeholders to evaluate the management team’s competence and qualifications, as a strong team can instill confidence in the company’s ability to succeed.

Why is the Management Team Section of a Business Plan Important?

Your management team plan has 3 goals:

- To prove to you that you have the right team to execute on the opportunity you have defined, and if not, to identify who you must hire to round out your current team

- To convince lenders and investors (e.g., angel investors, venture capitalists) to fund your company (if needed)

- To document how your Board (if applicable) can best help your team succeed

What to Include in Your Management Team Section

There are two key elements to include in your management team business plan as follows:

Management Team Members

For each key member of your team, document their name, title, and background.

Their backgrounds are most important in telling you and investors they are qualified to execute. Describe what positions each member has held in the past and what they accomplished in those positions. For example, if your VP of Sales was formerly the VP of Sales for another company in which they grew sales from zero to $10 million, that would be an important and compelling accomplishment to document.

Importantly, try to relate your team members’ past job experience with what you need them to accomplish at your company. For example, if a former high school principal was on your team, you could state that their vast experience working with both teenagers and their parents will help them succeed in their current position (particularly if the current position required them to work with both customer segments).

This is true for a management team for a small business, a medium-sized or large business.

Management Team Gaps

In this section, detail if your management team currently has any gaps or missing individuals. Not having a complete team at the time you develop your business plan. But, you must show your plan to complete your team.

As such, describe what positions are missing and who will fill the positions. For example, if you know you need to hire a VP of Marketing, state this. Further, state the job description of this person. For example, you might say that this hire will have 10 years of experience managing a marketing team, establishing new accounts, working with social media marketing, have startup experience, etc.

To give you a “checklist” of the employees you might want to include in your Management Team Members and/or Gaps sections, below are the most common management titles at a growing startup (note that many are specific to tech startups):

- Founder, CEO, and/or President

- Chief Operating Officer

- Chief Financial Officer

- VP of Sales

- VP of Marketing

- VP of Web Development and/or Engineering

- UX Designer/Manager

- Product Manager

- Digital Marketing Manager

- Business Development Manager

- Account Management/Customer Service Manager

- Sales Managers/Sales Staff

- Board Members

If you have a Board of Directors or Board of Advisors, you would include the bios of the members of your board in this section.

A Board of Directors is a paid group of individuals who help guide your company. Typically startups do not have such a board until they raise VC funding.

If your company is not at this stage, consider forming a Board of Advisors. Such a board is ideal particularly if your team is missing expertise and/or experience in certain areas. An advisory board includes 2 to 8 individuals who act as mentors to your business. Usually, you meet with them monthly or quarterly and they help answer questions and provide strategic guidance. You typically do not pay advisory board members with cash, but offering them options in your company is a best practice as it allows you to attract better board members and better motivate them.

Management Team Business Plan Example

Below are examples of how to include your management section in your business plan.

Key Team Members

Jim Smith, Founder & CEO

Jim has 15 years of experience in online software development, having co-founded two previous successful online businesses. His first company specialized in developing workflow automation software for government agencies and was sold to a public company in 2003. Jim’s second company developed a mobile app for parents to manage their children’s activities, which was sold to a large public company in 2014. Jim has a B.S. in computer science from MIT and an M.B.A from the University of Chicago

Bill Jones, COO

Bill has 20 years of sales and business development experience from working with several startups that he helped grow into large businesses. He has a B.S. in mechanical engineering from M.I.T., where he also played Division I lacrosse for four years.

We currently have no gaps in our management team, but we plan to expand our team by hiring a Vice President of Marketing to be responsible for all digital marketing efforts.

Vance Williamson, Founder & CEO

Prior to founding GoDoIt, Vance was the CIO of a major corporation with more than 100 retail locations. He oversaw all IT initiatives including software development, sales technology, mobile apps for customers and employees, security systems, customer databases/CRM platforms, etc. He has a B.S in computer science and an MBA in operations management from UCLA.

We currently have two gaps in our Management Team:

A VP of Sales with 10 years of experience managing sales teams, overseeing sales processes, working with manufacturers, establishing new accounts, working with digital marketing/advertising agencies to build brand awareness, etc.

In addition, we need to hire a VP of Marketing with experience creating online marketing campaigns that attract new customers to our site.

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Click here to finish your business plan today.

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success.

Click here to see how Growthink’s professional business plan consulting services can create your business plan for you.

Other Resources for Writing Your Business Plan

- How to Write an Executive Summary

- How to Expertly Write the Company Description in Your Business Plan

- How to Write the Market Analysis Section of a Business Plan

- The Customer Analysis Section of Your Business Plan

- Completing the Competitive Analysis Section of Your Business Plan

- Financial Assumptions and Your Business Plan

- How to Create Financial Projections for Your Business Plan

- Everything You Need to Know about the Business Plan Appendix

- Business Plan Conclusion: Summary & Recap

Other Helpful Business Plan Articles & Templates

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

Writing the Organization and Management Section of Your Business Plan

What is the organization and management section in a business plan.

- What to Put in the Organization and Management Section

Organization

The management team, helpful tips to write this section, frequently asked questions (faqs).

vm / E+ / Getty Images

Every business plan needs an organization and management section. This document will help you convey your vision for how your business will be structured. Here's how to write a good one.

Key Takeaways

- This section of your business plan details your corporate structure.

- It should explain the hierarchy of management, including details about the owners, the board of directors, and any professional partners.

- The point of this section is to clarify who will be in charge of each aspect of your business, as well as how those individuals will help the business succeed.

The organization and management section of your business plan should summarize information about your business structure and team. It usually comes after the market analysis section in a business plan . It's especially important to include this section if you have a partnership or a multi-member limited liability company (LLC). However, if you're starting a home business or are writing a business plan for one that's already operating, and you're the only person involved, then you don't need to include this section.

What To Put in the Organization and Management Section

You can separate the two terms to better understand how to write this section of the business plan.

The "organization" in this section refers to how your business is structured and the people involved. "Management" refers to the responsibilities different managers have and what those individuals bring to the company.

In the opening of the section, you want to give a summary of your management team, including size, composition, and a bit about each member's experience.

For example, you might write something like "Our management team of five has more than 20 years of experience in the industry."

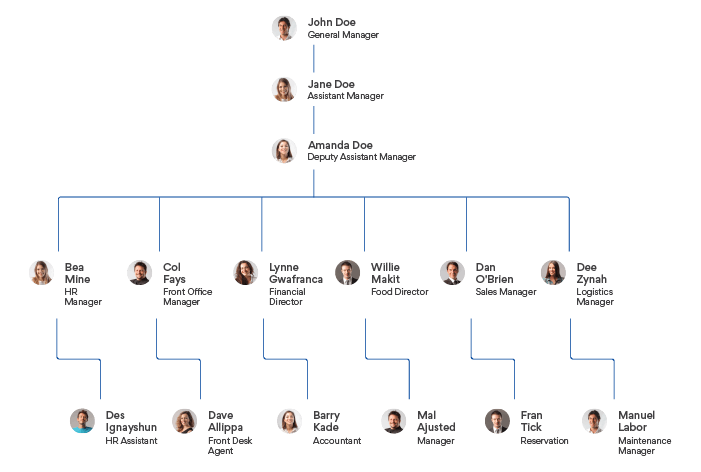

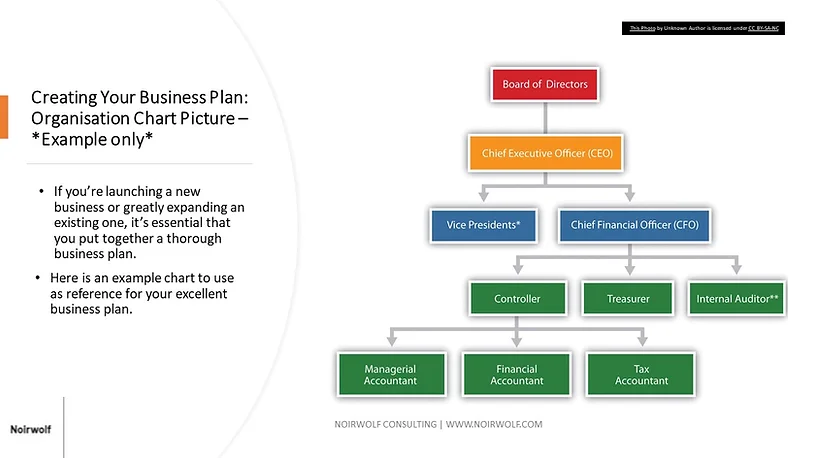

The organization section sets up the hierarchy of the people involved in your business. It's often set up in a chart form. If you have a partnership or multi-member LLC, this is where you indicate who is president or CEO, the CFO, director of marketing, and any other roles you have in your business. If you're a single-person home business, this becomes easy as you're the only one on the chart.

