Get your funerals / burials paid using life insurance!

@t need insurance assignments professionals, how to get started with a claim, call mich bledsoe at 256-770-0772 to get started..

Insurance Lessons and Worksheets

Welcome to the Insurance Lessons and worksheets category!

Insurance is an essential aspect of personal finance management as it provides financial protection against unforeseeable losses. At Money Instructor, we believe in the importance of understanding different types of insurance policies, concepts, and principles.

Our resources cover a broad range of insurance policies, including health and medical, auto, life, travel, homeowners, and rental insurance. Our goal is to equip you with the knowledge and skills necessary to make informed decisions about your insurance needs.

We offer comprehensive lessons and worksheets on important insurance terms, principles, rules, and procedures. You can learn at your own pace, and our materials are suitable for students of all levels. Our informative articles, helpful tips, and other relevant topics are designed to help you navigate the complex world of insurance with ease.

If you are a teacher or an educator, we have resources that can help you teach insurance to your students. Our lessons and worksheets are customizable, and you can use them to create engaging lesson plans that cater to your students' unique learning needs.

Insurance Lessons

Insurance Introduction: Types of Insurance

An introduction to insurance, the different types of insurance, and terminology.

WHAT IS INSURANCE VIDEO LESSON

What is Insurance?

An instructional video lesson introducing students to the basics of insurance, how does it work, and its importance. Learn about controlling risk, contract costs and benefits, premiums and deductibles, common types of insurance policies. Meaning, definition, and explanation of insurance.

Car Insurance

An introductory lesson on basic car insurance terminology. Learn about car insurance monthly premiums and answer the questions about choosing car insurance. Teaching focus is on price comparison, and early understanding of basic liability insurance.

WHAT IS CAR INSURANCE? HOW DOES IT WORK?

What is Car Insurance? How does it Work?

In this lesson students will learn learn the basics of car insurance, including what it is, why you need it, and common car insurance terminology. We cover different types of car insurance coverage, factors affecting insurance premiums, and optional coverages.

What is Renters Insurance Lesson

A lesson about what is a renters insurance. Students learn about Renters Insurance, including its key coverage types, cost estimation, policy types, and also the significance of risk management to best protect assets and avoid potential financial issues when renting. This lesson covers the key components of such policies, illustrating how they serve as a financial safety net for individuals renting their living spaces.

Health Insurance

Learn about health insurance monthly premiums and answer the questions about choosing a company's health insurance plan.

PREPARING YOUR FINANCES FOR AN EMERGENCY OR DISASTER

How to Prepare your Finances for an Emergency or Disaster

There are many situations in which you need to be financially prepared, including hurricanes, house fires, floods, pandemics, and more. Proper planning, including saving emergency money with a emergency savings fund, is key to help avoid a personal financial crisis. An instructional video lesson introducing students to the basic steps to make sure their finances are ready for emergencies, natural disasters, and other related events.

ADDITIONAL LESSONS

Insurance – Identifying and Managing Risk

Students learn about risk and insurance.

Different Types of Insurance

Students learn about different types of insurance.

Using Insurance to Manage Risk

Students learn how insurance can be used to manage risk.

INFORMATION AND ARTICLES ON INSURANCE

An Overview of Permanent Health Insurance Coverage Permanent health insurance provides you and your family with peace of mind and protection, providing access to an array of health services. Here is an overview of what permanent health insurance provides.

Types of Family Health Insurance Information on the basic types of family health insurance.

Which Benefit Plan is Right for Me? Learn the basics on companies employee health benefit plans.

Choosing the Right Level of Auto Insurance Learn about the different types of auto insurance coverage, and what types of insurance you may need for your car.

Different Types of Auto Insurance Information on the different types of auto insurance policies available.

An Overview of Life Insurance We don't know what the future may bring. Here is an overview and information on life insurance.

The Importance of Homeowner Insurance Coverage Your home and property are at risk from dangers beyond your control. You can help eliminate these financial risks with homeowner insurance coverage.

Strategies to Cutting Insurance Costs

Here are some tips to help cut and lower your insurance costs.

More Insurance Information

More information and advice on health insurance, auto insurance, life insurance, and more.

Additional Insurance Information

Additional insurance information.

Business Math Teach and learn the concepts of basic business math. These lesson plans, business lessons, interactive material, and worksheets will introduce your students to these basic math concepts. Topics include earning money, income and wages, taxes, checking accounts, bank savings accounts, and more consumer math skills, examples and problems.

Back to more Teaching Earning and Spending Money Worksheets and Lessons

Additional Lesson Categories

© Copyright 2002-2024 Money Instructor. All Rights Reserved.

COMPLETE THE VERIFICATION & POA FORM & ALL THE OTHER FORMS AUTOMATICALLY FILL IN TO SAVE YOU TIME!

Click the button links to access our most current forms. The forms can be filled out online and printed for faxing back to us. The Forms Package contains all forms needed to start the process. These versions will also "auto populate" several required fields.

COMPLETE THE FIRST FORM & ALL THE OTHER FORMS AUTOMATICALLY FILL IN TO SAVE YOU TIME!

✓ The Funeral Home gets the assignment of the insurance policy from the beneficiary and faxes (or emails it to [email protected]) First National with the necessary information

✓ The paralegals at First National investigate and verify the insurance information.

✓ The paralegal calls the Funeral Home to inform if the insurance is acceptable.

✓ First National sends the Funeral Home's payment by overnight mail, wire transfer or ACH transfer

LINKS TO OUR FORMS

- Assignment Forms

- SUBMIT CLAIM

Life Insurance Assignments – What They Are and Why You Need Them

Everything You Need to Know about Absolute vs. Collateral Assignments

Table of Contents

Collateral assignment, how is a collateral assignment used, how to complete a collateral assignment, releasing a collateral assignment, death and collateral assignments, collateral assignments for the uninsurable, absolute assignment, final words.

What is a collateral assignment?

A collateral assignment of life insurance gives lenders the right to collect your policy’s death benefit up to the amount of the outstanding loan balance.

A typical scenario involves taking out a business loan .

The lender may require a life insurance policy as collateral.

The type of life insurance policy used, whether a term, whole life, or universal life doesn’t matter.

The insurance policy will pay off the balance if you die while the loan is outstanding.

Life insurance for SBA loans is required when you borrow from the SBA.

The collateral assignment applies to the entire policy, including any life insurance rider benefits that may be part of the policy.

The process is similar whether you are adding the assignment to an existing policy or are buying new coverage.

There are two parties to a collateral assignment.

- Assignor – Is the owner of the life insurance policy

- Assignee – Is the lender

Life insurance companies have standardized forms used for this purpose.

- The owner completes the form and sends it to the lender for review and signature.

- Once complete, you will send the form to the insurance company.

- The insurance company records the assignment and sends a confirmation to the owner and lender that the assignment is complete.

This may all seem confusing if you haven’t used an assignment before, but the reality is that most life insurers make it pretty easy to complete.

When you pay off your lender, you have the right to have the collateral assignment removed.

The life insurance companies have collateral release forms as well.

- The owner completes the form and sends it to the lender.

- The lender signs off on the release.

- Once complete, the insurance company records the release and sends the discharge letter to all parties.

Once complete, you should re-check with the home office to ensure that your policy released the assignment.

Your agent can help with this.

How do collateral assignments work when you die?

Check out this example:

- Policy Face Amount = $1,000,000

- Beneficiary = Your Spouse

- Original Bank Loan = $200,000

- Outstanding Loan Balance at Death = $100,000

What happens next?

- Your beneficiary will file the death claim with the life insurance company.

- The life insurance company will review the claim and see a collateral assignment attached to your policy.

