Capitalization | Sources and Uses of Funds

What is a sources and uses of funds section in a business plan, a sources and uses of fund section is a summary of how much money will be required for startup expenses and operating capital, and where you expect that money to come from..

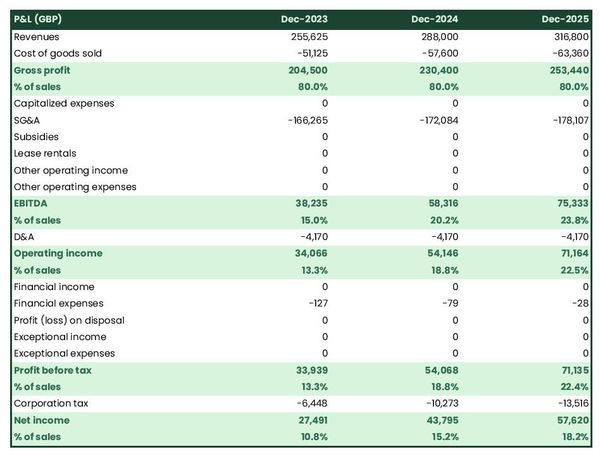

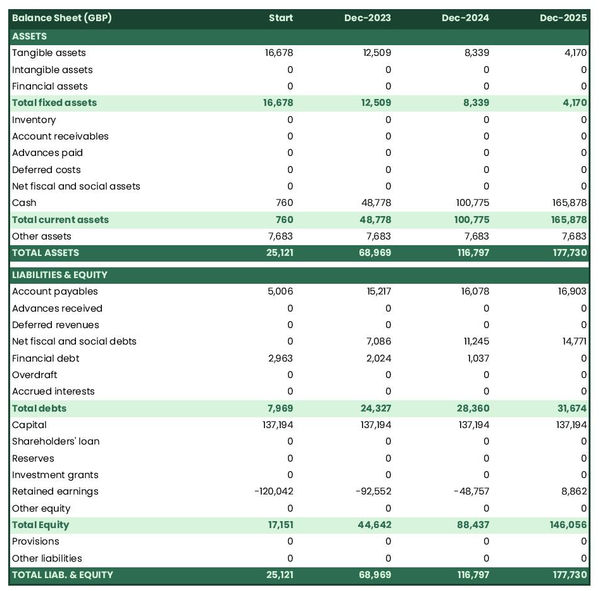

The sources and uses of funds section of a business plan is an important financial component that outlines where the funds for the business will come from and how they will be used. This section typically includes information on the business’s funding requirements, the sources of funding that have been secured or are being sought, and a detailed breakdown of how the funds will be used to support the business’s operations and growth. It is important for a business to have a clear understanding of its funding needs and how the funds will be used in order to attract investors and secure financing.

The level of detail in the sources and uses of funds section of a business plan can depend on the intended audience and purpose of the plan. For example, if the plan is being used to attract investors or secure financing, it may need to be more detailed and include specific numbers and projections.

In this case, the section should include spreadsheets or tables that clearly show the funding requirements, sources of funding, and detailed breakdown of how the funds will be used.

If the plan is being used as an internal tool for current investors or the board, it may be more high-level and not include as much detail. It should still however, provide a clear overview of the funding needs, sources and usage of funds.

As a best practice, it’s always a good idea to include financial projections in the form of spreadsheets or tables, this way the audience can see the financial viability of the business, in a clear and easy-to-understand format.

Why the Sources of Uses of Funds Section is Vitally Important

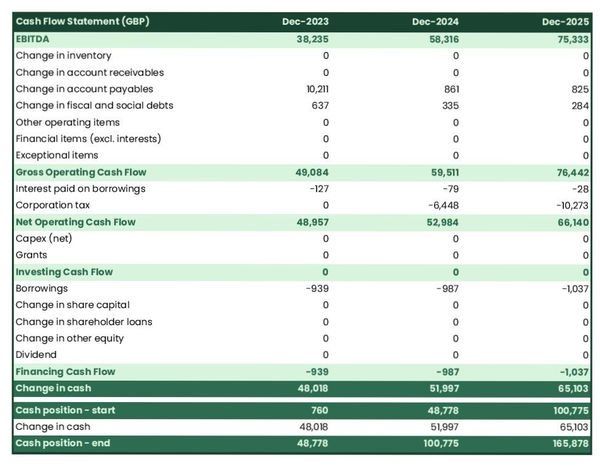

Many entrepreneurs and business owners rely far too much on intuition and positive expectations. “I’m not an accountant” is not a good enough reason to forego having an understanding of the basics of cash flow. Of all the traditional financial statements including the balance sheet and income statement, a reliable cash flow statement is most important. The sources and uses of funds section of your business plan is in effect a high-level cash flow statement for investors. The primary purpose of fund statements is to demonstrate that the business will have sufficient capital to start, grow and thrive.

Your company’s financial health is critical to investors and the use of funds document is a simple financial statement they’ll expect to see.

If Charles Lindberg or Emelia Earhart came to a group of equity investors or providers of debt financing, they probably would have known very little about transatlantic flying, particularly since it had never been done. But the business minds would have quickly converged on the sources and uses of funds statement. The investors would want to know that the funds statement accounted for sufficient capital to build the plane and fly it across the ocean. After all, who would want to provide funding to get a plane halfway across the ocean?

Now, this a light-hearted way to talk about a funds statement, but it makes the point: Your sources and uses of funds statements will ensure that you have thought through the business requirements and are raising sufficient capital to get your business to the next investable milestone or profitability.

Creating Your Statement of Sources and Uses of Funds

The various sections of your business plan spell out how you will go about finding new customers, creating products and services they need, and building your business. The details regarding the costs and revenues from your “word plan” make it to the “numbers plan” in the financial section. So, what’s left?

This section on Capitalization and Use of Funds summarizes how much money will be required for startup expenses and operating capital, and where you expect that money to come from. Show your financial needs for a minimum of one year into the future, or until your business will become cash-flow positive, whichever is longer.

Business Plan Outline for Capitalization and Use of Funds Should Include:

Use of Funds

Startup Costs

Working Capital

Sources of funds.

Owner’s investment

Debt or senior debt (from lenders)

Equity (from investors)

Important Considerations

This section of your business plan is intended to provide an overview of the funds your business will require. The specific details regarding terms for investing in your company must be in a separate document, which will be governed by specific legal guidelines. By law, securities can be offered for sale or solicited only by a private placement memorandum, which is a formal legal document.

Start with the Use of Funds Section

The Use of Funds section of your business plan must include all of the costs required as well as the capital to sustain your business until it becomes cash-flow positive. The initial costs are those costs required to open the business. Working capital is the money it takes to pay your bills (including labor) until your business is generating sufficient cash to fund itself. Your financial projections (Section 9) will have taken you through the hard work required to arrive at these numbers.

A simple table or spreadsheet should be used to show your use of funds or costs. Summarize costs into major categories. Customize the example below for your business. Most importantly, include all expenses that are listed on your financial statements.

For the working capital number, look at your cash flow statement. If you had no funding whatsoever, how much money would your business consume before it starts to turn a profit or become cash-flow positive? That’s how much working capital your business will need, plus a contingency fund.

The example below is meant to be easily understood and is modeled around a startup business. It also includes rolled up numbers at a high level. It is okay to present your numbers in this manner, so long as you have the detailed version –that totals to the same amounts- if asked.

Sample Start-up Costs

Office Build-Out $12,000

Prepaid Rent $ 4,000

Office Equipment $ 6,000

Grand Opening $ 3,000

90-Day Ad Campaign $ 5,000

Website Design $ 2,000

Administrative Costs

Insurance $2,000

Fees & Permits $ 1000

Miscellaneous Startup Costs, $15,000

Total Startup Costs $50,000

Annual Salaries for 3 employees $300,000

Contingency capital funds $50,000

Total W/C $350,000

Total Use of Funds $400,000

Let’s start with the obvious. The sources of funds needs to meet or exceed the use of funds from the section above.

