Do you have the world's best boss? Enter them to win two tickets to Sandals!

- Starting a Business

Our Top Picks

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our In-Depth Reviews

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Explore More

- Business Solutions

- Entrepreneurship

- Franchising

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

- Financial Solutions

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

- HR Solutions

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

- Business Intelligence

- Marketing Solutions

- Marketing Strategy

- Public Relations

- Social Media

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

- Technology Solutions

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

- FreshBooks vs. QuickBooks Comparison

- Salesforce CRM vs. Zoho CRM

- RingCentral vs. Zoom Comparison

- 10 Ways to Generate More Sales Leads

How to Create a Market Research Plan

Table of Contents

While having a great idea is an important part of establishing a business, you’ll only get so far without laying the proper groundwork. To help your business take off, not only do you need to size up the competition, but you also need to identify who will buy your product, how much it will cost, the best approach to selling it and how many people will demand it.

To get answers to these questions, you’ll need a market research plan, which you can create yourself or pay a specialist to create for you. Market research plans define an existing problem and/or outline an opportunity. From there, the marketing strategy is broken down task by task. Your plan should include objectives and the methods that you’ll use to achieve those objectives, along with a time frame for completing the work.

What should a market research plan include?

A market research plan should provide a thorough examination of how your product or service will fare in a defined area. It should include:

- An examination of the current marketplace and an analysis of the need for your product or service: To know where you fit in the market, it’s important to have a broad understanding of your industry — covering everything from its annual revenue to the industry standards to the total number of businesses operating within it. Start by gathering statistical data from sources like the U.S. Bureau of Labor Statistics and BMI Research and consider the industry’s market size, potential customer base and how external factors such as laws, technology, world events and socioeconomic changes impact it.

- An assessment of the competition: By analyzing your competitors, you can discover strategies to fill market gaps. This involves identifying well-known competitors and noting trends they employ successfully, scrutinizing customer feedback about businesses in your sector, such as through online reviews, and understanding competitors’ product or service offerings. This knowledge can then guide the refinement of your own products or services to differentiate them from others in the market.

- Data about customers: Identify which segment of potential customers in your industry you can effectively target, considering their demographics — such as age, ethnicity, income and location and psychographics, including beliefs, values and lifestyle. Learn about the challenges your customers face in their daily lives and determine how the features and benefits of your offerings address their needs.

- The direction for your marketing in the upcoming year: Your plan should provide a clear roadmap for your marketing strategies for the next year, focusing on approaches to distinguish your brand from competitors. Develop marketing messages that resonate with and display empathy toward your target market and find ways to address customers’ needs and demonstrate value.

- Goals to be met: Outline goals your business would like to achieve and make these goals clear to all employees on your team. Create goals that are realistic and attainable while also making a meaningful impact on the business’s growth. Consider factors including your target number of products or services, the expected number of units to sell based on market size, target market behavior, pricing for each item and the cost of production and advertising.

How to create your market research plan

Doing business without having a marketing plan is like driving without directions. You may eventually reach your destination, but there will be many costly and time-consuming mistakes made along the way.

Many entrepreneurs mistakenly believe there is a big demand for their service or product but, in reality, there may not be, your prices may be too high or too low or you may be going into a business with so many restrictions that it’s almost impossible to be successful. A market research plan will help you uncover significant issues or roadblocks.

Step 1. Conduct a comprehensive situation analysis.

One of the first steps in constructing your marketing plan is to create a strengths, weaknesses, opportunities and threats (SWOT) analysis , which is used to identify your competition, to know how they operate and then to understand their strengths and weaknesses.

When developing a market research plan, it is essential that you do your homework to determine your possible customer base, to gain knowledge about the competition and to have a solid foundation for your marketing strategy.

Step 2: Develop clear marketing objectives.

In this section, describe the desired outcome for your marketing plan with realistic and attainable objectives, the targets and a clear and concise time frame. The most common way to approach this is with marketing objectives, which may include the total number of customers and the retention rate, the average volume of purchases, total market share and the proportion of your potential market that makes purchases.

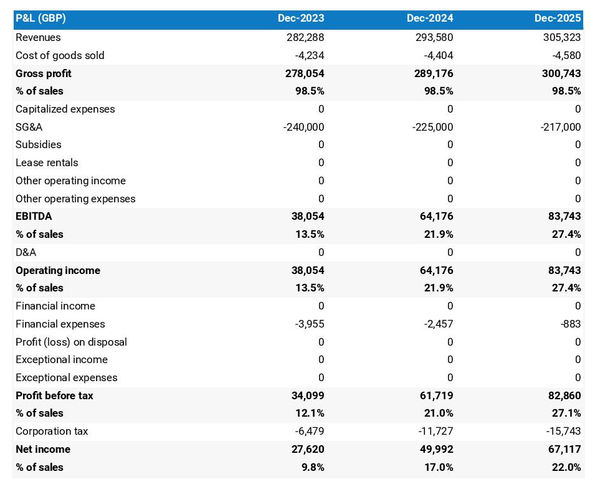

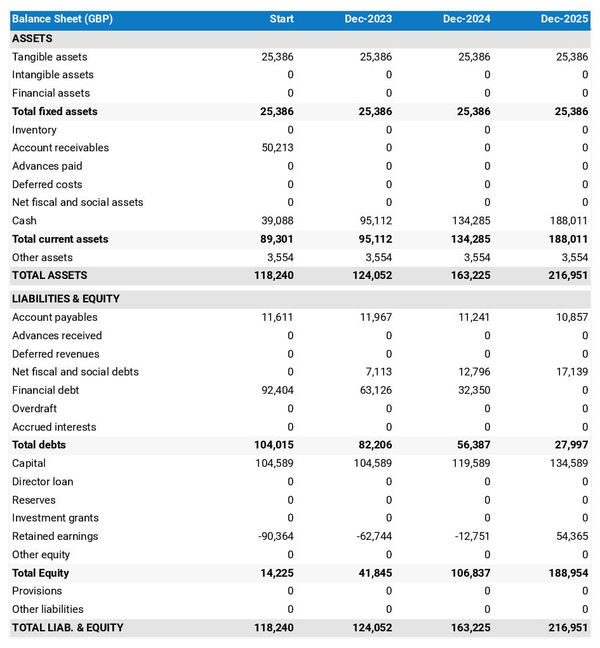

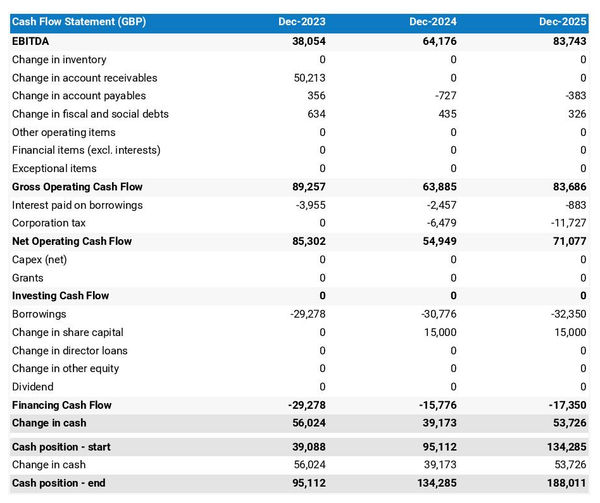

Step 3: Make a financial plan.

A financial plan is essentia l for creating a solid marketing plan. The financial plan answers a range of questions that are critical components of your business, such as how much you intend to sell, what will you charge, how much will it cost to deliver your services or produce your products, how much will it cost for your basic operating expenses and how much financing will you need to operate your business.

