ROI Templates and Calculators For Many Disciplines

By Andy Marker | October 11, 2018

- Share on Facebook

- Share on LinkedIn

Link copied

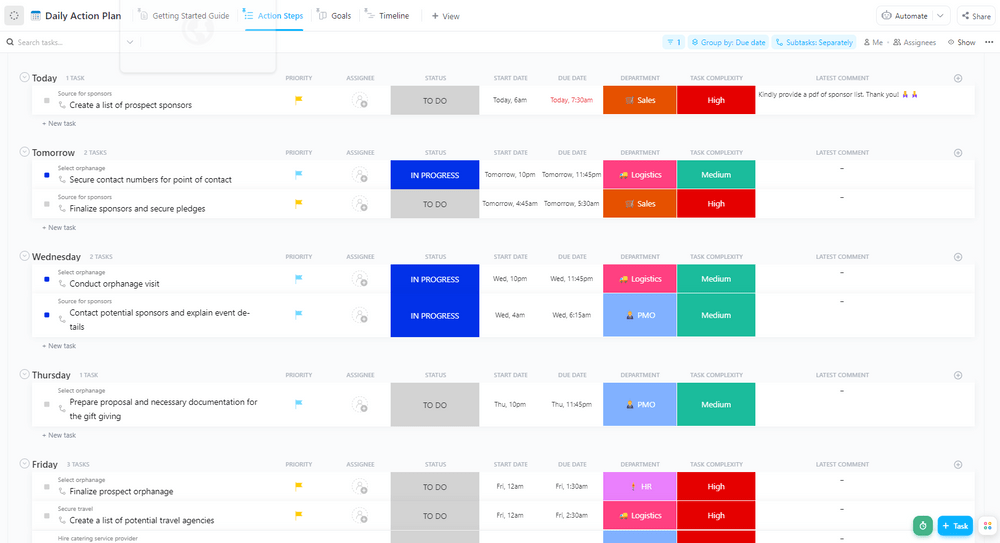

In this guide, you will learn about the role of ROI, its formula, why you would use it, the four methods to easily calculate it, and additional methods to break down work. Download the essential Excel templates to perform a variety of ROI tasks, including content marketing metrics, website ROI analysis, healthcare quality initiative ROI, event ROI calculator, PLM ROI calculator, IT ROI, cost avoidance calculator, and TCO ROI.

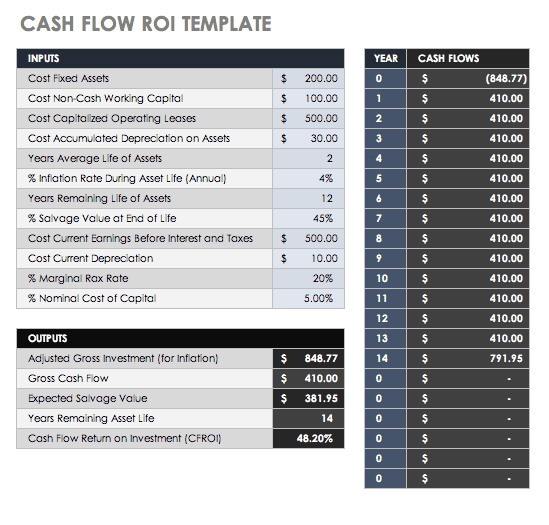

Cash Flow ROI and Template

Cash Flow ROI (CFROI) is a proxy for a company’s economic return. This return is compared to the interest rate charged to commercial banks from the Federal Reserve’s standard (the discount rate), to see if there is value-added potential. CFROI is the average economic return in a year on all of a company’s investments. Enter your variables in this template to determine your company’s CFROI.

Download Cash Flow ROI and Template - Excel

In this template, you will enter the following variables:

Cost Fixed Assets : These are assets not expected to be used up or converted into cash within a year. They can include property, plant, and equipment (PPE), and may be used to generate income.

Cost Non-cash Working Capital : The sum of inventory and receivables

Cost Capitalized Operating Leases : Posted as an asset on the balance sheet, this type of lease expenses the lease payments.

Cost Accumulated Depreciation on Assets : An asset account with a credit balance.

Years Average Life of Assets : The accumulated depreciation divided by the current depreciation expense.

Percent Inflation Rate During Asset Life (Annual) : The change in purchasing power.

Years Remaining Life of Assets : This is calculated based on when the asset went into service and the preferred depreciation method.

Percent Salvage Value at End of Life : The resale value at the end of the asset’s useful life.

Cost Current Earnings Before Interest and Taxes (EBIT) : All incomes and expenses, except interest and income tax expenses.

Cost Current Depreciation : The deduction that helps spread the cost over many years.

Percent Marginal Tax Rate : The tax percent of your income based on your tax bracket.

Percent Nominal Cost of Capital : The rate of return needed to persuade your company to make a given investment.

Below are the outputs from these inputs:

Adjusted gross investment (for inflation)

Gross cash flow

Expected salvage value

Years remaining asset life

Cash flow return on investment (CFROI)

Cash flows per investment year

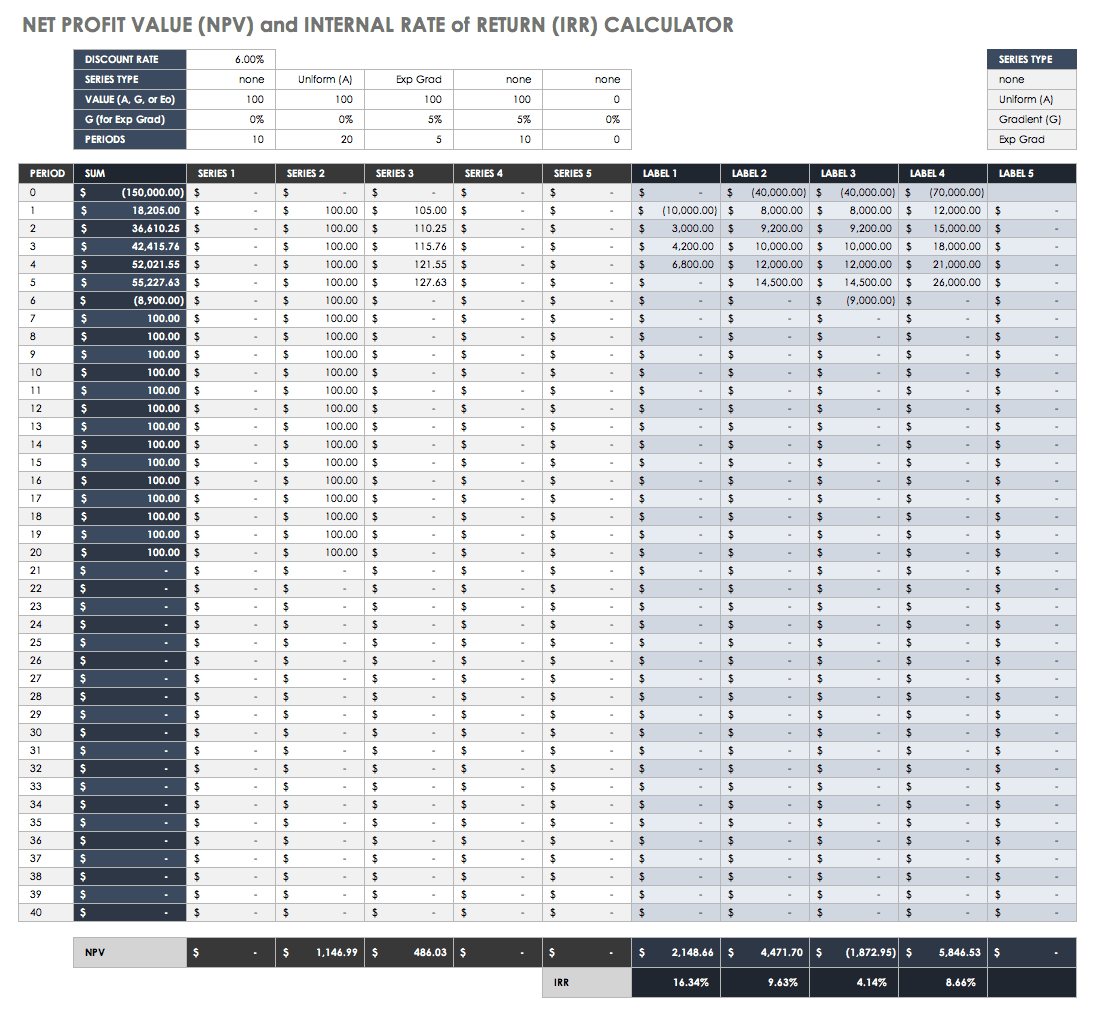

NPV and IRR Calculations and Template

Net present value (NPV) and internal rate of return (IRR) are metrics used to estimate ROI. NPV is the dollar difference between the present value of cash inflows and outflows over time. Companies use NPV as a tool to help them decide if an investment will provide long-term value, to compare different investment options, and to decide whether they should introduce a new product. IRR is the calculation that estimates the percent profitability of possible investments by taking the NPV equal to zero.

NPV looks at each cash flow separately, even when the discount rate is unknown. An NPV greater than zero makes a project financially worthwhile. IRR compares projects using one discount rate, predictable cash flows, equal risk, and a shorter time. IRR does not account for changes in the discount rate, which at times makes it a poor metric. Further, if there are a mix of positive and negative cash flows, IRR calculations are not effective. To calculate your company’s NPV and IRR, use this template.

Download NPV and IRR Calculations and Template - Excel

In this template, you will input the following:

Discount rate

Series payment type (None, Uniform, Gradient, or Exp Grad)

Value (A, G, or Eo)

G % for Exp Grad

The number of periods

For each period, the values

Below are the outputs for this template:

The sum for each period

The different series for each period

NPV for each series

NPV for each label

IRR for each label

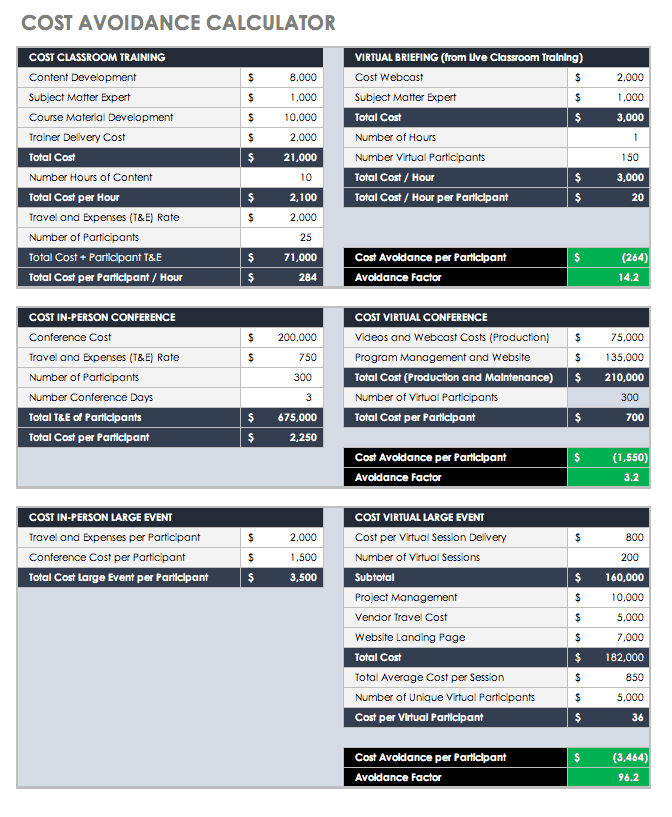

Cost Avoidance Calculator Template

Preparing for a conference or large event is a big commitment for a business. There are direct costs, such as airfare, registration, and accommodations, and indirect costs such as the hours of preparation. Cost avoidance includes actions or event-substitutions that reduce future costs, such as planning virtual conferences, trainings, or parts replacement before failure (and subsequent damage to other parts). Cost avoidance activities may incur higher immediate costs but save money — sometimes totaling extreme savings — over time. This is a different concept from cost savings , in which you actually save the money you plan on spending. Lower spending, investment, or debt levels is what saves money.

