- Vol 20, No 1 (2021)

Cryptocurrencies in Modern Finance: A Literature Review

The focus on cryptocurrencies in the finance and banking sectors is gaining momentum. In this paper, we investigate the role of cryptocurrencies in modern finance. We apply a narrative literature review method to synthesize prior research and draw insights into the opportunities and challenges of leveraging cryptocurrencies. The results indicate that cryptocurrencies offer businesses and individuals’ lower transaction costs, higher efficiencies, increased security and privacy, meaningful diversification benefits, alternative financing solutions, and financial inclusion.Challenges exist related to the integration of cryptocurrencies in modern finance. These include the lack of regulatory standards, the risk of criminal activity, high energy and environmental costs, regulatory bans and usage restrictions, security and privacy concerns, and the high volatility of cryptocurrencies.The current review is useful for scholars and managers, including those seeking to have a more balanced understanding of these emerging financial instruments.

JEL Classification: E42, F30, F65, G21, G23

How to Cite:

Rejeb, A., Rejeb, K., & Keogh, J. G. (2021). Cryptocurrencies in Modern Finance: a Literature Review. Etikonomi , 20(1), 93 – 118. https://doi.org/10.15408/etk.v20i1.16911.

Adhami, S., Giudici, G., & Martinazzi, S. (2018). Why Do Businesses Go Crypto? An Empirical Analysis of Initial Coin Offerings. Journal of Economics and Business, 100, 64–75. https://doi.org/10.1016/j.jeconbus.2018.04.001

Afzal, A., & Asif, A. (2019). Cryptocurrencies, Blockchain and Regulation: A Review. The Lahore Journal of Economics, 24(1), 103–130.

Alam, N., & Zameni, A. P. (2019). Existing Regulatory Frameworks of Cryptocurrency and the Shari’ah Alternative. In Billah, M (eds). Halal Cryptocurrency Management, 179–194. London: Palgrave Macmillan.

Alonso, N., & Luis, S. (2019). Activities and Operations with Cryptocurrencies and Their Taxation Implications: The Spanish Case. Laws, 8(3), 1-13.

Alonso-Monsalve, S., Suárez-Cetrulo, A. L., Cervantes, A., & Quintana, D. (2020). Convolution on Neural Networks for High-Frequency Trend Prediction of Cryptocurrency Exchange Rates using Technical indicators. Expert Systems with Applications, 149, 113250. https://doi.org/10.1016/j.eswa.2020.113250

Amsden, R., & Schweizer, D. (2018). Are Blockchain Crowdsales the New “Gold Rush”? Success Determinants of Initial Coin Offerings, SSRN Scholarly Paper ID 3163849.

Aslan, A., & Sensoy, A. (2020). Intraday Efficiency-Frequency Nexus in The Cryptocurrency Markets. Finance Research Letters, 35, 101298. https://doi.org/10.1016/j.frl.2019.09.013

Auer, R. (2019). Beyond the Doomsday Economics of “Proof-of-Work” in Cryptocurrencies. SSRN Scholarly Paper ID 3331413.

Avdeychik, V., & Capozzi, J. (2018). SEC’s Division of Investment Management Voices Concerns Over Registered Funds Investing in Cryptocurrencies and Cryptocurrency-Related Products. Journal of Investment Compliance, 19(2), 8–12.

Babkin, A. V., Burkaltseva, D., Pshenichnikov, W., & Tyulin, A. (2017). Cryptocurrency and Blockchain-Technology in Digital Economy: Development Genesis. St. Petersburg State Polytechnical University Journal. Economics, 67(5), 9–22.

Bação, P., Duarte, A. P., Sebastião, H., & Redzepagic, S. (2018). Information Transmission Between Cryptocurrencies: Does Bitcoin Rule the Cryptocurrency World? Scientific Annals of Economics and Business, 65(2), 97–117.

Baldimtsi, F., Kiayias, A., & Samari, K. (2017). Watermarking Public-Key Cryptographic Functionalities and Implementations. In Nguyen, P. Q., & Zhou, J. (Eds.). Information Security, 173–191. Berlin: Springer.

Baldwin, J. (2018). In Digital We Trust: Bitcoin Discourse, Digital Currencies, and Decentralized Network Fetishism. Palgrave Communications, 4(1), 1–10. https://doi.org/10.1057/s41599-018-0065-0

Bartos, J. (2015). Does Bitcoin follow the hypothesis of efficient market? International Journal of Economic Sciences, 4(2), 10–23.

Baumöhl, E. (2019). Are Cryptocurrencies Connected to Forex? A Quantile Cross-Spectral Approach. Finance Research Letters, 29, 363–372. https://doi.org/10.1016/j.frl.2018.09.002

Baur, A. W., Bühler, J., Bick, M., & Bonorden, C. S. (2015). Cryptocurrencies as a Disruption? Empirical Findings on User Adoption and Future Potential of Bitcoin and Co. In Janssen, M., Mäntymäki, M., Hidders, J., Klievink, B., Lamersdorf, W., van Loenen, B., & Zuiderwijk, A. (Eds.), Open and Big Data Management and Innovation, 63–80. Berlin: Springer International Publishing.

Baur, D. G., Hong, K., & Lee, A. D. (2018). Bitcoin: Medium of Exchange or Speculative Assets? Journal of International Financial Markets, Institutions and Money, 54, 177–189. https://doi.org/10.1016/j.intfin.2017.12.004

Bech, M. L., & Garratt, R. (2017). Central Bank Cryptocurrencies. SSRN Scholarly Paper ID 3041906.

Berg, C., Davidson, S., & Potts, J. (2019). Blockchain Technology as Economic Infrastructure: Revisiting the Electronic Markets Hypothesis. Frontiers in Blockchain, 2. https://doi.org/10.3389/fbloc.2019.00022

Boell, S. K., & Cecez-Kecmanovic, D. (2015). On being ‘systematic’ in literature reviews. In Willcocks, L. P ., Sauer, C., & Lacity, M. C. (Eds.), Formulating Research Methods for Information Systems: Volume 2, 48–78. London: Palgrave Macmillan UK.

Bonneau, J., Miller, A., Clark, J., Narayanan, A., Kroll, J. A., & Felten, E. W. (2015). SoK: Research Perspectives and Challenges for Bitcoin and Cryptocurrencies. 2015 IEEE Symposium on Security and Privacy, 104–121. https://doi.org/10.1109/SP.2015.14

Bouri, E., Azzi, G., & Dyhrberg, A. H. (2017). On the Return-Volatility Relationship in The Bitcoin Market Around the Price Crash of 2013. Economics - The Open-Access, Open-Assessment E-Journal, 11, 1–16.

Bouri, E., Gupta, R., Lau, C. K. M., Roubaud, D., & Wang, S. (2018). Bitcoin and global financial stress: A copula-based approach to dependence and causality in the quantiles. The Quarterly Review of Economics and Finance, 69, 297–307.

Bouri, E., Molnár, P., Azzi, G., Roubaud, D., & Hagfors, L. I. (2017). On The Hedge and Safe Haven Properties of Bitcoin: Is It Really More than a Diversifier? Finance Research Letters, 20, 192–198. https://doi.org/10.1016/j.frl.2016.09.025

Briere, M., Oosterlinck, K., & Szafarz, A. (2013). Virtual currency, tangible return: Portfolio diversification with bitcoins ULB–Universite Libre de Bruxelles. Working Papers CEB, 13-031.

Brito, J., Shadab, H. B., & Castillo O’Sullivan, A. (2015). Bitcoin Financial Regulation: Securities, Derivatives, Prediction Markets, and Gambling. SSRN Scholarly Paper ID 2423461.

Buhalis, D., Harwood, T., Bogicevic, V., Viglia, G., Beldona, S., & Hofacker, C. (2019). Technological Disruptions in Services: Lessons from Tourism and Hospitality. Journal of Service Management, 30(4), 484–506.

Bulut, A. (2018). Cryptocurrencies in the New Economy. Journal of International Trade, Logistics and Law, 4(2), 45–52.

Bunjaku, F., Gorgieva-Trajkovska, O., & Miteva-Kacarski, E. (2017). Cryptocurrencies – Advantages and Disadvantages. Journal of Economics, 2(1), 31-39.

Burniske, C., & White, A. (2017). Bitcoin: Ringing the bell for a new asset class. Ark Invest (January 2017) Https://Research. Ark-Invest. Com/Hubfs/1_Download_Files_ARK-Invest/White_Papers/Bitcoin-Ringing-The-Bell-For-A-New-Asset-Class. Pdf.

Button, S. (2018). Cryptocurrency and Blockchains in Emerging Economies. Software Quality Professional, 20(3).

Calcaterra, C., Kaal, W. A., & Rao, V. (2020). Stable Cryptocurrencies. Washington University Journal of Law & Policy, 61, 193-228.

Campbell-Verduyn, M.. (2017). Conclusion: Towards a Block Age or Blockages of Global Governance? In Tendulkar, S (Ed). Bitcoin and Beyond, 178–197. London: Routledge.

Catalini, C., & Gans, J. S. (2016). Some Simple Economics of the Blockchain. https://doi.org/10.2139/ssrn.2874598

Cennamo, C., Marchesi, C., & Meyer, T. (2020). Two Sides of The Same Coin? Decentralized Versus Proprietary Blockchains and The Performance of Digital Currencies. Academy of Management Discoveries, 6(3). https://doi.org/10.5465/amd.2019.0044.

Cerqueti, R., Giacalone, M., & Mattera, R. (2020). Skewed Non-Gaussian GARCH Models for Cryptocurrencies Volatility Modelling. Information Sciences, 527, 1–26. https://doi.org/10.1016/j.ins.2020.03.075

Charfeddine, L., Benlagha, N., & Maouchi, Y. (2020). Investigating the Dynamic Relationship Between Cryptocurrencies and Conventional Assets: Implications for Financial Investors. Economic Modelling, 85, 198-217.

Chapron, G. (2017). The Environment Needs Cryptogovernance. Nature News, 545(7655), 403–405.

Chohan, U. W. (2017). The Double Spending Problem and Cryptocurrencies. SSRN Scholarly Paper ID 3090174.

Clark, B., & Burstall, R. (2018). Blockchain, IP and The Pharma Industry—How Distributed Ledger Technologies Can Help Secure the Pharma Supply Chain. Journal of Intellectual Property Law & Practice, 13(7), 531–533.

Cocco, L., Concas, G., & Marchesi, M. (2017). Using an artificial financial market for studying a cryptocurrency market. Journal of Economic Interaction and Coordination, 12(2), 345–365. https://doi.org/10.1007/s11403-015-0168-2

Conti, M., Sandeep Kumar, E., Lal, C., & Ruj, S. (2018). A Survey on Security and Privacy Issues of Bitcoin. IEEE Communications Surveys Tutorials, 20(4), 3416–3452. https://doi.org/10.1109/COMST.2018.2842460

Corbet, S., Lucey, B., Urquhart, A., & Yarovaya, L. (2019). Cryptocurrencies as a Financial Asset: A Systematic Analysis. International Review of Financial Analysis, 62, 182–199. https://doi.org/10.1016/j.irfa.2018.09.003

Courtois, N. T., Grajek, M., & Naik, R. (2014). The Unreasonable Fundamental Incertitudes Behind Bitcoin Mining. ArXiv:1310.7935 [Cs]. http://arxiv.org/abs/1310.7935

Cronin, P., Ryan, F., & Coughlan, M. (2008). Undertaking a Literature Review: A Step-by-Step Approach. British Journal of Nursing, 17(1), 38–43.