In your business plan, be sure to describe who you are, what your business will be about, your business goals and what your inspiration was to buy, begin or grow your business.

Step 4: Determine your target audience.

Once you know what makes you stand out from your competitors and how you’ll market yourself, you should decide who to target with all this information. That’s why your market research plan should delineate your target audience. What are their demographics and how will these qualities affect your plan? How do your company’s current products and services affect which consumers you can realistically make customers? Will that change in the future? All of these questions should be answered in your plan.

Step 5: List your research methods.

Rarely does one research avenue make for a comprehensive market research plan. Instead, your plan should indicate several methods that will be used to determine the market share you can realistically obtain. This way, you get as much information as possible from as many sources as possible. The result is a more robust path toward establishing the exact footprint you desire for your company.

A good market research plan involves using more than one type of research to obtain the information you need.

Step 6: Establish a timeline.

With your plan in place, you’ll need to figure out how long your market research process will take. Project management charts are often helpful in this regard as they divide tasks and personnel over a timeframe that you have set. No matter which type of project management chart you use, try to build some flexibility into your timeframe. A two-week buffer toward the home stretch comes in handy when a process scheduled for one week takes two — that buffer will keep you on deadline.

Step 7: Acknowledge ethical concerns.

Market research always presents opportunities for ethical missteps. After all, you’ll need to obtain competitor information and sensitive financial data that may not always be readily available. Your market research plan should thus encourage your team to not take any dicey steps to obtain this information. It may be better to state, “we could not obtain this competitor information,” than to spy on the competitor or pressure their current employees for knowledge. Plus, there’s nothing wrong with simply feeling better about the final state of your plan and how you got it there.

Using a market research firm

If the thought of trying to create your own market research plan seems daunting or too time-consuming, there are plenty of other people willing to do the work for you.

You don’t need to pay thousands of dollars for assistance crafting a market research plan. University business schools often provide free resources that can assist you.

Pros of using a market research firm

As an objective third party, businesses can benefit from a market research firm’s impartial perspective and guidance, helping to shape impactful brand strategies and marketing campaigns. These firms, which can help businesses with everything from their marketing campaigns to brand launches, deliver precise results, drawing on their expertise and experience to provide in-depth insights and solutions tailored specifically to your company’s needs.

Even more, working with a market research firm can elevate a brand above the competition, as they provide credible and unique research that is highly valued by the media, enhancing brand credibility and potentially increasing website traffic, social media shares and online visibility.

Cons of using a market research firm

Although hiring a firm can provide businesses with tremendous results, certain downsides can lead a business toward the do-it-yourself route. Most notably, market research firms can be a costly expense that some businesses can’t afford. However, businesses that can allocate the funds will likely see a positive return on investment, as they are paying for the expertise and proficiency of seasoned professionals in the field.

Additionally, finding the right market research firm for your business’s needs can take some time — and even longer, ranging from weeks to months, for a market research firm to complete a plan. This lack of immediate results can be detrimental for businesses that don’t have the time to wait.

Market research firms can charge into the thousands of dollars for a market research plan, but there are ways to get help more affordably, including:

- Outline your plans carefully and spell out objectives.

- Examine as many sources as possible.

- Before paying for any information, check with librarians, small business development centers or market research professors to see if they can help you access market research data for free.

- You may think you’ll need to spend a hefty sum to create a market research plan, but there are plenty of free and low-cost sources available, especially through university business schools that will guide you through the process.

Miranda Fraraccio contributed to this article.

Get Weekly 5-Minute Business Advice

B. newsletter is your digest of bite-sized news, thought & brand leadership, and entertainment. All in one email.

Our mission is to help you take your team, your business and your career to the next level. Whether you're here for product recommendations, research or career advice, we're happy you're here!

Market Research for a Business Plan: How to Do It in a Day

Whether it’s your first time using market research for a business plan or this isn’t exactly your first rodeo: a quick refresh on the topic can do no harm.

If anything, it’s the smart route to take. Particularly when you consider modern-day market research data can be obtained quicker than ever – when the right tools are used.

Today, I’m going to explain exactly how to conduct market research for a business plan, and how to access that key data and juicy intel without hassle.

The importance of market research in business planning

They say knowledge is power, and where your rivals and your market are concerned, there’s nothing quite like it. By looking at things like consumer behavior, the competitive landscape , market size, and the digital strategies of others; companies at any stage in their lifecycle can stay relevant, maintain a competitive edge, set strategic direction, and experience growth. Doing periodic market research also helps businesses develop a deeper, more informed understanding of a market, its audience, and key players. If you’re seeking financial backing, doing market research is essential to show credibility and build confidence in your plans.

How to conduct market research for a business plan

Good market research for a business plan should be contextualized with information about your company, its goals, products, pricing, and financials. Sounds like a lot of work, right? Read on to learn how to conduct all the market research for a business plan you’re going to need – quickly, using the most up-to-date data there is. I’ll show you how to:

- Understand your audience

- Identify target personas

- Size your market

- Research the competition

- Discover your unique sales proposition

- Define marketing priorities

Before you start, make sure your business planning document includes the following 10 headings:

This format is considered best practice, so I’ve indicated the specific sections that each element of your market research fits into.

Sound good? Then let’s get started.

1. Understand your audience

What it is – A target audience is a social segment of people who are likely to be interested in your products or services. It’s a snapshot of your target customer base, sorted by certain characteristics. It’s also known as audience demographics and can contain data like age, gender, location, values, attitudes, behaviors, and more.

Where to use this market research in a business plan – Demographical data can help determine the size of your market, which slots into the executive summary, marketing plan, market sizing, and financial sections of the plan. What’s more, when you use it to identify groups of people to target, it can also be used in the products and services, competitive research tools , and SWOT analysis sections.

Bonus: Audience demographics can also help you develop stronger branding by choosing imagery that appeals most to your ideal customers.

How to do a quick audience analysis

Similarweb Digital Research Intelligence gives you the ability to view almost any industry in a few seconds; you can also create a custom industry based on specific players in your market. Here’s how to see relevant audience demographics in a market. For this example, I chose the airline industry.

View typical audience relevant to your sector with gender and age distribution, along with geographical data . You can see which companies are experiencing growth and at what rate. Audience loyalty is also key to understanding how people behave, if they tend to shop around and what search terms they use to discover sites in any niche.

Read more: Learn more about how to do a demographic analysis of your market’s audience .

2. Identify target personas

What it is – An audience or target persona is a typical customer profile. It starts with audience demographics, and then zooms into a much deeper level. Most organizations develop multiple target personas, based on things like pain points, location, gender, background, occupation, influential factors, decision-making, likes, dislikes, goals, ideals, and more.

Pro Tip: If you’re in B2B, your target personas are based on the people who make purchasing decisions, not the business itself.

Where to use this market research in a business plan – Creating target personas for your business shows you know whom you’re targeting, and how to market to them. This information will help you complete market sizing, product or service overview, marketing plan, and could fit into the competitive research section too.

How to create a buyer persona in five steps

Guesswork does not equal less work – there’s no place for shortcuts here. Your success depends on developing the most accurate representation of who your customers are, and what they care about.

1. Research: If you’re already in business, use market research surveys as a tool to collect information about your customers. If you’re a startup or pre-startup, you can use a platform like Similarweb to establish a typical customer profile for your market. Don’t forget to use mobile app intelligence and website analytics in tandem to build a complete picture of your audience.

Pro Tip: Secondary market research is another good source of intel for startups. You might be able to find published surveys that relate to your products or market to learn more.

