Learning, Earning & Building Empires…

Blog » Real Estate Wholesaling » Template & Guide To Real Estate Wholesale Assignment Contracts – FREE DOWNLOAD

Template & Guide To Real Estate Wholesale Assignment Contracts – FREE DOWNLOAD

In a real estate wholesale deal, real estate wholesale assignment contracts are the tools used to ensure that the deal finder gets paid.

What Contracts Do I Need To Wholesale Real Estate?

If you are interested in wholesaling real estate, you will need to sign contracts with sellers and buyers.

Contracts can be in the form of a purchase and sale agreement, a lease agreement, or a deed of trust.

What is the deed of trust?

Wow, that’s an important question!

A deed of trust is a legal document that secures a loan or debt.

It’s also known as a trust deed or a mortgage.

Basically, it’s an agreement between a borrower and a lender that the borrower will transfer the title of a property to a trustee until the loan is paid off.

It’s an important document that can help protect both parties.

A deed of trust can help with wholesaling real estate by providing a secure and legal way for a wholesaler to purchase a property from a seller and then transfer it to a buyer.

The deed of trust allows the wholesaler to act as the middleman between the seller and the buyer, and it also provides the wholesaler with the legal authority to transfer the property from the seller to the buyer.

The deed of trust also provides the wholesaler with the ability to collect a fee from the buyer for their services.

This fee can be negotiated between the wholesaler and the buyer, and it can be a fixed amount or a percentage of the purchase price.

By using a deed of trust, a wholesaler can ensure that the transfer of the property is done legally and securely, and that they are able to receive payment for their services.

Please check with a local attorney in your state for every document referenced on this page.

Assignment Contract

This is another agreement that will allow you to transfer my rights and interests in a real estate property to another party.

The details of the agreement will include the property address, the parties involved, the transfer date, and any other relevant information.

This agreement will also outline the responsibilities of each party, including payment, taxes, and other related costs.

I’m confident that this agreement will be beneficial for all parties involved and I look forward to a successful transaction.

Real Estate Option Contract

This is another contract that is a great way to secure a property without having to make a full commitment.

It allows you to purchase the property at a later date, giving you the flexibility to make sure it’s the right fit for you.

It’s a great way to protect yourself and your investment. I highly recommend exploring this option if you’re considering buying a property.

This is the contract I used for my first deal. I made $10,000.

Can you wholesale without a contract?

Absolutely! You can definitely wholesale without a contract.

It’s a great way to get started and can be a great way to test the waters.

You don’t have to worry about signing any long-term agreements and it’s a great way to start building relationships with other businesses.

It’s a win-win situation!

How do I set up a wholesale contract?

Setting up a wholesale contract sounds like a great idea! It’s a great way to ensure that you get the best deal possible when purchasing items in bulk.

To get started, you’ll need to research what type of contract works best for your business.

Consider the terms of the contract, such as the payment terms, delivery dates, and any other relevant details.

Once you have all the information you need, you can start drafting the contract.

Make sure to include all the details you’ve discussed, and be sure to get it reviewed by a lawyer to ensure everything is in order.

How do you assign a wholesaling contract to real estate?

That’s a great question! Assigning a wholesaling contract to real estate is actually quite simple.

All you need to do is find a buyer who is willing to purchase the contract and then have them sign an assignment of contract form.

This form will transfer the rights of the contract to the buyer, and they will then be responsible for closing the deal.

It’s a great way to make money in real estate, so I definitely recommend giving it a try!

Look around this page for access to a free wholesale real estate contract pdf or template that you can check with your local attorney.

Where To Get Wholesaling Contracts

Wholesaling contracts can be found in a variety of places!

You can find them through real estate agents, online marketplaces, or even through word of mouth.

It’s great to have so many options when it comes to finding wholesaling contracts – it makes it much easier to get started in the world of real estate investing.

Plus, it’s always a good idea to network and build relationships with other investors in your area, as they may be able to provide you with leads and other resources.

What is a wholesale assignment contract?

Finding and creating real estate wholesale deals is an awesome way to make $20,000 – $40,000 every month.

In order to do that, a person who is essentially a marketer would:

- Find motivated sellers from lead sources such as unwanted inheritances, pre-foreclosures, tax defaults, expired mls listings, for sale by owners etc

- Put a house with an accepted offer under an assignable contract with a purchase price = 65% of the after repair value minus repair estimate.

- Then assigns the contract to a end buy who now pays a fee for finding the deal.

This contract and its content varies from state to state. Therefore the best place to find the appropriate one is at your local rein (real estate investing association)

Gurus and coaches may have generic version embedded inside their course.

But it’s better to find the one use consistently by asking active real estate investors and wholesalers in your local market.

That can also mean that you have to offer to work with or for existing investors for free.

The bottom line is that a good relationship can become handy here.

Even as you build relationships by bringing value to them, you can download or send the PDF version of the whole assignment contract to yourself by email from the investors computer.

It’s not stealing? It’s friendship.

In my opinion, finding a wholesale assignment contract is the least of your problems.

Your focus should be in finding deals, finding motivated sellers, finding and building a list of end buyer.

WATCH THE VIDEO FOR MORE.

Without an agreement as evident by an executed real estate wholesale assignment contracts, you can’t collect an average of $25,000 per deal from wholesaling real estate.

This document is what initiates everything and it is the main commodity that you acquire rights to so that you can sell that right to others.

That’s essentially what we call wholesale real estate; a very lucrative business model.

About Real Estate Wholesale & Assignment Contracts

There are 2 types of contract usually involved in any given real estate wholesale deal.

But that’s not it; there are also 2 different types of contracts combinations that you can have with any deal.

Let’s talk about the 2 real estate wholesale assignment contracts first.

At least one simple but assignable real estate purchase contract is always present in any wholesale transaction.

This represents the agreement between you as a buyer and the seller of the subject property.

In addition to that one contract, a 2nd type of contract is needed to secure your finders fee when you do find an end buyer for the deal.

You have 2 choices:

(1) You can either assign the contract between you and the seller to an ended buyer using a real estate assignment contract

- (i) Simple Real Estate Purchase Contract

- (ii) Real Estate Assignment Contract

(2) Another simple real estate purchase contract may be execute between you as a seller and the end buyer…

- (i) Simple Real Estate Purchase Contract-A

- (ii) Simple Real Estate Purchase Contract-B

In which case, a 2nd transaction and/or closing will be conducted by the closing agent(s).

This is called DOUBLE ESCROW or DOUBLE CLOSING which means 2 sets of closing cost will be incurred to consummate the deal and go home with $5,000 – $82,000 each time you do it successfully.

The 1st choice which is to assign the original contract to an end buyer with an assignment contract will only involve that same ONE transaction.

The disadvantage of it however is that your seller will be exposed to your fees which can trigger unnecessary greed.

They may start asking for more money than they initially agreed to.

In fact, it happened to me on my first deal back in 2005.

When you download my book Smart Real Estate Wholesaling for free, you will also gain a free access to a Simple Real Estate Purchase and Assignment contract PDF.

Also, look out for a contract PDF generator with all information pre-filled for you.

We are working on that at the moment to make your life easier when it comes to cranking them out and locking them under contract with speed.

7 Essential Parts of a Real Estate Wholesale Assignment Contract

This is the part of the contract that specifies who the seller is and who the buyers is.

In an assignment contract, the parties would be the buyer and the assignor and the end buyers as the assignee.

(2) Property

Your contract have to specify the address and/or legal description of the subject property whose deed is being transfer to another owner.

In legal terminology, some call this the consideration.

Basically, what is being exchanged for the subject property.