Crosby, M., Pattanayak, P., Verma, S., & Kalyanaraman, V. (2016). Blockchain technology: Beyond bitcoin. Applied Innovation, 2(6–10), 7-19.

Dashkevich, N., Counsell, S., & Destefanis, G. (2020). Blockchain Application for Central Banks: A Systematic Mapping Study. IEEE Access, 8, 139918–139952.

Demidenko, D. S., Malevskaia-Malevich, E. D., & Dubolazova, Y. A. (2018). ISO as a Real Source of Funding. Pricing issues. 2018 International Conference on Information Networking (ICOIN), 622–625. https://doi.org/10.1109/ICOIN.2018.8343193

Dimitrova, V., Fernández-Martínez, M., Sánchez-Granero, M. A., & Segovia, J. E. T. (2019). Some Comments on Bitcoin Market (In)Efficiency. PLOS ONE, 14(7), e0219243. https://doi.org/10.1371/journal.pone.0219243

Dodd, N. (2018). The Social Life of Bitcoin. Theory, Culture and Society, 35(3), 35–56. https://doi.org/10.1177/0263276417746464

Dorfleitner, G., & Lung, C. (2018). Cryptocurrencies from The Perspective of Euro Investors: A Re-examination of Diversification Benefits and a New Day-of-The-Week Effect. Journal of Asset Management, 19(7), 472–494.

Dostov, V., & Shust, P. (2014). Cryptocurrencies: An unconventional Challenge to The AML/CFT Regulators? Journal of Financial Crime, 21(3), 249–263.

Duque, J. J. (2020). State Involvement in Cryptocurrencies. A Potential World Money? The Japanese Political Economy, 46(1), 65–82.

Dyhrberg, A. H., Foley, S., & Svec, J. (2018). How Investible is Bitcoin? Analyzing The Liquidity and Transaction Costs of Bitcoin Markets. Economics Letters, 171, 140–143. https://doi.org/10.1016/j.econlet.2018.07.032

Fabian, B., Ermakova, T., & Sander, U. (2016). Anonymity in Bitcoin—The Users’ Perspective. ICIS 2016 Proceedings.

Fadeyi, O., Krejcar, O., Maresova, P., Kuca, K., Brida, P., & Selamat, A. (2020). Opinions on Sustainability of Smart Cities in the Context of Energy Challenges Posed by Cryptocurrency Mining. Sustainability, 12(1), 169. https://doi.org/10.3390/su12010169

Fantacci, L. (2019). Cryptocurrencies and the Denationalization of Money. International Journal of Political Economy, 48(2), 105–126. https://doi.org/10.1080/08911916.2019.1624319

Flori, A. (2019). Cryptocurrencies In Finance: Review and Applications. International Journal of Theoretical and Applied Finance, 22(5), 1–22.

Foley, S., Karlsen, J. R., & Putniņš, T. J. (2019). Sex, Drugs, and Bitcoin: How Much Illegal Activity Is Financed through Cryptocurrencies? The Review of Financial Studies, 32(5), 1798–1853. https://doi.org/10.1093/rfs/hhz015

García-Medina, A., & Hernández, J. B. (2020). Network Analysis of Multivariate Transfer Entropy of Cryptocurrencies in Times of Turbulence. Entropy, 22(7), 760-762. https://doi.org/10.3390/e22070760

Glaser, F., & Bezzenberger, L. (2015). Beyond Cryptocurrencies—A Taxonomy of Decentralized Consensus Systems. SSRN Scholarly Paper ID 2605803.

Gott, M., Ward, S., Gardiner, C., Cobb, M., & Ingleton, C. (2011). A Narrative Literature Review of The Evidence Regarding The Economic Impact of Avoidable hospitalizations Amongst Palliative Care Patients in The UK. Progress in Palliative Care, 19(6), 291–298. https://doi.org/10.1179/1743291X11Y.0000000014

Guadamuz, A., & Marsden, C. (2015). Blockchains and Bitcoin: Regulatory Responses to Cryptocurrencies. First Monday, 20(12). https://doi.org/10.5210/fm.v20i12.6198

Gurrib, I., Kweh, Q. L., Nourani, M., & Ting, I. W. K. (2019). Are Cryptocurrencies Affected by Their Asset Class Movements or News Announcements? Malaysian Journal of Economic Studies, 56(2), 201–225. https://doi.org/10.22452/MJES.vol56no2.2

Härdle, W. K., Harvey, C. R., & Reule, R. C. G. (2020). Understanding Cryptocurrencies. Journal of Financial Econometrics, 18(2), 181–208. https://doi.org/10.1093/jjfinec/nbz033

Harvey, J., & Branco-Illodo, I. (2020). Why Cryptocurrencies Want Privacy: A Review of Political Motivations and Branding Expressed in “Privacy Coin” Whitepapers. Journal of Political Marketing, 19(1–2), 107–136.

Hashemi Joo, M., Nishikawa, Y., & Dandapani, K. (2019). Cryptocurrency, a Successful Application of Blockchain Technology. Managerial Finance, 46(6), 715–733.

Hayes, A. (2015). A Cost of Production Model for Bitcoin. Working Papers No. 1505. New School for Social Research, Department of Economics.

Herskind, L., Katsikouli, P., & Dragoni, N. (2020). Privacy and Cryptocurrencies—A Systematic Literature Review. IEEE Access, 8, 54044–54059.

Hong, K. (2017). Bitcoin as an alternative investment vehicle. Information Technology and Management, 18(4), 265–275. https://doi.org/10.1007/s10799-016-0264-6

Houy, N. (2014). The economics of Bitcoin transaction fees. Working Papers Halshs-00951358.

Hsieh, Y.-Y., Vergne, J.-P., Anderson, P., Lakhani, K., & Reitzig, M. (2018). Bitcoin and the Rise of Decentralized Autonomous Organizations. Journal of Organization Design, 7(1), 14. https://doi.org/10.1186/s41469-018-0038-1

Hu, A., Parlour, C. A., & Rajan, U. (2018). Cryptocurrencies: Stylized Facts on a New Investible Instrument. SSRN Scholarly Paper ID 3182113.

Hudson, R., & Urquhart, A. (2019). Technical Trading and Cryptocurrencies. Annals of Operations Research, 297, 191-220. https://doi.org/10.1007/s10479-019-03357-1.

Hughes, S., & Middlebrook, S. (2014). Regulating Cryptocurrencies in the United States: Current Issues and Future Directions. William Mitchell Law Review, 40(2), 814–848.

Ibba, S., Pinna, A., Baralla, G., & Marchesi, M. (2018). ICOs Overview: Should Investors Choose an ICO Developed with the Lean Startup Methodology? In Garbajosa, J., Wang, X., & Aguiar, A. (Eds.), Agile Processes in Software Engineering and Extreme Programming, 293–308. Berlin: Springer International Publishing.

Jaag, C., & Bach, C. (2015). Cryptocurrencies: New Opportunities for Postal Financial Services. Working Paper No. 0052.

Kaponda, K. (2019). An Investigation into the State of Cryptocurrencies and Regulatory Challenges in Zambia. SSRN Scholarly Paper ID 3433153.

Karpan, A. (2019). Cryptocurrencies and Blockchain Technology. New York: Greenhaven Publishing LLC.

Katsiampa, P. (2017). Volatility Estimation for Bitcoin: A Comparison of GARCH Models. Economics Letters, 158, 3–6. https://doi.org/10.1016/j.econlet.2017.06.023

Keogh, J. G., Dube, L., Rejeb, A., Hand, K. J., Khan, N., & Dean, K. (2020). The Future Food Chain: Digitization as an Enabler of Society 5.0. In Detwiler, D. (Ed.), Building the Future of Food Safety Technology. Netherlands: Elsevier.

Keogh, J. G., Rejeb, A., Khan, N., Dean, K., & Hand, K. J. (2020). Blockchain and GS1 Standards in the Food Chain: A Review of the Possibilities and Challenges. In Detwiler, D. (Ed.), Building the Future of Food Safety Technology. Netherlands: Elsevier.

Kerr, J. (2018). How Can Legislators Protect Sport from the Integrity Threat Posed by Cryptocurrencies? The International Sports Law Journal, 18(1), 79–97.

Kfir, I. (2020). Cryptocurrencies, National Security, Crime and Terrorism. Comparative Strategy, 39(2), 113–127. https://doi.org/10.1080/01495933.2020.1718983

Kim, S. (2018). Chapter Two—Blockchain for a Trust Network Among Intelligent Vehicles. In Raj, P., & Deka, G. C. (Eds.), Advances in Computers, Vol. 111, 43–68. Netherlands: Elsevier.

Kolber, A. J. (2018). Not-So-Smart Blockchain Contracts and Artificial Responsibility. Stanford Technology Law Review, 21, 198. https://heinonline.org/HOL/Page?handle=hein.journals/stantlr21&id=198&div=&collection=

Korpela, K., Hallikas, J., & Dahlberg, T. (2017). Digital Supply Chain Transformation toward Blockchain Integration. Proceedings of the 50th Hawaii International Conference on System Sciences.

Lanko, A., Vatin, N., & Kaklauskas, A. (2018). Application of RFID Combined with Blockchain Technology in Logistics of Construction Materials. MATEC Web of Conferences, 170, 03032. https://doi.org/10.1051/matecconf/201817003032

Larios-Hernández, G. J. (2017). Blockchain Entrepreneurship Opportunity in The Practices of The Unbanked. Business Horizons, 60(6), 865–874.

Lerer, M., & McGarrigle, C. (2018). Art in the Age of Financial Crisis. Visual Resources, 34(1–2), 1–12. https://doi.org/10.1080/01973762.2018.1455355

Lim, I.-K., Kim, Y.-H., Lee, J.-G., Lee, J.-P., Nam-Gung, H., & Lee, J.-K. (2014). The Analysis and Countermeasures on Security Breach of Bitcoin. In Murgante, B., Misra, S., Rocha, A. M. A. C., Torre, C., Rocha, J. G., Falcão, M. I., Taniar, D., Apduhan, B. O., & Gervasi, O. (Eds.), Computational Science and Its Applications – ICCSA 2014, 720–732. Berlin: Springer International Publishing.

Lu, Q., Xu, X., Liu, Y., Weber, I., Zhu, L., & Zhang, W. (2019). uBaaS: A Unified Blockchain as a Service Platform. Future Generation Computer Systems, 101, 564–575.

Marian, O. (2013). Are Cryptocurrencies Super Tax Havens? Michigan Law Review First Impressions, 112(1), 38–48. https://repository.law.umich.edu/mlr_fi/vol112/iss1/2

Marquez-Velazquez, A. (2010). The Report of the Stiglitz Commission: A Summary and Comment. SSRN Scholarly Paper ID 2196125.

