A How-To Guide for Creating a Business Budget

Amanda Smith

Reviewed by

September 23, 2022

This article is Tax Professional approved

Most business owners know how important a business budget is when it comes to managing expenses and planning for the future—but in a challenging economic environment like the one we’ve been experiencing, your business budget takes on even greater significance.

With inflation running rampant and the possibility of a recession looming, business owners need to be able to forecast their cash flow, manage their expenses, and plan for the future. Creating a detailed business budget is the first step.

Whether you want to revamp your budgeting method, or you’ve never created a business budget before, this guide will walk you through the process.

I am the text that will be copied.

What is a business budget?

A budget is a detailed plan that outlines where you’ll spend your money monthly or annually.

You give every dollar a “job,” based on what you think is the best use of your business funds, and then go back and compare your plan with reality to see how you did.

A budget will help you:

- Forecast what money you expect to earn

- Plan where to spend that revenue

- See the difference between your plan and reality

What makes a good budget?

The best budgets are simple and flexible. If circumstances change (as they do), your budget can flex to give you a clear picture of where you stand at all times.

Every good budget should include seven components:

1. Your estimated revenue

This is the amount you expect to make from the sale of goods or services. It’s all of the cash you bring in the door, regardless of what you spent to get there. This is the first line on your budget. It can be based on last year’s numbers or (if you’re a startup ), based on industry averages.

2. Your fixed costs

These are all your regular, consistent costs that don’t change according to how much you make—things like rent, insurance, utilities, bank fees, accounting and legal services, and equipment leasing.

Further reading: Fixed Costs (Everything You Need to Know)

3. Your variable costs

These change according to production or sales volume and are closely related to “ costs of goods sold ,” i.e., anything related to the production or purchase of the product your business sells. Variable costs might include raw materials, inventory, production costs, packaging, or shipping. Other variable costs can include sales commission, credit card fees, and travel. A clear budget plan outlines what you expect to spend on all these costs.

The cost of salaries can fall under both fixed and variable costs. For example, your core in-house team is usually associated with fixed costs, while production or manufacturing teams—anything related to the production of goods—are treated as variable costs. Make sure you file your different salary costs in the correct area of your budget.

Further reading: Variable Costs (A Simple Guide)

4. Your one-off costs

One-off costs fall outside the usual work your business does. These are startup costs like moving offices, equipment, furniture, and software, as well as other costs related to launch and research.

5. Your cash flow

Cash flow is all money traveling into and out of a business. You have positive cash flow if there is more money coming into your business over a set period of time than going out. This is most easily calculated by subtracting the amount of money available at the beginning of a set period of time and at the end.

Since cash flow is the oxygen of every business, make sure you monitor this weekly, or at least monthly. You could be raking it in and still not have enough money on hand to pay your suppliers.

6. Your profit

Profit is what you take home after deducting your expenses from your revenue. Growing profits mean a growing business. Here you’ll plan out how much profit you plan to make based on your projected revenue, expenses, and cost of goods sold. If the difference between revenue and expenses (aka “ profit margins ”) aren’t where you’d like them to be, you need to rethink your cost of goods sold and consider raising prices .

Or, if you think you can’t squeeze any more profit margin out of your business, consider boosting the Advertising and Promotions line in your budget to increase total sales.

7. A budget calculator

A budget calculator can help you see exactly where you stand when it comes to your business budget planning. It might sound obvious, but getting all the numbers in your budget in one easy-to-read summary is really helpful.

In your spreadsheet, create a summary page with a row for each of the budget categories above. This is the framework of your basic budget. Then, next to each category, list the total amount you’ve budgeted. Finally, create another column to the right—when the time period ends, use it to record the actual amounts spent in each category. This gives you a snapshot of your budget that’s easy to find without diving into layers of crowded spreadsheets.

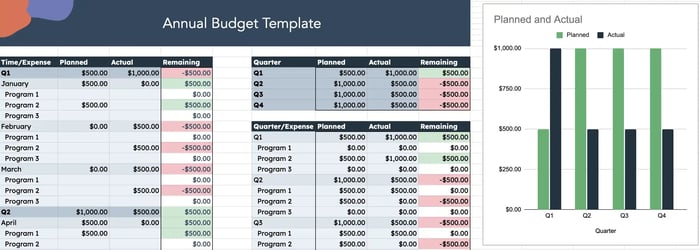

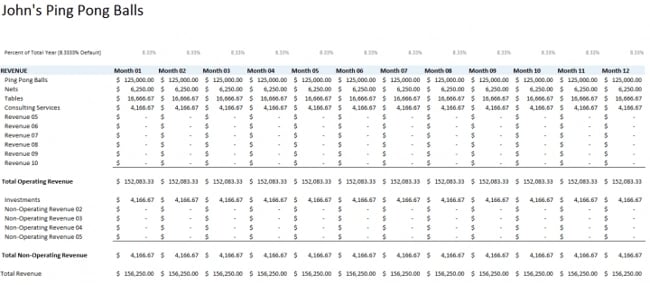

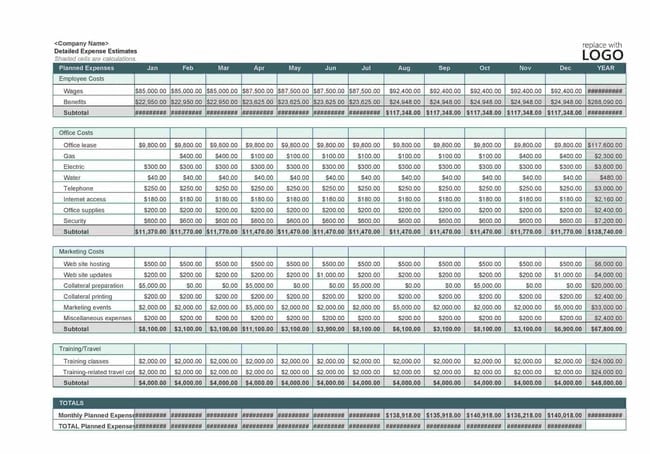

See the sample below.

Pro tip: link the totals on the summary page to the original sums in your other budget tabs . That way when you update any figures, your budget summary gets updated at the same time. The result: your very own budget calculator.

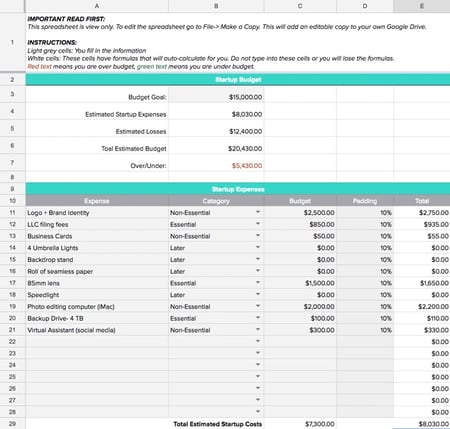

You can also check out this simple Startup Cost Calculator from CardConnect. It lays out some of the most common expenses that you might not have considered. From there, you can customize a rough budget for your own industry.

Small business budgets for different types of company

While every good budget has the same framework, you’ll need to think about the unique budgeting quirks of your industry and business type.

Seasonal businesses

If your business has a busy season and a slow season, budgeting is doubly important.

Because your business isn’t consistent each month, a budget gives you a good view of past and present data to predict future cash flow . Forecasting in this way helps you spot annual trends, see how much money you need to get you through the slow months, and look for opportunities to cut costs to offset the low season. You can use your slow season to plan for the next year, negotiate with vendors, and build customer loyalty through engagement.

Don’t assume the same thing will happen every year, though. Just like any budget, forecasting is a process that evolves. So start with what you know, and if you don’t know something—like what kind of unexpected costs might pop up next quarter— just give it your best guess . Better to set aside money for an emergency that doesn’t happen than to be blindsided.

Ecommerce businesses

The main budgeting factor for ecommerce is shipping. Shipping costs (and potential import duties) can have a huge impact.

Do you have space in your budget to cover shipping to customers? If not, do you have an alternative strategy that’s in line with your budget—like flat rate shipping or real-time shipping quotes for customers? Packaging can affect shipping rates, so factor that into your cost of goods sold too. While you’re at it, consider any international warehousing costs and duties.

You’ll also want to create the best online shopping experience for your customers, so make sure you include a good web hosting service, web design, product photography, advertising, blogging, and social media in your budget.

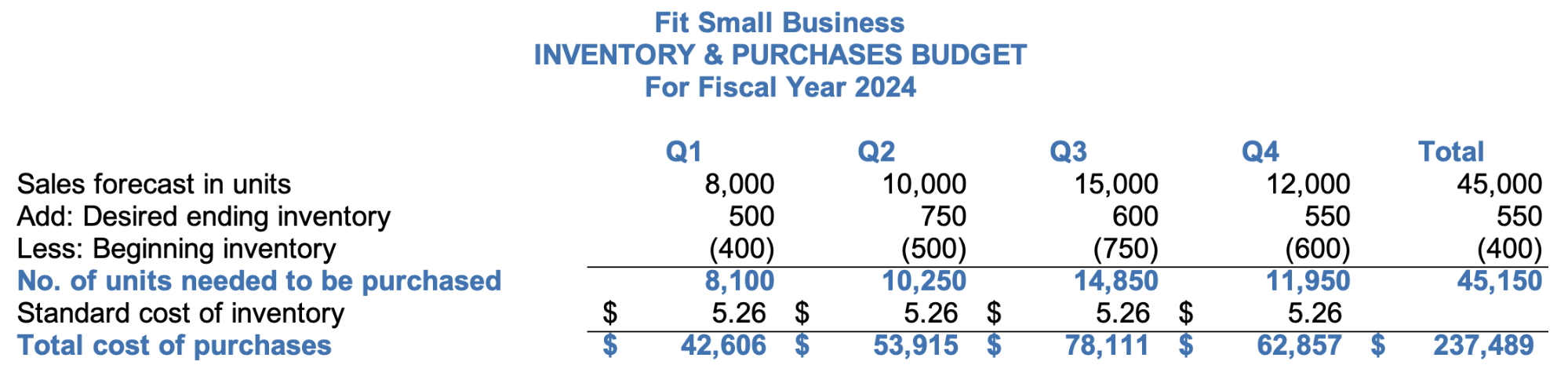

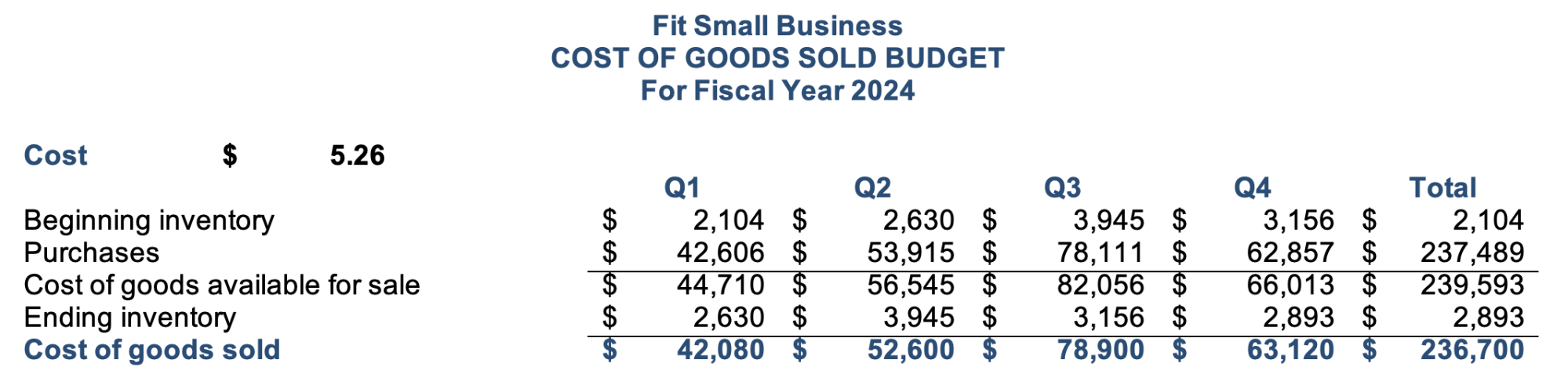

Inventory businesses

If you need to stock up on inventory to meet demand, factor this into your cost of goods sold. Use the previous year’s sales or industry benchmarks to take a best guess at the amount of inventory you need. A little upfront research will help ensure you’re getting the best prices from your vendors and shipping the right amount to satisfy need, mitigate shipping costs, and fit within your budget.

The volume of inventory might affect your pricing. For example, if you order more stock, your cost per unit will be lower, but your overall spend will be higher. Make sure this is factored into your budget and pricing, and that the volume ordered isn’t greater than actual product demand.

You may also need to include the cost of storage solutions or disposal of leftover stock.

Custom order businesses

When creating custom ordered goods, factor in labor time and cost of operations and materials. These vary from order to order, so make an average estimate.

Budgeting is tricky for startups—you rarely have an existing model to use. Do your due diligence by researching industry benchmarks for salaries, rent, and marketing costs. Ask your network what you can expect to pay for professional fees, benefits, and equipment. Set aside a portion of your budget for advisors—accountants, lawyers, that kind of thing. A few thousand dollars upfront could save you thousands more in legal fees and inefficiencies later on.

This is just scratching the surface, and there’s plenty more to consider when creating a budget for a startup. This business startup budget guide from The Balance is a great start.

Service businesses

If you don’t have a physical product, focus on projected sales, revenue, salaries, and consultant costs. Figures in these industries—whether accounting, legal services, creative, or insurance—can vary greatly, which means budgets need flexibility. These figures are reliant on the number of people required to provide the service, the cost of their time, and fluctuating customer demand.

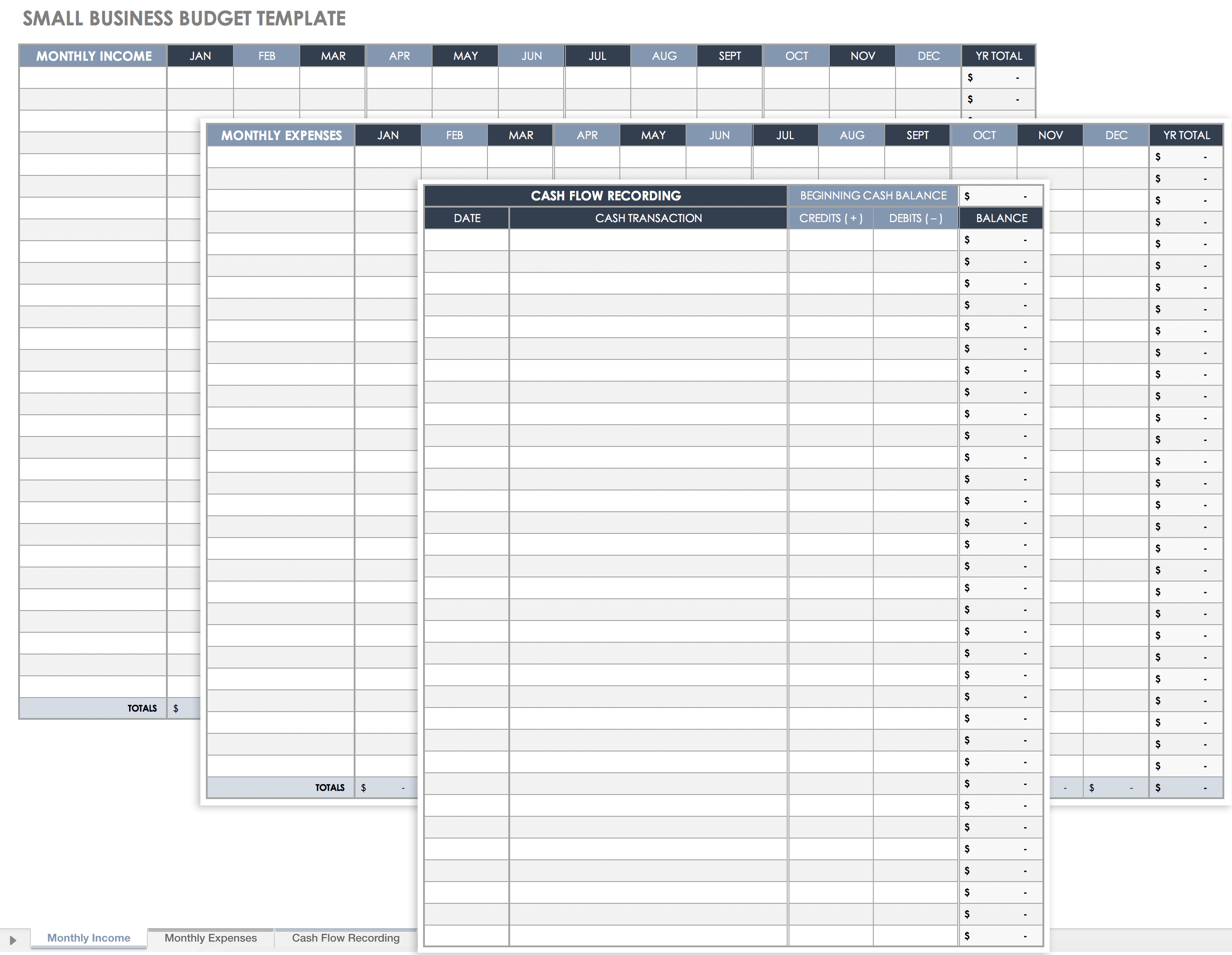

Small business budgeting templates

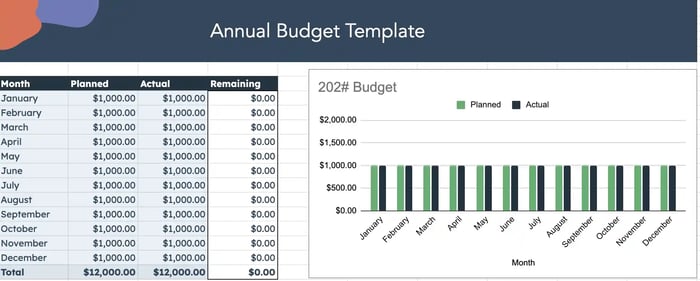

A business budget template can be as simple as a table or as complex as a multi-page spreadsheet. Just make sure you’re creating something that you’ll actually use.

