To read this content please select one of the options below:

Please note you do not have access to teaching notes, mobile banking adoption: a systematic review.

International Journal of Bank Marketing

ISSN : 0265-2323

Article publication date: 28 December 2020

Issue publication date: 19 March 2021

This study is a systematic review of mobile banking services. Its main objective is to provide a state-of-the-art review of this particular growing type of services. It inventories and assesses the most significant determinants of and barriers to consumers' adoption of mobile banking. Moreover, it identifies the most common consequences of this adoption.

Design/methodology/approach

By using three major academic databases (ABI/INFORM global, Web of Science and Business Source Premier), this paper selected 76 manuscripts and produced a systematic review that exposes the main theories, conceptual frameworks and models used to explain consumers' adoption of mobile banking.

The results show that the TAM (technology of acceptance model), followed by the UTAUT (unified theory of acceptance and usage of technology), are still the main conceptual frameworks and models adopted and adapted by scholars to explain consumers' use or intention of using mobile banking. Using the vote counting method, a myriad of antecedents and consequences that are frequently used in the literature of mobile banking are reported. These were categorized into five main perspectives: (1) m-banking attributes-based perspective, (2) customer-based perspective, (3) social influence-based perspective, (4) trust-based perspective and (5) barriers-based perspective.

Originality/value

An integrated model regrouping and relating the five perspectives is proposed, leading to intriguing implications for both academics and practitioners.

- Systematic review

- Mobile banking

- Antecedents and consequences

Souiden, N. , Ladhari, R. and Chaouali, W. (2021), "Mobile banking adoption: a systematic review", International Journal of Bank Marketing , Vol. 39 No. 2, pp. 214-241. https://doi.org/10.1108/IJBM-04-2020-0182

Emerald Publishing Limited

Copyright © 2020, Emerald Publishing Limited

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

The Adoption and Impact of Mobile Banking in Kenya

Tavneet Suri ’s research investigates more closely the remarkable rise of M-PESA, the mobile banking service that has spread rapidly across Kenya.

This project will further clarify the impact and influence of M-PESA. As only a small fraction of Kenyans are banked, and given the high costs of transferring money by non-bank means, M-PESA promises to deliver a wide range of financial and cash-management services to a broad swath of people. Until now, these services had been severely limited in their reach.

More than 30% of adult Kenyans now use M-PESA since its introduction in 2007. By employing simple SMS technology and the established communication network of the dominant cell phone company, Safaricom, M-PESA allows for significant sums of money to be stored in phone-based accounts and sent to other users around the country. Deposits and withdrawals can be made through “agents.”

In 2008, Suri helped to lead a survey of 3,000 households, almost half of which were M-PESA users and agents. Her CFSP research project follows up on that investigation with further surveys that inquire about a range of compelling issues.

Research Questions:

- What is the impact of the technology on savings behavior, consumption, risk smoothing, remittances and other financial decisions?

- How does M-PESA change the network of people with whom individuals interact with financially and their decisions about such things as internal migration?

- How has the use of technology spread over time and geographically? What determinants of adoption patterns can we isolate?

- How well do agents manage their cash inventories?

- More broadly, how important are financial intermediation services for individuals in a developing economy like Kenya’s?

Data Notes:

Survey Time Frame and Rounds:

- Start six-month interval surveys, (northern) Summer of 2009

- Second survey, January 2010

- Third Survey, July 2010

- Experimental component of survey, Fall 2009-Fall 2010

- Micro entrepreneurs

Survey size: 4,700 (3,600 households, 500 agents, and 600 micro entrepreneurs [300 assigned to the treatment and 300 to control]). Sample: Households and agents from districts of Kenya with at least M-PESA agents as well as 600 micro entrepreneurs.

Intervention:

- Provide incentives for customers of M-PESA to accumulate savings on the M-PESA account by making payments comparable to markets rate of interest on balances held in the accounts and by subsidizing transaction costs of making deposits and withdrawals.

- Make payment reimbursing half of the transactions costs incurred, to more closely mimic conditions that might be present in a more competitive system.

Financial Sector Deepening (FSD) Kenya

An official website of the United States government

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- Publications

- Account settings

Preview improvements coming to the PMC website in October 2024. Learn More or Try it out now .

- Advanced Search

- Journal List

- Front Public Health

Analyzing the Effect of People Utilizing Mobile Technology to Make Banking Services More Accessible

Associated data.

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author/s.

Many firms in the modern world utilize m-banking systems to communicate with their consumers. The word m-banking refers to a widespread method of providing financial services and localization to customers. Since m-banking is important to both banks and users, it has been included in numerous literary works. As a result, embracing financial services via the m-banking platform is critical. This article's technique is mostly descriptive research that investigates common views, current situations, modern tactics, tangible emerging consequences, etc. The main objective here is to analyze the benefits of this study by investigating the past. Since this article analyzes what exists and is descriptive, the data is being retrieved by conducting a cross-sectional survey method about different features that are relevant by sampling the population. The main aim of this study is to explore the adoption of mobile banking technology by consumers. Based on the values of different variables such as affective commitment (AC), transaction convenience (TC), perceived ease of use (PEU), perceived reliability (PR), pre and post benefits (PPB), service, system, and information quality (SSIQ), bank trust (BT), and profitability (P), the inter-relationship between them and the adoption of m-banking technique by the users in banking technology. The model is investigated by examining the hypothesis and identifying the relationship that exists between these different parameters. A simple linear regression method is implemented using the Statistical Package for the Social Sciences (SPSS) software.

Introduction

Nowadays, mobile technology plays a vital role in many industries such as banking on managing stocks and finances, business firms sell their products through applications and websites. Mobile banking services such as payment systems influence people's lives more dramatically than other innovations in the recent times ( 1 ). Mobile technology made banking services such as payment, transaction, and other services easy through the online mode instead of offline mode. Even the adoption of mobile banking services increased day-by-day by the consumers, still mobile payments do not become ordinary to many of the public ( 2 ). Due to the growth of mobile network technology, there is a need for security infrastructure for mobile payments. The security measures give trust to the consumers to adopt mobile banking at anytime from anywhere.

For achieving a successful outcome in business, mobile technology is recognized as competitive and creative equipment that provides better online transaction options ( 3 ). Recently, cellphones are being widely used as a tool by people for online shopping, banking, paying bills, etc. Our day-to-day routine lives have been changed through the adoption and development of mobile technology that modifies the way of communication, approaches for selling and buying goods and services, and also the mode of information collection. Such corresponding correlation arises in a constructive environment that has no limitation regarding the time or place ( 4 ).

The rapid development in mobile technology and the protection framework facilitate the people to perform m-banking transactions at any time from anywhere, whereas m-banking comprises financial service which is implemented directly or indirectly over a network of wireless telecommunication ( 3 ). In the financial sector, the services applied by mobile are referred to as mobile financial services (MFSs) they also include mobile banking and mobile payment. Several studies were conducted to examine the peoples' mindset in view of understanding the mode of adopting mobile banking as a unique and usual service ( 5 ). According to the statistics, the level of usage of smartphones has increased from 35 to 80% in 2020, also worldwide, the number of mobile phone beneficiaries is about 6.8 billion, though each mobile was fully activated with the internet. Thus, mobile banking helps in the development of bank access rates which influences bank perception ( 6 ). In the banking sector, it is observed that most of the customers have switched to smartphone, apps, or tablets which are highly utilized in their day-to-day life for shopping, entertainment, learning, socializing, and jobs, and these mobile-centric customers are preferred by more bankers ( 7 ). For example, a bank in Japan, Jibun Bank whose principal communication with customers is through the mobile channel and was the first bank that affords their complete banking services and products over mobile channels. With the help of cameras and mobile phone, customer has the facility to start a new account with their bank. This mode of banking enables the bank to improve their customer service over anywhere at any time basis. Also, the different mobile banking services are payment, web-related shopping, fund transfer, and web-related marketing. This Jibun Bank has reached more popular for its efficient services within the short duration of their mobile banking introduction ( 8 ). Through this, they have attained above 500,000 new bank accounts in their bank. In the initial days, the bank had the facility to send usual text messages related to money transfer and withdrawal and these services were updated to provide its customer a complete functional banking experience ( 9 ).