Now that you have laid out the financial needs of the business, where will that money come from? Ideally, at least some of that will be coming directly from you. Perhaps you’ll even include a “family and friends” round of investment. The balance will be the amount you need to bring in either as loans or outside investments. Customize the example below to your business.

Sources of Funds Table

Owner’s Cash Investment $50,000

Family and Friends Investment (Equity) $20,000

Loan Sought $330,000

While you don’t have to include it in your business plan, you should be prepared to talk about your collateral, or how you will guarantee that the lender will be repaid. Most financial institutions require a primary and secondary source of collateral. This topic is covered in the section titled, Exit Strategy or Payback Analysis.

Many people think about the balance sheet and income statement as the most important financial statements. It’s the cash flow statement that tells most about the company’s financial health and ability to continue. The “sources and uses of funds” section of your business plan is a means of looking ahead at the cash flows of the business – both incoming and outgoing – to determine how much cash you’ll need to raise.

Ready to complete your business plan in just 1 day?

Click GET STARTED to learn more about our fill-in-the-blank business plan template. We’ll step you through all the details you need to develop a professional business plan in just one day!

Successfully used by thousands of people starting a business and writing a business plan. It will work for you too!

- Line of Credit

- How It Works

- Small Business Resources

- Small Business Blog

- Business Stories

- Our Platform

- Lender and Partner Resources

- Our Company

- Source of Funds Examples in a Business Plan: 8 Suggestions

- Learning Center

- Small Business Loans

A solid business plan is one of the most important documents you’ll need to create for your company. This document provides a roadmap for your company’s future developments. However, no growth can occur without a sufficient amount of working capital. That’s why your business plan should include a source of funds section – it can remind you how to maintain the cash flow your company needs.

There’s another reason this part of your business plan matters. It can show certain lenders how much money you need beyond what the funding sources in your business plan can get you. That said, not all lenders will require you to share a business plan. For example, SmartBiz’s loan approval requirements don’t include business plans among the necessary paperwork. Either way, below are some source of funds examples in business plans.

What is a business plan?

A business plan is a document that guides your company’s growth. It helps define your business goals and provides a clear overview of how you’ll achieve them. You can also use it to plot out your marketing, operational, and sales approaches. Your business plan can be the foundation of a strategy to minimize risk and maximize growth.

Another reason why solid business plans are essential is that you’ll often need to provide them as you apply for business loans. Business plans provide an in-depth look at a company’s plan for profits, so lenders can more easily judge the borrower’s likelihood of repayment. Lenders are much more likely to finance borrowers whom they believe can pay back the loan amount in a reasonable timeframe.

8 source of funds examples

Having a source of funds – sometimes several sources of funding – is vital to growing your business . Common funding options include business loans, and sometimes, to qualify for them, you must show lenders your other funding sources. Understanding the below source of funds examples in business plans can help you better structure yours.

1. Personal savings

When you’re just getting your business off the ground, sometimes, the fastest way to fund it is directly from your current savings. However, entwining your personal savings into a company that could fail is a risky prospect – but it also shows commitment. Lenders and investors often respond well to a borrower who’s ready to go the distance with their ideas.

2. Money from friends and family

Money from family and friends, which you’ll also see called “love money,” is a viable source of funds in your business plan. However, just as it’s risky to get your own money wrapped up in a business, it’s dangerous with other people’s finances too. Plus, accepting money from a loved one can come with drawbacks. For starters, not everyone in your life has much to spare in the first place. Furthermore, if you borrow money from friends or family and you can’t repay it, the relationship could be damaged.

3. Federal and private grants

Occasionally, your business model can put you in line for federal grants. That said, rare is the business that qualifies for federal grants – technically, the government does not provide grants for small businesses growth. However, private companies ranging from FedEx to the NBA offer grants to small businesses that fit certain criteria. If there’s a chance your company could fit these criteria, you can include private grants as sources of funding in your business plan.

4. Share sales and dividends

Selling shares of your company to investors – as in, anyone who buys stocks – falls under a category of funding known as equity financing. This arrangement can be lucrative, which is a main reason why you see so many companies having initial public offerings (IPOs).

However, equity financing has a few drawbacks. For one, you’ll no longer have complete control over your company's future, as stockholders dilute your ownership. Additionally, you’ll have to account for dividends in your financial planning. You pay these sums to your shareholders every quarter.

5. Venture capital

If you need a large amount of cash, venture capitalists can be a viable option. Typically, though, venture capitalists are only interested in funding startup businesses in the tech sector with high growth potential.

Venture capital is a high-reward but high-risk funding source. It often requires you ceding a certain amount of ownership – and thus control – of your business. Furthermore, if your business fails, you may still need to repay any venture capitalists or firms that have funded your operations.

6. Angel investors

An angel investor is a wealthy private individual who invests in small businesses to help them get off the ground. They tend not to offer as much starting capital as a venture capitalist, but they can make up for the smaller amount with experience. Angel investors are often experts within a specific industry and put money back into it by investing in newer businesses within that sphere.

Although you’ll have to give an angel investor some control over your company, their experience and network can help your business grow. Additionally, the word “angel” in their name reflects that they typically don’t ask for their money back if your business fails. That makes them a safer bet than venture capitalists.

7. Business incubators

Unlike the previous funding options, a business incubator doesn’t offer direct monetary support. Instead, incubators help fledgling businesses thrive by allowing them into their workspace and letting them share resources as they get started. This type of funding is indirect – you’ll rarely get direct cash infusions, but you’ll get resources that would otherwise cost you money. It’s common in high-tech industries such as biotechnology, industrial technology, and multimedia.

8. Bank loans

Bank loans probably ring a bell for you. When a current or aspiring small business owner needs additional funds, these loans are often the first thing that comes to mind. They’re among the most in-demand funding options available given their large funding amounts, long-term repayment periods, and low interest rates . However, their high amounts introduce lender risk that can make them difficult to obtain. To minimize risk, most lenders impose strict qualification criteria that you might not make.

Why do you need to provide sources of funds in your business plan?

Providing a source of funds in your business plan paves a path toward obtaining and using your funding. Knowing where your money is coming from and what you’re spending can help with strategic financial planning. It also minimizes the chances of your business partners spending money the company doesn’t actually have.

In a lending context, your sources of funds may help you qualify for any loans you need in the future. Depending on the funding sources you’re using, lenders may view you as someone able to repay the debt financing they offer. For example, using personal savings shows your commitment to your business, meaning you’re likely a reliable borrower who won’t flake on a loan. You’ll show your commitment to your company and your business at the same time.

Parting thoughts

Reliable funding sources are essential to achieving your company’s objectives, and their presence in your business plan can help you obtain more funding. Namely, certain entities that offer small business loans require business plans as part of the borrower approval process. When your approval plan clearly shows why you need the loan money and how else you’re getting funding, lenders may trust you more.

However, certain lenders don’t require business plans. In fact, when you apply for SBA 7(a) loans , bank term loans, or custom financing through SmartBiz ® , you don't need a business plan. Check now to see if you pre-qualify * – the business funding you need might be closer than you think.

Have 5 minutes? Apply online

- Follow SmartBiz

Access to the right loan for right now

- Business Credit

- Business Finances

- Business Marketing

- Business Owners

- Business Technologies

- Emergency Resources

- Employee Management

- SmartBiz University

- More SBA Articles

Related Posts

Smartbiz helps facilitate access to financing for underrepresented entrepreneurs, women-owned business certification: learn about how to get yours, bank term loans 101: understanding the basics for small business, smart growth is smart business.

See if you pre-qualify, without impacting your credit score. 1

*We conduct a soft credit pull that will not affect your credit score. However, in processing your loan application, the lenders with whom we work will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and happens after your application is in the funding process and matched with a lender who is likely to fund your loan.

The SmartBiz® Small Business Blog and other related communications from SmartBiz Loans® are intended to provide general information on relevant topics for managing small businesses. Be aware that this is not a comprehensive analysis of the subject matter covered and is not intended to provide specific recommendations to you or your business with respect to the matters addressed. Please consult legal and financial processionals for further information.