- The insurer contacts the lender for an updated payoff figure.

- Payoff amounts are sent directly to the lender.

- Your beneficiary receives the balance of the policy death benefit .

For the above example, your lender would receive $100,000, and your beneficiary would receive the remaining $900,000 as intended.

I would like to remind you that you NEVER want to name your lender as the beneficiary, as they would receive the entire proceeds rather than just what was owed.

While lenders may want a life insurance policy as collateral, sometimes it’s difficult to obtain if the insured has substantial health issues .

If you have an existing life insurance policy in effect, it’s possible to use that for the assignment.

Another option that exists in some states is contingent coverage.

Contingent coverage is a one-year policy that you can renew.

The policy will exclude death from the known health issue but provide coverage for new health issues that develop or from accidental deaths .

Many lenders accept this coverage when it’s the only option available.

What is an absolute assignment?

You use absolute assignments when you permanently relinquish all ownership rights to your life insurance policy.

Some examples:

Life Insurance Settlements

With this transaction, you are selling your life insurance policy to a third party.

You may convert a term policy to permanent insurance before it is sold.

Another example may involve admitting seniors to a nursing home.

The nursing home may take over the policy you have.

1035 Exchange

A 1035 exchange is a tax-free transfer of cash value from universal life or whole life policy to another similar policy.

Gifting Life Insurance to Charities

You can use absolute assignments to permanently transfer your policy to your favorite charity.

Irrevocable Life Insurance Trusts (ILIT)

You use absolute assignments to permanently transfer your policy to an ILIT.

An example would be a survivorship policy you and your spouse own that you are transferring to the trust.

Many other potential issues may arise with transfers to an ILIT that are beyond the scope of this article.

Business Cases

If you purchased key person life insurance on an employee, absolute assignments are used to transfer ownership to the employee.

You may have questions about your life insurance assignment and how it works.

The following are general guidelines, as each situation is uniquely different.

Can the collateral assignment change the beneficiary?

No, the collateral assignment does not change the beneficiary.

The life insurance assignment gives the lender the right to receive proceeds equal to their outstanding loan balance.

Can a business be a beneficiary in a collateral assignment of life insurance?

A business can be the beneficiary of a life insurance policy that is collaterally assigned.

Life insurance assignments are common for absolute and collateral assignments.

What is most important is that we understand what is involved with this process.

That’s where we’ll help you make the best decision for your life insurance.

There is never any pressure or obligation with our life insurance service.

Please take a few minutes to submit your quote request today. Thank you.

Recent Articles

- Life Insurance for Police Officers

- How Does Family History Affect Life Insurance

- 40-Year Term Life Insurance

- AICPA Group Term Life Insurance

- How Much Life Insurance Do You Need?

About The Author

Michael Horbal

Start typing and press enter to search.

Call: 1-828-248-1234

RESOURCES

Insurance assignments.

About 65% of our clientele pay for our services with an insurance assignment. An insurance assignment is when the family brings in a life insurance policy to assist in paying for funeral cost. A beneficiary is under no obligation to use an insurance policy as means of payment for funeral cost - but many, many families do. The process is this: the insurance policy information is brought in, primarily we are going to need to know the Insurance company name and a policy number. Other information is helpful if known, the death benefit amount, the beneficiary, and if any loans have been made against the policy.

North Carolina GS 58.58.97 indicates that when the person WITH THE RESPONSIBILITY FOR DISPOSITION of the deceased signs our release form, and we submit that and a North Carolina Notification of Death to the insurance company - then that gives the insurance company permission to speak to us on the family's behalf to secure and verify that information and also we request to receive claim forms. The beneficiary would sign an insurance assignment form we have, that is written just for the dollar amount of the funeral cost. Some insurance companies will accept the assignment form and a death certificate for means for them to pay out the claim.

We deal with many companies over the years and have found this - there's not much in between with the quality of service from insurance companies. They either provide excellent service handling requests, sending forms, and paying out the claim or they are terrible to deal with and have policies in place that are consistent with the way insurance claims were handled 40 years ago.

An interesting element to NC GS 58.58.97 says that the person signing the release - can be the person with the right of disposition... We have many families come in who don't know who the beneficiary is. This part was written to assist in that manner. We have had insurance companies argue that the release form needed to be signed by the beneficiary, but then turn around and won't tell you who the beneficiary is. So that part of the law assists us now, so we don't have to be sure of the beneficiary. Again, once the beneficiary is determined, that beneficiary is under no obligation to pay the funeral bill through the insurance proceeds.

Most reputable companies, when asked will either fax claim forms, email claim forms, or already have a downloadable form on their website. Companies with poor service tell us, "We need 5 to 7 days to research who the beneficiary is..." or, "We will MAIL claim forms with 10 to 14 business days...". In 2022, this is a poor way to process an insurance claim. Mail service for this claim service worked fine in 1976, but 40 years later they can do better. We can't understand why most insurance companies don't provide excellent policy service at the time of a claim - it appears that would be their best advertising. Several great companies, FARM BUREAU, MUTUAL OF OMAHA, Great Western Insurance and Old American Insurance stand out as companies we have dealt with that went out of their way to process the claim efficiently and quickly. But unfortunately, most companies fall into the poor service bracket. There are some very large insurance companies with recognizable names from hearing their advertising, that can't deliver good claims service.

Handling these claims for families, I can tell you it is easy to spend 20 minutes on hold with an insurance companies' claims service - just to be told one of those statements - that something will get mailed later. Anymore, we don't play baby games with companies who still insist on doing business like they did in 1976, as I tell them, either their IT department is woefully inadequate, or else they are understaffed. In these cases, we simply file a complaint with the North Carolina Commissioner of Insurance.

Families and individuals have paid their premiums in to these companies for years, and simply ask for excellent policy service when they need the services of a life claim department. Companies, in our opinion, should not add to the consumers' grief and worry issues by issuing statements such as "we'll mail something in 10 days..." or "Let us stare at the computer for 5 to 7 days and see when it can produce a beneficiary name..." . I can tell you from experience, families hear statements and policies such as these as stalling techniques to hang on to the funds a little longer. Most companies pay out the death benefit in 7 days to 5 weeks, though 3 weeks is probably a norm. A good Funeral Director will always make a copy of the check they have received from an insurance company and send that to the responsible family member along with their receipt - it's just good business.

There is one downside to using insurance at the time of death that is not the fault of the family - and that is when a Medical Examiner's case requires further investigation and autopsy and the death certificate gets the cause of death as PENDING. When this is entered, usually, that means it will be a minimum of 12 weeks before a cause of death will be entered. In most situations, an insurance company will not pay out on a PENDING death certificate - it depends on the circumstances. Sometimes, it is not uncommon for that cause of death to be entered 4 or 5 MONTHS after death. In these cases, unfortunately, the funeral home is going to require another form of payment for services. Filing insurance for families an accepting payment 3 weeks after the death is one thing, waiting 3 months or more is another. If you ever want to know what life insurance companies give great service, you can call Funeral Director Kent Dorsey at 828-248-1234 and he will tell you... because there are very few that consistently give good service.

There are a tremendous amount of complaints that originate out of a small funeral parlor in Bostic, NC, simply because when we are working on the family's behalf to get their insurance filed, we don't play baby games, hence, we keep the Commissioner of Insurance' complaint page at handy access all the time, should you ever need it... here's the link:

https://www.ncdoi.gov/contactscomplaints/assistance-or-file-complaint

359 East Church Street

P.O. Box 190

Bostic, NC 28018

Phone: 1-828-248-1234

Email: [email protected]

Planning Ahead

Grief Support

We offer the GriefPlan Video Program free to our families. Click here to view the GriefPlan Video Program.

