- Case Studies

Insurance Client Managed Services – Case Study

The client is a large insurance provider of valuable insurance coverages and services to home and auto owners, as well as business owners.

Company Description

The client is a large insurance provider of valuable insurance coverages and services to home and auto owners, as well as business owners. Leveraging a large-scale internal and partially external-facing web application, they serve their customers daily with extensive functionality. To achieve other internal processes, they keep numerous background programs that shift data where it can be further harnessed and analyzed. This sophisticated infrastructure enables the client not only to efficiently manage policy issuance, claims processing, and customer interactions but also to extract valuable insights from the data generated. The integration of these background programs ensures a seamless flow of information, contributing to the client’s ability to make informed decisions, enhance operational efficiency, and ultimately provide top-notch services to their diverse customer base.

The client needed to revitalize their core application for their customers and employees to increase productivity. This required an additional effort from experts to learn their systems and maintain their current operations so they could execute this initiative separately.

Our challenge was to absorb as much knowledge of their architecture as possible to transform our team into mirrors of themselves. With so many applications, all with different purposes, grasping and orchestrating the workflows as naturally as the client was paramount. Full-scope awareness was needed to ensure there was minimal effort while delivering on requirements. The sooner we became familiar with the territory, the quicker we would ramp up to clockwork.

Project Goals

- Learn client systems and applications.

- Improve functionality to increase maintainability.

- Document processes to add learned insight.

- Remediate existing issues.

- Append necessary functionality of the client’s current application.

Our strategy we employed was to build a team that the client could recognize as their own and have that team engage with the business stake holders often to keep in parallel with their goals. One unit of the team is determined to keep the intricacies of the day-to-day business in motion; the other unit is to enhance their applications and ensure evolution of business needs are met with equal development. Like incremental code changes to steadily progress these systems, we continuously, sprint after sprint, learned new facets of their business which only added to our tooling and reasoning when approaching tasks whether it be support or development.

Innovations

As mentioned above, one of our goals was to improve upon maintainability. When approaching a series of work items, our team sought to create additions to the client’s codebase that emphasized scalability and removal of limitations. One such improvement was to implement a way to migrate several stored procedures and surrounding code to utilize new extended columns that not only fixed an impassable truncation issue but did so in the least invasive way possible.

In using feature flags, new stored procedures in parallel with old, and new columns we corrected a boundary that as the system grew the values of essential fields were being truncated for one of their lines of business.

Another accomplishment that gave the client’s userbase a useful feature was our team’s implementation of stored payment methods. Putting this in place meant end users could keep their preferred selections of payment method, adding convenience to transactions with the client.

Core Technologies

To accomplish our goals, we leveraged several technologies.

- ASP.NET Core

- ASP.NET Framework

- Classic ASP

- Azure Function Apps

Their core application, due to several years of life cycles, required all these technologies to work together in unison. Some portions such as the client-side were written in VB.NET and Classic ASP while the server-side portions consisted of C#, VB.NET which retrieved data through services referencing their DB2 mainframe and MS SQL databases.

Many times, solutioning a work item called upon a combination of these technologies, where modifications, such as updating a stored procedure, meant also adjusting the .NET code to accommodate the change and ensuring regressive testing was successful. This integrated approach ensured that changes in one aspect of the system were seamlessly reflected throughout, maintaining the overall integrity and functionality of the application. Collaborative problem-solving became a cornerstone of our workflow, as we adeptly navigated the intricate interdependencies between technologies, swiftly adapting to evolving project requirements. This holistic perspective not only streamlined our development process but also fortified the robustness of the entire system, contributing to the overall success of our projects.

Consisting of .NET full stack engineers, we all brought extensive experience to the equation. Though split into two units, each with its unique objectives, we seamlessly collaborated to provide a comprehensive and integrated solution, ensuring a wide coverage of value for the client. Our collective expertise in front-end and back-end development, database management, and system architecture allowed us to tackle diverse challenges efficiently. By fostering a culture of open communication and knowledge-sharing, we leveraged the strengths of each unit to create a cohesive and synergistic team. This collaborative approach not only enhanced our productivity but also enriched the final deliverables, demonstrating the effectiveness of a unified, multidisciplinary team in achieving client success.

Though important to keep in our purview, Primary Key Indicators (PKI) were metrics we assured through collaboration and improvisation. We applied Agile concepts and methodology to how we conducted our implementations. By always seeking ways to alleviate blockers and keep the team thriving, we kept the development momentum going and our metrics reflected this.

Our client saw a drastic reduction in ticket counts and corrections to issues that had long caused problems. No matter how small the incident was our team determined the root cause to eliminate future tickets. The more we resolved the more our service snowballed into streamlined support for their business which ultimately resulted not only in an unhindered effort towards their roadmap but also an ever-increasing, stabilizing set of applications left better than before.

In conclusion, this case study highlights the successful collaboration between our team and the insurance client, showcasing our commitment to delivering innovative solutions and exceptional service. Through a dedicated effort to absorb the intricacies of the client’s architecture, our team has effectively mirrored the client’s expertise, ensuring seamless delivery of services and support. This partnership demonstrates our ability to tackle complex challenges and deliver tangible results, reinforcing our position as a leader in providing top-tier managed services. We look forward to continuing our relationship with the client, driving further advancements, and contributing to their ongoing success in the dynamic insurance sector.

Get In Touch With Us

Would you like to discuss how Xorbix can help with your enterprise IT needs.

How is Cloud Computing Helping Businesses?

Cloud computing is reshaping how companies operate and compete. While larger corporations have long embraced this technology, small and medium-sized enterprises now realize their potential to level the playing field and reach new markets

Informatica Migration for Big Data Workflows

Informatica, a leading data integration platform, has been a cornerstone for our client’s big data workflows.

How Does Data Visualization Help Reduce Customer Churn?

In the current competitive business world, keeping customers and building strong relationships is crucial for long-term success.

One Inc ClaimsPay Integration

One Inc’s ClaimsPay integration is our major Midwest headquartered Insurance provider client’s ambitious electronic payment integration project.

insurance CASE sTUDy

Innovate with innovation minds.

See how leading enterprises use Innovation Minds to tap the collective intelligence of their employees, customers, partners, and vendors.

Emerald Publishing Limited

Copyright © 2020, Galena Pisoni.

Published by Emerald Publishing Limited. This article is published under the Creative Commons Attribution (CC BY 4.0) licence. Anyone may reproduce, distribute, translate and create derivative works of this article (for both commercial and non-commercial purposes), subject to full attribution to the original publication and authors. The full terms of this licence maybe seen at http://creativecommons.org/licences/by/4.0/legalcode

Since the first insurance contract, dating from over 600 years ago, the basic model of how insurance companies work has remained unchanged. Companies compensate clients financially against loss or damage from a specified event. Customers pay premiums to obtain such coverage. The long history of insurance has proven that the model works. People and businesses buy insurance products and studies show that consumers have a high level of confidence in the industry.

While insurance companies continue doing business the same way they have for years, they have failed to innovate. This failure to improve is most glaring with the customer experience. For example, many customers have difficulty understanding the differences between insurance policies and complicated insurance contracts. Many do not understand the conditions of the contracts and they are not confident the insurance product offered will satisfy their needs completely.

Customer expectations have changed. In the past, when buying goods or services, customers had few possibilities to compare prices between local agents or dealers. With the emergence of the internet, this has changed and readily accessible information allows for 24/7 active comparisons and searches for the best price via different channels.

Because of digital transformation, insurance consumers increasingly want to interact with companies anytime and anywhere. Therefore, companies constantly search for new ways to engage consumers digitally and where they want to be engaged. Companies are now expected to engage via channels such as text, chat, voice assistants, websites and mobile devices for customer acquisition and service. If a company does not offer a positive digital experience, many customers, particularly younger people, will move to industry competitors that offer better customer experiences digitally or they may turn to adjacent industries that offer the service as an “add on.”

Most insurance companies are left with systems, processes and practices that would be still recognizable by those in the industry in the 1980s. Though the insurance sector has stagnated, changes across other industries have been groundbreaking (invention of smartphones, social media, YouTube, Google and Amazon). Changes brought by digitalization of other industries exert even more pressure to the insurance industry.

