- Candlesticks Book

- Stock Compare

- Superstar Portfolio

- Stock Buckets

- Nifty Heatmap

- *Now Available in Hindi

HDFC Bank Case Study 2021 – Industry, SWOT, Financials & Shareholding

by Jitendra Singh | Mar 4, 2021 | Case Study , Stocks | 1 comment

HDFC Bank Case Study and analysis 2021: In this article, we will look into the fundamentals of HDFC Bank, focusing on both qualitative and quantitative aspects. Here, we will perform the SWOT Analysis of HDFC Bank, Michael Porter’s 5 Force Analysis, followed by looking into HDFC Bank’s key financials. We hope you will find the HDFC Bank case study helpful.

Disclaimer: This article is only for informational purposes and should not be considered any kind of advisory/advice. Please perform your independent analysis before investing in stocks, or take the help of your investment advisor. The data is collected from Trade Brains Portal .

Table of Contents

About HDFC Bank and its Business Model

Incorporated in 1994, HDFC Bank is one of the earliest private sector banks to get approval from RBI in this segment. HDFC Bank has a pan India presence with over 5400+ banking outlets in 2800+ cities, having a wide base of more than 56 million customers and all its branches interlinked on an online real-time basis.

HDFC Limited is the promoter of the company, which was established in 1977. HDFC Bank came up with its 50 crore-IPO in March 1996, receiving 55 times subscription. Currently, HDFC Bank is the largest bank in India in terms of market capitalization (Nearly Rs 8.8 Lac Cr.). HDFC Securities and HDB Financial Services are the subsidiary companies of the bank.

HDFC Bank primarily provides the following services:

Note: If you want to learn Candlesticks and Chart Trading from Scratch, here’s the best book available on Amazon ! Get the book now!

- Retail Banking (Loan Products, Deposits, Insurance, Cards, Demat services, etc.)

- Wholesale Banking (Commercial Banking. Investment Banking, etc.)

- Treasury (Forex, Debt Securities, Asset Liability Management)

HDFC Bank Case Study – Industry Analysis

There are 12 PSU banks, 22 Private sector banks, 1485 urban cooperative banks, 56 regional rural banks, 46 foreign banks and 96,000 rural cooperative banks in India. The total number of ATMs in India has constantly seen a rise and there are 209,110 ATMs in India as of August 2020, which are expected to further grow to 407,000 by the end of 2021.

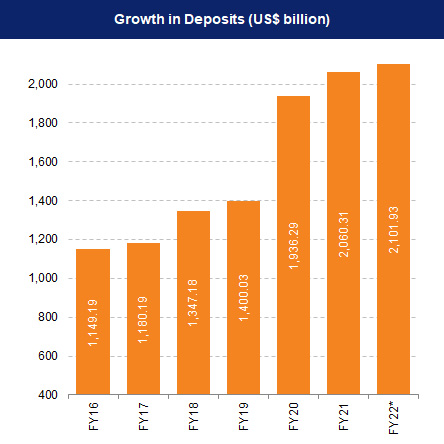

In the last four years, bank credit recorded a growth of 3.57% CAGR, surging to $1698.97 billion as of FY20. At the same time, deposits rose with a CAGR of 13.93% reaching $1.93trillion by FY20. However, the growth in total deposits to GDB has fallen to 7.9% in FY20 owing to pandemic crises, which was above 9% before it.

Due to strong economic activity and growth, rising salaries, and easier access to credit, the credit demand has surged resulting in the Credit to GDP ratio advancing to 56%. However, it is still far less than the developed economies of the world. Even in China, it is revolving around 150 to 200%.

As of FY20, India’s Retail lending to GDP ratio is 18% , whereas in developed economies (US, UK) it varies between 70% – 80%).

Michael Porter’s 5 Force Analysis of HDFC Bank

1. rivalry amongst competitors.

- The banking sector has evolved very rapidly in the past few years with technology coming in, and now it is not only limited to depositing and lending but various categories of loans and advances, digital services, insurance schemes, cards, broking services, etc.; hence, the banks face stiff competition from its rivals.

2. A Threat by Substitutes

- For services like mutual funds, investments, insurances, categorized loans, etc., banks are not the only option these days because a lot of niche players have put their foot in the specialized category, surging the threat by substitutes for the banks.

- Another threat for the traditional banks is NEO Banks. The Neo Banks are virtual banks that operate online, are completely digital, and have a minimum physical presence.

3. Barriers to Entry

- Banks run in a highly regulated sector. Strict regulatory norms, huge initial capital requirements and winning the trust of people make it very tough for new players to come out as a national level bank in India. However, if a company enters as a niche player, there are relatively fewer entry barriers.

- With RBI approving the functioning of new small finance banks, payment banks and entry of foreign banks, the competition has further intensified in the Indian banking sector.

4. Bargaining Power of Suppliers

- The only supply which banks need is capital and they have four sources for the capital supply viz. deposits from customers, mortgage securities, loans, and loans from financial institutions. Customer deposits enjoy higher bargaining power as it is totally dependent on income and availability of options.

- Financial Institutions need to hedge inflation, and banks are liable to the rules and regulations of the RBI which makes them a safer bet; hence, they have less bargaining power.

5. Bargaining Power of Customers

- In modern days, customers not only expect proper banking but also the quality and faster services. With the advent of digitalization and the entry of new private banks and foreign banks, the bargaining power of customers has increased a lot.

- In terms of lending, creditworthy borrowers enjoy a high level of bargaining power as there is a large availability of banks and NBFCs which are ready to offer attractive loans and services at low switching and other costs.

HDFC Bank Case Study – SWOT Analysis

Now, moving forward in our HDFC Bank case study, we will perform the SWOT analysis.

1. Strengths

- Currently, HDFC Bank is the leader in the retail loan segment (personal, car and home loans) and credit card business, increasing its market share each year

- The HDFC tag has become a sign of trust in the people as HDFC has come out as a pioneer not only in banking, but loans, insurances, mutual funds, AMC and brokerage.

- HDFC Bank has always been an institution of its words as it has, without fail, delivered its guidance and this has created a strong brand loyalty in the market for them.

- HDFC Bank has very well leveraged the technology to help its profitability, only 34% transaction via Internet Banking in 2010 to 95% transaction in 2020.

2. Weaknesses

- HDFC bank doesn’t have a significant rural presence as compared to its peers. Since its inception, it has focused mainly on high-end clients. However, the focus is shifting in the recent period as nearly 50% of its branches are now in semi-urban and rural areas.

3. Opportunities

- The average age of the Indian population is around 28 years and more than 65% of the population is below 35, with increasing disposable income and rising urbanization, the demand for retail loans is expected to increase. HDFC Bank, being a leader in retail lending, can make the best out of this opportunity.

- With modernization in farming and a rise in rural and semi-urban disposable income, consumer spending is expected to rise. HDFC Bank can increase its market share in these segments by grabbing this opportunity. Currently, the bank has only 21% of the branches in rural areas.

- A lot of niche players have set up their strong branches in respective segments, which has shown stiff competition and has shrined the market share and profit margin for the company. Example – Gold Loans, Mutual Funds , Brokerage, etc.

- In-Vehicle Financing (which is HDFC Bank’s major source of lending income), most of the leading vehicle companies are providing the same service, which is a threat to the bank’s business.

Asian Paints Case Study 2021 – Industry, SWOT, Financials & Shareholding

HDFC Bank’s Management

HDFC Bank has set high standards in corporate governance since its inception.

Right from sticking to their words to proper book writing, HDFC has never compromised with the banking standards, and all the credit goes to Mr. Aditya Puri, the man behind HDFC Bank, who took the bank to such great heights that today its market capitalization is more than that of Goldman Sachs and Morgan Stanley of the US.

In 2020, after 26 years of service, he retired from his position in the bank and passed on the baton of Managing Director to Mr. Shasidhar Jagadishan. He joined the bank as a Manager in the finance function in 1996 and with an experience of over 29 years in banking, Jagadishan has led various segments of the sector in the past.

Financial Analysis of HDFC Bank

- 48% of the total revenue for HDFC bank comes from Retail Banking, followed by Wholesale Banking (27%), Treasury (12%), and 13% of the total comes from other sources.

- Industries receive a maximum share of loans issued by HDFC bank, which is 31.7%, followed by Personal Loans and Services both at a 28.7% share of the total. Only 10.9% of the total loans are issued to Agricultural and allied activities.

- HDFC Bank has a 31.3% market share in credit card transactions, showing a growth of 0.23% from the previous fiscal year, which makes it the market leader, followed by SBI.

- HDFC Bank is the market leader in large corporate Banking and Mid-Size Corporate Banking with 75% and 60% share respectively.