2. Analysis: Here, you’re looking to answer key questions to fill in the blanks and build a complete picture of your ideal customer. Tools like Similarweb Digital Research Intelligence, Google Analytics, and competitors’ social media channels can help you find this out. Typical questions include:

- Where is your audience coming from?

- What channels do they use to find your site?

- Do they favor access via mobile site, app, or desktop?

- What are their demographics? Think age, job, salary, location, and gender.

3. Competitive market research: This shows you what marketing channels, referral partners, and keywords are sending traffic to businesses similar to yours When you combine this data with what you learned in sections 1 + 2, you are ready to build your personas.

4. Fill in a buyer persona template: We’ve done the hard work for you. Download a pre-made template below .

Further reading: The complete guide to creating buyer personas

3. Size your market

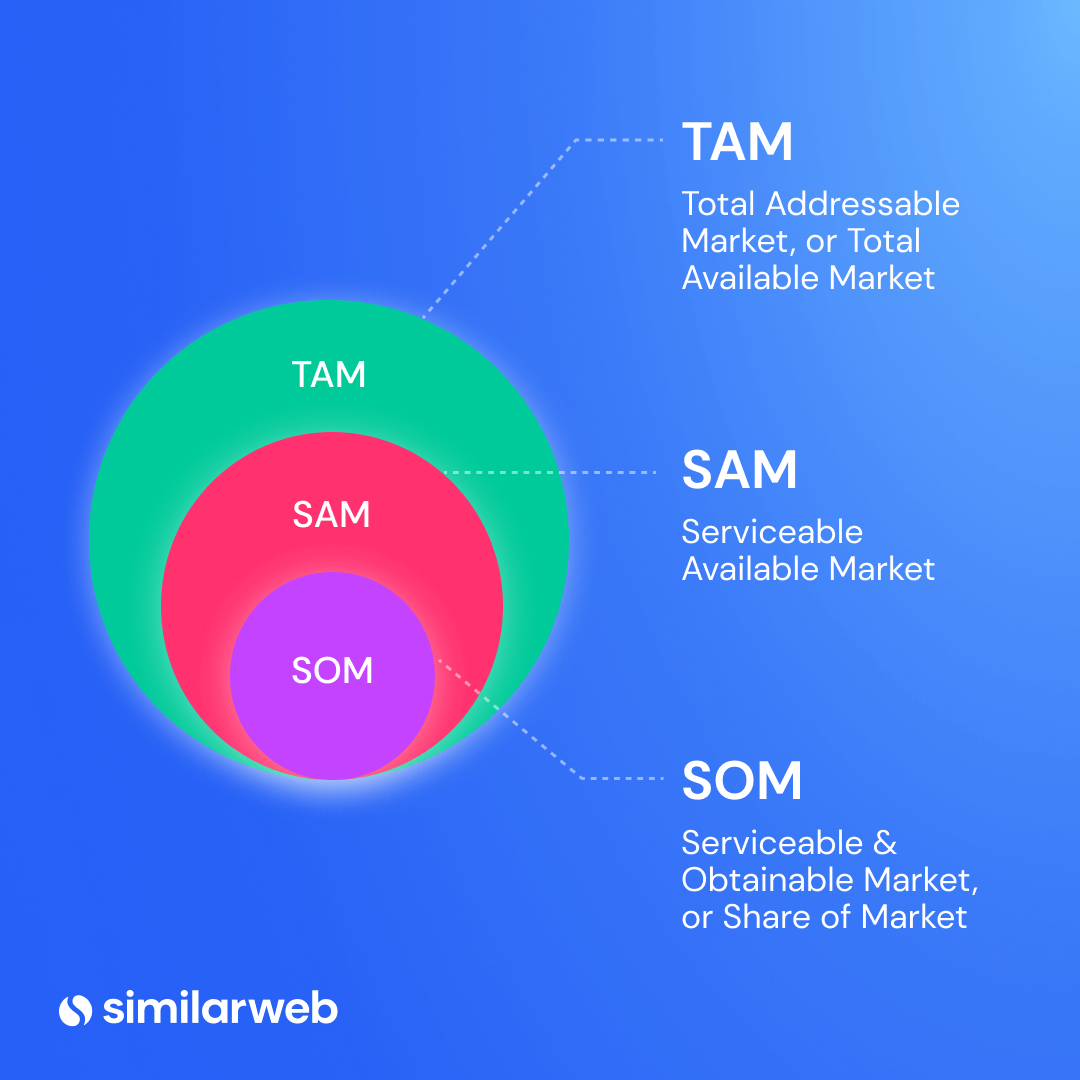

What it is – Market sizing is a way to determine the potential size of a target market using informed estimation. This is how you find out the potential revenue and market volume applicable to your business . There are three key metrics: total addressable market (TAM), service addressable market (SAM), and service obtainable market (SOM).

Where to use this market research in a business plan – Knowing how big the slice of the pie you’re going after is crucial. It can inform any goal setting and help with forecasting too. This data can be used in your executive summary, marketing plan, competitive research, SWOT analysis, market sizing, operations, and financial sections.

Further reading: How to do market sizing shows you how to calculate the TAM, SAM, and SOM for your business.

4. Research the competition

What it is – Competitive landscaping shows who you’re up against and how your offering stacks up vs others in your space. By evaluating rivals in-depth and looking at things like features, pricing, support, content, and additional products, you can form a detailed picture of the competition.

Where to use this market research in a business plan – The information you gain from performing a competitive analysis can transform what you offer and how you go to market. In business planning, this market research supports the executive summary, product or service overview, marketing plan, competitive research, SWOT analysis, and operation sections.

How to do competitive landscaping

Using the industry overview section of Similarweb Digital Research Intelligence, competitor research is made quick and easy. Access key metrics on an industry or specific players, then download raw data in a workable excel file or get a PNG image of charts in an instant. Most data can be downloaded via excel or as an image and included in the resource section of your plan.

Here, you can see a summary of a market, yearly growth, and top sites. A quick click to industry leaders shows you market leaders and rising stars. Select any name for a complete picture of their digital presence – use this to spot potential opportunities to gain a competitive advantage.

Read more: See how to do a competitive analysis and get a free template to help you get started.

5. Discover your unique sales proposition

What it is – Not all businesses have them, and that’s OK. A unique selling proposition (USP) is something distinctive your business offers but your rivals don’t . It can be anything that’s unique to a product, service, pricing model, or other.

Why it’s useful – Having a compelling USP helps your company stand out in a market. It can make your business more valuable to a customer vs the competition, and ultimately help you win and retain more customers.

Where to use this market research in a business plan – Your USP should be highlighted in the executive summary, the product and service overview, and the SWOT analysis.

How to find your USP

Unless you’ve developed a unique product or service, or you’re planning to sell to the market at a lower-than-average price point, you’re going to have to look for some kind of service differentiator that’ll help you stand out. In my experience, the quickest way to discover this is through competitive benchmarking. Here, I’m talking about evaluating your closest rivals to uncover things they’re not doing, or looking for gaps that your business can capitalize on.

A competitive review of their site should look at things like:

- Customer support: do they have live chat, email support, telephone support, etc.?

- Content: do they produce additional content that offers value, free resources, etc.?

- Offers: what promotions or offers do they run?

- Loyalty or referral programs: do they reward loyalty or referrals?

- Service level agreements: what commitments do they make to their customers?

- Operations: consider delivery methods, lead times, returns policy etc.

- Price promises: what satisfaction or price promises do they offer, if at all?

Go easy on yourself and create a basic template that details each point. Once complete, look for opportunities to provide something unique that nobody else currently offers.