Maurer, B., Nelms, T. C., & Swartz, L. (2013). “When Perhaps the Real Problem is Money Itself!”: The Practical Materiality of Bitcoin. Social Semiotics, 23(2), 261–277. https://doi.org/10.1080/10350330.2013.777594

Mendoza-Tello, J. C., Mora, H., Pujol-López, F. A., & Lytras, M. D. (2018). Social Commerce as a Driver to Enhance Trust and Intention to Use Cryptocurrencies for Electronic Payments. IEEE Access, 6, 50737–50751.

Mendoza-Tello, J. C., Mora, H., Pujol-López, F. A., & Lytras, M. D. (2019). Disruptive Innovation of Cryptocurrencies in Consumer Acceptance and Trust. Information Systems and E-Business Management, 17(2), 195–222.

Michelman, P. (2017). Seeing Beyond the Blockchain Hype. MIT Sloan Management Review, 58(4), 17-20.

Miller, P. (2016). Chapter 1—The Cryptocurrency Enigma. In Sammons, J. (Ed.), Digital Forensics, 1–25. Syngress. https://doi.org/10.1016/B978-0-12-804526-8.00001-0

Milne, A. (2018). Cryptocurrencies from an Austrian Perspective. In Godart-van der Kroon, A., & Vonlanthen, P. (Eds.), Banking and Monetary Policy from the Perspective of Austrian Economics, 223–257. Berlin: Springer International Publishing.

Momtaz, P. P. (2019). The Pricing and Performance of Cryptocurrency. The European Journal of Finance, 1–14. https://doi.org/10.1080/1351847X.2019.1647259

Nakamoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System. Satoshi Nakamoto Institute Working Paper. Retrieved from: http://nakamotoinstitute.org/bitcoin/

Ng, D., & Griffin, P. (2018). The wider impact of a national cryptocurrency. Global Policy, 1–18. https://ink.library.smu.edu.sg/lkcsb_research/5880

Nica, O., Piotrowska, K., & Schenk-Hoppé, K. R. (2017). Cryptocurrencies: Economic Benefits and Risks. SSRN Scholarly Paper ID 3059856.

Omane-Adjepong, M., & Alagidede, I. P. (2020). High- and Low-Level Chaos in The Time and Frequency Market Returns of Leading Cryptocurrencies and Emerging Assets. Chaos, Solitons & Fractals, 132, 109563. https://doi.org/10.1016/j.chaos.2019.109563

Omane-Adjepong, M., Alagidede, P., & Akosah, N. K. (2019). Wavelet Time-Scale Persistence Analysis of Cryptocurrency Market Returns and Volatility. Physica A: Statistical Mechanics and Its Applications, 514, 105–120.

Peters, G. W., Panayi, E., & Chapelle, A. (2015). Trends in Crypto-Currencies and Blockchain Technologies: A Monetary Theory and Regulation Perspective. Journal of Financial Perspectives, 3(3), 92-113.

Pinna, A., Tonelli, R., Orrú, M., & Marchesi, M. (2018). A Petri Nets Model for Blockchain Analysis. The Computer Journal, 61(9), 1374–1388.

Platanakis, E., Sutcliffe, C., & Urquhart, A. (2018). Optimal vs Naïve Diversification in Cryptocurrencies. Economics Letters, 171, 93–96.

Polasik, M., Piotrowska, A. I., Wisniewski, T. P., Kotkowski, R., & Lightfoot, G. (2015). Price Fluctuations and the Use of Bitcoin: An Empirical Inquiry. International Journal of Electronic Commerce, 20(1), 9–49. https://doi.org/10.1080/10864415.2016.1061413

Pournader, M., Shi, Y., Seuring, S., & Koh, S. C. L. (2020). Blockchain Applications in Supply Chains, Transport and Logistics: A Systematic Review of the Literature. International Journal of Production Research, 58(7), 2063–2081.

Raymaekers, W. (2015). Cryptocurrency Bitcoin: Disruption, Challenges and Opportunities. Journal of Payments Strategy & Systems, 9(1), 30–46.

Rehman, M. H. ur, Salah, K., Damiani, E., & Svetinovic, D. (2019). Trust in Blockchain Cryptocurrency Ecosystem. IEEE Transactions on Engineering Management, 1–17.

Rejeb, A. (2018a). Blockchain Potential in Tilapia Supply Chain in Ghana. Acta Technica Jaurinensis, 11(2), 104–118.

Rejeb, A. (2018b). Halal Meat Supply Chain Traceability Based on HACCP , Blockchain and Internet of Things. Acta Technica Jaurinensis, 11(4), 1–30. https://doi.org/10.14513/actatechjaur.v11.n1.000

Rejeb, A., & Bell, L. (2019). Potentials of Blockchain for Healthcare: Case of Tunisia. World Scientific News, 136, 173–193.

Rejeb, A., Keogh, J. G., & Treiblmaier, H. (2019a). Leveraging the Internet of Things and Blockchain Technology in Supply Chain Management. Future Internet, 11(7), 161. https://doi.org/10.3390/fi11070161

Rejeb, A., Keogh, J. G., & Treiblmaier, H. (2019b). The impact of blockchain on medical tourism. WeB2019 Workshop on E-Business, 1–12.

Rejeb, A., & Rejeb, K. (2019). Blockchain Technology in Tourism: Applications and Possibilities. World Scientific News, 137, 119–144.

Rejeb, A., & Rejeb, K. (2020). Blockchain and supply chain sustainability. Logforum, 16(3), 363–372. https://doi.org/10.17270/J.LOG.2020.467

Rejeb, A., Sűle, E., & Keogh, J. G. (2018). Exploring new technologies in procurement. Transport & Logistics: The International Journal, 18(45), 76–86.

Ricciardi, V. (2004). A Risk Perception Primer: A Narrative Research Review of the Risk Perception Literature in Behavioral Accounting and Behavioral Finance. SSRN Scholarly Paper ID 566802.

Richards, T., & Briefing, A. B. E. (2018). Cryptocurrencies and Distributed Ledger Technology. Australian Business Economists Briefing, Sydney, 26.

Rowan, S., Clear, M., Gerla, M., Huggard, M., & Goldrick, C. M. (2017). Securing Vehicle to Vehicle Communications using Blockchain through Visible Light and Acoustic Side-Channels. ArXiv:1704.02553 [Cs]. http://arxiv.org/abs/1704.02553

Scharding, T. (2019). National Currency, World Currency, Cryptocurrency: A Fichtean Approach to the Ethics of Bitcoin. Business and Society Review, 124(2), 219–238.

Searing, J. M., & MacLeod, D. (2019). Cryptocurrency Gift Strategies for Not-for-Profits: Here’s What Organizations Should Consider as They Ponder Whether and How to Accept Donations of Virtual Currency. Journal of Accountancy, 227(2), 34-36.

Shahzad, F., Xiu, G., Wang, J., & Shahbaz, M. (2018). An Empirical Investigation on the Adoption of Cryptocurrencies Among the People of Mainland China. Technology in Society, 55, 33–40. https://doi.org/10.1016/j.techsoc.2018.05.006

Sharma, A. K., & Kumar, S. (2010). Economic Value Added (EVA)—Literature Review and Relevant Issues. International Journal of Economics and Finance, 2(2), 200-220.

Sharma, D. K., Pant, S., Sharma, M., & Brahmachari, S. (2020). Chapter 13 - Cryptocurrency Mechanisms for Blockchains: Models, Characteristics, Challenges, and Applications. In Krishnan, S., Balas, V. E., Julie, E. G., Robinson, Y. H., Balaji, S., & Kumar, R. (Eds.), Handbook of Research on Blockchain Technology, 323–348. Academic Press. https://doi.org/10.1016/B978-0-12-819816-2.00013-7

Söderlund, P., & Kestilä-Kekkonen, E. (2014). Economic Voting in Finland Before and After an Economic Crisis. Acta Politica, 49(4), 395–412.

Srokosz, W., & Kopciaski, T. (2015). Legal and Economic Analysis of The Cryptocurrencies Impact on The Financial System Stability. Journal of Teaching and Education, 4(2), 619–627.

Sudzina, F. (2018). Distribution of Foreign Aid in Cryptocurrencies: Initial Considerations. International Advances in Economic Research, 24(4), 387–388.

Symitsi, E., & Chalvatzis, K. J. (2018). Return, Volatility and Shock Spillovers of Bitcoin with Energy and Technology Companies. Economics Letters, 170, 127–130. https://doi.org/10.1016/j.econlet.2018.06.012

Tama, B. A., Kweka, B. J., Park, Y., & Rhee, K.-H. (2017). A Critical Review of Blockchain and Its Current Applications. 2017 International Conference on Electrical Engineering and Computer Science (ICECOS), 109–113.

Till, B. M., Peters, A. W., Afshar, S., & Meara, J. G. (2017). From Blockchain Technology to Global Health Equity: Can Cryptocurrencies Finance Universal Health Coverage? BMJ Global Health, 2(4), e000570. https://doi.org/10.1136/bmjgh-2017-000570

Trautman, L. J. (2014). Virtual Currencies; Bitcoin & What Now After Liberty Reserve, Silk Road, and Mt. Gox? Richmond Journal of Law and Technology, 20(4), 1-108.

Treiblmaier, H. (2018). The Impact of The Blockchain on The Supply Chain: A Theory-Based Research Framework and a Call for Action. Supply Chain Management: An International Journal, 23(6), 545–559. https://doi.org/10.1108/SCM-01-2018-0029

Treiblmaier, H. (2019). Combining Blockchain Technology and the Physical Internet to Achieve Triple Bottom Line Sustainability: A Comprehensive Research Agenda for Modern Logistics and Supply Chain Management. Logistics, 3(1), 1–13.

Treiblmaier, H., Rejeb, A., & Strebinger, A. (2020). Blockchain as a Driver for Smart City Development: Application Fields and a Comprehensive Research Agenda. Smart Cities, 3(3), 853–872. https://doi.org/10.3390/smartcities3030044

Truby, J. (2018). Decarbonizing Bitcoin: Law and Policy Choices for Reducing the Energy Consumption of Blockchain Technologies and Digital Currencies. Energy Research & Social Science, 44, 399–410.

Tucker, T. (2013, December 5). Bitcoin’s Volatility Problem: Why Today’s Selloff Won’t Be the Last. Bloomberg.Com. https://www.bloomberg.com/news/articles/2013-12-05/bitcoins-volatility-problem-why-todays-selloff-wont-be-the-last

Uddin, M. A., Stranieri, A., Gondal, I., & Balasurbramanian, V. (2019). A Lightweight Blockchain Based Framework for Underwater IoT. Electronics, 8(12), 1552. https://doi.org/10.3390/electronics8121552

Vandezande, N. (2017). Virtual Currencies Under EU Anti-money Laundering Law. Computer Law & Security Review, 33(3), 341–353.