- Sample Plans

- WHY UPMETRICS?

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

- 400+ Sample Business Plans

Customers Success Stories

Business Plan Course

Strategic Canvas Templates

E-books, Guides & More

Business consultants

Entrepreneurs and Small Business

Accelerators and Incubators

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai pitch deck generator

Stratrgic Planning

See How Upmetrics Works →

Small Business Tools

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Strategic Planning

Key Considerations of the Sources and Uses of Funds Statements

Free Startup Fundraising Checklist

Rudri Mehta

- January 2, 2024

A flow of funds statement is a document created to examine the factors that led to changes in a company’s financial position between two balance sheets . It displays the movement of money in and out, i.e. funding sources and applications for a specific period.

In other words, the source and uses of funds statement explain where a company’s money came from and how the organization has put it to use in the past and how they will use the funds in the future. It is also one of the business plan elements.

It contains the cash inflows into the company, the cash received, the cash outflows from the company, or the money spent.

So, what purpose does it serve?

Mostly, lenders will ask for these statements when you apply for a business loan . It will also help investors understand where the funds have been used.

If sources and uses of funds statement are accurately prepared, it can communicate well with the readers, and hence, it is quite crucial to prepare compelling sources and uses of funds statement.

This article explains the sources and uses of funds statements and the step in creating the statements with examples.

Table of Contents

What is the Sources and Uses of the Funds Statement?

Steps to create the sources and uses of funds statement, sample sources and uses of funds statement.

- How Can Upmetrics Help?

A company’s sources and uses of funds is a statement that provides information on how much did the company raise the money and how they were applied to achieve the company’s goals.

The sources and use of funds statements reflect the impact of changes in the balance sheet contents on the organization’s cash-in-hand. These are the statements that also guide organizations in their short-term planning decisions that involve available funds.

These statements are widely used for

- For business loan purposes,

- Attracting investors, and

- Predicting the impact of changes in the balance sheet

The Sources and Uses of Funds have two parts,

- The first part is the sources from which the company gets its funds, and

- The second part is the uses, applications, or spending of the money

Let’s understand both sections of the statement in detail.

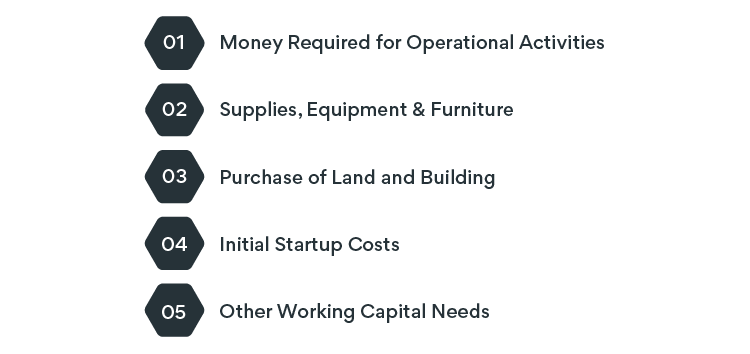

Uses of Funds

It generally consists of the following components:

1. Money Required for Operational Activities

Organizations will need cash and working capital to run the business and perform day-to-day activities.

2. Opening Quantities of Supplies, Equipment, and Furniture

The opening balance of the supplies, equipment, and furniture tells us where the organization has already spent its money.

3. Purchase of Land and Building

The amount spent on acquiring land and building for business use is a huge capital expense and results in cash outflow.

4. Initial Startup Costs

These costs include rent, deposits paid for the rented building/apartment, machinery acquisition costs, initial payments for insurance, company setup costs, etc.

5. Other Working Capital Needs

These include other operating costs such as the rental expenses of the leased machinery, repairs and maintenance expenses, outsourcing costs, etc.

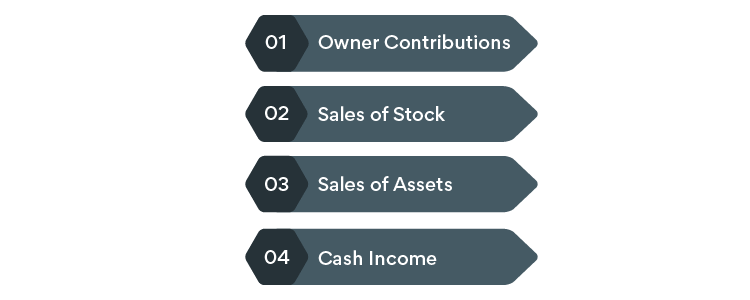

Sources of Funds

Hence, the sources of funds also include the money your investors have given to you.

Below are the other elements of the sources of funds for most businesses.

1. Owner Contributions

Owners of the businesses bring specific amounts of capital to start the company and they also contribute more capital as and when needed from time to time.

2. Sales of Stock

It includes the sale of finished goods and any other inventory that will not be used by the company.

3. Sales of Assets

The assets that the companies sell due to the discontinuance of some of the operations or assets becoming non-operatable are another source of funds.

4. Cash Income

Any other cash income generated from the sale is also considered one of the sources of funds.

Funds statement’s uses

The following are prominent uses of funds:

- Adjusting operating net loss

- Purchase of non-current assets

- Repayment of either long-term or short-term debt , such as bank loans (debentures or bonds)

- Redeemable preference share redemption

- Payment of dividends in cash

One of the essential tasks of an organization in preparing the financial statements of the company would be to prepare the sources and uses of funds statement.

It is because the statement reflects the efficiency of the business in depicting how effectively funds were utilized from the available sources. Even if you want to fund, then you will need these fund statements in your business plan. If you are not aware of that, then worry not, visit our business plan app .

The uses of funds section are prepared first, and then the sources of funds.

Let’s learn how to prepare the uses of funds section of the sources and uses of the fund’s statement.

Steps to Create Uses of Funds

- Note down all the costs included in the uses of funds, such as plant and machinery, initial startup costs, suppliers and marketing expenses, and other working capital costs.

- Add all the numbers and make a total to name ‘total of startup costs’ as shown in the example below.

- The capital costs required for purchasing the buildings, machinery, and vehicles and

- The working capital requirements to fund day-to-day operations.

While generating the uses of funds statement, focus on all the needs for the smooth and profitable functioning of the business rather than on the sources of funds.

Steps to Create Sources of Funds

- This section lists all the sources of funds, depicting where the money has come to fund the business.

- List the contributions received from the owners and the investors.

- Write the security that you offer for the loan you wish to secure.

- Any other sources of funds that you can use to fund the business in case you cannot pay the loan?

- It is also advisable to include all details concerning the contribution particulars.

While preparing the statement for sources and uses of funds, please note it has to be simple, and easy to understand. If you complicate the statement by adding difficult terms or complex numbers, readers may misinterpret the statement and you may lose a potential investor or a bank loan.

Statement of Sources and Uses of Funds:

The Bottom Line

As you grow your business , you may need more funds to meet the business expansion costs, and hence, it is important not only the startup companies but the well-established businesses as well to craft a compelling statement of sources and uses of funds.

How Can We Help?

We can help you prepare the statement of sources and uses of funds faster and more accurately along with other reports such as financial statements , and ratio analysis to help you better understand the financial position of your company.

Request your free demo at Upmetrics ~ a business plan app to input only the minimum elements so that we can compute it for you.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

What are the factors to be considered in choosing the source of funds.

- Tax benefits

- Flexibility & ease

- Purpose & time period

What are the 2 most important sources of funds?

- Equity shares

- Retained earnings

What is the importance of the sources and uses in the fund flow statement?

An organization’s working capital movements are described in a flow of funds statement. It takes into account the inflows and outflows of money (the sources and uses of money) throughout a specific period. The statement aids in analyzing how the financial situation of a company has changed across two balance sheet periods.

What are the uses of the funds flow statement?

Thus, the funds flow statement help in locating liquidity blockages and in formulating an efficient dividend policy. This declaration also acts as a company’s financial road map. It highlights the monetary difficulties that an organization can have soon.

About the Author

Rudri is a passionate financial content writer and a Chartered Accountant by profession. She enjoys sharing knowledge through her writing skills in finance, investments, banking, and taxation while also exploring graphic designing for her own content.

