- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

Cashing Out: What Every Entrepreneur Should Know Before Selling a Business When the allure of selling your startup becomes too hard to resist, a business broker can be your ace in the hole.

By James Moran • Jun 3, 2019

Opinions expressed by Entrepreneur contributors are their own.

Nearly 550,000 people become business owners every month, according to the Kauffman Index of Startup Activity. Many of these new entrepreneurs get into the startup space with one goal in mind: selling a business.

It's no wonder. After failing to secure backing for a wi-fi enabled video doorbell on Shark Tank , Jamie Siminoff went on to build Ring. In 2018, Amazon purchased the company for more than $1 billion.

Related: Is The Business Broker Working for You or Your Buyer?

Entrepreneurs can make serious money by selling successful businesses, no doubt. But a great deal of work goes into the transaction itself. Finding just the right buyer, for one, can be an arduous task. And the higher the price tag, the more complex the transaction can become.

That's why many people seek out the assistance of a business broker -- essentially a real estate agent for businesses. Similar to a Realtor, a broker facilitates the selling process by helping set the asking price, find potential buyers and market the business to the right buyers.

So, who is the professional whom you, yourself, need?

Broker or no broker?

Using a business broker is a personal choice. You'll be paying the broker a commission of anywhere from 10 percent to 15 percent of the sale, so it can definitely eat into your profits. And despite what you think, working with a broker won't necessarily speed up the process. The transaction will more than likely take between seven and 12 months .

A good business broker, however, can eliminate the day-to-day interactions related to selling your business, and the best brokers will prevent those "tire kickers" (people who have no intention of making a purchase) from ever making it through your door. Assuming you choose wisely, this person will know how to craft a unique and compelling narrative about your business to inspire people to pony up the necessary dough -- all the while helping you navigate the emotional ups and downs that accompany the selling process.

This then leads us to the obvious question: How exactly do you find the right broker to sell your business? The following are a few things to know when you start your search:

1. Be choosey about whom you work with.

More than 90 percent of consumers say they read online reviews before making a purchase, according to a survey from Influence Central. If you're going to do your research before buying a new sofa or TV, it only makes sense to do your due diligence when hiring a broker, too. Better yet, treat the process as if you were hiring an employee: Interview candidates in person and ask about the business types they typically work with, the number of listings on their roster, etc.

Related: 9 Questions You Should Ask Before Hiring a Business Broker

Let's say, for example, that a broker claims to have 35 active listings ranging in price from $50,000 to $25 million. Impressive, sure, but those numbers could be an indication of an overworked, distracted and commission-hunting broker. A better answer might be, "I sell in X and Y industries, and I have four listings at the moment." This is someone who likely has a client's best interest in mind.

2. Inquire about marketing practices.

Using business-for-sale websites as the crux of a marketing strategy isn't typically the sign of a quality broker. Business News Daily reported that Businessesforsale.com alone averaged roughly 73,000 business listings around the world -- not exactly the best way to drum up demand for your business.

Instead, look for a broker who uses a mix of inbound and outbound marketing strategies. In addition to online sites, this might include anything from a proprietary email list, to confidential inquiries, to industry-specific, targeted ads. The goal here is to attract buyers for your business, which calls for a broader marketing plan.

3. Network, network, network.

As with anything in business, the best results often come from networking. If you're thinking you might want to sell, start attending industry events and asking your peers whether they know any potential buyers. Seek input from your attorney, CPA and other business professionals -- you never know who might have the right connections.

Related: 7 Perfect Questions to Ask While Networking

Also, vet brokers early in the process to get a sense of their professionalism. Someone who won't give you the time of day until you're ready to sell will treat prospective buyers the same way. And with a 6.5 percent year-over-year decline in small business transactions , according to the BizBuySell Insight Report , your broker choice matters.

Business brokers with high levels of professionalism and experience can keep sellers and buyers moving forward with a deal, even when all seems to be lost. For first-time sellers or inexperienced owners, in particular, a broker can be a helpful guide. The important thing is to understand your needs, do your homework ahead of time and stay involved throughout the process.

Founder and Managing Partner, ValueStreet Equity Partners

Want to be an Entrepreneur Leadership Network contributor? Apply now to join.

Editor's Pick Red Arrow

- James Clear Explains Why the 'Two Minute Rule' Is the Key to Long-Term Habit Building

- They Designed One Simple Product With a 'Focus on Human Health' — and Made $40 Million Last Year

- Lock Younger Americans Don't Necessarily Want to Retire in Florida — and the 2 Affordable States at the Top of Their List Might Surprise You

- I Tried Airchat , the Hottest New Social Media App in Silicon Valley — Here's How It Works

- Lock This Side Hustle Is Helping Farmers Earn Up to $60,000 a Year While Connecting Outdoor Lovers With Untouched Wilderness

- Are Franchises in the Clear After the Expanded Joint Employer Rule Was Struck Down? Industry Experts Answer 2 Critical Questions About What's Next.

Most Popular Red Arrow

Franchising is not for everyone. explore these lucrative alternatives to expand your business..

Not every business can be franchised, nor should it. While franchising can be the right growth vehicle for someone with an established brand and proven concept that's ripe for growth, there are other options available for business owners.

Passengers Are Now Entitled to a Full Cash Refund for Canceled Flights, 'Significant' Delays

The U.S. Department of Transportation announced new rules for commercial passengers on Wednesday.

Elon Musk Tells Investors Cheaper Tesla Electric Cars Should Arrive Ahead of Schedule

On an earnings call, Musk told shareholders that Tesla could start producing new, affordable electric cars earlier than expected.

63 Small Business Ideas to Start in 2024

We put together a list of the best, most profitable small business ideas for entrepreneurs to pursue in 2024.

Why Companies Should Prioritize Emotional Intelligence Training Alongside AI Implementation

Emotional intelligence is just as important as artificial intelligence, and we need it now more than ever.

The TikTok Ban Bill Has Been Signed — Here's How Long ByteDance Has to Sell, and Why TikTok Is Preparing for a Legal Battle

TikTok has nine months to cut ties with its China-based parent company ByteDance.

Successfully copied link

The Basics Guide

Cashing Out

Cashing out is the conversion of an investment or business ownership stake into liquid assets, driven by motives like profit realization or risk management. This process, encompassing diverse strategies, is subject to various financial, legal, and emotional considerations. Its consequences, like increased liquidity or potential profit loss, necessitate careful planning and possible professional guidance.

Cashing out refers to the process of selling an ownership interest in a business or investment, in order to convert it into cash or cash equivalents. It is usually done when investors or owners believe they have maximized the value from their investment.

Reasons for Cashing Out

- Profit Realization: The primary reason for cashing out is to realize profits from an investment.

- Risk Management: Cashing out may be a way to manage risk or to diversify an investment portfolio.

- Life Events: Some owners or investors may decide to cash out due to personal reasons like retirement or need for liquidity.

Types of Cashing Out

- Individual Investments: This could be selling stocks, bonds, or other types of securities held in a personal account.

- Business Ownership: This refers to the sale of a business or part of it. This could take the form of a full sale, merger, or an initial public offering (IPO).

- Real Estate: This refers to the sale of property, often for a profit.

Tax Considerations

- Capital Gains Tax: This tax applies to the profits from selling investments or real estate. The amount of tax depends on the investment type, the length of ownership, and the investor’s tax bracket.

- Depreciation Recapture: This tax applies when selling property that has been depreciated for tax purposes.

Strategies for Cashing Out

- Gradual Sale: This strategy involves selling off investments slowly over time, often to manage risk.

- Lump-Sum Sale: This strategy involves selling all investments at once. This is often used when leaving a market entirely.

