47 case interview examples (from McKinsey, BCG, Bain, etc.)

One of the best ways to prepare for case interviews at firms like McKinsey, BCG, or Bain, is by studying case interview examples.

There are a lot of free sample cases out there, but it's really hard to know where to start. So in this article, we have listed all the best free case examples available, in one place.

The below list of resources includes interactive case interview samples provided by consulting firms, video case interview demonstrations, case books, and materials developed by the team here at IGotAnOffer. Let's continue to the list.

- McKinsey examples

- BCG examples

- Bain examples

- Deloitte examples

- Other firms' examples

- Case books from consulting clubs

- Case interview preparation

Click here to practise 1-on-1 with MBB ex-interviewers

1. mckinsey case interview examples.

- Beautify case interview (McKinsey website)

- Diconsa case interview (McKinsey website)

- Electro-light case interview (McKinsey website)

- GlobaPharm case interview (McKinsey website)

- National Education case interview (McKinsey website)

- Talbot Trucks case interview (McKinsey website)

- Shops Corporation case interview (McKinsey website)

- Conservation Forever case interview (McKinsey website)

- McKinsey case interview guide (by IGotAnOffer)

- McKinsey live case interview extract (by IGotAnOffer) - See below

2. BCG case interview examples

- Foods Inc and GenCo case samples (BCG website)

- Chateau Boomerang written case interview (BCG website)

- BCG case interview guide (by IGotAnOffer)

- Written cases guide (by IGotAnOffer)

- BCG live case interview with notes (by IGotAnOffer)

- BCG mock case interview with ex-BCG associate director - Public sector case (by IGotAnOffer)

- BCG mock case interview: Revenue problem case (by IGotAnOffer) - See below

3. Bain case interview examples

- CoffeeCo practice case (Bain website)

- FashionCo practice case (Bain website)

- Associate Consultant mock interview video (Bain website)

- Consultant mock interview video (Bain website)

- Written case interview tips (Bain website)

- Bain case interview guide (by IGotAnOffer)

- Bain case mock interview with ex-Bain manager (below)

4. Deloitte case interview examples

- Engagement Strategy practice case (Deloitte website)

- Recreation Unlimited practice case (Deloitte website)

- Strategic Vision practice case (Deloitte website)

- Retail Strategy practice case (Deloitte website)

- Finance Strategy practice case (Deloitte website)

- Talent Management practice case (Deloitte website)

- Enterprise Resource Management practice case (Deloitte website)

- Footloose written case (by Deloitte)

- Deloitte case interview guide (by IGotAnOffer)

5. Accenture case interview examples

- Case interview workbook (by Accenture)

- Accenture case interview guide (by IGotAnOffer)

6. OC&C case interview examples

- Leisure Club case example (by OC&C)

- Imported Spirits case example (by OC&C)

7. Oliver Wyman case interview examples

- Wumbleworld case sample (Oliver Wyman website)

- Aqualine case sample (Oliver Wyman website)

- Oliver Wyman case interview guide (by IGotAnOffer)

8. A.T. Kearney case interview examples

- Promotion planning case question (A.T. Kearney website)

- Consulting case book and examples (by A.T. Kearney)

- AT Kearney case interview guide (by IGotAnOffer)

9. Strategy& / PWC case interview examples

- Presentation overview with sample questions (by Strategy& / PWC)

- Strategy& / PWC case interview guide (by IGotAnOffer)

10. L.E.K. Consulting case interview examples

- Case interview example video walkthrough (L.E.K. website)

- Market sizing case example video walkthrough (L.E.K. website)

11. Roland Berger case interview examples

- Transit oriented development case webinar part 1 (Roland Berger website)

- Transit oriented development case webinar part 2 (Roland Berger website)

- 3D printed hip implants case webinar part 1 (Roland Berger website)

- 3D printed hip implants case webinar part 2 (Roland Berger website)

- Roland Berger case interview guide (by IGotAnOffer)

12. Capital One case interview examples

- Case interview example video walkthrough (Capital One website)

- Capital One case interview guide (by IGotAnOffer)

13. Consulting clubs case interview examples

- Berkeley case book (2006)

- Columbia case book (2006)

- Darden case book (2012)

- Darden case book (2018)

- Duke case book (2010)

- Duke case book (2014)

- ESADE case book (2011)

- Goizueta case book (2006)

- Illinois case book (2015)

- LBS case book (2006)

- MIT case book (2001)

- Notre Dame case book (2017)

- Ross case book (2010)

- Wharton case book (2010)

Practice with experts

Using case interview examples is a key part of your interview preparation, but it isn’t enough.

At some point you’ll want to practise with friends or family who can give some useful feedback. However, if you really want the best possible preparation for your case interview, you'll also want to work with ex-consultants who have experience running interviews at McKinsey, Bain, BCG, etc.

If you know anyone who fits that description, fantastic! But for most of us, it's tough to find the right connections to make this happen. And it might also be difficult to practice multiple hours with that person unless you know them really well.

Here's the good news. We've already made the connections for you. We’ve created a coaching service where you can do mock case interviews 1-on-1 with ex-interviewers from MBB firms . Start scheduling sessions today!

The IGotAnOffer team

Hacking the Case Interview

We’ve compiled 50 case interview examples and organized them by industry, function, and consulting firm to give you the best, free case interview practice. Use these case interview examples for practice as you prepare for your consulting interviews.

If you’re looking for a step-by-step shortcut to learn case interviews quickly, enroll in our case interview course . These insider strategies from a former Bain interviewer helped 30,000+ land consulting offers while saving hundreds of hours of prep time.

Case Interview Examples Organized by Industry

Below, we’ve linked all of the case interview examples we could find from consulting firm websites and YouTube videos and organized them by industry. This will be helpful for your case interview practice if there is a specific consulting industry role that you are interviewing for that you need more practice in.

Aerospace, Defense, & Government Case Interview Examples

- Agency V (Deloitte)

- The Agency (Deloitte)

- Federal Finance Agency (Deloitte)

- Federal Civil Cargo Protection Bureau (Deloitte)

Consumer Products & Retail Case Interview Examples

- Electro-light (McKinsey)

- Beautify (McKinsey)

- Shops Corporation (McKinsey)

- Climate Case (BCG)

- Foods Inc. (BCG) *scroll to bottom of page

- Chateau Boomerang (BCG) *written case interview

- PrintCo (Bain)

- Coffee Co. (Bain)

- Fashion Co. (Bain)

- Recreation Unlimited (Deloitte)

- Footlose (Deloitte)

- National Grocery and Drug Store (Kearney)

- Whisky Co. (OC&C)

- Dry Cleaners (Accenture) *scroll to page 15

- UK Grocery Retail (Strategy&) *scroll to page 24

- Ice Cream Co. (Capital One)

Healthcare & Life Sciences Case Interview Examples

- GlobaPharm (McKinsey)

- GenCo (BCG) *scroll to middle of page

- PrevenT (BCG)

- MedX (Deloitte)

- Medical Consumables (LEK)

- Medicine Company (HackingTheCaseInterview)

- Pharma Company (Indian Institute of Management)

Manufacturing & Production Case Interview Examples

- Aqualine (Oliver Wyman)

- 3D Printed Hip Implants (Roland Berger)

- Talbot Trucks (McKinsey)

- Playworks (Yale School of Management)

Social & Non-Profit Case Interview Examples

- Diconsa (McKinsey)

- National Education (McKinsey)

- Conservation Forever (McKinsey)

- Federal Health Agency (Deloitte)

- Robinson Philanthropy (Bridgespan)

- Home Nurses for New Families (Bridgespan)

- Reach for the Stars (Bridgespan)

- Venture Philanthropy (Bridgespan)

Technology, Media, & Telecom Case Interview Examples

- NextGen Tech (Bain)

- Smart Phone Introduction (Simon-Kucher)

- MicroTechnos (HackingTheCaseInterview)

Transportation Case Interview Examples

- Low Cost Carrier Airline (BCG)

- Transit Oriented Development (Roland Berger)

- Northeast Airlines (HackingTheCaseInterview)

- A+ Airline Co. (Yale School of Management)

- Ryder (HackingTheCaseInterview)

Travel & Entertainment Case Interview Examples

- Wumbleworld (Oliver Wyman)

- Theater Co. (LEK)

- Hotel and Casino Co. (OC&C)

Case Interview Examples Organized by Function

Below, we’ve taken the same cases listed in the “Case Interview Examples Organized by Industry” section and organized them by function instead. This will be helpful for your case interview practice if there is a specific type of case interview that you need more practice with.

