Bank Business Plan Template

Written by Dave Lavinsky

Bank Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their banks.

If you’re unfamiliar with creating a bank business plan, you may think creating one will be a time-consuming and frustrating process. For most entrepreneurs it is, but for you, it won’t be since we’re here to help. We have the experience, resources, and knowledge to help you create a great business plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write a bank business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What Is a Business Plan?

A business plan provides a snapshot of your bank as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan

If you’re looking to start a bank or grow your existing bank, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your bank to improve your chances of success. Your bank business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Banks

With regards to funding, the main sources of funding for a bank are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for banks.

Finish Your Business Plan Today!

How to write a business plan for a bank.

If you want to start a bank or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your bank business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of bank you are running and the status. For example, are you a startup, do you have a bank that you would like to grow, or are you operating a chain of banks?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the bank industry.

- Discuss the type of bank you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of bank you are operating.

For example, you might specialize in one of the following types of banks:

- Commercial bank : this type of bank tends to concentrate on supporting businesses. Both large corporations and small businesses can turn to commercial banks if they need to open a checking or savings account, borrow money, obtain access to credit or transfer funds to companies in foreign markets.

- Credit union: this type of bank operates much like a traditional bank (issues loans, provides checking and savings accounts, etc.) but banks are for-profit whereas credit unions are not. Credit unions fall under the direction of their own members. They tend to serve people affiliated with a particular group, such as people living in the same area, low-income members of a community or armed service members. They also tend to charge lower fees and offer lower loan rates.

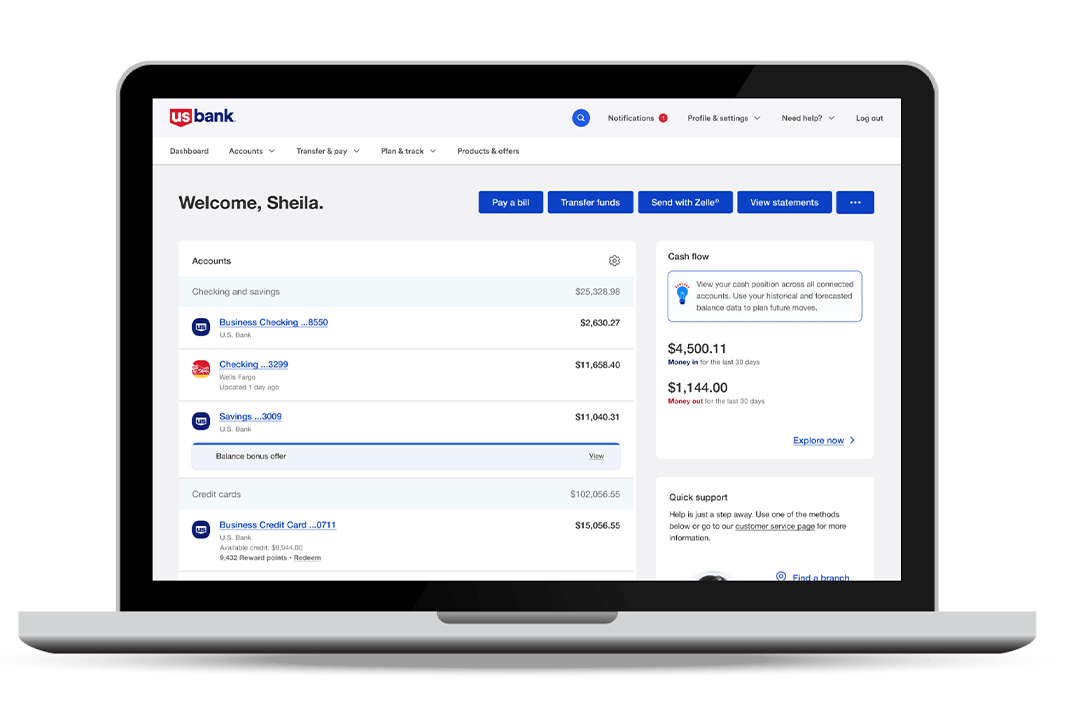

- Retail bank: retail banks can be traditional, brick-and-mortar brands that customers can access in-person, online, or through their mobile phones. They also offer general public financial products and services such as bank accounts, loans, credit cards, and insurance.

- Investment bank: this type of bank manages the trading of stocks, bonds, and other securities between companies and investors. They also advise individuals and corporations who need financial guidance, reorganize companies through mergers and acquisitions, manage investment portfolios or raise money for certain businesses and the federal government.

In addition to explaining the type of bank you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of clients served, the number of clients with positive reviews, reaching X number of clients served, etc.

- Your legal business Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the bank industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the bank industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your bank business plan:

- How big is the bank industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your bank? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your bank business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, small businesses, families, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of bank you operate. Clearly, corporations would respond to different marketing promotions than individuals, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Bank Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other banks.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes trust accounts, investment companies, or the stock market. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of bank are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide loans and retirement savings accounts?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a bank business plan, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type of bank company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you provide savings accounts, auto loans, mortgage loans, or financial advice?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your bank. Document where your company is situated and mention how the site will impact your success. For example, is your bank located in a busy retail district, a business district, a standalone office, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your bank marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your bank, including reconciling accounts, customer service, accounting, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to sign up your Xth customer, or when you hope to reach $X in revenue. It could also be when you expect to expand your bank to a new city.

Management Team

To demonstrate your bank’s potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing banks. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a bank or successfully running a small financial advisory firm.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you see 5 clients per day, and/or offer sign up bonuses? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your bank, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a bank:

- Cost of furniture and office supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your bank location lease or a list of accounts and loans you plan to offer.

Writing a business plan for your bank is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will understand the bank industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful bank.

Bank Business Plan Template FAQs

What is the easiest way to complete my bank business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily write your bank business plan.

How Do You Start a Bank Business?

Starting a bank business is easy with these 14 steps:

- Choose the Name for Your Bank Business

- Create Your Bank Business Plan

- Choose the Legal Structure for Your Bank Business

- Secure Startup Funding for Your Bank Business (If Needed)

- Secure a Location for Your Business

- Register Your Bank Business with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Bank Business

- Buy or Lease the Right Bank Business Equipment

- Develop Your Bank Business Marketing Materials

- Purchase and Setup the Software Needed to Run Your Bank Business

- Open for Business

Don’t you wish there was a faster, easier way to finish your Bank business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how a Growthink business plan consultant can create your business plan for you.