Technically, this part of the plan is about owner members, but if you plan to outsource work or hire a virtual assistant, you can include them here, as well. For example, you might have a freelance webmaster, marketing assistant, and copywriter. You might even have a virtual assistant whose job it is to work with your other freelancers. These people aren't owners but have significant duties in your business.

Some common types of business structures include sole proprietorships, partnerships, LLCs, and corporations.

Sole Proprietorship

This type of business isn't a separate entity. Instead, business assets and liabilities are entwined with your personal finances. You're the sole person in charge, and you won't be allowed to sell stock or bring in new owners. If you don't register as any other kind of business, you'll automatically be considered a sole proprietorship.

Partnership

Partnerships can be either limited (LP) or limited liability (LLP). LPs have one general partner who takes on the bulk of the liability for the company, while all other partner owners have limited liability (and limited control over the business). LLPs are like an LP without a general partner; all partners have limited liability from debts as well as the actions of other partners.

Limited Liability Company

A limited liability company (LLC) combines elements of partnership and corporate structures. Your personal liability is limited, and profits are passed through to your personal returns.

Corporation

There are many variations of corporate structure that an organization might choose. These include C corps, which allow companies to issue stock shares, pay corporate taxes (rather than passing profits through to personal returns), and offer the highest level of personal protection from business activities. There are also nonprofit corporations, which are similar to C corps, but they don't seek profits and don't pay state or federal income taxes.

This section highlights what you and the others involved in the running of your business bring to the table. This not only includes owners and managers but also your board of directors (if you have one) and support professionals. Start by indicating your business structure, and then list the team members.

Owner/Manager/Members

Provide the following information on each owner/manager/member:

- Percentage of ownership (LLC, corporation, etc.)

- Extent of involvement (active or silent partner)

- Type of ownership (stock options, general partner, etc.)

- Position in the business (CEO, CFO, etc.)

- Duties and responsibilities

- Educational background

- Experience or skills that are relevant to the business and the duties

- Past employment

- Skills will benefit the business

- Awards and recognition

- Compensation (how paid)

- How each person's skills and experience will complement you and each other

Board of Directors

A board of directors is another part of your management team. If you don't have a board of directors, you don't need this information. This section provides much of the same information as in the ownership and management team sub-section.

- Position (if there are positions)

- Involvement with the company

Even a one-person business could benefit from a small group of other business owners providing feedback, support, and accountability as an advisory board.

Support Professionals

Especially if you're seeking funding, let potential investors know you're on the ball with a lawyer, accountant, and other professionals that are involved in your business. This is the place to list any freelancers or contractors you're using. Like the other sections, you'll want to include:

- Background information such as education or certificates

- Services provided to your business

- Relationship information (retainer, as-needed, regular, etc.)

- Skills and experience making them ideal for the work you need

- Anything else that makes them stand out as quality professionals (awards, etc.)

Writing a business plan seems like an overwhelming activity, especially if you're starting a small, one-person business. But writing a business plan can be fairly simple.

Like other parts of the business plan, this is a section you'll want to update if you have team member changes, or if you and your team members receive any additional training, awards, or other resume changes that benefit the business.

Because it highlights the skills and experience you and your team offer, it can be a great resource to refer to when seeking publicity and marketing opportunities. You can refer to it when creating your media kit or pitching for publicity.

Why are organization and management important to a business plan?

The point of this section is to clarify who's in charge of what. This document can clarify these roles for yourself, as well as investors and employees.

What should you cover in the organization and management section of a business plan?

The organization and management section should explain the chain of command , roles, and responsibilities. It should also explain a bit about what makes each person particularly well-suited to take charge of their area of the business.

Want to read more content like this? Sign up for The Balance’s newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

Small Business Administration. " Write Your Business Plan ."

City of Eagle, Idaho. " Step 2—Write Your Business Plan ."

Small Business Administration. " Choose a Business Structure ."

- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

- How to Use Your Business Plan Most Effectively

- The Basics of Writing a Business Plan

- 12 Reasons You Need a Business Plan

- The Main Objectives of a Business Plan

- What to Include and Not Include in a Successful Business Plan

- The Top 4 Types of Business Plans

- A Step-by-Step Guide to Presenting Your Business Plan in 10 Slides

- 6 Tips for Making a Winning Business Presentation

- 12 Ways to Set Realistic Business Goals and Objectives

- 3 Key Things You Need to Know About Financing Your Business

- How to Perfectly Pitch Your Business Plan in 10 Minutes

- How to Fund Your Business Through Friends and Family Loans and Crowdsourcing

- How to Fund Your Business Using Banks and Credit Unions

- How to Fund Your Business With an SBA Loan

- How to Fund Your Business With Bonds and Indirect Funding Sources

- How to Fund Your Business With Venture Capital

- How to Fund Your Business With Angel Investors

- How to Use Your Business Plan to Track Performance

- How to Make Your Business Plan Attractive to Prospective Partners

- Is This Idea Going to Work? How to Assess the Potential of Your Business.

- When to Update Your Business Plan

- How to Write the Management Team Section to Your Business Plan

- How to Create a Strategic Hiring Plan

- How to Write a Business Plan Executive Summary That Sells Your Idea

- How to Build a Team of Outside Experts for Your Business

- Use This Worksheet to Write a Product Description That Sells

- What Is Your Unique Selling Proposition? Use This Worksheet to Find Your Greatest Strength.

- How to Raise Money With Your Business Plan

- Customers and Investors Don't Want Products. They Want Solutions.

- 5 Essential Elements of Your Industry Trends Plan

- How to Identify and Research Your Competition

- Who Is Your Ideal Customer? 4 Questions to Ask Yourself.

- How to Identify Market Trends in Your Business Plan

- How to Define Your Product and Set Your Prices

- How to Determine the Barriers to Entry for Your Business

- How to Get Customers in Your Store and Drive Traffic to Your Website

- How to Effectively Promote Your Business to Customers and Investors

- What Equipment and Facilities to Include in Your Business Plan

- How to Write an Income Statement for Your Business Plan

- How to Make a Balance Sheet

- How to Make a Cash Flow Statement

- How to Use Financial Ratios to Understand the Health of Your Business

- How to Write an Operations Plan for Retail and Sales Businesses

- How to Make Realistic Financial Forecasts

- How to Write an Operations Plan for Manufacturers

- What Technology Needs to Include In Your Business Plan

- How to List Personnel and Materials in Your Business Plan

- The Role of Franchising

- The Best Ways to Follow Up on a Buisiness Plan

- The Best Books, Sites, Trade Associations and Resources to Get Your Business Funded and Running

- How to Hire the Right Business Plan Consultant

- Business Plan Lingo and Resources All Entrepreneurs Should Know

- How to Write a Letter of Introduction

- What To Put on the Cover Page of a Business Plan

- How to Format Your Business Plan

- 6 Steps to Getting Your Business Plan In Front of Investors

How to Write the Management Team Section to Your Business Plan Think you've got an all-star lineup? These are the key characteristics to showcase.

By Eric Butow • Oct 27, 2023

Key Takeaways

- Who to include in your org chart

- The key traits to highlight

Opinions expressed by Entrepreneur contributors are their own.

This is part 1 / 8 of Write Your Business Plan: Section 3: Selling Your Product and Team series.

One crucial aspect of any business plan is the management team slide, which outlines the key employees in the organization. Here are some things to keep in mind when putting together your all-star lineup.

Put Yourself First

Don't be modest. If you're the head of the business, you should feature yourself first. After all, you are the entrepreneur behind the business venture, and you will have to put your neck on the line, answer the hard questions, and take the criticism— as well as the praise and acclaim, should there be some.

