Banking cover letter examples

If you’re hoping to land your next banking role, then you need a cover letter that’s right on the money.

In our step-by-step guide, we’ll share our top tips and advice for writing an impressive application.

We’ve also created some banking cover letter examples to inspire your own. Check them out below.

CV templates

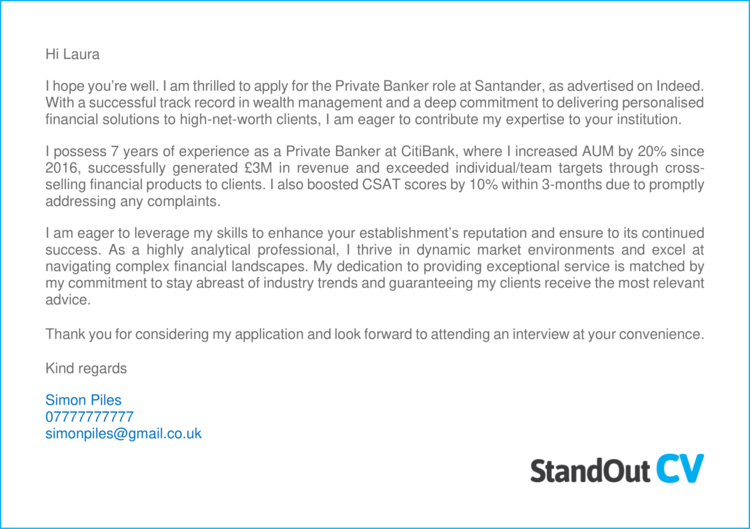

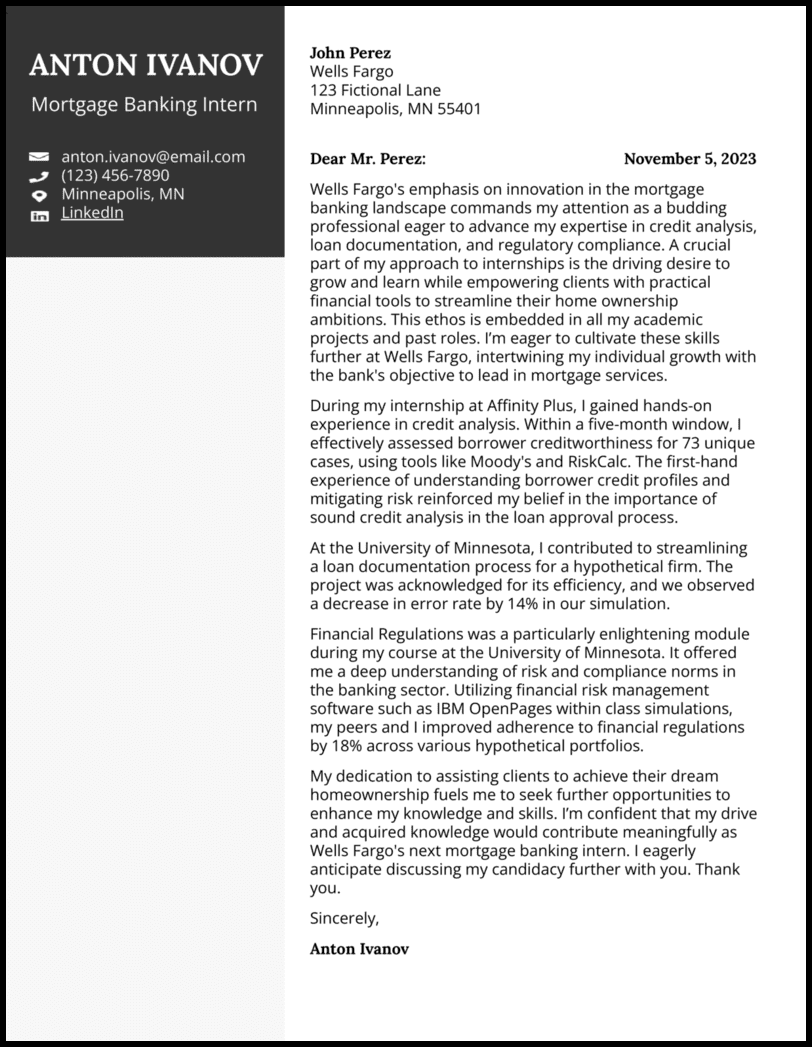

Banking cover letter example 1

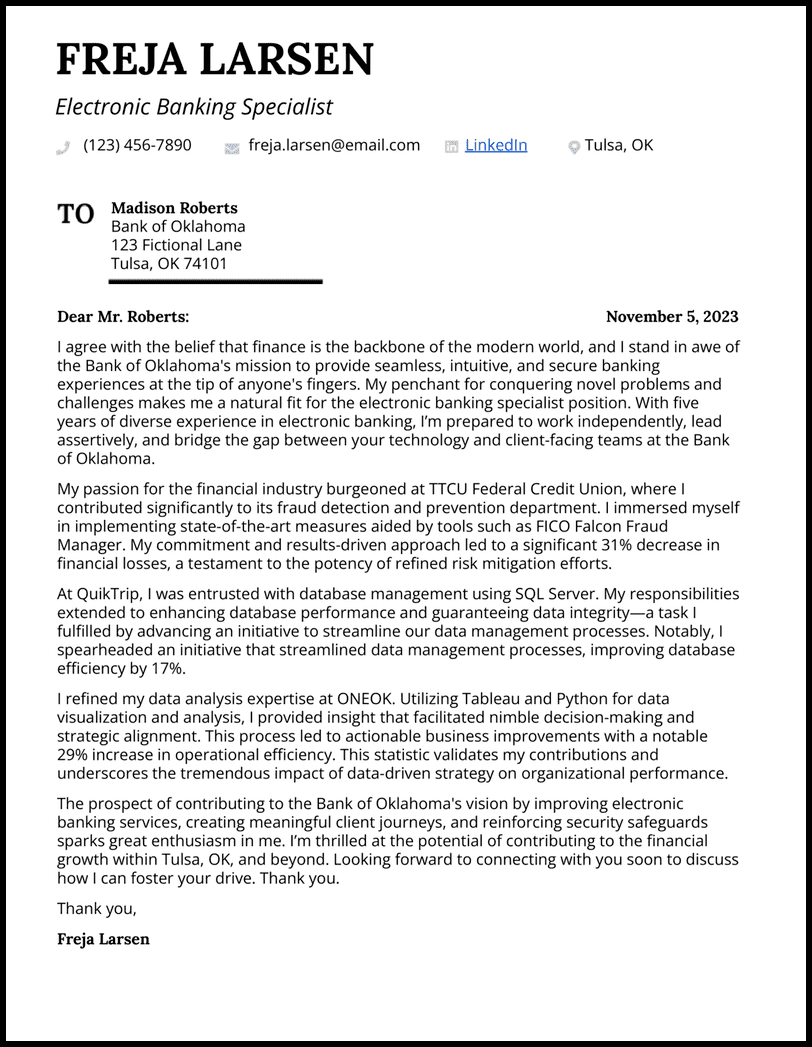

Banking cover letter example 2

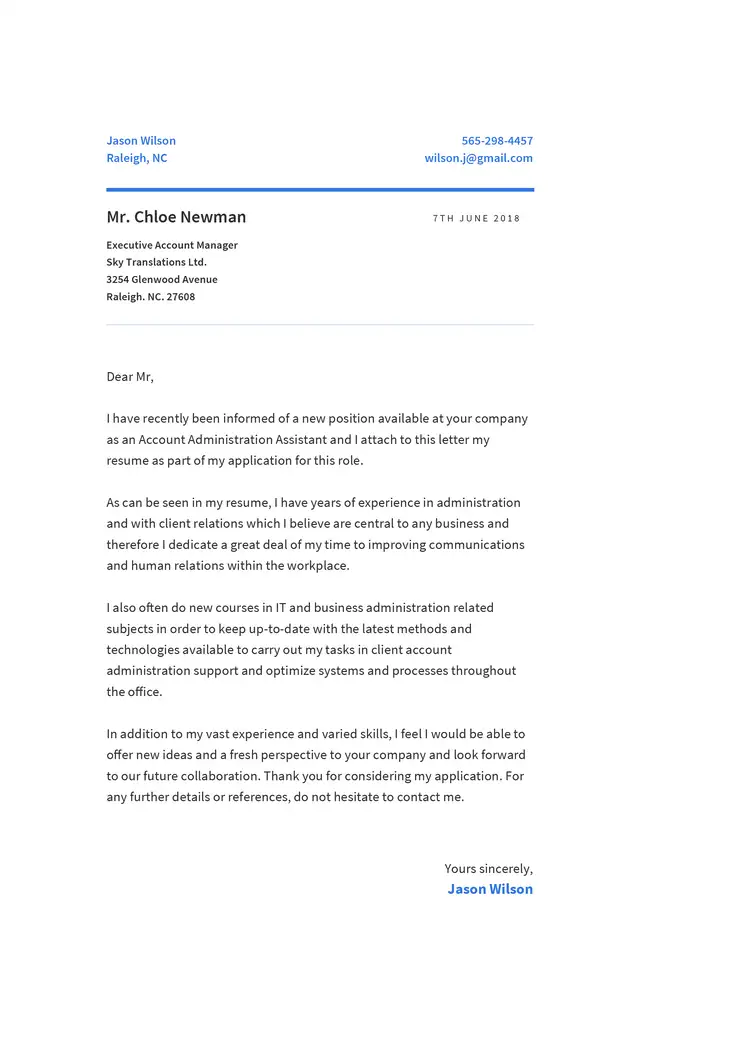

Banking cover letter example 3

These 3 Banking cover letter example s should provide you with a good steer on how to write your own cover letter, and the general structure to follow.