Other Helpful Business Plan Articles & Templates

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning Services

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB-1 Business Plan

- EB-2 NIW Business Plan

- EB-5 Business Plan

- Innovator Founder Visa Business Plan

- Start-Up Visa Business Plan

- Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Plan

- Landlord business plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- Ecommerce business plan

- Online boutique business plan

- Mobile application business plan

- Daycare business plan

- Restaurant business plan

- Food delivery business plan

- Real estate business plan

- Business Continuity Plan

- Pitch Deck Consulting Services

- Financial Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

How to Write a Business Plan to Start a Bank

FEB.10, 2024

Bank Business Plan Checklist

A bank business plan is a document that describes the bank’s goals, strategies, operations, and financial projections. It communicates the bank’s vision and value proposition to potential investors, regulators, and stakeholders. A SBA business plan should be clear, concise, and realistic. It should also cover all the essential aspects of the bank’s business model.

Here is a checklist of the main sections that you should keep in mind while building a bank business plan:

- Executive summary

- Company description

- Industry analysis

- Competitive analysis

- Service or product list

- Marketing and sales plan

- Operations plan

- Management team

- Funding request

- Financial plan

Sample Business Plan for Bank

The following is a bank business plan template that operates in the USA. This bank business plan example is regarding ABC Bank, and it includes the following sections:

Executive Summary

ABC Bank is a new bank for California’s SMBs and individuals. We offer convenient banking services tailored to our customers’ needs and preferences. We have a large target market with over 500,000 SMBs spending billions on banking services annually. We have the licenses and approvals to operate our bank and raised $20 million in seed funding. We are looking for another $30 million in debt financing.

Our goal is to launch our bank by the end of 2024 and achieve the following objectives in the first five years of operation:

- Acquire 100,000 customers and 10% market share

- Generate $100 million in annual revenue and $20 million in net profit

- Achieve a return on equity (ROE) of 15% and a return on assets (ROA) of 1.5%

- Expand our network to 10 branches and 50 ATMs

- Increase our brand awareness and customer loyalty

Our bank has great potential to succeed and grow in the banking industry. We invite you to read the rest of our microfinance business plan to learn about how to set up a business plan for the bank and how we will achieve our goals.

Industry Analysis

California has one of the biggest and most active banking industries in the US and the world. According to the Federal Deposit Insurance Corp , California has 128 financial institutions, with total assets exceeding $560 billion.

The California banking industry is regulated and supervised by various federal and state authorities. However, they also face several risks and challenges, such as:

- High competition and consolidation

- Increasing regulation and compliance

- Rising customer demand for digital and mobile banking

- Cyberattacks and data breaches

- Environmental and social issues

The banking industry in California is highly competitive and fragmented. According to the FDIC, the top 10 banks and thrifts in California by total deposits as of June 30, 2023, were:

Customer Analysis

We serve SMBs who need local, easy, and cheap banking. We divide our customers into four segments by size, industry, location, and needs:

SMB Segment 1 – Tech SMBs in big cities of California. These are fast-growing, banking-intensive customers. They account for a fifth of our market share and a third of our revenue and are loyal and referable.

SMB Segment 2 – Entertainment SMBs in California’s entertainment hubs. These are high-profile, banking-heavy customers. They make up a sixth of our market and a fourth of our revenue and are loyal and influential.

SMB Segment 3 – Tourism SMBs in California’s tourist spots. These are seasonal, banking-dependent customers. They represent a quarter of our market and a fifth of our revenue and are loyal and satisfied.

SMB Segment 4 – Other SMBs in various regions of California. These are slow-growing, banking-light customers. They constitute two-fifths of our market and a quarter of our revenue and are loyal and stable.

Competitive Analysis

We compete with other banks and financial institutions that offer similar or substitute products and services to our target customers in our target market. We group our competitors into four categories based on their size and scope:

1. National Banks

- Key Players – Bank of America, Wells Fargo, JPMorgan Chase, Citibank, U.S. Bank

- Strengths – Large customer base, strong brand, extensive branch/ATM network, innovation, robust operations, solid financial performance

- Weaknesses – High competition, regulatory costs, low customer satisfaction, high attrition

- Strategies – Maintain dominance through customer acquisition/retention, revenue growth, efficiency

2. Regional Banks

- Key Players – MUFG Union Bank, Bank of the West, First Republic Bank, Silicon Valley Bank, East West Bank

- Strengths – Loyal customer base, brand recognition, convenient branch/ATM network, flexible operations

- Weaknesses – Moderate competition, regulatory costs, customer attrition

- Strategies – Grow market presence through customer acquisition/retention, revenue optimization, efficiency

3. Community Banks

- Key Players – Mechanics Bank, Bank of Marin, Pacific Premier Bank, Tri Counties Bank, Luther Burbank Savings

- Strengths – Small loyal customer base, reputation, convenient branches, ability to adapt

- Weaknesses – Low innovation and technology adoption

- Strategies – Maintain niche identity through customer loyalty, revenue optimization, efficiency

4. Online Banks

- Key Players – Ally Bank, Capital One 360, Discover Bank, Chime Bank, Varo Bank

- Strengths – Large growing customer base, strong brand, no branches, lean operations, high efficiency

- Weaknesses – High competition, regulatory costs, low customer satisfaction and trust, high attrition

- Strategies – Disrupt the industry by acquiring/retaining customers, optimizing revenue, improving efficiency

Market Research

Our market research shows that:

- California has a large, competitive, growing banking market with 128 banks and $560 billion in assets.

- Our target customers are the SMBs in California, which is 99.8% of the businesses and employ 7.2-7.4 million employees.

- Our main competitors are national and regional banks in California that offer similar banking products and services.

We conclude that:

- Based on the information provided in our loan officer business plan , there is a promising business opportunity for us to venture into and establish a presence in the banking market in California.

- We should focus on the SMBs in California, as they have various unmet banking needs, preferences, behavior, and a high potential for growth and profitability.

Operations Plan

Our operational structure and processes form the basis of our operations plan, and they are as follows:

- Location and Layout – We have a network of 10 branches and 50 ATMs across our target area in California. We strategically place our branches and ATMs in convenient and high-traffic locations.

