Educational Tax Credits and Deductions You Can Claim for Tax Year 2023

Several tax breaks can help you cover the high costs of education, future college expenses and interest you pay on student loans.

Tax Breaks for Education

Getty Images

If you're going to grad school or taking any continuing education classes – even if you aren't working toward a degree – you may be eligible for the lifetime learning credit.

Key Takeaways

- The American opportunity credit can reduce your tax liability by up to $2,500 if you’re paying college tuition and fees.

- Continuing education, part-time classes and graduate school costs can be eligible for the lifetime learning credit, which can lower your tax bill by up to $2,000.

- Now that student loan payments have resumed, the tax break for student loan interest is even more attractive.

- You can withdraw money tax-free from a 529 college-savings plan for a wide range of education expenses, and a new rule lets you roll unused money over to a Roth IRA.

College is expensive, but there are several valuable tax breaks that can help ease the pain.

You may be able to cut your tax bill by up to $2,500 if you're paying college tuition, and you may even be eligible for tax credits that can help cover the cost of continuing education classes to improve your job skills.

Interest you pay on student loans might also be tax deductible – which is especially timely now that payments have resumed. You can use tax-advantaged savings accounts to pay for college costs, and new rules let you roll over unused money in a 529 college-savings plan into a Roth IRA.

Here's how families can make the most of these tax breaks to stretch their savings :

American Opportunity Credit for College Costs

The American opportunity credit can cut your tax liability by up to $2,500 if you're paying for the first four years of higher education for yourself, your spouse or a dependent you claim on your tax return.

To qualify for this credit, the student must be enrolled at least half time and be pursuing a degree or other recognized educational credential at a college, university, vocational school or other eligible postsecondary educational institution.

To claim the full credit, your modified adjusted gross income, or MAGI, must be $80,000 or less if you're filing as single or head of household – or $160,000 or less for married couples filing jointly .

You can claim a partial credit if your MAGI is more than $80,000 but less than $90,000 if you're filing as single or head of household – or more than $160,000 but less than $180,000 if you're married and filing jointly. The credit is calculated as 100% of the first $2,000 of qualifying expenses, plus 25% of the next $2,000 – making the maximum credit $2,500 per student.

Eligible expenses include tuition and fees, plus books, supplies and equipment.

"The expenses must be paid during the tax year for you to qualify for the tax credit, but you can pay for expenses in 2023 for an academic period that begins during the first three months of 2024,” says financial aid expert Mark Kantrowitz, author of “How to Appeal for More College Financial Aid.”

You'll usually receive Form 1098-T from the college reporting the qualified expenses you paid. To claim the credit, use IRS Form 8863 . For more information, see IRS Publication 970 Tax Benefits for Education .

Lifetime Learning Credit for Grad School and Continuing Education

If you're going to grad school or taking any continuing education classes – even if you aren't working toward a degree – you may be eligible for the lifetime learning credit. It's worth 20% of up to $10,000 in eligible expenses, with a maximum credit of $2,000 per tax return.

"Having multiple individuals in college does not get you additional credits," says Tracie Miller, a CPA and professor at Franklin University. Eligible expenses include tuition and required fees for yourself, your spouse or a dependent you claim on your tax return.

The income limits are the same as they are for the American opportunity credit – to claim the full credit for tax year 2023, your MAGI must be $80,000 or less if you're filing as single or head of household, or $160,000 or less for joint filers. You can claim a partial credit if your MAGI is between $80,000 and $90,000 as a single or head of household filer – or $160,000 to $180,000 as a married person filing jointly.

There's no limit to the number of years you can claim the lifetime learning credit, and its education requirements are much broader than the American opportunity credit.

You can take the lifetime learning credit for graduate or undergraduate expenses, and you don't have to be enrolled at least half time or working toward a degree. You can also claim the credit for continuing education, certificate programs or separate classes you take to acquire or improve job skills, and it's available for an unlimited number of tax years.

The key is that the class must be offered by an eligible educational institution, including any college, university, vocational school or other postsecondary educational institution eligible to participate in a U.S. Department of Education student aid program.

This credit can also be valuable for people who lost their jobs and took classes to improve their job prospects.

"Courses to acquire new skills may be especially relevant right now," says Melody Thornton, a CPA and tax manager at Fitzgerald and Company in San Diego.

You should receive Form 1098-T from the eligible institution reporting the qualified expenses you paid. To claim the credit, complete IRS Form 8863.

Deduction for Student Loan Interest

If you're paying back student loans, you may be able to deduct up to $2,500 in interest. Payments restarted on federal student loans, and interest began accruing, on September 1, 2023. Many borrowers who didn’t pay any student loan interest during the pandemic will be able to start claiming this tax break again, Kantrowitz says.

“The student loan interest deduction allows a deduction for interest you pay on certain student loans for you, your spouse or a dependent. The interest deduction goes to the person legally obligated to pay the interest," says Timothy M. Todd, a law professor at Liberty University School of Law in Lynchburg, Virginia.

"So, if a parent takes out the loan for his or her dependent child and the parent makes the interest payments, the parent gets the deduction. However, if a student takes out the loan and the parent pays the interest, it is treated as though the parent transferred the money to the student who then makes the payment,” he adds.

The student can't get the break, however, if their parents claim them as a dependent.

To qualify for the deduction in 2023, your MAGI must be less than $90,000 if you're filing as single or head of household – or $185,000 if you're married and filing jointly. The size of the deduction starts to phase out if your MAGI is more than $75,000 if single or head of household – or $155,000 for married, fjoint filers.

There is a $2,500 cap on the deduction per return, which means that a married couple gets a maximum deduction of $2,500 even though they could each deduct up to $2,500 if they were single, Todd says. You don't have to itemize to claim the student loan interest deduction.

Maximizing 529 Tax Breaks for Education at All Ages

You can withdraw money tax-free from a 529 savings plan for college tuition, fees and equipment such as a computer or printer. You can also withdraw money tax-free for room and board if you're enrolled at least half time, even if you don't live on campus.

Eligible expenses for off-campus housing are generally limited to room and board costs that the college reports for financial aid purposes (look for the number on your financial aid reward page or ask the aid office).

"For example, if the room and board cost reported by the school is $15,000 but it costs $30,000 for the student living off campus, then only $15,000 is a valid 529 expense," Thornton says.

You can also withdraw money tax-free for a computer, whether you attend school on campus or virtually. Computer-program costs are also eligible expenses.

"As long as the student is using it for 529-related coursework, then you can use the 529 for those expenses," says Mary Morris, CEO of Virginia529.

There's no age limit for using the money, and you don't need to be working toward a degree.

"One of the really important things we see are adults going back to school – maybe they lost their job and are taking classes or a certificate program that puts them on a road to a new career," Morris says.

You can withdraw money tax-free from a 529 for those expenses as long as you're taking the classes from an eligible educational institution. You'll get the biggest tax benefits if you can keep the money growing for years in the tax-advantaged account.

It's Not Too Late to Start a 529 Plan

If you don't already have a 529, it might still be worthwhile to open one and make the most of any tax breaks you get for contributions, even if you plan to use the money soon for education expenses.

“For parents thinking of starting a 529 plan, it’s important to realize that although many states offer a state income tax break for contributions to such plans, states typically require that the contributions be made to the 529 plan sponsored by that state,” Todd says.

Visit the Saving For College website for details about each state's plans and tax rules, and the College Savings Plans Network website for information and links to each state program’s website.

You can also withdraw up to $10,000 per year, per beneficiary, from a 529 to pay tuition for kindergarten through 12th grade and avoid paying taxes.

If your child doesn't use the money for educational expenses, you can switch the beneficiary to another eligible family member. If you take withdrawals that aren't for eligible education expenses, the earnings are taxable and subject to a 10% penalty, although the penalty is waived in some circumstances.

"If a child receives a scholarship, a distribution for up to the amount of the scholarship can be made without being subject to the 10% penalty," Miller says. "The taxpayer must, though, still pay tax on the earnings of this distribution."

