What is Efficient Market Hypothesis? | EMH Theory Explained

The efficient market hypothesis (EMH) can help explain why many investors opt for passive investing strategies, such as buying index funds or exchange-traded funds ( ETFs ), which generate consistent returns over an extended period. However, the EMH theory remains controversial and has found as many opponents as proponents. This guide will explain the efficient market hypothesis, how it works, and why it is so contradictory.

Best Crypto Exchange for Intermediate Traders and Investors

Invest in 70+ cryptocurrencies and 3,000+ other assets including stocks and precious metals.

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

Copy top-performing traders in real time, automatically.

eToro USA is registered with FINRA for securities trading.

What is the efficient market hypothesis?

The efficient market hypothesis (EMH) claims that all assets are always fairly and accurately priced and trade at their fair market value on exchanges. If this theory is true, nothing can give you an edge to outperform the market using different investing strategies and make excess profits compared to those who follow market indexes.

Efficient market definition

An efficient market is where all asset prices listed on exchanges fully reflect their true and only value, thus making it impossible for investors to “beat the market” and profit from price discrepancies between the market price and the stock’s intrinsic value. The EMH claims the stock’s fair value, also called intrinsic value , is much the same as its market value , and finding undervalued or overvalued assets is non-viable.

Intrinsic value refers to an asset’s true, actual value, which is calculated using fundamental and technical analysis, whereas the market price is the currently listed price at which stock is bought and sold. When markets are efficient, the two values should be the same, but when they differ, it poses opportunities for investors to make an excess profit.

For markets to be completely efficient, all information should already be accounted for in stock prices and are trading on exchanges at their fair market value, which is practically impossible.

Hypothesis definition

A hypothesis is merely an assumption, an idea, or an argument that can be tested and reasoned not to be true. Something that isn’t fully supported by full facts or doesn’t match applied research.

For example, if sugar causes cavities, people who eat a lot of sweets are prone to cavities. And if the same applies here – if all information is reflected in a stock’s price, then its fair value should be the same as its market value and can not differ or be impacted by any other factors.

Beginners’ corner:

- What is Investing? Putting Money to Work ;

- 17 Common Investing Mistakes to Avoid ;

- 15 Top-Rated Investment Books of All Time ;

- How to Buy Stocks? Complete Beginner’s Guide ;

- 10 Best Stock Trading Books for Beginners ;

- 15 Highest-Rated Crypto Books for Beginners ;

- 6 Basic Rules of Investing ;

- Dividend Investing for Beginners ;

- Top 6 Real Estate Investing Books for Beginners ;

- 5 Passive Income Investment Ideas .

Fundamental and technical analysis in an efficient market

According to the EMH, stock prices are already accurately priced and consider all possible information. If markets are fully efficient, then no fundamental or technical analysis can help investors find anomalies and make an extra profit.

Fundamental analysis is a method to calculate a stock’s fair or intrinsic value by looking beyond the current market price by examining additional external factors like financial statements, the overall state of the economy, and competition, which can help define whether the stock is undervalued.

Also relevant is technical analysis , a method of forecasting the value of stocks by analyzing the historical price data, mainly looking at price and volume fluctuations occurring daily, weekly, or any other constant period, usually displayed on a chart.

The efficient market theory directly contradicts the possibility of outperforming the market using these two strategies; however, there are three different versions of EMH, and each slightly differs from the other.

Three forms of market efficiency

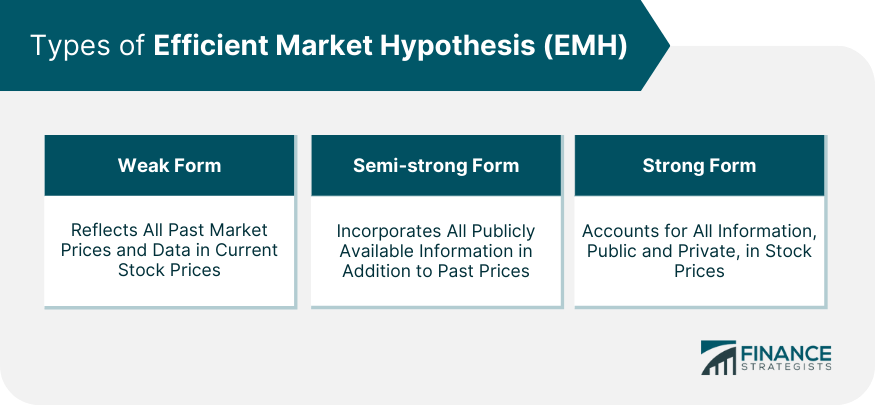

The efficient market hypothesis can take three different forms , depending on how efficient the markets are and which information is considered in theory:

1. Strong form efficiency

Strong form efficiency is the EMH’s purest form, and it is an assumption that all current and historical, both public and private, information that could affect the asset’s price is already considered in a stock’s price and reflects its actual value. According to this theory, stock prices listed on exchanges are entirely accurate.

Investors who support this theory trust that even inside information can’t give a trader an advantage, meaning that no matter how much extra information they have access to or how much analysis and research they do, they can not exceed standard returns.

Burton G. Malkiel, a leading proponent of the strong-form market efficiency hypothesis, doesn’t believe any analysis can help identify price discrepancies. Instead, he firmly believes in buy-and-hold investing, trusting it is the best way to maximize profits. However, factual research doesn’t support the possibility of a strong form of efficiency in any market.

2. Semi-strong form efficiency

The semi-strong version of the EMH suggests that only current and historical public (and not private) information is considered in the stock’s listed share prices. It is the most appropriate form of the efficient market hypothesis, and factual evidence supports that most capital markets in developed countries are generally semi-strong efficient.

This form of efficiency relies on the fact that public news about a particular stock or security has an immediate effect on the stock prices in the market and also suggests that technical and fundamental analysis can’t be used to make excess profits.

A semi-strong form of market efficiency theory accepts that investors can gain an advantage in trading only when they have access to any unknown private information unknown to the rest of the market.

3. Weak form efficiency

Weak market efficiency, also called a random walk theory, implies that investors can’t predict prices by analyzing past events, they are entirely random, and technical analysis cannot be used to beat the market.

Random walk theory proclaims stock prices always take a randomized path and are unpredictable, that investors can’t use past price changes and historical data trends to predict future prices, and that stock prices already reflect all current information.

For example, advocates of this form see no or limited benefit to technical analysis to discover investment opportunities. Instead, they would maintain a passive investment portfolio by buying index funds that track the overall market performance.

For example, the momentum investing method analyzes past price movements of stocks to predict future prices – it goes directly against the weak form efficiency, where all the current and past information is already reflected in their market prices.

A brief history of the efficient market hypothesis

The concept of the efficient market hypothesis is based on a Ph.D. dissertation by Eugene Fama , an American economist, and it assumes all prices of stocks or other financial instruments in the market are entirely accurate.

In 1970, Fama published this theory in “Efficient Capital Markets: A Review of Theory and Empirical Work,” which outlines his vision where he describes the efficient market as: “A market in which prices always “fully reflect” available information is called “efficient.”

Another theory based on the EMH, the random walk theory by Burton G. Malkiel , states that prices are completely random and not dependent on any factor. Not even past information, and that outperforming the market is a matter of chance and luck and not a point of skill.

Fama has acknowledged that the term can be misleading and that markets can’t be efficient 100% of the time, as there is no accurate way of measuring it. The EMH accepts that random and unexpected events can affect prices but claims they will always be leveled out and revert to their fair market value.

What is an inefficient market?