- Equipment and Technology – We use modern equipment and technology to provide our products and services. We have c omputers and software for banking functions; security systems to protect branches and ATMs; communication systems to communicate with customers and staff; i nventory and supplies to operate branches and ATMs.

- Suppliers and Vendors – We work with reliable suppliers and vendors that provide our inventory and supplies like cash, cards, paper, etc. We have supplier management systems to evaluate performance.

- Staff and Management – Our branches have staff like branch managers, customer service representatives, tellers, and ATM technicians with suitable qualifications and experience.

- Policies and Procedures – We have policies for customer service, cash handling, card handling, and paper handling to ensure quality, minimize losses, and comply with regulations. We use various tools and systems to implement these policies.

Management Team

The following individuals make up our management team:

- Earl Yao, CEO and Founder – Earl is responsible for establishing and guiding the bank’s vision, mission, strategy, and overall operations. He brings with him over 20 years of banking experience.

- Paula Wells, CFO and Co-Founder – Paula oversees financial planning, reporting, analysis, compliance, and risk management.

- Mark Hans, CTO – Mark leads our technology strategy, infrastructure, innovation, and digital transformation.

- Emma Smith, CMO – Emma is responsible for designing and implementing our marketing strategy and campaigns.

- David O’kane, COO – David manages the daily operations and processes of the bank ensuring our products and services meet the highest standards of quality and efficiency.

Financial Projections

Our assumptions and drivers form the basis of our financial projections, which are as follows:

Assumptions: We have made the following assumptions for our collection agency business plan :

- Start with 10 branches, 50 ATMs in January 2024

- Grow branches and ATMs 10% annually

- 10,000 customers per branch, 2,000 per ATM

- 5% average loan rate, 2% average deposit rate

- 80% average loan-to-deposit ratio

- $10 average fee per customer monthly

- $100,000 average operating expense per branch monthly

- $10,000 average operating expense per ATM monthly

- 25% average tax rate

Our financial projections are as per our:

- Projected Income Statement

- Projected Cash Flow Statement

- Projected Balance Sheet

- Projected Financial Ratios and Indicators

Select the Legal Framework for Your Bank

Our legal structure and requirements form the basis of our legal framework, which are as follows:

Legal Structure and Entity – We have chosen to incorporate our bank as a limited liability company (LLC) under the laws of California.

Members – We have two members who own and control our bank: Earl Yao and Paula Wells, the founders and co-founders of our bank.

Manager – We have appointed Mark Hans as our manager who oversees our bank’s day-to-day operations and activities.

Name – We have registered our bank’s name as ABC Bank LLC with the California Secretary of State. We have also obtained a trademark registration for our name and logo.

Registered Agent – We have designated XYZ Registered Agent Services LLC as our registered agent authorized to receive and handle legal notices and documents on behalf of our bank.

Licenses and Approvals – We have obtained the necessary licenses and approvals to operate our bank in California, including:

- Federal Deposit Insurance Corporation (FDIC) Insurance

- Federal Reserve System Membership

- California Department of Financial Protection and Innovation (DFPI) License

- Business License

- Employer Identification Number (EIN)

- Zoning and Building Permits

Legal Documents and Agreements – We have prepared and signed the necessary legal documents and agreements to form and operate our bank, including:

- Certificate of Formation

- Operating Agreement

- Membership Agreement

- Loan Agreement

- Card Agreement

- Paper Agreement

Keys to Success

We analyze our market, customers, competitors, and industry to determine our keys to success. We have identified the following keys to success for our bank.

Customer Satisfaction

Customer satisfaction is vital for any business, especially a bank relying on loyalty and referrals. It is the degree customers are happy with our products, services, and interactions. It is influenced by:

- Product and service quality – High-quality products and services that meet customer needs and preferences

- Customer service quality – Friendly, professional, and helpful customer service across channels

- Customer experience quality – Convenient, reliable, and secure customer access and transactions

We will measure satisfaction with surveys, feedback, mystery shopping, and net promoter scores. Our goal is a net promoter score of at least 8.

Operational Efficiency

Efficiency is key in a regulated, competitive environment. It is using resources and processes effectively to achieve goals and objectives. It is influenced by:

- Resource optimization – Effective and efficient use and control of capital, staff, and technology

- Process improvement – Streamlined, standardized processes measured for performance

- Performance management – Managing financial, operational, customer, and stakeholder performance

We will measure efficiency with KPIs, metrics, dashboards, and operational efficiency ratios. Our goal is an operational efficiency ratio below 50%.

Partner with OGSCapital for Your Bank Business Plan Success

Highly efficient service.

Highly Efficient Service! I am incredibly happy with the outcome; Alex and his team are highly efficient professionals with a diverse bank of knowledge.

Are you looking to hire business plan writers to start a bank business plan? At OGSCapital, we can help you create a customized and high-quality bank development business plan to meet your goals and exceed your expectations.

We have a team of senior business plan experts with extensive experience and expertise in various industries and markets. We will conduct thorough market research, develop a unique value proposition, design a compelling financial model, and craft a persuasive pitch deck for your business plan. We will also offer you strategic advice, guidance, and access to a network of investors and other crucial contacts.

We are not just a business plan writing service. We are a partner and a mentor who will support you throughout your entrepreneurial journey. We will help you achieve your business goals with smart solutions and professional advice. Contact us today and let us help you turn your business idea into a reality.

Frequently Asked Questions

How do I start a small bank business?

To start a small bank business in the US, you need to raise enough capital, understand how to make a business plan for the bank, apply for a federal or state charter, register your bank for taxes, open a business bank account, set up accounting, get the necessary permits and licenses, get bank insurance, define your brand, create your website, and set up your phone system.

Are banks profitable businesses?

Yes, banks are profitable businesses in the US. They earn money through interest on loans and fees for other services. The commercial banking industry in the US has grown 5.6% per year on average between 2018 and 2023.

Download Bank Business Plan Sample in pdf

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Add comment

E-mail is already registered on the site. Please use the Login form or enter another .

You entered an incorrect username or password

Comments (0)

mentioned in the press:

Search the site:

OGScapital website is not supported for your current browser. Please use:

How To Write a Business Plan for Bank in 9 Steps: Checklist

By henry sheykin, resources on bank.