Our simple step-by-step guide below provides some more detailed advice on how you can craft a winning cover letter for yourself, that will ensure your CV gets opened.

How to write a Banking cover letter

A simple step-by-step guide to writing your very own winning cover letter.

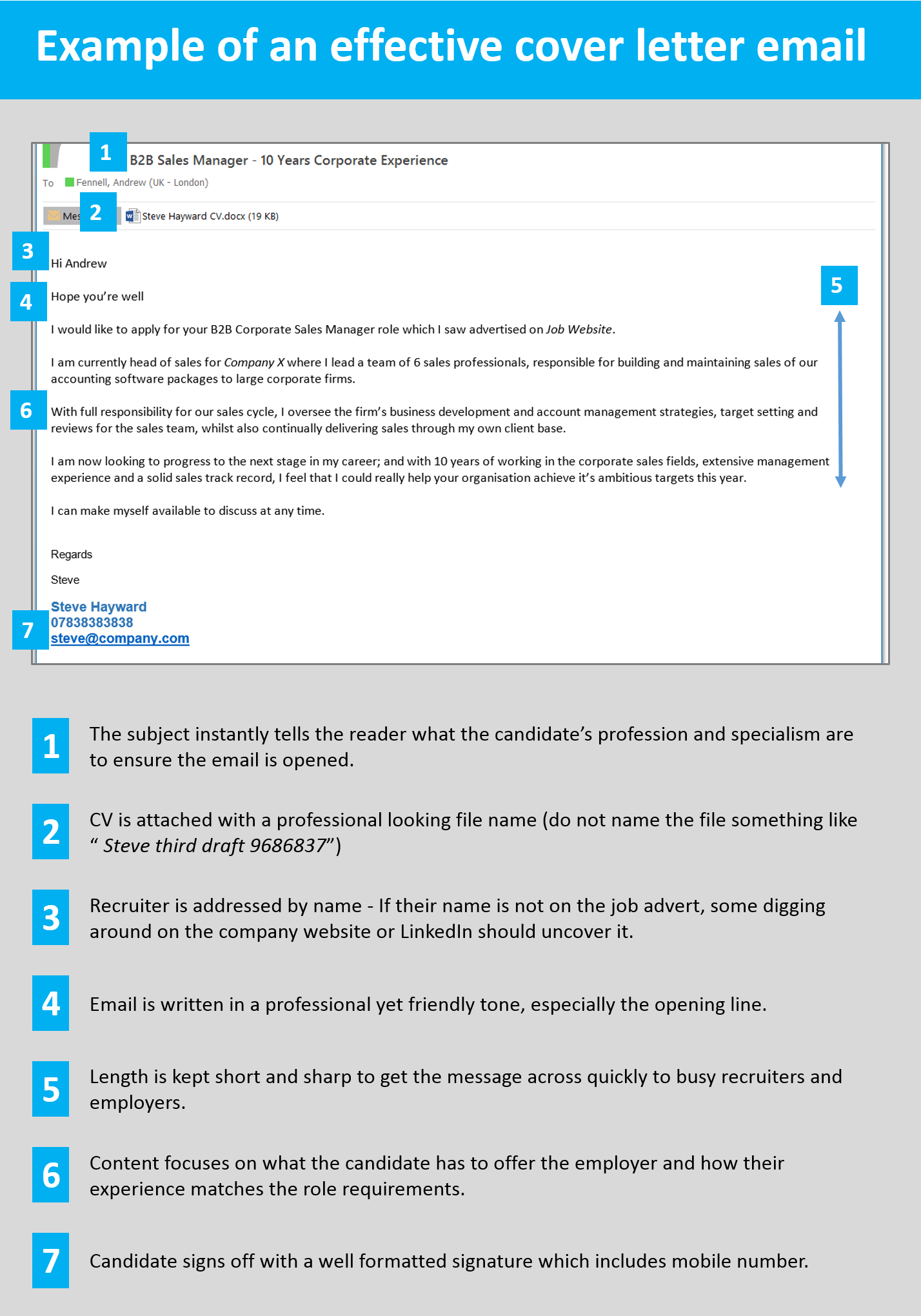

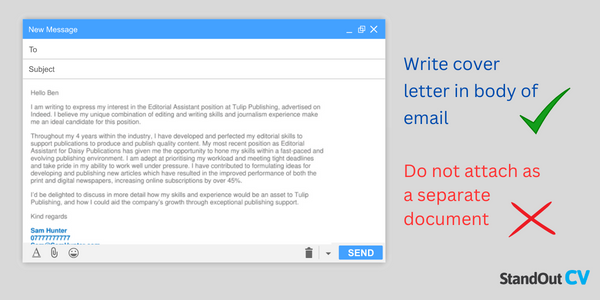

Write your cover letter in the body of an email/message

When writing your Banking cover letter, it’s best to type the content into the body of your email (or the job site messaging system) and not to attach the cover letter as a separate document.

This ensures that your cover letter gets seen as soon as a recruiter or employer opens your message.

If you attach the cover letter as a document, you’re making the reader go through an unnecessary step of opening the document before reading it.

If it’s in the body of the message itself, it will be seen instantly, which hugely increases the chances of it being read.

Start with a friendly greeting

To start building rapport with the recruiter or hiring manager right away, lead with a friendly greeting.

Try to strike a balance between professional and personable.

Go with something like…

- Hi [insert recruiter name]

- Hi [insert department/team name]

Stay away from old-fashioned greetings like “Dear sir/madam ” unless applying to very formal companies – they can come across as cold and robotic.

How to find the contact’s name?

Addressing the recruitment contact by name is an excellent way to start building a strong relationship. If it is not listed in the job advert, try to uncover it via these methods.

- Check out the company website and look at their About page. If you see a hiring manager, HR person or internal recruiter, use their name. You could also try to figure out who would be your manager in the role and use their name.

- Head to LinkedIn , search for the company and scan through the list of employees. Most professionals are on LinkedIn these days, so this is a good bet.

Identify the role you are applying for

Once you’ve opened up the cover letter with a warm greeting to start building a relationship, it is time to identify which role you want to apply for.

Recruiters are often managing multiple vacancies, so you need to ensure you apply to the correct one.

Be very specific and use a reference number if you can find one.

- I am interested in applying for the position of *Banking role* with your company.

- I would like to apply for the role of Sales assistant (Ref: 406f57393)

- I would like to express my interest in the customer service vacancy within your retail department

- I saw your advert for a junior project manager on Reed and would like to apply for the role.

See also: CV examples – how to write a CV – CV profiles

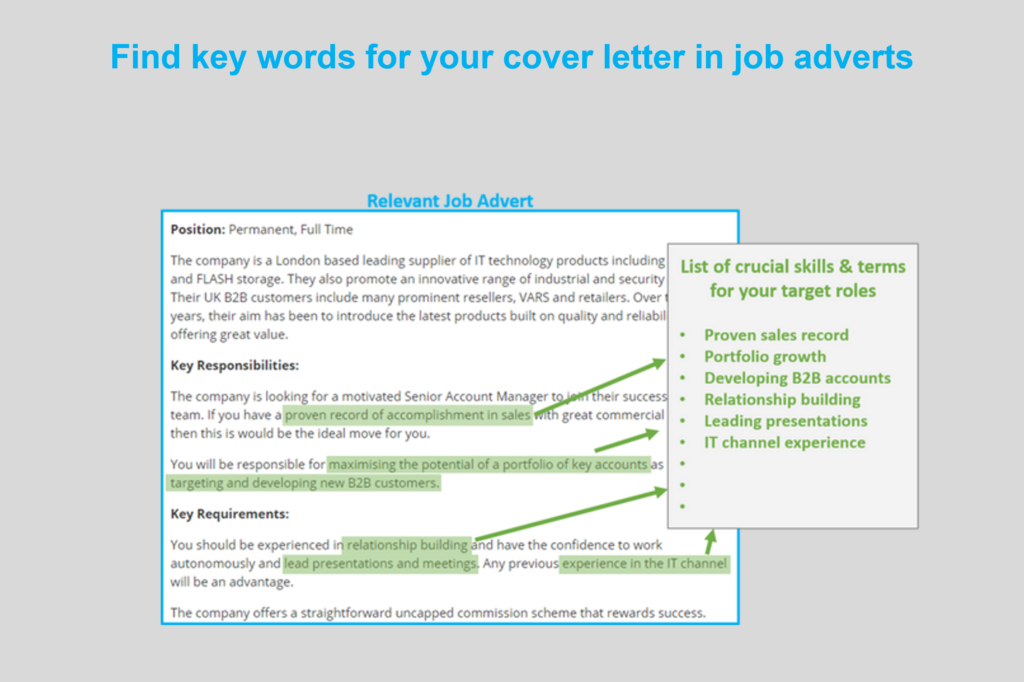

Highlight your suitability

The sole objective of your cover letter is to motivate recruiters into to opening your CV. And you achieve this by quickly explaining your suitability to the roles you are applying for.

Take a look at the job descriptions you are applying to, and make note of the most important skills and qualifications being asked for.

Then, when crafting your cover letter, make your suitability the central focus.

Explain why you are the best qualified candidate, and why you are so well suited to carry out the job.

This will give recruiters all the encouragement they need to open your CV and consider you for the job.

Keep it short and sharp

A good cover letter is short and sharp, getting to the point quickly with just enough information to grab the attention of recruiters.

Ideally your cover letter should be around 4-8 sentences long – anything longer will risk losing the attention of time-strapped recruiters and hiring managers .

Essentially you need to include just enough information to persuade the reader to open up your CV, where the in-depth details will sit.