The efficient market hypothesis is a theory, and in reality, most markets always display some inefficiencies to a certain extent. It means that market prices don’t always reflect their true value and sometimes fail to incorporate all available information to be priced accurately.

In extreme cases, an inefficient market may even lead to a market failure and can occur for several reasons.

An inefficient market can happen due to:

- A lack of buyers and sellers;

- Absence of information;

- Delayed price reaction to the news;

- Transaction costs;

- Human emotion;

- Market psychology.

The EMH claims that in an efficiently operating market, all asset prices are always correct and consider all information; however, in an inefficient market, all available information isn’t reflected in the price, making bargain opportunities possible.

Moreover, the fact that there are inefficient markets in the world directly contradicts the efficient market theory, proving that some assets can be overvalued or undervalued, creating investment opportunities for excess gains.

Validity of the efficient market hypothesis

With several arguments and real-life proof that assets can become under- or overvalued, the efficient market hypothesis has some inconsistencies, and its validity has repeatedly been questioned.

While supporters argue that searching for undervalued stock opportunities using technical and fundamental analysis to predict trends is pointless, opponents have proven otherwise. Although academics have proof supporting the EMH, there’s also evidence that overturns it.

The EMH implies there are no chances for investors to beat the market, but for example, investing strategies like arbitrage trading or value investing rely on minor discrepancies between the listed prices and the actual value of the assets.

A prime example is Warren Buffet, one of the world’s wealthiest and most successful investors, who has consistently beaten the market over more extended periods through value investing approach, which by definition of EMH is unfeasible.

Another example is the stock market crash in 1987, when the Dow Jones Industrial Average (DJIA) fell over 20% on the same day, which shows that asset prices can significantly deviate from their values.

Moreover, the fact that active traders and active investing techniques exist also displays some evidence of inconsistencies and that a completely efficient market is, in reality, impossible.

Contrasting beliefs about the efficient market hypothesis

Although the EMH has been largely accepted as the cornerstone of modern financial theory, it is also controversial. The proponents of the EMH argue that those who outperform the market and generate an excess profit have managed to do so purely out of luck, that there is no skill involved, and that stocks can still, without a real cause or reason, outperform, whereas others underperform.

Moreover, it is necessary to consider that even new information takes time to take effect in prices, and in actual efficiency, prices should adjust immediately. If the EMH allows for these inefficiencies, it is a question of whether an absolute market efficiency, strong form efficiency, is at all possible. But as this theory implies, there is little room for beating the market, and believers can rely on returns from a passive index investing strategy.

Even though possible, proponents assume neither technical nor fundamental analysis can help predict trends and produce excess profits consistently, and theoretically, only inside information could result in outsized returns.

Moreover, several anomalies contradict the market efficiency, including the January anomaly, size anomaly, and winners-losers anomaly, but as usual, factual evidence both contradicts and supports these anomalies.

Parting opinions about the different versions of the EMH reflect in investors’ investing strategies. For example, supporters of the strong form efficiency might opt for passive investing strategies like buying index funds. In contrast, practitioners of the weak form of efficiency might leverage arbitrage trading to generate profits.

Marketing strategies in an efficient and inefficient market

On the one side, some academics and investors support Fama’s theory and most likely opt for passive investing strategies. On the other, some investors believe assets can become undervalued and try to use skill and analysis to outperform the market via active trading.

Passive investing

Passive investing is a buy-and-hold strategy where investors seek to generate stable gains over a more extended period as fewer complexities are involved, such as less time and tax spent compared to an actively managed portfolio.

People who believe in the efficient market hypothesis use passive investing techniques to create lower yet stable gains and use strategies with optimal gains through maximizing returns and minimizing risk.

Proponents of the EMH would use passive investing, for example:

- Invest in Index Funds;

- Invest in Exchange-traded Funds (ETFs).

However, it is important to note that other mutual funds also use active portfolio management intending to outperform indices, and passive investing strategies aren’t only for those who believe in the EMH.

Active investing

Active portfolio managers use research, analysis, skill, and experience to discover market inefficiencies to generate a higher profit over a shorter period and exceed the benchmark returns.

Generally, passive investing strategies generate returns in the long run, whereas active investing can generate higher returns in the short term.

Opponents of the EMH might use active investing techniques, for example:

- Arbitrage and speculation;

- Momentum investing ;

- Value investing .

The fact that these active trading strategies exist and have proven to generate above-market returns shows that prices don’t always reflect their market value.

For instance, if a technology company launches a new innovative product, it might not be immediately reflected in its stock price and have a delayed reaction in the market.

Suppose a trader has access to unpublished and private inside information. In that case, it will allow them to purchase stocks at a much lower value and sell for a profit after the announcement goes public, capitalizing on the speculated price movements.

Passive and active portfolio managers are often compared in terms of performance, e.g., investment returns, and research hasn’t fully concluded which one outperforms the other,

Efficient market examples

Investors and academics have divided opinions about the efficient market hypothesis, and there have been cases where this theory has been overturned and proven inaccurate, especially with strong form efficiency. However, proof from the real world has shown how financial information directly affects the prices of assets and securities, making the market more efficient.

For example, when the Sarbanes-Oxley Act in the United States, which required more financial transparency through quarterly reporting from publicly traded businesses, came into effect in 2002, it affected stock price volatility. Every time a company released its quarterly numbers, stock market prices were deemed more credible, reliable, and accurate, making markets more efficient.

Example of a semi-strong form efficient market hypothesis

Let’s assume that ‘stock X’ is trading at $40 per share and is about to release its quarterly financial results. In addition, there was some unofficial and unconfirmed information that the company has achieved impressive growth, which increased the stock price to $50 per share.

After the release of the actual results, the stock price decreased to $30 per share instead. So whereas the general talk before the official announcement made the stock price jump, the official news launch dropped it.

Only investors who had inside private information would have known to short-sell the stock , and the ones who followed the publicly available information would have bought it at a high price and incurred a loss.

What can make markets more efficient?

There are a few ways markets can become more efficient, and even though it is easy to prove the EMH has no solid base, there is some evidence its relevance is growing.

First , markets become more efficient when more people participate, buy and sell and engage, and bring more information to be incorporated into the stock prices. Moreover, as markets become more liquid, it brings arbitrage opportunities; arbitrageurs exploiting these inefficiencies will, in turn, contribute to a more efficient market.

Secondly , given the faster speed and availability of information and its quality, markets can become more efficient, thus reducing above-market return opportunities. A thoroughly efficient market, strong efficiency, is characterized by the complete and instant transmission of information.

To make this possible, there should be:

- Complete absence of human emotion in investing decisions;

- Universal access to high-speed pricing analysis systems;

- Universally accepted system for pricing stocks;

- All investors accept identical returns and losses.

The bottom line

At its core, market efficiency is the ability to incorporate all information in stock prices and provide the most accurate opportunities for investors; however, it isn’t easy to imagine a fully efficient market.

Research has shown that most developed capital markets fall into the semi-strong efficient category. However, whether or not stock markets can be fully efficient conclusively and to what degree continues to be a heated debate among academics and investors.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs on the efficient market hypothesis

The efficient market hypothesis (EMH) claims that prices of assets such as stocks are trading at accurate market prices, leaving no opportunities to generate outsized returns. As a result, nothing could give investors an edge to outperform the market, and assets can’t become under- or overvalued.

What are three forms of the efficient market hypothesis?

The efficient market hypothesis takes three forms: first, the purest form is strong form efficiency, which considers current and past information. The second form is semi-strong efficiency, which includes only current and past public, and not private, information. Finally, the third version is weak form efficiency, which claims stock prices always take a randomized path.