A new era also brings new risks. For instance, organizations are increasingly concerned about their cyber risk exposure. As a result, companies have increasingly turned to the insurance industry with a need for cyber risk insurance products to better manage cyber threats and any resulting legal liability from data breaches. These new risks are opening the doors for insurance companies to provide new products and services, but the industry is immature and takes considerable resources to develop products and services in this new market. New technologies such as big data, cloud computing and social media increase the risks resulting from cybercrimes and cyber risks are now one of the top concerns of business leaders. Every organization is vulnerable to potential losses resulting from electronic data theft. Organizations want to protect themselves and their reputations from cyber risks as well as the data and records of their customers. For this, they turn to insurance companies, which in turn may not be prepared to help a company understand its cyber security risk profile.

leverage the most advanced technologies, as the most innovative solutions are at the core of the company;

focus on improving the experience to foster a user-centric approach, for instance, some focus on improving the purchasing stage, the underwriting process or streamlining claims management; and

develop an agile culture and approach, along with leveraging analytics to make faster business decisions.

In this paper, we analyze what small- and medium-sized insurance companies can do to leverage new technology and describe digital transformation in an Italian company that used this approach.

The case study company

Assinord Verona S.R.L offers insurance products in five different lines of business (all types of insurance products) and functioning relies on 15 people in the company and a number of collaborators from all over Italy that contribute to the growth of the company. Now, the company has more than 10,000 clients across Italy.

The study of the adoption strategy of innovative digital insurance solutions to improve everyday operations of the company.

Understanding the needs of the company and the customers with one-on-one sessions with team members and the development of first prototype for a platform to better connect the company with the customers.

The study of different cyber risk policies to enrich the product portfolio and company offering.

We explored the company offers and the established company processes to understand how to implement effective digital transformation. We studied the differences in complex insurance offers for existing clients and the author talked with the owners to understand how to make the whole process smoother.

The paper is organized as follows: in Section 2, we present the analysis of the different strategies to approach innovation and the one chosen by the company; in Section 3, we present the platform for connecting the company with the clients; and in Section 4, we present the analysis of cyber risks and the kind of insurance policies the company enriched the portfolio with to offer more up-to-date products. We conclude the paper with Section 5, in which we present the takeaways from the process and recommendations for potential next steps.

Strategy for adoption of new insurance technologies

Based on the literature, we researched how other companies of similar size have approached the digital transformation phenomenon and which approach best fits this company. We summarize the different strategies used by companies in the past: internal innovation, buy from startups, partner with startups and invest in startups. A brief summary of the different methods and the reaction to these by the company is discussed.

Internal innovation

One strategy that companies have been using to embrace digital trends is to foster innovation and the birth of new ideas internally. Different tools and methods for internal innovation have been described in the literature ( Wilson, 2017 ; O’Brien, 2004 ; Kohli and Melville, 2019 ). We present a summary of the possible tools to use in Figure 1 . With internal innovation, the idea is to encourage employees to generate ideas from their everyday experience and rely on simple methods such as researching current trends, applying customer intelligence, identifying customer needs, applying design thinking and user-driven innovation to implement process improvements and redesign business strategies. Key to this process is using brainstorming techniques to come up with innovative ideas.

The company’s ability to implement the ideas is limited and that is why ideas generated internally are usually implemented by dedicated teams.

Buy from startups

Other companies partner with tech startups by purchasing their services, licensing their solutions or co-developing solutions. Companies usually partner with highly specialized startups on new technologies that insurance companies can purchase to improve operations. One such example is Cognotekt, which provides software as a service for insurers to automate claims. Another example is Insurify, a personal insurance company that compares car insurance.

Partner with startups

Another strategy involves partnering with other companies to offer services to customers by bundling offers between two companies or by providing customers new “white brand” products. New technologies require special knowledge and expertise that insurance companies do not usually have. Existing insurers can partner with technology companies to innovate along different parts of the customer value chain.

Invest in startups

This strategy is most common for big incumbents but is occasionally used by smaller companies. This approach involves investing in a startup that may rely upon one incumbent for funding. The majority of the world’s largest insurers (AXA, Allianz, AIG, MetLife and Generali) have established their own in-house venture capital (VC) funds and committed investment in startups. These insurers select the areas where they want to innovate, and then look for startups in the field. In 2019, more than 140 traditional and corporate VC firms invested in an InsurTech startup.

What did the company decide?

The objectives when partnering with an InsurTech startup should be clearly aligned with the expected impact, which should be incremental, adjacent or transformative.

Business objectives should determine the model of cooperation and help to prioritize solutions and types of relationships to have with the InsurTech startups.

When choosing the companies to collaborate with, the expected impact on the company operations should be quite clear.

The different options were presented to the case study company and the decision was to do both: to try internal innovation (and in the following section, we show some examples of this approach) and to look for startups to buy products from or partner with in cases where there are mutual benefits. For the latter, we decided to rely on Plug and Play in Munich.

Partnership with Plug and Play in Munich: Plug and Play accelerates and invests in startups. It runs over 28 stage agnostic programs a year and invests in over 260 companies. Plug and Play matches startups and corporations worldwide. Our company chose to get in touch with the headquarters in Munich to start collaboration. Plug and Play supports three main lines of program: product innovation (startups working on digital transformation, improving user experience and risk assessments), new sources of risk (startups working on cyber security and other modern concerns) and disruptive ideas (startups working on industry changing business models such as the shared economy that are transforming current markets). The company decided to continue looking into startups coming from the production innovation track. In sequential meetings, different solutions will be presented to the business owners and will be made available for future analysis.

Platform for connecting the company with the clients

In this section, we show the results from pursuing internal innovation efforts to come up with a platform for connecting the company with its clients.

We started with underlining the actors involved in the system (customers and people inside the company) by using design thinking ( Brown and Wyatt, 2010 ; Kumar, 2009 ) and creative facilitation ( Van Boeijen et al. , 2014 ) as methods. The author performed one-to-one interviews with customers of the company to understand what kind of technology can better serve their needs in terms of insurance and can bring a better understanding of complicated insurance terms and contracts. The author performed 15 interviews (each lasting 1 h) with loyal clients the company selected. The questions were intended to help us understand how customers make buying insurance policy decisions. It also mapped the user experience from the time the individual started thinking about buying insurance all the way through the actual purchase of the insurance policy. In our search for the best ideas, we also involved employees. The author had three brainstorming sessions (each lasting 1 h) in which all the employees participated. In the brainstorming sessions, the employees were asked to reflect on the needs and situations in which the customers usually buy products (the customer interview data were given as input for each session) and they were asked to develop ideas for design concepts that were used later to develop a prototype.

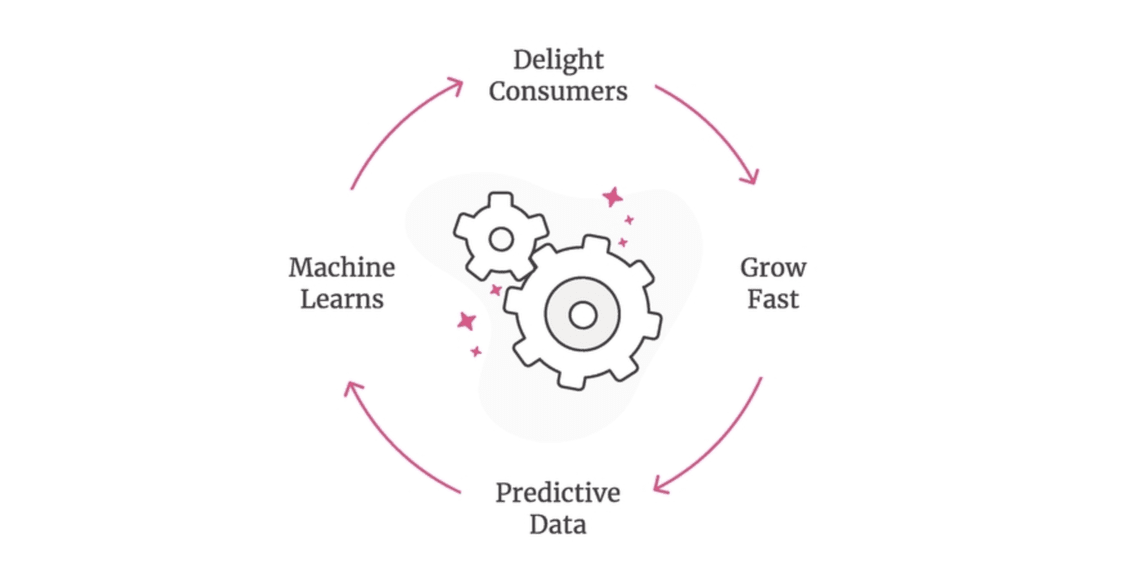

From the interviews with the customers and employee brainstorming sessions, it became clear that life insurance policies presented a clear opportunity to simplify the user experience. We pursued this further by working on a prototype. After all the data was gathered and analyzed, we developed a prototype that would advise the customer about the ideal amount of life insurance coverage they should purchase. The prototype was based on demographic data entered by the consumer (age, income, partner’s income and children). This data made it possible to better understand the consumer’s life situation to present them with a recommended amount of life insurance. With this information, the yearly premium could be calculated and presented to the customer for the suggested amount of life insurance.