Profitability Case Interview Examples

To learn how to solve profitability case interviews, check out our video below:

Market Entry Case Interview Examples

Merger & acquisition case interview examples.

Growth Strategy Case Interview Examples

Pricing case interview examples.

New Product Launch Case Interview Examples

Market sizing case interview examples.

To learn how to solve market sizing case interviews, check out our video below:

Operations Case Interview Examples

Other case interview examples.

These are cases that don’t quite fit into any of the above categories. These cases are the more unusual, atypical, and nontraditional cases out there.

Case Interview Examples Organized by Consulting Firm

Below, we’ve taken the same cases listed previously and organized them by company instead. This will be helpful for your case interview practice if there is a specific company that you are interviewing with.

McKinsey Case Interview Examples

BCG Case Interview Examples

Bain Case Interview Examples

Deloitte Case Interview Examples

Lek case interview examples, kearney case interview examples, oliver wyman case interview examples, roland berger case interview examples, oc&c case interview examples, bridgespan case interview examples, strategy& case interview examples, accenture case interview examples, simon kutcher case interview examples, capital one case interview examples, case interview examples from mba casebooks.

For more case interview examples, check out our article on 23 MBA consulting casebooks with 700+ free practice cases . There additional cases created by MBA consulting clubs that make for great case interview practice. For your convenience, we’ve listed some of the best MBA consulting casebooks below:

- Australian Graduate School of Management (2002)

- Booth (2005)

- Columbia (2007)

- Darden (2019)

- ESADE (2011)

- Fuqua (2018)

- Goizueta (2006)

- Haas (2019)

- Harvard Business School (2012)

- Illinois (2015)

- INSEAD (2011)

- Johnson (2003)

- Kellogg (2012)

- London Business School (2013)

- McCombs (2018)

- Notre Dame (2017)

- Queens (2019)

- Ross (2010)

- Sloan (2015)

- Stern (2018)

- Tuck (2009)

- Wharton (2017)

- Yale (2013)

Consulting casebooks are documents that MBA consulting clubs put together to help their members prepare for consulting case interviews. Consulting casebooks provide some case interview strategies and tips, but they mostly contain case interview practice cases.

While consulting casebooks contain tons of practice cases, there is quite a bit of variety in the sources and formats of these cases.

Some practice cases are taken from actual consulting interviews given by consulting firms. These are the best types of cases to practice with because they closely simulate the length and difficulty of an actual case interview. Other practice cases may be written by the consulting club’s officers. These cases are less realistic, but can still offer great practice.

The formats of the practice cases in consulting casebooks also vary significantly.

Some practice cases are written in a question and answer format. This type of format makes it easy to practice the case by yourself, without a case partner. Other practices cases are written in a dialogue format. These cases are better for practicing with a case interview partner.

MBA consulting casebooks can be a great resource because they are free and provide tons of practice cases to hone your case interview skills. However, there are several caveats that you should be aware of.

- Similarity to real case interviews : Some cases in MBA consulting casebooks are not representative of actual case interviews because they are written by consulting club officers instead of interviewers from consulting firms

- Quality of sample answers : While consulting casebooks provide sample solutions, these answers are often not the best or highest quality answers

- Ease of use : Consulting casebooks are all written in different formats and by different people. Therefore, it can be challenging to find cases that you can consistently use to practice cases by yourself or with a partner

Therefore, we recommend that you first use the case interview examples listed in this article and wait until you’ve exhausted all of them before using MBA consulting casebooks.

Case Interview Examples from HackingTheCaseInterview

Below, we've pulled together several of our very own case interview examples. You can use these case interview examples for your case interview practice.

1. Tech retailer profitability case interview

2. Airline profitability case interview

3. Ride sharing app market entry

4. Increasing Drug Adoption

How to Use Case Interview Examples to Practice Case Interviews

To get the most out of these case interview examples and maximize your time spent on case interview practice, follow these three steps.

1. Understand the case interview structure beforehand

If case interviews are something new to you, we recommend watching the following video to learn the basics of case interviews in under 30 minutes.

Know that there are seven major steps of a case interview.

- Understanding the case background : Take note while the interviewer gives you the case background information. Afterwards, provide a concise synthesis to confirm your understanding of the situation and objective

- Asking clarifying questions : Ask questions to better understand the case background and objective

- Structuring a framework : Lay out a framework of what areas you want to look into in order to answer or solve the case

- Kicking off the case : Propose an area of your framework that you would like to dive deeper into

- Solving quantitative problems : Solve a variety of different quantitative problems, such as market sizing questions and profitability questions. You may also be given charts and graphs to analyze or interpret

- Answering qualitative questions : You may be asked to brainstorm ideas or be asked to give your business opinion on a particular issue or topic

- Delivering a recommendation : Summarize the key takeaways from the case to deliver a firm and concise recommendation

2. Learn how to practice case interviews by yourself

There are 6 steps to practice case interviews by yourself. The goal of these steps is to simulate a real case interview as closely as you can so that you practice the same skills and techniques that you are going to use in a real case interview.

- Synthesize the case background information out loud : Start the practice case interview by reading the case background information. Then, just as you would do in a live case interview, summarize the case background information out loud

- Ask clarifying questions out loud : Just as you would do in a live case interview, ask clarifying questions out loud. Although you do not have a case partner that can answer your questions, it is important to practice identifying the critical questions that need to be asked to fully understand the case

- Structure a framework and present it out loud : Pretend that you are in an actual interview in which you’ll only have a few minutes to put together a comprehensive and coherent framework. Replicate the stress that you will feel in an interview when you are practicing case interviews on your own by giving yourself time pressure.

When you have finished creating your framework, turn your paper around to face an imaginary interviewer and walk through the framework out loud. You will need to get good at presenting your framework concisely and in an easy to understand way.

- Propose an area to start the case : Propose an area of your framework to start the case. Make sure to say out loud the reasons why you want to start with that particular area

- Answer each case question out loud : If the question is a quantitative problem, create a structure and walk the interviewer through how you would solve the problem. When doing math, do your calculations out loud and explain the steps that you are taking.

If the question is qualitative, structure your thinking and then brainstorm your ideas out loud. Walk the interviewer through your ideas and opinions.

- Deliver a recommendation out loud : Just as you would do in a real case interview, ask for a brief moment to collect your thoughts and review your notes. Once you have decided on a recommendation, present your recommendation to the interviewer.

3. Follow best practices while practicing case interviews :

You’ll most likely be watching, reading, or working through these case interview examples by yourself. To get the most practice and learnings out of each case interview example, follow these tips:

- Don’t have notes or a calculator out when you are practicing since you won’t have these in your actual interview

- Don’t take breaks in the middle of a mock case interview

- Don’t read the case answer until you completely finish answering each question

- Talk through everything out loud as if there were an interviewer in the room

- Occasionally record yourself to understand what you look like and sound like when you speak

4. Identify improvement areas to work on

When the case is completed, review your framework and answers and compare them to the model answers that the case provides. Reflect on how you could have made your framework or answers stronger.

Also, take the time to reflect on what parts of the case you could have done better. Could your case synthesis be more concise? Was your framework mutually exclusive and collectively exhaustive? Could your math calculations be done more smoothly? Was your recommendation structured enough?

This is the most important part of practicing case interviews by yourself. Since you have no partner to provide you feedback, you will need to be introspective and identify your own improvement areas.

At the end of each practice case interview, you should have a list of new things that you have learned and a list of improvement areas to work on in future practice cases. You’ll continue to work on your improvement areas in future practice cases either by yourself or with a partner.

5. Eventually find a case partner to practice with

You can only do so many practice case interviews by yourself before your learning will start to plateau. Eventually, you should be practicing case interviews with a case partner.

Practicing with a case partner is the best way to simulate a real case interview. There are many aspects of case interviews that you won’t be able to improve on unless you practice live with a partner:

- Driving the direction of the case

- Asking for more information

- Collaborating to get the right approach or structure

- Answering follow-up questions

If you are practicing with a case partner, decide who is going to be giving the case and who is going to be receiving the case.

If you are giving the case, read the entire case information carefully. It may be helpful to read through everything twice so that you are familiar with all of the information and can answer any question that your partner asks you to clarify.

As the person giving the case, you need to be the case expert.

You should become familiar with the overall direction of the case. In other words, you should know what the major questions of the case are and what the major areas of investigation are. This will help you run the mock case interview more smoothly.

Depending on whether you want the case interview to be interviewer-led or candidate-led, you will need to decide how much you want to steer the direction of the case.

If your partner gets stuck and is taking a long time, you may need to step in and provide suggestions or hints. If your partner is proceeding down a wrong direction, you will need to direct them towards the right direction.