Related Articles

Write the Funding Request Section of Your Business Plan

How to Write a Business Plan Complete Guide

How to Prepare a Financial Plan for Startup Business (w/ example)

Reach your goals with accurate planning.

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Building a Strong Business Plan with the Use of Funds Slide

September 26, 2023 / Blog

A well-structured business plan outlines a business’s vision, mission, and strategies, providing a roadmap to success. However, one pitch deck slide that often stands out for investors and lenders alike is the Use of Funds slide.

Need a Presentation Designed? Click Here To View Our Amazing Portfolio

Let’s explore why a business plan is essential , what the Use of Funds slide entails, and how to make it an asset that propels your business forward.

The Role of a Business Plan

Before diving into the specifics of the Use of Funds slide, let’s take a moment to understand the broader role of a business plan. It’s not just a document; it’s the blueprint for your business’s future. A well-crafted business plan:

- Defines Your Vision : It lays out your business’s purpose, mission, and values. It clarifies what your company stands for and where it’s headed.

- Attracts Stakeholders : Investors, lenders, and partners often require a business plan before committing their resources. A solid plan can captivate their interest and support.

- Guides Decision-Making : It’s your compass for making informed decisions. From marketing strategies to financial projections, your plan ensures you stay on the right track.

Understanding the Use of Funds Slide

The Use of Funds slide offers a snapshot of how you intend to allocate the capital you seek . It’s not just about stating the sum; it’s detailing where every dollar will go.

What Is It?

The Use of Funds slide is a visual representation of your financial strategy. It succinctly outlines how much money you need, what you’ll use it for, and over what timeframe.

Why It Matters

This slide is a make-or-break element of your plan. Investors want to know that you will put their investment to good use—and this slide tells them precisely that.

The Use of Funds slide is typically in the early parts of the financial slides, right after your funding requirements. It sets the stage for the nitty-gritty financial details that follow.

Components of a Strong Use of Funds Slide

A compelling Use of Funds slide isn’t just about numbers but displaying clarity and precision. Here are the key components you should include:

- Funding Allocation : State clearly how much capital you’re seeking. Be specific. Investors appreciate a precise figure.

- Purpose of Funds : Detail what the money will be used for. Whether it’s product development, marketing, or hiring, be specific about your intentions.

- Timeline : Investors want to know when they can expect to see returns. Include a timeline indicating when the funds will be deployed and when results are anticipated.

Clarity is Key

Avoid vague or ambiguous language . Make it easy for anyone reading the slide to understand where the money is going.

Aligning the Slide with Business Goals

Your Use of Funds slide shouldn’t operate in isolation. It should seamlessly align with your broader business goals and strategies. Here’s the reason why alignment matters:

- Credibility : When your Use of Funds slide harmonizes with your business strategy, it instills confidence in investors. They see that you have a cohesive plan for success.

- Supports Strategy : Ensure that the allocation of funds supports your overarching business strategy. If you’re emphasizing growth, allocate funds accordingly.

- Transparency : Investors appreciate transparency. They want to see a logical connection between the capital you’re seeking and your business’s goals.

Addressing Risk and Contingency Planning

Investors are savvy individuals. They understand that risks are inherent in business. Thus, addressing risks in your Use of Funds slide demonstrates foresight and a willingness to adapt.

Risk Mitigation

Alongside the allocation of funds, consider including how you plan to mitigate risks . For example, set aside a portion of funds as a contingency for unforeseen challenges.

Contingency Plans

If your business faces a particular risk, such as supply chain disruptions, mention how you’ll navigate these hurdles using the allocated funds.

The Use of Funds slide is a pivotal element within your business plan, captivating investors and ensuring the alignment of financial strategies with broader business goals. By crafting a clear, precise, and well-thought-out slide, you set the stage for attracting support and achieving success in your entrepreneurial journey.

Popular Posts

Save your deck: methods to recover an unsaved powerpoint file.

Twitter: Lessons from Social Media

Oscar Speech Sounds A Lot Like…..

Olympians Can Teach Presenters a Thing or Two

Overcoming a Public Speaking Disaster: A Lesson from Michael Bay

The Similarities Between Presentations and Advertisments : Super Bowl Edition

The Sources & Uses of Funds Spreadsheet: What You Need to Know

by Diane Tarshis | Financials

If you’re not a numbers person, I recommend reading or listening to Financial Projections Explained (Even If You’re Not a Numbers Person) and The Difference Between P&L and Cash Flow Projections before reading this article.

- How much money do you really need?

- What will you be spending that money on?

- How, exactly, are you coming up with that number?

Even if you’re bootstrapping, you’re not off the hook.

Answering these questions helps to ensure that you have enough access to cash (also known as working capital or liquidity) to keep your business afloat until you become what I call “reliably profitable.” I say “reliably” because a single month or quarter isn’t enough time to guarantee that you’re on solid enough financial footing to be self-sustaining.

Where to start…

To answer these questions, you first need to build realistic financial projections using the standard spreadsheets I covered in Financial Projections Explained (Even If You’re Not a Numbers Person) . Specifically, you’re going to need the Sources & Uses of Funds.

- All the cash coming into your startup from loans, investments and grants (and from whom)

- How you plan to use that cash (by type or category)

The Sources & Uses of Funds will not only provide this information, but just as importantly, show that you’ve done your homework, which is a fantastic way to make sure you’re taken seriously. Gold star for you!

Why this spreadsheet is different from the others.

When you look closely at the 5 main spreadsheets startups use for their financial projections, you’ll see that the Sources & Uses of Funds is different from the all the others in one important aspect:

It’s the only spreadsheet that relies on information from other spreadsheets.

Specifically, you need to complete your Cash Flow Projections and Equipment List first. Then you can begin work on your Sources & Uses of Funds.

So let’s go over what you need to know to build this spreadsheet the right way, so you’ll have all your ducks in a row when you start asking for money.

First off, avoid this common mistake.

An unfortunate but common error many entrepreneurs make is including startup costs * in their profit and loss (P&L) and cash flow projections. Doing this is a problem because it distorts your financial picture.

The P&L relies on your estimated revenues and expenses to show your startup’s profitability, whereas cash flow projections rely on those same estimates to show your startup’s ability to pay its bills. Both are essential tools when it comes to setting your prices as well as budgeting. Including startup costs in these spreadsheets will throw your financial picture out of whack because they’re not part of your daily operations.

For example, money received from investors or other funding sources is not revenue. In fact, funding has nothing to do with measuring sales, which is what revenue is meant to show. And startup costs, such as building your website, buying a delivery van or hiring a consultant to write your business plan, have nothing to do with your daily operating expenses.

* When I refer to startup costs, I mean the one-time expenses you incur before you begin your normal daily operations.

Here’s what the Sources & Uses of Funds tells you:

Done right, a Sources & Uses of Funds will show you how much cash you’re going to need to:

- Launch your business.

- Cover your expenses until your startup is generating enough cash to cover its own expenses… or reach the next round of funding.

- Raise from investors, borrow from lenders or budget for yourself if you’re planning to bootstrap.

What goes in the “Sources” section.

In the Sources section you’re going to list everyone who is providing the startup funds that you need. Regardless of whether you’re planning to find outside investors, secure a loan, use your own money or some combination, this part of the spreadsheet has to show all the sources of funding for your business.

You’ll need to list each one on its own line, including the source’s name along with the amount they are investing or loaning to you.

Founder Contribution: Suzy Q. $xxx Founder Contribution: Andre M. xxx Investment from Tony Smith: xxx Investment from XYZ Ventures: xxx Total Sources: $xxx

When you’re completing this section, make sure not to leave out anything, including money coming from friends, family, co-founders or yourself, if you’re using your own money.

After each source is listed, you’ll total them up to determine the sum of all incoming funds. Then you’re ready to move on!

What goes in the “Uses” section.

The Uses section includes two different categories:

- Startup costs

- Working capital

1. Startup costs.

In the first category, you need to consider all of the expenses you’ll incur before you launch your business. This includes things like a website, furniture, equipment, legal fees, consultant fees, grand opening expenses and more.