(4) Deposit

The earnest money deposit (EMD) is the amount that the buyer is willing to put as downpayment and goodwill at the point contract execution.

For the end side of the transaction, I require the EMD to be non-refundable as my security to protect time and ensure that the end buyer is serious about the deal.

This is possible because we only deal in deals that are actually good deals and steals for an average buyer investor.

(5) Term & Terms of the Real Estate Wholesale Assignment Contracts

When I say ‘term’, I mean a limited time for inspection, funding commitment and closing must be specified.

In addition to that, terms and condition for the transaction must be explicitly specified on the contract.

This may include disclosures and disclaimers with desire clauses to property the parties involved in the sales agreement.

(6) Signature

The contract has to be signed by all parties involved in the transaction.

Spouses of involved parties may also be required to sign the real estate wholesale assignment contracts if involved in qualifying for funding the deal.

Last but not least, the contract must be dated while signing it so that accountability and requirements from each parties between execution and closing can be properly controlled and monitored.

In addition to these essential 7 parts, a real estate assignment contract need to reference the original sales contract between you (as the original buyer) and the seller.

Double Close Contract PDF: Double Closing vs Assignment Contracts

In the world of real estate wholesaling, the methods of double closing and assignment contracts play a significant role in facilitating profitable transactions.

Wholesalers use these techniques to exit deals with profits as title transfers from a seller to a buyer.

While both methods have their advantages, this video will focus on using a simple double close contract PDF document and explore its benefits over the assignment method.

1. What is a Double Close Contract?

A double close contract, also known as a simultaneous closing or “double escrow,” involves two separate transactions.

In this process, the wholesaler acts as the intermediary between the original seller and the end buyer, facilitating the sale of the property without using their own funds.

The wholesaler will be the buyer of the SIDE A transaction and the seller of the SIDE B transaction.

2. Understanding Assignment Contracts:

An assignment transaction, on the other hand, involves using an assignment contract to transfer the equitable rights of the original sales contract to the end buyer.

In this scenario, the wholesaler does not acquire the property but instead sells the contract to the buyer for an assignment fee.

3. The Question: Double Close vs. Assignment

One common question that arises is whether to choose double closing or assignment.

While assignment contracts may seem simpler and require less capital, there are limitations.

Hard money lenders, for instance, might impose restrictions on the amount of assignment fees, potentially limiting the wholesaler’s profits.

4. Benefits of Double Closing:

A) avoiding assignment fee restrictions: .

Double closing allows wholesalers to bypass assignment fee limitations set by some hard money lenders.

As a result, they can handle deals with larger spreads and generate higher profits without facing unnecessary hurdles.

This is precisely how I did my $82,000 deal and how I lost $10,000 out of the $20,000 I was supposed to make on my first deal.

B) Reduced Scrutiny:

Assignments can sometimes raise red flags for lenders, who may view them as unconventional fees for unlicensed realtors.

Double closing eliminates this concern as the wholesaler actually takes ownership of the property briefly before selling it to the end buyer.

C) Increased Profit Potential:

With double closing, wholesalers can explore deals with more significant equity spreads.

This opens up opportunities to find properties with higher potential profits for both the end buyer and the seller.

5. How to Execute a Double Close:

A) Step 1: Finding the Right Deal: The process starts by identifying a property with substantial equity spread and potential for profitable reselling.

B) Step 2: Securing Financing: For the first transaction (SIDE A), the wholesaler arranges for transactional funding or uses their own cash to purchase the property from the original seller.

Transactional funding will cost less than 3%.

C) Step 3: Second Transaction (SIDE B): With ownership of the property now in the wholesaler’s name, they proceed to sell it to the end buyer in a separate transaction.

This transaction is funded by the end buyer’s financing, which might be provided by a hard money lender.

D) Step 4: Documentation: Proper documentation is essential for a smooth double closing process.

This includes drafting and signing the double close contract, purchase and sale agreements, and other legal paperwork.

6. Downloading a Double Close Contract PDF:

To assist wholesalers in conducting double closings effectively, we offer a free downloadable Double Close Contract PDF in our programs that can be tweaked by your lawyer to fit the property’s local jurisdiction.

This document is designed to streamline the process and ensure compliance with legal requirements.

Conclusion:

In conclusion, while both double closing and assignment contracts serve their purposes in real estate wholesaling, the double close contract PDF offers several benefits that make it a preferred choice for deals with substantial equity spreads.

By using this method, wholesalers can increase their profit potential, avoid unnecessary scrutiny, and optimize their real estate ventures for success.

Remember to exercise due diligence, consult legal professionals when needed, and utilize the free downloadable Double Close Contract PDF for seamless transactions. Happy wholesaling!

By following the tips in this blog post, you can increase your chances of successfully double closing real estate deals.

Are you ready to take your real estate wholesaling to the next level? Join our masterclass and access comprehensive step-by-step guidance and valuable resources on double closings. In fact, you get 3 free books as soon as you register for the class. Click here to learn more.

Frequently Asked Questions

A double closing contract is a legal agreement used in real estate wholesaling that facilitates two separate transactions: buying the property from the seller and immediately selling it to the end buyer.

To do a double closing, purchase the property from the seller in the first transaction and then sell it to the end buyer in a separate transaction, ensuring proper documentation and financing.

Yes, you can double close with no money by using transactional funding for the initial purchase and relying on the end buyer’s financing for the resale.

The difference between a double closing and an assignment contract is that a double closing involves two separate transactions where the wholesaler briefly owns the property, while an assignment contract transfers the contract rights to the end buyer without taking ownership of the property…

Micro Flipping in Real Estate: A Comprehensive Guide

In the ever-evolving world of real estate investing, new strategies and trends often emerge.

One such trend that has gained traction in recent years is micro flipping.

This innovative approach to real estate investment has captured the attention of investors looking for a quicker and potentially more profitable way to turn properties.

In the next segment of this blog post, we’ll delve into the concept of micro flipping, explore its differences from wholesaling, discuss the 70% rule, delve into the pros and cons, and provide guidance on how to get started with micro flipping.

What is Micro Flipping in Real Estate?

Micro flipping is a real estate investment strategy where investors buy properties, often distressed or undervalued, at a discount and quickly resell them for a profit.

Unlike traditional house flipping, which involves significant renovations and holding periods, micro flipping focuses on rapid transactions with minimal renovations.

The goal is to identify and capitalize on quick profit opportunities by purchasing properties below market value, and then immediately selling them to another buyer, usually an end-user or another investor.

Micro Flipping Vs. Wholesaling

While both micro flipping and wholesaling involve the quick turnover of properties, they differ in certain aspects:

1. Strategy: Micro flipping involves a faster process and usually minimal or no renovations before selling the property.

In contrast, wholesaling focuses on finding deeply discounted properties and assigning the contracts to other investors without taking ownership.

2. Ownership: In micro flipping, the investor takes temporary ownership of the property before selling it.

Wholesaling, on the other hand, does not involve actual ownership transfer; instead, it revolves around assigning the contract rights.

However, wholesale real estate sometimes uses double closing which involves title passing through a wholesaler’s name for a brief moment.

3. Profit: Micro flipping aims for relatively smaller profits on each deal but completes transactions at a higher volume.

Wholesaling typically targets higher profits per deal, but the volume of deals may be lower due to the longer acquisition process. Time is worth more than money.

How much profit is the 70% rule?

The 70% rule is a widely-used guideline in real estate investing, including micro flipping and traditional house flipping.

It states that an investor should not pay more than 70% of the after-repair value (ARV) of a property, minus the repair costs.

The formula for the 70% rule is:

Maximum Purchase Price = (ARV x 0.70) – Repair Costs

In other contexts, it may go down to 65% and others, as high as 85% in very busy cities with high demand.