The prototype also helped with understanding the operations of the company. Usually only one employee in the company performs these tasks, recommending the amount of life insurance a person should have. This employee makes recommendations based on his own experience. With this prototype, the idea is to create a tool that optimizes the process to recommend and quote life insurance, by enabling all employees to do life insurance quotes, eliminating the need to rely on or wait for a single employee with such knowledge. It also allows better productivity by making it faster to do estimates.

Does the idea enhance the existing product offering?

Is the solution compliant with regulatory requirements or are they unknown or undefinedat the moment?

Is the idea something the customer wants and needs?

Is the idea commercially viable? Does it bring potential commercial benefits for the company and is it feasible to implement?

This process has been adapted from different approaches for service design presented in Kimbell (2014) . The idea seemed to satisfy all the above-mentioned aspects. After several iterations of the design, we came up with the prototype shown in Figures 2 – 4 .

We tested the prototype with several customers and several employees. The initial comments from both of sides were positive and the prototype yielded recognition and enjoyment by all involved parties. The users were curious to find out about the recommended amount that was proposed to them and were very interested in reading the detailed descriptions on why the suggested amount was suited for their particular case. The employees appreciated the ease of use the prototype provided for generating life insurance quotes for customers and the detailed descriptions of why the particular life insurance amount was recommended to them.

It was difficult to change the internal mind-set of the company. It took time and patience to get all the members of the organization on board with using the technology.

It was important to spread the knowledge and competency of the tool across the different key positions in the company and “energize” them about the solution. By having a shared language and communication daily, it allowed for a better understanding of the tool features.

Including multiple stakeholders in the design phase of the prototype allowed employers and customers to bring different perspectives to what different features pffered/

Cyber risk and digital insurance policies

The last area we investigated was the growing need for cyber security by businesses. As the pace of technological change continues unabated, organizations’ reliance on technology has become critical to their ability to offer products and services. Technology is critical to help companies interact with customers and employees. The significant economic impact of cyber risks on companies as well as the recent attention of the media has led companies to look for solutions from available insurance products. Because of this and the increased frequency of cyberattacks, cyber risks are now widely accepted as one of the top emerging risks. Cyber insurance policies provide twofold benefits for the companies buying them: they create awareness that cyberattacks might happen and the company looks for options to reduce these risks. The act of buying cyber insurance makes the company put a price on the potential damage in case the company is compromised by a cyberattack.

Liability risk – It provides compensation and legal support in the event of third-party claims, resulting from loss of personal and/or business data.

Crisis costs – It provides compensation to undertake forensic investigations, reputation public repair, customer notification costs, IT services and cyber incidents.

Fines – It provides compensation for research costs, legal assistance and administrative fines.

Digital media breaches – It covers compensation and defense costs related to third-party claims against the client company arising out of multimedia activities (e.g. defamation, allegation or plagiarism).

Cyber risk – It provides compensations for attacks from malicious software.

Insurance policy for network interruption – It provides protection for loss of revenues or net profits associated with network downtime.

With these products, the company enriched its portfolio of insurance products covering cyber products. With these new products in the portfolio, the sales team started actively promoting these products to businesses. The initial results are positive, at the moment of writing of this paper, the SME has issued five cyber risk policies.

Conclusions and future steps

In this paper, we presented the steps a small Italian insurance company took to respond to the wave of digital transformation. The technology-based organizational transformation required the organization to be flexible and responsive to changes. The article describes how an organization can embrace digital innovation via internal innovation, buying from startups, partnering with startups or investing in startups. It also discusses how the company decided to respond to the challenge by partnering with Plug and Play, an accelerator connecting corporations to startups. The company found the first contacts promising when presented with a number of product possibilities.

The article shows how a company can apply for internal innovation and come up with a simple tool to bring insurers closer to their customers. The approach presented in this paper shows how different design-based approaches and tools can find ways to improvise in a rapidly changing environment, especially at a stage where the needs of users are uncertain. At the moment, the developed platform supports the needs of the company and their everyday work in the office. Future steps foresee full development of the prototype into a working application including the expansion and support of other types of insurance policies, especially car and home insurance policies. The idea will be passed on and developed further by a small separate company that already works on other solutions for insurance incumbents.

The company enriched the portfolio with new insurance products, tackling diverse digital risks. The company can offer insurance products to other companies that go through digital transformation and need to respond to cyber risk. The company has already started selling these products with positive results.

The management of insurance claims continues to be painful for customers – both retail and corporate. Well-managed claims can create a number of efficiencies for an insurance company and help with client retention. Yet at this moment, this area is still under-served by new technology. We see a great opportunity for driving change here and will be exploring startups offering solutions in this space.

The company can potentially increase retention rates by offering benefits for loyal customers or customers who have multiple insurance policies with the company. The company will look for a solution through digital channels to build a behavior-linked loyalty program that tracks people’s activities and rewards them adequately. We plan to study reward mechanisms as a future extension of this work.

Different tools and methods a company can use for internal innovation based on the literature review used in different insurance companies of similar size

In the first screen ( Figure 2 ), the user is asked to enter key personal data points such as age, profession, presence of a partner, children, possession of a house and the income levels as well as level of coverage they would prefer to have

In this screen, the user is shown the ideal amount of insurance, as well as the yearly fee for the coverage amount

Third screen explains the proposed amount for the user’s specific case

Brown , T. and Wyatt , J. ( 2010 ), “ Design thinking for social innovation ”, Development Outreach , Vol. 12 No. 1 , pp. 29 - 43 .

Greineder , M. , Riasanow , T. , Böhm , M. and Krcmar , H. ( 2019 ), “ The generic InsurTech ecosystem and its strategic implications for the digital transformation of insurance industry ”, 40th GI EMISA .

Kimbell , L. ( 2014 ), The Service Innovation Handbook: Action-Oriented Creative Thinking Toolkit for Service Organizations , BIS publishers .

Kohli , R. and Melville , N.P. ( 2019 ), “ Digital innovation: a review and synthesis ”, Information Systems Journal , Vol. 29 No. 1 , pp. 200 - 223 .

Kumar , V. ( 2009 ), “ A process for practicing design innovation ”, Journal of Business Strategy , Vol. 30 No. 2/3 , pp. 91 - 100 .

Nicoletti , B. ( 2017 ), “ A business model for insurtech initiatives ”, The Future of FinTech , Palgrave Macmillan , Cham , pp. 211 - 249 .

O’Brien , C. ( 2004 ), “ Product innovation in financial services: a survey ”.

Van Boeijen , A. Daalhuizen , J. van der Schoor , R. and Zijlstra , J. ( 2014 ), “ Delft design guide: design strategies and methods ”.

Wilson , J.D. Jr. ( 2017 ), Creating Strategic Value through Financial Technology , John Wiley & Sons .

Further reading

Menhart , M. , Pyka , A. , Ebersberger , B. and Hanusch , H. ( 2004 ), “ Product innovation and population dynamics in the German insurance market ”, Zeitschrift Für Die Gesamte Versicherungswissenschaft , Vol. 93 No. 3 , pp. 477 - 519 .

Acknowledgements

The author would like to thank the company host Assinord Verona S.R.L. and all the employees for their time and effort dedicated to this project.

Corresponding author

About the author.

Galena Pisoni is based at the Department of Information Engineering and Computer Science, University of Trento, Trento, Italy.

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

Asking the better questions that unlock new answers to the working world's most complex issues.

Trending topics

AI insights

EY Center for board matters

EY podcasts

EY webcasts

Operations leaders

Technology leaders

EY helps clients create long-term value for all stakeholders. Enabled by data and technology, our services and solutions provide trust through assurance and help clients transform, grow and operate.