6. Define marketing priorities

What it is – A detailed plan showing how you position and market your products or service. It should define realistic, clear, and measurable goals that articulate tactics, customer profiles, and the position of your products in the market.

Where to use this market research in a business plan – Relevant intel you uncover should inform the marketing plan first and foremost. However, it can also be used in the SWOT analysis, operation, and financial sections.

How to do it – with a market research example

Using the marketing channels within Similarweb Digital Research Intelligence, you can short-cut the lengthy (and often costly) process of trial and error when trying to decide which channels and activities work best.

Let me show you how.

Using Similarweb Digital Research Intelligence, I can hone in on any site I like, and look at key marketing intel to uncover the strategies they’re using, along with insights into what’s driving traffic, and traffic opportunities.

In less than 60 seconds, I can see easyJet’s complete online presence; its marketing and social channels, and a snapshot of every metric that matters, like referrals, organic and paid ads, keywords, and more. Expand any section to get granular data, and view insights that show exactly where key losses, gains, and opportunities exist.

You can take this a step further and add other sites into the mix. Compare sites side-by-side to see who is winning, and how they’re doing it. While this snapshot shows a comparison of a single competitor, you can compare five at any one time. What’s more, I can see industry leaders, rising players, and any relevant mobile app intelligence stats, should a company or its rivals have an app as part of their offering.

Best practice for market research data in business plans

When doing any type of market research , it’s important to use the most up-to-date data you can get your hands on. There are two key factors for data are timeliness and trustworthiness.

For any market, look for data that applies to any period over the last 12 months. With how fast markets evolve and how quickly consumer behaviors change, being able to view dynamic data is key. What’s more, the source of any data matters just as much as its age.

To emphasize the importance of using the right type of data in a business plan, here’s some timely advice from SBA commercial lending expert and VP of Commerce National Bank and Trust, Steve Fulmer. As someone who, in the past 15 years, has approved approximately $150 million in loans to SMBs; his advice is worth paying attention to.

“ For anybody doing market research for a business plan, they must cite sources. Most new or small businesses lack historical performance data, which removes substantial confidence in their plans. As a lender, we cannot support assumptions in their business plan or their projections if their data hasn’t come from a trustworthy source.”

Wrapping up…

Now you know the six ways to do market research for a business plan, it’s time to knuckle down and get started. With Similarweb, you’ve got access to all the market intel you’re going to need to conduct timely, accurate, and reliable market research. What’s more, you can return to the platform anytime to benchmark your performance , get fresh insights, and adapt your strategies to focus on growth – helping you build a sustainable business that can withstand the test of time.

How do I do market research for a business plan?

By using Digital Research Intelligence tools like Similarweb, you can quickly conduct audience research, company research, market analysis, and benchmarking from a single place. Another method is secondary market research, but this takes more time and data isn’t always up to date.

Why does a business plan need market research?

Doing market research for a business plan is the quickest and easiest way to validate a business idea and establish a clear view of the market and competitive landscape. When done right, it can show you opportunities for growth, strategies to avoid, and effective ways to market your business.

What is market research in a business plan?

Market research in business planning is one of the most powerful tools you can use to flesh out and validate your company or its products. It can tell you whether there’s a market for your product, and how big that market is – it also helps you discover industry trends, and examine the strategies of the rising stars and industry leaders in detail.

Related Posts

From AI to Buy: The Role of Artificial Intelligence in Retail

How to Conduct a Social Media Competitor Analysis: 5 Quick Steps

Industry Research: The Data-Backed Approach

Wondering what similarweb can do for you.

Here are two ways you can get started with Similarweb today!

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How to Write the Market Analysis Section of a Business Plan

Alyssa Gregory is an entrepreneur, writer, and marketer with 20 years of experience in the business world. She is the founder of the Small Business Bonfire, a community for entrepreneurs, and has authored more than 2,500 articles for The Balance and other popular small business websites.

:max_bytes(150000):strip_icc():format(webp)/alyssa-headshot-2018-5b73ee0046e0fb002531cb50.png)

The market analysis section of your business plan comes after the products or services section and should provide a detailed overview of the industry you intend to sell your product or service in, including statistics to support your claims.

In general, the market analysis section should include information about the industry, your target market, your competition, and how you intend to make a place for your own product and service. Extensive data for this section should be added to the end of the business plan as appendices, with only the most important statistics included in the market analysis section itself.

What Should a Market Analysis Include?

The market analysis section of your small business plan should include the following:

- Industry Description and Outlook : Describe your industry both qualitatively and quantitatively by laying out the factors that make your industry an attractive place to start and grow a business. Be sure to include detailed statistics that define the industry including size, growth rate , trends, and outlook.

- Target Market : Who is your ideal client/customer? This data should include demographics on the group you are targeting including age, gender, income level, and lifestyle preferences. This section should also include data on the size of the target market, the purchase potential and motivations of the audience, and how you intend to reach the market.

- Market Test Results : This is where you include the results of the market research you conducted as part of your initial investigation into the market. Details about your testing process and supporting statistics should be included in the appendix.

- Lead Time : Lead time is the amount of time it takes for an order to be fulfilled once a customer makes a purchase. This is where you provide information on the research you've completed on how long it will take to handle individual orders and large volume purchases, if applicable.

- Competitive Analysis : Who is your competition? What are the strengths and weaknesses of the competition? What are the potential roadblocks preventing you from entering the market?

7 Tips for Writing a Market Analysis

Here is a collection of tips to help you write an effective and well-rounded market analysis for your small business plan.

- Use the Internet : Since much of the market analysis section relies on raw data, the Internet is a great place to start. Demographic data can be gathered from the U.S. Census Bureau. A series of searches can uncover information on your competition, and you can conduct a portion of your market research online.

- Be the Customer : One of the most effective ways to gauge opportunity among your target market is to look at your products and services through the eyes of a purchaser. What is the problem that needs to be solved? How does the competition solve that problem? How will you solve the problem better or differently?

- Cut to the Chase : It can be helpful to your business plan audience if you include a summary of the market analysis section before diving into the details. This gives the reader an idea about what's to come and helps them zero in on the most important details quickly.

- Conduct Thorough Market Research : Put in the necessary time during the initial exploration phase to research the market and gather as much information as you can. Send out surveys, conduct focus groups, and ask for feedback when you have an opportunity. Then use the data gathered as supporting materials for your market analysis.

- Use Visual Aids : Information that is highly number-driven, such as statistics and metrics included in the market analysis, is typically easier to grasp when it's presented visually. Use charts and graphs to illustrate the most important numbers.

- Be Concise : In most cases, those reading your business plan already have some understanding of the market. Include the most important data and results in the market analysis section and move the support documentation and statistics to the appendix.

- Relate Back to Your Business : All of the statistics and data you incorporate in your market analysis should be related back to your company and your products and services. When you outline the target market's needs, put the focus on how you are uniquely positioned to fulfill those needs.

How to Conduct Market Research for a Business Plan

Rev › Blog › Marketing › How to Conduct Market Research for a Business Plan

Any successful business starts with a thorough, written business plan. For most small business owners, the prospect of gathering and compiling all the data required for a business plan can often seem intimidating. Fortunately, several helpful tools can make conducting market research faster and easier, especially when conducting target customer interviews.

What Does a Business Plan Include?

When building a business plan, you may include different sections or topics depending on how you intend to use the final product. For instance, business plans for internal use might not need to be quite as detailed or structured as plans that will be presented externally in order to secure financing from investors. Regardless of your purpose, most business plans include the following core sections:

- Industry Background – Include analysis of special business considerations that apply to your particular industries, such as trends, growth rates, or recent litigation.