- Financial Model

- Business Plan

- Value Proposition

- One-Page Business Plan

Welcome to our blog post on How To Write a Business Plan for a Bank in 9 Steps. In today's digital age, the banking industry is undergoing a significant transformation with the rise of online banking platforms. According to recent statistics, the global digital banking market is projected to reach $22.3 trillion by 2027, with a CAGR of 8.6% from 2020 to 2027. This exponential growth highlights the immense potential for entrepreneurs and aspiring bankers to establish their own digital banking platform.

When it comes to starting a digital banking platform, having a well-designed business plan is crucial for success. A comprehensive business plan not only serves as a roadmap, but also helps attract potential investors and secure necessary funding. In this article, we will guide you through the essential steps to create a compelling business plan that banks will find irresistible.

Step 1: Conduct market research and analysis

Step 2: Determine the target market and customer profile

Step 3: Identify and analyze potential competitors

Step 4: Perform a feasibility study

Step 5: Define the unique value proposition and competitive advantage

Step 6: Develop a comprehensive financial plan

Step 7: Establish strategic goals and objectives

Step 8: Define the organizational structure and management team

Step 9: Obtain necessary licenses and regulatory approvals

In the upcoming sections, we will delve into each step in detail, providing you with valuable insights and practical tips to successfully navigate the process of writing a business plan for a bank.

Building a digital banking platform that offers convenience, security, and financial literacy can revolutionize the banking industry. So, let's dive into the first step - conducting market research and analysis to lay the foundation for your business plan.

Conduct Market Research And Analysis

Conducting thorough market research and analysis is a crucial step in developing a successful business plan for a digital banking platform. This process allows you to gain a deep understanding of the market landscape, identify potential opportunities and challenges, and make informed decisions when it comes to your target market and customer profile.

- Identify the size and growth potential of the market: Begin by gathering data on the size of the market you intend to enter. This will help you assess the growth potential and determine if it presents a viable opportunity for your digital banking platform.

- Analyze your target market: Dive deeper into your target market by identifying demographic characteristics, such as age, income, and location. Understanding the needs and preferences of your target market is crucial in developing tailored financial products and services.

- Assess market trends and competition: Stay updated on the latest market trends and innovations in the digital banking industry. Analyze your potential competitors to understand their strengths, weaknesses, and market positioning. This will help you identify gaps in the market and differentiate your platform.

- Evaluate customer needs and pain points: Interview potential customers and conduct surveys to gather insights into their financial needs, challenges, and pain points. This information will be invaluable in designing solutions that address their specific requirements.

Tips for Conducting Market Research and Analysis:

- Utilize both primary and secondary research methods to gather comprehensive market data.

- Monitor industry reports, publications, and online resources to stay up-to-date with market trends.

- Consider partnering with market research firms or consultants for a more in-depth analysis.

- Engage with potential customers through focus groups or online communities to gather qualitative insights.

- Regularly review and update your market research to adapt to evolving market dynamics.

By conducting thorough market research and analysis, you will be equipped with valuable information to guide your business decisions and develop a compelling business plan for your digital banking platform.

Determine The Target Market And Customer Profile

Identifying and understanding your target market is crucial for the success of your digital banking platform. It allows you to tailor your products, services, and marketing efforts to meet the specific needs and preferences of your customers. Here are the important steps to determine your target market and customer profile:

- Conduct market research: Start by conducting thorough market research to gather insights and data about the demographics, psychographics, and behavior of potential customers. This will help you understand who your ideal customers are and what they are looking for in a digital banking platform.

- Segmentation: Once you have collected the necessary information, segment your target market based on criteria such as age, income level, location, and financial goals. This will allow you to create targeted marketing campaigns and develop personalized offerings for each segment.

- Identify customer needs: Analyze the pain points and challenges faced by your target market. Identify their financial goals and aspirations, and determine how your platform can address their needs effectively.

- Competitor analysis: Evaluate your competitors' target markets and customer profiles to identify any gaps or opportunities in the market. Differentiate your platform by offering unique features or services that specifically cater to your target market's needs.

Tips for determining the target market and customer profile:

- Use surveys, interviews, and focus groups to gather firsthand feedback from potential customers. This will give you valuable insights into their preferences, pain points, and expectations.

- Stay updated with market trends and changes in customer behavior. Continuously monitor and analyze data to ensure your target market profile remains relevant and accurate.

- Consider utilizing data analytics tools to gain a deeper understanding of your target market. This will help you make data-driven decisions and refine your marketing strategies based on customer preferences.

- Regularly review and adapt your target market and customer profile as your platform grows and evolves. Customer needs and preferences may change over time, and it is crucial to stay agile and proactive in meeting those changes.

Identify And Analyze Potential Competitors

Identifying and analyzing potential competitors is a crucial step in creating a business plan for a bank. This step helps you assess the competitive landscape and understand the strengths and weaknesses of other players in the market. Here are some key considerations:

- Research: Conduct thorough research to identify existing banks and financial institutions offering similar services. Look for both traditional brick-and-mortar banks as well as digital banking platforms.

- Online Presence: Explore their online presence and evaluate their digital banking capabilities. Look for features, functionalities, and user experience that differentiate them.

- Competitive Advantages: Identify the unique selling propositions (USPs) of your competitors. Determine what sets them apart from others in terms of product offerings, customer service, technology, or any other factors.

- Customer Reviews: Analyze customer reviews and feedback on various platforms to gain insights into customer satisfaction and grievances. This will help you identify areas where your competitors excel or fall short.

- Market Share: Determine the market share and customer base of each competitor. This will give you an idea of the scale and reach you need to target.

- Financial Performance: Analyze the financial performance of your competitors by studying their annual reports, financial statements, and any available data. This will help you understand their growth trajectory and potential vulnerabilities.

- Look beyond direct competitors and consider indirect ones, such as fintech start-ups or alternative financial service providers.

- Keep an eye on emerging trends and innovations in the banking industry to stay ahead of your competitors.

- Consider conducting a SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis for each major competitor to gain a deeper understanding of their positioning.

Identifying and analyzing potential competitors is not only about understanding the competition but also about finding opportunities to differentiate your digital banking platform. By studying your competitors, you can identify gaps in the market and develop strategies that align with your unique value proposition.