Where to Find More Case Interview Examples

To find more case interview examples, you can use a variety of different case interview prep books, online courses, and coaching. We'll cover each of these different categories of resources for more case interview practice in more detail.

Case Interview Prep Books

Case interview prep books are great resources to use because they are fairly inexpensive, only costing $20 to $30. They contain a tremendous amount of information that you can read, digest, and re-read at your own pace.

Based on our comprehensive review of the 12 popular case interview prep books , we ranked nearly all of the case prep books in the market.

The three case interview prep books we recommend using are:

- Hacking the Case Interview : In this book, learn exactly what to do and what to say in every step of the case interview. This is the perfect book for beginners that are looking to learn the basics of case interviews quickly.

- The Ultimate Case Interview Workbook : In this book, hone your case interview skills through 65+ problems tailored towards each type of question asked in case interviews and 15 full-length practice cases. This book is great for intermediates looking to get quality practice.

- Case Interview Secrets : This book provides great explanations of essential case interview concepts and fundamentals. The stories and anecdotes that the author provides are entertaining and help paint a clear picture of what to expect in a case interview, what interviewers are looking for, and how to solve a case interview.

Case Interview Courses

Case interview courses are more expensive to use than case interview prep books, but offer more efficient and effective learning. You’ll learn much more quickly from watching someone teach you the material, provide examples, and then walk through practice problems than from reading a book by yourself.

Courses typically cost anywhere between $200 to $400.

If you are looking for a single resource to learn the best case interview strategies in the most efficient way possible, enroll in our comprehensive case interview course .

Through 70+ concise video lessons and 20 full-length practice cases based on real interviews from top-tier consulting firms, you’ll learn step-by-step how to crush your case interview.

We’ve had students pass their consulting first round interview with just a week of preparation, but know that your success depends on the amount of effort you put in and your starting capabilities.

Case Interview Coaching

With case interview coaching, you’ll pay anywhere between $100 to $300 for a 40- to 60-minute mock case interview session with a case coach. Typically, case coaches are former consultants or interviewers that have worked at top-tier consulting firms.

Although very expensive, case interview coaching can provide you with high quality feedback that can significantly improve your case interview performance. By working with a case coach, you will be practicing high quality cases with an expert. You’ll get detailed feedback that ordinary case interview partners are not able to provide.

Know that you do not need to purchase case interview coaching to receive a consulting job offer. The vast majority of candidates that receive offers from top firms did not purchase case interview coaching. By purchasing case interview coaching, you are essentially purchasing convenience and learning efficiency.

Case interview coaching is best for those that have already learned as much as they can about case interviews on their own and feel that they have reached a plateau in their learning. For case interview beginners and intermediates, it may be a better use of their money to first purchase a case interview course or case interview prep book before purchasing expensive coaching sessions.

If you do decide to eventually use a case interview coach, consider using our case coaching service .

There is a wide range of quality among coaches, so ensure that you are working with someone that is invested in your development and success. If possible, ask for reviews from previous candidates that your coach has worked with.

Summary of the Best Case Interview Resources

To prepare for consulting case interviews, we recommend the following resources to find more case interview examples and practice:

- Comprehensive Case Interview Course (our #1 recommendation): The only resource you need. Whether you have no business background, rusty math skills, or are short on time, this step-by-step course will transform you into a top 1% caser that lands multiple consulting offers.

- Hacking the Case Interview Book (available on Amazon): Perfect for beginners that are short on time. Transform yourself from a stressed-out case interview newbie to a confident intermediate in under a week. Some readers finish this book in a day and can already tackle tough cases.

- The Ultimate Case Interview Workbook (available on Amazon): Perfect for intermediates struggling with frameworks, case math, or generating business insights. No need to find a case partner – these drills, practice problems, and full-length cases can all be done by yourself.

- Case Interview Coaching : Personalized, one-on-one coaching with former consulting interviewers

- Behavioral & Fit Interview Course : Be prepared for 98% of behavioral and fit questions in just a few hours. We'll teach you exactly how to draft answers that will impress your interviewer

- Resume Review & Editing : Transform your resume into one that will get you multiple interviews

Land Multiple Consulting Offers

Complete, step-by-step case interview course. 30,000+ happy customers.

Financial Services Case Interview: 4 Tips on How to Pass

- Last Updated December, 2021

A good case structure will get through any consulting case interview question. But some industries have specific issues that make it a lot easier to pass the case if you know what to expect. Financial services case interviews are like that.

Government regulation of financial institutions, their corporate structure, and business models are quite different from other industries, so it’s good to brush up on the financial services industry before facing a case.

In this article, we’ll discuss:

- Differences between financial services firms and other firms.

- Common types of financial services case interviews.

- A financial services case example.

- 4 Tips on acing your financial services case interview.

Let’s get started!

Differences Between Financial Services Firms & Other Firms

Financial services case interview example, common types of financial services case interviews.

5 Tips On Acing Your Financial Services Case Interview

Financial services firms don’t make cars or serve hamburgers to customers to generate revenue the way an auto company or a fast-food restaurant does. Instead, they provide retail customers (individual consumers – people like you and me) and businesses with loans, deposit accounts, or insurance policies. Or they help them invest their money in stocks, bonds, or other financial instruments.

Corporate Structure

There are many different types of financial institutions and they exist both on paper (e.g., online banks) and in actual brick-and-mortar form (e.g., retail bank branches with ATMs). Typical financial institutions include:

- Commercial banks (provide business loans, home mortgage loans, and savings/checking accounts)

- Investment banks and securities firms (help people buy and sell stocks and bonds and help companies issue them)

- Insurance companies (provide insurance for homes, cars, business risk, health, etc.)

- Mutual funds and pension funds (manage retirement savings or savings for other goals, e.g., education, health, etc., by investing it in stocks, bonds, and other assets)

- Microfinance companies (provide small loans to populations underserved by traditional financial institutions)

Businesses that “make stuff” have a factory where parts go in one end and cars or hamburgers go out the other. Financial institutions, on the other hand, have people who handle the bank accounts, stocks purchases/sales, or insurance products that they provide, and all the investment decisions and paperwork that go with that service.

Business Model

Unlike other sectors, the financial services industry’s business model is largely based on interest, fees, and premiums. Don’t get bogged down by the variety of products and services that a financial institution has to offer. You only need to remember:

- Key income sources: interest earned by selling retail and corporate loans, premiums earned on insurance policies, fees earned on financial advisory (e.g., stockbroking) or on deposit accounts, etc.

- Key costs: interest paid on deposits from retail investors and corporates, insurance claims/payouts, branch operations, manpower, SG&A, etc.

Always confirm and validate the drivers of revenue and cost with your interviewer before jumping to solving any financial services case.

Regulation and Risk

A well-functioning financial system is vital for the economy, businesses, and consumers. When a financial institution fails, it can create problems for the wider economy as the 2007-2009 financial crisis showed us. Financial services firms, therefore, attract high levels of scrutiny and oversight.

Government regulation helps make sure that these institutions have good management so they don’t make bad investments or become too risky. They require that financial institutions hold “shock absorbers” (i.e., capital) to help deal with bad investments. Each country has its own set of norms and regulations that create the framework and operating model for financial institutions.

In a financial services case, therefore, it’s always important to include regulation as a category in your issue tree. You can check with your interviewer on which aspects of financial regulation and risk are relevant to ensure that ideas you brainstorm in the case won’t break laws. Aligning on this upfront increases your credibility with the interviewer, but regulation is not typically the focus of the case.

Nail the case & fit interview with strategies from former MBB Interviewers that have helped 89.6% of our clients pass the case interview.

Financial services cases can include revenue growth, cost reduction, or new product introduction like they would for any other industry. They can also include managing the “back office” where financial account information is maintained or stock and bond trades are cleared.

Here are some financial services case interview examples:

- Disconsa – A McKinsey case on developing better financial service offerings for a not-for-profit entity serving remote Mexican communities.

- Internet Bank – An L.E.K. case on product diversification for a large insurance company in Europe.

- Big Bucks Bank – A Deloitte case on technology transformation for a large US-based bank.

- Bank of Zurich – A Deloitte case on developing a strategy to structure the organization’s data program.

We’ve also curated a list of case examples , to help you hone your business problem-solving skills. Head to Our Ultimate Guide to Case Interview Prep to learn what a case interview is and its various stages (i.e., opening, structure, analysis, and conclusion). The best way to get smarter about answering financial services case interview questions is to master this general four-part approach first and then apply financial services specifics as appropriate.

Let’s dive into a financial services case example.