Vaz, J., & Brown, K. (2020). Sustainable Development and Cryptocurrencies as Private Money. Journal of Industrial and Business Economics, 47(1), 163–184. https://doi.org/10.1007/s40812-019-00139-5

Vidal-Tomás, D., Ibáñez, A. M., & Farinós, J. E. (2019). Weak efficiency of the cryptocurrency market: A market portfolio approach. Applied Economics Letters, 26(19), 1627–1633. https://doi.org/10.1080/13504851.2019.1591583

Vincent, O., & Evans, O. (2019). Can Cryptocurrency, Mobile Phones, and Internet Herald Sustainable Financial Sector Development in Emerging Markets? Journal of Transnational Management, 24(3), 259–279.

Volosovych, S., & Baraniuk, Y. (2018). Tax control of cryptocurrency transactions in Ukraine. Banks and Bank Systems, 13(2), 89–106. https://www.ceeol.com/search/article-detail?id=696926

Wang, G. (2019). Marx’s Monetary Theory and Its Practical Value. China Political Economy, 2(2), 182–200. https://doi.org/10.1108/CPE-10-2019-0026

Wang, J., Wu, P., Wang, X., & Shou, W. (2017). The Outlook of Blockchain Technology for Construction Engineering Management. Frontiers of Engineering Management, 4(1), 67–75. https://doi.org/10.15302/J-FEM-2017006

Wang, Y., Singgih, M., Wang, J., & Rit, M. (2019). Making Sense of Blockchain Technology: How Will It Transform Supply Chains? International Journal of Production Economics, 211, 221–236. https://doi.org/10.1016/j.ijpe.2019.02.002

Wei, Q., Li, S., Li, W., Li, H., & Wang, M. (2019). Decentralized Hierarchical Authorized Payment with Online Wallet for Blockchain. In Biagioni, E. S., Zheng, Y., & Cheng, S (Eds.), Wireless Algorithms, Systems, and Applications, 358–369. Berlin: Springer.

Wet, J. H. v H. D. (2005). EVA versus traditional accounting measures of performance as drivers of shareholder value—A comparative analysis. Meditari : Research Journal of the School of Accounting Sciences, 13(2), 1–16.

Wetherell, M., & Potter, J. (1992). Mapping the Language of Racism: Discourse and the Legitimation of Exploitation. London and New York: Harvester Wheatsheaf and Columbia University Press.

Wilson, C. (2019). Cryptocurrencies: The Future of Finance? In Yu, F-L. T., & Kwan, D. S. (Eds.). Contemporary Issues in International Political Economy, 359–394. Berlin: Springer.

Yalaman, G. Ö., & Yıldırım, H. (2019). Cryptocurrency and Tax Regulation: Global Challenges for Tax Administration. In Hacioglu, U (Ed.), Blockchain Economics and Financial Market Innovation: Financial Innovations in the Digital Age, 407–422. Berlin: Springer International Publishing.

Zhang, J. Y. (2017). The Rise of Market Concentration and Rent Seeking in the Financial Sector. John M. Olin Center for Law, Economics, and Business Fellows’ Discussion Paper Series.

Zook, M. A., & Blankenship, J. (2018). New Spaces of Disruption? The Failures of Bitcoin and the Rhetorical Power of Algorithmic Governance. Geoforum, 96, 248–255. https://doi.org/10.1016/j.geoforum.2018.08.023

- There are currently no refbacks.

Abderahman Rejeb Doctoral School of Regional Sciences and Business Administration, Széchenyi István University, 9026 Gyor Hungary

Karim Rejeb Higher Institute of Computer Science of El Manar, 2, Rue Abou Raïhan El Bayrouni, 2080 Ariana Tunisia

John G. Keogh Henley Business School, University of Reading‚ Greenlands, Henley-on-Thames, RG9 3AU, UK United Kingdom

- Other Journals

- For Readers

- For Authors

- For Librarians

- Focus and Scope

- Section Policies

- Peer Review Process

- Open Access Policy

Submissions

- Online Submissions

- Author Guidelines

- Copyright Notice

- Privacy Statement

- Journal Sponsorship

- About this Publishing System

ISSN: 2461-0771

To read this content please select one of the options below:

Please note you do not have access to teaching notes, cryptocurrency adoption: a systematic literature review and bibliometric analysis.

EuroMed Journal of Business

ISSN : 1450-2194

Article publication date: 17 May 2022

Issue publication date: 16 August 2022

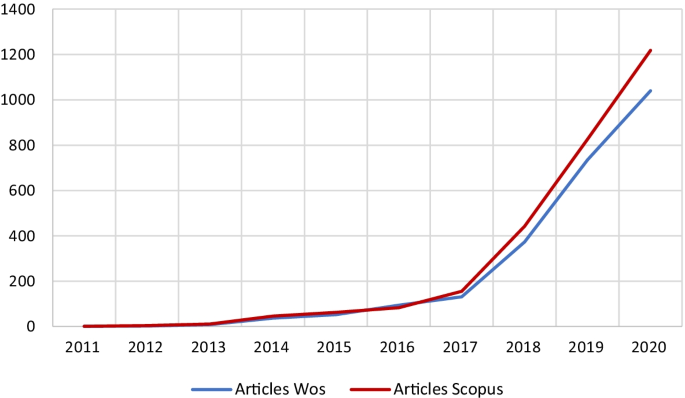

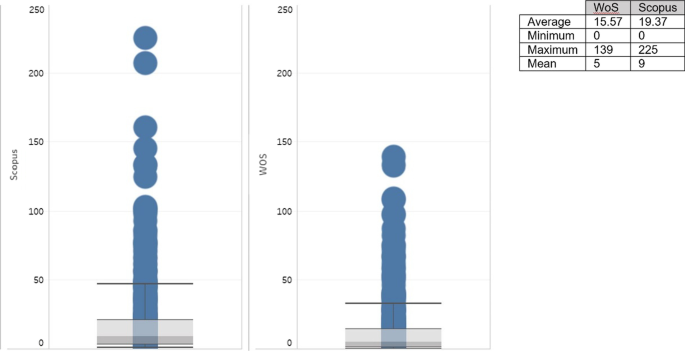

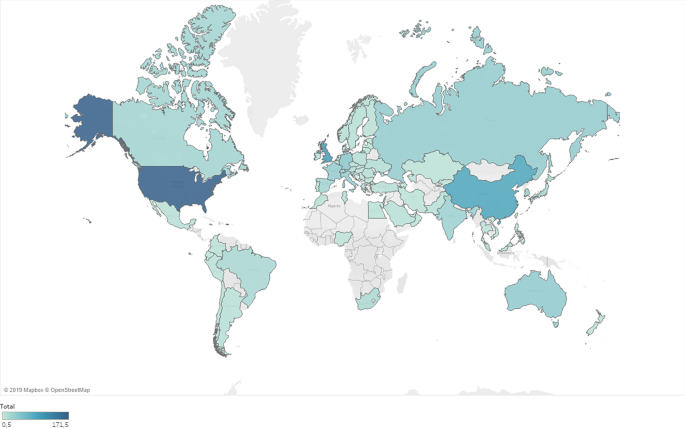

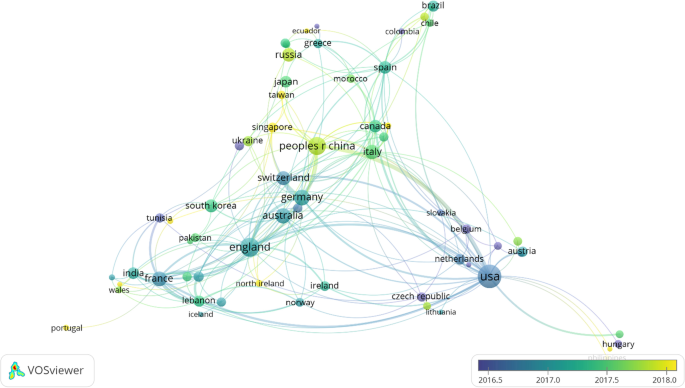

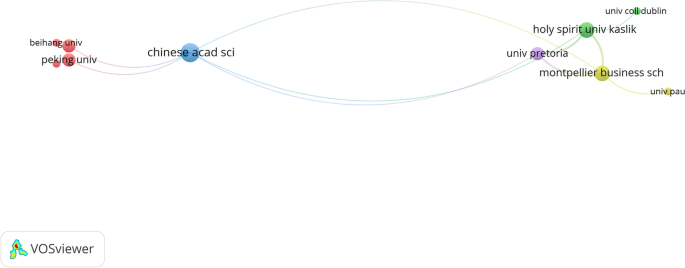

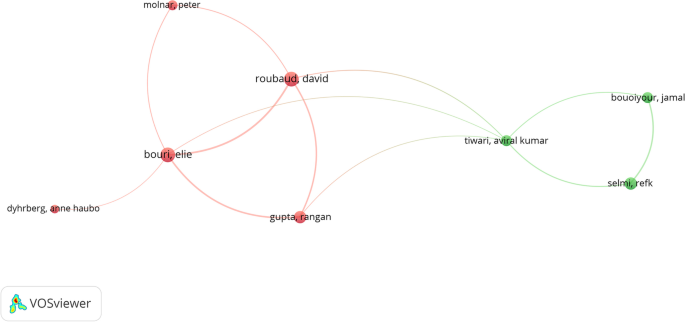

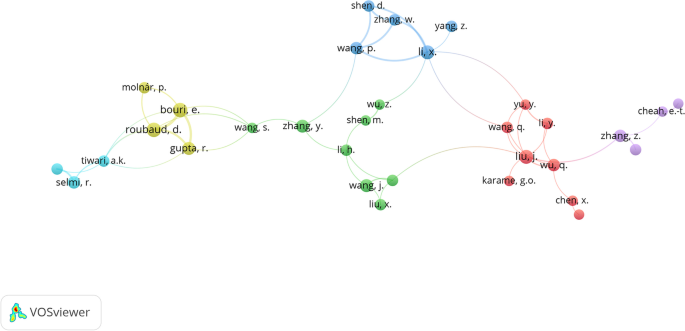

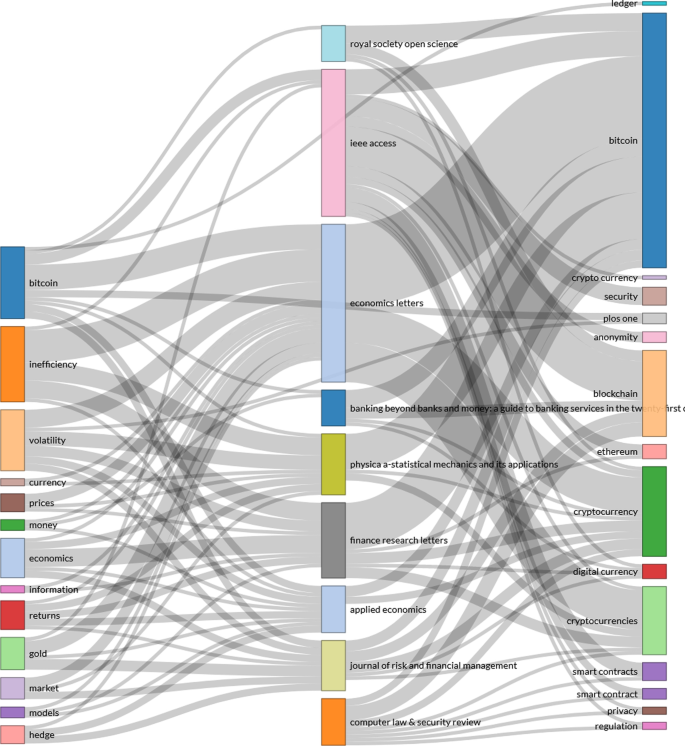

Cryptocurrencies put consumers at the heart of a potential revolution by shifting central authority to a distributed peer-to-peer monetary system. This study aims to perform a systematic literature review and bibliometric analysis within the topic of cryptocurrencies and consumer trust.