If you want to impress people with your management team, it's essential to let your readers know who is at the helm and who is selecting the management team. Explain your background, including your vision, your credentials, and why you chose the management team you did.

A business follows the lead of the founder, and as such, you need to briefly explain what is expected of this management team and the role you see it, as a group, playing in the future of this business.

Related: Does Your Team Have the Right Stuff to Attract Venture Capital?

Highlight These Characteristics

Identifying your managers is about presenting what they bring to the table. You can provide this by describing them in terms of the following characteristics:

Education Impressive educational credentials among company managers provide strong reasons for an investor or other plan reader to feel good about your company. Use your judgment in deciding what educational background to include and how to emphasize it. If you're starting a fine restaurant, for example, and your chef graduated at the top of her class from the Culinary Institute of America, play that front and center. If you're starting a courier service and your partner has an anthropology degree from a little-known school, mention it, but don't make a big deal out of it.

Employment Prior work experience in a related field is something many investors look for. If you've spent ten years in management in the retail men's apparel business before opening a tuxedo outlet, an investor can feel confident that you know what you're doing. Likewise, you'll want to explain your team members' key, appropriate positions. Describe any relevant jobs in terms of job title, years of experience, names of employers, and so on. But remember, this isn't a resume. You can feel free to skim over or omit any irrelevant experience. You do not have to provide exact dates of employment.

Related: How to Craft a Business Plan That Will Turn Investors' Heads

Skills A title is one thing, but what you learn while holding it is another. In addition to pointing out that you were a district sales manager for a stereo equipment wholesaler, you should describe your responsibilities and the skills you honed while fulfilling them. Again, list your management team's skills that pertain to this business. A great cook may have incredible accounting skills, but that doesn't matter in the new restaurant's kitchen.

Each time you mention skills that you or a management team member has spent years acquiring at another company, it will be another reason for an investor to believe you can do it at your own company.

Accomplishments Dust off your plaques and trot out your calculator for this one. If you or one of your team members has been awarded patents, achieved record sales gains, or once opened an unbelievable number of new stores in the space of a year, now's the time to talk about it. Don't brag. Just be factual and remember to quantify. If, for example, you have twelve patents, your sales manager had five years of thirty percent annual sales gains, and you oversaw the grand openings of forty-two stores in eleven months, this is the stuff investors and others reading your business plan will want to see. Investors are looking to back impressive winners, and quantifiable results speak strongly to businesspeople of all stripes.

Personal information Investors want to know with whom they're dealing in terms of the personal side. Personal information on each member of your management team may include age, city of residence, notable charitable or community activities, and, last but not least, personal motivation for joining the company. Investors like to see vigorous, committed, and involved people in the companies they back. Mentioning one or two of the relevant personal details of your key managers may help investors feel they know what they're getting into, especially in today's increasingly transparent business climate.

Related: How to Evaluate Your Startup Like a VC

Who to Include in Your Plan

Should you mention everyone in your organization down to shop foremen or stop with the people on your executive committee? The answer is probably neither. Instead, think about your managers in terms of the crucial functions of your business.

In deciding the scope of the management section of your plan, consider the following business functions, and make sure you've explained who will handle those that are important to your enterprise:

- Advertising

- Distribution

- Human Resources

- Technical Operations

Related: How To Build a Team of Outside Experts for Your Business

What Does Each Person Do?

There's more to a job than a title. A director in one organization is a high and mighty individual, whereas a director is practically nobody in another company. Many industries have unique job titles, such as managing editor, creative director, and junior accountant level II, with no counterparts in other industries.

In a longer plan, when you give your management team's background and describe their titles, don't stop there. Go on and tell the reader exactly what each management team member will be expected to do in the company. This may be especially important in a startup, where not every position is filled. If the CFO will handle your marketing work until you get further down the road, let readers know this upfront. You certainly can't expect them to figure that out on their own.

In a shorter business plan, or mini-plan , choose those people most vital to your business. If you are opening a martial arts studio, the instructors, or lead instructors, are significant, as is the software developer in a new software company. While you have room to describe these people in more detail in a longer plan, in the shorter miniplans, use one defining sentence for your top five people.

Related: 6 Tips for Making a Winning Business Presentation

Future Hires

If you do have significant holes in your management team, you'll want to describe your plans for filling them. You may say, for example, "Marketing duties are being handled temporarily by the vice president for finance. Once sales have reached the $500,000 per month level, approximately six months after startup, a dedicated vice president of marketing will be retained to fulfill that function."

In some cases, particularly if you're in a really shaky startup and need solid talent, you may have to describe in some detail your plans for luring a hotshot industry expert to your fledgling enterprise. Then, briefly describe your ideal candidate. For a mini-plan, you may write, "We plan to hire a marketing VP who excels in reaching our 20–29 target market."

Related: Vusi Thembekwayo's 7 Rules of Pitching

More in Write Your Business Plan

Section 1: the foundation of a business plan, section 2: putting your business plan to work, section 3: selling your product and team, section 4: marketing your business plan, section 5: organizing operations and finances, section 6: getting your business plan to investors.

Successfully copied link

- Sample Plans

- WHY UPMETRICS?

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

- 400+ Sample Business Plans

Customers Success Stories

Business Plan Course

Strategic Canvas Templates

E-books, Guides & More

Business consultants

Entrepreneurs and Small Business

Accelerators and Incubators

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai pitch deck generator

Stratrgic Planning

See How Upmetrics Works →

Small Business Tools

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Strategic Planning

Tips on Writing the Management Team Section of a Business Plan

Free Ultimate Guide On Writing A Business Plan

- December 21, 2023

10 Min Read

A business is as efficient as its team and its management. It, therefore, becomes important for business owners to build a structured management team that achieves the objectives and goals set by the organization. Thus, making the management section of a business plan the most essential component.

Andrew Carnegie , an American steel magnate, beautifully summarized it –

Teamwork is the ability to work together toward a common vision. The ability to direct individual accomplishments toward organizational objectives. It is the fuel that allows common people to attain uncommon results.

A business management plan helps build an efficient team and formalize business operations . This helps businesses streamline strategies to achieve their goals.

It, therefore, becomes imperative that business owners pay utmost importance while writing the management section of a business plan.

So, if you are a business owner who is looking to formalize their business structure and write the management team section in their business plan , this guide is for you.

Here’s a sneak peek into what you’ll learn:

Table of Contents

- What Is the Management Section?

- Importance of the Management Section

- What to Include in the Management Section?

- Example of a Management Section Plan

- Ensure That the Management Section Is Fool-proof?

Sounds good? Let’s dive in.

What Is The Management Section Of A Business Plan?

The management section of a business plan is an in-depth description of a business’s team, its structure, and the ownership of a business.

The section discusses in detail who is on the management team – internal and external- their skill sets, experiences, and how meaningfully they would contribute to an organization’s goals and outcomes.

Now that we have defined what is the management section of a business plan, let’s understand why it is so important.

The Importance Of The Management Section Of A Business Plan

The management section helps you to:

1. Convince your investors (banks and government agencies) to disburse loans and grants for your business idea

2. Prove that your management team can execute your idea and if not, help hire the right fit for a position

3. Share how your advisory board can help your team succeed

What To Include In the Management Section Of A Business Plan?

The management section of a business plan helps in formalizing and structuring the management team plan and is comprised of

- The Management Team

- The Management Team Gaps

- The Management Structure

Let’s understand them in detail.

1. The Management Team

An organization’s entire management team can be divided into parts – the internal team and the external team.

The Internal Management Team

A business team consists of several departments. The most common departments are – Marketing, Sales, IT, Customer Service, Operations, Finance, and HR.

These departments may or may not be required. It purely depends on the nature and functioning of your business. For example, a dental clinic may not require a sales department per se.

The entire management team is compartmentalized according to their responsibility. This helps the business owners and investors be aware of the roles, benefits, ESOPs (if applicable), profit sharing (for sales), work contracts, NDAs (Non-Disclosure Agreements), and Non-Competition Agreements of the entire team.