What contradicts the efficient market hypothesis?

The efficient market hypothesis directly contradicts the existence of investment strategies, and cases that have proved to generate excess gains are possible, for example, via approaches like value or momentum investing.

When more investors engage in the market by buying and selling, they also bring more information that can be incorporated into the stock prices and make them more accurate. Moreover, the faster movement of information and news nowadays increases accuracy and data quality, thus making markets more efficient.

Weekly Finance Digest

By subscribing you agree with Finbold T&C’s & Privacy Policy

Related guides

PrimeXBT: how spot Bitcoin ETFs have changed the Crypto trading industry

Is it safe to integrate your card payment solution for business?

5 Benefits of Paying Your Staff With Crypto

How to Buy Red Bull Stock [2024]

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Technical Skills

- Trading & Investing Guides

Efficient Markets Hypothesis

The efficient market hypothesis (EMH) suggests that financial markets operate in such a way that the prices of equities, or shares in companies, are always efficient.

Elliot currently works as a Private Equity Associate at Greenridge Investment Partners, a middle market fund based in Austin, TX. He was previously an Analyst in Piper Jaffray 's Leveraged Finance group, working across all industry verticals on LBOs , acquisition financings, refinancings, and recapitalizations. Prior to Piper Jaffray, he spent 2 years at Citi in the Leveraged Finance Credit Portfolio group focused on origination and ongoing credit monitoring of outstanding loans and was also a member of the Columbia recruiting committee for the Investment Banking Division for incoming summer and full-time analysts.

Elliot has a Bachelor of Arts in Business Management from Columbia University.

- What Is The Efficient Market Hypothesis (EMH)?

- Variations Of The Efficient Markets Hypothesis

- Are Capital Markets Efficient?

What Is the Efficient Market Hypothesis (EMH)?

The efficient market hypothesis (EMH) suggests that financial markets operate in such a way that the prices of equities, or shares in companies, are always efficient. In simpler terms, these prices accurately reflect the true value of the underlying companies they represent.

The efficient market hypothesis is one of the most foundational theories developed in finance. It was developed by Nobel laureate Eugene Fama in the 1960s and is widely known amongst finance professionals in the industry.

There are many implications arising from this hypothesis; however, the main proposition is that it is impossible to “beat the market” and generate alpha.

What does beating the market or generating alpha mean? Broadly speaking, you can think of how much the return of your risk-adjusted investments exceeds benchmark indices.

For example, a proxy for the US market will be the S&P 500, which covers the top 500 companies in the United States or over 80% of its total market capitalization .

If your portfolio of investments generated an alpha of 3%, then it is considered that your portfolio outperformed the S&P 500 by 3% (assuming that you trade in the US market)

How is it possible that share prices are always efficient and reflect the actual value of the underlying company following the efficient market hypothesis?

It is because, at all times, a company's share price reflects certain relevant available information to all investors who trade upon it, and the type of information required to ensure efficient prices depends on what form of efficiency the market is in.

If you are interested in a profession surrounding capital markets, be it asset management , sales & trading, or even hedge funds, the EMH is a theory you need to know to ace your interviews.

However, this is only one topic in the diverse world of finance that you will truly need to know if you want to break into these careers. To gain a deeper understanding of finance, look at Wall Street Oasis's courses. For a link to our courses, click here .

Key Takeaways

- Developed by Eugene Fama, the EMH suggests that financial markets reflect all available information and that it's impossible to consistently "beat the market" to generate abnormal returns (alpha).

- The EMH has three forms: weak, semi-strong, and strong. Each form describes the extent of information already reflected in stock prices.

- Under this form, stock prices incorporate historical information like past earnings and price movements. Investors can't gain alpha by trading on this historical data as it's already "priced in."

- In this form, stock prices reflect all publicly available information, including recent news and announcements. Even with access to this information, investors can't consistently beat the market.

- The strongest form of EMH incorporates all information, including insider information. Even with insider knowledge, investors can't generate abnormal returns. However, some argue that real-world markets may not fully adhere to this hypothesis due to behavioral biases and inefficiencies.

Variations of the Efficient Markets Hypothesis

According to Eugene Fama, there are three variations of efficient markets:

Semi-strong form

Strong form

Depending on which form the market takes, the share price of companies incorporates different types of information. Let’s go over what kind of information is required for each form of the efficient market.

Weak form efficiency

Under the weak form of efficient markets, share prices incorporate all historical information of stocks. This would typically cover a company’s historical earnings, price movements, technical indicators, etc.

Another way to look at it is that when a market is weakly efficient, it means - there is no predictive power from historical information.

Investors are unlikely to generate alpha from investing in a company just because they saw that the company outperformed earnings estimates last week. That information was already “priced in,” and there is nothing to gain trading off that information.

Semi-strong form efficiency

The semi-strong form of efficiency within markets is believed to be most prevalent across markets. Under this form of efficiency, share prices incorporate all historical information of stocks and go a step further by including all publicly available information.

This implies that share prices practically adjust immediately following the announcement of relevant information to a company’s stock.

What this means is that investors are not able to generate alpha by trading off relevant information that is publicly available, no matter how recent that piece of information became public.

This partially explains why you’ve probably heard those investment gurus tell you to buy the rumors and sell on the news.

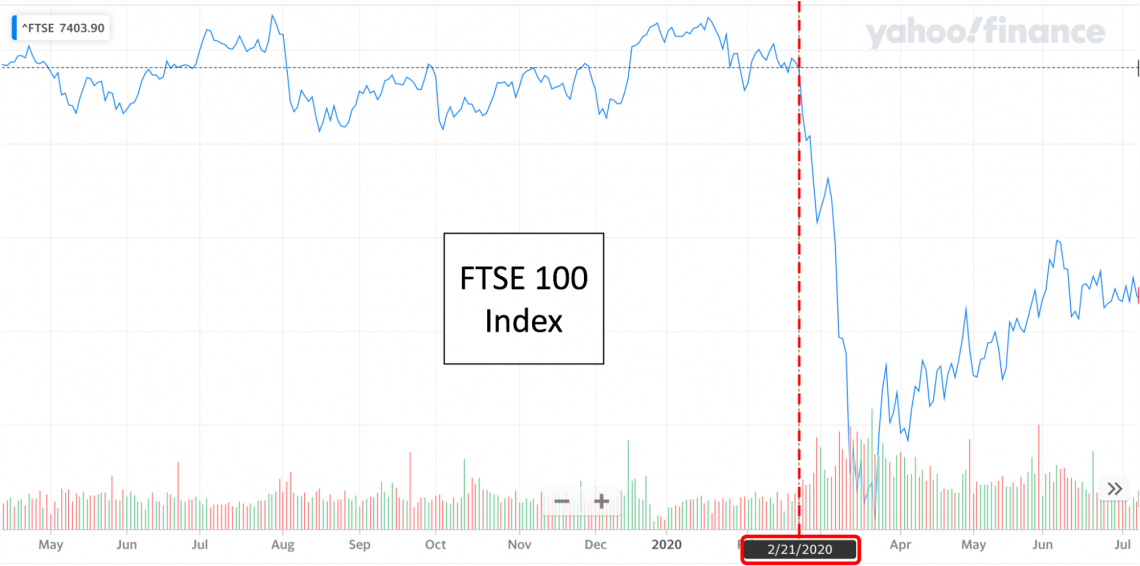

One relevant example would be the reaction from every stock exchange worldwide on specific key dates surrounding the World Health Organization and the Covid-19 pandemic.

The market crashed following specific announcements because, at that time, the market anticipated lockdowns to occur, which would damage every company’s supply chain and sales.