This rule helps investors ensure they acquire properties with enough built-in profit potential or equity to cover expenses and still generate a satisfactory return on investment (ROI).

How do I avoid capital gains tax on a flip?

Capital gains tax can significantly impact the profits made from flipping properties.

However, there are several strategies to minimize or avoid capital gains tax:

1. 1031 Exchange: Under Section 1031 of the Internal Revenue Code, investors can defer capital gains tax by reinvesting the proceeds from the sale of one property into a like-kind property of equal or higher value.

2. Primary Residence Exemption: If the property being flipped was your primary residence for at least two of the past five years, you may qualify for the primary residence exemption, which allows you to exclude up to $250,000 (or $500,000 for married couples filing jointly) of capital gains from taxation.

3. Real Estate Professional Status: If you are considered a real estate professional by the IRS, you may be able to offset your real estate gains with real estate losses, reducing your overall tax liability.

Please check with your local tax professional.

What is a good profit on a house flip?

The profit margin on a house flip can vary depending on factors like location, property type, market conditions, and renovation costs.

However, a good rule of thumb for a successful flip is to aim for a net profit of 10% to 20% of the after-repair value (ARV).

For example, if the ARV of a property is $300,000, a satisfactory profit would be between $30,000 and $60,000.

What is the Rule of 70 (Doubling Time)?

While it may be confused with the 70% rule used to secure a healthy ROi as discussed earlier, it’s different in the broader world of real estate.

The Rule of 70 is a mathematical formula used to estimate the time it takes for an investment or economy to double in size.

It is calculated by dividing 70 by the annual growth rate.

For example, if an investment is growing at a rate of 7% per year, it would take approximately 10 years for it to double (70 ÷ 7 = 10).

To Recap, what is a Microflip?

A microflip refers to the act of conducting a micro flipping transaction.

It involves identifying and acquiring a property at a discounted price, and then rapidly reselling it to another buyer for a profit, often without significant renovations or improvements.

What is a Micro Real Estate Portfolio?

A micro real estate portfolio is a collection of properties acquired through the micro flipping strategy.

Investors who specialize in micro flipping may accumulate several properties in a relatively short period, leveraging the faster turnover to build a diverse portfolio.

Pros and Cons of Micro Flipping

Like any investment strategy, micro flipping has its advantages and drawbacks:

Quick Turnaround: Micro flipping allows for faster transactions, enabling investors to generate profits more rapidly.

Lower Risk: With minimal renovations, there is less exposure to renovation costs, construction delays, and market fluctuations.

Less Capital Intensive: Compared to traditional house flipping, micro flipping requires less upfront capital, making it accessible to a broader range of investors.

Market Agility: The ability to adapt quickly to changing market conditions can be advantageous in dynamic real estate markets.

Lower Profit Margin: Each microflip may yield smaller profits compared to traditional house flipping, necessitating higher transaction volumes to achieve the same earnings.

Market Dependency: Success in micro flipping heavily relies on finding an active market with enough demand for quick property turnovers.

Limited Upside: Since micro flipping involves selling properties as-is, there may be missed opportunities for higher profits with significant renovations.

Transaction Costs: Rapidly buying and selling properties can incur higher transaction costs and fees.

Best Micro Flipping Software

Several software tools can assist investors in streamlining their micro flipping endeavors.

These tools typically offer features such as property analysis, deal tracking, lead generation, and marketing automation.

While the best software will depend on an investor’s specific needs, some popular options include PropStream, DealMachine, Realeflow, and Zoho CRM.

[Click Here for the Best One: link to http://empirebigdata.com]

How to Start Micro Flipping

Getting started with micro flipping requires a well-thought-out approach:

1. Education and Research: Familiarize yourself with the micro flipping strategy, study local real estate markets, and analyze successful micro flips.

2. Build a Network: Connect with local real estate agents, wholesalers, and other investors to find potential deals and buyers.

3. Financing: Secure adequate funding or partner with investors to have the necessary capital for acquisitions.

4. Marketing: Develop a marketing strategy to reach potential sellers and buyers, using online platforms, direct mail, and other targeted methods.

5. Property Analysis: Conduct thorough property analysis to ensure potential flips meet the 70% rule and offer a favorable profit margin.

6. Negotiation: Hone your negotiation skills to secure properties at the best possible prices.

7. Legal and Tax Advice: Seek guidance from real estate attorneys and tax professionals to ensure compliance with regulations and optimize tax strategies; especially after you start closing more than a few deals.

Micro Real Estate Investing and PIN Micro Flipping

Micro real estate investing is essentially the same as micro flipping, focusing on quick transactions and fast profits.

The term “PIN micro flipping” may refer to utilizing Property Identification Numbers (PINs) to identify and track properties for potential micro flips.

Why Flipping Houses Is a Bad Idea

While flipping houses can be lucrative, it is not without risks and challenges:

1. Market Fluctuations: Flipping relies on a stable and active real estate market.

Economic downturns or local market shifts can negatively impact profitability.

2. High Competition: The popularity of house flipping can lead to increased competition, making it harder to find profitable deals.

3. Renovation Risks: Renovation costs and unforeseen issues can eat into profits, especially if not accounted for in the initial budget.

4. Holding Costs: If a property takes longer to sell, holding costs like mortgage payments, property taxes, and maintenance expenses can accumulate.

Flipping Houses TV Shows Lie

Flipping houses has become a popular subject for television shows, with programs showcasing the challenges and successes of real estate investors as they flip properties for profit.

These shows have contributed to the increased popularity of real estate investing and have given rise to new investment strategies like micro flipping.

In conclusion, micro flipping in real estate is a strategy that offers a faster and potentially more accessible way to generate profits by identifying undervalued properties and quickly reselling them.

It differs from wholesaling and traditional house flipping in terms of strategy, ownership, and profit expectations.

While micro flipping has its pros and cons, investors can leverage software tools, networking, and proper education to embark on a successful micro flipping journey.

As with any investment endeavor, it’s crucial to thoroughly research the local market and have a clear plan in place before diving into micro flipping.

If you like this blog post, you will the one we wrote on “ Do I need an llc to wholesale real estate? “:

If a state requires a state issued contract, what parts of a contracts for wholesaling real estate should include from your contract?

When it comes to wholesaling real estate contracts, there might be instances where a state mandates the use of a state-issued real estate contract.

In such cases, it’s important to understand which elements from your wholesaling contract should be incorporated into the required contract.

While it’s somewhat doubtful whether such a requirement truly exists, typically real estate agents are bound by regulations imposed by the realtor board if there is any such obligation.

However, to be fully prepared, seeking advice from a title agency or attorney experienced in real estate investment matters can provide accurate guidance on this matter.

It’s advisable not to overly concern yourself with this aspect until you’re in the process of finalizing the deal with a title agency or attorney who understands the real estate investor landscape.

It’s worth emphasizing that rectifying any contractual issues is possible even at the eleventh hour before the closing.

This can be achieved through the addition of an addendum to the contract, particularly if the seller is genuinely motivated to swiftly dispose of a property that has been causing significant challenges.

In an extreme situation, if complications persist, a combination of approaches like double closing, transactional funding , and building a network within the local real estate investing community can effectively address the issue.

This solution is especially viable when dealing with a motivated seller who is eager to proceed with the transaction despite any procedural hurdles.

As a wholesaler, your primary focus should remain on streamlining your processes, becoming proficient in marketing and identifying potential sellers.

Micro flipping in real estate is a strategy where investors buy undervalued properties and quickly resell them for a profit without significant renovations.

The 70% rule in real estate suggests that an investor should aim for a net profit of 30% after subtracting the purchase price and repair costs from the property’s after-repair value (ARV).