- Leveraged Buyout (LBO): In the case of business ownership, this strategy involves another party buying the business with a combination of equity and borrowed funds.

Consequences of Cashing Out

- Liquidity Increase: Cashing out typically increases an individual’s liquidity, providing more available cash for spending or further investment.

- Potential Profit Loss: If the investment continues to appreciate in value after cashing out, the investor forgoes potential profits.

- Possible Market Impact: Large scale cash outs may have market implications, potentially affecting the price of the investment.

Alternatives to Cashing Out

- Reinvestment: Instead of cashing out, profits can be reinvested back into the market, a process known as “compounding”.

- Borrowing: If cash is needed, borrowing against the value of the investment might be possible, allowing the investor to retain ownership.

Role of Financial Advisors

Financial advisors can play a critical role in the cashing out process, offering advice on timing, tax considerations, and alternative strategies.

Explore Related

- Get in touch: 920.659.6000

- Client Portal

- How ESOPs Work

- Benefits of an ESOP

- Starting Your ESOP

- ESOP Participants' Guide

- Free ESOP Readiness Assessment

- Feasibility Studies

- Administration and Consulting

- Culture and Communication Consulting

- Repurchase Obligation Studies

- Why We're Here

- Who We Serve

- Where We're Going

- Resource Library

Top Strategies for Cashing Out On a Business Before Retirement

Just as a steady flow of cash is key to a healthy company, sometimes events in life demand access to liquidity.

For a business owner, a lot of wealth can be tied up in the company. Any diligent entrepreneur knows to segregate personal and business assets and expenses.

But at least part of the reason you established a business was to make money — and maybe now is the time you need access to some of that hard-earned cash.

So whether you want cash to invest and diversify your holdings, you need liquidity to pay for an unforeseen expense, or you have your eye on a special purchase as a reward for your hard work … you have several options for getting your money out of your business.

Pay Yourself: Salary, Owner’s Draw, Distributions, & Bonuses

If you’re a sole proprietor, you can take an owner’s draw from profits, essentially writing yourself a check. If you’re not a sole proprietor, your company structure dictates your options for how to take money out of your business. Partnerships may involve guaranteed payments and partner draws from profits.

Corporate structures typically allow for shareholders to be paid a salary, and in fact, IRS regulations stipulate that an S corporation owner who substantially works for the business is required to be paid a “reasonable” salary. Year-end profits can mean bonus payments and dividends, too. But salaries, bonuses, and distributions are unlikely to come close to the substantial value of your business enterprise.

Maybe you personally own the facilities that house your business, and your company pays you rent. Sure, there are these and other ways to maximize your annual proceeds. But what if you need or want more significant liquidity out of your business — and what if you’re not ready to retire or walk away from your company entirely?

You can take a loan from your business, but borrowing money presents its own risks in terms of tax liability. Should the IRS recharacterize the loan as a dividend or distribution, you’ll have to pay taxes on the loan amount. And again, there are limits to how much you can expect to borrow from your business, based on limits to cash flow.

Selling Your Business: Risks & Rewards

For most business owners, the company’s enterprise value plays an outsize role in their long-term financial plans, including retirement planning. But when cash needs are unexpected or come on suddenly, it can be easy to lose out on business value over the course of the sale transaction.

Business valuation methods and market conditions can affect the sale price. Negotiations can be complicated. Finding a buyer can be tricky and time-consuming, and a business broker’s commission, tax liabilities, legal fees, and more can all chew away at your sale proceeds.

In addition, selling to a third party or merging with a competitor can mean leadership overhauls that could also leave you without a job when it’s all over. That might be fine if retirement is your plan, but what if you intend to work for a few more years — or decades?

How to Access Your Cash & Control Your Exit

Selling all or a portion of your company to an ESOP enables you to get money out of an S corporation, cashing in on the value of your lifelong investment while exercising control over your exit from ownership. In fact, selling to an ESOP makes room for you to continue working as an employee for years, even decades, after the sale, earning an employee-ownership stake in the value of the company … because an ESOP is also a qualified retirement plan .

One key benefit of an ESOP sale is that it creates the liquidity event on a predictable timeline that starts when the seller makes the decision. Because the ESOP sale creates a buyer, there is no buyer search. For the same reason, it’s important to recognize that an ESOP doesn’t pay a strategic premium — so your sale price may be lower than it could be in a third-party sale.

But that doesn’t necessarily mean an ESOP sale will net you less cash. The tax advantages of an ESOP , along with sale structure and seller-financing options, make it important to consider after-tax proceeds when comparing your choices.

Your Business, Your Choice

The success of your company is a result of your investments, your time, and your hard work — so you get to choose the best way to access the cash tied up in the business. So what if you knew that a tax-efficient, cash-efficient choice could also have a long-lasting, positive impact on your employees and the community where you do business?

Selling your company to an ESOP can give you the balance of healthy ROR and control over your exit while also delivering strategic advantages to the business, setting it up for ongoing success. Learn how, and discover the many benefits of selling your company to an ESOP when you read our eBook, Key Benefits of Incorporating an ESOP Into Your Business Strategy . Click the link below to download your copy today.

Subscribe Now

Other articles for you.

How to Create a Cash Flow Forecast

10 min. read

Updated October 27, 2023

A good cash flow forecast might be the most important single piece of a business plan . All the strategy, tactics, and ongoing business activities mean nothing if there isn’t enough money to pay the bills.

That’s what a cash flow forecast is about—predicting your money needs in advance.

By cash, we mean money you can spend. Cash includes your checking account, savings, and liquid securities like money market funds. It is not just coins and bills.

Profits aren’t the same as cash

Profitable companies can run out of cash if they don’t know their numbers and manage their cash as well as their profits.

For example, your business can spend money that does not show up as an expense on your profit and loss statement . Normal expenses reduce your profitability. But, certain spending, such as spending on inventory, debt repayment, new equipment, and purchasing assets reduces your cash but does not reduce your profitability. Because of this, your business can spend money and still look profitable.

On the sales side of things, your business can make a sale to a customer and send out an invoice, but not get paid right away. That sale adds to the revenue in your profit and loss statement but doesn’t show up in your bank account until the customer pays you.

That’s why a cash flow forecast is so important. It helps you predict how much money you’ll have in the bank at the end of every month, regardless of how profitable your business is.

Learn more about the differences between cash and profits .

- Two ways to create a cash flow forecast

There are several legitimate ways to do a cash flow forecast. The first method is called the “Direct Method” and the second is called the “Indirect Method.” Both methods are accurate and valid – you can choose the method that works best for you and is easiest for you to understand.

Unfortunately, experts can be annoying. Sometimes it seems like as soon as you use one method, somebody who is supposed to know business financials tells you you’ve done it wrong. Often that means that the expert doesn’t know enough to realize there is more than one way to do it.

- The direct method for forecasting cash flow

The direct method for forecasting cash flow is less popular than the indirect method but it can be much easier to use.

The reason it’s less popular is that it can’t be easily created using standard reports from your business’s accounting software. But, if you’re creating a forecast – looking forward into the future – you aren’t relying on reports from your accounting system so it may be a better choice for you.

That downside of choosing the direct method is that some bankers, accountants, and investors may prefer to see the indirect method of a cash flow forecast. Don’t worry, though, the direct method is just as accurate. After we explain the direct method, we’ll explain the indirect method as well.