If lockdowns did occur, companies wouldn’t be able to produce goods and services. Furthermore, customers wouldn’t be able to purchase goods, resulting in companies taking a hit on their earnings. And this was exactly what happened.

Although Covid was known since November 2019, If you look at the S&P 500 and the FTSE 100, they both crashed on the same date (21st February 2020), with the impact on markets being equally significant.

It would be safe to say that this was the date that the market started incorporating the impact of Covid-19 on a company’s share price. It is no coincidence that the World Health Organization also hosted a press conference that day.

You can look at the FTSE 100 and S&P 500 index, which represent the UK and US market conditions. The following images show the drop in benchmark indices due to Covid-19:

Unfortunately, there are a couple of caveats to this example.

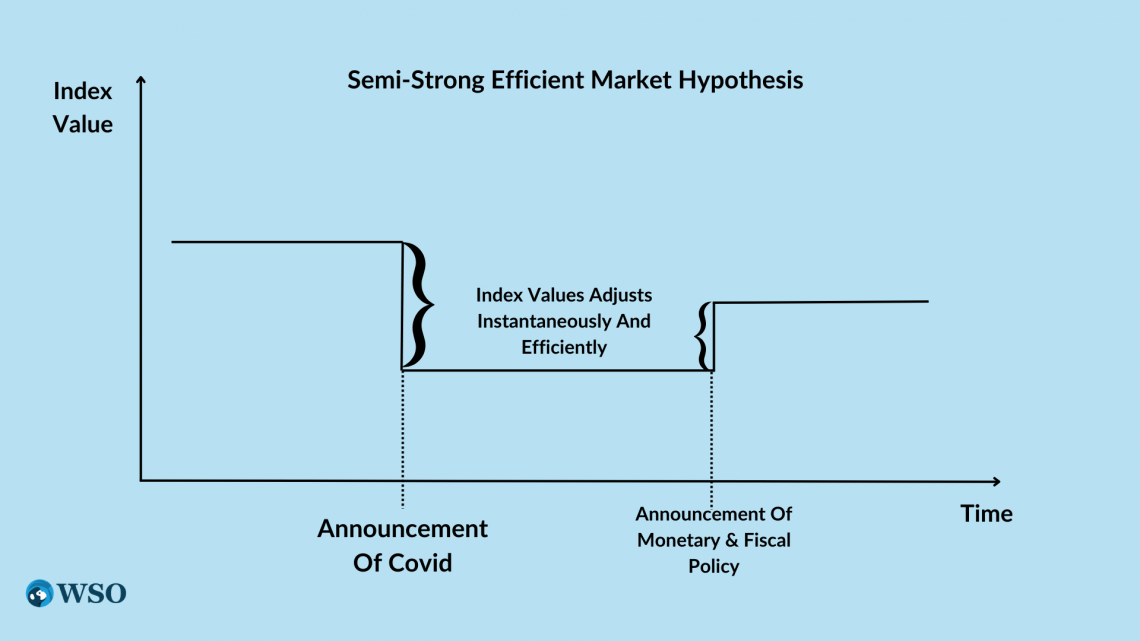

In Eugene Fama’s purest depiction of the semi-strong form of an efficient market hypothesis, prices are meant to adjust instantaneously following the public announcement of relevant information, with the new prices reflecting the market’s new actual value.

When you look at the market’s reaction to Covid-19, the market crash happened gradually over a certain period.

Furthermore, if you look at the FTSE 100 and S&P 500, the index started showing signs of recovery immediately after the market crash.

Broadly speaking, there are two reasons this could have happened:

There was an announcement of new publicly available information with a positive impact on markets

The market had initially overreacted to the Covid-19 pandemic

An excellent example of newly announced publicly available information with a positive impact on markets would be something like the respective countries’ governments and central banks both promoting aggressive monetary and fiscal policies designed to improve economic situations.

Although it is impossible to say, and every investor will have a different opinion on the market, the consensus is that the market has reacted to monetary and fiscal policies. As a result, there was an initial overreaction to Covid-19 in the market.

This is where the practical example strays away from theory. In the market’s reaction to Covid-19, the impact of new information was gradual (but still quick) and argued to be inefficient at the trough.

However, Eugene Fama’s efficient market hypothesis anticipates rapid price movements following the release of public information, and prices are always efficient, moving from one true value to another.

Market indices that genuinely follow the semi-strong form efficient market hypothesis would look something like this:

And this is what the true efficient market hypothesis envisions. There is no exaggeration in this graph, and the market index isn 't expected to have any daily fluctuation because it reflects the valid, efficient value pricing in all the publicly available information.

Reaction to new relevant information is instant and accurate, leaving no room for values to readjust over time.

This example applies to all forms of efficient markets, including the weak and strong forms. However, the difference is the type of information that will cause a company's share price to readjust.

Strong form efficiency

The share prices of companies in strongly efficient markets incorporate everything that the semi-strong form efficiency incorporates but go a step further by also incorporating insider information.

This implies that investors who know something about a company that isn't publicly known cannot generate abnormal returns trading off that information.

Generally speaking, you should expect more developed countries to have more efficient markets, mainly because more asset managers are analyzing stocks and more educated individuals make better investment decisions.

However, if any country were likely to display powerfully efficient markets, you would expect them to exist within more corrupt and opaque countries. This is because countries like the US and UK have implemented sanctions against insider trading purely because of how profitable it is.

Investors with insider information are known to have an edge in markets, which is why there are policies in place dictating that asset managers and substantial shareholders must disclose their trades to the Securities and Exchange Commission ( SEC ).

Under Rule 10b-5 , the SEC explicitly states that insiders are prohibited from trading on material non-public information.

In November 2021, a McKinsey partner was charged with insider trading because he assisted Goldman Sachs with its acquisition of GreenSky.

The Mckinsey partner had private information regarding the GreenSky acquisition and purchased multiple call options on GreenSky, profiting over $450,000.

Aside from the fact that the man was blatantly insider trading, the fact that he was able to profit off insider information is evidence that the US market does NOT possess strong form efficiency.

The above is somewhat considered to be proof by contradiction. If markets were efficient, trading off insider information would not let investors generate abnormal returns. But in this case, the Mckinsey partner could make almost half a million dollars!

To put that into perspective, $450 thousand is more than two years of the average investment banking analyst’s total compensation and slightly over four years of base pay.

Are capital markets efficient?

After developing a decent understanding of the efficient market hypothesis, the real question is: is the market truly efficient, and do they follow the EMH? This topic is controversial, and many individuals will support different sides of the argument.

Supporters of the efficient market hypothesis generally believe in traditional neoclassical finance. Neoclassical finance has been around since the twentieth century, and its approach revolves around key assumptions like perfect knowledge or rationality among individuals.

In fact, most of the material taught at university and in textbooks are materials that talk about neoclassical finance - one might argue that the world of finance was built by theories such as the EMH.

However, some of the assumptions in neoclassical finance have always been known to be overly restrictive and not at all realistic. For example, humans are not the objective supercomputers that neoclassical finance believes us to be.

The fact is that humans are ruled by emotions and subjected to behavioral biases. We do not act the same as everyone else, and it is absurd to believe that we all behave rationally or even have perfect knowledge about a subject before making decisions.

Some of the latest developments in academics have been surrounding behavioral finance, with Nobel laureates including Robert Shiller and Richard Thaler (cameo in a classic finance film titled The Big Short) leading the field and relaxing unrealistic assumptions in neoclassical finance.