Sign off professionally

To round of your CV, you should sign off with a professional signature.

This will give your cover letter a slick appearance and also give the recruiter all of the necessary contact information they need to get in touch with you.

The information to add should include:

- A friendly sign off – e.g. “Kindest regards”

- Your full name

- Phone number (one you can answer quickly)

- Email address

- Profession title

- Professional social network – e.g. LinkedIn

Here is an example signature;

Warm regards,

Jill North IT Project Manager 078837437373 [email protected] LinkedIn

Quick tip: To save yourself from having to write your signature every time you send a job application, you can save it within your email drafts, or on a separate documents that you could copy in.

What to include in your Banking cover letter

Here’s what kind of content you should include in your Banking cover letter…

The exact info will obviously depend on your industry and experience level, but these are the essentials.

- Your relevant experience – Where have you worked and what type of jobs have you held?

- Your qualifications – Let recruiters know about your highest level of qualification to show them you have the credentials for the job.

- The impact you have made – Show how your actions have made a positive impact on previous employers; perhaps you’ve saved them money or helped them to acquire new customers?

- Your reasons for moving – Hiring managers will want to know why you are leaving your current or previous role, so give them a brief explanation.

- Your availability – When can you start a new job ? Recruiters will want to know how soon they can get you on board.

Don’t forget to tailor these points to the requirements of the job advert for best results.

Banking cover letter templates

Copy and paste these Banking cover letter templates to get a head start on your own.

Hello Harry

I am keen to showcase my interest in the Bank Manager position at Investec. With a distinguished career in the financial service industry spanning over 15 years, I am excited about the opportunity to lead a dynamic team, steer exceptional customer experiences, and contribute to the success of your company.

Throughout my career at Metro Bank, I have held progressively responsible roles, where I honed my expertise in optimising branch operations, client service, team management, and business development across all activities. Some of the significant contributions I have played throughout my time at Metro Bank include, increasing deposits by 30% through integrating targeted marketing campaigns and relationship-building strategies, developing training programs which enhanced branch staff’s cross-selling of bank products by 50%, and lessening annual expenses by £80K by negotiating favourable contracts with suitable vendors.

My passion for fostering a customer-centric culture has been the driving force behind my success, and I am confident that my collaborative approach and ability to build and maintain relationships will ensure continued growth for Investec as a whole. Thank you very much for considering my application and I hope to hear from you very soon regarding scheduling an interview.

Kind regards

Ellen Mount ¦ 07777777777 ¦ [email protected]

I hope you’re well. I am thrilled to apply for the Private Banker role at Santander, as advertised on Indeed. With a successful track record in wealth management and a deep commitment to delivering personalised financial solutions to high-net-worth clients, I am eager to contribute my expertise to your institution.

I possess 7 years of experience as a Private Banker at CitiBank, where I increased AUM by 20% since 2016, successfully generated £3M in revenue and exceeded individual/team targets through cross-selling financial products to clients. I also boosted CSAT scores by 10% within 3-months due to promptly addressing any complaints.

I am eager to leverage my skills to enhance your establishment’s reputation and ensure to its continued success. As a highly analytical professional, I thrive in dynamic market environments and excel at navigating complex financial landscapes. My dedication to providing exceptional service is matched by my commitment to stay abreast of industry trends and guaranteeing my clients receive the most relevant advice.

Thank you for considering my application and look forward to attending an interview at your convenience.

Simon Piles ¦ 07777777777 ¦ [email protected]

Good morning, Gary

I am excited to apply for the Junior Teller role at Fidelity Bank. I am eager to leverage my skills and commitment towards maintaining the high standards of service associated with your institution.

Throughout my academic journey and part-time experiences, I have developed a deep understanding of banking procedures, where I gained valuable insights into the importance of accuracy, confidentiality, and efficiency in handling transactions. As a recent HND Banking Graduate from Lincoln College, I possess theoretical knowledge in financial accounting and economics.

Additionally, I completed a one-year internship at TD Group where I was exposed to real-world cash handling, account management, and customer interactions. During this internship I assisted in the implementation of a new process for addressing inquiries that reduced wait times by 20%, as well as assuring a 100% record of compliance with bank policies which led to successful audits with no major findings.

Please feel free to reach out to me via email or by phone at your convenience to schedule an interview. Thank you for considering my application.

Lisa McKenzie ¦ 07777777777 ¦ [email protected]

Writing an impressive cover letter is a crucial step in landing a Banking job, so taking the time to perfect it is well worth while.

By following the tips and examples above you will be able to create an eye-catching cover letter that will wow recruiters and ensure your CV gets read – leading to more job interviews for you.

Good luck with your job search!

Build my resume

- Resume builder

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- 184 free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

3 Banking Cover Letter Examples Landing Jobs in 2024

- Banking Cover Letter

- Mortgage Banking Intern Cover Letter

- Electronic Banking Specialist Cover Letter

- Write Your Banking Cover Letter

The banking industry requires a detail-oriented mindset with compliance as a top concern. You shine in that role by overseeing client accounts, monitoring transactions, and providing excellent customer service.

Are your banking resume and cover letter helping you connect with hiring managers to show you’re right for the job?

When banks are looking for skilled employees, they’ll perform detailed reviews to ensure they bring in the most qualified applicants for interviews. To ensure you stand out, use our banking cover letter examples as templates, or leverage the power of our free cover letter builder to help display your abilities successfully.

Banking Cover Letter Example

USE THIS TEMPLATE

Microsoft Word

Google Docs

Block Format

Why this cover letter works

- Speaking of the structure, craft a compelling intro diving into your passion, motivations, and possibly, company knowledge; a middle highlighting your professional experiences in reverse chronological order, and a conclusion reinstating your interest and encouraging further discussion.

Level up your cover letter game

Relax! We’ll do the heavy lifiting to write your cover letter in seconds.

Mortgage Banking Intern Cover Letter Example

- Following Anton’s lead, kick off by strategically aligning your career aspirations with the hiring company’s mission and values. From there, intertwine your objectives for the roles with the shared values, showing your readiness to inject passion and drive into the role.

Electronic Banking Specialist Cover Letter Example

- Quickly draw attention to your career’s landmarks that saw you apply relevant industry-relevant skills, such as fraud detection and prevention, database management, and data visualization and analysis, solidifying each experience with numbers. Did you slash financial losses by 31%? Improved operational efficiency by 29%? Flaunt these triumphs, but concisely.

Related cover letter examples

- Banking resume

- Bank teller

- Financial analyst

How to Optimize Your Banking Cover Letter

While all banks have standardized processes to ensure compliance, that doesn’t mean that each one won’t have unique qualifications they’re looking for applicants to possess.

For instance, one bank may be seeking a reconciliation expert, whereas another may be looking for a customer-centric teller who can create a great experience for everyone who walks through their doors. You’ll want to customize each cover letter you submit based on the job description .

Write an attention-grabbing intro to your banking cover letter

When someone walks into the bank, you know the importance of creating a friendly atmosphere since every customer makes a first impression quickly. The same is true when bank hiring managers are reviewing cover letters.

The first step to stand out is greeting a specific hiring manager by name if it’s listed in the job description or on the bank’s website. It’s the same as connecting with customers by learning their names before discussing investment opportunities.

Then, once you get into the first paragraph, you’ll want to show how you connect with the bank’s mission and where your skills fit in. For instance, how you want to use your knowledge of debt consolidation and index funds to help customers make smart financial decisions.

The intro below doesn’t make enough of a connection since it lacks key details about the applicant’s specific mortgage banking skills and the company’s mission.

Not connecting enough!

Hello Mr. Halbert,

Upon seeing the mortgage banking job you have available, I immediately thought this sounded like a great role for my skills. This sounds like a great company to work for, and I would be excited to join your team.

The opener below makes a better connection since the applicant showcases an evident passion for Citibank’s commitment to customer service excellence and exceptional banking experiences.

A well-connected opener based on the bank’s mission!

Dear Mr. Mitchell,

Having long admired Citibank’s commitment to precision and customer service excellence, I’m thrilled at the opportunity to contribute to your mission of delivering exceptional banking experiences that serve clients and promote financial success. I share your goal of providing reliable and accurate financial services to individuals globally. My valuable experience in this field can help enhance customer satisfaction, streamline banking procedures, and foster stronger client relationships as your bank teller.

How to make the body of your banking cover letter more impactful

As you get into the body section when writing a cover letter , it’s time to think about how you can share more details about the customer service and financial solutions skills you highlighted in the opening paragraph.

A great way to illustrate your impact as a banker is by using metrics since every financial solution requires data to make accurate decisions. Depending on your role in the bank’s success, everything from customer satisfaction rates to loan-to-asset ratios could work well in this section.

Additionally, if you’re applying to a role like a mortgage banker or investment banker that requires some education, you could also explain how your degree in finance or related fields has equipped you to succeed.

A well-formed body paragraph with banking metrics!

As an operations associate at 1st United Credit Union, I handled, on average, $267,124 in cash transactions daily. This task necessitated meticulous cash management and record keeping, aiding a 24% reduction in transaction anomalies.

Make the closer of your banking cover letter stand out

As you begin the closing paragraph of your banking cover letter, you’ll want to relate back to some of the key financial solutions skills and your connection to the bank’s mission. For example, your passion for the bank’s commitment to excellence and how you want to use your financial analysis skills to provide accurate service to every customer.

After that, it’s a good idea to thank the bank’s hiring manager for their time and end with a light call to action. It’s similar to thanking customers for banking with you and saying you look forward to seeing them again to increase customer retention rates.

The closer below lacks impactfulness since the applicant doesn’t use a call to action or reference the bank’s mission.