The direct method of forecasting cash flow relies on this simple overall formula:

Cash Flow = Cash Received – Cash Spent

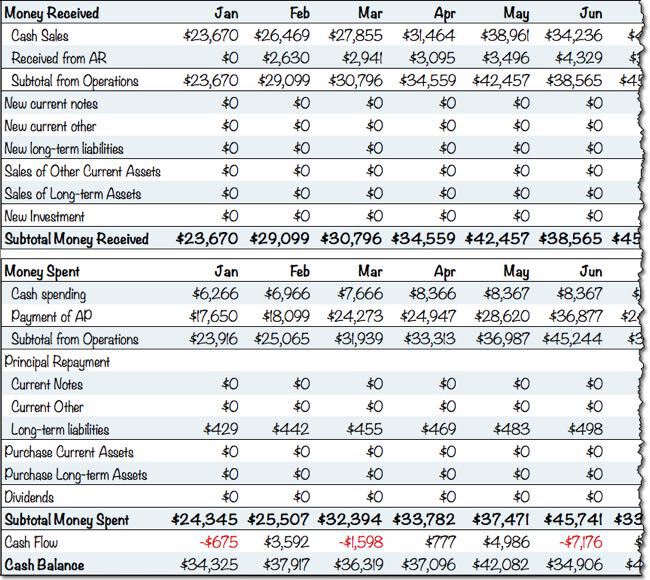

And here’s what that cash flow forecast actually looks like:

Let’s start by estimating your cash received and then we’ll move on to the other sections of the cash flow forecast.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Forecasting cash received

You receive cash from four primary sources:

1. Sales of your products and services

In your cash flow forecast, this is the “Cash from Operations” section. When you sell your products and services, some customers will pay you immediately in cash – that’s the “cash sales” row in your spreadsheet. You get that money right away and can deposit it in your bank account. You might also send invoices to customers and then have to collect payment. When you do that, you keep track of the money you are owed in Accounts Receivable . When customers pay those invoices, that cash shows up on your cash flow forecast in the “Cash from Accounts Receivable” row. The easiest way to think about forecasting this row is to think about what invoices will be paid by your customers and when.

2. New loans and investments in your business

You can also receive cash by getting a new loan from a bank or an investment. When you receive this kind of cash, you’ll track it in the rows for loans and investments. It’s worth keeping these two different types of cash in-flows separate from each other, mostly because loans need to be repaid while investments do not need to be repaid.

3. Sales of assets

Assets are things that your business owns, such as vehicles, equipment, or property. When you sell an asset, you’ll usually receive cash from that sale and you track that cash in the “Sales of Assets” section of your cash flow forecast. For example, if you sell a truck that your company no longer needs, the proceeds from that sale would show up in your cash flow statement.

4. Other income and sales tax

Businesses can bring in money from other sources besides sales. For example, your business may make interest income from the money that it has in a savings account. Many businesses also collect taxes from their customers in the form of sales tax, VAT, HST/GST, and other tax mechanisms. Ideally, businesses record the collection of this money not in sales but in the cash flow forecast in a specific row. You want to do this because the tax money collected isn’t yours – it’s the government’s money and you’ll eventually end up paying it to them.

Forecasting cash spent

Similar to how you forecast the cash that you plan on receiving, you’ll forecast the cash that you plan on spending in a few categories:

1. Cash spending and paying your bills

You’ll want to forecast two types of cash spending related to your business’s operations: Cash Spending and Payment of Accounts Payable. Cash spending is money that you spend when you use petty cash or pay a bill immediately. But, there are also bills that you get and then pay later. You track these bills in Accounts Payable . When you pay bills that you’ve been tracking in accounts payable, that cash payment will show up in your cash flow forecast as “payment of accounts payable”. When you’re forecasting this row, think about what bills you’ll pay and when you’ll pay them. In this section of your cash flow forecast, you exclude a few things: loan payments, asset purchases, dividends, and sales taxes.

2. Loan Payments

When you make forecast loan repayments, you’ll forecast the repayment of the principal in your cash flow forecast. The interest on the loan is tracked in the “non-operating expense” that we’ll discuss below.

3. Purchasing Assets

Similar to how you track sales of assets, you’ll forecast asset purchases in your cash flow forecast. Asset purchases are purchases of long-lasting, tangible things. Typically, vehicles, equipment, buildings, and other things that you could potentially re-sell in the future. Inventory is an asset that your business might purchase if you keep inventory on hand.

4. Other non-operating expenses and sales tax

Your business may have other expenses that are considered “non-operating” expenses. These are expenses that are not associated with running your business, such as investments that your business may make and interest that you pay on loans. In addition, you’ll forecast when you make tax payments and include those cash outflows in this section.

Forecasting cash flow and cash balance

In the direct cash flow forecasting method, calculating cash flow is simple. Just subtract the amount of cash you plan on spending in a month from the amount of cash you plan on receiving. This will be your “net cash flow”. If the number is positive, you receive more cash than you spend. If the number is negative, you will be spending more cash than you receive. You can predict your cash balance by adding your net cash flow to your cash balance.

- The indirect method

The indirect method of cash flow forecasting is as valid as the direct and reaches the same results.

Where the direct method looks at sources and uses of cash, the indirect method starts with net income and adds back items like depreciation that affect your profitability but don’t affect the cash balance.

The indirect method is more popular for creating cash flow statements about the past because you can easily get the data for the report from your accounting system.

You create the indirect cash flow statement by getting your Net Income (your profits) and then adding back in things that impact profit, but not cash. You also remove things like sales that have been booked, but not paid for yet.

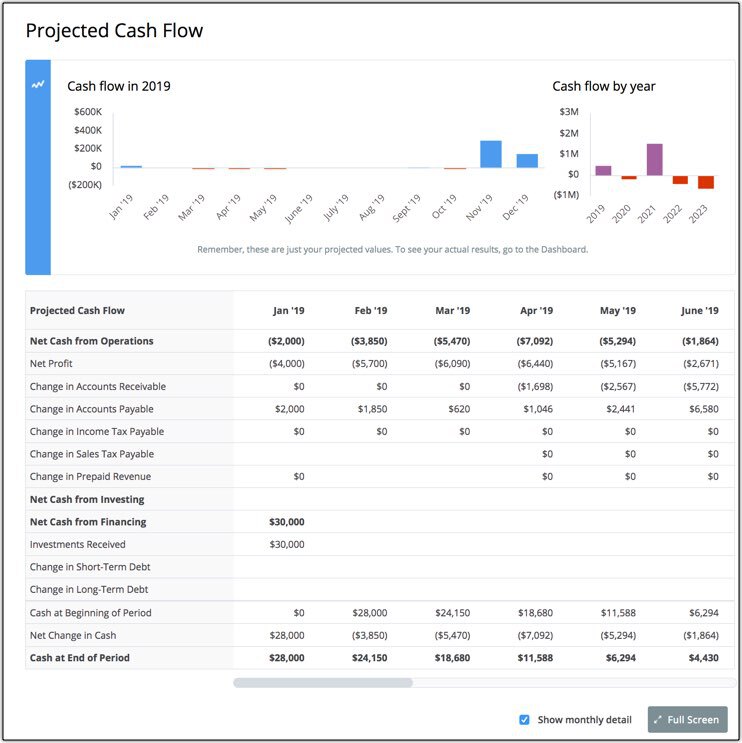

Here’s what an indirect cash flow statement looks like:

There are five primary categories of adjustments that you’ll make to your profit number to figure out your actual cash flow:

1. Adjust for the change in accounts receivable

Not all of your sales arrive as cash immediately. In the indirect cash flow forecast, you need to adjust your net profit to account for the fact that some of your sales didn’t end up as cash in the bank but instead increased your accounts receivable.

2. Adjust for the change in accounts payable

Very similar to how you make an adjustment for accounts receivable, you’ll need to account for expenses that you may have booked on your income statement but not actually paid yet. You’ll need to add these expenses back because you still have that cash on hand and haven’t paid the bills yet.