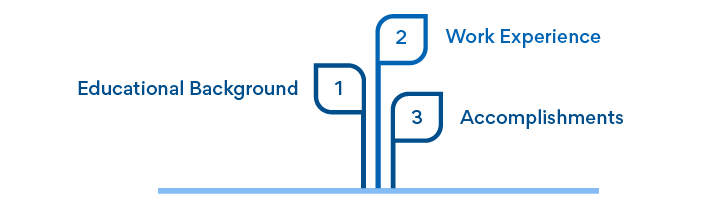

It is recommended that business owners collect and document the following information about their team:

- Educational Background

- Work Experience

- Accomplishments

For example, your present VP of Marketing helped their previous company grow its bottom line from $3 million to $10 million over 18 months.

The External Management Team

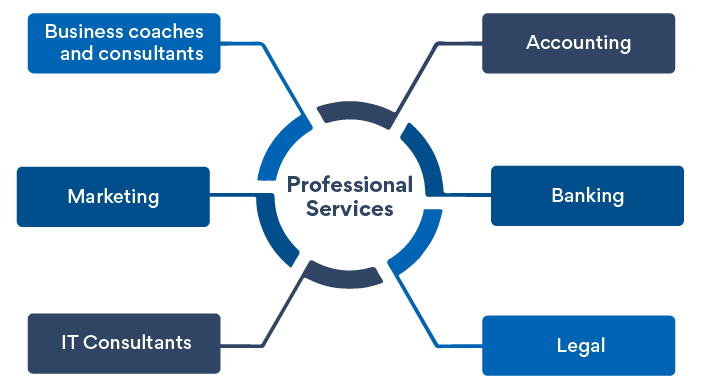

The external management team is usually composed of – Advisory Board Members and Professional Services.

Advisory board members help by :

- Establishing trust, showing results, and experiencing the table.

- Increasing the confidence of investors and consumers.

This helps attract talented employees to the team. Credible advisory board members show great commitment to a company’s growth. Therefore, it becomes important to document their experience and specialization in the business management plan. The advisory board members can help give valuable advice that internal team members need or lack.

If your business has not or will not have VC funding, you may not require board members on your team.

Usually, board members meet quarterly or monthly to provide strategic guidance in place of stock options in your company. This helps attract the best advisors and motivates them to invest in your business.

For example, founders and business owners coming to raise funds in Shark Tank , a business television series, are looking for advisory members who would invest money and provide guidance on necessary steps.

On the other hand, Professional Service helps by

- Offering highly specialized advice and sharing knowledge.

- Business owners make key strategic management decisions.

Such services help businesses leverage skills that would be difficult to build and acquire over a short period.

Examples of such professional services are

- IT Consultants

- Business coaches and consultants

After a brief overview of the Management Team of an organization, let’s dive into what to include in Management Team Gaps.

2. The Management Team Gaps

The management team gap is an important part of the management section. Primarily because it helps document if your management team currently has gaps or missing skills. Your team may lack a few required skills while starting. The management team gaps help you to be aware and make efforts to close this gap.

As a business owner, you must document what positions are missing and who ought to fill that positions or take responsibility.

For example, if you need a VP of Sales, clearly document this in the section.

Also, write down the job description and key responsibilities to be undertaken,

Example – You might mention that role required 10 years of experience in the sales domain. The applicant must have experience handling a sales team, closing new accounts, working in tandem with the marketing team, and having relevant startup experience.

Be as detailed as possible. This will help you build a checklist while interviewing the right candidate and also win investor confidence in your managerial skills.

Following are a few key positions you would want to include in your management team:

- Founder and/or, CEO

- Chief Technical Officer (CTO)

- Chief Marketing Officer (CMO)

- Chief Operating Officer (COO)

- Chief Financial Officer (CFO)

- Chief Human Resources Officer (CHRO)

- Head of Product Management (PM)

- VP of Sales

- VP of Marketing

- UX Designer

- Digital Marketing Manager

- Business Development Manager

- Customer Service Manager

- Customer Success Manager

- Sales Managers/Sales Staff

- Advisory Board Members

Let’s dive into the nitty-gritty of the management structure.

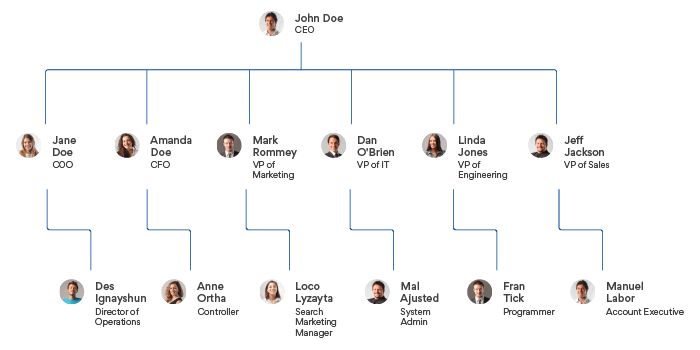

3. The Management Structure

The management structure defines how a business organizes its management hierarchy. A hierarchy helps determine the roles, positions, power, and responsibilities of all team members.

The management structure also depends upon the type of business ownership. Business ownership can be – a sole proprietorship, partnership, or simply an LLC.

Following is a sample management structure of an organization.

Now that we understand what details we need to document in the business management plan, let’s look at a few examples of the management plan.

Example Of A Management Section Plan

[management section of a hotel], [management team], internal team members.

Name: Charles Fargo Role: Owner Responsibility: Formulating key strategies, defining budgets, and building a business plan Experience: 35 years of owning multiple hotels in Las Vegas Educational Background: B.Sc in Hospitality Management from South Dakota State University.

Name: Michael Clark Role: General Manager Responsibility: Overall hotel operations – guest interactions, revenue management, brand ambassador of the hotel, customer satisfaction, and experience, leadership to all departments Experience: 25 years working with several technology hotels as the general manager. Educational Background: MBA from Wharton School

Name: George Trump Role: Department Manager Responsibility: Manage employees, smooth coordination amongst employees, plan daily affairs of the department, strategize, prepare reports, and deal with complaints and suggestions. Lead team members to function as a team Experience: 15 years working as a department manager Educational Background: BSc in Hotel Management from Texas University

Note: There can be multiple Department Managers depending on the nature of your business. In the case of hotels, departments can include – housekeeping, logistics, security, food, and banquets.

Name: Donald Clooney Role: Marketing and Sales Manager Responsibility: Increase occupancy and generate revenue. Position the hotel as an option for leisure activities, relaxation, and holidays. Experience: 11 years working as the marketing and sales manager for hotels Educational Background: MBA in Tourism and Hospitality from Midway University

External Team Members

Advisory Board Member

#1 Richard Branson Responsibility: Strategic advisory for sustainable growth and expansion Experience: Founder of Virgin Group

Professional Services

[management structure].

There is a gap in one key position in our startup.

#1 Chief Finance Officer (CFO) Responsibilities: Finance, Accounting, Tracking Profit and Loss, and overseeing FP&A (Financial Planning and Analysis)

How To Ensure That The Management Section Of Your Business Plan Is Fool-Proof?

“In preparing for battle I have always found that plans are useless, but planning is indispensable.” ― Dwight D. Eisenhower

By building a fool-proof management plan and ensuring that all the intricate details are accounted for, we can ensure that your business has a greater chance of succeeding.