Mobile banking is adopted by many consumers as it is easy to open an account, pay bills, transfer funds, do mobile-based shopping, etc. Many banks in China and America who introduced mobile banking for all their services experienced high demand for their services through mobile banking ( 10 ). But many challenges were faced by these banks due to no face-to-face interactions. Trust is an important factor in mobile banking but lack of interaction led to the risk of uncertainty and anonymity. On the other hand, the consumers also suffer from uncertainty whether the bank is trustworthy are not.

During the last decades, mobile banking became relevant all over the world. The number of fund transfers through mobile banking also increased since last year, but mobile banking has many security problems. Sometimes, the security setting of mobile phones can be overridden by the virus in smartphones ( 11 ). Many banks open their banking applications, these apps should be updated frequently otherwise the consumers can be vulnerable to the attacks such as DDoS attacks, phishing, spoofing, corporate account takeover, and skimming ( 12 ).

The major contribution of the article is:

- To analyze the benefits of this study by investigating the past.

- To explore the adoption of mobile banking technology by consumers.

The remaining article is arranged accordingly. Section Literature Review presents the related work and the hypothesis is formulated in Section Hypothesis Development and Research Methodology. The results in terms of linear regression and descriptive analysis are provided in Section Results and the article is concluded in Section Conclusion and Discussions.

Literature Review

In the modern world, many firms use systems of mobile banking to communicate with the customers. The payment system in mobile banking services benefited people's lives. This article aims to analyze the effect of people using the technology of mobile to make banking services more accessible. Literature on mobile banking adoption, electronic banking services, mobile payment service user acceptance are reviewed.

Hamidi et al. ( 13 ) studied the influence of mobile banking adoption on consumer engagement and satisfaction utilizing the customer relationship management (CRM) system, which is the most essential aspect in banking industry. CRM is also seen as a critical role for enhancing client satisfaction in mobile banking. The statistical study performed evaluated the dialogue between the bank's customer sector and their client. The statistical analysis findings have a favorable influence on consumer interactions and satisfaction.

Geebren et al. ( 14 ) investigated the importance of consumer satisfaction in mobile eco-systems that used electronic banking services, particularly in developing nations. This entailed researching consumer satisfaction in mobile banking, with a focus on the importance of trust. To determine consumer satisfaction, structural modeling using partial least squares (PLS–SEM) methods were employed to examine the data, and trust demonstrated that customer contentment had a beneficial influence.

The relevance of an early trust theoretical model in mobile payment service user acceptance was highlighted by Gao et al. ( 15 ). The initial trust theoretical model highlighted the facilitators and barriers to user trust in m-payment services. The links in the original trust theoretical model were assessed using partial least squares structural modeling (PLS–SEM). The findings may be used in m-payment adoption research and practice in a variety of ways. In total, 52.3% of the difference in usage intention was explained by the current model.

Hentzen JK et al. ( 16 ) offered a mobile technology that allows for vital involvement, as well as an explanation of how a retirement app might assist people in planning for their post-retirement strategy. The available literature survey data were used to evaluate a sample of 440 Australian pension fund members. The findings show that consumers' perceived financial security, financial self-efficacy, retirement planning involvement, future consequences consideration, and perceived usefulness with a mobile retirement app have direct and indirect effects on their expected engagement through their goal to adopt the app.

Zhu et al. ( 17 ) investigated existing technology designs, including mobile banking, used by rural communities in six Chinese regions. According to the findings, interpersonal and mass communication channels have a bigger influence than organizational communication channels. Mobile banking should be examined since it can assist alleviate the lack of access to financial goods and financial infrastructure in rural areas.

Afeti et al. ( 18 ) developed a mobile payment technology for payment for micro-businesses. The study draws on the transaction cost theory and the task-technology fit (TTF) theory as the assumed lens. In total, 20 micro-businesses based on qualitative data were analyzed and the research findings denote those micro-businesses adoption of mobile payments results in strategic and operational benefits.

Alamoudi et al. ( 19 ) proposed that the mobile technology acceptance lookalike was changed as we investigated consumers' acceptance of mobile shopping in general stores by examining transaction convenience, usefulness, attitudes, ease of use, transaction speed, optimism, and personal innovativeness. A total of 351 respondents completed the questionnaire evaluation. Consumers are willing to use mobile shopping channels if the system is clear and straightforward to use.

Jebarajakirthy et al. ( 20 ) used a comprehensive moderated mediation framework to evaluate the influence of online convenience aspects on mobile banking uptake. Covariance-based structural equation modeling and the process macro are utilized to test these predictions. This study examines how convenience characteristics influence mobile banking adoption intentions.

Abdinoor et al. ( 21 ) studied the adoption of mobile financial services in Tanzania with the use of a technology acceptance model. To select the sample from data collection, a random sampling technique was used. The user and non-user of mobile financial services were included in the sample. Zhang et al. ( 3 ) investigated customers' use of mobile technology to help them with banking services and activities, as well as the variables that impact their adoption and engagement. Here, the analysis is done by the structural equation modeling technique to know the consumers' intentions toward mobile banking. The result examines the adoption of mobile banking apps to facilitate bank consumers' banking services.

Tiwart et al. ( 22 ) researched the variable that influences adoption in Commercial Bank Ethiopia. The author used factors such as perceived ease of use (PEOU), infrastructure (INF), security (SEC), trust, and e-banking adoption. Here, a structural equation model based on least partial square analysis is used. The result of this analysis proves that the trust of customers mediates between PEOU, INF, SEC, and e-banking adoption and realized the factors that guess the purpose and adoption of e-banking by Ethiopian customers.

The problem identified in mobile banking services is critical financial services through mobile banking because it has security problems.

Hypothesis Development and Research Methodology

Participant's demographic information.

This study is mainly conducted in China by taking the top e-banks that utilize m-banking. The questionnaire is distributed to both the users and staff of the bank. Within 6 months, 293 questionnaires were completed. These details were taken into consideration in this study. The details of the questionnaires were obtained online and also provided to the users on their official bank pages. The information obtained in the questionnaire is provided in Tables 1 , ,2 2 .

Demographic analysis.

Participant details.

Participant Details

The information of the customers is mainly obtained based on their m-bank usage. The five main banks such as state-owned, joint-stock, postal savings, commercial city bank, and the agricultural bank were selected. Each participant was asked to say about their experience of their usage.

The amount of time spent by each user on average is provided in Figure 1A . As seen in Figure 1A , more than 39.38% of users are using more than 3 h a day and a minimum of is online Conceptual Model for less than 1 h. In total, 8.21% of the users only use the application for a limited amount of time (below 30 min).

Usage analysis of m-banking application (A) Users using m-banking during the day and (B) users' friends and references using mobile banking.

Figure 1B presents the percentage of people the users have referred for mobile banking. Based on Figure 1B , a total of 48.52% has more than 100 contacts who have been referred to the m-banking. The increase in m-banking contact can improve efficiency.

Conceptual Model

The main aim of this research is to identify the usage of mobile technology of consumers for the banking system. The hypothesis provided for each variable is explained in detail in this section and the conceptual model is provided in Figure 2 . The measurement instrument used for this study is presented in Table 3 .

Conceptual modeling structure.

Measurement instrument to analyze different parameters.

Hypothesis Modeling

Service, system, and information quality (ssiq)".

System quality mainly measures the efficiency of the overall m-banking system in terms of service provider anonymity. The system quality of the m-banking mainly depends upon the ease of use, the attractiveness of the application, trust of the user, etc. If the user trusts the system quality, then they mainly select the system for future transactions. Service Quality mainly relies on the service provided by the m-banking system and it also evaluated the effectiveness of the service in terms of personalization, reliability, delay, etc. Hence, service quality is crucial to improve the quality of m-banking since poor-service quality can result in minimal user trust and satisfaction. Information quality mainly implies that high-quality information is reliable, complete, accurate, relevant, and accessible. The information quality is an important variable that improves the usage, trust, and satisfaction of the customers in the m-banking system.

Hypothesis (H6): The service, system, and information quality had a positive relationship in improving the m-banking quality and user satisfaction.