Perform A Feasibility Study

A feasibility study is a crucial step in the business planning process. It involves conducting a comprehensive analysis to determine the viability of your digital banking platform. This study will help you assess the potential risks and benefits associated with your business idea and make informed decisions.

During the feasibility study, you should analyze various aspects of your business idea, including the market demand, competition, technological requirements, financial projections, and regulatory landscape. Here are the key steps to perform a feasibility study:

- Conduct thorough market research to understand the current demand for digital banking services and identify any gaps in the market.

- Evaluate the potential size of your target market and identify your ideal customer profile to tailor your offerings effectively.

- Assess the competitive landscape by analyzing existing digital banking platforms, their features, pricing strategies, and customer base.

- Consider the technological requirements for establishing and maintaining your online banking platform. Ensure that you have access to reliable and secure infrastructure.

- Develop financial projections and assess the profitability and sustainability of your business model. Consider factors such as revenue streams, operating expenses, and potential return on investment.

- Study the regulatory environment and identify the licenses and approvals required to operate a digital banking platform in your target market.

- Engage with industry experts and seek their advice during the feasibility study to gain valuable insights.

- Consider conducting surveys or focus groups to gather feedback from potential customers and validate your assumptions.

- Regularly review and update your feasibility study as market conditions and industry trends evolve.

By conducting a thorough feasibility study, you will gain a deeper understanding of the viability and potential of your digital banking platform. This study will serve as a foundation for making informed decisions throughout the business planning process.

Define The Unique Value Proposition And Competitive Advantage

Defining the unique value proposition and competitive advantage of your digital banking platform is crucial in order to differentiate yourself from other financial institutions and attract customers. Your value proposition is the core promise you make to customers about the benefits they will receive by using your platform. Your competitive advantage is what sets you apart from competitors and gives you an edge in the market.

- Identify Your Unique Selling Points: Determine what makes your platform unique and why customers should choose it over others. Consider features such as advanced security measures, user-friendly interface, personalized financial advice, or innovative banking solutions. These selling points will help you stand out and provide value that your competitors might not offer.

- Prioritize Customer Needs: Understand your target market's pain points and financial needs. Tailor your offerings and services to address these specific needs. Whether it is offering low-interest rates on loans, providing competitive investment options, or simplifying the account opening process, make sure your value proposition directly addresses the challenges your customers face.

- Analyze Competitors: Study your competitors' value propositions and competitive advantages. Identify the gaps and areas where you can excel. Look for opportunities to offer a better customer experience, more innovative products, or superior customer service. This analysis will allow you to position your platform as a market leader and attract customers seeking a better banking experience.

Tips for Defining Your Value Proposition and Competitive Advantage:

- Emphasize the convenience and accessibility of your digital banking platform.

- Showcase your commitment to security and privacy.

- Highlight any partnerships or collaborations that add value to your platform.

- Demonstrate your expertise in financial education and advisory services.

- Offer unique features such as budgeting tools, financial planning, or rewards programs.

By clearly defining your unique value proposition and competitive advantage, you can effectively market your digital banking platform to potential customers and secure their trust and loyalty. Remember, your value proposition should clearly communicate the benefits customers will gain by choosing your platform and should differentiate you from competitors. Building a strong value proposition will be instrumental in the success of your business plan.

Develop A Comprehensive Financial Plan

Developing a comprehensive financial plan is a crucial step in creating a business plan for a bank. This plan outlines the projected financial performance of your digital banking platform and demonstrates to potential investors and lenders that your business is financially viable.

When developing your financial plan, consider the following:

- Revenue projections: Estimate the revenue your digital banking platform is expected to generate. This can include income from various sources such as transaction fees, interest on loans, and commissions from financial products.

- Expense projections: Forecast the expenses associated with running your platform, including personnel costs, technology infrastructure, marketing expenses, and regulatory compliance costs.

- Capital requirements: Calculate the amount of capital needed to start and operate your digital banking platform. This includes upfront costs such as software development, marketing campaigns, and initial infrastructure investments.

- Profitability analysis: Assess the profitability of your platform by calculating the net income and profit margin. This analysis helps determine the financial feasibility and sustainability of your business.

- Cash flow projections: Forecast the cash flow of your digital banking platform, including the inflows from revenue and investment, as well as the outflows from expenses and loan repayments.

- Funding sources: Identify potential funding sources for your platform, such as bank loans, venture capital investments, or crowdfunding campaigns.

- Research industry benchmarks and financial ratios to ensure your projections are realistic and market-aligned.

- Consider the potential impact of external factors such as economic conditions, regulatory changes, and customer behavior on your financial plan.

- Regularly review and update your financial plan to reflect any changes in your business or market conditions.

By developing a comprehensive financial plan, you can demonstrate to banks and investors that your digital banking platform has a clear pathway to profitability and long-term success.

Establish Strategic Goals And Objectives

Establishing strategic goals and objectives is a crucial step in writing a business plan for a bank. These goals and objectives will serve as a roadmap for your digital banking platform, guiding all your actions and decisions towards a defined direction. It is important to clearly define and articulate these goals and objectives to ensure that everyone in the organization is aligned and working towards a common vision.

When establishing strategic goals and objectives, consider the long-term vision of your digital banking platform . What do you envision your platform to become in the next five or ten years? How do you see it evolving and growing? Define these aspirations into specific goals that are achievable and measurable.

Additionally, it is important to set objectives that are SMART - Specific, Measurable, Achievable, Relevant, and Time-bound. This means that each objective should be clearly defined, quantifiable, realistic, relevant to your business, and have a deadline for completion.

Here are some tips to consider when establishing strategic goals and objectives for your digital banking platform:

- Take into account market trends and customer demands when defining goals and objectives.

- Align your goals and objectives with your unique value proposition and competitive advantage.

- Consider both financial and non-financial objectives, such as customer satisfaction and innovation.

- Involve key stakeholders in the goal-setting process to ensure buy-in and commitment.

- Regularly review and update your goals and objectives to adapt to changes in the market and industry.

By establishing clear strategic goals and objectives, you are providing a direction for your digital banking platform to strive towards. These goals will serve as a compass, guiding your decisions and actions as you work towards success in the competitive banking industry.