Use this template to calculate cost avoidance as ROI. This calculator has a variety of event scenarios, including training, conference, and an in-person event. These costs are compared to a virtual briefing, a virtual conference, and a virtual large event, respectively. With your input, you can calculate the costs per participant for each, the cost avoidance factor per participant, and the avoidance factor.

Download Cost Avoidance Calculator - Excel

Marketing ROI and Content Marketing Templates

Marketing is a huge expense for any business. Whether your company invests in a comprehensive program that rolls out print and television ads as well as a social media presence, or just has a Facebook page, you should know the worth of your content over time. Sirius Decisions stated in 2013 that 60 to 70 percent of content goes unused. The cost of creation itself involves the per hour cost of each person by the number of creation hours involved, plus any actual content expenses. Having the ROI for marketing content can help motivate your staff to use it.

The marketing ROI (MROI) is simply the revenue generated from your content minus the cost to produce your content. This is a simple calculation, but some professionals caution that marketing professionals should define how and what they have measured in order to signal to stakeholders whether they are defining short-term channel-specific ROI or informing for long-term budget or strategic decisions. In this marketing ROI template, you will find space for multiple marketing initiatives in order to compare their relative value.

Download Marketing ROI Template - Excel

To use this template, input the following:

Total initiative cost

Total circulation/audience

Response rate (percent of generated leads by the audience)

Conversion rate (percent of leads which will purchase)

Average revenue per sale

Average profit per sale

From these inputs, you will get these outputs:

Total costs of all initiatives

Total cost/audience for all initiatives

Average profit per sale for all initiatives

Number of leads generated

Number of sales

Total revenue uplift

Total profit uplift

ROI percent

Cost per lead

Cost per sale

Break even response rate

Break even conversion rate

Break even profit per sale

The demand for marketing measurement and reporting is rising with marketing costs. There are many metrics that should be reported to show the success of your marketing program. Many professionals are not comfortable communicating their impact on the bottom line metrics to get the support they need. The key metrics that every marketing person should be comfortable reporting include the following:

Total Reach : The number of people your company can reach across your different networks and platforms. Each is a potential client.

Reach by Channel : The number of people following or subscribed per channel.

Total Website Visits : The number of people who visited your website in a period of time. This metric shows how well your inbound marketing is directing people to your website, which is also tracked month over month (MoM).

Website Visits by Source : This metric reports where people are coming to your website from to determine how well specific campaigns are working.

Total Leads Generated : This metric shows the interest your campaign generates for the products or services. It is one of the strongest ROI indicators.

Leads Generated by Source : This metric shows the channels that produce the most leads, which allows you to focus on the most valuable sources.

Total Customers Driven by Marketing : This metric tracks which marketing campaigns are yielding the most customers.

Marketing Generated Customers by Source : Track the source of the customers acquired by each campaign.

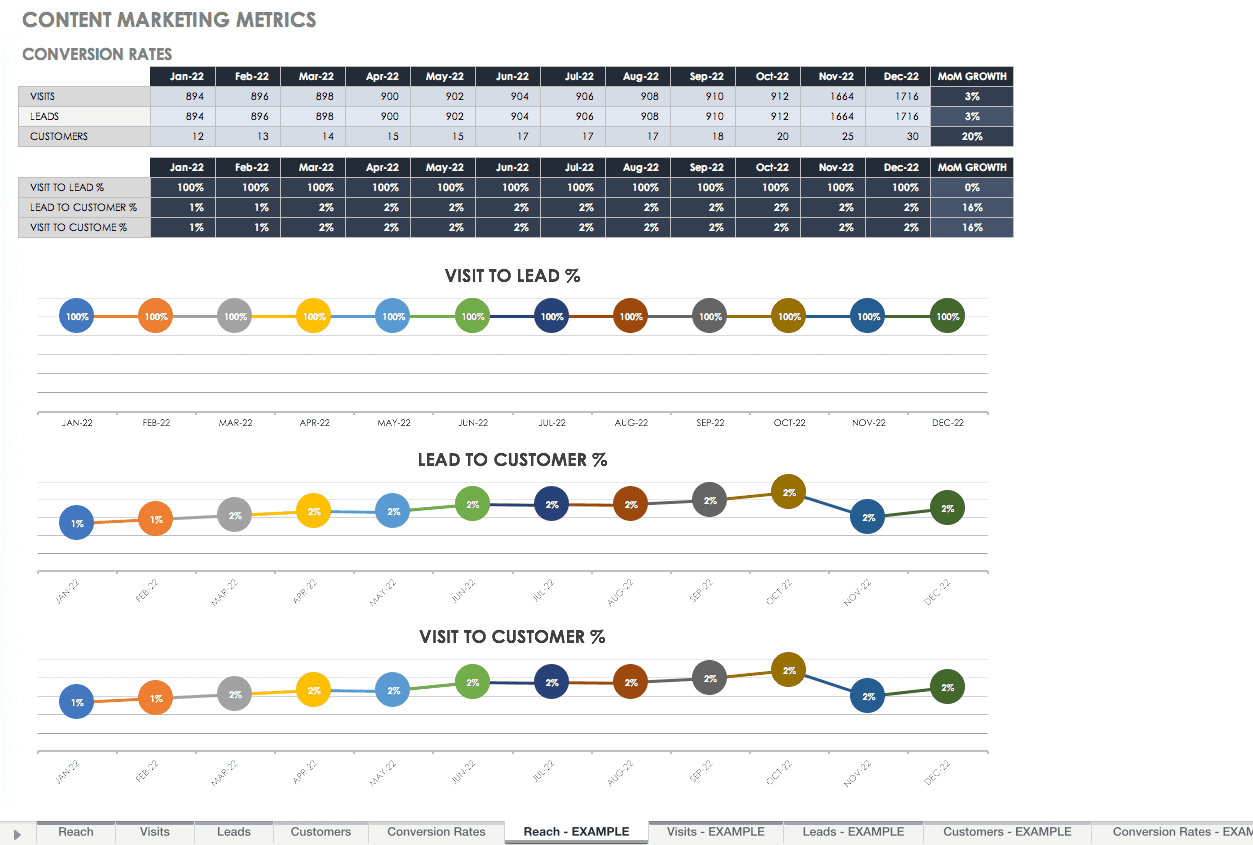

Conversion Rates

Visit to Lead Conversion Rat e: This measures the percent of people whose website visit becomes a new lead for sales.

Lead to Customer Conversion Rate : This measures the percent of people moving from leads to customers. This metric helps determine if your campaigns are generating sales-ready leads.

Visit to Customer Conversion Rat e: This is the overall funnel: whether your traffic generated turns into customers.

Content Marketing Metrics Template

Use each of the above five categories to record metrics for reporting with this template. It provides a space for each metric and ready-made graphs to add to your marketing deck so you can present your success. Fill out the reach, visits, leads, and customers templates, and your conversion rates template will automatically fill from your data.

Download Content Marketing Metrics Template

Excel | Smartsheet

Website ROI Analyses and Template

Google Analytics 4 (GA4) can help you determine the financial value of your content so you can calculate ROI. Use GA4 to track the URLs from all your web materials, such as your website, Facebook, newsletters, and any other sources. You can track who comes to your site and the path they took to get there. For example, you can get a count of how many times someone accessed your site from a Facebook post, or how many times your content was downloaded from your site.

To set up Google Analytics 4, start by either signing in or creating an Analytics account. Set up your GA4 property, add a data stream and install your Google Analytics with Google Tag Manager. Here’s how to set up Google Analytics 4:

Create an Analytics account, unless you already have one.

Create a Google Analytics 4 Property:

Go to the Admin section of your Google Analytics 4 interface and then click Create Property .

Enter the name of your property, choose your company’s country, reporting time zone, and the main currency your business operates.

Press Next , and answer several questions.

Then select your business objectives.

Click Create .

Configure your first Data Stream:

In Admin , in the desired Property column, click Data Streams > Add stream .

Click iOS app , Android app , or Web . In this article we focus on the Web stream.

For the Web , enter the URL of your website (the protocol https is already selected) and enter the name of your website.

You have the option to enable or disable Enhanced Measurement feature. By default it is enabled, but you can disable it if you want.

Press the Create Stream button.

Install Google Analytics 4 with Google Tag Manager (GTM):

Install GTM on your site.

After that, go to GA4 > Admin > Data Streams , select your Web data stream, and copy the Measurement ID .

Go to your Google Tag Manager container > Tags > New and choose Google Analytics: GA4 Configuration .

In the Measurement ID field, enter the Measurement ID you copied in the GA4 interface.

In the Triggering section, select Initialization – All Pages .

Name the tag and save it.

Test the GA4 installation:

Click Preview in the top right corner of the GTM interface.

Once you enable the preview mode, you should see the new GA4 tag among the tags that fired. If your tag didn't fire, check your tag's trigger settings.

Publish your changes in GTM by clicking the Submit button in the top right corner and then completing all the other steps that the user interface asks you to do.

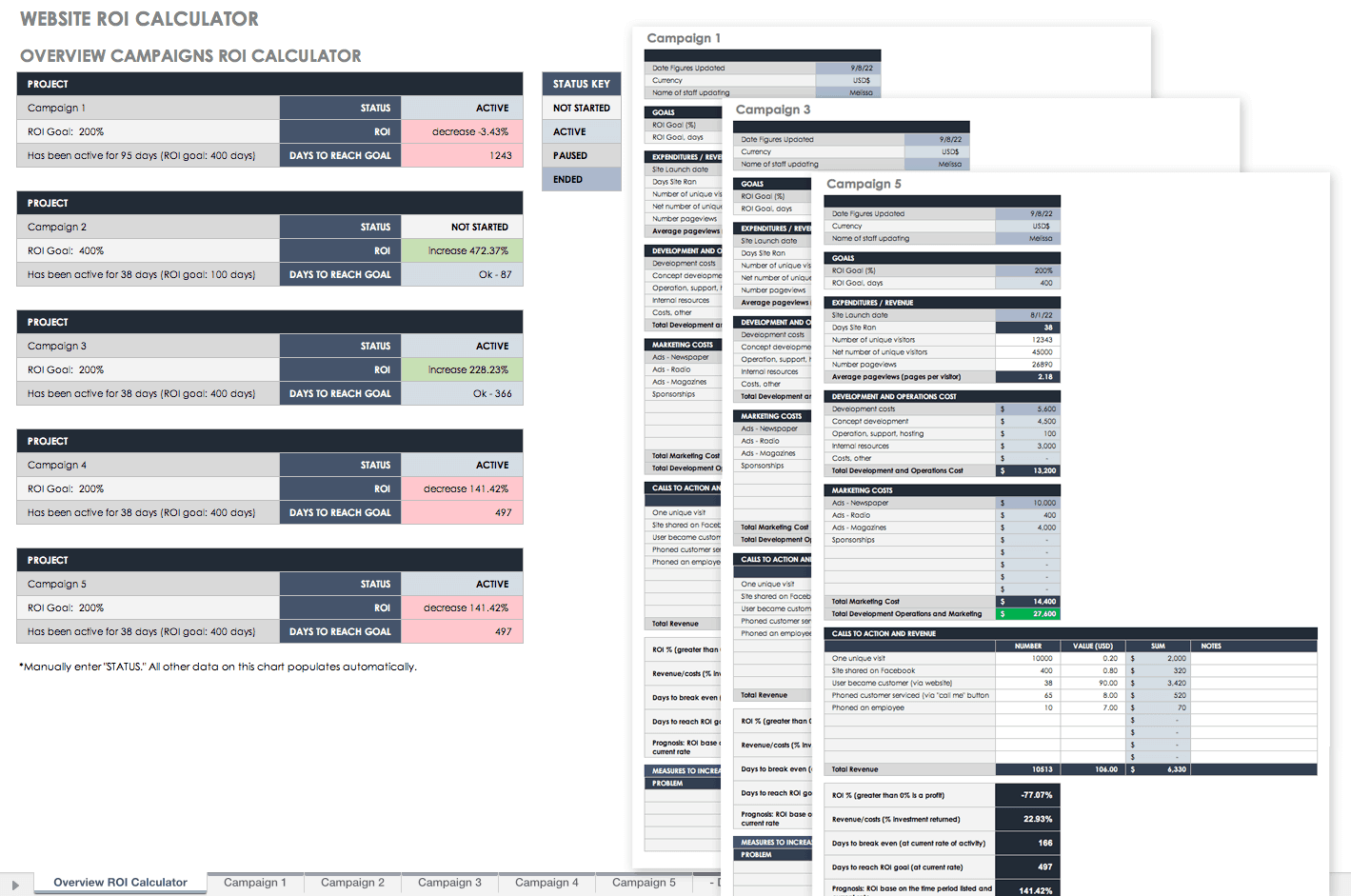

Website ROI Calculator Template

You can add Goals in your analytics page to determine how well your pages are performing. Import the information from your website or app into this website ROI calculator to determine the ROI for your web-based traffic. You’ll find a full website campaign overview in a roll-up sheet, which tells you which campaigns are the most successful so you can compare them.