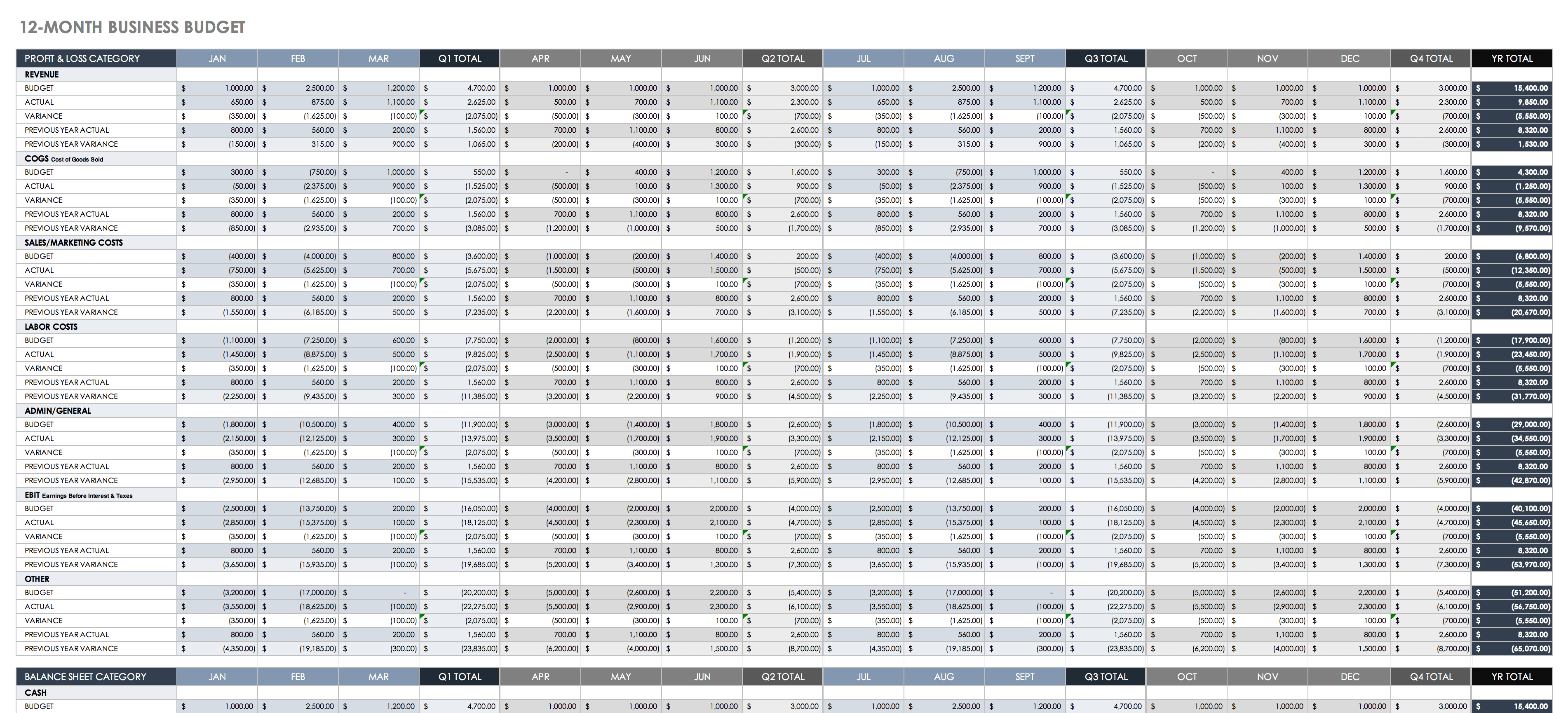

Create your budget yearly—a 12-month budget is standard fare—with quarterly or monthly updates and check-ins to ensure you’re on track.

Here are some of our favorite templates for you to plug into and get rolling.

- The Balance has a clear table template that lists every budget item, the budgeted amount, the actual amount, and the difference between the two. Use this one if you’re looking to keep it simple.

- Capterra has both monthly and annual breakdowns in their Excel download. It’s straightforward, thorough, and fairly foolproof.

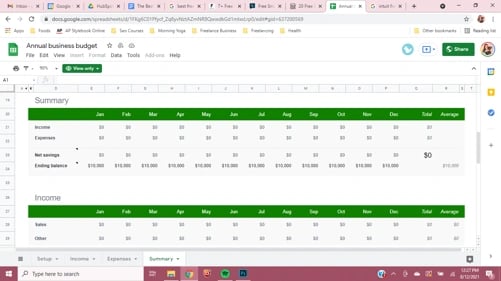

- Google Sheets has plenty of budget templates hiding right under your nose. They’re easy to use, and they translate your figures into clear tables and charts on a concise, visual summary page.