Affective Commitment

Affective obligations between business partners reflect mental reliance on others and are founded on emotions, loyalty, and dependency. The psychological bond in this example demonstrates an emotional commitment. Support for differences in particular data among new and long-term clients. Based on their differing expectations, new and loyal clients behave in the same way.

Hypothesis (H1): The interaction of customers helps to develop a good relationship with the affective commitment of a person to the bank which is focused on interaction.

Pre- and Post-benefit Convenience

The time and attempt to acquire some benefits of services is said to be benefit convenience. Some of the components of benefit convenience are fast service, timely services, and bank employee attitudes. Sometimes in banks, the consumer needs to visit repeatedly to avail specific service. But in m-banking, consumers can avail any services on the go from the home itself. So, the time and attempt to acquire the service became very easy. Therefore, benefit convenience shows a positive result in mobile banking adoption ( 23 ). The time and attempt to contact a service provider for a particular service is said to be post benefit convenience. In m-banking, the service provider can be contacted and solve the grievances within a few clicks through various means such as email, live chat, and toll-free numbers. But in offline banking, the consumer needs to visit the branch and wait for the service provider to solve the problem in service. So, the post benefit convenience shows a positive result in mobile banking adoption ( 20 ).

Hypothesis (H5): The pre- and post-benefit convenience are positively interrelated with m-banking.

Transaction Convenience

The fast and simple way to complete the transaction is said to be transaction convenience. Acquiring the service of transaction in a lesser time is the main component of transaction convenience. Other components of transaction convenience are uninterrupted transaction, transaction confirmation, easy checkout, and price inconsistency. By using m-banking, the transaction can be done in any place at any time in a few clicks and can do several transactions simultaneously. But in offline banking, consumer needs to wait in a queue for availing a transaction service. Hence, transaction convenience shows a positive result in mobile banking adoption ( 24 ).

Hypothesis (H2): The transaction convenience is positively interrelated with m-banking.

Profitability

Customer participation in an organization's mobile banking may increase customer value and profitability ( 25 ).

Hypothesis (H8): Profitability shows positive results in mobile banking adoption.

Perceived Reliability

Perceived reliability is specified as the limit to which the individual has independently considered the technology as a faithful one. In order to offer a trustworthy technical service, the system reliability is important that enables the user to attain the aimed objective. An undependable technology that is employed by an individual seems to be low confidence and such technology utilization should be restricted ( 26 ). Research related to mobile technology and information system has revealed that a technology with perceived reliability possesses has an important impact on customers' perceived satisfaction, detected value, and observed quality. Also, customers' understanding level of trust is examined and analyzed as an antecedent of confidence in an organization through the mobile commerce setting. Though mobile is a wireless technology, it is easily susceptible to violations or attacks ( 27 ). Mostly, the customers were insisted to share their personal data while consuming and shopping services performed through mobile technology such as date of birth, debit and credit card details, funds, and address. The reliability of mobile technology should be improved thereby increasing customers' belief in securing their personal data. The postulated hypotheses are mentioned as follows:

Hypothesis (H4): Perceived reliability in m-banking helps to improve the consumer's trust and ease of use of banking services.

Banking Trust

In this hypothesis, trust is considered as a faith of competence, integrity, ability, and benevolence that the individual has toward each other. Trust has become an important reducing feature of risk, whereas the e-commerce connection is considered as a naturally risky factor ( 28 ). Also, trust in banking is specified that it is linked to reliability and perceived privacy. Generally, the primary interaction between the customer and banker will significantly affect the trust progress in them.

Hypothesis (H7): Based on their usage of mobile devices and attitude, the consumer trust toward M-banking increases.

Perceived Ease of Use (PEU)

Perceived ease of use evaluates the increase in the amount of work required to acquire a job utilizing new technologies on an individual basis. In the effort condition, the simplicity of use of mobile innovation is critical for including customers in the co-creation of value experiences ( 29 ). Mobile technology's ability to increase advantages for bank clients has been widely shown, and its simplicity of use is a key factor in consumer acceptability. PEU has been linked to advanced tackling new technologies in the banking industry in several research. However, the launch was difficult, and it was claimed that customers' inclination to utilize mobile banking services is not intrinsically related to employment prospects. As a consequence, it indicates that study into PEU and its influence on consumer attitudes, as well as the interactive method, are both worthwhile endeavors ( 30 – 32 ).

Hypothesis (H3): Customers' views about the usage of mobile devices for facilitating financial services are favorably associated with their perceived ease of use (PEU).

Scale Validity and Reliability

The reliability of the scales was assessed using Cronbach's alpha values. Goodness-of-fit approaches were used to assess the overall model fit for confirmatory factor analysis (CFA). The RMSEA was 0.09, the comparative fit index (CFI) was 0.99, the goodness-of-fit (GFI) was 0.98, and the standardized root mean square residual (RMR) was 0.06. The X2 to df ratio was 4.14, the root mean square error of approximation (RMSEA) was 0.09, the CFI was 0.99, the GFI was 0.98, and the standardized RMR was 0.06. As indicated in Table 4 , the reliability coefficients of all constructs were more than 0.87, which is higher than the 0.9 thresholds. The extracted average variance was used to assess convergent validity (AVE). Because the AVE values ranged from 0.58 to 0.92, convergent validity was not an issue. The AVE scores were lower than the squared correlations between pairs of constructs, indicating discriminant validity in the data set. Table 4 shows the results of the Cronbach's alpha and AVE tests.

Hypothesis testing.

Linear Regression Test

Regression tests are run when the allowable alpha coefficient for the scales has been determined. Table 5 shows the regression test results for each of the assumptions discussed in the following sections. Affective commitment (AC) and interaction were investigated, and the correlation coefficient 0.297 and likelihood of significance 0.000 indicate that there is a positive and significant relationship between the two. The regression test supports this positive relationship, showing that the interaction variable may be able to predict AC variation.

The results of the linear regression test.

With a correlation value of 0.333 and a probability of significance of 0.000, the following test demonstrated a positive relationship between perceived ease of use and satisfaction (PEU). The correlation coefficient between the variables perceived reliability (PR) and interaction was 0.172, with a probability of significance of 0.000, demonstrating a positive link between the two variables. The correlation value of 0.430 and the probability of significance of 0.000 indicated a positive relationship between satisfaction and service, system, and information quality (SSIQ) ( 3 ).

Descriptive Data

The items in this questionnaire were answered using a five-point Likert scale, with the alternatives being: very low (1), low (2), medium (3), high (4), and very high (5). Table 6 shows the SD, middle value (MV), and lowest value (LV) of the descriptive data received from the surveys ( 3 ).

Descriptive data analysis.

Conclusion and Discussions

Mobile banking is a cost-effective way to reach customers. The different activities that can be performed by the consumers in m-banking are checking their bank balance, making transactions, making investments, getting account statements, paying bills, etc. The motivation for user adoption and use of mobile banking is examined in this research. Positive connections between profitability, trust, and transaction convenience to utilize mobile banking have been found in previous studies. Users' confidence in using mobile banking services, enjoyment, utility of the system, etc., are not the same thing. The participants were unconcerned about the danger of fraud, system dependability, or perceived privacy while building and extending faith in their banks and mobile services. Because of today's technology-driven lifestyle, individuals are receptive to embracing new technologies that are compatible with their mobile phones.

To add value to practice, we must obtain convincing and widespread results from both users and mobile banking service providers. Like mobile phones, smartwatches have become more popular among people nowadays. With this wearable technology, banks have the greatest responsibility to fulfill hedonic and social needs. The purpose and use of this research are common to all consumers irrespective of various countries, populations, and socio-economic status. The variables used in this work are, namely, affective commitment (AC), transaction convenience (TC), perceived ease of use (PEU), perceived reliability (PR), pre- and post benefits (PPBs) service, system, and information quality (SSIQ), bank trust (BT), and profitability (P). Consumer behavior such as untrustworthiness, fraudulence, and so on, as well as mobile banking transaction risks such as financial, privacy, and cyber security, are important risk concerns that may be addressed in future research developments.

The problems and risks that arise by the consumers and banking sector for adopting mobile banking services would be reduced by the scientific researchers using various technologies and methodologies in the future. The results in this article show the different statistical surveys and believed that it is true for both mobile banking consumers and non-mobile banking consumers with various socioeconomic environments. But when we consider globally each country had its own rules and regulations regarding mobile banking transactions, services, and products. And these rules and regulations react differently in different countries.