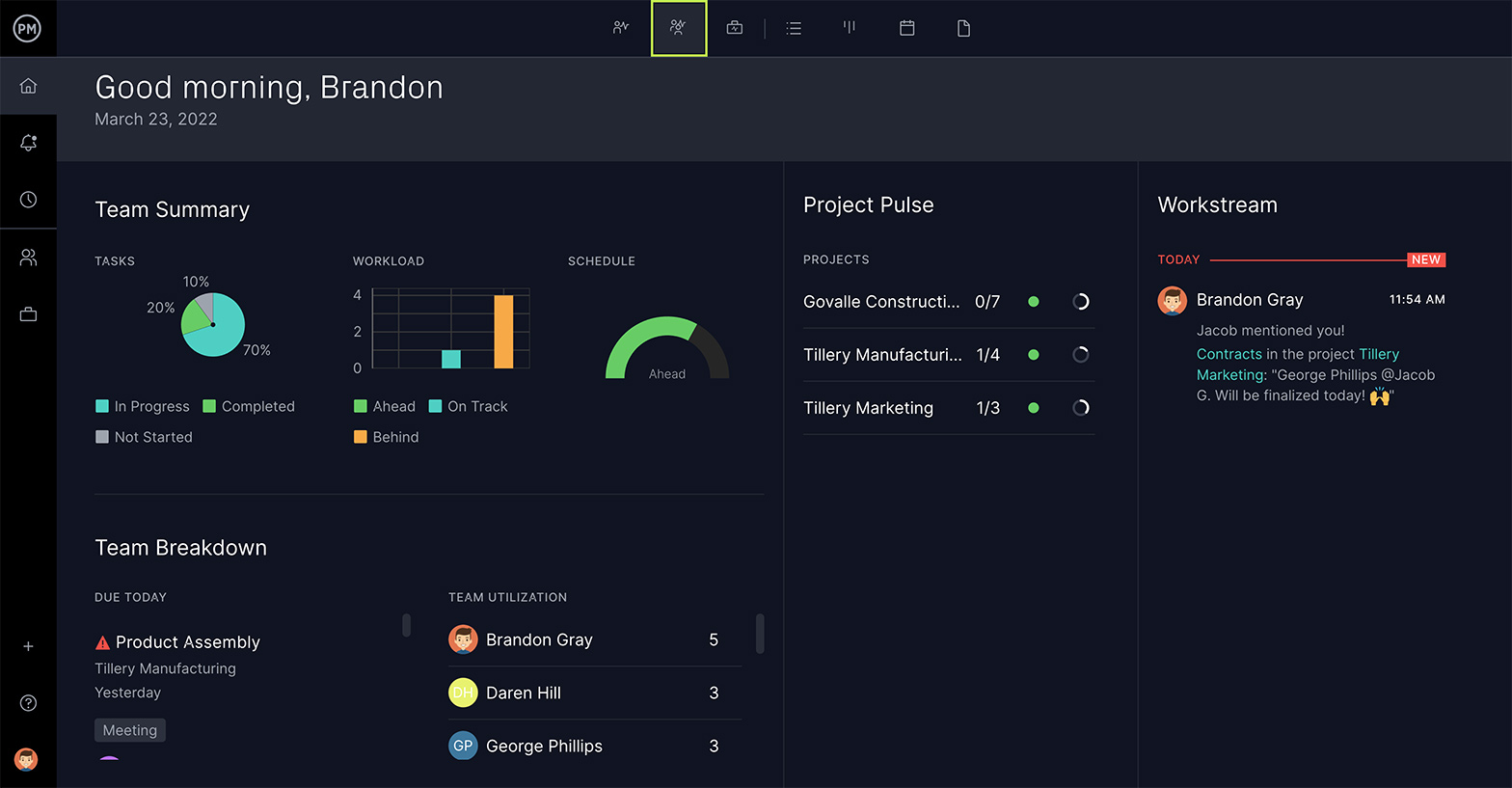

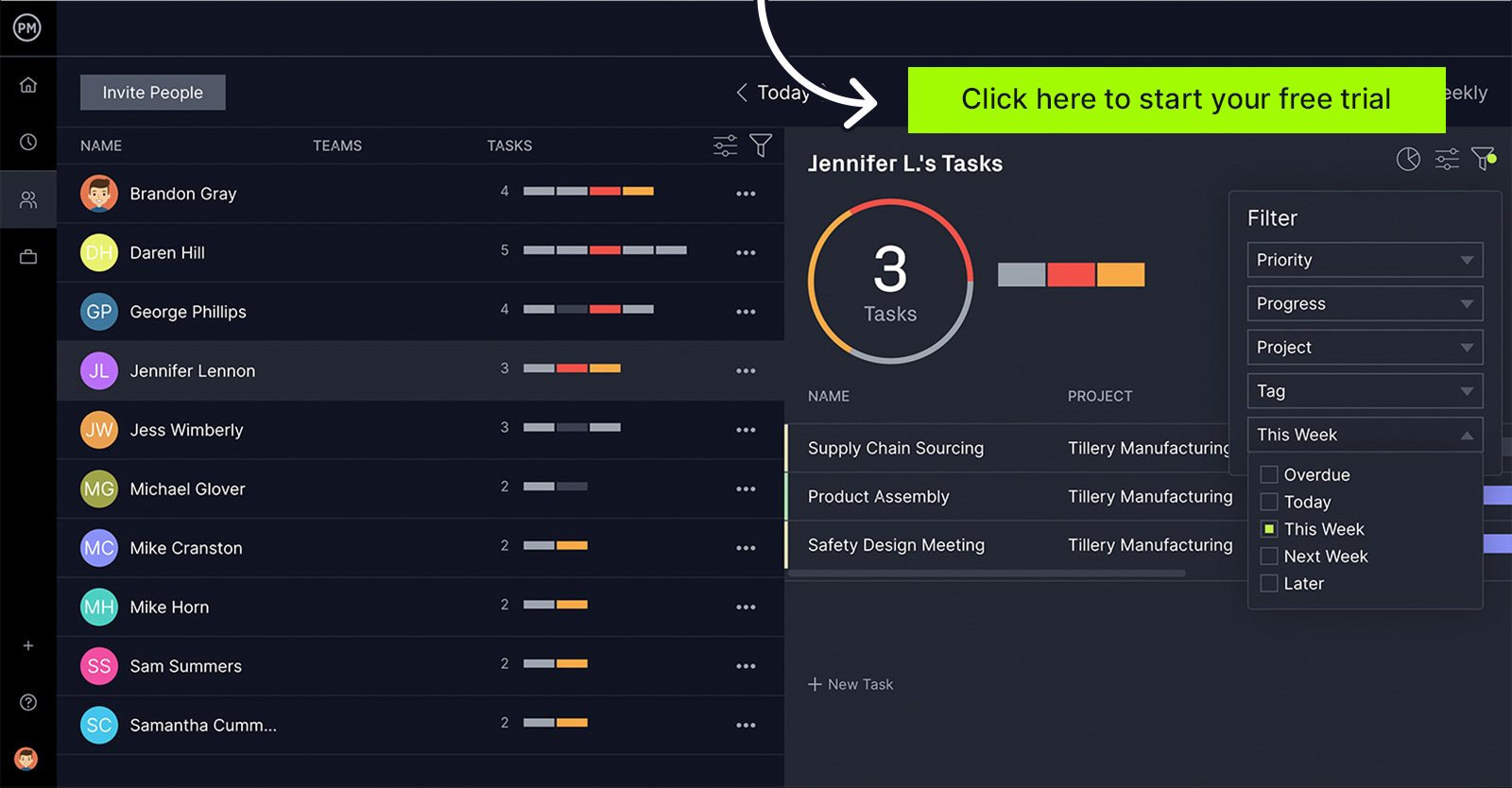

Business planning software like Upmetrics ensures that business owners, like you, get the management section planning correct on the first attempt itself.

You can also get started with a free demo today to discover how Upmetrics can help you plan your business in a breeze.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Related Articles

How to Write an Operations Plan Section of your Business Plan

What to Include in Your Business Plan Appendix Section

How to Prepare a Financial Plan for Startup Business (w/ example)

Reach your goals with accurate planning.

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Business Plan Management Team Section

An overview of your founders, key employees, and advisors, management team.

The purpose of including the management team in a business plan is that it provides an overview of your founders and key employees. Yet, in the beginning, that might be just one person. You can increase your plan’s credibility by establishing a supporting cast of key mentors and advisors and including them in this section.

This article provides information about how to present your management team, including examples and a management team template you can use for your business plan.

Important Considerations for Presenting Your Management Team

Venture capitalists will often say, “We don’t invest in ideas. We invest in people.” Their rationale is that, over time, the idea will have to evolve. The right team will develop the idea into a winner. But the wrong team can ruin even what was initially an outstanding idea. So the question to be answered by this section is, “What experience and achievements in this team’s past demonstrate that they will succeed in this new business?”

Business Plan Outline for your Management Team:

The structure for the management team section of your business plan is straightforward. For each bullet point item below, expand on the experience and value brought to your company by their participation. The following sections will recommend best practices for presenting your management team in a way that investors and lenders will appreciate.

- Key Employees

Hiring Plans

Board members.