- Funeral Funding

- FAQ’s

- Request a Demo

How to Use Insurance Assignments to Improve Your Cash Flow

As a busy funeral professional, you work tirelessly to serve every family that comes through your door. And when it comes to getting paid for your services, it’s easy for life insurance assignments to pile up on your desk.

And when they do, you might try to set aside time to process those assignments. But no matter how quickly you work, you may still have to wait weeks or months for those pending payments to finally hit your bank account.

When it comes down to it, handling insurance assignments on your own is frustrating, stressful, and time-consuming. It doesn’t have to be that way.

In this blog post, we’ll share how you can increase your cash flow and profitability with your next at-need call using insurance assignments.

1. Offer Assignments Up-Front in the Arrangement Conference

Many families arrive at the arrangement conference thinking, “How much is this going to cost?” and “How am I going to pay for this?” A good way to ease your families’ concerns is to explain the option of life insurance assignments up front.

After talking with funeral directors nationwide, we found that those who do this see an increase of approximately 30% on their at-need contracts . This method has been tested on both large and small firms, and they all saw the same results. This is likely because sharing this option with families relieves them of the initial stress and fear of paying for funeral arrangements out of pocket. They can be at ease knowing they can pay for the service they want without cutting corners.

That’s a true win-win situation! If you don’t already, try offering insurance assignments to your families before you begin the planning process, not after.

2. Learn How to Avoid Delays in Assignment Processing

Many funeral homes still process their life insurance assignments in-house. Many don’t realize that manually processing assignments could cost you more than you realize. Life insurance assignments create more work for the funeral home, tie up your staff’s time, and can dramatically affect your cash flow, delaying payment for services for 6 to 8 weeks or more.

On top of the up-front work taking up time, every insurance company has its own requirements and often make changes to claim forms, meaning that your payments get delayed even further. Any delay with death certificates, a pending coroner’s case, or new at-need families coming through your door mean that assignments can sit on your desk unattended for months.

It doesn’t have to be this way! Assignment companies can fund within a few days and then handle all the changing requirements and requests from the insurance company.

If you let experts handle your insurance assignments, you can free up your own time or your staff’s time to enhance service to families rather than spend it processing insurance assignments.

3. Don’t Assume All the Risk

When you take on a life insurance assignment, it can be a risk because there is always a chance the claim gets denied. And then you’re left holding the bag or have to go back to the family to request an alternative form of payment. No, thank you!

You can minimize your risk when accepting insurance assignments when you work with an advanced funding company that guarantees their verification of a policy’s benefits. But not all funding companies are created equal. Some will seek repayment of advanced funds plus interest if the claim gets denied.

As long as you are working with a company that guarantees its verification process and offers 100% risk-free advanced funds, you know that when you take an assignment, it won’t come back to bite you. Find an assignment company providing this crucial service guarantee, and you won’t have to assume all the risk anymore!

4. Work With an Insurance Assignment Company to Avoid Red Flags

When you do not deal with an insurance assignment regularly, it’s easy to miss the red flags. Here are a few examples:

What if you don’t catch that there are loans or liens against a policy? If you miss this red flag, there may be nothing available to pay out from the policy.

Is a policy assignable? If this gets missed, it can leave you with an unpaid contract.

Is the beneficiary contestable? Often, policies are not updated after divorce or death. Or the beneficiary could be a trust or a minor.

All of these are red flags that most funeral directors don’t see coming, which can become costly mistakes for the funeral home. However, an insurance assignment company has expertise in all types of policies because they handle thousands of cases each year, and they know exactly what to look for and what to ask when verifying the policy benefits.

5. Present Prearrangement Options to Everyone

This fifth tip might surprise you. With insurance assignments, funeral homes can grow their business’s future. How? Well, depending on the insurance assignment partner you use, you have the option to offer your families advanced payment on a portion or all of the remaining policy benefits.

This is the perfect opportunity to discuss prearrangements. With money in hand, many families are willing to plan ahead and alleviate the burdens on their loved ones so those decisions are not left for others in the future. So, insurance assignments can not only help you increase your at-need contract size by an average of 30%, but they can also help you grow your preneed block of business and further secure the future of your funeral home.

Bonus: Relieve Pressure on the Family

Even if the family plans to pay with cash, credit card, preneed plan, or any other payment method, it doesn’t mean they won’t be interested in getting an advance payment on their insurance claim.

Who knows? They may need those funds for immediate needs. With available cash, families will feel less financial stress and pressure, and may be more likely to plan ahead. Plus, offering this service, even if they don’t need it to pay for the funeral, creates value for that family and offers them a better experience than the insurance company can provide them, and you get to be the hero to the families you serve.

Start using insurance assignments to improve your cash flow

Insurance assignments can be a gamechanger in improving your cash flow if you work with the proper funeral funding partner. When looking for a company to partner with, it’s important to do your research first.

Find out if you are taking extra risk with your current assignment company. Look closely at your accounts receivable and see how much of that balance could be handled with one phone call to a reputable advance funding company.

Working with a company you can trust will improve your cash flow, put more time into your day, help you offer families a valuable service and a better experience, and give you more time to dedicate to the families you serve. By following these simple principles, you will be on your way to a healthier business, less stress, and better cash flow for your business.

About the Author: Nadene Smith serves as Director of Business Services for CLAIMCHECK. She has over 10 years of experience in the preneed insurance industry. Having lost her husband, Nadene brings a compassionate perspective to fast funding business, understanding how difficult it can be to work with insurance companies directly to process claims. Nadene is passionate about helping families and funeral homes navigate this difficult process when time is of the essence. To contact Nadene, email her at [email protected] .

Questions? Contact Us.

Phone: 800.692.3688

Email: [email protected]

Recent Posts

- Are Your Death Certificates Delayed?

Course offered by

AINS 103: Exploring Commercial Insurance

Add to Cart

Increase your effectiveness as an insurance professional by expanding your knowledge of the commercial sector. This course covers the evolving world of commercial insurance and will give you the skills you need to understand the key components of commercial property and liability policies, additional types of commercial coverage, and customization of small business coverage.

Skills You’ll Gain

Ready-Made Career Skills:

- Commercial Insurance

- Insurance Policies

- Cross-Organization Collaboration

- Property Claims

- Small Business Insurance

Assignments

Exam prep tools.

AINS 103 comes with proven comprehensive study materials to help you take The Institutes Designations' exam with confidence:

- Printable Study Outline

- Practice Quizzes

- Simulated Exam

- Discussion Boards

Try AINS For Free!

Sample the AINS designation in just 10-30 minutes to make sure it’s the right fit for you!

Online AINS Micro-Course

- Introduction to Insurance

- Common Types of Insurance

- Types of Insurers

- How Risk Management Has Evolved

- Yes! AINS 103 gives you credit toward the Associate in Insurance (AINS) designation.

- AINS 103 typically takes students 6-9 hours to complete.

- Virtual exams are timed. You will have 65 minutes to complete 50 questions.

- Your course materials include a printable study outline, assignment quizzes, practice exams, and a simulated credentialing exam.

- Quarter 1: January 15 – March 15

- Quarter 2: April 15 – June 15

- Quarter 3: July 15 – September 15

- Quarter 4: October 15 – December 15

- Better productivity tools for teams and at-need businesses.

- Robust tracking and reporting built for trade businesses.

- Planning Center

- Integrations

Ready to get started?

- Tailored launch plans, data transfers, and more.

- Ongoing help with our support plans, customized training, and more.

Change is hard. We can help!

See how our support teams can help you get started with Passare.