- In Mobile Banking Transaction, the market share of HDFC bank is 11.8%, which has seen a degrowth of 0.66% in the current fiscal year.

- With each year, HDFC Bank has shown increasing net profit, which makes the 1-year profit growth (24.57%) greater than both 3-year CAGR (21.75%) and 5-year CAGR (20.78%).

- Capital Adequacy Ratio, which is a very important figure for any bank stands at 18.52% for HDFC Bank.

- As of Sept 2020 HDFC, is at the second position in bank advances with a 10.1% market share, which has shown a rise from 9.25% a year ago. SBI tops this list with a 22.8% market share, Bank of Baroda is at the third spot with a 6.68% share, followed by Kotak Mahindra Bank (6.35%).

- HDFC Bank is again at the second spot in the market share of Bank deposits with 8.6%. SBI leads with a nearly 24.57% market share. PNB holds 7.5% of the market share in this category, coming out as the third followed by Bank of Baroda with 6.89%.

HDFC Bank Financial Ratios

1. profitability ratios.

- As of FY20, the net profit margin for the bank stands at 22.87%, which has seen a continuous rise for the last 4 fiscal years. This a very positive sign for the bank’s profitability.

- The Net Interest Margin (NIM) has been fluctuating from the range of 3.85% to 4.05% in the last 5 fiscal years. Currently, it stands at 3.82% as of FY20.

- Since FY16, there has been a constant fall in RoE, right from the high of 18.26% to 16.4% as of FY20.

- RoA has been more or less constant for the company, currently at 1.89%, which is a very positive sign.

2. Operational Ratios

- Gross NPA for the bank has fallen from FY19 (1.36) to 1.26, which a positive sign for the company. A similar improvement is also visible in the Net NPA, currently standing at 0.36.

- The CASA ratio for the bank is 42.23%, which has been seeing a continuous fall since FY17 (48.03%). However, there has been a spike rise in FY17 as in FY16, it was 43.25 and in FY18, again came to the almost same level of 43.5.

- In FY19, Advance Growth witnessed a massive spike from 18.71 level in FY18 rising to 24.47%. However, in FY20, it again fell nearly 4 points, coming down to 21.27%.

HDFC Bank Case Study – Shareholding Pattern

- Promoters hold 26% shares in the bank, which has been almost at the same level for the last many quarters. In the December quarter a years ago, the promoter holding was 26.18%. The marginal fall is only due to Aditya Puri retiring and selling few shares for his post-retirement finance, which he stated.

- FIIs own 39.95% shareholding in the bank, which has been increasing for years in every quarter. HDFC bank has been a darling share in the investor community.

- 21.70% of shares are owned by DIIs as of December Quarter 2020. Although it is less than the SeptQ2020(22.90%), it is still far above the year-ago quarter (21.07).

- Public holding in HDFC bank is 12.95% as of Dec Q2020, which has tanked from the year-ago quarter (14.83%) as FIIs increasing their share, which is evident from the rising share prices.

Closing Thoughts

In this article, we tried to perform a quick HDFC Bank case study. Although there are still many other prospects to look into, however, this guide would have given you a basic idea about HDFC Bank.

What do you think about HDFC Bank fundamentals from the long-term investment point of view? Do let us know in the comment section below. Take care and happy investing!

Start Your Stock Market Journey Today!

Want to learn Stock Market trading and Investing? Make sure to check out exclusive Stock Market courses by FinGrad, the learning initiative by Trade Brains. You can enroll in FREE courses and webinars available on FinGrad today and get ahead in your trading career. Join now!!

Nice can I get full case

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Search Topic or Keyword

Trending articles.

Recent IPO’s

- JNK India IPO Review 2024 – GMP, Financials And More

- Bharti Hexacom IPO Review 2024 – GMP, Financials And More

- SRM Contractors IPO Review 2024 – GMP, Financials And More

- Krystal Integrated Services IPO Review 2024 – GMP, Financials & More

- Popular Vehicles IPO Review – GMP, Financials & More

Easiest Stock Screener Tool!

Best stock discovery tool with +130 filters, built for fundamental analysis. Profitability, Growth, Valuation, Liquidity, and many more filters. Search Stocks Industry-wise, Export Data For Offline Analysis, Customizable Filters.

- — Stock Screener

- — Compare Stocks

- — Stock Buckets

- — Portfolio Backtesting

Start your stock analysis journey with Trade Brains Portal today. Launch here !

Keep the Learning On!

Subscribe to Youtube to watch our latest stock market videos. Subscribe here .

Case study: How one of India’s largest public sector banks merged and transformed itself

EY merged three large banks with smooth Day-1 integration, minimal disruption and new operating model.

- Link copied

Abizer Diwanji

EY India Financial Services Leader

Harshvardhan Bisht

EY India Banking and Capital Markets Leader

The better the question

How would the bank transform its operating model amidst a merger?

Successful Day-1 integration with best-in-class operating model design led to a holistic transformation.

O ne of India’s leading public sector banks merged with two other banks and the combined entity resulted in one of the country’s largest banking entities. It was the largest merger in the Indian banking industry at the time.

At the time of the merger, the bank’s primary objective was to achieve seamless Day-1 integration with minimal customer disruption and smooth structural, cultural, operational, and functional integration. The bank sought support to manage the scale and complexity of this integration. It also wanted to ensure that the combined entity realized all synergistic opportunities for future growth.

EY worked with the bank to deploy a destination operating model for providing a competitive advantage across the value chain. The new operating model set a foundation for scalable growth and higher efficiencies across sales, credit, collections, and internal operations.

The better the answer

EY led Day-1 integration and destination model roll-out to transform the bank

The transformation involved building an operating model with a revamped organizational structure, efficient operations and a culturally aligned workforce.

EY conducted a detailed diagnostic and comprehensive Day-1 readiness assessment across the business, support and control functions of the bank. The key focus areas were:

- Harmonization of products, processes and policies

- Ensuring minimal customer disruption

- Enhancing geographical reach with an optimum product mix

- Alignment and integration of unified digital platforms for customers

Subsequent to the successful Day-1 merger, EY created a destination operating model with an 18-month long transformation roadmap targeting:

- A four-tiered credit operating model with specific focus on large corporates, mid and small corporates, micro, small and medium enterprises

- A revamped organization structure to create specialized verticals including fintech and collections and recovery

- A comprehensive assessment of potential cost and revenues synergy arising from the amalgamation and developing a 3-year roadmap for the bank for realizing the same

- Seamless customer experience with inter-operability across branches and other digital and physical channels

Related case study

The better the world works

The bank saw successful business transformation with an efficient operating model

The bank is set to continue its momentum and grow rapidly to achieve its future targets.

As the merger stabilized and concluded, the bank saw substantial improvement in its overall business and operational performance, leading to a sustainable change in the bank’s financial metrics with a significant value delivered by EY.

Improvement in cost-to-income ratio

Cost synergies

Revenue synergies

The engagement was led by the EY team and senior bank leaders including the MD and CXOs. The EY team included a cross-functional mix of partners, directors, senior managers and over 40+ consultants who came together to devise the merger and integration strategy for the bank.

EY became a trusted partner for the bank by enhancing its geographical footprint, strong future roadmap and optimized target operating model. These milestones were achieved by establishing strong relationships with the senior executive management and division stakeholders.

How EY can help

Digital transformation services.

We help companies thrive in the transformative age by refreshing themselves constantly, experimenting with new ideas and scaling successes.

Technology transformation

Organizations must consider foundational transformation rather than quick fixes and ad hoc investments to give them the agility to adapt.

Transformation Realized

Connect with us

Our locations

Legal and privacy

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

EY | Assurance | Consulting | Strategy and Transactions | Tax

EY is a global leader in assurance, consulting, strategy and transactions, and tax services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities.

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. For more information about our organization, please visit ey.com.

© 2020 EYGM Limited. All Rights Reserved.

EYG/OC/FEA no.

This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, or other professional advice. Please refer to your advisors for specific advice.

Drive digital transformation and innovation in your organization

Send us your queries.

Welcome to EY.com

In addition to cookies that are strictly necessary to operate this website, we use the following types of cookies to improve your experience and our services: Functional cookies to enhance your experience (e.g. remember settings), and Performance cookies to measure the website's performance and improve your experience . , and Marketing/Targeting cookies , which are set by third parties with whom we execute marketing campaigns and allow us to provide you with content relevant to you.

We have detected that Do Not Track/Global Privacy Control is enabled in your browser; as a result, Marketing/Targeting cookies , which are set by third parties with whom we execute marketing campaigns and allow us to provide you with content relevant to you, are automatically disabled.

You may withdraw your consent to cookies at any time once you have entered the website through a link in the privacy policy, which you can find at the bottom of each page on the website.

Review our cookie policy for more information.