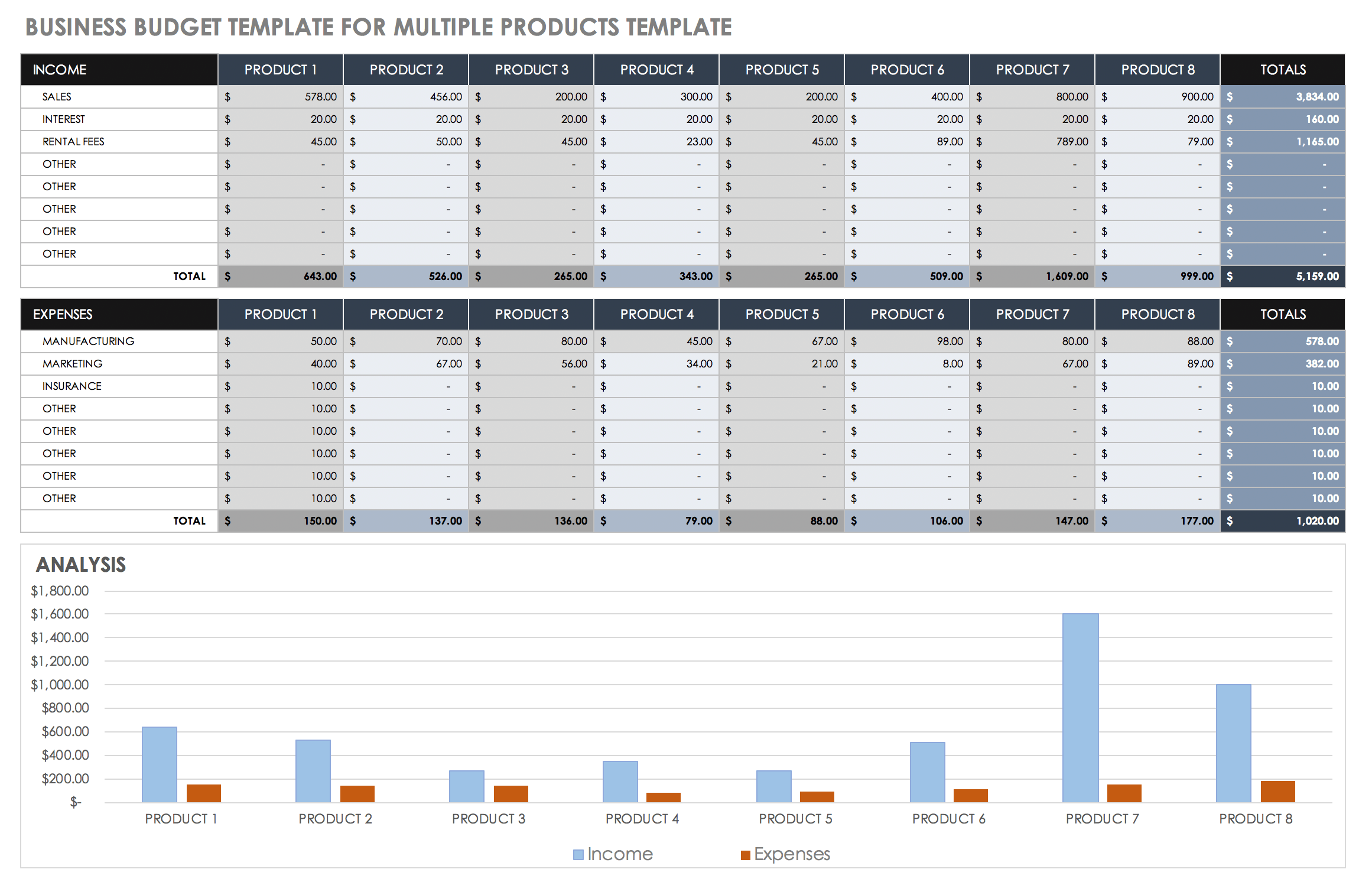

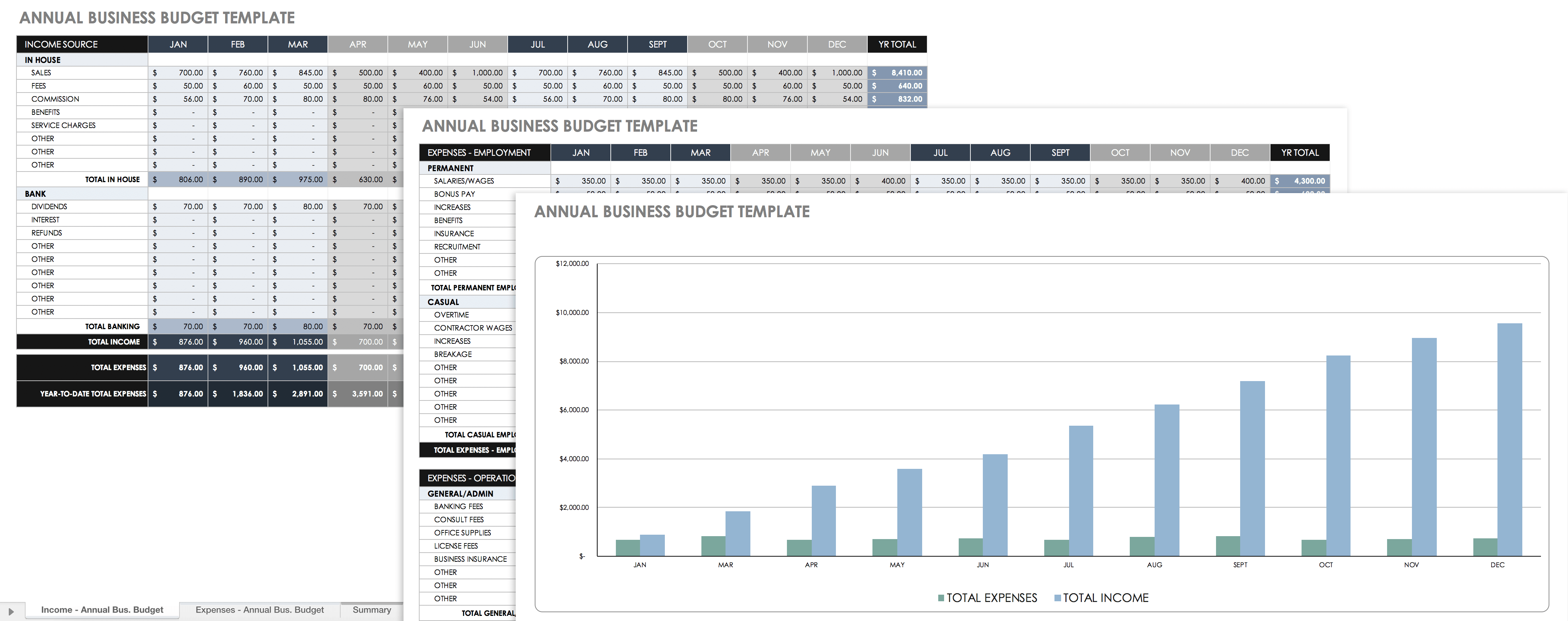

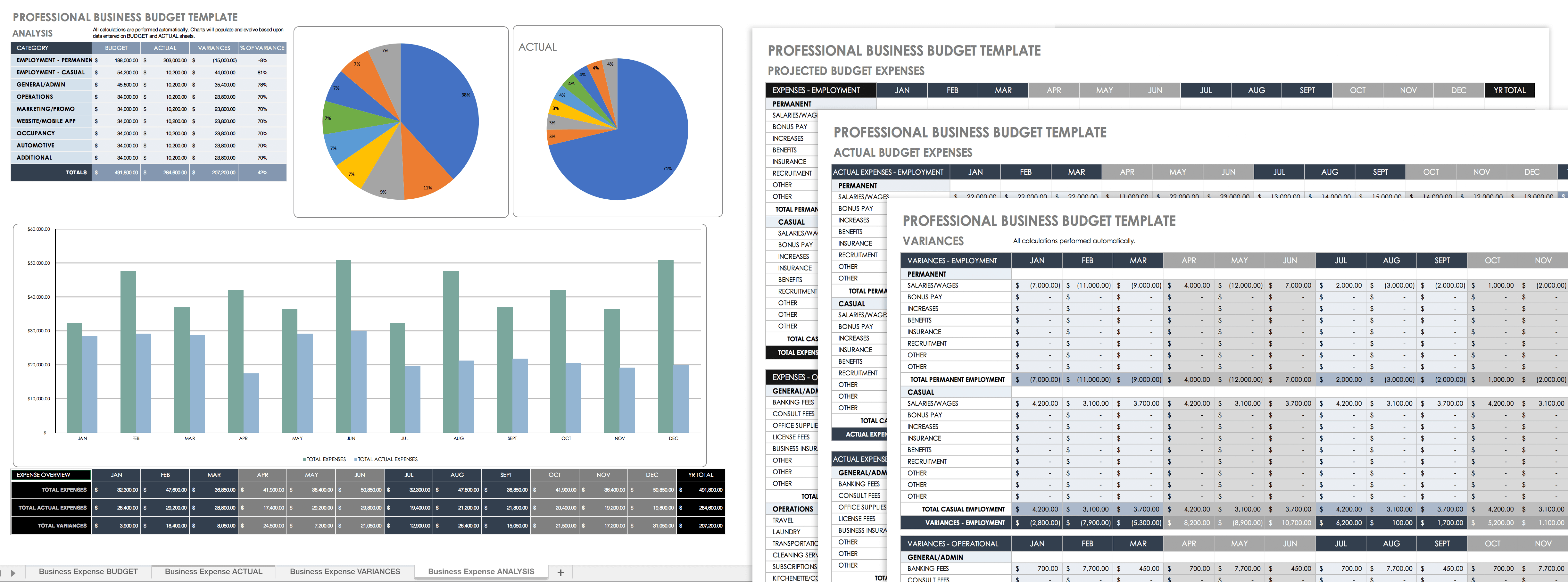

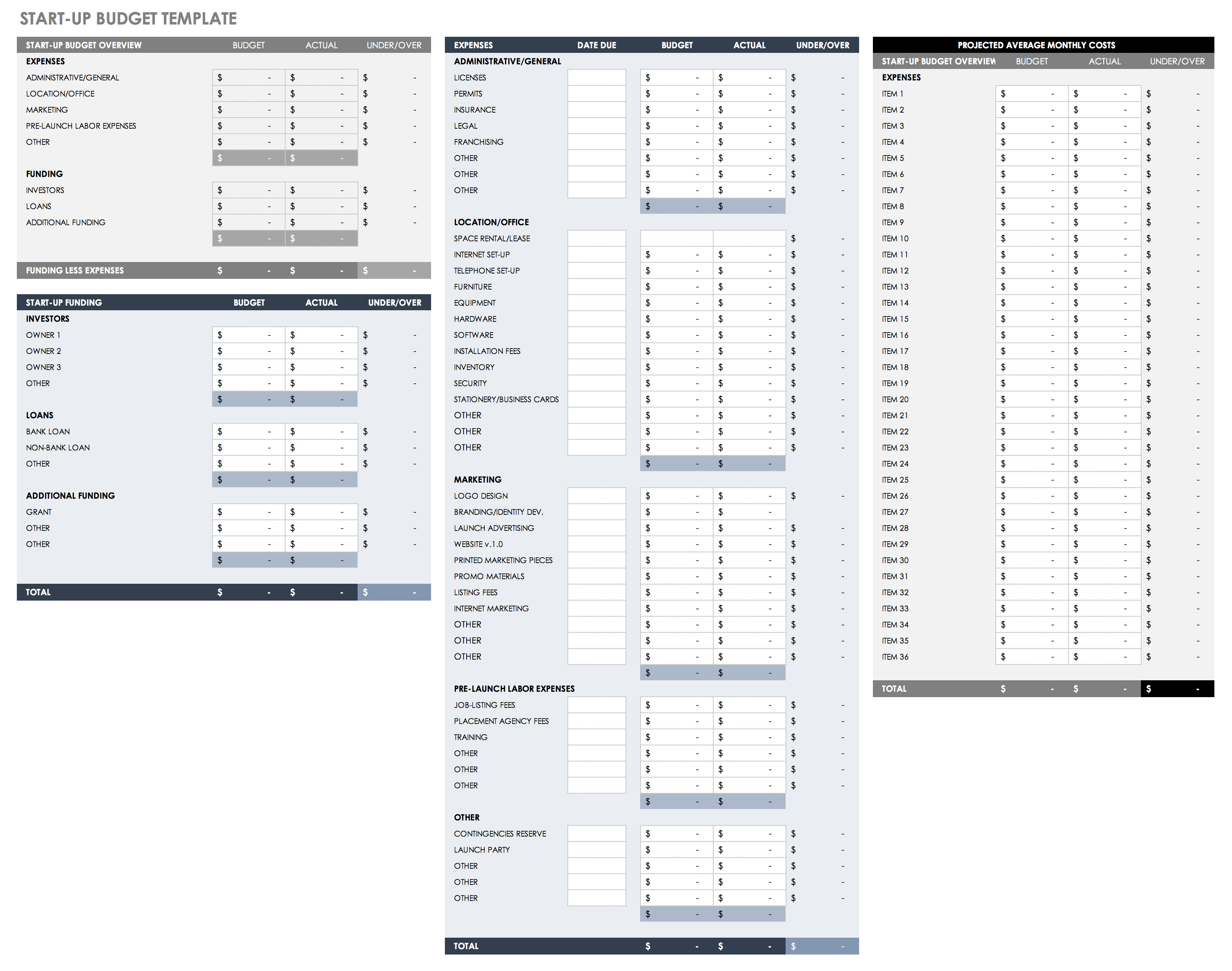

- Smartsheet has multiple resources for small businesses, including 12-month budget spreadsheets, department budget templates, projection templates, project-by-project templates, and startup templates. These templates are ideal if you’re looking for a little more detail.

- Scott’s Marketplace is a blog for small businesses. Their budget template comes with step-by-step instructions that make it dead simple for anyone.

- Vertex42 focuses on Excel spreadsheets and offers templates for both product-based and service-based businesses, as well as a business startup costs template for anyone launching a new business.

Budgeting + bookkeeping = a match made in heaven

Making a budget is kind of like dreaming: it’s mostly pretend. But when you can start pulling on accurate historical financials to plan the upcoming year, and when you can check your budget against real numbers, that’s when budgets start to become useful.

The only way to get accurate financial data is through consistent bookkeeping.

Don’t have a regular bookkeeping process down pat? Check out our free guide, Bookkeeping Basics for Entrepreneurs . We’ll walk you through everything you need to know to get going yourself, for free.

If you need a bit more help, get in touch with us. Bookkeeping isn’t for everyone, especially when you’re also trying to stay on top of a growing business—but at Bench, bookkeeping is what we do best.

Related Posts

Statement of Retained Earnings: A Complete Guide

Understanding the statement of retained earnings can help you evaluate your business’s profitability and help you plan for future growth.

Financial Literacy 101 for Small Business Owners

Your financial statements are more than a look at how your business performed in the past. They can help you make decisions now and in the future.

Accumulated Depreciation Explained

What exactly is that accumulated depreciation account on your balance sheet? Here’s what you need to know about this important line item.

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Get a regular dose of educational guides and resources curated from the experts at Bench to help you confidently make the right decisions to grow your business. No spam. Unsubscribe at any time.

The Best Free Business Budget Templates

Published: October 12, 2023

Business budgets are a source of truth for your income and expenses. That includes all the money you spend — from A/B testing your marketing campaigns to your monthly office rent.

While organizing the numbers may sound difficult, using a business budget template makes the process simple. Plus, there are thousands of business budget templates for you to choose from.

We’ll share seven budget templates that can help organize your finances. But first, you’ll learn about different types of business budgets and how to create one.

What is a Business Budget?

A business budget is a spending plan that estimates the revenue and expenses of a business for a period of time, typically monthly, quarterly, or yearly.

The business budget follows a set template, which you can fill in with estimated revenues, plus any recurring or expected business expenses.

For example, say your business is planning a website redesign. You'd need to break down the costs by category: software, content and design, testing, and more.

Having a clear breakdown will help you estimate how much each category will cost and compare it with the actual costs.

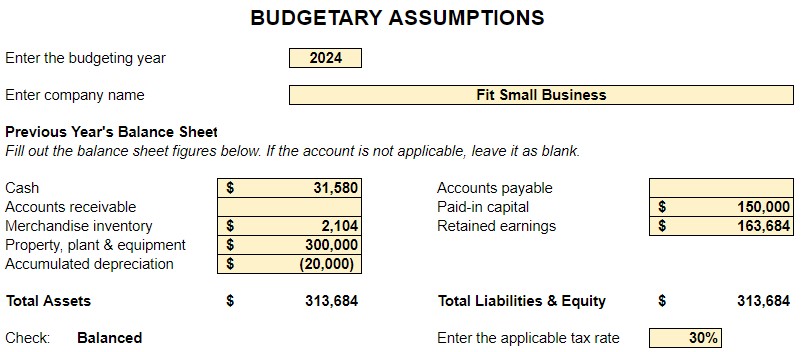

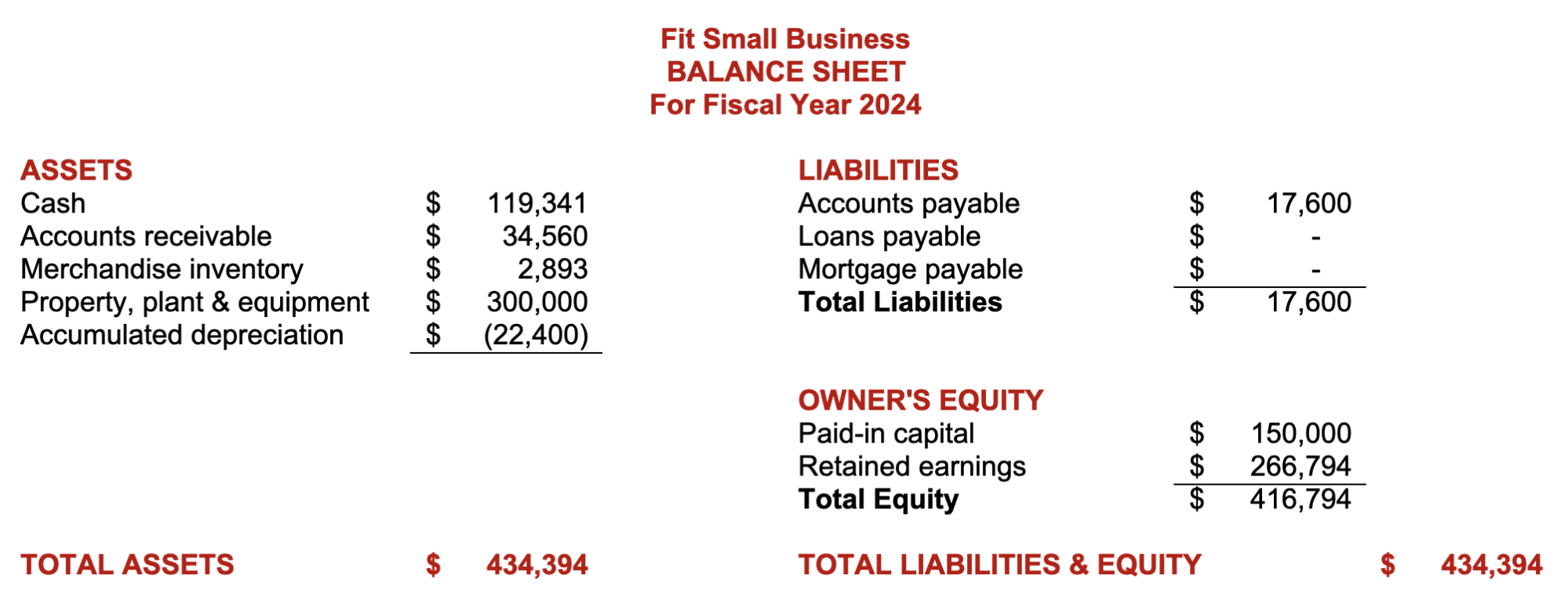

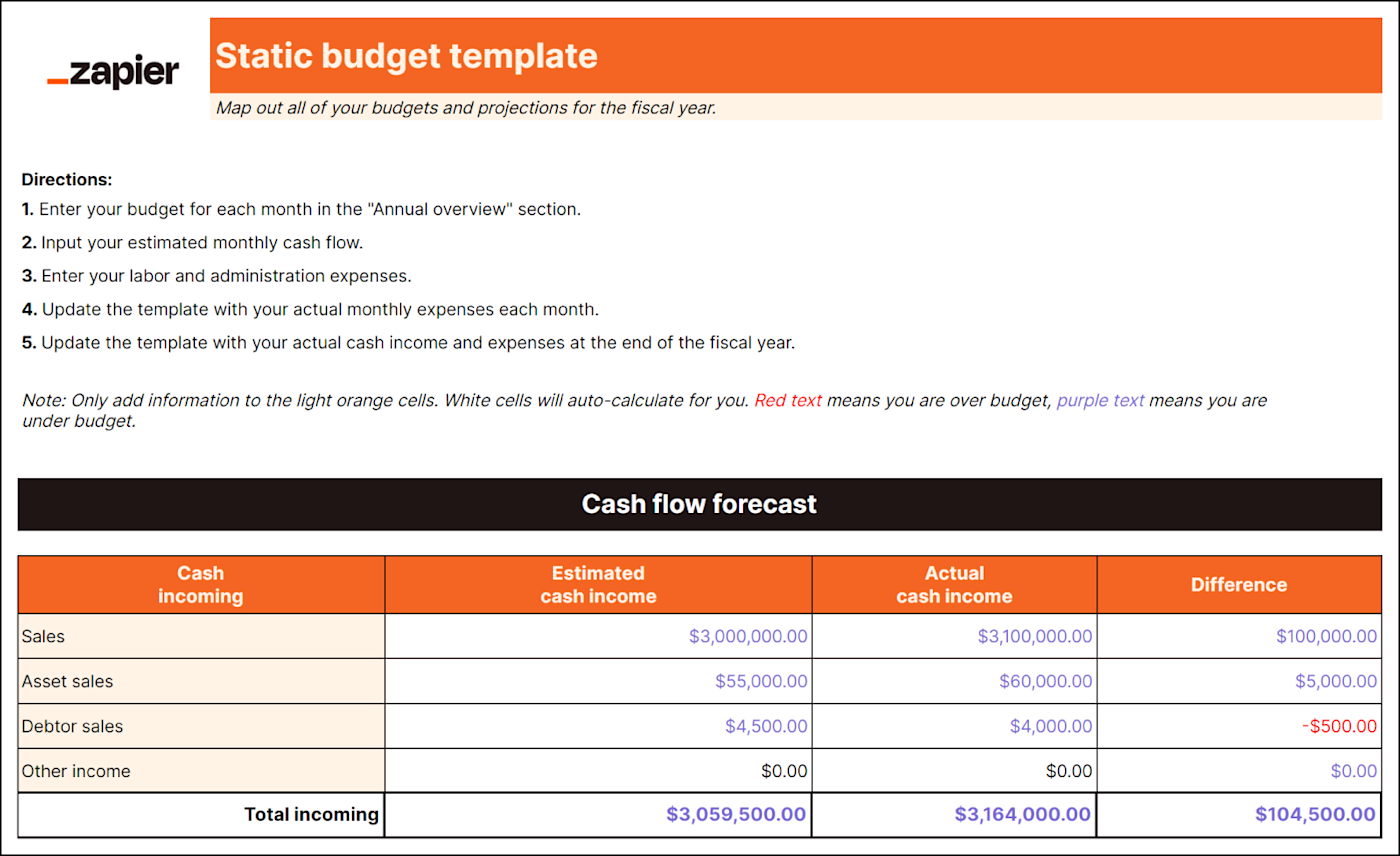

Image Source

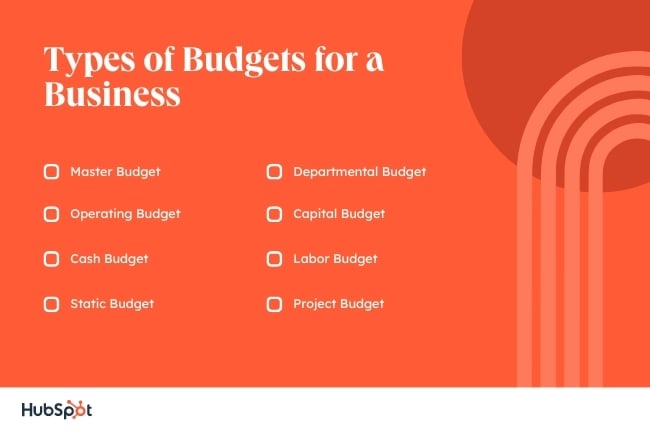

Types of Budgets for a Business

Master budget, operating budget, cash budget, static budget, departmental budget, capital budget, labor budget, project budget.

Business budgets aren’t one size fits all. In fact, there are many different types of budgets that serve various purposes. Let’s dive into some commonly used budgets:

Think of a master budget as the superhero of budgets — it brings together all the individual budgets from different parts of your company into one big, consolidated plan. It covers everything from sales and production to marketing and finances.