Each category should be listed on its own line of the spreadsheet. For example, you’ll have one line for furniture, one for equipment, one for consultant fees and so on.

Reminder: If you need to purchase equipment for your startup — things like machinery, display cases, a delivery van, etc. — you’ll need to create a separate Equipment List spreadsheet where the individual items are listed in detail, along with delivery and installation fees, sales tax, etc. Then you put that total in the Uses section.

App Development $xxx Business Plan xxx Equipment xxx Legal xxx Grand Opening xxx Inventory/Supplies xxx Website xxx

Cash Needs for 17 Months of Operations xxx Cash Reserve for Contigencies xxx Total Uses: $xxx

Now we’ll look at the next thing you have to account for in the Uses section…

2. Working capital.

This category refers to the amount of cash you’ll need to bridge the gap until your business is generating enough cash to fund itself and become self-sustaining.

This number will appear as its own line item labeled “Cash Needs for ___ Months of Operations.”

Of course, to figure out how many months it will take to become profitable, you’ll have to refer back to your Cash Flow Projections. That’s why you need to prepare them before tackling your Sources & Uses of Funds.

To estimate when your business will be “reliably profitable,” take a look at the bottom two lines of your Cash Flow Projections spreadsheet. They show the cumulative beginning and ending cash on hand each month.

Find the month when the negative numbers become consistently positive. However many months it is from when you start your business, that’s the number you’ll use to fill in the blank of “Cash Needs for ___ Months of Operations.”

Finally, I recommend adding an additional line labeled “ Cash Reserve for Contingencies . ” It’s always smart to have a small cushion to cover any surprises that crop up.

Two important points about the Sources & Uses of Funds:

1. the totals have to match..

In other words, Total Sources needs to equal Total Uses. This isn’t my rule, it’s an accounting rule.

If there’s a significant difference between Total Sources and Total Uses, then there’s something important missing in one of the sections. It’s important for you to find and fix any discrepancies.

It’s especially important to do this before showing your numbers to other people. If your Total Sources and Total Uses don’t match up, it’s a red flag to banks and potential investors that you don’t understand your financials.

If, on the other hand, your two totals are close but not exact, I tweak the Cash Reserves line item slightly — and I do mean slightly — to make the numbers match.

2. Double-check that your financial projections are realistic and credible.

You’ll know you’ve done things right when you’re confident that you can defend your assumptions if an investor or banker dives in and asks how/where/why you chose the numbers you did. Pro Tip: It’s not really about the numbers per se, it’s about the thinking behind the numbers that they’re testing you on.

Helpful reading and resources.

For more information on the financial spreadsheets mentioned in this article, take a look at my DIY Business Plan Kit . It goes into far greater detail on the five main spreadsheets you need for your business plan, and includes Excel templates with some formulas already built in.

Also take a look at The Difference Between Profit & Loss and Cash Flow Projections to get a better understanding of how each of those spreadsheets works. And if all of this numbers talk is new to you, be sure to take a look at Financial Vocabulary for People Who Hate Numbers .

Last but not least, if you’d like help putting together your financial projections — as well as learning how to use them so that you can take charge and feel comfortable changing things as you move forward — consider working with me one on one ( see more details here ).

Want some one-on-one help? Book a free discovery call.

Everything you need and nothing you don’t.

Get more tips like these delivered straight to your inbox.

Recent Posts

- Stop Saying You Don’t Have Time to Start a Business

- 5 Reasons People Over 40 are More Likely to Succeed When Starting a Business

- How to Fund Your Business Without Selling Your Soul

- How to Start a Business in a Crowded Market

- First Steps

- How To…

Share this post:

Transition to growth mode

with LivePlan Get 40% off now

0 results have been found for “”

Return to blog home

How to Manage Business Loans After You Receive Funding

Posted june 9, 2021 by diane gilleland.

So you landed some funding for your business. You finished writing a solid business plan and used it to apply for a small business loan, or perhaps you made a successful pitch to investors . Either way, congratulations!

Now comes, possibly the more difficult part of receiving funding, managing it.

The importance of managing your business finances

Consider this: When you wrote your original business plan, there were things you didn’t know. It’s true for every entrepreneur . No matter how much expertise you have in your field, there are always aspects of running a business that you won’t understand in advance.

This is completely fine because you’ll learn as you go. But that learning needs to be captured and acted on quickly, so your company can stay solvent. And this is where doing more use of funds reporting can really help you—not from a planning standpoint, but from a management standpoint.

The more you know about how your business is performing, the more you review and revise expectations, the better prepared you’ll be to take strategic action.

4 steps to manage small business finances and strategically use your funds

We’ll dive into specific funding scenarios later on in this article, but for now, here are the 4-steps you should take to better manage the cash you received.

1. Compare your forecasts to actual performance

Similar to how you don’t have all the answers regarding how you’ll actually spend funding before launching your business, your other projections likely aren’t perfect. Forecasting isn’t about seeing into the future, but making educated guesses regarding financial performance, market factors, and customer interest. And when you’re a virtually new business, you’re typically basing these assumptions off competitors or industry benchmarks, not previous sales or cash flow data.

So, rather than working off of outdated assumptions, the best thing you can do is compare your forecast to how your company actually performed . Doing this on a monthly basis helps you quickly identify where real-world sales and costs deviated from your projections.

With LivePlan’s Live Forecast™ feature , you can make these adjustments with a single click and start your analysis directly within your Profit and Loss Statement. This allows you to spend less time updating your forecasts, and more time exploring what changes you should be making based on actual results.

2. Adjust your forecast

The other piece of comparing your forecasts to actual performance is revising your forecasts with actual sales data. We call this adjust to actuals, and doing this practice regularly ensures that your upcoming projections are always more accurate than the last. This ensures that you won’t be surprised by dips in sales, a lack of cash, or not having enough supply to satisfy demand.

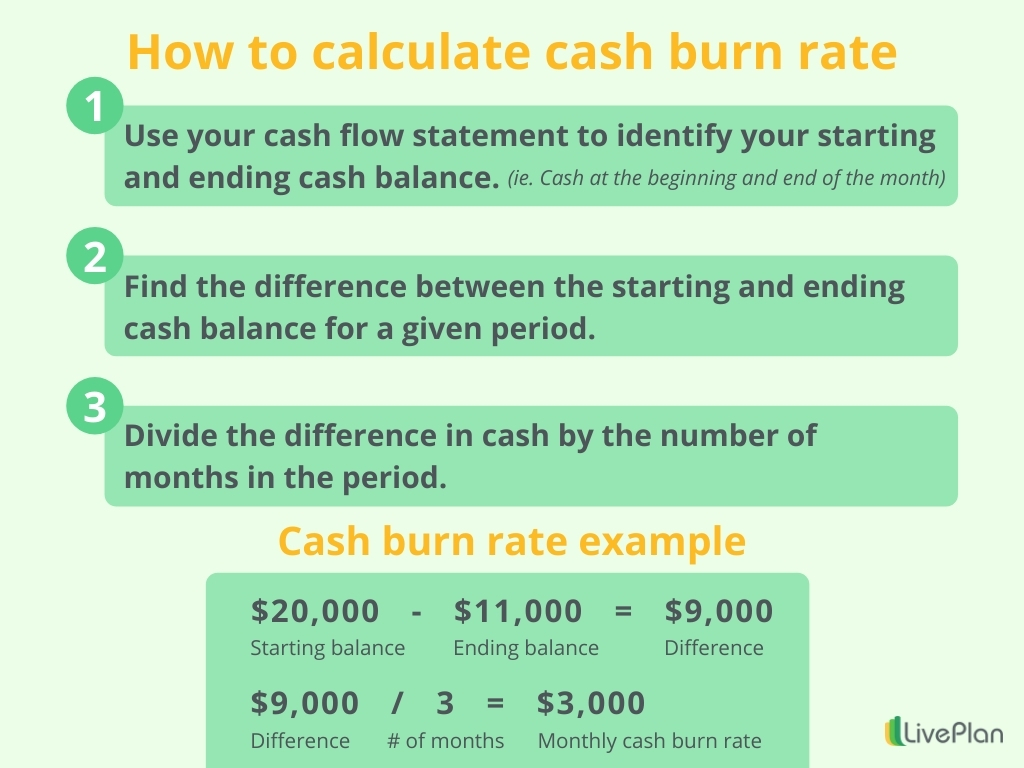

3. Review your cash runway

Part of revising forecasts based on actual performance is looking at your cash burn rate and understanding your cash runway. These metrics tell you how quickly you are using up your funding and how long you have left until it potentially runs out. You’ll want to look at your projected cash flow statement to fully understand how solvent your business is in the coming months.