EY.ai - A unifying platform

Strategy, transaction and transformation consulting

Technology transformation

Tax function operations

Climate change and sustainability services

EY Ecosystems

EY Nexus: business transformation platform

Discover how EY insights and services are helping to reframe the future of your industry.

Case studies

How Mojo Fertility is helping more men conceive

26-Sep-2023 Lisa Lindström

Strategy and Transactions

How a cosmetics giant’s transformation strategy is unlocking value

13-Sep-2023 Nobuko Kobayashi

How a global biopharma became a leader in ethical AI

15-Aug-2023 Catriona Campbell

We bring together extraordinary people, like you, to build a better working world.

Experienced professionals

EY-Parthenon careers

Student and entry level programs

Talent community

At EY, our purpose is building a better working world. The insights and services we provide help to create long-term value for clients, people and society, and to build trust in the capital markets.

EY announces launch of artificial intelligence platform EY.ai following US$1.4b investment

13-Sep-2023 Rachel Lloyd

EY reports record global revenue results of just under US$50b

Doris Hsu from Taiwan named EY World Entrepreneur Of The Year™ 2023

09-Jun-2023 Lauren Mosery

No results have been found

Recent Searches

Top 10 geopolitical developments for 2024

An even more complex geopolitical environment is on the horizon. Learn how businesses need to innovate and adapt their strategies to stay ahead.

Should CEOs double-down on business transformation in the face of uncertainty?

Business transformation is front and center on the 2024 CEO agenda, the latest EY report finds. Read more.

How supply chains benefit from using generative AI

Early use cases of generative AI in supply chains prove its worth in delivering cost savings and a simplified user experience. Read more.

Select your location

close expand_more

How a Nordic insurance company automated claims processing

By automating unstructured data, a Nordic insurer increased its operational efficiency and improved customer experience.

- 1. Better question

- 2. Better answer

- 3. Better working world

How EY can help

The better the question

How do you leverage AI to streamline insurance claims?

An insurer harnessed AI to streamline operations and boost agent capabilities.

N avigating large volumes of unstructured insurance claims data is a substantial challenge for any insurance company looking to automate repetitive yet complex tasks across its operations. The integration of advanced technologies such as automation and artificial intelligence (AI) has become a pivotal driver for the exponential transformation of insurance organizations.

A leading insurance firm in the Nordics wanted to modernize its claims management process. The current workflow required manual processing of each claim request, a time-consuming series of repetitive tasks which had to be performed by its agents. Amplifying the complexity was unstructured data from various sources, requiring detailed examination and categorization. The spectrum of claims data was also broad and varied, originating from multiple sources such as bills, invoices, cash receipts from pharmacies and local clinics, and medical treatment diagnoses with supporting documents.

Each document required thorough analysis by the agents to extract necessary data that could then be categorized based on the relevance for claim processing. As a result, customer service efficiency suffered; the teams struggled to process claims swiftly due to the limited capabilities of existing technology infrastructure that was ill-equipped to facilitate end-to-end automation.

A transformative approach was necessary. The insurance company engaged with EY teams to analyze its existing tech infrastructure and business needs. The goal was to develop an AI-based solution that could streamline their claims management process, automate routine tasks, and free up their agents to concentrate on building stronger customer relationships. By placing humans at the center of this AI-powered transformation, the company sought to augment the agents' capabilities, enhancing their performance and job satisfaction.

This strategy extended beyond a technological upgrade. It was about empowering their people, preparing them for a future where they can collaborate effectively with AI to drive impactful results. This initiative aimed to set the stage for the insurer's expansion into new markets, with their AI-powered claims management solution acting as a catalyst.

The better the answer

Transforming insurance claims with human-centric AI

An EY solution that transforms the insurer’s data process by converging business insights, domain knowledge and AI.

Transforming the insurer's traditional work environment required a robust, AI-powered solution. Manual handling of claim reimbursements involved laborious tasks like opening individual images and PDF scans, analyzing files, and uploading relevant documents to their systems. EY teams stepped in with EY Fabric Document Intelligence, an AI-powered product, to streamline this process.

Developed by EY wavespace™ Madrid and now integrated into EY Fabric, EY Fabric Document Intelligence is a technology that converts semi-structured and unstructured documents into actionable structured data. Built on machine learning and the Python programming language, the tool is hosted on an EY-secured cloud environment. It was scaled and customized to meet the insurer's specific requirements during the project.

The process was simple yet transformative. Agents uploaded the scanned copies to EY Fabric Document Intelligence, which began image cleansing by detecting relevant data. This involved removing image backgrounds, correcting document rotation and reducing noise to enhance the quality of scanned files. The product then performed preprocessing, document analysis and layout analysis. Using optical character recognition (OCR) and natural language processing (NLP), unstructured data was converted and classified. Finally, the structured data was transferred to the insurer's core claims system.

The product processes more documents over time, the system improves and has the potential to provide continuing value and insights for the insurer. Our team provided a solution that did more than just digitize and organize unstructured data. It combined EY business insights and industry knowledge within a strategic technology ecosystem to help modernize the insurer's operations. EY professionals offered comprehensive services, including solution design, system integration, data science, project management and cloud computing knowledge, with a human-centric approach.

Teams from Sweden, Denmark, Spain, the US and the UK collaborated to integrate EY Fabric Document Intelligence with the insurer's legacy system. They helped the insurer understand that AI, when guided by human insight, serves as a powerful enabler to expedite work.

The better the world works

Unlocking exponential transformation through AI-driven modernization

The EY team’s AI solution is driving accelerated claim processing, deepened customer relationships, and an enterprise-wide modernization.

The insurance firm now benefits from near real-time processing of claim documents. Since the solution's implementation, a remarkable 70% of the documents fed into the system are correctly extracted and interpreted. This crucial upgrade not only expedites decision-making but also allows agents to concentrate their efforts on enhancing customer interactions. Agents have more time to spend with their customers in providing personalized advice. This shift toward more meaningful engagements cultivates stronger relationships, maintaining trust and driving additional business value. The solution is designed in a way that it gives the required control of the automation and AI technologies to the insurance firm. The data is entered into the system and the output is driven through a controlled set of confidence levels avoiding blackbox implementation of AI. As the client was closely involved in all decision-making, they have sufficient transparency to the solution.

The AI solution has also been instrumental in facilitating the insurer's global expansion goals. The operational efficiency and customer service enhancements resulting from the implementation are sparking curiosity in other areas of the organization. The insurer is now actively exploring further modernization opportunities, recognizing the long-term business value of aligning with the right technology.

The EY-tailored solution has not only streamlined the insurer's processes but also served as a catalyst for reimagining their entire enterprise. The implementation has demonstrated how advanced AI can fuel exponential transformation in the industry, augment human capabilities, and create significant value. With EY and the insurer collaborating to place humans at the center of this AI transformation, the result is a long-term solution that empowers individuals and drives meaningful impact across the organization.

Navigate your AI journey

Build confidence, drive value and deliver positive human impact with EY.ai – a unifying platform for AI-enabled business transformation.

Artificial Intelligence Consulting Services

Our Consulting approach to the adoption of AI and intelligent automation is human-centered, pragmatic, outcomes-focused and ethical.

EY Nexus for Insurance

A transformative solution that helps accelerate innovation, unlocks value in your ecosystem and powers frictionless business. Learn more.

Finance Transformation in insurance

EY teams help insurers transform finance functions to become active leaders and value creators for the entire business.

Related topics

Fredrik Andren

Strong entrepreneurship professional. Demonstrated history of managing change in the financial services industry. Focused on business and technology transformation.

Sini Penttinen

AI technologist. Tech enthusiast. Curious about the future. Loves the outdoors.

- Connect with us

- Our locations

- Legal and privacy

- Open Facebook profile

- Open X profile

- Open LinkedIn profile

- Open Youtube profile

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Insurance Case Studies: The Ultimate Guide

How do you show your prospects exactly what your company can do for them? With a case study. Insurance case studies provide buyers with the solid facts, figures and performance examples they need to make a purchasing decision.

What Is a Case Study?

A case study is a powerful marketing tool that is often used in the middle or bottom of the sales funnel, to help buyers develop a preference for your offering. Case studies increase buying confidence and validate the buying decision. They prove that your product or service performs as promised.