Lacking impactfulness here!

Overall, I believe my experience as a mortgage banker will be a valuable addition to your team. Thank you for considering my qualifications.

Lucy Carlson

The closer below makes a much better impact by referencing the applicant’s passion for helping clients achieve their dream of homeownership.

An impactful closer relating to the bank’s needs!

My dedication to assisting clients to achieve their dream of homeownership fuels me to seek further opportunities to enhance my knowledge and skills. I’m confident that my drive and acquired knowledge would contribute meaningfully as Wells Fargo’s next mortgage banking intern. I eagerly anticipate discussing my candidacy further with you. Thank you.

Anton Ivanov

Reviewing the job description and understanding the bank’s needs is the best way to include job skills that stand out. For instance, if the position requires cross-selling, you could write about previous experiences cross-selling credit cards or business banking solutions.

The best way to optimize the tone you write in is by reviewing the job description and trying to match the tone each bank uses. For instance, if a bank uses a formal and logical tone, matching that shows how you’ll fit in with their professional and knowledgeable work culture.

If you haven’t worked in banking before, you could emphasize translatable skills like other jobs involving customer service or data entry. Or you could emphasize relevant education like a bachelor’s degree in finance that equipped you with the necessary skills.

- EXPLORE Random Article

How to Write a Cover Letter for a Banking Job

Last Updated: July 11, 2023 Fact Checked

This article was co-authored by Kolby Goodman . Kolby Goodman is a Career & Job Search Coach and the Founder of The Job Huntr. With over eight years of experience, he specializes in resume edits, interview preparation, LinkedIn profile feedback, and professional interview coaching. Additionally, his career advice has been featured in publications such as The Huffington Post. Kolby holds a Bachelor’s degree in Economics from San Diego State University. There are 10 references cited in this article, which can be found at the bottom of the page. This article has been fact-checked, ensuring the accuracy of any cited facts and confirming the authority of its sources. This article has been viewed 132,768 times.

If you are seeking a job in the banking industry, a cover letter is an essential component of your application process. Banks usually skim through large volumes of applications for open positions, so you need to maximize every word of your cover letter to make it stand out. Fortunately, by researching the company and the position, explaining how precisely you would fit both, and organizing and formatting your letter properly, you can increase the odds of your cover letter landing you the banking job of your dreams.

Gathering Information for Your Letter

- Study the company’s website closely. Look for anything that makes it distinctive in relation to its peers. Research its business strategy and culture, as well as all of the services it provides.

- For example, if the bank’s website highlights the amount of international clients it has, make a point of mentioning this fact in your cover letter and state that you’re particularly interested in international banking.

- Gather all the details you can about the nature of the position itself. Read the advertisement carefully. Reach out to the contact person on the job ad for more information.

- Whether you’re looking to become a loan officer at your local branch or an investment banker at a national firm, you should expect stiff competition for the job. A generic, cookie-cutter cover letter is unlikely to make the cut.

- For example, you can easily find a template and sample cover letter for a loan officer position online that uses a 3-paragraph format and bullet points to emphasize the most critical information. But this should only provide inspiration for a letter tailored to the precise job you are seeking.

- If you're sending out several applications to different banks, you can use the same rough template. But the heart of your letter, the central paragraph(s), should be specifically tailored to each particular position.

- Your letter essentially has to answer several key questions, including: “Who am I?”, “Why do I want this (specific) job?”, “Why should you want me for this (specific) job?”, and “What do I have (attributes, skills, experiences, etc.) that you need?”

- For example, when applying for a banking job, some skills that would make you a particularly strong candidate include communication skills, problem-solving abilities, and cash handling skills.

- If you want to get a job as a bank teller, it can be really helpful to garner some experience in a position that involves customer service and cash handling, such as a salesperson or cashier.

- This may be your academic achievements in relevant coursework; your prior successful experience in the industry; a successful internship with a glowing recommendation; or your relevant experiences in another field.

- For example, if you’re applying for a job as a bank teller, a good factor to emphasize would be your ample work experience in a customer service position that involved handling large amounts of cash.

Writing Your Letter

- Aim for at most 2-3 sentences for your introduction. Sticking to 35 total words, especially if you must stick with a one-page letter, will also leave ample space for the central paragraph(s).

- “Greetings. My name is Casey Weinberg, and I am applying for a job as an assistant branch manager” is brief but dull. Allow your introduction to introduce not only you, but the central components of your case for being hired: “Greetings. My name is Casey Weinberg, and with my 15 successful years of serving client needs both inside and outside the financial sector, I am ready to bring my knowledge and experience to being an assistant branch manager at Sunbelt Community Bank.”

- If you have any contacts or character references within the company, mention these in your introductory paragraph as well.

- An example of describing a positive achievement in a previous job would be: “As a project manager, I managed to successfully 3 projects within 4 months without going over our unit’s budget.”

- Be sure you match your skills and experiences to the specific qualifications listed in the job description. Give the reader a concrete sense of how your past experiences can come to bear in specific ways in this job.

- For example, if this particular banking company is known for producing some of the most successful people in the financial industry, say that you want to work for what is evidently one of the best financial institutions in the business.

- A slight hint of flattery and a lot of research will go a long way in this paragraph. Don’t be afraid to wear your heart on your sleeve when it comes to explaining why you’re seeking a job with this particular company.

- Make sure you include your contact information in this paragraph if it isn’t included at the top of your letter. If possible, include multiple different means of getting in touch with you.

- Thank the reader for their time and consideration before concluding the cover letter with “Sincerely, Casey Weinberg.”

Formatting and Editing Your Letter

- Use active phrases that focus on results and outcomes. Make it clear that you have gotten things done in the past and will continue to do so in this new position.

- For instance, consider the differing impact of the following 2 statements: “I’m a highly competent change management professional who has worked on a number of projects at major banks,” versus “I managed a team of 18 technology and business analyst staff who successfully switched to a major new payments system six weeks ahead of time and 8% under budget.”

- The more specific you can be in a limited number of words, the better.

- Some job postings may list word or page limits for cover letters. You can also ask the contact person if there are any.

- A cover letter is your opportunity to “personalize” your resume. They should complement each other to present a quick yet thorough portrait of you as a strong job candidate. Thus, place the most important information about you near the top of the letter, just as you would with a resume.

- Refrain from using bold fonts or colors; although these certainly will make your cover letter stand out, they may also make you seem unprofessional.

- With many letters to read and quick decisions to make, the people assessing applications want to be able to find what they need quickly and without distracting changes or errors. Nothing but the content of the text should occupy their attention.

- Use someone knowledgeable in the banking field, if possible, so they can suggest industry-specific clarifications, additions, or excisions.

- Always look for ways to cut words from your letter. A cover letter that references all the necessary information can never really be too short.

Expert Q&A

You Might Also Like

- ↑ https://hbr.org/2014/02/how-to-write-a-cover-letter

- ↑ https://www.indeed.com/career-advice/resumes-cover-letters/cover-letter-template

- ↑ Kolby Goodman. Career & Job Search Coach. Expert Interview. 28 June 2022.

- ↑ https://www.indeed.com/recruitment/job-description/banker

- ↑ https://www.grammarly.com/blog/cover-letter-format/

- ↑ https://writing.wisc.edu/handbook/assignments/coverletters/

- ↑ https://www.indeed.com/career-advice/resumes-cover-letters/powerful-ways-to-start-a-cover-letter

- ↑ https://www.glassdoor.com/blog/cover-letter-words/

- ↑ https://www.monster.com/career-advice/article/cover-letters

- ↑ https://targetjobs.co.uk/career-sectors/investment-banking-and-investment/advice/412890-applying-for-an-investment-graduate-job-write-a-covering

About this article

Reader Success Stories

Sebatian Mwelwa

Oct 17, 2019

Did this article help you?

- About wikiHow

- Terms of Use

- Privacy Policy

- Do Not Sell or Share My Info

- Not Selling Info

Bank Teller Cover Letter Example

Start a Bank Teller cover letter that gets employers to act and helps you get the job faster. Impress hiring managers with the aid of ResumeCoach’s Bank Teller example letter template and professional tips and tricks for success.

Resume and Cover Letter Experts

Congratulations! You’ve stumbled upon a Bank Teller job opening with excellent benefits and working hours, what’s next?

First, start by making sure you have an outstanding resume that fits the job description. If you do not have it, take advantage of our easy-to-use resume builder and get a customized version in minutes.

Besides a resume, it’s critical that you include a cover letter with your application that highlights your strengths and accomplishments to grab the recruiter’s attention and get you the interview.

In this guide, you’ll learn how to:

- Create a cover letter that sets you apart from other applicants

- Write a Bank Teller cover letter with or without experience

- Address any employment gaps

Plus access to expertly written samples tailored for Bank Teller positions!

How to Write a Cover Letter for Bank Teller with Experience

If you have previous job experience, writing a cover letter may seem like a straightforward task.

However, it’s essential to ensure that your cover letter effectively highlights your skills and qualifications for the position you’re applying for.

Looking over the Experience section on your resume can help you know exactly what to mention, such as your past responsibilities and results .

Below are some tips on how to write a Bank Teller cover letter with experience.

1. Customize Your Cover Letter for the Job Posting

Tailoring your letter to the specific job posting can help you stand out from other applicants. Point out the abilities and work history that are most relevant to the job.

For example, if the job advertisement mentions cash handling as a requirement, mention in your cover letter how your experience relates to that.

Here is one way to do it:

I was pleased to see in the job posting that you are looking for someone who is comfortable working with customers and has experience in handling cash transactions.

During my previous job as a cashier, I learned how to provide excellent customer service while accurately processing transactions. I also have experience in reconciling cash drawers and preparing daily deposits, which I believe will be beneficial in this role.