Design/methodology/approach

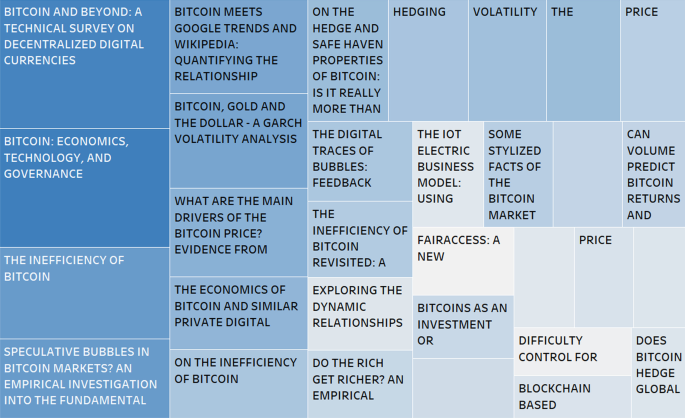

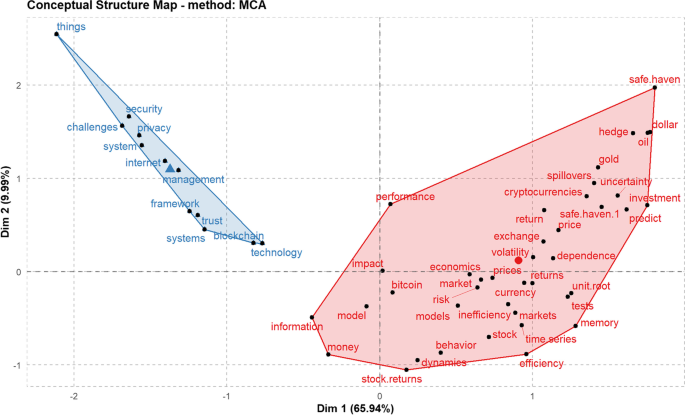

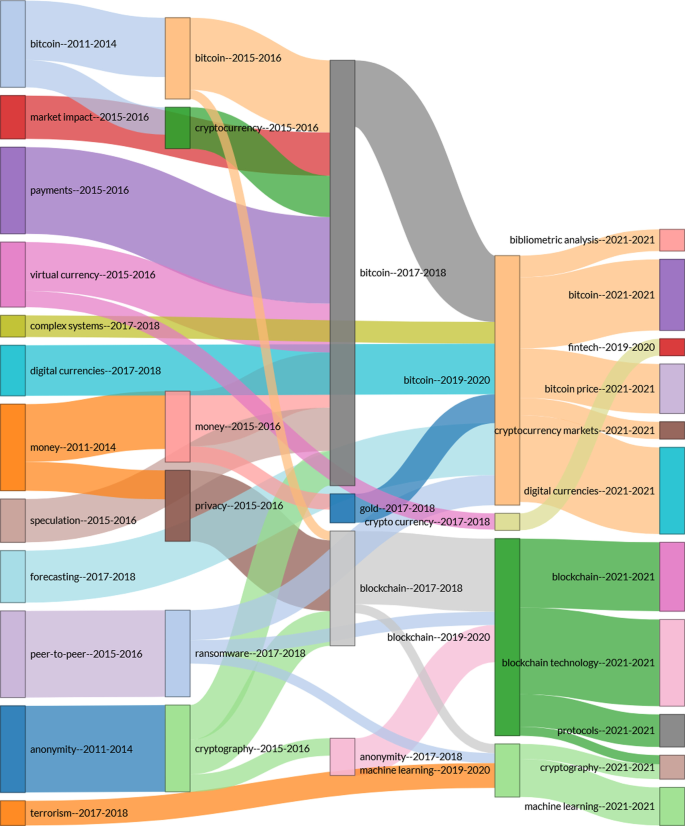

The Web of Science database has been selected, and the analyses performed allowed us to identify five research trends obtained from the bibliographic coupling analysis: (1) Understanding consumer's (non)acceptance of cryptocurrencies, (2) Ethical aspects and trust in cryptocurrencies, (3) Blockchain technology as a trust-free technology, (4) The blockchain/trust economy, and (5) Blockchain technology: challenging trust.

Findings uncover the intellectual structure in the field of cryptocurrencies and consumers' trust and offer insights on the pros and cons of consumers' willingness to trust the digital currency.

Originality/value

The study proved a great gap in the current literature in linking cryptocurrencies and trust theories in a consumer context. The authors also outline several gaps that allowed us to propose future research guidelines.

- Cryptocurrency

- Consumer trust

- Systematic literature review

- Bibliometric analysis

Acknowledgements

This work is supported by national funding’s of FCT - Fundação para a Ciência e a Tecnologia, I.P., in the project UIDB/04005/2020.

Sousa, A. , Calçada, E. , Rodrigues, P. and Pinto Borges, A. (2022), "Cryptocurrency adoption: a systematic literature review and bibliometric analysis", EuroMed Journal of Business , Vol. 17 No. 3, pp. 374-390. https://doi.org/10.1108/EMJB-01-2022-0003

Emerald Publishing Limited

Copyright © 2022, Emerald Publishing Limited

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

- Search Menu

- Browse content in A - General Economics and Teaching

- Browse content in A1 - General Economics

- A11 - Role of Economics; Role of Economists; Market for Economists

- A13 - Relation of Economics to Social Values

- A14 - Sociology of Economics

- Browse content in C - Mathematical and Quantitative Methods

- Browse content in C0 - General

- C02 - Mathematical Methods

- Browse content in C1 - Econometric and Statistical Methods and Methodology: General

- C10 - General

- C11 - Bayesian Analysis: General

- C12 - Hypothesis Testing: General

- C13 - Estimation: General

- C14 - Semiparametric and Nonparametric Methods: General

- C15 - Statistical Simulation Methods: General

- C18 - Methodological Issues: General

- Browse content in C2 - Single Equation Models; Single Variables

- C21 - Cross-Sectional Models; Spatial Models; Treatment Effect Models; Quantile Regressions

- C22 - Time-Series Models; Dynamic Quantile Regressions; Dynamic Treatment Effect Models; Diffusion Processes

- C23 - Panel Data Models; Spatio-temporal Models

- Browse content in C3 - Multiple or Simultaneous Equation Models; Multiple Variables

- C32 - Time-Series Models; Dynamic Quantile Regressions; Dynamic Treatment Effect Models; Diffusion Processes; State Space Models

- C38 - Classification Methods; Cluster Analysis; Principal Components; Factor Models

- Browse content in C4 - Econometric and Statistical Methods: Special Topics

- C45 - Neural Networks and Related Topics

- Browse content in C5 - Econometric Modeling

- C50 - General

- C51 - Model Construction and Estimation

- C52 - Model Evaluation, Validation, and Selection

- C53 - Forecasting and Prediction Methods; Simulation Methods

- C55 - Large Data Sets: Modeling and Analysis

- C58 - Financial Econometrics

- Browse content in C6 - Mathematical Methods; Programming Models; Mathematical and Simulation Modeling

- C61 - Optimization Techniques; Programming Models; Dynamic Analysis

- C62 - Existence and Stability Conditions of Equilibrium

- C65 - Miscellaneous Mathematical Tools

- Browse content in C7 - Game Theory and Bargaining Theory

- C70 - General

- C72 - Noncooperative Games

- C73 - Stochastic and Dynamic Games; Evolutionary Games; Repeated Games

- C78 - Bargaining Theory; Matching Theory

- Browse content in C8 - Data Collection and Data Estimation Methodology; Computer Programs

- C81 - Methodology for Collecting, Estimating, and Organizing Microeconomic Data; Data Access

- Browse content in C9 - Design of Experiments

- C91 - Laboratory, Individual Behavior

- C92 - Laboratory, Group Behavior

- C93 - Field Experiments

- Browse content in D - Microeconomics

- Browse content in D0 - General

- D03 - Behavioral Microeconomics: Underlying Principles

- Browse content in D1 - Household Behavior and Family Economics

- D10 - General

- D11 - Consumer Economics: Theory

- D12 - Consumer Economics: Empirical Analysis

- D14 - Household Saving; Personal Finance

- D15 - Intertemporal Household Choice: Life Cycle Models and Saving

- D18 - Consumer Protection

- Browse content in D2 - Production and Organizations

- D20 - General

- D21 - Firm Behavior: Theory

- D22 - Firm Behavior: Empirical Analysis

- D23 - Organizational Behavior; Transaction Costs; Property Rights

- D24 - Production; Cost; Capital; Capital, Total Factor, and Multifactor Productivity; Capacity

- D25 - Intertemporal Firm Choice: Investment, Capacity, and Financing

- Browse content in D3 - Distribution

- D30 - General

- D31 - Personal Income, Wealth, and Their Distributions

- Browse content in D4 - Market Structure, Pricing, and Design

- D40 - General

- D43 - Oligopoly and Other Forms of Market Imperfection

- D44 - Auctions

- D47 - Market Design

- D49 - Other

- Browse content in D5 - General Equilibrium and Disequilibrium

- D50 - General

- D51 - Exchange and Production Economies

- D52 - Incomplete Markets

- D53 - Financial Markets

- Browse content in D6 - Welfare Economics

- D60 - General

- D61 - Allocative Efficiency; Cost-Benefit Analysis

- D62 - Externalities

- Browse content in D7 - Analysis of Collective Decision-Making

- D70 - General

- D71 - Social Choice; Clubs; Committees; Associations

- D72 - Political Processes: Rent-seeking, Lobbying, Elections, Legislatures, and Voting Behavior

- D73 - Bureaucracy; Administrative Processes in Public Organizations; Corruption

- D74 - Conflict; Conflict Resolution; Alliances; Revolutions

- D78 - Positive Analysis of Policy Formulation and Implementation

- Browse content in D8 - Information, Knowledge, and Uncertainty

- D80 - General

- D81 - Criteria for Decision-Making under Risk and Uncertainty

- D82 - Asymmetric and Private Information; Mechanism Design

- D83 - Search; Learning; Information and Knowledge; Communication; Belief; Unawareness