- Value Proposition – Your value proposition (or Unique Selling Proposition) outlines how your business plans to bring value to its target customers in a way that isn’t currently being fulfilled in the market.

- Product Analysis – Describe in detail the product or service you offer, including features that are better than or differentiate you from current market offerings.

- Market Analysis – Examine your company’s target market, including customer demographics, estimated market capture, personas, and customer needs.

- Competitive Analysis – Here, you’ll compare the intended product or service to other offerings in the market and outline your company’s competitive advantages.

- Financial Analysis – Typically, your financial analysis will include estimated sales for the first 1-3 years of operation, as well as more detailed financial projections depending on who will be reading the plan.

Conducting a Market Analysis

Specific industries have different potential customers. It’s easier to reach your potential customers when you have a clear view of who they are. A market analysis helps clarify your ideal customer personas by researching both qualitative and quantitative aspects of your target market.

To better understand your potential customers, start by researching the demographics and segmentation of individuals who typically buy products and services in your industry. Your market analysis should also include:

- Research on the total size of the market

- How much additional market share is available

- Any currently unmet needs that could be sources of competitive advantage

- Features and qualities potential customers find valuable

Using Market Research to Support Your Business Plan

Market research helps assess a business idea’s strengths and weaknesses. his research will serve as the basis for strategic marketing decisions, price positioning, and financial projections listed in the Financial Analysis section of your business plan. You can also use it to help your management team think through important decisions, ultimately leading to choices that will resonate with your target audience and get customers to buy your product or service.

Secondary Research

Conducting market research begins with fact-finding through the internet and other publicly available resources. This secondary research, or research originally conducted and compiled by others, gathers statistics on market size, average market pricing, competitor promotional effectiveness, manufacturing costs, and more.

Secondary research is necessary because it is often expensive and time-consuming for individual business owners to conduct this research firsthand. There are many reliable professional research firms that gather comprehensive industry statistics and make them available at a much more granular level than individuals could gather on their own. Some governmental organizations, such as the U.S. Bureau of Labor Statistics will even provide this information at no charge. Fortunately for business owners, a free resource is still perfectly valid as long as it’s reputable.

Primary Research

Beyond the initial secondary research, you should also conduct thorough primary research to vet your business idea. Primary research is conducted by talking to members of the target audience firsthand through surveys, interviews, and focus groups . These tools can provide valuable insight into how prospects judge your product or service and how they compare it to alternative options.

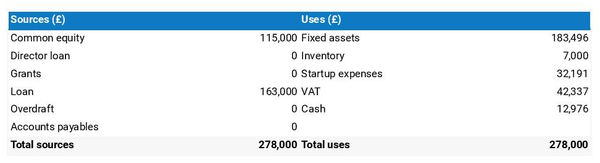

Primary research efforts will typically generate qualitative data in the form of audio and video recordings. These interviews are not always brief, and therefore can be difficult to process efficiently unless first converted to text. You can quickly and easily incorporate the content of these interviews into your plan once they’ve been transcribed.

With a speech-to-text service like Rev, you can get 99% accurate transcripts of your market research interviews in a matter of hours. Dramatically streamlining your business planning process with Rev gives you faster access to valuable customer feedback and potential insights, letting you skip the busy-work and get down to business.

Related Content

Latest article.

How to Analyze Focus Group Data

Most popular.

Differences in Focus Groups & In-Depth Interviews for a Successful Market Research

Featured article.

How to Use Automatic Transcription as a Marketing Professional

Everybody’s favorite speech-to-text blog.

We combine AI and a huge community of freelancers to make speech-to-text greatness every day. Wanna hear more about it?

- Pollfish School

- Market Research

- Survey Guides

- Get started

How to Do Market Research for a Business Plan Successfully

The entrepreneurial-minded folks may long have wondered how to do market research for a business plan.

After all, a business plan lays out the foundation, purpose and expectations of a new business venture. Given that the risks of starting a new business are manifold , entrepreneurs must conduct market research.

20% of American businesses fail after only their first year of operation, a dismal reality that climbs to 30% after two years.

Newfound entrepreneurs and serial entrepreneurs alike should therefore carefully commit to and execute a business plan.

While market research applies to a wide breadth of applications that cover various business cycles and processes, including opening and operating a new business, it too can be used for producing a

This article expounds upon how to do market research for a business plan — and succeed in your venture.

Defining A Business Plan and Its Needs

Before you set out to formulate a business plan, it is vital to fully understand all that it entails. Usually created for startups, it is necessary for all businesses to implement.

A business plan is a written document that summarizes the main aspects of starting up and managing a business, making it the foundation for your business .

A business plan specifically details a business’s objectives, along with its financial, marketing and operational needs and a roadmap thereof.

It is created to guide a business through each stage in its establishment and management. As such, it allows business owners to lay out their needs and goals and track them as the business grows.

A business plan must be updated at regular intervals , as priorities and goals are subject to change. Additionally, when an established business moves in a different direction, it needs a new or completely updated business plan.

The Importance of a Business Plan

A business plan is an important document and not merely for the purpose of monitoring your business as it develops. This is because this document is also needed to obtain investment , especially in the early stages of the business, in which it does not have an evidential track record.

Thus, a business plan shows investors whether your business is on the right course and is worth investing their funds into. Lenders will require proof of a business plan when they deliberate the approval of a loan.

Here are several other reasons as to why creating and updating a business plan is important:

- Making important decisions. It allows you to answer difficult questions at the onset, before they emerge. Understanding these decisions helps you understand how they fit into your overall strategy.

- Addressing key issues to avoid future problems . These include pricing, competition evaluation, market demand, capital and team members.

- Proving the viability of your business . Planning your vision into a full-fledged business bridges the gap between an idea and reality. Market research is essential for this point, as it helps you find key insights on various aspects of your industry, including your competitors and customers.

- Communicating objectives with team members and all those involved . This is important for larger teams, particularly for assistance when you are too busy to relay information or guidance to your team members. This may also help investors or partners who cannot reach you, as it lays out objectives and criteria.

- Standardizing and carrying out key objectives . Placing your objectives, criteria and other needs gives them more weight and attention. If they aren’t in your business plan, thereby, in writing, they can easily fall by the wayside. A business plan helps avoid this, standardizing key objectives and benchmarks.

- Guiding consultants, freelancers and other workers . When employing freelancers and contractors, you can turn to specific sections of a business plan to guide these workers, to ensure they understand your vision, goal and other key business aspects.

- Obtaining financial support. Whether it is via borrowing from a bank, turning to venture capitalists or putting your business up for an acquisition, a business plan makes your business and its viability clear for these key financial players.

- Acclimating to market changes . Updating your business plan can help you during periods of critical change in your market. These changes include: changes in customer needs, new regulations, trends or updates in your industry.

Defining Market Research

Market Research is a wide-encompassing practice that involves gathering information to bolster knowledge about a business’s industry, niche and target market .

It involves the systematic process of amassing, analyzing and interpreting data and information around the state of a business’s industry and its key actors . The key actors entail a business’s target market, competitors and the movers and shakers within its industry.

As such, it involves gathering research around the niche, trends and industry as a whole.

This involves gathering secondary research , research that has already been conducted and made available, along with primary research , the kind that requires you to conduct yourself. These main types of research gathering involve various means, techniques and tools that researchers can use.

Market research largely deals with evaluating the viability of a new product or service, although this aspect is primarily referred to as customer development . By conducting market research, you can therefore gather information on virtually all areas of your business.

Why a Business Plan Needs Market Research

A potent document, one that properly lays out the 7 components of a business plan , from the executive summary, to the market analysis, to the strategy, financial plan and all other in-betweens, most use market research to develop it.