Download Website ROI Calculator - Excel

In this calculator template, you will find spreadsheets for each of your campaigns. The inputs for each campaign are as follows:

Date figures updated

Name of staff updating

ROI goal (percent)

ROI goal (days)

Site launch date

Number of unique visitors

Net number of unique visitors

Number pageviews

Development costs

Concept development

Operation, support, hosting

Internal resources

Other costs

Marketing costs

Calls to action and revenue

From these inputs, the following are your outputs:

Days ste ran

Average pageviews (pages per visitor)

Total development and operations cost

Total marketing cost

Total development operations and marketing

Total revenue

ROI percent (greater than 0 percent is a profit)

Revenue/costs (percent investment returned)

Days to break even (at the current rate of activity)

Days to reach ROI goal (at current rate)

Prognosis: ROI based on the time period listed and the current rate

Another way to figure out the revenue from your web content is to look at your online sales. Each time you sell products on your website, you can use your digital content to push customers to your sales pages. Each time you post a blog article, there should be links your customers can follow to reach your products. From these page visits, look at the revenue earned over the period and the number of visits from your content.

There are other programs you can use to manage your social media and marketing content that you can purchase as well. Some of these plug into your existing software to make your reporting easier. It’s worth reviewing their features and ease of use for your company if your revenue is dependent on your social marketing content. Some of these apps include Hootsuite, Hubspot, Buzzsumo, and Quintly.

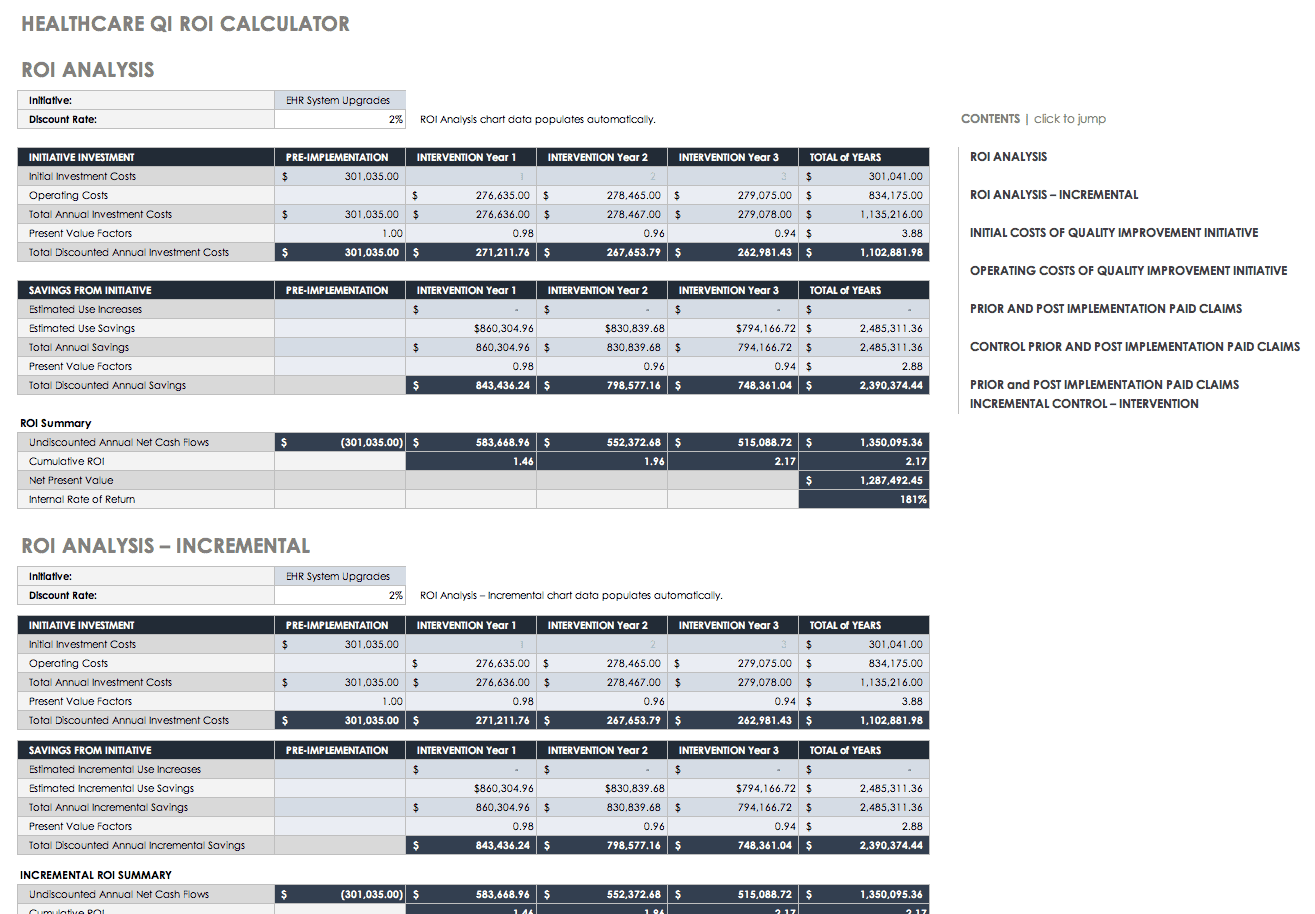

Healthcare Quality Initiative ROI Templates

With the cost of health care skyrocketing, state-sponsored and private health plans should be able to prove their ROI to measure the effect of their quality improvement initiatives. These seven worksheets can help you prove the ROI of your quality improvement initiative:

Initial Costs : In this template, the costs of the personnel involved in the initiative are laid out, as well as any additional costs such as supplies, contracted services, and equipment. The total costs of the initial investment are calculated. This is Year 1 costs.

Operating Costs : This spreadsheet template pulls data from your initial costs spreadsheet for Year 1 and allows you to add data for consecutive years of your initiative. You can add and adjust for additional staff and known costs, and then the worksheet calculates the total costs for each year.

Claims-Intervention : Data from claims is used to estimate savings per year. Inputs for this spreadsheet include the actual payments from each claim category and the estimated savings by claim category for each year, the monthly membership for the initiative, and the number of months in the year the initiative was operational.

Claims-Control : Data from a control group of claims (without the intervention) shows a difference in the intervention versus changes that are an artifact of other reasons. It is important to maintain a control group to show that improvements come from your initiative and not from other or natural progressions.

Claims-Incremental : This spreadsheet compiles data from your claims-control and claims-intervention spreadsheets to determine your savings, and whether these savings are relevant to your quality initiative.

ROI : This spreadsheet automatically compiles data from your other spreadsheets and calculates the total discounted annual investment costs, the total discounted annual savings, and the ROI summary, which includes undiscounted annual net cash flows, cumulative ROI, net present value, and internal rate of return.

ROI-Incremental : Like the ROI spreadsheet, this template calculates the savings and ROI summary, but for incremental data.

Download Healthcare Quality Initiative ROI Templates

Project ROI Templates

There are many projects that require you to calculate ROI. Some of these may be due to technology or software system changes that can get extremely expensive, so being able to report ROI to your stakeholders becomes critical.

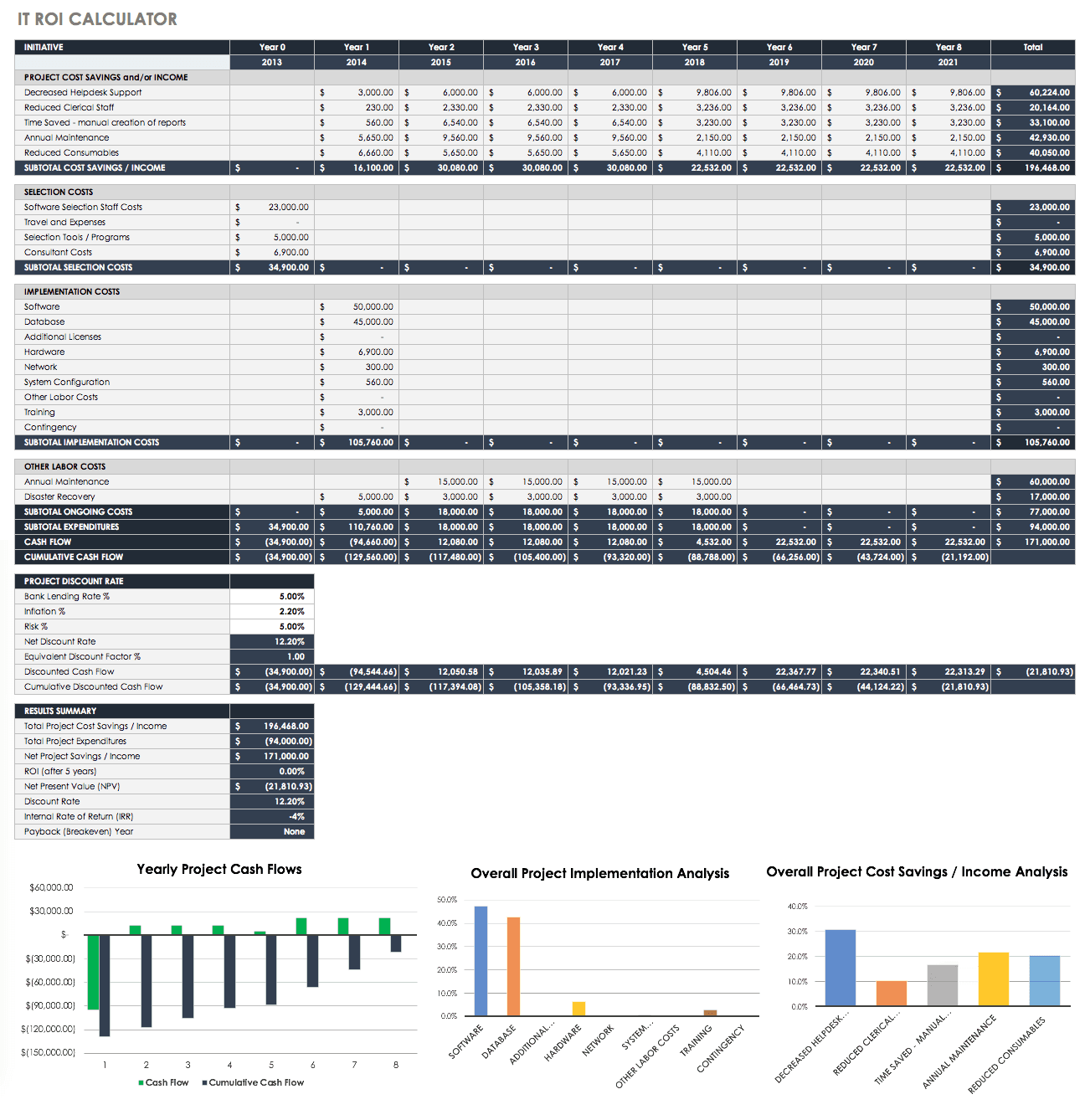

IT ROI Calculator Template

The following is an IT ROI calculator for any basic IT initiative or project. This calculator provides columns to include data for up to eight years, but you can add more years as columns. Inputs include the following:

Cost savings by year

Selection costs

Implementation costs

Ongoing costs

Project discount rates

The outputs from this include subtotals of each, cash flow, cumulative cash flow, and results. The results include the following:

Total project cost savings/income

Total project expenditures

Net project savings/income

ROI (after five years)

Net present value (NPV)

Internal rate of return (IRR)

Payback (breakeven) year

For ease of reporting, charts have been included that automatically show yearly project cash flows, overall project implementation analysis, and overall project cost savings/income analysis.