- How-to articles and videos to get you going.

- Relevant content updated weekly.

- Case studies, eBooks, and guides for the curious funeral professional.

NEW! 2 023 State of Funeral Service resource

See data from 250,000+ at-need cases in Passare that will help you improve service to families.

Awesomeness in your inbox every week.

- What makes us different from all the rest?

- Phone numbers and emails

- Get to know the team working to make Passare the best software in the funeral profession.

- See why we’ve been named a Great Place to Work 5 years running

Software with a new way of thinking.

If you're looking to make a change in mindset, you'll find this helpful.

Sign up for our newsletter.

The easiest way to process insurance assignments.

June 19, 2023

/Blog%20and%20Featured%20Image%20Illustrations/Passare-claimcheck-feat-2.png?width=1000&height=500&name=Passare-claimcheck-feat-2.png)

If you’re like most funeral professionals, you want to provide top-notch service.

You want your families to:

Know their loved one is in good hands.

Have a memorable and unique experience.

Feel seen, heard, and cared for.

But you also need to keep your funeral home’s finances in great shape.

And one thing that can tie up your cash flow is waiting for insurance companies to pay on a policy. That means you might spend hours on the phone each week trying to get assignments processed.

You shouldn’t have to wait 6-8 weeks to get paid. And you shouldn’t have to spend time on the phone with insurance companies.

Here’s the good news…

There are experts available who can handle this task for you. Plus, they can get you funded in about 2-3 days on average.

3 ways an insurance assignment processing company benefits your funeral home

If you’re processing assignments in house, take a look at these 3 ways a good insurance assignment company can benefit your funeral home.

It will help you:

Secure funding for funerals fast.

Get more hours back in your day. Less time with insurance companies = more time with families.

Create a stress-free process for your families. By verifying the policy each time, you and your families will be able to feel confident that everything is taken care of.

With the right insurance assignment company, you can experience less stress, increased productivity, and a positive cash flow. Plus, your families will be happier too.

Next, we’ll talk about the essentials to look for in an assignment company.

4 things to look for in an insurance assignment company

Not all insurance assignment companies are created equal.

Before choosing the first one that pops up in your search results, check out this list of essential things to look for in a partner.

Make sure that your company:

Guarantees its own verification process

Offers risk-free funds

Helps your staff complete paperwork

Goes above and beyond to take care of you and your families

Our friends over at CLAIMCHECK do all of these things and more.

CLAIMCHECK is fast, easy to use, and has excellent customer service.

About 85% of assignments received by CLAIMCHECK are paid within 1-3 business days so you get payment faster and get more time back in your day to care for your families.

“CLAIMCHECK provides a priceless commodity. Our employees can get other work done because they’re not on the phone with insurance companies. I can’t put into words how helpful that is.”

-Michael Capehart, New Hope Funeral Home

Sunnyvale, Texas

Learn more about all that CLAIMCHECK can offer here .

Make your process even more efficient with Passare

Lastly, you might be wondering what a funeral home software has to do with your insurance assignments. We’ll tell you!

Passare integrates with CLAIMCHECK to speed up the process so you can move on to your next task quickly. This integration works to make your insurance assignment process easier and quicker.

100% of information needed to fill out forms can be pulled directly from Passare to pre-fill assignments in CLAIMCHECK. Yep, you heard that right. Here’s exactly how it works:

After processing an assignment with the insurance company, you open a case in Passare to get started and select CLAIMCHECK assignment as the payment method.

CLAIMCHECK's insurance company library will trigger Passare to pull and pre-fill forms with the information you need.

And you’re ready to roll!

Plus, all the forms can be sent to the family and signed within Passare’s family collaboration tool, Planning Center.

With this dynamic duo, your funeral home will spend less time on the phone with insurance companies, free up your cash flow, and spend more time serving your families.

Start using CLAIMCHECK in Passare

Want to get the integration turned on today? You can contact our team or read this article for more information.

See exactly how it works

Not a Passare customer? Get a demo of Passare today to see exactly how this integration works, along with so many other features that will help you better manage your business.

3 Software Tips from Tech-Savvy Pennsylvania Funeral Directors

3 texas-sized tech tips from texas funeral directors.

- Search Search Please fill out this field.

- Life Insurance

- Definitions

What Is a Collateral Assignment of Life Insurance?

:max_bytes(150000):strip_icc():format(webp)/Group1805-3b9f749674f0434184ef75020339bd35.jpg)

Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

:max_bytes(150000):strip_icc():format(webp)/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg)

A collateral assignment of life insurance is a conditional assignment appointing a lender as an assignee of a policy. Essentially, the lender has a claim to some or all of the death benefit until the loan is repaid. The death benefit is used as collateral for a loan.

The advantage to using a collateral assignee over naming the lender as a beneficiary is that you can specify that the lender is only entitled to a certain amount, namely the amount of the outstanding loan. That would allow your beneficiaries still be entitled to any remaining death benefit.

Lenders commonly require that life insurance serve as collateral for a business loan to guarantee repayment if the borrower dies or defaults. They may even require you to get a life insurance policy to be approved for a business loan.

Key Takeaways

- The borrower of a business loan using life insurance as collateral must be the policy owner, who may or may not be the insured.

- The collateral assignment helps you avoid naming a lender as a beneficiary.

- The collateral assignment may be against all or part of the policy's value.

- If any amount of the death benefit remains after the lender is paid, it is distributed to beneficiaries.

- Once the loan is fully repaid, the life insurance policy is no longer used as collateral.

How a Collateral Assignment of Life Insurance Works

Collateral assignments make sure the lender gets paid only what they are due. The borrower must be the owner of the policy, but they do not have to be the insured person. And the policy must remain current for the life of the loan, with the policy owner continuing to pay all premiums . You can use either term or whole life insurance policy as collateral, but the death benefit must meet the lender's terms.

A permanent life insurance policy with a cash value allows the lender access to the cash value to use as loan payment if the borrower defaults. Many lenders don't accept term life insurance policies as collateral because they do not accumulate cash value.

Alternately, the policy owner's access to the cash value is restricted to protect the collateral. If the loan is repaid before the borrower's death, the assignment is removed, and the lender is no longer the beneficiary of the death benefit.

Insurance companies must be notified of the collateral assignment of a policy. However, other than their obligation to meet the terms of the contract, they are not involved in the agreement.

Example of Collateral Assignment of Life Insurance

For example, say you have a business plan for a floral shop and need a $50,000 loan to get started. When you apply for the loan, the bank says you must have collateral in the form of a life insurance policy to back it up. You have a whole life insurance policy with a cash value of $65,000 and a death benefit of $300,000, which the bank accepts as collateral.

So, you then designate the bank as the policy's assignee until you repay the $50,000 loan. That way, the bank can ensure it will be repaid the funds it lent you, even if you died. In this case, because the cash value and death benefit is more than what you owe the lender, your beneficiaries would still inherit money.

Alternatives to Collateral Assignment of Life Insurance

Using a collateral assignment to secure a business loan can help you access the funds you need to start or grow your business. However, you would be at risk of losing your life insurance policy if you defaulted on the loan, meaning your beneficiaries may not receive the money you'd planned for them to inherit.

Consult with a financial advisor to discuss whether a collateral assignment or one of these alternatives may be most appropriate for your financial situation.

Life insurance loan (policy loan) : If you already have a life insurance policy with a cash value, you can likely borrow against it. Policy loans are not taxed and have less stringent requirements such as no credit or income checks. However, this option would not work if you do not already have a permanent life insurance policy because the cash value component takes time to build.

Surrendering your policy : You can also surrender your policy to access any cash value you've built up. However, your beneficiaries would no longer receive a death benefit.