Aside from being unable to generate alpha, another significant implication arising from the EMH is that investors can blindly purchase any stock in the exchange without any prior analysis and still receive a fair return on equity .

That does not make sense because if everyone did that, then it would be safe to assume that the share prices would be wildly inaccurate and far apart from the company’s actual value.

The fact is that there is some reliance upon financial institutions such as asset managers or arbitrageurs to constantly monitor and exploit inefficiencies within capital markets (such as buying underpriced and shorting overpriced equities) to keep the market efficient.

Therefore, another argument arising from this is the idea that markets are efficiently inefficient where money managers who use costly financial information software such as Bloomberg Terminal or FactSet can gain a competitive edge in the market.

These money managers generate abnormal returns by exploiting inefficiencies within markets, such as longing for undervalued stocks or shorting overvalued stocks. A beneficial outcome of this activity is that market prices are slowly shifting towards efficient values.

The biggest argument supporting the efficient market hypothesis is that many money managers cannot outperform benchmark indices such as the S&P 500 on a year-to-year basis.

That argument is further supported when you compare the average 20-year annual return of the S&P 500 to any hedge fund’s average 20-year yearly return. You will find that MOST money managers underperform compared to the benchmark.

The table below displays the November 2021 return of the top hedge funds. For reference, the S&P 500 had a total return of 26.89% .

Therefore, if you compare the hedge funds to the S&P 500 (ignoring the hedge funds’ December 2021 performance), you can see that only three hedge funds outperformed the index.

Hedge funds are also costly, with many institutions imposing a minimum 2-20 fee structure where there is a 2% fee charged on the AUM of the fund and a 20% fee for any profit above the hurdle rate.

Nevertheless, while the data seems to point to the fact that hedge funds can be somewhat lackluster, a common argument is that the concept of a hedge fund is to “hedge,” which means to protect money.

Therefore, perhaps some hedge funds have a greater purpose of maintaining their AUM rather than growing it despite the fact that hedge funds are known for having the most aggressive investment strategies .

Overall, being a part of a hedge fund is still highly lucrative. For example, Kenneth Griffin, CEO of Citadel LLC, had total compensation of over $2 billion in 2021, whereas David Solomon, CEO of Goldman Sachs, had a total payment of $35 million in 2021.

If you want to make $2 billion a year in a hedge fund one day, you need to polish up your interviewing skills. To impress your interviewers, look at Wall Street Oasis’s Hedge Fund Interview Prep Course . For a link to our courses, click here .

Everything You Need To Master Financial Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Researched and authored by Jasper Lim | Linkedin

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

- Call Option

- Eurex Exchange

- Fallen Angel

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

- Search Search Please fill out this field.

- Assets & Markets

- Mutual Funds

Efficient Markets Hypothesis (EMH)

EMH Definition and Forms

:max_bytes(150000):strip_icc():format(webp)/ScreenShot2020-03-23at2.04.43PM-59de96b153e540c498f1f1da8ce5c965.png)

What Is Efficient Market Hypothesis?

What are the types of emh, emh and investing strategies, the bottom line, frequently asked questions (faqs).

The Efficient Market Hypothesis (EMH) is one of the main reasons some investors may choose a passive investing strategy. It helps to explain the valid rationale of buying these passive mutual funds and exchange-traded funds (ETFs).

The Efficient Market Hypothesis (EMH) essentially says that all known information about investment securities, such as stocks, is already factored into the prices of those securities. If that is true, no amount of analysis can give you an edge over "the market."

EMH does not require that investors be rational; it says that individual investors will act randomly. But as a whole, the market is always "right." In simple terms, "efficient" implies "normal."

For example, an unusual reaction to unusual information is normal. If a crowd suddenly starts running in one direction, it's normal for you to run that way as well, even if there isn't a rational reason for doing so.

There are three forms of EMH: weak, semi-strong, and strong. Here's what each says about the market.

- Weak Form EMH: Weak form EMH suggests that all past information is priced into securities. Fundamental analysis of securities can provide you with information to produce returns above market averages in the short term. But no "patterns" exist. Therefore, fundamental analysis does not provide a long-term advantage, and technical analysis will not work.

- Semi-Strong Form EMH: Semi-strong form EMH implies that neither fundamental analysis nor technical analysis can provide you with an advantage. It also suggests that new information is instantly priced into securities.

- Strong Form EMH: Strong form EMH says that all information, both public and private, is priced into stocks; therefore, no investor can gain advantage over the market as a whole. Strong form EMH does not say it's impossible to get an abnormally high return. That's because there are always outliers included in the averages.

EMH does not say that you can never outperform the market . It says that there are outliers who can beat the market averages. But there are also outliers who lose big to the market. The majority is closer to the median. Those who "win" are lucky; those who "lose" are unlucky.

Proponents of EMH, even in its weak form, often invest in index funds or certain ETFs. That is because those funds are passively managed and simply attempt to match, not beat, overall market returns.

Index investors might say they are going along with this common saying: "If you can't beat 'em, join 'em." Instead of trying to beat the market, they will buy an index fund that invests in the same securities as the benchmark index.

Some investors will still try to beat the market, believing that the movement of stock prices can be predicted, at least to some degree. For that reason, EMH does not align with a day trading strategy. Traders study short-term trends and patterns. Then, they attempt to figure out when to buy and sell based on these patterns. Day traders would reject the strong form of EMH.

For more on EMH, including arguments against it, check out the EMH paper from economist Burton G. Malkiel. Malkiel is also the author of the investing book "A Random Walk Down Main Street." The random walk theory says that movements in stock prices are random.

If you believe that you can't predict the stock market, you would most often support the EMH. But a short-term trader might reject the ideas put forth by EMH, because they believe that they are able to predict changes in stock prices.

For most investors, a passive, buy-and-hold , long-term strategy is useful. Capital markets are mostly unpredictable with random up and down movements in price.

When did the Efficient Market Hypothesis first emerge?

At the core of EMH is the theory that, in general, even professional traders are unable to beat the market in the long term with fundamental or technical analysis . That idea has roots in the 19th century and the "random walk" stock theory. EMH as a specific title is sometimes attributed to Eugene Fama's 1970 paper "Efficient Capital Markets: A Review of Theory and Empirical Work."

How is the Efficient Market Hypothesis used in the real world?

Investors who utilize EMH in their real-world portfolios are likely to make fewer decisions than investors who use fundamental or technical analysis. They are more likely to simply invest in broad market products, such as S&P 500 and total market funds.

Corporate Finance Institute. " Efficient Markets Hypothesis ."

IG.com. " Random Walk Theory Definition ."

Efficient Market Hypothesis (EMH)

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on July 12, 2023

Get Any Financial Question Answered

Table of contents, efficient market hypothesis (emh) overview.

The Efficient Market Hypothesis (EMH) is a theory that suggests financial markets are efficient and incorporate all available information into asset prices.

According to the EMH, it is impossible to consistently outperform the market by employing strategies such as technical analysis or fundamental analysis.

The hypothesis argues that since all relevant information is already reflected in stock prices, it is not possible to gain an advantage and generate abnormal returns through stock picking or market timing.

The EMH comes in three forms: weak, semi-strong, and strong, each representing different levels of market efficiency.

While the EMH has faced criticisms and challenges, it remains a prominent theory in finance that has significant implications for investors and market participants.

Types of Efficient Market Hypothesis

The Efficient Market Hypothesis can be categorized into the following:

Weak Form EMH

The weak form of EMH posits that all past market prices and data are fully reflected in current stock prices.

Therefore, technical analysis methods, which rely on historical data, are deemed useless as they cannot provide investors with a competitive edge. However, this form doesn't deny the potential value of fundamental analysis.