3. Taxes & Depreciation

On your income statement, taxes and depreciation work to reduce your profitability. On the cash flow statement, you’ll need to add back in depreciation because that number doesn’t actually impact your cash. Taxes are may have been calculated as an expense, but you may still have that money in your bank account. If that’s the case, you’ll need to add that back in as well to get an accurate forecast of your cash flow.

4. Loans and Investments

Similar to the direct method of cash flow, you’ll want to add in any additional cash you’ve received in the form of loans and investments. Make sure to also subtract any loan payments in this row.

5. Assets Purchased and Sold

If you bought or sold assets, you’ll need to add that into your cash flow calculations. This is, again, similar to the direct method of forecasting cash flow.

- Cash flow is about management

Remember: You should be able to project cash flow using competently educated guesses based on an understanding of the flow in your business of sales, sales on credit, receivables, inventory, and payables.

These are useful projections. But, real management is minding the projections every month with plan versus actual analysis so you can catch changes in time to manage them.

A good cash flow forecast will show you exactly when cash might run low in the future so you can prepare. It’s always better to plan ahead so you can set up a line of credit or secure additional investment so your business can survive periods of negative cash flow.

- Cash Flow Forecasting Tools

Forecasting cash flow is unfortunately not a simple task to accomplish on your own. You can do it with spreadsheets, but the process can be complicated and it’s easy to make mistakes.

Fortunately, there are affordable options that can make the process much easier – no spreadsheets or in-depth accounting knowledge required.

If you’re interested in checking out a cash flow forecasting tool, take a look at LivePlan for cash flow forecasting. It’s affordable and makes cash flow forecasting simple.

One of the key views in LivePlan is the cash flow assumptions view, as shown below, which highlights key cash flow assumptions in an interactive view that you can use to test the results of key assumptions:

With simple tools like this, you can explore different scenarios quickly to see how they will impact your future cash.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

.png?format=auto)

Table of Contents

- Profits aren’t the same as cash

Related Articles

9 Min. Read

What Is a Balance Sheet? Definition, Formulas, and Example

8 Min. Read

How to Forecast Personnel Costs in 3 Steps

7 Min. Read

7 Financial Terms Small Business Owners Need to Know

6 Min. Read

How to Create a Profit and Loss Forecast

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Search Search Please fill out this field.

- Retirement Planning

- 401(k) Plans

What to Know Before Cashing Out Your 401(k)

How to Cash Out Your 401(k)

:max_bytes(150000):strip_icc():format(webp)/DanaPhoto2016-75-percent-57a5e68c5f9b58974aeeb31f.jpg)

Eligibility for Cashing a 401(k) Plan

No more creditor protection.

- You'll Owe Taxes, Possible Penalties

Your Age Matters

Know how to cash out, receiving your money takes time, frequently asked questions (faqs).

Too many people cash out their 401(k) plans without fully understanding the consequences. That can be an expensive mistake, and there are some things you need to know before you take the cash.

Key Takeaways

- If you have a 401(k) and are still employed with your company, you can't "cash out" your account, but you may be able to if you no longer work there.

- Cashing out your account before retirement age can lead to many penalties and tax implications.

- If you decide to move forward, be sure to call your retirement company and fill out the paperwork. You won't receive the money immediately.

If you are still employed by the company that sponsors your 401(k) plan, you won't be eligible to cash out your plan unless it offers a 401(k) plan loan, allows hardship withdrawals , or offers in-service withdrawals.

Try to avoid taking 401(k) loans. Most people are underfunded for retirement. Your money needs as much time as possible to grow. The loan also must be paid back with interest, so you'd be losing money in multiple ways.

If you're no longer employed by the company that sponsors your 401(k) plan, then you are eligible to receive your money. You can cash out the plan or roll over your 401(k) plan balance to an IRA .

If you choose to roll your money over instead of cashing out, you will not have to pay income taxes or penalty taxes, because rollovers to IRAs are not taxable transactions if you do them the right way. Rolling your 401(k) over to another plan is not considered cashing it out by the IRS.

As long as your money is in a 401(k) plan, it's creditor protected, meaning it's shielded in the event of bankruptcy. It is unwise to cash out a 401(k) plan to pay down your debt if it is likely you will end up filing bankruptcy. The bankruptcy court can't touch the money in your 401(k) plan, and creditors can't attach liens against its assets, nor can they force you to withdraw this money to pay a debt. It is well-protected money that is meant for use in your retirement years.

You'll Owe Taxes and Possible Penalties

If you cash out your 401(k) plan, and you have not yet reached age 59 1/2, then the dollar amount you withdraw will be subject to ordinary income taxes and a 10% penalty tax .

If you are not yet age 59 1/2, your plan will likely enforce a required 20% amount withheld from any balance you cash out to cover federal taxes. So for every $1,000 you cash out, you would receive about $800. The other $200 would be sent to the IRS by your 401(k) administrator. At the end of the year, the 401(k) plan will send you tax form 1099-R that shows the amount of taxes withheld on your behalf.

In general, you should not cash out your 401(k). Instead, roll it over into an IRA. When you calculate how much money you would lose by cashing out the account, the choice will become clear. Use an early-withdrawal calculator to help you see how much a withdrawal will cost you.

If you are between ages 55 and 59 1/2, you may be able to avoid the 10% penalty tax if you terminated your employment no earlier than the year you turned 55. This is called the " age of 55 401(k) withdrawal provision ."

If you are over age 59 1/2, any amount you withdraw from your 401(k) plan will be subject to income taxes but not tax penalties.

The first step toward cashing out your 401(k) account is to call the phone number that appears on your 401(k) plan statement and ask them to send you the necessary paperwork you need to complete to cash out your plan. In some cases, you may be able to do that online or over the phone, but most of the time, you must fill out paperwork by hand.

Sometimes a signature from an HR employee or plan administrator from the firm at which you were employed will be required. If you worked for a smaller company, you may have to take this paperwork to them or contact them yourself to get this done. If you worked for a large company, this is often handled by the investment company that offers the investment choices inside the 401(k) plan.

When leaving your employer, be complimentary, positive, and grateful. Burning bridges will come back to haunt you when you need your ex-employer to complete paperwork for things such as 401(k) withdrawals and rollovers. They have to do it, but it probably won't be high on their priority list.

It often takes several weeks to cash out a 401(k) plan. Some plans for smaller companies have the right to allow account distributions only once per quarter or once per year. There is a 401(k) summary plan description document that will spell out the rules for your plan. The plan must follow its own rules.

It can feel as though your former employer is making it difficult for you to cash out your 401(k) plan, but there are strict rules they must follow, along with having all of the proper paperwork completed before they can distribute your money to you.

What tax rate do I pay if I cash out my 401(k)?

You must include any cashed-out amounts from your 401(k) plan as regular income when you file your income tax return, along with your other sources of income. You'll pay income tax on the balance after you subtract any deductions you're eligible to claim to reduce your taxable income. Your rate would be your marginal tax rate or top income tax bracket.

How does a hardship distribution from a 401(k) work?

Not all 401(k) plans provide for hardship distributions, because the federal government doesn't require them. Plans set their own rules for what qualifies as a hardship, and some employers prohibit contributions for six months after the withdrawal. A hardship distribution is different from a 401(k) loan in that you don't have to pay it back.

FINRA. " 401(k) Loans, Hardship Withdrawals and Other Important Considerations ."

IRS. " Rollovers of Retirement Plan and IRA Distributions ."

Yahoo Finance. " Cashing Out Your 401(k): What You Need To Know ."