Market research provides the key data, information and nuances your business plan needs. Although a new business or business idea is born on intuition, a business plan must be backed up with data to prove its viability and positioning in its industry.

As such, market research must be performed in the early stages of the business plan, as it is the phase in which you learn all about your niche, its trends and the demands of your target market (including the makeup of your target market via market segmentation ).

Only after analyzing all of your market research results, will you be able to populate the business plan within key areas such as market analysis, financial projections, strategy and implementation, marketing endeavors, pricing and location .

A business plan must be comprehensive, another way in which market research is of utmost importance, in that there are various methods and tools you can use to conduct it. By consolidating all of the different market research techniques , you are establishing an exhaustive business plan, the kind that leaves no key consideration out.

The following presents the key data and information of a business plan that market research can extract:

- Demand : Does your product/service have enough market potential to justify a new business?

- Pricing : How will you determine the pricing of your offerings?

- Target Market : Who makes up your target market? Do they have enough spending power to buy your product or service?

- Location : Does your business require opening a physical store or can it effectively reach its target market via ecommerce? Perhaps it needs both?

- Historic data on your product/ service : How have the products and services in your niche performed over time? How do they perform currently?

- Marketing and Market Entry : How will you form an explanation on how you’ll enter the market? How will you promote your products/services to solidify your entry?

- Labor Requirements : Do you have enough manpower to form a business? How many employees and contractors will your business require?

- Financial Plan : Do you have the financial means to cover all operations?

How to Conduct Market Research for a Business Plan

Since a business plan ought to include concrete information to pave the way for business success, it requires thorough market research. Given that market research encompasses so many modes and forms, it can be overwhelming and even intimidating to begin to conduct it for your business plan.

The following provides a step-by-step guide on how to do market research for a business plan, so you can craft your plan in an informed manner, equipped with critical market research.

- First, search the secondary sources available; while some are free, there will be many that aren’t.

- Then, narrow it down to a specific niche, with suspected market segments.

- Focus your research via secondary sources on your market. Look at trade publications, new sites dedicated to your market, industry reports, local reports, statistics websites, blogs on the startups in your niche, including their stories of success and failure and other secondary resources.

- Conduct further secondary research on your priorities.

- Then, switch to primary research methods to zero in on your most critical research subjects.

- You can achieve this by conducting secondary research on your target market.

- Use an online survey, a focus group or a survey panel .

- Segment your target market further and start building personas from the shared characteristics they exhibit.

- Be sure to find similar offerings available to identify your competitors.

- Survey your target market on their needs and feelings towards similar products/services, along with their aversions and desires for updates.

- This will help you understand how to set up your prices as well.

- Research the costs of marketing and publicizing the launch of your business.

- Compare all costs and establish a preliminary business budget.

- Jot down their strengths and weaknesses.

- Compare your offering to theirs, does it fill any gaps or voids? Is it better price-wise?

- Break this down from high to low levels of research. Ex: From the general industry to the exact niche, from a large target market, to specific segments, to specific personas.

- Adjust your budget, goals and plans.

- The executive summary, company description, products and services, market analysis, strategy and implementation, organization and management, financial plan and projections.

- Assure that everything makes sense. If there are gaps in the information you have outlined, consider conducting more research.

- Highlight areas of opportunity, along with areas of risk.

- Edit your business plan as needed.

Empowering Your Market Research-Powered Business Plan

Market research is a wide-reaching practice that blends consumer behavior and economic trends to help you validate and improve a business idea. It can also help you change the course or style of an already established business.

Thus, it is not solely for startups. Market research can be difficult to conduct and manage , as there are so many business aspects you’ll need to consider to lower your risk of failure. Concurrently, there is so many kinds of market research you can stand to conduct.

Even with the steps listed above, navigating through the jungle of market research can be a laborious and difficult task. While you can’t control secondary resources, you can wield control of your primary research endeavors via an online survey platform .

This kind of market research tool allows you to take the reigns in every aspect: from asking the exact questions you seek answers to , to targeting a specific market segment , to deploying your surveys across the most-frequented websites and apps.

A potent survey platform will complete all of these crucial tasks , making primary research an easy task. The trick is to find an online survey platform that can handle all of these tasks, along with making it easy to analyze the data.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $0.95 per complete. Launch your survey today.

Privacy Preference Center

Privacy preferences.

Business Plan Market Research Section: How to Write Guide .

Sep 17, 2023 | Business Consulting , Business Plan , Business Strategy Development , Comprehensive Business Plan , Market Analysis , Market Analysis , Market Research , Market Research , Small Business , Startup , Startup Business Plan

How to Write the Business Plan Market Research Section

“The best vision is insight.” – Malcolm Forbes

In developing your business plan market research section, conducting a comprehensive study of your customers, market, competition, and strategic position relative to all three is essential.

You must show a strong need for your product or service and have a unique selling point distinguishing you from your rivals. This will generate a lot of interest and attention.

This analysis can reveal new information you may not have been aware of before. Take the time to reflect on any exciting insights it offers. It could mean rethinking some elements of your strategy. However, it might also just confirm what you already knew.

Regardless, you can better understand what it takes to succeed.

When to do the business plan market research section

You should include a market research or analysis section after your business plan’s products or services section. This section should provide a detailed industry overview with statistics to support your claims.

Generally speaking, your market analysis section should provide information on the industry, target market, competition, and strategy for carving out a niche for your product or service. You should include extensive data in the appendices at the end of your business plan, with only the most essential statistics in the market analysis section.

Your business plan market research section should cover the industry, target market, competition, and how you’ll stand out.

What information should be included in a business plan’s market research analysis?

A comprehensive market research section is essential when creating a small business plan. This section should cover the following areas:

- Industry Description and Outlook : Clearly describe your industry and provide qualitative and quantitative information. This should include the aspects that make your drive a desirable place to start and grow a business and detailed statistics such as industry size, growth rate, trends, and outlook.

- Target Market : Define your ideal customer by providing information on their demographics, including age, gender, income level, and lifestyle preferences. You should also include data on your target market’s size, purchase potential motivations, and your plan for reaching them.

- Market Test Results : Include the results of any market research you have conducted and details about your testing process and supporting statistics. This information should be included in the appendix.

- Lead Time : Provide information on how long it will take to fulfill customer orders, both for individual purchases and large-volume orders, based on the research you have gathered on customer orders and any considerations (i.e., supply, resource availability, postage).

- Competitive Analysis : Identify your competition, including their strengths and weaknesses, and any potential roadblocks that may prevent you from entering the market.

Your business plan’s market research should address these critical questions:

Customers are the lifeblood of any business. People looking to invest in your company or provide financing need to see that you understand what they want and that you have a detailed plan for reaching them. To do this, you should focus your attention on four questions.

- Who are your customers? Describe your target market. Perhaps create a marketing persona profile of the people you want to reach, including their age range, income levels, lifestyle choices, interests, and more. What makes them tick?

- What are their current buying habits? Concerning the sorts of products or services you offer, what are they buying now? From whom are they buying, and is it a repeat purchase? What do they generally spend monthly or annually?

- What motivates them to buy? What are the features that drive their purchase decisions? Do they seek a low price or value? How important is the choice?

- How will you make them buy from you? Take the time to synthesize the answers to the first three questions. It would help if you could demonstrate how your strategy would satisfy your target market in a way your competitors have failed to implement.

Doing your business plan market research due diligence

To convince your readers of the thoroughness of your analysis, it’s crucial to conduct a rigorous, thorough exploration backed up by ample and accurate data. Mere words won’t cut it, as people will expect substantial evidence to support your claims.