Define The Organizational Structure And Management Team

Defining the organizational structure and management team is a crucial step in writing a business plan for a bank. This section outlines the key individuals who will be responsible for managing the operations and achieving the strategic goals of the digital banking platform.

To begin, it is important to clearly outline the various departments and positions within the organization. This includes roles such as CEO, CFO, CTO, and COO, as well as departments like finance, technology, operations, and customer service. Clearly defining these roles and responsibilities helps establish a clear chain of command and ensures that all areas of the business are properly managed.

- Consider including an organizational chart to visually depict the structure of the organization.

- Provide a brief description of each key management team member's background, skills, and experience.

- Highlight any unique qualities or expertise that these individuals bring to the table that make them a valuable asset to the organization.

- Consider including any advisory boards or external consultants that will be involved in decision-making processes.

Furthermore, it is essential to emphasize the qualifications and experience of each member of the management team. This includes their educational background, professional accomplishments, and relevant industry experience. Demonstrating that the team possesses the necessary skills and expertise significantly strengthens the credibility of the business plan and instills confidence in potential investors or lenders.

Lastly, it is important to consider and outline any plans for future expansion or growth. As the digital banking platform evolves, so too may the organizational structure and management team. Clearly articulate the expected growth trajectory and how the team will adapt to the changing needs of the business.

By properly defining the organizational structure and management team, the business plan for a digital banking platform becomes a comprehensive document that demonstrates a solid foundation for success. This section showcases the individuals driving the business forward, while also addressing how the organization will adapt and grow over time.

Obtain Necessary Licenses And Regulatory Approvals

Obtaining the necessary licenses and regulatory approvals is a crucial step in establishing a digital banking platform. Compliance with legal and regulatory requirements ensures that your business operates within the boundaries set by governing authorities. Here are the key steps to take when seeking licenses and approvals:

- Research Licensing Requirements: Begin by researching the specific licenses and permits required for operating a digital banking platform in your jurisdiction. Different countries and regions may have varying regulations, so it is essential to be well-informed. Consult with legal experts or industry professionals to navigate the complexities of licensing.

- Submit Applications: Once you have identified the licenses and permits needed for your digital banking platform, prepare and submit the required applications. Be sure to provide accurate and comprehensive information, as any discrepancies or oversights could lead to delays or rejection of your application.

- Engage with Regulatory Authorities: Throughout the licensing process, it is important to maintain open lines of communication with the relevant regulatory authorities. Address any queries or requests for additional information promptly and transparently. This will help in establishing a positive relationship with the authorities and expediting the approval process.

- Comply with Regulatory Requirements: As you progress towards obtaining licenses and approvals, ensure that your business fully complies with all relevant regulatory requirements. This may include maintaining appropriate capital adequacy ratios, implementing robust anti-money laundering measures, and adhering to data protection and privacy laws.

- Seek Legal Counsel: Working with experienced legal counsel specializing in financial regulations can prove invaluable during this process. They can offer guidance, review your compliance efforts, and help navigate any legal complexities that may arise.

- Stay Updated: Regulatory frameworks and requirements are subject to change, so it is crucial to stay informed about any updates or amendments. Continuously monitor regulatory developments to ensure that your digital banking platform remains compliant.

- Start the licensing process early: Obtaining licenses and regulatory approvals can be a time-consuming process. Starting early allows for any unexpected delays and ensures you meet your desired launch timeline.

- Be thorough and accurate: Pay meticulous attention to detail when completing license applications. Provide all necessary documentation and information to avoid unnecessary delays or complications.

- Engage with industry associations: Connecting with industry associations or peer networks can provide you with valuable insights into navigating the licensing process. Networking with experienced professionals can help you anticipate challenges and streamline the approval process.

- Maintain ongoing compliance: Obtaining licenses and regulatory approvals is just the first step. Develop robust compliance procedures and internal controls to ensure ongoing adherence to regulatory requirements. Regularly review and update your compliance practices as regulations evolve.

In conclusion, writing a business plan for a bank requires careful research, analysis, and strategic thinking. By following the nine steps outlined in this checklist, you can create a comprehensive and compelling plan that demonstrates the viability of your digital banking platform. From conducting market research to obtaining necessary licenses, each step is crucial in building a strong foundation for your business. Remember to highlight your unique value proposition and competitive advantage, develop a comprehensive financial plan, establish strategic goals, and define your organizational structure. With a well-crafted business plan, you can confidently approach banks and secure the funding needed to bring your digital banking platform to life.

$169.00 $99.00 Get Template

Related Blogs

- Starting a Business

- KPI Metrics

- Running Expenses

- Startup Costs

- Pitch Deck Example

- Increasing Profitability

- Sales Strategy

- Rising Capital

- Valuing a Business

- How Much Makes

- Sell a Business

- Business Idea

- How To Avoid Mistakes

Leave a comment

Your email address will not be published. Required fields are marked *

Please note, comments must be approved before they are published

HOW TO WRITE A BANK BUSINESS PLAN: Simple Steps & All You Need (+ Template)

- by Kenechukwu Muoghalu

- August 13, 2023

- No comments

- 6 minute read

Table of Contents Hide

What is a bank business plan, why do i need a bank business plan, #1. executive summary, #2. company overview, #3. customer analysis, #4. competitive analysis, #5. marketing plan, #6. operations plan, #7. management team, #8. financial plan, #9. appendix, bank business plan template, would you want to finish your bank’s business plan as quickly as possible, what is the easiest way to complete my bank business plan, how do banks make money, can an individual own a bank.

Opening a new bank is a cool investment that requires a stipulated level of attention and responsibilities for growth to take place. However, how can you start up a financial facility without a business plan? How do you intend to nurture the goals and growth of your bank business? Every investment needs a business plan and that is why this article has every little detail on what you need to know about this plan. You will also have access to a free template checklist and basic steps on how to write a bank business plan.

We also have a ready-made bank business plan for your comfort, just in case you wish to skip all procedures and get hold of your plan today.

A bank business plan is a document that provides a snapshot of your bank and lays out its future growth plan. Not just that, it also explains your business goals and gives strategies that can help you attain them. It is more like a road map for success, and without the road map, you cannot get to your desired destination.

It is also important to note that only a well-detailed and articulated bank business plan can achieve its potential purposes. Your bank’s business plan should also be updated annually to accommodate new changes in your business.