Other loan types : Finally, you can apply for other loans, such as a personal loan, that do not require life insurance as collateral. You could use loans that rely on other types of collateral, such as a home equity loan that uses your home equity.

What Are the Benefits of Collateral Assignment of Life Insurance?

A collateral assignment of a life insurance policy may be required if you need a business loan. Lenders typically require life insurance as collateral for business loans because they guarantee repayment if the borrower dies. A policy with cash value can guarantee repayment if the borrower defaults.

What Kind of Life Insurance Can Be Used for Collateral?

You can typically use any type of life insurance policy as collateral for a business loan, depending on the lender's requirements. A permanent life insurance policy with a cash value allows the lender a source of funds to use if the borrower defaults. Some lenders may not accept term life insurance policies, which have no cash value. The lender will typically require the death benefit be a certain amount, depending on your loan size.

Is Collateral Assignment of Life Insurance Irrevocable?

A collateral assignment of life insurance is irrevocable. So, the policyholder may not use the cash value of a life insurance policy dedicated toward collateral for a loan until that loan has been repaid.

What is the Difference Between an Assignment and a Collateral Assignment?

With an absolute assignment , the entire ownership of the policy would be transferred to the assignee, or the lender. Then, the lender would be entitled to the full death benefit. With a collateral assignment, the lender is only entitled to the balance of the outstanding loan.

The Bottom Line

If you are applying for life insurance to secure your own business loan, remember you do not need to make the lender the beneficiary. Instead you can use a collateral assignment. Consult a financial advisor or insurance broker who can walk you through the process and explain its pros and cons as they apply to your situation.

Progressive. " Collateral Assignment of Life Insurance ."

Fidelity Life. " What Is a Collateral Assignment of a Life Insurance Policy? "

Kansas Legislative Research Department. " Collateral Assignment of Life Insurance Proceeds ."

:max_bytes(150000):strip_icc():format(webp)/Life-Insurance-a8aee8e3024145a8b454ea19df030418.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Construction Accidents

Practice Areas

Assignment of Benefits: What You Need to Know

- August 17, 2022

- Steven Schwartzapfel

Insurance can be useful, but dealing with the back-and-forth between insurance companies and contractors, medical specialists, and others can be a time-consuming and ultimately unpleasant experience. You want your medical bills to be paid without having to act as a middleman between your healthcare provider and your insurer.

However, there’s a way you can streamline this process. With an assignment of benefits, you can designate your healthcare provider or any other insurance payout recipient as the go-to party for insurance claims. While this can be convenient, there are certain risks to keep in mind as well.

Below, we’ll explore what an assignment of insurance benefits is (as well as other forms of remediation), how it works, and when you should employ it. For more information, or to learn whether you may have a claim against an insurer, contact Schwartzapfel Lawyers now at 1-516-342-2200 .

What Is an Assignment of Benefits?

An assignment of benefits (AOB) is a legal process through which an insured individual or party signs paperwork that designates another party like a contractor, company, or healthcare provider as their insurance claimant .

Suppose you’re injured in a car accident and need to file a claim with your health insurance company for medical bills and related costs. However, you also need plenty of time to recover. The thought of constantly negotiating between your insurance company, your healthcare provider, and anyone else seems draining and unwelcome.

With an assignment of benefits, you can designate your healthcare provider as your insurance claimant. Then, your healthcare provider can request insurance payouts from your healthcare insurance provider directly.

Through this system, the health insurance provider directly pays your physician or hospital rather than paying you. This means you don’t have to pay your healthcare provider. It’s a streamlined, straightforward way to make sure insurance money gets where it needs to go. It also saves you time and prevents you from having to think about insurance payments unless absolutely necessary.

What Does an Assignment of Benefits Mean?

An AOB means that you designate another party as your insurance claimant. In the above example, that’s your healthcare provider, which could be a physician, hospital, or other organization.

With the assignment of insurance coverage, that healthcare provider can then make a claim for insurance payments directly to your insurance company. The insurance company then pays your healthcare provider directly, and you’re removed as the middleman.

As a bonus, this system sometimes cuts down on your overall costs by eliminating certain service fees. Since there’s only one transaction — the transaction between your healthcare provider and your health insurer — there’s only one set of service fees to contend with. You don’t have to deal with two sets of service fees from first receiving money from your insurance provider, then sending that money to your healthcare provider.

Ultimately, the point of an assignment of benefits is to make things easier for you, your insurer, and anyone else involved in the process.

What Types of Insurance Qualify for an Assignment of Benefits?

Most types of commonly held insurance can work with an assignment of benefits. These insurance types include car insurance, healthcare insurance, homeowners insurance, property insurance, and more.

Note that not all insurance companies allow you to use an assignment of benefits. For an assignment of benefits to work, the potential insurance claimant and the insurance company in question must each sign the paperwork and agree to the arrangement. This prevents fraud (to some extent) and ensures that every party goes into the arrangement with clear expectations.

If your insurance company does not accept assignments of benefits, you’ll have to take care of insurance payments the traditional way. There are many reasons why an insurance company may not accept an assignment of benefits.

To speak with a Schwartzapfel Lawyers expert about this directly, call 1-516-342-2200 for a free consultation today. It will be our privilege to assist you with all your legal questions, needs, and recovery efforts.

Who Uses Assignments of Benefits?

Many providers, services, and contractors use assignments of benefits. It’s often in their interests to accept an assignment of benefits since they can get paid for their work more quickly and make critical decisions without having to consult the insurance policyholder first.

Imagine a circumstance in which a homeowner wants a contractor to add a new room to their property. The contractor knows that the scale of the project could increase or shrink depending on the specifics of the job, the weather, and other factors.

If the homeowner uses an assignment of benefits to give the contractor rights to make insurance claims for the project, that contractor can then:

- Bill the insurer directly for their work. This is beneficial since it ensures that the contractor’s employees get paid promptly and they can purchase the supplies they need.

- Make important decisions to ensure that the project completes on time. For example, a contract can authorize another insurance claim for extra supplies without consulting with the homeowner beforehand, saving time and potentially money in the process.

Practically any company or organization that receives payments from insurance companies may choose to take advantage of an assignment of benefits with you. Example companies and providers include:

- Ambulance services

- Drug and biological companies

- Lab diagnostic services

- Hospitals and medical centers like clinics

- Certified medical professionals such as nurse anesthetists, nurse midwives, clinical psychologists, and others

- Ambulatory surgical center services

- Permanent repair and improvement contractors like carpenters, plumbers, roofers, restoration companies, and others

- Auto repair shops and mechanic organizations

Advantages of Using an Assignment of Benefits

An assignment of benefits can be an advantageous contract to employ, especially if you believe that you’ll need to pay a contractor, healthcare provider, and/or other organization via insurance payouts regularly for the near future.

These benefits include but are not limited to:

- Save time for yourself. Again, imagine a circumstance in which you are hospitalized and have to pay your healthcare provider through your health insurance payouts. If you use an assignment of benefits, you don’t have to make the payments personally or oversee the insurance payouts. Instead, you can focus on resting and recovering.

- Possibly save yourself money in the long run. As noted above, an assignment of benefits can help you circumvent some service fees by limiting the number of transactions or money transfers required to ensure everyone is paid on time.

- Increased peace of mind. Many people don’t like having to constantly think about insurance payouts, contacting their insurance company, or negotiating between insurers and contractors/providers. With an assignment of benefits, you can let your insurance company and a contractor or provider work things out between them, though this can lead to applications later down the road.

Because of these benefits, many recovering individuals, car accident victims, homeowners, and others utilize AOB agreements from time to time.