Customize cookies

I decline optional cookies

- Screen Reader

- Skip to main content

- Text Size A

- Language: English

Case Studies

- EXIM Procedure

Media & Events

- Image Gallery

- Media Coverage

Other Links

- GI of India

- Experience India

- Indian Trend Fair 2022

India Organic Biofach 2022

Gulfood dubai 2023, banking sector in india, as of 2022, more than 80% of the indian population has a bank account in comparison to 17% in 2009., advantage india, robust demand.

* According to the EY 2021 NextWave Global Consumer Banking Survey explored consumers’ primary financial relationships and found that FinTechs and neobanks are gaining ground.

* That demand seems particularly strong when it comes to the critical need of protecting consumer data, where incumbent banks have a trust advantage. Some super apps may also turn to banks for access to banking licenses and to meet other regulatory requirements.

* Indian Fintech industry is estimated to be at US$ 150 billion by 2025. India has the 3rd largest FinTech ecosystem globally.

* BCG predicts that the proportion of digital payments will grow to 65% by 2026.

Innovation in Services

* In the recent period, technological innovations have led to marked improvements in efficiency, productivity, quality, inclusion and competitiveness in the extension of financial services, especially in the area of digital lending.

* Digitalization of Agri-finance was conceptualized jointly by the Reserve Bank and the Reserve Bank Innovation Hub (RBIH). This will enable delivery of Kisan Credit Card (KCC) loans in a fully digital and hassle-free manner.

* In Union Budget 2023, the KYC process will be streamlined by using a 'risk-based' strategy rather than a 'one size fits all' approach.

* In September 2023, Hitachi Payment Services launched India's first-ever UPI-ATM with NPCI.

Business Fundamentals

* The Indian banking industry has been on an upward trajectory aided by strong economic growth, rising disposable incomes, increasing consumerism and easier access to credit.

* Digital modes of payments have grown by leaps and bounds over the last few years. As a result, conventional paper-based instruments such as cheques and demand drafts now constitute a negligible share in both the volume and value of payments.

Policy Support

* The RBI has launched a pilot to digitalize KCC lending in a bid for efficiency, higher cost savings, and reduction of TAT. This is expected to transform the flow of credit in the rural economy.

* In November 2022, RBI launched a pilot project on central bank digital currency (CBDC).

* In Union Budget 2023, a national financial information registry would be constructed to serve as the central repository for financial and ancillary data.

* In March 2023, India Post Payments Bank (IPPB), in collaboration with Airtel, announced the launch of WhatsApp Banking Services for IPPB customers in Delhi.

Banking Industry Report

Introduction.

As per the Reserve Bank of India (RBI), India’s banking sector is sufficiently capitalised and well-regulated. The financial and economic conditions in the country are far superior to any other country in the world. Credit, market and liquidity risk studies suggest that Indian banks are generally resilient and have withstood the global downturn well.

The Indian banking industry has recently witnessed the rollout of innovative banking models like payments and small finance banks. In recent years India has also focused on increasing its banking sector reach, through various schemes like the Pradhan Mantri Jan Dhan Yojana and Post payment banks. Schemes like these coupled with major banking sector reforms like digital payments, neo-banking, a rise of Indian NBFCs and fintech have significantly enhanced India’s financial inclusion and helped fuel the credit cycle in the country.

Indian Fintech industry is estimated to be at US$ 150 billion by 2025. India has the 3rd largest FinTech ecosystem globally. India is one of the fastest-growing Fintech markets in the world. There are currently more than 2,000 DPIIT-recognized Financial Technology (FinTech) businesses in India, and this number is rapidly increasing.

The digital payments system in India has evolved the most among 25 countries with India’s Immediate Payment Service (IMPS) being the only system at level five in the Faster Payments Innovation Index (FPII).* India’s Unified Payments Interface (UPI) has also revolutionized real-time payments and strived to increase its global reach in recent years.

Market Size

The Indian banking system consists of 12 public sector banks, 22 private sector banks, 46 foreign banks, 56 regional rural banks, 1485 urban cooperative banks and 96,000 rural cooperative banks in addition to cooperative credit institutions. As of October 2023, the total number of micro ATMs in India reached 15,30,287. Moreover, there are 1,25,969 on-site ATMs and Cash Recycling Machines (CRMs) and 93,771 off-site ATMs and CRMs.

Banks added 2,796 ATMs in the first four months of FY23, against 1,486 in FY22 and 2,815 in FY21. 100% of new bank account openings in rural India are being done digitally. BCG predicts that the proportion of digital payments will grow to 65% by 2026.

In 2023 (till December 1st, 2023), total assets in the public and private banking sectors were US$ 1688.15 billion and US$ 1017.26 billion, respectively. In 2023 (till December 1st, 2023), assets of public sector banks accounted for 58.32% of the total banking assets (including public, private sector and foreign banks).

Public sector banks accounted for over 57.48% of interest income in 2023 (till December 1st, 2023). The interest income of public banks reached US$ 102.51 billion in 2023 (till December 1st, 2023). In 2023 (till December 1st, 2023), interest income in the private banking sector reached US$ 70.07 billion.

India's digital lending market witnessed a growth of CAGR 39.5% over a span of 10 years. The Indian digital consumer lending market is projected to surpass US$ 720 billion by 2030, representing nearly 55% of the total US$ 1.3 trillion digital lending market opportunity in the country.

According to RBI’s Scheduled Banks’ Statement, deposits of all scheduled banks collectively surged by a whopping Rs.1.75 lakh crore (US$ 2,110.87 billion) as of December 1st, 2023.

According to the BCG Banking Sector Roundup Report of 9M FY23, credit growth is expected to hit 18.1% in 2022-23 which will be a double-digit growth in eight years.

Non-food bank credit registered a growth of 17.6% in November 2022 as compared with 7.1% a year ago on the back of robust credit demand from the segments such as services, industry, personal, and agriculture and allied activities, according to RBI’s statement on Sectoral Deployment of Bank Credit.

Investments/Developments

Key investments and developments in India’s banking industry include:

- In December 2023, ICICI Prudential Life Insurance and Ujjivan Small Finance Bank forged the Bancassurance Partnership.

- In October 2023, AU Small Finance Bank announced the acquisition of Fincare Small Finance Bank in an all-share deal and to merge it with itself.

- According to data released by the National Payments Corporation of India (NPCI), UPI transactions reached 10.241 billion until August 30th, 2023.

- In September 2023, Hitachi Payment Services launched India's first-ever UPI-ATM with NPCI.

- In September 2023, the Reserve Bank of India is likely to bring in CBDC in the call money market.

- In July 2023, Mahindra and Mahindra acquires minority stake in RBL Bank.

- In July 2023, State Bank of India to acquire 100% stake of SBI Capital in SBICAP Ventures for US$ 85.25 million (Rs. 708 crore).

- In June 2023, State Bank of India to acquire entire 20% stake of SBI Capital Markets in SBI Pension Funds.

- In April 2023, HDFC Bank to acquire 20% or more in Griha Pte subsidiary of HDFC Investments.

- M&A activity with an India angle hit a record US$ 171 billion in 2022.

- In April 2022, IDFC to sell Mutual Fund Business to Bandhan-Financial Holdings led Consortium for US$ 550.23 million (Rs. 4,500 crore).

- In March 2022, aggressive Axis Bank acquired Citi's India consumer business for US$ 1.6 billion.

- In December 2022, HDFC Bank to buy 7.75% stake in fintech start-up Mintoak.

- As per report by Refinitiv, Domestic M&A activity saw record levels of activity in 2022 at US$ 119.2 billion, up 156.3% from 2021. Companies like HDFC Bank, HDFC, Ambuja Cements, ACC, Adani Group Biocon, Mindtree, L&T Infotech, AM/NS, Essar Ports were involved in M&A deals in 2022

- On June, 2022, the number of bank accounts—opened under the government’s flagship financial inclusion drive ‘Pradhan Mantri Jan Dhan Yojana (PMJDY)’—reached 45.60 crore and deposits in the Jan Dhan bank accounts totaled Rs. 1.68 trillion (US$ 21.56 billion).

- In April 2022, India’s largest private bank HDFC Bank announced a transformational merger with HDFC Limited.

- On November 09, 2021, RBI announced the launch of its first global hackathon 'HARBINGER 2021 – Innovation for Transformation' with the theme ‘Smarter Digital Payments’.

- In November 2021, Kotak Mahindra Bank announced that it has completed the acquisition of a 9.98% stake in KFin Technologies for Rs. 310 crore (US$ 41.62 million).

- In October 2021, Indian Bank announced that it has acquired a 13.27% stake in the proposed National Asset Reconstruction Company Ltd. (NARCL).

- In July 2021, Google Pay for Business has enabled small merchants to access credit through tie-up with the digital lending platform for MSMEs—FlexiLoans.