IRS. " What if I Withdraw Money From My IRA? "

IRS. " About Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. "

IRS. " Topic No. 558 Additional Tax on Early Distributions From Retirement Plans Other Than IRAs ."

IRS. " Retirement Topics - Exceptions to Tax on Early Distributions ."

U.S. Department of Labor. " Plan Information ."

U.S. Securities and Exchange Commission. " Traditional and Roth 401(k) Plans ."

IRS. " Retirements Plans FAQs Regarding Hardship Distributions ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1163568487-8abefbb3eac4448b882d3262379a7aa8.jpg)

- Cash Flow Projection – The Comple...

Cash Flow Projection – The Complete Guide

Table of Content

Key takeaways.

- Cash flow projection is a vital tool for financial decision-making, providing a clear view of future cash movements.

- Cash flow is crucial for business survival and includes managing cash effectively and providing a financial planning roadmap.

- Automation in cash flow management is a game-changer. It enhances accuracy, efficiency, and scalability in projecting cash flows, helping businesses avoid common pitfalls.

Introduction

Cash flow is the lifeblood of any business. Yet, many companies constantly face the looming threat of cash shortages, often leading to their downfall. Despite its paramount importance, cash flow management can be overwhelming, leaving businesses uncertain about their financial stability.

But fear not, there’s a straightforward solution to this common problem – cash flow projection. By mastering the art of cash flow projection, you can gain better control over your finances and steer your business away from potential financial crises. Cash flow projections offer a proactive approach to managing cash flow, enabling you to anticipate challenges and make informed decisions to safeguard the future of your business.

If you’re unsure how to accurately perform cash flow projections or if you’re new to the concept altogether, this article will explain everything you need to know about cash flow projections – to help you confidently navigate the financial landscape of your business.

What Is Cash Flow?

To grasp the concept of cash flow projections, we must first understand the essence of cash flow itself. Cash flow is all about the movement of money flowing in and out of business. It reflects the company’s financial health and liquidity, capturing the inflows and outflows of cash over a specific timeframe.

To truly grasp your business’s financial landscape, you must understand the stages of cash flow: operating, investing, and financing activities, and how to analyze and make sense of it.

Read more to uncover a step-by-step guide on how to perform a cash flow analysis (template + examples) and methods to assess key items in cash flow statements.

What Is Cash Flow Projection?

Cash flow projection is the process of estimating and predicting future cash inflows and outflows within a defined period—usually monthly, quarterly, or annually.

Think of cash flow projection (also referred to as a cash flow forecast) as a financial crystal ball that allows you to peek into the future of your business’s cash movements. It involves mapping out the expected cash inflows (receivables) from sales, investments, and financing activities and the anticipated cash outflows (payables) for expenses, investments, and debt repayments.

It provides invaluable foresight into your business’s anticipated cash position, helping you plan for potential shortfalls, identify surplus funds, and make informed financial decisions.

Why Are Cash Flow Projections Important for Your Business?

Managing cash flow is a critical aspect of running a successful business. It can be the determining factor between flourishing and filing for Chapter 11 (aka bankruptcy ).

In fact, studies reveal that 30% of business failures stem from running out of money. To avoid such a fate, by understanding and predicting the inflow and outflow of cash, businesses can make informed decisions, plan effectively, and steer clear of potential financial disasters.

Cash Flow Projection vs. Cash Flow Forecast

Having control over your cash flow is the key to a successful business. By understanding the differences between cash flow statements and projections, small business owners can use these tools more effectively to manage their finances and plan for the future.

Discover the power of HighRadius cash flow forecasting software ,designed to precisely capture and analyze diverse scenarios , seamlessly integrating them into your cash forecasts. By visualizing the impact of these scenarios on your cash flows in real time, you gain a comprehensive understanding of potential outcomes and can proactively respond to changing circumstances.

Here’s how AI takes variance analysis to the next level and helps you generate accurate cash flow forecasts with low variance. It automates the collection of data on past cash flows, including bank statements, accounts receivable, accounts payable, and other financial transactions, and integrates with most financial systems. This data is analyzed to detect patterns and trends that can be used to anticipate future cash flows. Based on this historical analysis and regression analysis of complex cash flow categories such as A/R and A/P, AI selects an algorithm that can provide an accurate cash forecast.

Step-by-Step Guide to Creating a Cash Flow Projection

Step 1: choose the type of projection model.

- Determine the appropriate projection model based on your business needs and planning horizon.

- Consider the following factors when choosing a projection model:

- Short-term Projections: Covering a period of 3-12 months, these projections are suitable for immediate planning and monitoring.

- Long-term Projections: Extending beyond 12 months, these projections provide insights for strategic decision-making and future planning.

- Combination Approach: Use a combination of short-term and long-term projections to address both immediate and long-range goals.

Step 2: Gather historical data and sales information

- Want to determine where you’re going? Take a look at where you’ve already been. Collect relevant historical financial data, including cash inflows and outflows from previous periods.

- Analyze sales information, considering seasonality, customer payment patterns, and market trends.

Pro Tip: Finance teams often utilize accounting software to ingest a range of historical and transactional data. Read on to discover the business use cases of implementing a treasury management solution for optimal cash flow management .

Step 3: Project cash inflows

- Estimate cash inflows based on sales forecasts, considering factors such as payment terms and collection periods.

- Utilize historical data and market insights to refine your projections.

Step 4: Estimate cash outflows

- Identify and categorize various cash outflows components, such as operating expenses, loan repayments, supplier payments, and taxes.

- Use historical data and expense forecasts to estimate the timing and amount of cash outflows.

Pro Tip: By referencing the cash flow statement, you can identify the sources of cash inflows and outflows. Learn more about analyzing projected cash flow statement .

Step 5: Calculate opening and closing balances

- Calculate the opening balance for each period, which represents the cash available at the beginning of the period.

- Opening Balance = Previous Closing Balance

- Calculate the closing balance by considering the opening balance, cash inflows, and cash outflows for the period.

- Closing Balance = Opening Balance + Cash Inflows – Cash Outflows

Step 6: Account for timing and payment terms

- Consider the timing of cash inflows and outflows to create a realistic cash flow timeline.

- Account for payment terms with customers and suppliers to align projections with cash movements.

Step 7: Calculate net cash flow

- Calculate the net cash flow for each period, which represents the difference between cash inflows and cash outflows.

- Net Cash Flow = Cash Inflows – Cash Outflows

Pro Tip: Calculating the net cash flow for each period is vital for your business as it gives you a clear picture of your future cash position. Think of it as your future cash flow calculation.

Step 8: Build contingency plans

- Incorporate contingency plans to mitigate unexpected events impacting cash flow, such as economic downturns or late payments.

- Create buffers in your projections to handle unforeseen circumstances.

Step 9: Implement rolling forecasts

- Embrace a rolling forecast approach, where you regularly update and refine your cash flow projections based on actual performance and changing circumstances.

- Rolling forecasts provide a dynamic view of your cash flow, allowing for adjustments and increased accuracy.

Cash Flow Projection Example

Let’s take a sneak peek into the cash flow projection of Pizza Planet, a hypothetical firm. In March, they begin with an opening balance of $50,000. This snapshot will show us how their finances evolved during the next 4 months.

Here are 5 key takeaways from the above cash flow projection analysis for Pizza Planet:

Upsurge in Cash Flow from Receivables Collection (April):

- Successful efforts in collecting outstanding customer payments result in a significant increase in cash flow.

- Indicates effective accounts receivable management and timely collection processes.

Buffer Cash Addition (May and June):

- The company proactively adds buffer cash to prepare for potential financial disruptions.

- Demonstrates a prudent approach to financial planning and readiness for unexpected challenges.