Capital gains tax on a flip can be avoided through strategies like a 1031 exchange, primary residence exemption, or qualifying for real estate professional status.

A good profit on a house flip is typically between 10% to 20% of the property’s after-repair value (ARV).

The rule of 70 (doubling time) is a mathematical formula used to estimate the time it takes for an investment or economy to double in size by dividing 70 by the annual growth rate.

Micro flipping in real estate refers to a strategy of quickly buying and reselling properties without significant renovations for rapid profits.

A Microflip is a real estate transaction where an investor rapidly buys and sells a property to generate quick profits.

The 70% rule in flipping homes advises investors not to pay more than 70% of the after-repair value (ARV) of a property, minus repair costs, to ensure a satisfactory profit margin.

A micro real estate portfolio is a collection of properties acquired through the micro flipping strategy, often consisting of multiple quick turnover deals.

We help people make 6-7 figure income from home.

Are you next in line?

YES NO

Tool Categories

- Business Setup

- Cash Buyers

- Seller Leads

- Skip Tracing

Wholesale Real Estate Contracts

Are you new to the world of wholesale real estate? Look no further than our comprehensive collection of contracts, agreements, and documents designed to help you succeed in the industry.

Our free PDF and Word templates are available for download and use, and we even offer instructional videos to guide you through the process of filling out each contract in detail.

With a thorough understanding of each contract, you'll be able to confidently explain them to property sellers, cash buyers, and JV partners and even fill them out on the spot to boost your wholesale real estate business.

In the example videos below, I'll go over how to fill out the most basic real estate wholesaling contracts (listed below) so you'll have a solid understanding of each.

- Purchase agreements outline the terms of the sale, including the purchase price and closing date.

- Assignment agreement s allow you to assign your rights and obligations under a purchase agreement to another party.

- JV agreements establish a partnership between two or more parties for a specific real estate project.

- Option agreements give you the right to purchase a property at a specific price within a certain timeframe.

- Notice of cancellation forms allows you to cancel a contract within a specified period without penalty.

Wholesale Real Estate Purchase Agreement (Example)

The Purchase Agreement, also known as a "PA" or "Buy and Sell Agreement," outlines the terms and conditions of the purchase.

A wholesale real estate contract is a legal agreement between a wholesaler and a buyer outlining the terms of the sale of a property.

The wholesaler finds a distressed property, negotiates a deal with the seller, and then assigns the contract to a buyer for a fee.

The buyer then takes over the contract and completes the purchase of the property.

Who gets a copy of the purchase agreement? The seller, wholesaler, and title closing agent. (the buyer will also get a copy after they agree to the terms and sign your assignment agreement)

If you'd like me to email you editable copies of all the contracts and agreements, submit your name and email address below.

Wholesale Real Estate Assignment Agreement (Example)

The Wholesale Real Estate Assignment Agreement is a contract between a wholesaler and a buyer, where the wholesaler assigns their rights to purchase a property to the buyer for a fee.

The buyer then takes over the contract and closes on the property, while the wholesaler receives their fee without ever actually owning the property themselves.

It is a common strategy used in real estate wholesaling and investing.

Who gets a copy of the assignment agreement? The wholesaler, buyer, and title closing agent.

Wholesale Real Estate JV Agreement (Example)

The Wholesale Real Estate JV Agreement is a legal contract between two or more parties who agree to work together to purchase and sell real estate properties for profit.

The agreement outlines the property, terms, and conditions of the joint venture, including the responsibilities and obligations of each party, the distribution of profits, and the duration of the partnership.

This type of agreement is commonly used in the real estate industry by investors and wholesalers who want to pool their resources and expertise to maximize their profits.

Who gets a copy of the JV agreement? The wholesalers in the joint venture and the title closing agent. (neither the seller nor the buyer gets a copy of jv agreement)

Wholesale Real Estate Option Agreement (Example)

The Wholesale Real Estate Option Agreement is a contract between a real estate wholesaler and a property owner that gives the wholesaler the right to buy the property at a discounted price within a certain timeframe.

The wholesaler enters into an agreement with the property owner and can then work to locate a potential buyer for a higher price.

Once a buyer is found, the wholesaler can return to the buyer and exercise the option by entering into an actual purchase agreement.

Who gets a copy of the option agreement? Only the seller and wholesaler.

Wholesale Real Estate Notice of Cancellation (Example)

The Wholesale Real Estate Notice of Cancellation is a document used to cancel a contract for the sale of real estate between a wholesaler and a buyer.

It is typically used when the wholesaler is unable to find a buyer for the property within a specified timeframe.

The notice of cancellation must be provided to the buyer in writing and should include the reason for the cancellation and any applicable fees or penalties.

Who gets a copy of the notice of cancellation? The seller, wholesaler, and title closing agent.

Conclusion: In wholesale real estate, a thorough understanding of contracts and agreements is crucial for success. Our comprehensive collection of free PDF and Word templates and instructional videos provides valuable resources to guide you through the process.

However, it's important to note that real estate laws and regulations can vary by location, and it's essential to check your local laws and regulations and consult a real estate attorney before using any real estate contract.

This ensures compliance and protects your interests.

By familiarizing yourself with the various contract types, such as purchase agreements, assignment agreements, JV agreements, option agreements, and notice of cancellation forms, you'll be equipped to navigate the wholesale real estate business confidently.

These contracts outline the terms and conditions of the transactions and help facilitate successful deals.

Remember, while our resources provide a solid foundation, it's crucial to adapt them to your specific circumstances and seek professional advice when necessary.

Safeguard your business by staying informed and compliant with local guidelines.

Download our editable contracts and agreements to streamline your wholesale real estate endeavors. Just provide your name and email address, and we'll send them to your inbox.

Empower yourself with knowledge, consult experts, and utilize the proper contracts to build a thriving wholesale real estate business.

By downloading any of the forms, contracts and/or paperwork, You understand that such forms, contracts and/or paperwork are provided for your convenience, and you understand that real-estate law is governed state by state, and laws and regulations change from time to time.

You also understand that you may and should seek legal and professional advice before using said forms, contracts, and/or paperwork, and You agree to hereby hold us harmless from any liability by using said forms, contracts, and/or paperwork.

Written by:

David Frizzell

Your dream life filled with success and freedom begins with real

estate wholesaling

- [email protected]

- 250 Corey Ave #66873 , St Pete Beach, FL 33707

Copyright 2023 | The Wholsalers Toolbox

Privacy Policy | Affiliate Disclosure

How to Write a Wholesale Real Estate Agreement Contract Template

If you're a real estate wholesaler, you understand the importance of having the right contracts in your arsenal.

This comprehensive guide is designed to help you navigate the world of wholesaling real estate contracts. From understanding the role of wholesalers to successfully closing deals, this guide will provide you with the insights and knowledge you need to thrive in this exciting aspect of real estate investing.

We’ll also give you some wholesaling real estate contract templates you can download right away!

Understanding Wholesale Real Estate Contracts

Real estate wholesaling is a strategy where you secure exclusive buying rights from a seller without needing a real estate license. You then flip that contract (not the property) to a cash buyer for an assignment fee.

Of course, it’s important to understand the various types of wholesale contracts and the legal aspects involved to facilitate successful transactions.

The Wholesaling Real Estate Contracts Lifecycle

If you’re just getting started, it can be a little confusing when to do what and what to do when… Here's a breakdown from Tyler Austin of the entire contract lifecycle when you’re wholesaling properties.