Download IT ROI Calculator

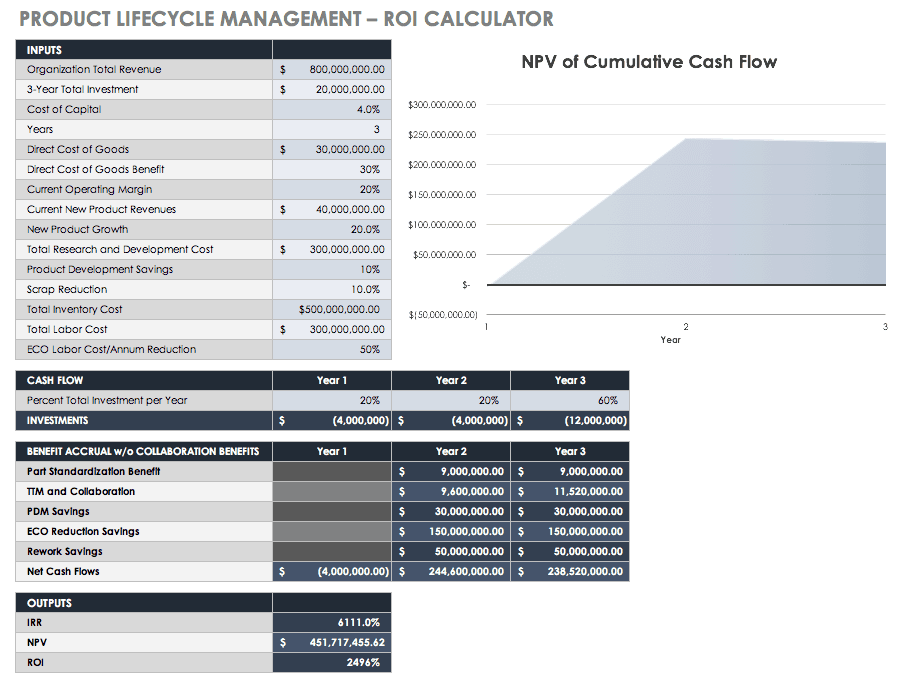

ROI Calculator for Product Lifecycle Management (PLM) Systems

Another software ROI calculator is for product lifecycle management (PLM) systems. Inputs for this calculator include the following:

Organization total revenue

Three-year total investment

Cost of capital

Direct cost of goods

Direct cost of goods benefit

Current operating margin

Current new product revenues

New product growth

Total research and development cost

Product development savings

Scrap reduction

Total inventory cost

Total labor cost

ECO labor cost/annum reduction

Percent total investment per year

Outputs from this calculator include the following:

Investment amounts

Part standardization benefit

TTM and collaboration

PDM savings

ECO reduction savings

Rework savings

Net cash flows

Use the diagram that visually shows the NPV of cumulative cash flow to update your stakeholders.

Download ROI Calculator for Product Lifecycle Management (PLM) Systems

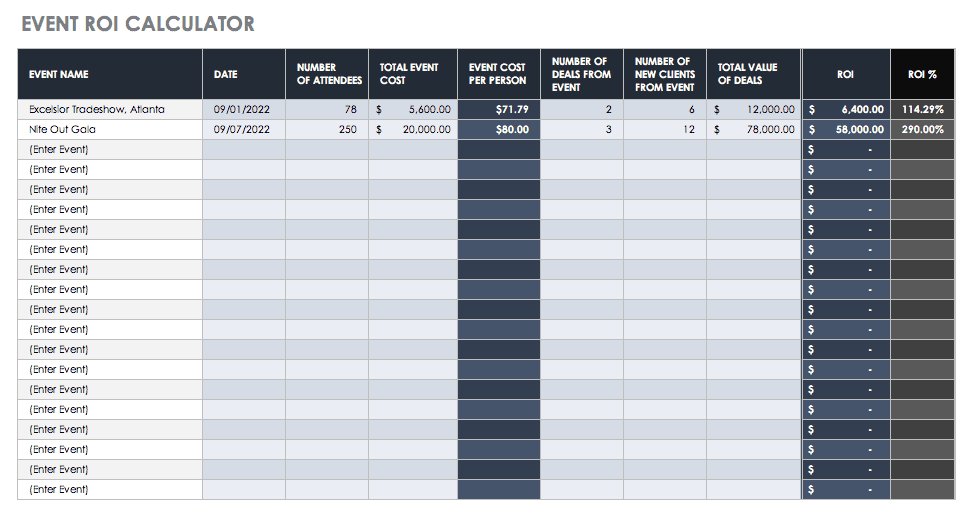

Business Case and Event ROI Template

Building a business case helps your team or company justify the funding in any proposal. This is the expected benefit from any undertaking, whether you are making a case for replacing old equipment or starting a fresh marketing program. Using ROI and other cash flow metrics are an excellent method to help you build your business case — especially in the case of technology investments where financial managers can identify expected costs and benefits to calculate ROI. For example, you may want to make a business case for an event your company is considering hosting. Based on the ROI of past events, you can give your company information on what level of event is relevant for their goals. For example, you can make a case for a large formal event rather than a small less-costly cocktail party if the ROIs are markedly different, and the large event generates more customers. Use this simple event ROI calculator template to discover what ROI your past events yielded by inputting the number of attendees, costs, and deal information. The outputs then give the event cost per person, the ROI, and the ROI percent.

Download Business Case and Event ROI Template - Excel

Justification and Total Cost of Ownership ROI Template

In the same vein as proving a business case, a business plan must have some type of economic justification to provide stakeholders with the knowledge that they are making sound policy and finance decisions. ROI is an appropriate choice, although it does not consider the intangible or fuzzy costs and the benefits that a cost-benefit analysis (CBA) might reveal. However, since those measures are fuzzy, they may not accurately represent the data anyway.

Total cost of ownership (TCO) helps assess costs across an enterprise for products or systems. Mainly used in IT, TCO generally includes not only the hardware and software, but the acquisition, management, support, expenses, training, and any other productivity losses to be expected during implementation. This calculation is made using data over a number of years, so you can present the TCO lifecycle. TCOs can be used to comprehensively justify new software purchases — especially since they are generally such expensive prospects. TCO is the negative data in an ROI equation that shows what you are spending.

Additionally, many professionals interested in TCO also want cost avoidance data, or the positive data in an ROI equation. For example, with both TCO and cost avoidance, you can calculate the ROI of replacing a software system that performs some function that saves you money.

Use this template for such a scenario, where the TCO of a software system (such as a virtual briefing platform) and the cost avoidance of a virtual briefing are combined to discover ROI. You can also use the template independently to determine either TCO or cost avoidance. In this template, you will find space to input your direct and indirect costs across several years. Inputs include costs for the following:

Implementation

Programmatic work

There is also space to enter cost avoidance data. The following are calculated from the input data:

Total cost of ownership/year

Total substitution cost avoidance

Total potential cost avoidance

Potential ROI

Potential ROI percent

Potential ROI/year

Download Justification and Total Cost of Ownership ROI- Template – Excel

Simple ROI Templates

An ROI analysis can vary in the levels of its complexity. Regardless of the amount of data, the basic ROI formula details three steps:

Estimate the Cost : Costs may be hard or soft, depending on the project or event planned. Hard costs are simple and are anything that comes with a receipt, such as travel costs, registration fees, and entertaining costs. Each of these can be a line item when you build or use an ROI calculator. Soft costs are more complex since they can include the number of hours spent on preparing, attending, and following-up after the event. This can also include the time spent corresponding, researching, and traveling. Multiply these “soft” hours by the employees’ hourly rate from their base pay to calculate the soft cost. Combine the hard and soft costs for a better representation of the cost estimate.

Estimate the Return : First, define your success metric. For a conference-type event, this may vary, but consider the type of event and your company’s function in the marketplace. Your team should help you define your success metrics. Defining success metrics is part art, part science. If the metrics are developed, they should align with your strategic plan and your key performance indicators (KPIs) .

Compute ROI : Calculate ROI by dividing the activity return by its cost. Below is another formula you may follow:

ROI = (Gain from investment – Cost of investment) / (Cost of investment)

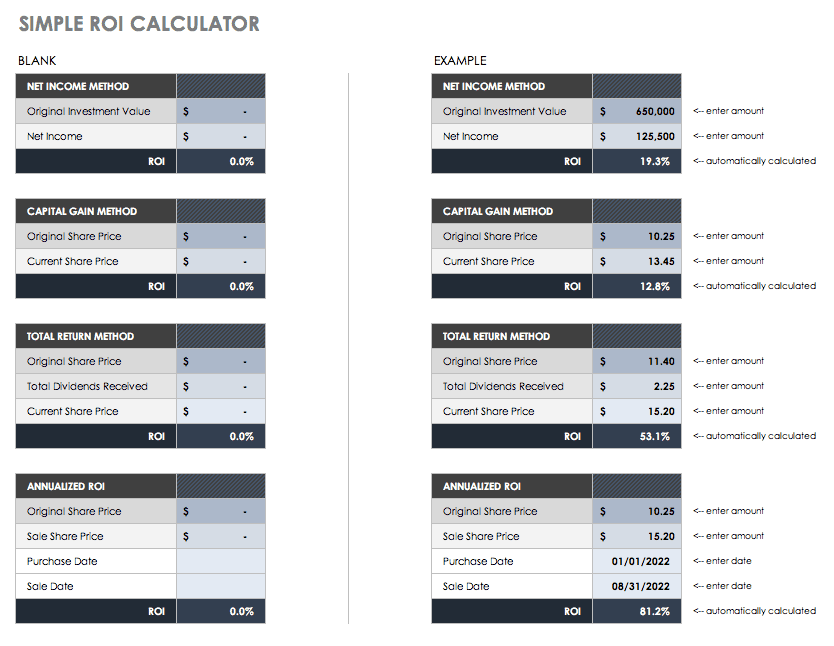

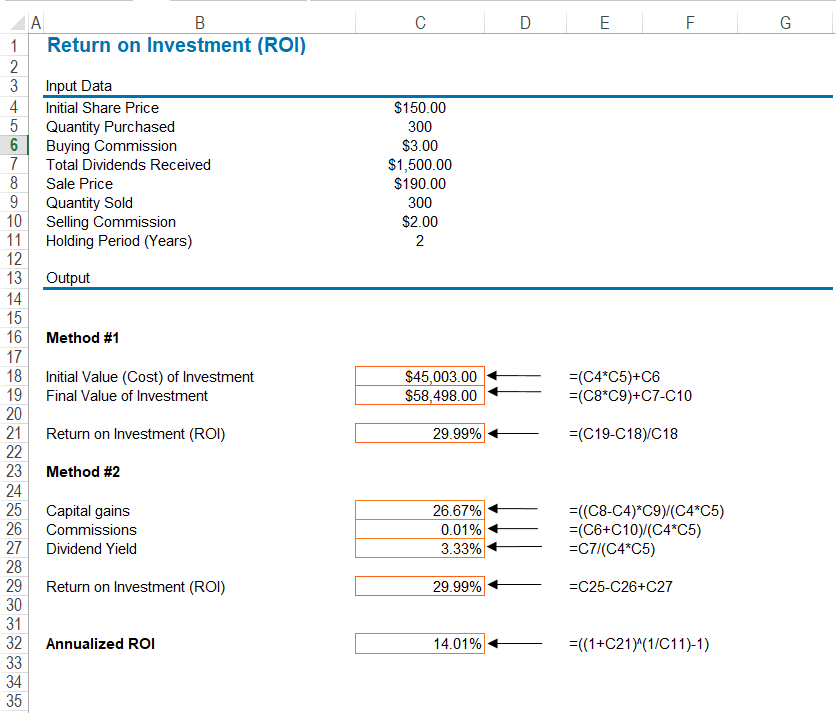

Simple ROI Calculator Excel Template

The attached simple ROI calculator is an Excel template. ROI may be calculated in Excel, but there is no specific formula for it — it simply displays inputs and outputs to help you come up with the final number. In this template, you will find four different methods to calculate ROI. But, you will always need to enter either your original investment value or share price.