Case Question

“Your client is Go-for-Growth bank, a large bank in a frontier market that wants to rapidly build its agent network to grow revenue for its payment and banking business. How should they go about it?”

First, repeat the main information in the prompt to the interviewer to make sure you got it right, and ask clarifying questions. If you don’t know what a frontier market is or who banking agents are, ask your interviewer.

Frontier market is a classification made by Standard & Poors, a financial rating agency, that’s used to classify less advanced economies in the developing world, e.g., Vietnam, Kenya, Nigeria, Cambodia, etc.

A banking agent is a retail or a postal outlet contracted out by a financial institution (in this case Go-for-Growth bank) to process clients’ transactions. Typically, in less advanced economies, the population has little access to banks but significantly higher interaction with establishments such as pharmacies, grocery stores, post offices, and beauty salons. The agents help the banks get new customers and typically make money on commissions.

Take a moment to develop your own hypothesis for the Go-for-Growth bank case.

Financial Services Case Hypothesis

Your hypothesis could be that a banking agent is a cost-efficient way for the bank to acquire customers and distribute financial products vs. having to set up their own branches across the country (including paying rent for office space and hiring staff in each location).

Next, validate your understanding of the bank’s business model, corporate structure, and applicable regulations. Here, the bank is a traditional commercial bank that wants to add agents as a channel to acquire retail customers and sell traditional financial products and services (e.g., loans, deposits, etc.) Building an agent network is allowed within the regulatory framework of the country.

A great candidate would also establish:

- The purpose of agent acquisition: “Why agents?” “Why now?” and “What is the size of the opportunity (or market) that the bank is chasing?” Here, the interviewer can confirm your hypothesis about agents being cost-efficient vs. Go-for-Growth Bank having to set up brick-and-mortar establishments.

- The size of the opportunity: Establishing an agent network is a big undertaking so it’s worth ensuring the opportunity size is big enough to justify the cost. In this case, the total opportunity size is $3 billion given the country is largely underpenetrated with only 10-20% of the total population of 100+ million having access to financial services, so the opportunity is worth it. (Note that to make this a short case or one that would be appropriate for undergrad summer interns, sizing the market could be the sole focus.)

- The client’s key success metrics : “What does success look like to Go-for-Growth Bank?” Here, you should clarify the target network size and the target timeframe to meet the client’s growth target. Say, your interviewer adds that they want to scale up to a size of 200,000 agents in 2 years to achieve the topline impact of $3+ billion.

You’d now ask for a minute to lay down your thoughts so that you can build your structure.

Take a moment to think about how you would structure this case before reading ahead. That will give you a sense of what business issues come naturally to you in a financial services case and where you need to push your thinking further.

Here’s a sample case structure:

- Which services/revenue streams should Go-for-Growth Bank market via the agents and to which end customers?

- Which of the existing products and services are most profitable?

- Which products and services don’t need extensive training for agents to sell?

- Which products and services best meet the needs of the customers who agents serve (e.g., payments and basic deposit accounts and loans, not more sophisticated financial products).

- Is there a segmentation of customers who should be targeted by the agents?

- Will the bank need to tweak their products to make them profitable to customers acquired through the agent network? (An A+ answer would note that clients with low incomes or lumpy earnings might need bank accounts with lower minimums.)

- Is there opportunity for cross-sell/ up-sell of products to customers?

- How to reach the agents? (sales force/feet on the ground vs. email campaign)

- How to get them interested in becoming a channel partner? Will one-time, up-front incentives be required?

- What is the process to get them on board?

- What cut can be given to the agents (so the bank continues to be profitable)?

- What will be meaningful for the agents?

- Can gamification reward schemes be introduced?

- Would certification or co-branding, such as a sticker to display the agent’s affiliation with Go-for-Growth Bank, appeal to potential agents?

- What banking products can be sold to the agents?

- Can the agents be offered discounted pricing on the products?

- What is the up-front effort/cost to acquire agents?

- What is the expected revenue or profit uplift per agent to the bank?

- How much should each agent sell annually/monthly to continue being profitable to the bank?

- What are the recurring costs to maintain the agent network?

- Which metrics should be used for tracking performance?

- Can low performers be segmented further based on their potential?

- What will be the plan of action for consistent low-performing agents?

- Which training(s) and products’ brochures should be offered to agents to keep the customer conversion rate high?

- How can we create a community within the agent network to provide product information updates and support agency retention (such as Facebook or WhatsApp groups)?

- How can we set up the right operating model for providing cash to agents as needed?

- How can we make sure the agents have the right processes in place to ensure Go-for-Growth Bank’s cash is safeguarded?

This structure is quite exhaustive. Don’t worry if you didn’t have every bullet point in your structure. In practice, since you only have about 2 minutes to lay this out, you don’t need to write full questions on your piece of paper but only a couple of keywords for each bucket and each sub-bucket.

We recommend going through our article on Issue Trees to learn more about how to create a case structure.

After you lay out your case structure, your interviewer would prompt you to brainstorm which agents to acquire and which products and services to sell, so if you’ve already alluded to it in your structure, that gives you a headstart.

Here, your interviewer would hand you a few exhibits that detail population density by region, classification of the retail stores with metrics on annual revenue, footfall, etc., a list of Go-for-Growth Bank’s products and the associated profitability of each product, and the results of a survey that details the wishlist of financial services and products by underserved consumers and small businesses.

On brainstorming ideas, you’ll be rated on both your structure and your creativity. Make sure to always articulate the logic behind your ideas, using your past experience, analogies, or your general knowledge.

Ideas for Increasing Go-for-Growth Bank’s Revenue

- Target the agents that receive the highest customer footfall (grocery stores) AND/OR agents that are well-versed in handling legal/administrative documentation (postal outlets). Let’s assume the bank can cover 60% of the untapped population by acquiring grocery stores and postal outlets as agents in the Tier 2 cities.

- Sell products that are profitable to the bank and at the same time relevant to the customers (payment transfer, insurance products, working capital loans, home loans, etc.)

- Onboard agents as customers first to establish other customers’ trust in the bank’s products. Given it’s a less advanced economy where customers rely on heavy interactions with retail stores for information on financial products, word-of-mouth from the agent will establish trust upfront and lead to longer lifetime value (LTV) for the bank.

Ideas on Incentives for Agents

- Provide commission to agents of 0.15% on each insurance/loan product.

- Organize monthly or quarterly leagues with leaderboards to recognize top performers, e.g., highest transaction value, highest growth, highest customer acquisition, etc.

- Leverage social media to build an agent community via Facebook or WhatsApp groups. These groups can create engagement and serve as an efficient mode of communication, allowing the bank to solicit agent referrals and publish leaderboards.

- Introduce friendly competitions like “Best shop-front display” to increase the visibility of Go-for-Growth Bank’s products.

- Test if affiliation with the Bank’s brand in the country is a motivator for agents.

You could classify “high performers” as agents with transaction volume and transaction value in the top 10%. Agent’s potential information (e.g., footfall, turnover, location potential) can also be collected to have a more nuanced segmentation for tracking and governance purposes.

Running the Numbers on Go-for-Growth’s Agent Strategy

Finally, you should consider pressure testing the unit economics of each agent to ensure the bank’s targets are met. To do this, you’ll need to leverage the information you were provided during the opening of the case as well as make some assumptions. A quick way to round this up would be:

- Total # of customers = % of population targeted * Annual conversion rate per agent = 60% of population targeted * 10% conversion rate = 60% * (80% [% of population currently underserved by financial institutions] * 100 million [total population]) * 10% [conversion rate]= 4.8 million customers

- Revenue per customer = Avg # of banking products sold per customer * Annual price per product = 1.5 avg # of products * $500 price 1 = $750 annual revenue per customer.

1 Based on data from interviewer.

- Therefore, Topline impact = 4.8 million * $750 = $3600 million = $3.6 billion (validated as this meets the $3+ billion target)

Keep drawing on the interviewer to test the assumptions and/or ask for industry benchmarks on conversion rates, average number of products, prices, etc. to make your analysis rigorous.

A great candidate would also establish bottom line impact for the bank:

- Total bottom line opportunity = Topline opportunity * Profit margin = $3.6 billion * (5-7% profit margin – 0.15% cut to agents) = $175 to $250 million.

“Go-for-Growth Bank’s CEO walks into the team room and asks you about your findings. What do you tell her?”

You should lead with your recommendation to the client and detail the key reasons supporting that recommendation. Then, mention any risks to consider which might impact the outcome and the next steps that you’d suggest to double down on the analysis. There is no need to repeat everything you covered during the case: be succinct and stick to the key arguments.