Even if your child qualifies for a scholarship, you may still have other eligible expenses that qualify for tax-free withdrawals, such as room and board, fees, books and equipment.

New 529 Options in 2024

The Secure 2.0 tax law expanded the options for unused 529 money. Starting in 2024, families saving for education in 529 plans can roll over unused funds from those accounts into Roth IRAs without tax penalties. The 529 plan beneficiary must own the Roth but you can change the beneficiary, Kantrowitz says.

You can roll over only up to the annual Roth IRA contribution limit each year – $7,000 for people under age 50 in 2024 – with a $35,000 lifetime limit per beneficiary. The 529 plan must have been in existence for at least 15 years, and only funds that have been in it for at least five years are eligible for a rollover, he says.

“Financial professionals agree that although there are limitations to the rollovers, it will provide a new option for individuals who find themselves with leftover or unused money in their 529 account but who don’t want to incur the tax penalties that come with taking a nonqualified withdrawal,” Morris says.

Coordinating Tax Credits for Education With Tax-Free 529 Withdrawals

You can qualify for the American opportunity credit or lifetime learning credit and take tax-free 529 withdrawals in the same year, but you need to be careful.

"To optimize the tax benefits, you can’t use 529 distributions for the same expenses,” Todd says.

"In short, you can't 'double dip.' If you end up taking out more from the 529 plan than qualified education expenses (after accounting for the expenses used for an education credit), part of the 529 distribution may be taxable,” he says.

For example, if you claim the full American opportunity credit, the $4,000 in tuition and fees you claim is not considered a qualified education expense for your 529, and part of the distribution may be taxable.

If you claim the full lifetime learning credit, you can't take tax-free 529 withdrawals for the first $10,000 in tuition expenses you claimed for the credit but you can withdraw money tax-free from the 529 for additional expenses.

"If you withdraw money from the 529 plan and are possibly eligible to claim a credit, make sure to keep receipts for all costs so that they maximize the benefits between the 529 and the credit," Thornton says.

Answers to 15 Common Tax Questions

Kimberly Lankford April 20, 2023

Tags: money , personal finance , taxes , tax deductions , income tax , education

The Best Financial Tools for You

Credit Cards

Find the Best Loan for You

Popular Stories

Saving and Budgeting

Personal Loans

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

Your Money Decisions

Advice on credit, loans, budgeting, taxes, retirement and other money matters.

You May Also Like

Best restaurant apps for free food.

Geoff Williams May 28, 2024

How to Save on Uber and Lyft Rides

Jessica Walrack May 28, 2024

How to Avoid Doom Spending

Jessica Walrack May 24, 2024

Financial Steps to Take During A Divorce

Trade School Trend

Erica Sandberg May 23, 2024

Crowdfunding Pros and Cons

Erica Sandberg May 22, 2024

Has Tap-to-Pay Made Spending Too Easy?

Erica Lamberg May 21, 2024

Will More IRS Funding Mean More Audits?

Maryalene LaPonsie May 21, 2024

Say Yes to the Different Dress

Erica Sandberg May 20, 2024

Grow Your Assets in 2024

Erica Sandberg May 17, 2024

Financial Checklist for Newlyweds

Emily Sherman May 17, 2024

Building Generational Wealth

Beth Braverman May 17, 2024

15 Retail Rewards and Loyalty Programs

Geoff Williams May 16, 2024

Latinas Building Wealth

Erica Sandberg May 16, 2024

12 Best Discount Shopping Apps

Maryalene LaPonsie May 15, 2024

How Much to Tip Valets

Emily H. Bratcher and Emily Sherman May 15, 2024

How to Be Financially Responsible

Emily Sherman May 14, 2024

Save $1,000 for Your Summer Vacation

Erica Lamberg May 13, 2024

Hate Budgeting? Here's How to Reframe It

Jessica Walrack May 10, 2024

How Much Does It Cost to Raise a Child?

Maryalene LaPonsie May 9, 2024

Published: January 4, 2022 | Last Updated: October 24, 2023

Education tax credits and deductions.

Did you know there can be tax benefits for p u rs u ing higher ed ucation and/or specialized job training ? Certain tax credits, deductions, and savings plans can help with the cost of higher education expenses. Read below to see which option could work for you and the students in your life .

What do I need to know?

Just like the start of most learning plans, let’s start off with a few key terms to help you understand which tax benefits are available . The IRS Information Center for tax benefits for education provides the following definitions :

- Credit – reduces the amount of income tax you have to pay.

- Deduction – reduces the amount of your income that is taxed, which generally reduces the amount of tax you have to pay.

- Savings Plans – certain savings plans allow you to grow savings tax-free until the money is taken out ( distribution ), or allow the distribution to ne tax-free, or both.

Typically , education-related tax breaks fall into one of these three categories: tax credits, tax deductions, or savings plans. This page will provide information specific to certain credits and deductions.

Education Credits

An education credit helps with the cost of higher education by reducing the amount of tax you owe on your return.

- The American Opportunity Tax Credit (AOTC) is a partially-refundable tax credit for college education where the student must attend at least half-time. The credit is available for the first four years of college education.

- The Lifetime Learning Credit is a non-refundable tax credit of up to $2,000 per tax return, where you can claim qualifying expenses for any level of college or education courses to advance or improve job skills. There is no minimum enrollment requirement or limit on the number of years you can claim the credit.

“Refundable” means the credit is like a payment on your return. For the A OTC, If that that the credit amount is more than you owe, you may get a refund of up to $1,000. “Non-refundable” means the credit will only reduce your tax. Even if the credit is more than you owe, you won’t get a refund.

You can claim both the American Opportunity Tax Credit and the Lifetime Learning Credit on the same tax return, but not for the same student.

Keep records of qualifying expenses you've paid

- The student should receive an IRS Form 1098-T , Tuition Statement, from the educational institution. If the student doesn’t receive the form, the student should request one from the institution. The credit can’t be claimed without an IRS Form 1098-T, Tuition Statement, unless the educational institution is not required to furnish the form under existing rules.

- Be sure to keep records that show the student was enrolled and the amount of paid qualified tuition and related expenses. You may need to send copies of those records if the IRS contacts you regarding your claim of the credit.

Be aware of common mistakes

- The student is listed as a dependent on another tax return.

- The student doesn’t have an IRS Form 1098-T showing he or she attended an eligible institution.

- Claiming non-qualifying education expenses (such as room and board, transportation, or other family/living expenses).

- Claiming the credit for a student not attending a college or other higher education institution.

- Trying to claim both credits for the same student.

- Filing a timely tax return and the student doesn’t have a valid SSN, ITIN, or an ATIN at that time.

Caution : The amount on Form 1098-T may not be the amount of expenses you can claim. Descriptions of which expenses qualify are available in IRS Publication 970 , Tax Benefits for Education.

What should I do?

Compare the educational credits to see which fits your situation best

Each credit has different requirements and benefits. You can compare education credits on the IRS’s comparison chart .

Determine your eligibility

You may be eligible to claim an education credit if:

- You, your spouse, or a dependent on your tax return is the student.

- Qualified education expenses are tuition, fees, and other related expenses required for enrollment or attendance at an eligible educational institution. Nonacademic fees (like student activity fees or athletic fees) are qualified only if the fee must be paid to the institution as a condition of enrollment or attendance. Personal expenses (like room and board) are never qualified education expenses.

- This means any college, university, vocational school, or other post-secondary educational institution eligible to participate in a student aid program run by the U.S. Department of Education. If you’re not sure your school is eligible, ask the financial aid office.

- Your modified adjusted gross income (MAGI) falls under the limit for the credit (see the IRS’s comparison chart for details).

- For the American Opportunity Tax Credit , the student must also be pursuing a degree or other recognized education credential, and must be enrolled at least half-time for at least one academic period beginning during the tax year (or the first three months of the next tax year if the expenses were paid in the tax year).