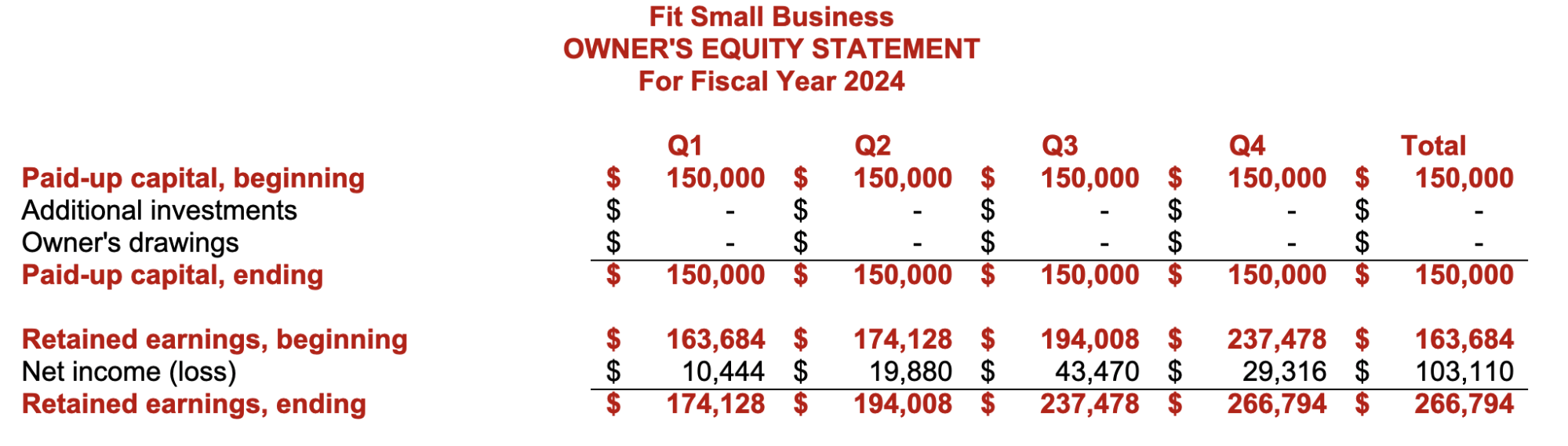

It includes details like projected revenues, expenses, and profitability for each department or business unit. It also considers important financial aspects like cash flow, capital expenditures, and even creates a budgeted balance sheet to show the organization's financial position.

The master budget acts as a guide for decision-making, helps with strategic planning, and gives a clear picture of the overall financial health and performance of your company. It's like the master plan that ties everything together and helps the organization move in the right direction.

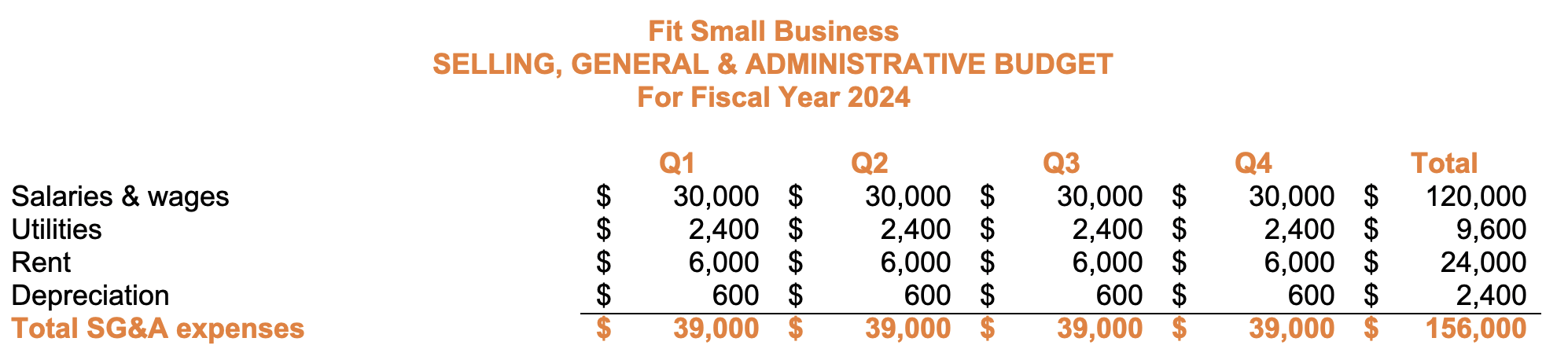

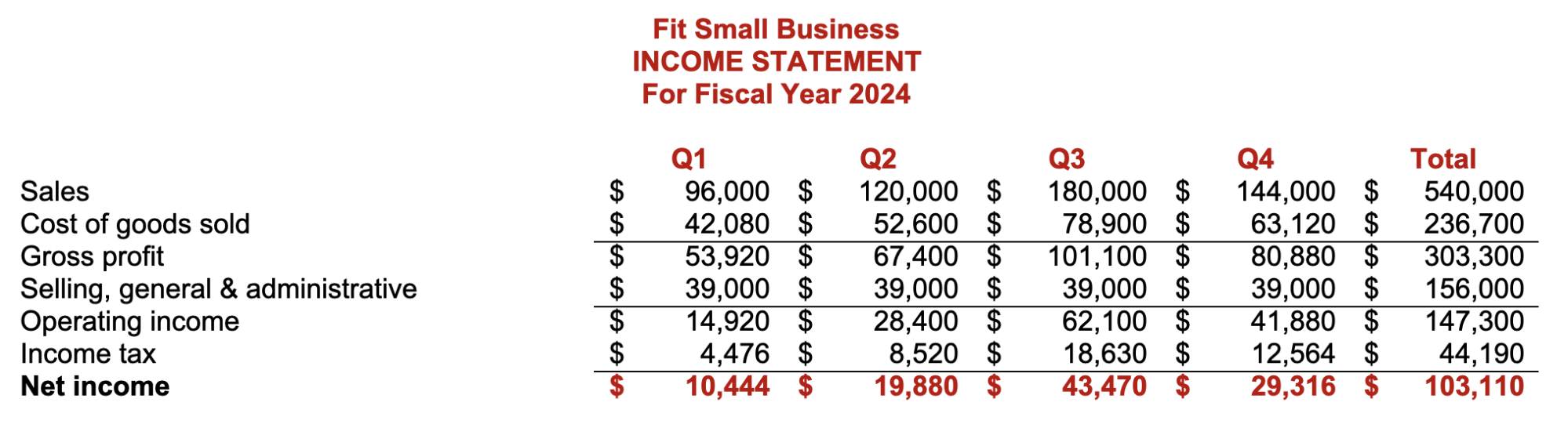

Your operating budget helps your company figure out how much money it expects to make and spend during a specific period, usually a year. It not only predicts the revenue your business will bring in, but also outlines expenses it will need to cover, like salaries, rent, bills, and other operational costs.

By comparing your actual expenses and revenue to the budgeted amounts, your company can see how it's performing and make adjustments if needed. It helps keep things in check, allowing your business to make wise financial decisions and stay on track with its goals.

.png)

Free Business Budget Templates

Manage your business, personal, and program spend on an annual, quarterly, and monthly basis.

- Personal Budget Template

- Annual Budget Template

- Program Budget Template

You're all set!

Click this link to access this resource at any time.

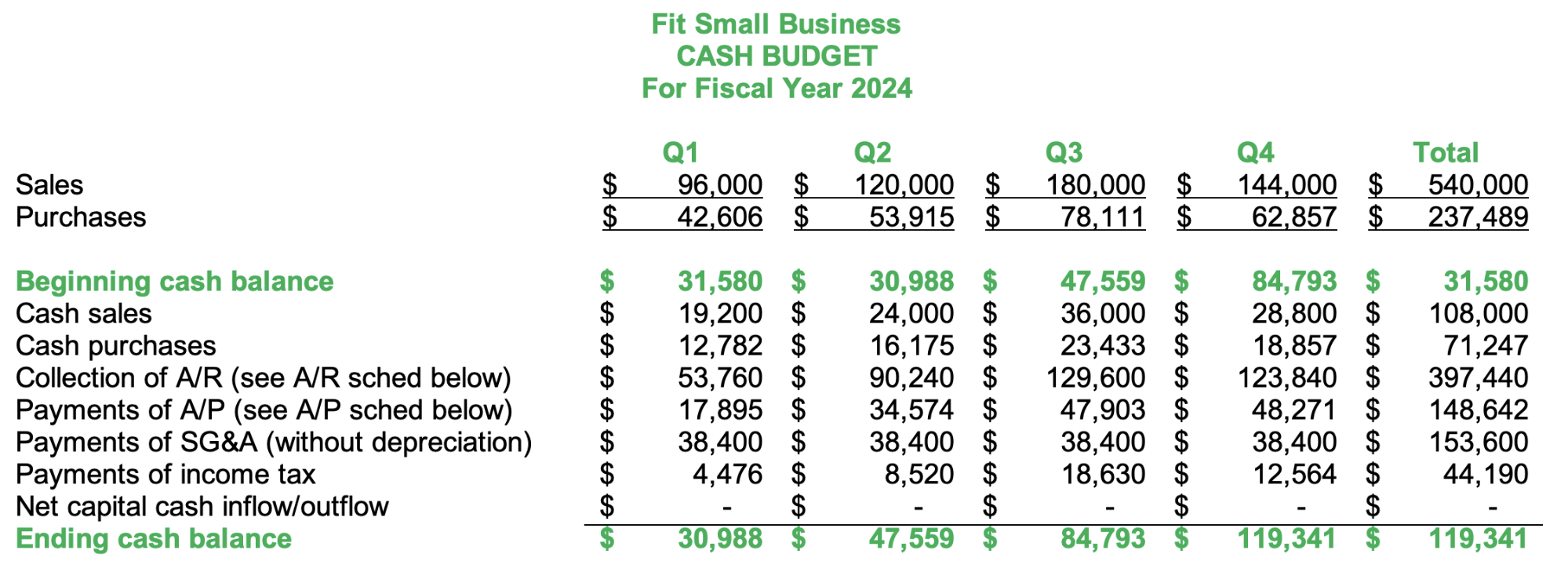

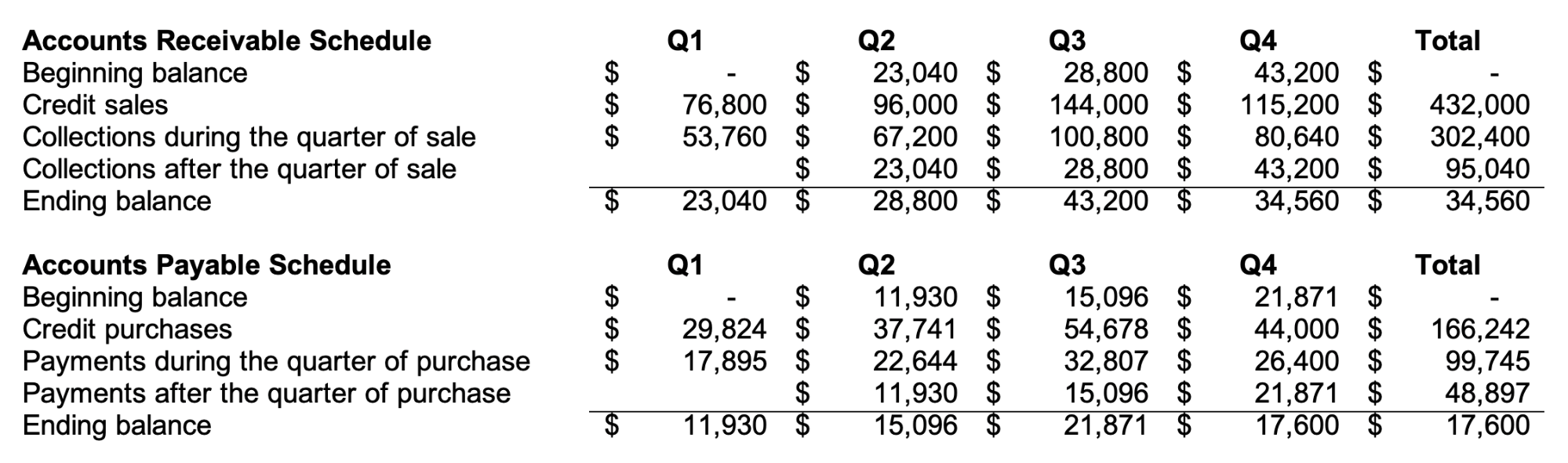

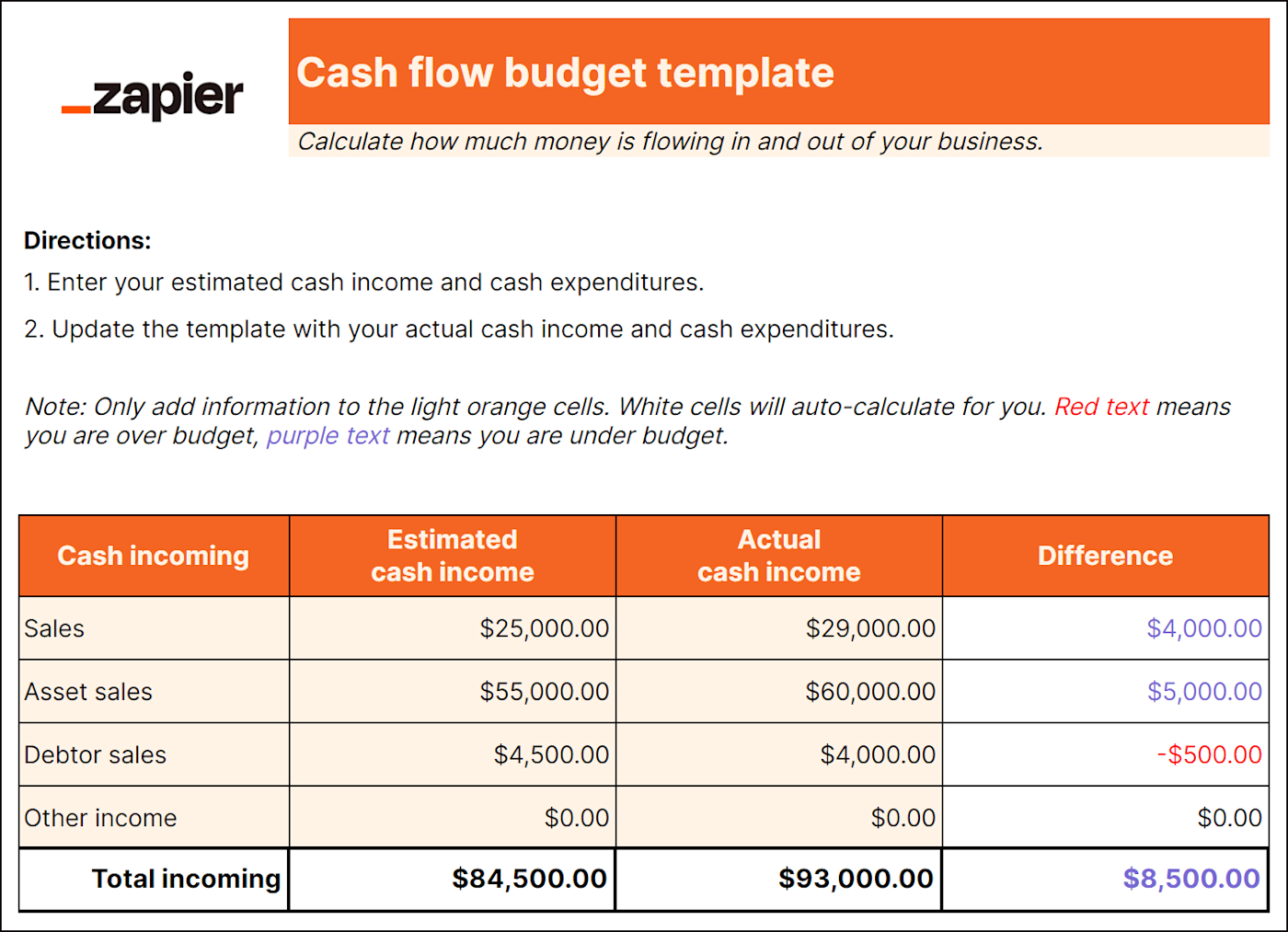

A cash budget estimates the cash inflows and outflows of your business over a specific period, typically a month, quarter, or year. It provides a detailed projection of cash sources and uses, including revenue, expenses, and financing activities.

The cash budget helps you effectively manage your cash flow, plan for cash shortages or surpluses, evaluate the need for external financing, and make informed decisions about resource allocation.

By utilizing a cash budget, your business can ensure it has enough cash on hand to meet its financial obligations, navigate fluctuations, and seize growth opportunities.

A static budget is a financial plan that remains unchanged, regardless of actual sales or production volumes.

It’s typically created at the beginning of a budget period and doesn’t account for any fluctuations or changes in business conditions. It also assumes that all variables, such as sales, expenses, and production levels, will remain the same throughout the budget period.