Data Availability Statement

Author contributions.

Both authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

- Browse All Articles

- Newsletter Sign-Up

BanksandBanking →

No results found in working knowledge.

- Were any results found in one of the other content buckets on the left?

- Try removing some search filters.

- Use different search filters.

Suggested Keywords

Businesses & Institutions

Global Research and Market Insights

Candace Browning

Head of BofA Global Research

March 24, 2024

Must Read Research: Changing the Game

This week we discuss the shift to Emerging Markets (EM), play-by-play from the 2024 Global Industrials Conference and 30 breakthrough technologies that can change the game.

Also featuring commentary from Global Economic Weekly

Global trends need global vision

Each week, our analysts discuss what’s emerging in global markets on the Global Research Unlocked™ podcast.

Featured content

10 Macro Themes for 2024 – Breadth in rate cuts and markets

We identify 10 macro themes across global economics and strategy and provide our year ahead outlooks.

It’s not just research. It’s results.

We are honored to be named #1 in the All-America Research Team survey on Oct 24, 2023, collected during the polling period of May 30 – June 23. Read more for details and methodology.

Around the world in 5 questions

The world economy is going through significant structural changes after many years of smooth globalization dynamics.

Delivering the energy transition

The planet is warming but challenges hinder efforts to tackle climate change. We outline obstacles to the energy transition.

Artificial Intelligence…Is Intelligent!

We are at a defining moment – like the internet in the ‘90s – where Artificial Intelligence (AI) is moving toward mass adoption.

See the latest from Bank of America Institute

Uncovering powerful insights that move business and society forward.

About Global Research

Our award-winning analysts, supported by our BofA Data Analytics team, provide insightful, objective and in-depth research to help you make informed investing decisions. We service individual investors and a wide variety of institutional money managers including hedge funds, mutual funds, pension funds and sovereign wealth management funds.

BofA Mercury®

Insights and tools to help optimize your trading strategies. Sign in to BofA Mercury®.

Combining Childhood Education and Nutrition to Cultivate Bright Futures in Senegal

Khady Coulibaly, volunteer teacher, and her students at a community preschool classroom.

Photo credit: Ousseynou Ndiaye, Project Implementation Unit (PIU), Ministry of Family.

Key Highlights

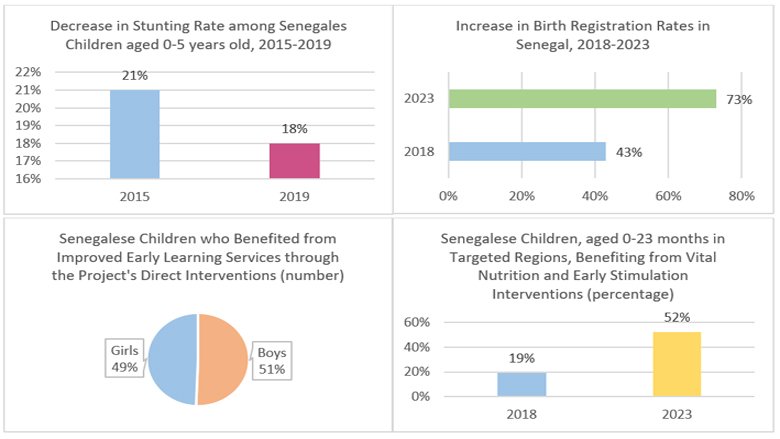

- Early childhood interventions benefited 14 million mothers and children in Senegal between 2020 and 2024.

- More than 10 million children aged 0 to 23 months in targeted regions benefit from vital nutrition and early stimulation interventions between 2020 and 2024.

- Early childhood interventions resulted in a decrease in stunting from 21 percent to 18 percent (2015-2019), as well as an increase in birth registration from 43 to 73 percent (2018-2023).

- An estimated 92,300 girls and 94,500 boys benefited from improved early learning services.

- With the help of 900 religious leaders, the National Nutrition Enhancement Program (CNDN) developed a key initiative to advocate for increased investments and parental involvement in early childhood development.

- Multi-sectoral collaboration involving national agencies, ministries, and technical partners has been crucial for effective implementation.

Addressing the multifaceted issues of poverty and inequality in Senegal, as in West Africa as a whole, represents a critical development challenge. Senegal currently ranks in the lowest quintile of the Human Development Index (HDI), ranked 170 of the 190 countries surveyed 1 , with 9.2 percent of the population living on less than $2.15 a day. While poverty figures are lower than some neighboring countries, such as Mali (15 percent), Guinea (14 percent), and Guinea Bissau (22 percent), they underscore the substantial hurdles facing the region. Rural areas in Senegal bear a disproportionate burden: they contain just over more than half the population (53 percent) but are home to 80 percent of chronically poor and vulnerable households. The impact is particularly severe on young children, as 85 percent of the poorest households have children under the age of five, and poverty adversely affects their nutrition, health, and education 2 .

Regarding nutrition, a significant proportion of infants, 64 percent, are not exclusively breastfed, and 93 percent of young children do not receive a minimum acceptable diet, thus hampering their growth and educational prospects. The gravity of the situation poses a threat to Senegal's achievement of key Sustainable Development Goals (SDGs).

In the education sector, despite a significant increase of over ten percentage points between 2000 and 2020, the proportion of children attending pre-school is still low compared to the regional average, with a rate of 18 percent for girls and 16 percent for boys in Senegal. This compares to an average of 24 percent for both sexes in the West and Central Africa region 3 . Thus, pre-school education reaches a small proportion of the country's school-age population; it is primarily a concern of the middle- and upper-income classes, who live in cities and see the benefits of pre-schooling for their children's success. Additionally, in both rural and urban areas, many parents prefer to give their children a religious education from an early age.

Despite Senegal's robust economic growth—consistently surpassing 6 percent annually from 2014 to 2020—inclusive development remains a challenge. Although government spending on social sectors averages 30 percent, there is a discernible gap in translating economic growth into widespread prosperity. The presence of a fragmented institutional framework and the lack of strong leadership compounds the complexities faced in achieving sustainable and inclusive development in Senegal. Difficulties in making progress spurred engagement with multiple actors and cross-sectoral coordination to tackle underlying challenges.

Aligned with the government’s Plan Senegal Emergent, and its Second Priority Action Plan (2019-2023), the World Bank's strategic focus emphasizes early childhood interventions, expanding access to services in marginalized rural and peri-urban areas, and enhancing the efficiency and transparency of governance institutions and social protection systems. The Investing in Early Years for Human Development Project support to this plan is twofold, involving support to both the education and nutrition sectors.

The Investing in Early Years for Human Development Project builds on the Investing in Maternal, Child, and Adolescent Health (ISMEA) Project, a World Bank initiative supporting maternal and child health services. Both projects have divided geographic regions during the same time period to ensure widespread coverage, implementing consistent early nutrition and stimulation activities nationwide. This collaborative approach aims to enhance the impact and reach of crucial initiatives to support early childhood development.

The World Bank's support for Senegal’s National Nutrition Enhancement Program (CNDN) is a pivotal initiative in the battle against poverty and malnutrition . As such, the Investing in Early Years for Human Development Project incorporates support for the CNDN, which is designed to dismantle the numerous barriers that families, especially women, encounter in accessing quality nutrition and resources for their households. The CNDN works with local communities and religious leaders to provide a stronger foundation for Senegalese children. Notably, the engagement of over 900 religious leaders plays a crucial role in advocating for increased investments and parental involvement in early childhood development.

The CNDN has embraced a multifaceted approach over the years, implementing cross-sectoral and innovative practices to empower women in rural and semi-urban areas grappling with high rates of food insecurity and acute malnutrition in infants. These practices encompass child nutrition and early stimulation in the crucial first 1,000 days by leveraging new technologies to strengthen existing systems, as well as promoting essential family health and nutrition practices. The success of this novel approach hinges on the empowerment of women and the prioritization of community assets.