- For the Lifetime Learning Credit, the student can be pursuing any course of instruction at an eligible educational institution to acquire or improve job skills. There is no requirement to be enrolled at least half-time. The student can take one or more courses at the qualified institution.

You’re NOT eligible if:

- Someone else, such as your parents, lists you as a dependent on their tax return.

- Your filing status is married filing separately.

- You already claimed or deducted another higher education benefit using the same student or same expenses.

- You (or your spouse) were a non-resident alien for any part of the year and didn’t choose to be treated as a resident alien for tax purposes.

- The student has a felony drug conviction (applies only to a claim for the American Opportunity Tax Credit).

- You, (or your spouse if filing a joint return), and the qualifying student didn’t have a valid taxpayer identification number (Social Security Number (SSN), or Individual Taxpayer Identification Number (ITIN), or Adoption Taxpayer Identification Number (ATIN)) issued or applied for on or before the due date of your return (including extensions).

How will this affect me?

You can only claim one education credit for any student and their expense. If you or your dependent qualifies for both credits, you may want to figure which deduction would give you the best benefit.

If you receive tax-free educational assistance, such as a grant, you need to subtract that amount from your qualified education expenses.

The PATH Act prevents you from filing past due returns or amended returns claiming the American Opportunity Tax Credit (AOTC) if the reason you’re filing is because you now have the type of valid Taxpayer Identification Number (TIN) required for each credit but such TIN wasn’t issued on or before the due date of the return (including a valid extension).

If for any reason you or one of your family members didn’t receive a valid “taxpayer identification number” on or before the due date of the tax return (including extensions) you can’t file a past due return or an amended return to claim any of these credits. A valid taxpayer identification number could be a SSN, ITIN, or ATIN depending on the requirement for each credit.

For tax years beginning after June 29, 2015, generally 2016 tax year returns, you must have received an IRS Form 1098-T from an eligible educational institution to claim the American Opportunity Tax Credit or Lifetime Learning Credit.

Wait, I still need help.

The Taxpayer Advocate Service is an independent organization within the IRS that helps taxpayers and protects taxpayers’ rights. We can offer you help if your tax problem is causing a financial difficulty, you’ve tried and been unable to resolve your issue with the IRS, or you believe an IRS system, process, or procedure just isn’t working as it should. If you qualify for our assistance, which is always free, we will do everything possible to help you.

Visit www.taxpayeradvocate.irs.gov or call 1-877-777-4778.

Low Income Taxpayer Clinics (LITCs) are independent from the IRS and TAS. LITCs represent individuals whose income is below a certain level and who need to resolve tax problems with the IRS. LITCs can represent taxpayers in audits, appeals, and tax collection disputes before the IRS and in court. In addition, LITCs can provide information about taxpayer rights and responsibilities in different languages for individuals who speak English as a second language. Services are offered for free or a small fee. For more information or to find an LITC near you, see the LITC page on the TAS website or Publication 4134 , Low Income Taxpayer Clinic List.

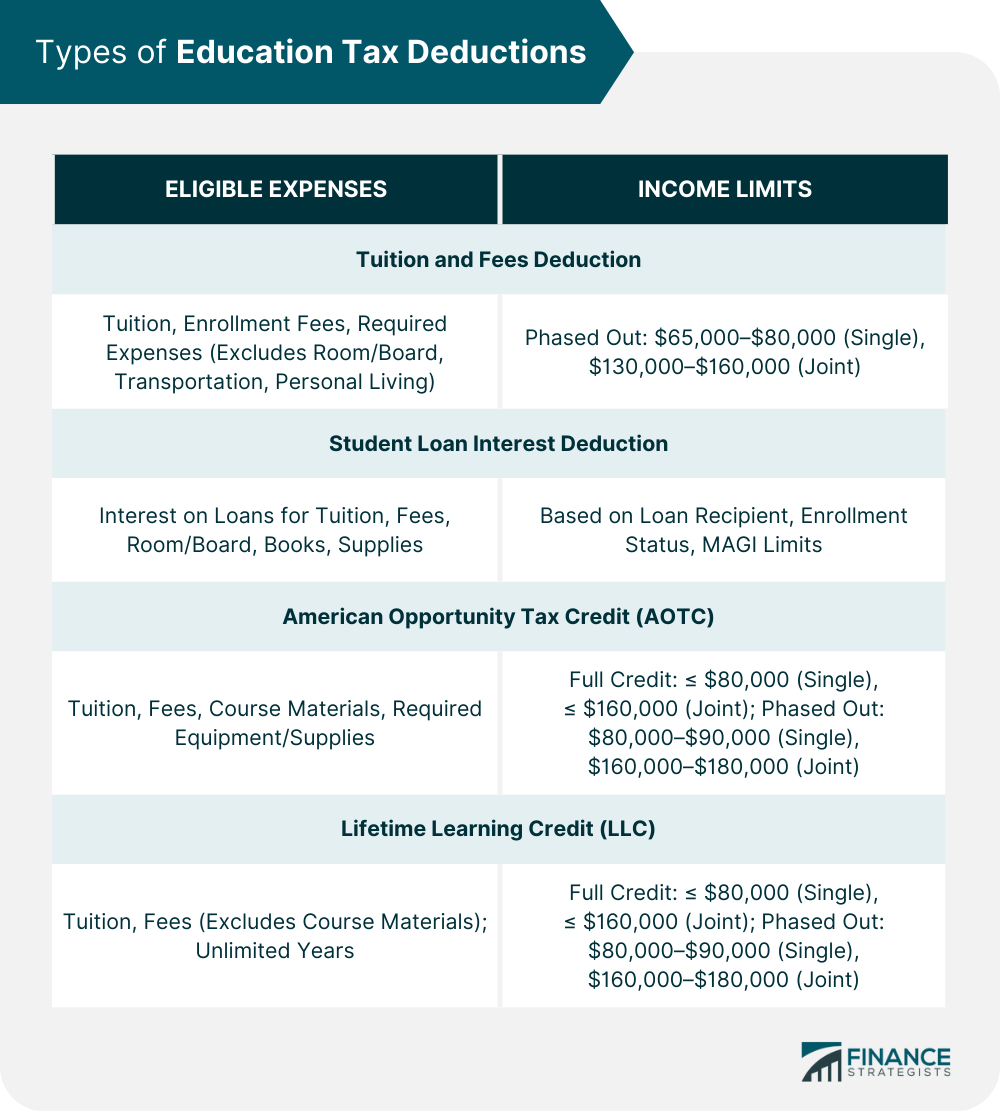

There are several education-related tax deductions that could also provide tax benefits.

Student Loan Interest Deduction

Depending on your income, you can take a special deduction for the interest you paid during the year on qualified student loans. The deduction can reduce your taxable income by up to $2,500 and can be claimed even if you do not itemize deductions on your tax return.

See IRS Publication 970 , Tax Benefits for Education, for income thresholds and other requirements.

Work-related Education Business Deduction

This deduction may benefit workers (including those who are self-employed) who itemize their deductions and paid for work-related education.

Claiming this deduction may reduce the amount of income you earn that is subject to tax. There are certain requirements you must meet to claim this deduction, and it cannot be claimed in addition to other education credits for the same expense.

Visit the IRS’s Information Center for tax benefits for education to learn about all the requirements.

MISCELLANEOUS: Educator Expense Deduction

The Educator Expense Deduction is not applicable to students or their parents pursuing higher education but is an important education-related tax benefit. Essentially, this deduction allows educators the opportunity to to deduct up to a certain amount for unreimbursed business expenses like books, supplies, computer equipment, classroom equipment and other materials used in the classroom.

The educator does not need to itemize deductions to take this credit. Read the IRS Tax Topic on Educator Expense Deduction for more details about how educators can qualify for this deduction.

Resources and Guidance

Publication 970,

Tax benefits for education.

Internal Revenue Manual (IRM)

Irm 21.6.3, credits (subsections 4.1.5, 4.1.5.1, and 4.2.11).