Ensure that you use the same keywords used in the job advertisement to avoid Applicant Tracking System (ATS) filters and getting disqualified.

2. Start With a Strong Opening

Your opening should grab the reader’s attention and clearly state the position you’re applying for. You may also want to briefly explain why you’re interested in the job or why you’re a good fit for the company.

The examples below provide some effective ways to start your Bank Teller cover letter:

- I am thrilled to apply for the Bank Teller position at your Chatham branch. With over three years of experience in customer service and cash handling, I am confident that I possess the skills and expertise necessary to excel in this role.

- I am writing to express my interest in the Bank Teller position at your Chatham branch. With a strong background in cash handling and customer service, including three years of experience in a similar role, I strongly believe I would be a valuable addition to your team.

- I am excited to apply for the Bank Teller position at your Chatham branch. With a proven track record of success in customer service and cash handling, including three years of experience in a similar role, I believe I have the skills and knowledge necessary to thrive in this position.

Remember that the purpose of the first paragraph is to get the reader’s attention so that they want to read the rest of your cover letter!

3. Provide Specific Examples

Use specific examples from your previous job experience to demonstrate your skills and accomplishments. This could include projects you’ve worked on, awards you’ve received, or specific metrics that show how you’ve contributed to your previous company.

Don’t just say “ I collaborated in a project to improve cash handling ”.

Say “ I collaborated with my team to develop and implement a new process for reconciling cash drawers and preparing deposits, which resulted in a 20% reduction in errors and discrepancies ”.

The more specifics you provide, the more credible your claims become.

4. Emphasize your transferable skills

Even if your previous job experience isn’t directly related to the position you’re applying for, you likely have transferable skills that are relevant . Make sure to emphasize these abilities and explain how they would be valuable in the new role.

The list below showcases some basic skills all Bank Tellers should have:

- Active listening

- Strong verbal communication abilities

- An ability to satisfy customers while adhering to bank standards

According to the Bureau of Labor Statistics , some similar occupations where applicants can acquire these abilities include cashier, customer service representative, receptionist, or information clerk.

5. Close With a Strong Call to Action

Your closing paragraph should reiterate your interest in the position and include a call to action, such as requesting an interview or expressing your availability to discuss the position further.

When closing your cover letter for a Bank Teller position, a powerful call to action can help you stand out from other applicants and showcase your enthusiasm for the job.

For example, you could write something like, “ I am eager to contribute my strong communication skills and passion for customer service to your bank. I would welcome the opportunity to discuss my qualifications with you further and answer any questions you may have. Please feel free to contact me at your convenience to schedule an interview ”.

Mastering the Art of Bank Teller Cover Letters: Illustrative Examples

Now, let’s take a look at another 2 examples to recap and get a deeper understanding of how to write a powerful Bank Teller cover letter:

I am applying for the Bank Teller position at West Coast Bank. I have worked as a Bank Teller for two years. I am familiar with handling cash and providing customer service. I am also a quick learner and work well under pressure.

The previous example lacks specific details about the applicant’s achievements or contributions in their previous Bank Teller roles.

The statement merely points out basic job duties and traits that are expected of a Bank Teller, which does not make the applicant stand out or showcase their unique qualifications.

During my two years as a Bank Teller at West Side People’s Bank, I consistently exceeded my sales goals and achieved a 98% customer satisfaction rating. I also implemented a new cash management system that reduced cash handling errors by 30% and saved the bank over $8,000 annually.

This example is very effective because it points out the candidate’s ability to perform well, provide excellent service, and think critically about their work. It’s also very specific by mentioning numbers and percentages, adding a lot of credibility.

Example Cover Letter for Bank Teller With Experience

To familiarize yourself with the elements of a strong cover letter for a Bank Teller with experience, you can examine the sample cover letter below.

Hiring Manager’s name

Company name

Company address

Dear Mr/Ms. [Hiring Manager Name]

I am writing to apply for the Bank Teller position being advertised by [Company]. As an accomplished Teller with over three years of experience working with customers and financial services, I am certain that I fit the profile perfectly.

In my current position with [Current Company], I have played an active part in helping the branch achieve a record increase in revenue. During the last 3 sales campaigns, intake and sales have increased by around 12% on average.

Furthermore, I demonstrably showed my abilities to enhance customer service in-branch. My personal customer feedback score has never fallen below 90% and my performance has often helped to improve repeat trade by over 30%.

My resume is enclosed with further details on my career successes so far. Naturally, I would be delighted to talk in person to discuss any queries you may have about my credentials.

Please feel free to contact me via my personal phone number and email address. I look forward to hearing from you.

Sincerely, Name

Address Phone number Email address

Along with reviewing these types of examples, using a cover letter writing guide to assist you can significantly streamline the entire writing process.

How to Write a Cover Letter for Bank Teller with No Experience

Many job applicants are discouraged from applying when they come across job postings that require prior job experience.

It’s no wonder that fresh graduates and those looking to transition into a Bank Teller position ask themselves, “How do I write a cover letter for a Bank Teller with no experience?”

It’s important not to give up on applying even if you don’t have any relevant work history.

Instead, you can create a compelling cover letter that highlights how your skills and qualities align with the job requirements.

To do this, you need to thoroughly understand the company’s needs and goals.

Take some time to analyze what they are looking for in an employee. Use your education and any relevant internship experience to demonstrate how you are a good fit for the position.

In your cover letter, focus on 3 key areas :

- the company’s needs

- your relevant achievements,

- and your valuable skills.

By addressing these points, you can show the hiring manager that you understand what they are looking for and that you have the potential to be a valuable addition to their team.

If you don’t have as much experience as other applicants, you can still demonstrate your enthusiasm and willingness to learn.

Use your cover letter as an opportunity to showcase your motivation and dedication, and convince the employer that you are the best candidate for the job.

Look at the following examples tailored to Bank Teller positions to get some ideas:

I have no experience as a Bank Teller, but I am a quick learner and am excited to start my career in banking. I have great customer service skills and am a team player.

Unfortunately, it doesn’t provide any specific examples or evidence of skills or qualifications that would make the candidate a good fit for the position.

Also, the statements “I am a quick learner” and “I have great customer service skills” are generic and overused phrases that don’t provide any tangible evidence of the candidate’s abilities.

Although I don’t have direct experience as a Bank Teller, my previous customer service internship at Amazonics taught me how to interact with customers, solve problems efficiently and handle cash transactions accurately. I am excited to bring these skills to your team at Atlantica Bank.

This is an excellent example because it highlights transferable skills gained from a previous customer service internship and shows enthusiasm for the position .

It also specifically mentions relevant abilities such as handling cash transactions accurately, which are important for a Bank Teller role.

Example Cover Letter for Bank Teller With No Experience

When you are just starting in the profession , the blank page before you begin typing your letter may be nerve-wracking!

We get that, but there are tricks for writing a great cover letter when you have little to no experience.

Refer to the sample Bank Teller cover letter for fresh graduates provided below to familiarize yourself with the components of an effective letter for someone who would like to get a job as a teller in a bank but has no prior experience.

I am writing to express my interest in the Bank Teller position at [Bank Name]. Although I do not have any direct experience in the banking industry, I am excited about the opportunity to learn and grow in this role.

As a recent graduate with a degree in finance, I have developed strong analytical and problem-solving skills that I believe will be valuable in the position. Additionally, my part-time job as a retail sales associate has provided me with customer service experience and sales skills.

During my time as a retail sales associate at Mediazon, I consistently met my sales targets and was able to upsell to customers, resulting in a 15% increase in revenue compared to the previous quarter. I also maintained a 99% accuracy rate when handling cash and credit card transactions, ensuring that there were no discrepancies in the store’s financial records.

My experience in retail sales and customer service, combined with my attention to detail and accuracy when handling financial transactions, make me a strong candidate for the Bank Teller position at [Bank Name].

While I understand that the role of a Bank Teller requires a specific set of skills and knowledge, I am confident in my ability to learn quickly and adapt to new situations. I am a detail-oriented individual who takes pride in providing excellent customer service and ensuring accuracy in all tasks.

I am excited about the prospect of joining a team of professionals at [Bank Name] and contributing to the success of the organization. Thank you for considering my application. I look forward to the opportunity to discuss my qualifications further.

Please let me know if you require any further information or if there are any next steps I should be aware of.

Cover Letter for Bank Teller with Employment Gap

If you have experienced a gap in your employment history, you may struggle to determine what to include in your Bank Teller cover letter and resume. It can be disheartening to think that this gap may decrease your chances of landing the job.

However, a gap in your career does not necessarily disqualify you from the job. There are various legitimate reasons why someone may not have worked for a certain amount of time, such as to take care of a sick family member.

When applying for a Bank Teller position, it’s crucial to clarify any employment gaps since banks value attention to detail, accuracy, and credibility in their highly formal work environments.

Providing clear explanations for any gaps in your employment history is important when applying for a role, particularly in highly regulated industries such as banking where adherence to strict protocols and guidelines is essential .

By demonstrating professionalism, honesty, and commitment to the job application process, you can establish yourself as a trustworthy and reliable candidate for the position.

There are some things you should and shouldn’t include in your cover letter to address the issue:

- Explain why: Briefly describe the reason for the gap. A hiring manager may find out about it anyway and draw their own conclusions. You’re better off taking the first step.

- Don’t worry about old or really short gaps: It’s important to note that not every single gap needs to be addressed in your cover letter.

During the interview process, be prepared to answer any questions related to your employment gap. You could even try to turn it into a positive by shortly mentioning any relevant skills you acquired during that time.

Remember to adhere to the proper cover letter and resume format when creating your documents.