While a static budget provides a baseline for comparison, it may not be realistic for businesses with fluctuating sales volumes or variable expenses.

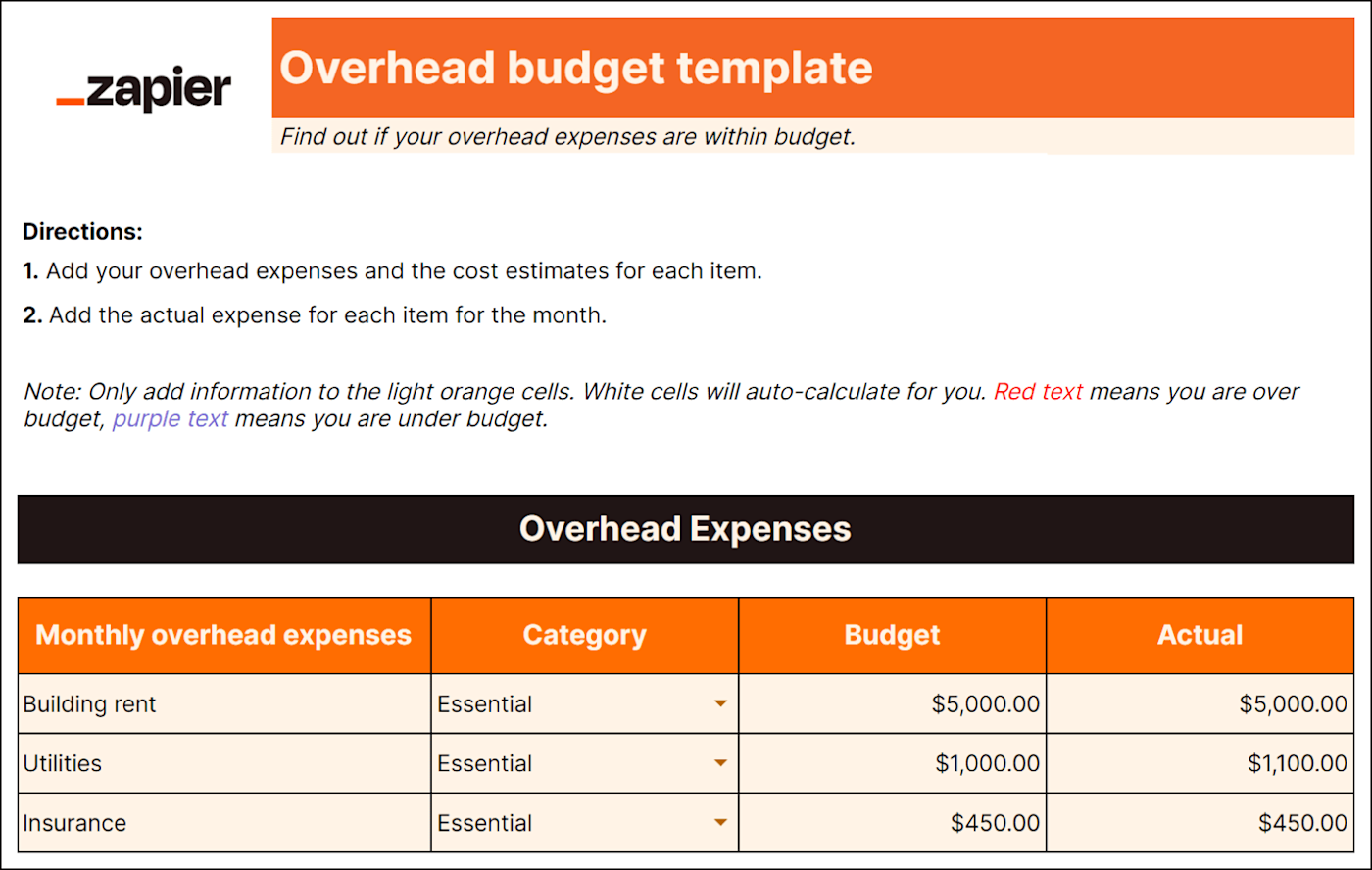

A departmental budget focuses on the financial aspects of a specific department within your company, such as sales, marketing or human resources.

When creating a departmental budget, you may look at revenue sources like departmental sales, grants, and other sources of income. On the expense side, you consider costs such as salaries, supplies, equipment, and any other expenses unique to that department.

The goal of a departmental budget is to help the department manage its finances wisely. It acts as a guide for making decisions and allocating resources effectively. By comparing the actual numbers to the budgeted amounts, department heads can see if they're on track or if adjustments need to be made.

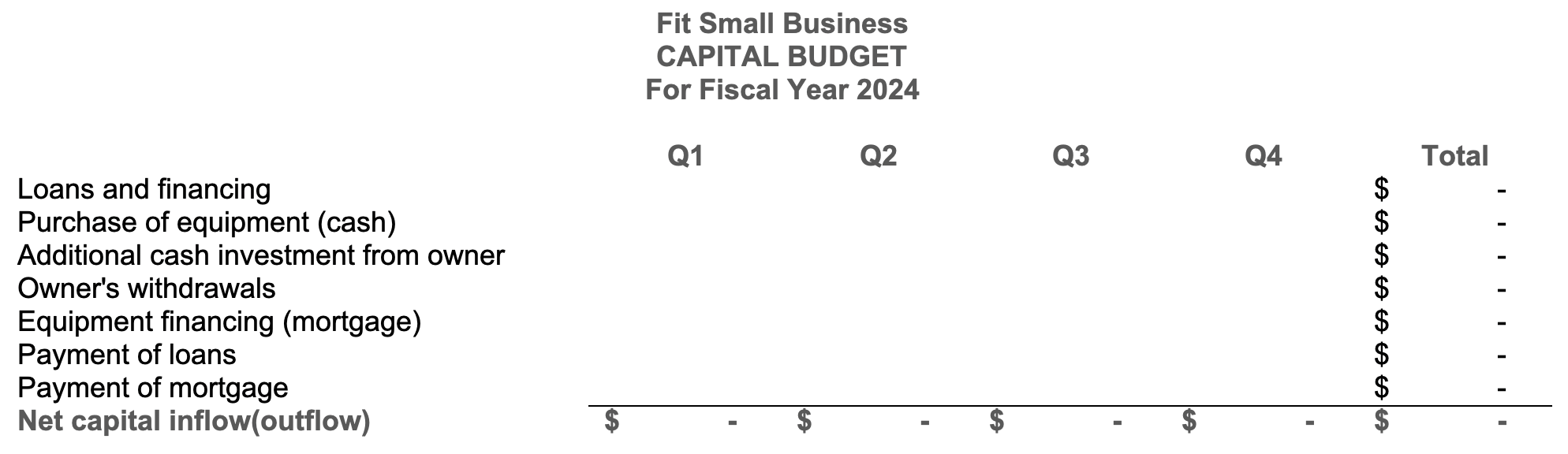

A capital budget is all about planning for big investments in the long term. It focuses on deciding where to spend money on things like upgrading equipment, maintaining facilities, developing new products, and hiring new employees.

The budget looks at the costs of buying new stuff, upgrading existing things, and even considers depreciation, which is when something loses value over time. It also considers the return on investment, like how much money these investments might bring in or how they could save costs in the future.

The budget also looks at different ways to finance these investments, whether it's through loans, leases, or other options. It's all about making smart decisions for the future, evaluating cash flow, and choosing investments that will help the company grow and succeed.

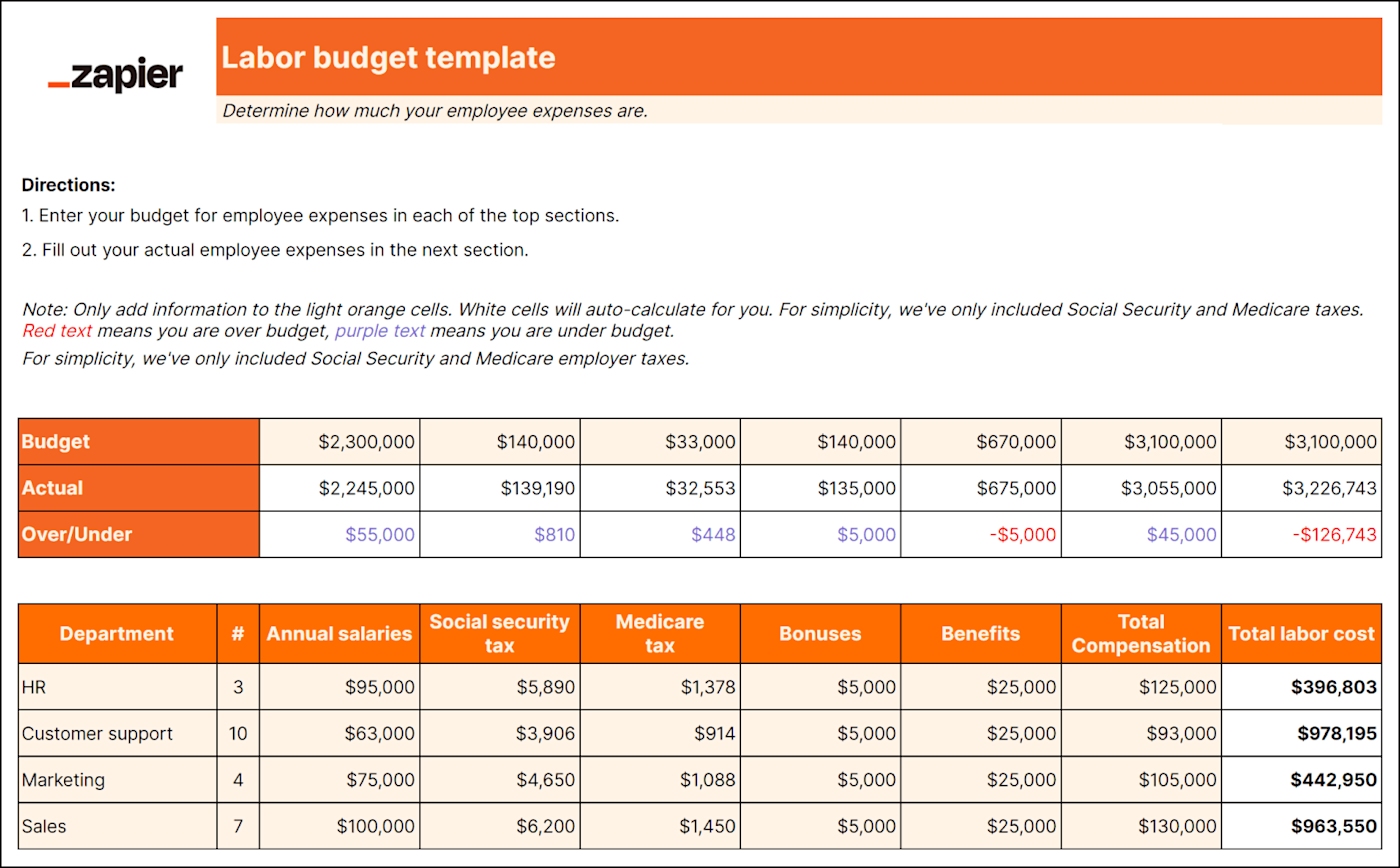

A labor budget helps you plan and manage the costs related to your employees. It involves figuring out how much your business will spend on wages, salaries, benefits, and other labor-related expenses.

To create a labor budget, you'll need to consider factors like how much work needs to be done, how many folks you'll need to get it done, and how much it'll all cost. This can help your business forecast and control labor-related expenses and ensure adequate staffing levels.

By having a labor budget in place, your business can monitor and analyze your labor costs to make informed decisions and optimize your resources effectively.

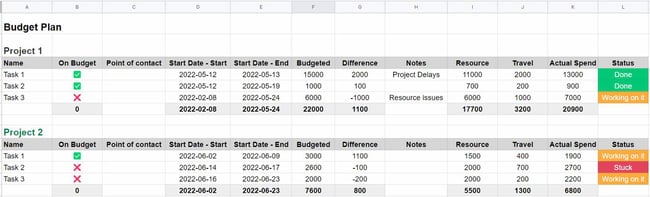

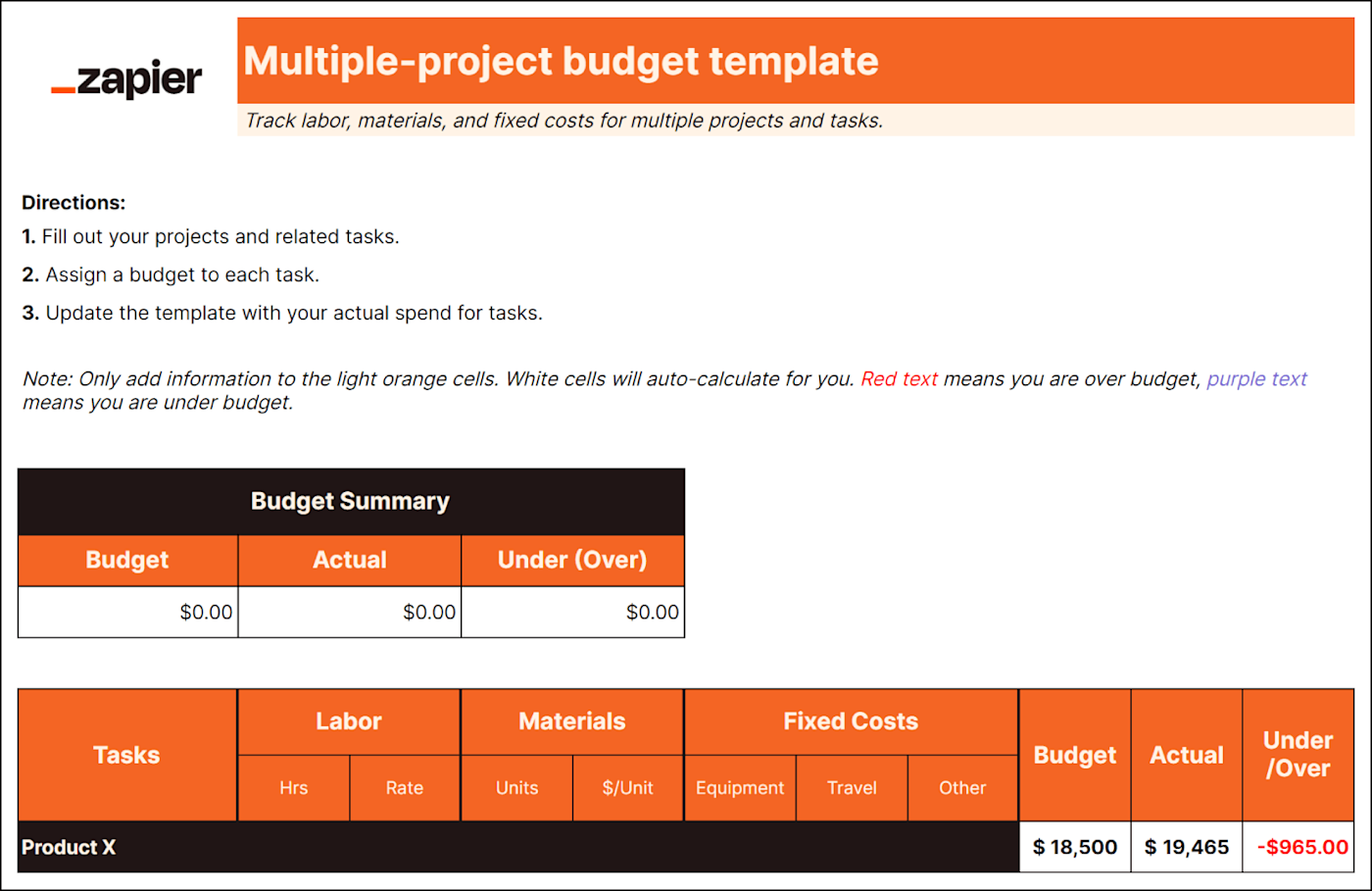

A project budget is the financial plan for a specific project.

Let's say you have an exciting new project you want to tackle. A project budget helps you figure out how much money you'll need and how it will be allocated. It covers everything from personnel to equipment and materials — basically, anything you'll need to make the project happen.

By creating a project budget, you can make sure the project is doable from a financial standpoint. It helps you keep track of how much you planned to spend versus how much you actually spend as you go along. That way, you have a clear idea of whether you're staying on track or if there are any financial challenges that need attention.