The Investing in Early Years for Human Development Project also aims to support quality education. Thus, it undertakes innovative partnerships with Koranic schools, known as Daaras in Senegal, an approach that has proven to be highly effective. Performance-based contracts with Daaras ensure the integration of at least 10 hours per week of quality, play-based early learning, thereby fostering cognitive and social development, as well as early literacy and math skills that can further advance children’s educational development. The project also supports the creation of community pre-school classes (CPCs) and the launching of the Read@Home initiative. By distributing story books in Arabic, French, and seven Senegalese languages, the Read@Home initiative aims to reach 50 percent of all children under the age of six in seven regions, particularly those with the lowest early childhood development outcomes.

Despite daunting challenges posed by the COVID-19 pandemic and government restructuring, since 2018 the Project has displayed remarkable progress and tangible achievements.

A standout accomplishment is the transformative impact for over 10 million children , 52 percent of those aged 0-23 months in targeted regions, who benefited from vital nutrition and early stimulation interventions . This represents a remarkable surge from a mere 19 percent in 2018, underscoring the Investing in Early Years for Human Development Project’s prowess in reaching and positively impacting a significant segment of the intended demographic.

Beyond education, the initiative has made substantial strides in improving birth registration rates for children aged 0-5 years, surging from 43 percent to a 73 percent . This achievement is of particular importance because birth registration is a prerequisite to enrollment in schools at an appropriate age and grade level, as well as to better targeted nutritional support.

The Investing in Early Years for Human Development Project’s focus on gender inclusivity is evident, particularly its emphasis on girls' access to quality early learning services. Direct interventions have resulted in over 92,000 girls and over 94,000 boys benefiting from improved early learning services .

Beneficiary Quote

Sokhna and her son, Khalifa Babacar Thiandoum. Thiekene village in the department of Pout, Thies region, Senegal.

Photo credit: Lamine Ndao, Senegal - National Nutrition Enhancement Program (SE-CNDN).

Data Highlights

Source: PIPADHS Project Monitoring and Evaluation team (World Bank).

Bank Group Contribution

The Investing in Early Years for Human Development Project, funded by a $75 million grant from the International Development Association (IDA), unfolds as a comprehensive initiative. This endeavor allocates $37 million to sow the seeds of health and development in the first 1,000 days. It also dedicates an additional $22 million to fostering quality early learning. Additional components build on this base, with an allocation of $11 million toward child protection and system strengthening to ensure resilience and safety for the most vulnerable.

Partners

The Investing in Early Years for Human Development Project's multi-sectoral approach necessitates collaboration with key stakeholders directly engaged in its implementation. This includes the National Council for Nutrition Development (CNDN); the Ministry of National Education (MEN); the Ministry of Family, Women and Child Protection (MFFPE); and the National Agency for Early Childhood Development (ANPECTP). To facilitate coordination, a dynamic multi-sectoral Technical Working Group has been established. It is chaired by the Secretary-General of the MFFPE and comprised of technical officers from the three implementing structures and the Project Implementation Unit (PIU). Building on a longstanding partnership dating back to the 2000s, the World Bank collaborates closely with the CNDN, resulting in a substantial expansion of early year services encompassing nutrition, stimulation, and protection within the Project. Implementation is further enriched by the involvement of entities, such as the Birth Registration Agency, as well as technical partners including the United Nations Children’s Fund (UNICEF), the United States Agency for International Development (USAID), Save The Children, ChildFund, the Associates in Research and Education for Development (ARED), La Lumiere, and Tostan, alongside various national non-governmental organizations (NGOs).

The World Bank’s partnership with UNICEF illustrates the broad range of activities carried out in partnership with other organizations. For example, early stimulation activities developed as part of the Investing in Early Years for Human Development Project were based on a pilot program financed by UNICEF. Similarly, the Project has drawn on UNICEF's work with the Ministry of National Education to develop a curriculum and pedagogical tools for Koranic schools. Additionally, regular consultations have been held with the UNICEF team since the design and implementation of the Project began. This seamless, cross-sectoral collaboration, bridging national agencies with local and regional actors, exemplifies effective project implementation, and provides a replicable model for similar settings in other countries and regions.

Looking Ahead

Senegal's government is forging ahead in its collaboration with the World Bank, demonstrating its dedication to constructing resilient communities. The ongoing Investing in Early Years for Human Development Project seeks to enhance management and accessibility to fundamental services across the remaining seven regions of Senegal, impacting nearly 4 million additional individuals. In addition, it will continue to refine strategies with a focus on improving childcare activities, education, as well as social protection in higher education and health initiatives.

The valuable lesson learned from this endeavor is the effective cross-sectorial approach, exemplified by the geographic distribution across two World Bank projects (namely, the Investing in Early Years for Human Development Project and the Investing in Maternal, Child and Adolescent Health Project) to ensure comprehensive coverage. Drawing from this experience, new higher education, and health projects in the region (including the Senegal Higher Education Project, Enseignement Supérieur Professionnel Orienté Insertion et Réussite des Jeunes (Espoir-Jeunes) Project in Senegal, effective in January 2024, and the Sahel Women’s Empowerment and Demographic Dividend (SWEDD) Project, effective in September 2023) integrate childcare activities. Social protection teams are also exploring innovative ways to utilize the social registry and cash transfers, while also working closely with mother leaders’ groups to bolster Early Childhood Development (ECD) initiatives.

Extending this cross-sectoral paradigm, other countries in West Africa are embracing the opportunity to reinforce developmental initiatives by fully incorporating diverse ministries into collaborative projects. In Benin, for instance, the Gbessoke Program (effective in 2023) is an integrated initiative that links people with a range of social services to foster productive livelihoods, resilience, and improved education and health outcomes. It is expected that 150,000 individuals, representing 61 percent of extremely poor households in the social registry, will benefit from the program, which will run until the end of 2027.

1. https://hdr.undp.org/data-center/country-insights#/ranks 2. Situation économique du Sénégal en 2023, World Bank (2023). 3. World Bank Data: https://data.worldbank.org/indicator/SE.PRE.ENRR

This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here .

Advertisement

Unlocking Financial Inclusion Through ICT and Mobile Banking: A Knowledge-Based Analysis of Microfinance Institutions in Ghana

- Published: 30 August 2023

Cite this article

- Ruoyun Liu 1 ,

- Zhan Wang 2 ,

- Stavros Sindakis ORCID: orcid.org/0000-0002-3542-364X 3 &

- Saloome Showkat 4

211 Accesses

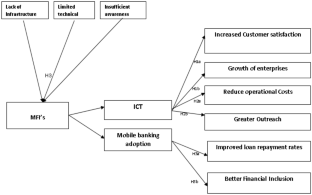

Explore all metrics

Microfinance institutions (MFIs) are critical in providing financial services to low-income individuals in developing countries, but challenges such as inadequate infrastructure, limited resources, and low financial literacy have affected effective service delivery. In Ghana, MFIs have adopted information and communication technology (ICT) and mobile banking/money solutions to address these challenges. This study uses qualitative and quantitative research methods to explore the impact of integrating ICT and mobile banking/money adoption on the efficiency, growth, and outreach of MFIs in Ghana. The findings reveal that the integration of ICT and mobile banking/money adoption positively impacts the efficiency, growth, and outreach of MFIs, loan repayment rates, and financial inclusion. However, effective utilization and adoption of these technologies face barriers such as limited ICT infrastructure, a lack of technical expertise, and insufficient awareness of the benefits of these technologies. Furthermore, the study shows that integrating ICT solutions into microfinance operations has a significant positive relationship with MFIs’ growth and customer satisfaction rates. The study contributes to the literature on the adoption of ICT solutions in microfinance operations and provides insights into how MFIs can integrate ICT solutions into their operations to enhance their performance.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Achieving Sustainability in Sudan Through Microfinance and Mobile Banking

Enabling mobile microfinance: opportunities and challenges.

Lower the Interest Burden for Microfinance

Data availability.

Data will be made available on request.

Abdulquadri, A., Mogaji, E., Kieu, T. A., & Nguyen, N. P. (2021). Digital transformation in financial services provision: A Nigerian perspective to the adoption of chatbot. Journal of Enterprising Communities: People and Places in the Global Economy, 15 (2), 258–281.

Article Google Scholar

Aboagye, J., & Anong, S. (2020). Provider and consumer perceptions on mobile money and microfinance integrations in Ghana: A financial inclusion approach. International Journal of Business and Economics Research. Special Issue: Microfinance and Local Development , 9 (4), 276–297.