4. Make a plan and set milestones to bridge that money gap

Keep in mind that, especially for startups, you’ll probably be looking at a hefty burn rate and negative cash flow in the first few months. That’s perfectly ok, but you want to be sure you have milestones in place for when you need to see your cash intake flip to positive. Otherwise, you’ll keep on burning through cash thinking it’s perfectly fine until it’s too late.

This is when you should revisit your overall business plan once again, and revise or adjust any initial milestones you have. Just like forecasts benefit from adjusting to actual results, your overall strategic plan does as well. You’ll want to consistently revisit elements of your plan over time and keep them up to date. That way it can be used as a management tool rather than just a static plan that helped you get funding.

Tips for managing your small business finances

Having a system in place to manage your finances is an excellent first step. Putting it into action can be a bit difficult at first, so here are some additional tips to help make it a consistent process.

Start with your business plan

When you built your business plan , you likely included a section that explained how you plan to use the money you requested from lenders or investors.

This probably looked like a report on “use of funds” (or “use of proceeds,” as it’s sometimes called). It’s a standard part of writing a business plan to get funding. A use of funds report is a simple statement of why you need the funding and how it will help your business.

Since there are so many ways to use funding (purchasing equipment or other assets, adding staff, expanding marketing, and so on), a use of funds report can take the form that best meets your needs. It might be a spreadsheet, a forecast, or simply a few paragraphs of text.

And now that you have that cash in hand, it’s tempting to think that your business plan has done its job, and now all you have to do is use the money. But many entrepreneurs fail because of this exact belief. They haven’t quite thought through all the ways their original plan will probably change over time, or how to manage their funding while they navigate these changes.

Revisit and revise your forecasts and strategy

Peter Gregory, chairman, and CEO of Green Energy Corp currently uses LivePlan to do strategic planning, use of funds management, and reporting. He is a vocal advocate of doing the process we just walked through early and often.

“If you spend the last 10 minutes of every day looking at your actuals and updating your forecast , then you can get your monthly reporting done in as little as 10 minutes,” says Gregory. “If you wait three months to check in with your numbers, then it’ll take more like four hours to build your report. If you wait a year to look at your numbers, you’ll spend three months coming up with a report.”

“It’s a little like cleaning the shower —if you do it often, it’s no big deal. Wait a year to do it, and you’re going to have to hire a contractor to come rip out your shower.”

Prepare for positive and negative outcomes

As Peter Gregory says, “Keep in mind that good news, as well as bad, can affect your cash flow.” A large, unplanned expense can cause you to run short of cash down the road. But a large, unplanned revenue event creates an opportunity to invest in growth. Either way, the sooner you know what’s happening, the more effectively you can react. By staying in touch with your forecast in this way, you’ll be much better able to see your future.

The cash flow statement, then, becomes a kind of crystal ball. If your forecast is up to date, then you’ll be able to see, on the bottom line, exactly when your cash will dip into the negative:

These are the months when you’ll plan to use your line of credit, and now you can see the amount you’ll be using. With this visibility, you can plan your spending effectively. Not only that, you’ll be able to see what funding you might need a year from now, and that gives you time to find it.

The worst moment to discover that you’re running out of cash is the moment when you’re actually running out of cash.

Stay on top of anything associated with your funding

Aside from the internal management of your funding, you’ll need to be aware of and effectively track some external factors as well. These may be directly tied to your funding, or are elements that can affect your business due to bringing on debt. Here are a few additional things to consider:

Keep track of your credit

Depending on the type of funding that you acquire, it can have an impact on your business credit score . A loan or line of credit specifically, will either add a new amount of debt to your credit report or increase the amount of available credit you have available. Taking on debt is a common part of business, but you want to be sure that when you do, you’re keeping track of your credit score and doing everything you can to improve it.

In general, you want to be aware of the following:

- Your payment history and overall repayment timeline

- The amount borrowed compared to the amount of credit you have available

- How long your credit has been on file

- The number of credit inquiries you have outstanding

- The types of credit and debt you have

In short, you want to make sure you’re making payments on time, lowering your overall debt to healthy levels, and have enough available credit to leverage in a crisis. Doing so will not only improve your credit score but make it easier for you to negotiate future loans and funding with favorable terms.

Leverage available cash

You’ve likely acquired funding to grow your business. As you begin to do so, you may find that you have more available cash than you initially forecasted. In this situation, it can be tempting to immediately go outside of how you initially scoped out your use of funds. Instead, it may be wise to use that extra cash to pay off higher debt or loans that you currently have.

Now, you don’t want to make this decision blindly. Thankfully, by leveraging this process and consistently reviewing your position, you should already have been making necessary adjustments. If you really have excess cash, having this prepared can make it far easier to determine where it could be reallocated, and how much can simply go toward paying off your loans.

Avoid new debt

As you manage the funding you’ve acquired, it’s important that you avoid bringing on additional debt if possible. You want to be sure that you’re able to effectively turn the debt you have into profit. So, first and foremost you want to be sure you’re able to make payments on time.

If you’re struggling to do so or find that the funding is not leading to growth like you initially expected, it’s time to identify some cost-cutting strategies. If you bring on more funding, loans, or any other type of debt in this situation, it will simply stack on additional risks that you may not be able to handle.

Stay in touch with your lender

Once you receive any form of funding, you’ll want to remain in touch with your lender. This ensures that you are actively addressing any questions, concerns, or potential changes that you or the lender have in mind. This may include things like:

- An extension or adjustment of the financing terms

- Adjustments to your repayment plan

- Interest rate adjustments

- Delay of payment

More than likely, you’ll also need to report on the way you use the funds in some way. Let’s dive into how to create a use of funds report.

How to report your use of funding

If you built your business plan in LivePlan, then you’re halfway to your use of funds report already. You can easily update your forecast, and see a visual comparison between your forecast and actual performance in the Dashboard tab . You can even generate reports for your investors or management team at any time.

You’ll need to do this reporting no matter what kind of funding you’ve taken on—a loan, line of credit, or angel investment. Let’s look at the specifics of the use of funds reporting for all three kinds of funding.

Do keep in mind that the reporting we will be walking through is based on how you do it in LivePlan. But the processes and methodology still apply even if you don’t currently use this planning tool.

Use of funds reporting if you’ve received a loan

When a bank loans you money, you aren’t required to formally report back to them on how you’ve used it. But you’ll want to maintain a personal record of what expenditures you’ve made with the funds, and how soon your funds might run out.

If you’re using accounting software like QuickBooks or Xero , this record will happen as part of your accounting, but if you are not yet using accounting software, you’ll want to keep an accurate record of your spending.

If you took on a loan of a specific amount, earmarked for a specific set of purchases, obviously that’s a simple picture. The money comes in, and you spend it on what your business plan said you were going to spend it on. And then you make sure that these expenditures are represented in your forecast.

The LivePlan Schedule tab can be very helpful in planning this kind of spending. Major business expenditures, such as buying equipment, often have important deadlines tied to them. It’s also possible that the loan you’ve received has deadlines attached to it as well. You can create milestones with due dates in LivePlan for these deadlines, which helps you and your team stay on track.

Use of funds reporting if you’ve received a line of credit

Another common type of lending small businesses use is a line of credit —a revolving loan that you can draw on and pay back as needed. When you’re managing a line of credit, LivePlan can not only help you track your use of funds, but it also helps you predict exactly when you’ll need to use that line of credit to bridge future gaps in your cash flow.