What would you say? Give it a try before reading ahead.

“We recommend acquiring the grocery stores and postal outlets in the Tier-2 cities as agents for the bank to help sell loan and insurance products at a profit margin of 5-7% to retail and small business clients with a 0.15% cut to the agents. This way, we cover 60%+ of the underpenetrated population with our highest profitability products and provide an additional source of income to the agents at no additional cost to them. The high perceived value in being affiliated with the Go-for-Growth Bank brand will attract agent interest. This will allow us to add $3 billion to the top line and $175-$250 million to the bottom line annually.

One concern we’d like to address next is whether competitors could potentially take away our first-mover advantage by luring away agents with better commissions, especially in densely populous areas. We should address this potential problem with contract terms and incentives in our agent agreements.”

Congrats, you made it through your first financial services case interview!

4 Tips On Acing Your Financial Services Case Interview

1. validate corporate structure and business model.

Always remember to validate the corporate structure and business model of the financial institution in your financial services case interview. You don’t want to end up confusing a commercial bank with an investment bank!

As a candidate, you’re not expected to know everything. Therefore, ask as many questions as possible to understand what you’re really dealing with. For instance, you could say, “Hey, I’m not familiar with the corporate structure and the business model of a pension fund, could you please explain that to me so I can start to understand the drivers of value for the business a bit better.”

2. Align on the Success Metrics

To be able to reach your destination, you must know what the destination is. This is especially relevant in the financial services case interview, where there could be dozens of metrics that can be solved for. Therefore, it’s critical to align on the North Star with your interviewer so you can solve for the target the client cares most about.

3. Apply First-Principles Thinking to Structure the Case

To navigate through a financial services case interview, you need to think on your toes. Chances are the corporate structure, business model, regulatory environment, and risk aspects will be unfamiliar to you. Instead of feeling bogged down by these nuances, take a big picture lens and apply first-principles thinking to structure the case.

You may not know the industry terms such as “net interest margin” or “dividend-adjusted return,” but you can always ask the first-principles question on “What drives value for the business?” and engage with your interviewer to identify the underlying sources of value.

Demonstrating intellectual curiosity in financial services cases will hold you in good stead. Start with “Why?” then get to the “What?” and only then solve for “How?”

4. Remain Calm and Confident

It’s easy to lose nerve when you’re out of your comfort zone. If financial services case interviews tend to throw you off, practice staying calm while solving the case. During your practice, monitor yourself for signs of nervousness. Pause, take a deep breath, smile, and then continue solving the case. The more practice you put in, the calmer your nerves will become. Also, include elements such as reading financial news, financial statements, etc., into your case prep so that you become familiar with industry terminologies. Incorporating these habits into your holistic practice will boost your confidence naturally.

– – – – –

In this article, we’ve covered:

- Key differences between financial services firms and other firms,

- Common types of financial services case interviews,

- A financial services case interview example, and

- 4 tips on acing your financial services case interview.

Still have questions?

If you have more questions about financial services case interviews, leave them in the comments below. One of My Consulting Offer’s case coaches will answer them.

Other people prepping for consulting case interviews found the following pages helpful:

- Our Ultimate Guide to Case Interview Prep

- Issue Trees

- Market-sizing Case Interview

- Supply Chain Case Interview

Help with Case Study Interview Prep

Thanks for turning to My Consulting Offer for advice on case study interview prep. My Consulting Offer has helped almost 85% of the people we’ve worked with to get a job in management consulting. We want you to be successful in your consulting interviews too. For example, here is how Julien was able to get his offer from Capital One.

© My CONSULTING Offer

3 Top Strategies to Master the Case Interview in Under a Week

We are sharing our powerful strategies to pass the case interview even if you have no business background, zero casing experience, or only have a week to prepare.

No thanks, I don't want free strategies to get into consulting.

We are excited to invite you to the online event., where should we send you the calendar invite and login information.

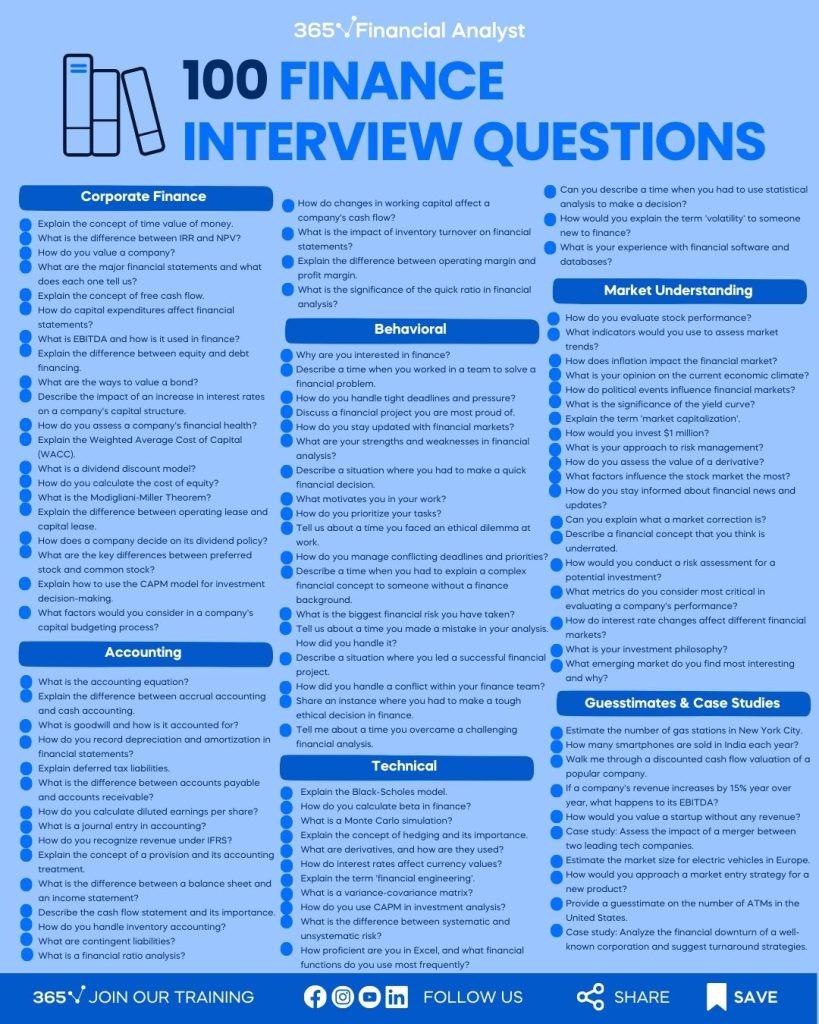

Top 10 Finance Interview Questions and Answers You Need to Know in 2024

Answers included. Ace your next interview with these finance interview questions & answers based on real experiences. Start preparing now.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Acing your finance interview requires more than just a firm grasp of numbers; it demands a lot of preparation and a deep understanding of industry trends. Employers expect you to be well-versed in traditional principles and contemporary market dynamics. This article addresses common finance interview questions and answers that hiring managers ask.

Table of Contents

- How to Prepare for a Finance Interview

- Common Finance Interview Questions and Answers

- Questions to Ask in a Finance Interview

- Finance Interview questions – Key Takeaways

- Bonus Finance Interview Questions

How to Prepare for a Finance Interview

Trying your best to answer complex questions about financial concepts, market trends, and your own experiences can be daunting when sitting in front of a board of seasoned professionals. It’s especially challenging when you’re fresh out of school and don’t have much interview experience.

But imagine you can prepare for the tough questions the board will ask you during your interview. What if you could learn from someone else’s mistakes without making them yourself? Well, that’s precisely why we’re here today.

Common Finance Interview Questions and Answers

This article explores the top 10 finance interview questions you need to know in 2024 and how to answer them like a pro. Whether you’re looking for financial analyst interview questions, searching for an investment analyst or banker role, or wanting to land your first job with interview questions for a finance intern, this guide will give you a leg up in your next interview.

Using the STAR method (Situation, Task, Action, and Result) is an excellent way to tackle these finance questions or any that require an anecdote about your personal experience.

1. How would you explain the time value of money to someone with little to no financial background?

Answering effectively.

It’s straightforward enough, but many candidates find it difficult to answer coherently. The difficulty isn’t that you don’t understand the concept itself, but rather that you don’t know how to break it down so that someone with no financial background could grasp it. Here, interviewers aim to test your ability to communicate effectively—this is a crucial skill in any finance role.

Employers aim to assess your grasp of finance with this basic finance interview question: can you simplify the concept? If not, you might not understand it as thoroughly as you believe.