Download Simple ROI Calculator Template

The four methods in the above template include net income method, capital gain method, total return method, and the annualized method: Net Income Method: Divide net profit by total assets. Enter your original investment value and its net income, which is what was earned less the taxes and deductions.

Capital Gain Method : Subtract your cost base from your capital proceeds. Enter your original share price and the current share price.

Total Return Method : The actual rate of return on an investment over a period of time, including capital gains, interest, and any dividends. Enter the original share price, your dividends, and the current share price.

Annualized Method: This is the geometric average amount earned every year over a given time. It is geometric to show compounding. Enter the original share price, the sale share price, when you purchased the share(s), and when you sold them.

What Is a Return on Investment (ROI)?

Companies use ROI to gauge the profits from any type of investment, whether time, money, or energy. Return on investment (ROI) is a performance measure that can be calculated in simple cases through a formula or in more complex cases via a template with multiple formulas. Calculations occur when you input what is spent versus what is earned. It can also be an investment view of a company’s cash flow via an action they took. In other words, the benefit of an investment is divided by the cost to see if it was worth making. ROI has many interpretations, depending on the business industry. For many businesses, ROI is simply the measurement of financial gain or loss relative to the costs such as deductions, fees, labor, or resources.

In project management, ROI helps businesses determine whether they want to invest in specific projects, and in the case of several projects, to decide between them. In the case of long-term projects, businesses must take into account inflation and future income to accurately calculate ROI. In the case of some quality projects, the ROI may be difficult to calculate because it’s hard to turn non-quantifiable data such as ideas and good feelings into monetary values. For example, spending money to put in a new breakroom may make your employees happier and feel more positive towards their environment. However, it’s difficult to calculate the revenue of a new break room.

ROI is used as a concept and a specific formula. As a concept, it can measure profitability or efficiency. People refer to ROI when discussing what they get back for their input. However, ROI is a true metric that can be calculated as a ratio or percentage. The basic formula to calculate ROI is:

ROI = Net Profit / Total Investment *100

You would use ROI for several reasons:

Provide Quantifiable Value : ROI provides leaders with information about a project’s worth, and can help garner their support by removing uncertainty and subjective benefits.

Build Stakeholder Support : When a project is up for decision (whether or not it gets approved), calculating the ROI gives stakeholders the information they need to either provide or deny their support.

Show Additional Benefits : Calculating ROI becomes a forcing function for staff to determine benefits they may not have considered at the start of a project.

Prioritize Projects : Many companies use ROI as a metric to rank their projects.

However, ROI modeling has some limitations. Some models do not adequately factor in accurate-enough costs and returns. Soft, or intangible, costs are difficult to assess. Another issue is that the costs and returns of a project may not match predictions. Finally, some ROI models may not give more than a financial measure of a project, giving stakeholders an inadequate measure of return or making the project’s actual return misunderstood.

There is more than one way to model ROI, and different analysts can model differently, possibly mischaracterizing the outcome. Therefore, stakeholders and business leaders should ask not only the ROI of a project but how it was modeled. The effects that a project has on more than just the business are sometimes left out. For example, social return on investment (SROI) is a modern metric that considers social, environmental, economic, and environmental outcomes in projects. SROI uses impact mapping, which is a strategic planning technique.

The ROI Formula

ROI is calculated by subtracting the project cost from the financial value. Financial value is what the project pays you back, but occasionally there is uncertainty in assigning monetary values to outcomes. To do so, break the values into known components and define them. These components usually include time, volume, and dollars for both the present and the project, such as this formula:

Financial value = TVD present – TVD project

V = volume, quantity of units

D = dollars/cost

Present = the current value

Project = the value of a successful project

One example of using this formula considers a project that decreases the production cycle by 20 percent. The team calculated that the production cost of their product was $5,000. The time to produce one unit was 10 hours, with a $90/hour wage and $41,00 worth of materials. For the production of 500 of these units, the product line cost was $2.5 million.

The project decreased the production cycle time by 20 percent, from 10 hours to eight hours, while keeping the remaining costs the same. The new production cost is $4,820 per unit and $2.41 million for the yearly product line. Therefore, using the formula above, the projects financial value is:

Financial value = $2,500,000 - $2,410,000 = $90,000 in annual savings

The project cost is the second component of the ROI formula. There are two main variables that compose project cost: work decomposition over time and cost of the work. The work decomposition over time breaks down the work or tasks into the most granular level possible, and in best practice by chronological order. In project management, this may also be known as the work breakdown structure (WBS). Here’s an example:

Insert Chart Here

For more information about WBS, see “ Getting Started with Work Breakdown Structures (WBS) .”

The costs of the required work need the practitioner to consider certain factors when they allot costs. Even these factors they can vary widely, they can include the following:

Any rentals/leases

Resources, such as workers

Hours to complete the work

Capital costs (hardware/software)

Once you have these costs defined, you can add them to your WBS, such as in the following example:

Some other methods of breaking down work include the following:

Gantt Charts : These are the WBS over time, and put your tasks into phases of work. To create your own, see “ How to Create a Gantt Chart in Excel .”

Process Maps or Process Flow Diagrams : These show the project work as workflow steps. This is a visual representation of your work. For more information on process maps, see “ Essential Guide to Business Process Mapping .”

These are all helpful tools to cost out your projects, but practitioners should also consider the following:

One-time Costs Versus Costs Over Time : Some equipment may be a one-time purchase or a rental over years. Include those costs over the period to get accurate ROI figures.

Consider What the Opportunity Cost May Be : When you have more than one project to compare, there may be savings you can attribute back to your company. Remember that the opportunity to perform the project may have value.

Estimate Liberally : Whenever there is a gray area for cost estimation, estimate higher. Cost overruns delay projects and erode confidence.

Once you have calculated all the financial values and project costs, the ROI formula is simple. Let’s assume in the following example that there is a one-time cost of $400,000 for our project to decrease the production time by 20 percent. In this example, Year 5 breaks even, and as the company goes forward, there is an appreciable saving:

ROI and Returns-Based Analysis

Another calculation that is important in a discussion of ROI is returns-based analysis . The financial industry performs style analyses when they are trying to determine the type of investment behavior either an investor or a money manager is using. Two distinct types of styles are holdings-based and returns-based. Returns-based is more widely used by financial professionals because monthly input data is readily available. The returns-based analysis compares three to five years of a portfolio’s monthly returns to the total returns of various style-based indexes. Inferences can be made about how closely the portfolio resembles the different indexes. In other words, a fund manager or investor professes that they will invest in a certain manner. A returns-based analysis is a model that shows if they have done so. Although not directly calculating ROI, a returns-based analysis can help determine whether your investment manager is worth their cost.