Risks of Using an Assignment of Benefits

Worth mentioning, too, is that an assignment of benefits does carry certain risks you should be aware of before presenting this contract to your insurance company or a contractor or provider. Remember, an assignment of benefits is a legally binding contract unless it is otherwise dissolved (which is technically possible).

The risks of using an assignment of benefits include:

- You give billing control to your healthcare provider, contractor, or another party. This allows them to bill your insurance company for charges that you might not find necessary. For example, a home improvement contractor might bill a homeowner’s insurance company for an unnecessary material or improvement. The homeowner only finds out after the fact and after all the money has been paid, resulting in a higher premium for their insurance policy or more fees than they expected.

- You allow a contractor or service provider to sue your insurance company if the insurer does not want to pay for a certain service or bill. This can happen if the insurance company and contractor or service provider disagree on one or another billable item. Then, you may be dragged into litigation or arbitration you did not agree to in the first place.

- You may lose track of what your insurance company pays for various services . As such, you could be surprised if your health insurance or other insurance premiums and deductibles increase suddenly.

Given these disadvantages, it’s still wise to keep track of insurance payments even if you choose to use an assignment of benefits. For example, you might request that your insurance company keep you up to date on all billable items a contractor or service provider charges for the duration of your treatment or project.

For more on this and related topic, call Schwartzapfel Lawyers now at 1-516-342-2200 .

How To Make Sure an Assignment of Benefits Is Safe

Even though AOBs do carry potential disadvantages, there are ways to make sure that your chosen contract is safe and legally airtight. First, it’s generally a wise idea to contact knowledgeable legal representatives so they can look over your paperwork and ensure that any given assignment of benefits doesn’t contain any loopholes that could be exploited by a service provider or contractor.

The right lawyer can also make sure that an assignment of benefits is legally binding for your insurance provider. To make sure an assignment of benefits is safe, you should perform the following steps:

- Always check for reviews and references before hiring a contractor or service provider, especially if you plan to use an AOB ahead of time. For example, you should stay away if a contractor has a reputation for abusing insurance claims.

- Always get several estimates for work, repairs, or bills. Then, you can compare the estimated bills and see whether one contractor or service provider is likely to be honest about their charges.

- Get all estimates, payment schedules, and project schedules in writing so you can refer back to them later on.

- Don’t let a service provider or contractor pressure you into hiring them for any reason . If they seem overly excited about getting started, they could be trying to rush things along or get you to sign an AOB so that they can start issuing charges to your insurance company.

- Read your assignment of benefits contract fully. Make sure that there aren’t any legal loopholes that a contractor or service provider can take advantage of. An experienced lawyer can help you draft and sign a beneficial AOB contract.

Can You Sue a Party for Abusing an Assignment of Benefits?

Sometimes. If you believe your assignment of benefits is being abused by a contractor or service provider, you may be able to sue them for breaching your contract or even AOB fraud. However, successfully suing for insurance fraud of any kind is often difficult.

Also, you should remember that a contractor or service provider can sue your insurance company if the insurance carrier decides not to pay them. For example, if your insurer decides that a service provider is engaging in billing scams and no longer wishes to make payouts, this could put you in legal hot water.

If you’re not sure whether you have grounds for a lawsuit, contact Schwartzapfel Lawyers today at 1-516-342-2200 . At no charge, we’ll examine the details of your case and provide you with a consultation. Don’t wait. Call now!

Assignment of Benefits FAQs

Which states allow assignments of benefits.

Every state allows you to offer an assignment of benefits to a contractor and/or insurance company. That means, whether you live in New York, Florida, Arizona, California, or some other state, you can rest assured that AOBs are viable tools to streamline the insurance payout process.

Can You Revoke an Assignment of Benefits?

Yes. There may come a time when you need to revoke an assignment of benefits. This may be because you no longer want the provider or contractor to have control over your insurance claims, or because you want to switch providers/contractors.

To revoke an assignment of benefits agreement, you must notify the assignee (i.e., the new insurance claimant). A legally solid assignment of benefits contract should also include terms and rules for this decision. Once more, it’s usually a wise idea to have an experienced lawyer look over an assignment of benefits contract to make sure you don’t miss these by accident.

Contact Schwartzapfel Lawyers Today

An assignment of benefits is an invaluable tool when you need to streamline the insurance claims process. For example, you can designate your healthcare provider as your primary claimant with an assignment of benefits, allowing them to charge your insurance company directly for healthcare costs.

However, there are also risks associated with an assignment of benefits. If you believe a contractor or healthcare provider is charging your insurance company unfairly, you may need legal representatives. Schwartzapfel Lawyers can help.

As knowledgeable New York attorneys who are well-versed in New York insurance law, we’re ready to assist with any and all litigation needs. For a free case evaluation and consultation, contact Schwartzapfel Lawyers today at 1-516-342-2200 !

Schwartzapfel Lawyers, P.C. | Fighting For You™™

What Is an Insurance Claim? | Experian

What is assignment of benefits, and how does it impact insurers? | Insurance Business Mag

Florida Insurance Ruling Sets Precedent for Assignment of Benefits | Law.com

Related Posts

What Does “Sustain The Objection” Mean?

You’ve seen it in movies, and you’ve heard about it in the news: A lawyer stands up, says, “Objection!” and

Repetitive Strain Injury: Compensation And More

Are you feeling the pinch in your hands or wrists after a long day at work? You should know that

Slander vs. Libel: What Are The Differences?

When most people think about personal injury, they think about the kind of injury that ends in a trip to

We'll Fight For You

Schwartzapfel® lawyers has a 99% client satisfaction rate.

Quick Links

- News & Events

- Verdicts & Settlements

- Video Gallery

- Wrongful Death

- Vehicle Accidents

- Slip & Fall

- Medical Malpractice

- Workers' Compensation

- Personal Injuries

- Product Liability

- Garden City

Search NAIC

Recommended.

Back to Newsroom

Consumer Insight

Sept. 13, 2023

Assignment of Benefits: Consumer Beware

You've just survived a severe storm, or a tornado and you've experienced some extensive damage to your home that requires repairs, including the roof. Your contractor is now asking for your permission to speak with your insurance company using an Assignment of Benefits. Before you sign, read the fine print. Otherwise, you may inadvertently sign over your benefits and any extra money you’re owed as part of your claim settlement.

The National Association of Insurance Commissioners (NAIC) offers information to help you better understand insurance, your risk and what to do in the event you need repairs after significant storm damage.

Be cautious about signing an Assignment of Benefits. An Assignment of Benefits, or an AOB, is an agreement signed by a policyholder that allows a third party—such as a water extraction company, a roofer or a plumber—to act on behalf of the insured and seek direct payment from the insurance company. An AOB can be a useful tool for getting repairs done, as it allows the repair company to deal directly with your insurance company when negotiating repairs and issuing payment directly to the repair company. However, an AOB is a legal contract, so you need to understand what rights you are signing away and you need to be sure the repair company is trustworthy.

- With an Assignment of Benefits, the third party, like a roofing company or plumber, files your claim, makes the repair decision and collects insurance payments without your involvement.

- Once you have signed an AOB, the insurer only communicates with the third party and the other party can sue your insurer and you can lose your right to mediation.

- It's possible the third party may demand a higher claim payment than the insurer offers and then sue the insurer when it denies your claim.

- You are not required to sign an AOB to have repairs completed. You can file a claim directly with your insurance company, which allows you to maintain control of the rights and benefits provided by your policy in resolving the claim.

Be on alert for fraud. Home repair fraud is common after a natural disaster. Contractors often come into disaster-struck regions looking to make quick money by taking advantage of victims.