How to Create a Business Budget

While creating a business budget can be straightforward, the process may be more complex for larger companies with multiple revenue streams and expenses.

No matter the size of your business, here are the basic steps to creating a business budget.

1. Gather financial data.

Before you create a business budget, it’s important to gather insights from your past financial data. By looking at things like income statements, expense reports, and sales data, you can spot trends, learn from past experiences, and see where you can make improvements.

Going through your financial history helps you paint a true picture of your income and expenses. So, when you start creating your budget, you can set achievable targets and make sure your estimates match what's actually been happening in your business.

2. Find a template, or make a spreadsheet.

There are many free or paid budget templates online. You can start with an already existing budget template. We list a few helpful templates below.

You may also opt to make a spreadsheet with custom rows and columns based on your business.

3. Fill in revenues.

Once you have your template, start by listing all the sources of your business’ income. With a budget, you’re planning for the future, so you’ll also need to forecast revenue streams based on previous months or years. For a new small business budget, you’ll rely on your market research to estimate early revenue for your company.

When you estimate your revenue , you're essentially figuring out how much money you have to work with. This helps you decide where to allocate your resources and which expenses you can fund.

4. Subtract fixed costs for the time period.

Fixed costs are the recurring costs you have during each month, quarter, or year. Examples include insurance, rent for office space, website hosting, and internet.

The key thing to remember about fixed costs is that they stay relatively stable, regardless of changes in business activity. Even if your sales decrease or production slows down, these costs remain the same.

However, it's important to note that fixed costs can still change over the long term, such as when renegotiating lease agreements or adjusting employee salaries.

5. Consider variable costs.

Variable costs will change from time to time. Unlike fixed costs, variable costs increase or decrease as the level of production or sales changes.

Examples include raw materials needed to manufacture your products, packaging and shipping costs, utility bills, advertising costs, office supplies, and new software or technology.

You may always need to pay some variable costs, like utility bills. However, you can shift how much you spend toward other expenses, like advertising costs, when you have a lower-than-average estimated income.

6. Set aside time for business budget planning.

Unexpected expenses might come up, or you might want to save to expand your business. Either way, review your budget after including all expenses, fixed costs, and variable costs. Once completed, you can determine how much money you can save. It’s wise to create multiple savings accounts. One should be used for emergencies. The other holds money that can be spent on the business to drive growth.

Fill out the form to get the free templates.

How to manage a business budget.

There are a few key components to managing a healthy business budget.

Budget Preparation

The process all starts with properly preparing and planning the budget at the beginning of each month, quarter, or year. You can also create multiple budgets, some short-term and some long-term. During this stage, you will also set spending limits and create a system to regularly monitor the budget.

Budget Monitoring

In larger businesses, you might delegate budget tracking to multiple supervisors. But even if you’re a one-person show, keep a close eye on your budget. That means setting a time in your schedule each day or week to review the budget and track actual income and expenses. Be sure to compare the actual numbers to the estimates.

Budget Forecasting

With regular budget tracking, you always know how your business is doing. Check in regularly to determine how you are doing in terms of revenue and where you have losses. Find where you can minimize expenses and how you can move more money into savings.

Why is a Budget Important for a Business?

A budget is crucial for businesses. Without one, you could easily be drowning in expenses or unexpected costs.

The business budget helps with several operations. You can use a business budget to keep track of your finances, save money to help you grow the business or pay bonuses in the future, and prepare for unexpected expenses or emergencies.

You can also review your budget to determine when to take the next leap for your business. For example, you might be dreaming of a larger office building or the latest software, but you want to make sure you have a healthy net revenue before you make the purchase.

Best Free Business Budget Templates

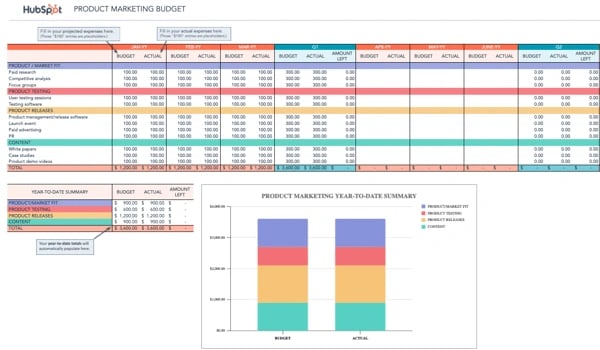

1. marketing budget template.

Knowing how to manage a marketing budget can be a challenge, but with helpful free templates like this marketing budget template bundle , you can track everything from advertising expenses to events and more.

This free bundle includes eight different templates, so you can create multiple budgets to help you determine how much money to put toward marketing, plus the return on your investment.

2. Small Business Budget Template

For small businesses, it can be hard to find the time to draw up a budget, but it’s crucial to help keep the business in good health.

Capterra offers a budget template specifically for small businesses. Plus, this template works with Excel. Start by inputting projections for the year. Then, the spreadsheet will project the month-to-month budget. You can input your actual revenue and expenses to compare, making profits and losses easy to spot.

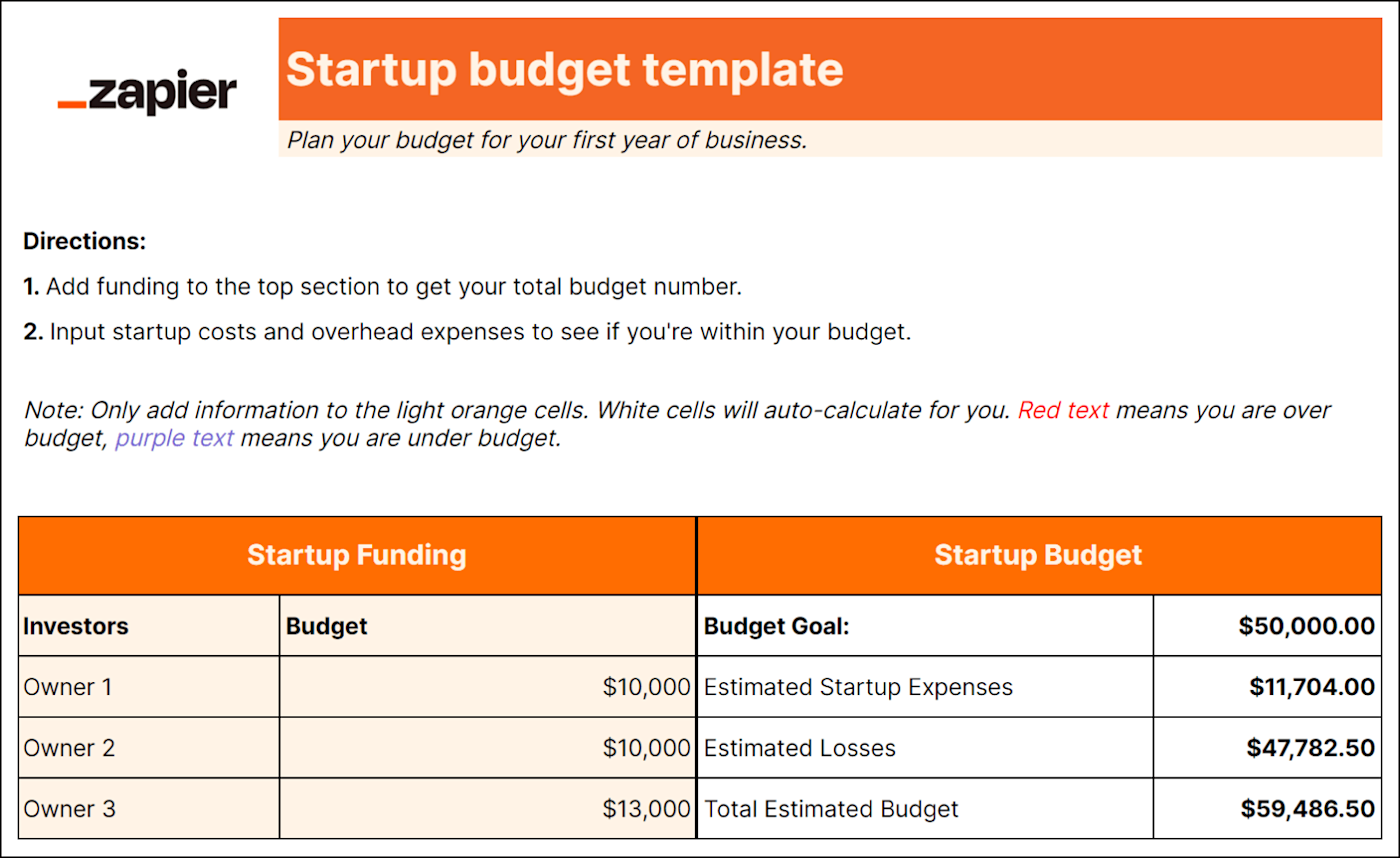

3. Startup Budget Template

What if you don’t have any previous numbers to rely on to create profit and expense estimates? If you are a startup, this Gusto budget template will help you draw up a budget before your business is officially in the market. This will help you track all the expenses you need to get your business up and running, estimate your first revenues, and determine where to pinch pennies.

4. Free Business Budget Template

You might be familiar with Intuit. Many companies, big and small, rely on Intuit’s services like Quickbooks and TurboTax. Even if you don’t use the company’s paid financial services, you can take advantage of Intuit’s free budget template , which works in Google Sheets or Excel.

It features multiple spreadsheet tabs and simple instructions. You enter your revenue in one specific tab and expenses in another. You can also add additional tabs as needed. Then, like magic, the spreadsheet uses the data in the income and expense tabs to summarize the information. This template can even determine net savings and the ending balance.

5. Department Budget Sheet

A mid- to large-size company will have multiple departments, all with different budgetary needs. These budgets will all be consolidated into a massive, company-wide budget sheet. Having a specific template for each department can help teams keep track of spending and plan for growth.

This free template from Template.net works in either document or spreadsheet formats. This budget template can help different departments keep track of their income and spending.

6. Project Budget Template

Every new project comes with expenses. This free budget template from Monday will help your team estimate costs before undertaking a project. You can easily spot if you're going over budget midway through a project so you can adjust.

This template is especially useful for small companies that are reporting budgets to clients and for in-house teams getting buy-in for complex projects.

7. Company Budget Template

Want to keep track of every penny? Use this template from TemplateLab to draw up a detailed budget. The list of expenses includes fixed costs, employee costs, and variable costs. This business template can be especially useful for small businesses that want to keep track of expenses in one, comprehensive document.

Create a Business Budget to Help Your Company Grow

Making your first business budget can be daunting, especially if you have several revenue streams and expenses. Using a budget template can make getting started easy. And, once you get it set up, these templates are simple to replicate.

With little planning and regular monitoring, you can plan for the future of your business.

Editor's note: This post was originally published in September 2021 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

![budget in a business plan Marketing Budget: How Much Should Your Team Spend in 2024? [By Industry]](https://blog.hubspot.com/hubfs/how%20to%20spend%20your%20marketing%20budget_featured.webp)

Marketing Budget: How Much Should Your Team Spend in 2024? [By Industry]

![budget in a business plan How Marketing Leaders are Navigating Recession [New Data]](https://blog.hubspot.com/hubfs/how%20marketing%20leaders%20are%20navigating%20recession.webp)

How Marketing Leaders are Navigating Recession [New Data]

![budget in a business plan 3 Ways Marketers are Already Navigating Potential Recession [Data]](https://blog.hubspot.com/hubfs/how-marketers-are-navigating-recession.jpg)

3 Ways Marketers are Already Navigating Potential Recession [Data]

![budget in a business plan Marketing Without a Budget? Use These 10 Tactics [Expert Tips]](https://blog.hubspot.com/hubfs/marketing%20without%20budget.jpg)

Marketing Without a Budget? Use These 10 Tactics [Expert Tips]

24 Ways to Spend Your Marketing Budget Next Quarter

Startup Marketing Budget: How to Write an Incredible Budget for 2023

![budget in a business plan How to Manage Your Entire Marketing Budget [Free Budget Planner Templates]](https://blog.hubspot.com/hubfs/free-marketing-budget-templates_5.webp)

How to Manage Your Entire Marketing Budget [Free Budget Planner Templates]

10 Best Free Project Management Budget Templates for Marketers

What Marketing Leaders Are Investing in This Year

The Best Free Business Budget Worksheets

6 templates to manage your business, personal, and program spend on an annual, quarterly, and monthly basis.

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

- Wealth Management

- IT Services

- Client Login

- (847) 247-8959

February 27, 2024

How to create a business budget: 8 simple steps.

No matter the size of your business, a business budget is vital to planning and guiding your business’s growth. By understanding the fixed expenses of a company and accounting for the ebb and flow of work, a proper business budget can help your business maintain itself through the year and create protection around unplanned expenses through well allocated funds. In this guide, we'll walk you through the process of creating a business budget, outlining essential steps to help you manage your finances effectively.

What Is a Business Budget?

A business budget is a financial plan outlining projected revenues and expenses for a business during a specific period of time (most typically a year, though there are often monthly or quarterly reexaminations). Although there are variables throughout the year, a complete and accurate budget will serve as a blueprint for businesses in managing income and expenditures, guiding decision-making processes, and ensuring financial stability.

What Should a Business Budget Include?

A comprehensive business budget’s purpose is to provide a business a holistic view of their financial health. When looking through bank statements, take note of those expenses that reoccur throughout the year and note those—as well as those unexpected expenses your company should instead anticipate. Key components to include are:

- Revenue Forecast: Anticipated income from sales, services, or other sources after deducting costs, taxes, and other fees.

- Fixed Operating Expenses: Costs associated with running the business, such as rent, utilities, salaries, and supplies.

- Capital Expenditures: Investments in assets like equipment, machinery, or property.

- Debt Service: Payments towards loans, credit lines, or other forms of debt.

- Taxes: Estimated tax liabilities, including income tax, sales tax, and payroll taxes.

- Contingency Funds: Reserves set aside for unexpected expenses or emergencies.

- Profit Targets: Desired levels of profitability, indicating the financial performance you aim to achieve.

Why Is Budgeting Important to a Business?

Budgeting plays a crucial role in the financial management of a business for several reasons:

- Resource Allocation: Helps allocate resources efficiently to prioritize essential activities and investments.

- Financial Control: Provides a framework for monitoring and controlling expenses to prevent overspending.

- Performance Evaluation: Facilitates performance measurement against predetermined targets, enabling timely corrective actions.

- Decision Making: Guides decision-making processes by providing insights into the financial implications of various options.

- Risk Management: Identifies potential risks and allows for proactive mitigation strategies to safeguard financial stability.

How Does Budgeting Help a Business?

Effective budgeting contributes to the success and sustainability of a business in numerous ways:

- Improved Cash Flow Management: Helps maintain adequate cash reserves to meet financial obligations and fund growth initiatives.

- Enhanced Profitability: Enables businesses to identify opportunities for revenue growth and cost optimization, leading to higher profitability.

- Better Resource Utilization: Ensures optimal utilization of resources by aligning expenditures with strategic priorities and operational needs.

- Increased Financial Transparency: Provides stakeholders with a clear understanding of the company's financial health and performance.

- Long-term Planning: Facilitates long-term planning by forecasting future financial requirements and setting achievable goals.

How to Create a Business Budget

Now that we’ve gone over the importance of a business budget, it’s time to understand the steps you need to take in order to create a comprehensive plan.

Gather Financial Information

Start by compiling relevant financial data, including past income statements, balance sheets, and cash flow statements. Analyze historical trends to identify patterns and make informed projections for the upcoming period.

Determine Your Financial Goals

Define clear, measurable financial goals aligned with your business objectives. Whether it's increasing revenue, reducing costs, or improving profitability, setting specific targets will provide a roadmap for your budgeting process.

Identify Revenue Sources

Identify all potential sources of revenue, including sales, services, investments, and other income streams. Estimate the expected revenue for each source based on market trends, historical data, and sales forecasts.

Estimate Expenses

Next, list all anticipated expenses, categorizing them into fixed and variable costs. Fixed expenses, such as rent and salaries, remain constant regardless of business activity, while variable expenses, like supplies and utilities, fluctuate based on demand.

Factor in Contingencies & Emergency Funds

Allocate a portion of your budget for contingencies and emergency funds to cover unforeseen expenses or revenue shortfalls. Building a financial cushion will provide stability and resilience during challenging times.