Adarkwah, M. A. (2021). “I’m not against online teaching, but what about us?”: ICT in Ghana post Covid-19. Education and Information Technologies, 26 (2), 1665–1685.

Afawubo, K., Couchoro, M. K., Agbaglah, M., & Gbandi, T. (2020). Mobile money adoption and households’ vulnerability to shocks: Evidence from Togo. Applied Economics, 52 (10), 1141–1162.

Agarwal, S., Qian, W., Tan, R., Agarwal, S., Qian, W., & Tan, R. (2020). Financial inclusion and financial technology. Household finance: A functional approach , 307–346.

Agur, I., Peria, S. M., & Rochon, C. (2020). Digital financial services and the pandemic: Opportunities and risks for emerging and developing economies. International Monetary Fund Special Series on COVID-19 . Transactions, 1 , 2–1.

Google Scholar

Agyapong, D. (2021). Implications of digital economy for financial institutions in Ghana: An exploratory inquiry. Transnational Corporations Review, 13 (1), 51–61.

Ahmad, A. H., Green, C., & Jiang, F. (2020). Mobile money, financial inclusion and development: A review with reference to African experience. Journal of Economic Surveys, 34 (4), 753–792.

Ahmed, S. T., Basha, S. M., Arumugam, S. R., & Patil, K. K. (2021). Big data analytics and cloud computing: A beginner’s guide . MileStone Research Publications.

Akamanzi, C., Deutscher, P., Guerich, B., Lobelle, A., & Ooko-Ombaka, A. (2016). Silicon Savannah: The Kenya ICT services cluster. Microeconomics of Competitiveness, 7 (2), 36–49.

Alabdali, S. A., Pileggi, S. F., & Cetindamar, D. (2023). Influential factors, enablers, and barriers to adopting smart technology in rural regions: A literature review. Sustainability, 15 (10), 7908.

Al-Adwan, A. S. (2020). Investigating the drivers and barriers to MOOCs adoption: The perspective of TAM. Education and Information Technologies, 25 (6), 5771–5795.

Alam, M. K. (2021). A systematic qualitative case study: Questions, data collection, NVivo analysis and saturation. Qualitative Research in Organizations and Management: An International Journal, 16 (1), 1–31.

Alemu, A., & Ganewo, Z. (2022). Impact analysis of formal microcredit on income of borrowers in rural areas of Sidama Region, Ethiopia: A propensity score matching approach. Journal of the Knowledge Economy , 1–21.

Ali, H., Gueyie, J. P., & Okou, C. (2021). Assessing the impact of information and communication technologies on the performance of microfinance institutions in Niger. Journal of Small Business & Entrepreneurship, 33 (1), 71–91.

Amendola, C., Calabrese, M., & Caputo, F. (2018). Fashion companies and customer satisfaction: A relation mediated by information and communication technologies. Journal of Retailing and Consumer Services, 43 , 251–257.

Amin, N. (2008). Enabling the expansion of microfinance using information and communication technologies. In Information communication technologies: Concepts, methodologies, tools, and applications (pp. 3658–3680). IGI Global.

Ammar, A., & Ahmed, E. M. (2016). Factors influencing Sudanese microfinance intention to adopt mobile banking. Cogent Business & Management, 3 (1), 1154257.

Anabila, P. (2020). Integrated marketing communications, brand equity, and business performance in micro-finance institutions: An emerging market perspective. Journal of Marketing Communications, 26 (3), 229–242.

Arner, D. W., Buckley, R. P., Zetzsche, D. A., & Veidt, R. (2020). Sustainability, FinTech and financial inclusion. European Business Organization Law Review, 21 , 7–35.

Aruleba, K., & Jere, N. (2022). Exploring digital transforming challenges in rural areas of South Africa through a systematic review of empirical studies. Scientific African , e01190.

Asante Boakye, E., Zhao, H., & Ahia, B. N. K. (2022). Blockchain technology prospects in transforming Ghana’s economy: A phenomenon-based approach. Information Technology for Development , 1–30.

Asongu, S. A., & Odhiambo, N. M. (2020). The mobile phone, information sharing, and financial sector development in Africa: A quantile regression approach. Journal of the Knowledge Economy, 11 , 1234–1269.

Aziz, A., & Naima, U. (2021). Rethinking digital financial inclusion: Evidence from Bangladesh. Technology in Society, 64 , 101509.

Banna, H., Mia, M. A., Nourani, M., & Yarovaya, L. (2022). Fintech-based financial inclusion and risk-taking of microfinance institutions (MFIs): Evidence from sub-Saharan Africa. Finance Research Letters, 45 , 102149.

Beckinsale, M., Ram, M., & Theodorakopoulos, N. (2011). ICT adoption and ebusiness development: Understanding ICT adoption amongst ethnic minority businesses. International Small Business Journal, 29 (3), 193–219.

Bongomin, G. O. C., Woldie, A., & Wakibi, A. (2020). Microfinance accessibility, social cohesion and survival of women MSMEs in post-war communities in sub-Saharan Africa: Lessons from Northern Uganda. Journal of Small Business and Enterprise Development, 27 (5), 749–774.

Brynjolfsson, E., & Hitt, L. M. (2000). Beyond computation: Information technology, organizational transformation and business performance. Journal of Economic Perspectives, 14 (4), 23–48.

Camilleri, M. A., & Falzon, L. (2021). Understanding motivations to use online streaming services: Integrating the technology acceptance model (TAM) and the uses and gratifications theory (UGT). Spanish Journal of Marketing-ESIC, 25 (2), 217–238.

Casadella, V., & Tahi, S. (2022). National innovation systems in low-income and middle-income countries: Re-evaluation of indicators and lessons for a learning economy in Senegal. Journal of the Knowledge Economy , 1–31.

Castleberry, A., & Nolen, A. (2018). Thematic analysis of qualitative research data: Is it as easy as it sounds? Currents in Pharmacy Teaching and Learning, 10 (6), 807–815.

Cerchiaro, D., Leo, S., Landriault, E., & De Vega, P. (2021). DLT to boost efficiency for financial intermediaries. An application in ESG reporting activities. Technology Analysis & Strategic Management , 1–14.

Chang, V., Baudier, P., Zhang, H., Xu, Q., Zhang, J., & Arami, M. (2020). How blockchain can impact financial services–the overview, challenges and recommendations from expert interviewees. Technological Forecasting and Social Change, 158 , 120166.

Chatterjee, A. (2020). Financial inclusion, information and communication technology diffusion, and economic growth: A panel data analysis. Information Technology for Development, 26 (3), 607–635.

Chege, S. M., & Wang, D. (2020). Information technology innovation and its impact on job creation by SMEs in developing countries: An analysis of the literature review. Technology Analysis & Strategic Management, 32 (3), 256–271.

Chen, L., & Aklikokou, A. K. (2020). Determinants of E-government adoption: Testing the mediating effects of perceived usefulness and perceived ease of use. International Journal of Public Administration, 43 (10), 850–865.

Chen, M. J., Michel, J. G., & Lin, W. (2021). Worlds apart? Connecting competitive dynamics and the resource-based view of the firm. Journal of Management, 47 (7), 1820–1840.

Chikwira, C., Vengesai, E., & Mandude, P. (2022). The impact of microfinance institutions on poverty alleviation. Journal of Risk and Financial Management, 15 (9), 393.

Chirambo, D. (2017). Enhancing climate change resilience through microfinance: Redefining the climate finance paradigm to promote inclusive growth in Africa. Journal of Developing Societies, 33 (1), 150–173.

Cobb, J. A., Wry, T., & Zhao, E. Y. (2016). Funding financial inclusion: Institutional logics and the contextual contingency of funding for microfinance organizations. Academy of Management Journal, 59 (6), 2103–2131.

Dang, T. T., & Vu, H. Q. (2020). Fintech in microfinance: A new direction for microfinance institutions in Vietnam. Asian Journal of Business Environment, 10 (3), 13–22.

Dang, T. T., Vu, Q. H., & Hau, N. T. (2021). Impact of outreach on operational self-sufficiency and profit of microfinance institutions in Vietnam. Data science for financial econometrics , 543–565.