Types of Wholesaling Contracts

Wholesalers require two key types of contracts, purchase agreements and assignment contracts, to secure deals and assign them to investors. A purchase agreement, also known as a Real Estate Purchase and Sale Agreement, is a contract that outlines the terms and conditions of the real estate transaction, guaranteeing your right to buy or sell the property to someone else. Being cognizant of any clauses that may prohibit assignment is crucial, as it could impact your capacity to wholesale the property.

An assignment contract, on the other hand, allows you to sell your buying rights to another buyer without actually purchasing the property yourself. This is the basis of a wholesale real estate assignment, where wholesalers connect sellers and buyers, making a profit from the assignment fee without owning the property. After signing the original purchase agreement, the next step involves ensuring your contractual rights are assigned to another investor. You can do this through an Assignment of Real Estate Purchase and Sale Agreement.

Disclaimer: These templates are meant to just be a starting place for your wholesaling real estate contracts. Please consult with a lawyer to customize the templates so that they’re legally binding for your local jurisdiction.

Legal Aspects

Legally binding contracts are the backbone of any successful wholesale real estate business, and understanding the legal aspects of these contracts is crucial. For instance, awareness of the rules and regulations applicable to the state where the property is located is vital. Contingency clauses are another vital aspect of wholesale real estate contracts, allowing a party to back out of the agreement without negative consequences if certain conditions aren’t met.

Restatement Second of Contracts 317 states that assignments are generally allowable within contracts. Unless the contract itself prohibits it, an assignment is permissible. To ensure a smooth transaction and avoid potential legal issues, make sure to consult a real estate attorney and include all the necessary elements in your wholesale contract, such as the parties involved, property description, purchase price, and financing terms.

Key Components of a Wholesale Contract

A well-crafted wholesale real estate contract should contain several key components to ensure it is legally binding and effective. These essential elements include:

- Clearly defining the parties involved

- Providing a detailed and accurate property description

- Outlining the agreed-upon purchase price

- Specifying the financing terms

Incorporating these components into your contract equips you to navigate the complexities of wholesale real estate transactions and safeguard your interests.

Parties Involved

In a wholesale real estate contract, clear definition of the roles and responsibilities of the buyer, seller, and wholesaler is vital. The roles are as follows:

- The buyer: the party purchasing the property from the wholesaler at a discounted price.

- The seller: the original owner of the property who contracts with the wholesaler to sell the property at a negotiated price.

- The wholesaler: plays a pivotal role in securing the contract from the seller and finding a suitable buyer to purchase the rights to the contract, ultimately making a profit from the difference in price.

In addition to the primary parties, a title company plays a significant role in wholesale real estate contracts. The title company is responsible for ensuring that the property title is legitimate and providing title insurance to protect both the buyer and seller during the transaction. Including all relevant parties in the contract helps to establish roles and responsibilities, minimize misunderstandings, and ensure a successful deal.

Property Description

A detailed property description is vital for a legally binding and efficient wholesale real estate contract. This description should include:

- The property’s legal address

- Property type

- Specific features such as the number of bedrooms, bathrooms, and other relevant details

Providing a thorough property description enables all parties involved to understand the property’s condition and value, helping to prevent disagreements and ensure a smooth transaction.

In addition to the basic property details, it’s important to include any disclosed issues, such as structural problems, termite damage, or lead-based paint, that may affect the property’s value or require repairs. Outlining the property’s condition clearly allows for an accurate assessment of the potential profit margin and negotiation of a fair purchase price with the seller, thus setting the foundation for a successful wholesale deal.

Purchase Price and Financing Terms

Outlining the agreed-upon purchase price and financing terms is another integral component of a wholesale real estate contract. The contract should include:

- The purchase price, which should be based on factors such as market value, necessary repairs, and the potential profit margin for the wholesaler.

- The payment method, specifying how and when the payment will be made.

- Any financing arrangements that both parties have agreed to.

When it comes to payment methods, wholesalers typically receive a deposit upon signing the Assignment of Real Estate Purchase and Sale Agreement, with the remaining profit paid at closing. However, it’s important to note that title companies may have restrictions on the types of payment they accept, such as not accepting credit cards, checks, or cash due to ‘good funds laws’. Clearly stating the purchase price and financing terms in your wholesale contract ensures a smooth transaction and safeguards your interests as a wholesaler.

Crafting a Wholesale Contract: Best Practices

Creating a solid wholesale real estate contract is essential for a successful deal, and there are several best practices to follow when crafting your agreement. These include:

- Conducting due diligence to research properties, laws, and potential buyers.

- Consulting an attorney for legal advice and contract customization.

- Utilizing pre-made contract templates to streamline the process and ensure all necessary components are included.

Implementing these best practices can enhance your chances of closing deals and making profits in the competitive realm of wholesale real estate investing. In the following sections, we’ll delve deeper into each of these practices, providing you with valuable insights and tips to help you craft an effective wholesale contract that meets your needs and protects your interests.

Due Diligence

Conducting thorough research on properties, laws, and potential buyers is critical to ensuring a successful wholesale deal. This process, known as due diligence, involves:

- Inspecting the property

- Performing a records search

- Seeking legal advice

- Preparing any special disclosures

Conducting due diligence enables you to gain a better understanding of the property’s value, condition, and potential issues that may arise during the transaction.

Due diligence also extends to researching the local laws and regulations that govern wholesale real estate contracts in the jurisdiction where the property is located. This knowledge can help you ensure that your contract is legally binding and compliant with all applicable laws, reducing the risk of disputes or legal issues down the line.

Investing time in thorough due diligence can improve your success chances as a real estate investor in the fast-paced domain of wholesale real estate investing, attracting real estate investors with similar goals.

Consulting an Attorney

Seeking legal advice is another crucial best practice when crafting a wholesale real estate contract. A real estate attorney can review and customize your contract template to ensure it complies with all relevant laws and regulations, as well as protect your interests in the transaction. This can be particularly important when dealing with contract assignment restrictions or navigating complex financing arrangements.

In addition to providing legal guidance, an attorney can also help you:

- Negotiate the terms of your contract, ensuring a fair and mutually beneficial agreement for all parties involved

- Avoid costly mistakes

- Safeguard your investment

- Increase your chances of success in wholesaling real estate

Consulting an experienced real estate attorney can provide you with benefits that even a skilled real estate agent might not be able to offer.

Utilizing Templates

Leveraging pre-made contract templates can greatly streamline the contract creation process and ensure all necessary components are included in your wholesale real estate contract. The use of a template can save time and effort, while enabling the crafting of a legally binding and effective agreement that suits your needs and protects your interests.

There are several reliable sources for wholesale real estate contract templates, such as:

- Real Estate Skills

- FortuneBuilders

- Property Mob

- Rocket Mortgage

While templates can provide a solid foundation for your contract, it’s important to remember that customization may be necessary to comply with local laws and regulations, as well as to address the unique aspects of your specific deal. Utilizing templates and seeking legal advice for customization to suit your situation allows the creation of a robust wholesale real estate contract, setting you up for success.

Strategies for Success in Wholesaling Real Estate

To thrive in the competitive world of wholesaling real estate, it’s essential to implement effective strategies that help you source properties, build a strong buyers list, and generate a consistent flow of leads. Focusing on these core aspects of your business positions you well to close deals quickly and maximize your profits as a real estate wholesaler.

In the following sections, we’ll explore some proven methods for sourcing distressed properties , establishing a network of potential investors, and generating leads through various marketing channels. By implementing these strategies, you can propel your wholesaling business to new heights and achieve long-term success in the real estate industry.

Sourcing Distressed Properties

Identifying undervalued properties, such as distressed property, is a critical step in the wholesaling process, as it allows you to secure deals at a lower price and sell them at a higher margin to your end buyers. To source distressed properties, it’s essential to conduct thorough research and utilize various lead generation channels, such as online real estate marketplaces, foreclosure listings, and local real estate agents.