Secondly, they test how you communicate complex ideas and whether you can convey them effectively to various audiences. In a finance role, you may need to explain complex financial data or concepts to colleagues, clients, or stakeholders who don’t have a financial background.

Our advice is to practice this skill. For your finance interview prep, choose a few complex financial concepts and try explaining them as simply as possible—as if you’re talking to a friend or family member. Remember, the aim is not to impress with big words but to communicate effectively.

Suppose you’re talking to a grandparent who has just asked you about the time value of money. You can ask them if they’ve ever heard of the saying, “A dollar today is worth more than a dollar tomorrow?” Continue by clarifying that that’s the idea behind the time value of money. The money you have right now is generally more valuable than the same amount in the future.

And why is that? There are a few reasons. One is that you can take advantage of the money you have now by putting it in a bank or investing it so that it can grow over time. In other words, you can earn more on top of what you already have.

Answer Example

Situation: Imagine explaining the concept of the time value of money to a college friend studying a non-finance major. They’re curious but don’t have a background in finance.

Task: I aim to explain the time value of money clearly and concisely, using an example that incorporates a bit more technical detail while remaining accessible.

Action: I begin by revisiting the familiar saying, “A dollar today is worth more than a dollar tomorrow,” to set a foundational understanding. Then, I introduce the concept of interest rates to add a layer of specificity. I explain, “If you have $100 today, and you put it in a savings account with an annual interest rate of 5%, in one year, your $100 will grow to $105. This growth is due to interest, which is essentially the reward you get for letting the bank use your money. Now, if you were to receive $100 a year from now instead, you’d miss out on that potential to earn an extra $5. That’s why we say the $100 today is more valuable—it has more potential to grow.”

Then, I move on to the concept of inflation. “Inflation reduces the purchasing power of money over time, meaning what you can buy for $100 today might cost more in the future. A few years ago, $100 could buy you a week’s worth of groceries. Today, it can only last you a few days. This is the result of inflation. So, if you were to receive that $100 one year from now, not only would you miss out on the opportunity to earn the additional $5 in interest, but that $100 might also buy less due to inflation.”

Result: My friend grasped that money has the potential to grow over time through interest, but not taking advantage of this interest could mean losing value through inflation. They recognized how the time value of money plays a crucial role in financial decisions, appreciating its importance in personal finance and investment planning.

2. Tell us about a time when you made a significant mistake in your financial analysis. How did you fix it?

This is a complex financial analyst interview question because it asks you to highlight something you’ve not succeeded at voluntarily. Isn’t the point of the interview to stand out? A good candidate also knows how to evaluate their work, which employers look for critically.

This common finance behavioral interview question puts many job applicants on the spot. Some are tempted to avoid admitting they made a mistake, but this could be a lack of self-awareness or an unwillingness to learn. Honesty is crucial when tackling this question. Choose a real example of a time you’ve made a mistake, but ensure it’s a situation you learned from. Give a brief overview to the interview board, focusing on the actions you took to correct the error and emphasize what you learned from the experience.

By showing that you can turn mistakes into opportunities for growth, you’ll demonstrate resilience, problem-solving skills, and a positive attitude. Remember, mistakes can happen; how you handle and learn from them sets you apart.

Situation: In my previous role as a financial analyst at XYZ Corporation, I was tasked with creating a quarterly financial forecast. Due to a tight deadline, I rushed through the data analysis phase, which led to a significant oversight in the revenue projections for one of our key product lines.

Task: My responsibility was to identify and correct the mistake and ensure such an error didn’t recur. Maintaining our financial forecasts’ credibility was crucial, and stakeholders relied heavily on it for strategic planning.

Action: Upon realizing the mistake, I immediately notified my supervisor and outlined a plan to rectify it. I thoroughly reviewed all the data and assumptions used in the forecast, which involved cross-verifying sales volumes, pricing strategies, and market trends.

After identifying the root cause (an incorrect data input), I corrected the error and re-analyzed our projections. To prevent similar mistakes in the future, I initiated a peer-review process for our forecasting methods and introduced a double-check system for data entry.

Result: The corrected forecast was more accurate and provided valuable insights for our strategic planning. My initiative to introduce a peer-review process was well-received and later adopted as a standard practice within our department.

This experience taught me the importance of diligence and verification in financial analysis. It also underscored the value of proactive communication and problem-solving when errors occur. From this mistake, I learned that thoroughness and teamwork are essential in ensuring the accuracy and reliability of financial forecasts.

3. What can you bring to this role that other applicants cannot?

Answering this finance interview question can be challenging because it requires you to articulate your unique value proposition that differentiates you from other candidates. It’s an opportunity to showcase your skills, experiences, and qualities that make you a standout candidate.

Start by reflecting on your strengths, experiences, and accomplishments that directly align with the role’s requirements. (There’s a better time to be modest about your achievements.)

Identify critical attributes that make you stand out. Consider your past achievements, industry knowledge, technical expertise, leadership qualities, or the ability to bring a fresh perspective. Clearly articulate how these will benefit the company and contribute to achieving its goals.

Remember: Be confident but also authentic in your response. This common finance interview question is your time to show why they should hire you for this role.

Answer Example

Throughout my career, I’ve gained experiences and skills that qualify me for this role — mainly through my tenure as a financial analyst at XYZ Company.

At XYZ Company, I wasn’t just another financial analyst—I worked heavily with financial modeling, mastering complex techniques that were pivotal for our strategic planning. I managed intricate financial models, analyzing and synthesizing data to develop insights that significantly influenced our decision-making processes.

My professional circle recognizes and values my dedication to accuracy and detail, coupled with my ability to distill and communicate complex financial information clearly.

What sets me apart from other applicants is my profound expertise in financial modeling combined with my analytical prowess and communication skills. These attributes have allowed me to contribute to the financial success of previous employers and positioned me as a go-to resource for my colleagues.

In this role, I’m eager to leverage these strengths to provide unique insights, drive strategic decisions, and foster a culture of clarity and efficiency in financial communication — supporting the company’s goals and growth.

4. If you had to choose one stock to invest in, which would you select?

In this banking interview question, the interviewer wants to assess your investment analysis skills , ability to identify potential opportunities, and thought process behind selecting a specific stock.

The stock you’ve selected is not important; what matters is your reason to add it to your portfolio. It’s essential to showcase your knowledge and provide a well-thought-out rationale for your choice.

So, how do you answer this question? Start by expressing your interest in researching various stock market players. Then, present your selection with confidence and explain why you chose it.

Providing clear reasoning backed by relevant information demonstrates your ability to analyze companies, assess growth potential, and make informed investment decisions. Your explanation also helps interviewers understand your own investment style—giving them a well-rounded answer to this finance interview question.

I’m constantly researching the latest and most significant players in the stock market, but if I could pick only one, it would be Netflix. The company still has a large market to capture abroad, and it’s well-positioned to increase its growth over the long term. Netflix’s industry position is enormous and has consistently beaten estimates on earnings, making its stock an appealing choice.