Case studies change the conversation from telling to showing. Instead of just telling prospects how great your brand is, you can show prospects exactly what your brand is capable of achieving. This gives prospects a more concrete understanding of what to expect and enables them to step into the shoes of a satisfied customer.

The Elements of a Case Study

An effective case study contains key elements that align with the buyer’s journey:

- Who is the customer? If you don’t have permission to name the customer, describe the customer by industry, size and other relevant details.

- What problem were they trying to solve? When B2B buyers are shopping for a product, they’re trying to solve a specific problem. Identify this problem so other prospects with similar problems can relate. Sometimes, there’s more than one problem.

- What other solutions did they consider? B2B buyers usually consider multiple options before deciding. This is a key part of the process, and including the details can help emphasize why your company stood out.

- Why did they choose your solution? State exactly what your company offered that other competitors couldn’t.

- What was the implementation process like? Switching B2B vendors can be a major undertaking. Describe the process so your prospects will know what to expect. Of course, you want to put your company in a positive light and focus on the positives, but you can include hiccups that occurred in the process and how you handled them. Prospects know that things don’t always go perfectly according to plan, and this shows that you’re competent and able to overcome any barriers that arise.

- How has the company benefited? In the beginning of the case study, you described the client’s problem. Now touch back on this and show how the problem has been solved. Include specific information about how the company has benefited from your product or service. For example, how much time or money has the client saved? How are they better prepared? How have you helped increase their revenues?

- What are the key takeaways for others in a similar situation? Convince prospects that they should follow the client’s example and partner with your company. Summarize your argument with key takeaways from the case study.

Case Study Dos and Don’ts

To squeeze the most value from your case study, you need to follow some best practices.

- Don’t just list bulleted facts. You might be able to pull a list of bulleted facts from your case study to use in other types of content, such as social media posts, but your actual case study should be at least two pages long to tell the story in a meaningful way.

- Do use names. Your case study will carry a lot more weight if the featured customer is named. You can also use anonymous case studies, but they are not quite as credible.

- Do appeal to emotions. Think of your case study as a story. You’re showing your prospects what it’s like to work with your company, so you need to build a narrative. This is also a good place to build an emotional argument by showing how your company can help clients deal with pain points and reduce problems.

- Don’t make your case study longer than it needs to be. Your prospects are busy, and they probably won’t have time to read an overly verbose document. Provide enough information to create a compelling story, but don’t get bogged down with unnecessary details. An effective case study will often be around two pages.

- Do include quotes. You can say that your company is great, but it sounds more convincing if one of your customers says it. The featured customer may be willing to provide you with quotes and their logo to include in your case study. As a bonus, this is also free publicity for them.

- Do get permission. If you’re naming a customer, you will need to secure their permission and allow them the opportunity to review and approve the final piece before it is used. Be sure to save their written approval in case questions arise in the future.

Case Studies Should Be Part of Your Content Library

Creating a case study can take some time and effort, but they are worth it.

According to the 2022 Edelman Trust Barometer , 63% of people worry business leaders are trying to mislead people with false or exaggerated statements. If you just say that your company can help people solve their problems, your prospects might not believe you. You need to build credibility, and a case study that provides concrete examples can help.

A case study is also a fantastic way to differentiate yourself from your competition. As mentioned earlier, case studies are often used in more advanced stages of the customer journey, when prospects are already familiar with your company and need information that’s going to guide their purchasing decision. You want to create preference for your company so you can close the sale, and a case study can help you do that.

Your Case Study Can Convert Leads for Years

Some content has a short life, but not case studies. Although creating a case study will require some effort, once you have it, you can use it for as long as you continue to offer the featured products and services, and the featured company is still a customer.

- Feature your case study on your website. You can create a landing page for your case study or case studies so prospects can find them easily. They can be offered as instant downloads or you can generate leads by gating them with a form.

- Promote your case study in social media posts. Spread the word about your case study on social media. You can always just write a post and link to the case study, but also consider designing graphics for the case study. A LinkedIn carousel post is another great way to highlight your case study on social media.

- Encourage prospects to download the study as a call to action in your blog posts . This is a practical way to encourage your audience to learn more about your company.

- Link to case studies in email nurturing campaigns . If you’re nurturing a prospect that has downloaded other content, a case study link can entice additional engagement.

- Build case studies into your sales processes . Sales professionals love using case studies as handouts as they provide a great springboard for meaningful conversations.

- Use content to develop webinars or videos . You can even use case study content as the foundation for very powerful webinars or videos.

Need Case Studies but Don’t Know Where to Start?

Inbound Insurance Marketing can help your company develop powerful, effective case studies. Learn more. Or, if you’re ready to get started, schedule 30 minutes to discuss your project.

Share this Article:

- Implementation

- Integration

- Optimization

- Wealth & Asset Management

- Banking and Credit Unions

- Consumer Goods and Retail

- Case Studies

A Customer Experience Case Study: Lemonade

RevOps , or revenue operations, is a strategy for businesses to align revenue-enhancing teams and activities while improving the customer journey. When discussing RevOps, the emphasis is usually on overcoming silos and having departments such as marketing, sales, and customer service working seamlessly. However, it's equally beneficial from the customer's point of view. The insurance company Lemonade is an instructive case study to illustrate best practices for optimizing the customer experience.

How Lemonade is Disrupting the Insurance Industry

Lemonade is an innovative insurance company, founded in 2015, that offers products such as homeowners, renters, life, and pet insurance. Lemonade has similar services as other insurance companies but has radically changed the customer experience. Here are some features that set Lemonade apart.

- • Strong branding. Lemonade has carved out a distinct niche for itself. Clearly targeted towards tech-savvy younger customers, it promises "Insurance built for the 21st century."

- • Personalized service. One of the qualities that distinguish Lemonade from other insurance companies is the level of personalized service. Maya, the company's chatbot, makes it easy for website visitors to get information and sign up. Maya takes visitors through a questionnaire that guides them to the most appropriate services and provides quick quotes. Another chatbot, named Jim, handles payouts.

- • Flat fee. Pricing is often confusing for insurance customers. Lemonade also appeals to millennials and other younger customers, who tend to have less experience with insurance policies. The company takes a flat fee of 20% from their customers' premiums, which is simple and straightforward. As they point out, their fee structure also eliminates a conflict of interest with customers. The flat rate, combined with their Giveback program (see below), means that Lemonade doesn't lose money by paying claims.

- • Giveback program. When customers sign up for insurance, they choose a nonprofit to support. At the end of the year, any unclaimed money from an account is donated to the nonprofit. Lemonade Giveback provides customers with the satisfaction that they're performing a social good, something that's extremely relevant to millennials. A Deloitte Global Millennial Survey revealed that 42% of millennials would start patronizing a business with a positive impact on society, while 38% would stop supporting a business with a negative impact.

A Data-Driven Approach

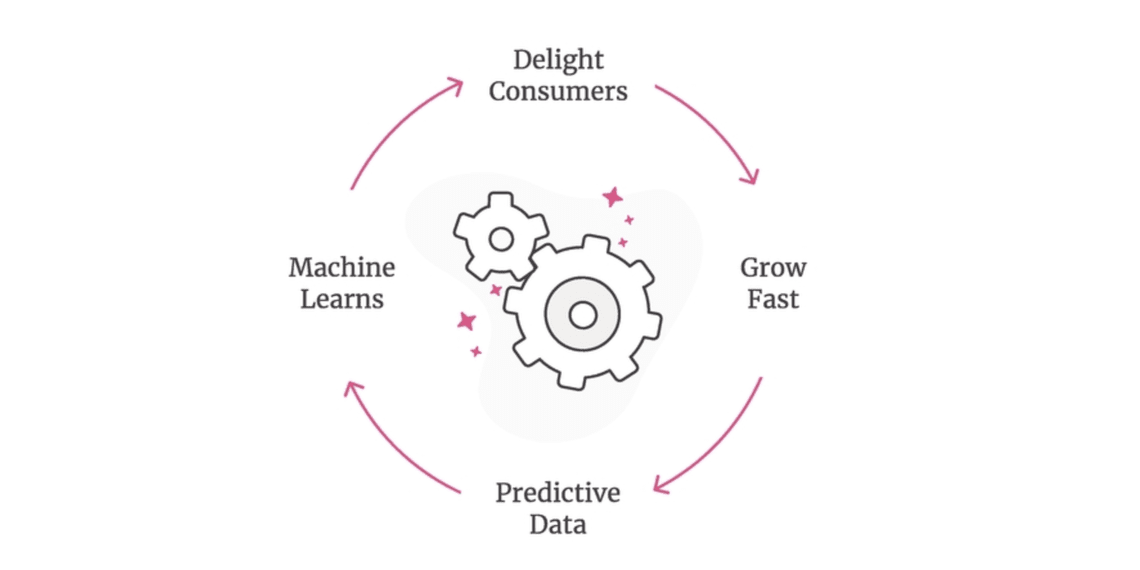

Source: Lemonade is disrupting insurance. The incumbents will have to respond Lemonade vs Traditional Insurance Companies: Customer Experience

Lemonade claims that it collects 100x more data points per customer compared to other companies. In a blog post, Lemonade describes how collecting and studying data are helping to improve its loss ratio . This is the ratio of losses to premiums. As the article explains, a very high loss ratio isn't sustainable for an insurance company, while a very low one is profitable for the business but not good for customers. Lemonade's system of charging a flat rate and donating leftover funds to charity allows it to maintain a stable loss ratio.