Let’s analyze 2 examples customized to Bank Teller roles for deeper insights:

I have a gap in my employment history, but I am eager to start working as a Bank Teller. I have great customer service skills and can handle cash transactions efficiently. I am a quick learner and can adapt to new situations easily.

Simply stating that you have gaps in your employment history without providing any context or explanation may raise concerns for the employer.

Additionally, the example does not provide any information about what the candidate has been doing during their time away, which could be perceived as a lack of productivity or commitment.

During my previous employment, I took a break to care for a family member who was ill. During that time, I volunteered at a local non-profit organization where I gained experience in cash handling and customer service.

I also took online courses to keep my skills up-to-date. I am excited to bring my experience and dedication to your team at Southern Entrepreneurs Bank.

The candidate mentions that they took a break to care for a sick family member, which is a valid reason for a gap in employment history.

The applicant also explains that they spent their time productively volunteering at a non-profit organization and taking online courses to improve their skills, which emphasizes their dedication and positions them as a strong candidate.

Example Cover Letter for Bank Teller With Employment Gap

If you are a Bank Teller with an employment gap in your resume, you may be wondering how to explain this to potential employers.

While taking time off from work can be a great opportunity for personal growth and development , it can also be a challenge when it comes to job searching.

However, with the right approach, it is possible to address the gap in a way that highlights your strengths and shows your commitment to your career .

In this example cover letter for a Bank Teller position, you can learn how to approach such an employment gap in a positive and professional manner .

I am excited to apply for the Bank Teller position at Bankomatic. I am confident that my experience and skills make me a strong candidate for this role and I am eager to contribute to your team’s success.

After several years working as a Bank Teller, I took a sabbatical to travel around Asia and gain new experiences. During this time, I had the opportunity to visit many different countries, learn about different cultures and customs, and enhance my communication and problem-solving skills.

I believe that these experiences have made me a more well-rounded and adaptable person, and have given me a fresh perspective that I can bring to my work.

Although I took time off to travel, I have stayed up-to-date on industry trends and have continued to develop my skills and knowledge. I have taken online courses to improve my understanding of financial regulations and procedures, and have stayed connected with the banking industry through networking events and industry publications.

As a Bank Teller, I am committed to providing excellent service to customers, building strong relationships with clients, and ensuring that their needs are met efficiently and effectively. I am also a quick learner, and am always looking for opportunities to grow and develop my skills.

I am excited about the opportunity to join ABC Bank and am confident that my experience, skills, and passion for customer service make me a great candidate for this position. Thank you for considering my application. I look forward to the opportunity to discuss my qualifications in further detail.

Creating a Bank Teller Cover Letter That Speaks to Employers: Key Takeaways

Are you ready to unlock the vault to your dream job as a bank teller? Your cover letter holds the key to making a lasting impression.

Here are some key takeaways for crafting an effective cover letter that will present your cash-handling skills, customer service experience, and passion for the banking industry:

- Powerful opening: Highlight your relevant experience, skills, and passion for banking, while also emphasizing why you are a good fit for the specific Bank Teller position you are applying for.

- Experience in other fields: Even if your previous work experience may not seem directly applicable to banking, demonstrate how your skills can benefit you in your new role.

- Specificity: Showcase your banking skills in action and provide concrete details about your achievements in the banking industry. Include metrics to make your claims more credible.

- Tailor your letter to the position: Use the same keywords and phrases that are used in the job advertisement to emphasize your relevant skills and experience in banking.

- Employment gaps: Taking time off for personal reasons can actually be turned into an advantage. Point out the skills and experiences you gained during that time.

- Request an interview: Conclude your cover letter expressing your eagerness for an interview and thanking the employer for their consideration.

Finally, make sure your spelling and grammar are perfect . Little mistakes in the text of the letter can get you immediately rejected from the hiring process; so it’s worth taking the time to proofread everything before you hit send.

Trouble getting your Cover Letter started?

Beat the blank page with expert help.

The cover letter that will get you a job in a bank

Do you really need to write a cover letter when you're applying for a job in an investment bank? These days, it's surely all about the skills in your CV - who's got the time to read that extra blurb saying how perfect you are for the role?

Recruiters working with experienced hires certaintly don't have the time. Most of the banking recruiters we speak to treat the cover letters (or 'cover emails') they receive from experienced candidates as an irrelevance. "For experienced roles, we rarely look at cover letters," says the CEO of one London-based financial services recruitment firm. I just go for the CV," agrees another. "I look at the CV and then I phone them. - If the CV is relevant, I'll get everything that would have been in the cover letter from that call."

This doesn't mean you should just attach a CV/resume with no introductory email. It does mean that the introductory email might not be read - but you still need to make sure you don't make common mistakes like referencing the wrong bank, or forgetting to attach your CV altogether.

However, there some situations in which cover letters can make all the difference.

These include:

- When you're applying for graduate jobs in banking.

- When you're applying to banks directly (without going through external recruiters),

- And... when you happen to be using a recruiter who simply likes cover letters (hard to tell!).

"For graduate hires, cover letters are very important," says one headhunter. Just how important is reflected by the fact that some banks specify them as a must-have in the ir graduate recruitment process . Banks like Goldman Sachs, Citigroup, Barclays, Morgan Stanley and Macquarie typically all demand that their would-be analysts in Europe write cover letters or something very similar, says Victoria McLean, a former Goldman Sachs recruiter and founder of banking CV specialists, City CV. "Some banks still ask for specific questions to be answered around motivation, strengths and key behaviours/competencies (these are of varying word counts depending on the bank)," she says.

Goldman Sachs historically demanded that recruits write a 300 word personal statement as a cover letter. A former recruiter at the firm told us it was very important. "Some students were excellent until they got to the cover letter," - those 300 words let them down.

What makes a good banking cover letter? Mai Le, a former Goldman Sachs investment banking associate who ran CoverLetterLibrary , a community which houses a collection of cover letters that have enabled juniors to get jobs at banks in the past. Le says the best cover letters have two things in common: narrative structure (they emphasize your story and show the choices that brought you here) and facts and figures that underscore your background and achievements. By comparison, Le says the worst banking cover letters suffer from key-word stuffing, irrelevant information and spelling and grammatical mistakes.

It can help to follow a general template...

You need to tailor your cover letters for each job you apply to. But this doesn't mean that you can't write a cover letter that follows a template. It does mean that each time you apply for a new job, you will need to fill in the template all over again.

McLean suggests your template follows the following format: Introduction. Why me? Why you? Why this job? In total, the text within the template should be no more than 750 words, or one A4 page, long. Le says some candidates also use a format that's ordered as, Why this job? Why this bank? Why me? "It's a matter of personal preference," she says. Ultimately, you want all these elements in the cover letter and should go with which ever you feel comfortable with.

Either way, here's what to include.

The easy introductory paragraph

The first paragraph is all about explaining why you're writing. If you're applying for a graduate job in a bank, keep it short and sweet.

"The first paragraph is just to say who you are and why you're writing the letter," says McLean.

This paragraph might read something like. "I am an X with X year history of X at global banking firms including X as well as X. I have been working for X for the past X years."

If you're writing a Goldman Sachs cover letter that's 300 words or less, you can ditch this style of opening paragraph. - There's just no space for it.

If you're writing to a recruiter, there's less need to be quite so brief with your introduction. Say who you are, and explain why you've approached that recruiter in particular: "If someone says they've been referred to me by someone I know and respect, I will sit up and pay attention," says one U.S. recruiter. "The same applies if they say they've learned that I mentor women and that this is something they're interested in too."

In other words, when you're writing a cover letter to a recruiter, you need to know who you're writing to. Use this introductory paragraph to address them in person. Flattery will get you everywhere.

The selling yourself paragraph. 'Why you?'

The second paragraph is usually harder. This is where you need to start selling yourself, expressing your personality, and explaining why you're such a hot catch. It's here that you can add in some of the narrative explaining how you came to apply for this role, plus some of the substantiating figures that Le says make successful cover letters so effective. Don't use bland and empty phrases like, "I am a determined, motivated person." Do look at the key words and skills used to describe the job you're applying for and (without too obviously reiterating the ad) explain how you match them. Focus on the results and on outcomes you've achieved in similar situations in the past. You need to be specific and you need to bring yourself to life.

If you're writing a cover letter to accompany a graduate application, McLean says you can use the second paragraph to talk about what you've studied and how it's relevant. If you've studied finance and know how to do a DCF, now's the time to mention that. If you haven't studied finance but have good relationship management skills and you want to work i n M&A (a relationship-focused business), say that here. Provide EVIDENCE for the skills you're claiming to have.- List any awards you've won. Never, ever, make empty statements. "Many successful trading cover letters feature the candidate's trading return profile and their rationales for their success or failure," says Le. " - Cover letters for sales positions highlight the candidate's track record that evident their ability as a natural salesperson."

The motivational paragraph. 'Why this job (in this sector?)'

If you're an experienced hire applying through a recruiter or applying directly to a bank, this is where you explain why you want the job you're applying for. If you're a student applying for a first job, this is why you need to explain why you want this job and why you want to work in this sector. Be specific - you'll need to know about the job and the sector before you start this section.

As a student, you'll need to link your skills back to your motivation for working in that area of banking above others, says McLean. Why M&A? Why not sales and trading? Why not compliance? - If you want to work in operations , for example, explain how you have a passion for building systems and improving efficiency, as evidenced by your system for serving customers in your weekend job...

"You should include what you love about the industry to which you are applying," says McLean. "Why is it important to YOU? Why does it matter to YOU? How does it make a difference to YOU? and why is it interesting to YOU? Especially valid for Graduates: Why finance? Why investment banking / asset management? before addressing the specifics of the division or programme to which you are applying. The key is to make this personal…. This is where most grads go wrong in their cover letters, they sound too generic and impersonal."