Although it may take up a significant amount of your time, doing your due diligence is a necessary investment to prioritize as a must-do activity when creating your business plan.

There are two types of research you can include in your analysis.

- Primary Research : Primary research focuses on data you gather about your customers and your competition. Companies will frequently use interviews, focus groups, and surveys to get feedback and acquire data on their target market.

- Secondary research : Secondary research takes a broader view, usually looking at your industry, and generally involves a meta-analysis of previously existing research. Important areas to check are trade groups, government agencies, and third-party research firms (which may charge a fee for their services).

- A point to include is the importance of balanced analysis. For your rationality, you should aim to compare yourself to similar companies in size, age, service area, and structure.

Choosing the right market for your business is essential, as selecting the wrong one can result in inaccurate outcomes. This can make your situation appear better or worse than it is, which can lead to your readers doubting your results. This can impact any funding you seek for your business plan.

Describe your niche and market position in your business plan market research.

Please describe your niche and market position in your business plan market research.

- Targeting a broad range of customers within your market can water down your offerings and make you less appealing.

- In the medical world, it’s the difference between a general practitioner and a specialist.

- The latter focuses on a narrower band of patients but is in higher demand because they can demonstrate thorough expertise in the services needed.

- It would help if, within your research, you articulate how your niche will service the band of customers you’re planning to target.

- These are your distinguishing features, the elements of your business that differentiate you in the marketplace.

- This includes your business model, team, offerings, and how you plan to market yourself.

Try to provide as many enriched details as possible to ensure your readers fully understand how your puzzle piece will fit with the rest of your industry.

Are you utilizing the Internet for market research?

Regarding how to write the business plan market research section, the Internet can be a valuable resource as it provides access to raw data. The USA Census Bureau and UK Gov ONS are excellent sources for gathering demographic information.

By conducting various online searches using Google , you can uncover data about your competition and show a significant part of your market research.

Accessing information about your competition is essential. You can distinguish your business and emphasize your competitive advantages by reviewing their website, social media, industry PR, and company registration information.

Get in Touch

Are you looking to grow your business but unsure where to start? Our small business consulting and leadership coaching services are here to help! We’ll work with you to scale your operations and achieve your goals. Plus, we offer a free 30-minute consultation to ensure we fit your needs correctly. Let’s get started!

Contact Noirwolf Consulting today using the website contact form or by emailing [email protected] or call us at +44 113 328 0868.

Recent posts .

Business Transformation Strategy: A 10-Step Strategy Guide

Mar 4, 2024

Business transformation strategy is a complex and dynamic process that fundamentally restructures an organization’s strategy, processes, and systems. Though each business transformation is unique, several critical steps remain foundational to a successful change management plan. A comprehensive business transformation framework ensures a smooth and practical transformation. This framework should encompass various elements, such as defining the vision and aims of the transformation, assessing the current state of the business, identifying gaps and areas of improvement, developing a roadmap and action plan, implementing the changes, monitoring and measuring progress, and continuously refining the transformation approach as needed.

What is the Change Management Process?

Feb 2, 2024

Change is the only constant in today’s fast-paced world, and organizations must adapt to stay ahead. Fortunately, change management provides a structured and coordinated approach that enables businesses to move from their current state to a future desirable state. To deliver business value, organizations introduce change through projects, programs, and portfolios. However, introducing change is just the beginning! The real challenge is to embed the change and make it a new normal state for the organization. This calls for implementing the main principles of change management, which we will discuss in this article. Get ready to transform your organization and achieve your desired outcomes by mastering the art of change management!

Starting a Business in the UK: Step-by-Step Guide

Jan 23, 2024

Starting a successful business requires researching the market, analyzing competitors, developing a business plan, choosing a suitable name, registering with Companies House, securing funding, establishing a solid brand, creating operational functions, and expanding operations as the business grows. Approaching each step thoughtfully and diligently is crucial to establishing a successful enterprise. Our helpful guide provides a comprehensive checklist to aid you in starting a successful business. Following these key steps can increase your chances of success and achieving your goals.

Happy clients .

Trevor mcomber, us.

I recently worked with Zoe@Noirwolf, who provided me with an outstanding 5-year business plan. The expertise in financial planning, market research, SWOT analysis, and consulting was exceptional. Zoe provided me with a comprehensive and well-researched plan tailored to my business. The entire process was professional, timely, and communicative.

Bill Walton, Leeds

Zoe provided first-rate work and is an excellent business consultant. I was trying to figure out my cash flow forecast for my startup. Zoe gave me an interactive consultation session over MS teams, which was valuable and saved me a lot of time. She is super quick in excel and knowledgeable about what to include in your estimates. She was able to offer me ideas & choices that I hadn't considered. Highly recommended.

Jeendanie Lorthe, US

Warren kim, us, oscar sinclair, london, get in touch ..

Looking to grow your business but feeling unsure about where to start? Our small business consulting and leadership coaching services are here to help! We'll work with you to scale your operations and achieve your goals. Plus, we offer a free one-hour consultation to ensure we fit your needs correctly. Let's get started!

6.3 Steps in a Successful Marketing Research Plan

Learning outcomes.

By the end of this section, you will be able to:

- 1 Identify and describe the steps in a marketing research plan.

- 2 Discuss the different types of data research.

- 3 Explain how data is analyzed.

- 4 Discuss the importance of effective research reports.

Define the Problem

There are seven steps to a successful marketing research project (see Figure 6.3 ). Each step will be explained as we investigate how a marketing research project is conducted.

The first step, defining the problem, is often a realization that more information is needed in order to make a data-driven decision. Problem definition is the realization that there is an issue that needs to be addressed. An entrepreneur may be interested in opening a small business but must first define the problem that is to be investigated. A marketing research problem in this example is to discover the needs of the community and also to identify a potentially successful business venture.

Many times, researchers define a research question or objectives in this first step. Objectives of this research study could include: identify a new business that would be successful in the community in question, determine the size and composition of a target market for the business venture, and collect any relevant primary and secondary data that would support such a venture. At this point, the definition of the problem may be “Why are cat owners not buying our new cat toy subscription service?”

Additionally, during this first step we would want to investigate our target population for research. This is similar to a target market, as it is the group that comprises the population of interest for the study. In order to have a successful research outcome, the researcher should start with an understanding of the problem in the current situational environment.

Develop the Research Plan

Step two is to develop the research plan. What type of research is necessary to meet the established objectives of the first step? How will this data be collected? Additionally, what is the time frame of the research and budget to consider? If you must have information in the next week, a different plan would be implemented than in a situation where several months were allowed. These are issues that a researcher should address in order to meet the needs identified.

Research is often classified as coming from one of two types of data: primary and secondary. Primary data is unique information that is collected by the specific researcher with the current project in mind. This type of research doesn’t currently exist until it is pulled together for the project. Examples of primary data collection include survey, observation, experiment, or focus group data that is gathered for the current project.

Secondary data is any research that was completed for another purpose but can be used to help inform the research process. Secondary data comes in many forms and includes census data, journal articles, previously collected survey or focus group data of related topics, and compiled company data. Secondary data may be internal, such as the company’s sales records for a previous quarter, or external, such as an industry report of all related product sales. Syndicated data , a type of external secondary data, is available through subscription services and is utilized by many marketers. As you can see in Table 6.1 , primary and secondary data features are often opposite—the positive aspects of primary data are the negative side of secondary data.