- In February 2021, Axis Bank acquired a 9.9% share in the Max Bupa Health Insurance Company for Rs. 90.8 crore (US$ 12.32 million).

- In December 2020, in response to the RBI’s cautionary message, the Digital Lenders’ Association issued a revised code of conduct for digital lending.

- On November 6, 2020, WhatsApp started UPI payments service in India on receiving the National Payments Corporation of India (NPCI) approval to ‘Go Live’ on UPI in a graded manner.

- In October 2020, HDFC Bank and Apollo Hospitals partnered to launch the ‘HealthyLife Programme’, a holistic healthcare solution that makes healthy living accessible and affordable on Apollo’s digital platform.

- In 2019, banking and financial services witnessed 32 M&A (merger and acquisition) activities worth US$ 1.72 billion.

- In April 2020, Axis Bank acquired additional 29% stake in Max Life Insurance.

- In March 2020, State Bank of India (SBI), India’s largest lender, raised US$ 100 million in green bonds through private placement.

- In February 2020, the Cabinet Committee on Economic Affairs gave its approval for continuation of the process of recapitalization of Regional Rural Banks (RRBs) by providing minimum regulatory capital to RRBs for another year beyond 2019-20 - till 2020-21 to those RRBs which are unable to maintain minimum Capital to Risk weighted Assets Ratio (CRAR) of 9% as per the regulatory norms prescribed by RBI.

Government Initiatives

- Bank accounts opened under GoI Pradhan Mantri Jan Dhan Yojana have deposits of over ~US$ 25.13 billion in beneficiary accounts. 51.11 crore beneficiaries banked till December 15th, 2023.

- In September 2023, IREDA partners with banks to boost renewable energy projects in India.

- In March 2023, India Post Payments Bank (IPPB), in collaboration with Airtel, announced the launch of WhatsApp Banking Services for IPPB customers in Delhi.

- In October 2022, Prime Minister Mr. Narendra Modi inaugurated 75 Digital Banking Units (DBUs) across 75 districts in India.

- In Union Budget 2023, a national financial information registry would be constructed to serve as the central repository for financial and ancillary data.

- In Union Budget 2023, the KYC process will be streamlined by using a 'risk-based' strategy rather than a 'one size fits all' approach.

- National Asset reconstruction company (NARCL) will take over, 15 non-performing loans (NPLs) worth Rs. 50,000 crore (US$ 6.70 billion) from the banks.

- National payments corporation India (NPCI) has plans to launch UPI lite which will provide offline UPI services for digital payments. Payments of up to Rs. 200 (US$ 2.67) can be made using this.

- In the Union budget of 2022-23 India has announced plans for a central bank digital currency (CBDC) which will be possibly known as Digital Rupee.

- National Asset reconstruction company (NARCL) will take over, 15 Non-performing loans (NPLs) worth Rs. 50,000 crore (US$ 6.70 billion) from the banks.

- In November 2021, RBI launched the ‘RBI Retail Direct Scheme’ for retail investors to increase retail participation in government securities.

- The RBI introduced new auto debit rules with a mandatory additional factor of authentication (AFA), effective from October 01, 2021, to improve the safety and security of card transactions, as part of its risk mitigation measures.

- In September 2021, Central Banks of India and Singapore announced to link their digital payment systems by July 2022 to initiate instant and low-cost fund transfers.

- In August 2021, Prime Minister Mr. Narendra Modi launched e-RUPI, a person and purpose-specific digital payment solution. e-RUPI is a QR code or SMS string-based e-voucher that is sent to the beneficiary’s cell phone. Users of this one-time payment mechanism will be able to redeem the voucher at the service provider without the usage of a card, digital payments app, or internet banking access.

- As per Union Budget 2021-22, the government will disinvest IDBI Bank and privatise two public sector banks.

- Government smoothly carried out consolidation, reducing the number of Public Sector Banks by eight.

- In May 2022, Unified Payments Interface (UPI) recorded 5.95 billion transactions worth Rs. 10.41 trillion (US$ 133.46 billion).

- According to the RBI, India’s foreign exchange reserves reached US$ 630.19 billion as of February 18, 2022.

- The number of transactions through immediate payment service (IMPS) reached 430.67 million and amounted to Rs. 3.70 trillion (US$ 49.75 billion) in October 2021.

- The RBI has launched a pilot to digitalize KCC lending in a bid for efficiency, higher cost savings, and reduction of TAT. This is expected to transform the flow of credit in the rural economy.

- The RBI has launched a pilot to digitalize KCC lending in a bid for efficiency, higher cost savings, and reduction of TAT. This is expected to transform the flow of credit in the rural economy

- As per the Union Budget 2023-24, the RBI has launched a pilot to digitalize Kisan Credit Card (KCC) lending in a bid for efficiency, higher cost savings, and reduction of TAT. This is expected to transform the flow of credit in the rural economy.

- As per the Union Budget 2023-24, digital banking, digital payments and fintech innovations have grown at a rapid pace in the country. Taking forward this agenda, and to mark 75 years of our independence, it is proposed to set up 75 Digital Banking Units in 75 districts of the country by Scheduled Commercial Banks.

- Additionally, the government proposed to introduce a digital rupee or a Central Bank Digital Currency (CBDC) which would be issued by the RBI using blockchain and other technologies.

- The government also proposed to bring all the 150,000 post offices under the digital banking core business to enable financial inclusion.

- As per the economic survey 2022-23, the permission by RBI to lending institutions to grant a total moratorium of 6 (3+3) months in case of payment failure due between 1st March 2020 to 31st August 2020, infusion of US$ 9.1 billion (Rs. 75,000 crore) for Non-Banking Financial Corporations (NBFCs), Housing Finance Companies (HFCs) and Micro Finance Institutions (MFIs), among others, have also contributed to the revival of the real estate sector. The permission by RBI to lending institutions to grant a total moratorium of 6 (3+3) months in case of payment failure due between 1st March 2020 to 31st August 2020, infusion of US$ 9.1 billion (Rs. 75,000 crore) for Non-Banking Financial Corporations (NBFCs), Housing Finance Companies (HFCs) and Micro Finance Institutions (MFIs), among others, have also contributed to the revival of the real estate sector.

- According to the Economic Survey 2022-23, Over the last few years, the number of neo banking platforms and global investments in the neo-banking segment has also risen consistently. Neo-banks operate under mainstream finance's umbrella but empower specific services long associated with traditional institutions such as banks, payment providers, etc.

Enhanced spending on infrastructure, speedy implementation of projects and continuation of reforms are expected to provide further impetus to growth in the banking sector. All these factors suggest that India’s banking sector is poised for robust growth as rapidly growing businesses will turn to banks for their credit needs. The advancement in technology has brought mobile and internet banking services to the fore. The banking sector is laying greater emphasis on providing improved services to their clients and upgrading their technology infrastructure to enhance customer’s overall experience as well as give banks a competitive edge.

In recent years India has experienced a rise in fintech and microfinancing. India’s digital lending stood at US$ 75 billion in FY18 and is estimated to reach US$ 1 trillion by FY23 driven by the five-fold increase in digital disbursements. The Indian fintech market has attracted US$ 29 billion in funding over 2,084 deals so far (January 2017-July 2022), accounting for 14% of global funding and ranking second in terms of deal volume. By 2025, India's fintech market is expected to reach Rs. 6.2 trillion (US$ 83.48 billion).

References: Media Reports, Press releases, Reserve Bank of India, Press Information Bureau, www.pmjdy.gov.in , Union Budget 2023-24, Economic Survey 2023-24

Note: Conversion rate used in November 2023, Rs. 1 = US$ 0.012, * - according to an FIS report, # - Microfinances Institution Network

Related News

Outward remittances from India reached a record high of US$ 29 billion under the liberalised remittance scheme, showing a 21.7% increase compared to the previous year, with significant allocations towards international travel and education.

The RBI seeks to improve retail user access to the e-rupee through collaboration with non-bank payment system operators, such as PhonePe, Google Pay, and Paytm.

NBFCs saw a 6% y-o-y rise in loan sanctions in third quarter of FY24, fuelled by robust consumer, gold, and personal loans.

Credit card transactions rose 11% to US$ 111.4 billion (Rs. 9.30 trillion) during June-December 2023, outpacing sluggish debit card usage.

Prime Minister, Mr. Narendra Modi emphasized India's strategic need to enhance economic self-sufficiency in the coming decade, enabling resilience against global crises and elevating the international prominence of the Indian rupee.

Banking India

- Public Sector

- Private Sector

- Foreign Bank

Industry Contacts

- Indian Banks Association

- Reserve Bank of India

- Institute for Development and Research in Banking Technology

NEW INDIA DIGITAL INDIA

India will contribute 2.2% to the world's digital payments market by 2023, while the value of such transaction is expected to reach US$ 12.4 trillion globally by 2025.