It all begins with your business plan forecast . When you take on a line of credit, you’ll first enter it in your forecast. Then you’ll make monthly predictions about your spending, entering them as dollar values in each month.

As the months’ progress, check in on these values and make sure they represent your actual spending picture. Doing these regular checks will keep your cash flow forecast up to date, giving you a more accurate picture of what your cash will look like in upcoming months. A good entrepreneur regularly updates her forecast, so it reflects any unexpected expenses (or earnings) month to month.

When you were pitching to investors , it’s likely you showed them your early use of funds report, so they could understand how you were planning to spend the money. Now that you have an investor, you’ll need to submit a use of funds report to them regularly.

The frequency and level of detail in your reports will usually be dictated by the investment contract you’ve signed, but it’s good to plan on reporting to your investors monthly. (Or if you like, you can always send your investors an invitation to your LivePlan account , so they can check on the data whenever they want to.)

The process for preparing these reports is the same as the process we recommend above for managing a loan or line of credit. You’ll regularly:

- Check your forecast against your actual performance

- Update the forecast

- Look for future cash flow problems, and make a plan to solve them

The only difference is, in this case, you’ll need to make a presentation of your findings to the investor. Most investors will want to see a set of projected financial statements— profit and loss , balance sheet , and cash flow . You can print these from the Forecast tab in LivePlan.

Investors want to see how you react to the unexpected

Your investor will also want to see how you’re reacting to the unexpected events that pop up as your company operates.

“Investors want to know how their money is being used now, and how it will be used it in the future,” says Gregory. “That future picture can shift over time, so it’s important to be able to explain what that means to the investor. Investors are used to seeing companies change. They just want to know that you’re on top of it, and what the next 12 months to three years look like. That way they can either plan to invest more or not lose more.”

Not only that, an entrepreneur who keeps up on her forecast has more value for investors. “An investor would much rather see your forecast evolve into a target you can hit,” says Gregory. “It doesn’t help anyone if you stick to your original forecast goals and don’t meet them. Investors want to know that you can use this month’s numbers to plan a realistic future. That gives them more confidence, so they’re more likely to stay with you.”

Funding is cyclical

Many new entrepreneurs think that their initial funding is all they’ll need and that the business will be funding itself by the time that borrowed or invested cash is spent.

In reality, however, a business will likely need to seek funding more than once in its lifetime. According to a 2017 Federal Reserve survey of small businesses, over 60 percent needed additional funding to either grow or resolve business challenges.

There could be a temporary dip in your market or an unforeseen pandemic , and you’ll need bridge cash. Or there may be times when you’re ready to grow the company in a new direction, and you’ll need an infusion of cash to ramp up.

This is why good use of funds reporting is so important. The more you can show that you’ve used your funding well to make a positive impact on your company, the more attractive your business will look to lenders and investors in the future.

Editors’ note: This article was originally published in 2019 and updated for 2021.

Like this post? Share with a friend!

Diane Gilleland

Posted in growth & metrics, join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

How to Prepare a Sources and Uses of Funds Statement

What Is a Sources and Uses of Funds Statement?

The sources and uses of fund statement is an accounting statement that summarizes the financial statement and financial plan . It shows the sources from which a business or a company obtains its cash and the uses to which this cash is put during a trading period.

Large companies and businesses include sources and uses of funds statement in their annual report . It is their way to show the lenders how much they need for a startup financial and how much collateral they will contribute. Creating sources and uses of fund statement is also one of the ways to strategize business financially.

The Sources and the Uses

Let us take a closer look at the sources and the uses of funds.

Sources of funds. The sources of funds is where all the money for funding is going to come from. For example, you may be providing furniture for your office, getting a loan to purchase equipment, or getting a line of credit for working capital.

Uses of funds. The money needed for various purposes for business startup. This includes:

- The beginning quantities of supplies, equipment, and furniture.

- Purchase of building or land.

- Costs of deposits for rent

What Is the Statement of Sources and Application of Funds?

The statement example in word of sources and application of funds shows the total sources of new funds that are generated between the balance sheet dates and the total uses of those funds in the same period. it is also made up of a list of the changes that occur in all of the Balance Sheet Items between any two balance sheet dates.

The statement of sources and application of funds will exactly tell where the company got their money from and detail how the money was spent. It also tells whether the management plan has made reasonable investment decisions.

Steps in Creating a Sources and Uses of Funds Statement

As we have already learned in this article, there are two sections of the statement example in excel for funds: the sources and the uses. Here are the steps in creating the sources and the uses in the fund statement.

- In the first section, which is the uses of funds, use the subtotals from your startup costs worksheets, such as the facilities, equipment and vehicles, supplies and advertising, and other startup costs. After that, total those numbers.

- Include an estimate of your working capital needs. The working capital needs are the amount of money you have to obtain in order for you to pay the bills while you are still establishing your business analysis .

- To determine the total use of funds, Add the total of startup funds and working capital needs.

- Equity in your company

- A savings account

- An IRA (Individual Retirement Account)

- The difference of the total of the uses of funds and the total collateral you are providing must be equal to the amount of financing needed.

AI Generator

Text prompt

- Instructive

- Professional

10 Examples of Public speaking

20 Examples of Gas lighting

How to Create a Winning 'Use of Funds' Slide for Your Pitch Deck

There might not be any slide more important than the "use of funds" slide in your pitch deck. This crucial slide does more than just outline where the money will go; it paints a picture of how each dollar will strategically drive your startup's growth and success.

For potential investors, it’s a window into your planning and financial acumen, showcasing your understanding of resource allocation and your strategic vision for the future.

Creating a winning use of funds slide demands a balance of clarity, detail and foresight, ensuring that investors can see the direct correlation between their funding and your startup’s trajectory.

What Is a Use of Funds Slide?

A use of funds slide details how the capital raised will be utilized. It’s a clear, concise breakdown of the different areas where the investment will be allocated, such as product development, marketing, hiring, operations or research and development.

This slide is more than just a financial plan. It’s a strategic tool that communicates to potential investors how their funds will directly contribute to the growth and scaling of the business.

Why Are Use of Funds Slides Important to Investors?

For investors, the use of funds slide is a critical factor in their decision-making process. It demonstrates the startup’s strategic planning skills and its understanding of what it takes to grow the business.

Investors use this slide to gauge:

- Financial Acumen - How well the startup understands and manages financial resources. It shows that the founders are prudent, realistic and have a clear plan for managing capital efficiently.

- Strategic Prioritization - The allocation of funds highlights the startup’s priorities. It answers crucial questions about which aspects of the business are deemed most critical to its success and how different areas will be balanced.

- Growth Potential - By showing where the funds will be spent, this slide outlines the startup's roadmap for growth. Investors can see how their investment will fuel key activities like market expansion, product development or talent acquisition.

- Return on Investment - Ultimately, investors want to know that their investment will yield a significant return. The use of funds slide should connect the dots between the investment and the anticipated growth outcomes, indicating a clear path to profitability.

Crafting an Effective Use of Funds Slide

An effective use of funds is more than a simple list of expenses. It weaves a narrative that aligns your financial planning with the long-term objectives of your startup.

Clarity and Precision

The use of funds slide must be clear and precise. Avoid vague categories and generalizations. Instead, provide specific, itemized breakdowns of how the funds will be allocated.

This might include detailed percentages or figures for areas like product development, marketing, staff salaries or operational costs. The aim is to give investors a transparent and detailed view of your spending strategy, ensuring they understand exactly how their capital will be utilized to drive growth.

Aligning with Business Goals

Every dollar outlined in your use of funds slide should clearly contribute to your overarching business goals.

Whether it's expanding your team to accelerate product development or allocating funds for market research, it's important to show how each expenditure is a strategic step towards achieving your business objectives. This alignment reassures investors that their funds will be used to directly support the growth and scalability of your startup.

Presenting Evidence

Support your financial projections and allocations with evidence. This could include market research, pilot studies or historical financial data from your business.