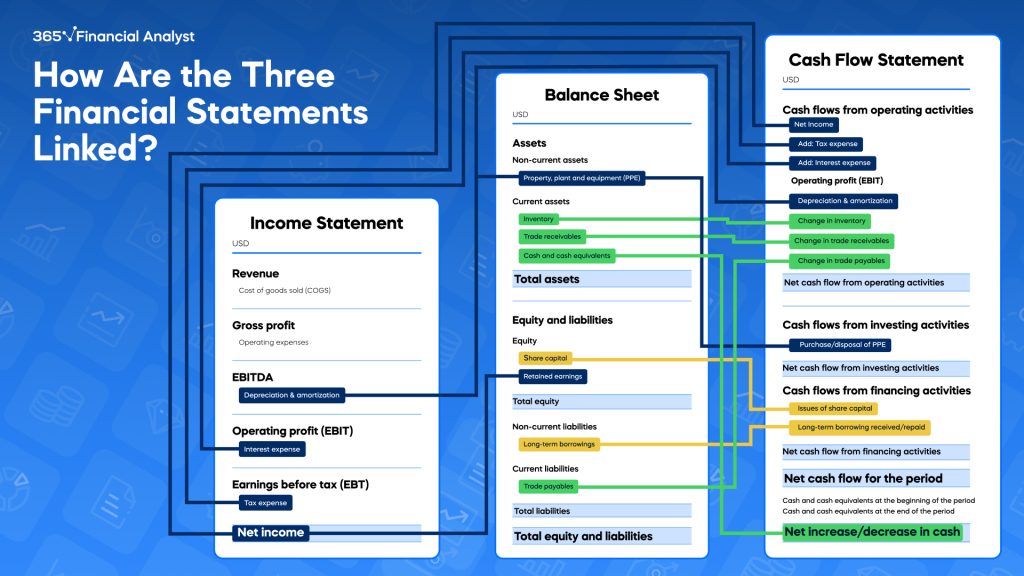

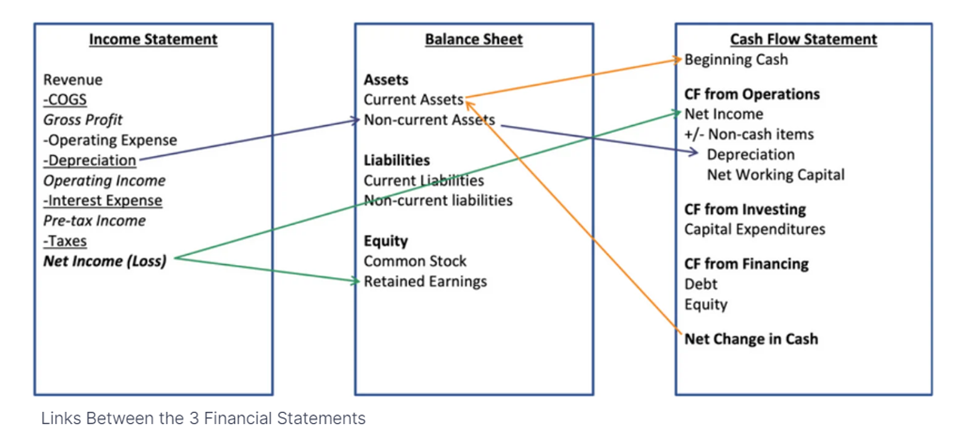

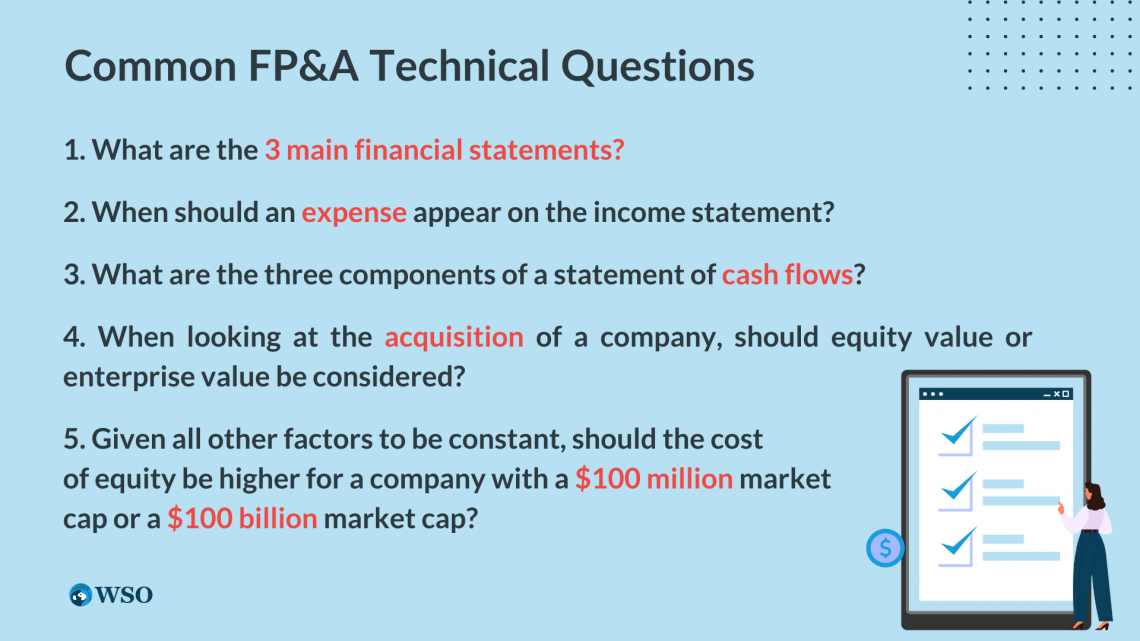

5. How are the three primary financial statements connected?

You’ll encounter this FP&A interview question in interviews for various finance roles. Understanding how the three financial statements are interconnected is also crucial in financial modeling.

Most often, candidates answer that question by stating that net income links to the three financial statements : the Income Statement, Balance Sheet, and Cash Flow Statement.

And while that’s correct, the key to answering this finance question is to be thorough. In your finance interview prep, practice your detailed answer to showcase your in-depth knowledge of financial statements.

Let’s start with the income statement, which determines the net income. This figure is crucial because it links directly to the Balance Sheet, particularly impacting the retained earnings. The formula here is simple yet fundamental —we add the net income to the beginning retained earnings and subtract any dividends to arrive at the ending retained earnings.

Moving on to the Cash Flow Statement, net income is the starting point in calculating cash from operating activities. This demonstrates how profitability translates into actual cash flow —emphasizing the direct relationship between these statements.

Another critical link is depreciation . While it’s recorded as an expense on the income statement, reducing net income doesn’t involve an actual cash outlay. So, we add it back to the operating cash flows.

Moreover, depreciation affects the Balance Sheet by reducing the book value of non-current assets, specifically property, plant, and equipment (PP&E). This ties back to the Cash Flow Statement, where capital expenditures on PP&E are recorded as investing activities.

Current assets like inventory and trade receivables on the Balance Sheet are closely tied to cash flow from operating activities. An increase in these assets indicates the use of cash, subtracted in the Cash Flow Statement, whereas a decrease signifies a source of money, therefore added back.

Lastly, financial activities like issuing shares or taking on new debt provide cash inflow —as seen in the cash flow from financing activities. Conversely, repaying debt or repurchasing shares are cash outflows.

By understanding these connections, we can see how changes in one statement affect the others —providing a comprehensive picture of a company’s financial health. This interconnectedness is vital for accurate financial modeling and strategic decision-making.

6. What is the impact on the Income Statement when the value of inventory increases by $10?

This is a common deceptive question you’ll most likely encounter when applying for an accounting or financial analyst position. There’s no impact on the Income Statements. The interviewer wants to evaluate your knowledge of how inventory-related transactions impact the statement.

When answering this technical finance interview question, applicants often overthink and look for a hidden relationship between the two. The interviewee usually states that the Working Capital changes appear on the Income Statement.

The Income Statement doesn’t directly capture changes in inventory because related expenses—such as the Cost of Goods Sold (COGS) or Operating expenses—are only recognized when the goods are sold. Until the company sells the products associated with the inventory, it does not impact the Income Statement. In other words, inventory represents the value of goods the company holds but has not yet sold.

It’s easy to get tripped up by deceptive questions like these, but staying level-headed can help you spot them quickly and impress potential employers.

An increase of $10 in the inventory value doesn’t directly impact the Income Statement. Inventory is recorded as an asset on the Balance Sheet, and its value changes are not reflected on the Income Statement until the associated goods are sold. At that point, it affects the Cost of Goods Sold and, subsequently, the net income. Therefore, this $10 increase in inventory would only be recognized on the Income Statement when the inventory is sold, impacting the COGS and, ultimately, the net profit.

7. How does an inventory write-down impact the three primary financial statements?

This is a classic finance interview question. The interviewer wants to see if you understand how the Income Statement, the Balance Sheet, and the Cash Flow Statement interact.

There are no shortcuts; you must understand the interactions detailed below:

The write-down on the Income Statement is recognized as an expense in either the COGS or a separate line item, ultimately reducing the net income. And although we observe a decrease, it’s important to note that the write-down is a non-cash expense. Therefore, it has been added to the Cash Flow from the Operations section. This adjustment acknowledges that the write-down does not impact the company’s cash position.

The Balance Sheet is impacted in two ways:

The asset’s inventory decreases by the amount of the write-down, which reflects the lower value of the inventory after the write-down.

The shareholders’ equity also decreases by the same amount, as the reduction in net income impacts the retained earnings.

The following is how you could answer this strategic finance interview question.

In the event of an inventory write-down, all three primary financial statements are affected. On the Income Statement, the write-down is recorded as an expense, which reduces the company’s net income.

This expense could appear in the COGS or as a separate line item. Although it decreases net income, it’s crucial to understand that this is a non-cash expense. As a result, when we move to the Cash Flow Statement, this write-down is added to the Cash Flow from Operations, recognizing that there has been no actual cash outflow due to this adjustment.