IBEF Campaigns

APEDA India Pavilion Gulfood February 20th-26th, 2022 | World Trade Centre,...

Ibef Organic Indian Pavilion BIOFACH2022 July 26th-29th, 2022 | Nuremberg, ...

Promoting Indigenous Start-ups: Case Study of Investor Interest in Small-town Start-ups

As urban markets become saturated, investors are turning their gaze towards the untapped potential of small-town innovation, driven by a desire to fos...

India's White Revolution

The "White Revolution" in India refers to the successful implementation of Operation Flood, a dairy development program launched on January ...

The Growth of Ayurveda in India

Ayurveda, an ancient health system originating from India, has a longstanding history. It revolves around using plants and herbs to maintain health an...

India's Solar Power Revolution

India is leading the renewable energy revolution, with a strategic emphasis...

Empowering MSMEs: Fintech Solutions for Small Businesses in India

Micro, small, and medium enterprises (MSMEs) are the backbone of the Indian...

Unlocking India's Digital SME Credit Gap and Economic Potential

The Indian economy thrives on the contributions of the Micro, Small, and Me...

Not a member

Green banking initiatives: a qualitative study on Indian banking sector

- Published: 02 May 2021

- Volume 24 , pages 293–319, ( 2022 )

Cite this article

- Meenakshi Sharma ORCID: orcid.org/0000-0002-6841-052X 1 &

- Akanksha Choubey 1

30k Accesses

77 Citations

Explore all metrics

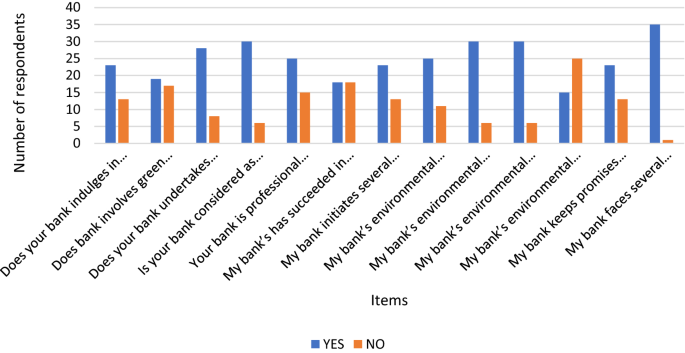

The environmental concern is on rise in all types of business; however, banking assumes a special niche due to its ability to influence the economic growth and development of the country. The present study proposes conceptual model of Green banking initiatives and studies the impact of three Green banking initiatives, viz. green products development, green corporate social responsibility and green internal process on two possible outcomes, viz. Green brand image and Green trust. The study is qualitative in nature comprising of semistructured in-depth interviews conducted with 36 middle- to senior-level managers of twelve public and private Indian banks. Banking sector can play a crucial role in greening the banking system by enhancing the availability of finance and serve the needs of a “green economy”. The findings of the study revealed that 63% of the total respondents were of view that their bank indulges in development of several green banking products and services, 53% of the bankers said that their bank incorporates green internal processes in their daily activities, and 78% respondents said that their bank undertakes several green corporate social responsibility initiatives. This investigation further highlights that more than 60% respondents believed that Green banking initiatives have positive role in restoring customer trust through enhanced Green brand image. With dearth of studies on green banking in India, the present qualitative study contributes to the body of knowledge and paves way for future research in green banking for sustainable development.

Similar content being viewed by others

Study of Green Banking Practices in the Sri Lankan Context: A Critical Review

Green banking practices, bank reputation, and environmental awareness: evidence from Islamic banks in a developing economy

Ikram Ullah Khan, Zahid Hameed, … Manzoor Ahmad Khan

Nexus between providers and users of green finance: Case study of commercial banks in Mauritius

Avoid common mistakes on your manuscript.

1 Introduction

Sustainability today is an “emerging mega-trend” (Lubin & Esty, 2020 ) and a very important business objective to drive green business innovation (Raska & Shaw, 2012 ; Royne et al., 2011 ). Companies like Cisco, HP and Walmart have successfully integrated it into their business practices (Sheth et al., 2010 ). The relevance of green marketing in existent scenario is conspicuous because of environmental concerns amongst marketing researchers and practitioners (Chamorro et al., 2009 ; Peattie & Crane, 2005 ; Ottman et al., 2006 ; Lee, 2008 ; Polonsky, 2011 ; Sharma, 2018 ). Industrialization has resulted in ecological inequality, and corporates are blooming at the expense of local community (Porter & Kramer, 2014 ). Uneven industrialization has disturbed ecological balance and has resulted in natural and industrial disasters (Rehman et al., 2021 ). High levels of environmental pollution have raised social concern over environmental issues (Chen, 2010 ). This environmental concern is surging in divergent businesses. Manufacturing, technology, electronics and IT industries (Bae, 2011 ) all are willingly accepting environmental dedication as a paramount business responsibility (Chen et al., 2006 ).

Banks play a pivotal role in sustainable development of a country, and green banking today has become a phraseology. Due to financial, economic and environmental changes, financial services market is re-shaping and an all-inclusive engagement of ethical proposal and values into banking practices is taking place (Lymperopoulos et al., 2012 ; San-Jose et al., 2009 ). Banking sector facilitates adaptation of environment friendly strategies, mitigates climate risks and supports recovery by diverting funds to climate-sensitive sectors (Part & Kim, 2020 ). Today, environmental and green banking has become synonym with sustainability (Kärnä et al., 2003 ), so banks are broadcasting corporate social responsibility (CSR) activities (Scholtens, 2011 ). Banks globally are investing substantially in green strategies (Evangelinos et al., 2009 ) to create green image. Greening of bank is further reducing carbon footprints from banking activities, and this is mutually beneficial to the banks, industries and the economy (Bihari & Pandey, 2015 ).

Many relevant studies have been conducted on green banking before. Scholtens assigns green bank marketing as a component of larger CSR concept. Economic agents banks play an important role in financing environment-friendly projects (Nizam et al., 2019 ) and thus contribute towards society (Rehman et al., 2021 ). Kärnä et al. ( 2003 ) and Grove et al. ( 1996 ) explained association between green marketing and CSR, in non-banking sector. Lymperopoulos et al. ( 2012 ) tested the favorable impact of green bank marketing and green image ; for Evangelinos et al. ( 2009 ) development of green services was the prime focus. Kumar and Prakash ( 2018 ) also opine that implementing sustainable banking practices can be a strong stimulus to sustainable development and points towards scarcity of studies related to sustainable banking in Indian banks. Nizam et al. ( 2019 ) emphasized the need for implementing Green banking initiatives in routine operations, whereas Masukujjaman et al. ( 2017 ) talked about pivotal role played by green banking in developing economies at social, corporate and environmental level.

Developed nations have attracted major research on green banking though developing nations have ignored them (Khan et al., 2015 ; Jeucken, 2015 ; Amacanin, 2005 ; Scholtens, 2011 ; Roca & Searcy, 2012 ; Weber, 2016 ), and in countries like India research on green banking is relatively undiscovered (Prakash et al., 2018 ). Majority of research in India is on corporate social responsibility and management of environment (Biswas, 2011 ; Narwal, 2007 ; Rajput et al., 2013 ; Sahoo & Nayak, 2007 ; Sharma & Mani, 2013 ), green banking strategies (Bihari, 2010 ; Bahl, 2012 ; Jha & Bhoome, 2013 ; Tara & Singh, 2014 ) and green practices adopted by public and private sector banks.

Equator Principles (EPs) and United National Environmental Protection Finance initiative (UNEPF1) and Equator Principles (EPs) promote sustainable development through financial institutions. It has been embraced by more than 200 member nations, and India also being a member nation is following the guidelines of RBI (Reserve Bank of India, 2017). However, despite taking vigorous steps by Indian government, sustainability is yet to dribble down to ordinary people.

Communication gap between the various stakeholders, lack of awareness, lack of green image of the banks and lack of trust are amongst the various reasons why the outcome of the green outreach by the banks is not as expected. Lymperopoulos et al. ( 2012 ) empirically validated that green bank marketing positively influences green image of the bank. However, no such study has been conducted in Indian scenario. The impact of Green banking initiatives to enhance the Green trust and further Green brand image has not been studied so far in Indian scenario.

Henceforth, there is a need to develop a framework that will fill the research gaps by asking following research questions:

What are the Green banking initiatives of leading Indian public and private banks?

What are the major challenges for Indian banks towards “going green”?

How the Green banking initiatives contribute towards creation of Green trust?

How the Green banking initiatives contribute towards creation of Green brand image?