- D84 - Expectations; Speculations

- D85 - Network Formation and Analysis: Theory

- D86 - Economics of Contract: Theory

- D87 - Neuroeconomics

- Browse content in D9 - Micro-Based Behavioral Economics

- D90 - General

- D91 - Role and Effects of Psychological, Emotional, Social, and Cognitive Factors on Decision Making

- D92 - Intertemporal Firm Choice, Investment, Capacity, and Financing

- Browse content in E - Macroeconomics and Monetary Economics

- Browse content in E0 - General

- E00 - General

- E03 - Behavioral Macroeconomics

- Browse content in E1 - General Aggregative Models

- E17 - Forecasting and Simulation: Models and Applications

- Browse content in E2 - Consumption, Saving, Production, Investment, Labor Markets, and Informal Economy

- E20 - General

- E21 - Consumption; Saving; Wealth

- E22 - Investment; Capital; Intangible Capital; Capacity

- E23 - Production

- E24 - Employment; Unemployment; Wages; Intergenerational Income Distribution; Aggregate Human Capital; Aggregate Labor Productivity

- Browse content in E3 - Prices, Business Fluctuations, and Cycles

- E30 - General

- E31 - Price Level; Inflation; Deflation

- E32 - Business Fluctuations; Cycles

- E37 - Forecasting and Simulation: Models and Applications

- Browse content in E4 - Money and Interest Rates

- E40 - General

- E41 - Demand for Money

- E42 - Monetary Systems; Standards; Regimes; Government and the Monetary System; Payment Systems

- E43 - Interest Rates: Determination, Term Structure, and Effects

- E44 - Financial Markets and the Macroeconomy

- E47 - Forecasting and Simulation: Models and Applications

- Browse content in E5 - Monetary Policy, Central Banking, and the Supply of Money and Credit

- E50 - General

- E51 - Money Supply; Credit; Money Multipliers

- E52 - Monetary Policy

- E58 - Central Banks and Their Policies

- Browse content in E6 - Macroeconomic Policy, Macroeconomic Aspects of Public Finance, and General Outlook

- E60 - General

- E61 - Policy Objectives; Policy Designs and Consistency; Policy Coordination

- E62 - Fiscal Policy

- E63 - Comparative or Joint Analysis of Fiscal and Monetary Policy; Stabilization; Treasury Policy

- E64 - Incomes Policy; Price Policy

- E65 - Studies of Particular Policy Episodes

- E66 - General Outlook and Conditions

- Browse content in E7 - Macro-Based Behavioral Economics

- E71 - Role and Effects of Psychological, Emotional, Social, and Cognitive Factors on the Macro Economy

- Browse content in F - International Economics

- Browse content in F0 - General

- F02 - International Economic Order and Integration

- Browse content in F1 - Trade

- F14 - Empirical Studies of Trade

- Browse content in F2 - International Factor Movements and International Business

- F21 - International Investment; Long-Term Capital Movements

- F22 - International Migration

- F23 - Multinational Firms; International Business

- Browse content in F3 - International Finance

- F30 - General

- F31 - Foreign Exchange

- F32 - Current Account Adjustment; Short-Term Capital Movements

- F33 - International Monetary Arrangements and Institutions

- F34 - International Lending and Debt Problems

- F36 - Financial Aspects of Economic Integration

- F37 - International Finance Forecasting and Simulation: Models and Applications

- F38 - International Financial Policy: Financial Transactions Tax; Capital Controls

- Browse content in F4 - Macroeconomic Aspects of International Trade and Finance

- F40 - General

- F41 - Open Economy Macroeconomics

- F42 - International Policy Coordination and Transmission

- F43 - Economic Growth of Open Economies

- F44 - International Business Cycles

- F47 - Forecasting and Simulation: Models and Applications

- Browse content in F5 - International Relations, National Security, and International Political Economy

- F51 - International Conflicts; Negotiations; Sanctions

- Browse content in F6 - Economic Impacts of Globalization

- F63 - Economic Development

- F65 - Finance

- Browse content in G - Financial Economics

- Browse content in G0 - General

- G00 - General

- G01 - Financial Crises

- G02 - Behavioral Finance: Underlying Principles

- Browse content in G1 - General Financial Markets

- G10 - General

- G11 - Portfolio Choice; Investment Decisions

- G12 - Asset Pricing; Trading volume; Bond Interest Rates

- G13 - Contingent Pricing; Futures Pricing

- G14 - Information and Market Efficiency; Event Studies; Insider Trading

- G15 - International Financial Markets

- G17 - Financial Forecasting and Simulation

- G18 - Government Policy and Regulation

- G19 - Other

- Browse content in G2 - Financial Institutions and Services

- G20 - General

- G21 - Banks; Depository Institutions; Micro Finance Institutions; Mortgages

- G22 - Insurance; Insurance Companies; Actuarial Studies

- G23 - Non-bank Financial Institutions; Financial Instruments; Institutional Investors

- G24 - Investment Banking; Venture Capital; Brokerage; Ratings and Ratings Agencies

- G28 - Government Policy and Regulation

- G29 - Other

- Browse content in G3 - Corporate Finance and Governance

- G30 - General

- G31 - Capital Budgeting; Fixed Investment and Inventory Studies; Capacity

- G32 - Financing Policy; Financial Risk and Risk Management; Capital and Ownership Structure; Value of Firms; Goodwill

- G33 - Bankruptcy; Liquidation

- G34 - Mergers; Acquisitions; Restructuring; Corporate Governance

- G35 - Payout Policy

- G38 - Government Policy and Regulation

- G39 - Other

- Browse content in G4 - Behavioral Finance

- G40 - General

- G41 - Role and Effects of Psychological, Emotional, Social, and Cognitive Factors on Decision Making in Financial Markets

- Browse content in G5 - Household Finance

- G50 - General

- G51 - Household Saving, Borrowing, Debt, and Wealth

- G52 - Insurance

- G53 - Financial Literacy

- Browse content in H - Public Economics

- H0 - General

- Browse content in H1 - Structure and Scope of Government

- H11 - Structure, Scope, and Performance of Government

- H19 - Other

- Browse content in H2 - Taxation, Subsidies, and Revenue

- H22 - Incidence

- H24 - Personal Income and Other Nonbusiness Taxes and Subsidies; includes inheritance and gift taxes

- H25 - Business Taxes and Subsidies

- H26 - Tax Evasion and Avoidance

- Browse content in H3 - Fiscal Policies and Behavior of Economic Agents

- H31 - Household

- Browse content in H4 - Publicly Provided Goods

- H40 - General

- H41 - Public Goods

- Browse content in H5 - National Government Expenditures and Related Policies

- H50 - General

- H52 - Government Expenditures and Education

- H53 - Government Expenditures and Welfare Programs

- H54 - Infrastructures; Other Public Investment and Capital Stock

- H55 - Social Security and Public Pensions

- H56 - National Security and War

- H57 - Procurement

- Browse content in H6 - National Budget, Deficit, and Debt

- H63 - Debt; Debt Management; Sovereign Debt

- Browse content in H7 - State and Local Government; Intergovernmental Relations

- H70 - General

- H72 - State and Local Budget and Expenditures

- H74 - State and Local Borrowing

- H75 - State and Local Government: Health; Education; Welfare; Public Pensions

- Browse content in H8 - Miscellaneous Issues

- H81 - Governmental Loans; Loan Guarantees; Credits; Grants; Bailouts

- Browse content in I - Health, Education, and Welfare

- Browse content in I1 - Health

- I11 - Analysis of Health Care Markets

- I12 - Health Behavior

- I13 - Health Insurance, Public and Private

- I18 - Government Policy; Regulation; Public Health

- Browse content in I2 - Education and Research Institutions

- I22 - Educational Finance; Financial Aid

- I23 - Higher Education; Research Institutions

- I28 - Government Policy

- Browse content in I3 - Welfare, Well-Being, and Poverty

- I30 - General

- I38 - Government Policy; Provision and Effects of Welfare Programs

- Browse content in J - Labor and Demographic Economics

- Browse content in J0 - General

- J00 - General

- Browse content in J1 - Demographic Economics

- J11 - Demographic Trends, Macroeconomic Effects, and Forecasts

- J12 - Marriage; Marital Dissolution; Family Structure; Domestic Abuse

- J13 - Fertility; Family Planning; Child Care; Children; Youth

- J15 - Economics of Minorities, Races, Indigenous Peoples, and Immigrants; Non-labor Discrimination

- J16 - Economics of Gender; Non-labor Discrimination

- J18 - Public Policy

- Browse content in J2 - Demand and Supply of Labor

- J20 - General

- J21 - Labor Force and Employment, Size, and Structure

- J22 - Time Allocation and Labor Supply

- J23 - Labor Demand

- J24 - Human Capital; Skills; Occupational Choice; Labor Productivity

- J26 - Retirement; Retirement Policies

- J28 - Safety; Job Satisfaction; Related Public Policy

- Browse content in J3 - Wages, Compensation, and Labor Costs

- J30 - General

- J31 - Wage Level and Structure; Wage Differentials

- J32 - Nonwage Labor Costs and Benefits; Retirement Plans; Private Pensions

- J33 - Compensation Packages; Payment Methods

- J38 - Public Policy

- Browse content in J4 - Particular Labor Markets

- J41 - Labor Contracts

- J44 - Professional Labor Markets; Occupational Licensing

- J45 - Public Sector Labor Markets

- J46 - Informal Labor Markets

- J49 - Other

- Browse content in J5 - Labor-Management Relations, Trade Unions, and Collective Bargaining

- J51 - Trade Unions: Objectives, Structure, and Effects

- J52 - Dispute Resolution: Strikes, Arbitration, and Mediation; Collective Bargaining

- Browse content in J6 - Mobility, Unemployment, Vacancies, and Immigrant Workers

- J61 - Geographic Labor Mobility; Immigrant Workers

- J62 - Job, Occupational, and Intergenerational Mobility

- J63 - Turnover; Vacancies; Layoffs

- J64 - Unemployment: Models, Duration, Incidence, and Job Search

- J65 - Unemployment Insurance; Severance Pay; Plant Closings

- J68 - Public Policy

- Browse content in J7 - Labor Discrimination

- J71 - Discrimination

- Browse content in J8 - Labor Standards: National and International

- J88 - Public Policy

- Browse content in K - Law and Economics

- Browse content in K1 - Basic Areas of Law

- K12 - Contract Law

- Browse content in K2 - Regulation and Business Law

- K22 - Business and Securities Law

- K23 - Regulated Industries and Administrative Law

- Browse content in K3 - Other Substantive Areas of Law

- K31 - Labor Law

- K32 - Environmental, Health, and Safety Law

- K34 - Tax Law

- K35 - Personal Bankruptcy Law

- Browse content in K4 - Legal Procedure, the Legal System, and Illegal Behavior

- K42 - Illegal Behavior and the Enforcement of Law

- Browse content in L - Industrial Organization

- Browse content in L1 - Market Structure, Firm Strategy, and Market Performance

- L10 - General

- L11 - Production, Pricing, and Market Structure; Size Distribution of Firms

- L13 - Oligopoly and Other Imperfect Markets

- L14 - Transactional Relationships; Contracts and Reputation; Networks

- L15 - Information and Product Quality; Standardization and Compatibility

- Browse content in L2 - Firm Objectives, Organization, and Behavior

- L21 - Business Objectives of the Firm

- L22 - Firm Organization and Market Structure

- L23 - Organization of Production

- L24 - Contracting Out; Joint Ventures; Technology Licensing

- L25 - Firm Performance: Size, Diversification, and Scope

- L26 - Entrepreneurship

- L29 - Other

- Browse content in L3 - Nonprofit Organizations and Public Enterprise

- L33 - Comparison of Public and Private Enterprises and Nonprofit Institutions; Privatization; Contracting Out