Demonstrating a data-driven approach in your financial planning adds credibility to your use of funds slide. It shows investors that your allocations are not just theoretical but are based on solid research and realistic projections of your business’s growth trajectory.

Common Mistakes to Avoid in Your Use of Funds Slide

We'll preface this section by saying that your mileage may vary, as different investors look for different things in pitch decks. However, there are some common mistakes that founders run into when presenting their business plans.

- Overgeneralization - One of the most common errors is being too vague about how the funds will be used. Broad categories like 'marketing' or 'development' don't offer enough insight into your strategy. Investors prefer detailed breakdowns that show a thorough understanding of how each dollar will be utilized.

- Lack of Alignment with Business Strategy - Every item on your use of funds slide should directly relate to and support your overall business strategy and objectives. Including expenses that don't clearly contribute to specific business goals can raise doubts about your strategic planning abilities.

- Unrealistic Projections - Overly optimistic or unrealistic financial projections can be a red flag for investors. Your financial needs should be grounded in realistic assumptions and backed by credible market research and data.

- Ignoring Operational Costs - While it might be tempting to focus solely on growth-focused expenditures like product development or marketing, neglecting to include operational costs can give an incomplete picture of your financial needs and raise questions about your understanding of running a business. And conversely, only including salaries in your use of funds slide tells investors that you aren't as focused on growth as you should be.

- Forgetting Contingency Plans - Not including a budget for contingencies or unexpected expenses can make your financial planning appear naive. It's important to show investors that you're prepared for potential hurdles.

- Omitting Future Funding Rounds - If you anticipate the need for additional funding rounds in the future, it's wise to mention this in your use of funds slide. This transparency helps set realistic expectations about the company's financial trajectory and funding requirements.

Preparing for Investor Questions

When presenting your pitch deck, particularly the use of funds slide, be prepared for a thorough questioning from potential investors. These questions are not just about validating the information presented, but also about gauging your understanding of the business and your readiness to handle the challenges ahead.

- Clarifications on Expenditure Breakdowns - Investors may ask for more details about specific line items on your use of funds slide. Be prepared to explain the rationale behind each allocation, how you arrived at the figures and how each expense will contribute to the business’s growth.

- Assumptions Behind Projections - Be ready to discuss the assumptions underlying your financial projections. Investors will be interested in understanding the market research, historical data or trends you’ve used to inform your forecasts.

- Scalability and Long-Term Funding - Questions may arise about your startup’s scalability and long-term financial sustainability. Investors will be interested in how the current funding round will help you reach key milestones and what your plans are for future funding needs.

- Risk Management and Contingency Plans - Expect questions about risks and your plans to mitigate them. Be honest about the risks your business faces and discuss your strategies for managing these risks, including contingency budgets.

- Performance Metrics and Milestones - Investors will likely inquire about the metrics and milestones you plan to use to measure success and progress. Be specific about your key performance indicators and how they align with the use of funds.

- Operational Costs and Management - Be prepared to discuss the operational aspects of your business. This includes questions about day-to-day management, the efficiency of operations and how operational costs have been factored into your financial planning.

Remember, the key to effectively addressing investor questions is not just in providing the answers, but in demonstrating a deep and thoughtful understanding of your business. Your responses should reflect thorough preparation and confidence,

Need a Hand With Your Startup Idea?

The startup journey can be an exhilarating yet challenging experience, especially when it comes to navigating the intricacies of developing and pitching your idea. It's important to continually interrogate the ideas behind your startup to be sure you're on the right track.

Archie is an AI-powered solutions architect that we developed here at 8base. The way it works is simple: Plug in your startup idea, and within moments, Archie will give you feedback on how attractive your idea would be to investors and how to structure your business model.

That's just the start: Archie will present ideas for monetization, structuring your digital properties and even how you can incorporate AI into your business idea. Archie is free, and you can try it here .

Share this post on social media!

Dig the post check these out:, archie named top ai & data product in the 2024 product awards.

Archie by 8base awarded Best Product in AI & Data; recognized as one of the best products for product managers

How to Sustainably Improve Profit Margin at Your Software Development Agency

Improving your margin is an exercise in balancing costs against the tactics you are using to generate revenue while continually working to make your team more efficient.

10 Questions to Ask a Software Development Company

Choosing the right software development company is a decision that can shape the future of your project.

Ready to try 8base?

We're excited about helping you achieve amazing results.

- Deals Funded

- Deals in Process

Testimonials

Before you can proceed with a real estate project, you must identify how you will obtain funding and how you will spend those funds. Clearly, Sources and Uses (S&U) of funds is key to property development. Therefore, this article defines sources and uses of funds, where funds come from and how we use them. Next, we’ll explain the sources and uses table and the sources and uses template. Finally, we’ll conclude with the answers to some frequently asked questions about sources and uses of cash.

Video: LBO Model: Sources and Uses

What Are Sources and Uses of Funds?

Sources and uses of funds is an accounting concept used by all sorts of businesses. In this article, we’ll focus on sources and uses of funds for commercial real estate projects. Besides being a fundamental accounting concept, the sources and uses statement is one of the major accounting reports. Managers, investors and regulators pour over the latest S&U reports to help evaluate the health of an organization or project.

The S&U Statement

The S&U statement shows how project funding arises and where the capital goes. The primary rule for the sources and uses of cash statement is that the combined sources of funds must match the combined uses. The report itself can have a basic format. First, you list sources by line item and then total them. Next, uses receive the same treatment. Obviously, the statement reader can quickly verify that total sources equals total uses. In order to make the two totals match, the preparer may have to add a category. Specifically, that category plugs for the difference between sources and uses as follows:

- If sources > uses, plug with the use category “cash flow distribution.”

- If sources < uses, plug with the source category “additional equity required.”

Apply For Financing

Major uses of funds.

The use of funds section is the first one you derive because it dictates how much money to raise. Typically, the project sponsor identifies project costs as price per square foot or price per unit. Also, sponsors can specify each item’s percentage of total costs. Normally, you group project costs by purchase price, hard costs and soft costs. Thereafter, you can break down each group into line items and/or roll up the costs to the group level.

Purchase Price

There is no great mystery about purchase price. Specifically, it is the price the sponsor pays for the land and any improvements, such as infrastructure and buildings. If you don’t purchase the land, then the price includes the cost of the lease-hold interest on the property acquired. By specifying the cost per square foot, you can compare the price to comparable transactions.

Another major use of funds is to pay hard costs. Specifically, hard costs are items that directly add to property improvement, such as materials and labor. In addition, hard costs can include contingencies for direct cost overruns. By including unit costing, you can compare your costs to market averages.

Hard cost projections can tell you a lot about the project. To illustrate, suppose an investor must choose between two $20 million acquisition properties. In the first, the hard cost estimate is only $1 million, but the second one anticipates a $9 million hard cost. In the first project, the building requires little development or rehab. However, the second project requires extensive improvement. As an investor with specific risk preferences, you can use this information to decide on the right investment.

Hard Cost Line Items

A use of funds template might break down the category into line items. That is, the template might specify detailed costs, such as roof repair, new HVAC, sewage hookups and so forth. The breakdown of costs might indicate substantial deferred maintenance that the sponsor must address. Indeed, the cost to rehab the property will help the sponsor to keep existing tenants from moving to another property. On the other hand, the costs might indicate a desire to move the property upscale. For example, these might be costs like renovating the lobby, new landscaping, and bathroom renovations. Clearly, these costs aim to allow the sponsor to charge new tenants market rents or possibly even higher.

Soft costs arise from a project but don’t tangibly improve the property’s value. They include use of funds template items like:

- Organizational fees

- Purchase closing costs

- Broker and leasing commissions

- Acquisition costs

- Equity reserves

- Interest reserves

You improve the report’s usefulness by including soft costs per square foot and as a percentage of total costs. If the sponsor seems to be paying too much for soft costs, it could indicate incompetence or even bad luck. Furthermore, excessive reserves for equity and interest might indicate high uncertainty within the business plan.

Major Sources of Cash Flow