Education Benefits – – No Double Benefits Allowed

Treasury Regulation §1.25A-1

Calculation of education tax credit and general eligibility requirements.

Questions and Answers

American Opportunity and Lifetime Learning credits

Eligibility Tool

“am i eligible to claim an education credit”.

Did you know there is a Taxpayer Bill of Rights?

The taxpayer Bill of Rights is grouped into 10 easy to understand categories outlining the taxpayer rights and protections embedded in the tax code.

It is also what guides the advocacy work we do for taxpayers.

Related Content

Higher Education Tax Credits

Here’s what taxpayers need to know

Did you receive a letter/notice from the IRS?

See where you are in the tax system

Visit the Taxpayer Roadmap

Name, Image, and Likeness

Income Paid to Student-Athletes Is Taxable Income

An official website of the United States Government

Earned Income Tax Credit

& Other Refundable Credits

- SEARCH Toggle search Main Site Search Search

- MENU Toggle menu

Compare Education Credits

There are several differences and some similarities between the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). You can claim these two benefits on the same return but not for the same student or the same qualified expenses. See " No Double Benefits Allowed " for more information on claiming one or more education benefits.

Tax Year 2023 Education Benefits Comparison

ˆ Third Party -Qualified education expenses paid by a third party for you or a student you claimed as a dependent on your return are considered paid by you for the AOTC and LLC. Payments by third parties include amounts paid by relatives or friends.

* MAGI , modified adjusted gross income: For most people, MAGI is the amount of AGI, adjusted gross income, shown on your tax return. If you file Form 1040 or Form 1040SR, AGI is on line 8b and you add back the following:

- Foreign earned income exclusion,

- Foreign housing exclusion,

- Foreign housing deduction,

- Exclusion of income by bona fide residents of American Samoa, and

- Exclusion of income by bona fide residents of Puerto Rico.

If you need to adjust your AGI to find your MAGI, there are worksheets in the Publication 970 PDF to help you.

Education Benefits Resources

- Education Credits

- What You Need to Know about AOTC and LLC

- Education Credit Products

- Tax Benefits for Education: Information Center

- Publication 970, Tax Benefits for Education PDF

- Department of Education website

Return to Refundable Credit Toolkit

Page 6 of 11

Differences Between the Two Credits

The amount of the American Opportunity Credit is gradually reduced as taxpayers' income increases.

There is no limit on the number of years the Lifetime Learning Credit can be claimed.

The differences between the two credits are summarized in this chart.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

American Opportunity Tax Credit and Other Education Tax Credits for 2023

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The American Opportunity Tax Credit and the Lifetime Learning Credit are federal tax credits that can lower your upcoming tax bill if you paid for college in 2023.

You can claim these education tax credits as a student if you're not claimed as a dependent on anyone else's tax return. Parents can claim the credit for a student who is a dependent. Spouses can claim the credit if they use the married filing jointly status .

Here's what you need to know about the American Opportunity Tax Credit, Lifetime Learning Credit and education tax forms.

» MORE: NerdWallet's guide to the best tax software

Simple tax filing with a $50 flat fee for every scenario

With NerdWallet Taxes powered by Column Tax, registered NerdWallet members pay one fee, regardless of your tax situation. Plus, you'll get free support from tax experts. Sign up for access today.

for a NerdWallet account

Transparent pricing

Maximum refund guaranteed

Faster filing

*guaranteed by Column Tax

What is the American Opportunity Tax Credit?

The American Opportunity Tax Credit is a federal tax credit that allows you to lower your tax bill by up to $2,500 if you paid that much in undergraduate education expenses last year.

How the American Opportunity Tax Credit works

The American Opportunity Tax Credit lets you claim all of the first $2,000 you spend on eligible education expenses, plus 25% of the next $2,000, for a total of $2,500. Qualified expenses include:

Mandatory school fees.

Books and supplies.

You may not claim living expenses or transportation costs.

Who can claim the American Opportunity Tax Credit?

The American Opportunity Tax Credit is for undergraduate college students only. To qualify, students must meet the following criteria, according to the IRS:

Be pursuing a degree or other recognized education credential.

Be enrolled at least half time for at least one academic period beginning in the tax year.

Not have finished the first four years of higher education at the beginning of the tax year.

Not have claimed the American Opportunity Tax Credit for more than four tax years.

Not have a felony drug conviction at the end of the tax year.

As a student, you can claim the credit on your taxes for a maximum of four years as long as no one else, like your parents, claims you as a dependent on their tax returns. Parents will claim the credit, instead of the student, if they paid for the student's education expenses and have the student listed as a dependent on their return.

Your 2023 modified adjusted gross income, or MAGI, determines how much of the American Opportunity Tax Credit you can claim:

What the American Opportunity Credit is worth

The American Opportunity Tax Credit lowers the amount of taxes you pay. For example, if you owe $3,000 in taxes and get the full $2,500 credit, you’ll only have to pay $500 to the IRS.

Is the American Opportunity Tax Credit refundable?

Yes, it's refundable. You can still receive 40% of the American Opportunity Tax Credit's value — up to $1,000 — even if you earned no income last year or owe no tax. For example, if you qualified for a refund, this credit could increase the amount you'd receive by up to $1,000. That's why the American Opportunity Tax Credit is typically the best education tax break for students and their families.

» MORE: Guide to filing taxes with student loans

What is the Lifetime Learning Credit?

The Lifetime Learning Credit is a a federal tax credit that can reduce your taxable income by up to $2,000 if you're pursuing an undergraduate, graduate, vocational or non-degree program. Unlike the American Opportunity Tax Credit, there's no limit to the number of tax years in which you can claim this credit.

How the Lifetime Learning Credit works

You can claim 20% of the first $10,000 you paid toward 2023 tuition and fees, for a maximum of $2,000 each year.

Course supplies, living expenses and transportation costs are not qualified expenses for the Lifetime Learning Credit.

Who can claim the Lifetime Learning Credit?

The Lifetime Learning Credit is ideal for graduate students or anyone taking classes to develop new skills, even if you already claimed the American Opportunity Tax Credit on your taxes in the past.

Students can claim the Lifetime Learning Credit for themselves if they file their own taxes. Parents of dependent students can also claim the credit.

To qualify for the Lifetime Learning Credit, you must meet the following criteria, according to the IRS:

Be enrolled or taking courses at an eligible educational institution.

Be taking higher education courses to get a degree or other recognized education credential or to get or improve job skills.

Be enrolled for at least one academic period beginning in the tax year.

Your 2023 modified adjusted gross income, or MAGI, determines how much of the Lifetime Learning Credit you can claim:

Is the Lifetime Learning Credit refundable?

No, the Lifetime Learning Credit is not refundable. You can use the credit to pay any tax you owe, but you won't receive the money back as a refund, even if you earned no income or owe no tax.

» MORE: The difference between tax credits and tax deductions

American Opportunity Tax Credit vs. Lifetime Learning Credit

The American Tax Opportunity Credit is generally more valuable that the Lifetime Learning Credit, if you qualify. You can't claim both the American Opportunity Tax Credit and the Lifetime Learning Credit for the same student or the same qualified expenses.

Here are the key differences between these two education tax credits:

Education tax forms

In January your school will send you Form 1098-T, a tuition statement that shows the education expenses you paid for the year. You’ll use that form to enter the corresponding amounts on your tax return to claim an education tax credit or deduction.

If you also paid student loans , you may be able to deduct student loan interest from your taxable income. If you paid more than $600 in interest, your servicer will automatically send you Form 1098-E. You can still deduct interest if you paid less than $600, but you’ll have to ask your servicer for the form.

If your company provided funds for educational assistance — like tuition reimbursement or employer student loan repayment — up to $5,250 can be excluded from your taxable income.

On a similar note...

Policygenius does not allow the submission of personal information by users located within the EU or the UK. If you believe this action is in error, or have any questions, please contact us at [email protected]

- Life Stages

- Tax Breaks and Money

- View all Tax Center topics

Tax Credits For Higher Education

If you have post-secondary school education expenses, you might be eligible for two credits.