- Browse content in L4 - Antitrust Issues and Policies

- L43 - Legal Monopolies and Regulation or Deregulation

- L44 - Antitrust Policy and Public Enterprises, Nonprofit Institutions, and Professional Organizations

- Browse content in L5 - Regulation and Industrial Policy

- L51 - Economics of Regulation

- Browse content in L6 - Industry Studies: Manufacturing

- L66 - Food; Beverages; Cosmetics; Tobacco; Wine and Spirits

- Browse content in L8 - Industry Studies: Services

- L81 - Retail and Wholesale Trade; e-Commerce

- L85 - Real Estate Services

- L86 - Information and Internet Services; Computer Software

- Browse content in L9 - Industry Studies: Transportation and Utilities

- L92 - Railroads and Other Surface Transportation

- L94 - Electric Utilities

- Browse content in M - Business Administration and Business Economics; Marketing; Accounting; Personnel Economics

- Browse content in M0 - General

- M00 - General

- Browse content in M1 - Business Administration

- M12 - Personnel Management; Executives; Executive Compensation

- M13 - New Firms; Startups

- M14 - Corporate Culture; Social Responsibility

- M16 - International Business Administration

- Browse content in M2 - Business Economics

- M20 - General

- M21 - Business Economics

- Browse content in M3 - Marketing and Advertising

- M30 - General

- M31 - Marketing

- M37 - Advertising

- Browse content in M4 - Accounting and Auditing

- M40 - General

- M41 - Accounting

- M42 - Auditing

- M48 - Government Policy and Regulation

- Browse content in M5 - Personnel Economics

- M51 - Firm Employment Decisions; Promotions

- M52 - Compensation and Compensation Methods and Their Effects

- M54 - Labor Management

- Browse content in N - Economic History

- Browse content in N1 - Macroeconomics and Monetary Economics; Industrial Structure; Growth; Fluctuations

- N10 - General, International, or Comparative

- N12 - U.S.; Canada: 1913-

- Browse content in N2 - Financial Markets and Institutions

- N20 - General, International, or Comparative

- N21 - U.S.; Canada: Pre-1913

- N22 - U.S.; Canada: 1913-

- N23 - Europe: Pre-1913

- N24 - Europe: 1913-

- N25 - Asia including Middle East

- N27 - Africa; Oceania

- Browse content in N3 - Labor and Consumers, Demography, Education, Health, Welfare, Income, Wealth, Religion, and Philanthropy

- N32 - U.S.; Canada: 1913-

- Browse content in N4 - Government, War, Law, International Relations, and Regulation

- N43 - Europe: Pre-1913

- Browse content in N7 - Transport, Trade, Energy, Technology, and Other Services

- N71 - U.S.; Canada: Pre-1913

- Browse content in N8 - Micro-Business History

- N80 - General, International, or Comparative

- N82 - U.S.; Canada: 1913-

- Browse content in O - Economic Development, Innovation, Technological Change, and Growth

- Browse content in O1 - Economic Development

- O11 - Macroeconomic Analyses of Economic Development

- O12 - Microeconomic Analyses of Economic Development

- O13 - Agriculture; Natural Resources; Energy; Environment; Other Primary Products

- O16 - Financial Markets; Saving and Capital Investment; Corporate Finance and Governance

- O17 - Formal and Informal Sectors; Shadow Economy; Institutional Arrangements

- Browse content in O2 - Development Planning and Policy

- O23 - Fiscal and Monetary Policy in Development

- Browse content in O3 - Innovation; Research and Development; Technological Change; Intellectual Property Rights

- O30 - General

- O31 - Innovation and Invention: Processes and Incentives

- O32 - Management of Technological Innovation and R&D

- O33 - Technological Change: Choices and Consequences; Diffusion Processes

- O34 - Intellectual Property and Intellectual Capital

- O35 - Social Innovation

- O38 - Government Policy

- Browse content in O4 - Economic Growth and Aggregate Productivity

- O40 - General

- O43 - Institutions and Growth

- Browse content in O5 - Economywide Country Studies

- O53 - Asia including Middle East

- Browse content in P - Economic Systems

- Browse content in P1 - Capitalist Systems

- P16 - Political Economy

- P18 - Energy: Environment

- Browse content in P2 - Socialist Systems and Transitional Economies

- P26 - Political Economy; Property Rights

- Browse content in P3 - Socialist Institutions and Their Transitions

- P31 - Socialist Enterprises and Their Transitions

- P34 - Financial Economics

- P39 - Other

- Browse content in P4 - Other Economic Systems

- P43 - Public Economics; Financial Economics

- P48 - Political Economy; Legal Institutions; Property Rights; Natural Resources; Energy; Environment; Regional Studies

- Browse content in Q - Agricultural and Natural Resource Economics; Environmental and Ecological Economics

- Browse content in Q0 - General

- Q02 - Commodity Markets

- Browse content in Q3 - Nonrenewable Resources and Conservation

- Q31 - Demand and Supply; Prices

- Q32 - Exhaustible Resources and Economic Development

- Browse content in Q4 - Energy

- Q40 - General

- Q41 - Demand and Supply; Prices

- Q42 - Alternative Energy Sources

- Q43 - Energy and the Macroeconomy

- Browse content in Q5 - Environmental Economics

- Q50 - General

- Q51 - Valuation of Environmental Effects

- Q53 - Air Pollution; Water Pollution; Noise; Hazardous Waste; Solid Waste; Recycling

- Q54 - Climate; Natural Disasters; Global Warming

- Q56 - Environment and Development; Environment and Trade; Sustainability; Environmental Accounts and Accounting; Environmental Equity; Population Growth

- Browse content in R - Urban, Rural, Regional, Real Estate, and Transportation Economics

- Browse content in R0 - General

- R00 - General

- Browse content in R1 - General Regional Economics

- R10 - General

- R11 - Regional Economic Activity: Growth, Development, Environmental Issues, and Changes

- R12 - Size and Spatial Distributions of Regional Economic Activity

- Browse content in R2 - Household Analysis

- R20 - General

- R21 - Housing Demand

- R23 - Regional Migration; Regional Labor Markets; Population; Neighborhood Characteristics

- Browse content in R3 - Real Estate Markets, Spatial Production Analysis, and Firm Location

- R30 - General

- R31 - Housing Supply and Markets

- R32 - Other Spatial Production and Pricing Analysis

- R33 - Nonagricultural and Nonresidential Real Estate Markets

- R38 - Government Policy

- Browse content in R4 - Transportation Economics

- R41 - Transportation: Demand, Supply, and Congestion; Travel Time; Safety and Accidents; Transportation Noise

- Browse content in R5 - Regional Government Analysis

- R51 - Finance in Urban and Rural Economies

- Browse content in Z - Other Special Topics

- Browse content in Z1 - Cultural Economics; Economic Sociology; Economic Anthropology

- Z11 - Economics of the Arts and Literature

- Z13 - Economic Sociology; Economic Anthropology; Social and Economic Stratification

- Advance articles

- Editor's Choice

- Author Guidelines

- Submission Site

- Open Access

- About The Review of Financial Studies

- Editorial Board

- Advertising and Corporate Services

- Journals Career Network

- Self-Archiving Policy

- Dispatch Dates

- Terms and Conditions

- Journals on Oxford Academic

- Books on Oxford Academic

Article Contents

1. data and basic characteristics, 2. cryptocurrency-specific factors, 3. exposures to other assets, 4. additional results, 5. conclusion, acknowledgement, risks and returns of cryptocurrency.

- Article contents

- Figures & tables

- Supplementary Data

Yukun Liu, Aleh Tsyvinski, Risks and Returns of Cryptocurrency, The Review of Financial Studies , Volume 34, Issue 6, June 2021, Pages 2689–2727, https://doi.org/10.1093/rfs/hhaa113

- Permissions Icon Permissions

We establish that cryptocurrency returns are driven and can be predicted by factors that are specific to cryptocurrency markets. Cryptocurrency returns are exposed to cryptocurrency network factors but not cryptocurrency production factors. We construct the network factors to capture the user adoption of cryptocurrencies and the production factors to proxy for the costs of cryptocurrency production. Moreover, there is a strong time-series momentum effect, and proxies for investor attention strongly forecast future cryptocurrency returns.

Cryptocurrency is a recent phenomenon that is receiving significant attention. On the one hand, it is based on a fundamentally new technology, the potential of which is not fully understood. On the other hand, at least in the current form, it fulfills similar functions as other, more traditional assets. Extensive academic attention has focused on developing theoretical models of cryptocurrencies. The theoretical literature on cryptocurrencies has suggested a number of factors that are potentially important in the valuation of cryptocurrencies. The first group of papers builds models stressing the network effect of cryptocurrency adoption (e.g., Pagnotta and Buraschi 2018 ; Biais et al. 2018 ; Cong, Li, and Wang 2019 ) and emphasizes the price dynamics induced by the positive externality of the network effect. The second group of papers focuses on the production side of the coins—the miners’ problem (e.g., Cong, He, and Li 2018 ; Sockin and Xiong 2019 )—and shows that the evolution of cryptocurrency prices is linked to the marginal cost of production. The third group of papers ties the movements of cryptocurrency prices to those of traditional asset classes such as fiat money (e.g., Athey et al. 2016 ; Schilling and Uhlig 2019 ; Jermann 2018 ). There is also a growing literature on the empirical regularities of cryptocurrencies. Borri (2019) shows that individual cryptocurrencies are exposed to cryptomarket tail-risks. Makarov and Schoar (2020) find that cryptocurrency markets exhibit periods of potential arbitrage opportunites across exchanges. Griffin and Shams (2020) study Bitcoin price manipulation. Our paper is the first comprehensive analysis of cryptocurrencies through the lens of empirical asset pricing. Its contribution is twofold. First, it tests the mechanisms and predictions of the existing theoretical models. Second, it establishes a set of basic asset pricing facts for this asset class, which provides a common benchmark that the current and future models of cryptocurrencies should take into consideration.