Balance Your Budget

Balance your budget by ensuring that projected revenues exceed estimated expenses. If there's a deficit, identify areas where you can reduce costs or increase revenue to achieve equilibrium.

Monitor & Track Your Budget

Regularly monitor and track your budget against actual financial performance to identify variances and deviations. Use accounting software or spreadsheets to update your budget and make adjustments as needed to stay on course.

Review & Adjust Budget Regularly

Review your budget periodically, ideally on a quarterly or annual basis, to assess its effectiveness and relevance. Adjust your budget as necessary based on changing market conditions, business priorities, and performance trends.

Contact Mowery & Schoenfeld for Help with Business Budgeting

Creating and managing a business budget requires expertise and strategic planning. At Mowery & Schoenfeld, we specialize in helping businesses develop robust financial strategies to achieve their financial goals. Contact us today to learn how our team of experienced professionals can assist you with business budgeting and financial management.

Get expert advice delivered straight to your inbox.

How to Create a Basic Business Budget

8 Min Read | Mar 13, 2024

You’d never intentionally set your business up to fail, right? But if you don’t know your numbers and how to make a business budget, that’s exactly what you’re doing. Money problems and bad accounting are two reasons why many small businesses don’t make it past their first five years. 1

Talking about budgets can feel overwhelming. We get it. For a lot of business leaders, it’s a lot more comfortable dreaming up big ideas and getting stuff done than digging into numbers. But you can’t set yourself up for steady growth until you have a handle on the money flowing in and out of your company. You also can’t enjoy financial peace in your business.

Not a numbers person? That’s okay. Follow the simple steps below to learn how to create a budget for a business and manage your finances with confidence. We’ll even give you a link to an easy-to-use small-business budget template in the EntreLeader’s Guide to Business Finances .

But before we get to that, let’s unpack what a budget is and why you need one.

Don't Let Your Numbers Intimidate You

With the EntreLeader’s Guide to Business Finances, you can grow your profits without debt—even if numbers aren’t your thing. Plus, get a free business budget template as part of the guide!

What Is a Business Budget?

A business budget is a plan for how you’ll use the money your business generates every month, quarter and year. It’s like looking through a windshield to see the expenses, revenue and profit coming down the road. Your business budget helps you decide what to do with business profit, when and where to cut spending and grow revenue, and how to invest for growth when the time comes. Leadership expert John Maxwell sums it up: “A budget is telling your money where to go instead of wondering where it went.”

But here’s what a business budget is not: a profit and loss (P&L) report you read at the end of the month. Your P&L is like a rearview mirror—it lets you look backward at what’s already happened. Your P&L statement and budget are meant to work together so you can see your financial problems and opportunities and use those findings to forecast your future, set educated goals, and stay on track.

Why Do I Need to Budget for My Business?

Creating a budget should be your very first accounting task because your business won’t survive without it. Sound dramatic? Check this out: There are 33.2 million small businesses in the United States. Out of the small businesses that opened from 1994 to 2020, 67.7% survived at least two years. But less than half survived past five years. 2 The top reasons these businesses went under? They hit a wall with cash-flow problems, faced pricing and cost issues, and failed to plan strategically . 3

As a business owner, one of the worst feelings in the world is wondering whether you’ll be able to make payroll and keep your doors open. That’s why we can’t say it enough: Make a business budget to stay more in control and have more financial peace in running your business.

A budget won’t help you earn more money, but it will help you:

- Maximize the money you’ve got

- Manage your cash flow

- Spend less than your business earns

- Stay on top of tax payments and other bills

- Know if you’re hitting your numbers so you can move at the true speed of cash

How to Create a Budget for a Business

Your ultimate goal is to create a 12–18-month business budget—and you will get there! But start by building out your first month. Don’t even worry about using a fancy accounting program yet. Good ol’ pen and paper or a simple computer document is fine. Just start! Plus, setting up a monthly budget could become a keystone habit that helps kick-start other smart business habits.

Here’s how to create your first budget for business:

1. Write down your revenue streams.

Your revenue is the money you earn in exchange for your products or services. You’ll start your small- business budget by listing all the ways you make money. Look at last month’s P&L—or even just your checking account statement—to help you account for all your revenue streams. You’re not filling in numbers yet. Just list what brings in revenue.

For example, if you run an HVAC business, your revenue streams could be:

- Maintenance service calls

- Repair services and sales

- New unit installation

- Insulation installation

- Air duct cleaning

2. Write down the cost of goods sold (if you have them).

Cost of goods is also called inventory. These expenses are directly related to producing your product or service. In the HVAC example, your cost of goods would be the price you pay for each furnace and air conditioning unit you sell and install. It could also include the cost of thermostats, insulation and new ductwork.

3. List your expense categories.

It’s crazy how much money can slip through the cracks when we’re not careful about putting it in the budget. Think through all your business expenses—down to the last shoe cover your technicians wear to protect your customers’ flooring during house calls. Here’s a list of common business budget categories for expenses to get you started:

- Office supplies and equipment

- Technology services

- Training and education

Related articles : Product Launch: 10 Questions to Ask Before You Launch a New Product New Product Launch: Your 10-Step Checklist

4. Fill in your own numbers.

Now that you have a solid list of revenue and expense categories, plug in your real (or projected) numbers associated with them. It’s okay if you’re not sure how much you’ll sell just yet or exactly how much you’ll spend. Make an educated guess if you’re just starting out. If your business has been earning money for a while, use past P&L statements to guide what you expect to bring in. Your first budget is about combining thoughtful guesswork with history and then getting a more realistic picture month over month.

5. Calculate your expected profit (or loss).

Now, number nerds and number haters alike—buckle in. We’re about to do some basic accounting so you know whether you have a profit or loss. This is your chance to figure out exactly how much you’re spending and making in your business.

Take your gross revenue (the total amount of money you expect to make this month) and subtract your expenses and cost of goods sold to find your profit or loss. Here’s what that calculation looks like:

Revenue - Expenses - Cost of Goods Sold = Profit or Loss

Don’t freak out if your first budget shows a loss. That actually happens a lot with your first few monthly budgets. You’re learning and getting context on what’s coming in and going out so you can make adjustments. Keep doing your budget, and before you know it, you’ll be a rock star at telling your money where to go, planning for emergencies , investments and opportunities , and building momentum.

6. Review your budget often.

Whew! Once you get that first business budget under your belt, take a deep breath and celebrate. You’ve just done something huge for your business! (You’ll also be happy to know, budgeting gets easier from here since you can copy and paste your first one and tweak your income and expenses each month.)

But here’s the thing: Your budget can’t just sit in a drawer or on your computer. You’ve got to look at it consistently to make sure you’re actually following it.

Weekly Review

At least once a week, someone in your business (whether it’s you, a qualified team member or a bookkeeper) needs to track your transactions so you know what’s happening with your money all month. Then you can make adjustments before you have more month than money.

Every time you review your budget, ask yourself these three questions:

- Are we on target to hit our revenue goal this month?

- If not, what we can change to get there?

- Are there any expenses we can cut or minimize?

Monthly Review

You also need to review your business budget when you close your books every month to compare it to your actuals—your P&L. Otherwise, how can you know how you’re doing?

7. Work toward a 12–18-month budget.

Now that you’ve created your first month’s budget, move on to the next one. You’ve got this! The more budget-building reps you get in, the better you’ll be at looking forward and planning for growth. In no time, you’ll reach that ultimate goal of a 12–18-month budget. Just keep adjusting as you go based on all you’re learning about getting an accurate road map for your finances.

As you start owning your numbers, remember: It’s okay if you’re a little intimidated by the process of accounting and making a budget for business. But it’s not okay to avoid the financial details that will make or break you. So just keep applying the basics we covered and keep moving forward.

Follow the steps above to create your budget, and review it often to stay on track.

Want a tool to make budget building simpler? Check out the EntreLeader’s Guide to Business Finances. It includes an easy-to-use small-business budget template in the extra resources section.

What are the benefits of budgeting?

A business budget will help you:

- Make informed, strategic decisions

- Invest in under-resourced areas

- Trim over-resourced areas

- Plan for the future

- Set goals and track your progress

Does using a small-business budget template save time?

Yes! Using a small-business budget template helps you plug in the numbers you need to operate with more confidence and fewer wrong turns. Check out the small-business-budget template inside our EntreLeader’s Guide to Business Finances .

How do I budget if I own a seasonal business?

Just like farmers put extra hay in the barn to cover leaner months, if you’re a seasonal business owner, you need to set aside resources in times of plenty to cover months your business turns down. Use your P&L statements to go back in time and look at financial performance year over year. Then, create your business budget based on what you learn and on any changes you see coming. You can also go to trade conferences to get an idea of your industry’s seasonal benchmarks.

Did you find this article helpful? Share it!

About the author

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books (including 12 national bestsellers) published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Learn More.

7 Tips for How to Run a Business Debt-Free

True or false: Running a business requires debt. The answer? False. The truth is, you can’t run a business if you’re broke—and debt increases your risk of going broke when a storm hits. Here’s how to run a business debt-free.

How to Create a Profit-Sharing Plan

It's easy to feel discouraged when trying to compete for top talent and keep your team happy. Learn how a profit-sharing plan can help you build and keep an awesome team even when the market shifts.

How to Create a Business Budget for Your Small Business

According to a study done by CBinsights, a few of the top reasons why small businesses fail include include pricing and cost issues, losing focus and running out of cash. These issues can be prevented by having a realistic budget in place.

Before you can focus on the budget, however, you need to identify what aspects of your business you’d like to improve. This will allow you to decide what can be done with your funds. Based on that list, you can set up short-term and long-term goals.

These goals will be directly affected by your incoming and outgoing cash. A short-term goal can be paying off a debt or purchasing new equipment. Long-term goals, like keeping aside marketing expenses, are crucial because they are connected to the overall growth of your business.

You should be practical about the goals you set. They should be purely based on your business’ capacity to spend and save. Once you have your goals in place, you can create an effective, foolproof budget by following these steps.

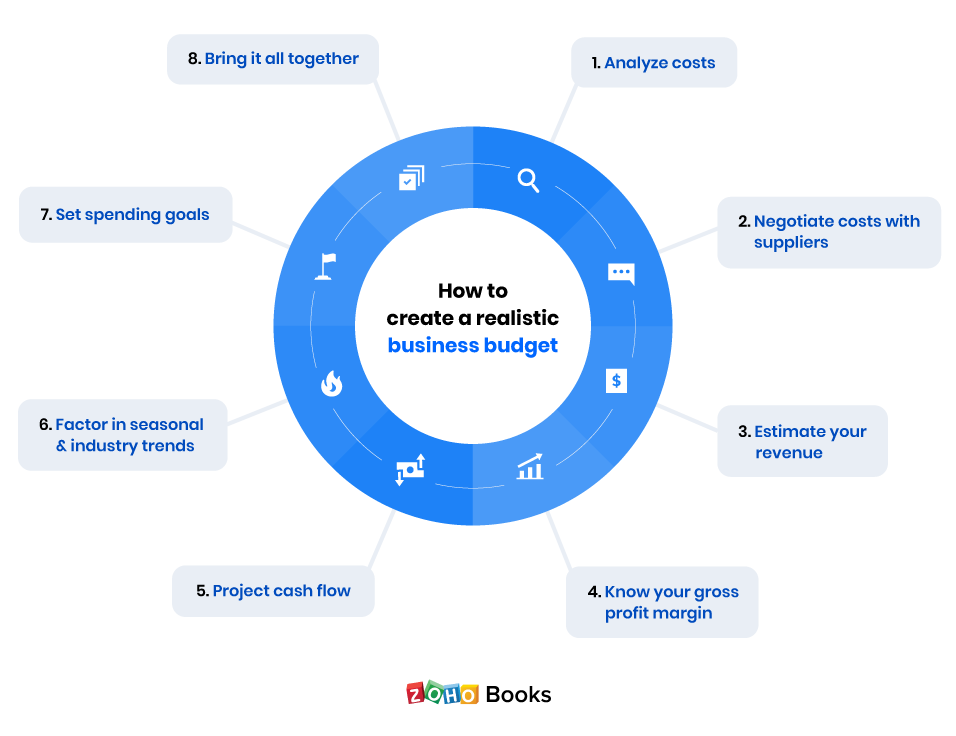

1. Analyze costs

Before you start drafting a budget, you must research the operating costs involved in your business. Knowing your costs inside and out gives you the baseline knowledge needed to craft an effective spending plan.

If you create a rough budget and later discover that you need more money for your business activities, this will jeopardize your goals. Your budget should be such that you can increase your revenue and profit enough as your business expands to handle your growing expenses. Your budget should factor in fixed, variable, one-time, and unexpected costs. Some examples of a fixed expense are rent, mortgages, salaries, internet, accounting services, and insurance. Examples of variable costs include cost of goods sold and commissions for labor.

There is not much harm in overestimating the costs involved since you will need enough cash to handle your future expenditures. If your business is new, then you must include start-up costs as well. Planning the budget this way will help you make informed decisions and tackle any unwanted financial surprises.

2. Negotiate costs with suppliers

This step will be useful for those businesses which have been functional for more than a year and are dependent on suppliers to sell products. Before you get started on your yearly budget, have a chat with your suppliers and try getting discounted rates for the materials, products, or services you need before you make your payments.

Negotiations allow you to create trustworthy relationships with your suppliers. This will be helpful when incoming cash is thin. For example, you might have a seasonal business. When you have enough cash saved, you can pay advance amounts to your suppliers as compensation for the times when you are unable to make payments. The main goal here is to find efficient ways to reduce cost of doing business.

3. Estimate your revenue

Many businesses have failed in the past by overestimating revenue and borrowing more cash to meet operational needs. This defeats the very purpose of creating a budget. To keep things realistic, it’s a good idea to analyze previously recorded revenue. Businesses must track revenue periodically on a monthly, quarterly and annual basis.

Your previous year’s revenue figures can act as a reference point for the upcoming year. It’s important to rely solely on this empirical data. This will help you set realistic goals for your team, leading to the eventual growth of your business.

4. Know your gross profit margin

The gross profit margin is the cash you are left with after your business has dealt with all the expenses at the end of the year. It gives insight into the financial health of your business. Here’s an example of why you need to understand this parameter while creating a budget.

Suppose your business made a revenue $5,000,000 and yet there are debts to be paid. At the end of the year, your expenses are more than your revenue, which is not a good sign for a growing business. This tells you that you must identify the expenses that are not benefiting the business in any way and eliminate them. The best way to do this would be to list out the cost of goods sold for all materials and deduct them from the overall sales revenue. This information is needed to get a real picture on how your business is faring, allowing you to increase profit and reduce costs.

5. Project cash flow

There are two components to cash flow : customer payments and vendor payments. You need to balance these two components to keep the cash flowing in your organization.

To do your best to ensure timely customer payments, it’s important to have flexible payment terms and the ability to receive payments through common payment channels. Unfortunately you will need to deal with customers who might not comply to the stated terms. This might affect your cash flow forecast due to missing payments.

You can encourage payment by giving customers a grace period and creating strict business policies for paying late. Beyond this, you must have some money allocated in your budget for ‘bad debt,’ in case the customer never pays.

When you know your incoming cash flow, you can fix an amount for your employee salaries and travel expenses. You can also allocate some money to pay off your fixed vendor expenses. If you are still left with cash, you can then spend on business initiatives such as professional development or new equipment.

6. Factor in seasonal and industry trends

It’s unrealistic to expect that you will achieve every business goal and reach your estimates every month. In an annual cycle, there will be months where your business will be booming, and there may be a few months where sales are slow. Due to seasonal inconsistency and industry trends, you will have to spend cash effectively so that the business isn’t at risk of shutting down during slower periods.

To overcome this challenge while creating a budget, gather insights as to when your business performs better. The aim should be to generate enough revenue during peak months to sustain the business during off seasons.

For example, let’s assume that you are a business owner of a winter clothing company. Your products are on demand only during that season, so most of your revenue comes during that period. For the rest of the year, you can use the earnings to keep the business going and market to specific target groups, like hikers or travelers. This will help you gauge how successful your products are during off seasons, what revenue to expect, and how much to save during your peak periods.