Networking is another key strategy for finding motivated sellers and distressed properties. By attending local real estate events, joining real estate clubs, and leveraging referrals, you can establish connections with property owners who may be interested in selling their properties at a discount. Honing your skills in sourcing distressed properties enhances your chances of securing profitable deals and expanding your wholesale real estate business.

Building a Buyers List

Establishing a network of potential investors and buyers is crucial to quickly assigning contracts and closing deals in the world of wholesaling real estate. To build a strong buyers list , you can start by:

- Networking with local real estate agents

- Attending real estate events

- Joining real estate clubs in your area

- Utilizing online platforms like Craigslist and social media groups to connect with potential cash buyers

When adding leads to your buyers list, make sure to collect essential information such as:

- Their names

- Contact details

- Buying criteria

- Funding sources

Cultivating a robust buyers list equips you better to quickly assign contracts, close deals, and generate consistent revenue from your wholesale real estate business.

Marketing and Lead Generation

Attracting motivated sellers and generating a steady flow of leads is essential for success in wholesaling real estate. Implementing marketing strategies like:

- Direct mail

- Social media

- Display ads

can help you reach your target audience and establish your brand in the industry.

In addition to traditional marketing channels, leveraging content marketing can be a highly effective strategy for lead generation. By creating valuable and informative content, you can:

- Attract motivated sellers

- Establish yourself as an expert in the industry

- Increase brand awareness, visibility, and reach

- Ultimately drive more leads and deals for your wholesaling business.

Overcoming Challenges in Wholesale Real Estate

While wholesaling real estate can be a lucrative venture, it’s not without its challenges. Common obstacles include dealing with contract assignment restrictions and managing contingencies. By understanding these potential challenges and implementing the strategies discussed in this guide, you can navigate the complexities of wholesale real estate contracts and set yourself up for success in this thriving niche of the real estate market.

Contract Assignment Restrictions

One common challenge faced by wholesalers is the presence of contract assignment restrictions, which can limit your ability to assign contracts to other buyers. To overcome this obstacle, you can utilize a Standard Contract Assignment Addendum, which modifies the original contract to allow for assignment, or consider alternative strategies such as double closings.

Awareness of potential limitations on contract assignments and exploration of alternative strategies enable navigation through these challenges and assurance of a successful wholesale deal. Additionally, seeking legal advice from a real estate attorney can help you tailor your contract to comply with local laws and regulations, further reducing the risk of disputes or legal issues down the line.

Managing Contingencies

The inclusion of contingency clauses in your wholesale real estate contracts is vital for the protection of all parties involved and the assurance of a successful transaction. Common contingencies include:

- Financing contingencies

- Inspection contingencies

- Sale contingencies

- Title contingencies

These contingencies allow a party to back out of the agreement without negative consequences if certain conditions aren’t met.

Effective management of contingencies requires ensuring that all parties understand the terms of the contingency clause and establishing a realistic timeline to meet the conditions. Additionally, seeking legal advice from an attorney can help you craft contingency clauses that safeguard your interests and reduce the risk of disputes or legal issues down the road.

Final Thoughts

Mastering the art of wholesaling real estate contracts can unlock a world of opportunities for savvy investors. By understanding the fundamentals of wholesale contracts, crafting solid agreements, and implementing effective strategies for sourcing properties, building a buyers list, and generating leads, you’ll be well on your way to success in this thriving niche of the real estate market. With the knowledge and best practices shared in this comprehensive guide, you’re now equipped to overcome challenges, close deals, and reap the rewards of wholesale real estate investing.

Frequently Asked Questions

What type of contract is used for wholesale real estate.

A wholesale real estate contract is an Assignment of Real Estate Purchase and Sale Agreement which facilitates the transfer of rights from the wholesaler to the end buyer.

How do you assign a wholesaling contract to real estate?

To assign a wholesaling contract to real estate, you may need to include an assignment clause in the purchase agreement and draft an assignment of contract agreement. You also need to disclose to the seller that you have the authority to sell or assign the property, as stated by the clause "and/or assigns" next to your name in the contract. Finally, you must find a buyer and assign the contract assignment.

How does a wholesaler get paid?

The wholesaler gets paid when the buyer assumes legal rights of sales contract, or when the closing of the transaction is complete and funds and title of the property change hands.

How can I find distressed properties for my wholesale real estate business?

Do your research, network with industry professionals, attend local real estate events, and leverage online real estate marketplaces to find distressed properties for your wholesale real estate business.

What are some effective marketing strategies for attracting motivated sellers?

Target motivated sellers with direct mail, social media, display ads, and search ads to generate leads and make the most of your marketing efforts.

Listen on other platforms

Join our ninja newsletter.

Subscription implies consent to our privacy policy

TRENDING POST

A2p / 10dlc: read this before you send real estate sms campaigns, 7 mailing lists most real estate investors ignore, 5 top real estate wholesaling online courses in 2023, wholesaling real estate salary: how much can you make, visit our store to see all the courses available, popular tags, looking for more leads get it with reisift.

Related posts

Ready for more?

Subscription implies consent to our privacy policy.

Real Estate Assignment Contract

Email delivery.

Last updated April 17th, 2023

- Purchase Agreements »

A real estate assignment contract allows a real estate buyer to transfer their purchasing rights and responsibilities to someone else before the closing date. Typically, the new buyer pays a fee to the original buyer for the assignment. The form specifies the amount and due date of the assignment fee (if applicable), as well as all other details of the transaction, including the new buyer’s liabilities , payment requirements , and rights under the purchase agreement .

Download: PDF , Word (.docx) , OpenDocument

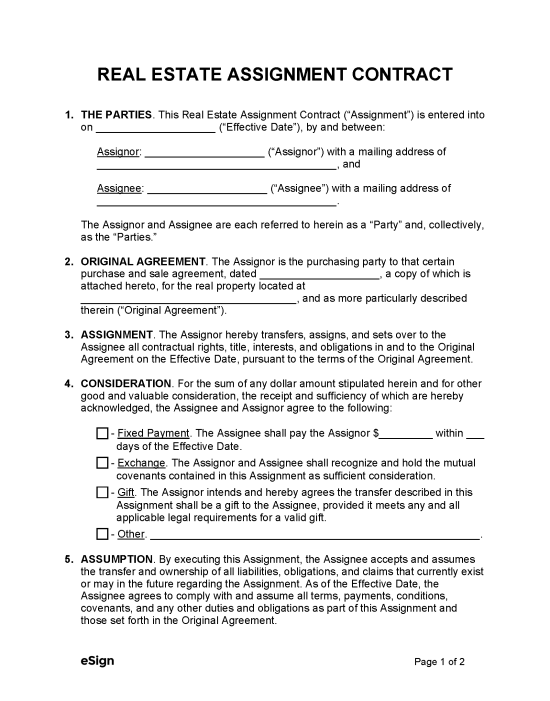

REAL ESTATE ASSIGNMENT CONTRACT

1. THE PARTIES . This Real Estate Assignment Contract (“Assignment”) is entered into on [MM/DD/YYYY] (“Effective Date”), by and between:

Assignor : [ASSIGNOR’S NAME] (“Assignor”) with a mailing address of [ADDRESS] , and

Assignee : [ASSIGNEE’S NAME] (“Assignee”) with a mailing address of [ADDRESS] .

The Assignor and Assignee are each referred to herein as a “Party” and, collectively, as the “Parties.”

2. ORIGINAL AGREEMENT . The Assignor is the purchasing party to that certain purchase and sale agreement, dated [MM/DD/YYYY] , for the real property located at [PROPERTY ADDRESS] , and as more particularly described therein (“Original Agreement”).