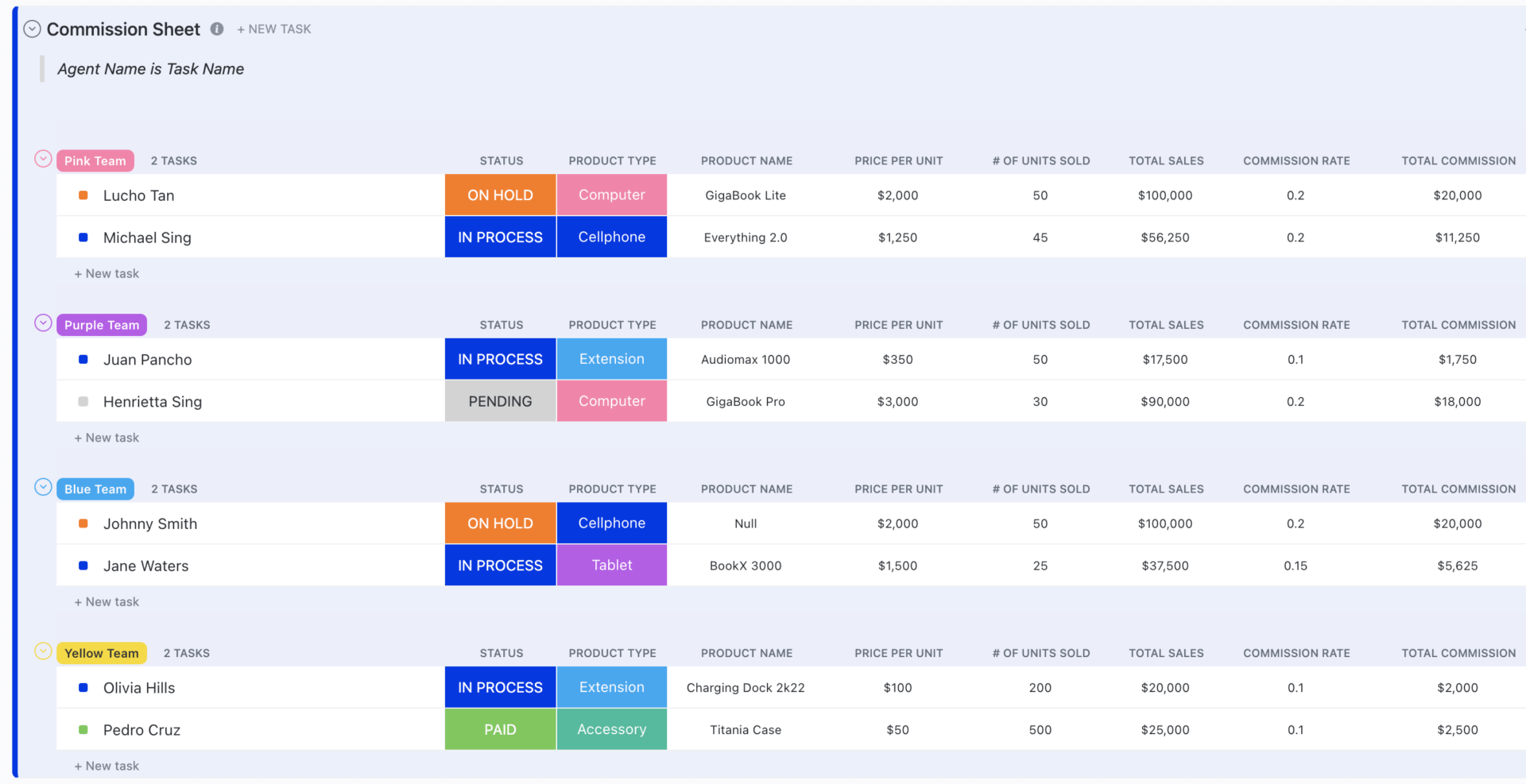

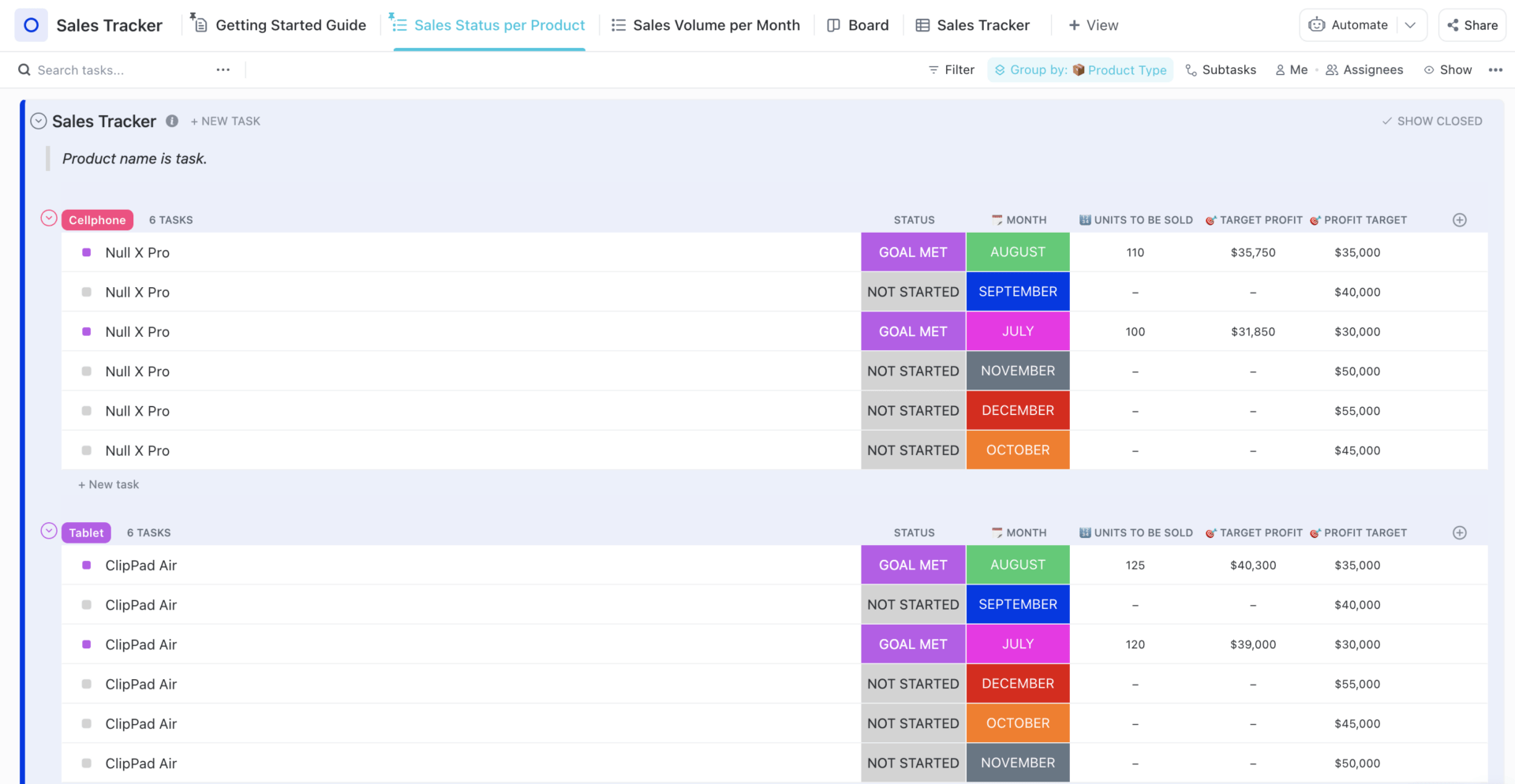

Make Better ROI Decisions, Faster with Charts in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- *New* Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

How to Calculate ROI to Justify a Project

- 12 May 2020

Understanding how to calculate the potential return on investment (ROI) of a project is an essential financial skill for all professionals to develop.

If you’re an employee, knowing how to calculate ROI can help you make the case for a project you’re interested in pursuing and have taken the lead on proposing. If you’re a manager, understanding ROI can give you greater insight into your team's performance . If you’re an executive, working knowledge of ROI can make it easier for you to identify which projects should be greenlit and which should be passed over. Once ROI is proven, it may be possible to replicate success by applying lessons learned from the first project to other segments of the business.

If you’re unfamiliar with accounting and finance , the prospect of determining the ROI of a project may seem beyond your abilities. However, it’s not an overly complicated process. By understanding the basics of financial valuation, which can enable you to put a monetary value on companies, projects, or anything that produces cash flows, anyone can learn to calculate the ROI of a project.

Access your free e-book today.

What Is Return on Investment?

Return on investment (ROI) is a metric used to denote how much profit has been generated from an investment that’s been made. In the case of a business, return on investment comes in two primary forms, depending on when it’s calculated: anticipated ROI and actual ROI.

Anticipated vs. Actual ROI

Anticipated ROI , or expected ROI, is calculated before a project kicks off, and is often used to determine if that project makes sense to pursue. Anticipated ROI uses estimated costs, revenues, and other assumptions to determine how much profit a project is likely to generate.

Often, this figure will be run under a number of different scenarios to determine the range of possible outcomes. These numbers are then used to understand risk and, ultimately, decide whether an initiative should move forward.

Actual ROI is the true return on investment generated from a project. This number is typically calculated after a project has concluded, and uses final costs and revenues to determine how much profit a project produced compared to what was estimated.

Positive vs. Negative ROI

When a project yields a positive return on investment , it can be considered profitable, because it yielded more in revenue than it cost to pursue. If, on the other hand, the project yields a negative return on investment , it means the project cost more to pursue than it generated in revenue. If the project breaks even, then it means the total revenue generated by the project matched the expenses.

Return on Investment Formula

Return on investment is typically calculated by taking the actual or estimated income from a project and subtracting the actual or estimated costs. That number is the total profit that a project has generated, or is expected to generate. That number is then divided by the costs.

The formula for ROI is typically written as:

ROI = (Net Profit / Cost of Investment) x 100

In project management, the formula is written similarly, but with slightly different terms:

ROI = [(Financial Value - Project Cost) / Project Cost] x 100

Check out our video on return on investment below, and subscribe to our YouTube channel for more explainer content!

Calculating the ROI of a Project: An Example

Imagine that you have the opportunity to purchase 1,000 bars of chocolate for $2 apiece. You would then sell the chocolate to a grocery store for $3 per piece. In addition to the cost of purchasing the chocolate, you need to pay $100 in transportation costs.

To decide whether this would be profitable, you would first tally your total expenses and your total expected revenues.

Expected Revenues = 1,000 x $3 = $3,000

Total Expenses = (1,000 x $2) + $100 = $2,100

You would then subtract the expenses from your expected revenue to determine the net profit.

Net Profit = $3,000 - $2,100 = $900

To calculate the expected return on investment, you would divide the net profit by the cost of the investment, and multiply that number by 100.

ROI = ($900 / $2,100) x 100 = 42.9%

By running this calculation, you can see the project will yield a positive return on investment, so long as factors remain as predicted. Therefore, it’s a sound financial decision. If the endeavor yielded a negative ROI, or an ROI that was so low it didn’t justify the amount of work involved, you would know to avoid it moving forward.

It’s important to note that this example calculates an anticipated ROI for your project. If any of the factors affecting expenses or revenue were to change during implementation, your actual ROI could be different.

For example, imagine that you have already purchased your chocolate bars for the agreed-upon $2 apiece and paid $100 to transport them. If the most that the store will pay you is $2.25 per chocolate bar, then your actual revenues drop substantially compared to your projected revenues. The result is a reduced net profit and a reduced actual ROI.

Actual Revenues = 1,000 x $2.25 = $2,250

Net Profit = $2,250 - $2,100 = $150

ROI = ($150 / $2,100) x 100 = 7.14%

Circumstances are rarely as straightforward as this example. There are typically additional costs that should be accounted for, such as overhead and taxes. In addition, there’s always the possibility that an anticipated ROI will not be met due to unforeseen circumstances, but the same general principles hold true.

How to Use Finance to Pitch Your Project

Have you ever pitched a project to senior management, only to have the idea shot down under the guise of “not making financial sense?" It happens more often than you might think. By learning how to calculate ROI for projects you’re interested in pursuing, you can self-evaluate them before they're raised up to decision-makers within your organization and defend them as they’re being considered.

Similarly, by understanding how to calculate ROI after a project you’ve spearhead is done, you can better speak to the contributions that you and your team have made toward shared company goals.

High-performing businesses are successful because they make smart decisions about when and where they allocate available resources. Calculating the ROI of a project before it moves forward can help ensure that you’re making the best possible use of the resources you have available.

To learn more ways that you can use financial concepts to improve your efficacy and advance your career, explore our online finance and accounting courses . Download your free flowchart to determine which is right for you.

About the Author

How to Calculate the Return on Investment for Your Startup

How to calculate roi for a startup.

Return on investment is a typical business concept for calculating the financial benefits of an investment. To measure the performance of a business, managers and executives often calculate the return on investment (ROI). This value can be used to define anything from a monetary return to an efficiency ratio and is typically expressed as a percentage or a ratio.

In this article, we will go through the definition of Return on Investment, the importance and benefits of ROI calculations, and teach you how to calculate ROI for your startup.

What is ROI?

Return on investment is a performance measure that can be used to evaluate the effectiveness or profitability of an investment or compare the efficacy of several different investments. The return on investment, or ROI, is an attempt to directly evaluate the amount of return on a specific investment in relation to the cost of the investment.

A company can measure the profitability of any expenditure by calculating the return on investment. Buying pens or fixing an employee's desk are expenses that may not have a direct or monetary return on investment (ROI), but they are still part of a more significant investment. Spending money on a graphic designer to make commercials, a photographer to capture headshots, or a web developer to redesign the company's website are all investments with the potential for a return.

Return on investment (ROI) is a standard metric to assess a project's viability. An angel investor , for instance, might want to calculate the expected return on their investment before putting money into a company. Divide the annual income or profit by the initial or current investment to estimate the return on investment (ROI).

What is ROI used for?

The return on investment (ROI) metric can assess numerous investment choices by contrasting them to their starting prices. Calculations of return on investment (ROI) are frequently used by businesses when considering previous or prospective investments.

Individuals can analyze their investments and compare one investment to another, whether a stock holding or a financial stake in a small firm, by calculating the return on investment (ROI) and comparing the two.

Sometimes, businesses will employ a project's return on investment (ROI) as a metric of its performance. Before committing to an advertising campaign, a business owner will want to know what kind of return they can expect on their investment. A company's return on investment is considered positive if the money earned is greater than the sum spent.

When calculating annualized ROI, the average yearly return on investment realized during the investment term is what you're after. This is useful because the return on investment (ROI) doesn't account for the time spent holding an investment when calculating ROI. The rate of return on an annualized basis is helpful for comparing the results of various investments across different time frames.

What Are Examples of ROI Calculations?

Businesses might encounter difficulties calculating the investment amounts for each part of the ROI equation.

Considerable investment in new computers, for instance, has several deployment expenses that must be calculated and accounted for. The company must calculate the total cost of ownership, which includes the purchase price, any applicable taxes and shipping fees, any consultation or support fees paid, and the cost of initial installation and ongoing upkeep.

After that, the company would need to determine its net profit for a specified time frame. Hard monetary gains from enhanced efficiency and decreased upkeep expenses relative to older computer systems may contribute to these bottom-line gains.

Thus, a company can compare the return on investment (ROI) of two different computer systems by factoring in upfront expenses and long-term benefits. Which of these two computers, then, is the better financial bet?

At the end of the specified period, the company may use actual data for the total net income and the entire investment cost to determine the ROI. The computer implementation can be gauged by comparing the actual and predicted ROI.

What Are the Benefits of ROI?

When making decisions for your business, knowing how investments affect your profits and your business is essential and beneficial.