American Opportunity Credit

You might be able to claim an American Opportunity Credit of up to $2,500 for 2023. You can apply this to qualified education expenses paid for each eligible student. The credit is calculated in two parts and is equal to:

- 100% of the first $2,000 of eligible expenses

- 25% of the next $2,000 in eligible expenses

This is a per-student limit. You can only claim it for the first four years of higher education. This credit is 40% refundable for most taxpayers.

Lifetime Learning Credit

You might be able to claim a Lifetime Learning Credit of up to $2,000 for qualified education expenses. You can claim this credit only once per return. However, there’s no limit on the number of years you can claim the credit.

For the Lifetime Learning Credit, you can claim a maximum of $10,000 in total expenses for all eligible students. The credit is equal to 20% of the expenses. So, the maximum credit allowed is $2,000 (20% of $10,000). If you have fewer expenses, your credit will be lower.

Credit eligibility

To qualify for the American Opportunity Credit or the Lifetime Learning Credit, you must meet all of these requirements:

Eligible educational institution

Eligible expenses

- Eligible student

An eligible institution for both credits:

- Is a post-secondary institution

- Can participate in a student financial aid program from the U.S. Department of Education

Institutions include:

- Universities

- Post-secondary vocational schools

- Other post-secondary educational institutions

These expenses for the Lifetime Learning Credit include:

- During the year

- Within three months after the close of the year

Expenses for the American Opportunity Credit include tuition and fees required for the course or program. This is for courses or programs you take:

- Books, supplies, and equipment needed for a course of study. It doesn’t matter if you bought these materials from the school as a condition of enrollment or attendance.

Ineligible expenses for the education credits include:

- Incidentals

- Transportation

- Medical expenses

- Noncredit courses

Eligible students

Each credit has a different definition of an eligible student. Eligible students for the American Opportunity Credit must meet these requirements:

- Carry at least half the normal full-time workload for the student’s course of study in at least one academic period during the year

- Certificate

- Other recognized educational credential

- Not have expenses used for an American Opportunity Credit in any four earlier tax years. This includes a tax year when you claimed the Hope Credit for the same student.

- Not have completed the first four years of higher education as determined by the institution

- Not have been convicted of a felony offense for possessing or distributing a controlled substance

- Not have an adjusted gross income (AGI) that’s more than the phase-out limits — $80,000 if filing as single or $160,000 if married filing jointly. The credit is completely phased out for AGIs of $90,000 if single and $180,000 if married filing jointly

Eligibility for the Lifetime Learning Credit isn’t based on a student’s workload. A student who takes one or more courses is eligible. The credit also isn’t limited to a student’s first four years.

Qualified expenses for the Lifetime Learning Credit also include the cost of courses that aren’t part of a degree or certificate program. So, working adults who take occasional courses to strengthen their job skills are eligible to claim this credit.

Other requirements

These are other requirements for the credits:

- You can’t claim both the American Opportunity Credit and the Lifetime Learning Credit for the same student.

- You’re married.

- You and your spouse file separate returns.

Both credits are phased out as your income climbs:

- If you’re filing as single or head of household, the credit starts phasing out at $55,000 and is eliminated at $65,000.

- If married filing jointly, the credit starts phasing out at $110,000 and is eliminated at $130,000.

- If you’re filing as single or head of household, the credit starts phasing out at $80,000 and is eliminated at $90,000.

- If married filing jointly, the credit starts phasing out at $160,000 and is eliminated at $180,000.

To learn more, see these at www.irs.gov:

- Publication 970: Tax Benefits for Higher Education

Was this topic helpful?

Yes, loved it

Could be better

Related topics

Need to know how to claim a dependent or if someone qualifies? We’ll help you find the answers you need.

Confused about tax deductions? Find out what adjustments and deductions are available and whether you qualify.

We can help you with your taxes without leaving your home! Learn about our remote tax assist options.

Find out about your state taxes—property taxes, tax rates and brackets, common forms, and much more.

Recommended articles

Personal tax planning

Filing taxes for a deceased taxpayer: FAQs

Adjustments and deductions

Don’t overlook these 11 common tax deductions

New baby or house? How major life changes affect your taxes

No one offers more ways to get tax help than H&R Block.

IRS Form 8917: Full Guide to Understanding Tuition and Fees Deduction

Share this article!

Here’s a great reason to continue your education – The IRS will allow you to claim a deduction on your post-secondary tuition and fees! When you or your tax preparer files IRS form 8917, you can deduct a portion of your tuition and fees for all qualifying post-secondary education.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

What is the IRS form 8917?

IRS Form 8917 allows you to take a tuition and fee deduction on a qualifying post-secondary course.

When you enroll into a post-secondary school course, the school will send you Form 1098-T. This form will allow you to file your tuition and fees deduction.

You will only be allowed to deduct the amount stated on the Form 1098-T.

Other educational costs such as books, equipment, room & board can not be deducted with IRS form 8917.

File with Ease from Home Today!

Example Scenario for Form 8917

Becky is a single 26 year old high school guidance counselor who is enrolled in the Masters Program for Psychology at the University of Georgia. Her in-state tuition and fees during the 2019 tax year was $11,357. Her additional costs for textbooks, room and board were $7,289. Becky received a Form 1098-T from the University of Georgia which indicated a tuition and fee cost of $11,357. Becky’s salary as a high school guidance counselor is $48,700. Her salary as a single tax filer is under the $80,000 adjusted gross income (AGI) single filer limit for IRS Form 8917 eligibility. Therefore, she will qualify for the Tuition and Fees Deduction. She will be able to file IRS Form 8917 and include $11,357 on the form for the 2019 tax year. Becky’s maximum deduction will be $4,000.

What to Know About this IRS Tax Form

Here are some frequently asked questions regarding IRS Form 8917.

What is the tuition and fees deduction Form 8917?

The tuition and fees deduction Form 8917 is a form that allows you to deduct a portion of your qualifying post-secondary education during a given tax year.

How many courses do you need to attend to qualify for the deduction?

You only need to take one course during the tax year to qualify for the deduction. Even if you drop out, you can still qualify for the deduction if the school does not issue you a refund.

What is the difference between form 8863 and 8917?

Both IRS form 8863 and IRS form 8917 offer tax savings for education expenses and are often confused with each other.

Here is the main difference between form 8863 and form 8917:

- Form 8873 gives you the Tuition and Fees Deduction

- IRS Form 8917 offers you two different tax deductions – the Opportunity Tax Credit and the Lifetime Learning Credit.

- Form 8873 is a tax deduction while Form 8917 is a tax credit. A deduction reduces your taxable income while a tax credit gives you a dollar for dollar reduction on your taxes.

What courses do not qualify for Form 8917?

The following courses will not qualify if taken at a post secondary school:

- Courses or any other education involving games, sports or hobbies

- Non-credit courses (Exceptions are non-credit courses that is part of a student’s degree program or a course that helps the student acquire a job or improve job skills)

Can I take the tuition and fees deduction?

You can take the tuition and fees deduction if you have taken at least one course from a qualifying post-secondary school in a tax year.

Does Form 1098-T affect Form 8917?

Form 1098-T is the form that is issued by the school to show how much tuition and fees that you paid to the school during the tax year.

You will need to submit Form 1098-T in order to file Form 8917.

What is the deduction limited, per tax year. Form Form 8917?

The most that you can deduct during a tax year is $4,000 for tax year 2019. If you spend more than

$4,000, then that amount can not be deducted. Also, the excess cost can not be carried over to the next year.

What post-secondary schools qualify for Form 8917?

A qualifying school must be an educational program that is eligible for the Federal student financial aid program.

The qualifying school will typically require a high school or GED diploma before enrolling.

Can I make deductions for tuition that I prepaid for the next year?

Yes, you can take a deduction if you paid this year for a course that you will be taking the next year. However, the course will have to start before April 1 of the next year.

Is there an income limit to using IRS Form 8917?