- Professional Advisors

Founders and CEOs

Most startup businesses will be led by the founder as the Chief Executive Officer or CEO. For a startup, the title of President is equally suitable.

If Your Founder is also the CEO

Assuming your President or CEO is also the founder, begin your Management Team section with a description of the individual who will be the CEO or senior person in charge of running the company.

Under the heading of Founder and CEO, include a mini-bio relevant to the credibility of this person leading the firm to success. A lender or investor will go to LinkedIn to get the full bio, so stick to the essential elements.

The best thing you can say about the founder is that he or she has CEO-level experience running a similar business or one in a similar space. Realistically, you’re only sometimes going to be able to say that. What can you say?

First, present the most relevant experience that makes the CEO “investable.” That could be technical expertise, sales experience, or management skills from another company. By stating the most relevant experience to the new business right up front, you’ll help the reader see the transferable skills. If there is no CEO experience, don’t worry. In the following sections, we’ll show you how to build a bridge of confidence to cover that gap.

If Your Founder is not the CEO

If the founder is not the CEO, two questions must be answered in this lead-off sub-section of your business plan management team. First, why is the founder not leading the company as its CEO? Next, what role will the founder play in the business?

Hopefully, the first question answers itself by presenting the outstanding qualifications of the CEO, such that the reader would be impressed by the fact that you were able to get this person to come on board to grow your business. A simple example would be:

Robert Nelson has 20 years of experience in our industry, 10 of that as a CEO. Robert will lead MyCo as our CEO. Robert is known and respected in the field and will surely accelerate our growth.

Dana Elders, our founder, worked under Robert as the head of sales, where he flourished. Dana will be MyCo’s President and will also be responsible for driving revenue.

Whatever the circumstances are that led to your founder not being the CEO, one would expect that there is an advantage with an upside. Otherwise, why would the founder abdicate this role? Be sure to identify the upside in your business plan.

Key Management Team Members

Highlight the relevant experience and accomplishments your team brings to the table. You can include the resumes of your key management team members as appendices in your business plan and refer to them in this section.

Whom should you include?

Include as many of the following roles in your management team as you have filled. Adapt these to align more closely with the important roles in your industry.

- Any VP-level person

- Chief Operating Officer

- Chief Financial Officer

- Chief Product Officer

- Chief Technology Officer

- Head of Sales

- Head of Marketing

- Head of Operations

- Any outstanding contributor with experience that will obviously contribute to the success of your business.

What to Say about Each Person on Your Management Team

For each individual you list, include their relevant experience, transferable skills, and key accomplishments, emphasizing factors that will contribute to your business’ success. Avoid making readers “connect the dots” on their own. Rather, make the connection for them.

For example:

Jose Rodero, VP of Product and Marketing.

In Jose’s previous role as Chief Product Officer of LikeMine Company, he expanded into new markets and tripled the size of the business in three years. This experience is ideal for MyCo as we move beyond a single market to expand into adjacent markets.

Highlight Relevant Accomplishments

For each person you list in the key management section, it’s helpful to convey a pattern of accomplishments, such as, “At her last company, Ms. Johnson was named Employee of the Year for the past two years. During that time, she was twice promoted. First to VP of Sales and then to COO.

Leave out admirable but “sideline” accolades such as, “Ms. Johnson is a two-time winner of the La Jolla Triathlon.” Unless an accolade relates to the success of your business, you’re better off mentioning it in the biography (included as an appendix) or leaving it out altogether.

At the early stages of your company, you might be missing some key people on your management team—this is normal and acceptable. Usually, this has a lot to do with why you are seeking funding. If you haven’t yet hired all your key people, you can address this in your business plan in two ways.

First, if you have lined up some individuals who will come on board when you bring in your funding, you can identify them in your business plan. If this information is not ready to be disclosed, you can allude to it in generalized terms without divulging the person’s name or current company.

“We have identified an individual with ten years of experience in a similar company to fill the Director of Marketing role. Pending the timing of our funding, we expect this person to join our team.

Next, address any gaps in your management team that need to be filled. Identify key hires that remain and the order in which you expect to fill the positions. Doing so shows that you’re thinking ahead and shields you from any criticism about holes in your current team.

While you may think these gaps are a weakness in your plan, your potential investors or lenders become a source of free candidate referrals!

Board of Directors versus Board of Advisors

There are two types of boards: a board of directors and a board of advisors, sometimes called an advisory board. A board of directors can have specific legal responsibilities and authority. For that reason, some individuals would prefer to join a board of advisors.

A board of advisors generally has fewer or no formal responsibilities but can be just as beneficial to the company through the guidance they provide. It’s never too early, and your business is never too small to have a board of advisors.

Whether it’s a board of directors or a board of advisors, it is important to surround yourself with experienced advisors who will provide sound advice that you will be willing to follow. Anything less will waste your time and theirs.

One founder we met with had this to say about a particular board member:

“I selected him to be on the board of my first company because he was strongly recommended by two successful business people I knew. I found him to be someone who pushed back on many of my ideas, asked lots of tough questions, and always held me to task on everything I said we would accomplish. We were not friends outside of the business.

When I started my next business, and we needed to set up a board–he was the first person I called.”

Your best board members may not be your best friends, and hopefully, they won’t be people who think just like you. A board brings a diversity of thought and critical thinking. They help you be a better version of yourself.

Having a board of directors or board of advisors tells lenders and investors that you value the input of outside thinking and have the skills to build relationships with people who can help your business succeed. That bodes well for the future success of your business!

Board of Directors

Your initial board of directors will almost certainly be led by the founder as its Chair. Typically, a co-founder, angel investor, or key employee with very senior executive experience might also be on the board. A small board of directors is fine, especially if you’ll be adding a board of advisors.

Depending on the state where you start your business and your corporate structure, a minimum number of board members may be prescribed.

Advisory Board

If you still need to get a board of directors beyond the minimum required roles, consider putting together a board of advisors. Chances are you have mentors and people with relevant experience who are giving you input on your business idea. Perhaps one of them is even a customer or potential customer.

Consider asking these people to agree to be on your board of advisors, a group that would meet quarterly to hear updates on your business and to provide input. With their consent, you can list members of your board of advisors in your business plan. You’ll find that accomplished people are often happy to join your board of advisors for little or no compensation.

What to Show in Your Business Plan for Board Members (Directors and Advisors)

For each board member in your board of directors and board of advisors, list their name, current or most recent position, and company. If members have special experience that pertains strongly to your business, naturally, you would also want to include that information. Include up to two or three sentences of narrative about each board member.

Using the format above, first list your Board of Directors and then your Board of Advisors.

Professional Services Advisors

If you have worked with an attorney to establish your business, an accountant to help prepare your financial forecasts, or an advertising or PR firm to help prepare some promotional materials—include these organizations in your business plan’s management section under the heading “Professional Advisors.”

Bankers and investors are often well-connected to area professional service providers. Knowing that you are working with recognized names in the business community can boost your credibility. It also tells the reader that you’re being advised by professionals.

Be sure to let your advisors know in advance that you’ve listed them in your business plan since oftentimes, they’ll get a phone call asking for their impressions of the business. Better still, seek and obtain their permission.

In this section, include the type of services provided, the name of the firm, and your primary contact.

Legal Advisors: Dewey and Howe. Jerry Mander, Partner.

Management Team Example Summary

Most startup businesses have a lean management team. A savvy founder will find a way to surround him or herself with individuals who will help the business get started, grow and thrive as non-executive contributors.

Use our provided information and management team examples to present a well-rounded management team section in your business plan.

If you still need to get some of the ancillary advisors we’ve recommended, now is the time to expand your influence circle. You’ll find that there are highly qualified individuals who are willing and even enthusiastic to be a part of your success.

Ready to complete your business plan in just 1 day?

Click GET STARTED to learn more about our fill-in-the-blank business plan template. We’ll step you through all the details you need to develop a professional business plan in just one day!

Successfully used by thousands of people starting a business and writing a business plan. It will work for you too!

How to present the management team in your business plan?

Behind every successful business venture lies a dynamic and capable management team that serves as the driving force behind its growth and success.

In the world of entrepreneurship, having a strong management team is a crucial element that investors and stakeholders closely examine before deciding to invest in or support a business.