On the Balance Sheet, the inventory value decreases by the write-down amount, reflecting the reduced valuation of the inventory. This reduction in assets also affects shareholders’ equity, as the decrease in net income from the Income Statement lowers retained earnings. So, the Balance Sheet shows reduced assets (inventory) and equity (retained earnings). At the same time, the Cash Flow Statement adjusts for the non-cash nature of the write-down, ensuring the operating cash flow is not unduly affected.

8. How would you value a company?

Now that we’ve discussed the interrelation of financial statements, let’s shift our focus to a crucial aspect of financial analysis: company valuation.

A common finance interview question you’ll most likely encounter when applying for a financial or investment banking analyst position is, “How would you value a company?”

This question is a hurdle for applicants, but why?

There are many valuation models, and stating just one is not enough. The challenge is effectively responding to this finance interview question by providing a structured approach and highlighting critical valuation methodologies. You can start with the most popular ones.

For example, the Precedent Transactions Method involves looking at the prices paid for similar companies in the past to determine a current value. This method is often used in mergers and acquisitions (M&A) and works best if the companies are in the same industry.

While the Precedent Transactions Method provides a quick and easy method to estimate a company’s value, it’s often supplemented with other valuation techniques To understand its worth better.

One includes the discounted cash flow (DCF) model , which involves projecting a company’s future cash flows, determining an appropriate discount rate, and calculating the present value of those cash flows to estimate the firm’s intrinsic value.

Another valuation method is the relative valuation model, where you estimate an asset’s value relative to that of another. The fundamental principle of relative valuation asserts that similar assets should trade at similar prices. It entails comparing the financial ratios and metrics of the target company to those of comparable firms—examining multiples like price-to-earnings (P/E), price-to-sales (P/S), and enterprise value-to-EBITDA ( EV/EBITDA ).

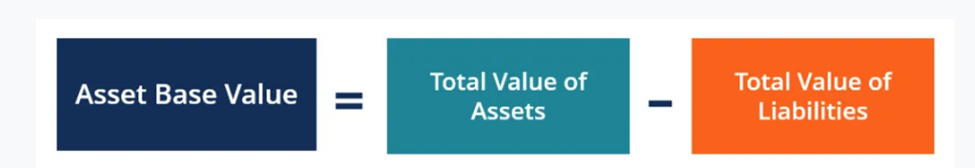

Next, we have an asset-based valuation , which estimates a company’s intrinsic value as the difference between the market value of its assets and liabilities. With this method, there’s room for interpretation as to which assets and liabilities to include in the valuation and how to measure their worth. And that may be tricky at times.

These popular valuation methods should thoroughly prepare you for this finance interview question.

Situation: In my previous role as a financial analyst, I valued a mid-sized manufacturing company, which provided a hands-on opportunity to apply various valuation methodologies.

Task: I aimed to determine a fair and comprehensive company valuation to guide our investment decision-making process.

Action: I began with the Precedent Transactions Method, analyzing recent acquisitions within the manufacturing sector to establish a baseline. I looked at several vital transactions to understand the price paid for similar companies, adjusting for size, market position, and financial health.

Next, I employed the Discounted Cash Flow (DCF) model. I projected the company’s future cash flows based on historical performance, industry trends, and economic forecasts. By determining an appropriate discount rate, I calculated the present value of these cash flows, providing insight into the company’s intrinsic value.

To complement these methods, I conducted a relative valuation analysis. I compared the company’s financial ratios, such as P/E and EV/EBITDA, with those of similar companies in the sector, which helped contextualize its market standing and potential value.

Finally, I considered an asset-based valuation approach because the company had significant tangible assets. I assessed the market value of its assets and liabilities to understand its net asset value, ensuring a holistic view of its worth.

Result: Combining these methodologies allowed me to present a well-rounded valuation to our team, highlighting different perspectives on the company’s value. This multifaceted approach informed our investment decision and reinforced my ability to adapt and apply various valuation techniques in real-world scenarios — showcasing my analytical depth and versatility in financial analysis.

9. Why should a company consider issuing debt instead of equity?

There are no hidden traps here. With this corporate finance interview question, the interviewer wants to assess your understanding of corporate finance principles, capital structure decisions, and your ability to weigh the pros and cons of different financing options.

To effectively respond, highlight the benefits of debt financing, such as potential tax advantages and fixed interest payments, as well as maintaining ownership control and decision-making authority within the company.

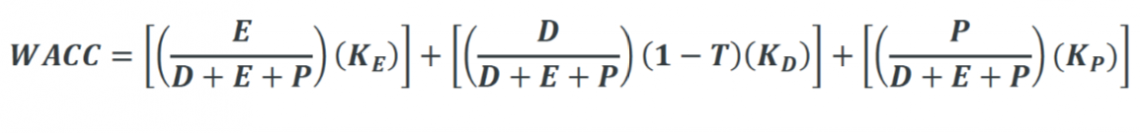

Note that a firm should always raise capital according to its optimal capital structure. If the business consistently has sufficient cash flows to cover interest payments, issuing debt might be justified if it lowers the company’s weighted average cost of capital.

Here’s how you might answer this finance question.

A company might choose to issue debt over equity for several reasons.

Firstly, debt financing offers tax advantages because interest payments on debt are tax-deductible, reducing the company’s overall tax liability.

Secondly, debt does not affect the ownership structure, unlike equity—which involves selling a portion of the company’s ownership and possibly diluting control among shareholders. This means the original owners retain full decision-making authority and control over the company.

Additionally, debt comes with fixed interest payments, which can be planned for and managed within the company’s financial forecasting. This predictability is often seen as an advantage over the potentially variable costs associated with equity financing, such as dividends.

It’s also essential to consider the company’s capital structure. A firm with a stable and predictable cash flow can support the regular interest payments associated with debt, making it a viable option.

Suppose the cost of debt is lower than the cost of equity. In that case, issuing debt can lower the company’s weighted average cost of capital (WACC), enhancing shareholder value and making it an economically sound decision.

But a company must assess its financial situation carefully because excessive debt can lead to financial distress. Ultimately, the decision to issue debt or equity should align with the company’s financial strategy, growth plans, and overall goal of maximizing shareholder value.

10. If you were the CFO of our company, what are some key challenges that you’d face?

You’ll likely encounter the CFO interview question in an interview for a higher-up finance role. A strategic mindset and the ability to consider the bigger picture is essential.

You must adopt a long-term perspective and consider various aspects of a company—including its goals, financial performance, and overall well-being. Your answer will showcase your ability to think strategically and connect your response to relevant issues, encompassing the three financial statements.

To tackle this finance interview question , take a step back and provide a high-level overview of the company’s current financial standing or the position of industry players in general. Highlight key aspects from each financial statement and considerations beyond them to demonstrate well-rounded analytical thinking.

Starting with the Income Statement , assess the growth rates, margins, and profitability to gauge the company’s financial performance. Look at revenue growth trends, gross profit, and net income margins to understand if the business can generate consistent profits and sustain growth over time.

Moving to the Balance Sheet , evaluate liquidity, capital assets, credit metrics, and leverage. Consider the company’s ability to meet short-term obligations through current assets and liquidity ratios. Assess the composition and quality of its capital assets and examine credit metrics such as credit ratings and debt levels to assess the financial stability and borrowing capacity.

Finally, the Cash Flow Statement must be scrutinized to determine the company’s short-term and long-term cash flow profile. Identify potential cash flow challenges, such as negative operating cash flow or significant investing or financing cash flows. Evaluate the need to raise money through external sources or return capital to shareholders through dividends or share buybacks.

Situation: If I were the CFO of your company, I’d anticipate facing a variety of challenges that span across operational, strategic, and financial aspects. These challenges could range from managing the company’s capital structure to navigating market volatility, ensuring compliance with new financial regulations, and driving the company’s financial strategy amidst economic uncertainties.

Task: As CFO, I would proactively identify, assess, and address these challenges. This would involve a strategic approach to balance risk and opportunity, optimize financial performance, and align the company’s financial strategy with its long-term goals.

Action: To tackle these challenges, I would first analyze the Income Statement to assess our financial performance, focusing on revenue growth, profit margins, and cost management. Understanding these metrics is crucial to identifying areas for improvement and driving profitability.

Next, I will examine the Balance Sheet to evaluate our liquidity and capital structure. This includes assessing the company’s ability to meet short-term obligations and reviewing our asset management to ensure it supports our strategic objectives.

Additionally, I would scrutinize our debt levels and equity to maintain a healthy capital structure and ensure financial stability.

On the Cash Flow Statement, I would focus on maintaining a positive cash flow, which is essential for operational effectiveness and strategic investments. I would closely monitor cash flows from operating, investing, and financing activities to ensure the company maintains a strong liquidity position and is prepared for future growth or downturns.