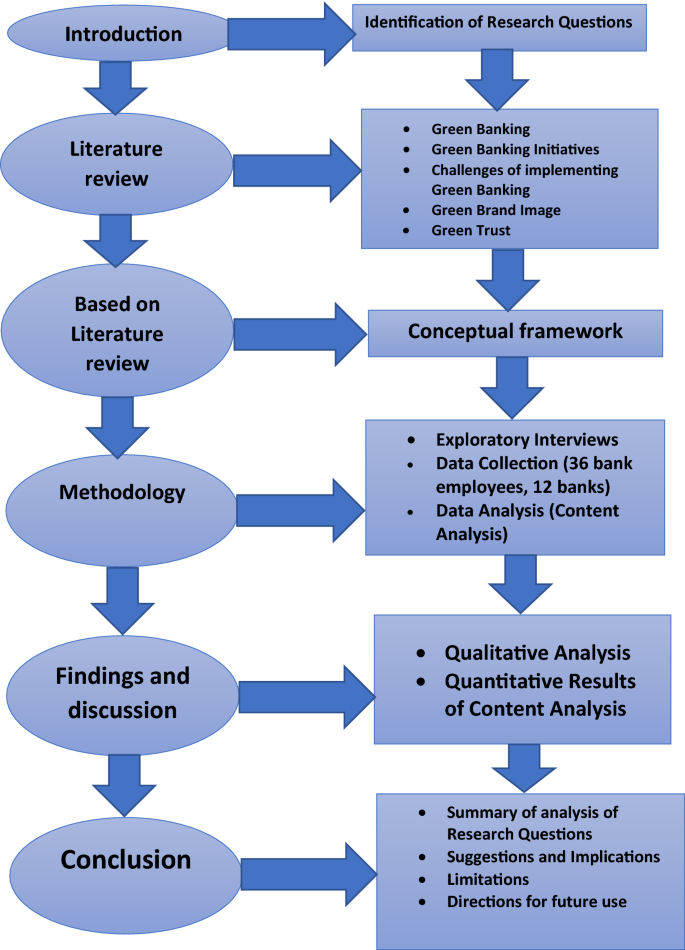

The remaining of this paper is organized as follows: the next section discusses literature review which throws light on green banking, Green banking initiatives in India and challenges of implementing Green banking initiatives in India. Thereafter, the outcomes of Green banking initiatives, viz. Green brand image and Green trust, are discussed as subsections. Afterwards, the research methodology is explained with the help of techniques used for data collection and data analysis. Thereby, findings are discussed which elucidate how research questions are answered. The study is concluded by highlighting the implications and limitations of the research.

2 Literature review

2.1 green banking.

Green banking was initially introduced in the year 2009 in State of Florida. In India, SBI (state bank of India) being the largest commercial bank took a lead towards setting higher standards of sustainability and undertook foremost step towards “green banking” initiative. SBI was the first bank to inaugurate wind farm project in Coimbatore.

Green banking is a form of banking activity where the banks take initiative to do its daily activates as a conscious entity in the society by considering in-house and external environmental sustainability. The banks who do such type of banking activities are termed as socially responsible and a sustainable bank or green bank or ethical bank (Hossain et al., 2020 ; Zhixia et al., 2018 ).

A green bank is a bank that promotes and enacts green technologies in bank operations both internally and externally to minimize carbon footprints and facilitates environment management (Bose et al., 2017 ). It is an influencer for holistic growth of economy in the nation (Jeucken & Bouma, 1999 ; UNEP FI, 2016 ). Green banks adopt social and economic aspect into their strategies and progress towards sustainable practices (UNEP FI, 2011 , 2017 ).

According to Indian Banks Association, green banking refers to a normal banking system which involves all environmental as well as social factors with an aim to ensure ecological sustainability and optimum use of natural resources (Scholtens, 2009 ; Lymperopoulos et al., 2012 ; Kumar & Prakash, 2018 ; Sahi & Pahuja, 2020 ). Hermes et al. ( 2005 ) said that banks involve a shift from traditional towards sustainable practices and social, governance and environment criteria are being integrated into their core strategy. Scholtens ( 2009 ) has explained the concept of green corporate social responsibility in banking and pronounces that a green bank offers savings accounts to stakeholders, ensuring that the savings will finance sustainable projects. He developed a framework to assess the social responsibility of global banks and further tested it on 30 institutions and concluded that there is a positive and significant association between a bank’s CSR score and its financial size and quality. As per Evangelinos et al. ( 2009 ), development of green products like green financial products, loans for renewable energies, greener technologies, green lending and environmental management strategies is green marketing in bank. This improves banks’ reputation and contribute towards sustainability. This has motivated several banks implementing green strategies to invest in developing environmental image to better prepare for future challenges.

Lymperopoulos et al. ( 2012 ) verified empirically that banking initiatives that are green result in a favorable, green image. His green bank marketing construct is comprised of green corporate social responsibility (GCSR), green internal process (GIP) and green product development (GPD).

According to (Dewi & Dewi, 2017 ), green banking promotes environment-friendly practices in banking sector. He further postulated that green banking guides the bank’s core operation towards sustainability. Kumar and Prakash ( 2018 ) have studied the adoption level of sustainable banking tools and categorized 40 criteria into five heads. They further used content analysis to evaluate the sustainable practices of Indian banks and concluded that green banking adoption is still at the nascent stage in Indian banking.

As a part of Green banking initiatives, several banks throughout the globe and NBFIs have adopted eco-friendly mechanisms for financing as well as green transformation of internal operations. For instance, banks in nations like Bangladesh, Brazil, Columbia and Indonesia have started practicing green banking relatively along the lines of the policy framework (Bahl, 2012 ; Rahman & Akhtar, 2016 ). Bank of Ceylon in its annual report of 2015 stated that all their services and goods are driven towards more technology-oriented platforms which helps in reduction of carbon footprints. Also, peoples bank has initiated a paradigm shift to its old model of banking (Oyegunle & Weber, 2015 ). Banks in China, Turkey, Mongolia, Vietnam, Indonesia, Kenya and Peru have also introduced green banking concepts like SmartGen with mobile and internet-oriented passbook free application, fortune branches being installed and initiation of smart zones (Scholtens, 2009 ; Bank of Ceylon, 2015 ; Herath & Herath, 2019 ).

Currently, Indian banks are seen being desirable towards entering global markets (Laskowska, 2018 ; Nuryakin & Maryati, 2020 ; Paramesswari, 2018 ), and it has become important that they recognize their environmental and social responsibilities (Prasanth et al., 2018 ; Sahi & Pahuja, 2020 ; Zhixia et al., 2018 ). As a result, green strategies have become prevalent, not only amongst smaller alternative and cooperative banks, but also amongst diversified financial service providers, asset management firms and insurance companies (Allen & Craig, 2016 ; Gopalakrishnan & Priya, 2020 ; Hossain et al., 2020 ; Kapoor et al., 2016 ).

2.2 Green banking initiatives in India

Green initiatives may be referred to as developing green products which consume less energy, and accordingly distribution, pricing and communication strategies follow. Peattie and Charter ( 1994 ) have defined green marketing as a comprehensive process of management which identify, anticipate and satisfy the needs of customers and society, in a fruitful and sustainable way.

Banking defines green marketing in a similar manner as other industries do. Evangelinos et al. ( 2009 ) defined green bank marketing as developing an innovative environment-friendly financial product like green loans that finance clean technology, and green strategies, like waste management programs and energy efficiency to augment banks’ green reputation and performance.

Green marketing by banks or green initiatives forms a favorable eco-friendly image that satisfies the customer’s green needs and green desires (Chang & Fong, 2010 ) and contributes towards sustainable development (Portney, 2008 ). Several banks are already implementing green banking, green strategies and building their green image to handle existing confrontation. Such green actions can help banks to procure environmental reputation and inculcate their environmental concern (Evangelinos et al., 2009 ; Lymperopoulos et al., 2012 ; Portney, 2008 ).

Green marketing in banks should address green methods and process (Kärnä et al., 2003 ) that suggests green communication also be a part of green initiatives. Evangelinos et al. ( 2009 ) suggest three aspects of green bank marketing in banking literature: lending decisions of banks should be based on environmental criteria; bank environmental management strategies; and developing environmental financial products. He suggested that “green” marketing refers to development of new green financial products that improves banks reputation and performance.

Lymperopoulos et al. ( 2012 ) empirically validated that green bank marketing which comprises of green product development (GPD), green corporate social responsibility (GCSR) and green internal processing (GIP) is a complex concept, is crucial for the bank’s green image (Hartmann et al., 2005 ) and critically contributes in developing customer loyalty and satisfaction (Chang & Fong, 2010 ).