When crafting a compelling business plan, showcasing your management team effectively is vital. This section should include details regarding the members of your management team and explain how their respective skillsets compliment each other and will give your business the best chance of success.

So, let's delve into the essential strategies and best practices to effectively introduce your management team and leave a lasting impression on those who hold the keys to your business's success.

In this guide:

What is the objective of the management team subsection of your business plan?

What information should i include when presenting the management team in my business plan.

- How long should the management section of your business plan be?

- Example of management section in a business plan

What tools should I use to write my business plan?

The part presenting the management team aims to detail the qualifications and experience of the management team responsible for leading the company.

When writing this section, your goal should be to demonstrate to potential investors that the professionals hired by your business are qualified to hold leadership roles because they have the required expertise and exeperience.

It is crucial to address any skills or experience gaps within your management team. Explain your strategies for filling these gaps, and mention if involving a board member to provide additional support in those areas is a possibility.

Another pivotal aspect is emphasizing your management team's cohesiveness and successful collaboration. This is necessary as potential investors are not just interested in the product or service you offer, but they also invest in the people behind the business.

Need a convincing business plan?

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

In professional business plans, the management team subsection is usually placed at the end of the company section, after the presentation of the business’ structure, ownership, and location.

The management team subsection should aim to provide the investors with a comprehensive understanding of who's responsible for delivering the business plan.

Let’s have a look at the different aspects that this section should cover:

Business structure and role

Start by giving an outline of how your business is or will be structured internally (i.e. the overall hierarchy and where each individual is positioned).

You should keep this section focused in people in leadership position. The exact number of relevant people will vary based on the size of your business. For example, this could involve naming the CEO, CFO and CMO, or the managing director and his right hand in a smaller business.

You can provide an organisational chart in the appendices to make this easier for the reader to understand your exact organization.

Thorough profile

A detailed profile for each member of the management team is necessary and should include the following details:

- Background information including their gender and nationality

- Their educational background emphasizing any degrees or certifications that are relevant to their roles

- Qualifications or accreditations that hold team members distinct in their particular industries

- A rundown of all relevant job experience, both in the same sector/role or in other industries

- Both hard and soft skills that each team member possesses which makes them an asset to the business

- Details of how long they've been with the company

Visual assets

Incorporating visual aids, such as organizational charts and images of the management team members helps improve the readability of this section.

These representations prove especially beneficial in situations like pitching sessions, where potential investors may have the opportunity to engage with the team face-to-face in the future.

Succession planning (if applicable)

Briefly describe your succession planning approach if your company has plans for future leadership transitions.

Discuss how important individuals may leave their positions over time and how the business aims to replace them.

Startups only

If your business is a start-up, describe why the founders decided to start this business together, how long they've known each other, and what motivated them.

Some roles or positions may be vacant for startups or businesses that are still in the early stages of growth. It is crucial to discuss these positions and provide a staffing strategy in such situations.

How long should the management section of your business plan be?

As a general rule of thumb, 2 to 3 paragraphs per individual can be considered a good starting point. This recommendation may need to be modified depending on the size of your management team and the specific characteristics of your industry:

- If your business has less than five people: each member of the management team is crucial. To showcase the team's trustworthiness in such situations, additional information about each member's background, credentials, and area of specialty is necessary.

- A more concise approach may be acceptable in larger companies with a larger management team. In this case, concentrate on key executives and give a general picture of the leadership structure rather than going into excessive detail on each individual.

- The nature of your industry can also define the level of detail required in the management section. In emerging industries or those with specialized technologies, the reader may not be familiar with all of the details and so it’s important to explain how each team member contributes to the business.

- In industries with strict rules and regulations - medical practice for example - your business plan's management section might need to focus more on the qualifications and experience of each team member. Mentioning their previous roles, especially if they were leaders in other organizations, can make your management section appear stronger and more effective.

Ensure a balance between providing enough detail and avoiding excessive elaboration (CVs can be included in appendix if necessary).

Need inspiration for your business plan?

The Business Plan Shop has dozens of business plan templates that you can use to get a clear idea of what a complete business plan looks like.

Example of management section in a business plan

Below is an example of how the management section of your business plan might look like. As you can see, it precedes the products and services section.

The management section of a business plan outlines the organizational structure, key team members, their roles, responsibilities, and expertise, demonstrating the leadership and operational framework of the business.

This example was taken from one of our business plan templates .

In this section, we will review three solutions for creating a business plan for your business: using Word and Excel, hiring a consultant to write the business plan, and utilizing an online business plan software.

Create your business plan using Word or Excel

This is the old-fashioned way of creating a business plan (1990s style) and using Word or Excel has both pros and cons.

On the one hand, using either of these two programs is cheap and they are widely available.

However, creating an error-free financial forecast with Excel is only possible if you have expertise in accounting and financial modeling.

Because of that investors and lenders might not trust the accuracy of your forecast unless you have a degree in finance or accounting.

Also, writing a business plan using Word means starting from scratch and formatting the document yourself once written - a process that can be quite tedious - especially when the numbers change and you need to manually update all the tables and text.

Ultimately, it's up to the business owner to decide which program is right for them and whether they have the expertise or resources needed to make Excel work.

Hire a consultant to write your business plan

Outsourcing your business plan to a consultant can be a viable option, but it also presents certain drawbacks.

On the plus side, consultants are experienced in writing business plans and adept at creating financial forecasts without errors. Furthermore, hiring a consultant can save you time and allow you to focus on the day-to-day operations of your business.

However, hiring consultants is expensive: budget at least £1.5k ($2.0k) for a complete business plan, more if you need to make changes after the initial version (which happens frequently after the first meetings with lenders).

For these reasons, outsourcing the plan to a consultant or accountant should be considered carefully, weighing both the advantages and disadvantages of hiring outside help.

Ultimately, it may be the right decision for some businesses, while others may find it beneficial to write their own business plan using an online software.

Use an online business plan software for your business plan

Another alternative is to use online business plan software .

There are several advantages to using specialized software:

- You are guided through the writing process by detailed instructions and examples for each part of the plan

- You can be inspired by already written business plan templates

- You can easily make your financial forecast by letting the software take care of the financial calculations for you without errors

- You get a professional document, formatted and ready to be sent to your bank

- The software will enable you to easily track your actual financial performance against your forecast and update your forecast as time goes by

If you're interested in using this type of solution, you can try our software for free by signing up here .

Whilst it’s true that all investors aim to maximise profit, it’s also important to remember that they probably won’t finance a business if they are uneasy about the individuals running it.

A well-written management section of your business is, therefore, critical in ensuring that your business plan is able to obtain funding and grow.

Also on The Business Plan Shop

- 7 tips for writing an effective business plan

- Where to write the conclusion of your business plan?

- How to write the location section of your business plan

- How to write the products and services section of your business plan

- How to write the milestones section of your business plan

Know someone who needs help writing up the management section of their business plan? Share this article with them and help them out!

Founder & CEO at The Business Plan Shop Ltd

Guillaume Le Brouster is a seasoned entrepreneur and financier.

Guillaume has been an entrepreneur for more than a decade and has first-hand experience of starting, running, and growing a successful business.

Prior to being a business owner, Guillaume worked in investment banking and private equity, where he spent most of his time creating complex financial forecasts, writing business plans, and analysing financial statements to make financing and investment decisions.

Guillaume holds a Master's Degree in Finance from ESCP Business School and a Bachelor of Science in Business & Management from Paris Dauphine University.

Create a convincing business plan

Assess the profitability of your business idea and create a persuasive business plan to pitch to investors

500,000+ entrepreneurs have already tried our solution - why not join them?

Not ready to try our on-line tool ? Learn more about our solution here

Need some inspiration for your business plan?

Subscribe to The Business Plan Shop and gain access to our business plan template library.

Need a professional business plan? Discover our solution

Write your business plan with ease!

It's easy to create a professional business plan with The Business Plan Shop

Want to find out more before you try? Learn more about our solution here

How to Write the Management Team Section of a Business Plan

- Small Business

- Business Planning & Strategy

- Write a Business Plan

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

How to Write a List of Key Company Principals

How to write a bio that sells you and your company, what are the functions of a business plan.