There are four research types that can be used: exploratory, descriptive, experimental, and ethnographic research designs (see Figure 6.4 ). Each type has specific formats of data that can be collected. Qualitative research can be shared through words, descriptions, and open-ended comments. Qualitative data gives context but cannot be reduced to a statistic. Qualitative data examples are categorical and include case studies, diary accounts, interviews, focus groups, and open-ended surveys. By comparison, quantitative data is data that can be reduced to number of responses. The number of responses to each answer on a multiple-choice question is quantitative data. Quantitative data is numerical and includes things like age, income, group size, and height.

Exploratory research is usually used when additional general information in desired about a topic. When in the initial steps of a new project, understanding the landscape is essential, so exploratory research helps the researcher to learn more about the general nature of the industry. Exploratory research can be collected through focus groups, interviews, and review of secondary data. When examining an exploratory research design, the best use is when your company hopes to collect data that is generally qualitative in nature. 7

For instance, if a company is considering a new service for registered users but is not quite sure how well the new service will be received or wants to gain clarity of exactly how customers may use a future service, the company can host a focus group. Focus groups and interviews will be examined later in the chapter. The insights collected during the focus group can assist the company when designing the service, help to inform promotional campaign options, and verify that the service is going to be a viable option for the company.

Descriptive research design takes a bigger step into collection of data through primary research complemented by secondary data. Descriptive research helps explain the market situation and define an “opinion, attitude, or behavior” of a group of consumers, employees, or other interested groups. 8 The most common method of deploying a descriptive research design is through the use of a survey. Several types of surveys will be defined later in this chapter. Descriptive data is quantitative in nature, meaning the data can be distilled into a statistic, such as in a table or chart.

Again, descriptive data is helpful in explaining the current situation. In the opening example of LEGO , the company wanted to describe the situation regarding children’s use of its product. In order to gather a large group of opinions, a survey was created. The data that was collected through this survey allowed the company to measure the existing perceptions of parents so that alterations could be made to future plans for the company.

Experimental research , also known as causal research , helps to define a cause-and-effect relationship between two or more factors. This type of research goes beyond a correlation to determine which feature caused the reaction. Researchers generally use some type of experimental design to determine a causal relationship. An example is A/B testing, a situation where one group of research participants, group A, is exposed to one treatment and then compared to the group B participants, who experience a different situation. An example might be showing two different television commercials to a panel of consumers and then measuring the difference in perception of the product. Another example would be to have two separate packaging options available in different markets. This research would answer the question “Does one design sell better than the other?” Comparing that to the sales in each market would be part of a causal research study. 9

The final method of collecting data is through an ethnographic design. Ethnographic research is conducted in the field by watching people interact in their natural environment. For marketing research, ethnographic designs help to identify how a product is used, what actions are included in a selection, or how the consumer interacts with the product. 10

Examples of ethnographic research would be to observe how a consumer uses a particular product, such as baking soda. Although many people buy baking soda, its uses are vast. So are they using it as a refrigerator deodorizer, a toothpaste, to polish a belt buckle, or to use in baking a cake?

Select the Data Collection Method

Data collection is the systematic gathering of information that addresses the identified problem. What is the best method to do that? Picking the right method of collecting data requires that the researcher understand the target population and the design picked in the previous step. There is no perfect method; each method has both advantages and disadvantages, so it’s essential that the researcher understand the target population of the research and the research objectives in order to pick the best option.

Sometimes the data desired is best collected by watching the actions of consumers. For instance, how many cars pass a specific billboard in a day? What website led a potential customer to the company’s website? When are consumers most likely to use the snack vending machines at work? What time of day has the highest traffic on a social media post? What is the most streamed television program this week? Observational research is the collecting of data based on actions taken by those observed. Many data observations do not require the researched individuals to participate in the data collection effort to be highly valuable. Some observation requires an individual to watch and record the activities of the target population through personal observations .

Unobtrusive observation happens when those being observed aren’t aware that they are being watched. An example of an unobtrusive observation would be to watch how shoppers interact with a new stuffed animal display by using a one-way mirror. Marketers can identify which products were handled more often while also determining which were ignored.

Other methods can use technology to collect the data instead. Instances of mechanical observation include the use of vehicle recorders, which count the number of vehicles that pass a specific location. Computers can also assess the number of shoppers who enter a store, the most popular entry point for train station commuters, or the peak time for cars to park in a parking garage.

When you want to get a more in-depth response from research participants, one method is to complete a one-on-one interview . One-on-one interviews allow the researcher to ask specific questions that match the respondent’s unique perspective as well as follow-up questions that piggyback on responses already completed. An interview allows the researcher to have a deeper understanding of the needs of the respondent, which is another strength of this type of data collection. The downside of personal interviews it that a discussion can be very time-consuming and results in only one respondent’s answers. Therefore, in order to get a large sample of respondents, the interview method may not be the most efficient method.

Taking the benefits of an interview and applying them to a small group of people is the design of a focus group . A focus group is a small number of people, usually 8 to 12, who meet the sample requirements. These individuals together are asked a series of questions where they are encouraged to build upon each other’s responses, either by agreeing or disagreeing with the other group members. Focus groups are similar to interviews in that they allow the researcher, through a moderator, to get more detailed information from a small group of potential customers (see Figure 6.5 ).

Link to Learning

Focus groups.

Focus groups are a common method for gathering insights into consumer thinking and habits. Companies will use this information to develop or shift their initiatives. The best way to understand a focus group is to watch a few examples or explanations. TED-Ed has this video that explains how focus groups work.

You might be asking when it is best to use a focus group or a survey. Learn the differences, the pros and cons of each, and the specific types of questions you ask in both situations in this article .

Preparing for a focus group is critical to success. It requires knowing the material and questions while also managing the group of people. Watch this video to learn more about how to prepare for a focus group and the types of things to be aware of.

One of the benefits of a focus group over individual interviews is that synergy can be generated when a participant builds on another’s ideas. Additionally, for the same amount of time, a researcher can hear from multiple respondents instead of just one. 11 Of course, as with every method of data collection, there are downsides to a focus group as well. Focus groups have the potential to be overwhelmed by one or two aggressive personalities, and the format can discourage more reserved individuals from speaking up. Finally, like interviews, the responses in a focus group are qualitative in nature and are difficult to distill into an easy statistic or two.

Combining a variety of questions on one instrument is called a survey or questionnaire . Collecting primary data is commonly done through surveys due to their versatility. A survey allows the researcher to ask the same set of questions of a large group of respondents. Response rates of surveys are calculated by dividing the number of surveys completed by the total number attempted. Surveys are flexible and can collect a variety of quantitative and qualitative data. Questions can include simplified yes or no questions, select all that apply, questions that are on a scale, or a variety of open-ended types of questions. There are four types of surveys (see Table 6.2 ) we will cover, each with strengths and weaknesses defined.

Let’s start off with mailed surveys —surveys that are sent to potential respondents through a mail service. Mailed surveys used to be more commonly used due to the ability to reach every household. In some instances, a mailed survey is still the best way to collect data. For example, every 10 years the United States conducts a census of its population (see Figure 6.6 ). The first step in that data collection is to send every household a survey through the US Postal Service (USPS). The benefit is that respondents can complete and return the survey at their convenience. The downside of mailed surveys are expense and timeliness of responses. A mailed survey requires postage, both when it is sent to the recipient and when it is returned. That, along with the cost of printing, paper, and both sending and return envelopes, adds up quickly. Additionally, physically mailing surveys takes time. One method of reducing cost is to send with bulk-rate postage, but that slows down the delivery of the survey. Also, because of the convenience to the respondent, completed surveys may be returned several weeks after being sent. Finally, some mailed survey data must be manually entered into the analysis software, which can cause delays or issues due to entry errors.