Role of CSR in banks in creating Green brand image has not been explored much (Lymperopoulos et al., 2012 ). CSR is decision making in business, and it has ethical values, compliance with law and regards for environment, communities and people, communities attached to it. Banking relates to CSR with reference to cause-related marketing, ethical issues concerning minority and environment and quality of life (Donaldson & Dunfee, 2002 ). GCSR in banking has been emphasized by Scholtens ( 2009 ), as a socially responsible bank that safeguard savings that are financing environmental projects.

In the contemporary circumstances in market, financial service sector has been reshaped, demanding fresh marketing insight with an aim to provide instructions for successful practice. Going ecological has become a massive trend in the banking industry worldwide. The idea of green banking has encouraged banks to familiarize with paperless, technology driven goods and services while curtailing ecological impacts and performing their role as a corporate citizen on country’s development. The need of the hour is to understand the demand for green initiatives because the eventual success or even failures of these investments are influenced by apparent satisfaction of green consumers. They also assist banks to develop environmental reputation and concern, which is has become imperative today.

Several issues of green marketing like green corporate social responsibility, green product development and green internal processing are addressed by previous studies (Scholtens, 2009 ; Evangelinos et al., 2009 ; Lymperopoulos et al., 2012 ; Herath & Herath, 2019 ) and are long established by several experts, as measurements of Green banking initiatives. Additionally, the outcomes of several qualitative research underline the major contribution of GCSR as an accomplishment for green banks, thereby backing up several former studies (Grove et al., 1996 ; Kärnä et al., 2003 ). Green communications also form an important part of green initiatives as the success of implementation depends upon how well they are communicated to the masses. Lymperopoulos et al. ( 2012 ) also pointed out that environmental awareness can be included in green banking.

India lags other market economies that are in emerging stage in terms of distinctive sustainability policy for their banking practices. Ministry of Finance and RBI together are focusing on developing a policy framework specifically for Indian green banking sector (Roy, 2017 ; Kumar & Prakash, 2018 ). The present study has clubbed the Green banking initiatives of leading Indian private and public sector banks in Indian banking into three categories, viz. green product development, green corporate social responsibility and green internal process (Scholtens, 2009 ; Evangelinos et al., 2009 ; Lymperopoulos et al., 2012 ) as presented in Table 1 . Table 1 explains the three categories of Green banking initiatives, viz. GPD, GCSR and GIP, and different products introduced by different banks under each category.

2.2.1 Green product development

Green product development has actually become the major strategic consideration for several firms throughout the globe because of the ecological regulations and public awareness of eco-friendly practices (Nuryakin & Maryati, 2020 ; Paramesswari, 2018 ). Green product development can be defined as development of business loans for green logistics and waste management, renewable energy sources, loans granted to produce organic products, green mutual funds, stimulating purchase of hybrid cars and other green products, installing photovoltaic systems and investing in production of eco-friendly products (Lymperopoulos et al., 2012 ), green mortgages and green bonds (Campiglio, 2016 ; Kumar & Prakash, 2018 ) and climate fund (Jeucken, 2001 ; Scholtens, 2009 ; Islam et al., 2016 ; GRI G4-FSS1,8, EN6). GPD emphasizes on “end of pipe technology” where organizations are well aware of environmental issues via procedure of production and product design. As per Chen (2001), the product designed to minimize the use of non-renewable resource and avoid toxic materials and renewable resource during its whole life-cycle would be the most effective to display green technological development (Driessen et al., 2013 ; Fraccascia et al., 2018 ; Gopalakrishnan & Priya, 2020 ; Nuryakin & Maryati, 2020 ; Prasanth et al., 2018 ; Yan & Yazdanifard, 2014 ).

2.2.2 Green corporate social responsibility

Green corporate social responsibility (GCSR) can be described as the environmental aspect of CSR—the duty to cover the environmental implications of the company’s operations and the minimization of practices that might adversely affect the enjoyment of the country’s resources by future generations (Laskowska, 2018 ; Nuryakin & Maryati, 2020 ). It can be defined as development of community involvement program (GRI G4-26; Mitra & Schmidpeter, 2017 ; Hossain & Reaz2 007), charity and sponsoring (Jeucken, 2001 ; Scholtens, 2009 ; GRI G4-EC1; Islam et al., 2016 ; Shukla & Donovan, 2014 ) and health care and sanitation program (Hossain & Reaz, 2007 ; Narwal, 2007 ). Access points for financial services in low populated or remote areas of the country (GRI FSS 13; Kumar et al., 2015 ) improve access to financial services for disadvantaged people (GRI FSS 14; Hossain & Reaz, 2007 ; Sarma & Pais, 2011 ). GCSR can decrease business risk, rally reputation as well as afford opportunities for cost savings . Thus, GCSR is no longer a luxury but a requirement . While much of the drive for sustainability has come from regulatory directives, research has shown that if implemented constructively, GCSR can drive business performance improvements in many areas ( Allen & Craig, 2016 ; Nuryakin & Maryati, 2020 ) .

2.2.3 Green internal process

Green internal process can be defined as relevant strategies for maximizing the utilization of bank’s resources and preserving energy such as saving paper and water, recycling and providing eco-friendly equipment; appropriate curriculum for personnel training to safeguard environment; and upgraded internal functions in to insulate the environment.

2.2.4 Challenges of implementing Green banking initiatives

Implementing Green banking initiatives in India involves a lot of problems. There is a lack of awareness amongst the customers and the bank employees about the concept of “green banking” and even if they are aware, the information they have is inaccurate (The Boston Consulting Group, 2009 ; Jayadatta & Nitin, 2017 ; Sharma et al., 2014 ; Maheshwari, 2014 ; Rastogi & Khan, 2015 ; Sindhu, 2015 ). A huge gap has been found in what banks want or try to spread and what people think of banks to be doing regarding green banking (Jayadatta & Nitin, 2017 ; The Boston Consulting Group, 2009 ). Green washing has led consumers to doubt towards environmental advertising and has led to increase in skepticism that has negative influence on green brand equity (Alniacik & Yilmaz, 2012 ; Shrum et al., 1995 ). It was found that almost three-fourth of people using online facilities provided by their banks were unaware of the term green banking or misunderstood it with digital banking (Sharma et al., 2014 ; Maheshwari, 2014 ; Rastogi & Khan, 2015 ; Sindhu, 2015 ). Awareness of green banking is especially less within middle and senior age groups (Sahoo et al., 2016 ). Henceforth, significant gap in terms of studying the impact of demographic exists.

Inclusive growth of economy requires a robust and healthy banking practices (Kumar & Prakash, 2018 ) Most of the activities of a green bank in India are focused on ATMs, internet banking, paperless banking, etc. (Biswas, 2011 ). It is also researched that Indian banks are not so well equipped to implement Green banking initiatives (Rajput et al., 2013 ), and they still have a long way to go (Kumar & Prakash, 2018 ). Reserve Bank of India is a major contributor in facilitating environmental policies. A developing country like India requires more thrust on the social dimension of banking and couples it with economic growth (UNEP FI, 2017 ). Limited Indian banks have advocated the green banking principles as per international standard. There is a need to improve regulatory framework (UNEP FI, 2011 ).

3 Outcomes of Green banking initiatives

3.1 green brand image.

Chang and Fong ( 2010 ) defined green corporate image as “the perceptions developed from the interaction among the institute, personnel, customers and the community that are linked to environmental commitments and environmental concerns”. If the green products of a company are reliable and stable, they converge with the environmental needs of consumer, enjoy excellent environmental performance and have green reputation that company will relish green image. According to Chen ( 2010 ), Green brand image is when a product is perceived by the customers as having green commitment and green concerns. It is accepted via its competence in green reputation, success in sustainable achievement and trustworthiness of environmental promises. Chen ( 2010 ) also endorsed that green marketing positively influences a company to obtain competitive advantages, enhance corporate image and product value and hunt for innovative opportunities in market and augment the product value with reference to information technology products. Hartmann et al. ( 2005 ) posit that an efficiently chalked out green positioning strategy can provide direction towards more appreciative brand perceptions.

In the banking studies, green bank image is related to bank superiority substantially and reputation in their environmental endeavor vis-a-vis competition (Lewis & Soureli, 2006 ). This clubbed with the impression of the customers plays an important role in describing Green brand image (Nguyen & LeBlanc, 2001 ). Further, green bank image can help in retaining the customers, winning back the lost and attracting new ones, thus leading to banks’ prosperity and future sustainability. Thus, it can be presumed that corporate image has a substantial impact on customer loyalty and achieving the fundamentals of green marketing (Chaudhuri, 1997 ; Chen & Chang, 2013 ; Lewis & Weigert, 1985 ; Mitchell et al., 1997 ).