- How to Make a Creative "About Me" on Facebook

- How to Write Your Business Proposal

Of course, they'll read the market analysis section – and you can expect them to linger over the financial projections section. But if there's one section of a business plan that may carry the greatest weight with lenders, investors and potential strategic partners, it's the management team section. This is where you provide details about the education, qualifications and experience that you and your management team bring to your small business. Written in a crisp and focused manner, the management team section should help those third parties recognize what sets your business apart from others. And it should give meaning to that oft-repeated business maxim: “I don't invest in ideas; I invest in people.”

Gather Key Information

Before you put pen to paper – or your fingers to the keyboard – gather the information you need on your management team. At the least, you should have their resumes handy – and include them in the appendix of your business plan.

Also, be prepared to speak with members of your management team to fill in any blanks. Structure the management team section to include:

- An organizational chart of your small business, including departments, department managers and employees. Biographical information about you, the owner, and any other owners. Specify your ownership percentage and exactly what your day-to-day responsibilities will be. Biographical information on your management team.* The credentials of any advisers who will be at your side providing expert advice, such as an accountant and a lawyer.

One Paragraph Poses One Big Challenge

Like many small-business owners, you may not think of yourself as a writer. So you may be relieved to know that you should devote only about one paragraph to each person you profile in the management section. But in the end, that should be one substantive paragraph, and it will require some finesse to pull it off.

As many writers will attest, being verbose isn't difficult; being concise yet enlightening can be a challenge. Put another way, you want to include only the most relevant and insightful information about your management team – and you want to be quick about it. So be prepared to edit your words ruthlessly as you structure the paragraph to include the team members' info:

- Name and title. Education and professional credentials and some personal information. Primary responsibilities at your small business.

Expand the Second Component

Providing names and titles should be the easy part. The most robust part of your paragraph should proceed with ease if you include:

- Education credentials, including college and major, and any relevant certifications. Employment highlights. Pick the last or last two titles and company affiliations unless there is something truly stellar in someone's past worth mentioning. Skills or specialties, meaning those things that someone truly excels at or is known for.* Notable accomplishments, which can serve as a subliminal message that they can be repeated at your small business.

- Personal insights, which may include anything from community involvement to someone's rationale for joining your company. You have a lot of latitude here, so try to think in terms of what conveys the mark of a can-do, energetic person. If you're impressed by it, chances are someone reading your business plan will be too.

Spell Out the Third Component

Because you opened the paragraph with the person's name and title, you want to close it with a summation of the contributions you expect the person to make. Discretion here is important; you want to demonstrate to people reading your business plan that you've hired accomplished people, but you don't want to stray into the realm of hyperbole, either.

This said, after spelling out so many numbers and analytics in your business plan, the management section is your chance to expose the human side of your business. A good balance can be found in this paragraph:

Thomas Cole, Director of Marketing A mass communication graduate of Illinois State University, Tom brings to us nearly 20 years of marketing experience and a proven ability to integrate best practices into emerging businesses. Websites, smartphones and digital marketing all came of age as the proud redbird worked as a district marketing manager for ABC Media and then marketing manager for XYZ Newspaper Group, both in Chicago. Tom helped these companies navigate sea changes in the newspaper industry and return to profitability by developing imaginative and synergistic marketing campaigns. We expect him to replicate these efforts at Write-On Marketing, at least when he's not busy critiquing the latest creations at his family's award-winning Illinois winery.

Assuming that you believe people are your greatest asset, write your management section like the proud small-business owner you are – your instincts should serve you well.

- NFIB: Parts of a Business Plan: 7 Essential Sections

- Inc.: How to Write a Great Business Plan: Management Team

- Entrepreneur: First Steps: Writing the Management Section of Your Business Plan

- BP Plans: Coffee Export Business Plan

Mary Wroblewski earned a master's degree with high honors in communications and has worked as a reporter and editor in two Chicago newsrooms. Then she launched her own small business, which specialized in assisting small business owners with “all things marketing” – from drafting a marketing plan and writing website copy to crafting media plans and developing email campaigns. Mary writes extensively about small business issues and especially “all things marketing.”

Related Articles

What is an appendix in a business plan, how to write an executive summary on a marketing plan, what are the components of a good business plan, what are the 4 important parts of a business plan, why is an effective business plan introduction important, how to display your bio on wordpress, definition of a swot analysis, final summary for a marketing plan, opening statements for a sales letter, most popular.

- 1 What Is an Appendix in a Business Plan?

- 2 How to Write an Executive Summary on a Marketing Plan

- 3 What Are the Components of a Good Business Plan?

- 4 What Are the 4 Important Parts of a Business Plan?

Business Plan Organization and Management: How to Write Guide .

Sep 17, 2023 | Business Consulting , Business Plan , Organization and Management , Organizational Development , Strategy

Writing the Business Plan Organization and Management Section

It provides critical information for those looking for evidence that your staff has the necessary experience, skills, and pedigree to realize the objectives detailed in the rest of your business plan.

What Is the Organization and Management Section in a Business Plan?

The organization and management section of your business plan should provide details about your business structure and team. This section typically comes after the executive summary. However, some people have it further in the document after the market analysis section.

This section generally is separated into two parts. The first concerns the organization as a whole. It gives readers an overview of the company structure, which is an excellent opportunity for the reader to lift the roof off your office and peer into its inner workings. For your legal design, you may set up as a limited liability company (LLC) or nonprofit/ charity or form a partnership. It’s crucial to include this section. However, suppose you’re starting a home business or have an already operating business where you’re the only person involved. In that case, you can skip this section or show the company registration details from either the company’s house or the awarding .gov.

The second part focuses specifically on your management team and introduces readers to each member — your chance to impress them with the many accomplishments pinned to your organization’s management team.

This section may seem less important than some of the other parts of your business plan, but the truth is that your people are your business. If they’re highly competent and accomplished, the implication is that so is your business.

Of course, if you’re a sole proprietor with no management structure or any employees, this section is unnecessary other than to talk about yourself and your achievements.

The section on organization and management should outline the hierarchy, individual roles, and corresponding responsibilities. It should also highlight each person’s strengths and qualifications for their positions.

Business Plan Organization Section

The organizational section of your business plan outlines the hierarchy of individuals involved in your business, typically in a chart format. This section identifies the President or CEO, CFO, Director of Marketing, and other roles for partnerships or multi-member LLCs. If you’re a single-person home business, this section is straightforward as you are the only person on the chart.

Although this section primarily focuses on owner members, you can include outsourced workers or virtual assistants if you plan to hire them. For example, you may have a freelance web admin, marketing assistant, or copywriter. You may even have a virtual assistant who coordinates with your other freelancers. While these individuals are not owners, they hold significant responsibilities in your business.

There are various business structures, such as sole proprietorships, partnerships, LLCs, and corporations.

Detail the Legal Structure within the Business Plan Organization and Management Section

Here is an indicative list of business structures. It would help if you talked to your accountant and legal advisors to determine which legal form is the best for your business proposition.

Sole Proprietorship

When embarking on a business venture, it’s essential to consider the various structures available. A sole proprietorship is a structure whereby the business is not regarded as separate from its owner’s finances. The owner retains complete control and responsibility for the company. However, they are unable to sell stocks or bring in new owners. The business becomes a sole proprietorship if not registered under any other structure.

Partnership

When forming a partnership, it can either be a limited partnership (LP) or a limited liability partnership (LLP). One partner assumes most liability in a limited partnership (LP). In contrast, the other partners have limited liability and control over the business. Alternatively, in a limited liability partnership (LLP), all partners have limited liability from debts and actions of other partners, and there is no general partner.

Limited Liability Company

A limited company (LTD) or limited liability company (LLC) is a mixture of business structures that mixes aspects of partnerships and corporations. It offers limited personal liability to the owner and passes profits through to their tax returns.

Corporation

There are various types of corporate structures. A C-corporation enables the issuance of stock shares, pays corporate taxes instead of personal returns, and provides the highest level of personal protection from business activities. On the other hand, nonprofit corporations are similar to C corporations. However, they do not aim to make profits and are exempt from state or federal income taxes.

More information on company legal structures is available on UK.Gov and USA.SBA websites.

Describe Your Company’s Organizational Structure

This first step illustrates the positions in your organization’s employee hierarchy and how they all relate to each other.