Yes. If you are single and have an Adjusted Gross Income (AGI) of more than $80,000 or if you are married and have an AGI over $160,000 then you will not be able to qualify for the tuition and fees deduction.

Is there a residency requirement to file Form 8917?

There is no residency requirement to file Form 8917.

What information do I need to have to fill out IRS Form 8917?

IRS Form 8719 is a relatively short IRS form that is only half a page long. Here is the information that you will need to have in order to complete the form:

- Student name

- Student social security number

- Adjusted qualified expenses (tuition & fees)

- Your adjusted gross income

Who can not file Form 8917?

You can not file Form 8917 if:

- Your filing status is married and filing separately.

- Someone can claim you as a dependent.

- Your AGI is over $80,000 as a single filer.

- If your AGI is over $160,000 as a married filer.

- You are a non-resident alien and you didn’t elect the non-resident alien tax status.

3 Easy Tips to Remember for Form 8917

- Make sure that the course(s) that you are taking is eligible for the Form 8917 deduction.

- Make sure that your AGI is below the limit to be eligible for the Form 8917 deduction.

- Ask your school or university where you will receive Form 1098-T.

Getting your tuition and fee deduction this year

IRS Form 8917 allows you to claim a tax deduction for your post-secondary education expenses. Be sure to check if you qualify for the Tuition and Fees Deduction before you enroll.

For more money-saving tips and guides, subscribe to the weekly newsletter !

I hope this helps your situation.

If you enjoyed this article, then you’ll love these:

- Best Rules for Claiming a Dependent on Your Tax Return

- When and How to Claim Tips on Your Tax Return

- Do I Need to File a Tax Return?

- How to Choose the Best Filing Status

- Top 12 Things You Must Know About the New Tax Law

Get started on your taxes early here!

Until the next money adventure, take care!

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**

Nikida Metellus

Nikida Metellus is a financial freedom advocate, author, and the reimagined voice behind ThemeParkHipster.com, now focused on helping you achieve a debt-free life and financial success. Based in Orlando, Florida, she combines her love for theme parks with actionable financial strategies, offering a unique perspective on balancing fun and finances. As the author of Complete Tax Planning Guide , she has now expanded her expertise to guide you on the road to financial freedom. Co-founder of Bramework and a coffee enthusiast at heart, Nikida is committed to empowering you with practical tips and insights to manage your money wisely. When she's not blogging or exploring Florida's attractions, she enjoys quality time with her husband and two daughters. Welcome to your journey toward a financially free life!

11 Education Tax Credits and Deductions

Education tax credits and deductions are available for college savings, current students, and college graduates.

- Newsletter sign up Newsletter

It's not always easy to determine which education tax credits and deductions you qualify for, and you might not know about all the tax breaks available. In fact, you probably have more options for saving on college costs than you think.

There are tax breaks for people saving for college, current students, and graduates who are paying off student loans .

Taking advantage of these tax breaks may help you keep more of your money.

Here's what you need to know about education tax credits and deductions before you file your 2023 income tax return this year.

To continue reading this article please register for free

This is different from signing in to your print subscription

Why am I seeing this? Find out more here

Education tax break: 529 plans

While investment income is generally taxable, income from investments in a 529 college savings plan is not. That means you won't need to pay federal taxes on the income you earn from your 529 plan (as long as you use it for qualified education expenses).

Some states also allow you to deduct your 529 plan contributions from your taxable income. That means you may not need to pay state income tax on the money you use to fund your 529 plan.

The rules for 529 savings plans don't always limit qualifying education expenses to college tuition or books. Parents and guardians may be able to use the savings to pay for other types of education. For example:

- You may use up to $10,000 for private K-12 education

- You may use your 529 savings plan to pay for trade school.

- You may change the beneficiary of the 529 savings plan if needed (transfer the plan to another individual).

What if my child doesn't go to college? Starting in 2024, up to $35,000 (lifetime limit) can, under a provision in the SECURE 2.0 Act , be rolled over from a 529 plan to a Roth IRA. So, your child or grandchild might be able to eventually benefit from your 529 contributions, even if they don't use the funds for education. However, there are rules governing these 529-to-Roth rollovers, one of which is that you had to have to 529 plan for at least 15 years. There are also specific plan beneficiary requirements.

Overall, rules and benefits for 529 plans vary by state and are based on the 529 savings plan you choose, so it is always important to do your research to see which plan best aligns with your family’s needs.

Sponsored Content

Education tax break: Coverdell education savings accounts (ESAs)

Another way to save for college is through a Coverdell Education Savings Account (ESA). Like 529 plans, money deposited in a Coverdell ESA grows tax free, and there's no tax on distributions used for qualified college expenses. Additionally, you may choose your own investments with a Coverdell savings account. However, unlike 529 plans, the tax code places limits on who can contribute to a Coverdell ESA.

- Single people can contribute to a Coverdell ESA only if they have a modified adjusted gross income (MAGI) of $110,000 or less.

- Married couples filing a joint return can't have a modified AGI of more than $220,000.

(Modified AGI is equal to your federal AGI, plus any foreign earned income exclusion and/or housing exclusion, foreign housing deduction, and excluded income from Puerto Rico or American Samoa.)

There are other limits for Coverdell Education Savings Accounts.

- The maximum contribution limit for 2023 is $2,000 per child.

- You can only contribute to a Coverdell ESA until your child is 18 (unless your child has special needs).

- Amounts still remaining in a Coverdell ESA must be distributed within 30 days after the beneficiary's 30th birthday (unless the beneficiary has special needs).

American opportunity tax credit

The American Opportunity tax credit (AOTC) is an education tax credit available to people who are currently enrolled in college courses. The credit is partially refundable, meaning it is possible to receive part of the total credit as a tax refund.

- Eligible taxpayers (student, parent or spouse) can claim the credit for 100% of the first $2,000 spent on qualified education expenses (such as tuition, fees and textbooks).

- Eligible taxpayers can claim 25% of the next $2,000.

- The total credit is worth up to $2,500 for each qualifying student.

- If the credit amount exceeds the tax you owe for the year, you'll get a refund for 40% of the remaining amount, up to $1,000, for each qualifying student.

Not every student can claim the credit. If any of the following apply, you are not eligible to claim the AOTC.

- You are not in your first four years of college.

- You are not enrolled in college courses at least half-time for at least one academic period in the tax year.

- You are not pursuing a college degree or other qualified education credential.

- You have had a felony drug conviction.

- You are claimed as a dependent on another tax return.

- You have already claimed the AOTC (or the former Hope credit) for four tax years.

(Note: If the IRS audits your return and determines you claimed the credit when you were not eligible, you could be banned from claiming the credit for up to 10 years. Additionally, the IRS could impose a penalty for fraud.)

You can only claim qualified expenses for the AOTC. These include tuition and certain related expenses required for enrollment or attendance at the student's college (for example, necessary fees, books, supplies, and equipment).

What expenses do not qualify? Amounts paid for insurance, medical expenses (including student health fees), room and board, transportation, and living or family expenses do not qualify.

The amount of the credit you can claim depends on your adjusted gross income (AGI). If you can't claim the full credit, you may be able to claim part of it.

- Joint filers qualify for the full credit if their modified AGI is $160,000 or less

- Single filers get the full amount with a modified AGI of $80,000 or less

- The credit is gradually reduced to zero for married couples with a modified AGI between $160,000 and $180,000

- The credit is gradually reduced to zero for single taxpayers with a modified AGI between $80,000 and $90,000

There are a number of rules that prevent duplicate tax benefits. You can't deduct education expenses you use to calculate the AOTC anywhere else on your tax return. For example, if you deduct textbook expenses as a business expense, the IRS says you can't use those book expenses to calculate the AOTC.

Lifetime learning tax credit

Another tax credit for people currently enrolled in college is the Lifetime Learning Credit (LLC). This credit is worth up to $2,000 per tax return. Unlike the American Opportunity tax credit, eligible graduate students can claim the credit. And students don't need to attend at least half-time to claim the credit, either.