The connection paragraph. 'Why this bank ?'

The fourth paragraph is all about explaining why you want to work for that particular bank. Again, you need to be specific. McLean says graduates often copy and paste from banks' own websites. For example, it's not unheard of for them to write, "I want to work for Goldman Sachs because you have 170 locations across 90 cities in over 30 countries." This will get you nowhere.

"The idea is not to flatter your potential employer but to identify what makes them a good choice for you and you a good fit," says McLean. "Telling Goldman or Citi you want to work for them because they are the best is not going to impress anyone. However, writing that it’s an opportunity to work with some of the best minds on the street and that you want to be held to those same exacting standards is a bit more engaging." But you need to put this in your own words: you need to make it personal and say what the banks strengths mean to YOU.

The other ex-Goldman Sachs recruiter we spoke to said she particularly looked for, "creativity and effort and writing about Goldman Sachs," when running through students' cover letters. People were expected to say exactly why they wanted to work for Goldman rather than, say, J.P. Morgan.

Instead of just reiterating what you've read on banks' websites, therefore, you need to cite some unusual reasons for choosing that bank that will make you stand out. If you're a student, it helps to say that you've met some of the banks' staff and were impressed by them. Citigroup, for example, suggests that student cover letters reference encounters with the bank's staff at recruitment events. - Make a note of the staff you meet and explain what they said or did that impressed you, and what made you think you'd like to work with them.

Mark Hatz, a former M&A associate at Goldman Sachs and Perella Weinberg Partners who now helps people get jobs in banking , says stressing your rapport with people you've met from the firm is particularly important when you're applying for a job in M&A or capital markets: "These are advisory businesses and they want to see that you can build a rapport and work in a team. If you get the job, you'll also be spending a lot of hours in the office with these people, so showing you like them is very important."

It also helps to reference the bank's strategy, to mention any awards the bank won, and to cite any conversations you've had with or comments you've read from other industry professionals and analysts who've given concrete reasons why it's good place to work. Everything in this section needs to be positive. - You need to explain why you want to work for Deutsche Bank specifically without writing anything that denigrates its rivals. The more senior you are, the more you will need to reference solid strategy points at this stage.

"Show a grasp of where they are going, what the plan is and why this appeals to you," says McLean. Show that you know their strategy and that you agree with the way they're addressing challenges. "You should also write about the future of the firm. You should be planning to be there for a few years and hoping to share that future with them," McLean adds. Look at the shareholder letter in the last annual report for information on a bank's strategy.

The call to action

Finally, you need to end the cover letter with a call to action. McLean suggests completing the letter with the following sentence: "I really look forward to hearing from you. I am available for interview and contactable by X.'

Simple. Except all of this has to be written in 750 words - or just 300 if you're a student applying to Goldman Sachs. It's not so easy after all.

Click here to create a profile on eFinancialCareers. Make yourself visible to recruiters hiring for top jobs in technology and finance.

Have a confidential story, tip, or comment you’d like to share? Contact: [email protected] in the first instance. Whatsapp/Signal/Telegram also available.

Bear with us if you leave a comment at the bottom of this article: all our comments are moderated by human beings. Sometimes these humans might be asleep, or away from their desks, so it may take a while for your comment to appear. Eventually it will – unless it’s offensive or libelous (in which case it won’t.)

Photo by Florian Klauer on Unsplash

Sign up to Morning Coffee!

The essential daily roundup of news and analysis read by everyone from senior bankers and traders to new recruits.

Boost your career

The Goldman Sachs resume template, by Goldman Sachs recruiters

"My daughter is very unhappy with her Goldman Sachs bonus"

The latest Hirevue questions from US investment banks

An ex-goldman sachs salesman's guide to writing a cover letter that works.

Banks are opening 2025 applications, and JPMorgan heads to HireVues

Accenture added 13,000 AI specialists, only needs 27,000 more

Citi's equities professionals are complaining about two current employees

Goldman Sachs' popular, kind, French MD makes "hardest" decision to quit

Goldman Sachs protected London employees while 2023 revenues plummeted

Morning Coffee: JPMorgan's top high yield trader made a huge loss at a hedge fund. Citigroup's other ranking of female graduates

Related articles

Banking resume guide: How to get hired when the market softens

Standard Chartered's changes include a warning on how not to advance your career

"How to pivot in the middle of your financial services career"

"If your resume shows you job hopping for higher pay, I will not hire you"

Bank Customer Service Representative Cover Letter Examples & Writing Tips

Use these Bank Customer Service Representative cover letter examples and writing tips to help you write a powerful cover letter that will separate you from the competition.

Table Of Contents

- Bank Customer Service Representative Example 1

- Bank Customer Service Representative Example 2

- Bank Customer Service Representative Example 3

- Cover Letter Writing Tips

Bank customer service representatives are the first point of contact for customers who need assistance with their accounts. They need to be friendly, helpful, and organized to handle a variety of tasks.

When you’re applying for a bank customer service representative position, your cover letter is a great place to highlight your skills and experience.

Check out the examples and tips below to learn how to write a cover letter that helps you get hired.

Bank Customer Service Representative Cover Letter Example 1

I am excited to be applying for the Bank Customer Service Representative position at ABC Bank. I have more than five years of experience in the banking and customer service industries, and I firmly believe that my skills and experience would be an excellent fit for this role.

I pride myself on my ability to provide excellent customer service. In my previous role at XYZ Bank, I was responsible for providing support to customers via phone, email, and chat. I was able to resolve more than 95% of customer inquiries on the first contact, and I was consistently praised by customers for my friendly and helpful demeanor.

I also have experience in managing and resolving escalated customer inquiries. In one instance, I was able to successfully resolve a dispute that had been going on for more than six months. I have a proven track record of being able to think on my feet and find creative solutions to complex customer service issues.

I am confident that I have the skills and experience to be a valuable member of the ABC Bank team. I look forward to hearing from you soon about the next steps in the hiring process. Thank you for your time and consideration.

Bank Customer Service Representative Cover Letter Example 2

I am writing in regards to the open Bank Customer Service Representative position. I am confident that I have the skills and experience that would make me the perfect candidate for the job.

I have over three years of experience in the banking and customer service industry. I have consistently been praised by my employers for my exceptional customer service skills and my ability to go above and beyond to meet the needs of my customers. I have a deep understanding of banking and financial products, and I am confident in my ability to provide accurate and timely information to my customers.

I am a highly motivated and driven individual who is always looking for new challenges and opportunities to grow. I am confident that I can be a valuable asset to your team, and I am eager to utilize my skills and experience to help your bank reach its goals.

I have attached my resume for your review, and I would be happy to answer any questions you may have. I look forward to hearing from you soon.

Bank Customer Service Representative Cover Letter Example 3

I am writing to express my interest in the Customer Service Representative position that you have posted. I believe that my experience and skills make me a strong candidate for this position.

I have been working as a Bank Teller for the past three years, and have gained valuable experience in customer service, problem solving, and conflict resolution. I have also gained experience in working with computers and software programs such as Quicken, Microsoft Office, and Quickbooks. I am currently enrolled in college and will be graduating with an Associate’s Degree in Business Administration next year.

I am confident that my experience and skills would make me a great addition to your team. I look forward to hearing from you soon.

Bank Customer Service Representative Cover Letter Writing Tips

1. show your customer service skills.

When applying for a job as a bank customer service representative, you need to show how well you communicate with people from all walks of life. You’ll be communicating with customers, opposing counsel, expert witnesses and your team on a regular basis. So it’s important that you show your strong communication skills to the hiring manager in the cover letter.

To do this, talk about how effective you are at verbal and written communication. The more examples of each type of communication (written and verbal) that you can provide in your cover letter the better!

2. Customize your cover letter

Bank customer service representatives deal with a wide range of customers, so it’s important that you customize your cover letter to fit the specific job you’re applying for. Highlight your skills and experience that match the job requirements and explain how you can use those skills to help the bank reach its goals.

3. Show that you’re a team player

As a bank customer service representative, you’ll be working with other members of the team to provide the best customer service possible. Show hiring managers that you’re a team player by explaining how you work well with others and are always willing to lend a helping hand.

4. Proofread your cover letter

Proofreading your cover letter is the first step to landing an interview for a bank customer service representative position. As with any position, it’s important to spell-check and double-check that there are no errors in your resume or cover letter. Otherwise, you risk being disqualified before the employer even sees your qualifications.

Accounts Payable Manager Cover Letter Examples & Writing Tips

Vehicle inspector cover letter examples & writing tips, you may also be interested in..., bookstore clerk cover letter examples & writing tips, call center agent cover letter examples, radiographer cover letter examples & writing tips, accounts assistant cover letter examples.

What is a Letter of Intent? How to Write One for a Job [+ Examples]

Published: March 14, 2024

Standard job applications have a standard set of practices. You turn in a resume and cover letter, and then, if selected, you move through a few rounds of interviews and get the job.

However, not all potential job opportunities start with an application. In fact, many begin with initiative from a job seeker.

Those job seekers will send in a letter of intent rather than a cover letter . In this article, we’ll take a look at what a letter of intent is and highlight some strategies for writing the best LOI you can. We’ve even included a template to help you get started.

Here’s what you’ll find:

What is a letter of intent?

Letter of intent vs. cover letter, letter of intent vs. letter of interest, when to use a letter of intent.

How to Write a Letter of Intent for a Job

Letter of Intent Samples

Letter of intent template.

A letter of intent is a less common way of expressing interest in a company. It targets reasons you’re looking for opportunities with a specific organization.