The essence of a bank business plan can vary from one business owner to another. One can start up a business plan to attract investors or lenders to aid them in raising funds because, like other businesses, the banking industry also requires capital investment on a large scale to start its operations.

Most of the time, you will need a bank business plan to map out the goals and growth of your bank and excessively improve your chances of success. You can also need a bank business plan for a combination of both reasons. A banking industry business plan plays an important role in the initiation and expansion of banks. Moreover, a business plan for banks is also required by the financial institutions.

To write a winning bank business plan, you need to understand some basic steps on how to construct a comprehensive and well-detailed plan. Writing a plan comes with some procedures, and you can only yield results in your company when these procedures are followed. Let’s analyze what these procedures entail.

Simple Steps on How to Write a Bank Business Plan

The executive summary of your bank’s business plan should be an introduction to your business. It is usually the first to appear on the plan but the last to write. This is because you will need some information from other sections. This section should be interesting to your readers. Don’t fail to explain the kind of bank you run, which can be either a startup or a chain of banks.

Also one of the steps in how to write this section of your bank business plan is to include an overview of your competitors and your financial plan.

There are different types of banks that one can invest in, and in your company overview, you will need to detail the type of bank you are operating.

- Commercial Bank

A commercial bank is built to support both large corporations and small businesses. They can open a savings account, and lend money or trust funds to companies in foreign markets.

- Retail Bank

Retail banks are normally traditional banks that customers can access online or in person. They also offer loans and insurance.

- Investment Bank

This bank normally trades in stocks that are mostly between companies and investors. They can offer advice to individuals and corporations who need financial guidance.

- Credit Union

Credit unions are basically like traditional banks, but they are different because they’re not profit-oriented. Regardless, they perform basic operations like loans and providing savings accounts.

When you indicate the type of bank that suits you, then you will proceed to give a brief introduction of your company. Tell your readers why you started this business and the things you have achieved.

This is where you include the details of the customers you will be offering your services to. Your customers might be individuals, small businesses, families, or big corporations. It is important to note that each customer will be following the type of bank you run. You will also need to research your customers and try to meet your target audience.

This is where you need to mention your competitors which can be either direct or indirect. Direct competitors are other banks, and indirect competitors are other options that your potential customers can purchase from. It can be trust accounts, investment companies, or even the stock market. They are not directly competing with your products.

You will need to list those competitors and give a brief description of their weaknesses and strengths. Then at the end of this section, you can provide how the services you offer are unique from your competitors.

As a financial facility, your marketing strategy should include your products, price, place, and promotions. In the product section, just talk about the type of bank you run, and state the prices of the products you offer as well. The place should be the location of your bank and how that site will impact your success. The promotion is meant to explain how you will attract potential customers to your company, which can be either an advertisement, websites, flyers, or social media platforms.

The operation plan should explain how you intend to meet the goals of your business. It should cover both the short-term and long-term processes. You should include how you intend to reshape your company within that time frame.

Just like the name implies, this section should be all about your strong management team. Highlight your key players by including their backgrounds, skills, and experiences that prove that they are capable enough to grow a company. It is a bonus if your management team has had direct experience in managing banks. If your team is lacking, you can consider assembling an advisory board.

A financial plan should include your 5-year financial statement. It should also cover your income statement, balance sheet, and cash flow statements. An income statement should contain your profit and loss statement. A balance sheet will cover your assets and liabilities, while a cash flow statement will determine how much money you need to start and grow your business to avoid going bankrupt.

In the appendix section, you can include any information that can make your bank business plan more compelling. You can attach your financial projections to a list of loans you plan to give.

Having learned how to effectively write a bank business plan, you will also need to practice the use of a template. A bank business plan template is essential when starting a bank business. It is with this template checklist that you will understand the full processes that are involved with starting a bank business. So, before you proceed with your investment, you need to keep these steps in check.

- Know the business

- Write a business plan

- Raise Capital

- Choose a business name

- Get a license

- Attract customers

Don’t you wish there was an easier way to finish your bank’s business plan? Understandably, creating a business plan can be overwhelming, but there is a way around it. At BusinessYield Consult, we specialize in creating business plans for entrepreneurs like you.

That is why we have composed a unique, ready-made bank business plan for your comfort. Now you won’t have to spend hours trying to get over a section of your business plan.

All you need to do is to grab a copy of your bank business plan now!

A business plan is essential in every company, whether a big or small business. It tends to bring some changes into every business and also helps you manage that business effectively. Although sometimes creating one for yourself might be a bit daunting, when you follow the steps above, you can come up with a successful bank business plan that will boost the growth of your company.

If you need an easier way to complete your business plan without having to go through the long process of writing one yourself, then you can try our ready-made bank business plan .

Banks mainly make money by borrowing money from depositors and then compensating them with an interest rate. Then that same bank will lend the money to borrowers and charge them a high-interest rate. It is from that profit that their profit comes.

Yes. There is a possibility of individual ownership but most times individuals commonly buy shares of bank stock which can be directly from the bank or fund managers.

Related Articles

- BUY-TO-LET BUSINESS PLAN: How to Create a Property Business Plan For Your Business

- GROWTH SHARES: Overview, Features and Benefits

- HOW DOES MOTABILITY WORK: Definitions And Eligibility

- How Long Does It Take For A Check To Clear: Detailed Explanation

- How to Start an Estate Agency: Easy Guide For Beginners

Kenechukwu Muoghalu

Kenny, an accomplished business writer with a decade of experience, excels in translating intricate industry insights into engaging articles. Her passion revolves around distilling the latest trends, offering actionable advice, and nurturing a comprehensive understanding of the business landscape. With a proven track record of delivering insightful content, Kenny is dedicated to empowering her readers with the knowledge needed to thrive in the dynamic and ever-evolving world of business.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

SUPPORTED LIVING BUSINESS PLAN: Template And How to Write One

Inheriting a house from your parents uk: steps to take after inheriting a house.

We noticed you're visiting from Netherlands. We've updated our prices to Euro for your shopping convenience. Use Pound sterling instead. Dismiss

Writing a Bank Business Plan

- Written By Dave Lavinsky

When it comes to seeking funding from a bank or other financial institution, one of the most important things you can do is have a well-written business plan . This document will not only give potential lenders and investors an idea of your company’s current position and future goals but will also provide them with a clear understanding of the risks involved in lending you money or investing in your business.