There are many benefits to calculating ROI for your business . Let's take a look at some.

- It's easy to figure out how to calculate return on investment. It only requires a few numbers that may easily be found in any set of financial statements or balance sheets. You need a few business metrics, like net profit and the amount of investment required, which will give you a quick idea of your initial investment.

- It's easy to figure out what your ROI means. If the number is positive, you made money on this investment. If the number is negative, it means you lost money. ROI is easy to understand, even for people who aren't accountants. Because it is so widely used and so simple to calculate, it enables more accurate comparisons between various companies regarding their investment returns. This makes the calculation results a valuable metric to use when talking to investors.

- ROI can be worked out for several different investments or your business. This lets you see what parts of your business have been helped by a particular investment, like a marketing campaign that brought in more money or a second location that helped you sell more. As we mentioned, it is a metric used to measure the success of an organization's financial decisions for a specific department or division. The improved metric will help determine which businesses or teams are the most profitable.

How Do You Calculate ROI?

For big companies, figuring out ROI can be a difficult task. But the process is easy for people who own small businesses.

For example, to determine the return on your first business investment, you need to know how much you put into the business and, if you have any, how much long-term debt you have now. You will also need to know how much money you made after taxes for the year. All this information is in your accounting software, your spreadsheet, or your accounting journals.

There are several ways to figure out the ROI. Most people use net income divided by the total cost of the investment = Net income / Cost of investment x 100.

Here is an example of how a business might calculate its return on investment.

Let's assume that Joel has an e-commerce business. He runs an e-commerce business that sells dog-related products. He wants to raise awareness and boost sales before the holidays, so he buys some social media ads. He spent a total of $2,000 on ads on social media sites to get people to visit his site during the holidays.

After the end of the holiday shopping season, Joel does the math on his net profit and discovers that the online store he owns has made $10,000 more money than it did during the same time the previous year. After that, he can calculate the advertising's return on investment using the following formula:

ROI = (10,000 / $2,000) x 100 = 500%

This indicates that Joel made five dollars more in net profit for every dollar he invested in advertisements. He can now start to budget for increased expenditure for the upcoming holiday season now that he has seen such a high return on investment (ROI).

Why Is ROI Important for Your Business?

Making smart financial decisions is essential for the success of your business. Your return on investment (ROI) is a crucial metric that can help you compare different investment strategies and determine which will make you the most money.

You can use this metric to make business decisions like investing in a new business or buying a new property to make room for growth.

You can A/B test ways to invest, like on social media platforms. This could be a comparison between Meta and Instagram in terms of your return on investment. For example, you could put the same amount of money into advertisements on each platform, which may give you a better return.

By comparing and evaluating this metric across different investment channels, you can make better financial decisions, get the best return, and grow your business.

How to Increase Your ROI

Depending on what kind of investment you want to make, the best way to increase returns will vary. But there is a way you can try before investing to increase your chances of getting a high return on your money. Eurokick is the solution!

Eurokick is ready to help your startup calculate your return on investment and increase your ROI. Eurokick supports and monitors your startup in every way possible. Contact us and get more information now!

Related Insights

Pre Seed Funding for Startups: What Is It & How Does It Work?

6 Ways To Find Investors And Raise Millions For Small Business

- Search Search Please fill out this field.

What Is Return on Investment (ROI)?

- How to Calculate ROI

Why Is ROI a Useful Measurement?

- Limitations

What Is a Good ROI?

- Developments

Is ROI Calculated Annually?

The bottom line.

- Corporate Finance

- Financial Ratios

Return on Investment (ROI): How to Calculate It and What It Means

:max_bytes(150000):strip_icc():format(webp)/jason_mugshot__jason_fernando-5bfc261946e0fb00260a1cea.jpg)

Return on investment (ROI) is a performance measure used to evaluate the efficiency or profitability of an investment or compare the efficiency of a number of different investments. ROI tries to directly measure the amount of return on a particular investment, relative to the investment’s cost.

To calculate ROI , the benefit (or return) of an investment is divided by the cost of the investment. The result is expressed as a percentage or a ratio .

Key Takeaways

- Return on Investment (ROI) is a popular profitability metric used to evaluate how well an investment has performed.

- ROI is expressed as a percentage and is calculated by dividing an investment's net profit (or loss) by its initial cost or outlay.

- ROI can be used to make apples-to-apples comparisons and rank investments in different projects or assets.

- ROI does not take into account the holding period or passage of time, and so it can miss opportunity costs of investing elsewhere.

- Whether or not something delivers a good ROI should be compared relative to other available opportunities.

Investopedia / Lara Antal

How to Calculate Return on Investment (ROI)

The return on investment (ROI) formula is as follows :

ROI = Current Value of Investment − Cost of Investment Cost of Investment \begin{aligned} &\text{ROI} = \dfrac{\text{Current Value of Investment}-\text{Cost of Investment}}{\text{Cost of Investment}}\\ \end{aligned} ROI = Cost of Investment Current Value of Investment − Cost of Investment

"Current Value of Investment” refers to the proceeds obtained from the sale of the investment of interest. Because ROI is measured as a percentage, it can be easily compared with returns from other investments, allowing one to measure a variety of types of investments against one another.

ROI is a popular metric because of its versatility and simplicity. Essentially, ROI can be used as a rudimentary gauge of an investment’s profitability. This could be the ROI on a stock investment, the ROI a company expects on expanding a factory, or the ROI generated in a real estate transaction.

The calculation itself is not too complicated, and it is relatively easy to interpret for its wide range of applications. If an investment’s ROI is net positive, it is probably worthwhile. But if other opportunities with higher ROIs are available, these signals can help investors eliminate or select the best options. Likewise, investors should avoid negative ROIs , which imply a net loss.

For example, suppose Jo invested $1,000 in Slice Pizza Corp. in 2017 and sold the shares for a total of $1,200 one year later. To calculate the return on this investment, divide the net profits ($1,200 - $1,000 = $200) by the investment cost ($1,000), for an ROI of $200/$1,000, or 20%.

With this information, one could compare the investment in Slice Pizza with any other projects. Suppose Jo also invested $2,000 in Big-Sale Stores Inc. in 2014 and sold the shares for a total of $2,800 in 2017. The ROI on Jo’s holdings in Big-Sale would be $800/$2,000, or 40%.

What Are the Limitations of ROI?

Examples like Jo's (above) reveal some limitations of using ROI, particularly when comparing investments. While the ROI of Jo's second investment was twice that of the first investment, the time between Jo’s purchase and the sale was one year for the first investment but three years for the second.

Jo could adjust the ROI of the multi-year investment accordingly. Since the total ROI was 40%, to obtain the average annual ROI, Jo could divide 40% by 3 to yield 13.33% annualized. With this adjustment, it appears that although Jo’s second investment earned more profit, the first investment was actually the more efficient choice.

ROI can be used in conjunction with the rate of return (RoR) , which takes into account a project’s time frame. One may also use net present value (NPV) , which accounts for differences in the value of money over time due to inflation. The application of NPV when calculating the RoR is often called the real rate of return .

Determining what constitutes a "good" ROI is crucial for investors seeking to maximize their returns while managing risk. While there's no universal benchmark, several factors influence what's considered satisfactory.

- Risk tolerance: Investors vary in their willingness to tolerate risk. Those who are more risk-averse may accept lower ROIs in exchange for greater stability and predictability in their investments. On the other hand, risk-tolerant investors may seek higher ROIs but are willing to accept greater uncertainty and volatility.

- Investment duration: The time horizon of an investment plays a significant role in determining what qualifies as a good ROI. Longer-term investments typically require higher ROIs to justify tying up capital for an extended period. Shorter-term investments may offer lower ROIs but provide liquidity and flexibility.

- Industry norms: Different industries have varying expectations for ROI based on factors such as market conditions, competitive landscape, and regulatory environment. For example, industries with high barriers to entry or significant capital requirements may require higher ROIs to attract investment.

- Personal goals: Ultimately, what qualifies as a "good" ROI depends on an investor's specific financial objectives. Whether aiming for wealth accumulation, income generation, or capital preservation, investors should align their ROI expectations with their individual goals and circumstances.

What Are the Wider Applications of ROI?

Recently, certain investors and businesses have taken an interest in the development of new forms of ROIs, called social return on investment (SROI) . SROI was initially developed in the late 1990s and takes into account broader impacts of projects using extra-financial value (i.e., social and environmental metrics not currently reflected in conventional financial accounts).

SROI helps understand the value proposition of certain environmental, social, and governance (ESG) criteria used in socially responsible investing (SRI) practices. For instance, a company may decide to recycle water in its factories and replace its lighting with all LED bulbs. These undertakings have an immediate cost that may negatively impact traditional ROI—however, the net benefit to society and the environment could lead to a positive SROI.

There are several other new variations of ROIs that have been developed for particular purposes. Social media statistics ROI pinpoints the effectiveness of social media campaigns—for example how many clicks or likes are generated for a unit of effort. Similarly, marketing statistics ROI tries to identify the return attributable to advertising or marketing campaigns.

So-called learning ROI relates to the amount of information learned and retained as a return on education or skills training. As the world progresses and the economy changes, several other niche forms of ROI are sure to be developed in the future.

What Is ROI in Simple Terms?

Basically, return on investment (ROI) tells you how much money you've made (or lost) on an investment or project after accounting for its cost.

ROI can be calculated over any period of time, but it's most commonly calculated on an annual basis. This allows for easier comparison between different investments and provides a standardized measure of performance. However, in some cases, ROI can also be calculated over shorter or longer periods depending on the specific context and needs of the analysis.

How Do You Calculate Return on Investment (ROI)?

Return on investment (ROI) is calculated by dividing the profit earned on an investment by the cost of that investment. For instance, an investment with a profit of $100 and a cost of $100 would have an ROI of 1, or 100% when expressed as a percentage. Although ROI is a quick and easy way to estimate the success of an investment, it has some serious limitations. ROI fails to reflect the time value of money , for instance, and it can be difficult to meaningfully compare ROIs because some investments will take longer to generate a profit than others. For this reason, professional investors tend to use other metrics, such as net present value (NPV) or the internal rate of return (IRR) .

What Industries Have the Highest ROI?

Historically, the average ROI for the S&P 500 has been about 10% per year. Within that, though, there can be considerable variation depending on the industry. During 2020, for example, many technology companies generated annual returns well above this 10% threshold. Meanwhile, companies in other industries, such as energy companies and utilities, generated much lower ROIs and in some cases faced losses year-over-year. Over time, it is normal for the average ROI of an industry to shift due to factors such as increased competition, technological changes, and shifts in consumer preferences.

Return on investment is a metric that investors often use to evaluate the profitability of an investment or to compare returns across a number of investments. It is expressed as a percentage. ROI is limited in that it doesn't take into account the time frame, opportunity costs, or the effect of inflation on investment returns, which are all important factors to consider.

World Health Organization. " Investment for Health and Well-Being: A Review of the Social Return on Investment From Public Health Policies, " PDF Download. Pages 2-4.

DQYDJ. " S&P 500 Historical Return Calculator ."

Fortune. " The Best Stocks of 2020 Have Made Pandemic Investors Even Richer ."