A letter of intent does include elements of a traditional cover letter, such as relevant experience and skills, but it’s used in slightly different contexts. LOIs emphasize alignment between a job seeker and an organization.

.webp?width=650&height=731&name=image1%20(4).webp)

There are a few key differences between a cover letter and a letter of intent, including:

Context. While a cover letter responds to a specific job listing, a letter of intent targets an organization more generally. It may or may not have a specific job opening at the time that the LOI is sent in.

Focus. A cover letter explains why an applicant is a good fit for a specific role . An LOI, on the other hand, addresses an individual’s compatibility with an overall organization or more general role.

Initiative. A cover letter is a reactive document responding to a job opening. A letter of intent, however, demonstrates more initiative and provides information before an organization specifically requests it.

22 Job Seeking Templates

Download this bundle of 22 expertly-crafted templates for cover letters, resignation notices, and resumes.

- Resignation Letter Templates

- Cover Letter Templates

- Resume Templates

You're all set!

Click this link to access this resource at any time.

Letter of intent and letter of interest are often used interchangeably. While there are a lot of similarities between the two documents, there are also a few key differences:

Level of intent. Letters of intent have a high level of intentionality, while letters of interest are more exploratory. A letter of intent proposes action, while letters of interest are for information gathering.

Commitment level. A letter of intent is a high-commitment way of expressing interest in a company, while a letter of interest is a lower commitment. An individual is more likely to send out multiple letters of interest.

Action orientation. A letter of intent always ends with a call to action, while a letter of interest is more laid-back and may not request anything specific from the recipient.

While both letters demonstrate initiative and are closely tailored to the company, they do serve slightly different purposes.

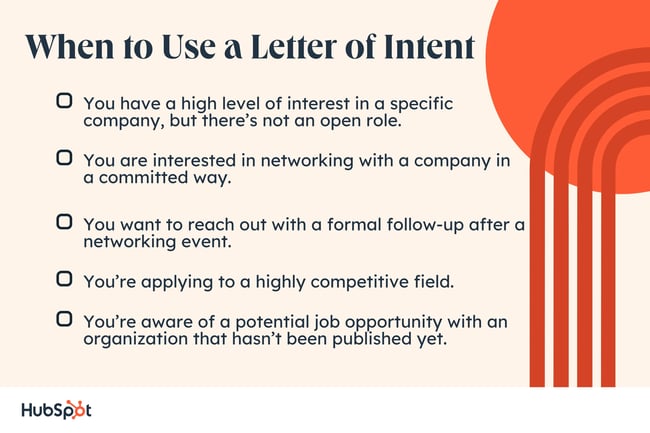

There are lots of scenarios where a job seeker may want to send out a letter of intent. Here are a few examples:

You have a high level of interest in a specific company, but there’s not an open role.

You are interested in networking with a company in a committed way.

You want to reach out with a formal follow-up after a networking event.

You’re applying to a highly competitive field.

You’re aware of a potential job opportunity with an organization that hasn’t been published yet.

Additionally, students or job seekers switching industries may use letters of intent to apply to educational opportunities like internships and apprenticeships — though those may also be called cover letters .

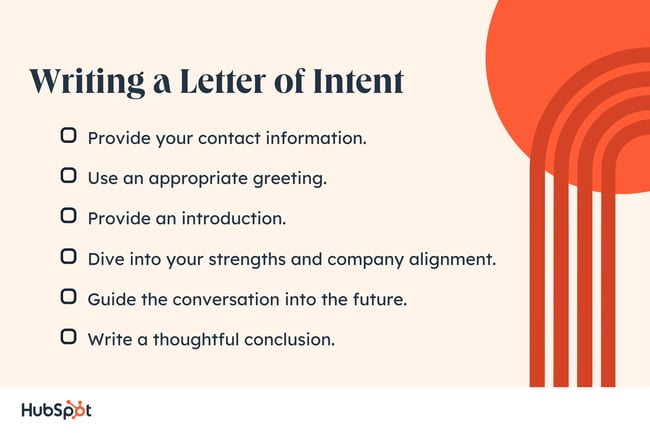

How to Write a Letter of Intent

There are plenty of ways to approach writing a letter of intent for a job. Here’s a step-by-step process for writing your LOI draft:

1. Provide your contact information.

At the top of your LOI, you’ll want to provide contact information so your recipient can contact you about future opportunities. This can include your phone number, email, and address.

2. Use an appropriate greeting.

For some opportunities, a formal greeting is appropriate. In other situations, a more informal approach may be ideal. If possible, address the specific recipient.

3. Provide an introduction.

In the intro paragraphs, you’ll want to tap into three specifics:

Who you are.

Why you’re reaching out.

How you got this company’s information.

Feel free to vary the order of this information. Your LOI intro may be formal or more playful, depending on who you are and the organization you’re submitting to.

4. Dive into your strengths and company alignment.

An LOI is created to clearly convey why you’re a good fit for the organization. In the body paragraphs of your letter, you’ll want to explain:

- Your strengths.

- What you do.

- How those things would fit with the organization.

5. Guide the conversation into the future.

All LOIs end with a call to action, which is one of the things that differentiates it from a letter of interest or a cover letter. Map out potential next steps so it’s easy for the reader to take action. It could include:

A request to schedule a meeting.

Making a specific pitch.

Encouraging the recipient to send a follow-up email.

6. Write a thoughtful conclusion .

Conclude your LOI by reiterating your interest in the company. Make sure to thank the recipient for their time, too — there wasn’t a job opening request, so they took time out of their day to read your letter.

If you’re sending your LOI because of an internal referral, be sure to reference them within the letter.

Let’s go through a few different samples of LOIs and highlight what each does well. Refer to these samples as you draft your own letter of intent for guidance on incorporating the elements of an LOI seamlessly.

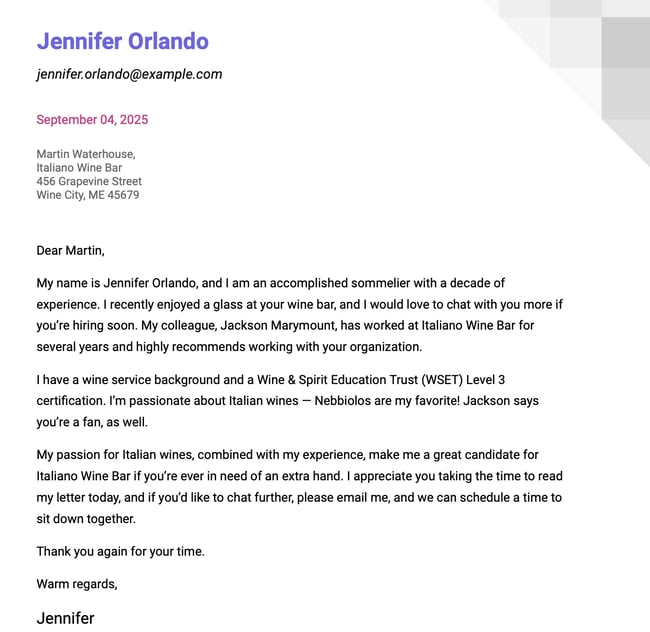

Internal Connection

In this letter of intent, Jennifer leverages an internal connection. This is a great way to earn a few extra points when explaining how you know about the business. Beyond that, Jennifer’s experiences align well with the work that the wine bar does.

What I like: This letter of intent does a great job of personalization, weaving through the internal connection perfectly in a few different spots. A referral is a powerful aid to incorporate into an LOI, and Jennifer did a great job dropping hints of her connection.

Making a Pitch

.webp?width=650&height=651&name=image4%20(1).webp)

What I like: In this letter, Mark is making a pitch. He still covers the bases of a great LOI — discussing his strengths and alignment with the brand. But instead of just calling for a meeting, he makes a pitch that is specific to the organization. This provides value to the recipient and makes Mark look like a strong collaborator.

Mark could benefit from HubSpot’s CMS Hub to manage his pitches. Lead generation and content creation are important parts of freelancing, and Mark needs to stay organized in order to do it well. Learn more about HubSpot’s CMS Hub here .

Diving Into Alignment

.webp?width=650&height=819&name=image7%20(1).webp)

Letters of intent are standard documents, so you don’t need to worry about reinventing the wheel each time you send one. Use this template as a resource to ensure your letter includes all the important parts.

[Your name]

[Your contact information]

[Recipient’s Name]

[Recipient’s contact information]

Dear [Recipient or To Whom It May Concern] ,

My name is [Your Name] , [title/relevant information about yourself] , and I heard about your organization through [how you know the organization] . I’m reaching out to connect. I would love to chat if your team plans on expanding.

I have skills in [skills] that I believe would be a great fit for your organization. Your values of [company values] are in close alignment with my strengths, and I believe I could make a great contribution.

I believe that my [abilities/skills/interests] would benefit your company, and I’d love to talk more about any potential opportunities that arise with [name of organization] . If interested, please reach out by [phone/email] to schedule a time to meet with me.

Thank you for taking the time to read my letter, and I hope to talk with you further in the future.

Of course, you’ll want to edit the template for tone and specifics related to yourself and the organization you’re contacting.

Finding Success With a Great Letter of Intent

Sending a letter of intent can be vulnerable, but it’s a great way to make new connections and set yourself up for employment success.

Refer to these strategies, samples, and templates to make sure your LOI is going to be the most effective letter possible. Emphasize your alignment with the organization, and you’re sure to see success!

Don't forget to share this post!

Related articles.

![applying for a bank job cover letter The Best 30-60-90 Day Plan for Your New Job [Template + Example]](https://blog.hubspot.com/hubfs/Untitled%20design%20%2859%29.jpg)