7. Set spending goals

Making a budget is more than just adding your costs and subtracting them from your earnings. How wisely you spend your money determines how well your business will fare. Goals provide a system to check if your money is being spent on the right areas to avoid unwanted expenses.

For example, if you are spending money on stationary that is going unused for operational or marketing efforts, it may be time to cut those costs. This money can be better applied to your marketing campaigns, bringing in more leads and revenue. Gauge and invest in those expenses that would benefit your business in the long run.

8. Bring it all together

Once you have gathered all the information from the previous steps, it’s time to create your budget. After you have subtracted your fixed and variable expenses from your income, you will get an idea of the amount that you can work with. Be prepared to tackle the unexpected one-time expenses that come your way. You can then find ways to use the money effectively to achieve your short-term and long-term goals.

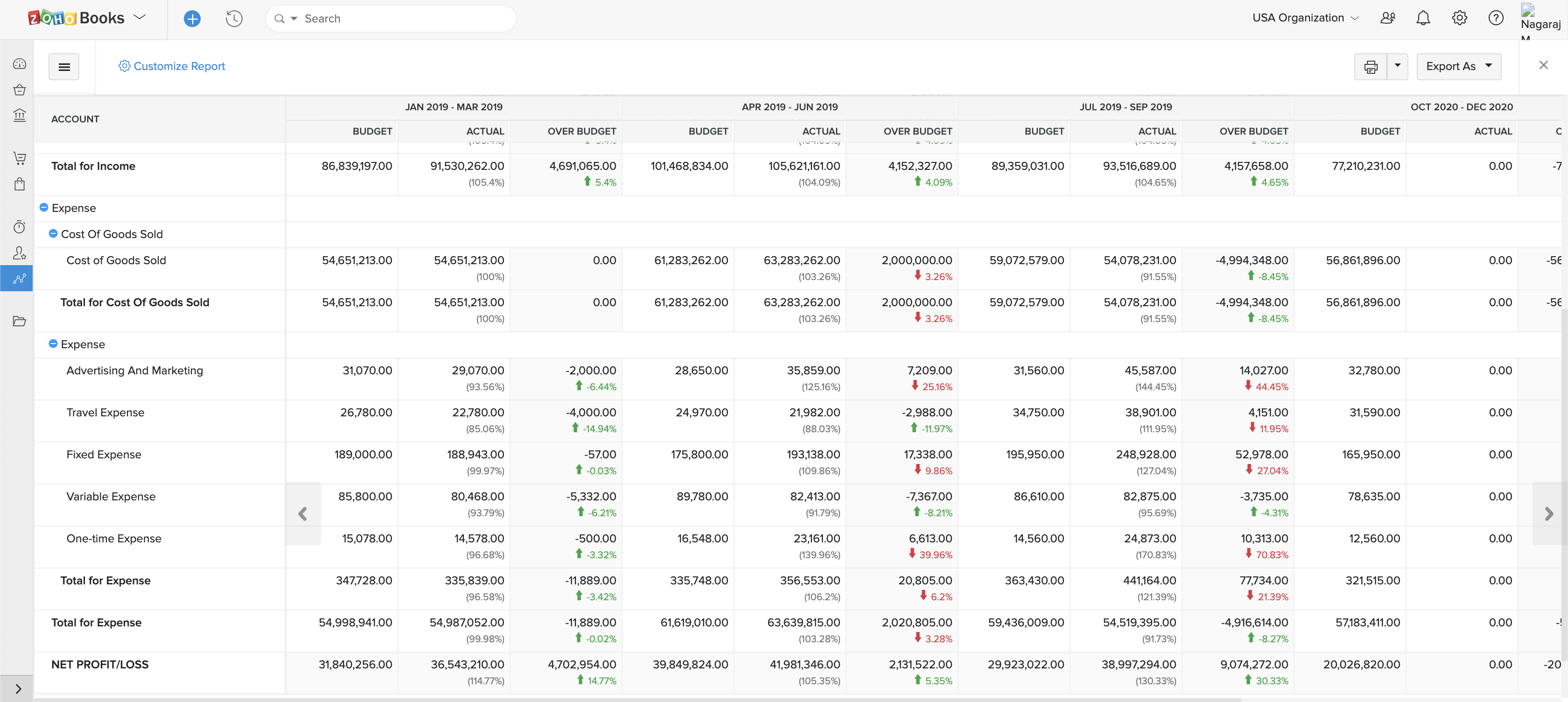

Role of accounting software in budgeting

Budgeting for a business is a large task, which is why you might need assistance. Creating a budget will involve analyzing costs, estimating revenue, and projecting cash flow. Having an accounting system in place will give you real-time information about your finances, helping you to create a feasible budget.

The key to creating a good budget is to evaluate the previous years’ data and draw realistic projections. An accounting system can give you access to all this information in one place, no matter when you need it.

The effectiveness of a budget also depends on how well any projected goals have been achieved by your business. To check this, an accounting system generates financial reports that record your actuals, and those can then be compared with the budget. Comparing your budget with your actuals is an important step to gauge the effectiveness of a budget.

Budgeting is an essential process, especially for small businesses, as it allows business owners to estimate and allocate money for different business activities. Preparing a budget also gives you a clear idea of the money that can be used to achieve business goals and ensure that there is enough in hand to handle a crisis. For small businesses, it might get a bit difficult to make estimations for the whole year as the initial stages of growing an organization are often volatile. In such cases, you can create smaller budget estimates for a duration of two or three months and keep reviewing it for better results. When an accounting system is introduced, the process becomes even more manageable. You can easily handle tasks like projecting cash flow or estimating costs, and you can set realistic goals for your business.

Related Posts

- Business Budget: What is it & Why is it important?

- How Is Cash Flow Calculated?

Cancel reply

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Great article, Easy to read, straight to the point, very informative.

Wonderful article! Just what I needed

a valuable information for person like me who doesn’t has finance background.

wonderful said,

I really like this article, it is very easy to read, gives an idea and try to make the budget process a much easier task

Simple and precise article

You might also like

Switch to smart accounting. try zoho books today.

How to Create a Small Business Budget in 5 Simple Steps

Want to protect the financial health of your small business? You need a business budget. Here's how to create one.

When you build a business, there are a lot of things to stay on top of, from marketing and finding new clients to building a website and establishing your digital presence. But there’s one element that you want to stay on top of from the very beginning—and that’s your business budget.

Having a detailed and accurate budget is a must if you want to build a thriving, sustainable business. But how, exactly, do you create one? What are the steps for business budget planning?

As a small business owner, let’s take a look at how to create a business budget in five simple, straightforward steps.

What’s a Business Budget—and Why Is It Important?

Before we jump into creating a business budget, let’s quickly cover what a business budget is—and why it’s so important for small businesses.

A business budget is an overview of your business funds. It outlines key information on both the current state of your finances (including income and expenses) and your long-term financial goals. Because your budget will play a key role in making sound financial decisions for your business, it should be one of the first tasks you tackle to improve business success.

And, as a financially savvy owners, you’ll also want to have a budget in place to help you:

- Make sound financial decisions. In many ways, your business budgets are like a financial road map. It helps you evaluate where your business finances currently stand—and what you need to do to hit your financial goals in the future for business growth.

- Identify where to cut spending or grow revenue. Your business budgets can help you identify areas to decrease your spending or increase your revenue, which will increase your profitability in the process, outline unexpected costs, and help your sustain your business goals.

- Land funding to grow your business. If you’re planning to apply for a business loan or raise funding from investors, you’ll need to provide a detailed budget that outlines your income and expenses.

Now that you understand why budget creation is so important to your business decisions, let’s jump into how to do it.

Business Budget Step 1: Tally Your Income Sources

First things first. When building a small business budget, you need to figure out how much money your business is bringing in each month and where that money is coming from – this will hep create an operating budget based on your business income.

Your sales figures (which you can access using the Profit & Loss report function in FreshBooks) are a great place to start. From there, you can add any other sources of income for your business throughout the month.

Your total number of income sources will depend on your business model.

For example, if you run a freelance writing business, you might have multiple sources of income from:

- Freelance writing projects

- A writing course you sell on your website

- Consulting with other writers who are starting small businesses

Or, if you run a brick-and-mortar retail business, you may only have one source of income from your store sales.

However many income sources you have, make sure to account for any and all income that’s flowing into your business—then tally all those sources to get a clear picture of your total monthly income to build your master business budget template.

Business Budget Step 2: Determine Fixed Costs

Once you’ve got a handle on your income, it’s time to get a handle of your costs—starting with fixed costs.

Your fixed costs are any expenses that stay the same from month to month. This can include expenses like rent, certain utilities (like internet or phone plans), website hosting, and payroll costs.

Review your expenses (either via your bank statements or through your FreshBooks reports) and see which costs have stayed the same from month to month. These are the expenses you’re going to categorize as fixed costs.

Once these costs are determined, add them together to get your total fixed and variable costs expense for the month.

TIP: If you’re just starting your business and don’t have financial data to review, make sure to use projected costs. For example, if you’ve signed a lease for office space, use the monthly rent you will pay moving forward.

Business Budget Step 3: Include Variable Expenses

Related articles.

Variable costs don’t come with a fixed price tag—and will vary each month based on your business performance and activity. These can include things like usage-based utilities (like electricity or gas), shipping costs, sales commissions, or travel costs.

Variable expenses will, by definition, change from month to month. When your profits are higher than expected, you can spend more on the variables that will help your business scale faster. But when your profits are lower than expected, consider cutting these variable costs until you can get your profits up.

At the end of each month, tally these expenses. Over time, you’ll get a sense of how these expenses fluctuate with your business performance or during certain months, which can help you make more accurate financial projections and budget accordingly.

Business Budget Step 4: Predict One-Time Spends

Many of your business expenses will be regular expenses that you pay for each month, whether they’re fixed or variable costs. But there are also costs that will happen far less frequently. Just don’t forget to factor those expenses when you create a budget as well.

If you know you have one-time spends on the horizon (for example, an upcoming business course or a new laptop), adding them to your budget can help you set aside the financial resources necessary to cover those expenses—and protect your business from unexpected costs in the form of a sudden or large financial burden.

On top of adding planned one-time spends to your budget, you should also add a buffer to cover any unplanned purchases or expenses, like fixing a damaged cell phone or hiring an IT consultant to deal with a security breach. That way, when an unexpected expense pops up (and they always do), you’re prepared!

Business Budget Step 5: Pull It All Together

You’ve gathered all of your income sources and all of your revenue and expenses. What’s next? Pulling it all together to get a comprehensive view of your financial standing for the month.

On your businesses master budget, you’ll want to tally your total income and your total expenses (i.e., adding your total fixed costs, variable expenses, cost of goods, and one-time spends)—then compare cash flow in (income) to cash flow out (expenses) to determine your overall profitability.

Having a hard time visualizing what a business budget looks like in action? Here’s an operating budget example to give you an idea of what your new business budget might look like each month:

A Client Hourly Earnings: $5,000 B Client Hourly Earnings: $4,500 C Client Hourly Earnings: $6,000 Product Sales: $1,500 Loans: $1,000 Savings: $1,000 Investment Income: $500

Total Income: $19,500

Fixed Costs

Rent: $1,000 Internet: $50 Payroll costs: $5,000 Website hosting: $50 Insurance: $50 Government and bank fees: $25 Cell phone: $50 Accounting services : $100 Legal services: $100

Total Fixed Costs: $6,425

Variable Expenses

Sales commissions: $2,000 Contractor wages: $500 Electricity bill: $125 Gas bill: $75 Water bill: $125 Printing services: $300 Raw materials: $200 Digital advertising costs: $750 Travel and events: $0 Transportation: $50

Total Variable Expenses: $4,125

One-Time Spends

Office furniture: $450 Office supplies for new location: $300 December business retreat: $1,000 New time tracking software: $500 Client gifts : $100

One-Time Spends: $2,350

Expenses: $12,900

Total Income ($19,500) – Total Expenses ($12,900) = Total Net Income ($6,600)

Above all, once you have a clear sense of your profitability for the month, you can use it to make the right financial decisions for your small business moving forward.

For example, if you realize you’re in the red and spending more than you earn, you might cut your spending and focus on finding new clients . Alternatively, if your income is significantly higher than your expenses, you might consider investing your profits back into your business (like investing in new software or equipment).

Use Your Business Budget to Stay on Track

Putting in the work to create a budget for your small business may seem like a hassle. But while it takes a bit of time and energy, it’s worth the extra effort. Thorough business budgeting gives you the financial insights you need to make the right decisions for your business to grow, scale, and prosper in the future.

This post was updated in October 2023

Written by Deanna deBara , Freelance Contributor

Posted on June 20, 2017

Freshly picked for you

Thanks for subscribing to the FreshBooks Blog Newsletter.

Expect the first one to arrive in your inbox in the next two weeks. Happy reading!

How to create a business budget

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Small business loans

- • Bad credit loans

- • Funding inequality

- Connect with Emily Maracle on LinkedIn Linkedin

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Our writers and editors used an in-house natural language generation platform to assist with portions of this article, allowing them to focus on adding information that is uniquely helpful. The article was reviewed, fact-checked and edited by our editorial staff prior to publication.

Key takeaways

- A business budget is a financial plan that helps estimate a company's revenue and expenses, making it an essential tool for small businesses

- The steps to creating a business budget include choosing budget and accounting software, listing expenses and forecasting revenue

- If a business finds itself in a budget deficit, strategies such as cutting costs, negotiating with suppliers and diversifying revenue streams can help

As a small business owner, keeping your finances organized through a business budget is crucial to running a successful company.

Business budgeting involves creating a financial plan that estimates future revenue and expenses to make informed financial decisions, which can ultimately move the needle on your business’s financial goals and help it grow in profitability.

What is a business budget?

A business budget is a financial plan that outlines the company’s current revenue and expenses. The budget also forecasts expected revenue that can be used for future business activities, such as purchasing equipment. It sets targets for your business’s revenue, expenses and profit and helps you determine if you’ll have more money coming in than you pay out.

A business budget is an essential tool that helps you make wise business decisions. Without it, it’s difficult to gauge your business’s financial health.

What is the difference between a cash flow statement and a business budget?

A cash flow statement (CFS) is a financial document that summarizes the movement of cash coming in and going out of a company. The CFS gauges how effectively a company manages its finances, including how it manages debt responsibilities and funds day-to-day operations.

It’s similar to a business budget in that you can see expenses and revenue. But while a budget gives a moment-in-time snapshot of your business’s financial performance compared to forecasts, the cash flow statement focuses on the actual inflows and outflows of money through your business.

Follow these steps to ensure a well-developed budget, from understanding your expenses to generating revenue and adjusting expenses to balance the budget.

1. Choose a budget and accounting software

First, you’ll want to store your expense and revenue information with accounting software to help you track your numbers and generate reports. Some software may also help you assign categories to the transactions, identify tax deductions and file taxes. Quickbooks is an example of accounting software.

Some business bank accounts also have accounting software built in, helping you stay organized by keeping your accounting and banking in one place.

2. List your business expenses

The next step in creating a small business budget is to list all your business expenses. Here are the types of expenses you want to include in your budget:

- Fixed expenses: Fixed expenses cost a fixed amount monthly or within the assessed period. Those costs include rent, insurance, salaries and loan payments.

- Variable expenses: Variable expenses can change monthly or over time, making them trickier to budget. This might include materials, direct labor, utility bills or marketing expenses.

- Annual or one-time costs: Some costs only occur a few times per year, while others you’ll only pay for as needed, such as buying new equipment. You still want to budget for these expenses by allocating a portion of your weekly or monthly budget toward one-time expenses.

- Contingency funds: Unexpected business costs can throw a wrench in your budget if not planned for. Such costs could include emergency repairs, necessary equipment purchases, sudden tax increases or unforeseen legal fees. To plan for these costs, you can create a contingency or emergency fund that’s separate from your operational budget.

- Maintenance costs: To allocate funds for maintenance costs, begin by including regular inspections and maintenance in your budget. Then, make sure to leave room for changes and unexpected maintenance costs.

3. Forecast your revenue

To estimate your future revenue, start by deciding on a timeline for your forecast. A good place to start is the previous 12 months. Your accounting software may also include revenue forecasting as one of its features, which can automate this step for you.

The timeline and your recent past growth can help you understand how much revenue you’ll generate in the future. Consider external factors that could drive revenue growth, such as planned business activities like expansion, marketing campaigns or new product launches.