This education credit can be claimed for an unlimited number of years. However, the Lifetime Learning credit is not refundable. This means it can lower your tax bill to zero, but you won't receive any portion of the credit as a tax refund.

Income guidelines for the Lifetime Learning Credit are the same as those for the American Opportunity Tax Credit (AOTC).

- If you're married and filing a joint return, you can claim the full credit if you're modified AGI is $160,000 or less.

- Single filers with a modified AGI of $80,000 or less can claim the full credit.

- The credit is gradually reduced to zero for joint filers with a modified AGI between $160,000 and $180,000.

- For single taxpayers, the credit is gradually reduced to zero when the modified AGI is between $80,000 and $90,000.

Like with the AOTC, education tuition and fees required for enrollment qualify as education expenses. But more people may qualify for the Lifetime Learning Credit since classes to improve job skills might qualify.

Note: Just like with the AOTC, the IRS says you cannot claim expenses you use to calculate the Lifetime Learning credit anywhere else on your tax return.

Tax breaks for scholarships and other assistance

A scholarship, fellowship, or grant may be excluded from taxable income if you're pursuing a degree at an eligible educational institution. Education assistance is only tax-free if the funds are used to pay for qualified education expenses.

What are Qualified Education Expenses?

- Tuition or fees that are required for enrollment or attendance

- Books, supplies, equipment or other expenses that are required by the learning institution for a class.

To be considered tax-free, scholarships can't exceed your education expenses or be used to pay for expenses such as room and board or travel.

What about VA education benefits? Payments to veterans for education under any law administered by the Department of Veterans Affairs are tax-free. However, if you qualify for other education tax benefits in addition to military benefits , you may have to reduce the amount of education expenses that you claim.

Qualified Tuition Reduction: If your tuition is reduced because you or a relative work for a college, you might not have to pay tax on the discount.

For graduate courses, only students who perform teaching or research activities for the educational institution can receive tax-free tuition reductions.

If you receive a tuition reduction for undergraduate courses, it's tax-free only if you meet one of the following criteria.

- Are an employee of the college

- Are a former employee of the college who retired or left on disability

- Are a widow(er) of someone who died while employed by the college or who retired or left on disability

- Are the dependent child or spouse of someone described above

Employer-provided educational assistance

While not an education tax credit, employer-provided education assistance can sometimes result in a tax break. Workers who receive educational assistance benefits from their employer can exclude up to $5,250 of those benefits from their taxable income each year.

Employee educational assistance benefits must be paid under a written educational assistance program.

However, payments for the following items are not considered tax-exempt as part of employee education assistance.

- Meals, lodging or transportation

- Tools or supplies (other than textbooks) that you can keep

- Courses involving sports, games or hobbies (unless they have a reasonable relationship to the employer's business or are required as part of a degree program)

Employees generally have to pay tax on any educational assistance benefits over $5,250. However, benefits over the $5,250 limit are still tax-free if they qualify as a working condition fringe benefit. (A benefit that would be allowable as a business expense deduction if you had paid for it.)

If any portion of your employee education assistance is taxable, the amount will be listed in box 1 of your Form W2 .

As a reminder, the IRS says you cannot claim expenses paid with tax-free employee assistance anywhere else on your tax return.

Education tax deduction for the self-employed

There are a number of self-employment tax deductions . For example, self-employed people generally can deduct the cost of work-related education as a business expense. This reduces the amount of income subject to both the federal income tax and self-employment tax. To qualify as a business deduction, the education must meet meet one of the following conditions:

- Be required to keep your present salary, status or job

- Taken to maintain or improve skills needed in your present work

Even if your education meets the above qualifications, the IRS says you won't be able to claim education expenses as business deductions if any of the following apply:

- The education is needed to meet the minimum qualifications of your trade or business

- The education is part of a program that would qualify you for a new trade

Various types of expenses can qualify for education tax deductions if you are self-employed. These include (but are not limited to) the following:

- Books and supplies

- Some transportation expenses (for example, transportation costs to get to and from classes)

What expenses aren't deductible? You cannot deduct the dollar value of vacation time or annual leave taken to attend classes.

If you used funds from a tax-free scholarship, grant, or employer-provided educational assistance to cover the cost of education expenses, you cannot those costs as a business expense.

You also cannot deduct education expenses if you used the expenses to calculate another credit (like the AOTC or Lifetime Learning Credit).

Early distributions from IRAs

Individual retirement accounts (IRAs) are meant to be used in retirement. You generally have to pay a 10% tax if you take money out of an IRA before you reach age 59½ .

However, it's possible to withdraw funds from an IRA to pay for qualified higher education expenses without having to pay the 10% tax penalty.

For the 10% penalty tax to be waived, early distributions should be taken in the same year that expenses are paid. Additionally, education expenses must be for one of the following people:

- Your spouse

- Your or your spouse's child, foster child or adopted child

- Your or your spouse's grandchild

Many types of education expenses qualify to avoid the 10% penalty. According to the IRS, you can use early distributions to pay for the following qualified education expenses:

- Tuition and fees

- Books, supplies, and equipment required for enrollment or attendance

- Room and board for student's attending at least half-time

- For students with special needs, expenses for any special services incurred in connection with the student's enrollment or attendance also qualify

Distributions that exceed the dollar amount of qualified education expenses are subject to the 10% penalty.

Note: You will still need to pay income tax on the amount withdrawn from IRAs, even if the distributions are used to pay for qualified education expenses.

Education savings bond program

You might be able to cash in savings bonds without paying tax on the interest earned. To avoid paying tax on interest earnings, you can use the earnings to pay qualified education expenses for yourself, your spouse, or a dependent.

The savings bonds must be series EE bonds issued after 1989 or series I bonds . The bonds must also be issued either in your name (as the sole owner) or in the name of you and your spouse (as co-owners). Additionally, the owner must be at least 24 years old before the bond's issue date.

If you want to avoid paying federal income tax on interest from these savings bonds, you must use the earnings to pay for qualified education expenses.

Qualified Education Expenses

- Equipment and supplies (for example, a laptop)

Qualifying expenses must be paid to a school that is eligible to participate in federal student aid programs. The expenses should also be paid in the same year that savings bonds are redeemed.

You also need to have income that does not exceed the income threshold the IRS sets each year. You will claim your exclusion of interest from series EE and I savings bonds on Form 8815 .

Tax deduction for student loan interest

In some cases, you can take an education tax deduction for the interest you paid on your student loans. You can take this deduction whether or not you itemize. (Most people take the standard deduction .)

You can only deduct up to $2,500 of student loan interest paid each year. However, how much you can deduct depends on your modified AGI . That $2,500 is gradually reduced to zero for single filers with a modified AGI between $70,000 and $85,000. For joint filers, the amount is reduced with a modified AGI between $145,000 and $175,000.

To deduct student loan interest, you must have taken out the loan solely to pay qualified education expenses for you, your spouse, or a person who was your dependent at the time you took out the loan.

These items are typically considered by the IRS to be qualified education expenses:

- Room and board

- Books, supplies, and equipment

- Other necessary expenses (such as transportation to and from classes)

Married couples filing separate returns cannot claim the student loan interest deduction . You're also disqualified if someone else (such as a parent or guardian) claims you as a dependent on their tax return.

Education tax breaks for student loan forgiveness

While federal student loan payments have resumed, some graduates might have student loans forgiven through other programs. So, it's good to know whether your forgiven student loan amounts are taxable or tax-free.

If you have had $600 or more of your student loans forgiven, the forgiven amount could be considered taxable income . However, discharged loan amounts resulting from certain student loan forgiveness and repayment assistance programs are tax-free.

You may not need to pay income tax on amounts forgiven through the public service loan forgiveness or other assistance programs that are listed below.

- Teacher loan forgiveness

- Law School repayment assistance

- National Health Service Corps Loan Repayment Program (The 2023 application cycle is currently closed).