Spike in Cash Outflow from Loan Payment (May):

- A noticeable cash outflow increase is attributed to the repayment of borrowed funds.

- Suggests a commitment to honoring loan obligations and maintaining a healthy financial standing.

Manageable Negative Net Cash Flow (May and June):

- A negative net cash flow during these months is offset by positive net cash flow in other months.

- Indicates the ability to handle short-term cash fluctuations and maintain overall financial stability.

Consistent Closing Balance Growth:

- The closing balance exhibits a consistent and upward trend over the projection period.

- Reflects effective cash flow management, where inflows cover outflows and support the growth of the closing cash position.

How to Calculate Projected Cash Flow?

To calculate projected cash flow, start by estimating incoming cash from sources like sales, investments, and financing. Then, deduct anticipated cash outflows such as operating expenses, loan payments, taxes, and capital expenditures. The resulting net cash flow clearly shows how much cash the business expects to generate or use within the forecasted period.

Calculating projected cash flow is a crucial process for businesses to anticipate their future financial health and make informed decisions. This process involves forecasting expected cash inflows and outflows over a specific period using historical data, sales forecasts, expense projections, and other relevant information. Regularly updating and reviewing projected cash flow helps businesses identify potential cash shortages or surpluses, allowing for proactive cash management strategies and financial planning.

Benjamin Franklin once said, ‘Beware of little expenses; a small leak will sink a great ship.’ This underscores the importance of managing and understanding cash flow in business.

Download this cash flow calculator to effortlessly track your company’s operating cash flow, net cash flow (in/out), projected cash flow, and closing balance.

6 Common Pitfalls to Avoid When Creating Cash Flow Projections

At HighRadius, we recently turned our research engine toward cash flow forecasting to shed light on the sources of projection failures. One of our significant findings was that most companies opt for unrealistic projections models that don’t mirror the actual workings of your finance force.

Cash flow projections are only as strong as the numbers behind them. No one can be completely certain months in advance if literal or figurative storm clouds are waiting for them on the horizon. Defining a realistic cash flow projection for your company is crucial to achieving more accurate results. Don’t let optimism cloud your key assumptions. Stick to the most likely numbers for your projections.

A 5% variance is acceptable, but exceeding this threshold warrants a closer look at your key assumptions. Identify any logical flaws that may compromise accuracy. Take note of these pitfall insights we’ve gathered from finance executives who have shared their experiences:

- Avoid overly generous sales forecasts that can undermine projection accuracy.

- Maintain a realistic approach to sales projections to ensure reliable cash flow projections.

- Reflect the payment behavior of your customers accurately in projections, especially if they tend to pay on the last possible day despite a 30-day payment schedule.

- Adjust the projection cycle to align with the actual payment patterns.

- Factor in annual and quarterly bills on the payables side of your projections.

- Consider potential changes in tax rates if your business is expected to reach a new tax level.

- Account for seasonal fluctuations and cyclical trends specific to your industry.

- Analyze historical data to identify patterns and adjust projections accordingly to reflect these variations.

- Incorporate contingencies in your projections to prepare for unforeseen circumstances such as economic downturns, natural disasters, or changes in market conditions.

- Build buffers to mitigate the impact of unexpected events on your cash flow.

- Failing to create multiple scenarios can leave you unprepared for different business outcomes.

- Develop projections for best-case, worst-case, and moderate scenarios to assess the impact of various circumstances on cash flow.

By addressing these pitfalls and adopting best practices shared by finance executives, you can create more reliable and effective cash flow projections for your business. Stay proactive and keep your projections aligned with the realities of your industry and market conditions.

How Automation Helps in Projecting Cash Flow?

Building a cash flow projection chart is just the first step; the real power lies in the insights it can provide. Cash flow projection is crucial, but let’s face it – the traditional process is resource-consuming and hampers productivity. Finance teams have no choice but to abandon it and let it gather dust for the remainder of a month.

However, there’s a solution: a cash flow projection automation tool.

Professionals in Controlling or Treasury understand this need for automation, but it requires an investment of time and money. Building a compelling business case is straightforward, especially for companies prioritizing cash reporting, forecasting, and leveraging the output for day-to-day cash management and investment planning.

Consider the following 3 business use cases shared by finance executives, highlighting the benefits that outweigh the initial investment:

Scalability and adaptability:

Forecasting cash flow in spreadsheets is manageable in the early stages, but as your business grows, it becomes challenging and resource-intensive. Manual cash flow management struggles to keep up with the increasing transactions and customer portfolios.

Many businesses rely on one-off solutions that only temporarily patch up cash flow processes without considering the implications for the future. Your business needs an automation tool that can effortlessly scale with your business, accommodating evolving needs.

Moreover, such dependable partners often offer customization options, allowing you to tailor the cash flow projections to your specific business requirements and adapt to changing market dynamics.

Time savings:

Consider a simple example of the time and effort involved in compiling a 13-week cash flow projection for stakeholders every week. The process typically includes

- Capture cash flow data from banking and accounting platforms and classify transactions.

- Create short-term forecasts using payables and receivables data.

- Model budget and other business plans for medium-term forecasts.

- Collect data from various business units, subsidiaries, and inventory levels.

- Consolidate the data into a single cash flow projection.

- Perform variance and sensitivity analysis.

- Compile reporting with commentary.

This process alone can consume many hours each week. Let’s assume it takes six hours for a single resource and another six hours for other contributors, totaling 12 hours per week or 624 hours per year. Whether you are an enterprise or an SMB, learn how a 13-week cash flow projection template can help you keep your business on track and achieve your financial goals.

Imagine the added time spent on data conversations, information requests, and follow-ups. Cash reporting can quickly become an ongoing, never-ending process.

By implementing a cash flow projection automation tool, you can say goodbye to tedious manual tasks such as logging in, downloading data, manipulating spreadsheets, and compiling reports. Automating these processes saves your team countless hours, allowing them to focus on strategic initiatives and high-value activities.

Accuracy and efficiency:

When it comes to cash flow monitoring and projection, accuracy is paramount for effective risk management. However, manual data handling introduces the risk of human error, which can have significant financial implications for businesses. These challenges may include:

- Inaccurate financial decision-making

- Cash flow uncertainty

- Increased financial risks

- Impaired stakeholder confidence

- Wasted resources and time

- Compliance and reporting challenges

- Inconsistent data processing

Automating cash flow projections mitigates these risks by ensuring accurate and reliable results. An automation tool’s consistent data processing, real-time integration, error detection, and data validation capabilities instill greater accuracy, reliability, and confidence in the projected cash flow figures.

For example, Harris, a leading national mechanical contractor, transformed their cash flow management by adopting an automation tool. They achieved up to 85% accuracy across forecasts for 900+ projects and gained multiple 360-view projection horizons, from 1-Day to 6-Months, updated daily. This improvement in accuracy allowed the team to focus on higher-value tasks, driving better outcomes.

Cash Flow Projections with HighRadius

Managing cash flow projections today requires a host of tools to track data, usage, and historic revenue trends as seen above. Teams rely on spreadsheets, data warehouses, business intelligence tools, and analysts to compile and report the data.

HighRadius has consistently provided its customers with powerful AI and forecasting tools to support real-time visibility, historical tracking, and predictive insights so your teams can reap the benefits of automated cash flow management.

When your forecast is off, you can miss opportunities to invest in growth or undermine your credibility and investor confidence. An accurate forecast means predictable growth and increased shareholder confidence.

Cash Flow Projection FAQs

1) how do you prepare a projected cash flow statement.

Steps to prepare a projected cash flow statement :

- Analyze historical cash flows.

- Estimate future sales and collections from customers.

- Forecast expected payments to suppliers and vendors.

- Consider changes in operating, investing, and financing activities.