Semi-strong Form EMH

The semi-strong form of EMH extends beyond historical prices and suggests that all publicly available information is instantly priced into the market.

This includes financial statements, news releases, economic indicators, and other public disclosures. Therefore, neither technical analysis nor fundamental analysis can yield superior returns consistently.

Strong Form EMH

The most extreme version of EMH, the strong form, asserts that all information, both public and private, is fully reflected in stock prices.

Even insiders with privileged information cannot consistently achieve higher-than-average market returns. This form, however, is widely criticized as it conflicts with securities regulations that prohibit insider trading .

Assumptions of the Efficient Market Hypothesis

Three fundamental assumptions underpin the Efficient Market Hypothesis.

All Investors Have Access to All Publicly Available Information

This assumption holds that the dissemination of information is perfect and instantaneous. All market participants receive all relevant news and data about a security or market simultaneously, and no investor has privileged access to information.

All Investors Have a Rational Expectation

In EMH, it is assumed that investors collectively have a rational expectation about future market movements. This means that they will act in a way that maximizes their profits based on available information, and their collective actions will cause securities' prices to adjust appropriately.

Investors React Instantly to New Information

In an efficient market, investors instantaneously incorporate new information into their investment decisions. This immediate response to news and data leads to swift adjustments in securities' prices, rendering it impossible to "beat the market."

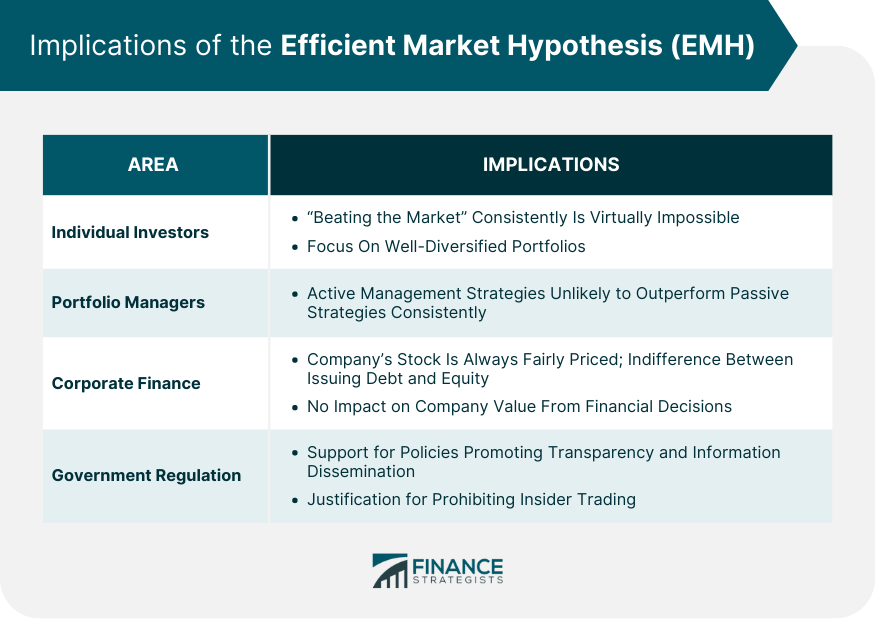

Implications of the Efficient Market Hypothesis

The EMH has several implications across different areas of finance.

Implications for Individual Investors

For individual investors, EMH suggests that "beating the market" consistently is virtually impossible. Instead, investors are advised to invest in a well-diversified portfolio that mirrors the market, such as index funds.

Implications for Portfolio Managers

For portfolio managers , EMH implies that active management strategies are unlikely to outperform passive strategies consistently. It discourages the pursuit of " undervalued " stocks or timing the market.

Implications for Corporate Finance

In corporate finance, EMH implies that a company's stock is always fairly priced, meaning it should be indifferent between issuing debt and equity . It also suggests that stock splits , dividends , and other financial decisions have no impact on a company's value.

Implications for Government Regulation

For regulators , EMH supports policies that promote transparency and information dissemination. It also justifies the prohibition of insider trading.

Criticisms and Controversies Surrounding the Efficient Market Hypothesis

Despite its widespread acceptance, the EMH has attracted significant criticism and controversy.

Behavioral Finance and the Challenge to EMH

Behavioral finance argues against the notion of investor rationality assumed by EMH. It suggests that cognitive biases often lead to irrational decisions, resulting in mispriced securities.

Examples include overconfidence, anchoring, loss aversion, and herd mentality, all of which can lead to market anomalies.

Market Anomalies and Inefficiencies

EMH struggles to explain various market anomalies and inefficiencies. For instance, the "January effect," where stocks tend to perform better in January, contradicts the EMH.

Similarly, the "momentum effect" suggests that stocks that have performed well recently tend to continue performing well, which also challenges EMH.

Financial Crises and the Question of Market Efficiency

The Global Financial Crisis of 2008 raised serious questions about market efficiency. The catastrophic market failure suggested that markets might not always price securities accurately, casting doubt on the validity of EMH.

Empirical Evidence of the Efficient Market Hypothesis

Empirical evidence on the EMH is mixed, with some studies supporting the hypothesis and others refuting it.

Evidence Supporting EMH

Several studies have found that professional fund managers, on average, do not outperform the market after accounting for fees and expenses.

This finding supports the semi-strong form of EMH. Similarly, numerous studies have shown that stock prices tend to follow a random walk, supporting the weak form of EMH.

Evidence Against EMH

Conversely, other studies have documented persistent market anomalies that contradict EMH.

The previously mentioned January and momentum effects are examples of such anomalies. Moreover, the occurrence of financial bubbles and crashes provides strong evidence against the strong form of EMH.

Efficient Market Hypothesis in Modern Finance

Despite criticisms, the EMH continues to shape modern finance in profound ways.

EMH and the Rise of Passive Investing

The EMH has been a driving force behind the rise of passive investing. If markets are efficient and all information is already priced into securities, then active management cannot consistently outperform the market.

As a result, many investors have turned to passive strategies, such as index funds and ETFs .

Impact of Technology on Market Efficiency

Advances in technology have significantly improved the speed and efficiency of information dissemination, arguably making markets more efficient. High-frequency trading and algorithmic trading are now commonplace, further reducing the possibility of beating the market.

Future of EMH in Light of Evolving Financial Markets

While the debate over market efficiency continues, the growing influence of machine learning and artificial intelligence in finance could further challenge the EMH.

These technologies have the potential to identify and exploit subtle patterns and relationships that human investors might miss, potentially leading to market inefficiencies.

The Efficient Market Hypothesis is a crucial financial theory positing that all available information is reflected in market prices, making it impossible to consistently outperform the market. It manifests in three forms, each with distinct implications.

The weak form asserts that all historical market information is accounted for in current prices, suggesting technical analysis is futile.

The semi-strong form extends this to all publicly available information, rendering both technical and fundamental analysis ineffective.

The strongest form includes even insider information, making all efforts to beat the market futile. EMH's implications are profound, affecting individual investors, portfolio managers, corporate finance decisions, and government regulations.

Despite criticisms and evidence of market inefficiencies, EMH remains a cornerstone of modern finance, shaping investment strategies and financial policies.

Efficient Market Hypothesis (EMH) FAQs

What is the efficient market hypothesis (emh), and why is it important.

The Efficient Market Hypothesis (EMH) is a theory suggesting that financial markets are perfectly efficient, meaning that all securities are fairly priced as their prices reflect all available public information. It's important because it forms the basis for many investment strategies and regulatory policies.

What are the three forms of the Efficient Market Hypothesis (EMH)?