One of Lemonade's taglines is to turn insurance "from a necessary evil to a social good." The Giveback program plays a big role in this. But what does this really mean for the average customer? Let's explore if (or how) the customer experience differs with Lemonade when compared to traditional insurance companies.

Do Everything Online

At a time when 73% of millennials prefer to shop online using their phones (the figures are 2x higher for Zoomers, or Generation Z), Lemonade has perfectly tapped into this target market. The traditional process for getting insurance information requires the user to contact an agent, fill out a form, and wait for a quote. With Lemonade, the process is streamlined to be much faster and more convenient. The system's built-in AI (Maya the chatbot) provides personalized service without the user having to talk to a live agent.

What really sets Lemonade's customer service apart is the way it seamlessly transitions customers from one function to another. A new user is presented with information tailored to their buyer persona as they see comparisons of data so they can choose the best service. They can just as easily access claims processing when needed. All of this is automated, without the need to wait on hold or fill out complicated forms.

For a thorough review of the UX advantages of Lemonade's landing page, see A UX Review of Lemonade Insurance in Less Than 5 Minutes .

Image Source: Lemonade

Fast Payments

Another distinctive customer experience feature of Lemonade is guaranteeing fast payments without any paperwork. As with the application process, customers can complete everything online. Claims are approved in seconds.

Easy to Switch

Lemonade targets customers who already have insurance as well as people buying it for the first time. Their "Check Prices and Switch" guides users through the process. As with other tasks on the site, Maya the chatbot guides users through a series of questions to highlight the advantages of switching to Lemonade.

Mobile Apps

Speed and convenience are supported by mobile apps that customers can download. Customers can set up and manage their policies on their mobile devices.

Active on Social Media

Another way Lemonade taps into its millennial customers is by providing news and policy information on social media. Their twitter account is frequently updated. They're also active on Facebook and Instagram. Social posts aren't simply ads for insurance, but links to news items and timely blog posts.

Lemonade posts stories that are educational and helpful to its audience. For example, a recent post addresses concerns that renters may have about eviction and suggests resources to help. This type of post isn't directly related to Lemonade's services, but it establishes them as a useful source of information.

What Lemonade Has Accomplished

Is Lemonade actually disrupting insurance and stealing customers from more established companies? The Motley Fool, in the article, Can Lemonade Disrupt the Insurance Market? shares some impressive facts.

- • While 50% of renters are under 30, only 37% get renter's insurance. Lemonade is targeting this largely untapped market.

- • Customers who signed up with Lemonade three years ago have increased their spending on renter's insurance by 56%.

- • Between 2017 and 2019, Lemonade increased the number of premiums sold from $9 million to $16 million.

While the article goes on to question whether Lemonade can succeed at converting older and more affluent customers, in our opinion this innovative model will prove to be a clear competitive advantage for Lemonade.

Lessons From Lemonade

Here are some lessons that businesses in any sector can take from Lemonade.

- • Long-standing products and services can be marketed in a new and fresh way.

- • Target specific demographics (e.g. Lemonade targets millennials and renters).

- • Today's customers appreciate speed and efficiency.

- • Provide simple and personalized services. AI tools such as chatbots can help improve the customer experience.

- • Use automation tools to collect and analyze data.

Related Blog

Case Study: FinServ Company Increased Sales Effectiveness

A Customer Experience Case Study: Wealthsimple

Case Study: ShipHero Scales with Learners.ai

to receive more sales insights, analysis, and perspectives from Learners.ai

- Bahasa Indonesia

- Sign out of AWS Builder ID

- AWS Management Console

- Account Settings

- Billing & Cost Management

- Security Credentials

- AWS Personal Health Dashboard

- Support Center

- Expert Help

- Knowledge Center

- AWS Support Overview

- AWS re:Post

Our collaboration to figure things out feels like more than a customer-vendor relationship. It genuinely feels like AWS is part of our team.”

Dave Anderson Director of Technology, Liberty Mutual

Building a Future-Proof, Agile Global Business

With $40 billion in annual revenue, Liberty Mutual is the world’s sixth-largest property and casualty insurance company and is an industry frontrunner in technological innovation. The company began exploring solutions for security and test data on AWS in 2013. In 2015, Liberty Mutual began its serverless journey on AWS when James McGlennon, the company’s chief information officer, pushed for Liberty Mutual to become more agile and customer-centric in the cloud. The company previously had on-premises systems, but using those to write event-driven systems proved too complicated.

Serverless computing, however, enabled the engineers at Liberty Mutual to build event-driven systems faster because it sped up the feedback cycle so that the systems iterated more efficiently. “The light bulb moment for me was realizing that it’s not a good day’s work for a developer to write 10,000 lines of code,” says Anderson. “We started to use the phrase ‘Code is a liability,’ reminding our engineers and architects that they shouldn’t be writing code when they don’t need to.” The engineering team shifted its focus from the nuts and bolts of building to using the building blocks of serverless architecture to quickly add business value.

Liberty Mutual chose to use AWS in its modernization journey toward serverless infrastructure because AWS offered engineering experience, a customer-centric approach, and a strong focus on security—a top priority in the highly regulated insurance industry.

Transitioning to a Serverless Infrastructure on AWS

Liberty Mutual views its transformation to serverless infrastructure as a constant journey. During the initial phase, the company built the foundational elements of its infrastructure, such as network security and deployment pipelines. In the second phase, it modernized application development and layered on serverless-first principles. Now Liberty Mutual has a serverless-first policy, so engineers must first strive to build serverless software or functions. Many serverless-first projects have already been completed, all of which use AWS Lambda , a serverless compute service that lets companies run code for any type of application or backend service with zero administration. When using the serverless-first approach isn’t feasible, the engineering team looks for a cloud-native option or—as a fallback—containerized solutions, which Liberty Mutual relies on for its legacy workloads. “These are things we’ve spent 20 years developing, so we’re not going to simply rewrite those to AWS Lambda tomorrow,” Anderson explains. “There is a huge advantage to us having those workloads containerized in the cloud, where we can build serverless infrastructure around them.” Now more than 50 percent of Liberty Mutual’s workloads run in the cloud.

In 2019, Liberty Mutual used serverless computing to consolidate its disparate lines of business from around the globe into a centralized general ledger known as Financial Central Services (FCS)—a job too complex for an on-premises system. It wrote an extract, transform, load process that uses AWS Step Functions , a serverless function orchestrator for sequencing AWS Lambda functions and multiple AWS services into business-critical applications. Using AWS Step Functions, Liberty Mutual created an event-driven workflow in which the data feeds from each line of business are transformed into a series of events, or financial transactions, that then move into FCS. Now FCS processes 100 million transactions in one run at the end of every month, which means that for the majority of the month, it is offline and therefore not accruing costs. Processing one million transactions costs just $60. The flexibility and resiliency of the serverless architecture virtually eliminates failure.