Related Content

- A Little-Known Tax-Free Way To Help Pay Your Student Loan

- Don’t Miss This $2,500 Tax Break for Paying Your Student Loan

- Is Your Scholarship Tax-Free or Taxable?

- 2023 Child Tax Credit: Who Qualifies and What It’s Worth

Katelyn has more than 6 years of experience working in tax and finance. While she specialized in tax content while working at Kiplinger from 2023 to 2024, Katelyn has also written for digital publications on topics including insurance, retirement, and financial planning and had financial advice commissioned by national print publications. She believes knowledge is the key to success and enjoys providing content that educates and informs.

Both spouses can receive Social Security based on their individual earnings records and at what age they claim benefits

By Kathryn Pomroy Published 26 May 24

There are many technological solutions to help retirees live at home, rather than enter homes and communities.

By Elaine Silvestrini Published 26 May 24

Tax Credits Treasury and IRS have finalized regulations for the up to $7,500 electric vehicle tax credit.

By Kelley R. Taylor Last updated 6 May 24

Health Savings HSAs offer valuable tax benefits, but can 'hidden costs' erode those advantages?

Tax Rules A pending Biden administration marijuana rule change could help some businesses lower their taxes.

By Kelley R. Taylor Last updated 5 May 24

Tax Cuts Georgians now have a tax package containing income tax cuts, childcare relief, and potential property tax caps.

By Kelley R. Taylor Last updated 23 April 24

Tax Breaks Lowering your taxable income is the key to paying less to the IRS. Several federal tax credits and deductions can help.

By Kelley R. Taylor Last updated 9 April 24

Tax Deductions Do you qualify for the student loan interest deduction this year?

By Katelyn Washington Last updated 29 March 24

Tax Breaks Depending on your age, several tax credits, deductions, and amounts change — sometimes for the better.

By Kelley R. Taylor Last updated 19 March 24

Tax Credits President Biden is calling for new middle-class tax breaks including a mortgage tax credit.

By Kelley R. Taylor Last updated 9 March 24

- Contact Future's experts

- Terms and Conditions

- Privacy Policy

- Cookie Policy

- Advertise with us

Kiplinger is part of Future plc, an international media group and leading digital publisher. Visit our corporate site . © Future US, Inc. Full 7th Floor, 130 West 42nd Street, New York, NY 10036.

Member Login

- Get Listed Today

5 Education Tax Credits and Deductions You Can Claim for 2022

Education tax credits and deductions can provide significant tax savings for individuals paying for higher education expenses. For the 2022 tax year, there are two main education tax credits available: the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). In addition, several education-related deductions can be claimed, including the tuition and fees deduction, the student loan interest deduction, and the educator expenses deduction.

The AOTC is a tax credit of up to $2,500 per eligible student and is available for the first four years of post-secondary education. The LLC is a tax credit of up to $2,000 per tax return and is available for unlimited years of post-secondary education.

Education tax deductions can provide a dollar-for-dollar reduction of your taxable income and can be especially valuable for taxpayers who are not eligible for the education tax credits. The tuition and fees deduction provides a maximum deduction of $4,000 for qualified higher education expenses. The student loan interest deduction allows you to deduct up to $2,500 of student loan interest paid during the year. The educator expenses deduction provides a deduction of up to $250 for qualified out-of-pocket expenses incurred by K-12 educators.

It is important to understand the eligibility requirements and rules for each of these education tax benefits and to consult with a tax professional for guidance on how to claim them on your tax return.

Below are 5 Education related Tax Credits & deductions for college.

The American Opportunity Tax Credit (AOTC)

The American Opportunity Tax Credit (AOTC) is a tax credit of up to $2,500 per eligible student for the first four years of post-secondary education. Here's how it works:

Eligibility: To be eligible for the AOTC, the student must be pursuing a degree or other recognized education credential and must be enrolled at least half-time for at least one academic period that begins during the tax year. Additionally, the student must not have completed the first four years of post-secondary education as of the beginning of the tax year.

Calculation: The AOTC is equal to 100% of the first $2,000 of qualified education expenses plus 25% of the next $2,000 of qualified education expenses. This means that the maximum credit is $2,500 per eligible student.

Refundability: The AOTC is partially refundable, which means that if the credit exceeds your tax liability, you may receive a refund for up to 40% of the unused credit or up to $1,000.

Who can claim the AOTC: The AOTC can be claimed by the taxpayer who pays the qualified education expenses for an eligible student, which is typically the student's parent or guardian. The credit can only be claimed by one taxpayer per eligible student and is subject to income limits.

It is important to consult with a tax professional for guidance on the specific rules and requirements for claiming the AOTC and determine if you are eligible for this tax credit based on your specific circumstances.

Lifetime Learning Credit

The Lifetime Learning Credit (LLC) is a tax credit available for post-secondary education expenses, such as tuition and fees, books, and supplies. The credit is worth up to $2,000 per tax return and is available for unlimited years of post-secondary education.

Who can claim the LLC:

The taxpayer, their spouse, or a dependent listed on their tax return must be paying for post-secondary education expenses.

The taxpayer's modified adjusted gross income must be within certain limits, which are subject to change each year.

The LLC can be claimed for any type of post-secondary education, including courses to acquire or improve job skills.

Refundability: The LLC is not refundable, meaning that it can only reduce your tax liability to zero but not generate a refund. If the credit exceeds your tax liability, the excess cannot be refunded or carried forward to future tax years.

It is important to note that the LLC may not be claimed in the same year as the American Opportunity Tax Credit (AOTC) for the same student. Therefore, taxpayers should compare the AOTC and LLC to determine which provides the greatest benefit and consult with a tax professional for guidance.

Student loan interest deduction

The student loan interest deduction is a tax benefit that allows individuals to deduct up to $2,500 of student loan interest paid during the year. Here's how it works:

Eligibility: To claim the student loan interest deduction, the taxpayer must be legally obligated to pay interest on a qualified student loan. The loan must be used solely to pay for qualified higher education expenses for the taxpayer, their spouse, or their dependents.

Income limitations: The student loan interest deduction is subject to income limitations, and the amount of the deduction is gradually reduced for taxpayers with modified adjusted gross income (AGI) between $70,000 and $85,000 for individuals and $140,000 and $170,000 for married couples filing jointly.

How to claim: The student loan interest deduction is claimed as an adjustment to income on Form 1040 or Form 1040-SR.

Deductibility: The student loan interest deduction is not refundable, meaning it cannot be claimed for a tax refund. However, it can still provide significant tax savings by reducing the taxpayer's taxable income.

Educator expense deduction

The educator expense deduction is a tax benefit available to K-12 educators who incur out-of-pocket expenses for classroom supplies and equipment. Here's how it works:

Eligibility: To be eligible for the educator expense deduction, the taxpayer must be a K-12 educator who works at least 900 hours during a school year. The deduction is available for expenses incurred for books, supplies, computer equipment (including related software and services), other equipment, and supplementary materials used in the classroom.

Amount of deduction: The deduction is equal to up to $250 per taxpayer, regardless of the number of students or classrooms the taxpayer works in. The deduction is taken as an adjustment to income and is therefore taken before the calculation of AGI.

How to claim: The educator expense deduction is claimed on Form 1040 or 1040-SR and is reported as an adjustment to income. No itemization is required.

Refundability: The educator expense deduction is not refundable, meaning that it cannot reduce a taxpayer's liability to less than zero. If the deduction reduces a taxpayer's liability to zero, any unused portion of the deduction is lost and cannot be carried forward to future tax years.

Work-related education expense deduction

The work-related education expense deduction allows taxpayers to deduct qualified expenses incurred for education that is required by their employer or the law to maintain their current job or that improves or maintains skills needed in their current job. This deduction can provide a significant tax benefit for individuals who are paying for work-related education expenses.

Who can claim it: To be eligible for the work-related education expense deduction, the education must be directly related to your current job, and you must not be reimbursed for the expenses by your employer. The deduction is available for all taxpayers, regardless of their income level.