Daowd, A., Kamal, M. M., Eldabi, T., Hasan, R., Missi, F., & Dey, B. L. (2021). The impact of social media on the performance of microfinance institutions in developing countries: A quantitative approach. Information Technology & People, 34 (1), 25–49.

Dary, S. K., & Issahaku, H. (2013). Exploring innovations in microfinance institutions in Northern Ghana. Business and Economic Research, 3 (1), 442–460.

De’, R., & Ratan, A. L. (2009). Whose gain is it anyway? Structurational perspectives on deploying ICTs for development in India’s microfinance sector. Information Technology for Development, 15 (4), 259–282.

Dorfleitner, G., & Nguyen, Q. A. (2022). Mobile money for women’s economic empowerment: The mediating role of financial management practices. Review of Managerial Science , 1–30

Dorfleitner, G., Forcella, D., & Nguyen, Q. A. (2022). The digital transformation of microfinance institutions: An empirical analysis. Journal of Applied Accounting Research, 23 (2), 454–479.

Duncombe, R., & Boateng, R. (2009). Mobile phones and financial services in developing countries: A review of concepts, methods, issues, evidence and future research directions. Third World Quarterly, 30 (7), 1237–1258.

Durrani, A., Rosmin, M., & Volz, U. (2020). The role of central banks in scaling up sustainable finance–what do monetary authorities in the Asia-Pacific region think? Journal of Sustainable Finance & Investment, 10 (2), 92–112.

Elzahi Saaid Ali, A. (2022). Overcoming financial inclusion challenges through digital finance. Empowering the poor through financial and social inclusion in Africa: An Islamic perspective (pp. 119–136). Springer International Publishing.

Chapter Google Scholar

Etim, A. S., & Etim, D. N. (2021). Gender, ICT, and micro-loans for small business operations in Ghana. In Overcoming Challenges and Barriers for Women in Business and Education: Socioeconomic Issues and Strategies for the Future (pp. 1–20). IGI Global.

Fairooz, H. M. M., & Wickramasinghe, C. N. (2019). Innovation and development of digital finance: A review on digital transformation in banking & financial sector of Sri Lanka. Asian Journal of Economics, Finance and Management , 69–78.

Freeman, C. (2020). Multiple methods beyond triangulation: Collage as a methodological framework in geography. Geografiska Annaler: Series b, Human Geography, 102 (4), 328–340.

Gichoya, D. (2005). Factors affecting the successful implementation of ICT projects in government. Electronic Journal of E-Government, 3 (4), 175–184.

Gigante, G., & Zago, A. (2023). DARQ technologies in the financial sector: Artificial intelligence applications in personalized banking. Qualitative Research in Financial Markets , 15 (1), 29–57.

Gill, P., & Baillie, J. (2018). Interviews and focus groups in qualitative research: An update for the digital age. British Dental Journal, 225 (7), 668–672.

Githaiga, P. N. (2022). Revenue diversification and financial sustainability of microfinance institutions. Asian Journal of Accounting Research, 7 (1), 31–43.

Glavee-Geo, R., Shaikh, A. A., Karjaluoto, H., & Hinson, R. E. (2020). Drivers and outcomes of consumer engagement: Insights from mobile money usage in Ghana. International Journal of Bank Marketing, 38 (1), 1–20.

Gutierrez-Goiria, J., San-Jose, L., & Retolaza, J. L. (2017). Social efficiency in microfinance institutions: Identifying how to improve it. Journal of International Development, 29 (2), 259–280.

Gyamfi, G. D. (2012). Assessing the effectiveness of credit risk management techniques of microfinance firms in Accra. Journal of Science and Technology (ghana), 32 (1), 96–103.

Hani, U., Wickramasinghe, A., Kattiyapornpong, U., & Sajib, S. (2022). The future of data-driven relationship innovation in the microfinance industry. Annals of Operations Research , 1–27.

Hartarska, V. (2005). Governance and performance of microfinance institutions in Central and Eastern Europe and the newly independent states. World Development, 33 (10), 1627–1643.

Hartarska, V., & Nadolnyak, D. (2007). Do regulated microfinance institutions achieve better sustainability and outreach? Cross-Country Evidence. Applied Economics, 39 (10), 1207–1222.

Hartarska, V., & Mersland, R. (2012). Which governance mechanisms promote efficiency in reaching poor clients? Evidence from rated microfinance institutions. European Financial Management, 18 (2), 218–239.

Hasan, M., Popp, J., & Oláh, J. (2020). Current landscape and influence of big data on finance. Journal of Big Data, 7 (1), 1–17.

Hermes, N., Lensink, R., & Meesters, A. (2018). Financial development and the efficiency of microfinance institutions. In Research Handbook on Small Business Social Responsibility (pp. 177–205). Edward Elgar Publishing.

Herrero-Crespo, A., Viejo-Fernández, N., Collado-Agudo, J., & Sanzo Perez, M. J. (2022). Webrooming or showrooming, that is the question: Explaining omnichannel behavioural intention through the technology acceptance model and exploratory behaviour. Journal of Fashion Marketing and Management: An International Journal, 26 (3), 401–419.

Im, J., & Sun, S. L. (2015). Profits and outreach to the poor: The institutional logics of microfinance institutions. Asia Pacific Journal of Management, 32 , 95–117.

Jansen, S. A., Mast, C., & Spiess-Knafl, W. (2021). Social finance investments with a focus on digital social business models. Innovations in Social Finance: Transitioning Beyond Economic Value , 235–249.

Kamal, S. A., Shafiq, M., & Kakria, P. (2020). Investigating acceptance of telemedicine services through an extended technology acceptance model (TAM). Technology in Society, 60 , 101212.

Kauffman, R. J., & Riggins, F. J. (2012). Information and communication technology and the sustainability of microfinance. Electronic Commerce Research and Applications, 11 (5), 450–468.

Kayongo, S., & Mathiassen, L. (2020, September). Dynamic capabilities in microfinance innovation: A case study of the Grameen Foundation. In The Tenth International Conference on Engaged Management Scholarship .

Kayongo, S., & Mathiassen, L. (2023). Improving agricultural relations and innovation: Financial inclusion through microfinancing. Journal of Business & Industrial Marketing .

Khan, F. N., Sana, A., & Arif, U. (2020). Information and communication technology (ICT) and environmental sustainability: A panel data analysis. Environmental Science and Pollution Research, 27 , 36718–36731.

Kim, M., Zoo, H., Lee, H., & Kang, J. (2018). Mobile financial services, financial inclusion, and development: A systematic review of academic literature. The Electronic Journal of Information Systems in Developing Countries, 84 (5), e12044.

Kinde, B. A. (2012). Financial sustainability of microfinance institutions (MFIs) in Ethiopia. European Journal of Business and Management, 4 (15), 1–10.

Kolokas, D., Vanacker, T., Veredas, D., & Zahra, S. A. (2022). Venture capital, credit, and fintech start-up formation: A cross-country study. Entrepreneurship Theory and Practice, 46 (5), 1198–1230.

Korankye-Sakyi, F. K., Abe, O. O., & Yin, E. T. (2023). Revisiting MSMEs financing through banking reform processes: Assessing the Ghanaian legal experiences. Financial Sector Development in Ghana: Exploring Bank Stability, Financing Models, and Development Challenges for Sustainable Financial Markets (pp. 207–229). Springer International Publishing.

Lashitew, A. A., van Tulder, R., & Liasse, Y. (2019). Mobile phones for financial inclusion: What explains the diffusion of mobile money innovations? Research Policy, 48 (5), 1201–1215.

Ling, L. T. (2017). The impacts of system quality and information quality on mobile users’ behavioral intentions to use trade show application systems in Hong Kong: The mediating effects of perceived ease of use and perceived usefulness (Doctoral dissertation, The University of Newcastle, Australia).

Liu, Y., Luan, L., Wu, W., Zhang, Z., & Hsu, Y. (2021). Can digital financial inclusion promote China’s economic growth? International Review of Financial Analysis, 78 , 101889.

Mader, P. (2018). Contesting financial inclusion. Development and Change, 49 (2), 461–483.