- It is a good idea to do business with local or trusted companies. Ask friends and family for references.

- Your insurer may also have recommendations or a list of preferred contractors.

- Always get more than one bid on work projects. Your adjuster may want to review estimates before you make repairs.

Immediately after the disaster, have an accurate account of the damage for your insurance company when you file a claim.

- Before removing any debris or belongings, document all losses.

- Take photos or video and make a list of the damages and lost items.

- Save damaged items if possible so your insurer can inspect them, some insurance companies may have this as a requirement in their policy.

Most insurance companies have a time requirement for reporting a claim, so contact your agent or company as soon as possible. Your state insurance department can help you find contact information for your insurance company, if you cannot find it.

- Insurance company officials can help you determine what damages are covered, start your claim and even issue a check to start the recovery process.

- When reporting losses, you will need insurance information, current contact information and a home inventory or list of damaged and lost property . If you do not have a list, the adjuster will give you some time to make one. Ask the adjuster how much time you have to submit this inventory list. The NAIC Post Disaster Claims Guide has details on what you can do if you do not have a home inventory list.

After you report damage to your insurance company, they will send a claims adjuster to assess the damage at no cost to you . An adjuster from your insurance company will walk through and around your home to inspect damaged items and temporary repairs you may have made.

- A public adjuster is different from an adjuster from your insurance company and has no ties to the insurance company.

- They estimate the damage to your home and property, review your insurance coverage, and negotiate a settlement of the insurance claim for you.

- Many states require public adjusters to be licensed. Some states prohibit public adjusters from negotiating insurance claims for you. In those states, only a licensed attorney can represent you.

- You have to pay a public adjuster.

- The NAIC Post Disaster Claims Guide has information on the different types of adjusters.

Once the adjuster has completed an assessment, they will provide documentation of the loss to your insurer to determine your claims settlement. When it comes to getting paid, you may receive more than one check. If the damage is severe or you are displaced from your home, the first check may be an emergency advance. Other payments may be for the contents of your home, other personal property, and structural damages. Please note that if there is a mortgage on your home, the payment for structural damage may be payable to you and your mortgage lender. Lenders may put that money into an escrow account and pay for repairs as the work is completed.

More information. States have rules governing how insurance companies handle claims. If you think that your insurer is not responding in a timely manner or completing a reasonable investigation of your claim, contact your state insurance department .

About the National Association of Insurance Commissioners

As part of our state-based system of insurance regulation in the United States, the National Association of Insurance Commissioners (NAIC) provides expertise, data, and analysis for insurance commissioners to effectively regulate the industry and protect consumers. The U.S. standard-setting organization is governed by the chief insurance regulators from the 50 states, the District of Columbia and five U.S. territories. Through the NAIC, state insurance regulators establish standards and best practices, conduct peer reviews, and coordinate regulatory oversight. NAIC staff supports these efforts and represents the collective views of state regulators domestically and internationally.

Assignment of Benefits: What It Is, and How It Can Affect your Property Insurance Claim

Table of Contents

What is an Assignment of Benefits?

In the context of insured property claims, an assignment of benefits (AOB) is an agreement between you and a contractor in which you give the contractor your right to insurance payments for a specific scope of work . In exchange, the contractor agrees that it will not seek payment from you for that scope of work, except for the amount of any applicable deductible. In other words, you give part of your insurance claim to your contractor, and your contractor agrees not to collect from you for part of its work.

The most important thing to know about an assignment of benefits is that it puts your contractor in control your claim , at least for their scope of work. Losing that control can significantly affect the direction and outcome of your claim, so you should fully understand the implications of an AOB (sometimes called an assignment of claims or AOC) before signing one.

How Does an Assignment of Benefits Work in Practice?

Let’s say you’re an insured homeowner, and Hurricane Ian significantly damaged your roof. Let’s also assume your homeowner’s policy covers that damage. A roofer, after inspecting your roof and reviewing your insurance policy, might conclude that your insurer is probably going to pay for a roof replacement under your insurance policy. The only problem is that it’s early in the recovery process, and your insurer hasn’t yet stated whether it will pay for the roof replacement proposed by your contractor. So if you want your roof replaced now, you would ordinarily agree to pay your roofer for the replacement, and wait in hopes that your insurer reimburses you for the work. This means that if your insurance company refuses to pay or drags out payment, you’re on the hook to your roofer for the cost of the replacement.

As an alternative to agreeing to pay your roofer for the full cost of the work, you could sign an assignment of benefits for the roof replacement. In this scenario, your roofer owns the part of your insurance claim that pertains to the roof replacement. You might have to pay your roofer for the amount of your deductible, but you probably don’t have to pay them for the rest of the cost of the work. And if your insurance company refuses to pay or drags out payment for the roof replacement, it’s your roofer, and not you, who would be on the hook for that shortfall.

So should you sign an AOB? Not necessarily. Read below to understand the pros and cons of an assignment of benefits.

Are There any Downsides to Signing an Assignment of Benefits?

Yes.

You lose control of your claim . This is the most important factor to understand when considering whether to sign an AOB. An AOB is a formal assignment of your legal rights to payment under your insurance contract. Unless you’re able to cancel the AOB, your contractor will have full control over your claim as it relates to their work.

To explain why that control could matter, let’s go back to the roof replacement example. When you signed the AOB, the scope of work you agreed on was to replace the roof. But you’re not a roofing expert, so you don’t know whether the costs charged or the materials used by the roofer in its statement of work are industry appropriate or not. In most cases, they probably are appropriate, and there’s no problem. But if they’re not – if, for instance, the roofer’s prices are unreasonably high – then the insurer may not approve coverage for the replacement. At that point, the roofer could lower its prices so the insurer approves the work, but it doesn’t have to, because it controls the claim . Instead it could hold up work and threaten to sue your insurer unless it approves the work at the originally proposed price. Now the entire project is insnared in litigation, leaving you in a tough spot with your insurer for your other claims and, most importantly, with an old leaky roof.

Misunderstanding the Scope of Work. Another issue that can arise is that you don’t understand the scope of the assignment of benefits. Contractor estimates and scopes of work are often highly technical documents that can be long on detail but short on clarity. Contractors are experts at reading and writing them. You are not. That difference matters because the extent of your assignment of benefits is based on that technical, difficult-to-understand scope of work. This can lead to situations where your understanding of what you’re authorizing the contractor to do is very different from what you’ve actually authorized in the AOB agreement.

In many cases, it’s not necessary . Many contractors will work with you and your insurer to provide a detailed estimate of their work, and will not begin that work until your insurer has approved coverage for it. This arrangement significantly reduces the risk of you being on the hook for uninsured repairs, without creating any of the potential problems that can occur when you give away your rights to your claim.

Do I have to sign an Assignment of Benefits?

No. You are absolutely not required to sign an AOB if you do not want to.

Are There any Benefits to Signing an Assignment of Benefits?

Potentially, but only if you’ve fully vetted your contractor and your claim involves complicated and technical construction issues that you don’t want to deal with.

First, you must do your homework to fully vet your contractor! Do not just take their word for it or be duped by slick ads. Read reviews, understand their certificate of insurance, know where they’re located, and, if possible, ask for and talk to references. If you’ve determined that the contractor is highly competent at the work they do, is fully insured, and has a good reputation with customers, then that reduces the risk that they’ll abuse their rights to your claim.

Second, if your claim involves complicated reconstruction issues, a reputable contractor may be well equipped to handle the claim and move it forward. If you don’t want to deal with the hassle of handling a complicated claim like this, and you know you have a good contractor, one way to get rid of that hassle is an AOB.