The three forms of the EMH are the weak form, semi-strong form, and strong form. The weak form suggests that all past market prices are reflected in current prices. The semi-strong form posits that all publicly available information is instantly priced into the market. The strong form asserts that all information, both public and private, is fully reflected in stock prices.

How does the Efficient Market Hypothesis (EMH) impact individual investors and portfolio managers?

According to the EMH, consistently outperforming the market is virtually impossible because all available information is already factored into the prices of securities. Therefore, it suggests that individual investors and portfolio managers should focus on creating well-diversified portfolios that mirror the market rather than trying to beat the market.

What are some criticisms of the Efficient Market Hypothesis (EMH)?

Criticisms of the EMH often come from behavioral finance, which argues that cognitive biases can lead investors to make irrational decisions, resulting in mispriced securities. Additionally, the EMH has difficulty explaining certain market anomalies, such as the "January effect" or the "momentum effect." The occurrence of financial crises also raises questions about the validity of EMH.

How does the Efficient Market Hypothesis (EMH) influence modern finance and its future?

Despite criticisms, the EMH has profoundly shaped modern finance. It has driven the rise of passive investing and influenced the development of many financial regulations. With advances in technology, the speed and efficiency of information dissemination have increased, arguably making markets more efficient. Looking forward, the growing influence of artificial intelligence and machine learning could further challenge the EMH.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- AML Regulations for Cryptocurrencies

- Advantages and Disadvantages of Cryptocurrencies

- Asset Management vs Investment Management

- Becoming a Millionaire With Cryptocurrency

- Burning Cryptocurrency

- Cheapest Cryptocurrencies With High Returns

- Complete List of Cryptocurrencies & Their Market Capitalization

- Countries Using Cryptocurrency

- Countries Where Bitcoin Is Illegal

- Crypto Investor’s Guide to Form 1099-B

- Cryptocurrency Airdrop

- Cryptocurrency Alerting

- Cryptocurrency Analysis Tool

- Cryptocurrency Cloud Mining

- Cryptocurrency Risks

- Cryptocurrency Taxes

- Depth of Market

- Digital Currency vs Cryptocurrency

- Fiat vs Cryptocurrency

- Fundamental Analysis in Cryptocurrencies

- Global Macro Hedge Fund

- Gold-Backed Cryptocurrency

- History of Cryptocurrencies

- How to Buy a House With Cryptocurrencies

- How to Cash Out Your Cryptocurrency

- Largest Cryptocurrencies by Market Cap

- NFT vs Cryptocurrency

- Pros and Cons of Asset-Liability Management

- Types of Fixed Income Investments

Ask a Financial Professional Any Question

Discover wealth management solutions near you, find advisor near you, our recommended advisors.

Taylor Kovar, CFP®

WHY WE RECOMMEND:

Fee-Only Financial Advisor Show explanation

Certified financial planner™, 3x investopedia top 100 advisor, author of the 5 money personalities & keynote speaker.

IDEAL CLIENTS:

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

Claudia Valladares

Bilingual in english / spanish, founder of wisedollarmom.com, quoted in gobanking rates, yahoo finance & forbes.

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

Hey, did we answer your financial question.

We want to make sure that all of our readers get their questions answered.

Great, Want to Test Your Knowledge of This Lesson?

Create an Account to Test Your Knowledge of This Topic and Thousands of Others.

Get Your Question Answered by a Financial Professional

Create a free account and submit your question. We'll make sure a financial professional gets back to you shortly.

To Ensure One Vote Per Person, Please Include the Following Info

Great thank you for voting..

The Efficient Market Hypothesis

Matthias Hossp 3/19/2024

As an expert in the field, I am thrilled to present to you this comprehensive guide on the Efficient Market Hypothesis (EMH). In this article, we will explore the key concepts, the three forms of market efficiency, the underlying assumptions, and the criticisms surrounding this theory.

Understanding the Efficient Market Hypothesis

Before diving into the details, let’s start by understanding what the Efficient Market Hypothesis is all about. In simple terms, the EMH suggests that financial markets are efficient in processing and incorporating all available information into asset prices. In other words, it implies that it is impossible to consistently achieve above-average returns by outsmarting the market.

One of the key implications of the Efficient Market Hypothesis is that it poses a challenge to active investment strategies that aim to beat the market through stock picking or market timing. According to the EMH, such strategies are unlikely to consistently outperform the market in the long run, as all available information is already reflected in asset prices.

The Concept of Efficient Market Hypothesis

The concept of the EMH originated from the idea that market prices reflect rational investor behavior and that any deviations from market efficiency are temporary and unpredictable. Proponents argue that it is a direct result of the competition among market participants to use available information to their advantage.

Furthermore, the Efficient Market Hypothesis is often categorized into three forms: weak, semi-strong, and strong. The weak form suggests that all past price information is already reflected in current prices, making it impossible to gain an edge through technical analysis . The semi-strong form extends this idea to all publicly available information, including financial statements and economic data. Lastly, the strong form posits that even insider information cannot be used to consistently outperform the market, as it is quickly incorporated into prices.

The Origins of the Efficient Market Hypothesis

The roots of the EMH can be traced back to the works of Eugene Fama in the 1960s and 1970s. Fama, a renowned economist, developed the theory by studying the behavior of stock market prices and challenging the prevailing notion that markets are predictable.

Fama’s research laid the foundation for modern finance theory and revolutionized the way investors perceive the markets. By demonstrating that stock prices follow a random walk and are not predictable based on past information, Fama’s work highlighted the efficiency of financial markets in processing and reflecting all available information.

The Three Forms of Market Efficiency

Within the framework of the Efficient Market Hypothesis (EMH), market efficiency is classified into three forms, each representing a different level of information incorporation into asset prices.

Weak Form Efficiency

In weak form efficiency, asset prices already reflect all historical price and trading data. This implies that past stock prices and trading volumes are not useful in predicting future price movements. Consequently, technical analysis based on historical data is considered ineffective in identifying profitable trading opportunities.

One of the key implications of weak form efficiency is that investors cannot consistently outperform the market by solely relying on historical price data or patterns. This challenges the idea of market timing strategies based on historical trends and emphasizes the importance of other forms of analysis in making investment decisions.

Semi-Strong Form Efficiency

Semi-strong form efficiency goes a step further by asserting that asset prices reflect not only historical information but also all publicly available information. This encompasses financial statements, economic data, news releases, and other widely disseminated information. As a result, fundamental analysis , which involves analyzing financial data, is unlikely to consistently generate superior returns.

Investors operating in a semi-strong efficient market must focus on acquiring non-public information or developing unique insights to gain a competitive edge. This form of efficiency challenges investors to look beyond publicly available data and seek alternative sources of information to make informed investment decisions.

Strong Form Efficiency

Strong form efficiency represents the most extreme version of the EMH, asserting that asset prices reflect all information, both public and private. In other words, no individual or group can consistently profit by leveraging non-public information. This challenges the notion of insider trading, suggesting that it is impossible to make substantial gains consistently based on non-public information.

For market participants, the concept of strong form efficiency underscores the importance of ethical behavior and transparency in financial markets. It promotes fair and equal access to information for all investors, leveling the playing field and reducing the potential for market manipulation based on undisclosed information.

The Assumptions of the Efficient Market Hypothesis

To understand the implications of the Efficient Market Hypothesis (EMH), it is essential to delve deeper into the underlying assumptions that form the bedrock of this widely debated theory.