3. ASSIGNMENT . The Assignor hereby transfers, assigns, and sets over to the Assignee all contractual rights, title, interests, and obligations in and to the Original Agreement on the Effective Date, pursuant to the terms of the Original Agreement

4. CONSIDERATION . For the sum of any dollar amount stipulated herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree to the following: [DESCRIBE PAYMENT OR OTHER CONSIDERATION] .

5. ASSUMPTION . By executing this Assignment, the Assignee accepts and assumes the transfer and ownership of all liabilities, obligations, and claims that currently exist or may in the future regarding the Assignment. As of the Effective Date, the Assignee agrees to comply with and assume all terms, payments, conditions, covenants, and any other duties and obligations as part of this Assignment and those set forth in the Original Agreement.

6. REPRESENTATIONS . The Parties acknowledge that they have a full understanding of the terms of this Assignment. The Assignor further warrants and represents that they own the rights transferred in this Assignment and has prior consent to execute this Assignment under the terms of the Original Agreement or otherwise through the written consent of the selling party under the Original Agreement; in the latter case, the written and signed consent of said party shall be attached to this Assignment. The Parties agree to provide and complete any obligations under this Assignment and the Original Agreement.

Assignor Signature : ___________________ Date: [MM/DD/YYYY] Print Name: [ASSIGNOR’S NAME]

Assignee Signature : ___________________ Date: [MM/DD/YYYY] Print Name: [ASSIGNEE’S NAME]

Thank you for downloading!

How would you rate your free form, when you're ready, visit our homepage to collect signatures or sign yourself - 100% free.

- Wholesale contract

Adobe Acrobat Sign

How to create a wholesale real estate contract.

Learn what a wholesaler’s role is in real estate transactions and how to create a wholesale contract.

Explore Acrobat Sign

JUMP TO SECTION

How and why to use real estate wholesaling

What does the wholesaler invest in

Who is involved in a wholesale deal

What to include in a wholesale real estate contract

Create, sign, and manage wholesale contracts with Adobe

Frequently asked questions about wholesale real estate contracts

What is a wholesale contract?

A real estate wholesaler acts as the intermediary between the buyer and seller in a real estate transaction. Unlike a traditional real estate agent, in a wholesale deal, the wholesaler seeks out a potential buyer and connects them with a seller. Once the new buyer is ready to go through with the purchase, the wholesaler assigns a purchase contract (or wholesale contract) to the end buyer and collects an assignment fee for their services.

This purchase agreement does not represent the sale of the property. It simply gives the buyer the exclusive right to purchase the property by assigning the contract to the buyer. This is why wholesaling contracts are also called “real estate purchase and sale agreements” or “real estate assignment contracts” — the wholesaler’s work is connecting their buyers list to their sellers to set up both parties for a smooth and easy transaction. Once this is done, the wholesaler’s role in the transaction is finished.

Get contracts signed with Adobe

How and why to use real estate wholesaling.

Wholesaling real estate is a form of short-term real estate investing. Anyone can start wholesaling — you don’t need a real estate license to take part in this investment strategy, although it is advisable to form an LLC under which you can conduct your business. With due diligence and a little real estate know-how, wholesale purchases are a great way to get familiar with the real estate world and make money in a relatively short time frame.

Wholesalers usually seek out properties priced below market value in order to turn the most profit — for example, foreclosures, properties with liens, distressed property, those that need serious repairs, or those that are owned by highly motivated sellers. Once a wholesaler strikes an agreement with the seller, the wholesaler may then work with a title company, contractor, and appraiser to properly vet the property and prepare it for any renovations they — or the seller — want to make.

When the property is ready to be sold, the wholesaler lists it at a higher price — at or above market value. The difference between this purchase price and the wholesale price accounts for the wholesaler’s cut, or the assignment fee, as well as the added value from any repairs or renovations. This can look similar to flipping a house, but wholesaling is generally a shorter, more hands-off process than a complete renovation. Additionally, the buyer is less likely to be a future homeowner and more likely to be a real estate investor.

Wholesale real estate requires unique knowledge to be successful and avoid loss. Familiarity with the real estate industry and legal documentation is helpful. Spotting the opportunities in market properties, however, is key. Success in wholesale real estate means being able to forecast factors like eventual sale price, potential rental property, and real estate market comps.

What does the wholesaler invest in?

Wholesaling is considered a relatively fast and easy investment with quick profits, because in most deals, the wholesaler never owns the property but simply matches a buyer with the seller. In some cases, however, the wholesaler will purchase the wholesale property and resell it. This is known as double closing.

Who is involved in a wholesale deal?

The seller, the wholesaler, and the buyer (also called the end buyer of the real estate deal) to whom the wholesaler hands over the assignment agreement are the three parties involved in a wholesale contract . The assignee (buyer) could be anyone from a real estate agent or real estate investor to a first-time homeowner.

What to include in a wholesale real estate contract.

Make sure you consult with a real estate attorney to confirm that the terms of the agreement are legally sound for all parties. Here are some common parts of a wholesale contract:

- Name and contact information of the buyer and current property owner (seller)

- Legal description of the property

- Condition of premises

- Purchase price and financing

- Closing costs, who pays them, and when

- Assignment clause to transfer property rights

- Buyer and seller default clauses

- Signature by both parties

Create, sign, and manage wholesale contracts with Adobe.

Fortune favors the fast when it comes to wholesaling — make sure you don’t lose out due to time-consuming paperwork or negotiations.

With e-docs you can collaborate, edit, and comment on PDFs with all parties involved so that you can keep sellers and investors in the loop. Quickly send out contracts for digital signatures and receive notifications when the other party signs. Get started with your own wholesale contract template with Acrobat Pro.

Try Adobe Acrobat Sign

Frequently asked questions about wholesale real estate contracts.

Do you need a real estate license to wholesale.

No. You don’t need a real estate license to take part in this investment strategy, but wholesale real estate requires unique knowledge to be successful and avoid loss. Familiarity with the real estate industry and legal documentation is helpful, as is knowledge of the real estate market in your area. Real estate investment clubs can often provide information about getting started in wholesale real estate investing.

Is a wholesale assignment contract the same as a wholesale real estate contract?

No. A wholesale real estate contract gives an investor the right to buy a property from a seller. A wholesale assignment contract transfers the right to purchase a property from the wholesaler to a buyer. Using these two contracts, a wholesaler can act as an intermediary between interested sellers and buyers.

https://main--dc--adobecom.hlx.page/dc-shared/fragments/seo-articles/acrobat-color-blade

404 Not found

404 Not found

404 Not found

- Sample Contracts

FREE 10+ Wholesale Assignment Contract Samples in PDF

If you want to jump into property investment but you’re short on cash, being a wholesaler could be a lucrative alternative for you. In fact, with a little luck and a little know-how, you can make quick money without spending any money. However, before you get too excited, you need learn how a wholesale real estate transaction works, as well as the risks involved. Today’s most successful wholesalers already know it, and it’s about time you did, too: a wholesale deal can be profitable in one of two ways. Selling the contract, also known as the assignment of contract procedure, and a double closing are the two most typical ways to finish a wholesale agreement.

Wholesale Assignment Contract

Free 11+ assignment of insurance policy samples, free 11+ notice of assignment samples, free 9+ dealership contract samples, 10+ wholesale assignment contract samples.