Another way to get rid of the hassle is to try Claimly, the all-in-one claims handling tool that get you results but keeps you in control of your claim.

Can my insurance policy restrict the use of AOBs?

Yes, it’s possible that your Florida insurance policy restricts the use of AOBs, but only if all of the following criteria are met:

- When you selected your coverage, your insurer offered you a different policy with the same coverage, only it did not restrict the right to sign an AOB.

- Your insurer made the restricted policy available at a lower cost than the unrestricted policy.

- If the policy completely prohibits AOBs, then it was made available at a lower cost than any policy partially prohibiting AOBs.

- The policy includes on its face the following notice in 18-point uppercase and boldfaced type:

THIS POLICY DOES NOT ALLOW THE UNRESTRICTED ASSIGNMENT OF POST-LOSS INSURANCE BENEFITS. BY SELECTING THIS POLICY, YOU WAIVE YOUR RIGHT TO FREELY ASSIGN OR TRANSFER THE POST-LOSS PROPERTY INSURANCE BENEFITS AVAILABLE UNDER THIS POLICY TO A THIRD PARTY OR TO OTHERWISE FREELY ENTER INTO AN ASSIGNMENT AGREEMENT AS THE TERM IS DEFINED IN SECTION 627.7153 OF THE FLORIDA STATUTES.

627.7153.

Pro Tip : If you have an electronic copy of your complete insurance policy (not just the declaration page), then search for “policy does not allow the unrestricted assignment” or another phrase from the required language above to see if your policy restricts an AOB. If your policy doesn’t contain this required language, it probably doesn’t restrict AOBs.

Do I have any rights or protections concerning Assignments of Benefits?

Yes, you do. Florida recently enacted laws that protect consumers when dealing with an AOB.

Protections in the AOB Contract

To be enforceable, a Assignments of Benefits must meet all of the following requirements:

- Be in writing and executed by and between you and the contractor.

- Contain a provision that allows you to cancel the assignment agreement without a penalty or fee by submitting a written notice of cancellation signed by the you to the assignee:

- at least 30 days after the date work on the property is scheduled to commence if the assignee has not substantially performed, or

- at least 30 days after the execution of the agreement if the agreement does not contain a commencement date and the assignee has not begun substantial work on the property.

- Contain a provision requiring the assignee to provide a copy of the executed assignment agreement to the insurer within 3 business days after the date on which the assignment agreement is executed or the date on which work begins, whichever is earlier.

- Contain a written, itemized, per-unit cost estimate of the services to be performed by the assignee .

- Relate only to work to be performed by the assignee for services to protect, repair, restore, or replace a dwelling or structure or to mitigate against further damage to such property.

- Contain the following notice in 18-point uppercase and boldfaced type:

YOU ARE AGREEING TO GIVE UP CERTAIN RIGHTS YOU HAVE UNDER YOUR INSURANCE POLICY TO A THIRD PARTY, WHICH MAY RESULT IN LITIGATION AGAINST YOUR INSURER. PLEASE READ AND UNDERSTAND THIS DOCUMENT BEFORE SIGNING IT. YOU HAVE THE RIGHT TO CANCEL THIS AGREEMENT WITHOUT PENALTY WITHIN 14 DAYS AFTER THE DATE THIS AGREEMENT IS EXECUTED, AT LEAST 30 DAYS AFTER THE DATE WORK ON THE PROPERTY IS SCHEDULED TO COMMENCE IF THE ASSIGNEE HAS NOT SUBSTANTIALLY PERFORMED, OR AT LEAST 30 DAYS AFTER THE EXECUTION OF THE AGREEMENT IF THE AGREEMENT DOES NOT CONTAIN A COMMENCEMENT DATE AND THE ASSIGNEE HAS NOT BEGUN SUBSTANTIAL WORK ON THE PROPERTY. HOWEVER, YOU ARE OBLIGATED FOR PAYMENT OF ANY CONTRACTED WORK PERFORMED BEFORE THE AGREEMENT IS RESCINDED. THIS AGREEMENT DOES NOT CHANGE YOUR OBLIGATION TO PERFORM THE DUTIES REQUIRED UNDER YOUR PROPERTY INSURANCE POLICY.

- Contain a provision requiring the assignee to indemnify and hold harmless the assignor from all liabilities, damages, losses, and costs, including, but not limited to, attorney fees.

Contractor Duties

Under Florida law, a contractor (or anyone else) receiving rights to a claim under an AOB:

- Must provide you with accurate and up-to-date revised estimates of the scope of work to be performed as supplemental or additional repairs are required.

- Must perform the work in accordance with accepted industry standards.

- May not seek payment from you exceeding the applicable deductible under the policy unless asked the contractor to perform additional work at the your own expense.

- Must, as a condition precedent to filing suit under the policy, and, if required by the insurer, submit to examinations under oath and recorded statements conducted by the insurer or the insurer’s representative that are reasonably necessary, based on the scope of the work and the complexity of the claim, which examinations and recorded statements must be limited to matters related to the services provided, the cost of the services, and the assignment agreement.

- Must, as a condition precedent to filing suit under the policy, and, if required by the insurer, participate in appraisal or other alternative dispute resolution methods in accordance with the terms of the policy.

- If the contractor is making emergency repairs, the assignment of benefits cannot exceed the greater of $3,000 or 1% of your Coverage A limit.

Recommended Posts

Public adjusting laws in florida: what pas need to know, property coverages in homeowners insurance: everything you need to know., understanding the new proof-of-loss form requirements in florida..

Brelly’s tools and resources are your secret weapon to getting your insurance claim filed right, moving fast, and paid fully .

Risk Management

Capital markets.

Ariel Tavor

Keith yagnik, ariel serber, michael kikoz.

Life Insurance Quote Tool

See the he numbers and the numbers behind the numbers — all policy valuations, underwriting, cost and returns — so you can make an informed decision for your financial future.

Life Settlement Calculator

Maximize the value of your life insurance policy with our life settlement calculator. Explore the policy valuations, underwriting assessments, costs, and potential returns, including the numbers behind the numbers.

- (212) 548-6201

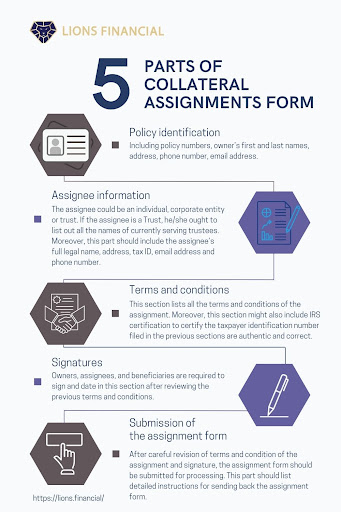

Guidelines for Collateral Assignment of Life Insurance

- By: Risk Management Team

Lions Financial provides comprehensive guidelines for the collateral assignment of life insurance. The collateral assignment involves using a life insurance policy as collateral for a loan or debt. Lions Financial assists individuals and businesses in understanding the process and implications of collateral assignment, ensuring they make informed decisions.

The guidelines cover important aspects such as determining the policy’s cash surrender value, establishing the assignment amount, and defining the rights and responsibilities of the assignee and assignor. Lions Financial also helps clients navigate legal and tax considerations related to collateral assignment.

Banks require insurance for collateral assignment so that they can always get any outstanding loan amount back if the loaner defaults or dies before being able to pay the loan back.

Collateral is pledged as security for repayment of a loan, to be forfeited in the event of a default. A collateral assignment of insurance is a conditional assignment appointing a lender as the primary beneficiary of a benefit to use as collateral for a loan. If the borrower is unable to pay, the lender can cash in the insurance policy and recover what is owed.