- Compile all these estimates into a projected cash flow statement for the desired period.

2) What is projected cash flow budget?

A projected cash flow budget is a financial statement that estimates the amount of cash your business is expected to receive and pay out over a specific time period. This information can be helpful in determining whether your business has enough cash flow to maintain its regular operations during the given period. It can also provide valuable insight into how to allocate your budget effectively.

3) What is a 3-year projected cash flow statement?

A 3-year projected cash flow statement forecasts cash inflows and outflows for the next three years. It helps businesses assess their expected cash position and plan for future financial needs and opportunities.

4) What is projected cash flow and fund flow statement?

Projected cash flow statement forecasts cash inflows and outflows over a period, aiding in budgeting and planning. Fund flow statement tracks the movement of funds between sources and uses, analyzing financial position. Both provide insights into a company’s liquidity and financial health.

5) What are the 4 key uses for a cash flow forecast?

- Evaluate cash availability for operational expenses and investments.

- Identify potential cash flow gaps or surpluses.

- Support financial planning, budgeting, and decision-making.

- Assist in securing financing or negotiating favorable terms with stakeholders.

6) What is the cash flow projection ratio?

The term cash flow projection ratio is not a commonly used financial ratio. However, various ratios like operating cash flow ratio, cash flow margin, and cash flow coverage ratio are used to assess a company’s cash flow generation and management capabilities.

7) What is the formula for projected cash flow?

The projected cash flow formula is Projected Cash Flow = Projected Cash Inflows – Projected Cash Outflows . It calculates the anticipated net cash flow by subtracting projected expenses from projected revenues, considering all sources of inflows and outflows.

8) What are the advantages of cash flow projection?

Cash flow projection helps businesses:

- Anticipate future financial needs

- Manage cash shortages effectively

- Make informed decisions

- Ensure stability and growth

- Provide a roadmap for financial planning

- Stay proactive in managing finances

Related Resources

Balance Sheet Forecasting: A Complete Guide to Financial Forecasts

Moving Beyond Spreadsheets for Cash Forecasting

How To Make The Treasury System Your Strategic Planner?

Streamline your order-to-cash operations with highradius.

Automate invoicing, collections, deduction, and credit risk management with our AI-powered AR suite and experience enhanced cash flow and lower DSO & bad debt

Please fill in the details below

Get the hottest Accounts Receivable stories

Delivered straight to your inbox.

- Order To Cash

- Credit Cloud

- Electronic Invoicing

- Cash Application Management

- Deductions Management

- Collections Management

- B2B Payments

- Payment Gateway

- Surcharge Management

- Interchange Fee Optimizer

- Payment Gateway For SAP

- Record To Report

- Financial Close Management

- Account Reconciliation

- Anomaly Management

- Accounts Payable Automation

- Treasury & Risk

- Cash Management

- Cash Forecasting

- Treasury Payments

- Learn & Transform

- Whitepapers

- Courses & Certifications

- Why Choose Us

- Data Sheets

- Case Studies

- Analyst Reports

- Integration Capabilities

- Partner Ecosystem

- Speed to Value

- Company Overview

- Leadership Team

- Upcoming Events

- Schedule a Demo

- Privacy Policy

HighRadius Corporation 2107 CityWest Blvd, Suite 1100, Houston, TX 77042

We have seen financial services costs decline by $2.5M while the volume, quality, and productivity increase.

Colleen Zdrojewski

Trusted By 800+ Global Businesses

- Video Bytes

- Book Speaking Engagement

- NEW BOOK! Selling Your Business

- Book - Cashing Out of Your Business

- Maximize Business Value

- Exit Planning

- Live Your Ideal Life

- The Selling Process

- Executing the Exit

- Maximizing the Value of Your Business

Want to exit your business on your own terms and achieve your goals?

This book is a must-read for every owner who is facing an ownership transition in the next decade.

Cashing Out of Your Business , co-authored by Jane M. Johnson and written especially for business owners, introduces the concept of business ownership transition planning. It outlines a roadmap that may be used by ALL owners to analyze their current situation, determine their goals and design a Business Ownership Transition Plan that is custom to their needs.

SMALL BUSINESS TRENDS MAGAZINE SAYS…

"Cashing Out Your Business will open up your eyes to what will ensure your business survival after moving on. Whether you plan to transfer your business next year or years from now, give this book a read to learn what structure will work best for all the people important in your business and your life."

Our roadmap consists of six modules. Here are just a few of the key concepts that we discuss in our book and illustrate using real-life client case studies :

Getting Yourself Prepared

- Preparing yourself for transition is the first and most important step in this process.

- Your identity may now be one with your business, and it will take time to separate the two.

- Consider both financial and non-financial goals when you think about ownership transition.

Counting Beans

- You should take stock of the assets you have saved outside of the business, calculate how much income you will need post-transition, and then determine your wealth gap—or how much money you will need to net from the ownership transition.

- Counting your beans will allow you to assess how financially dependent you are on the business.

Building a Better Box

- Most owners have not saved enough money outside their businesses and will therefore need the wealth trapped inside their company to fund their next phases of life.

- Privately held companies have a range of values. Each prospective buyer will determine how much they are willing to pay, based on their perceived risk, as well as the cash flow and overall quality of your business.

- Many qualitative factors drive business value. We outline the top eight factors that will help you to maximize the value of your company.

Follow the Yellow Brick Road

- Two general types of ownership transition options exist—internal and external. “Internal” refers to selling or gifting the business to insiders such as key employees, managers, or family members involved in the business. “External” refers to selling to an outsider such as a competitor, customer, or investor.

- Each transition option has its own transfer value, associated taxes and fees, as well as pros and cons. Our planning process allows you to assess each option and determine how well it meets both your financial and non-financial goals.

The Art of the Deal

- Selling externally is desired by many owners, but of those who make an attempt, less than one in five actually consummate a transaction.

- The "art" is in positioning the business, finding the right buyer, and negotiating the best possible deal.

- Baby-boomer business owners will be flooding the market in the next 10-15 years as they attempt to transition their businesses to others. This is likely to drive business values down.

- Planning well in advance will dramatically improve your chances of selling to an outsider at a desirable price.

Paint by Numbers

- This module describes how to pull together all of the key concepts above into your own, custom Business Ownership Transition Plan that will outline how and when the ownership of your business will be transferred to others.

See What People Are Saying On Amazon

Great book on what is required to prepare your business for sale! It is insightful and has great examples.

Jeffrey J. Diercks

This book tells you what to do in order to sell your business. Many business owners seem to always say they might sell in five years or so but when you check back with them in a couple of years it is still the same five years away until one day they are in a rush due to changing health or family situations. This book helps you get moving on what you need to do to be ready to sell or transition ownership to the next generation so you will be able to get the most value for your business when the time comes.

Scott R. Loring

I grabbed this book out of a pile late last August for an easy summer afternoon read. I really liked the author's style - she cuts right to it, in plain talk. What's interesting is that it turned me around in terms of my exit strategy. I had been focused on assuming an external sale, but after reading what the author had to say, I reconsidered advantages on an internal transition of ownership, and that's what I'm now pursuing...and yes, I got in touch with author Jane Johnson and engaged her to be a guide on this journey. Good for me. Good for my leadership team. And hooray for the future of independent, privately held business.

This book is a must read for any business owner who plans on selling all or part of the interest in his/her company. If you've been careful and thoughtful in growing a profitable business, you simply owe it to yourself to follow Johnson's & Richardson-Mauro's well-designed model from planning through closing. You'll be amazed as to how much wisdom is packed into this slim, crucial guide. Do yourself a favor and pick up a copy!