To help deploy new applications quickly, Liberty Mutual created a software accelerator using the AWS Cloud Development Kit (AWS CDK), an open-source software development framework in which engineers can use familiar programming languages to define cloud application resources. Engineers use the programming language TypeScript to create templates, or serverless patterns, in AWS CDK. These templates can then be used to rapidly build projects rather than writing the code from scratch. The patterns also give staff a common language with which to collaborate, and new hires and engineers with little cloud experience can use the patterns to hit the ground running. About 3,500 serverless patterns were deployed from 2019 to 2020. “As a large company, you don’t want to say to developers, ‘Just search online for AWS Lambda and code something,’” says Anderson. “You need to give more support.” So the company supports its engineers in earning AWS certifications and provides training and in-house workshops. Liberty Mutual also guides engineers using AWS Well-Architected , a framework that helps cloud architects build secure, high-performing, resilient, and efficient infrastructure for their applications and workloads.

Liberty Mutual has used serverless architecture to build several systems in just 3 months, compared to the 1 year it would take on premises. In one case, a team of four developers used serverless patterns in AWS CDK to build an equine and livestock insurance sales and administration application in 12 weeks—3 months ahead of schedule. The team used the extra time to create visual dashboards that added value to the application. “We can spend more time using the AWS Well-Architected Review to make a product extremely high quality,” says Anderson.

Continuing to Grow the Serverless-First Approach

Liberty Mutual plans to implement Amazon EventBridge , a serverless event bus that makes it easy to connect applications using data from one’s own applications, integrated software-as-a-service applications, and AWS services. Amazon EventBridge will enable the company to offload the complexity of building its own eventing backbone.

By using serverless architecture on AWS, Liberty Mutual has become more agile, releasing higher-quality solutions for customers on a faster time line while reducing costs and removing the responsibility of infrastructure maintenance from staff. Internal surveys of Liberty Mutual’s engineering teams have revealed that staff are happier and have fewer frustrations. “Their engagement lifted,” Anderson observes. “They feel more productive because they’ve got a better set of tools at hand.”

Support from AWS has enabled Liberty Mutual to keep expanding and reaping the benefits of its serverless-first approach. “Our collaboration to figure things out feels like more than a customer-vendor relationship,” Anderson says. “It genuinely feels like AWS is part of our team.”

Liberty Mutual Reference Architecture

Ending Support for Internet Explorer

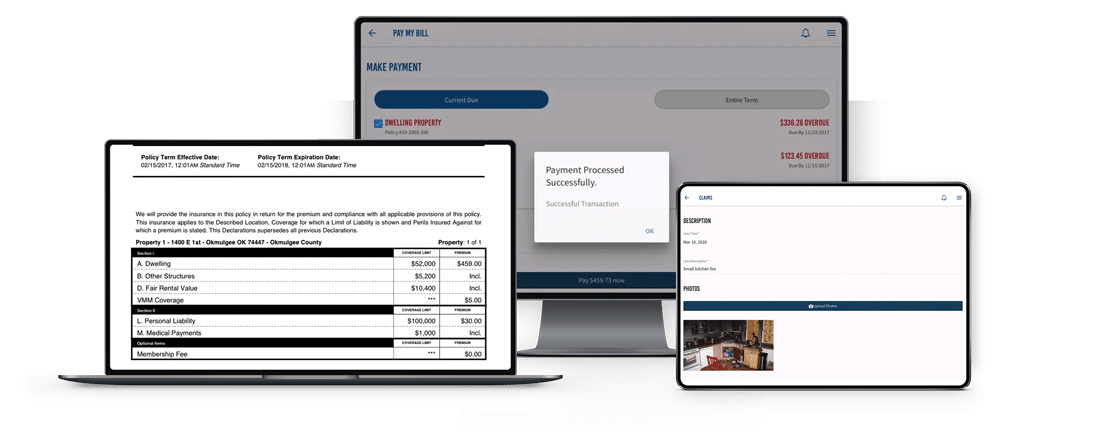

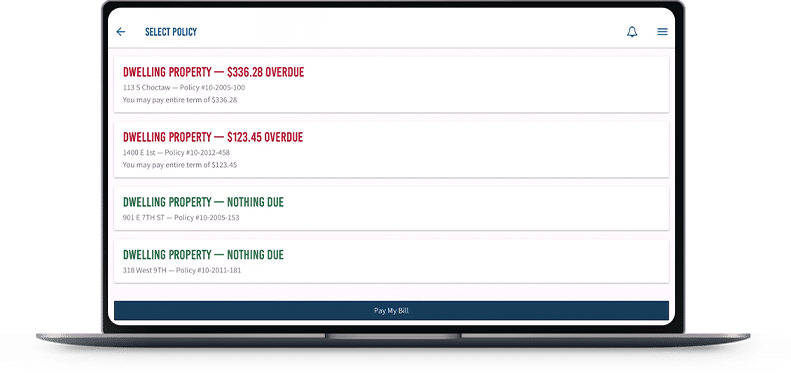

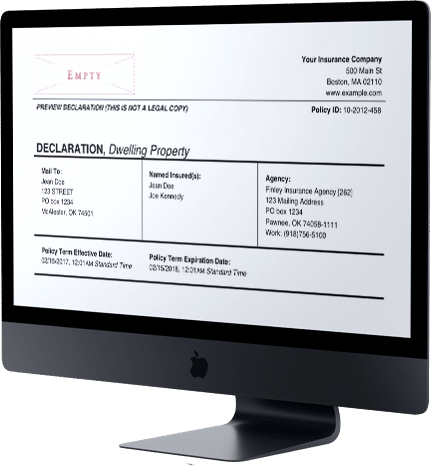

Applications for BriteCore’s P&C insurance core platform

Project overview, client information.

BriteCore offers cloud-based software for enterprises to ensure high security, performance, and scalability. It is recognized as an established industry leader, offering world-class solutions, services, and expertise to over 50 insurance carriers, InsurTechs, and managing general agents. It helps companies enhance their time-to-market, become more competitive, and gain higher revenue.

Team composition

Client name

Expertise used

Cloud solutions , BI and reporting

Services provided

Software architecture , UI/UX design , Web app development , Mobile app development , Custom software development

United States of America

Insurance , InsurTech

Business challenge

BriteCore first partnered with DICEUS to build an internal administrative cash flow management and budgeting app for BriteCore. After the initial project was complete, BriteCore invited DICEUS to participate in BriteCore’s Community Code Contribution program where the team continues to provide overflow capacity and support to BriteCore engineers. Through the program, DICEUS engineers work alongside BriteCore engineers to develop multiple enterprise-level products (modules) including BriteQuote, BriteApps, and BriteDocs.

Technical challenges

DICEUS helped develop mobile and desktop solutions that seamlessly integrate with the BriteCore platform. All solutions had to be fully customizable to meet carrier needs and interoperable with other BriteCore products.

Solution delivered

First, DICEUS created an internal budgeting application in Python and adopted new data transformation processes according to specific customer needs. Next, we contributed to the development of three BriteCore products: BriteApps are mobile and desktop BriteCore products that can be tailored and branded according to the carrier’s needs. BriteQuote provides configurable pages, fields, and components to create quoting wizards for different lines of business. The solution is interoperable with other BriteCore modules. BriteDocs is a new, standalone document management system designed to handle documents throughout the insurance lifecycle.

Key features

BriteApps policyholder portal

Provides a new digital channel for policyholders. Available for mobile and desktop; it can be tailored by the insurer to reflect their logo and company color scheme. The portal itself has the following capabilities:

Claims management

Policy documents

Payment processes

View insurance provider

View messages

BriteApps administrative portal

Manages BriteApps administrative processes within the company including user settings, application monitoring, and control

Enrolled user management

Access rights management

Activity monitoring

Messaging to one or multiple users

Paperless document delivery

Customizing your applications

BriteApps message center

Enables insurers to send messages to a single user or to all users. Text can be translated into the user’s preferred language. Supports emails, in-app messages, and push notifications.

BriteQuote configuration

Enables the creation of quoting wizards that allow agents to perform a sequence of steps to make a quote. The quote wizards are fully configurable by lines of business, role, transaction type.

BriteQuote pages & components

Controls the display of information for agents over single or multiple pages and the ability to move through the pages and display data in pre-defined places.

BriteDocs stock & custom templates

Supplies stock and custom templates to use throughout the insurance lifecycle.

BriteDocs data aggregation

Acts as a data aggregator for claims, policies, quotes. This data can be transformed and inspected easily, as well.

Value to our client

Enhanced user experience.

The BriteApps portal equips policyholders with a new digital channel to access their documents and perform payments or enroll autopay, eliminating the requirement for in-person interaction.