Maphosa, V., & Maphosa, M. (2022). Factors influencing the adoption of ICT for remote work among Zimbabwean SMEs: A case study of Bulawayo Metropolitan province. International Journal of Advanced and Applied Sciences, 9 (3), 150–158.

McGahan, A. M. (2021). Integrating insights from the resource-based view of the firm into the new stakeholder theory. Journal of Management, 47 (7), 1734–1756.

Miled, K. B. H., Younsi, M., & Landolsi, M. (2022). Does microfinance program innovation reduce income inequality? Cross-country and panel data analysis. Journal of Innovation and Entrepreneurship, 11 (1), 1–15.

Mogaji, E., & Nguyen, N. P. (2022). Managers’ understanding of artificial intelligence in relation to marketing financial services: Insights from a cross-country study. International Journal of Bank Marketing, 40 (6), 1272–1298.

Mohamed, T. S., & Elgammal, M. M. (2023). Does the extent of branchless banking adoption enhance the social and financial performance of microfinance institutions?. Applied Economics , 1–18.

Munyengeterwa, K. (2020). Financial inclusion technologies and bank performance: Insights from Zimbabwe’s banking sector (Master’s thesis, Faculty of Commerce).

Muriithi, A. W., & Waithaka, P. (2019). People analytics and performance of deposit-taking micro finance institutions in Nyeri County, Kenya. International Journal of Current Aspects, 3 , 186–209.

Mushtaq, R., & Bruneau, C. (2019). Microfinance, financial inclusion and ICT: Implications for poverty and inequality. Technology in Society, 59 , 101154.

Nan, W., Zhu, X., & Lynne Markus, M. (2021). What we know and don’t know about the socioeconomic impacts of mobile money in sub-Saharan Africa: A systematic literature review. The Electronic Journal of Information Systems in Developing Countries, 87 (2), e12155.

Navin, N., & Sinha, P. (2021). Social and financial performance of MFIs: Complementary or compromise? Vilakshan-XIMB Journal of Management, 18 (1), 42–61.

Nguimkeu, P., & Okou, C. (2021). Leveraging digital technologies to boost productivity in the informal sector in sub-Saharan Africa. Review of Policy Research, 38 (6), 707–731.

Nonvide, G. M. A., & Alinsato, A. S. (2023). Who uses mobile money, and what factors affect its adoption process? Evidence from smallholder households in Cote d’Ivoire. Journal of Financial Services Marketing, 28 (1), 117–127.

Ntoiti, R., & Jagongo, A. (2021). Non-performing loans and financial stability of deposit taking saccos regulated by SASRA. International Journal of Finance and Accounting, 6 (2), 29–39.

Odoom, R., & Kosiba, J. P. (2020). Mobile money usage and continuance intention among micro enterprises in an emerging market–the mediating role of agent credibility. Journal of Systems and Information Technology, 22 (1), 97–117.

OECD | European Commission. (2021). Designing effective microfinance schemes for inclusive entrepreneurship.

Pazarbasioglu, C., Mora, A. G., Uttamchandani, M., Natarajan, H., Feyen, E., & Saal, M. (2020). Digital financial services. World Bank , 54 .

Pomeroy, R., Arango, C., Lomboy, C. G., & Box, S. (2020). Financial inclusion to build economic resilience in small-scale fisheries. Marine Policy, 118 , 103982.

Racero, F. J., Bueno, S., & Gallego, M. D. (2020). Predicting students’ behavioral intention to use open source software: A combined view of the technology acceptance model and self-determination theory. Applied Sciences, 10 (8), 2711.

Rahman, M. M. (2020). Financial inclusion for poverty alleviation: The role of Islamic finance in Bangladesh. Enhancing Financial Inclusion through Islamic Finance, II , 17–50.

Rehman, T. U., ul Hassan, M. N., Imran, Z., & Khan, R. M. N. (2022). FinTech implementation: A way forward to expedite bank operations. Journal of Financial Technologies (Fintech), Inclusion and Sustainability , 1 (1), 27–38.

Sangwan, S., Nayak, N. C., & Samanta, D. (2020). Loan repayment behavior among the clients of Indian microfinance institutions: A household-level investigation. Journal of Human Behavior in the Social Environment, 30 (4), 474–497.

Sapovadia, V. (2018). Financial inclusion, digital currency, and mobile technology. In Handbook of Blockchain, Digital Finance, and Inclusion, Volume 2 (pp. 361–385). Academic Press.

Shaikh, S. A. (2021). Using fintech in scaling up Islamic microfinance. Journal of Islamic Accounting and Business Research, 12 (2), 186–203.

Singh, V., & Padhi, P. (2015). Information and communication technology in microfinance sector: Case study of three Indian MFIS. IIM Kozhikode Society & Management Review, 4 (2), 106–123.

Smolo, E., & Ismail, A. G. (2011). A theory and contractual framework of Islamic micro-financial institutions’ operations. Journal of Financial Services Marketing, 15 (4), 287–295.

Ssewanyana, J. K. (2009). ICT usage in microfinance institutions in Uganda. The African Journal of Information Systems, 1 (3), 3.

Tanima, F. A., Brown, J., & Dillard, J. (2020). Surfacing the political: Women’s empowerment, microfinance, critical dialogic accounting and accountability. Accounting, Organizations and Society, 85 , 101141.

Tchamyou, V. S. (2017). The role of knowledge economy in African business. Journal of the Knowledge Economy, 8 , 1189–1228.

Tumwebaze, Z., Bananuka, J., Alinda, K., & Dorcus, K. (2021). Intellectual capital: Mediator of board of directors’ effectiveness and adoption of International Financial Reporting Standards. Journal of Financial Reporting and Accounting, 19 (2), 272–298.

Turaga, J. (2004). Opportunities and challenges in India “Kuch Apru Sock aur Kuch Jugaad”: Crafting the MFI/IT Paradigm-The Indian Experience. Retrived on, 18 (8), 2008.

United Nations. (2021). The millennium development goals report. https://www.un.org/millenniumgoals/2015_MDG_Report/pdf/MDG%202015%20rev%20(July%201).pdf

Varadarajan, R. (2020). Customer information resources advantage, marketing strategy and business performance: A market resources based view. Industrial Marketing Management, 89 , 89–97.

Wakunuma, K., Siwale, J., & Beck, R. (2019). Computing for social good: Supporting microfinance institutions in Zambia. The Electronic Journal of Information Systems in Developing Countries, 85 (3), e12090.

Wang, F., & De Filippi, P. (2020). Self-sovereign identity in a globalized world: Credentials-based identity systems as a driver for economic inclusion. Frontiers in Blockchain , 28.

Woldu, T., & Belay, D. (2020). Assessment on the roles of information technology in improving the customer satisfaction and employee performance of commercial banks: The case of Dashen and United Bank Branches in Mizan-Aman, Southwestern Ethiopia. Journal of Economics and International Finance, 12 (4), 174–186.

Yeboah, T., Antoh, E. F., & Kumi, E. (2022). Strategic responses of microfinance institutions to the coronavirus disease (COVID-19) crisis in Ghana. Development in Practice, 32 (1), 112–127.

Zouhayer, M., Tarek, B. H., & Anis, J. (2018). Mediating effects of management of information on the relationship between mechanisms of governance and lack of reimbursement of Tunisian’s associations of microfinance. Journal of the Knowledge Economy, 9 (1), 40–61.

Download references

Author information

Authors and affiliations.

School of Foreign Languages and Literature, Wuhan University, Wuhan, China

Yunshan Studio, Guangdong University of Foreign Studies, Guangzhou, China

School of Social Sciences, Hellenic Open University, 18 Aristotelous Street, 26335, Patras, Greece

Stavros Sindakis

Institute of Strategy, Entrepreneurship and Education for Growth, Athens, Greece

Saloome Showkat

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Zhan Wang .

Ethics declarations

Conflict of interest.

The authors declare no competing interests.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

Reprints and permissions

About this article

Liu, R., Wang, Z., Sindakis, S. et al. Unlocking Financial Inclusion Through ICT and Mobile Banking: A Knowledge-Based Analysis of Microfinance Institutions in Ghana. J Knowl Econ (2023). https://doi.org/10.1007/s13132-023-01460-0

Download citation

Received : 24 May 2023

Accepted : 21 July 2023

Published : 30 August 2023