- Guide to Financial Ratios 1 of 31

- What Is the Best Measure of a Company's Financial Health? 2 of 31

- Which Financial Ratios Are Used to Measure Risk? 3 of 31

- Profitability Ratios: What They Are, Common Types, and How Businesses Use Them 4 of 31

- Understanding Liquidity Ratios: Types and Their Importance 5 of 31

- What Is a Solvency Ratio, and How Is It Calculated? 6 of 31

- Solvency Ratios vs. Liquidity Ratios: What's the Difference? 7 of 31

- Key Ratio: Meaning, Example, Pros and Cons 8 of 31

- Multiples Approach 9 of 31

- Return on Assets (ROA): Formula and 'Good' ROA Defined 10 of 31

- How Return on Equity Can Help Uncover Profitable Stocks 11 of 31

- Return on Investment (ROI): How to Calculate It and What It Means 12 of 31

- Return on Invested Capital: What Is It, Formula and Calculation, and Example 13 of 31

- EBITDA Margin: What It Is, Formula, and How to Use It 14 of 31

- What Is Net Profit Margin? Formula for Calculation and Examples 15 of 31

- Operating Margin: What It Is and the Formula for Calculating It, With Examples 16 of 31

- Current Ratio Explained With Formula and Examples 17 of 31

- Quick Ratio Formula With Examples, Pros and Cons 18 of 31

- Cash Ratio: Definition, Formula, and Example 19 of 31

- Operating Cash Flow (OCF): Definition, Types, and Formula 20 of 31

- Receivables Turnover Ratio Defined: Formula, Importance, Examples, Limitations 21 of 31

- Inventory Turnover Ratio: What It Is, How It Works, and Formula 22 of 31

- Working Capital Turnover Ratio: Meaning, Formula, and Example 23 of 31

- Debt-to-Equity (D/E) Ratio Formula and How to Interpret It 24 of 31

- Total Debt-to-Total Assets Ratio: Meaning, Formula, and What's Good 25 of 31

- Interest Coverage Ratio: Formula, How It Works, and Example 26 of 31

- Shareholder Equity Ratio: Definition and Formula for Calculation 27 of 31

- Can Investors Trust the P/E Ratio? 28 of 31

- Using the Price-to-Book (P/B) Ratio to Evaluate Companies 29 of 31

- Price-to-Sales (P/S) Ratio: What It Is, Formula To Calculate It 30 of 31

- Price-to-Cash Flow (P/CF) Ratio? Definition, Formula, and Example 31 of 31

:max_bytes(150000):strip_icc():format(webp)/Investopedia_Returnoninvestmentformula_colorv1-6d281839c5814e109e316ebbbb61a5bd.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Technical Skills

- Finance Articles

ROI Formula (Return on Investment)

It is an important financial ratio that measures the net return or profit an investor receives on its original investment amount.

Currently an investment analyst focused on the TMT sector at 1818 Partners (a New York Based Hedge Fund), Sid previously worked in private equity at BV Investment Partners and BBH Capital Partners and prior to that in investment banking at UBS.

Sid holds a BS from The Tepper School of Business at Carnegie Mellon.

What is Return on Investment (ROI)?

Roi formula, example of the roi formula calculation, benefits of the roi formula, limitations of the roi formula, annualized roi formula, alternatives to the roi formula.

Return on Investment is an important financial ratio that measures the net return or profit an investor receives on its original investment amount. The calculation involves dividing the investment's net income by the initial investment cost.

This profitability ratio, expressed as a percentage, compares net profits at the investment's exit to the initial cost. Businesses and investors widely utilize this ratio to evaluate the performance of investments, guiding strategic decisions and future investment prospects.

The ROI formula , a simple yet powerful tool, helps compare different investments and assess their potential returns. It allows investors to discern which investments yield better returns and aids in optimizing their investment portfolios.

By analyzing this ratio, investors gain insights into the profitability and viability of various investment options, aiding them in making informed decisions regarding resource allocation and investment prioritization.

This metric acts as a guiding beacon, assisting in evaluating, comparing, and maximizing returns on investment, contributing significantly to sound financial decision-making.

Key Takeaways

- Return on Investment is an important financial ratio that measures an investor's net return or profit on its original investment amount.

- It is calculated by dividing an investment's net return by the initial investment cost, expressed as a percentage.

- Serving as a benchmark, it allows comparisons across different investments and projects, enabling analysts to gauge performance irrespective of scale or industry.

- However, the formula's inability to consider timeframes and its vulnerability to manipulation and subjective interpretations necessitate supplementary metrics for a comprehensive assessment.

- Several alternatives exist to the conventional ROI formula, such as IRR, NPV, ROE, and Profitability Index (PI), offering nuanced perspectives and diverse evaluations of investment performance.

The Return on Investment formula offers a clear path to assess an investment's performance. It can be calculated as

Return On Investment = (Net Return / Cost of Investment) × 100

The numerator, the net return obtained by subtracting the investment cost from either gross returns or total exit proceeds, encapsulates the total profits received. In contrast, the denominator, the cost of the investment, signifies the total amount spent by the investor.

Expressed as a percentage, this metric simplifies complex financial evaluations, allowing investors to gauge the efficiency of their capital allocation strategy.

A higher ratio signals greater monetary benefits, provided other factors remain constant. Yet, determining the adequacy of this ratio hinges on various factors, such as individual target returns and the investment's holding period.

So, in finance, this formula isn't just about numbers; it's a compass that guides investors and businesses through the intricacies of investment evaluation and strategic decision-making.

Having established the formula on how to compute the return on investment, let’s look at an illustration to help you understand the calculations vividly.

Consider an investment whose gross returns amount to $100,000 while the cost of investment initially stood at $80,000. Therefore, the net return from this investment is

Net Return = Gross Return - Cost of Investment

= $100,000 - $80,000 = $20,000

= ($20,000 / $80,000) × 100

This can be further interpreted as for every dollar invested; an additional 25 cents are generated as profit for the investor. This ratio gives an overview of the benefits one can expect from a particular investment, which helps investors and corporations make informed strategic decisions.

These are very simplistic computations that give both the investor and the firm a single benchmark on the profitability of any investment and how resources should be allocated to maximize returns.

This formula holds several advantages, providing a versatile and comprehensive evaluation of investments:

- Simplicity in Calculation: It requires only two figures – the original investment cost and the net profit, making it straightforward and accessible for quick assessments of various investment opportunities.

- Universal Understanding: ROI is a globally recognized concept that ensures clarity and comprehension across diverse audiences. Its widespread acknowledgment facilitates effective communication and decision-making, as it resonates universally in financial discussions.

- Efficiency Benchmark: Serving as a benchmark, it allows comparisons across different investments and projects, enabling analysts to gauge performance irrespective of scale or industry. This enables informed decisions regarding resource allocation.

- Forward-Looking Tool: ROI doesn’t just analyze past performance; it's a forward-looking tool. It assists in financial forecasting and planning by indicating potential returns and aiding in assessing future investment prospects.

- Versatility in Application: Its adaptability makes it applicable across various sectors and investment types, from individual stocks to large-scale business initiatives. This versatility grants flexibility in assessing diverse portfolios and business endeavors.

This formula holds undeniable utility, yet it has inherent limitations that warrant consideration.

Time Disregard

Ignoring the element of time, the formula oversimplifies by solely focusing on returns and costs. It fails to differentiate between investments with similar ROIs but differing timeframes.

For instance, two investments boasting a 50% ROI might seem identical, but one taking three years to yield and another thirty years unveils a disparity in their actual worth over time, where factors such as inflation and the time value of money come into play.

Vulnerability to Manipulation

Variances emerge in calculations due to subjective interpretations and exclusions. Different formula applications or omissions of costs can skew the outcomes.

For example, a marketing manager might overlook additional expenses in property investment calculations, such as maintenance costs, property taxes, and other legal fees, which leads to inflated ROI projections that don't encompass all incurred costs.

Limited Scope

The ROI formula falls short of encapsulating the complete financial landscape. It omits comprehensive factors like risk, opportunity cost, and qualitative aspects of investments, providing a narrow quantitative perspective.

Inability to Account for Changing Conditions

The formula often fails to adapt to changing market conditions or dynamic factors influencing investment performances. It remains static and doesn't accommodate fluctuations that could affect future returns.

This formula, while valuable, requires supplementing with additional metrics and qualitative assessments to form a holistic view, ensuring informed decision-making and comprehensive investment evaluations.

The Annualized ROI formula corrects the time-related deficiencies of traditional ROI, offering a more accurate depiction of investment performance over varying timeframes.

Calculated by considering the holding period provides a standardized metric for comparing investments with different durations.

Annualized ROI = [(Ending Value ÷ Beginning Value) ^ (1 ÷ Number of Years)] - 1

For instance, consider two investments with identical regular ROIs of 40%. Investment A yields the return in 2 years, while Investment B realizes it in 5 years. Applying the Annualized ROI formula:

- Investment A: [(1 + 0.40) ^ (1 / 2 years)] - 1 = 18.92% annualized

- Investment B: [(1 + 0.40) ^ (1 / 5 years)] - 1 = 7.24% annualized

Despite both investments having the same regular ROI, the annualized ROI uncovers the stark difference due to varying holding periods.

Investment A, yielding 18.92% annually over 2 years, outshines Investment B, generating a mere 7.24% annually over 5 years. Therefore, Investment A presents a better opportunity, showcasing higher annual returns within a shorter timeframe.

Annualized ROI acts as a magnifying glass, illuminating the true potential of investments and making it a crucial metric for investors evaluating opportunities.

It emphasizes investments' returns and time efficiency, guiding investors toward more fruitful avenues, thereby balancing returns and holding periods for informed investment decisions.

Several alternatives exist to the conventional Return on Investment formula, offering nuanced perspectives and diverse evaluations of investment performance:

- Internal Rate of Return (IRR): IRR represents all cash flows across an investment's lifespan, expressed as an annual growth rate. It considers the timing and size of cash flows made during the investment period, making it favorable in sectors like private equity and venture capital.

- Return on Equity (ROE) and Return on Assets (ROA): These ratios, unlike ROI, focus on specific components like equity and assets, offering a more targeted approach. However, they solely depict annual returns without considering cash flow timing, making them less comprehensive in evaluating the investment's full lifespan.

- Net Present Value (NPV): NPV determines an investment's worth by subtracting the original investment cost from the present value of future cash flows. It considers the time value of money and helps evaluate whether an investment generates more returns than the cost of investment. A positive NPV value is profitable for investing, as the present value of the future cash flows is greater than the initial investment cost.

- Profitability Index (PI): PI measures the investment's profitability. It compares the present value of future cash flows to the initial investment, offering a ratio for ranking and selecting projects. A PI value greater than 1 is desirable for the investment.

Each alternative presents a unique viewpoint, emphasizing different aspects of an investment. IRR, NPV, ROE, ROA, and PI cater to varied preferences and requirements, providing a multifaceted understanding of investment performance beyond the conventional formula.

Their diversity enables analysts and investors to choose metrics aligning with their specific evaluation needs and investment objectives.

ROI, a fundamental financial metric, encapsulates an investment's performance by gauging returns relative to its cost. This ratio, expressed in percentage, is a pivotal tool for investors and businesses, providing critical insights and aiding in strategic decision-making.

It serves as a compass, guiding evaluations of current and prospective investments and unveiling profitability or loss scenarios. The simplicity of its calculation - dividing net profit (or loss) by the initial investment - makes it accessible and widely used across diverse industries.

However, while this metric offers a bird's-eye view of investment success, its limitations are notable. The formula's inability to consider timeframes and its vulnerability to manipulation and subjective interpretations necessitate supplementary metrics for a comprehensive assessment.

To truly comprehend an investment's worth, considering alternatives like IRR, NPV, ROE, and Profitability Index (PI), among others, proves crucial. These metrics offer a nuanced view, accounting for different facets like timing, size of cash flows, and profitability, complementing the ROI's perspective.

Everything You Need To Master Financial Statement Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Researched and authored by Sauryan Pandey | LinkedIn

Reviewed and edited by Parul Gupta | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

- Rate of Return

- Return on Assets & ROA Formula

- Return on Common Equity

- Return on Equity (ROE)

- Return on Invested Capital

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

Home > Finance > Investing

How to Calculate Your Return on Investment

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

We recently updated this page to fix a formatting error with superscripts. Our formulas are formatted accurately now; we regret the previous error.

You invested in property a few years ago, and now you want to know: Was that investment worth it? To find out, you need to calculate your return on investment (ROI). We walk you through how to use the ROI formula and also where you can go for easy calculations.