Efficiency gains & cost savings

Self-service capabilities in BriteApps enable policyholders, agents, and the insurer to communicate and transact business more efficiently and conveniently, enabling more process automation, reducing cycle times, and driving costs down.

Higher mobile security

Instead of using passwords, mobile users are now able to use face recognition, touch ID, or fingerprints for authentication.

Improved communication

All the communication goes through the message center that provides capabilities for text messages, push notifications, in-app messages, emails.

Our tech stack

Client feedback

The DICEUS team has consistently supported the BriteCore team for many years. Their engineers are well-educated and highly invested in the ongoing quality of the BriteCore platform with sustained relationships that extend over four years. We appreciate everything the DICEUS team brings to the table as a development partner.

Phil Reynolds, CEO, BriteCore

Software solutions bringing business values

100% data privacy guarantee

USA (Headquarters)

Faroe Islands

Hey there! This website uses “cookies” to give you best, most relevant experience. Please accept cookies for optimal performance. Read more

Team composition:

Client name:

Expertise used:

Services provided:

- Executive Search Services

- Insurance Recruiting

- Temporary Staffing

- Contingent Workforce Solutions

- Project Solutions

- Subject Matter Experts - Consulting Alternative

- Customized Talent Solutions

- Insurance Careers

- Search Our Insurance Jobs

- Why Work with Us

- Our Benefits

- Sign In / Join Our Talent Network

- Corporate Careers

- The Career Catalyst Blog

- Mission, Vision, Values

- Corporate Responsibility

- Corporate Citizenship

- News and Events

- Latest Insights

- The Jacobson Journal Blog

- Newsletters

- Insurance Labor Market Study

- The Insurance Talent Podcast

- CASE STUDIES

- FIND A CONSULTANT

Insurance Consultant Case Studies

GET TALENT NOW

Recently completed projects.

Life Actuary Life Insurance Company

Impaired Risk Underwriter Protective Life Insurance Company

GAAP Year-end Reporting Expert Financial Company

Rate Filing Support Health Plan

Valuation Actuary Reinsurance Group

- Executive Search

- Subject Matter Experts

- Customized Talent Solution

- News And Events

- Industry Insights

- The Jacobson Group 190 South LaSalle Street, Suite 2850 Chicago , IL 60603 | USA + 1 (800) 466-1578

- Terms and Conditions

- Privacy Policy

- Research note

- Open access

- Published: 10 September 2022

A case study of adapting a health insurance decision intervention from trial into routine cancer care

- Miles E. Charles ORCID: orcid.org/0000-0001-8381-6803 1 ,

- Lindsay M. Kuroki 2 ,

- Ana A. Baumann 1 ,

- Rachel G. Tabak 3 , 4 ,

- Aimee James 1 ,

- Krista Cooksey 1 &

- Mary C. Politi 1

BMC Research Notes volume 15 , Article number: 298 ( 2022 ) Cite this article

3037 Accesses

3 Altmetric

Metrics details

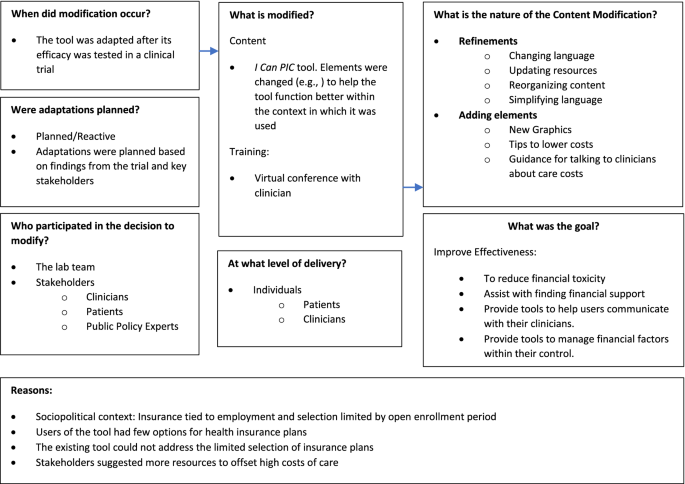

This study adapted Improving Cancer Patients’ Insurance Choices ( I Can PIC), an intervention to help cancer patients navigate health insurance decisions and care costs. The original intervention improved knowledge and confidence making insurance decisions , however, users felt limited by choices provided in insurance markets. Using decision trees and frameworks to guide adaptations, we modified I Can PIC to focus on using rather than choosing health insurance. The COVID-19 pandemic introduced unforeseen obstacles, prompting changes to study protocols. As a result, we allowed users outside of the study to use I Can PIC (> 1050 guest users) to optimize public benefit. This paper describes the steps took to conduct the study, evaluating both the effectiveness of I Can PIC and the implementation process to improve its impact.

Although I Can PIC users had higher knowledge and health insurance literacy compared to the control group, results were not statistically significant. This outcome may be associated with systems-level challenges as well as the number and demographic characteristics of participants. The publicly available tool can be a resource for those navigating insurance and care costs, and researchers can use this flexible approach to intervention delivery and testing as future health emergencies arise.

Introduction

JL is a 66-year-old patient with progressive, recurrent ovarian cancer whose clinician recommended that she start on a targeted, oral cancer therapy based on genomic testing of her cancer. A month after receiving this recommendation, JL received a “summary of benefits” from her insurance company reflecting she owed a $3000 USD co-pay for a 30-day supply of this targeted therapy (the goal was to continue this therapy until her disease no longer responded to it, or she had intolerable side effects; her clinicians estimated this might take 1–2 years). As a full-time employed nurse, JL had health insurance. However, she did not qualify for the industry-sponsored financial assistance drug program because her annual income was slightly ($3500) over the allowed threshold. She would have to spend down 3% of her income on prescriptions that year in order to receive 100% coverage for the medication. Furthermore, because she had both government-sponsored and private insurance, her government-sponsored insurance made her ineligible for a “co-pay card” sponsored by the pharmaceutical company. JL was extremely distressed about this financial strain and considered whether and how she could take this therapy recommended by her doctor.

JL, like many under-insured patients, was inadvertently overlooked by her oncology team to be at risk for what scholars refer to as “financial toxicity,” or the material and psychosocial hardship from high costs of care. Yet, as many as 64% of patients report financial hardship following a cancer diagnosis [ 1 ], and many face barriers, like those described above, that prohibit affordable access to needed cancer therapies [ 2 , 3 ]. We use this case study to describe the critical steps we took to adapt and implement a health insurance decision intervention for cancer patients and survivors like JL, while balancing intervention testing and adaptation with real-world needs during a global pandemic.

Evidence supporting the intervention and the need for adaptation

Improving Cancer Patients’ Insurance Choices ( I Can PIC) is an interactive online decision tool originally designed to help cancer patients, like JL, think through their health insurance choices and identify ways to offset high costs of cancer and survivorship [ 4 ]. It provides tailored cost estimates across insurance plan types based on demographic and health characteristics and provides financial support resources.

In a randomized controlled trial of I Can PIC compared to an attention control group where participants were given an alternative intervention: a handout that lists financial resources along with brief definitions of health insurance terms, I Can PIC users knew more about health insurance and were more confident understanding insurance terms [ 4 ]. However, many I Can PIC users reported that their employer-based and marketplace insurance gave them limited choices [ 4 ]. This implied the potential to better align the tool within the current insurance landscape, even if it required adaptation before meeting all of its goals [ 5 ]. Therefore, the team elicited feedback from clinicians, patients, and policy experts on ways to emphasize using health insurance rather than focusing mostly on choosing health insurance (Additional file 2 : Table S1). This paper describes the adaptation process of I Can PIC to achieve these goals.

Intervention adaptation process

We used two guides to structure the adaptation process. The Iterative Decision-making for Evaluation of Adaptations (IDEA) decision tree informed the process of adaptation [ 6 ], and the Framework for Reporting Adaptation and Modifications-Expanded (FRAME) guided the tracking of adaptations (Fig. 1 ) [ 7 ]. To start the adaptation process, we first identified the core elements of the intervention that improved outcomes: health insurance educational resources, cost-of-care conversation guidance, and resources to offset costs which are critical to patients like JL (Additional file 1 : Fig S1). During this iterative process, we then added new elements to I Can PIC and made content, format, and functional improvements based on stakeholder feedback and the original trial results (Additional file 2 : Table S1).