3.2 Green trust

Rotter ( 1971 ) defined trust as the extent to which a party can entrust on another party’s word, statement or promise. Hart and Saunders ( 1997 ) believe that trust is the assurance that others would behave as is conventional based on integrity, ability and benevolence (Schurr & Ozanne, 1985 ), a degree of willingness to believe another party based on ability, reliability and benevolence (Ganesan, 1994 ). Green trust is a willingness to rely on a product, brand or service or expectation arising out of its ability and credibility because of its environmental performance (Chen, 2010 ). Prior research has shown a positive relationship between trust and long-term consumer behavior (Lee et al., 2011 ) and purchase intentions (Harris & Goode, 2010 ; Schlosser et al., 2006 ) and is an antecedent of the same (Van der Heijden et al., 2003 ). Chen and Chang ( 2013 ) endorse that green initiatives can enhance customer trust and their willingness to purchase a product or service (Gefen & Straub, 2004 ).

Henceforth, it can be concluded that Green banking initiatives will have positive influence on Green trust and customers’ green expectations. However, exaggerating the green performance can also lead to reluctance of customers to trust (Kalafatis et al., 1999 ). For a bank to gain Green trust of its customer, its environmental performance, expectations and promises should be reliable, dependable and trustworthy (Chen, 2010 ); more information about the “greenness” of product should be shared with stakeholders (Chen & Chang, 2013 ); else it can give rise to mistrust (Jain & Kaur, 2004 ). Table 2 summarizes the various items of the major constructs of the study, viz. Green banking initiatives, Green brand image and Green trust.

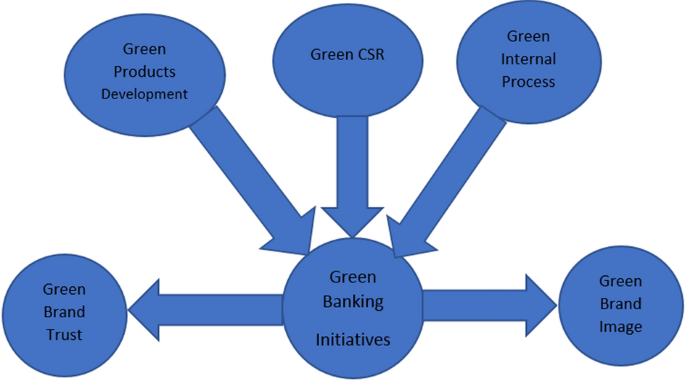

4 Proposed framework

This research develops a conceptual framework (Fig. 1 ) that illustrates the impact of Green banking initiatives on Green brand image and Green trust. Green banking initiatives consist of three items, viz. green product development, green corporate social responsibility and green internal process (Lymperopoulos et al., 2012 ). The outcomes of Green banking initiatives are Green brand image measured by four items in the scale by Chen ( 2010 ) and Green trust measured by five items in the scale given by (Chen & Chang, 2013 ) (Table 2 ).

Conceptual model of Green banking initiatives

Green banking initiatives positively influence Green brand image (Lymperopoulos et al., 2012 ), and Green banking initiatives enhance customer trust and their willingness to purchase a product or service (Gefen & Straub, 2004 ).

5 Methodology and case study

As mentioned before, there is dearth of extensive study on green banking in India. Henceforth, the need for exploratory research is realized and chosen for the present study. Qualitative research provides a deep-seated understanding of the experience or case under observation and study by illuminating uncovering loosely connected insights and taking forward the casual relationship. Use of qualitative research is more apt for formulization and theory dissemination in the background when not much is public about the elemental variance. According to Eisenhardt ( 1989 ), developing a case study method which is based on theory is the favored investigation technique which assist not only in testing but also provoke innovative policy in new arenas.

The present analysis is based on multiple case study where the same phenomenon is investigated in multiple situations. However, the multiple cases shall be selected in such a careful manner so that it either anticipates analogous outcome or anticipates contradictory outcome for anticipated inference (Yin, 2003 ). The above-mentioned twin conditions are addressed in the present study by taking into consideration more than one branch of the same bank and branches from different banks. Henceforth, the findings obtained from analysis of each case from contrasting groups (between State bank of India (SBI), Punjab National Bank (PNB), Bank of Baroda (BOB), Canara Bank, ICICI Bank Ltd, HDFC Bank Ltd, Axis Bank Ltd, Kotak Mahindra Bank, IndusInd Bank, YES Bank, IDFC Group, IDBI) were regarded as object of comparison and the results from each case from similar group (amongst three branches of SBI or three branches of PNB) are findings which further exaggerate the understanding of Green banking initiatives of Indian banks.

In comparison to a single case study, multiple case study provides more sturdy, persuasive and conclusive results. Furthermore, the findings from multiple case study can be hypothesized to a larger extent and collaborate in theory building. Henceforth, a study based on multiple case study is more accurate, logical, and sound (Ray & Sharma, 2019 ). The findings accomplished from multiple case study method are more robust and trustworthy (Baxter & Jack, 2008 ). They allow for a comprehensive development of research questions and academic transformation. The results validate the described complementary and comparative findings to enrich the knowledge base of green banking.

5.1 Exploratory interviews

As the study is exploratory in nature, the research questions focused on what (do you […], e.g., believe?), how (do you […], e.g., feel?), why (do you […], e.g., believe?), in contrast to how much and how many and other quantifiable question. Exploratory interviews were found to be more fruitful technique of providing relevant information deemed necessary for developing a new theory (Amaratunga et al., 2002 ; De Ruyter & Scholl, 1998 ). Several probing questions like “what are the Green banking initiatives used by your bank?”, “what are the problems faced in communicating Green banking initiatives?” …….” Were asked to reveal as much information as possible. The benefit of asking such practical questions was that they provided a structure for reference and conceded the researcher to explore deeper and get analytical. Laddering and funneling techniques were used (Eisenhardt & Graebner, 2007 ; Kvale & Brinkmann, 2009 ) to discover the hidden meaning. The questions were semistructured so had flexibility of words and sequence guided by interviewee’s response. Divergent themes and subthemes were explored dictated by interviewee’s interest and expertise. The focus of the conversation was on green initiatives, their impact on Green brand image and Green trust. This directed the study to conduct interviews in the form of conversation, which were deemed apt for the study’s exploratory nature. It was also considered relevant to conduct detailed analysis (Flick, 2009 ).

5.2 Data collection

Exploratory research design has been used in the present study, and data have been collected by interviewing 36 middle to senior level bank employees from 12 public and private sector banks. Twelve banks that were targeted were State Bank of India (SBI), Punjab National Bank (PNB), Bank of Baroda (BOB), Canara Bank, ICICI Bank Ltd, HDFC Bank Ltd, Axis Bank Ltd, Kotak Mahindra Bank, IndusInd Bank, YES Bank, IDFC Group, IDBI from Delhi NCR region. From each bank three middle-level managers were selected using purposive sampling and were interviewed using semistructured questionnaire method. The chosen respondents with their knowledge and expertise answered the semistructured questionnaire, and this helped in gathering critical points and in-depth knowledge of different aspects of green banking. The theoretical insights that emerged increased the likelihood to expand based on emergent theories (Baker, 2002 ; Eisenhardt & Graebner, 2007 ). As not much research has been done in green banking in India, if analysis had considered a sample up to twelve for conducting in-depth interviews it was considered sufficient (Carson et al., 2001 ). However, this investigation conducted in-depth semistructured interviews with 36 banking sector employees. The detailed profile of the respondents is provided in Table 3 .

The details of the interview were duly recorded and were written on paper. The interview lasted for 50 min on an average, varying from 30 to 90 min (total number of hours exceeding 30 h). Interviews were conducted face to face, and each interview was classified into tables encompassing the most relevant headings under research (as explained earlier), to organize the data. This phenomenon focused attention on distinctive opinions and segregated those from customary perspective shared. Repetitive and interpreted logic produced strong hypothesis development. With the help of in-text, entwined with germane literature, the liaison between factual documentation and emerging theory was established (Amaratunga et al., 2002 ; Eisenhardt & Graebner, 2007 ).

5.3 Data analysis

After reaching the point of exhaustion when no contribution was done by new interviews, data analysis was done. The data were analyzed based on conceptual framework (Fig. 1 ) once interview material was transcripted. Thereafter, process of data analysis was initiated wherein for each item in the interview detailed content analysis was performed (Flick, 2009 ) to remove the crucial facets. It was followed by an interesting exercise of highlighting the cut-outs and freezing the nucleus statements in association with the conceptual framework in Fig. 1 (Saldaña, 2012 ). Characterization was performed for each interview, cut-outs found intriguing were underlined, and further important statements were frozen in association with the conceptual framework (Saldaña, 2012 ). A characterization emerged out of each interview. Then intensity analysis was performed wherein excellent responses were analyzed further to compare the phenomenon under study.