What is a Business Plan?

A business plan is a document that provides a detailed description of a business, its products or services, its market, and its financial projections. It is used to secure funding from lenders or investors and to provide guidance for the business’s future operations.

Why Write a Business Plan

There are several reasons why you might want to write a plan for your business, even if you’re not looking for funding, they are:

- To clarify your company’s purpose and direction

- To better understand your industry and customers

- To develop a realistic financial plan and accurate projections

- To identify potential risks and opportunities

- To track your company’s progress over time

An effective and well-written plan is helpful for potential investors and clarifies the plans you have for any future business partners.

Sources of Business Funding for Banks

There are many sources of business funding available to banks, including:

- Equity financing: This is when you sell a portion of your business to investors in exchange for capital. This can be a good option if you need a large amount of money quickly, as it doesn’t require you to pay back the funds over time.

- Debt financing: This is when you borrow money from a lender, such as a bank, in exchange for repayment plus interest. This type of financing can be helpful if you need to keep your cash flow low in the early stages of your business.

- Grants: There are several different government and private grants available to businesses, which can often be used for start-up costs or expansion.

- Venture capital: This is when you receive funding from a venture capitalist in exchange for a portion of your company’s equity. Venture capitalists typically invest their own personal savings in high-growth businesses with a lot of potential.

Resources to Write a Bank Business Plan

To write a bank business plan, you’ll need access to a variety of resources, including:

Sample Plans for Your Business

A good place to start is by looking at some sample plans for businesses in your industry. This will give you a good idea of the types of information to include in your own plan.

Business planning software

There are a number of software programs that can help you create professional-looking plans for your business.

Market Research

When writing a business plan for a bank, it’s important to include a section on your company’s market research. This will include detailed information about your industry, your market, and your competition.

Industry Analysis

In order to accurately describe your industry and the market for your products or services, you’ll need to conduct an industry analysis. This should include information about the size and growth of the industry, the key players in the industry, and any major trends or changes that are taking place.

Target Market Analysis

To effectively market your products or services, you need to understand who your target market is. This should include information about the demographics of your target customers (age, gender, income, etc.), psychographics (lifestyle preferences, interests, etc.), and geographic (location, region).

Competition Analysis

In order to differentiate your business from the competition, you’ll need to know what they’re offering and how they’re positioning themselves in the market. This should include a SWOT analysis (strengths, weaknesses, opportunities, threats) of your competitors.

Customer Segments

A customer segment is a group of customers who share common characteristics, such as age, income, location, or lifestyle preferences. When creating business plans for a bank, it’s important to identify and target your key customer segments. This will help you focus your marketing efforts and create products and services that appeal to your target market.

There are a variety of ways to segment customers, including:

- Demographics: Age, gender, income, location, etc.

- Psychographics: Lifestyle preferences, interests, etc.

- Behavior: How they interact with your brand, what channels they use to purchase products or services, etc.

- Usage: How often they purchase your product or service, how much they spend, etc.

- Value: How much they’re willing to pay for your product or service, how much they value customer service, etc.

Once you’ve identified your customers, you can create buyer personas. These are fictional characters that represent your ideal customer within each segment. Creating buyer personas will help you better understand your target market and create more effective marketing campaigns.

Financial templates

If you’re not familiar with financial terminology or calculations, use a financial template to help you develop your business’s financial projections as well as including an income statement and balance sheets.

Accounting and Legal Advice

It’s important to seek out accounting and legal advice from professionals who can help ensure that your business plan is accurate and complete.

Bank Business Plan Template

While there is no one-size-fits-all template for writing a business plan, there are some key elements that should be included. Here is a brief overview of what should be included:

Executive Summary

This is a high-level overview of your company, its products or services, and its financial situation. Be sure to include information on your target market, your competitive advantage, and your plans for growth.

Company Description

This section provides more detail on your company, including its history, structure, and management team. Be sure to include information on your company’s mission and vision, as well as its values and goals.

Products and Services

Here you will describe your company’s products or services in detail, including information on your target market and your competitive advantage.

Market Analysis

In this section, you will provide an overview of your market, including demographic information and information on current and future trends. This is also a good section to add the marketing plan you have developed to appeal to potential customers.

Sales and Marketing

This section will detail your sales and marketing strategy, including information on your pricing, your distribution channels, and your promotion plans.

Financial projections

This is perhaps the most important section of your business plan, as it will provide lenders and investors with an idea of your company’s financial health. Be sure to include detailed information on your past financial performance, as well as your projections for future revenue and expenses. This is also a good section to include your cash flow statements, income statements, and information about any bank accounts opened for your business.

This is where you will include any supporting documents, such as your financial statements, marketing materials, or product data sheets.

While this is not an exhaustive list of everything that should be included in your bank business plan, it covers the most important elements. By taking the time to write a well-thought-out and detailed business plan, you will increase your chances of securing the funding you need to grow your business.

Opening a bank is a detailed and complex process, but it can be enormously rewarding both professionally and financially. The best way to increase your chances of success is to write a business plan that outlines all aspects of opening and running a bank. This document should include market analysis, organizational structure, financial projections, and more. Our team has extensive experience helping entrepreneurs open banks. We have created a comprehensive business plan template that covers all the key points you need to consider when writing your own business plan. By following our template, you can be sure that you haven’t missed any essential elements in your planning process. Investing in professional help when writing your business plan gives you the best chance for success when opening a new bank.

Bank Business Plan Template FAQs

Do i need to use a business plan template.

There is no one-size-fits-all answer to this question. If you are seeking funding from a lender or investor, they may have specific requirements for the format and content of your business plan. In other cases, using a template can be helpful in ensuring that you include all of the important information in your plan.

Where can I find a business plan template?

There are a number of resources that offer business plan templates, including the Small Business Administration (SBA) and the U.S. Chamber of Commerce. Additionally, many software programs that offer business planning tools also include templates.

How long should my business plan be?

Again, there is no one-size-fits-all answer to this question. The length of your business plan will depend on the complexity of your business and the amount of detail you need to include. In general, however, most business plans range from 20 to 50 pages.

Do I need to hire a professional to help me write my business plan?