One of the key assumptions of the EMH is the rationality of investors. The hypothesis posits that market participants are rational beings who process information efficiently, evaluate risks and rewards accurately, and ultimately make logical investment decisions. While this assumption is fundamental to the theory, critics argue that in reality, human behavior can often be influenced by emotions and cognitive biases, leading to irrational decision-making and potentially creating market inefficiencies.

Rationality of Investors

The EMH assumes that investors are rational, meaning they process information efficiently, weigh risks and rewards accurately, and make logical investment decisions. However, it is worth noting that in practice, individuals may exhibit irrational behavior, leading to market inefficiencies.

Another crucial assumption of the EMH is the independent distribution of price changes. This assumption suggests that each price movement in the market is unrelated to previous movements, implying that past price changes do not impact future price movements. This assumption is particularly significant in the context of the weak form of market efficiency, where technical analysis, which relies on historical price data, is considered ineffective in predicting future price movements.

Independent Distribution of Price Changes

Another assumption of the EMH is that price changes are independent of each other, which means that past price movements do not influence future price movements. This assumption is crucial for the weak form of efficiency, where technical analysis is deemed ineffective.

Lastly, the EMH assumes that information is efficiently and swiftly reflected in asset prices. This assumption implies that all relevant information is rapidly incorporated into market prices, leaving no room for undervalued or overvalued assets to persist for an extended period. In an ideal efficient market, investors have access to all available information and act on it promptly, ensuring that prices adjust instantaneously to new information.

The Impact of Information on Prices

Finally, the EMH assumes that information swiftly and accurately flows into the market, and asset prices adjust promptly in response. Essentially, this implies that no valuable information is overlooked or mispriced for an extended period.

Criticisms of the Efficient Market Hypothesis

While the EMH has gained popularity over the years, it has not escaped criticism. Let’s explore a few of the notable criticisms surrounding this theory.

Behavioral Finance and Market Efficiency

One criticism arises from the field of behavioral finance, which suggests that investor psychology and biases can lead to predictable market anomalies. Behavioral factors such as herd mentality, overconfidence, and fear can cause market inefficiencies that contradict the EMH’s assumptions.

The Role of Market Manipulation

Another notable criticism is the argument that market manipulation can distort asset prices and undermine market efficiency. Instances of fraud, insider trading, or even market manipulation through sophisticated trading strategies can challenge the EMH’s assertion of market efficiency.

The Limits of Arbitrage

Finally, critics argue that certain barriers and costs, such as limited resources, regulatory restrictions, and short-selling constraints, can limit the ability of arbitrageurs to correct mispriced assets promptly, thereby challenging the EMH’s premise.

Wrap-up: A Personal Advice

As an expert in the field, I must emphasize that while the Efficient Market Hypothesis is a widely accepted theory, it is crucial to approach investing with caution and a healthy skepticism. Market inefficiencies can still exist and be exploited, but these opportunities are often short-lived and highly competitive. Proper diversification, understanding risk management , and staying informed with sound research are key elements to successfully navigate financial markets.

FAQ – Frequently Asked Questions

What is the efficient market hypothesis.

The Efficient Market Hypothesis suggests that financial markets are efficient and that it is impossible to consistently outperform the market and achieve above-average returns by exploiting information.

What are the three forms of market efficiency?

The three forms of market efficiency within the EMH are weak form efficiency, semi-strong form efficiency, and strong form efficiency.

What are the assumptions of the Efficient Market Hypothesis?

The EMH assumes rational investors, independent distribution of price changes, and the swift incorporation of all information into asset prices.

What are the main criticisms of the Efficient Market Hypothesis?

The EMH has been criticized for its limitations in accounting for behavioral factors, the potential impact of market manipulation, and the challenges faced by arbitrageurs in correcting mispriced assets.

I hope this comprehensive guide has shed light on the Efficient Market Hypothesis, its forms, assumptions, and criticisms. Remember, understanding the principles and limitations of this theory will help you navigate the dynamic world of finance with confidence and informed decision-making.

While the Efficient Market Hypothesis suggests that beating the market is a challenge, innovative platforms like Morpher are changing the game. Morpher.com leverages blockchain technology to offer a unique trading experience with zero fees, infinite liquidity, and the ability to trade a vast array of assets. Whether you’re interested in stocks, cryptocurrencies, or even niche markets like NFTs, Morpher provides the tools for a new era of investing. Embrace the future of trading with fractional investing, short selling without interest fees, and up to 10x leverage. Plus, with the Morpher Wallet, you maintain complete control over your funds. Ready to experience the Morpher difference? Sign Up and Get Your Free Sign Up Bonus today and join the revolution in global trading.

Painless trading for everyone

Hundreds of markets all in one place - Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more.

Related Posts

Top 5 Indicators for Candlestick Pattern Strategies

4 Assets for Successful Weekend Trading

Top 5 Alternative Investment Strategies for Diver…

We use cookies 🍪 to build better products. Close to accept or Learn More . Got It

Thanks for subscribing! Please check your email for further instructions.

Efficient Market Hypothesis (EMH): What is It and Why Does It Matter?

What is Efficient Market Hypothesis (EMH)?

The efficient market hypothesis (EMH) is a theory in financial economics that states that the prices of assets, such as stocks, bonds, or commodities, reflect all the available information about their value. This means that investors cannot consistently beat the market by using any strategy, such as fundamental analysis, technical analysis, or insider trading. The only way to achieve higher returns is by taking more risk.

The EMH has important implications for investors, traders, and financial professionals. It suggests that the best way to invest is to buy and hold a diversified portfolio of low-cost index funds that track the market performance. This is a pillar strategy embraced by many on their financial independence journey. It also implies that financial markets are rational and efficient, and that price movements are unpredictable and random.

However, the EMH is also highly controversial and widely debated. Many critics argue that the EMH is based on unrealistic assumptions about human behavior, market structure, and information quality. They point to various anomalies and inefficiencies in the market, such as bubbles, crashes, momentum, value effects, and behavioral biases. They also cite examples of successful investors who have consistently outperformed the market over long periods of time, such as Warren Buffett, George Soros, or Peter Lynch.

In this article, we will explain the main concepts and assumptions of the EMH, the different forms and tests of market efficiency, the main arguments for and against the EMH, and the practical implications of the EMH for investors and financial professionals.

Key Takeaways

The main concepts and assumptions of the efficient market hypothesis (emh).

The EMH is based on the idea that the market is a collective and efficient mechanism that processes all the available information about the value of assets and incorporates it into their prices. Therefore, the market price of an asset is the best estimate of its true or intrinsic value, and any deviation from it is random and temporary.

The Efficient Market Hypothesis relies on several assumptions about the market participants, the market structure, and the information quality. Some of the main assumptions are:

- Rationality : Investors are rational and act in their own self-interest. They have consistent preferences and expectations, and they update them based on new information. They seek to maximize their expected utility and minimize their risk.

- Independence : Investors are independent and do not influence each other’s decisions. They have diverse opinions and beliefs, and they do not follow trends or fads. They do not suffer from any behavioral biases or irrational emotions.

- Competition : Investors are numerous and have equal access to the market. They have similar information and analytical skills, and they can trade without any barriers or costs.

- Information Quality : Information is publicly available, accurate, and timely. Investors have access to the same information and can process it efficiently. There is no asymmetric information or insider trading in the market.

- No Transaction Costs : Investors can trade without any friction or costs. There are no taxes, fees, commissions, or bid-ask spreads in the market. There are also no liquidity or short-selling constraints.

These assumptions are necessary for the EMH to hold, but they are also very idealistic and unrealistic. In reality, many of these assumptions are violated or relaxed in the real world, which creates opportunities for market inefficiencies and anomalies.