A wholesale contract, like any other legally enforceable agreement, is a document used by investors to secure the right to purchase a subject property. To be clear, real estate wholesaling contracts do not constitute a home sale; instead, they grant investors the right to purchase the property in issue. It’s vital to note that investors interested in wholesaling houses aren’t usually interested in purchasing subject properties. Rather, they want to obtain the right to purchase a certain home and then sell it to someone else. After that, the wholesaler will sell their rights to a new buyer. The wholesaler isn’t selling a home; rather, they’re selling their rights to buy one.

1. Wholesale Assignment Agreement Contract

Size: 37 KB

2. Wholesale Property Assignment Contract

Size: 49 KB

3. Company Wholesale Assignment Contract

Size: 145 KB

4. Wholesale Assignment Services Contract

Size: 829 KB

5. Firm Wholesale Assignment Contract

6. Wholesale Assignment Purchase Contract

Size: 192 KB

7. Wholesale Business Assignment Contract

Size: 228 KB

8. Sample Wholesale Assignment Contract

Size: 189 KB

9. Standard Wholesale Assignment Contract

Size: 653 KB

10. Basic Wholesale Assignment Contract

11. Wholesale Assignment Development Contract

Size: 574 KB

Property Wholesale

A wholesale real estate contract is a relatively brief investment technique where the wholesaler intends to make their money in 30 days. Though wholesale real estate laws vary from state to state, the wholesaler always acts as a middleman in between home’s seller and an end buyer.

The wholesaler establishes a contract with the seller for exclusive right to purchase the property for a specified fee. Then they try to resell the contract to a different bidder for a higher price. The distinction between the 2 prices is the wholesaler’s profit.

The wholesaler and the seller agree to the reasonable conversion doctrine at the time of the contract. The wholesaler thereby becomes the owner of the property with the ability to transfer the contract, while the seller retains title to the residence. The ultimate buyer fulfills the real estate deal directly with the seller after the wholesaler reassigns the contract.

To be a successful wholesaler, a real estate investor must accomplish two things at once: create a wholesale buyer list and find properties to contract. The wholesaler’s buyers list is a list of possible end buyers, mainly other real estate investors such as flippers or renters.

To get repeat sales, the wholesaler should develop good relationships with these investors. The wholesaler’s job of promptly reassigning contracts will be much more difficult without regular buyers. Investors in wholesale real estate must always be on the lookout for good wholesale residences.

Wholesalers typically choose distressed properties, also known as fixer-uppers, when it comes to choosing a property. The wholesaler can obtain the home under contract below market value and benefit handsomely from the contract reassignment because the sellers are frequently very motivated.

What is a real estate wholesale contract?

A real estate wholesale contract is a legal agreement between a wholesaler and a seller that gives the investors the right to purchase the property. You’re simply putting up the game for others to engage as a wholesaler. As a middleman, your role is to find a good bargain, get the rights, and then delegate the contract to a real estate investor. “A wholesale real estate contract is a legal instrument between a real estate wholesaler and a seller, which grants the investor the right to buy the property. Assignment contract is the transferring of rights from the wholesaler to the buyer. A wholesale agreement is comparable to a purchase agreement in concept, but the operations are very different.

What is an assignment of contract in real estate?

An assignment of contract in real estate is launched when the legal owner chose to sell their home to an investor and forms a wholesale contract pledging themselves to the upcoming agreement. As a result, the investor holds the right to acquire the property, which they could then sell to another buyer. It’s vital to note that they’re not selling the house; they’re selling the right to buy the house. You see, when you sell a contract, you’re not actually selling the property; you’re selling the deal you have with the homeowner to sell the house to another buyer. As a result, an investor’s first choice should usually be the assignment of contract strategy.

If you want to see more samples and formats, check out some wholesale assignment contract samples and templates provided in the article for your reference.

Related Posts

Free 18+ financial proposal samples in pdf | ms word | google docs | pages, free 13+ witness letter samples in pdf | ms word, free 11+ awarding contract letter templates in pdf | ms word | google docs | pages, free 8+ sample material lists in ms word | pdf, free 10+ feasibility study samples in pdf, free 25+ sample contracts in pdf | ms word | excel, free 20+ readiness checklist samples in pdf, free 15+ nanny checklist samples in google docs | ms word | apple pages | pdf, free 8+ construction employment contract samples in ms word | google docs | pdf, free 7+ construction daily log samples in ms word | google docs | pdf, free 37+ supply request samples in pdf | ms word, free 13+ patient report samples in ms word | google docs | pdf, free 35+ sales request form samples in pdf | ms word, free 10+ agreement contract samples in pdf, free 29+ wordpress templates in pdf | ms word | google docs | apple pages | wordpress, free 11+ sample novation agreement, free 10+ intellectual property agreement samples, free 10+ responsibility assignment matrix samples, free 9+ security guard contract samples.

404 Not found

- Coaching Team

- Investor Tools

- Student Success

- Real Estate Investing Strategies

- Real Estate Business

- Real Estate Markets

- Real Estate Financing

- REITs & Stock Investing

Wholesale Real Estate Contract: A Guide For Beginners

What is a wholesale real estate contract?

Wholesale real estate assignment contract

Wholesale purchase agreement

Contracts and marketing

Generating wholesale leads

Wholesaling is an excellent entry into the profession of real estate investing. It offers powerful wealth-building benefits and does not require significant capital to get started. However, the conundrum for many investors is the intricacies of the wholesale real estate contract .

This is especially true if you’re new to the investing business and unfamiliar with many of the contracts and legal forms required. Even real estate agents, dipping their toes into investing for the first time, can find the wholesale contract a bit of a challenge.

Because there are numerous misconceptions about selling contracts and wholesaling in general, the following breaks down the in’s and out’s of a wholesale real estate contract.

What Is A Wholesale Real Estate Contract?

A real estate wholesale contract is a legal document between a real estate wholesaler and a seller, essentially giving the investor the right to buy the property. As a wholesaler , you are essentially setting up the game for others to play. Your job as the middleman is to locate a potential deal, secure the rights (much how a real estate agent would), and then assign the contract to a real estate investor. “A wholesale real estate contract is a legal document between a real estate wholesaler and a seller, which gives the investor the right to buy the property. Assignment contract is the transfer of rights from the wholesaler to the buyer”, says Rasti Nikolic, a financial consultant at Loan Advisor. The concept of a wholesale is similar to a purchase agreement, but the mechanics are much different.

It is also worth noting that a wholesale real estate contract may be carried out in reverse order. Otherwise known as reverse wholesaling, this process will have the investor seek a buyer before even having a property lined up. In doing so, the investor will already have a buyer lined up the second they initiate a wholesale contract. Additionally, seeking out the buyer first will give the investor an idea of what type of deal to look for. The primary benefit of conducting a wholesale real estate contract in reverse ultimately has to do with efficiency. If, for nothing else, time is the most valuable commodity of an investor, and having a buyer lined up will save them both time and money.

To better understand how a real estate wholesale contract works, wholesalers will need to first familiarize themselves with the basics of a purchase and sale agreement. The framework of this legal agreement, which provides the right to buy and sell a property, will include—but isn’t limited to—the following:

Wholesale Real Estate Assignment Contract

When you sign a wholesale real estate contract to purchase a property from a seller, you now have an equitable interest in the property. Under what is known as the doctrine of equitable conversion, a buyer can become the equitable owner of the property. At the same time, the seller maintains the bare legal title to the property under the terms of the agreement.

Although you won’t have the title to the property, you’ll be able to control it using a contract. On that note, it’s important to mention that every state and county will have its own laws on wholesaling and the formalities of the real estate wholesale contract.

The next step will then be to assign your contractual rights to an investor, which will require an Assignment of Real Estate Purchase and Sale Agreement. This contractual document will basically state the new buyer is assuming your responsibilities, including purchasing the property to the agreed-upon terms in the purchase and sale agreement.