Christopher M. Bond

Discover the ultimate guide to selling your business successfully!

Grab a FREE copy of our latest book, Sell Your Business. Discover the secrets to selling your business at the right time, for the right price, and to the ideal buyer!

Visit Our Blog

Be sure to subscribe to our blog and stay abreast of the latest topics. tactics. and advice on how you can successfully transition from your business. Whether you desire an internal or external sale, our blog will provide you with valuable, timely information to prepare you for your own deal of a lifetime.

Call Us: 844.469.3948 | Email Us | Schedule a Call With Us

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

401(k) Withdrawals: Penalties & Rules for Cashing Out a 401(k)

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

You can make a 401(k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes.

Some reasons for taking an early 401(k) distribution are penalty-free, such as a hardship withdrawal or if you leave your job.

Converting a 401(k) to an IRA could be a way to keep your funds and avoid the early distribution penalty.

Need your 401(k) money right now? If you haven’t reached age 59 ½, an early 401(k) withdrawal could trigger penalties and taxes, as well as impact your retirement savings in the long term. But if you’re considering tapping into your retirement funds, here’s what you need to know.

» Dive deeper: What to do when the stock market is crashing

Can you withdraw money from a 401(k) early?

Yes, it’s possible to make an early withdrawal from a 401(k) plan at any time and for any reason. Some withdrawals might qualify as hardship withdrawals and be penalty-free, but in many cases, taking money out of a 401(k) plan will still trigger taxes.

Get a custom financial plan and unlimited access to a Certified Financial Planner™

NerdWallet Advisory LLC

What is the 401(k) early withdrawal penalty?

If you withdraw money from your 401(k) before you’re 59 ½, the IRS usually assesses a 10% tax as an early distribution penalty. That could mean giving the government $1,000, or 10% of a $10,000 withdrawal, in addition to paying ordinary income tax on that money. Between the taxes and penalty, your immediate take-home total could be $7,000 from your original $10,000.

What reasons can you withdraw from your 401(k) early?

In certain situations, you may be able to withdraw from your 401(k) without incurring the 10% early distribution tax penalty.

If any of these situations apply to you

Generally, the IRS will waive the early distribution tax penalty if these scenarios apply:

You choose to receive “substantially equal periodic” payments. Basically, you agree to take a series of equal payments (at least one per year) from your account. They begin after you stop working, continue for life (yours or yours and your beneficiary’s) and generally have to stay the same for at least five years or until you hit 59 ½ (whichever comes last). A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

You leave your job. This works only if it happens in the year you turn 55 or later (50 if you work in federal law enforcement, federal firefighting, customs, border protection or air traffic control).

You have to divvy up a 401(k) in a divorce. If the court’s qualified domestic relations order in your divorce requires cashing out a 401(k) to split with your ex, the withdrawal to do that might be penalty-free.

You are a domestic abuse survivor. As of 2024, you can withdraw 50% of your account or $10,000 (indexed for inflation) if you self-certify that you experienced domestic abuse [0] Senate.gov . SECURE 2.0 Act of 2022 . Accessed Nov 6, 2023. View all sources .

You are terminally ill.

You become or are disabled.

You rolled the account over to another retirement plan (within 60 days).

Payments were made to your beneficiary or estate after you died.

You gave birth to a child or adopted a child during the year (up to $5,000 per account).

The money paid an IRS levy.

You were a victim of a disaster for which the IRS granted relief.

You over-contributed or were auto-enrolled in a 401(k) and want out (within certain time limits).

You were a military reservist called to active duty.

Finally, a provision in the Secure 2.0 Act allows special emergency distributions of up to $1,000 per year beginning in 2024. You can withdraw the money penalty-free and repay it over three years. Within those three years, no other emergency distributions can be taken out of the account unless the amount has been repaid.

If you qualify for a hardship withdrawal

A hardship withdrawal is a withdrawal of funds from a retirement plan due to “an immediate and heavy financial need.” A hardship withdrawal is limited to the amount needed to meet that need, and usually isn't subject to penalty [0] Internal Revenue Service . . View all sources .

Generally, these things qualify for a hardship withdrawal:

Medical bills for you, your spouse or dependents.

College tuition, fees, and room and board for you, your spouse or your dependents.

Money to avoid foreclosure or eviction.

Funeral expenses.

Certain costs to repair damage to your home.

How to make a hardship withdrawal

Your employer’s plan administrator usually decides if you qualify for a hardship withdrawal. You may need to explain why you can’t get the money elsewhere. You usually can withdraw your 401(k) contributions and maybe any matching contributions your employer has made, but not normally the gains on the contributions (check your plan). You may have to pay income taxes on a hardship distribution, and you may be subject to the 10% penalty mentioned earlier.

on Capitalize's website

If you are converting your 401(k) to an IRA

Individual retirement accounts — known as IRAs — have slightly different withdrawal rules from 401(k)s. You might be able to avoid that 10% 401(k) early withdrawal penalty by converting an old 401(k) to an IRA first. For example:

There’s no mandatory withholding on IRA withdrawals. That means you might be able to choose to have no income tax withheld and thus get a bigger check now. (You still have to pay the tax when you file your tax return.) If you’re in a desperate situation, rolling the money into an IRA and then taking the full amount out of the IRA might be a way to get 100% of the distribution. This strategy may be valuable for people in low tax brackets or who know they’re getting refunds. ( See what tax bracket you're in. )

You can take out up to $10,000 for a first-time home purchase. If that's why you need this cash, converting to an IRA first may be a better way to access it.

School costs could qualify. Withdrawals for college expenses could be OK from an IRA, if they fit the IRS’ definition of qualified higher education expenses [0] IRS.gov . Qualified Education Expenses . View all sources .

» Learn more: Review our options for best 401(k) to IRA rollover providers

Consider the costs of cashing out your 401(k)

“Anytime you take early withdrawals from your 401(k), you’ll have two primary costs — taxes and/or penalties — which will be pretty well defined based on your age and income tax rates, and the foregone investment experience you could have enjoyed if your funds remained invested in the 401(k). This total cost should be considered in detail before making early withdrawals,” says Adam Harding, a certified financial planner in Tempe, Arizona.

It's a good rule of thumb to avoid making a 401(k) early withdrawal just because you're nervous about losing money in the short term. It's also not a great idea to cash out your 401(k) to pay off debt or buy a car, Harding says. Early withdrawals from a 401(k) should be only for true emergencies, he says.

Even if you manage to avoid the 10% penalty, you probably will still have to pay income taxes when cashing out 401(k)s. Plus, you could stunt your retirement.

» Run your retirement numbers with our retirement calculator

Depending on who administers your 401(k) account, it can take between three and 10 business days to receive a check after cashing out your 401(k). If you need money in a pinch, it may be time to make some quick cash or look into other financial crisis options before taking money out of a retirement account.

If you make an early withdrawal of your 401(k), you’ll likely receive less cash than you expect due to penalties, fees and withholdings. With fewer funds left in the account, you’ll also likely be missing out on future returns. An early 401(k) withdrawal calculator could help you estimate how much you might receive by tapping into retirement funds early.

Depending on who administers your 401(k) account, it can take between three and 10 business days to receive a check after cashing out your 401(k). If you need money in a pinch, it may be time to

make some quick cash

or look into other financial crisis options before taking money out of a retirement account.

If you make an early withdrawal of your 401(k), you’ll likely receive less cash than you expect due to penalties, fees and withholdings. With fewer funds left in the account, you’ll also likely be missing out on future returns. An

early 401(k) withdrawal calculator

could help you estimate how much you might receive by tapping into retirement funds early.

On a similar note...

Open an IRA

View NerdWallet's picks for the best IRAs.