We start by constructing an index of cryptocurrency (or coin) market returns. This index is the value-weighted returns of all the coins with capitalizations of more than 1 million USD (1,707 coins in total) and covers the period of January 1, 2011, to December 31, 2018. We now describe some basic statistical properties of this index. During the sample period, the averages of the coin market returns at the daily, weekly, and monthly frequencies are 0.46%, 3.44%, and 20.44%, respectively. The daily, weekly, and monthly standard deviations of the coin market returns are 5.46%, 16.50%, and 70.80%, respectively. The coin market returns have positive skewness and kurtosis. We observe that the mean and standard deviation of the coin market returns are an order of magnitude higher than those of the stock returns during the same period. The Sharpe ratios at the daily and weekly levels are about 60% and 90% higher, and the Sharpe ratio at the monthly level is comparable to those of stocks. The returns have positive skewness increasing with the frequencies from daily to monthly. The returns experience high probabilities of extreme losses and gains. For example, an extreme loss of the daily 20% negative return on the coin market happens with a probability of 0.48%, while an extreme gain of the same size occurs with a probability of 0.89%.

We next turn to examine the relationship between the coin market returns and the main cryptocurrency-specific factors that are proposed in the theoretical literature. We formulate and investigate potential drivers and predictors for cryptocurrency returns. Specifically, we construct cryptocurrency network factors, cryptocurrency production factors, cryptocurrency momentum, proxies for average and negative investor attention, and proxies for cryptocurrency valuation ratios. For each of these factors, we aim to provide a number of possible empirical measures, as there are no canonical ways to define them in the cryptocurrency market.

We consider five measures to capture the cryptocurrency network effect. Consistent with the cryptocurrency models based on the network effect, 1 we find that the coin market returns are positively and significantly exposed to cryptocurrency network growth. Furthermore, we show that the evolution of cryptocurrency prices not only reflects current cryptocurrency adoption but also contains information about expected future network growth.

We then study the implications of the cryptocurrency models based on the miners’ production problem. 2 We construct production factors of cryptocurrency to proxy for the cost of mining and test the relationship between these production factors and cryptocurrency prices. To the first approximation, mining a cryptocurrency requires two inputs: electricity and computer power. We separately construct eight proxies for electricity costs and six proxies for computing costs. For electricity, we use time-varying and location-specific measures of the price, consumption, and generation of electricity in the United States and China (including Sichuan province, which hosts the largest mining farm in the world). For proxies of computing costs, we use the prices of Bitmain Antminer, one of the common Bitcoin mining equipments, as our primary measure. We also consider indirect measures—the stock returns of the companies that are major manufacturers of mining chips. Overall, we find that the coin market returns are not significantly exposed to the cryptocurrency production factors.

The existing theoretical models of cryptocurrencies have a number of implications for the predictability of cryptocurrency returns. Some papers argue that the evolution of cryptocurrency prices should follow a martingale, and thus cryptocurrency returns are not predictable (e.g., Schilling and Uhlig 2019 ). Other papers argue that, in dynamic cryptocurrency valuation models, cryptocurrency returns could potentially be predicted by momentum, investor attention, and cryptocurrency valuation ratios (e.g., Cong, Li, and Wang 2019 ; Sockin and Xiong 2019 ). We show that momentum and investor attention strongly predict future cryptocurrency cumulative returns, but cryptocurrency valuation ratios do not.

First, we show that there is a significant time-series momentum phenomenon in the cryptocurrency market. We find that the current coin market returns predict cumulative future coin market returns from one week to eight weeks ahead. For example, a one-standard-deviation increase in the current coin market returns predicts a 3.30% increase in the weekly returns over the next week. Grouping weekly returns by terciles, we find that the top terciles outperform the bottom terciles over the one- to four-week horizons. For example, at the one-week horizon, the average return of the top tercile is 8.01% per week with a t -statistic of 4.30, while the average return of the bottom tercile is only 1.10% per week with a t -statistic of 0.92. The time-series momentum results are valid both in sample and out of sample.

Second, we construct proxies for investor attention with Google searches and show that high investor attention predicts high future returns over the one- to six-week horizons. For example, a one-standard-deviation increase in the investor attention measure yields a 3.0% increase in the 1-week-ahead future coin market returns. At the one-week horizon, the average return of the investor attention tercile is 6.53% per week with a t -statistic of 3.82, while the average return of the bottom tercile is only 0.43% per week with a t -statistic of 0.42. Another proxy for investor attention we construct is Twitter post counts, and we reach similar results with the Twitter measure. Additionally, we construct a proxy for negative investor attention and show that relatively high negative investor attention negatively predicts future cumulative coin market returns.

Research on the equity market (e.g., Hong, Lim, and Stein 2000 ; Hou, Xiong, and Peng 2009 ) shows that there is a strong interaction between momentum and investor attention. Sockin and Xiong (2019) also show that investor attention can generate momentum in the cryptocurrency market, and in their model, the momentum effect disappears controlling for investor attention. We investigate whether there is a similar interaction between momentum and investor attention in the cryptocurrency market. We find that investor attention is high during and after periods of high coin market returns. However, in a bivariate coin market predictability regression with both variables, we show that the two effects do not subsume each other. Finally, we test whether the magnitude of the momentum effect is different during periods of high investor attention and vice versa. In contrast to the equity market, we show that there is limited interaction between cryptocurrency momentum and investor attention.

Moreover, we test whether the cryptocurrency valuation ratios similar to those in the financial markets can predict future coin market returns. In the equity market, the fundamental-to-market ratios are commonly referred to as valuation ratios and are measured as the ratio of the book value of equity to the market value of equity or some other ratio of fundamental value to market value. It is more difficult to define a similar measure of the fundamental value for cryptocurrency. In their dynamic cryptocurrency asset pricing model, Cong, Li, and Wang (2019) show that the cryptocurrency fundamental-to-value ratio, defined as the number of user adoptions over market capitalization, negatively predicts future cryptocurrency returns. Motivated by the theoretical model and studies of other financial markets, we construct six cryptocurrency valuation ratios and test the return predictability of these valuation ratios. Although the coefficient estimates are consistently negative, none of the six cryptocurrency valuation ratios predict future cumulative coin market returns significantly.

Another approach to study what cryptocurrencies represent is to examine the exposures of cryptocurrency returns to other asset classes. In other words, we assess how investors and markets value current and future prospects of cryptocurrencies. The theoretical literature and the community of cryptocurrency have proposed various narratives for what cryptocurrencies represent. Schilling and Uhlig (2019) argue that, in an endowment economy where fiat money and cryptocurrency coexist and compete, the cryptocurrency returns comove with the price evolution of the fiat money. Athey et al. (2016) emphasize the importance of currency exchange rates on cryptocurrency prices. Another popular narrative is that cryptocurrency is “digital gold” and represents a new way to store value. Specifically, we study whether major cryptocurrencies comove with currencies, commodities, stocks, and macroeconomic factors. In contrast to these popular explanations, we find that the exposures of cryptocurrencies to these traditional assets are low. Overall, there is little evidence, in the view of the markets, behind the narrative that there are similarities between cryptocurrencies and these traditional assets.

We note several additional results. First, we acknowledge that we have a short time series and that there is much uncertainty and learning about cryptocurrencies during the sample period. We show that our main results are similar for the first half and the second half of the sample. Second, we discuss the relationship between the cryptocurrency time-series momentum and cross-sectional momentum. Third, we investigate the importance of regulative events in affecting cryptocurrency prices, and show that negative regulative events but not positive regulative events significantly affect cryptocurrency prices. Fourth, we examine the importance of speculative interests in driving cryptocurrency prices. We show that cryptocurrency returns are higher when speculative interests increase, but the coefficient estimates are only marginally significant. Fifth, we construct a direct measure of cryptocurrency investor sentiment and show that the expected coin market return is higher when investor sentiment is high. In the multivariate regressions with the sentiment, investor attention, and momentum measures, all three variables are statistically significant in predicting future cryptocurrency returns. Sixth, we test the role of beauty contests in the cryptocurrency market. Motivated by Biais and Bossaerts (1998) , we use the volume-volatility ratio to capture the degree of disagreement in the cryptocurrency market and show that cryptocurrency return is high when the current volume-volatility ratio is high. Seventh, we conduct a VAR analysis with the coin market returns and the different measures of coin network growth measures. Eighth, we test the effect of production factors with an alternative specification. Lastly, we examine the subsample results based on cryptocurrency characteristics.

Our paper uses standard textbook empirical asset pricing tools and methods, the discussion of which we mostly omit for conciseness. Our findings on momentum are related to a series of papers such as Jegadeesh and Titman (1993) , Moskowitz and Grinblatt (1999) , Moskowitz, Ooi, and Pedersen (2012) , Asness, Moskowitz, and Pedersen (2013) , and Daniel and Moskowitz (2016) . Da, Engelberg, and Gao (2011) use Google searches to proxy for investor attention.

Yermack (2015) is one of the first papers that brought academic attention to the field of cryptocurrency. Several recent articles document individual facts related to cryptocurrency investment. Stoffels (2017) studies cross-sectional cryptocurrency momentum. Hu, Parlour, and Rajan (2018) show that individual cryptocurrency returns correlate with Bitcoin returns. Borri (2019) shows that individual cryptocurrencies are exposed to cryptomarket tail-risks. Makarov and Schoar (2020) and Borri and Shakhnov (2018) find that cryptocurrency markets exhibit periods of potential arbitrage opportunites across exchanges. Griffin and Shams (2020) study Bitcoin price manipulation. Corbet et al. (2019) studies cryptocurrencies as a financial asset. Moreover, a number of recent papers develop models of cryptocurrencies (see, e.g., Weber 2016 ; Huberman, Leshno, and Moallemi 2017 ; Biais et al. 2018 ; Chiu and Koeppl 2017 ; Cong and He 2019 ; Cong, Li, and Wang 2019 ; Cong, He, and Li 2018 ; Sockin and Xiong 2019 ; Saleh 2018 ; Schilling and Uhlig 2019 ; Jermann 2018 ; Abadi and Brunnermeier 2018 ; Routledge and Zetlin-Jones 2018 ).

We collect trading data of all cryptocurrencies available from Coinmarketcap.com. Coinmarketcap.com is a leading source of cryptocurrency price and volume data. It aggregates information from over 200 major exchanges and provides daily data on opening, closing, high, and low prices, as well as volume and market capitalization (in dollars) for most of the cryptocurrencies. 3 For each cryptocurrency on the website, Coinmarketcap.com calculates its price by taking the volume-weighted average of all prices reported at each market. A cryptocurrency needs to meet a list of criteria to be listed, such as being traded on a public exchange with an application programming interface (API) that reports the last traded price and the last 24-hour trading volume, and having a nonzero trading volume on at least one supported exchange so that a price can be determined. Coinmarketcap.com lists both active and defunct cryptocurrencies, thus alleviating concerns about survivorship bias.

We first construct a coin market return as the value-weighted return of all the underlying coins. We use daily close prices to construct daily coin market returns. The weekly and monthly coin market returns are calculated from the daily coin market returns. We require the coins to have information on price, volume, and market capitalization. We further exclude coins with market capitalizations of less than 1,000,000 USD. For earlier years that are not covered by Coinmarketcap.com, we splice the coin market returns with Bitcoin returns from earlier years. The data of the earlier year Bitcoin returns are from CoinDeck and span from January 1, 2011, to April 29, 2013. We start from January 1, 2011, because there was not much liquidity and trading before that date. Altogether, the index of the coin market return covers the period from January 1, 2011, to December 31, 2018.